Markets Update - 1/29/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

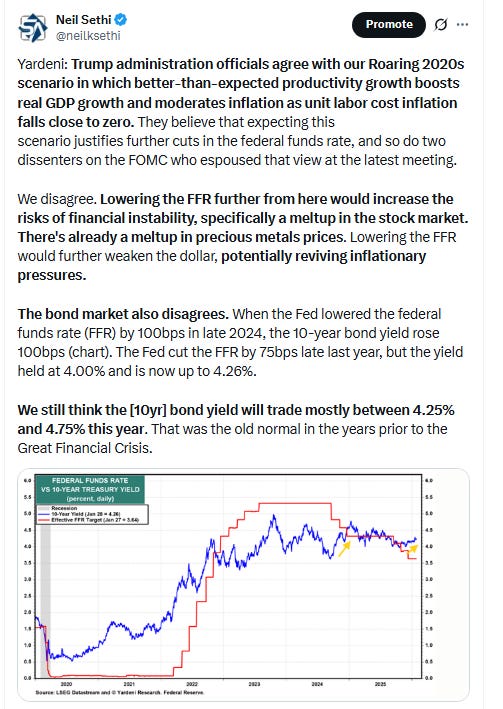

US equity indices opened today’s session trading slightly higher with mixed reactions to a slew of earnings since Wednesday’s close including three of the Mag-7. Meta Platforms jumped 9% in premarket trading after the Facebook parent gave a stronger-than-expected first-quarter sales forecast. Fellow “Magnificent Seven” member Tesla shares saw gains as well, climbing nearly 2% after the company’s fourth-quarter results beat expectations (those would reverse to losses with Tesla finishing 3.5%). The broad market gains were kept in check by Microsoft’s -6% fall (which would accelerate to -10%) after reporting larger than expected spending and cloud growth that slowed in the fiscal second quarter. The company also issued soft guidance on operating margins.

In other notable reactions, IBM shares soared nearly 10% on a strong earnings report, and Southwest Airlines rallied 5.3% (it would finish +18%) after forecasting a surge in 2026 profits on the back of its business model overhaul. But ServiceNow tumbled -8% despite the company reporting fourth-quarter earnings that beat expectations, and Las Vegas Sands shares shed -9%.

Indices would quickly fall into the red as the tech selloff would broaden and deepen to most names in the software space. Indices found a bottom around 11am though and climbed the rest of the day, but just the DJIA and Russell 2000 made it into the green (at +0.1%). SPX finished -0.1% (behind the RUT for the first time in five sessions), while the Nasdaq was -0.7%.

Elsewhere, bond yields edged lower, while the dollar continued to stabilize after hitting the lowest levels in nearly 4 years Tuesday. Gold and copper saw big volatility trading in 10% ranges but both finishing higher as did natgas and crude. Bitcoin though fell to the lowest since April.

The market-cap weighted S&P 500 (SPX) was -0.1%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite -0.7% (and the top 100 Nasdaq stocks (NDX) -0.5%), the SOXX semiconductor index +0.2%, and the Russell 2000 (RUT) +0.1%.

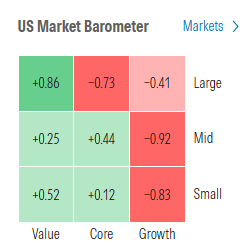

Morningstar style box continued to be mixed with today growth lagging although again no style moving more than 1%.

Market commentary:

“The AI theme, and who benefits from the AI capex going forward, remains the largest driver of factor and market cap calls,” said Dennis DeBusschere at 22V Research. “The macro backdrop is supportive of a broadening out of returns, but the main driver of returns has been related to AI themes.”

“The one-way bet on AI leadership is now starting to look overcrowded,” said Fawad Razaqzada at Forex.com. “There is now some fear creeping into investors’ minds that the AI theme may not be as immediately lucrative as hoped.” Still, all is not lost, he noted. The fact that the Nasdaq is easing back from elevated levels is a clear sign “it is far too early to talk about the peak in tech,” Razaqzada said.

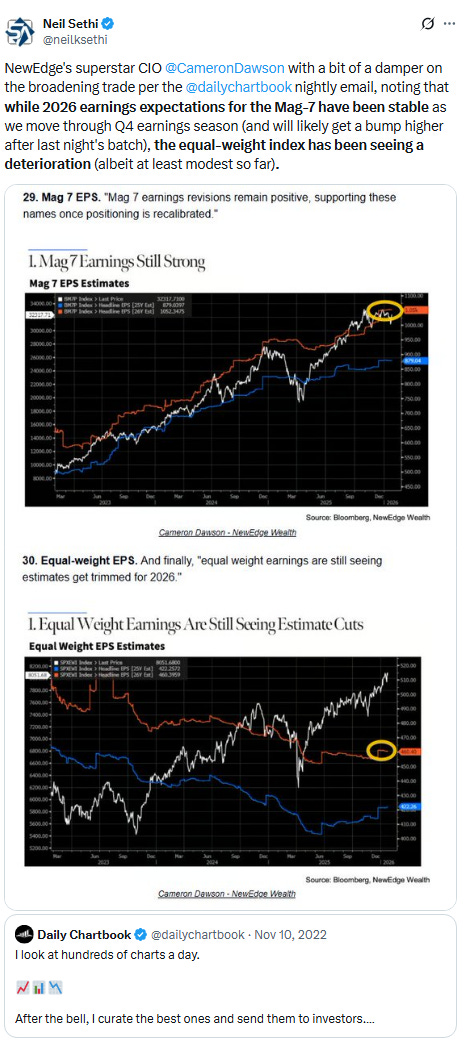

This week brought the first wave of major tech earnings, and a clear theme is emerging, according to Angelo Kourkafas at Edward Jones. “Companies are ramping up AI‑related infrastructure spending, and markets are rewarding those that can turn these investments into earnings,” he said. “Firms without a clear monetization strategy are facing more scrutiny.” More broadly, Kourkafas says the tech sector is still expected to deliver strong profit growth in the S&P 500, with AI remaining an important catalyst. “However, that growth is slowing from earlier quarters even as other sectors accelerate, supporting what we see as this year’s key theme: a broadening of market leadership,” he concluded.

“AI has become like a two-edged sword here. It’s a contributor to growth and spending. It’s a contributor to why valuations are the way they are,” said Rob Williams, chief investment strategist at Sage Advisory. “Now, there are more questions about it, so it’s becoming harder for it to continually deliver positive news.” Williams noted that because it’s only getting more difficult for megacap tech names to spur upbeat sentiment in the market unless they post “blowout” numbers, diversification will become key for investors moving forward. “Earnings are the path to good returns for the equity market this year, because multiples don’t have a lot of room to contribute,” he told CNBC. “Market breadth is improving, but we are still very concentrated.”

As investors react to yesterday’s Big Tech earnings, they’re showing scrutiny on what Direxion’s head of capital markets, Jake Behan, called “an AI monetization test.”

“Traders aren’t rewarding the spend anymore; they’re demanding visible monetization. Microsoft’s getting hit for rising capex that resulted in slower Azure growth, while Meta’s being rewarded because stronger ad sales and higher engagement are self-funding its AI spend,” Behan told MarketWatch in an email. “Against this backdrop, it’s understandable to see more cautious positioning heading into a heavy earnings slate next week headlined by Apple, Alphabet and Palantir,” he added. Behan said that the market’s reaction is “instructive” of what investors should expect as more tech earnings come in.

As earnings season kicks into high gear, investors are looking beyond the headline and guidance numbers. They seek clarity on the impacts of the evolving trade landscape as well as clues regarding the trajectory of AI capital investments, according to Rob Anderson and Thanh Nguyen at Ned Davis Research. “Earnings could help solidify the rotation away from growth to value if growth rates and revision trends continue to suggest a broadening beyond the tech megacaps later this year,” they said. “Conversely, a strong quarter from the megacaps could help growth sectors regain leadership status.”

