Markets Update - 1/6/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

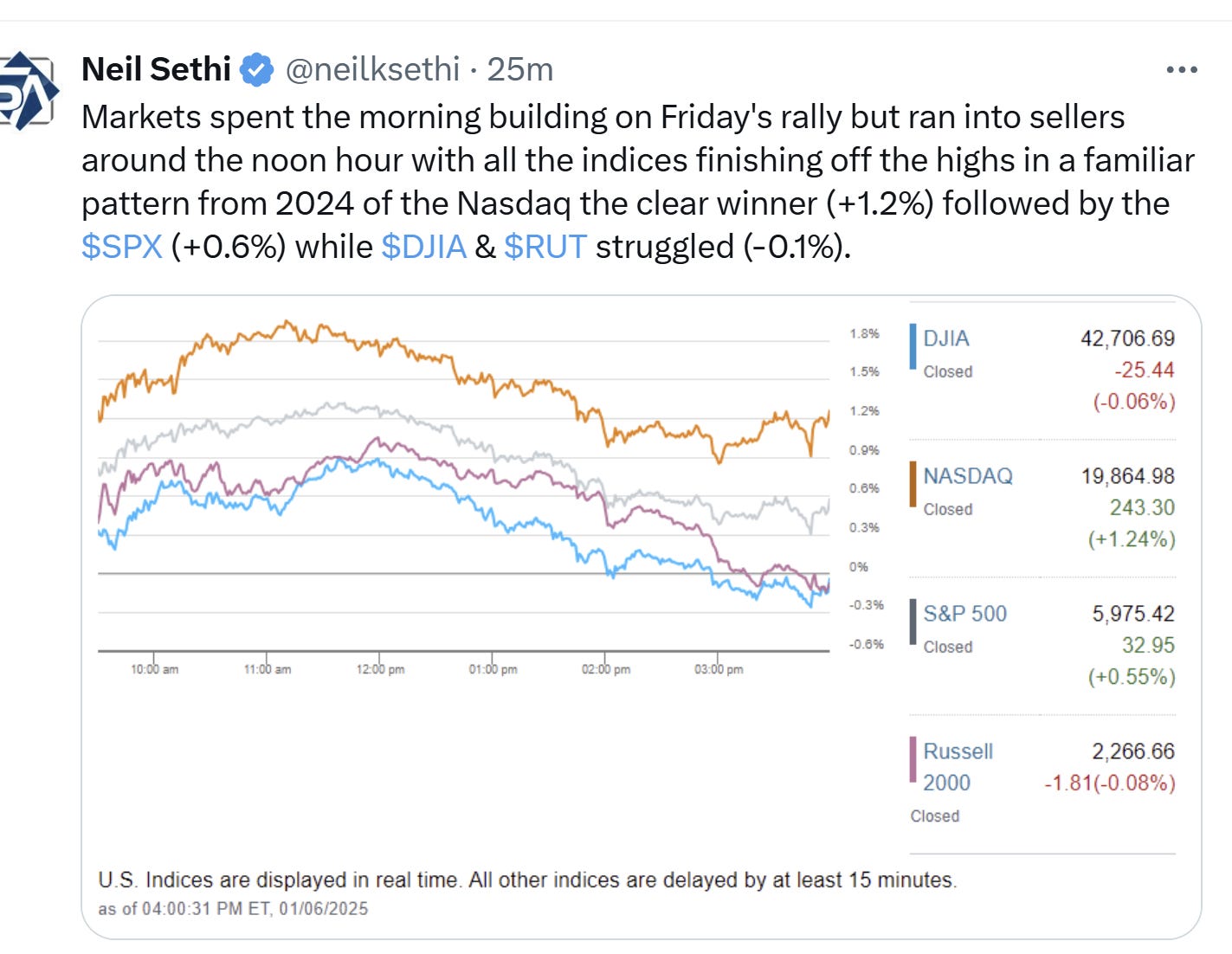

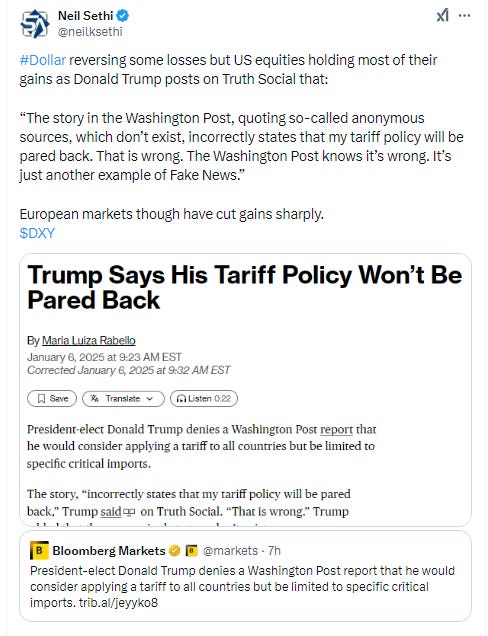

US equities started off the day extending Friday’s rally on the back of a Washington Post article reporting that Trump tariffs may be more limited in nature targeting “critical imports”. Equities pared gains after Trump dismissed the story, but equities thereafter pushed to new highs after a strong services PMI report before fading in the afternoon outside of the megacap growth stocks which pushed the Nasdaq to a strong gain (the Mag-7 index as up +1.9%). The equal-weighted SPX and Russell 2000 small cap indices in contrast settled with small losses.

Elsewhere, long duration yields edged higher for a 4th session, but the dollar fell sharply after the Washington Post story and never recovered. In commodities, crude fell back after hitting near 3-mth highs, nat gas shot higher, bitcoin pushed over $100k, copper hit a 3-wk high, while gold was little changed.

The market-cap weighted S&P 500 was +0.6%, the equal weighted S&P 500 index (SPXEW) -0.1%, Nasdaq Composite +1.2% (and the top 100 Nasdaq stocks (NDX) +1.1%), the SOX semiconductor index +2.8%, and the Russell 2000 -0.1%.

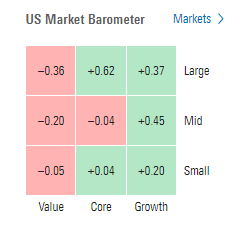

Morningstar style box also showed it was a weaker day outside of growth which outperformed for a second session.

Market commentary:

“The recovery we’ve seen Friday and today shows just how strong the ‘buy the dip’ mentality still is,” said Mark Hackett at Nationwide. “Investors continue to lean heavily on tech. Looking ahead, 2025 won’t be a year for easy double-digit gains by solely investing in the S&P 500. Success in this market will require more discipline and creativity from investors.”

