Markets Update - 1/28/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

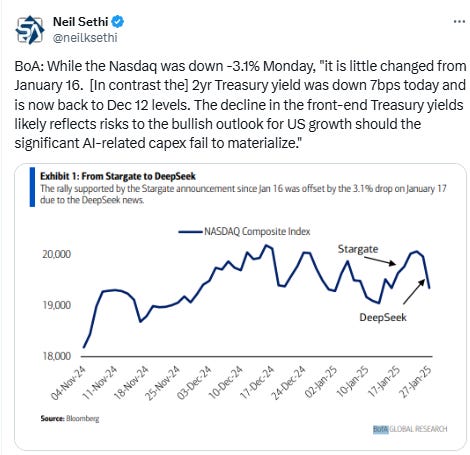

After in some respects the worst day for tech stocks since March 2020 Monday, Tuesday saw a reversal of some of that trade along with a number of others which saw the Nasdaq rally throughout the day to finish with solid gains. The SPX also saw a healthy advance while the Dow and the RUT saw much more modest days (and the equal-weighted SPX finished lower) given the strong outperformance of growth stocks at mostly the exclusion of everything else.

Elsewhere, similarly, bond yields and the dollar bounced after notable losses Monday, as did crude and gold. Bitcoin and nat gas though were lower while copper was little changed.

The market-cap weighted S&P 500 was +0.9%, the equal weighted S&P 500 index (SPXEW) -0.5%, Nasdaq Composite +2.0% (and the top 100 Nasdaq stocks (NDX) +1.6%), the SOX semiconductor index +1.1%, and the Russell 2000 +0.2%.

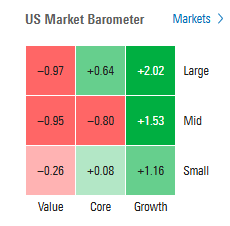

Morningstar style box showed the bounceback in growth stocks, particularly the largest while value stocks gave back some of Monday’s gains.

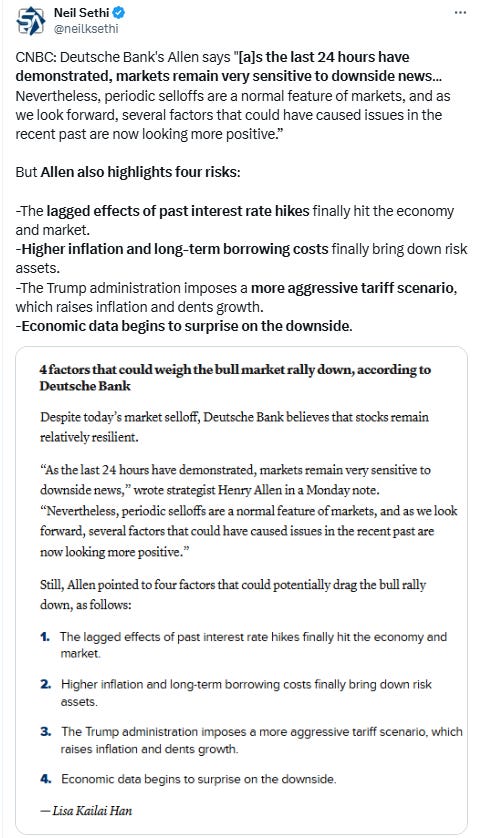

Market commentary:

“I remain an equity bull, and would view this as a dip to be bought,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “That said, understandably, conviction to ‘catch a falling knife’ might be a little lacking for the time being.”

“Was it a bit unnerving? Yes, for some. Should you panic? Not at all,” said Kenny Polcari at SlateStone Wealth. “If you talk to anyone that bought stock yesterday, they loved the opportunity to buy some of these names at a deep discount. In the end, no matter how this plays out, competition is good. And remember, you get what you pay for.”

Mohit Kumar, a strategist at Jefferies International Ltd., said Monday’s losses for the sector may have gone too far. “Is it time to fade yesterday’s move? Our view would be a selective yes,” Kumar said.

“Valuations remain extended, and while vulnerabilities were expected this year, developments like DeepSeek highlight the need for diversification beyond the Mag Seven,” said Seema Shah, chief global strategist at Principal Asset Management. “The 2025 theme of US exceptionalism is now facing uncertainty, with ongoing concerns around tariffs and inflation adding to market challenges.”

“The dust is now settling after Monday’s long overdue AI reckoning, and while we still believe in the AI-driven productivity story, investing in this sector going forward may not be as easy as it was over the past two years,” said Emily Bowersock Hill at Bowersock Capital Partners. “We expect investors to be more discerning and selective when it comes to AI investing.”

Craig Johnson at Piper Sandler noted that the fact that more stocks rose than fell during Monday’s selloff was a “a clear sign of strength beyond the AI sector as this market rally broadens out.”

At Wolfe Research, Chris Senyek said while the focus on DeepSeek rattled markets to start the week, the reaction was overblown in the short term.

“With that said, this news flow probably caps P/E multiples for data center driven industrials and power names to which AI enthusiasm had spread,” he said. “This makes upcoming earnings season all that more important.”

“Why are investors concerned? The news over the past few months has been about the huge capex announcements of Microsoft, which is spending $80bn in ’25, while Meta recently announced investments between $6bn and $65bn,” wrote JPMorgan analyst Sandeep Deshpande. “Thus, with these considerable sums flowing into AI investments in the US, that Deepseek’s highly efficient and lower resource-intensive AI model has shown such significant innovation and success is posing thoughts to investors that the AI investment cycle may be over-hyped and a more efficient future is possible.”

"Driving this orgy of investment was the assumption that training models and running them at scale requires much more computing than is available, and that even more will be needed in the future," Marketwatch’s Adam Levine wrote. "If DeepSeek’s achievement can be replicated by other researchers, then we would instantly go from a condition of AI computing undersupply to oversupply."

“The sudden, adverse market reaction to DeepSeek indicates that some of the key assumptions that have been driving the AI trade, and hence major indices, are getting reassessed today,” said Steve Sosnick at Interactive Brokers. “Part of the today’s sudden adverse market reaction was a direct result of a ‘wave of complacency’ that overtook the equity market.”

