Markets Update - 1/3/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

US equities finally got back on track Friday following their longest losing streak since April with their best day since the Presidential Election with growth stocks getting back in gear. Unfortunately it was too little too late, leaving the indices down for the “Santa Rally” period which started Christmas Eve and ended today (although the SPX made it close, down less than a percent (hence the picture)). They also were mostly down for the week (but up for the year!). We’ll see if the indices can build on their performance next week.

Elsewhere, yields edged higher, and the dollar fell back from 2+ year highs. In commodities, crude was up for a 5th day, bitcoin for a 3rd, and copper advanced, while nat gas fell sharply and gold also declined.

The market-cap weighted S&P 500 was +1.3%, the equal weighted S&P 500 index (SPXEW) +0.9%, Nasdaq Composite +1.8% (and the top 100 Nasdaq stocks (NDX) +1.7%), the SOX semiconductor index +2.8%, and the Russell 2000 +1.7%.

Morningstar style box showed the broad strength led by growth.

Market commentary:

“The setup for some of this weakness was probably very sentiment driven. We had really gotten to a lot of frothy conditions in the aftermath of the election, that post-election rally period, especially when we went back into that concentration problem,” Liz Ann Sonders, chief investment strategist at Charles Schwab, told CNBC’s “Closing Bell” on Thursday. “I don’t think there was really any kind of prime catalyst,” she added. “I think it was a little bit more of an exhaustion from a sentiment standpoint.”

“We really need to see more of that clarity on January 20th for markets to have greater conviction,” Laura Cooper, global investment strategist at Nuveen, said on Bloomberg Television. “But I think US exceptionalism will continue to be the dominant theme at least in the first half of the year, regardless of what some of those policies that come through are.”

Vital Knowledge’s Adam Crisafulli said the ISM readout was incrementally positive but “but it will reinforce worries about hawkish policy and elevated yields.”

“The secular growth drivers that have been driving earnings growth and market gains over the last two years, I think they’re still on strong footing and will continue to drive those earnings gains,” Jeremiah Buckley, portfolio manager at Janus Henderson Investors, said on CNBC’s “Squawk on the Street.”

“Generally, these are the days that you kind of have people just moving to the sidelines after what’s been a pretty tough last four weeks. And the fact that today you’re not seeing that means that perhaps this an orderly type of consolidation, not a beginning of some sort of incredibly painful period,” Mark Hackett, chief market strategist at Nationwide Financial, told CNBC.

In individual stock action, the consumer discretionary sector led the pack by a wide margin, jumping 2.4% thanks to a gain in Amazon.com (AMZN 224.19, +3.97, +1.8%) and a big move in Tesla (TSLA 410.44, +31.16, +8.2%). Shares of TSLA rebounded following its 20% drop from their December highs as of yesterday's close. Other mega cap names outperformed the broader equity market, boosting index performance. The Vanguard Mega Cap Growth ETF (MGK) closed 1.7% higher. Chip giant Nvidia climbed 4.7%, while server maker Super Micro Computer jumped 10.9%. Those stocks could benefit from continued spending on artificial intelligence, as will Constellation Energy and Vistra, with shares up 4% and 8.5%, respectively. Microsoft announced Friday that it would spend $80 billion on AI-enabled data centers in the 2025 fiscal year, and power producers have been boosted by the trend. Apple (AAPL 243.36, -0.49, -0.2%) was an exception, extending declines related to iPhone discounts and sliding demand in China.

Shares of US Steel (X 30.76, -1.84, -5.6%) also went against the upside grain, sliding after the White House confirmed that President Biden will block the Nippon Steel takeover. Nippon Steel Corporation and US Steel released a statement condemning the U.S. Government's decision to block proposed acquisition of US Steel, calling it unlawful.

Shares of drinks makers declined after the US Surgeon General said labels on alcohol products like beer and wine should carry warnings of their links to cancer. Constellation Brands Inc. slumped as much as 2.3% and Molson Coors Beverage Co. lost nearly 5%. In Brussels, Anheuser-Busch InBev NV, the maker of Budweiser beer, fell 2.8%.

Some tickers making moves at mid-day from CNBC.

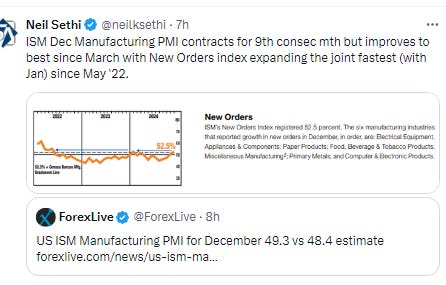

In US economic data we got the ISM manufacturing index which, while contracting for a 9th consec mth also was the least in that time.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX got right up against its 50-DMA but still failed to retake it for a 4th session. As noted Monday, “that’s a negative technical pattern. Adding to that the daily MACD remains weak, and the RSI is under 50, so we look lower until it can get back over the purple line.”

The Nasdaq Composite for its part remains under its 20-DMA and uptrend channel back to August. Its daily MACD remains weak, and its RSI is relatively weak as well.

RUT (Russell 2000) for its part got back over its 100-DMA and broke its steep downtrend, but really needs to get back over the 2300 level before we can really look higher. Daily MACD & RSI remain the weakest of the three but are improving the most rapidly.

Equity sector breadth from CME Indices the best since Christmas Eve with every sector in the green and 9 of 11 up at least +0.8% and 6 up around 1% or more. For the first time in 5 sessions energy didn’t finish first (but not last either) with two of the three megcap growth sectors taking the two top spots.

Stock-by-stock $SPX chart from Finviz similarly much improved with just a smattering of red and very little of the bright red kind (>-3%). Tesla bounced back +8%.