RBC Capital Markets LLC strategist Lori Calvasina expects that markets will soon get better clarity on Trump’s policies. “One of my core beliefs about politics and markets, whatever it is, you have to go through some temporary pricings, and those can be painful,” Calvasina told Bloomberg TV. “It tends to be rather short-term and then you move on.”

Calvisina also says investor exuberance in the stock market is starting to “self-correct” as a measure of sentiment and positioning fell into the year end. “While this doesn’t tell us that the recent period of malaise in the stock market is over, we do think this deterioration in sentiment is actually good news for the stock market longer term,” she wrote.

Daniel Murray, chief executive officer of EFG Asset Management in Zurich, urged caution about the sharp reaction to the tariff report, saying investors were still faced with many unknowns. “As ever with markets, it’s all about news flow relative to what is already priced in,” Murray said. “We don’t know what tariffs the Trump administration will levy on which countries, nor do we know how those countries will retaliate.”

To Paul Nolte at Murphy & Sylvest Wealth Management, 2025 should see a volatile market. “The large swings may provide opportunities for both buyers and sellers,” he noted.

The S&P 500’s December pullback didn’t prevent clients from being net buyers in nine of 11 sectors last month, according to Chris Larkin at E*Trade from Morgan Stanley. “While there may have been a defensive element to some of the buying in utilities and real estate, the push into the consumer discretionary sector suggested more of a ‘risk-on’ mindset — led by purchases of TSLA and AMZN,” he noted.

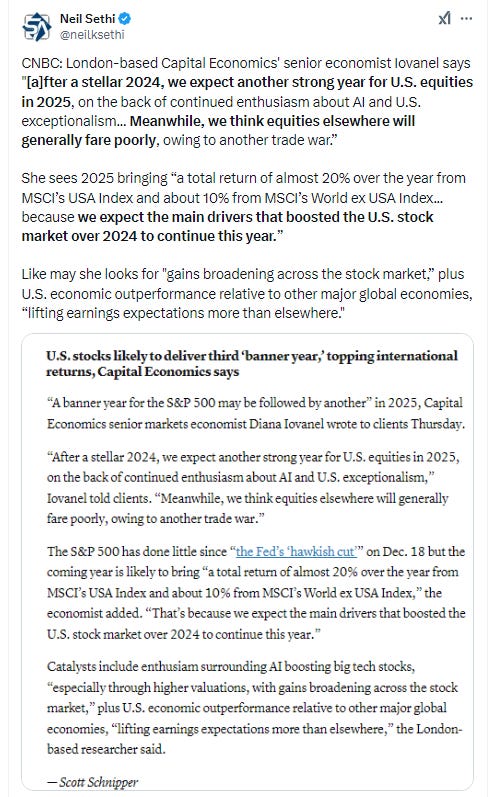

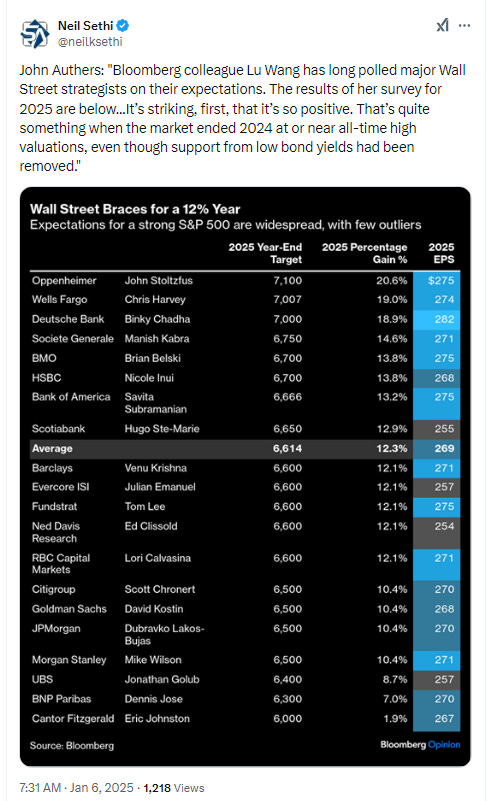

Notwithstanding fewer likely rate cuts, Solita Marcelli at UBS Global Wealth Management, sees a favorable backdrop ahead — driven by a mixture of lower borrowing costs, resilient US activity, a broadening of US earnings growth, further AI monetization, and the potential for greater capital market activity under a second Trump administration. “We expect the S&P 500 to hit 6,600 by end-2025 and suggest that under-allocated investors consider using any near-term turbulence to add to US stocks, including through structured strategies,” she noted.

Traders will be looking for clues about the strength of the economy and the sturdiness of Fed rate plans. Callie Cox, chief market strategist at Ritholtz Wealth Management, said the week ahead could be another opportunity for traders to recalibrate their expectations. “Data shows us that unemployment is climbing and people are having a hard time finding jobs. There are cracks in hiring that could re-appear at any time,” she told CNBC. “It’ll be important to watch yields too. The 10-year yield is near a high of 4.6%, and jobs days have rattled bond investors in the past.”

