Markets Update - 1/26/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

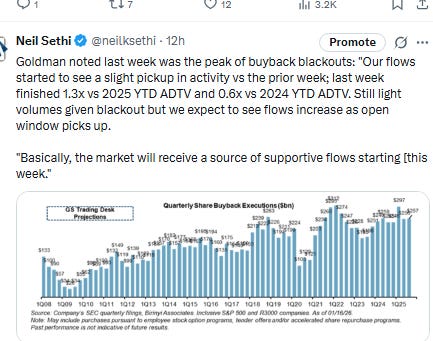

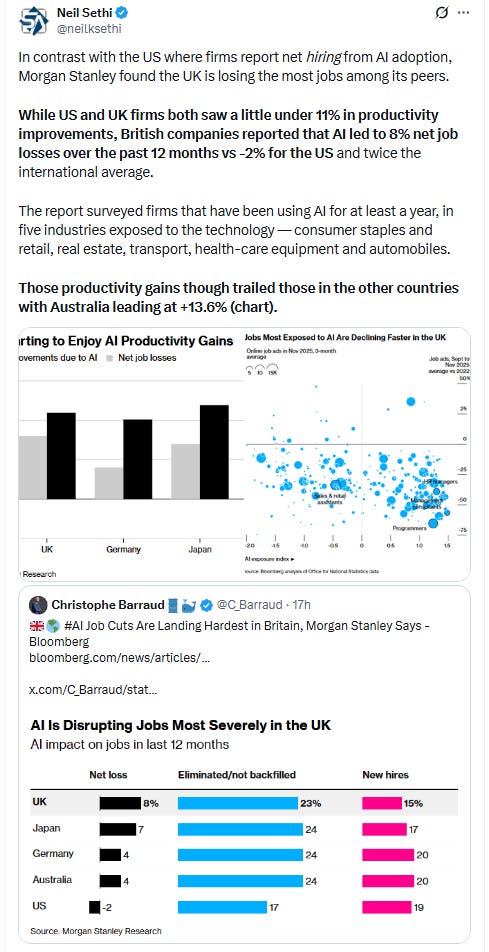

US equity indices opened today’s session trading little changed, with the SPX coming off only its second back-to-back down weeks since June, ahead of a week that will be dominated by corporate earnings (with 32% of the SPX by earnings weight reporting), a Fed meeting, renewed worries over a government shutdown, and the continued spectacular moves in commodity markets helped by a sharp drop in the US dollar.

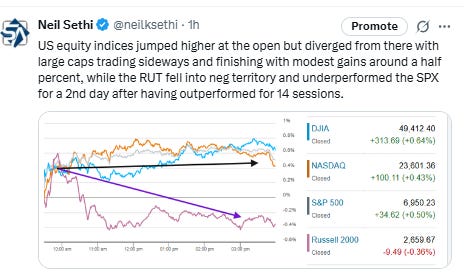

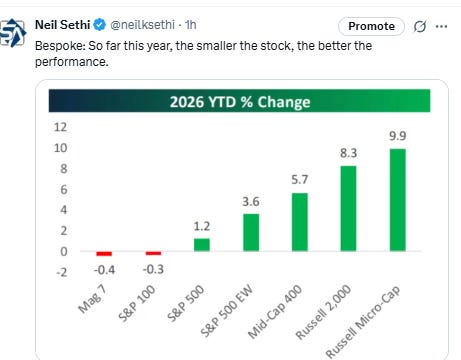

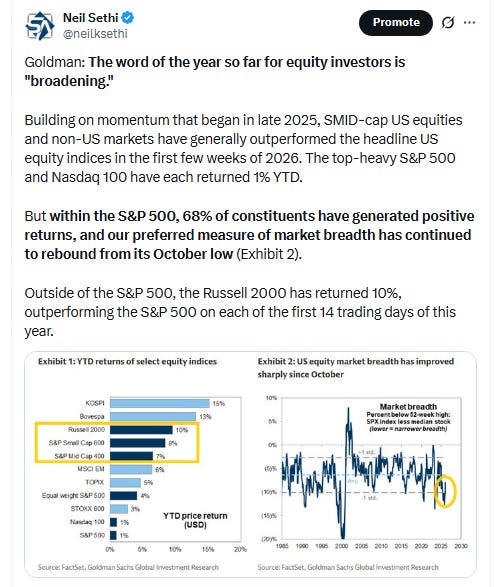

Indices jumped higher at the open, but diverged from there, with large caps trading sideways and finishing with modest gains around a half percent, but the small cap Russell 2000, which had outperformed the large cap indices every day this year until Friday, fell into negative territory and lagged for a second session finishing -0.4%.

Elsewhere, bond yields edged lower, but the dollar fell more abruptly, completing its worst three-day loss since April falling to the lowest since Sept. Natgas though jumped another +20% (at least the increasingly less liquid Feb contract which expires Wed (more below)), while gold closed above $5,000 for the first time. Copper, crude, and bitcoin though all were lower with the last closing at the lowest this year.

The market-cap weighted S&P 500 (SPX) was +0.5%, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite +0.4% (and the top 100 Nasdaq stocks (NDX) +0.4%), the SOXX semiconductor index -0.4%, and the Russell 2000 (RUT) -0.4%.

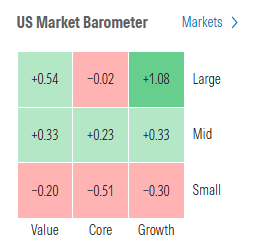

Morningstar style box one of the more mixed recently but a clear winner was large cap growth.

Market commentary (note almost all were before Trump took tariff threat completely off the table):

“It seems very much like he’s playing this playbook of like, ‘I’m going to go in kind of mad dog style. No one really knows what I could do.’ And then you almost need the market to have a tantrum and then he will back off,” said Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets. “From an options perspective, it’s when you see those potholes, those are pretty good signals of getting short volatility or reaching for a little upside.”

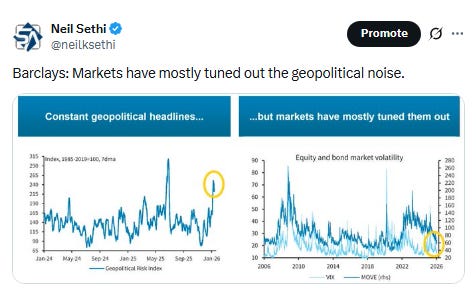

“Markets appear increasingly desensitized to breaches of international laws — whether in Venezuela, Iran, or Greenland,” said Antoine Bracq, head of advisory at Lighthouse Canton. “A similar indifference has prevailed in response to military exercises around Taiwan and the ongoing invasion of Ukraine.”

“The main focus from investors [in earnings this week] will likely be comments around AI-capex,” said Stephan Kemper, chief investment strategist at BNP Paribas Wealth Management. “Any sign of a slowdown could be seen as hyperscalers losing trust in the possibility to monetize those investments in a timely manner.”

