Markets Update - 1/30/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

US equities started the day with modest gains at the large cap level (due to weakness in tech), more robust at the small cap (Russell 2000) and equal-weight level, as they digested the tragic air collision in Washington, a slew of earnings reports, and a 4Q GDP report that came in slightly weaker than expected but mostly due to a big drop in inventories as consumption came in stronger than expected and core prices increased but overall as expected. Stocks moved back and forth throughout the day, particularly in the last half hour when Pres Trump confirmed he will be putting on 25% tariffs on Canada and Mexico Saturday, but overall finished around where they started.

Elsewhere, bond yields fell back with the 10yr Treasury yield slipping under 4.5% at one point, while the dollar was little changed. Gold, copper, crude and bitcoin all finished higher (the former at a record high), while nat gas fell again.

The market-cap weighted S&P 500 (SPX) was +0.5%, the equal weighted S&P 500 index (SPXEW) +1.0%, Nasdaq Composite +0.3% (and the top 100 Nasdaq stocks (NDX) +0.5%), the SOX semiconductor index +2.3%, and the Russell 2000 (RUT) +1.0%.

Morningstar style box showed the give back in large cap growth stocks with more modest changes elsewhere.

Market commentary:

“Further Fed easing expectations should keep a pressure lower on rates, while inflation uncertainty from tariff and fiscal policy should prevent a sharp rally [in bonds],” said Mohit Kumar, strategist at Jefferies International. “If the unemployment rate starts to pick up modestly, as is our view, we see room for further easing from the Fed.”

“‘Remaining patient’ and ‘no rush’ seem to be how the FOMC plans on operating into the middle of the year, with a bumpy path for inflation giving the Fed pause before reading too much into gains that could prove idiosyncratic,” said Marvin Loh and Hope Allard at State Street Global Markets.

“This bull market is still ‘breathing,’ and we should expect more stock participation in the months ahead if the economy cooperates and rates quiet down,” said Callie Cox at Ritholtz Wealth Management. It’s not that the AI story is “doomed,” but “there are so many opportunities in unloved sectors that have been ignored for so long.”

To Neil Birrell at Premier Miton Investors, while the data is all a bit historic now, the economy is “doing just fine.”

“Overall, the economy is on firm footing heading into 2025, which should support risk assets given the strong linkage between economic growth and corporate profits,” said Josh Jamner at ClearBridge Investments.

″“We had three major megacap technology companies report last night and for the most part, all of them sort of came in and out of their earnings unscathed,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “That’s a positive when you look at the aggregate number of companies that have reported and how many companies are beating expectations both on the top and bottom line.”

“We kind of get the chance to put the Fed not cutting rates in the rearview mirror because they’re likely doing that for the right reasons, meaning the economic data seems consistent with keeping rates unchanged for the time being,” Hogan said. “This also gives them time to look at policy from the new administration and try to model out what kind of impact that will have on both the economy and inflation.” He added: “So we’re sort of in a place today where the dust has settled on the Fed meeting, earnings on balance are better than expected and the economic data continues to be constructive. That’s what’s driving the turnaround.”

In individual stock action, an earnings-related decline in Microsoft (MSFT 414.99, -27.34, -6.2%) was overshadowed by positive responses to earnings results from the likes of IBM (IBM 258.27, +29.64, +13.0%), Meta Platforms (META 687.00, +10.51, +1.6%), and Tesla (TSLA 400.28, +11.18, +2.9%). A gauge of the “Magnificent Seven” megacaps was little changed.

Comcast shares tumbled more than -11%, the biggest one-day loss for the stock since October 2008, when shares plunged more than -14%. United Parcel Service shares performed even worse after the delivery giant said it reached a deal with Amazon, its largest customer, to lower volume by more than 50% by the second half of 2026. UPS also missed the consensus forecast of analysts polled by LSEG for revenue in the fourth quarter, but earnings per share exceeded their expectations. Shares tumbled -14%, the biggest one-day loss ever for UPS, which went public in 1999.

After hours Apple whipsawed after posting sales that were slightly better than analysts estimated but with iPhone and China sales weaker than anticipated.

After Hours movers from CNBC:

BBG Corporate Highlights:

An American Airlines Group Inc. regional jet collided with a military helicopter near Washington on Wednesday leaving no survivors, marking one of the deadliest US air disasters in recent decades.

Southwest Airlines Co. warned that costs will climb faster than expected as it grapples with heavy labor expenses, undercutting gains from strong demand for leisure travel.