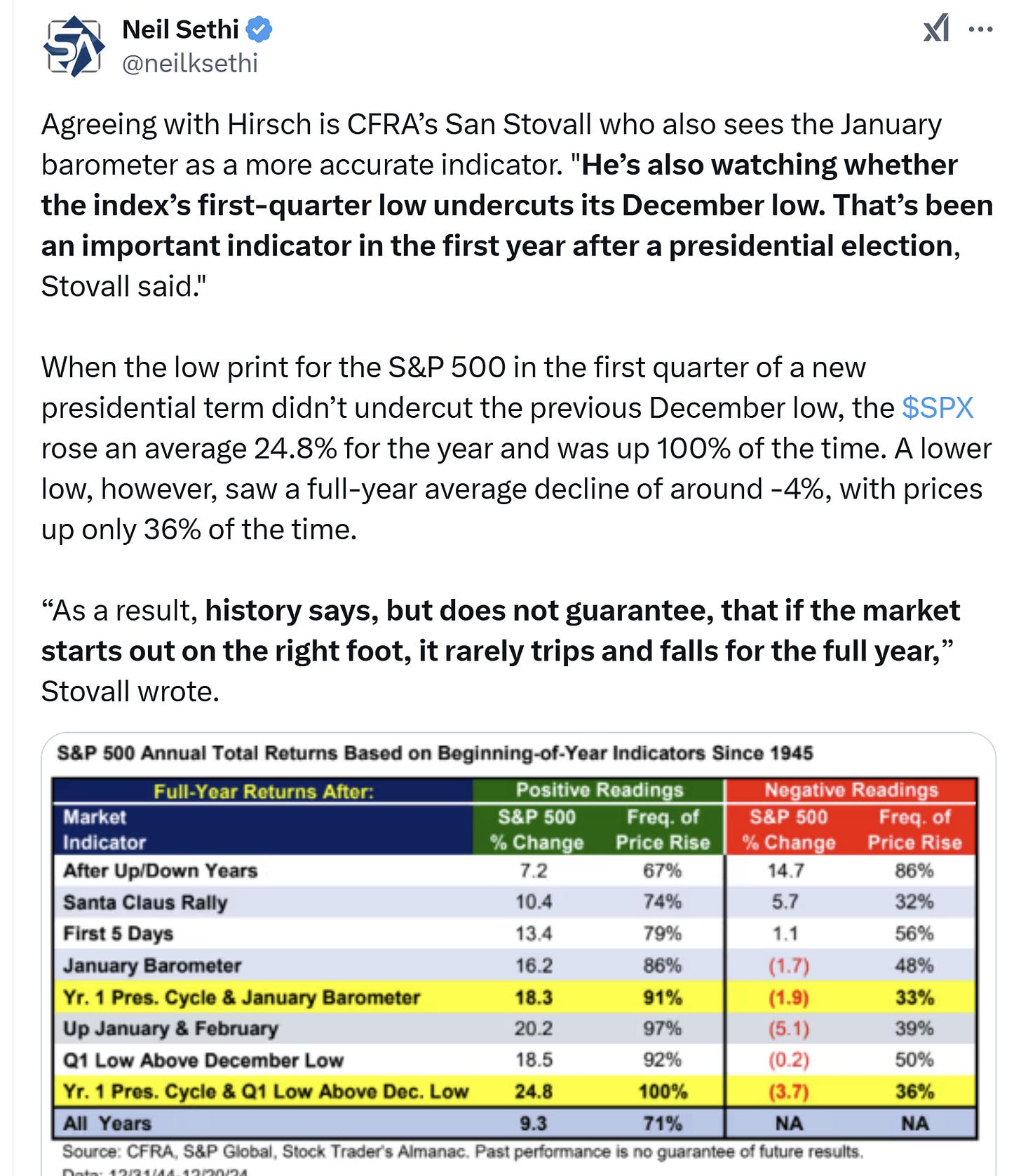

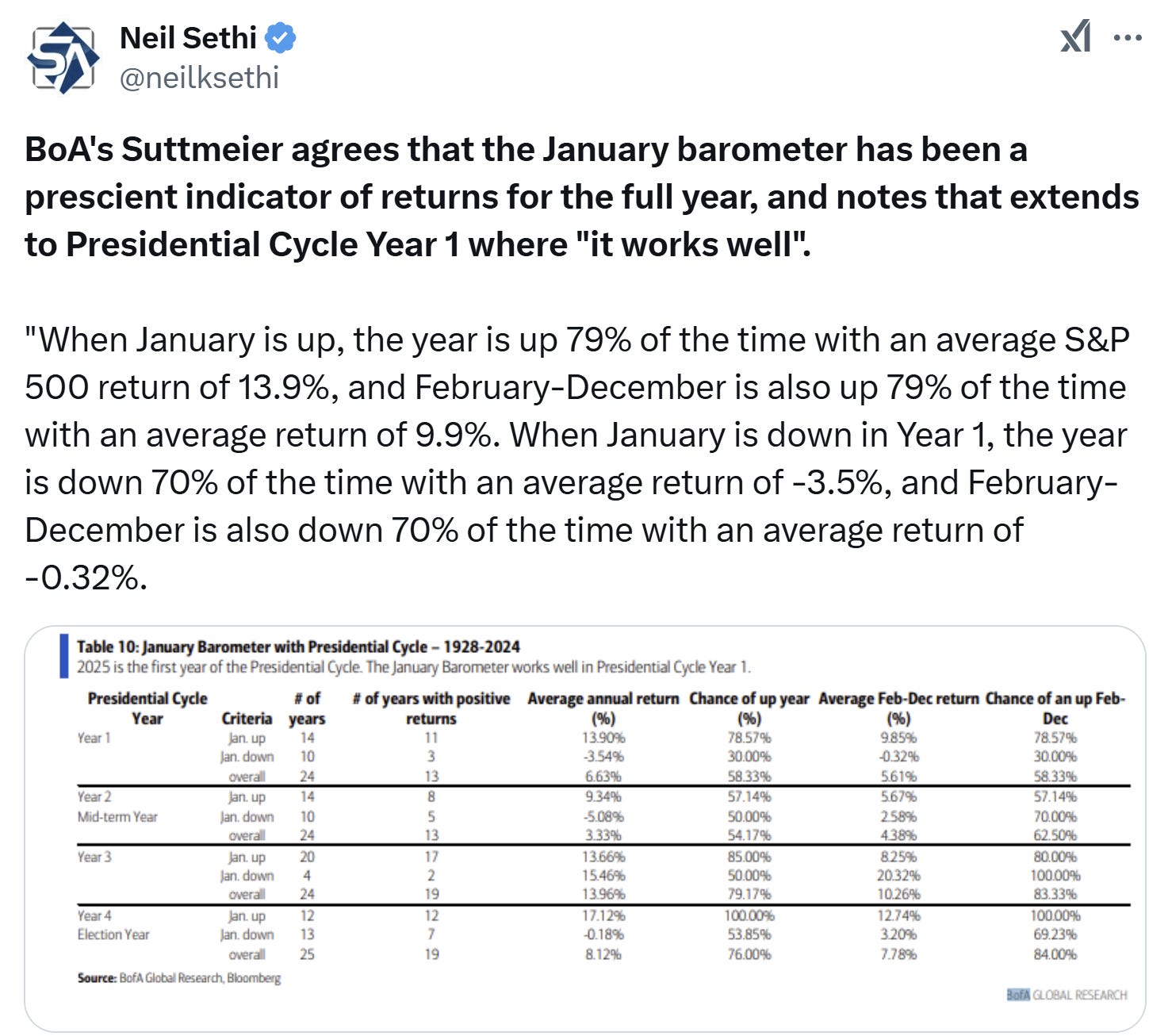

"The market is, I think, being pretty optimistic about tech right now, looking for earnings growth of 20% this year versus 12.8% for the market ... but valuations do appear restrictive," CFRA Research chief investment strategist Sam Stovall said. "The group will probably not rise based on P/E multiples, but will have to rise based on organic earnings growth." Stovall expects "heightened volatility" this year given expensive valuations, potential adjustments to interest rate forecasts and earnings projections, and a new presidential administration. The third year of a bull market also tends to be more challenging per historical data going back to World War II, he added.