“If revision trends continue to suggest earnings will broaden throughout 2026, it could support the case for the value rotation that began at the end of October to persist in 2026,” said Anderson and Nguyen.“Despite the carnage in parts of tech, overall [New York Stock Exchange] breadth is positive today,” Jonathan Krinsky, chief market technician at BTIG, wrote in a note.

“The AI theme is overcrowded, and investors are revaluing the AI trade, so they are re-weighting big-tech stocks in their portfolios,” said Matt Maley at Miller Tabak & Co.

Investors appear a little more willing at the start of the year to rebalance at least some of their positioning away from the AI trade, for valid reasons, and toward asset categories, sectors, industries, and companies that are more exposed to the “real” economy, accorrding to Anthony Saglimbene at Ameriprise. “Unless reports from Mag Seven companies materially reset the earnings outlook (which we believe will not be the case), the early-year preference for small caps and non-tech cyclicals could remain intact as investors seek a wider base of earnings contributors and index performance participants,” he said earlier this week.

“In addition to measuring AI monetization via cloud revenue growth, we are increasingly seeing evidence of productivity gains due to AI adoption,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “As in any innovation cycle in the past, we expect to see a performance handover from the enablers to the users, and companies that leverage AI to improve business outcomes should see tangible financial benefits.” That means AI beneficiaries are likely to “broaden” not only to the intelligence and application layers of the value chain, but also to other sectors such as financials and health care, she said. “So, we maintain our conviction that AI innovation will continue to drive equity returns in the coming years, and investors should broaden their exposure across the value chain,” Hoffmann-Burchardi concluded.

“Investors are climbing stairs, not walls today, and the step-ups are modest for extending trends, with a USD theme, gains for energy and gains for tech all expected,” Bob Savage, head of markets macro strategy at BNY, wrote in a Thursday client note.

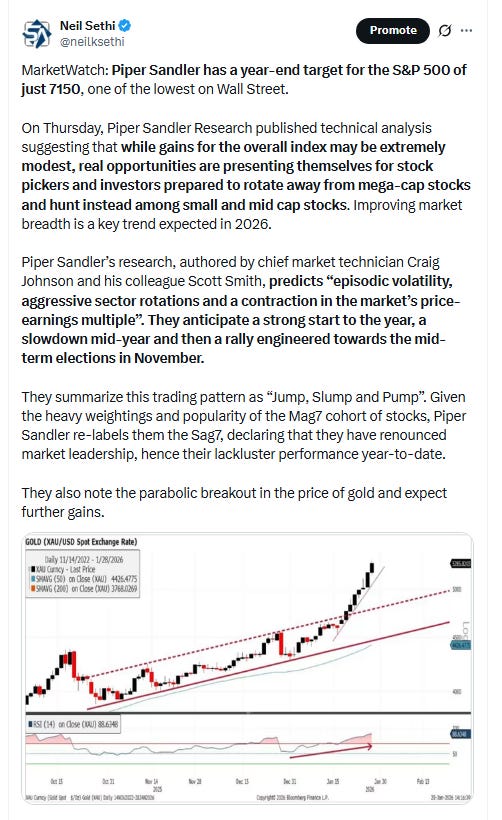

After three consecutive years of double-digit returns, the equity markets have proven to be incredibly resilient. However, the outlook for 2026 is for a “bull market with a lowercase ‘b’”— defined by episodic volatility, aggressive sector rotations, P/E multiple contraction, and outperformance by small- and mid- cap stocks, according to Craig Johnson at Piper Sandler. “Under the surface, a true stock-picker’s market is emerging with more constructive charts setting up across many sectors,” Johnson said. “We reiterate our S&P year-end price objective of 7,150 — a modest single-digit gain — but note that the real opportunity this year lies in stock picking, not at the index level.”

“This appears to be a classic buying opportunity,” said Louis Navellier at Navellier & Associates. “We’re already seeing a bounce off the bottom in all the major indexes. Volatility is clearly higher, but the trend is nevertheless still positive.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

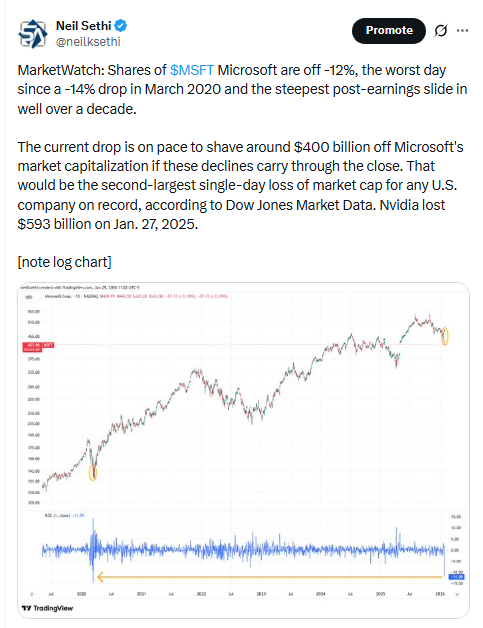

Microsoft dragged down the benchmark with a roughly 10% slide, posting its worst day since March 2020. That’s after the “Magnificent Seven” member reported that cloud growth slowed in the fiscal second quarter. The company also issued soft guidance on operating margin for the fiscal third quarter.

A tumble in software stocks added to the losses, with as fears grew among investors that artificial intelligence would disrupt Microsoft’s business model. ServiceNow shares pulled back about 10% even after better-than-expected earnings and revenue for the fourth quarter. Shares of Oracle and Salesforce moved lower by 2% and 6%, respectively. The iShares Expanded Tech-Software Sector ETF (IGV) — which tracks the performance of the software sector — fell into bear market territory Thursday, with its around 5% loss on the day placing it nearly 22% below its recent high. The fund’s move also puts it on track for its largest single-day drop since last April.

On a positive note, Meta Platforms shares jumped more than 10% after the Facebook parent gave a stronger-than-expected first-quarter sales forecast. Elsewhere, Caterpillar shares were up more than 3% after the industrial giant reported fourth-quarter results that easily beat the Street.

Apple Inc. posted strong results after the close. Amazon.com Inc. was said to be in talks to invest as much as $50 billion in OpenAI.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Tesla Inc. will spend over $20 billion on a dramatic reshuffling of factory lines reflecting Elon Musk’s repositioning of the carmaker coming off a multiyear sales slump. The firm’s fourth-quarter profit surpassed expectations.

SpaceX is in discussions with his artificial intelligence firm xAI about a potential merger ahead of the rocket and satellite maker’s potential blockbuster IPO, Reuters reported.

ServiceNow Inc. gave a sales outlook in the current quarter that was stronger than expected, but failed to reduce investor anxieties that artificial intelligence will disrupt the software maker’s business.

Lam Research Corp. forecast adjusted earnings per share for the third quarter that beat the average analyst estimate.

US auto safety regulators are investigating a Waymo autonomous vehicle that struck a child near a school in Santa Monica, California, the second recent probe to examine the behavior of the Alphabet Inc. unit’s robotaxis near children.

Caterpillar Inc. got an earnings boost from selling power generation equipment to AI data centers in its fourth quarter, helping drive quarterly results that topped Wall Street’s expectations.

Honeywell International Inc.’s outlook for 2026 topped Wall Street estimates, while the spinoff of its aerospace unit is set to happen earlier than expected.

Starbucks Corp. sees sales and earnings growth over the next few years as its turnaround plan takes hold.

Visa Inc. reported earnings that topped analyst estimates as payments surged 8% from a year earlier amid strong holiday spending.

Mastercard Inc. reported fourth-quarter earnings that beat estimates as consumers continued to turn to the company’s cards as a payment option.

