Markets Update - 1/27/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

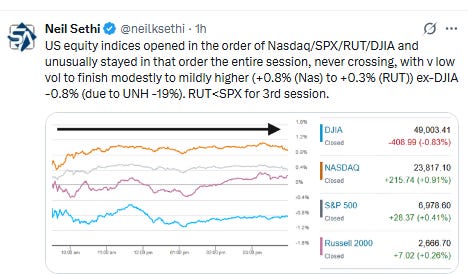

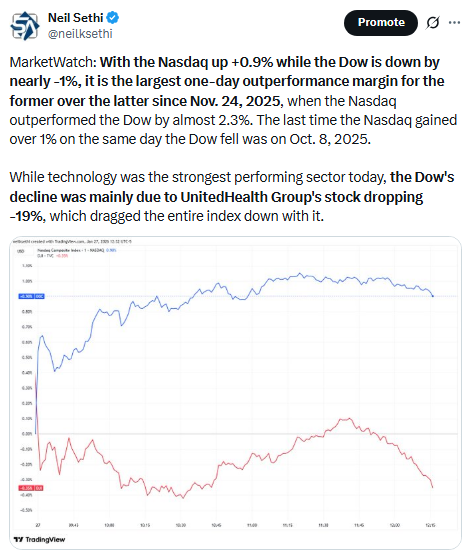

US equity indices opened today’s session trading modestly higher at the large cap level led by the Nasdaq on the back of more Tech outperformance (particularly semiconductors (software would be weak), while the Russell 2000 was working on a third consecutive day of underperformance which followed the longest streak of outperformance since 1996 (14 sessions). Apple, Meta Platforms and Microsoft were higher by more than 1%, 0.2% and 0.6% respectively and Micron Technology over 4%, and all would build on those initial gains.

On the downside, shares of several big-name health insurers were among the laggards Tuesday, plunging after the Centers for Medicare & Medicaid Services proposed raising payments to Medicare Advantage insurers by a net average of just 0.09% in 2027 versus expectations for 4-6%. Shares of Humana slid 15%, while CVS Health lost 11%. UnitedHealth shed 14%. Those would also continue to lose ground throughout the session the latter of which dragged the DJIA down to the bottom of the index list.

Indices would unusually stay in that initial order the entire session, never crossing, on a day with very low volatility as they shrugged off a consumer confidence report which came in the least since May 2014, with all but the DJIA ending modestly to mildly higher (+0.8% (Nas) to +0.3% (RUT)). The DJIA was -0.8%, while the SPX was +0.4%, enough for a new all-time high.

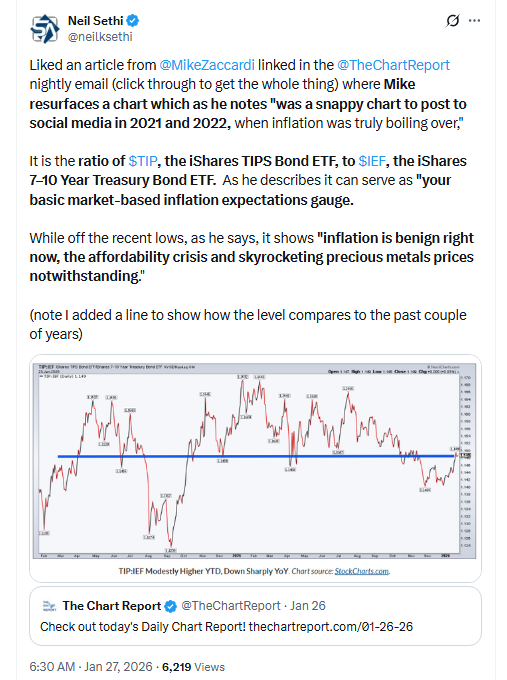

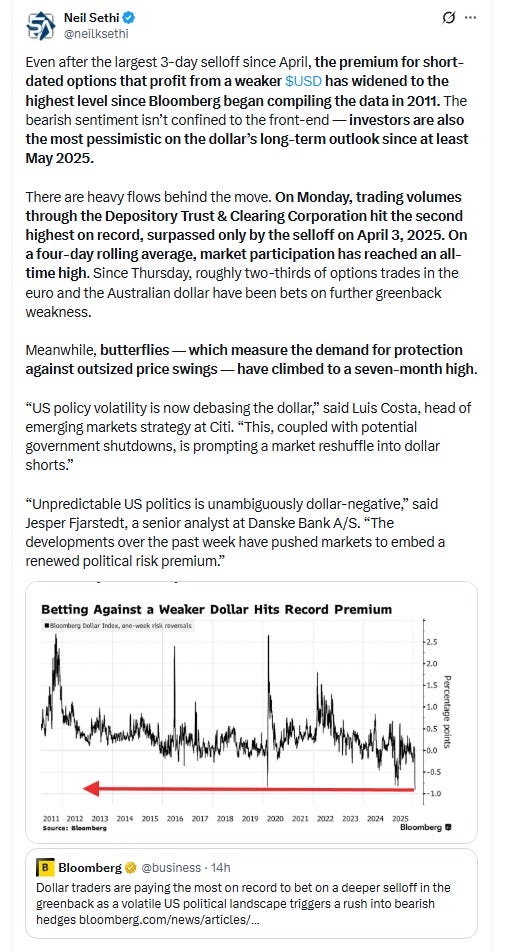

Elsewhere, bond yields were mixed but little changed overall, but the dollar continued its abrupt fall (the worst since April) to a 3-year low. Natgas remained volatile but ended little changed, while gold surged higher as did crude, the latter to the highest since Sept. Copper and bitcoin were also higher

The market-cap weighted S&P 500 (SPX) was +0.4%, the equal weighted S&P 500 index (SPXEW) -0.2%, Nasdaq Composite +0.9% (and the top 100 Nasdaq stocks (NDX) +0.9%), the SOXX semiconductor index +2.4%, and the Russell 2000 (RUT) +0.3%.

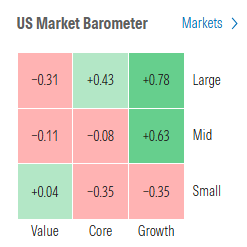

Morningstar style box again more mixed recently but again a clear winner was large cap growth.

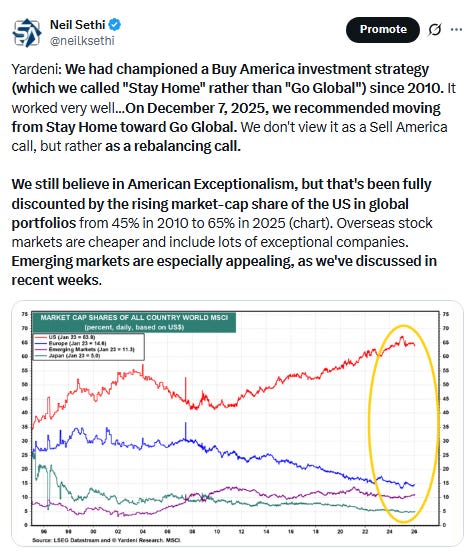

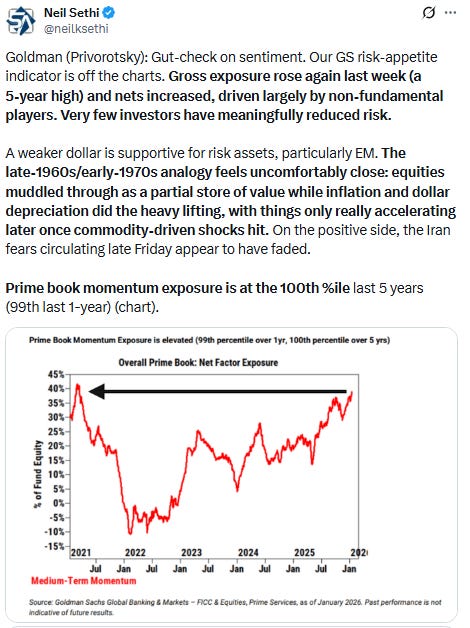

Market commentary (note almost all were before Trump took tariff threat completely off the table):