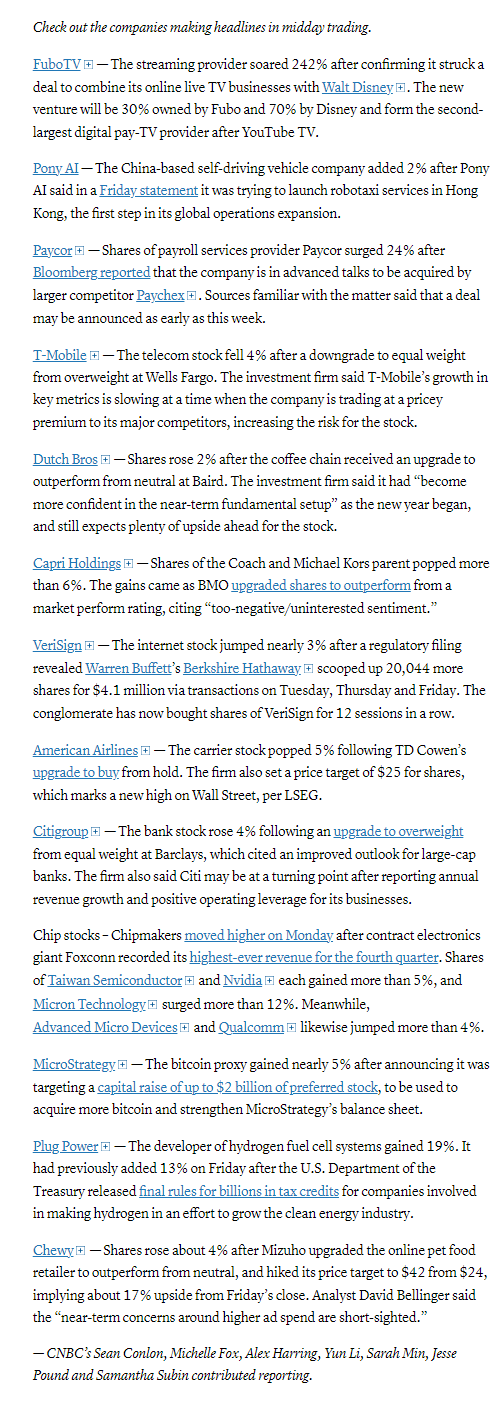

In individual stock action, the S&P 500 and Nasdaq Composite benefitted from buying interest in the mega cap and chipmaker space. NVIDIA (NVDA 149.43, +4.96, +3.4%), outperformed ahead of CEO Jensen Huang's keynote address at the Consumer Electronics Show (CES) tonight at 6:30 p.m. PST (9:30 p.m. ET), up as much as 5.3% at its high. NVIDIA's outperformance was also linked to AI enthusiasm after Foxconn reported a 15% yr/yr increase in record Q4 revenues. Broadcom gained 1.1%, while Micron Technology advanced more than 11.6%. The VanEck Semiconductor ETF traded 3.7% higher.

American Airlines Group Inc. rallied on a trio of analyst upgrades. Citigroup Inc. also jumped on a bullish call. Tencent Holdings Ltd. depositary receipts slid as the US added company to its Chinese military blacklist. The SPDR S&P Oil & Gas Exploration & Production (XOP) ETF traded higher on Monday, rising as much as 2% intraday, putting the ETF on pace for its 10th straight gain for the first time since April 2020. Shares of FuboTV surged more than 200% after the company confirmed in a press release that it was entering a definitive agreement with Walt Disney for the latter to combine its Hulu + Live TV business with Fubo.

BBG Corporate Higlights:

Nippon Steel Corp. and United States Steel Corp. jointly filed a pair of lawsuits in a last-ditch effort to preserve their planned merger, which was blocked last week by President Joe Biden.

Uber Technologies Inc. said it entered into an accelerated share repurchase agreement with Bank of America to repurchase $1.5 billion of shares of Uber common stock, as part of its previously announced share repurchase authorization.

Qualcomm Inc. introduced new chips designed to power personal computers capable of running the latest artificial intelligence software yet cost as little as $600.

Carvana Co. said it has reestablished an agreement with Ally Financial Inc. to sell the lender up to $4 billion in used-vehicle loan receivables over the next year, a move that counters one claim by short seller Hindenburg Research that the financier was pulling back on their relationship.

Walt Disney Co. and streaming provider FuboTV Inc. agreed to combine their online live TV businesses, creating the second-biggest digital pay-TV provider.

Paychex Inc. is in advanced talks to acquire Paycor HCM Inc., a smaller rival in payroll processing, according to people with knowledge of the matter.

Hon Hai Precision Industry Co. reported faster-than-expected 15% revenue growth after the server assembly partner to Nvidia rode sustained demand for AI infrastructure.

Some tickers making moves at mid-day from CNBC.

In US economic data:

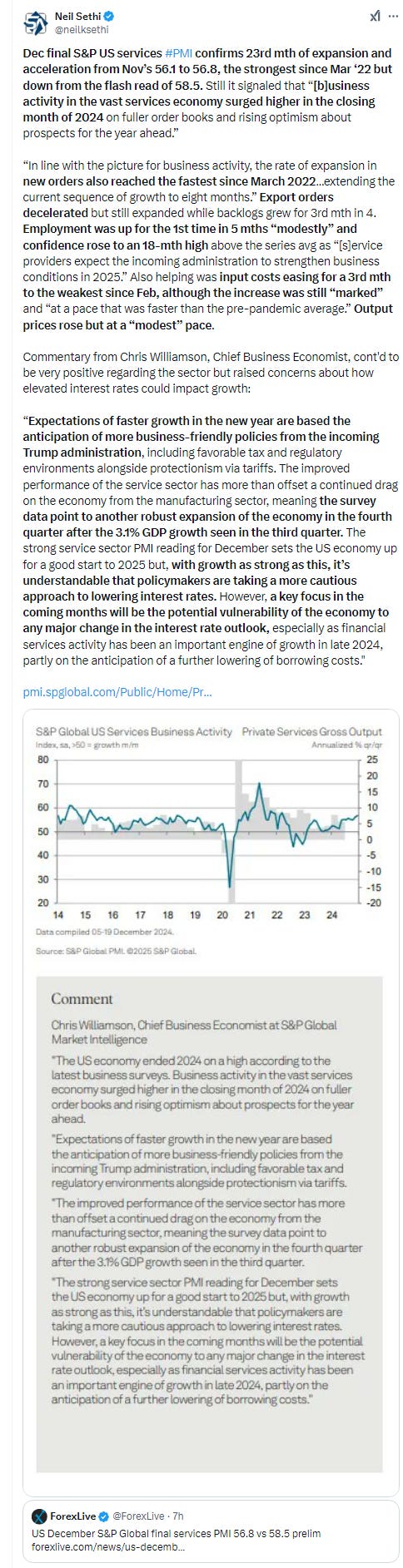

Dec final S&P US services PMI confirmed a 23rd mth of expansion and acceleration from Nov’s 56.1 to 56.8, the strongest since Mar ‘22 but down from the flash read of 58.5. Still it signaled that “[b]usiness activity in the vast services economy surged higher in the closing month of 2024 on fuller order books and rising optimism about prospects for the year ahead.”

Factory orders decreased 0.4% month-over-month in November (Briefing.com consensus -0.3%) following an upwardly revised 0.5% increase (from 0.2%) in October. Excluding transportation, factory orders rose 0.2% on the heels of a 0.2% increase in October. Shipments of manufactured goods edged 0.1% higher in November following a 0.2% decline in October. The key takeaway from the report is that the weakness in factory orders was concentrated in the volatile transportation equipment space; otherwise, there was a modest pickup in order activity.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

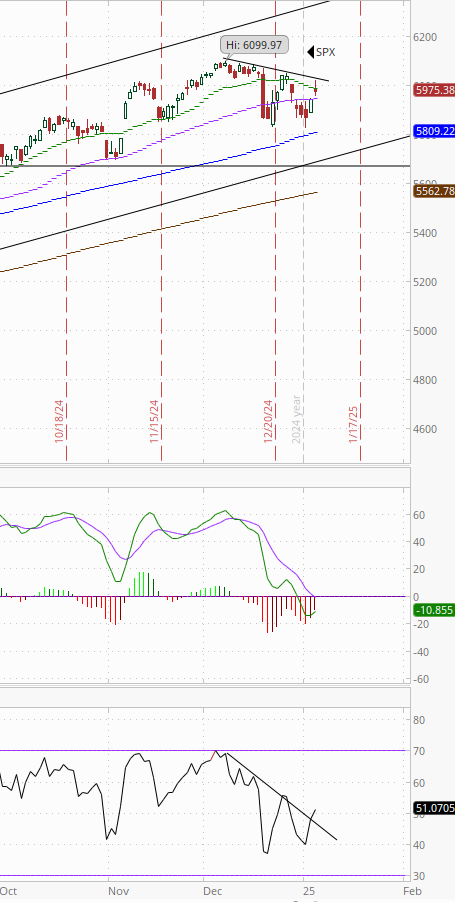

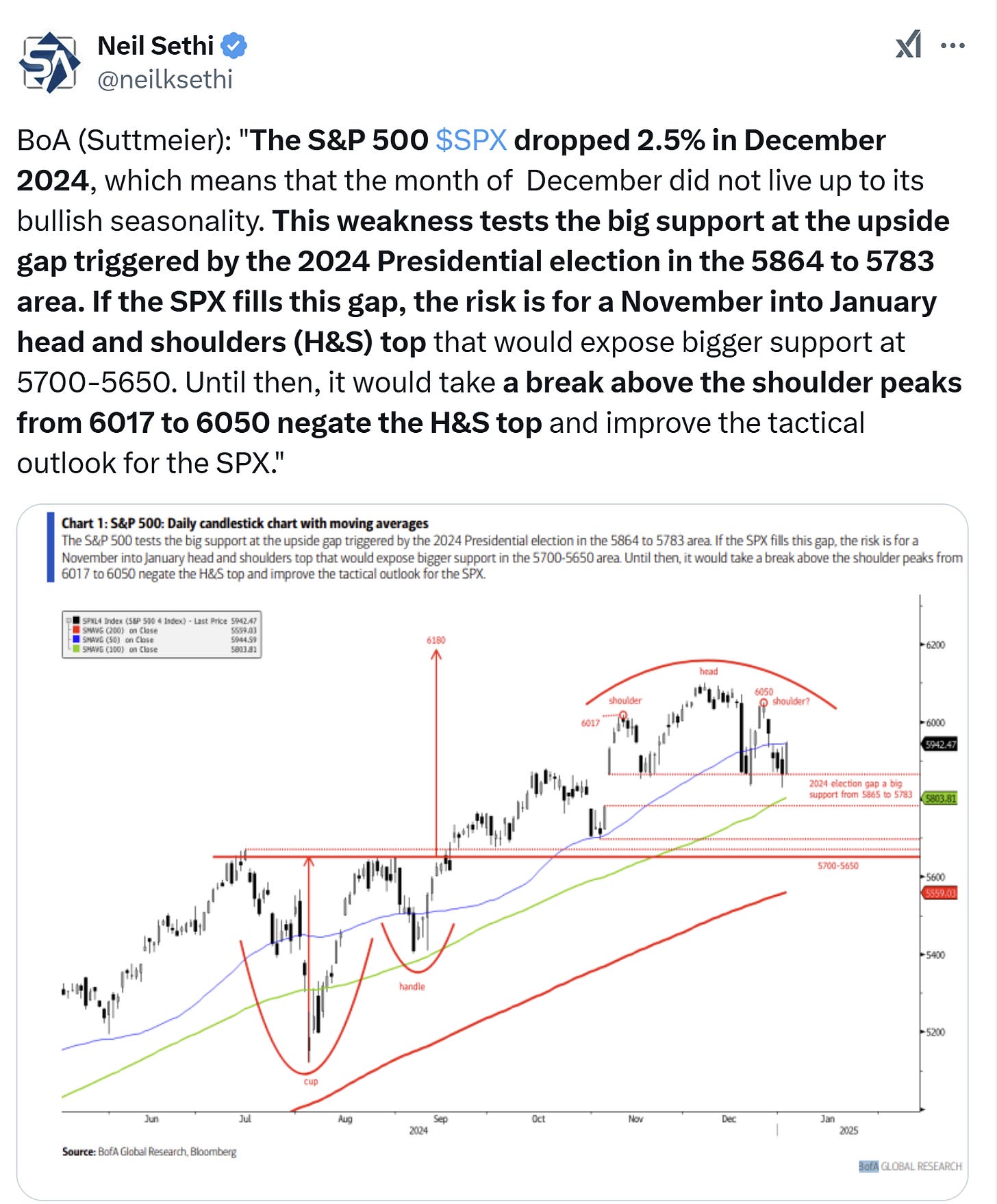

The SPX got over its 50-DMA on the 5th try and ran right to the downtrend line from its ATH. I am surprised that line has proven this much resistance, but that’s the next step to challenging the ATH. Daily MACD & RSI are improving as well.

