Markets Update - 1/31/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

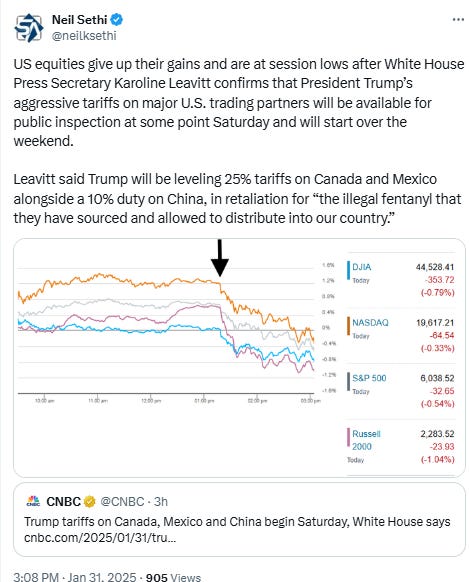

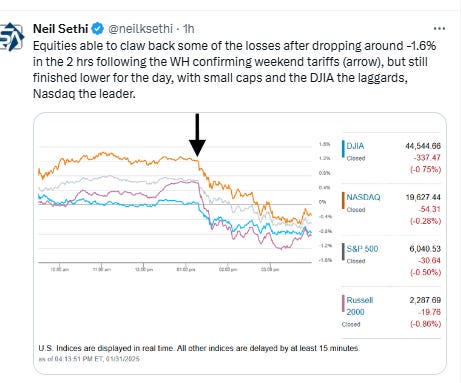

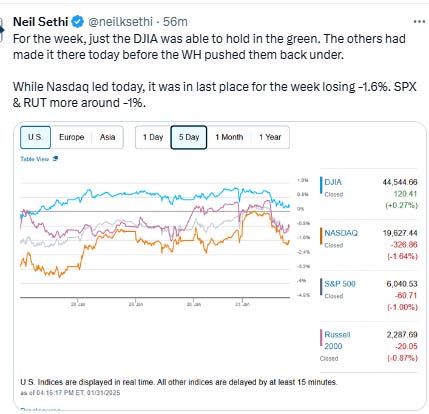

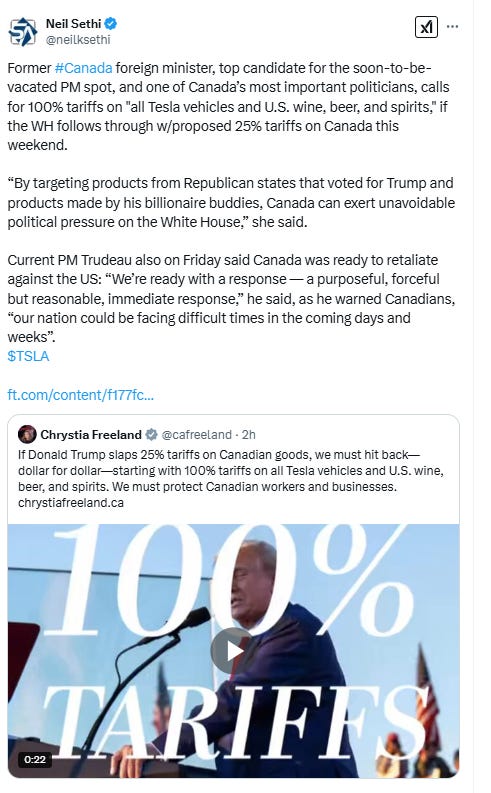

US equities started the Friday session with gains at the large cap level led by the Nasdaq on the back of a positive reaction to Apple’s earnings last night and following another round of mostly “as expected” data in the personal income and spending report (spending came in a little better than exp’d), which included core PCE prices, the Fed’s favorite price gauge, and the Employment Cost Index, Jerome Powell’s favorite wage metric. Stocks built on the gains throughout the day, pushing the major indices all into the green for the week at one point before the White House confirmed that the previously announced 25% tariffs on Canada and Mexico would be placed in force over the weekend, in addition to 10% tariffs on China. Equities quickly dropped into negative territory and were not able to recover, finishing the day and week lower (except the Dow which edged out a positive week). They did though close out a positive January, which I’ll have more on this weekend.

Elsewhere, bond yields reversed higher, as did the dollar and crude prices following the tariff talk, while gold, copper, and bitcoin all finished lower. Nat gas was little changed after at one point falling under $3.

The market-cap weighted S&P 500 (SPX) was -0.5%, the equal weighted S&P 500 index (SPXEW) -0.8%, Nasdaq Composite -0.3% (and the top 100 Nasdaq stocks (NDX) -0.1%), the SOX semiconductor index -0.3%, and the Russell 2000 (RUT) -0.9%.

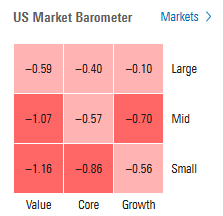

Morningstar style box showed the give back in large cap growth stocks with more modest changes elsewhere.

