Markets Update - 1/5/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

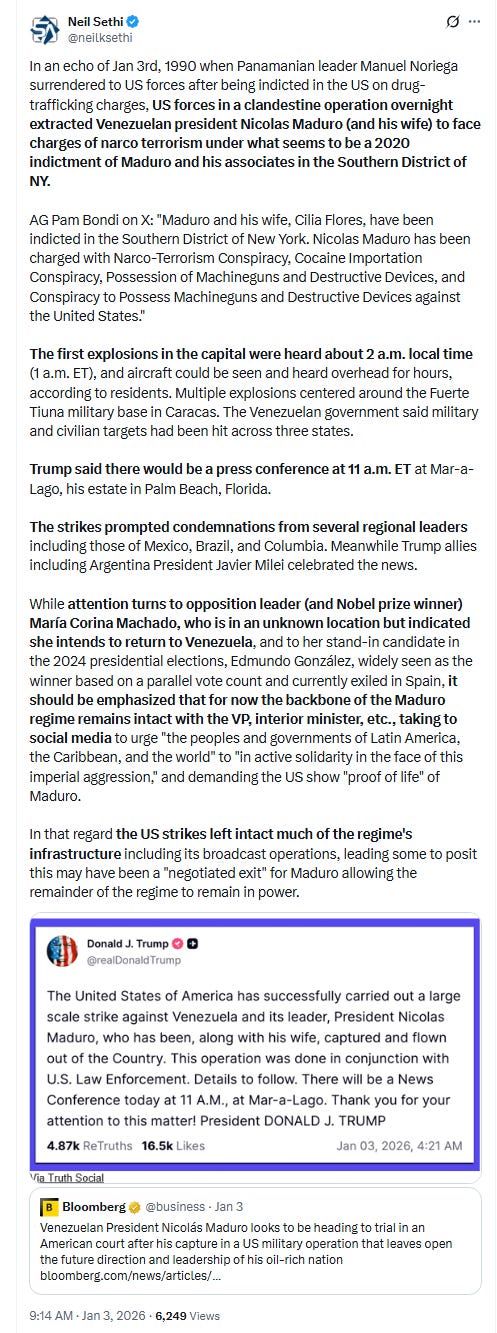

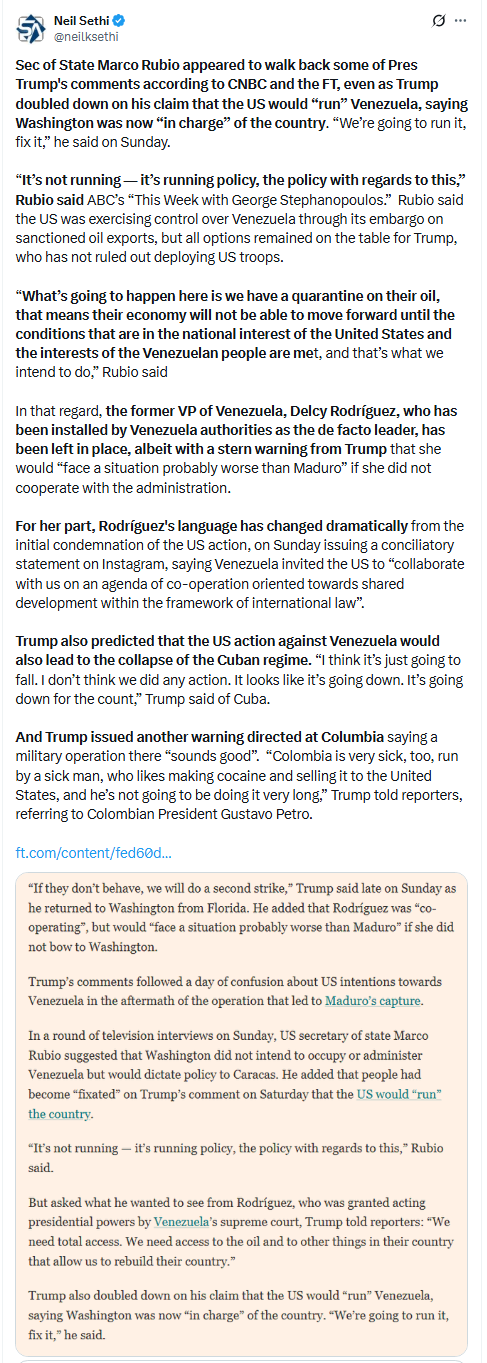

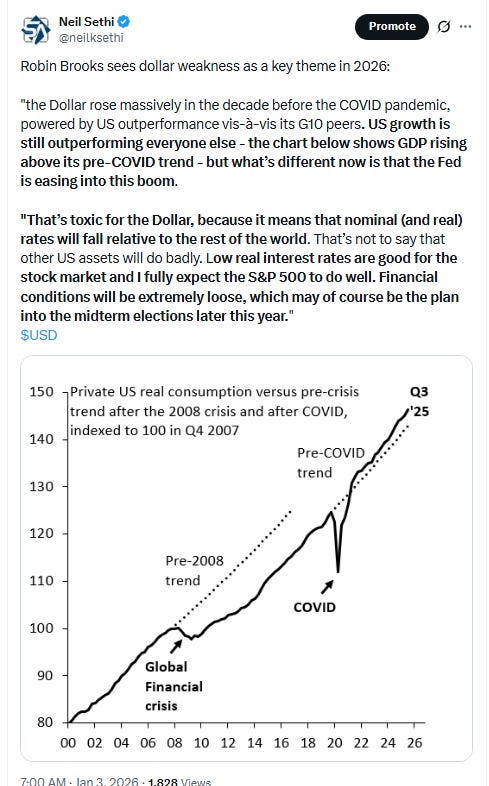

US equity indices started the week taking the U.S.′ attack on Venezuela and capture of Nicolas Maduro in stride, opening higher for a second session with energy shares getting a lift and many tech names doing well which saw the Nasdaq open with a +0.9% gain. But that early lead disappeared in the first 10 minutes as previous laggards in the small cap Russell 2000 index (RUT) and the DJIA pushed higher while the Nasdaq fell back and along with the SPX drifted lower for most of the session (although still finishing with respectable +0.6% advances). But those gains were more than doubled by the RUT at +1.6% while the DJIA finished +1.2% even as both softened in the last 90 minutes. The SPX advance though wasn’t quite enough for us to get a positive Santa Rally, missing by -0.11%.

Elsewhere, bond yields edged lower, as did the dollar which gave up early gains. Commodities ex-natgas were higher with gold, crude, bitcoin, and copper all seeing healthy advances, the latter to an ATH.

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +0.9%, Nasdaq Composite +0.6% (and the top 100 Nasdaq stocks (NDX) +0.8%), the SOXX semiconductor index +1.1%, and the Russell 2000 (RUT) +1.6%.

