Markets Update - 1/6/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

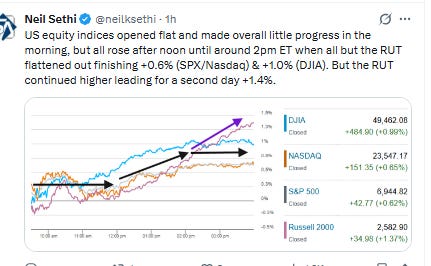

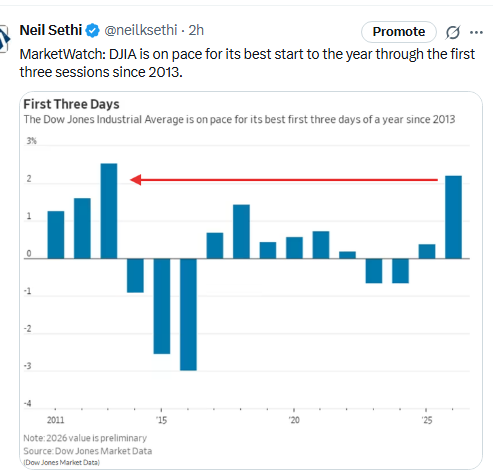

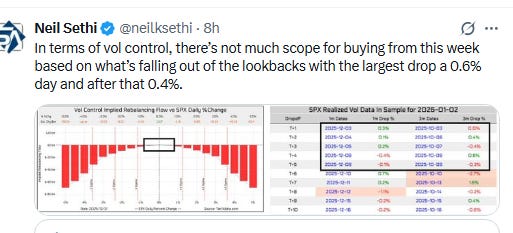

US equity indices opened Tuesday near their flat lines with no major headlines to push the direction even as shares in Europe and Asia were seeing strong performances and new record highs. US indices made overall little progress in the morning, but all rose after noon until around 2pm ET when all but the Russell 2000 (RUT) flattened out finishing +0.6% (SPX/Nasdaq for a second session) and +1.0% (DJIA). Still it was enough for all-time highs for the SPX and DJIA. And the RUT continued higher the last two hours leading for a second day +1.4%. Also, the equal-weighted SPX was up double the cap-weighted at +1.2% indicating a broad rally (more on that below).

Elsewhere, bond yields edged higher, as did the dollar. Gold and copper again saw healthy advances, the latter to an ATH, but crude, natgas, and bitcoin all were lower.

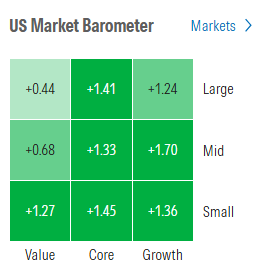

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +1.2%, Nasdaq Composite +0.6% (and the top 100 Nasdaq stocks (NDX) +0.9%), the SOXX semiconductor index +2.8%, and the Russell 2000 (RUT) +1.4%.

Morningstar style box again showed broad gains, with less relative outperformance from small caps than the prior two sessions outside of value.

Market commentary:

“Tech kind of took a pause at the back end of the year, but I don’t think anyone questions that AI is a game changing technology,” said Ross Mayfield, investment strategist at Baird. “We’re seeing the chip stocks lead. That’s probably to be expected, but that cyclical rotation is still continuing.”

“You can have the AI trade and tech stocks work and the other cyclical components of the market work as well,” he continued. “That’s the kind of thing you might expect in an economy that is going to be running hot in 2026 with rate cuts, tons of fiscal stimulus and an AI enthusiasm that’s getting closer and closer to a fever pitch.”

“These geopolitical events when they do impact markets or the consumer picture tend to come for the oil market, and here it’s just not there,” the strategist added.David Lefkowitz, head of U.S. equities at UBS Global Wealth Management, said that he expects the market to start broadening out in 2026, noting that recent corporate earnings support that belief. “We maintain our ‘Attractive’ view on U.S. equities. Despite the solid performance of the last three years, we think this bull market has more to go. But its composition might look a little different this year. Our year-end 2026 S&P 500 price target is 7,700 and our 2026 EPS estimate is USD 305 (10% growth),” Lefkowitz wrote in a note.