The Nasdaq Composite for its part moved back over its 20-DMA and into the uptrend channel back to August. Its daily MACD and RSI are improving as well.

RUT (Russell 2000) failed at the 2290 level I noted last week it “really needs to get back over before we can really look higher.” Daily MACD & RSI remain weak but are improving.

Equity sector breadth from CME Indices weak with just four sectors in the green after all 11 on Friday. All four were at least up +0.6% though with two up over 1% (but down from six Friday. The megcap growth sectors led again today taking three of the top four spots (along with materials).

Stock-by-stock SPX chart from Finviz looks a lot like most of 2024 with the Mag-7 all green but lots of red elsewhere. Intel only semiconductor component in the red.

Positive volume (the percent of volume traded in stocks that were up for the day) remained over 50% for both indices Monday at 62 & 69% respectively (from 67 & 78% Friday) the 4th straight session for the NYSE (and a very good number given the NYSE Composite was up just 7pts) and the 10th for the the Nasdaq (although the level was not great given the Nasdaq was up 240pts). Positive issues (percent of stocks trading higher for the day) though fell back to weak 42 & 50% from 75 & 71% respectively Friday.

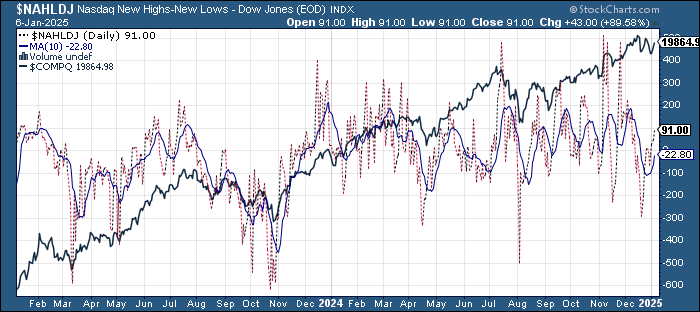

New highs-new lows (charts) did improve with the NYSE getting a positive read for the 1st time in 15 sessions at 34, while the Nasdaq moved to 87 from 45 (both the best since early December but from November levels). Both though remain above their 10-DMAs which both continue to curl up (more bullish).

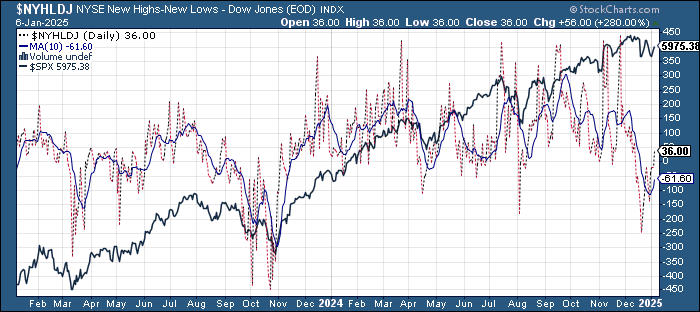

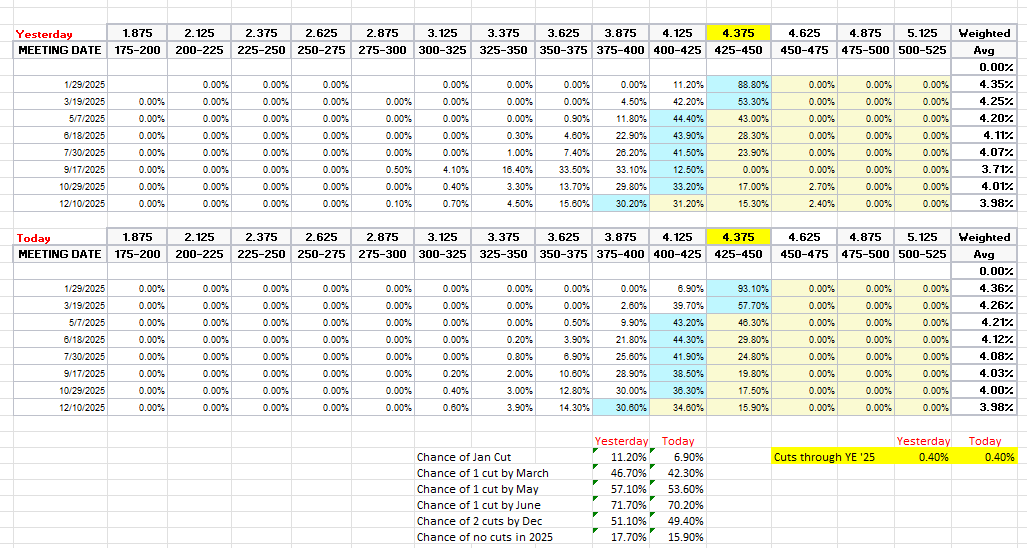

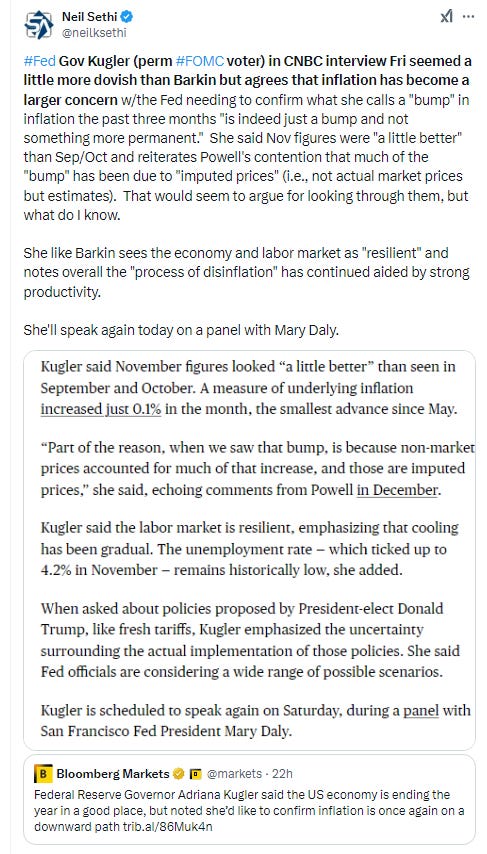

FOMC rate cut probabilities from CME’s #Fedwatch edged lower (fewer cuts) Monday following more hawkish Fed commentary with chances for a Jan cut down to just 7%. Pricing for a 2nd cut in 2025 fell just under 50% (49%) with overall 2025 cut expectations remaining at 40bps but the chance of a March cut fell to 42% (54% for May). Chance of no cuts at 16%.