Comcast Corp. reported revenue and profit in the fourth quarter that met or surpassed Wall Street expectations, even as it continued to lose cable TV and internet customers.

The UK warned some patients have died of severe inflammation of the pancreas linked to obesity and diabetes drugs such as Eli Lilly & Co.’s Mounjaro and Novo Nordisk A/S’s Wegovy.

Grubhub is removing delivery and service fees on all restaurant orders above $50, the latest move by the newly private food-delivery app to lure customers from rivals DoorDash Inc. and Uber Technologies Inc.

Carvana Co. bounced from a steep selloff as Wall Street analysts rushed to defend the online used-car dealer’s business following a report from short seller Gotham City Research that accused the company of overstating earnings.

Lazard Inc. named Tracy Farr chief financial officer as it reported fourth-quarter revenue and profit that beat analysts’ estimates.

Blackstone Inc. reported a surprise jump in distributable earnings as dealmaking reignited and reached what President Jon Gray calls “escape velocity.” For executives, that unleashed some of their richest rewards since the pandemic.

First Brands Group founder Patrick James and his brother Edward, a former executive at the company, were indicted in New York following the collapse of the bankrupt auto-parts maker last year.

Lockheed Martin Corp. said it reached a deal with the Pentagon to increase THAAD interceptor production, as the company issued an upbeat guidance for 2026 amid record deliveries of its F-35 fighter and growing missile sales.

Southwest Airlines Co. reported results that topped analyst estimates, signaling the fruits of a turnaround after a challenging year as the US carrier rolls out new initiatives to boost profit.

Royal Caribbean Cruises Ltd.’s results showed as demand for cruise holidays keeps accelerating, which could see the liner add as many as six additional ships to its fleet.

Joby Aviation Inc. is raising $1 billion from the sale of shares and convertible bonds, as the air taxi company seeks to double production capacity by 2027.

International Paper Co. plans to break up and spin off its European packaging business in a significant shift for the 128-year-old company as it seeks to strengthen operations amid a weak global economy.

Mid-day movers from CNBC:

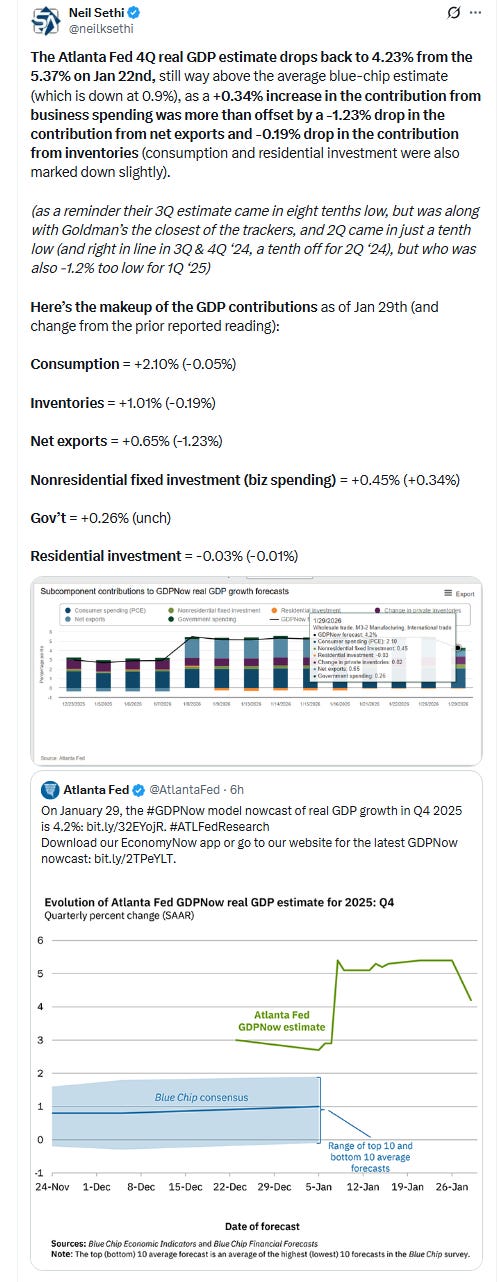

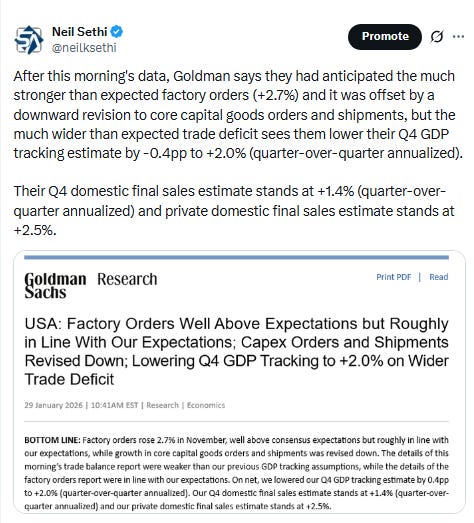

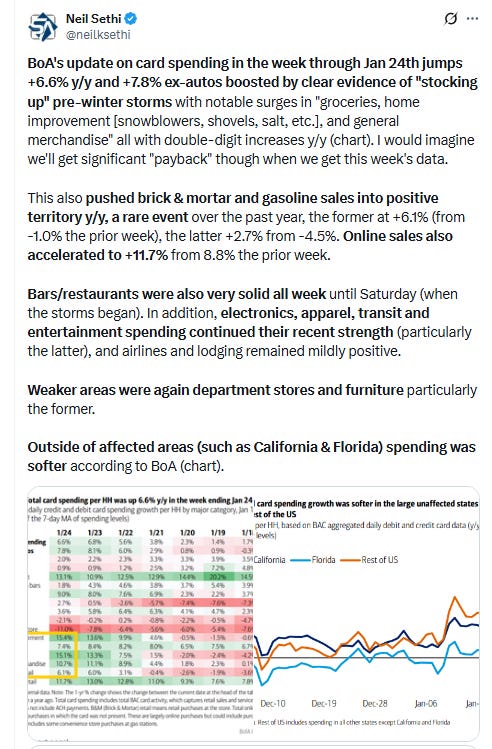

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X

The SPX was a touch lower but finished well off the lows of the day. The daily MACD remains in “go long” positioning while the RSI paused its bounce from the weakest since Nov but for now continues to remain in divergence.

The Nasdaq Composite a similar story.

RUT (Russell 2000) was the best performer but the chart still remains the weakest. The MACD remains in “sell longs” positioning but the RSI is at least above 50.