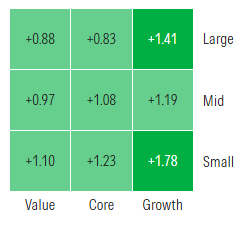

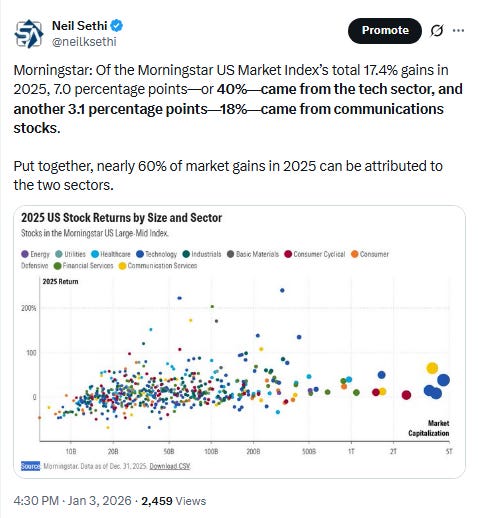

Morningstar style box again showed broad gains, but this time with large cap growth participating and growth overall outperforming despite the relative weakness in the Nasdaq. Small caps led for a second session.

Market commentary:

“Global markets are taking the latest surge in geopolitical risk largely in stride after the United States attacked Venezuela and detained President Nicolás Maduro over the weekend,” Karl Schamotta, chief market strategist at Corpay Cross-Border Solutions, said in a note Monday.

“While the capture of Venezuelan president Maduro by American forces has dominated headlines, financial markets seem unperturbed,” said Thomas Mathews, head of markets, Asia Pacific at Capital Economics. However, “the geopolitical ramifications are potentially important and could, among other things, keep risk premia elevated on some regional assets.”

“It’s reasonable to question whether the US operation in Venezuela will mark a period of even more overt US projection of power. If the White House thinks it will be a vote-winner come November, then that’s what we’re likely to see. That in turn could imply more volatility materializing at some point.” — Cameron Crise, Macro Strategist, Markets Live.

“This is a significant geopolitical event though unlikely to be a major near-term market-mover,” wrote Matthew Aks, policy analyst with Evercore ISI in a note. “For now, investors are left to navigate a now-familiar landscape of Trump’s likely purposeful ambiguity around his next steps.”

“Our instinct is that Trump is generally not interested in full-scale boots-on-the-ground regime change like the Iraq and Afghanistan wars he has long criticized. However, Trump’s statements today leave open the possibility this won’t quite be a one-and-done like the Iran nuclear strike last year,” Aks added.

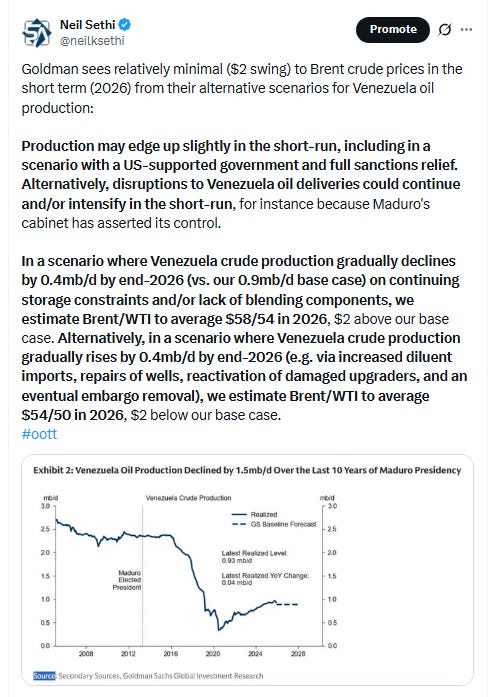

“The reason the ouster of Maduro is unlikely to impact markets is the same one that explains why the Russia/ Ukraine war hasn’t impacted markets nor the heightened U.S./Iran tensions: Oil supplies,” according to a note from Tom Essaye, founder and president of the Sevens Report Research. “Markets look at geopolitical events solely through the lens of impacts of critical resources,” and mostly oil, he said Monday. “Unless the event is going to reduce the supply of available oil,” spurring a jump in the price per barrel that risks slowing global growth, “then markets will largely ignore the event,” Essaye said. “In the case of Venezuela, if anything, the events of the weekend could boost oil supplies.”

“Maybe in the short term, it’ll boost the price of oil because the question is surrounding the supply and delivery of oil,” Sam Stovall, chief investment strategist at CFRA Research, said to CNBC. “Longer term, it could end up being an improvement because Venezuela represents only 1% of the world’s oil supply, and they’ve been getting worse and worse over the years. Their infrastructure needs to be improved, and possibly that is something that the U.S. can help with.”

“The market is basically saying, ‘We’re going to focus on putting money back to work after doing tax-loss harvesting, doing portfolio realignments in the end of 2025, and then buying back into stocks early in 2026,’” Stovall continued. “Investors are still focusing on what the Fed is likely to do, what corporate profits will do. So far, it remains a risk-on environment.”“Even as geopolitics are once again top of mind for investors, we’re reminded that this week offers an array of key fundamental updates,” wrote Ian Lyngen at BMO Capital Markets. Those are “still the most relevant wildcard for the US economy and monetary policy.”

The first trading week of 2026 “may likely revolve around whether tech will find its footing after stumbling into the end” of last year, said Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley.

Meanwhile, “volatility in the metals market continues to be a wild card,” he said in an email on Monday. And the bull market in stocks “hasn’t been derailed, but it still appears to be waiting in the station for its next source of momentum.”

“The bullish case for equities remains intact,” according to Adrian Helfert, chief investment officer at Westwood. “Broader market leadership should look past Venezuela entirely unless cascading geopolitical events emerge.”

It “feels like an inertia market, with investors still grumbling about a possible AI bubble, but too afraid to walk away from the promises of a bigger, better AI future,” said Michael Bailey at FBB Capital Partners.

AI “absolutely stays the most dominant factor in the markets right now,” Charu Chanana, chief investment strategist at Saxo Markets, told Bloomberg TV. “Tech optimism continues to overpower any of the other narratives.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

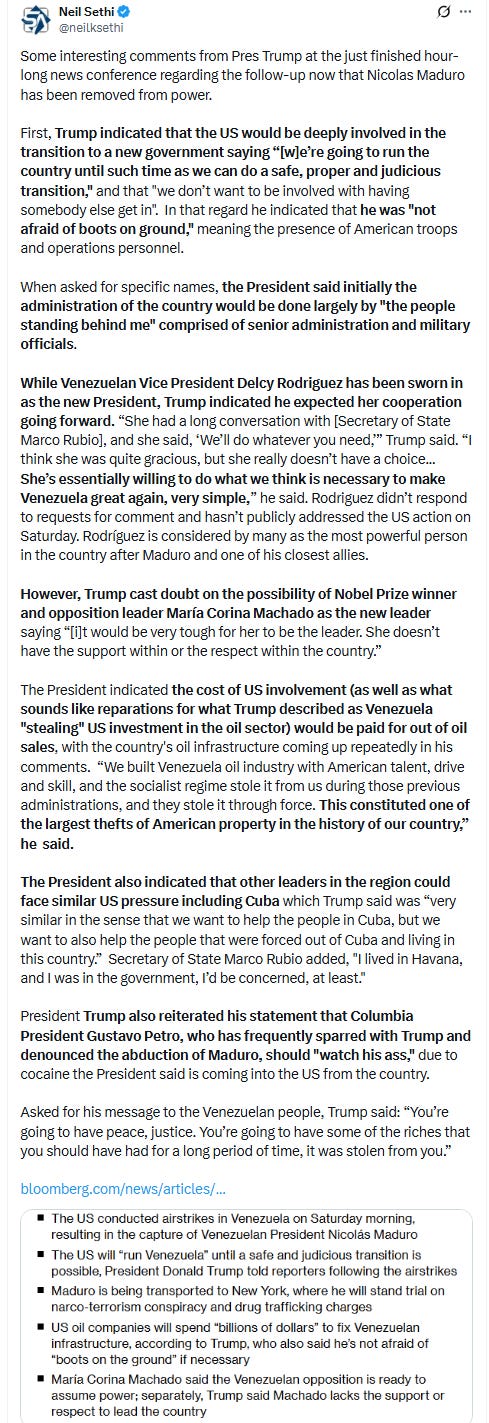

Energy stocks led the gains on the notion the companies would benefit from rebuilding Venezuela’s oil infrastructure. Chevron surged 5.1% and was seen as the biggest beneficiary because of its current presence in Venezuela, which has the largest proven oil reserves in the world. Exxon Mobil added 2.2%. Shares of oilfield services companies that could aid the Venezuela energy rebuild like Halliburton and SLB moved higher by 7.8% and nearly 9%, respectively. The State Street Energy Select Sector ETF (XLE) increased almost 3%.