Market commentary:

“We’ve cited the potential for volatility surrounding tariffs, and today we saw it play out in the markets,” said Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team. “As was the case for Monday’s AI news. There are still many unanswered questions, and the picture could look very different in the coming days. Overall, though, this week has been a reminder of how unexpected events can quickly shift market perceptions.”

“This is very similar to what we saw on Monday, with DeepSeek, right? So there was the news; the first reaction was to sell,” said Tom Hainlin, senior investment strategist at U.S. Bank Asset Management Group. “There’s the initial reaction to the headlines about tariffs. We still have few details about them. We have no details on whether they’re temporary or permanent, what reaction you might get from Canada or Mexico or China, what exemptions there might be. Our perspective is we’ll wait, and find out when the actual policy is implemented.”

“I did not expect President Trump to put a 25% tariff on two of our biggest trading partners, namely Canada and Mexico, since I thought this was just a threat to get them to secure their borders,” said Louis Navellier, chief investment officer of money-management firm Navellier, in emailed comments made earlier on his podcast. “I now suspect that representatives from both Canada and Mexico will be in Washington, D.C., negotiating until the tariff threat is resolved.”

“Bulls have tried their best to keep calm and carry on through all the turbulence this week, but the pressure of uncertainty keeps them from peacefully grazing on stocks,” said Max Gokhman at Franklin Templeton Investment Solutions.

“We still do have a fair amount of earnings,” said Jay Hatfield, CEO of Infrastructure Capital Advisors. “Usually, it pays to be long during earnings, so we would continue to be bullish into February.”

December’s PCE report on Friday suggests that inflation finished 2024 above the Federal Reserve's 2% target, but it didn't spiral out of control, which is "the ideal outcome" from a stock investor’s perspective, said Bret Kenwell, U.S. investment analyst at eToro. "A hot reading could have reignited the rally in Treasury yields, sending assets like tech, small caps, and bonds lower. While there’s still further progress to be made on inflation, investors can breathe a sigh of relief and refocus on the market’s more notable fundamentals, like earnings growth and the economy," he wrote in commentary Friday morning.

“It was a remarkably consensus round of data that has done nothing to shift the market’s read on the real economy,” said Ian Lyngen at BMO Capital Markets. “From here, we’ll be watching for any headlines from the White House related to the looming 25% tariff increases on Canada and Mexico — which have been suggested could begin as soon as tomorrow.”

To Matt Maley at Miller Tabak + Co., this week’s developments have put at least somewhat of a lid on the earnings growth than can be expected on the AI phenomenon. “It is our opinion that it’s not going to take very long before the stock market will need to adjust to the idea that although the AI phenomenon could/should continue to be a positive factor, it’s likely that it’s not going to be as powerful as the market has been pricing-in over the past six months,” Maley noted.

“We expect the greater efficiency from new, lower-cost algorithms to lead to increased economic productivity, which is supportive of the broader equity market,” said Solita Marcelli at UBS Global Wealth Management. “In addition to these potential productivity gains, we believe the combination of solid US economic activity, healthy earnings growth, lower borrowing costs, and the potential for greater capital market activity will lead stocks higher over the balance of 2025.”

“We don’t think the U.S. equity market outperformance is over yet, despite the challenge from DeepSeek,” wrote Thomas Mathews, Capital Economics’ head of markets. “The tone in U.S. equity markets has turned more positive lately, with a modest gain on Thursday ... In aggregate, more than half of Monday’s DeepSeek-instigated tumble has therefore now unwound.”

“DeepSeek remains a major theme,” said John Belton at Gabelli Funds. “It is clear that DeepSeek did achieve some exciting engineering breakthroughs which will help other AI labs build models more efficiently. But many headline figures associated with these breakthroughs are misleading. This is more evolutionary than revolutionary, and consistent with natural/normal tech progress where we’d expect compute efficiencies over time.”

In individual stock action, Apple (AAPL 236.00, -1.59, -0.7%), which was up as much as 4.0% after reporting earnings, ultimately closed lower on the day. Many other stocks also participated in the afternoon retreat. 26 of the 30 Dow components were in the red, nine of the 11 S&P 500 sectors closed lower, and market breadth favored decliners by a 5-to-2 margin at the NYSE and by a 2-to-1 margin at the Nasdaq.