“With DeepSeek likely to stay in investors’ minds, muted gains for beats and severe punishment for misses may be the outcome of the earnings season,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP.

At G Squared Private Wealth, Victoria Greene says that she’s “not convinced the bubble has burst,” but would be “silly” not to evaluate the potential risks.

“We are looking carefully at how the market progresses from here and if action needs to be taken to protect and shift portfolio allocations,” she noted. “We are not panickers, so tend to be buyers of big dislocations that are happening in tech, energy, and infrastructure today.”

“We don’t know whether this is the ‘Sputnik Moment’ for stocks, but this is certainly a wake-up call that we are not the only game in town,” said Paul Nolte at Murphy & Sylvest Wealth Management. “To put these very high valuations in the stocks thinking they have cornered the market is a huge mistake and that is being re-rated.”

Jim Thorne at Wellington-Altus Private Wealth says this is a natural evolutionary process to “work off the overbought.”

“It’s always going to be something that is going to pull back the market to the moving average,” he said. “In the 1990s the ‘it’ trade was Cisco. Every six months, there would’ve been something that would’ve corrected for it come back down.”

“What was shaping up to be a big week in the markets got even bigger with the disruption in the AI space,” said Chris Larkin at E*Trade from Morgan Stanley. “That could make this week’s megacap tech earnings even more critical to market sentiment.”

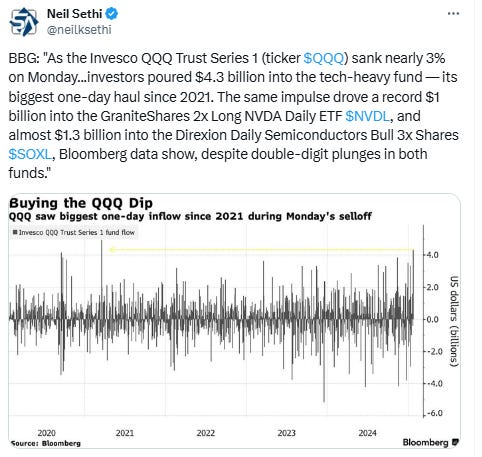

The next leg lower for the biggest US tech stocks may come from the retail crowd, according to Tony Pasquariello at Goldman Sachs Group Inc. “Tactically speaking, I suspect the next few days bring a hurried reduction of length by the retail community,” Pasquariello wrote in a note to clients Monday, adding that hedge funds have been aggressively reducing exposure for months, so this is really about the response of households. However, he’s a true believer in the structural supremacy of US tech companies, which “arguably have only more incentive to spend.”

“We think big tech can keep delivering on earnings, but misses could revive concerns that big capital spending on AI won’t pay off – one of three triggers to dial down our pro-risk view,” BlackRock Investment Institute strategists including Jean Boivin and Wei Li.

“A key theme in our outlook has been to stick with the primary uptrend — but expect disruptions along the way,” said Keith Lerner at Truist Advisory Services. “The disruption caused by DeepSeek was from a less obvious corner of the market. It’s doubtful that a Chinese startup will dominate globally given the current geopolitical tensions between China and the US.”

“Powell’s tone on inflation is crucial for Wall Street because traders need to hear that price pressures are continuing to ease,” said John Belton, a portfolio manager at Gabelli Funds. “There are clearly potential black swans out there.”

“We’re not making any big bets on Fed policy changes,” said Gabelli’s Belton, whose firm is optimistic on US stocks tied to AI growth. “It’s highly unlikely we’re going to get any pre-commitment from Powell on the timing of future cuts.”

“We’ll be focused on how Powell threads the needle between acknowledging more supportive economic data and ongoing policy uncertainty,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. His firm is positioning for a market rotation outside of tech with slight overweights to staples, energy and industrials.

The bottom line is so much is unknown, from the Fed’s rate path, to earnings growth, to how White House policy is implemented and affects Corporate America, according to Sevasti Balafas, chief executive officer of GoalVest Advisory. That leaves investors with one familiar strategy. “Don’t fight the Fed,” Balafas said. “If inflation stays elevated and rates remain high, that will negatively impact stocks, though if companies making heavy investments in AI continue to see a positive impact to their bottom lines, then the market will continue to run.”

In individual stock action, all eyes were on Nvidia in Tuesday’s trading with the major averages moving in step with the AI bull market leader’s intraday fluctuations. The stock picked up momentum to close around its highs of the day after rising nearly 9%. It briefly saw losses earlier in the session. In the prior session, Nvidia lost -17%, or almost $600 billion in market value, the biggest ever one-day drop in value for a U.S. company. Tech peers Broadcom and Oracle rose 2.6% and 3.6%, respectively, following steep losses Monday.

A gauge of the Magnificent Seven megacaps climbed 2.7%. Microsoft Corp. is in talks to acquire the US arm of ByteDance Ltd.’s TikTok, according to President Donald Trump. The software giant rose 2.9%. Boeing Co. rose 1.5% as its chief is optimistic the company can return to a key production target for its 737 airliner this year. JetBlue Airways Corp. tumbled 26% after projecting higher costs this year than Wall Street expected.

In late hours, Starbucks Corp. climbed as its sales slump eased.

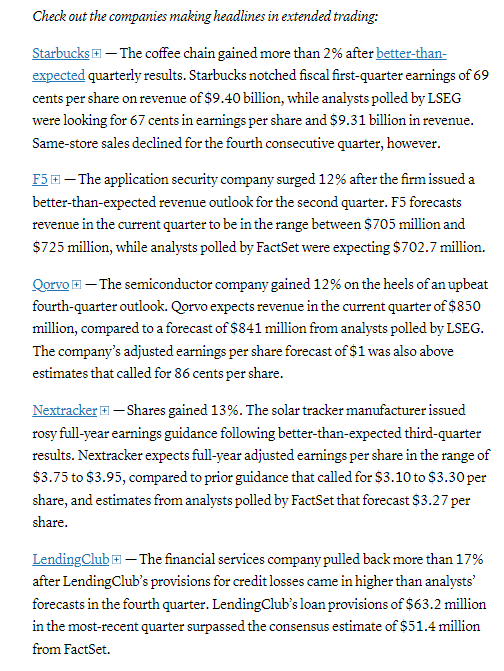

After Hours movers from CNBC:

BBG Corporate Highlights:

Starbucks Corp. is reorganizing its top ranks as part of Chief Executive Officer Brian Niccol’s plan to win back customers by speeding up service and making cafes feel more upscale.

