Markets Update - 1/29/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

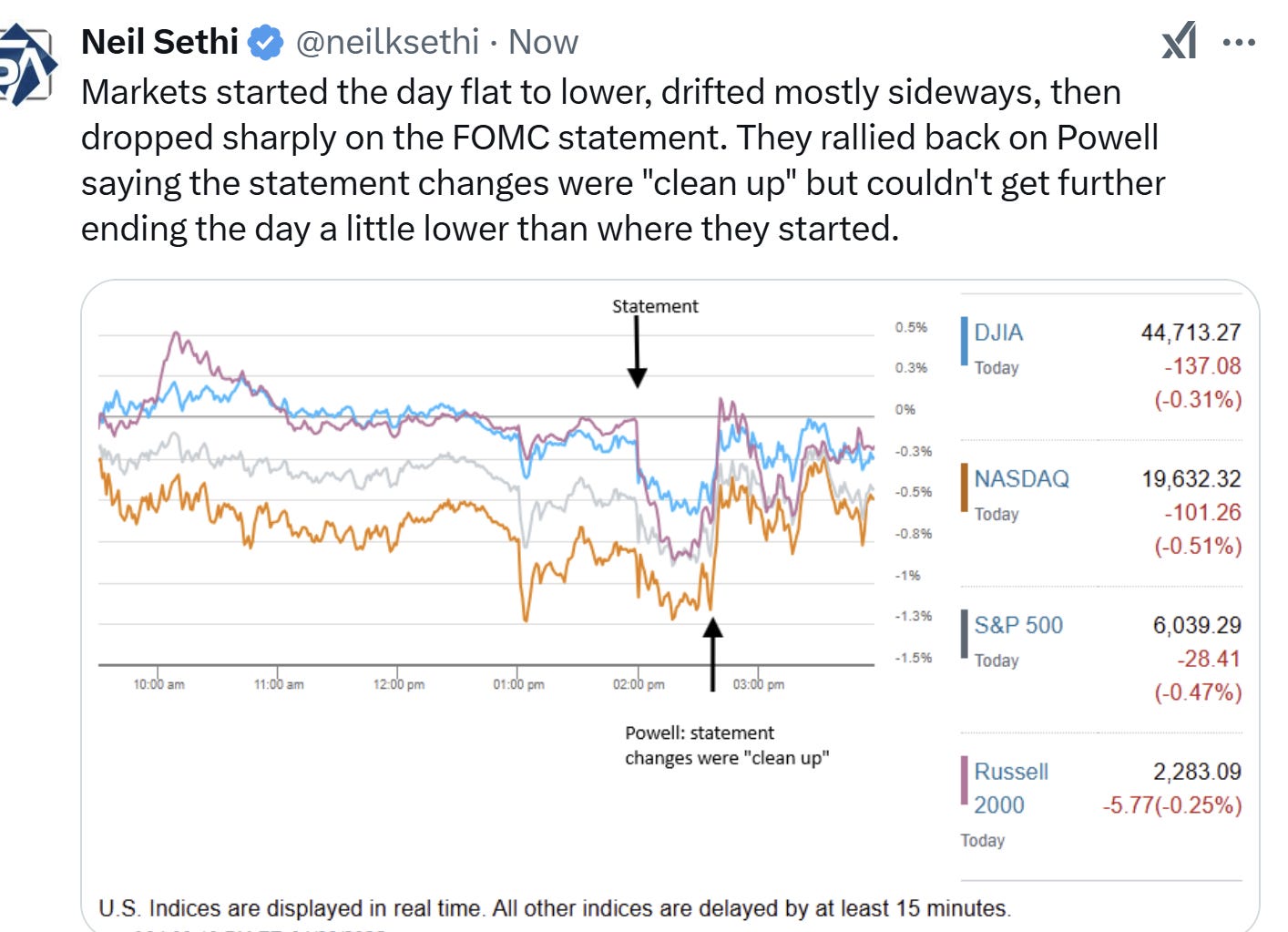

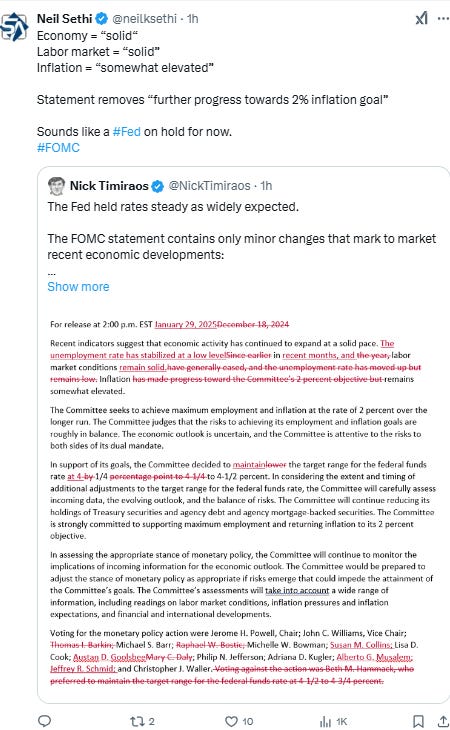

US equities started the day little changed to lower ahead of the FOMC decision which provided some drama as stocks initially fell around a percent on what was viewed as a hawkish statement as it removed a key line on inflation progress before recovering that loss when Chair Powell stated the removal was “clean up” and “should not read anything into it”. Still that left stocks with modest losses for the day.

Elsewhere, bond yields yo-yo’d along with equities to finish little changed as did the dollar. Gold, copper, and bitcoin finished higher, while crude and nat gas fell (the latter due to a roll to the March contract).

The market-cap weighted S&P 500 was -0.5%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite -0.5% (and the top 100 Nasdaq stocks (NDX) -0.2%), the SOX semiconductor index +0.2%, and the Russell 2000 -0.3%.

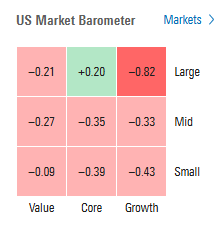

Morningstar style box showed the give back in large cap growth stocks with more modest changes elsewhere.