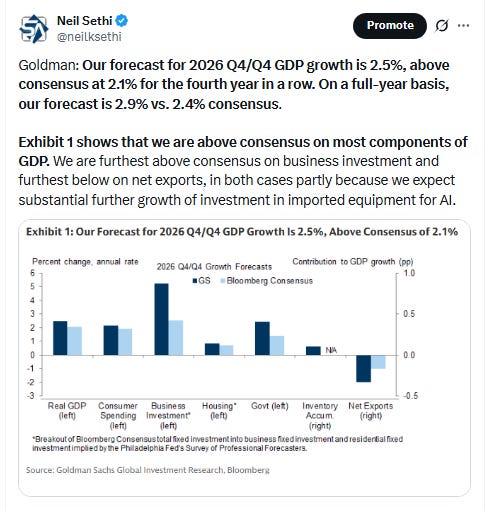

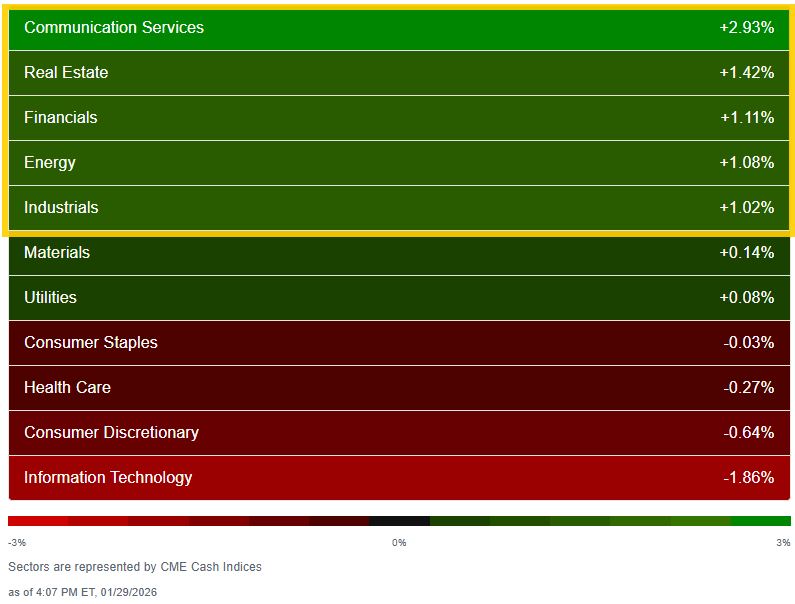

Despite the mildly down day for the SPX, sector breadth according to CME Cash Indices improved to 7 of 11 sectors in the green (after Wed seeing less than 6 sectors for only the third time this year (along with Jan 20th and 7th), with five of those up >1% (after none Wed) led by Comm Services on the back of META’s +10.7% (best day since Aug). Classic cyclicals were the others (RE, Financials, Energy, Industrials).

Just one sector down that much (Tech -1.9% led by MSFT -10.2%, but also PLTR -3.5%, PANW -4.2%, CRWD -5.2%, CRM -6.6, NOW -9.8%, ORCL -2.2%, etc.). Cons Discr was next -0.6% w/TSLA -3.5%.

Sectors were much more widely dispersed Thurs with a top to bottom spread of 4.8% after 1.7%,

In line with the sector chart, the stock-by-stock flag from @finviz_com overall quite green but where there was red it was often the bright kind particularly in software along with some other pockets.

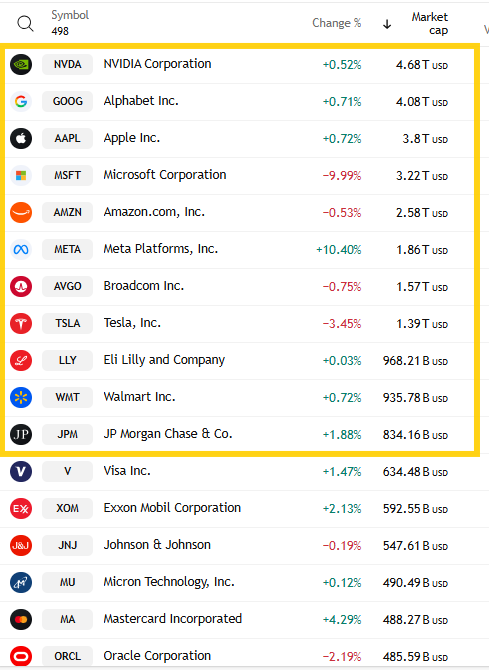

Seven of the largest 11 SPX components were higher (from 6 Wed, 7 Tues, 6 Mon) led far and away by META +10.4%. JPM (+1.9%) was the only other one up over 1%. MSFT easily led to the downside -10%, although as noted earlier TSLA was -3.5%. No other down more than -0.75%.

The gains/losses evened out with Mag-7 -0.1% after UNCH Wed, still +1.3% for the week after finishing last week +1.1%.

~35 SPX components were up 3% or more (after 22 Wed, 23 Tues, 12 Mon), led by two travel names in Southwest Airlines LUV and Royal Caribbean RCL both up +18.7%. Another NCLH was also up +10% as was META.

11 of those 22 were >$100bn in market cap in META, IBM, APP, HON, T, MA, LMT, LRXC, KLAC, PH, CAT (in descending order of percentage gains).

~45 SPX components down -3% or more (after 22 Wed, 26 Tues, 12 Mon) led by Las Vegas Sands LVS -14.0%. URI, FSLR, and MSFT also down -10% or more

12 of the 45 down -3% or more were >$100bn in market cap in MSFT, NOW, INTU, CRM, MO, CRWD, PANW, NEM, PLTR, TSLA, ACN, BA (in order of percentage losses).

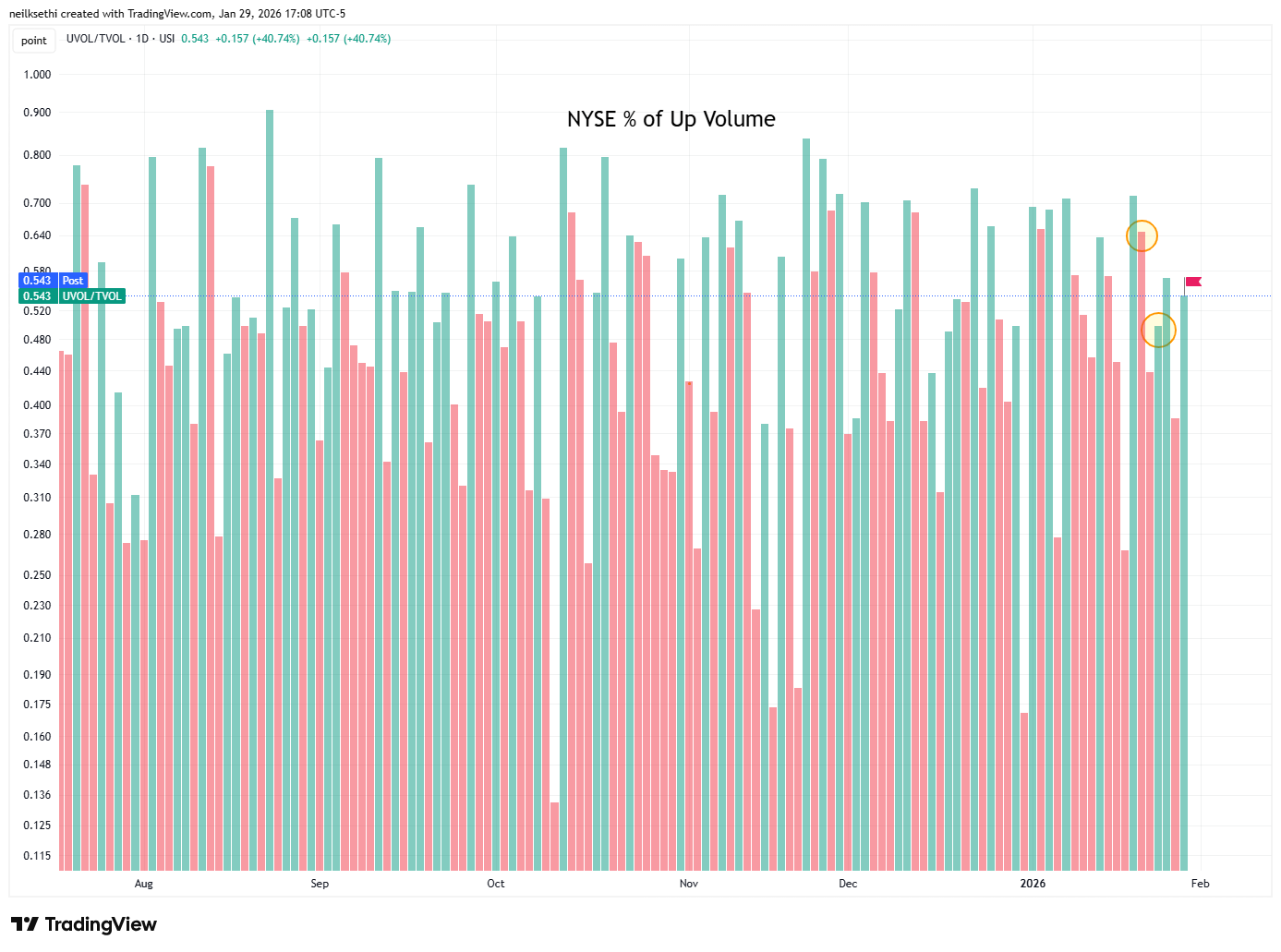

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) improved to 54.3% in line with the +0.33% gain in the index although this particular number a +0.31-0.33% gain) has seen very different results the last two times we hit it. On the 22nd positive volume was 64.6% while on Monday it was 49.8% (circles). A little unusual.