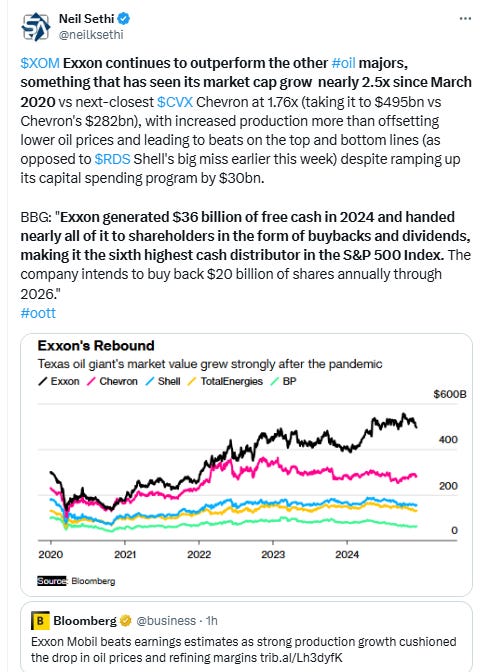

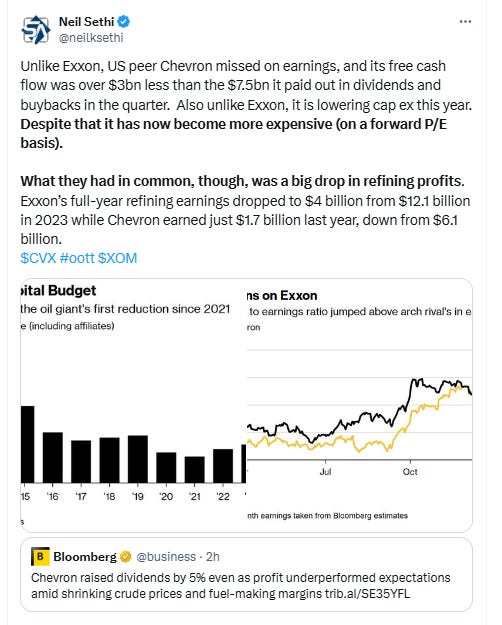

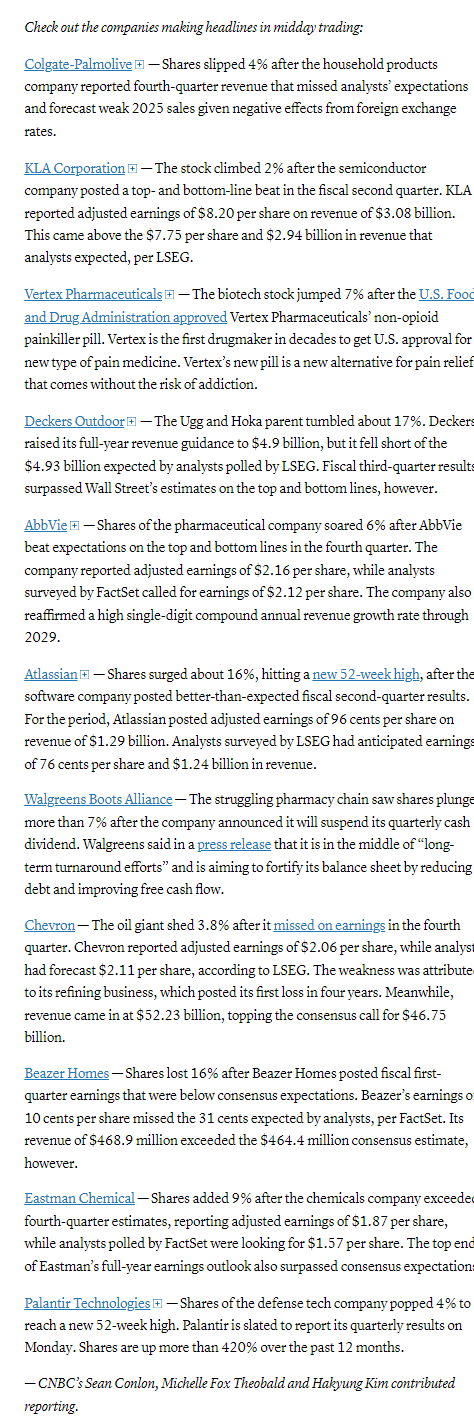

In other corporate news, responses to earnings results were mixed. AbbVie (ABBV 183.90, +8.25, +4.7%) and Atlassian (TEAM 306.78, +39.83, +14.9%) were among the earnings-related winners while Exxon Mobil (XOM 106.83, -2.74, -2.5%), Chevron (CVX 149.19, -7.13, -4.6%), and Colgate-Palmolive (CL 86.70, -4.19, -4.6%) registered declines.

Shares of pharmacy chain Walgreens Boots Alliance lost -10%after the company said on Thursday that it would suspend its quarterly cash dividend. The stock has shed more than 50% over the past year and is down 90% from its all-time closing high of $96.68 on Aug. 5, 2015.

Shares of Palantir hit a fresh all-time high on Friday. The software stock was last trading more than 4% higher. Palantir has soared 104% over the past three months and 427% over the past year. The company is scheduled to release its fourth-quarter earnings next Monday.

BBG Corporate Highlights:

Apple Inc. gave a reassuring revenue forecast for the current quarter, helping boost shares of the world’s most valuable company after its holiday results showed jarring declines for China and the iPhone.

Intel Corp. issued a revenue forecast for the current period that fell short of analysts’ expectations.

Exxon Mobil Corp. beat earnings estimates as strong production growth cushioned the drop in oil prices and refining margins, easing investor concerns about an increase in capital spending.