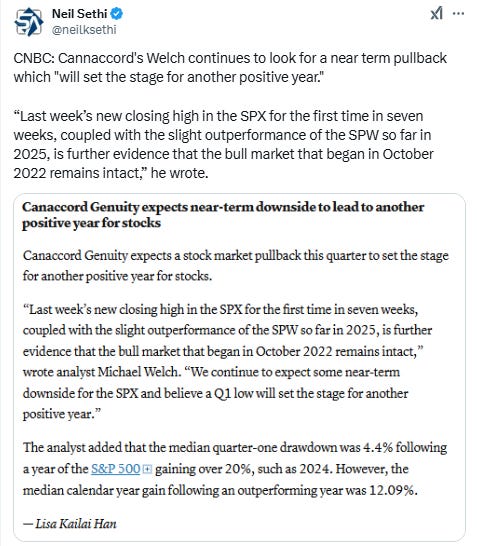

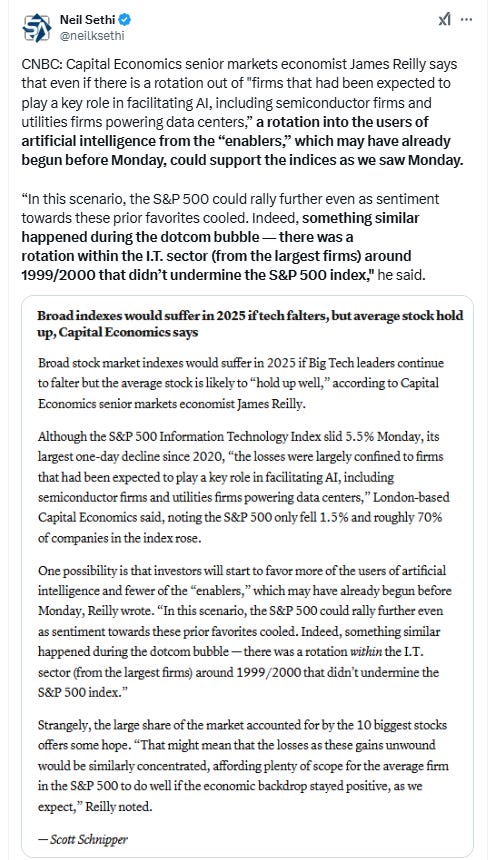

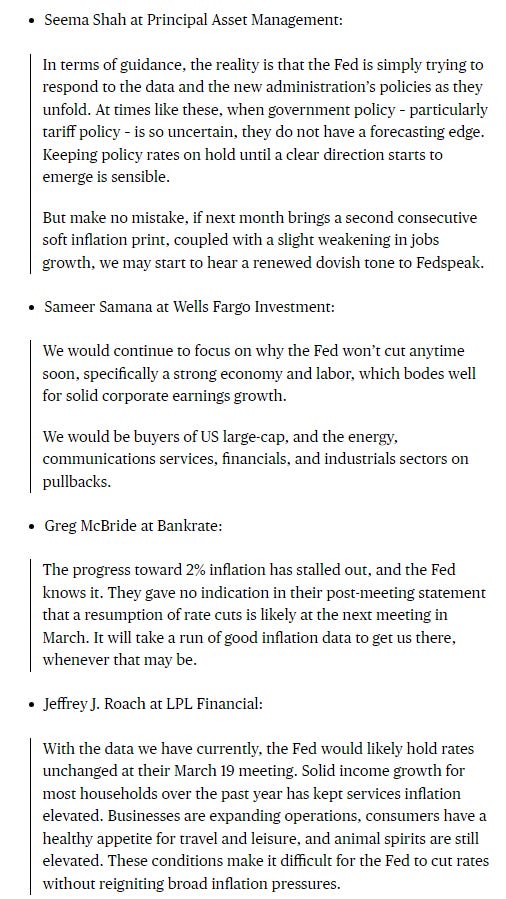

Market commentary:

“As far as the DeepSeek news over the weekend, at the end of the day today, there really hasn’t been that much of an impact on a market-wide basis,” Bespoke Investment Group co-founder Paul Hickey said Tuesday on CNBC’s “Closing Bell: Overtime.”

“The DeepSeek correction in tech stocks has not changed the overall concentration problem in the S&P 500,” said Torsten Slok at Apollo. “Investors in the S&P 500 continue to be dramatically over-exposed to the tech sector.”

The advent of cheaper artificial intelligence models is a “net positive” for global equity markets as it will fuel incremental growth, bring forward efficiency gains and drive inflation lower, according to JPMorgan Chase & Co. strategists Dubravko Lakos-Bujas.

“The DeepSeek selloff is an example of an unexpected surprise that cut right through the market’s crown jewels, the Magnificent Seven,” said David Laut at Abound Financial. “While the markets have staged a nice rebound since Monday’s declines, a larger correction doesn’t happen without the crown jewels being stolen or at least threatened, and that’s exactly what happened on Monday. A larger correction in AI is still possible.” Laut also noted that this week’s stock market volatility is a window of what to expect this year.

Following Monday’s global tech sell-off on the back of the DeepSeek developments, UBS’ Solita Marcelli said investors should be mindful of how they invest around artificial intelligence. The chief investment officer said to keep an eye on earnings results from companies in the tech sector and be ready to jump on any choppiness in the market. Marcelli also said traders should build out positions around longer-term growth areas with artificial intelligence, as well as in the power and resources space. “AI is here to stay, and if anything, DeepSeek reinforces that,” Marcelli wrote to clients. “However, the latest developments do also show that investment approaches that are too concentrated or overly passive can be risky, as value can quickly shift within the AI ecosystem. An active and diversified approach is a better way to gain exposure to AI, in our view.”