“The fact that we’re getting actual real-time economic data certainly seems to be a tailwind for investors,” said Art Hogan, chief market strategist at B. Riley Wealth. “That combined with excitement coming out of CES.”

“There are real, concrete things you can point to that support the markets in the here and now,” said Julie Biel, a portfolio manager at Kayne Anderson Rudnick.

Many of the themes that helped lift markets in 2025 will continue to give stocks a boost in early 2026, according to William T. Northey, investment director at U.S. Bank Wealth Management. Northey said that he expects artificial-intelligence investment to boost productivity across multiple sectors beyond technology, including healthcare, industrials and financials. He said that fiscal initiatives like tax cuts and Federal Reserve rate cuts will help drive corporate growth and support risk assets, and that tax cuts and wage growth will also help support consumer spending, which is a major driver of the U.S. economy. “After three years of strong market gains, we believe 2026 offers a constructive backdrop. Resilient consumer spending, accelerating technology investment, including AI, and supportive fiscal and monetary policy provide a foundation for growth. However, meaningful risks remain, including elevated valuations, tariffs and inflation uncertainty, labor-market cooling, geopolitical tension and pockets of consumer stress,” Northey told MarketWatch.

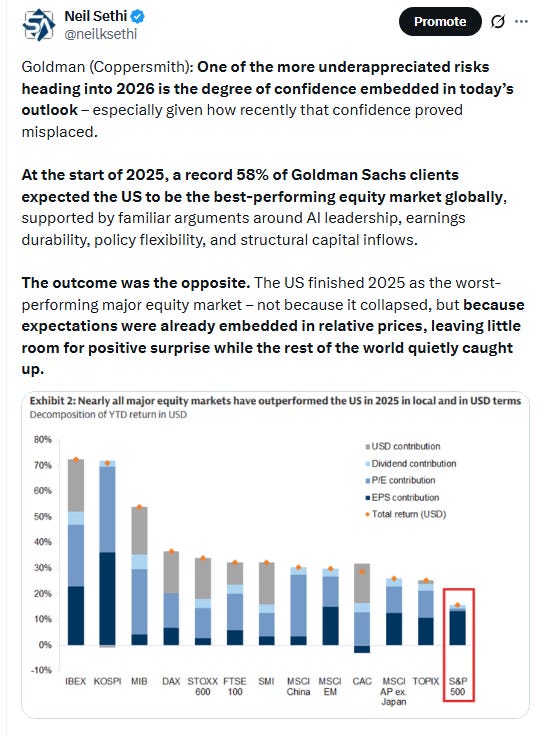

“[The outperformance of European and Asian indices] reflects a continuation of a theme that we are in the early innings of, which started last year, i.e. that US exceptionalism has peaked and has started to unwind,” Raymond Sagayam, managing partner at Banque Pictet & Cie SA, told Bloomberg TV.

“We are waiting for data,” said Emilie Tetard, a cross-asset strategist at Natixis. “Before this data, as macro uncertainty is probably stronger in the US vs. the rest of the world, it’s a good time to put in place the diversification.”

What the financial markets may understand is that “U.S. interventions in the Western Hemisphere, on the whole, have gone generally better than the U.S.’s Middle East adventures,” according to Thierry Wizman, global foreign-exchange and rates strategist at Macquarie Group. “Many of the major and minor post-1945 interventions have been beneficial, at least in a practical sense of promoting stability and growth,” Wizman wrote in a note on Tuesday. They include Panama in 1989, which produced a stable democracy and high-income economy, and Chile in 1990, which led to a full restoration of democracy and strong economic growth, the strategist added.

“Historically, headline-capturing geopolitical events can produce short-term volatility and falling equity prices,” Tom O’Shea, director of research and investment strategy at Innovator ETFs, said. “However, in this instance, the S&P 500 rose on the first trading day following the operation.”