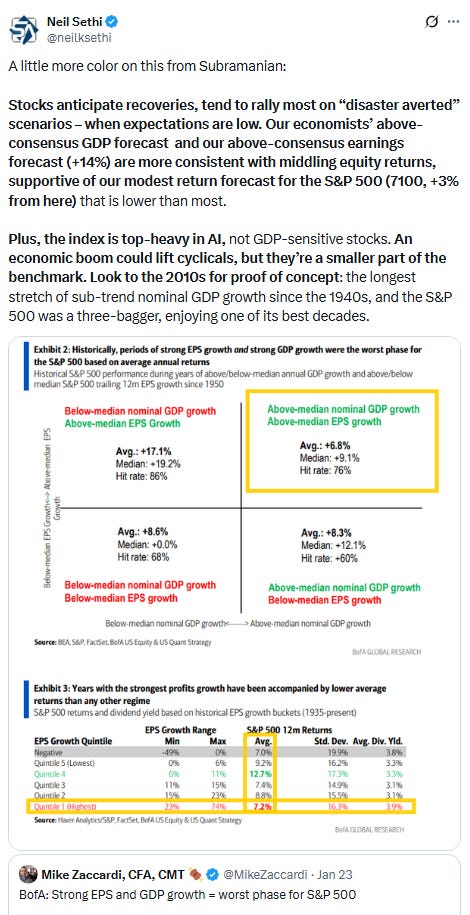

While the reporting season is still in its early stages, an analysis by JPMorgan Chase & Co. shows that forward guidance has topped expectations at roughly half of the S&P 500 companies that have provided an outlook for 2026. “Since most of the companies that have reported are outside the tech sector, this trend suggests a broadening of growth across other industries this year,” strategist Dubravko Lakos-Bujas wrote in a note.

“Based on what we’ve seen so far, the overall picture remains the same. We anticipate earnings growth accelerating to 14%, and thus we reiterate our recommendations from December: energy, basic materials, Magnificent Seven, Bitcoin, and Ethereum,” wrote Tom Lee, head of research at Fundstrat.

“Irrespective of a lot of geopolitical uncertainty and policy uncertainty, consumers still look like they’re in okay shape and continue to spend money, and businesses look like they’re doing well profitability wise and still investing those profits in AI and other productivity tools,” said Tom Hainlin, national investment strategist at U.S. Bank Asset Management Group. “We’ll start to broaden out the distribution of information beyond the financial sector and beyond airlines into a more broader read on the economy, and our expectation is that we think it’s still going to shape up to be a decent earnings season,” Hainlin added.

“Broad‑based earnings growth paired with a healthy macroeconomic backdrop helps support a diversified approach to equity sector positioning in US stocks,” Angelo Kourkafas at Edward Jones said.

“Unless the US dollar continues to move significantly lower, which seems unlikely, small caps, the broadening out trade and rest of world stocks should be fine,” said Dennis DeBusschere at 22V Research. “The macro tailwinds of the broadening out trade are unchanged.”

Hedge fund Bridgewater Associates favors stocks over bonds given the risks posed by governments ramping up public spending and the inflationary impact of AI. “It depends on how willing buyers are to hold an ever-expanding supply of debt and what it takes to entice the next marginal buyer,” Bob Prince, Greg Jensen and Karen Karniol-Tambour wrote in a note. There is “no magic number” that determines what level of debt or deficit is sustainable, but many developed world economies are “getting dangerously close” to such limits.

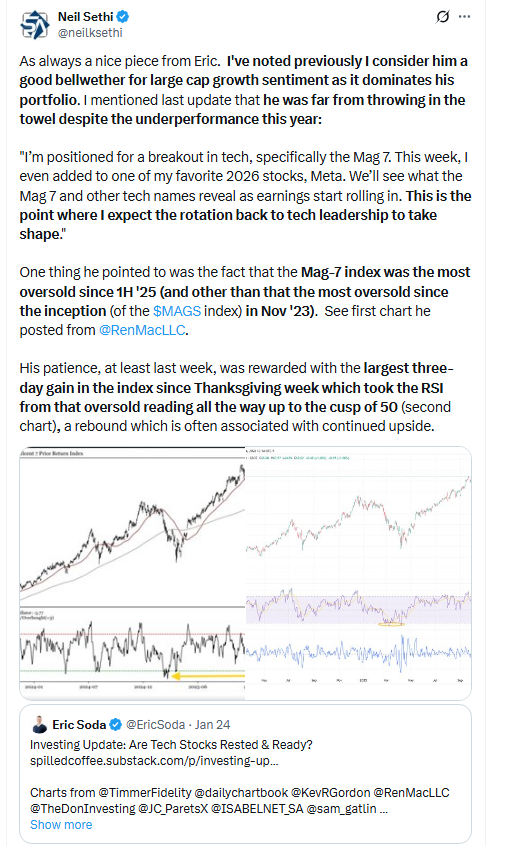

“Investors are raising their exposure to tech names prior to Magnificent Seven members reporting their results,” said Jose Torres, a markets economist at Interactive Brokers. Torres also pointed out that U.S. stocks seemed calm, despite a sharp rally in the Japanese yen. In the past, a stronger yen has been associated with weaker equities. The expectation that the White House and Tokyo were working together to ease the yen higher has helped to assuage investors’ worries, Torres said. This followed reports that the Federal Reserve performed “rate checks” on the dollar-yen currency pair on Friday, which helped send the yen sharply higher during U.S. trading hours.

“A potential shutdown would clearly represent some downside risks for the market mood as we just recover form the last one,” said BNP’s Kemper.

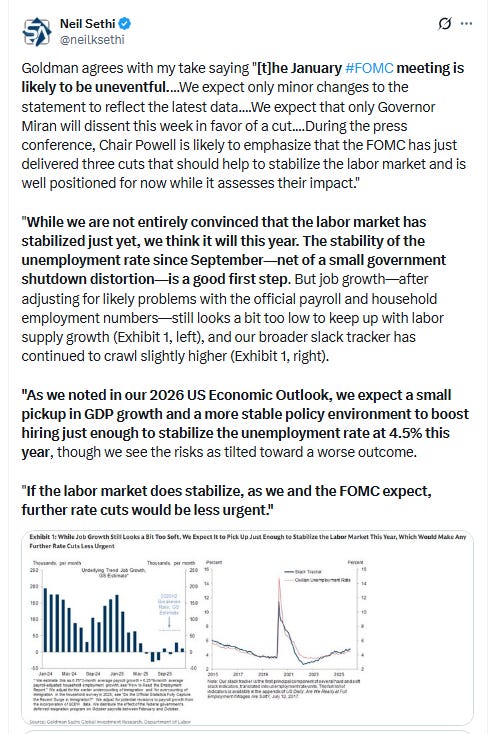

“Even though the Fed isn’t expected to cut interest rates, Powell’s press conference may be as much about Fed independence as it is policy,” Chris Larkin at E*Trade from Morgan Stanley said.

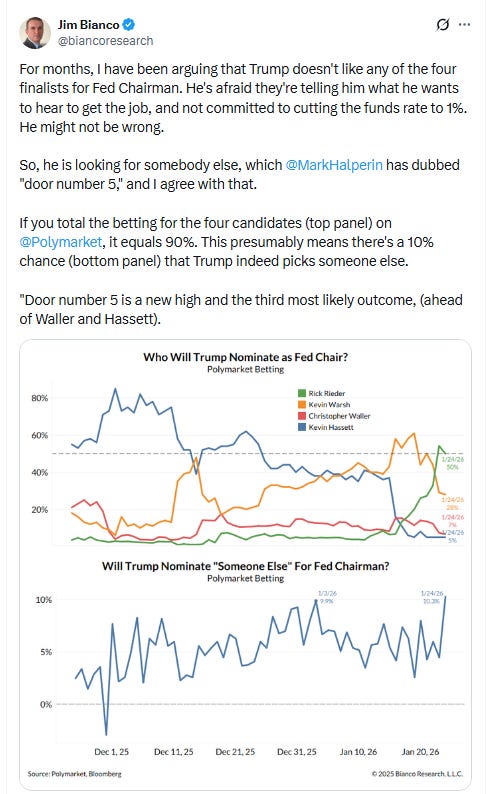

The biggest question for the Fed in 2026 will be the timing of its single projected rate cut, according to Stephen Kates at Bankrate. “I expect Chair Powell to remain tight-lipped about any definitive plans in order to preserve maximum flexibility for both the committee and his successor,” he said. “While concerns about the balance of risks between inflation and the labor market have eased slightly, achieving success on both fronts will still require careful judgment.” Meantime, ongoing tensions between the Fed and the White House elevate what might otherwise have been a quiet January meeting into a more sensational event, Kates noted.