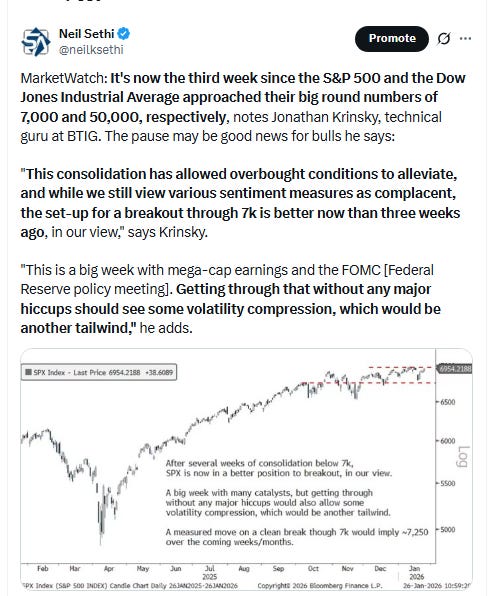

Jonathan Krinsky, BTIG’s chief market technician, writes that this is the third week since the S&P 500 and Dow approached the 7,000 and 50,0000 milestones, respectively, before pulling back. “This consolidation has allowed overbought conditions to alleviate, and while we still view various sentiment measures as complacent, the setup for a breakout through 7k is better now than three weeks ago, in our view,” Krinsky writes.“Getting through that without any major hiccups should see some volatility compression, which would be another tailwind,” Krinsky writes.

“Geopolitical shocks are very hard to price, but if the first month of 2026 has shown anything, it is that they are abundant. At the same time, it’s difficult to reduce exposure to risk assets, with fiscal and monetary easing still in the pipeline, feeding into already resilient growth. Against that backdrop, investors are understandably searching for an ‘everything hedge.’” — Skylar Montgomery Koning, macro strategist.

“Top of mind is earnings season. We got 200 companies reporting in the next two weeks and so far, so good,” said Adam Parker, founder and CEO of Trivariate Research. “I think the real issue is that the second half of the year estimates are way too high. And so the question is can we keep the momentum here through April guidance? I think yes.”

“Everybody is watching anything that gives you insight into the [artificial intelligence] narrative,” said Thomas Martin, senior portfolio manager at Globalt Investments, adding that investors will be focused on the companies’ capital spending levels and anything related to the monetization of AI. “It’s all going to be about commentary about that in addition to the amount of money that they’re spending, both on the capex line and the opex line.”

“AI isn’t going away,” he said. “Building of data centers isn’t going away. The usage of it, the usage of the models, the advent of agents, robotics, etc. — all that stuff is just going to continue its trajectory of discovery.”“It’s going to be backwards and forwards, but we expect it to be with a positive bias,” Martin said about AI’s market impact.

Ahead of earnings from a handful of “Magnificent Seven” stocks, SWBC chief investment officer Chris Brigati said he expects Big Tech to continue to lead the market. “Big Tech has been riding at the top of the valuation range for months, and earnings expectations have been just as elevated, yet the sector keeps powering higher,” Brigati wrote in an email. “Until a more significant macro or regulatory shock forces a reset, earnings momentum is likely to stay elevated and Big Tech will continue to lead the market narrative.” He said that investors should “stay constructive on near‑term growth while remaining realistic that the current pace will eventually cool.”

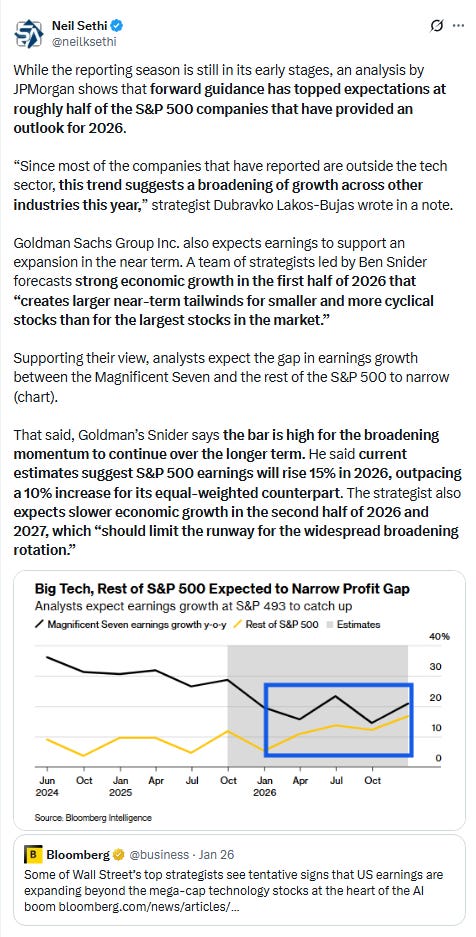

“While short-term volatility is likely, we maintain our overall positive view toward risk assets,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “Maintaining a diversified portfolio will help investors navigate markets with greater confidence.” With about a third of S&P 500 companies by market capitalization reporting results this week, she bets robust figures should boost sentiment and continue to underpin equity performance. “We expect tech earnings to be strong,” Hoffmann-Burchardi noted. “But we also expect earnings growth to broaden across sectors, with cyclical areas of the economy poised to benefit from supportive fiscal and monetary policies.”

At HSBC, Max Kettner says expectations for S&P 500 fourth-quarter results are still “way too low.” “So ahead of this week’s pivotal earnings releases, we think it makes sense to rotate from the rates-sensitive high-beta sectors back to megacaps,” he noted.

“Double beats are being punished for solid results,” Chris Senyek at Wolfe Research said. “We do not view this trend as sustainable through earnings season and expect double beats to exhibit positive price action as more companies report.” With several “Magnificent Seven” companies set to report this week, Senyek expects solid results from the space and positive price action luring investors back.

With the economy still displaying exceptional strength, the Fed’s messaging is likely to emphasize a data‑driven approach to future policy decisions, according to Chris Brigati at SWBC. Meantime, he said the tone from this week’s Magnificent Seven earnings should be solid, and upward revisions from analysts signal confidence is building. “This week is pivotal in setting the market’s near‑term tone as 2026 progresses,” Brigati noted. “History shows that a strong January often frames the narrative for the rest of the year, with investor psychology playing an outsized role.”

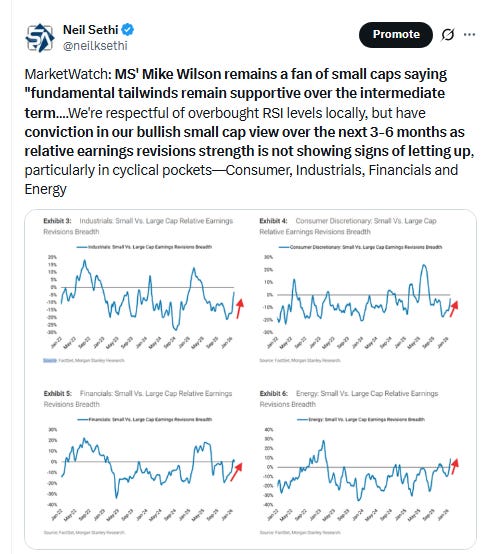

Amid persistent debate around an AI bubble, Ari Wald at Oppenheimer & Co. highlights a more nuanced market dynamic: the widening gap between large-cap growth and the rest of the market has been driven less by excess in leadership and more by persistent underperformance among lagging benchmarks. Long-term rate-of-change measures for the Nasdaq 100 remain well below late-1990s extremes, underscoring how steady – not speculative – the index’s advance has been, he said. By contrast, comparable momentum measures for small caps sit near the lower end of their historical range. “This divergence argues that a reversal in the internal spread is more likely to come via catch-up – broader participation – rather than catch-down via a market-wide unwind,” Wald concluded.

“Despite valuations being stretched, in particular in the US, I think investors are going into earnings season with quite high expectations,” said Louise Dudley, portfolio manager at Federated Hermes. “Companies that do fall short are likely to be punished fairly severely, kind of double-digit moves, even if it is not that bad.”