The US Federal Trade Commission is probing whether Uber Technologies Inc. and Lyft Inc. illegally coordinated to limit driver pay in New York City, according to documents reviewed by Bloomberg News.

The US Justice Department sued to block Hewlett Packard Enterprise Co.’s $14 billion acquisition of Juniper Networks Inc., arguing the tie-up would harm competition in the market for enterprise wireless equipment used by large companies, universities and hospitals.

Caterpillar Inc. warned that revenues will be “slightly lower” in 2025 as demand concerns weigh on the outlook of the heavy equipment maker.

Mastercard Inc. reported earnings that beat estimates as the firm diversifies beyond its traditional payment network into anti-fraud services, data analysis and global money movement.

Rogers Communications Inc. beat analysts’ fourth-quarter estimates as wireless service revenue gained and subscribers bought more expensive devices.

Cigna Group reported cost pressures from surprisingly high catastrophic medical claims that are likely to persist.

Some tickers making moves at mid-day from CNBC.

In US economic data:

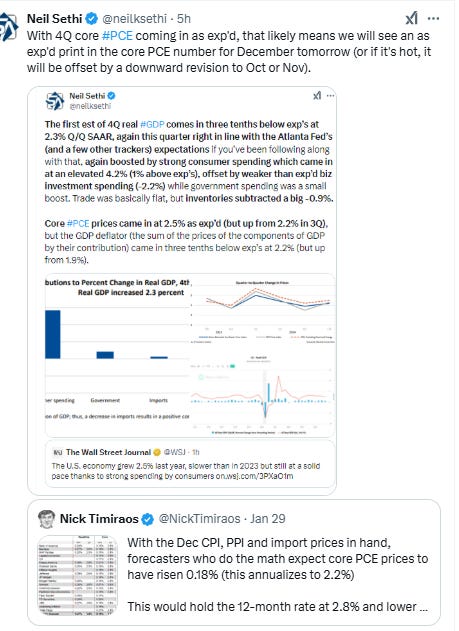

The first est of 4Q real GDP came in three tenths below exp’s at 2.3% Q/Q SAAR, again this quarter right in line with the Atlanta Fed’s (and a few other trackers’) expectations if you’ve been following along with that, again boosted by strong consumer spending which came in at an elevated 4.2% Q/Q SAAR (+1% above exp’s), gov’t outlays and residential investment, offset by weaker than exp’d biz investment (-2.2%). Trade was basically flat, but inventories subtracted a big -0.9% from the GDP number.

Initial and continuing jobless claims both fell back remaining historically low but the latter more elevated evidencing that while layoffs have remained very low, workers are having a little harder time finding a new job.

Dec pending home sales (contract signings so more forward looking) fell for the 1st time since July (when it hit a record low (to 2001)) -5.5% from the highest level since Feb ‘23, much worse than exp’s for no change, and the y/y number fell back into negative territory after turning positive in Sept for just the 3rd time since May ‘21. The drop was weaker than all estimates in a Bloomberg survey of economists and was dragged most by the West and Northeast (so perhaps weather/fire related), which each saw their biggest monthly declines since 2022.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX edged higher filling the “gap” from Monday’s drop, now back to within a percent of an ATH. The daily MACD remains favorable, the RSI a little less so.

The Nasdaq Composite continued to hold support. It hasn’t filled the Monday gap yet. Its daily MACD and RSI are also positive but less favorable than the the SPX.

RUT (Russell 2000) made it over the 2290 level, now needing to get over the 50-DMA that has capped it the past two weeks. Its daily MACD and RSI remain supportive.

Equity sector breadth from CME Cash Indices was very good improving to 10 of 11 sectors in the green, all of them up by at least a half percent. Tech the only outlier (-0.5% as MSFT was -6%). Eight sectors were up around 1% or more. Defensives outperformed.

SPX sector flag from Finviz consistent w/a lot of green, although there were a number of notable decliners >-3% (MSFT, CRM, NOW, CMCSA, CHTR, BX, UPS, CAT).

Positive volume (percent of total volume that was in advancing stocks) also much improved at 77% on the NYSE Thurs, in line with the strong gain in the NYSE Composite Index, while the Nasdaq was weaker at 68% but a good result given that index was only up a half percent. Positive issues (percent of stocks trading higher for the day) were 77 & 64% respectively.

New highs-new lows (charts) also improved to 116 on the NYSE (best since mid-Dec) and 48 on the Nasdaq. They are now back above their 10-DMAs which are still moving higher for now (more bullish).