Positive volume (the percent of volume traded in stocks that were up for the day) remained over 50% for both indices but actually didn’t improve that much from Thursday despite the big index gains at 67 & 78% respectively from 57 and 70%. Still it was the 3rd straight session for the NYSE and the 9th for the the Nasdaq over 50%. Positive issues (percent of stocks trading higher for the day) were more improved at 75 & 71% from 54 & 53% respectively.

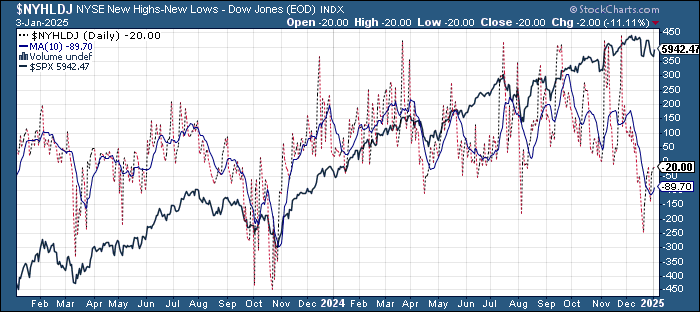

New highs-new lows (charts) also disappointing with the NYSE seeing no improvement and remaining negative for a 14th session at -19, while the Nasdaq added just 20 to 45. Both though remain above their 10-DMAs for and which are both now curling up (more bullish).

FOMC rate cut probabilities from CME’s #Fedwatch edged lower following the better than expected manufacturing PMI and relatively hawkish comments from Fed member Barkin still pricing in a 2nd cut in 2025 at better than 50% but just barely (51%) with overall 2025 cut expectations down -3bps to 40bps and the first cut moved to May (57%). Chance of no cuts up 5bps to 18%.

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that. Of course it’s all just a big guess as we know it will all come down to the data which we’ll get some of next week particularly Friday in payrolls.

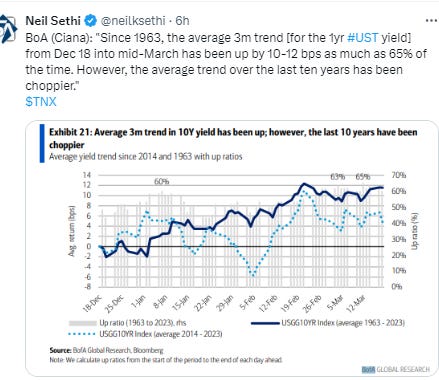

Longer duration Treasury yields again rebounded after starting lower early in the session with the 10yr yield up +2bps at 4.60%, 3bps below the recent high, and +21bps since the Dec FOMC meeting (& +84bps from the Sept FOMC meeting), as I’ve said the past 2 weeks “still eyeing the 4.7% level”. The 2yr yield, more sensitive to Fed policy, was +3bp to 4.28%, in the middle of its range since November.

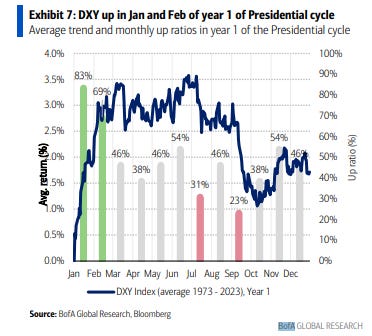

Dollar ($DXY) eased off after its big day Thursday after meeting its measured move. Daily MACD and RSI continue to tilt positive.

The VIX fell back although remains relatively elevated at 16.1 (consistent w/1% daily moves over the next 30 days). The VVIX (VIX of the VIX) a bigger drop to 94, back under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX also fell back, in its case to the lowest close since Dec 26th at 11.6, closer to the sub-10 readings we were seeing before the Dec FOMC meeting, looking for a move of 0.73% Monday.

WTI up for a 5th day, now just $1 from my target of the $75 area, as it continues to gain momentum with the daily relative strength now the highest since April and a clear "go long" signal on the MACD. Price the highest since Oct. As I said Thursday “would be surprised if it doesn't make it to the $75 resistance area.”

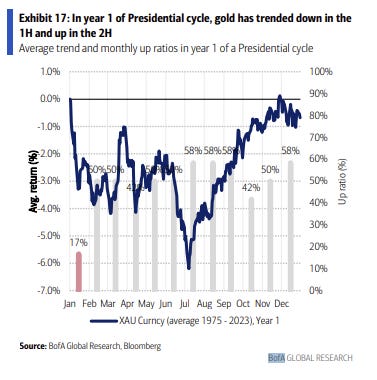

Gold wasn’t able to get through the 50-DMA which is key resistance, instead falling back though remaining above its 100-DMA. Daily MACD remains in "cover shorts" signal & daily RSI just under 50.

Copper (/HG) able to get a bounce from just above the $4 mark it has mostly stayed over since March. Its RSI and MACD remain negative for now though.

Nat gas (/NG) dropped sharply as it continued to complete the reversal pattern I noted in recent days, falling through the $3.65 breakout level and then through the 20-DMA (green line) which was my target. But it kept going after a weak storage draw report falling to some relatively weak support in an uptrend line. If that doesn’t hold, the 50-DMA (purple line is next). Daily MACD has now crossed over to “sell longs” and the RSI is now below 50 and the weakest since October.

Bitcoin futures up for a 3rd session pushing up to the 20-DMA/$100k level which have capped its rallies since it fell below two weeks ago. The daily MACD remains weak but is turning, and the RSI is over 50 but relatively weak as well.

The Day Ahead

Enjoy the weekend. More on Sunday. If you’re on the eastern half of the US (like me) it looks to be quite wintery in coming days.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,