“In the US, while very elevated valuations and the dollar weakness make us more cautious than in Europe, there’s possibly still one or two interest-rate cuts lined up for this year,” said Laurent Chaudeurge, an investment committee member at BDL Capital Management in Paris. “Investors are still chasing the AI trade, and at the moment this is done through semiconductors.”

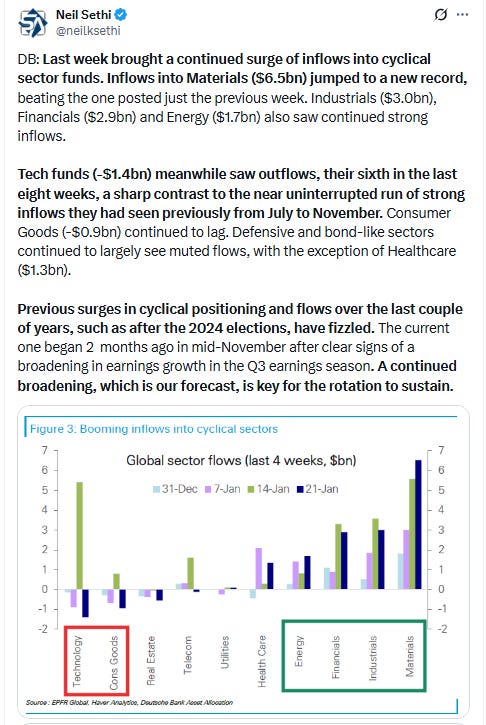

“Tech sector and Magnificent Seven leadership have stalled since the end of October, with investors embracing the call for broadening earnings growth,” Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, said in a Jan. 26 note to clients. “Consider preparing for new equity index leadership.”

“We still see healthy upside for U.S. equities. But we see a broader number of companies benefiting from current trends. As a result, market breadth looks poised to improve compared to the very low levels of the last three years,” David Lefkowitz, head of U.S. equities at UBS Global Wealth Management, wrote in a note. Because of this, UBS has upgraded its outlook on stocks in the consumer discretionary sector, saying they should benefit from fiscal stimulus.

“Given [today’s consumer confidence data], expect the unemployment rate to rise,” said Jeff Roach at LPL Financial. “This will weigh on retail sales in these coming months.”

On the surface, the latest consumer confidence report looks like a “red flag,” but for investors, the signal is more nuanced, according to Lale Akoner at eToro. “This kind of confidence slump tends to slow discretionary spending rather than trigger a full economic downturn,” Akoner said. “If inflation continues to cool and growth softens gradually, rate cuts later in the year or into 2026 become more likely.” That backdrop is typically supportive for long-duration assets like equities and bonds, even if volatility persists in the short term, Akoner noted.

With inflation sticky but not accelerating, the labor market cooling without collapsing, and fiscal stimulus set to support growth in early 2026, policy rates likely need to return to neutral — but not below, according to Seema Shah at Principal Asset Management. “With a leadership change approaching, the Fed is likely to place slightly more emphasis on the employment side of its dual mandate,” she said. “We expect two Fed cuts in 2026, taking rates close to neutral. Timing will be data-dependent, but a rising unemployment rate could prompt the cuts to be brought forward.”

While Fed Chair Jerome Powell will likely emphasize a cautious, data-driven approach, key insights into the central bank’s outlook on growth and inflation will be closely watched, according to Kezia Samuel at AssetMark. “Amid fading tariff pressures, an ongoing drop in shelter inflation, and a sluggish labor market, we anticipate the Federal Reserve will resume its easing cycle in 2026, most likely by implementing one or two 25-basis-point interest rate cuts,” Samuel said.

This is a very “boring” Fed meeting during very interesting times, according to Christian Hoffmann at Thornburg Investment Management. That’s not to say that fixed income markets won’t be volatile with lots of catalysts in the background with issues on the geopolitical front, the Japanese bond market, and the talk about a successor to Powell creating uncertainty, he noted. “Looking at the playing field today two to three rate cuts seems very reasonable, but the picture and the backdrop can evolve very quickly,” said Hoffmann.

There is now a higher burden to justify cuts, and while Powell is likely to sound non-committal around near term rate reductions, he may highlight that the median official still looks for easing this year, according to TD Securities strategists. “With cut pricing falling, investors will focus on any updated guidance,” they said. While the meeting is unlikely to be a big driver of the dollar, “our bias remains to sell into any USD rallies.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

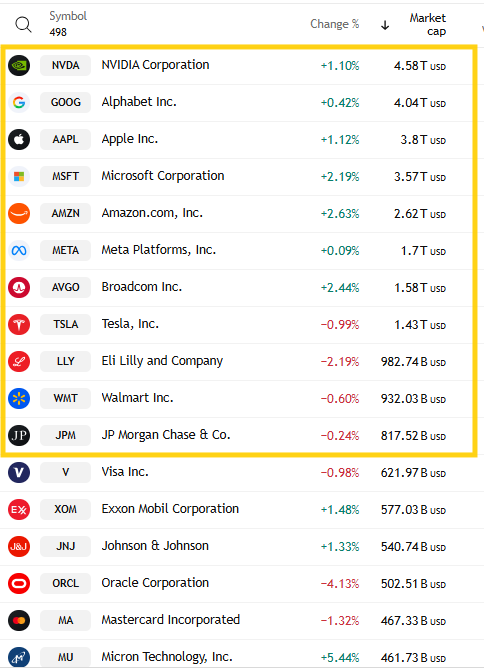

Apple advanced more than 1%, while Microsoft rose more than 2%. More than 90 S&P 500 will have reported earnings by the end of the week. Meta Platforms and Microsoft, as well as fellow “Magnificent Seven” giant Tesla, are all due Wednesday. Apple will share its results on Thursday.

Shares of several big-name health insurers were among the laggards Tuesday, plunging after the Centers for Medicare & Medicaid Services proposed raising payments to Medicare Advantage insurers by a net average of just 0.09% in 2027. Shares of Humana slid 21%, while CVS Health lost 14%.

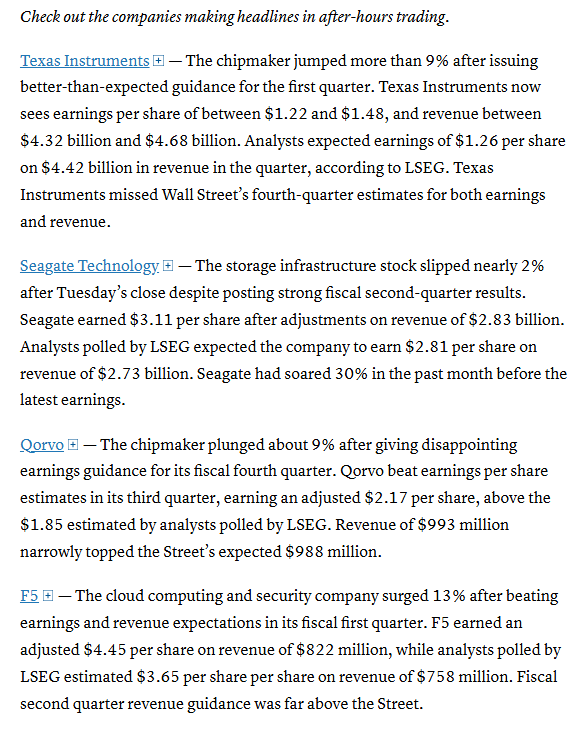

In late hours, Texas Instruments Inc. gave a strong outlook.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

United Parcel Service Inc. forecast full-year sales above Wall Street’s expectations as it forges ahead with plans to cut less-profitable package volume out of its network.

UPS expects to cut as many as 30,000 positions this year, part of an ongoing effort by the package-delivery giant to rein in costs and boost profitability.

UnitedHealth Group Inc. forecast a decline in 2026 revenue, the first annual contraction in more than three decades, as the insurer falters in its attempt to rebuild confidence with investors after a stunning fall last year.

Boeing Co. generated cash for a second straight quarter and reported a 57% bump in sales during the final three months of 2025, as the US planemaker continues its recovery and benefits from surging orders.