Chevron Corp. raised dividends by 5% even as profit underperformed expectations amid shrinking crude prices and fuel-making margins.

Walgreens Boots Alliance Inc. suspended the quarterly dividend it’s paid for the past 92 years in a bid to conserve cash and revive the business.

AstraZeneca Plc abandoned plans to invest £450 million ($558 million) in a UK vaccine manufacturing plant, following protracted wrangling with the new Labour government over the level of state funding for the site.

AbbVie Inc. rose the most in just over four years after it forecast 2025 earnings above Wall Street’s average expectation as two key medicines gained ground.

Some tickers making moves at mid-day from CNBC.

In US economic data:

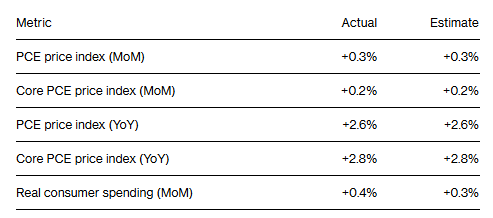

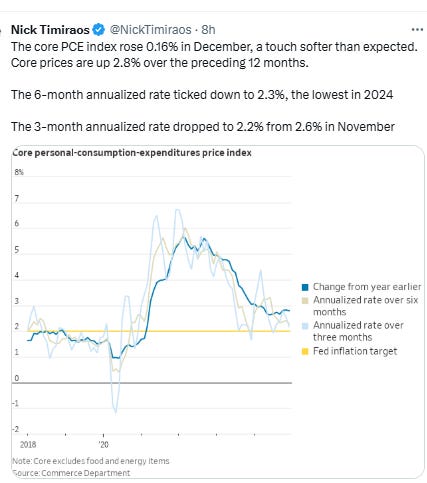

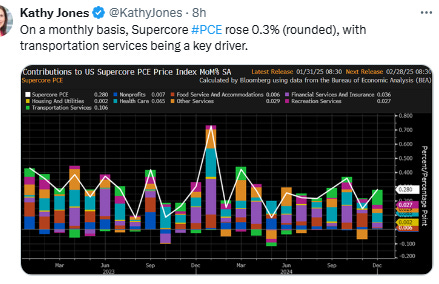

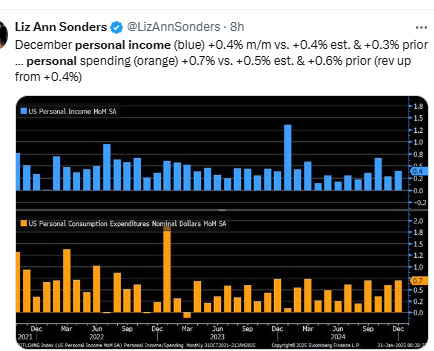

The personal income and spending report showed the personal consumption expenditures price index rising 0.3% in December, matching a Dow Jones consensus estimate. The benchmark rose 2.6% on an annualized basis, though, an acceleration from the prior month’s 2.4% advance. Meanwhile core PCE, the Fed’s preferred inflation gauge, rose 0.2% and accelerated to 2.8% on an a year-over-year basis. But on a three-month annualized basis — a metric some economists say paints a more accurate picture of the trajectory of inflation — the core PCE price gauge advanced 2.2%, the least since July. Meanwhile, real disposable income barely rose for a second month. That may be pressuring consumers to dip into savings more, as the saving rate fell to 3.8%, the lowest in two years. But that didn’t stop consumers from spending, as the report also showed robust gains in spending after upward revisions to the prior month. Adjusted for inflation, spending rose 0.4%, a second month of solid growth.