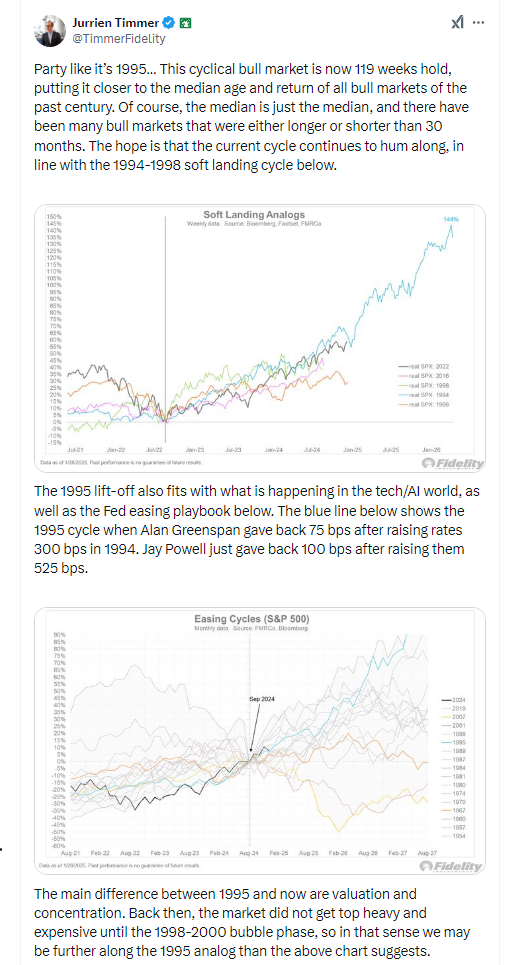

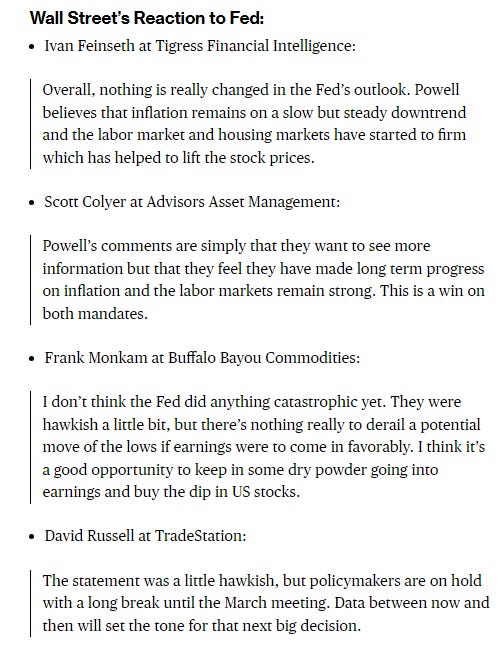

Wall St reaction to the FOMC:

In individual stock action, Nvidia shares hit their lows of the session after Bloomberg News reported Trump administration officials have discussed curbing chip sales of the company to China following the emergence of the DeepSeek AI model. Shares ended the session down -4%. For the week, the artificial intelligence darling is down more than -13%. Meanwhile shares of Starbucks finished 8% higher on Wednesday after the coffee giant topped Wall Street’s estimates for its fourth-quarter earnings and revenue. Investors were also optimistic after Starbucks CEO Brian Niccol said on CNBC’s “Squawk on the Street” that the company was starting to see progress in its turnaround plan. Starbucks’ Wednesday gains were the best since Aug. 13, 2024. Shares also surged to their highest point since Nov. 16, 2023.

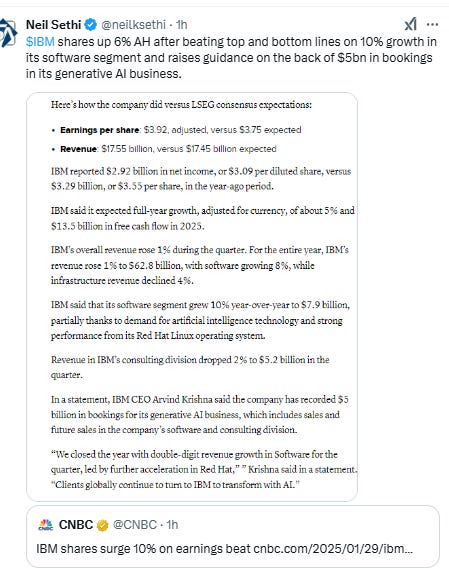

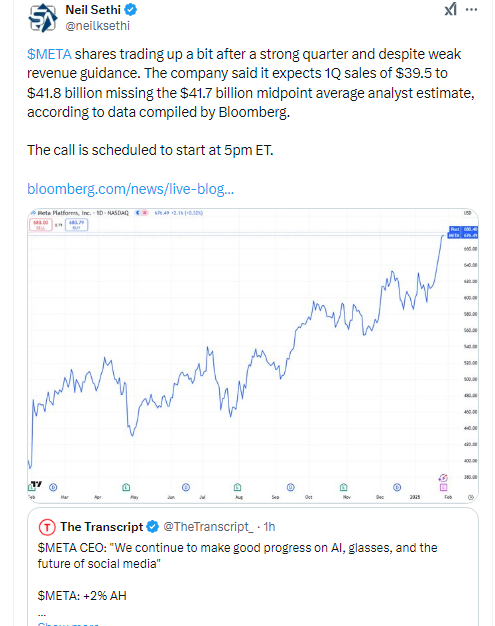

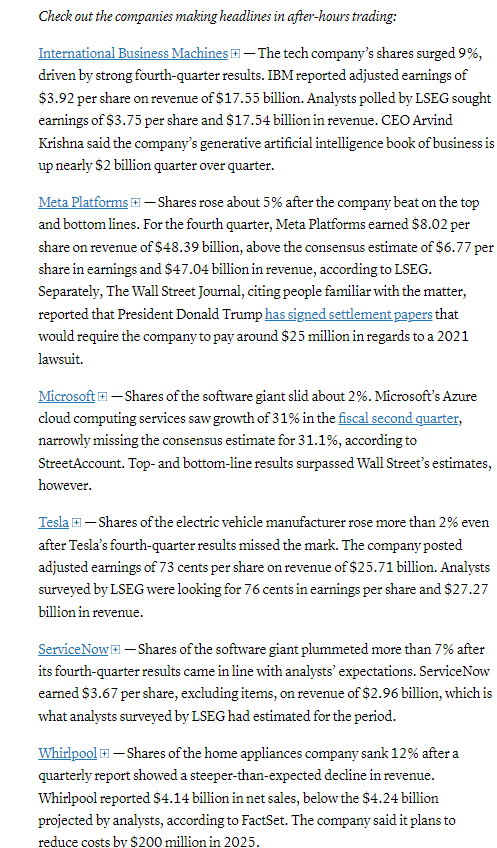

After hours Tesla Inc. climbed after saying it expects vehicle sales to rise this year after a challenging 2024. Meta Platforms Inc. rallied as its chief offered an upbeat outlook. International Business Machines Corp. soared after projecting strong revenue growth and a jump in AI-related bookings. Microsoft Corp. slid as growth in its cloud-computing business slowed.