Policymakers have signaled that easing may still be appropriate at some point later this year, although any action would remain dependent on how economic conditions evolve, according to Jason Pride and Michael Reynolds at Glenmede.

“The Fed’s dual mandate remains finely balanced,” they said. “Inflation has cooled substantially from its 2022 peak but still sits near the upper edge of what officials would likely view as price stability, while the unemployment rate has edged higher.” Taken together, the Fed, highly attuned to incoming data, is likely to keep rates unchanged over the next several meetings before adding one or two more cuts later in the year, they noted.

“Our base case remains that the Fed will remain on hold in coming months, with no additional cuts on the horizon,” said David Doyle at Macquarie Group.

A key risk to this view, Doyle noted, is the potential for an incoming Fed Chair to sway the committee in a more dovish direction. “However, we believe this risk is mitigated by a potential shift in the new Chair’s incentives once they assume the role,” he said.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

The tech-heavy Nasdaq was supported by jumps of about 3%, 2% and 1% in Apple, Meta Platforms and Microsoft, respectively, ahead of their earnings reports later in the week.

After the close, big US insurers including UnitedHealth Group Inc., CVS Health Corp. and Humana Inc. tumbled on a report the US will hold payments to private Medicare plans flat next year.

Companies making the biggest moves after-hours from CNBC.

None today.

Corporate Highlights from BBG:

Nvidia Corp., the dominant maker of artificial intelligence chips, invested an additional $2 billion in CoreWeave Inc. to help speed up an effort to add more than 5 gigawatts of AI computing capacity by 2030.

Nvidia is offering new open-source software and models designed to help governments and businesses more easily use artificial intelligence and complex data to build their own weather forecasting systems.

Microsoft Corp. is rolling out its second-generation artificial intelligence chip, the centerpiece of the company’s push to power its services more efficiently and provide an alternative to Nvidia Corp. hardware.

Apple Inc. unveiled an upgraded AirTag accessory, with the $29 item finder now offering longer range, a louder speaker and other improvements.

Oracle Corp. predicted that a massive data center it’s developing for OpenAI in New Mexico will create more jobs than previously announced, another example of tech companies trying promote positive impacts of server farms.

GameStop Corp. rallied after Michael Burry, the money manager made famous by The Big Short, wrote that he has been buying the stock.

Goldman Sachs Group Inc. sold a $2.5 billion US investment-grade bond on Monday, less than two weeks after the firm’s $16 billion sale set a record for a Wall Street bank.

Merck & Co. is no longer in talks to acquire biotech firm Revolution Medicines Inc. after the two companies couldn’t agree on a price, the Wall Street Journal reported, citing people familiar with the matter.

Chevron Corp. has assembled its largest fleet of vessels in almost a year to ship Venezuelan crude, after the US moved to exert control over the country’s oil sector following the capture of leader Nicolas Maduro.

Baker Hughes Co., one of the world’s biggest oilfield contractors, said it plans to double its data center equipment order target to $3 billion over a three-year period, driven by surging demand for power to run artificial intelligence.

Apollo Global Management Inc. took a roughly $170 million hit after an asset-backed financing for Amazon brand aggregator Perch was wiped out, a rare stumble for a strategy touted as one of private credit’s safest and most promising.

USA Rare Earth Inc. signed a non-binding agreement with the Commerce Department for $1.6 billion in funding, the latest White House deal to boost production of rare-earth elements on domestic soil.

Quantum computing firm IonQ Inc. has agreed to buy SkyWater Technology Inc. in a cash-and-stock deal that values the chipmaker at about $1.8 billion.

Ryanair Holdings Plc slightly increased some key targets for the full fiscal year, disappointing those investors hoping for a more robust outlook and joining some major US carriers in projecting caution because of geopolitical tensions.

Airbus SE is preparing its employees for a turbulent year ahead as geopolitical tensions between the US and other countries hang over the start of 2026.

Volkswagen AG’s plans for a possible Audi factory in the US aren’t progressing as President Donald Trump’s tariffs weigh and talks for local incentives haven’t yielded results, Chief Executive Officer Oliver Blume told Handelsblatt.

The split between Pirelli & C. SpA’s two biggest investors widened when a proposal by China’s Sinochem Group aimed at addressing the tiremaker’s US regulatory risks was rejected by its top Italian owner.

Wizz Air Holdings Plc’s UK subsidiary applied for permission to fly to the US, months after the budget carrier’s plans to expand in the Middle East fell through.

Abu Dhabi National Oil Co. is increasing its stake in the Rio Grande LNG project in Texas as part of a strategy by the UAE to grow international gas assets and do more business with the US.

A Zijin Mining Group Co. subsidiary agreed to buy Allied Gold Corp., which owns gold mines in Africa, for C$5.5 billion ($4 billion) in the latest step in the Chinese company’s rapid growth.

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X

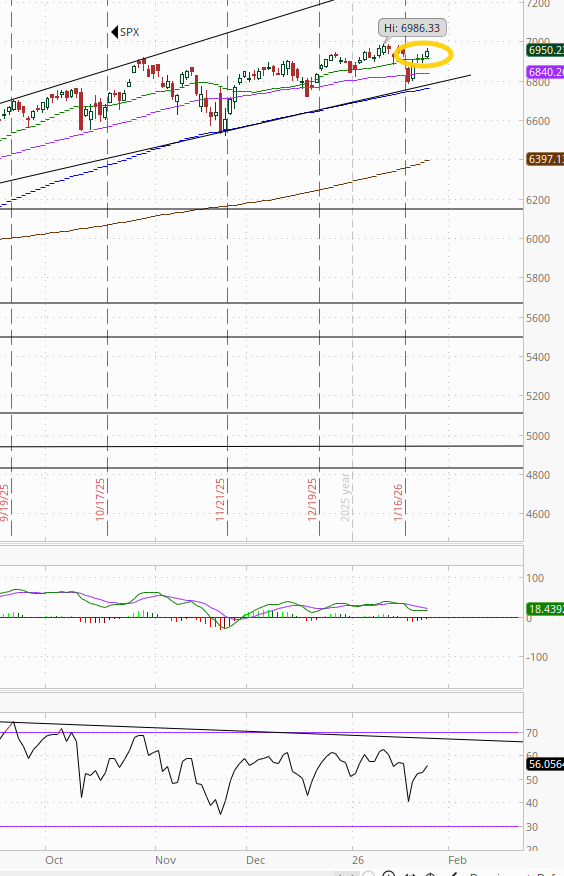

The SPX edged a little closer to its ATH with no other resistance in the way. The daily MACD remains in “sell longs” positioning while the RSI bounced from the weakest since Nov but continues to remain in divergence.

The Nasdaq Composite a similar story.

RUT (Russell 2000) remains the best chart of the bunch but increasingly less so with back-to-back losses. The MACD remains with a “go long signal,” but the RSI fell back to the least in a couple of weeks (I mentioned Thursday it had gotten to “levels that have seen the index stall out in the past year”).