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool saw rate cuts pushed out a bit following the mix of data. A cut by March fell to an 18% probability from 22% (and 32% before the FOMC), by May to 43% from 51% before the FOMC, and by June 70% from 72%. Chance of two 2025 cuts though remained at 60% and no cuts at 11%.

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that, and it looks like the market is mostly in agreement at this point.

Longer duration #UST yields fell, although finished off the lows with the 10yr falling under 4.5% level before finishing just over. It also has an important trendline just below.

The 2yr yield, more sensitive to Fed policy, fell for the 5th session in 6 but just -1bp to 4.21%. I still find this level rich, and I’m looking for it continue to soften in coming weeks (subject to next week’s NFP report).

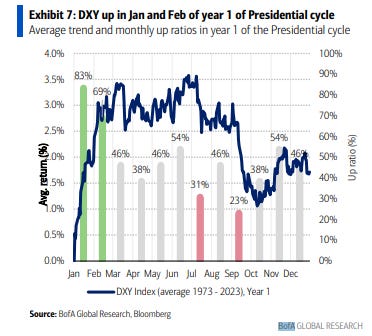

Dollar ($DXY) finished higher for a 3rd session at a 1-wk closing high. Daily MACD and RSI are weak and neutral respectively.

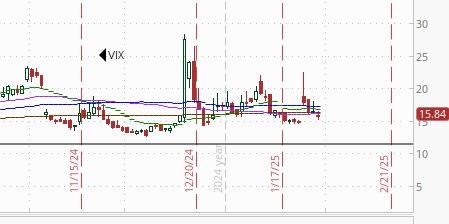

The VIX edged under 16 to 15.8 (consistent w/1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly edged just under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

Both are at 1-wk lows.

1-Day VIX edged lower but remained elevated due to the earnings after the close as well as some key data tomorrow morning, looking for a move of 0.93% Friday.

WTI almost made it to down to the $71.70 support level before bouncing to finish little changed remaining below the cluster of resistance at the $75 level. Daily MACD is not supportive while the RSI continues to hold its trendline. As I said Monday “I don’t have a lot of confidence in it regaining the $75 level quickly but we’ll see.”

Gold futures pushed through the $2800 level to an ATH and ran from there finishing up nearly 2%. Daily MACD & RSI remain supportive.

Copper (/HG) higher for a second day but overall remains in the middle of its range over the past 6 mths. Daily MACD & RSI remain neutral.

Nat gas futures (/NG) fell back to just above the $3 level which has continued to hold (consistent with my thinking that $3 would be “solid support”). Daily MACD remains in “sell longs” position, and the RSI continues to deteriorate though.

Bitcoin futures were up again today as they continue to trade between $100k & $110k over the past two weeks. Daily MACD and RSI tilt positive for now.

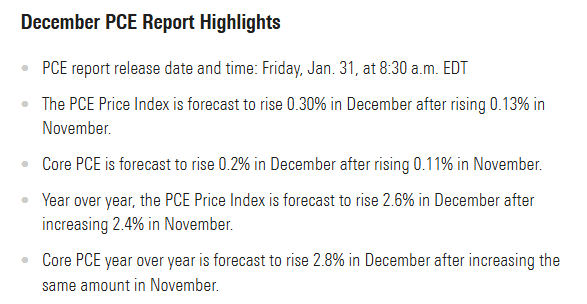

The Day Ahead

We wrap up a very busy economic week with two key reports, although both less key than in some other months: the December personal income and spending report which comes with core PCE prices, the Fed’s favorite inflation measure (less important because it was already incorporated into the Q4 GDP today, so we have a good idea of what we’re going to see), and the Q4 Employment Cost Index, the Fed’s favorite wage measure (less important because the Fed has been clear that they don’t see the labor market as contributing to inflation). Less important doesn’t though mean not important, as they contribute a lot of useful information.

We’ll also get (maybe) at least one Fed speaker tomorrow (according to BoA, although BBG doesn’t have her listed) in Michelle Bowman. Could be more (or less).

Earnings will remain heavy but lighten up a bit with 18 SPX components (down from 29 today) reporting including four > $100bn in market cap in Exxon Mobil (XOM), AbbVie (ABBV), Charter Communications (CHTR), and Eaton Corp (ETN), see the full earnings calendar from Seeking Alpha.

Ex-US the highlights are Jan Japan (Tokyo) CPI and Dec industrial production and employment, Jan Germany unemployment and CPI (as well as France Jan CPI) and UK house prices, Canada Nov/Dec GDP, and the EU’s Dec inflation expectations. In EM we’ll get policy decisions from Columbia and the Dominican Republic along with Brazil employment.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,