Royal Caribbean Cruises Ltd. reported a full-year profit forecast that blew past expectations as cruise demand continues to ramp up.

Chevron Corp., investor Engine No. 1 and GE Vernova Inc. formed a partnership to develop natural gas-fired power plants next to data centers, aiming to tap into artificial intelligence’s surging demand for electricity.

Defense company Lockheed Martin Corp.’s earnings per share forecast for 2025 fell short of the average analyst estimate.

Aerospace and defense manufacturer RTX Corp. is “fully prepared” to support President Donald Trump’s ambitions to build an orbital missile defense system to protect the US.

Kimberly-Clark Corp., the maker of Scott toilet paper and Huggies diapers, reported profit that missed expectations as its turnaround plan runs up against broader challenges.

LVMH’s sales of fashion and leather goods continued to decline in the fourth quarter, casting doubt on the prospects for a quick recovery in luxury demand.

Brookfield Asset Management Ltd. offered to buy outstanding shares in Neoen SA, the final step in its planned €6.1 billion takeover of the French renewable energy developer.

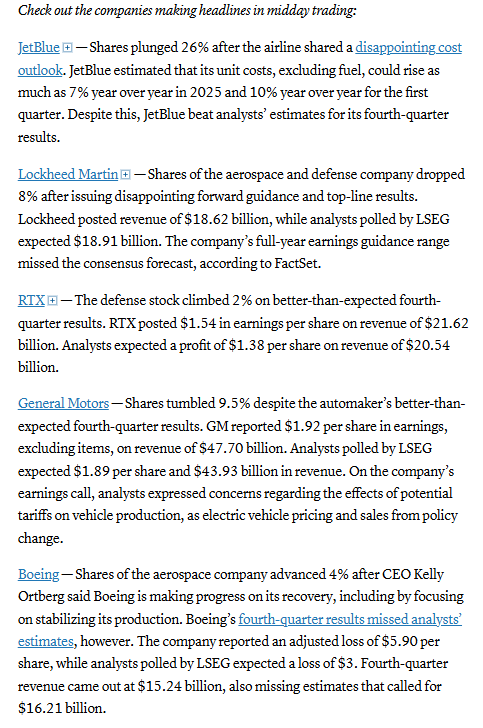

Some tickers making moves at mid-day from CNBC.

In US economic data:

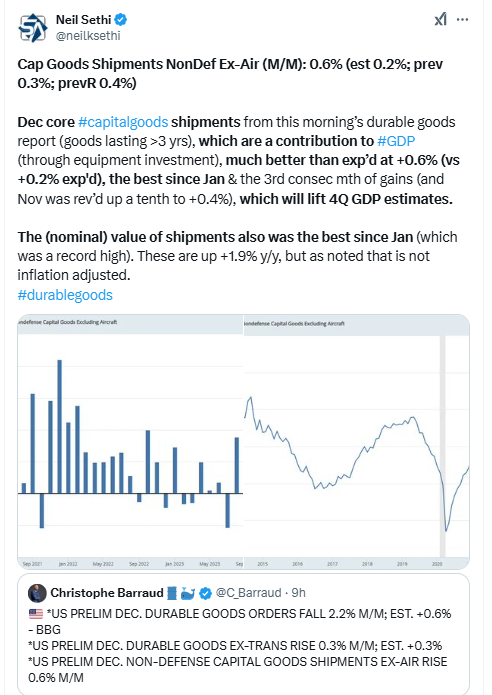

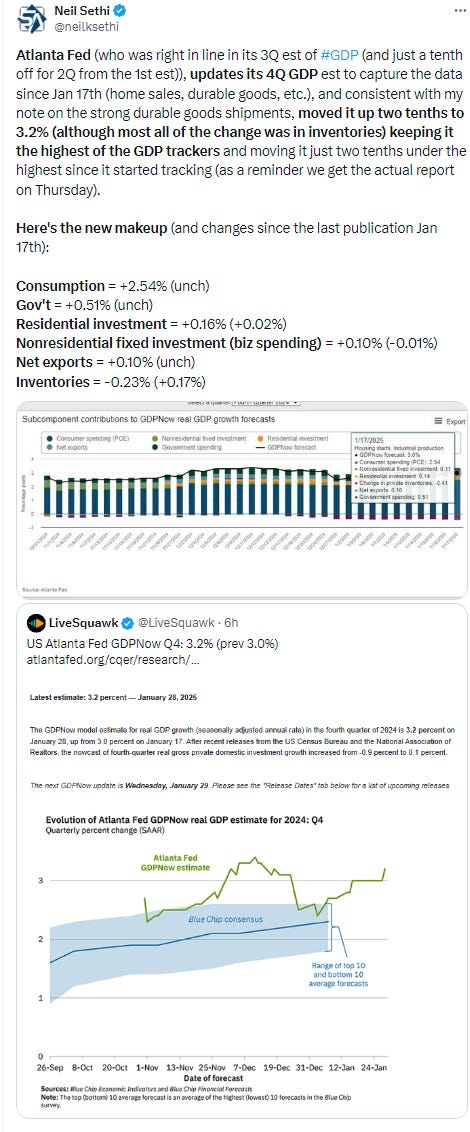

Durable goods orders came in weak due to volatile transport orders but core capital goods orders (proxy for business spending) was better than exp’d w/shipments the best since January boosting GDP.