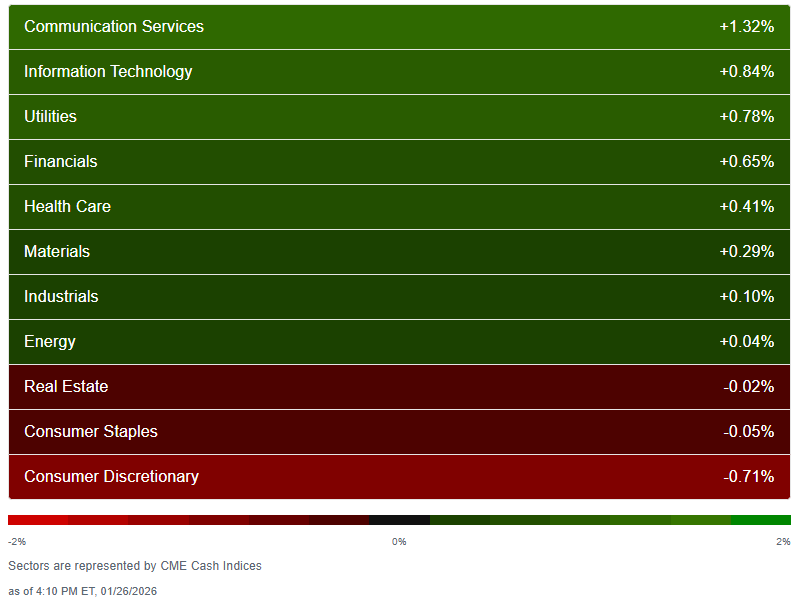

Despite the underperformance of small caps, sector breadth according to CME Cash Indices continued the solid run we've seen all year outside of Jan 20th and 7th (the only two days with less than 6 sectors higher) extending to 8 of 11 sectors in the green from 7 Fri.

Like Friday, indices were more tightly clustered than they had been earlier this year, with a top to bottom spread of 2% around what we saw Friday with only one sector finishing above 1% (after none Fri), and no sectors down that much (after one Friday).

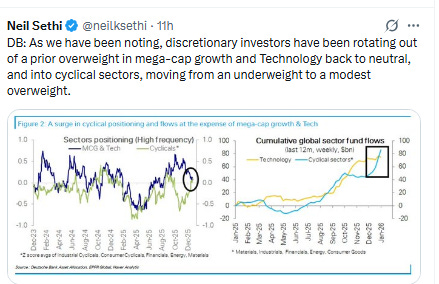

After having lagged all year until last Wed, the megacap growth sectors (Comm Services, Cons Discr, Tech) continued to overall look stronger (although Cons Discr sat out Monday finishing last -0.7%) with Comm Services and Tech leading (after all three finished at the top Thursday).

Much less red overall on the stock-by-stock flag from @finviz_com particularly in Financials, Utilities, and Tech.

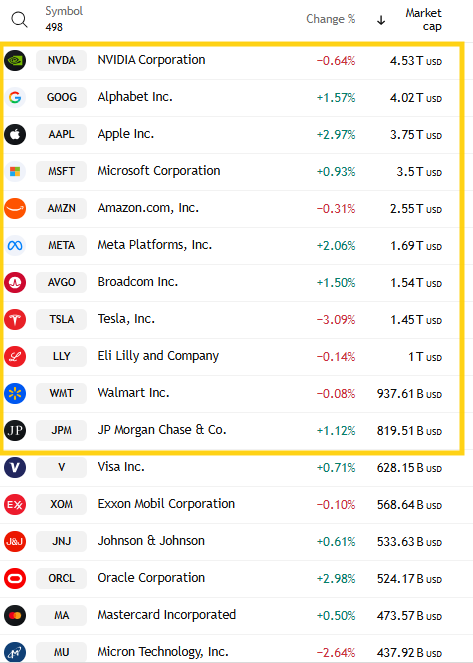

Six of the largest 11 SPX components were higher (from 4 Fri, 9 Thurs, 8 Wed, but 1 Tues) led by AAPL +3.0%. TSLA led to the downside -3.1%, the only of them down more than -0.65%.

Mag-7 was +0.5% after finishing last week +1.1%.

12 SPX components were up 3% or more (after 10 Fri, 20 Thurs, 100 Wed, 8 Tues), led by Arista Networks ANET +5.4%.

4 of those 12 up 3% or more were >$100bn in market cap in ANET, CRWD, CSCO, APH (in descending order of percentage gains). ORCL & AAPL just missed (+2.98 & 2.97% respectively).

12 SPX components down -3% or more (after 14 Fri, 13 Thurs/Wed, but 125 Tues, the most this year) led by The Trade Desk -7.5%, beating out Intel INTC who was down -5.7% after losing -17% Fri.

3 of the 12 down -3% or more were >$100bn in market cap in INTC, AMD, TSLA (in order of percentage losses).