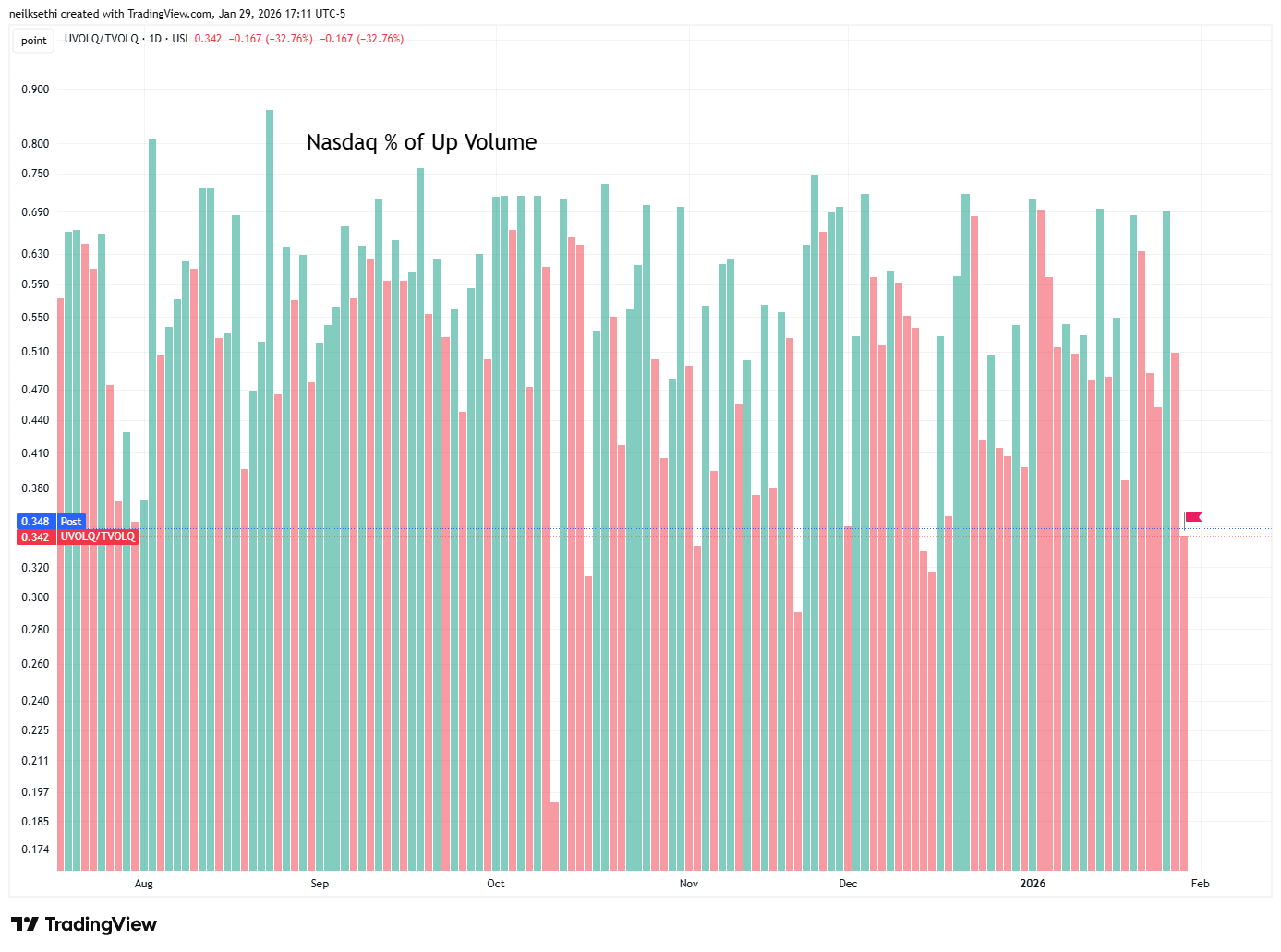

Nasdaq positive volume (% of total volume that was in advancing stocks) though fell to 34.2% as its gain turned into a -0.72% loss, slightly weaker than what history would suggest (with the usual caveat that positive volume on the Nasdaq is all over the place due to the speculative volumes).

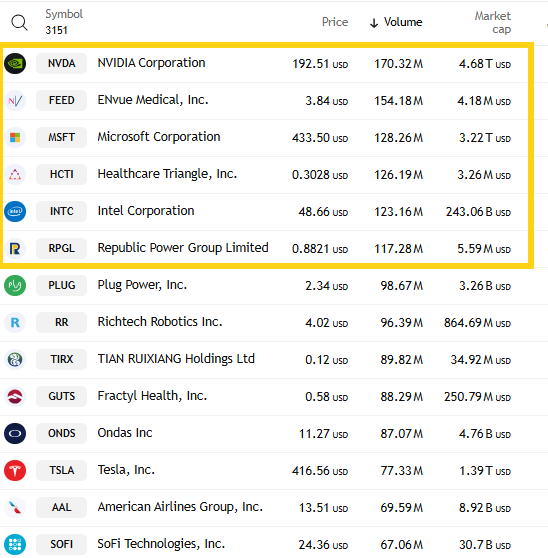

Looking at Nasdaq volumes though I am not surprised positive volume was a little weak as the top 3 stocks by volume collectively traded just 450mn shares (and notably two of them were NVDA and MSFT not penny stocks), around the least we’ve seen in months, down from ~900mn the prior two sessions and just three other stocks traded over 100mn shares (down from five the prior two sessions).

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, were higher as a result on the Nasdaq at 42%, and 55% on the NYSE.