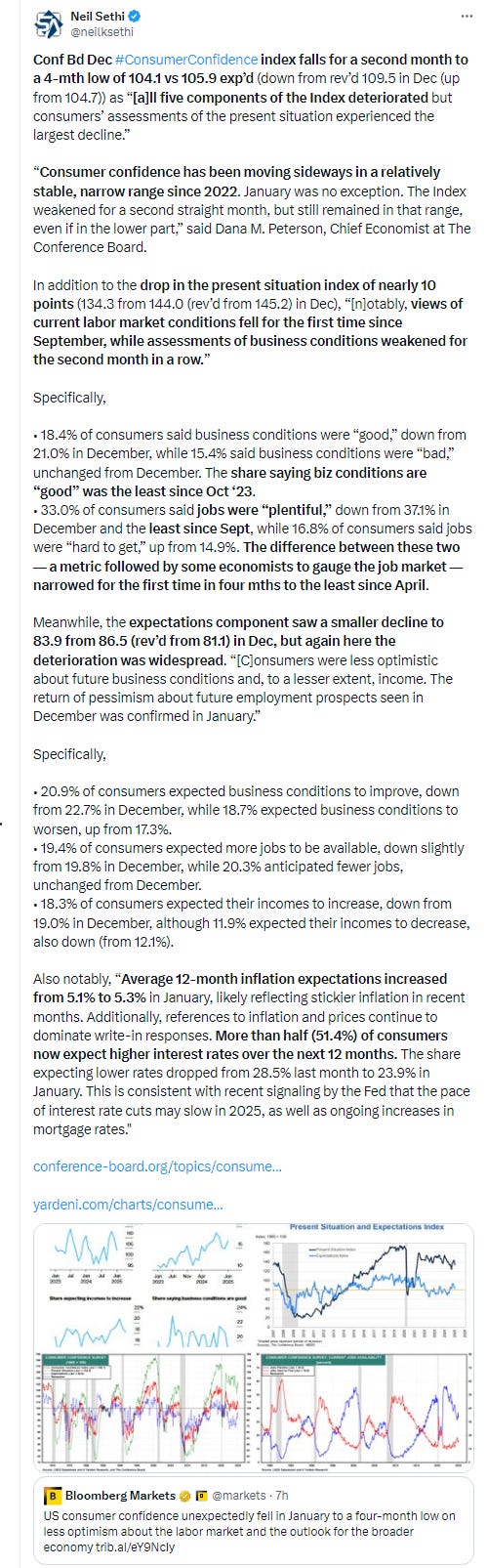

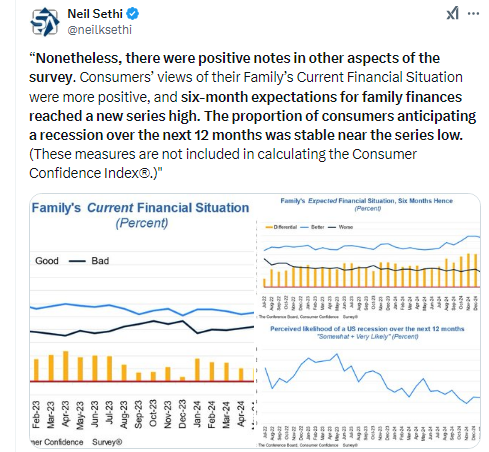

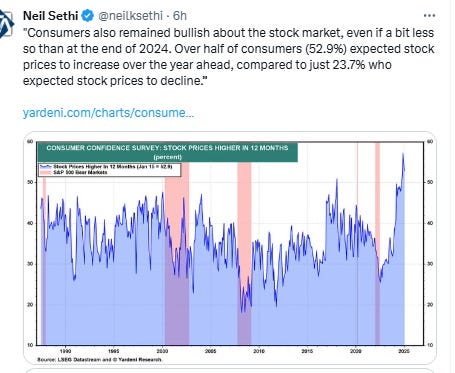

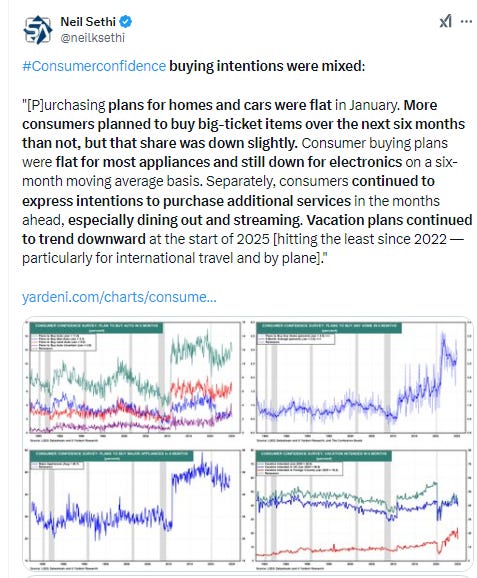

Conf Bd Dec Consumer Confidence index fell for a second month to a 4-mth low as “[a]ll five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline.” “Consumer confidence has been moving sideways in a relatively stable, narrow range since 2022. January was no exception. The Index weakened for a second straight month, but still remained in that range, even if in the lower part,” said Dana M. Peterson, Chief Economist at The Conference Board. In addition to the drop in the present situation index of nearly 10 points (134.3 from 144.0 (rev’d from 145.2) in Dec), “[n]otably, views of current labor market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row.”