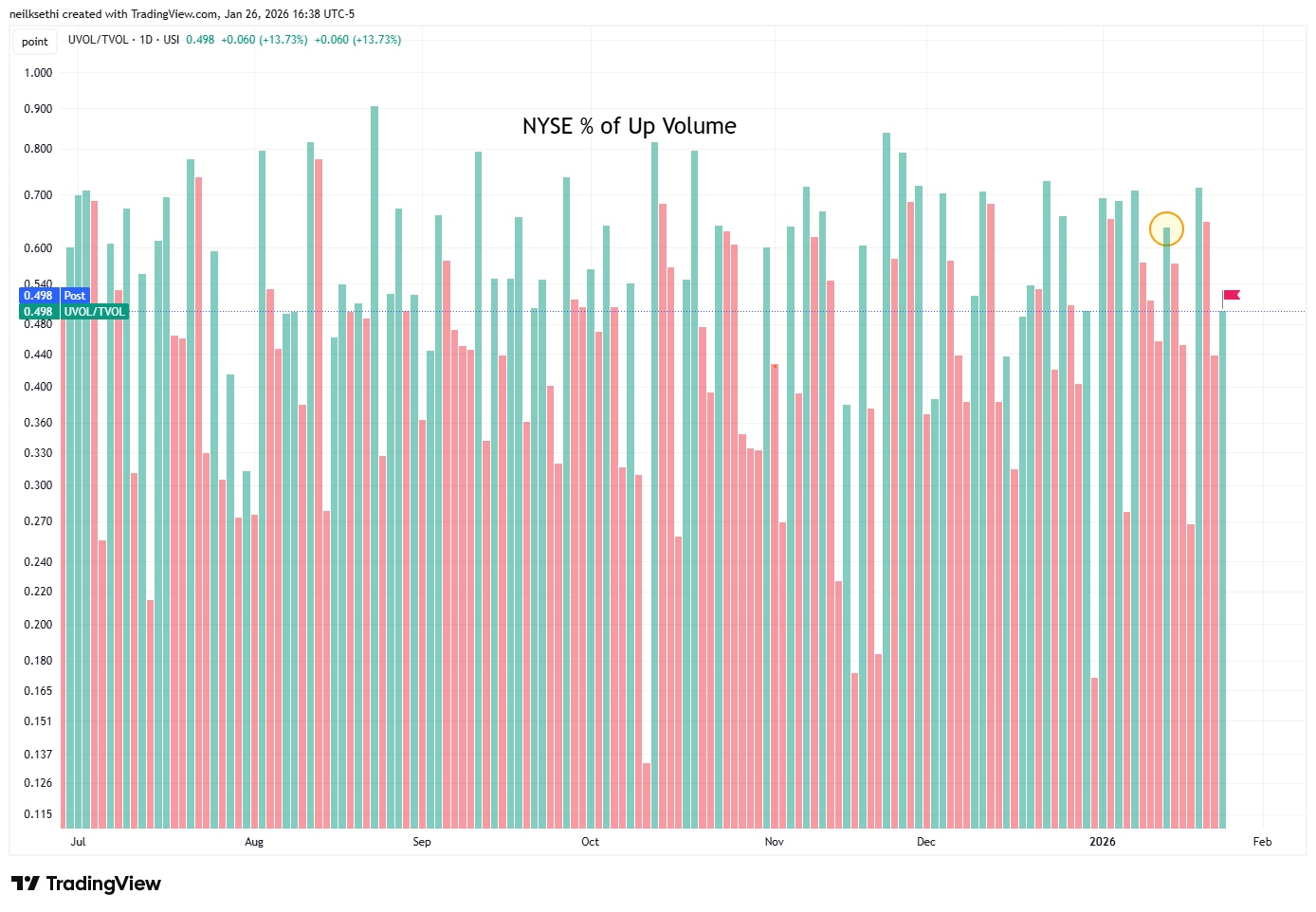

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) improved to 49.8% but that’s pretty weak given the +0.32% gain in the index. Compare to Jan 14th when it was an excellent 63.6% on a +0.29% gain (circle).

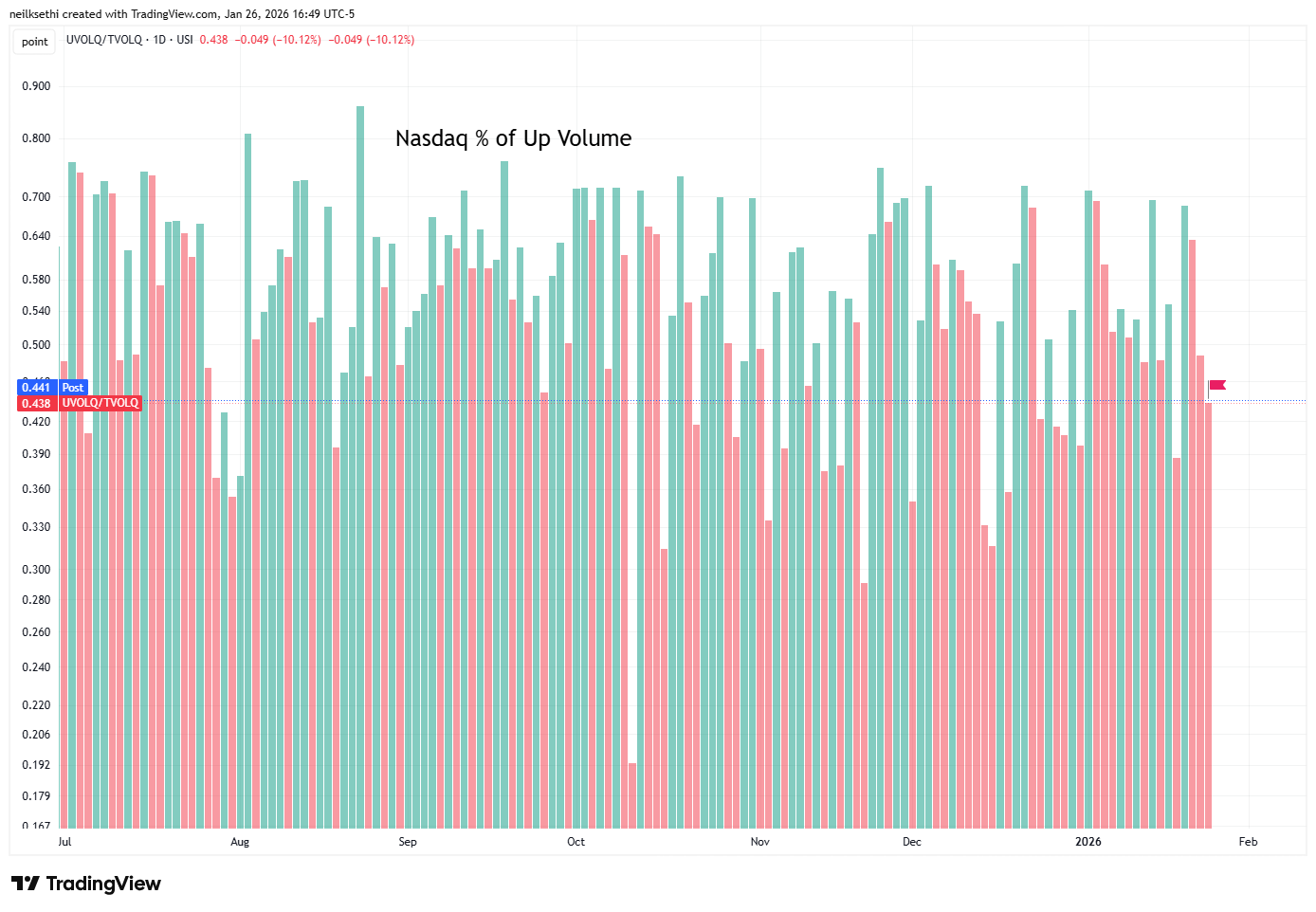

Nasdaq positive volume (% of total volume that was in advancing stocks) also was weak falling back to 44.1% from 48.5% Friday despite increasing its gain to +0.43% from +0.28% (with the usual caveat that positive volume on the Nasdaq is all over the place due to the speculative volumes).

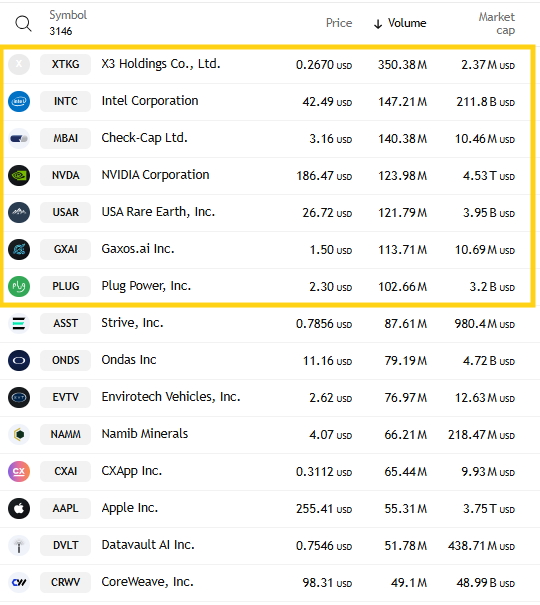

And in regard to those speculative volume on the Nasdaq, it doesn’t really explain the weaker positive volume this time as it remained similar to Friday with the top three stocks by volume at around 650mn, a touch above the 600mn Thurs, but down from 1bn the previous Friday (and 4bn Jan 14th).

There were another four stocks that traded over 100mn shares (down from five Fri but 10 the previous Friday) so speculative activity while still elevated remains less so than what we saw earlier in Jan.

Intel as a side note remained in the top 2 for a second day.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, were similar to positive volume at 47% on on the Nasdaq, 49% on the NYSE.