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that. Of course it’s all just a big guess as we know it will all come down to the data which we’ll get some of next week particularly Friday in payrolls.

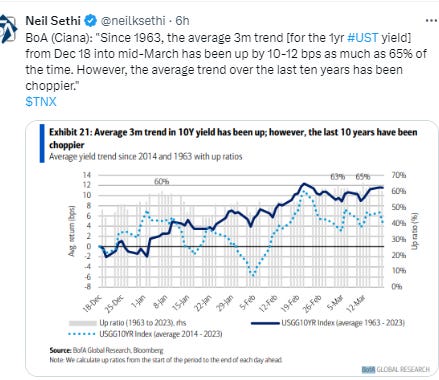

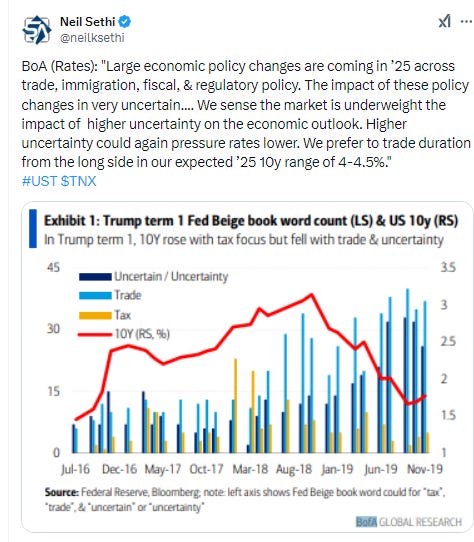

Longer duration Treasury yields up for a 4th session with the 10yr yield +2bps at 4.62%, just 1bps below the recent closing high, and +23bps since the Dec FOMC meeting (& +86bps from the Sept FOMC meeting), as I’ve said the past 2 weeks “still eyeing the 4.7% level”. The 2yr yield, more sensitive to Fed policy, was -1bp to 4.27%, in the middle of its range since November.

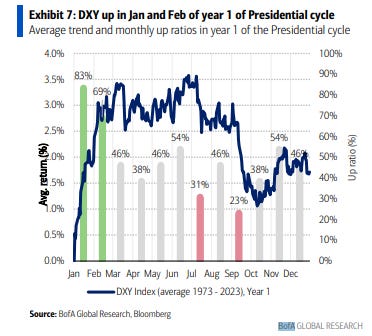

Dollar ($DXY) has a volatile day, falling the most at one point since Nov ‘23 on a Washington Post report that the Trump administration was considering limiting tariffs to “critical imports,” but which reversed somewhat after a Trump social media post called it “Fake News”. Still it was down sharply on the day, but remains in its uptrend. Daily MACD and RSI have turned less positive.

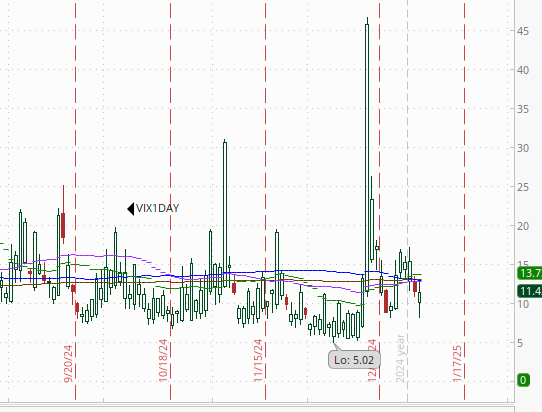

The VIX edged lower although remains relatively elevated at 16.0 (consistent w/1% daily moves over the next 30 days). The VVIX (VIX of the VIX) edged higher but at 95 remained under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX at one point fell to 8 before rebounding to close at 11.2, still its lowest close since Dec 26th, closer to the sub-10 readings we were seeing before the Dec FOMC meeting, looking for a move of 0.72% Tuesday.

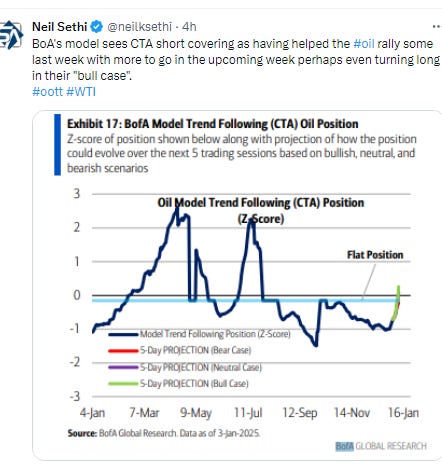

WTI was up for a 6th day, making it to my target of the $75 area,but as I suspected would be the case, found the resistance too much to overcome on the first test, falling back. It has some strong momentum but it also did in March, June and October when it tested the area of the same downtrend line but couldn’t get through. Still I would expect it will at least take one more shot. Daily MACD & RSI remain supportive.

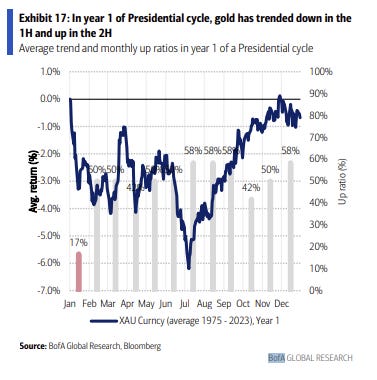

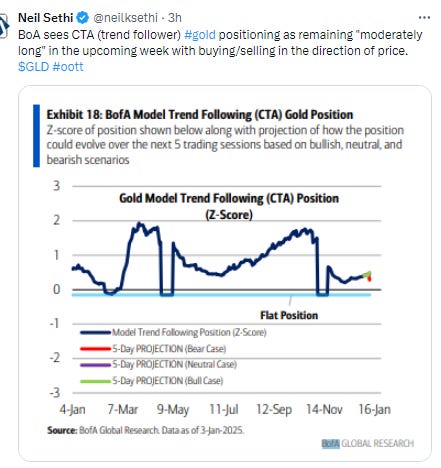

Gold little changed remaining under the 50-DMA which is key resistance, holding its uptrend. Daily MACD remains in "cover shorts" signal & daily RSI just under 50.