Shares of big bank Goldman Sachs and regional bank U.S. Bancorp jumped 3.7% and 2.9%, respectively.

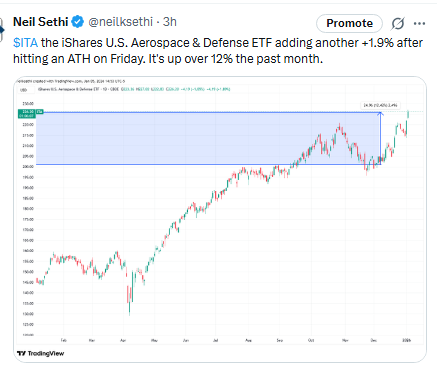

Shares of defense giants General Dynamics and Lockheed Martin received a bit of a boost, moving higher by 3.5% and 2.9%, respectively.

In US trading, gainers included Qualcomm Inc., which said it’s extending a push into the market for processors that are the heart of personal computers. Tech-focused megacaps such as Amazon.com Inc. and Tesla Inc. were also among the gainers

Corporate Highlights from BBG:

US Energy Secretary Chris Wright plans to talk this week with oil-industry executives about reviving Venezuela’s energy sector following the capture of President Nicolás Maduro, according to people familiar with the matter.

Vistra Corp. agreed to buy Cogentrix Energy, which consists of 10 natural gas-fired plants that boast a total capacity of 5.5 gigawatts. The independent power producer agreed to a net purchase price of about $4 billion.

US initial public offerings delivered underwhelming results in 2025 as equity-market volatility and increasing scrutiny around themes such as crypto and artificial intelligence hit some of the year’s most high-profile listings.

Saks Global Enterprises is looking to line up a loan of as much as $1 billion to keep the business running as part of a Chapter 11 bankruptcy filing that could happen in coming weeks, according to people familiar with the situation.

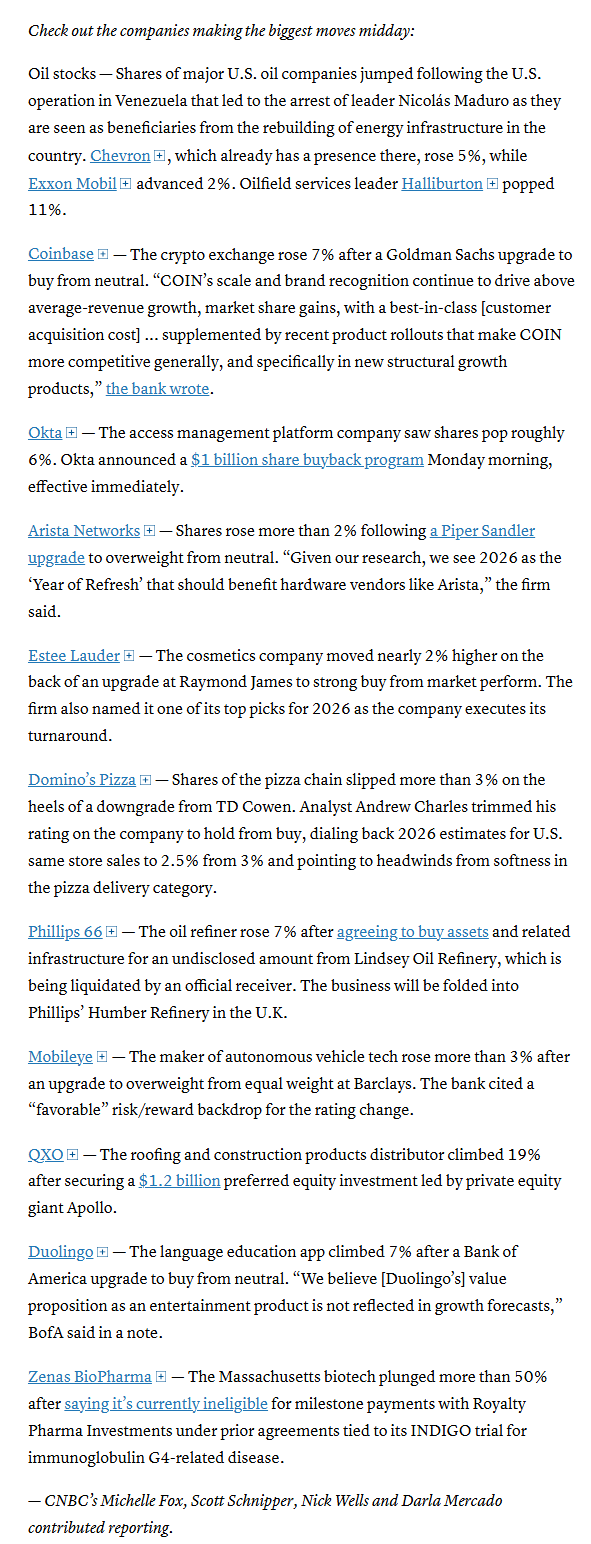

Mid-day movers from CNBC:

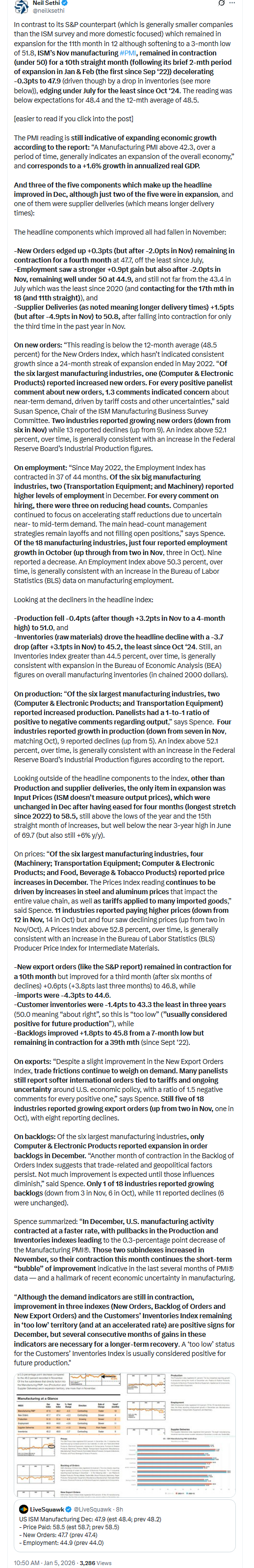

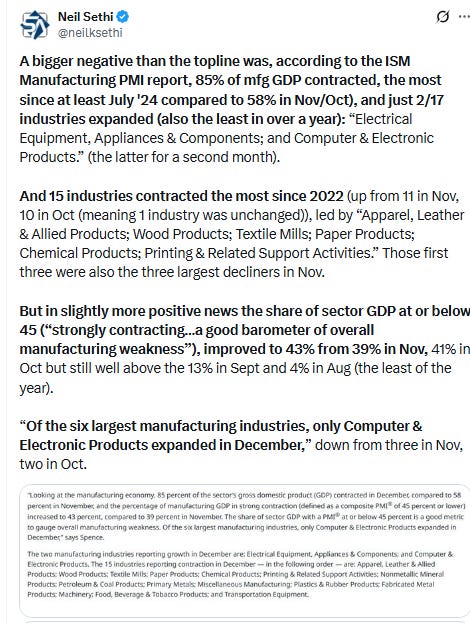

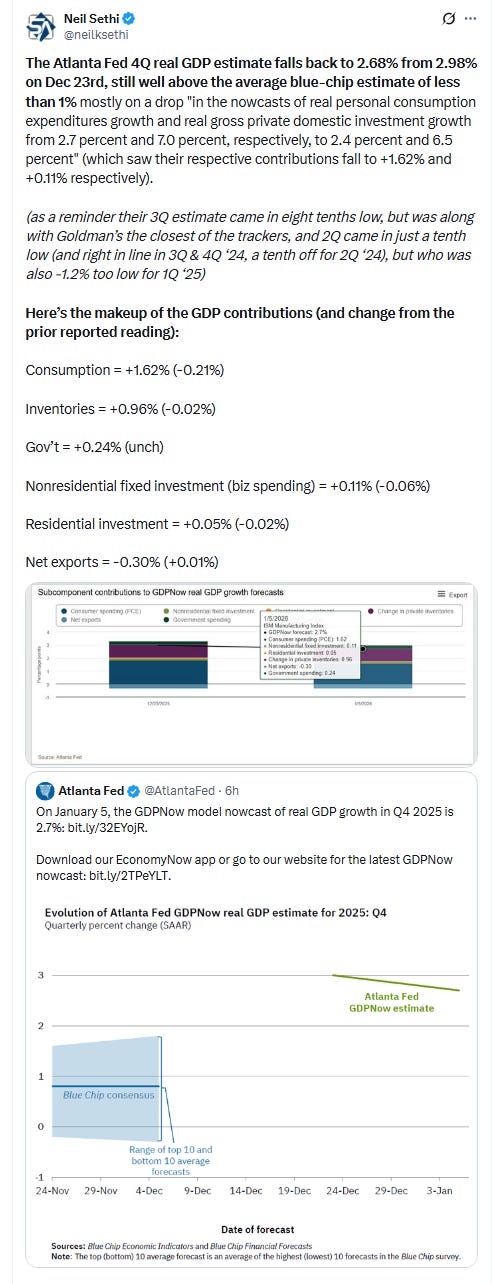

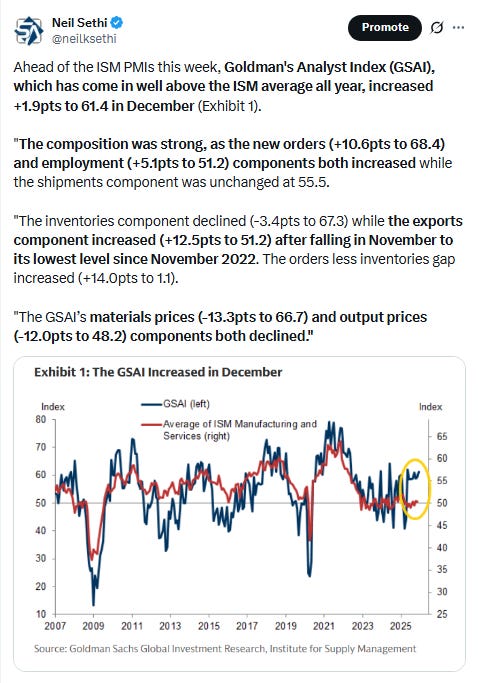

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

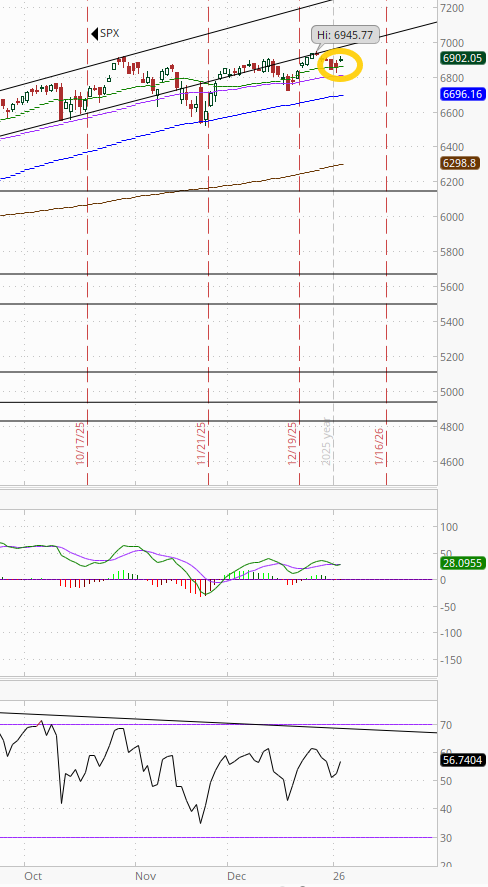

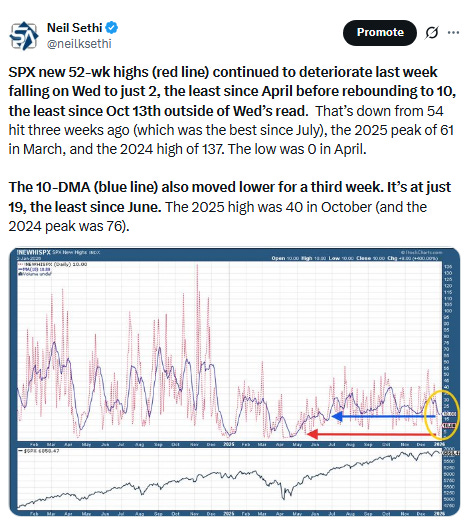

The SPX edged higher remaining just under ATHs. The daily MACD are both neutral but both with negative divergences (lower highs).

The Nasdaq Composite a similar story, although its divergences are more pronounced

RUT (Russell 2000) continued its rebound from its 50-DMA hit Thursday. It still has a “sell longs” MACD signal, but the RSI remains above 50.