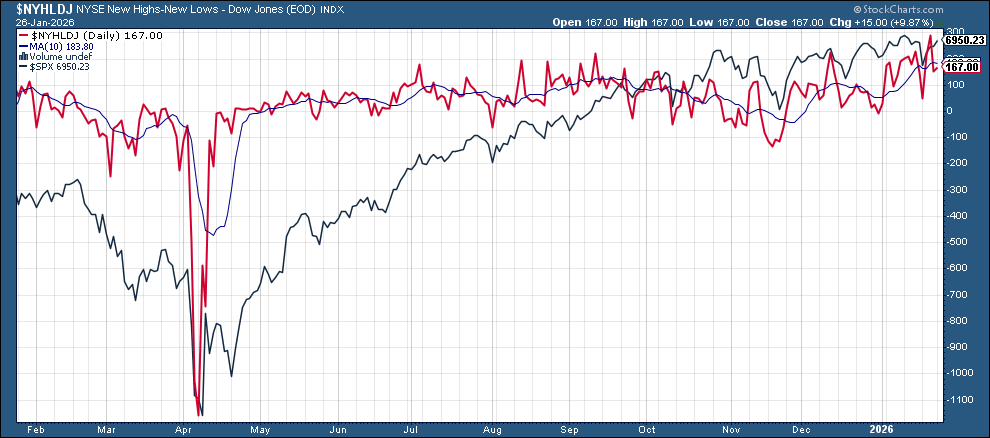

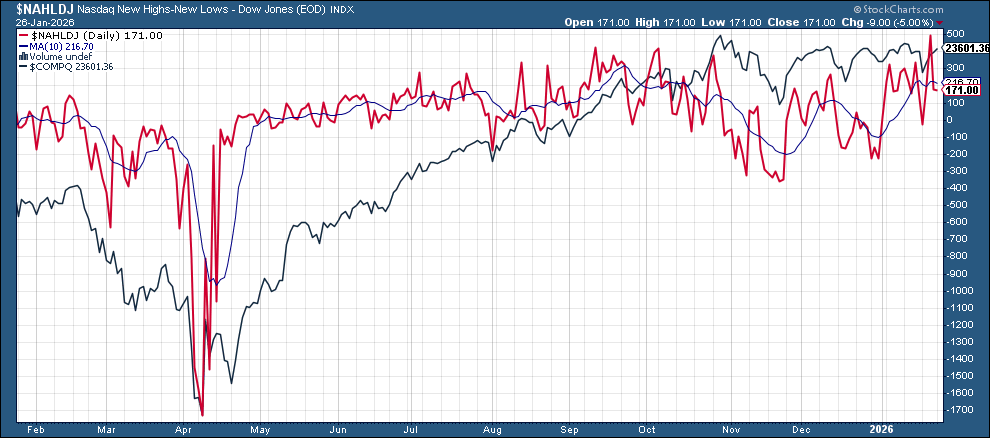

New 52-wk highs minus new 52-wk lows (red lines) were little changed at 167 on the NYSE (still down from 288 Thurs, the best since Nov ‘24 ), and 171 on the Nasdaq (down from 490 Thurs, also the best since Nov ‘24).

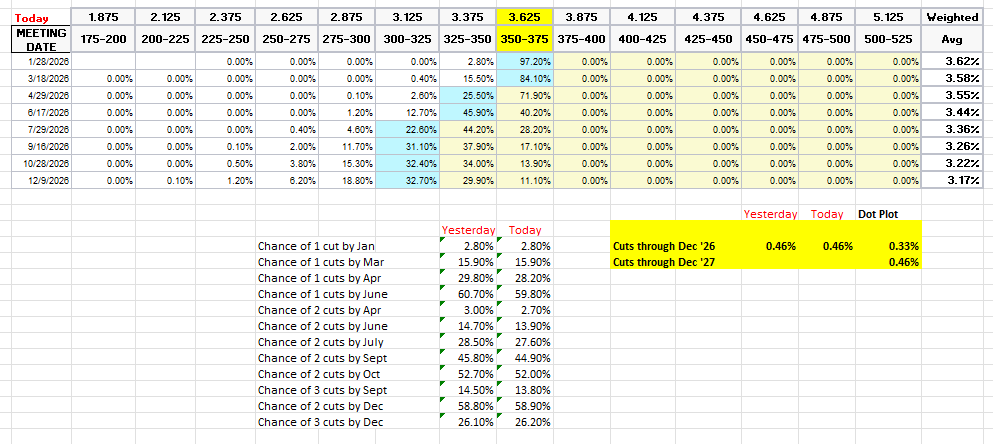

#FOMC 2026 rate cut pricing almost no change Monday just off the least since pricing for the Dec ‘26 contract was initiated (or at least as far back as the CME Fedwatch tool has been tracking it).

January remains at 2.8%, so off the table. March is 16% (from 51% Jan 6th), April 28% (from 63%), with the first cut in June (60%). A second cut is priced for Oct (52%, but as compared to a a 55% chance of a July cut on Jan 6th).

Pricing for 2026 remained at 46bps, with pricing for two cuts 59% and three cuts 26% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

The 10yr #UST yield fell back from the trendline from the Nov ‘24 highs for a fourth session and now through the 200-DMA ending at 4.21%. As I said Thurs “We’ll see if it breaks through that and returns to its old range or bounces to again test that major downtrend line.” So far looks like the former.

The 2yr yield, more sensitive to FOMC rate cut pricing, also was down for a second session from the highs of the year to 3.59% still over the top of the channel it had been in since the start of 2024 until breaking out two weeks ago. I hope it falls back in, because it was a really good channel.

It is -5bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for rate cuts, but now just one or two.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield., but I’m starting to get tempted.

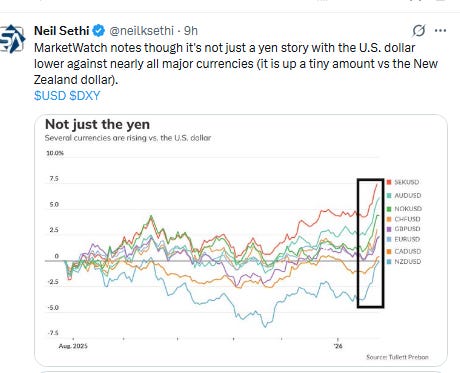

The weakening technicals I had noted Wednesday continued to point the way with the $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) dropping another -0.6% Monday (now down -1.7% the past three sessions a big move and the most since April), to the lowest close since Sept and now right on the decade+ uptrend line (I had asked Friday (“Test of the uptrend line coming?”). Now that we’re there, does it bounce?

The technicals are not favorable with the daily MACD now entering “go short” territory while the RSI has fallen to 30, the least since July.

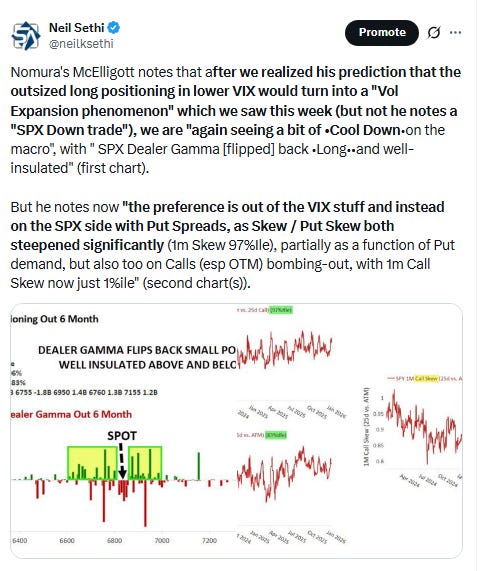

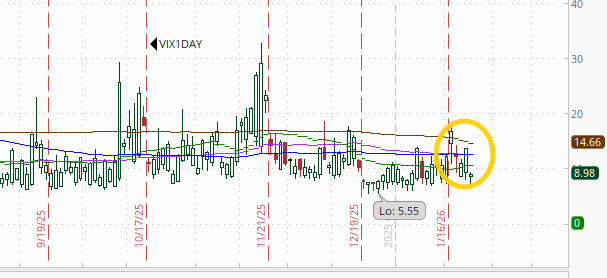

VIX little changed at 16.1. That level is consistent w/~1.01% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) edged lower to 99.8. The current level is consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is the level flagged by Charlie McElligott as one to watch.