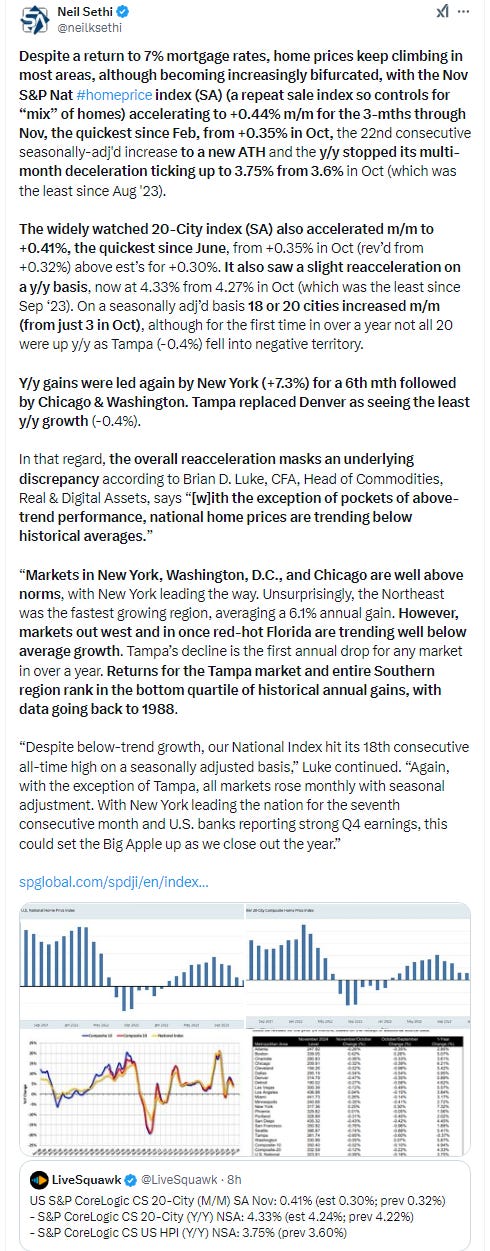

The Nov S&P National home price index (SA) (a repeat sale index so controls for “mix” of homes) accelerated to +0.44% m/m for the 3-mths through Nov, the quickest since Feb, from +0.35% in Oct, the 22nd consecutive seasonally-adj'd increase to a new ATH and the y/y stopped its multi-month deceleration ticking up to 3.75% from 3.6% in Oct (which was the least since Aug '23).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

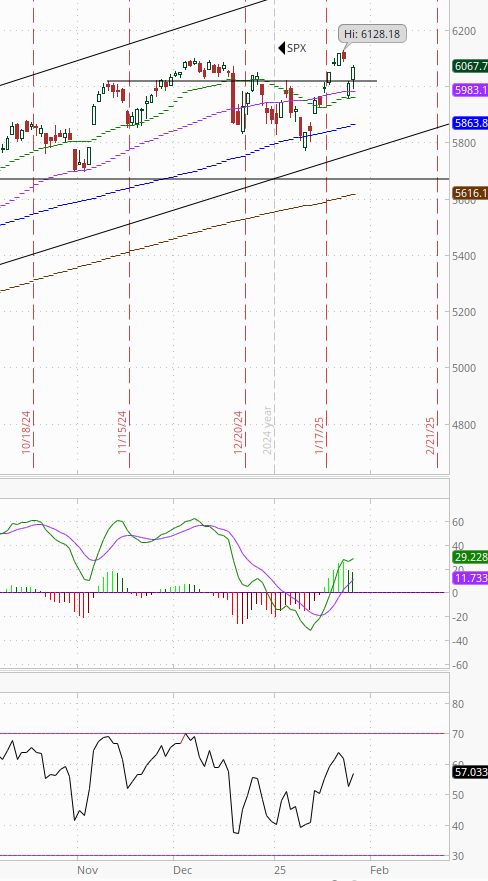

The SPX filled more than half of the gap from Monday’s drop taking it back to within a percent of its ATH. The daily MACD remains favorable, the RSI a little less so.

The Nasdaq Composite similarly got back more than half of Monday’s losses although remains a little further from its ATH. Its daily MACD and RSI are also positive but less favorable than the the SPX.

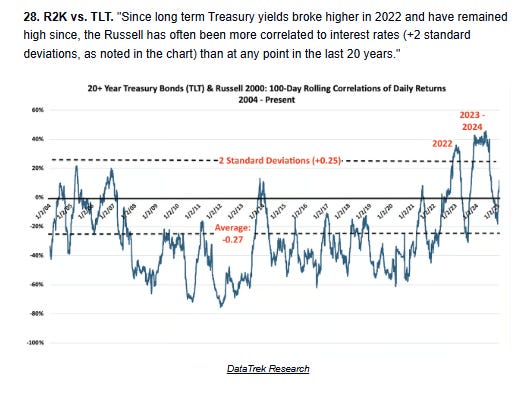

RUT (Russell 2000) was little changed for a second day remaining just under the 2290 level. It’s daily MACD and RSI remain positive but like Nasdaq a little less so than the SPX.

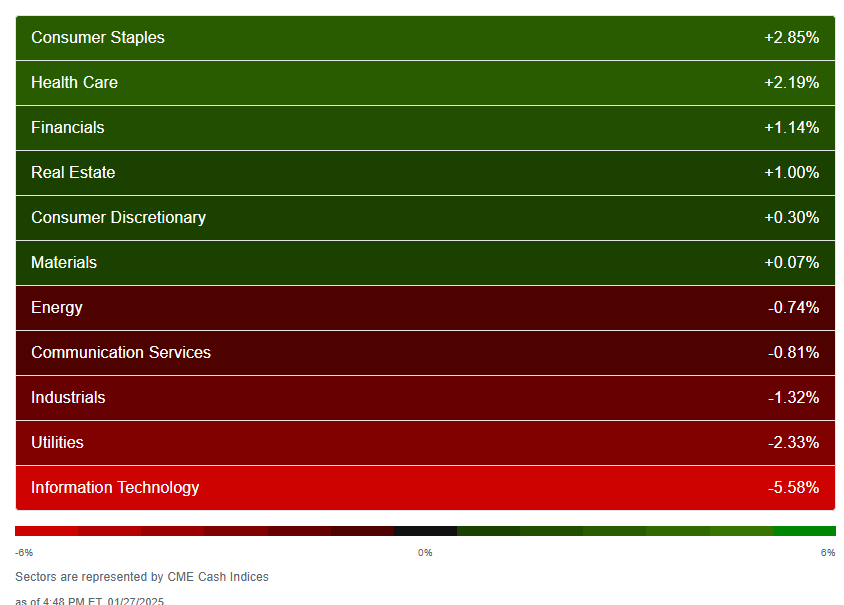

Equity sector breadth from CME Cash Indices deteriorated, looking a lot like long stretches of 2022 with growth sectors higher and everything else lower. Of the 8 red sectors, 6 were down at least -0.6% & four over -1%.