After Hours movers from CNBC:

BBG Corporate Highlights:

Trump Media and Technology Group Corp. launched a financial-services and fintech brand dubbed Truth.Fi, with a focus on crypto and customized exchange-traded funds.

Hewlett Packard Enterprise Co. representatives met with Donald Trump’s antitrust enforcers on Tuesday over its $14 billion bid to buy Juniper Networks Inc., according to people familiar with the matter.

Apple Inc. has been secretly working with SpaceX and T-Mobile US Inc. to add support for the Starlink network in its latest iPhone software, providing an alternative to the company’s in-house satellite-communication service.

ASML Holding NV reported booking orders worth twice as much as analysts expected, as the artificial intelligence boom fuels demand for its chipmaking machines.

Nasdaq Inc. Chief Executive Officer Adena Friedman said she expects a strong environment for initial public offerings in the second quarter and balance of 2025 as investors gain confidence from stabilizing interest rates and inflation.

Alibaba Group Holding Ltd. published benchmark scores and touted what it called world-leading performance with its new artificial intelligence model release.

Starbucks Corp. reported better-than-expected quarterly results, luring back lapsed customers with coffee-focused ads and by removing extra charges for nondairy milk.

T-Mobile US Inc. reported fourth-quarter results that beat analysts’ projections, benefiting from continued growth in wireless subscribers and home internet customers.

Cigna Group plans to limit patients’ out-of-pocket expenses for medications as the insurer faces pressure from Washington over its role in prescription costs.

Bankrupt Spirit Airlines Inc. rejected a new acquisition offer from the parent of Frontier Airlines but said it remains open to a long-discussed combination of the budget carriers.

Spotify Technology SA won dismissal of a lawsuit alleging it made a change to its premium service that cheated songwriters out of royalties.

A judge ordered Paramount Global to hand over some internal files to a pension fund that’s raising questions about the acquisition by Skydance Media, which shifts control of the storied Hollywood studio to producer David Ellison.

Some tickers making moves at mid-day from CNBC.

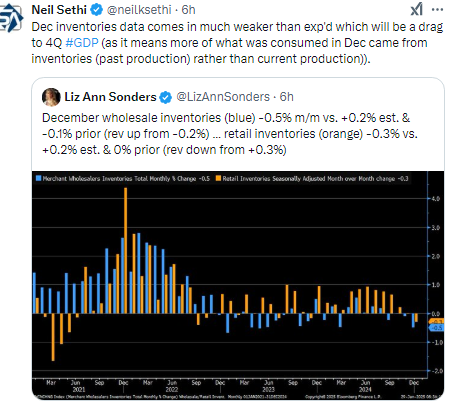

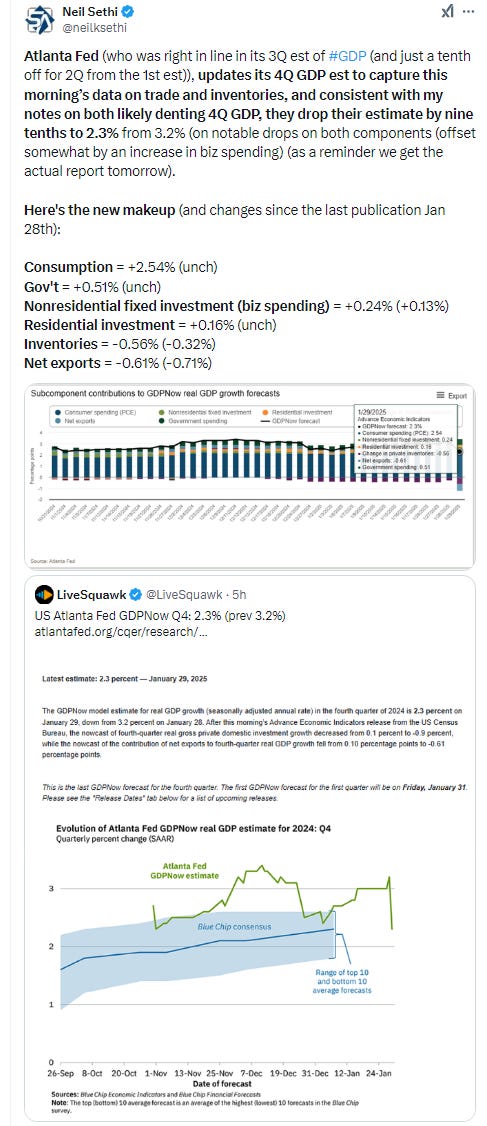

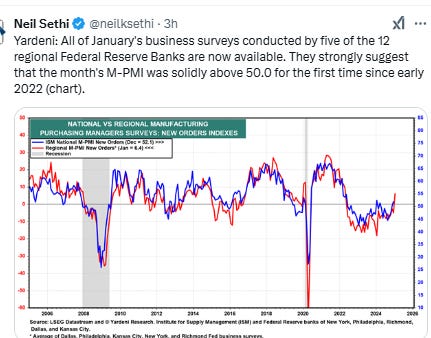

In US economic data:

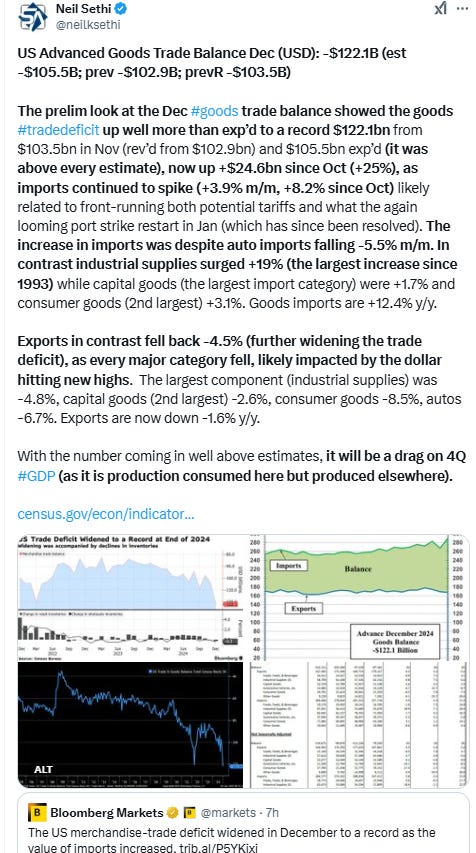

The preliminary look at the Dec goods trade balance showed the goods trade deficit up well more than exp’d to a record $122.1bn from $103.5bn in Nov (rev’d from $102.9bn) and $105.5bn exp’d (it was above every estimate), now up +$24.6bn since Oct (+25%), as imports continued to spike (+3.9% m/m, +8.2% since Oct) likely related to front-running both potential tariffs and the again (at the time) looming port strike restart in Jan (which has since been resolved). The increase in imports was despite auto imports falling -5.5% m/m. In contrast industrial supplies surged +19% (the largest increase since 1993) while capital goods (the largest import category) were +1.7% and consumer goods (2nd largest) +3.1%. Goods imports are +12.4% y/y. Exports in contrast fell back -4.5% (further widening the trade deficit), as every major category fell, likely impacted by the dollar hitting new highs.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX fell back to the 6020 breakout level which held. The daily MACD remains favorable, the RSI a little less so.

The Nasdaq Composite fell back to its 50-DMA where it bounced modestly. Its daily MACD and RSI are also positive but less favorable than the the SPX.

RUT (Russell 2000) was little changed for a third day remaining just under the 2290 level. Its daily MACD and RSI remain positive but like Nasdaq a little less so than the SPX.

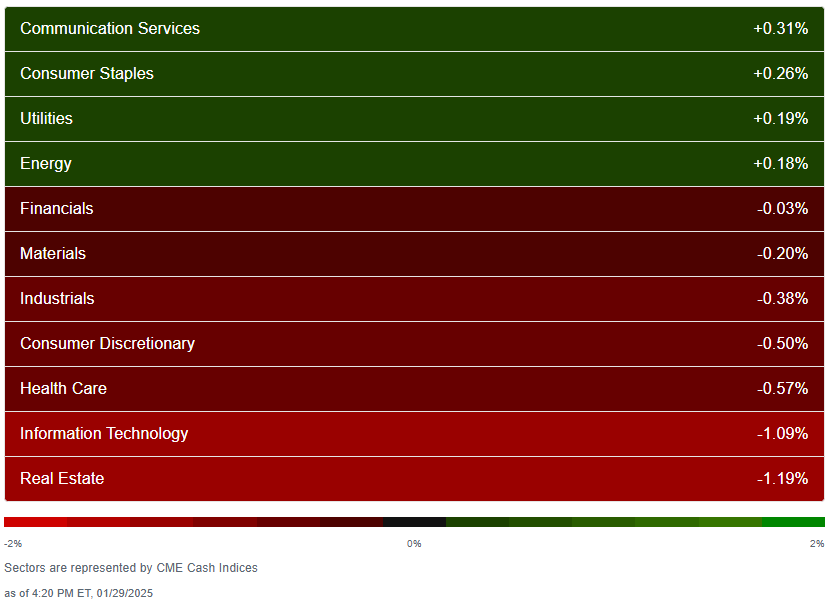

Equity sector breadth from CME Cash Indices improved slightly in terms of adding one more green sector (so four from three) but unlike Tuesday, when all three were up more, no sector was up over +0.3%. In contrast five sectors were down more than that, although just two down more than -0.6% vs six Tues & two down over -1% (vs four Tues).

SPX sector flag from Finviz consistent w/a very mixed day.

Positive volume was 46% on the NYSE Wed, in line with the loss in the NYSE Composite Index, while the Nasdaq was weaker at 39% but also around expectations given the larger loss there. Positive issues (percent of stocks trading higher for the day) were 36 & 40% respectively.

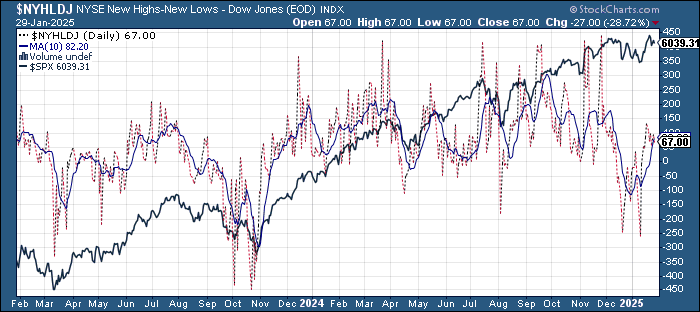

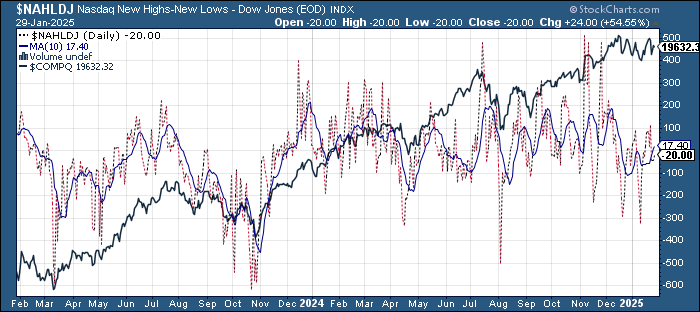

New highs-new lows (charts) were mixed falling to 67 on the NYSE but improving to -25 on the Nasdaq. They remain just below their 10-DMAs though those are still moving higher for now (more bullish).