With the weekend behind us and no major catalysts Tuesday, the 1-Day VIX fell back to 9.0. That reading implies a ~0.56% move in the SPX next session.

WTI futures took a stab higher after finishing Fri at the highest close since Oct 27th but fell back. Daily MACD remains in “go long” positioning while the RSI is now close to 60. As I mentioned Friday, “still lots of resistance overhead.”

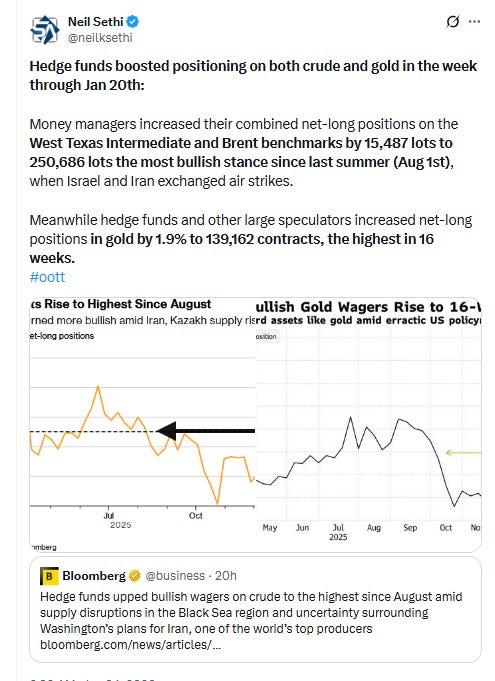

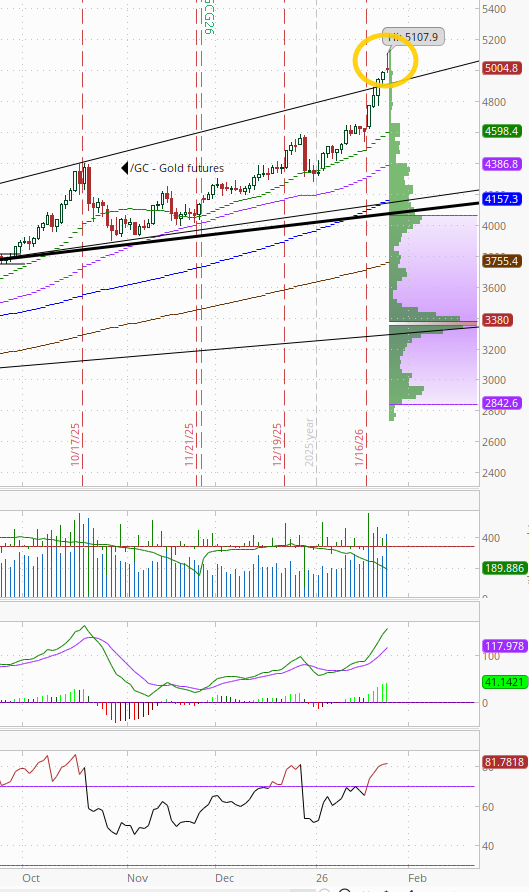

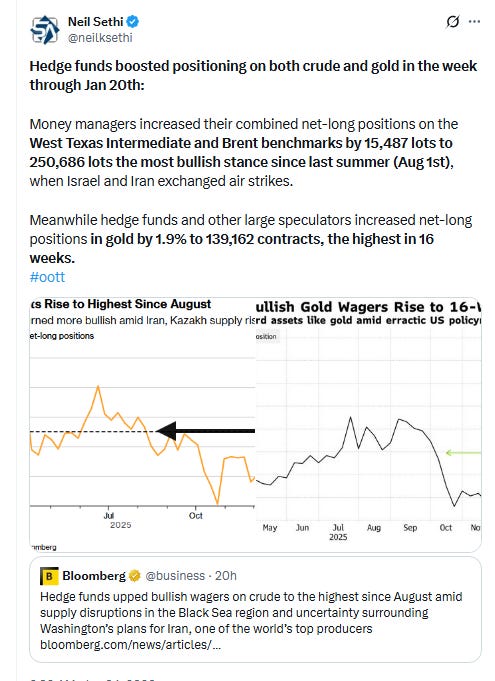

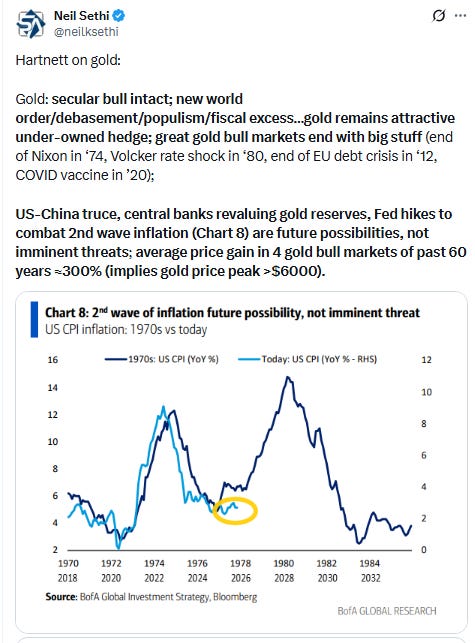

Gold hit another record but it gave up most of the gains. It still ended up over $5,000 for the first time following on from one of the best weekly performances since the GFC (it was the best for the GLD gold ETF). Daily MACD remains in “go long” positioning, but the RSI is now over 80.

Given how extended it is and the “shooting star” candle, I would say it could be setting up for a reversal, but c’mon, this is gold we’re talking about.

US copper futures (/HG) similar to gold started higher before reversing, but in the case of copper finishing lower. As noted two weeks ago “the daily MACD has crossed to ‘sell longs’ positioning while the RSI has fallen to the least since Nov, so we’ll see if a deeper pullback is in the cards.” As I said Friday, “those remain issues for now, so jury is still out,” but like gold it feels like it’s going to be tough to really dent the rally.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

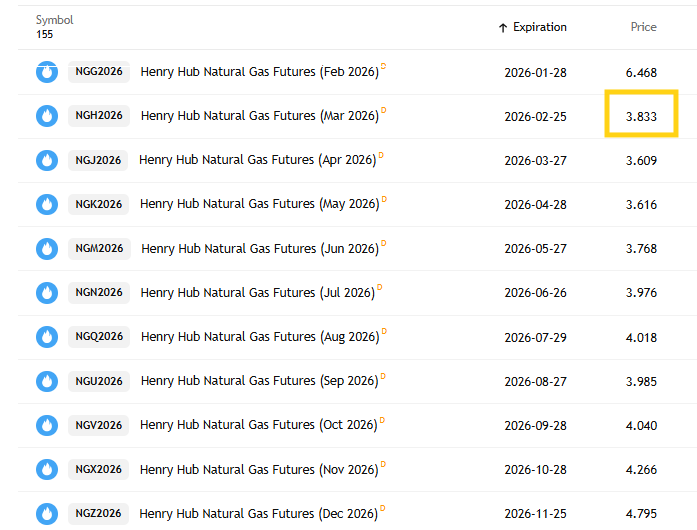

Natural gas has entered “ludicrous mode” with futures (/NG) jumping over $2 during the session (~40%) before cutting that in half still taking the gains over the past five sessions well over 100%. To a (very) large extent though this is a function of the Feb contract not yet rolling but being within a couple of days of expiration (Wed) meaning liquidity is increasingly thin.