Boeing aims to deliver 500 of its 737 family jets this year as it ramps up production, and it won’t be able to rely on a stockpile of previously built Max models to bolster its results, executives said.

American Airlines Group Inc. said it’s poised for a strong year as the carrier ramps up premium offerings, but first it’s trying to survive winter weather that’s prompting thousands of cancellations at major US hubs.

American Airlines reported fourth-quarter results that missed analyst estimates.

JetBlue Airways Corp. reported a wider loss than expected last quarter, capping a bruising 2025 as the US carrier hopes demand from higher-paying customers will fuel a return to profitability.

United Airlines Holdings Inc. is adding new routes and increasing flying from Chicago, escalating competition with American Airlines Group Inc. at one of the world’s busiest airports.

General Motors Co. expects profits to grow as much as $2 billion this year and plans to return more of that to shareholders with a higher dividend and buybacks, fueled by demand for its highest-margin vehicles.

Amazon.com Inc. is shuttering its Amazon-branded grocery stores and automated grab-and-go markets, eliminating two centerpieces of its push into physical retail.

RTX Corp.’s profit topped Wall Street estimates in the final months of last year, a sign of momentum as the aerospace and defense manufacturer awaits a potentially huge jump in US military spending.

RTX plans to continue paying dividends to investors after President Donald Trump attacked the company for sluggish weapons output and lavish shareholder returns.

Northrop Grumman Corp.’s fourth-quarter income rose 17% and the company reached a record backlog in orders as nations boost spending on weapons and space programs amid heightened global tensions.

FedEx Freight Holding Co. raised $3.7 billion in its debut investment-grade bond sale, ahead of its planned June 1 spinoff from FedEx Corp.

Kimberly-Clark Corp. reported profit that beat expectations as the maker of Huggies diapers and Scott paper towels captured more customers by cutting back on prices.

OpenAI is releasing a free tool aimed at making it easier for scientists to use ChatGPT to draft research papers and collaborate with colleagues, part of a larger effort to position its chatbot as an aide for scientific work and discoveries.

Google was handed a six-month European Union deadline to lift technical barriers to rival AI search assistants on Android and give key data to other search engine providers in the latest round of its Big Tech crackdown.

Micron Technology Inc. will invest an additional $24 billion in Singapore over the next decade to expand its manufacturing capabilities, part of a broader expansion effort during an AI-induced memory chip shortage.

Corning Inc. announced a multiyear, up to $6 billion agreement with Meta Platforms Inc. to supply optical fiber, cable, and connectivity solutions for Meta’s advanced data centers supporting its AI ambitions.

Cloudflare Inc. soared as analysts are upbeat about an increase in artificial-intelligence workloads and recent Clawdbot adoption.

Pinterest Inc. said it plans to cut “less than 15%” of its workforce and reduce office space as it shifts resources toward investing in artificial intelligence.

NextEra Energy Inc. is offering large amounts of power for sale from its nuclear plants in Wisconsin and New Hampshire, as major technology companies race to secure nuclear energy for artificial-intelligence data centers.

Lyft Inc. is working on offering its rideshare service to teenagers, catching up to an in-demand category that larger rival Uber Technologies Inc. first launched about three years ago.

HCA Healthcare Inc.’s better-than-expected guidance eased investor concerns about expiring Affordable Care Act subsidies.

Sysco Corp. said it expects to meet the high end of its full-year profit outlook on improving demand from customers.

Tether Holdings SA said it has launched a US-focused stablecoin, as the world’s largest issuer of dollar-pegged tokens prepares to return to crypto’s largest market.

Sonos Inc. introduced its first new device in over a year, marking the end of an intentional lull in product launches as the company prioritized improving its software and restoring the brand’s reputation under new Chief Executive Officer Tom Conrad.

UBS Group AG asked a US court to dismiss a suit filed by its ex-trader Tom Hayes that accuses the lender of handing him over on a “silver platter” to global prosecutors in order to protect the bank and its senior leadership during the Libor rigging scandal.

Sales at LVMH’s key fashion unit fell over the holiday season as the Louis Vuitton owner continued to suffer from sluggish demand.

Breitling AG’s chief executive officer expects the US to cut tariffs on Swiss watches, underscoring his bullishness on the private equity-backed firm’s biggest market even as Washington keeps the industry guessing.

France’s billionaire Pinault family agreed to sell its 29% stake in Puma SE to China’s Anta Sports Products Ltd., paring back its holdings beyond the luxury-goods industry as it focuses on a turnaround at the key Gucci brand.

Samsung Electronics Co. announced that its Galaxy Z TriFold, the first foldable phone of its kind to ship in the US, will sell for $2,899 and become available Jan. 30.

Mitsubishi UFJ Financial Group Inc. is considering issuing a significant risk transfer that’s designed to appeal to insurance companies, according to people familiar with the matter.

China Vanke Co. won more breathing room as it prepares what would be one of the country’s biggest-ever restructurings, after holders of two yuan bonds accepted the developer’s plan to delay the bulk of those payments by a year.

Billionaire Gautam Adani’s conglomerate and Brazil’s Embraer SA announced a partnership to build aircraft in India in what would be the country’s first manufacturing facility in civil aviation.

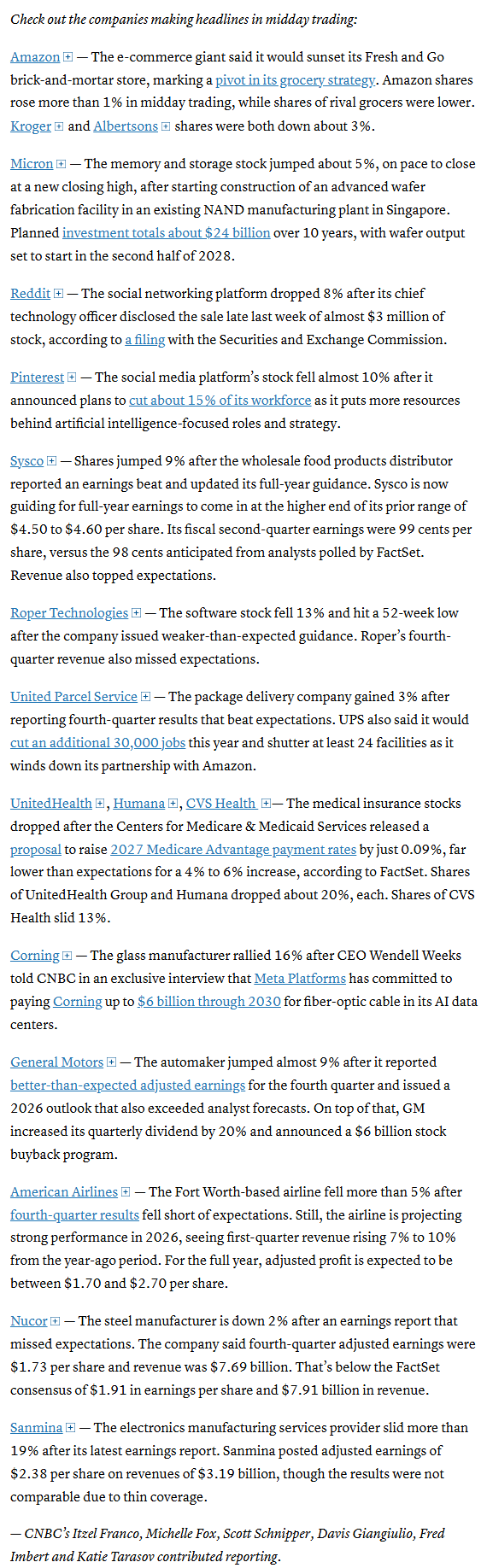

Mid-day movers from CNBC:

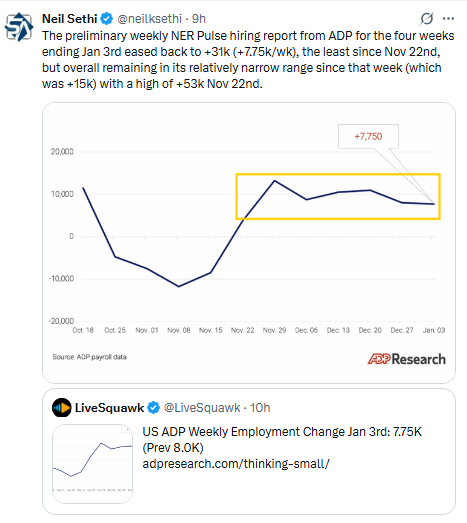

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X

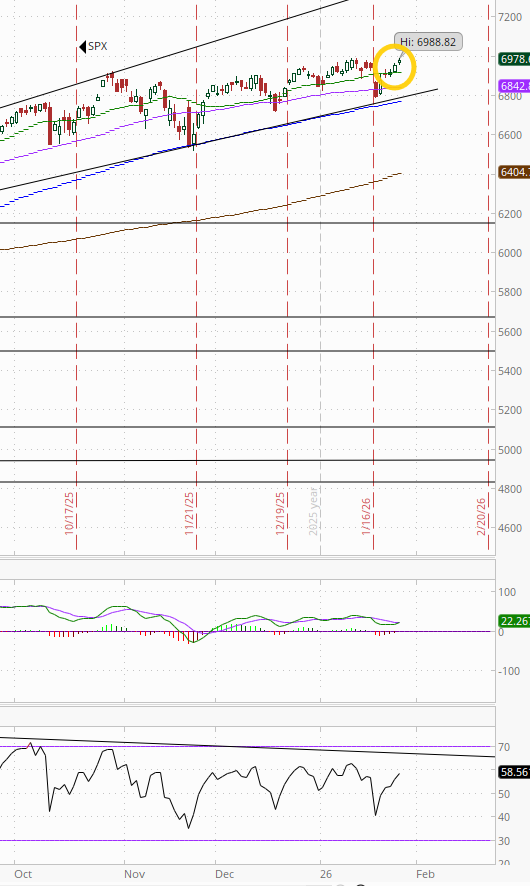

The SPX did make a new all-time high. The daily MACD remains in “sell longs” positioning but is close to crossing more positively while the RSI continues its bounce from the weakest since Nov but for now continues to remain in divergence.

The Nasdaq Composite is just below its all-time high. It did though get a MACD crossover to “go long” positioning, and its RSI is close to breaking out.

RUT (Russell 2000) no longer the best chart of the bunch, but not a terrible one either. The MACD though is close to crossing more negatively while the is least in a few of weeks (I mentioned Thursday it had gotten to “levels that have seen the index stall out in the past year”).

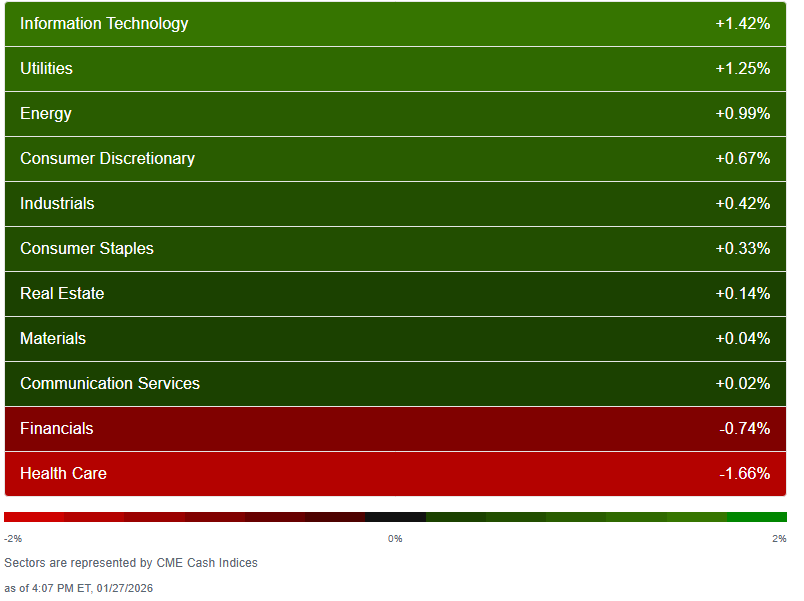

Sector breadth according to CME Cash Indices continued the solid run we've seen all year outside of Jan 20th and 7th (the only two days with less than 6 sectors higher) extending to 9 of 11 sectors in the green from 8 Mon, 7 Fri.

Indices more distributed today with a top to bottom spread of 3.1% after 2% the last two sessions with three sectors finishing 1% or higher (after one Mon, none Fri), led by Tech (which has been in the top 3 for the past three sessions), Utilities, and Energy.

One sector down that much (after none Mon, one Friday) in Health Care -1.7% dragged lower by the destruction in insurers (UNH -20%, CVS/ELV -14%, HUM -21%, etc.). Financials were the other sector lower -0.7%.

A lot more red Tuesday in Financials, software, health insurers, and consumer names (ex-AMZN and packaged food/tobacco) on the stock-by-stock flag from @finviz_com but more green in semiconductors (bright green in fact) and Energy.

Seven of the largest 11 SPX components (actually the seven largest) were higher (from 6 Mon, 4 Fri, 9 Thurs) led by AMZN +2.6%. AVGO & MSFT also up over 2%. LLY led to the downside -2.2%, the only of them down more than -1%.

Mag-7 was +0.9%, now +1.4% for the week after finishing last week +1.1%.

23 SPX components were up 3% or more (after 12 Mon, 10 Fri, 20 Thurs, 100 Wed), led by Corning GLW +15.6%.

9 of those were >$100bn in market cap in HCA, LRCX, APH (again), MU, KLAC, AMAT, GEV, RTX, INTC (in descending order of percentage gains).

26 SPX components down -3% or more (after 12 Mon, 14 Fri, 13 Thurs/Wed, but 125 a week ago, the most this year) led by insurers who took the top 5 spots in terms of largest losses led by HUM -21%. UNH, ELV, CVS, CNC were next, all down at least -10% (and MOH was -8.4%).

Just 3 of the 26 down -3% or more were >$100bn in market cap in UNH, ORCL, NOW (in order of percentage losses). CVS was before it lost -14% today, now $91bn.