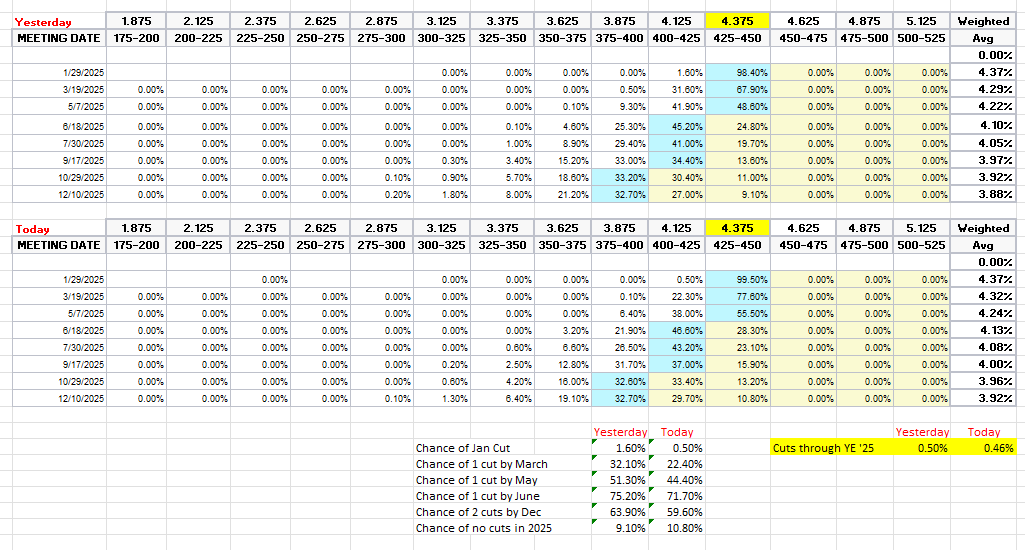

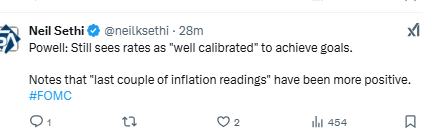

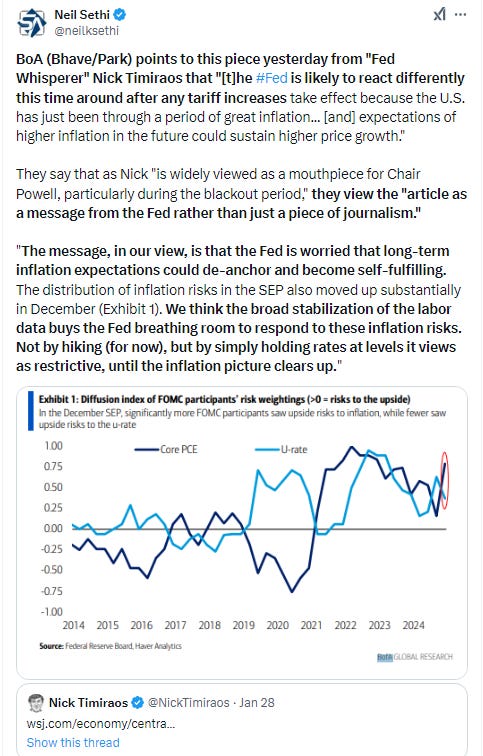

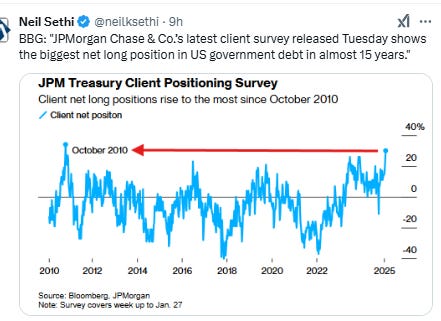

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool dropped 7bps of 2025 cuts following the statement which had described the labor market and economy as “solid” but inflation as “somewhat elevated” and took out a reference to “further progress to the 2% inflation goal.” Powell walked some of that back, but expectations still finished down from yesterday at 46bps of cuts from 50. A cut by March fell to a 22% probability from 32%, by May 44% from 51%, and by June 72% from 75%. Chance of two 2025 cuts ended 60% from 64% and no cuts up to 11% from 9%.

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that, and it looks like the market is mostly in agreement at this point.

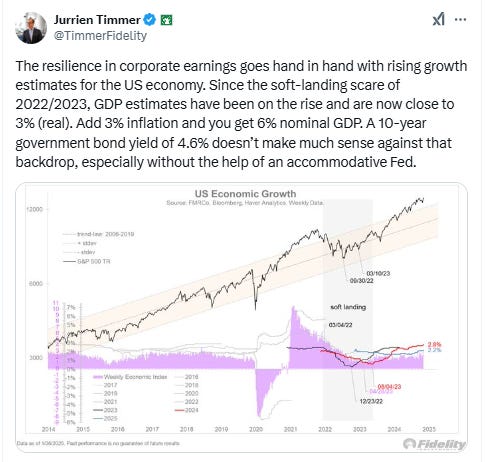

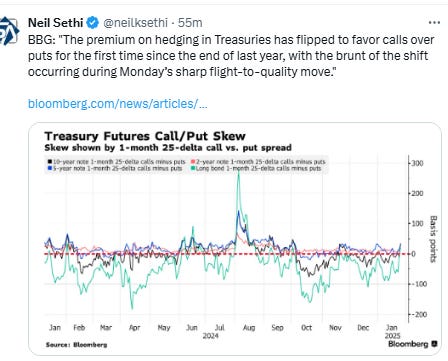

Longer duration #UST yields fell early in the session before rebounding with the 10yr testing the 4.5% level which held for now.