In that regard, note that the March contract (which it will roll to this week is way down at $3.83, a 41% drop from current levels. Given that, I’m not going to bother looking at the technicals until we get the roll and some stabilization.

Bitcoin futures fell to the lows of the year as they continue to sit out the party. I noted Wed “has a good deal of resistance above.” The daily MACD as mentioned Tues flipped to “sell longs” positioning, and is now “go short,” while the RSI approaches 40.

The Day Ahead

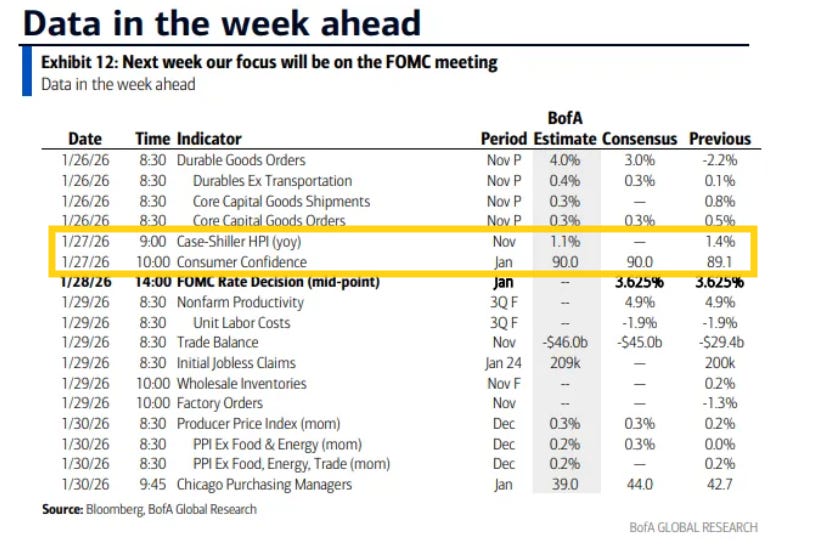

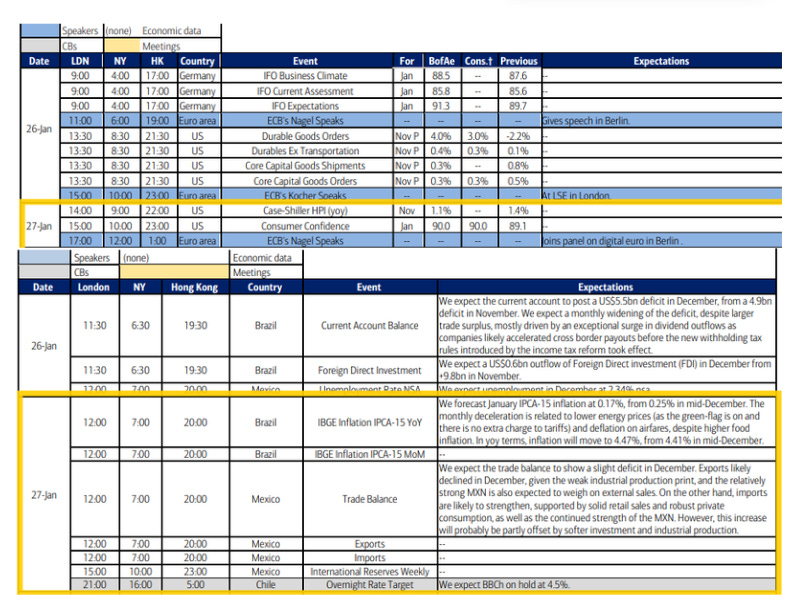

As noted in the Week Ahead, it’s a relatively light week (in terms of importance) for US economic data. Tuesday will bring us the Conference Board Jan consumer confidence report, the Nov repeat sale home price reports (S&P/FHFA), a couple of regional Fed PMIs, and the ADP weekly report.

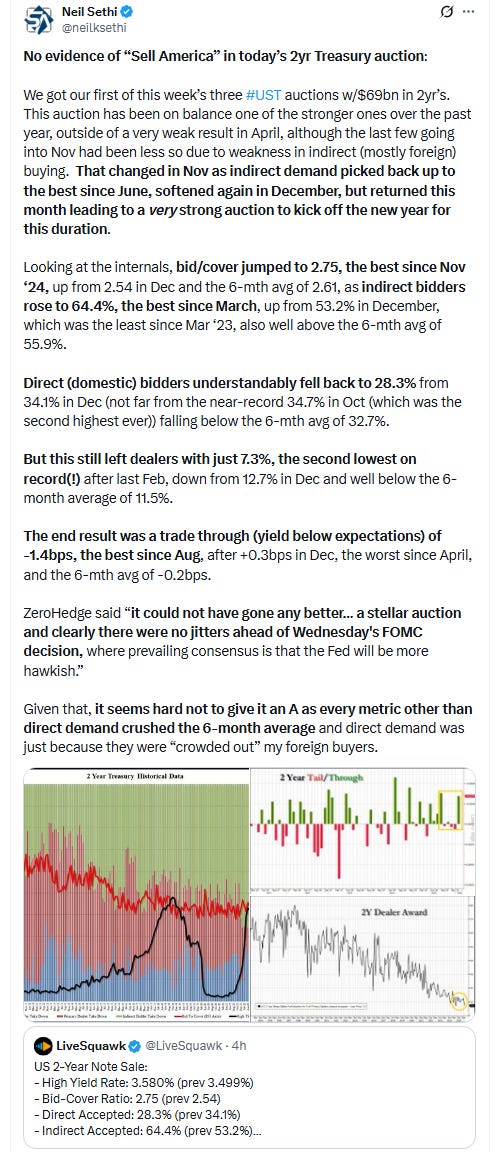

One more day until the Fed, but we will get another Treasury auctions in the 5-yr after today’s stellar 2-yr auction.

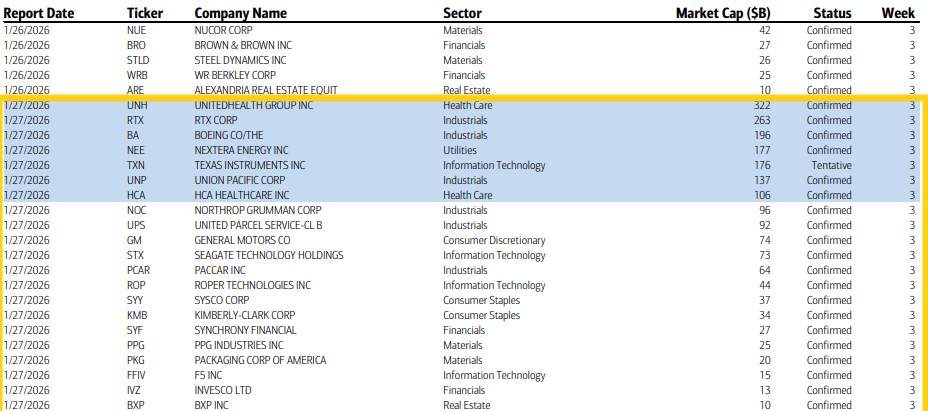

SPX earnings pick up with ~25 SPX components reporting. No Mag-7 yet, but seven are >$100bn in market cap in UNH, RTX, BA, NEE, TXN, UNP, HCA (in descending order by market cap).

Ex-US a lighter day before things pick up Wednesday with highlights UK BRC shop prices, Australia confidence, a policy decision in Chile, China industrial profits, Mexico trade balance, Brazil inflation

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,