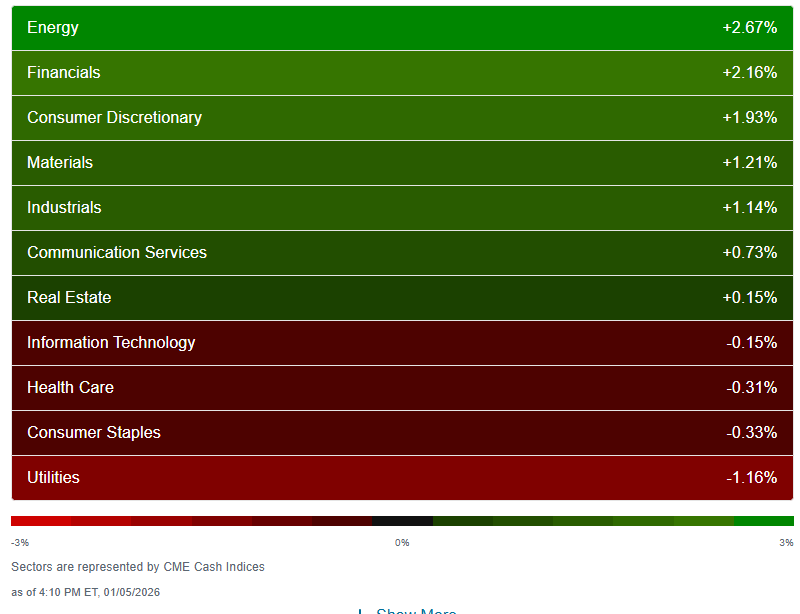

Sector breadth according to CME Cash Indices (uses futures prices) saw 7 of 11 sectors higher (down from 8 Fri, but two of those Fri were +0.5% vs just one marginal gainer Mon (RE +0.15%)) with six of those up +0.7% or more (up from four Fri) and five at least +1% (up from four Fri) led by Energy and Financials both up over +2%. Also Cons Discretionary which finished in last place Friday (the only sector down more than -1% Fri) was third at +1.9%.

The laggard Mon was Utilities (-1.2%), the only sector down more than -0.33%.

SPX stock-by-stock flag from @finviz_com consistent with weakness shifting from Comm Services to Health Care and Financials to Utilities. Tech also much less bright red. Staples remained weak, Energy and Industrials remained strong.

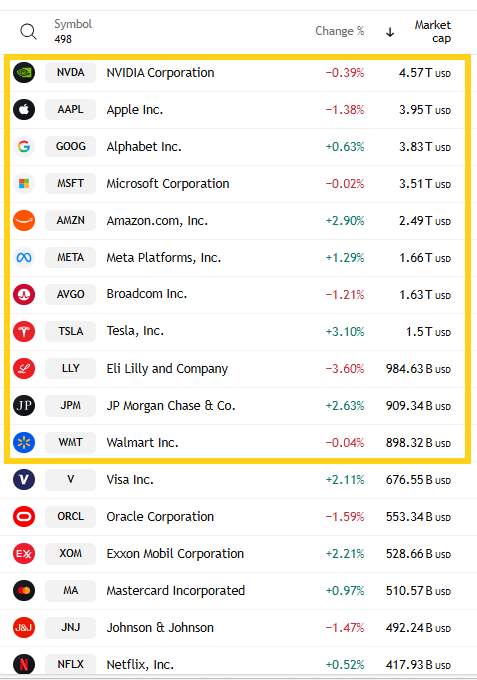

6 of the top 11 were lower (after 5 Fri, all 11 Wed). LLY led to the downside -3.6% while TSLA led to the upside after having dropped over -10% the prior two weeks +3.1%. Mag-7 was +0.9% after finishing last week -3.9% (the worst since April).

~50 SPX components were up 3% or more (after 68 Fri but a total of just four the week coming into Friday) led by heavy crude user (what Venezuela produces) Valero VLO +9.2%. Fourteen >$100bn in market cap up 3% or more (after sixteen Fri but only one total in the previous four sessions to that) in HOOD, IBKR, KLAC (again), AMAT LRCX (again), CVX, KKR, SPGI, C, GS (again), PLTR, BLK, TMO, TSLA (in descending order of percentage gains).

11 SPX components down -3% or more (down from 20 Fri, up from 4 Wed) led by Jabil JBL -7.1%. Three >$100bn in market cap down -3% or more (down from nine Fri but after seeing just one total the six sessions prior to that) in ABBV, LLY, CEG (in order of percentage losses).

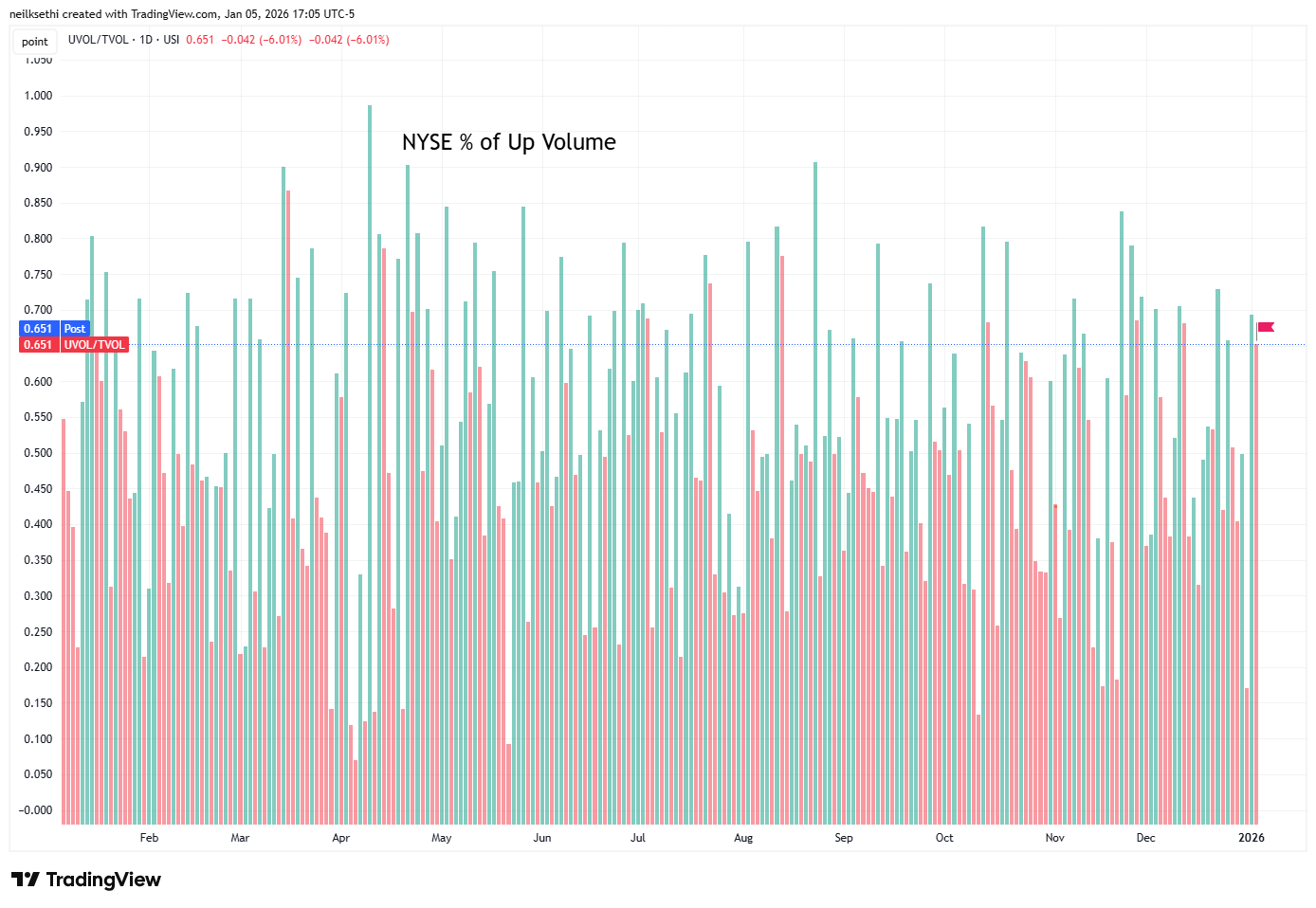

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) fell back to 65.1% from 69.3% along with the index gain decelerating to +0.89% from +1.04%, but as noted Friday both compare unfavorably Dec 22nd when it was 72.8% on a +0.85% gain.