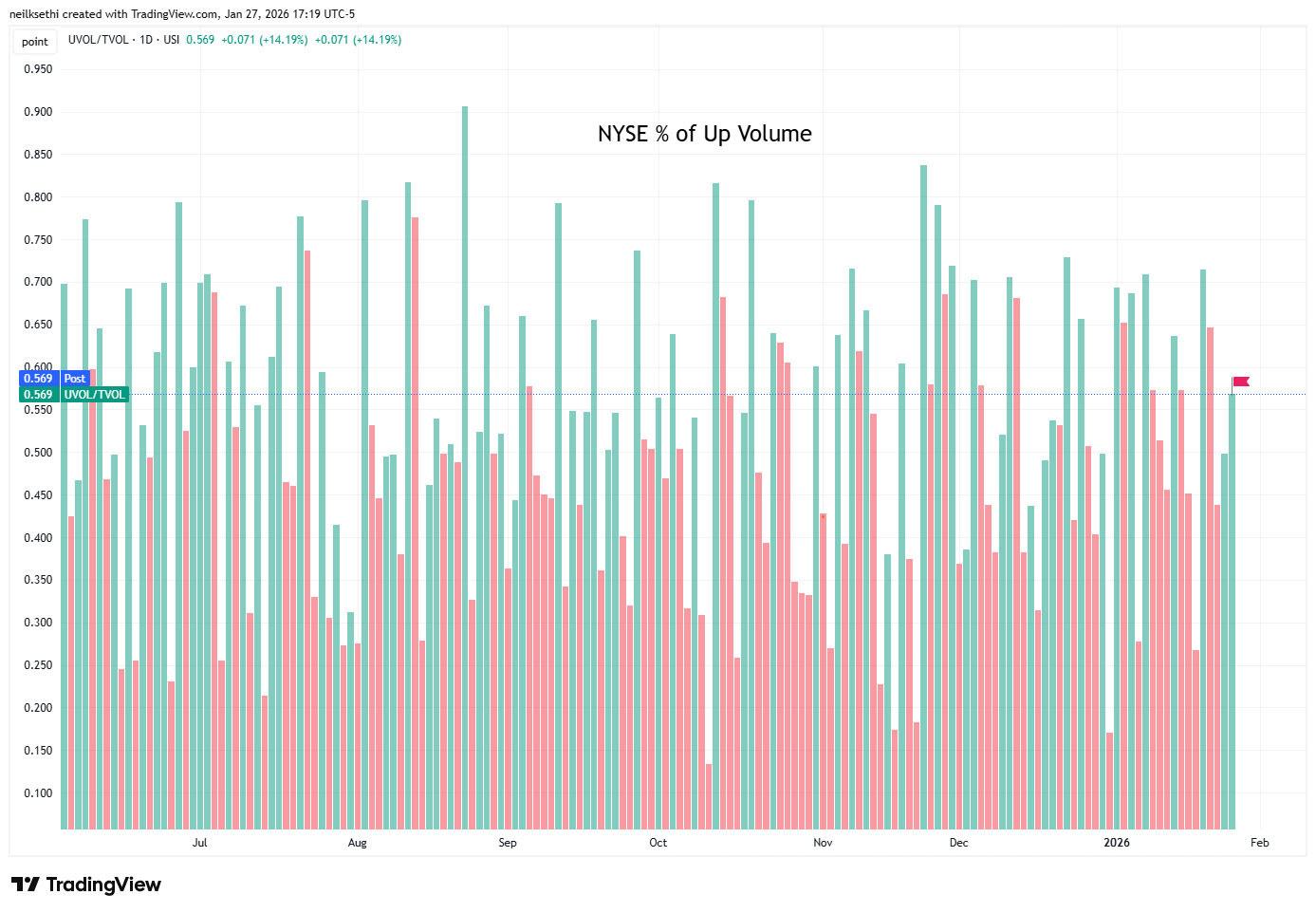

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) improved to 56.9% from 49.8% even as the gain in the index fell to +0.21% from +0.32% so definitely a better performance today.

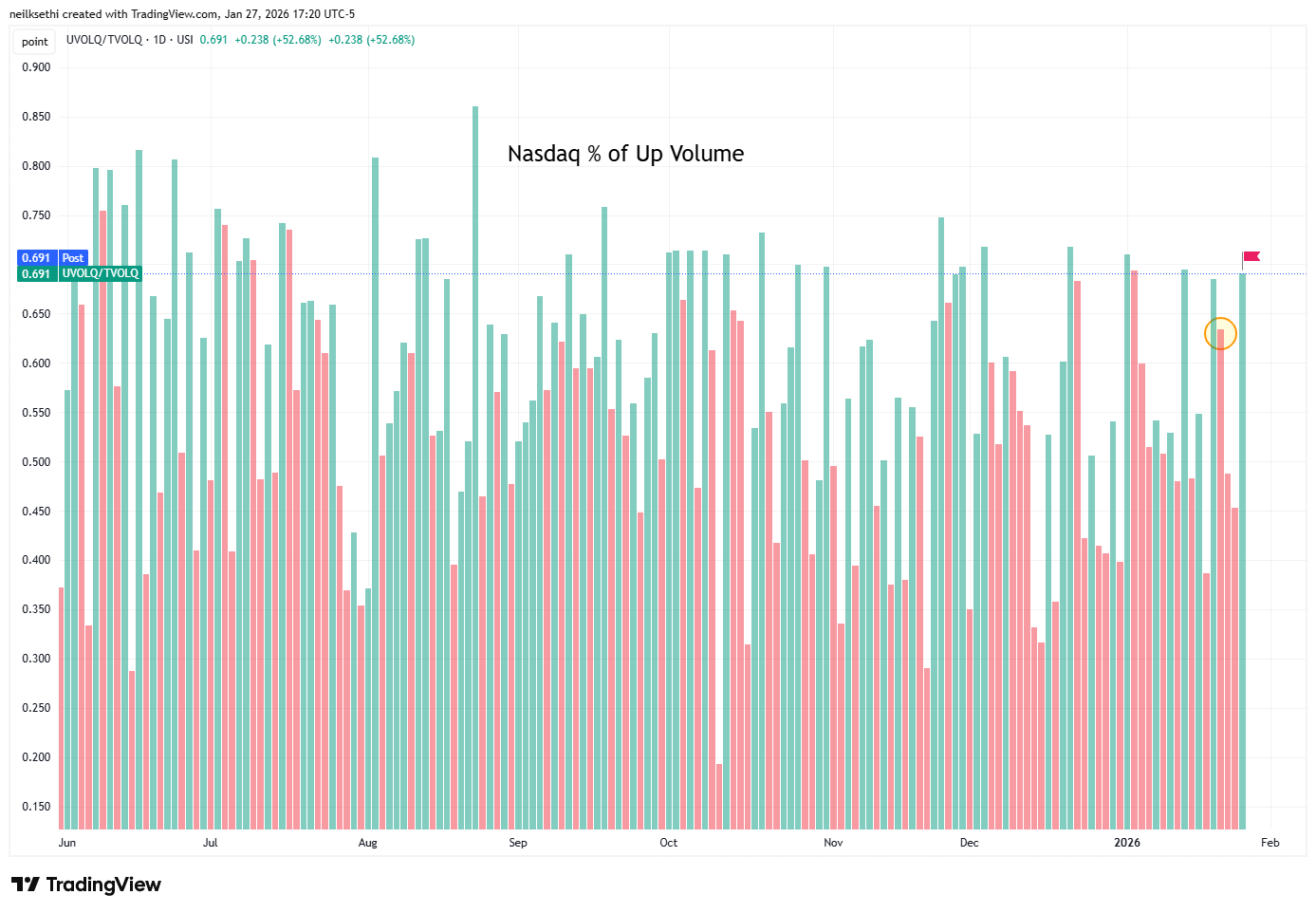

Nasdaq positive volume (% of total volume that was in advancing stocks) also improved to 69.1% although its gain also more than doubled to +0.91%, still compare to Thursday when it was 63.4% on the same gain (with the usual caveat that positive volume on the Nasdaq is all over the place due to the speculative volumes).

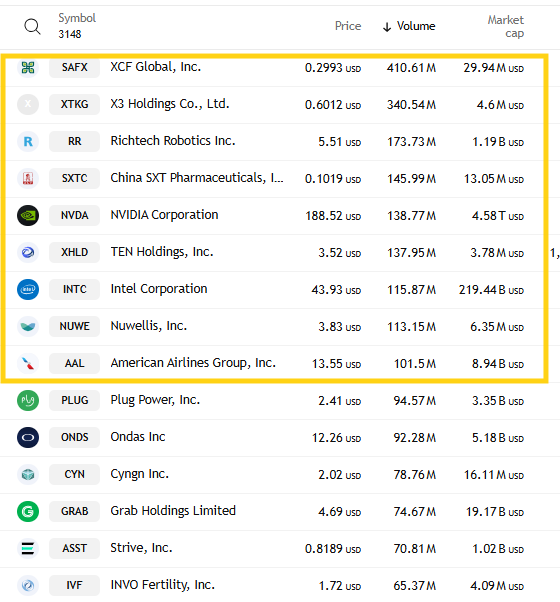

Some of that improvement in positive volume on the Nasdaq though was due to higher speculative volumes with the top three stocks by volume at around 900mn shares, up from 650mn Mon and 600mn Fri, (although still down from 1bn the previous Friday (and 4bn Jan 14th)).

There were another six stocks that traded over 100mn shares (up from four Mon, five Fri (but down from 10 the previous Friday)) with another two over 90mn.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, were lower as a result on the Nasdaq at 55%, 53% on the NYSE.