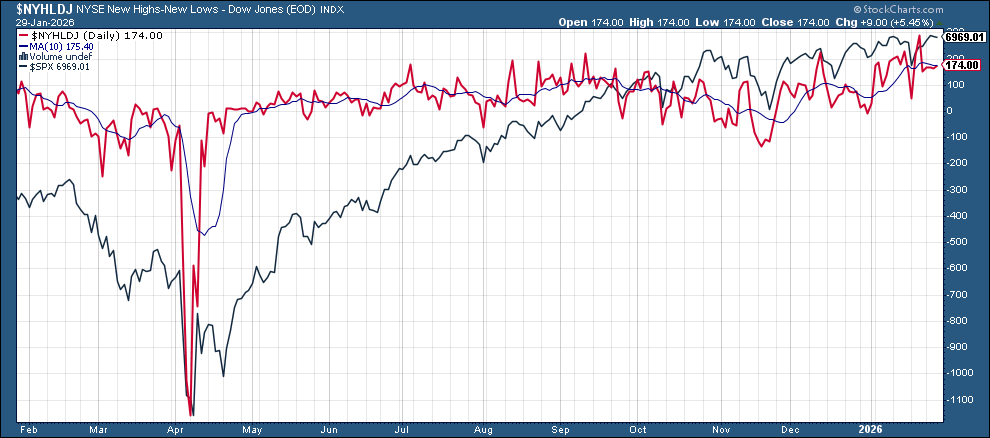

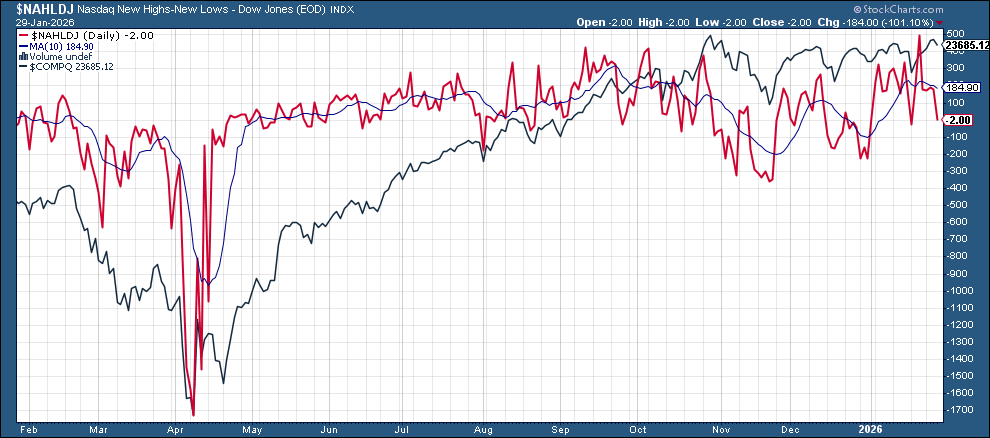

New 52-wk highs minus new 52-wk lows (red lines) were little changed for a four session on the NYSE at 174 (still down from 288 a week ago, the best since Nov ‘24 ), but fell to -2 on the Nasdaq (down from 490 a week ago, also the best since Nov ‘24).