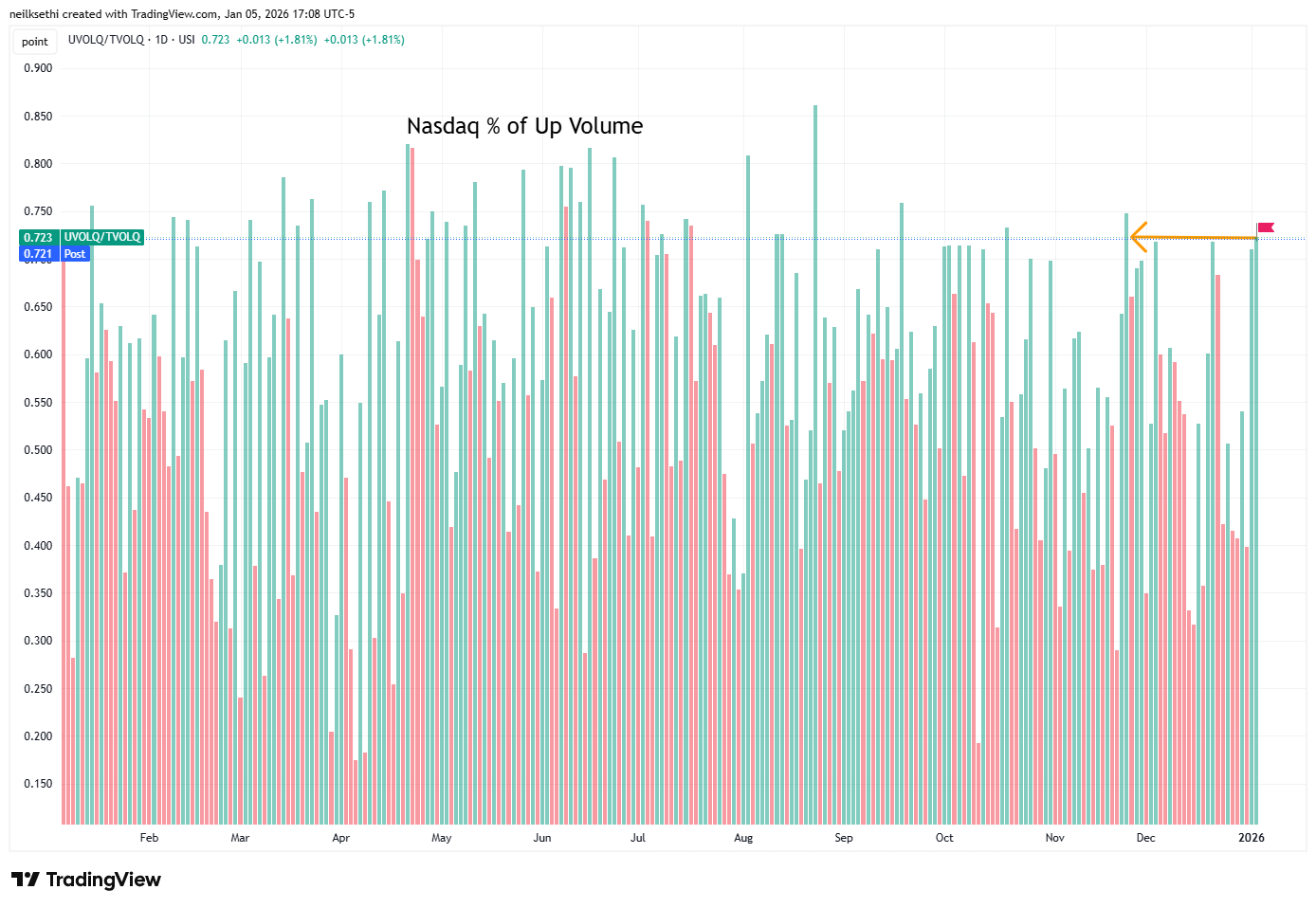

But Nasdaq positive volume (% of total volume that was in advancing stocks) moved to 72.1%, the best since Nov 24th, outperforming the gain of +0.69% (the index gain was +2.69% Nov 24th when it was 74.7%).

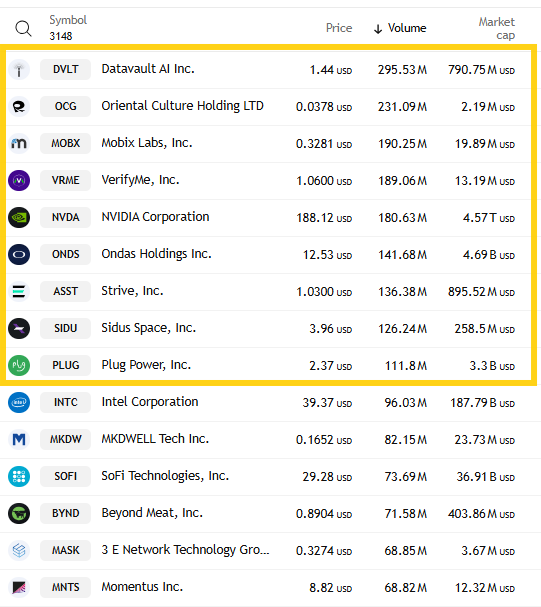

Which again of course made me think we probably had high speculative volumes on the Nasdaq, and while they were up from Fri with the top three stocks by volume on collectively trading a little over ~700mn shares, up from ~600mn, that’s down from 1.3bn two weeks ago. That said, 9 companies had volumes over 100mn shares up from 6 on Fri.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks saw just a small lag on the Nasdaq at 69.4% while the NYSE was 67.2%.