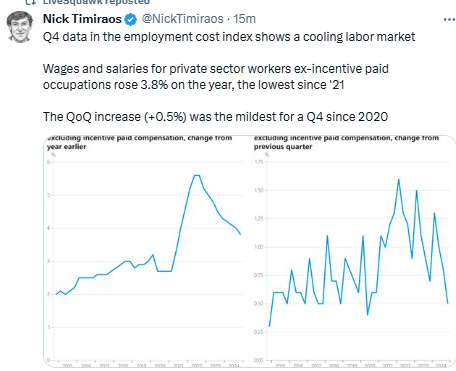

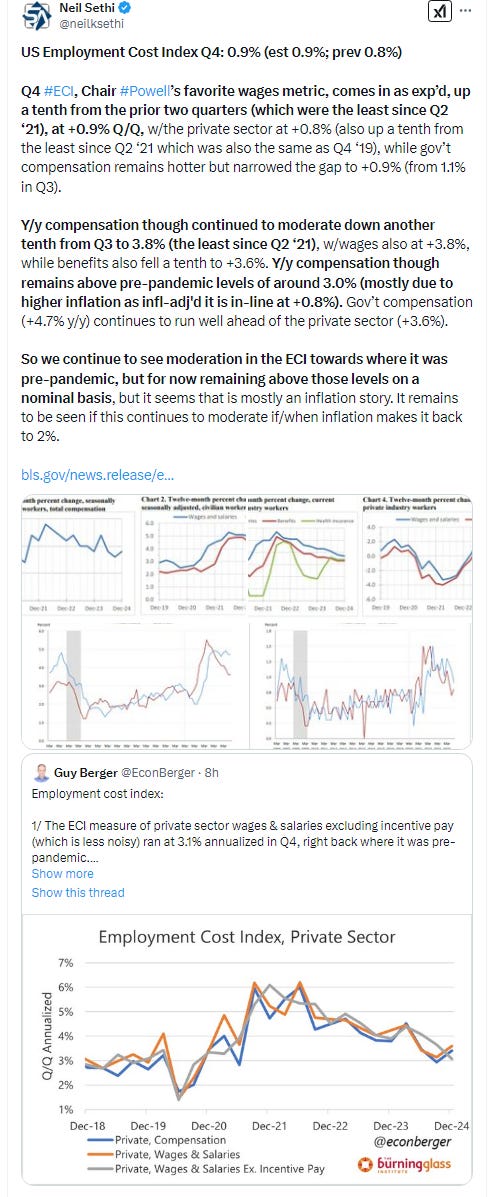

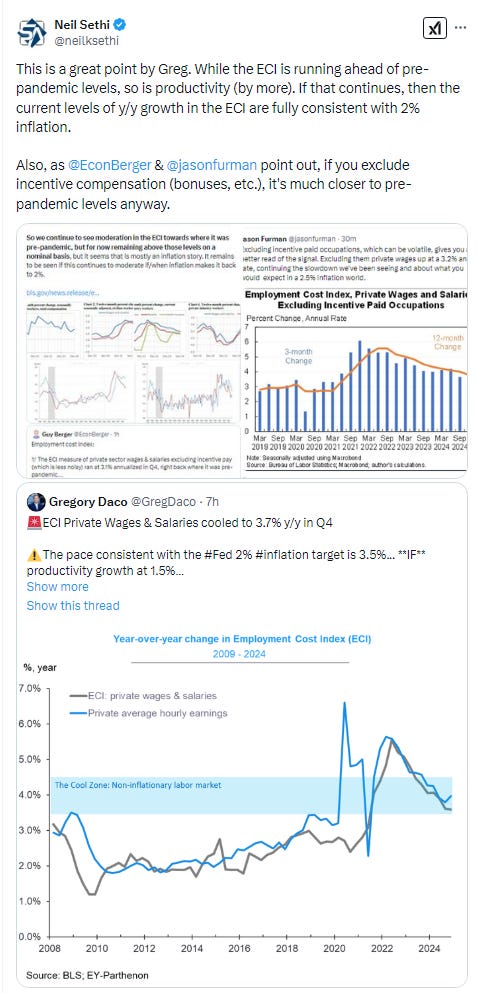

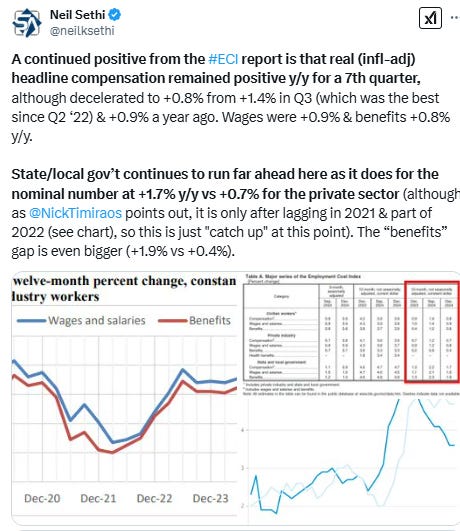

The Employment Cost Index, Chair Powell’s favorite wages metric, comes in as exp’d, up a tenth from the prior two quarters (which were the least since Q2 ‘21), at +0.9% Q/Q, w/the private sector at +0.8% (also up a tenth from the least since Q2 ‘21 which was also the same as Q4 ‘19), while gov’t compensation remains hotter but narrowed the gap to +0.9% (from 1.1% in Q3). Y/y compensation though continued to moderate down another tenth from Q3 to 3.8% (the least since Q2 ‘21), w/wages also at +3.8%, while benefits also fell a tenth to +3.6%. Y/y compensation though remains above pre-pandemic levels of around 3.0% (mostly due to higher inflation as infl-adj'd it is in-line at +0.8%). Gov’t compensation (+4.7% y/y) continues to run well ahead of the private sector (+3.6%) (as it catches up following a period of lagging in 2021-22).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX once again fell back after making it to within a percent of an ATH. The daily MACD remains favorable, the RSI a little less so.

The Nasdaq Composite continued to hold support. It did fill the Monday gap today. Its daily MACD and RSI are more neutral than the the SPX.

RUT (Russell 2000) fell back but held its support as its now traded in the same range over most of the past two weeks. Still needs to get over the 50-DMA that has capped it during that time. Like the SPX its daily MACD is supportive, RSI less so.