The 2yr yield, more sensitive to Fed policy, ended higher for the 1st session in five +2bps from a 1-mth low to 4.22%. I still find this level rich, and I’m looking for it continue to soften in coming weeks (subject to next week’s NFP report).

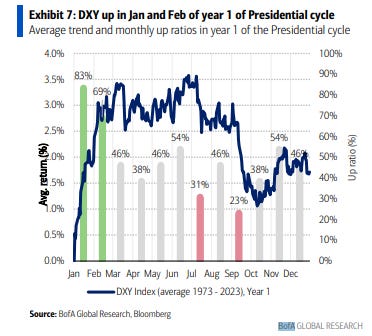

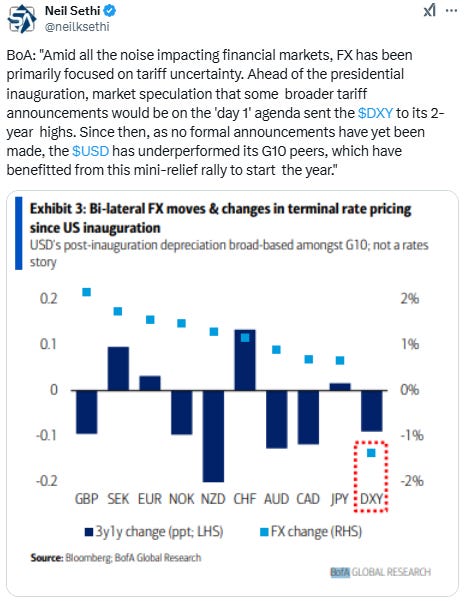

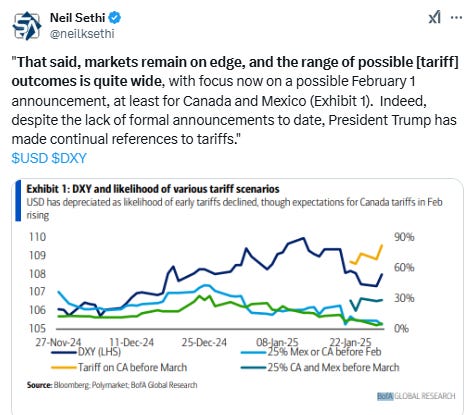

Dollar ($DXY) finished higher for a 2nd session but off its highs. Daily MACD and RSI remain weak.

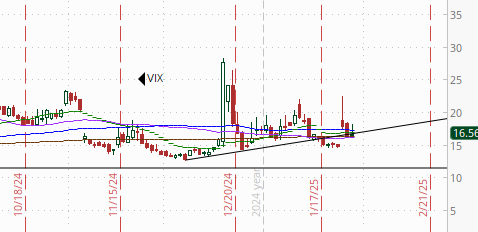

The VIX was little changed at 16.6 (consistent w/1.04% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly little changed at 102, just over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

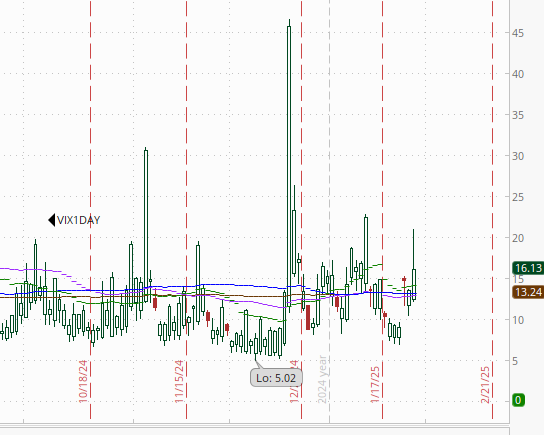

1-Day VIX at one point was over 20 before falling back to 16.1 (remaining elevated due to the big set of earnings after the close), looking for a move of 1.02% Thursday.

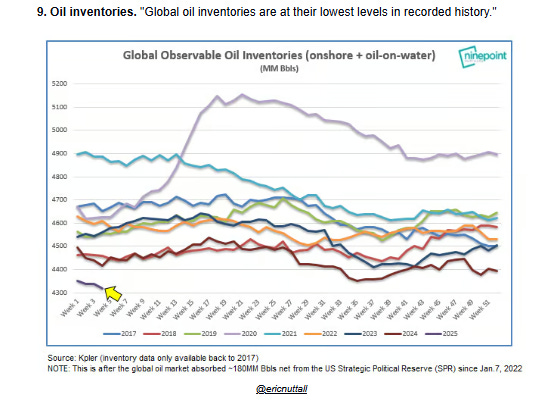

WTI fell back as it remains below a cluster of resistance at the $75 level. Daily MACD is not supportive while the RSI is neutral and could go either way. As I said Monday “I don’t have a lot of confidence in it regaining that level quickly but we’ll see.”

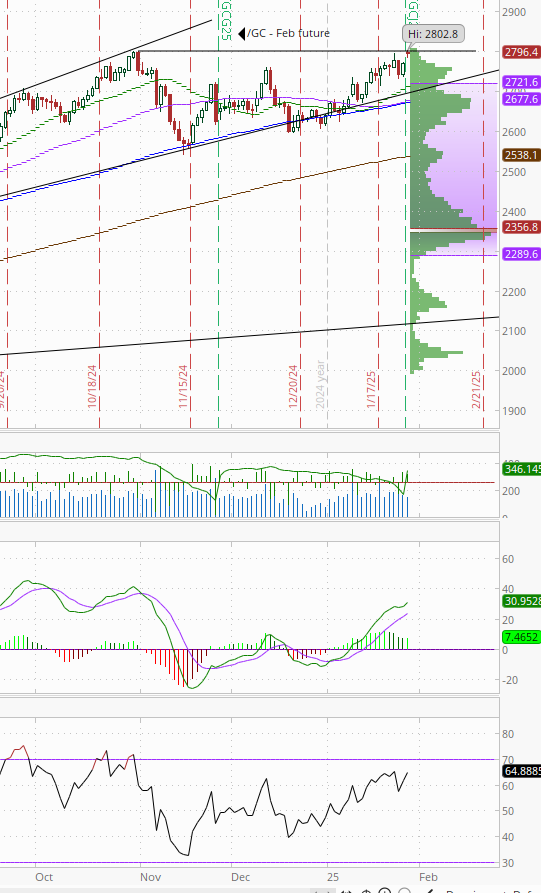

Gold up to ATH territory before edging back to just miss a new closing high. Daily MACD & RSI remain supportive.