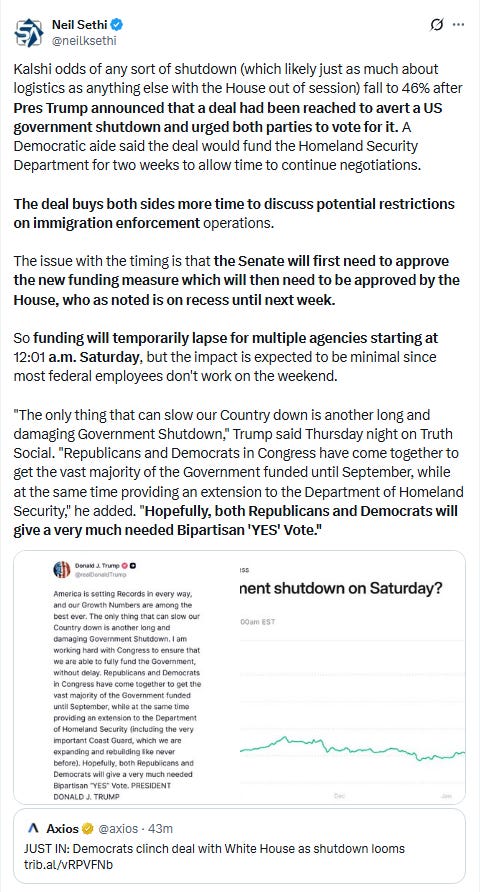

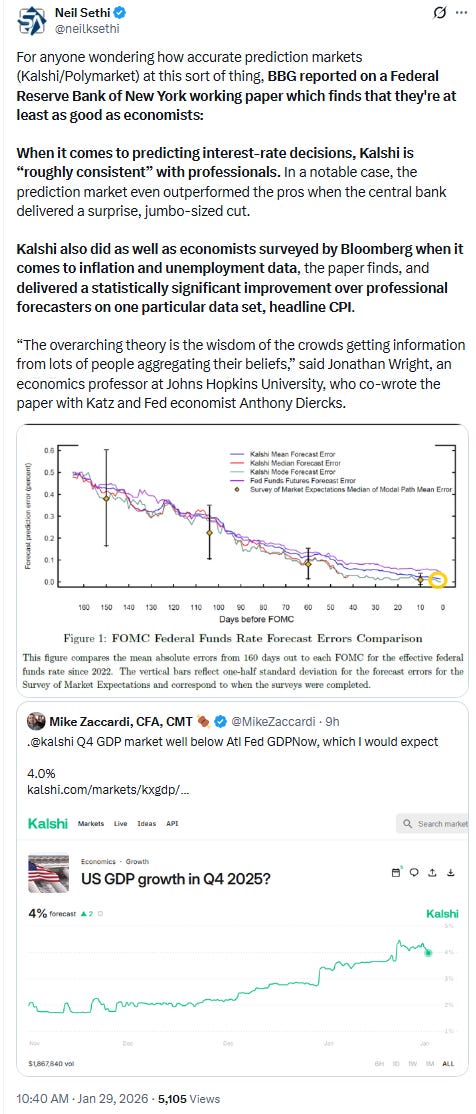

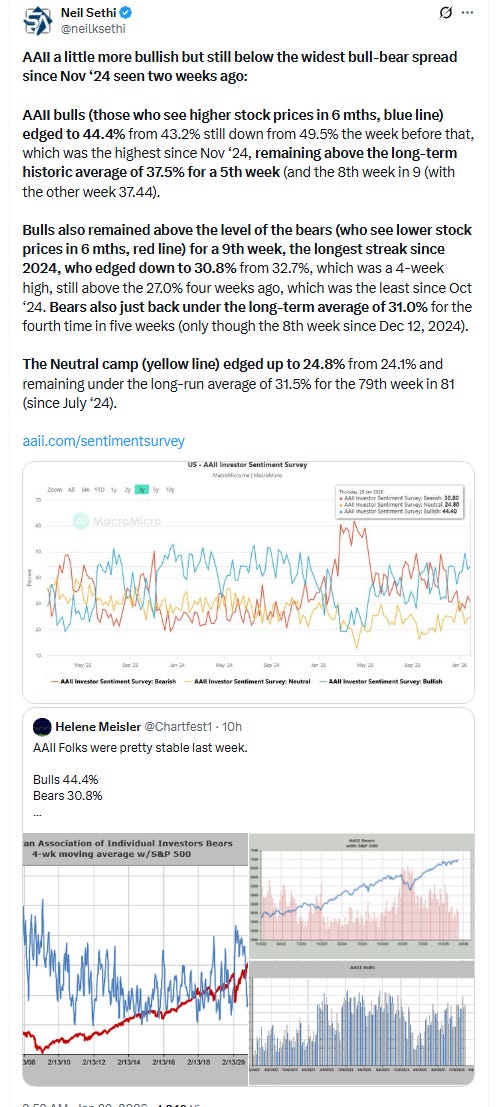

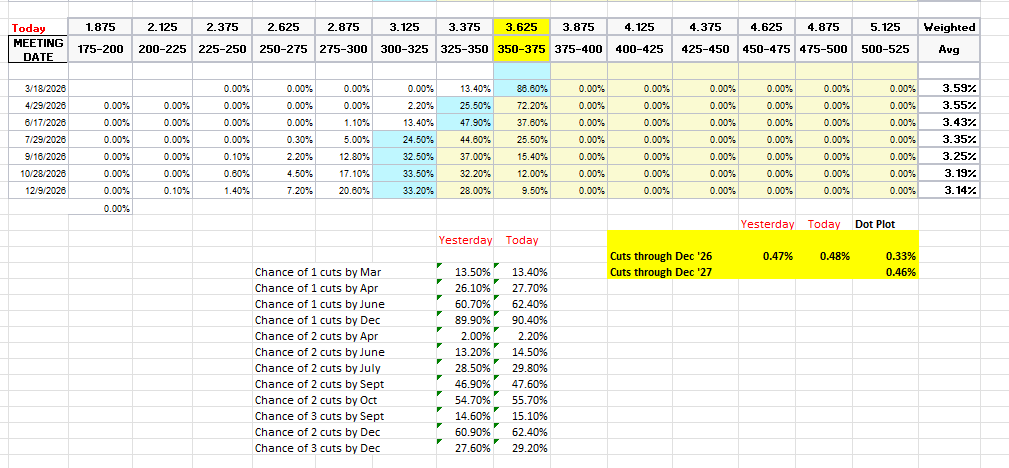

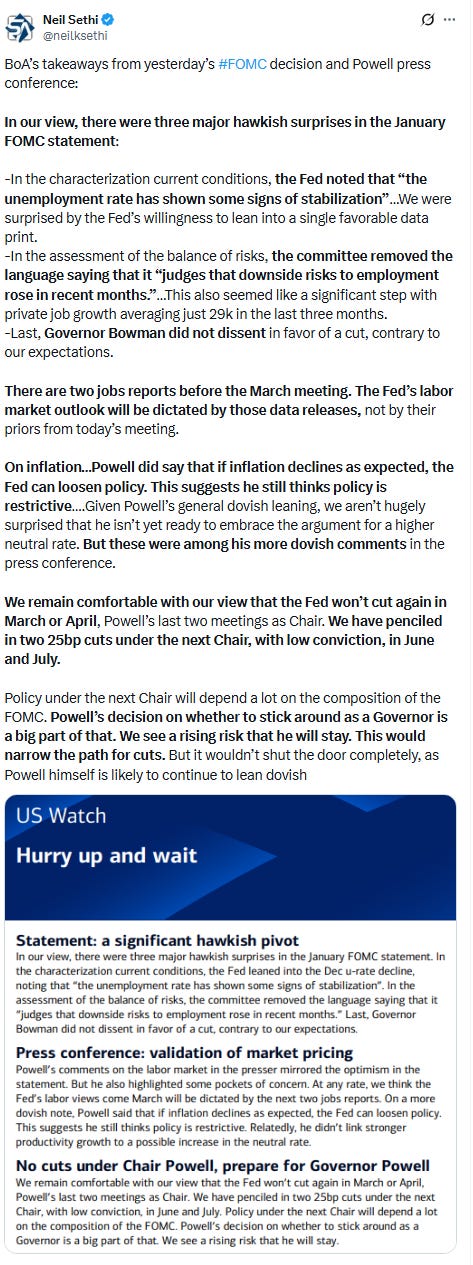

FOMC 2026 rate cut pricing hardly moved again remaining in its recent range (still though near the least since pricing for the Dec ‘26 contract was initiated (or at least as far back as the CME Fedwatch tool has been tracking it)).

March is at 13% (down from 51% Jan 6th), April is 28% (from 63%), with the first cut in June (62%). A second cut is priced for Oct (at 56%, but as compared to a a 55% chance of a July cut on Jan 6th).

Pricing for 2026 +1bps to 48bps (it had fallen as low as 44bps Jan 21st), with pricing for one cut 90%, two cuts 62% and three cuts 29% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

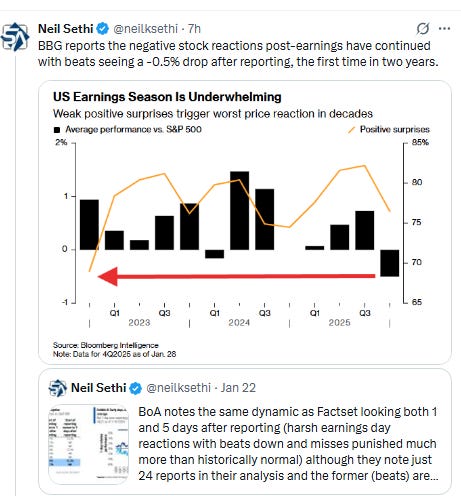

The 10yr #UST yield edged back but remains in somewhat of a short term uptrend at 4.23%.

The 2yr yield, more sensitive to FOMC rate cut pricing, fell for a fifth session from the highs of the year to 3.56% (but down just -5bps over that time) still over the top of the channel it had been in since the start of 2024 until breaking out two weeks ago. (It’s running out of time to fall back in).

It is -8bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for rate cuts, but now just one or two.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield., but I’m starting to get tempted.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) little changed after stabilizing Wed after the “clean up” from Treas Sec Bessent reaffirming a “strong dollar policy”. Still it’s just off the lowest close since Feb ‘22 and remains under the decade+ uptrend line (and at the bottom of the channel it’s been in since the Sep ‘22 peak).

The technicals remain not favorable with the daily MACD in “go short” territory, although the 14-day RSI is bouncing from just off the most oversold since July ‘20 (so oversold bounce coming?). So far not so much.

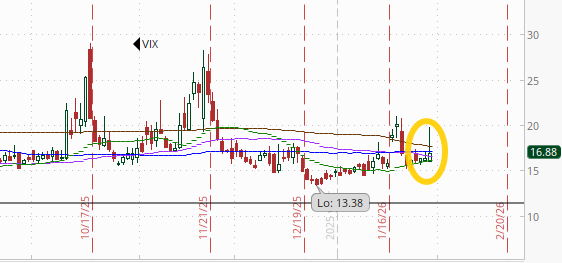

VIX little changed at 16.8. That level is consistent w/~1.05% average daily moves in the SPX over the next 30 days.

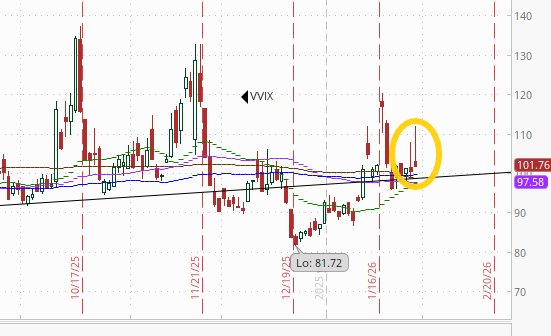

The VVIX (VIX of the VIX) also little changed at 101.8. The current level is consistent with “moderately elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is the level flagged by Charlie McElligott as one to watch.

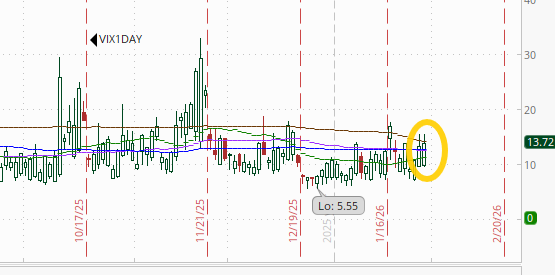

With another heavy dose of post-close earnings led by Apple, the 1-Day VIX remained at 13.7 despite moving past the META/MSFT/TSLA earnings (although the reactions were so severe that perhaps that is also leading to heavier expected volatility Friday). The current reading implies a ~0.85% move in the SPX next session.

#WTI futures continued to run higher on continued uncertainty surrounding potential Iran strikes making it to the $65-66 target I noted Tues, but not able to get through the top.

Daily MACD remains in “go long” positioning while the RSI is now the strongest since June providing support.

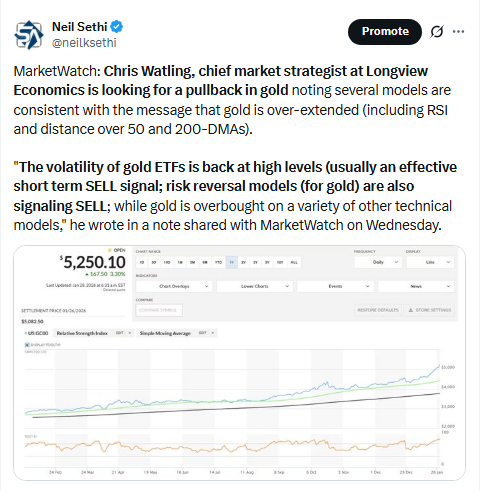

I still have no words for what’s going on with gold futures (/GC), which were first up another +5% before falling down around that much before finishing +1% (it was a 10% range).