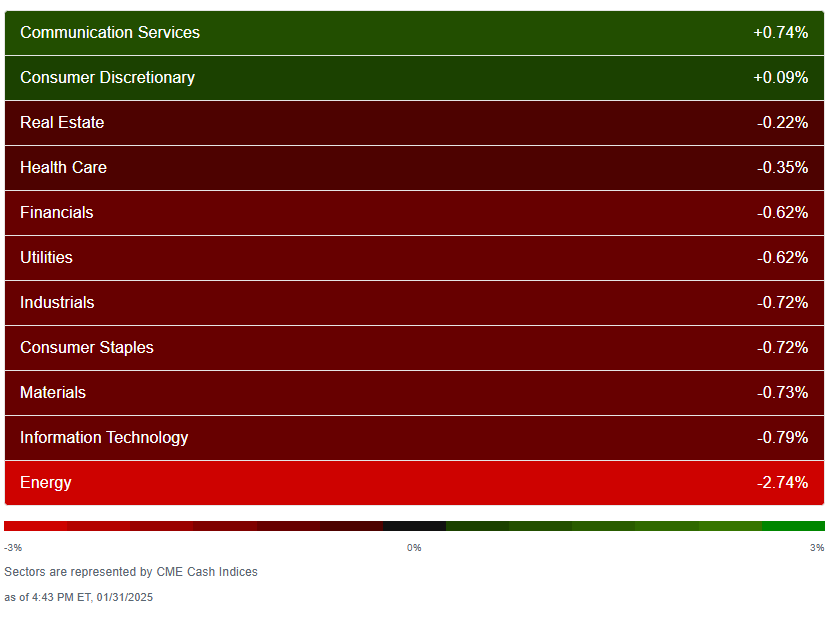

Equity sector breadth from CME Cash Indices went from very good Thursday to very weak Friday with just 2 of 11 sectors in the green (and one of them up less than 0.1%), down from 10 on Thursday. Seven sectors were down more than -6%. Just Comm Services was up that much. Still only one sector (Energy (-2.7%)) was down more than -0.8%.

SPX sector flag from Finviz consistent w/a lot more red than green, although most of the Mag-7 finished positive.

Positive volume (percent of total volume that was in advancing stocks) saw a big deterioration on the NYSE Friday, falling to 23%, the least since Dec 27th, from 77% Thursday, while the Nasdaq was much better at 52% a good result given that index down, something we saw (positive volume outperforming on the Nasdaq) for much of the fourth quarter. Positive issues (percent of stocks trading higher for the day) though were weak on both at 27 & 33% respectively.

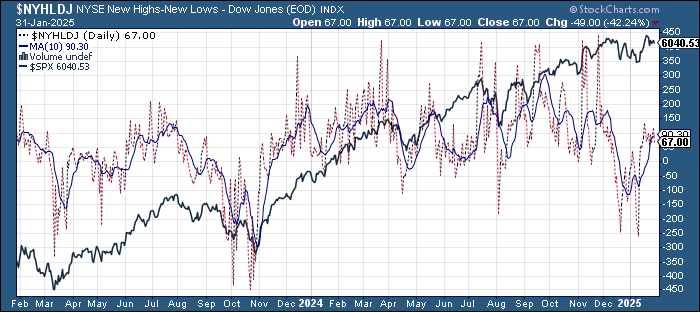

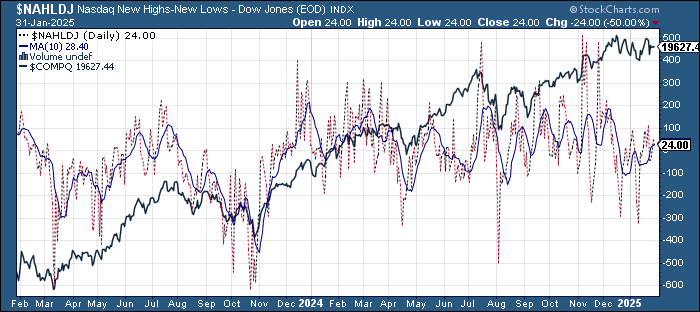

New highs-new lows (charts) also deteriorated to 68 on the NYSE (from 116 Thursday which was the best since mid-Dec) and 21 on the Nasdaq (from 48). They are now back below their 10-DMAs which are still moving higher for now (more bullish).