Copper (/HG) was higher but overall remains in the middle of its range over the past 6 mths. Daily MACD & RSI remain neutral.

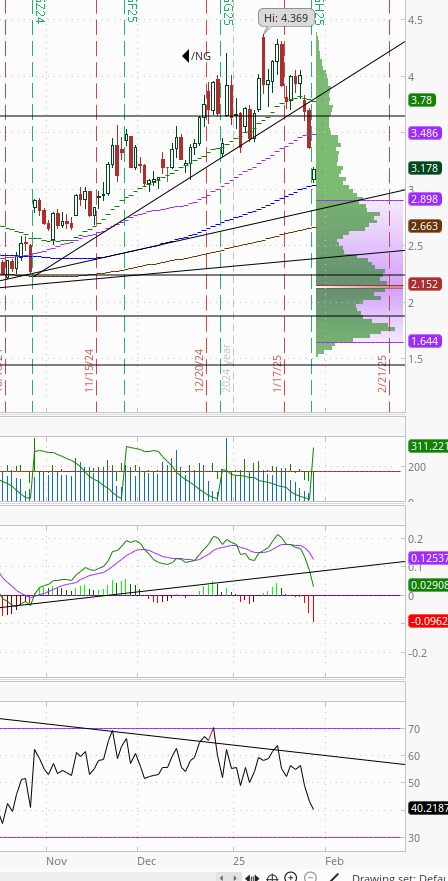

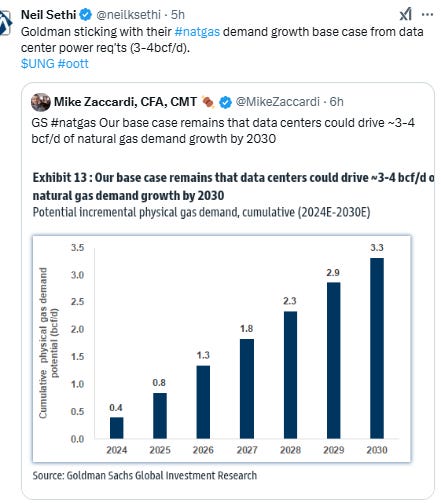

Nat gas (/NG) finished higher but only after a -10% drop due to a roll to the March contract. This put it just above the $3 level which it moved up a bit from (consistent with my thinking that $3 would be “solid support”). We’ll see if it can continue to fill the “roll gap”. Daily MACD though remains in “sell longs” position, and the RSI has fallen under 50 to the least since October.

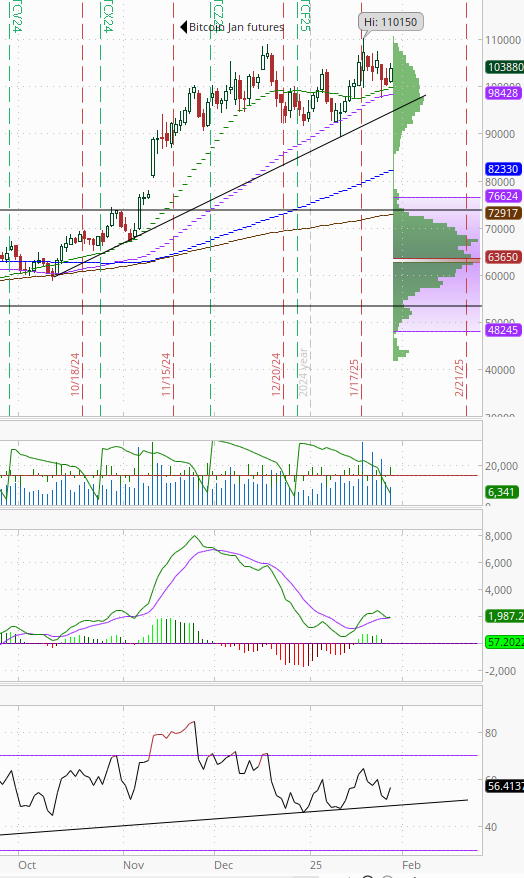

Bitcoin futures were up today as they continue to trade between $100k & $110k over the past week. Daily MACD and RSI tilt positive for now.

The Day Ahead

While we won’t have the Fed tomorrow, US econ data takes a step up headlined by 4Q GDP. We’ll also get weekly jobless claims and Dec pending home sales.

I don’t see any Fed speakers on the calendar, but you never know.

Earnings will remain heavy with another 39 SPX components reporting including another ten > $100bn in market cap and one more Mag-7 member who is > $3tn in market cap (Apple (AAPL), see the full earnings calendar from Seeking Alpha).

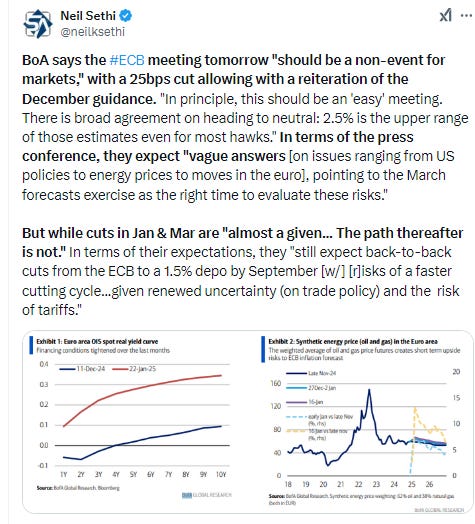

Ex-US the highlight is a policy decision from the ECB (25bps cut is exp’d). We’ll also get 4Q GDP and Jan consumer & biz confidence from the EU, Jan CPI from Spain, and Dec UK consumer credit among other reports. In EM we’ll get 4Q GDP from Mexico and Jan inflation from Brazil.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,