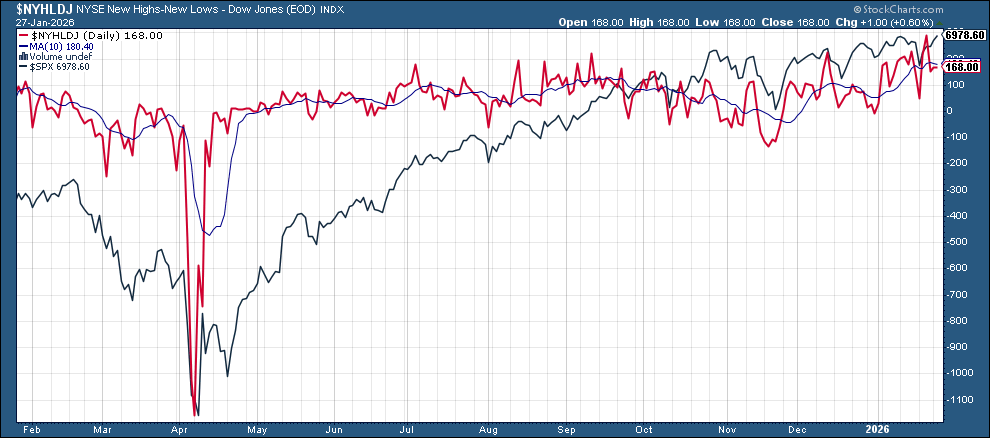

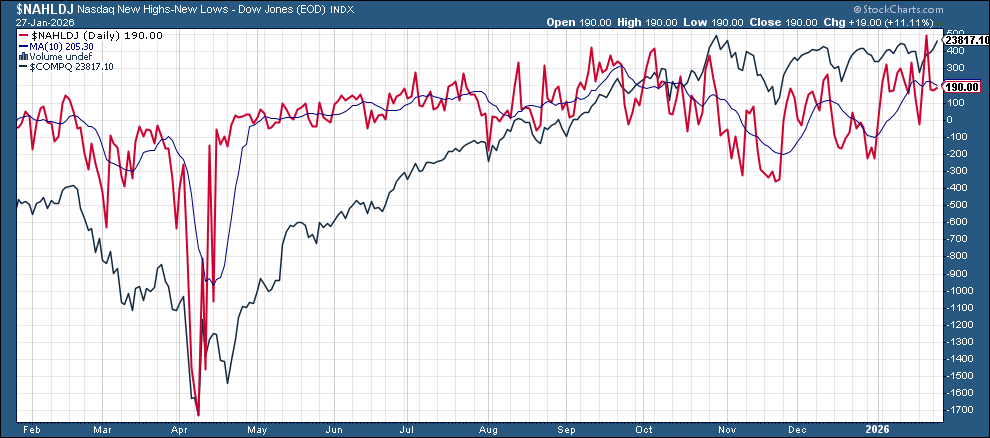

New 52-wk highs minus new 52-wk lows (red lines) were again little changed at 168 on the NYSE (still down from 288 Thurs, the best since Nov ‘24 ), and 190 on the Nasdaq (down from 490 Thurs, also the best since Nov ‘24).

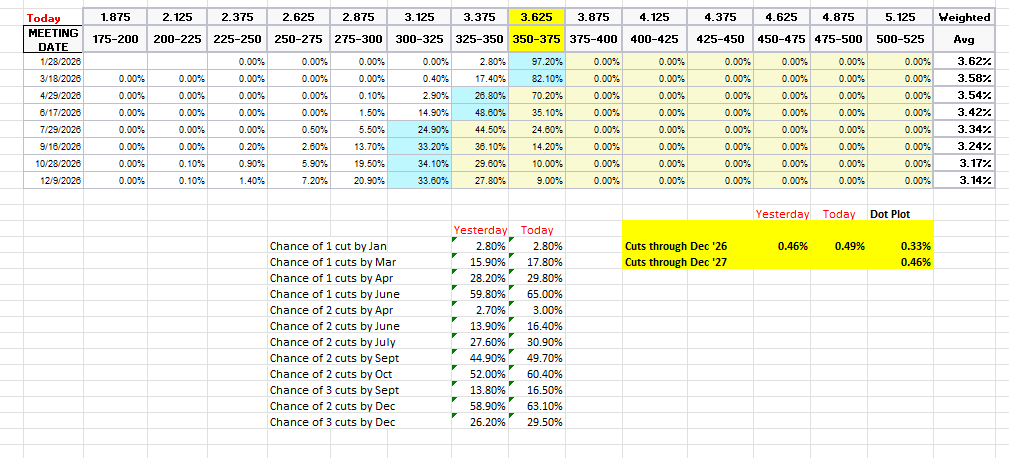

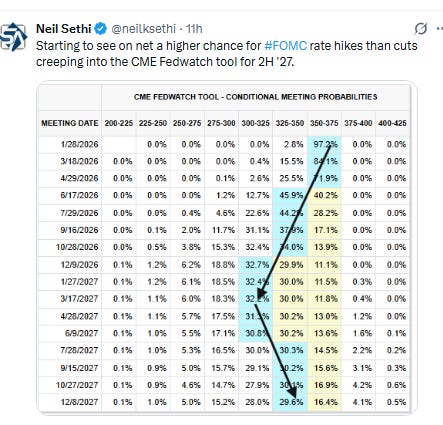

Ahead of the decision tomorrow, #FOMC 2026 rate cut pricing edged a little further off the the least since pricing for the Dec ‘26 contract was initiated (or at least as far back as the CME Fedwatch tool has been tracking it).

January remains at 2.8%, so off the table. March is 18% (still down from 51% Jan 6th), April 30% (from 63%), with the first cut in June (65%). A second cut is priced for Oct (but more firmly at 60% from 52% Mon, but as compared to a a 55% chance of a July cut on Jan 6th).

Pricing for 2026 up to 49bps (it had fallen as low as 44bps last week), with pricing for two cuts 63% and three cuts 30% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

The 10yr #UST yield rose to the underside of the 200-DMA it fell through Mon at 4.22%.

The 2yr yield, more sensitive to FOMC rate cut pricing, though fell for a third session from the highs of the year to 3.58% still over the top of the channel it had been in since the start of 2024 until breaking out two weeks ago. (I still hope it falls back in, because it was a really good channel.)

It is -6bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for rate cuts, but now just one or two.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield., but I’m starting to get tempted.

The weakening technicals I had noted Wednesday continued to point the way with the $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) dropping another big -1.38% Tuesday (the most since April, now down -3.1% the past four sessions, also the most since April (and before that Nov ‘22)), to the lowest close since Feb ‘22 and breaking cleanly under the decade+ uptrend line (and to the bottom of the channel it’s been in since the Sep ‘22 peak).

The technicals remain not favorable with the daily MACD in “go short” territory while the 14-day RSI has fallen to the most oversold since July ‘20.

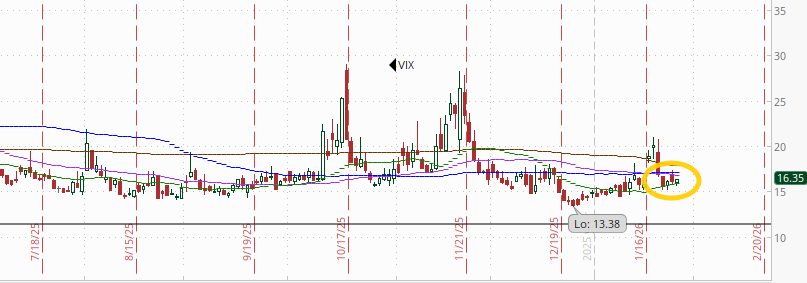

VIX little changed at 16.4. That level is consistent w/~1.03% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) edged higher to 101.3. The current level is consistent with “moderately elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is the level flagged by Charlie McElligott as one to watch.