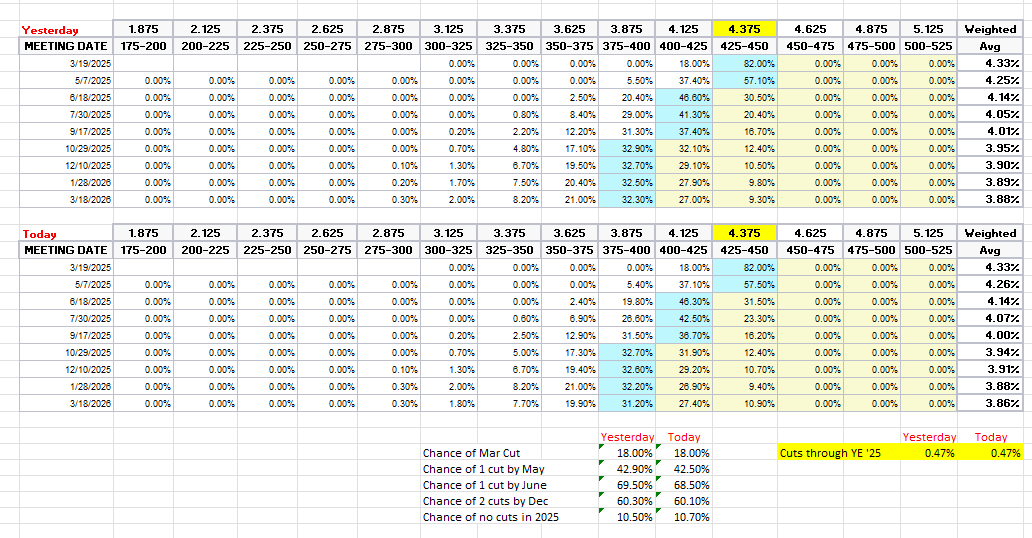

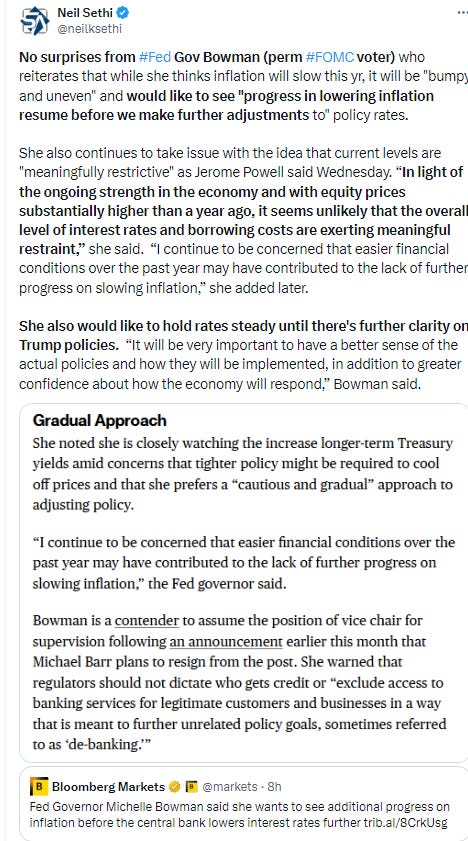

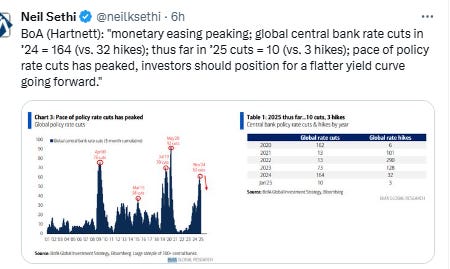

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool were little changed despite all of the Fed favorite data. A cut by March remained an 18% probability (down from 32% before the FOMC), by May at 43% from 51% before the FOMC, and by June 69% from 72%. Chance of two 2025 cuts remained at 60% and no cuts at 11%.

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that, and it looks like the market is mostly in agreement at this point.

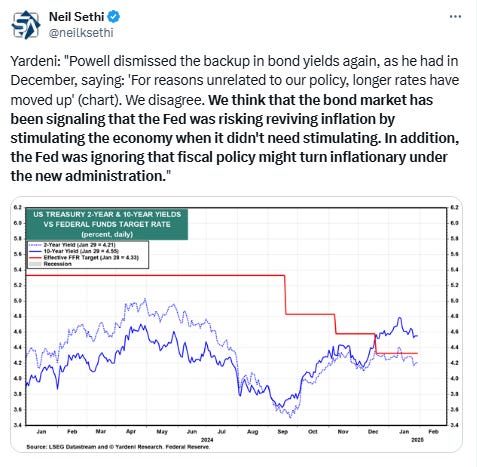

Longer duration #UST yields rebounded, particularly following the tariff talk, with the 10yr settling up 9bps from Thursday’s close at 4.6% (it softened in the post market to 4.54% though). It was down a few basis points for the week.

The 2yr yield, more sensitive to Fed policy, was unchanged though at 4.21%. It was down -5bps on the week. I still find this level rich, and I’m looking for it continue to soften in coming weeks (subject to next week’s NFP report).

Dollar ($DXY) finished higher for a 4th session at a 1-wk closing high Friday. Daily MACD and RSI are negative and positive respectively, but the former is turning to more constructive.