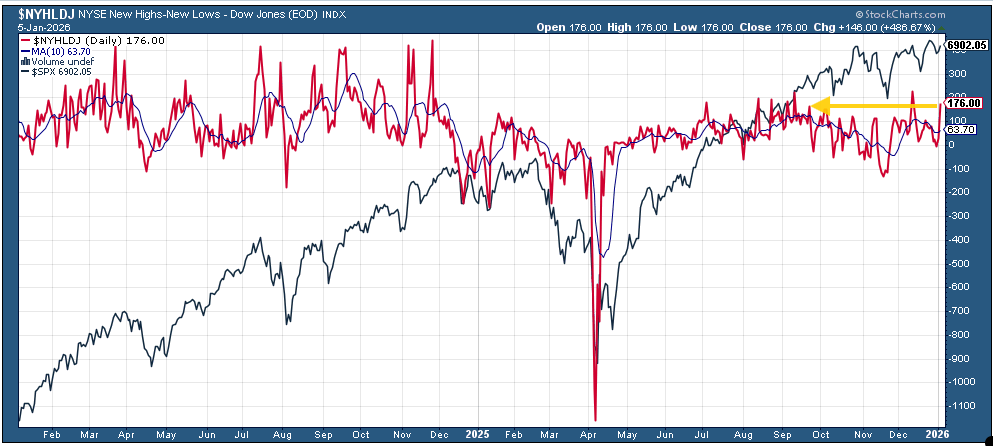

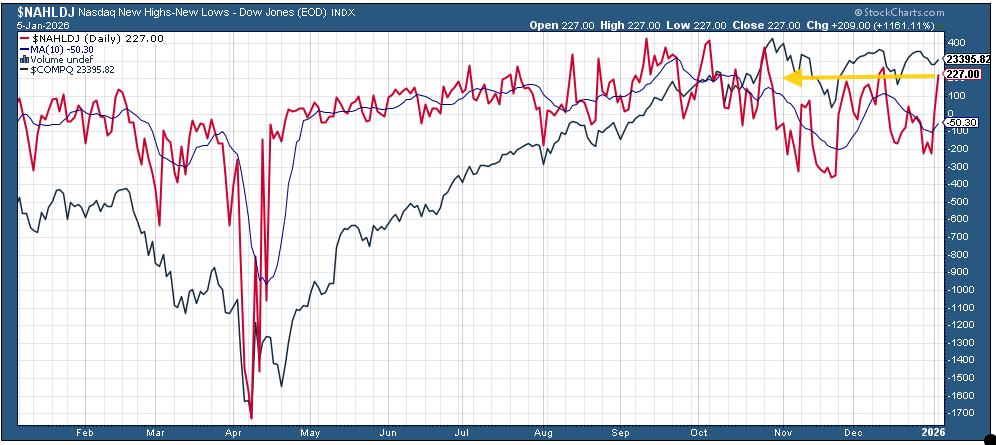

New 52-wk highs minus new 52-wk lows (red lines) continued to see good improvement to 176, the second highest since Aug, from -6 on Wed on the NYSE and to 223, the second highest since Oct, from -227 on Wed on the Nasdaq.

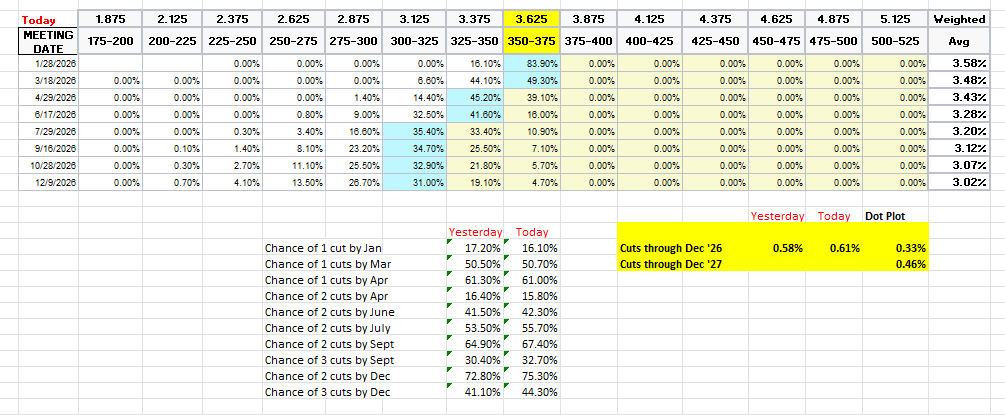

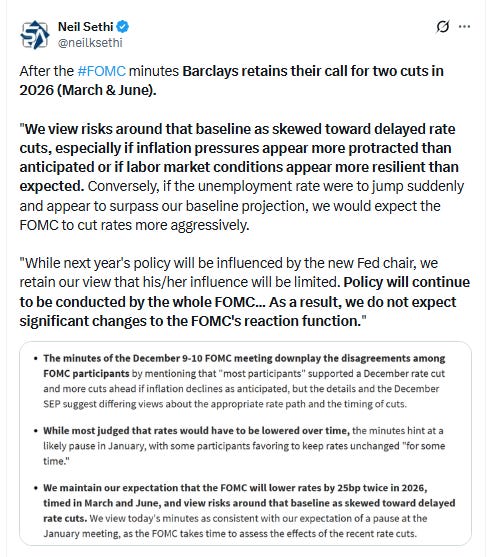

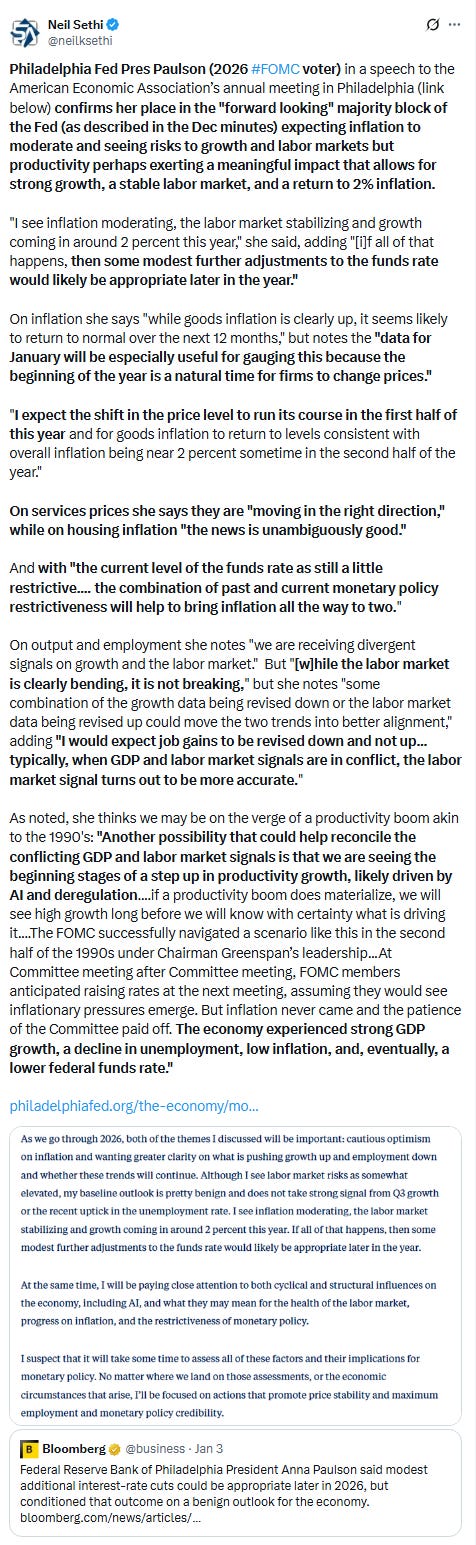

#FOMC rate cut pricing edged higher (more cuts) according to the CME’s Fedwatch tool. Probability of a cut in Jan remains low at 16% (up slightly from the recent low of 13% two weeks ago, the least since pre-Dec FOMC), with the first cut in March at 51% (from 47%). A second cut is in July at 56%.