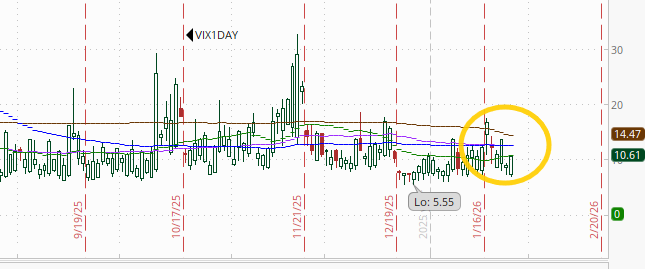

With the Fed meeting ahead the 1-Day VIX rose to 10.6, still pretty subdued for a pre-FOMC day. It will probably move higher tomorrow though as it incorporates the Mag-7 earnings coming after the close. The current reading implies a ~0.66% move in the SPX next session.

#WTI futures a little surprisingly pushed through the 200-DMA on their first attempt to the highest close since Sept, and now with a relatively clear look at the $65-66 level which is where the Sept rally stalled out.

Daily MACD remains in “go long” positioning while the RSI is now over 60 providing support.

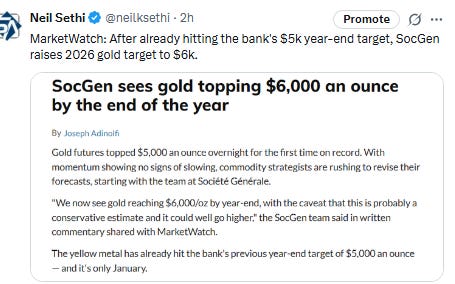

I said Monday that the potential reversal setup in gold futures (/GC) was meaningless as “this is gold we’re talking about,” and consistent with that they jumped +3.5% to another record high, looking to improve on the prior week’s historic gain.

Daily MACD remains in “go long” positioning, but the RSI is now at 85 and approaching the October peak which was the highest since 2020.

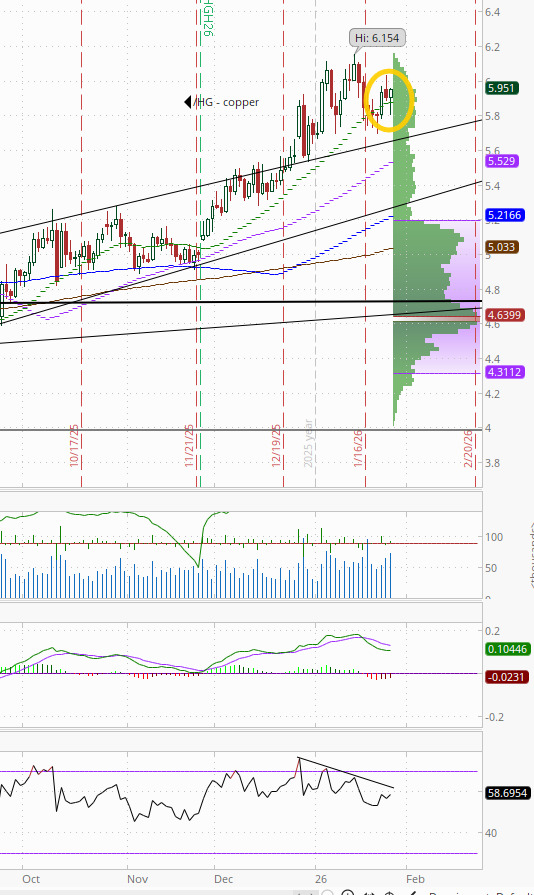

US copper futures (/HG) recovered from early losses to post a modest gain. As noted two weeks ago “the daily MACD has crossed to ‘sell longs’ positioning while the RSI has fallen to the least since Nov, so we’ll see if a deeper pullback is in the cards.” As I said Friday, “those remain issues for now, so jury is still out,” but like gold it feels like it’s going to be tough to really dent the rally.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natural gas futures (/NG) remained very volatile as liquidity gets ever more thin as we approach the roll to the March contract which will see a big drop as noted yesterday. They ended little changed after trading in a $1.50 band finishing just off the highest close since Dec ‘22. As I said Monday, given the upcoming roll, I’m not going to bother looking at the technicals until we get that and some stabilization.

Bitcoin futures edged off the lows of the year as they continue to sit out the party. I noted Wed “has a good deal of resistance above.” The daily MACD as mentioned last Tues flipped to “sell longs” positioning, and is now “go short,” while the RSI is under 50.

The Day Ahead

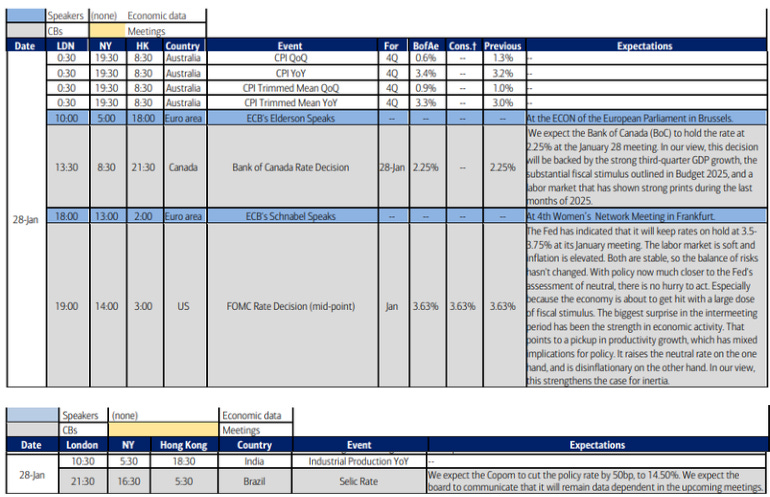

As noted in the Week Ahead, it’s a relatively light week (in terms of importance) for US economic data, and Wednesday brings us just weekly mortgage apps and US petroleum inventory data.

That will leave some room to get some work done (squeeze a workout in) between a.m. earnings and the Fed decision at 2pm ET. As I mentioned in the Week Ahead:

this will be the least exciting (if you’re interested in the path of interest rates) since last summer with a hold a lock, no updated SEP or dot plot, and Jerome Powell likely to get as many questions about Trump, his future, Fed independence, etc., as he is about the economy and monetary policy.

That said, it will at least be interesting, and hopefully Powell give some clues on what the core of the Fed is looking for in order to cut again, and perhaps even push back against market expectations that we’ve seen the last cut under his term. Also, we’re likely to get at least one dissent (Miran in what could be his last vote), but will be interesting to see if Bowman (who made a dovish speech earlier this month) and/or Waller (who is technically still in the running for the Fed job) join.

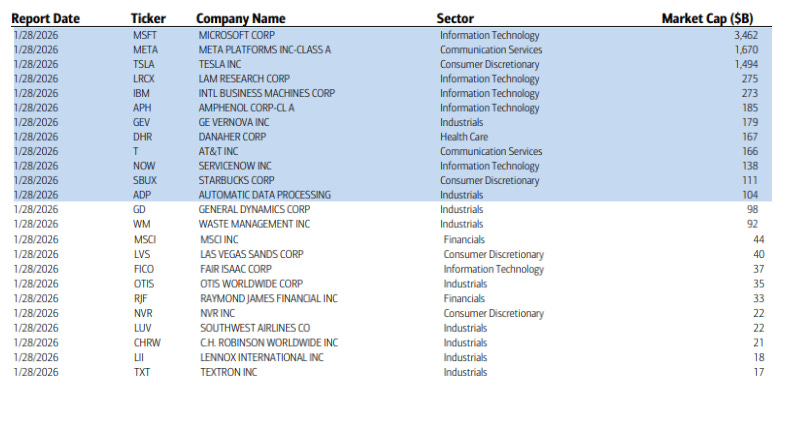

Wed might be a rare Fed day where SPX earnings are the bigger story (particularly post-Fed) with three of the Mag-7 reporting after the close (MSFT, META, TSLA). In total, there are again~25 SPX components, but 12 >$100bn in market cap in MSFT, META, TSLA, LRCX, IBM, APH, GEV, DHR, T, NOW, SBUX, ADP (in descending order by market cap).

Ex-US highlights are policy decisions from Canada and Brazil, Japan (BoJ) minutes, Germany GfK consumer sentiment, Italy business confidence, Australia CPI, India IP.

Also President Trump is scheduled to speak at 10am ET on the new “Trump accounts”.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,