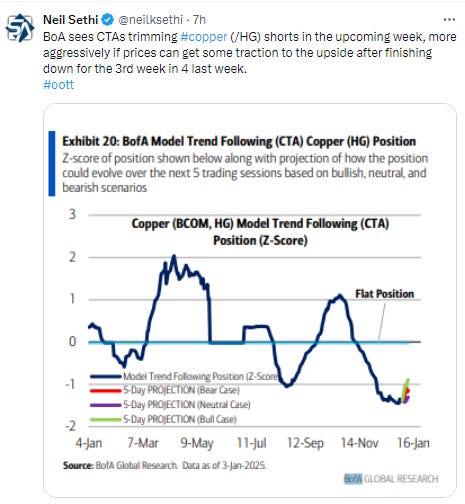

Copper (/HG) able to continue its bounce from just above the $4 mark it has mostly stayed over since March, hitting a 3-wk high before falling back some after hitting its 50-DMA. Its RSI and MACD are moving more positive, but it has very strong resistance just above.

Nat gas (/NG) remained volatile Monday jumping 10% from its uptrend line, getting back all of its losses from Friday and then some, pushing back through the $3.65 breakout level. Daily MACD remains in “sell longs” position but the RSI is now back over 50 after falling to the weakest since October.

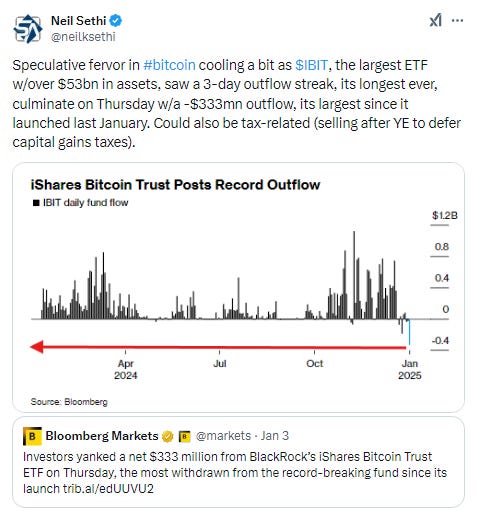

Bitcoin futures were up for a 4th session pushing through the 20-DMA/$100k level which had capped its rallies since it fell below two weeks ago, giving it a clear shot at ATH’s. The daily MACD remains weak but is quickly turning, and the RSI is over 50 and heading for its downtrend line.

The Day Ahead

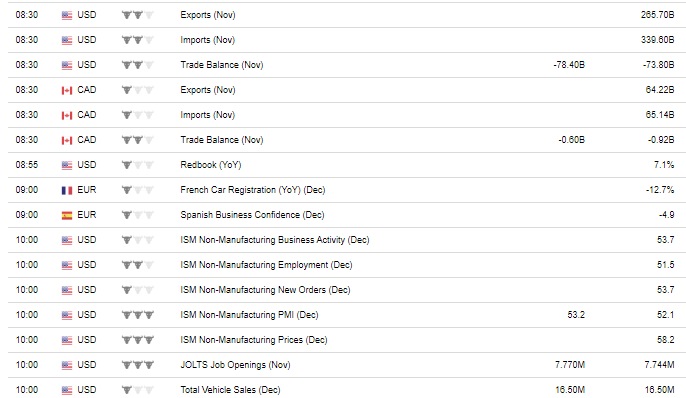

US economic data remains heavy with the Nov JOLTS report and trade deficit and Dec ISM services PMI.

Fed speakers will be a little lighter in Richmond Fed Pres Barkin who we have already heard from twice since the Dec FOMC meeting, so I’m not expecting anything new.

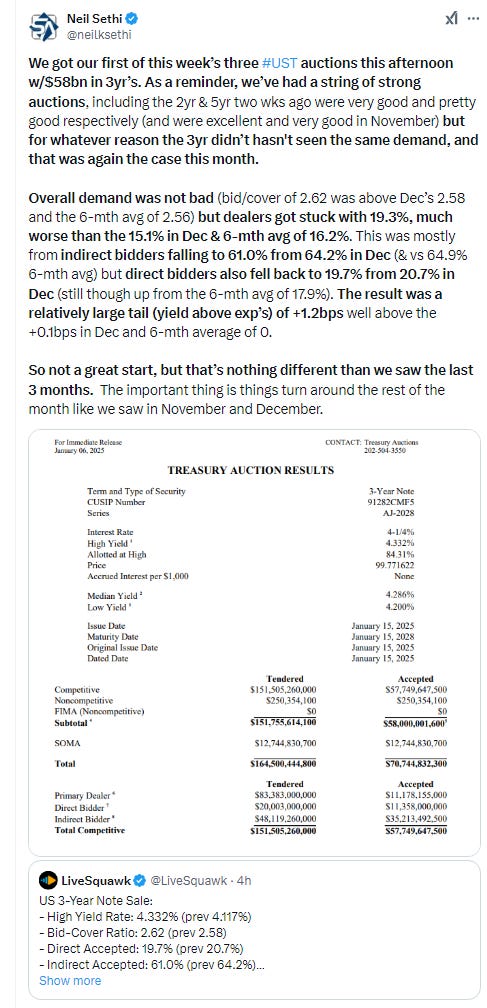

We’ll get the second of this week’s three US Treasury auctions with the benchmark 10yr note. If any auction is watched, it is that one.

Earnings will be light with no SPX components.

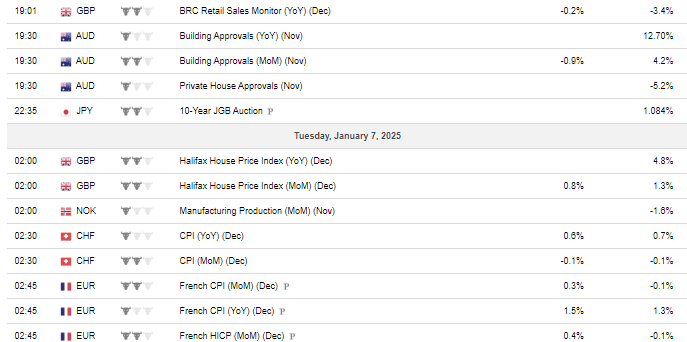

Ex-US highlights are preliminary Dec CPI readings from France, Italy, and the EU, UK home prices, and Nov Canada trade. In EM we’ll get inflation reads from India and Brazil.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,