SPX sector flag from Finviz consistent w/lots of green in growth names not much elsewhere.

Positive volume was 48% on the NYSE Tuesday, in line with the small loss in the NYSE Composite Index, while the Nasdaq was better at 63% but that’s pretty disappointing given the almost 400 point gain in the index. Still it was the 9th session in 10 of better than 50% positive volume for Nasdaq. Positive issues (percent of stocks trading higher for the day) not as good at 43 & 48% respectively.

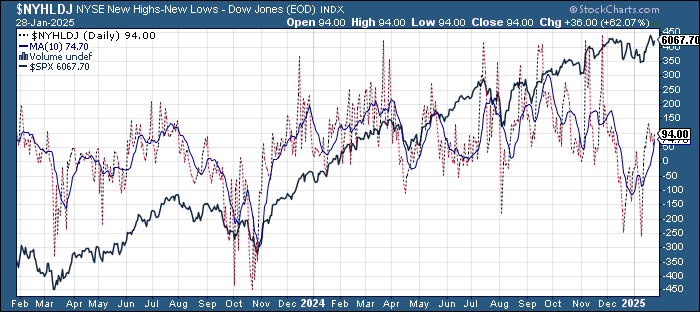

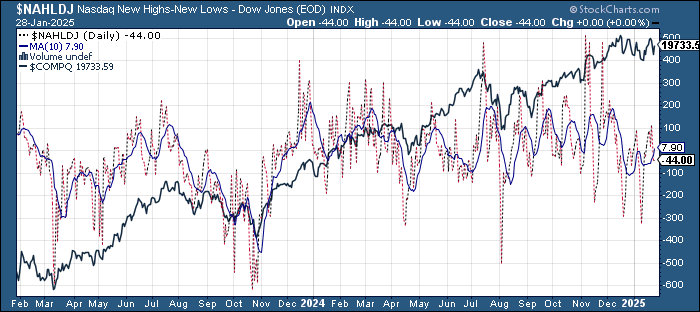

New highs-new lows (charts) improved to 94 on the NYSE but just to -43 on the Nasdaq. They are now though below their 10-DMAs though those are still moving higher for now (more bullish).

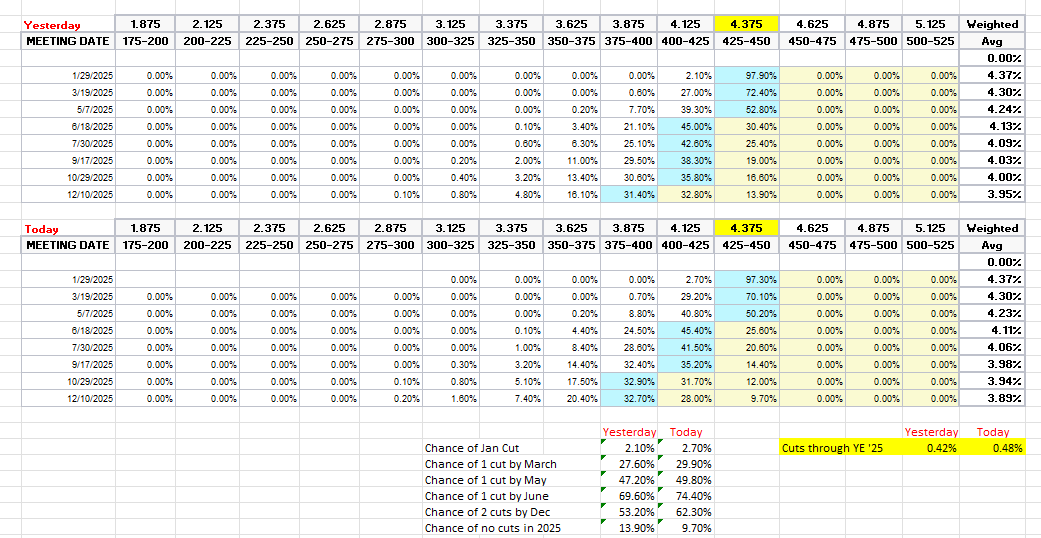

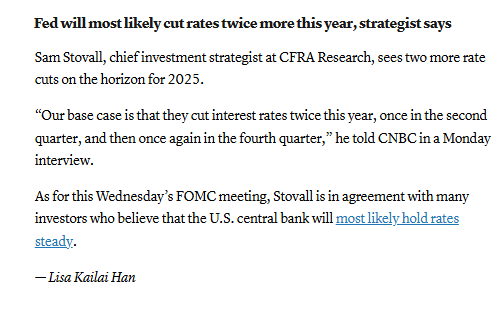

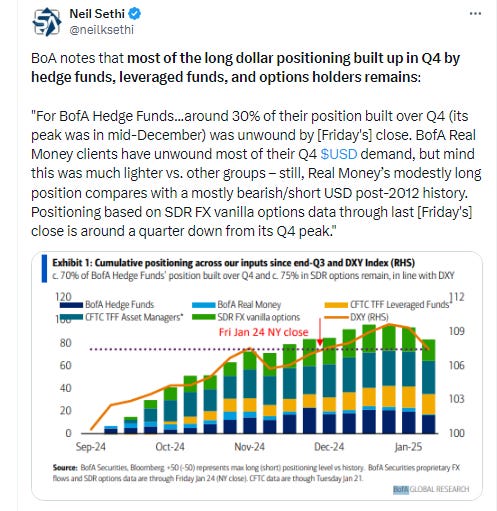

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool were little changed with odds of a January cut at 2% and a cut by March remaining doubtful at 33%, while a cut by May remains around 50% and there’s now 50bps (now two full cuts) priced in (from 27 a week ago).

Overall pricing for a 2nd cut in 2025 is now at 64% (from 53% early last week) with the chance of no cuts at just 9% (from 30% last Monday).

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that, and it looks like the market is moving in that direction as well. We’ll see what the Fed (in particular Powell) has to say tomorrow.