Pricing for 2026 overall moved up to 61bps, with pricing for two cuts 75% and three cuts 44%, still down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has just 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

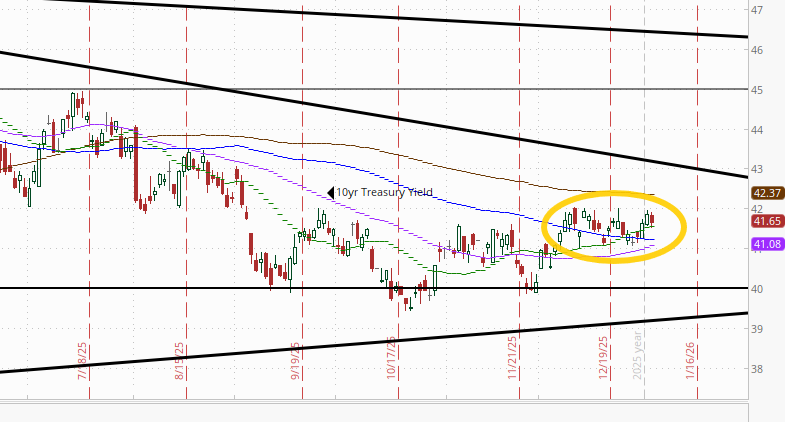

The 10yr #UST yield edged back to 4.17% remaining closer to the top of its range since the start of December.

The 2yr yield, more sensitive to FOMC rate cut pricing, fell -3bps to 3.45%, the least since Oct 22nd and now just 3bps above the least since 2022. It remains in the channel it’s been in since the start of 2024, -18bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) at one point made it to a 2-week high before giving that back and ending slightly lower, its first loss in four sessions. As noted Fri, the daily MACD has now crossed to “cover shorts” positioning and the RSI is near the best since Nov (although still under 50).

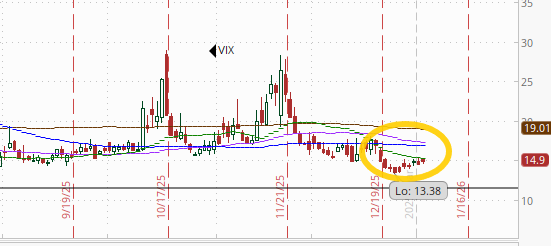

VIX continues to edge higher now at 14.9, but still around the lows of 2025. The current level is consistent w/~0.93% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) similarly has edged higher over the past two weeks from 81.7, which was the least since July ‘24, now to 90.5. The current level remains consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

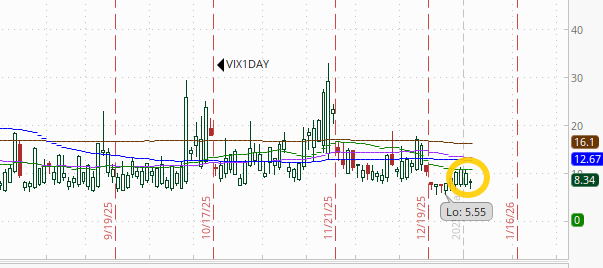

With the weekend behind us, the 1-Day VIX fell back to 8.3, just above the lows of 2025. That reading implies a ~0.52% move in the SPX next session.

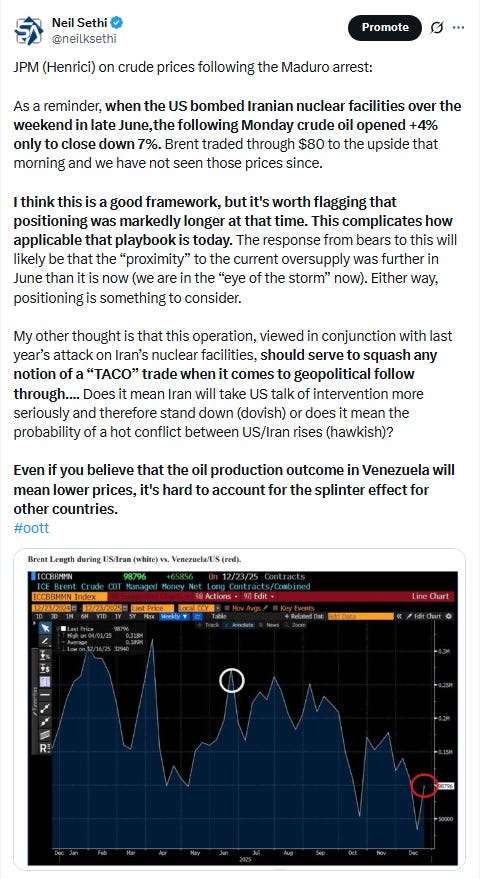

#WTI futures back up against the resistance they have struggled with since the start of Oct (50-DMA and downtrend line from the July highs). As I said two weeks ago, “like several previous times the daily MACD crossing to ‘cover shorts’ and the RSI moving over 50 weren’t enough [so far at least] to push it through.” That said, they are starting to “move around” the downtrend line (by not following the trendline lower). The 50-DMA though remain an obstacle (with lots more resistance above that).

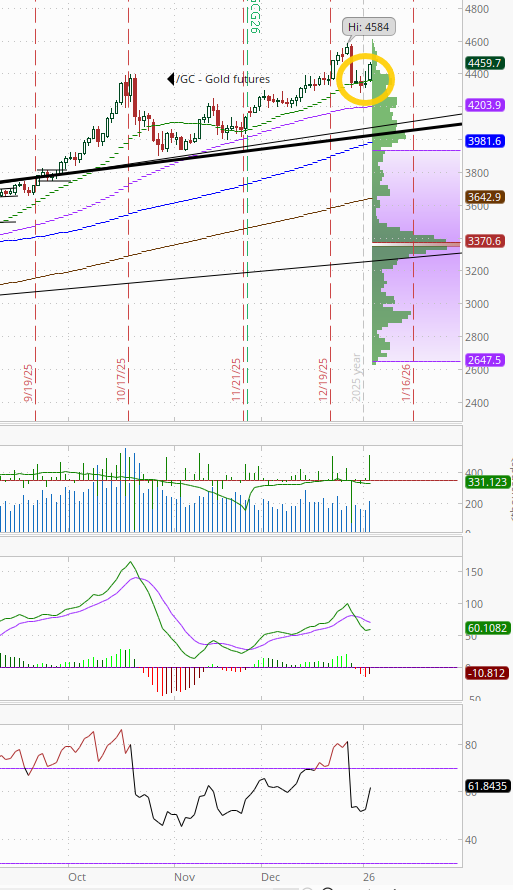

Gold futures (/GC) a solid session gaining +2.7%, their best day since Nov 10th as they broke out of their 3-day sideways pattern which followed their largest pullback since October a week ago.

As noted then, “like [the October pullback], the RSI fell from well over to well under 70, and the daily MACD has crossed over to ‘sell longs’ positioning. After that plunge, gold futures drifted lower over the following week or so before resuming the uptrend. We’ll see if we get something similar here. So far not so much.”

US copper futures (/HG) an even stronger session gaining +5.2%, the best day since Oct, to a new ATH as fears around potential tariffs continue to lead to hoarding and an inventory squeeze.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) dropped again, falling under the 200-DMA back down to levels around where they were Oct 28th before their big run higher, now down nearly -40% from the intraday high Dec 5th. The daily MACD remains in ‘sell longs’ positioning, and RSI is the weakest since Aug.

Bitcoin futures built on their breakout over $90k jumping +4.4% to the highest close since Nov 14th. The daily MACD remains in “cover shorts” positioning, and the RSI is now above 50 and the strongest since mid-Oct.

The Day Ahead

US economic data is backloaded, and Tuesday another one report day with S&P services PMI although that gets forgotten as soon as ISM comes out Wed.

In Fed speakers, on the official calendar we have Richmond Fed Pres Barkin (not a voter this year).

No SPX earnings reports Tuesday.

Ex-US we’ll also get the S&P services PMI from around the globe and CPI from Germany and France.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,