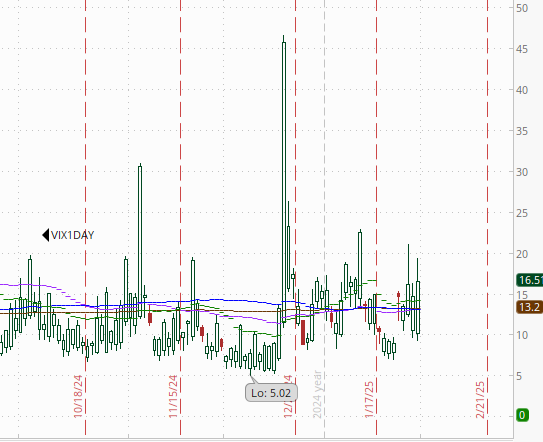

The VIX moved higher but less than a point at 16.4 (consistent w/1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly edged just back over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX pushed up to 16.5, the same level it was at after the FOMC Wednesday, looking for a move of a little over 1% Monday.

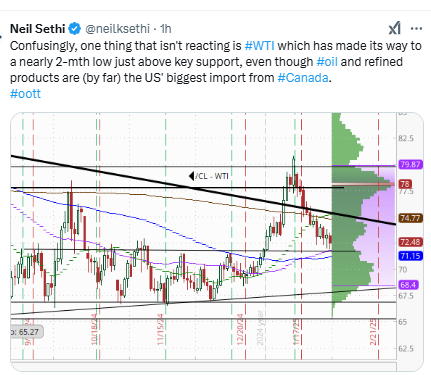

WTI did finally make it to down to the $71.70 support level and a nearly 2-mth low Friday before bouncing on the tariff news (while it didn’t on the initial news like stocks and bonds, it did following Trump’s Oval Office comments) to finish moderately higher but remaining below the cluster of resistance at the $75 level. Daily MACD remains not supportive while the RSI continues to hold its trendline. As I said Monday “I don’t have a lot of confidence in it regaining the $75 level quickly,” and I think over a week qualifies.

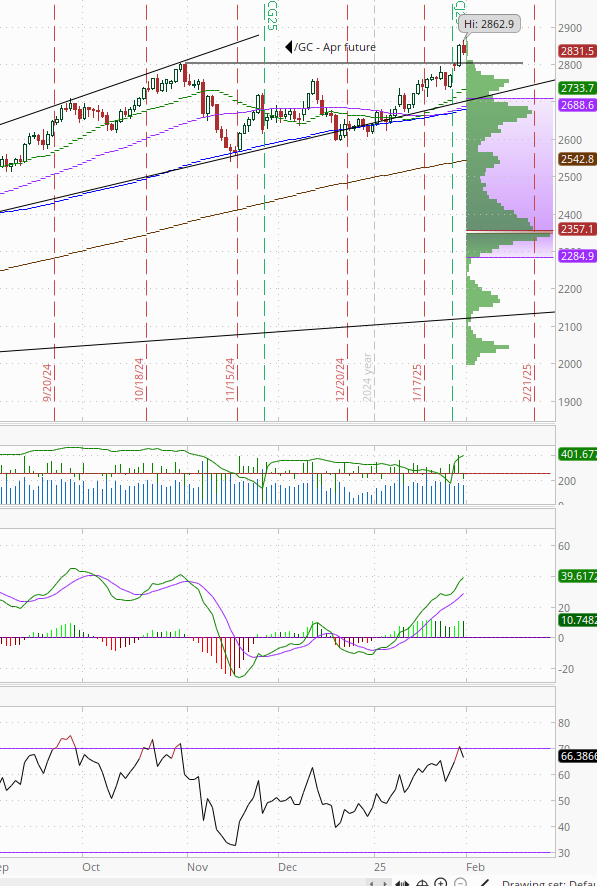

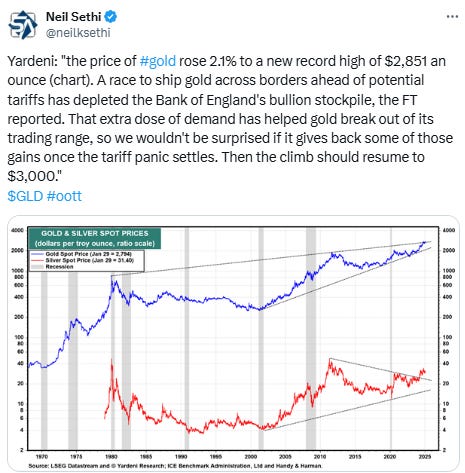

Gold futures pushed to another ATH before falling back with equities to finish moderately lower. Daily MACD & RSI remain very supportive.

Copper (/HG) ended lower Friday as it remains in the middle of its range over the past 6 mths. Daily MACD & RSI remain neutral.

Nat gas futures (/NG) fell under the $3 level at one point Friday before recovering to finish back above. Daily MACD remains in “sell longs” position, and the RSI continues to deteriorate though.

Bitcoin futures fell back Friday as they continue to trade between $100k & $110k over the past two weeks. Daily MACD and RSI tilt positive for now.

The Day Ahead

Enjoy the weekend (although this one should be busier than normal from a news perspective from all appearances). More on Sunday.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,