Longer duration #UST yields bounced after Monday’s drop with the 10yr from just above the 4.5% level I had targeted a week ago to 4.55%, the same level they were at the day after the December #FOMC meeting (still up +80bps from the Sept FOMC meeting).

The 2yr yield, more sensitive to Fed policy, though fell for a 4th session to a 1-mth low of 4.20% moving a little further below the current Fed Funds rate (indicating a higher probability of rate cuts). I still find this level rich, and I’m looking for it continue to soften in the near term.

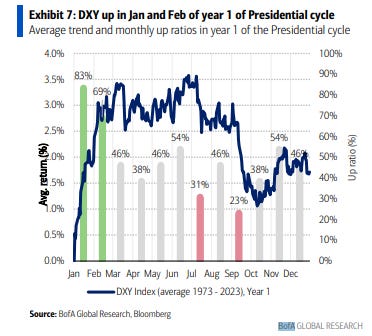

Dollar ($DXY) broke its 3-session losing streak which took it beneath the 50-DMA, finding support at the 107 level and bouncing back above. Daily MACD and RSI remain weak though.

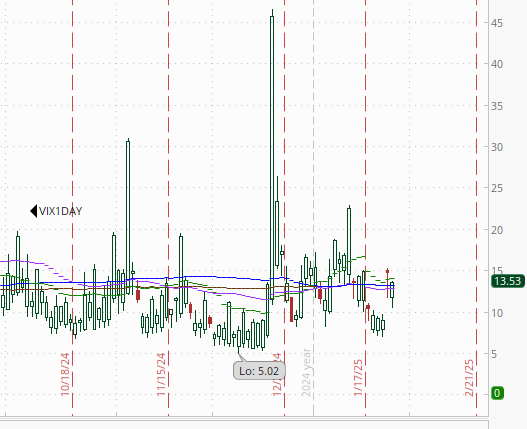

The VIX fell back again after hitting the highest since the Dec FOMC on Monday although remaining elevated at 16.4 (consistent w/1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly remains elevated at 104, over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

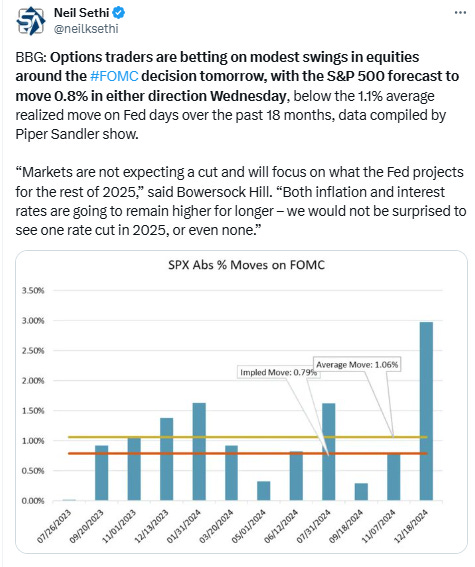

1-Day VIX actually fell back to 13.5 despite the upcoming FOMC decision, looking for a move of 0.85% Wednesday.

WTI was able to bounce (just its 2nd up session in 8) after falling Monday further below support consistent with my calls early last week for a consolidation. It remains though below a cluster of resistance at the $75 level. Daily MACD is not supportive while the RSI is neutral and could go either way. I don’t have a lot of confidence in it regaining that level quickly but we’ll see.

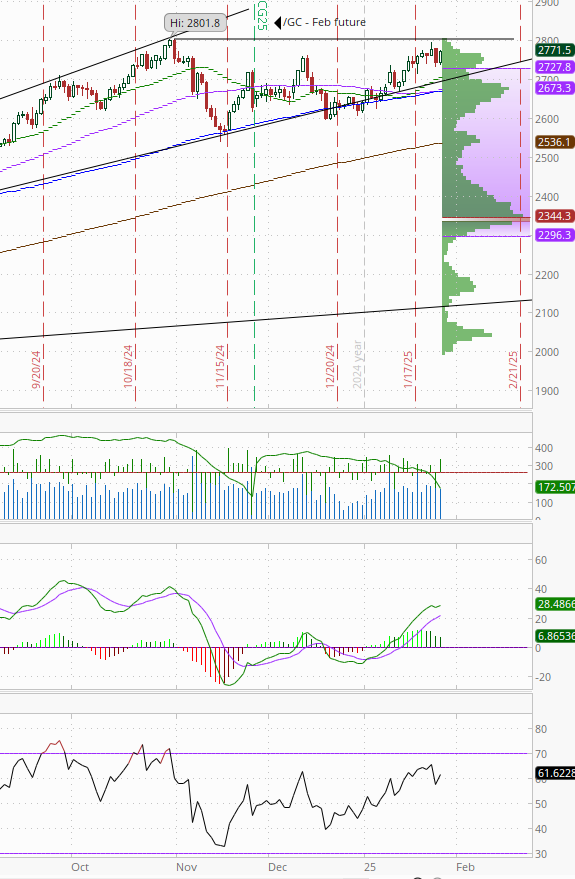

Gold recovered most of Monday’s losses remaining just below the $2800 level and ATH’s. Daily MACD & RSI are supportive.

Copper (/HG) was little changed remaining in the middle of its range over the past 6 mths. The pullback over the past week has seen the MACD & RSI soften to neutral from positive.