Daily MACD remains in “go long” positioning, but the RSI has “eased off” to 87 from 89, a level we haven’t seen in the past 20 years.

US copper futures (/HG) not wanting to be left out of the party also traded in a 10% range Thurs although that was all to the upside finishing +4.7% at a record high. Somehow the daily MACD is still in ‘sell longs’ positioning (but that will likely change tomorrow) and the RSI is back over 60.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natural gas futures (/NG) took a step towards filling the enormous “roll gap” following the roll to the March contract Wed which saw the price drop nearly in half, gaining +5%.

As I said Monday, given the upcoming roll, I’m not going to bother looking at the technicals until we get some stabilization in the chart.

I guess “sitting out the party” as they had done the past week is better than leaving the party which is what happened Thurs with Bitcoin futures as they fell back -5.7% to the lowest close since April. The daily MACD as mentioned last Tues flipped to “sell longs” positioning, and is now “go short,” while the RSI is under 40.

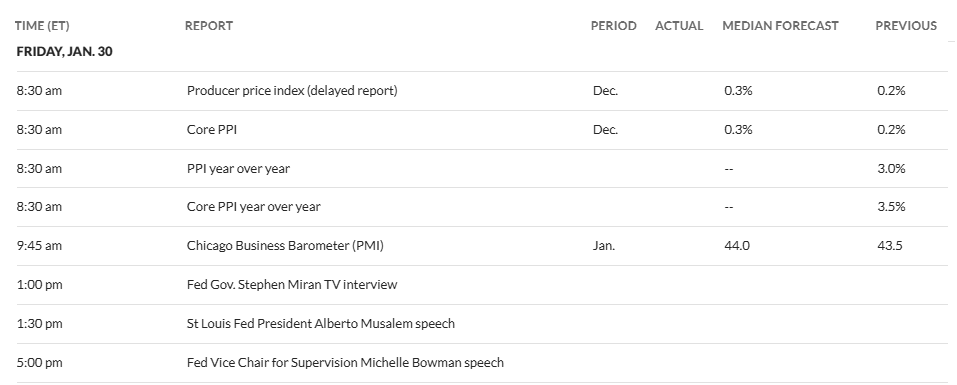

The Day Ahead

As noted in the Week Ahead, it’s a relatively light week (in terms of importance) for US economic data, and Friday brings us another delayed report (but just a couple of weeks in this case) in Dec PPI which will help us nail down what we can expect to see for Dec core PCE prices, the Fed’s preferred inflation index.

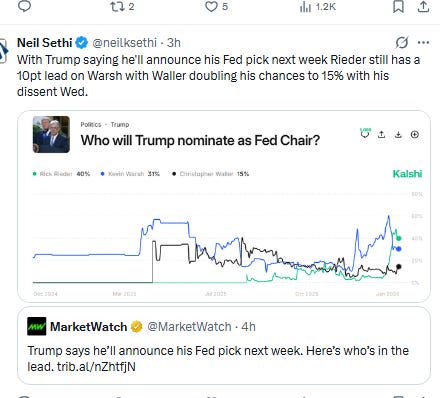

Fed monetary policy speaking blackout is over, and you can expect to hear from several Fed speakers tomorrow. Traditionally the dissenters provide a defense for their dissent so you can expect to hear from Gov’s Miran and Waller. In addition Gov Bowman is scheduled to make remarks as is St Louis Fed Pres Musalem (non-voter this year). I would be surprised if there weren’t more.

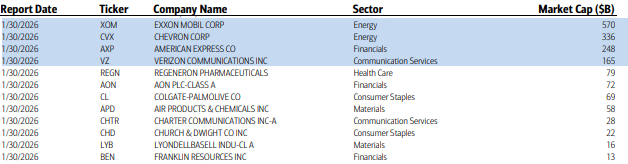

SPX earnings will ease off from here but we’ll still get another 12 SPX components, with 4 >$100bn in market cap in XOM, CVX, AXP, VZ (in descending order by market cap).

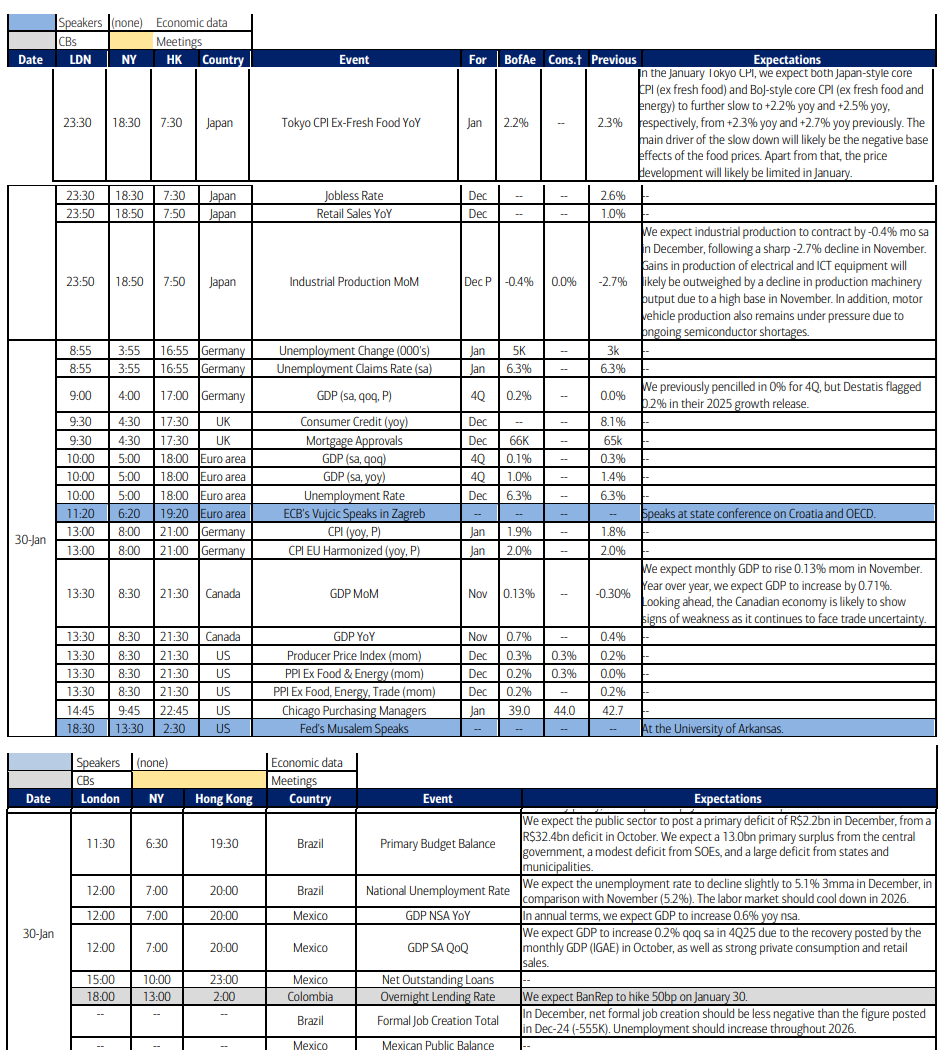

Ex-US highlights are a policy decision from Columbia (a 50bps hike is expected), and quite a bit of data including Japan unemployment, retail sales, industrial production, and Tokyo CPI, Germany unemployment, GDP, and CPI, EU unemployment and GDP, Canada GDP, UK consumer lending, Mexico GDP, and Brazil unemployment.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,