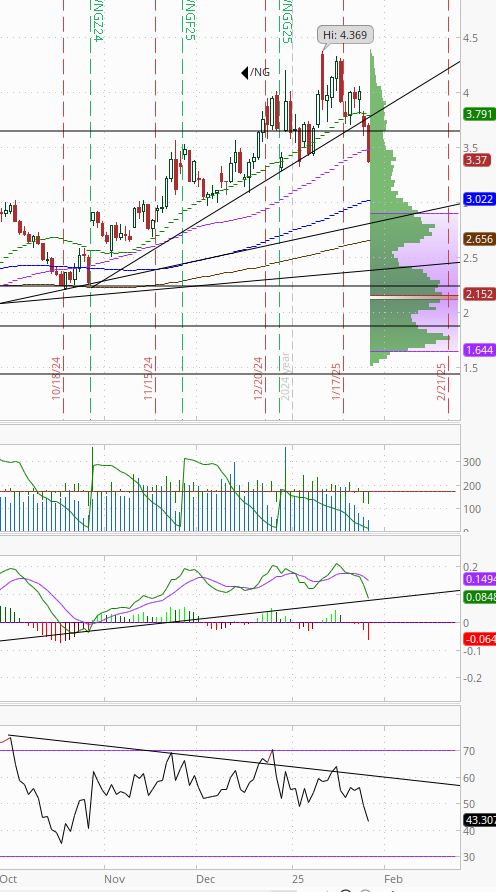

Nat gas (/NG) dropped sharply -8.7% on a combination of a warmer 8-14 day forecast combined with fears of less power demand needs from AI data centers. Daily MACD remains in “sell longs” position and RSI has fallen under 50 to the least since October. No solid support until around the $3 area.

Bitcoin futures gave up early gains to fall back for the 4th session in 5 after touching new highs last week. Also, the daily MACD and RSI are turning more neutral.

The Day Ahead

A big day in the US tomorrow. In terms of economic data, though, it’s one of the lighter days this week with just the advanced look at the goods trade balance and wholesale inventories for Dec in addition to weekly mortgage applications and EIA petroleum inventories.

Probably the highlight will be the FOMC decision, even though a hold is a virtual certainty, there won’t be any updates to the SEP (which includes the “dot plot”), and there haven’t been a lot of big changes in economic data since the December meeting. Still there is a not insignificant chance that in the press conference, between dodging questions about Fed independence and Trump policy implications, Powell provides some further clarity on the Fed’s thinking about a potential March cut, etc., given we’ve had another set of economic reports since December.

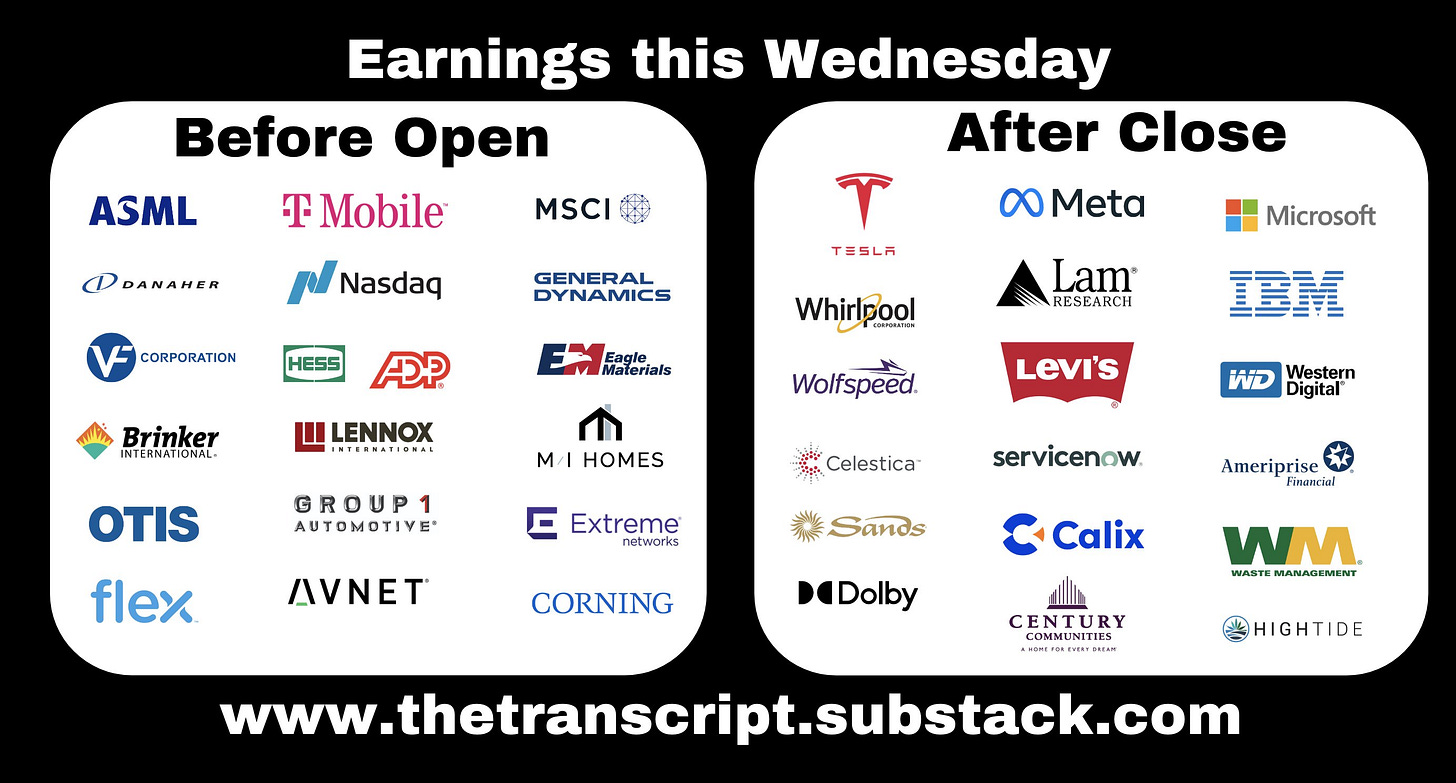

Earnings will be the other major catalyst tomorrow with 26 SPX components reporting including ten > $100bn in market cap and three Mag-7 members who are all > $1tn in market cap (Microsoft (MSFT), Meta Platforms (META), & Tesla (TSLA)). We also get ASML Holdings (ASML) who is also a $1tn company but not in the SPX (see the full earnings calendar from Seeking Alpha).

Ex-US the highlight is a policy decision from Bank of Canada (25bps cut is exp’d). We’ll also get BoJ minutes, Australia CPI, and Germany consumer sentiment. In EM we’ll get unemployment from Mexico.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,