“Geopolitical tensions and political uncertainty were a major concern for investors coming into 2026. However, while these issues could act as a headwind for equities and other risk-on assets, risk-off plays like precious metals and bonds could benefit from an uptick in uncertainty. It’s early in the year, but so far markets don’t appear too concerned about the developments in South America,” eToro analyst Bret Kenwell wrote in an email.

“Stocks and bonds begin the year with less stored up potential energy for big moves compared to last year. Larger shocks than the surprise extraction of foreign leaders from their presidential residences will be required to shake these assets into life.” — Simon White, BBG macro strategist.

“January is shaping up as a potential stress test for the market’s low bond volatility narrative. After a subdued end to last year, rates have been trading as if policy risks are largely parked. And the stakes extend well beyond rates. Suppressed bond volatility has been a key pillar for the equity rally, particularly in rate-sensitive technology stocks.” — Brendan Fagan, FX Strategist

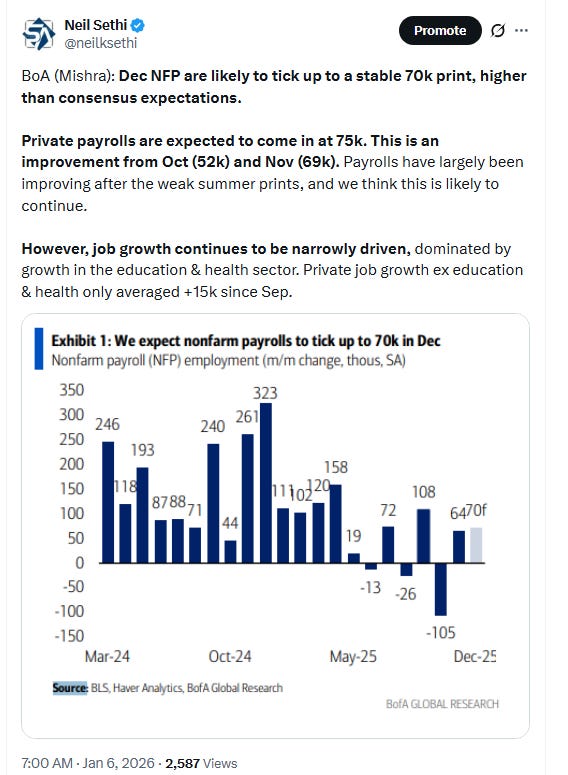

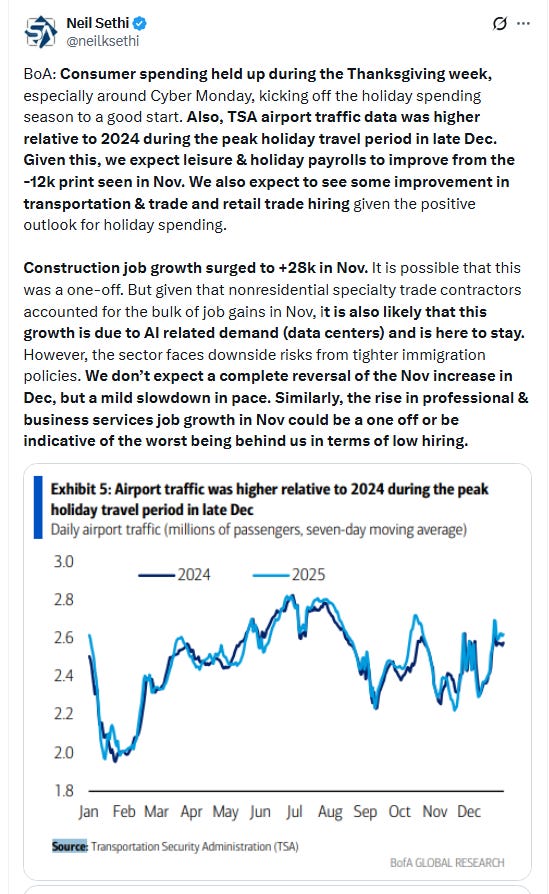

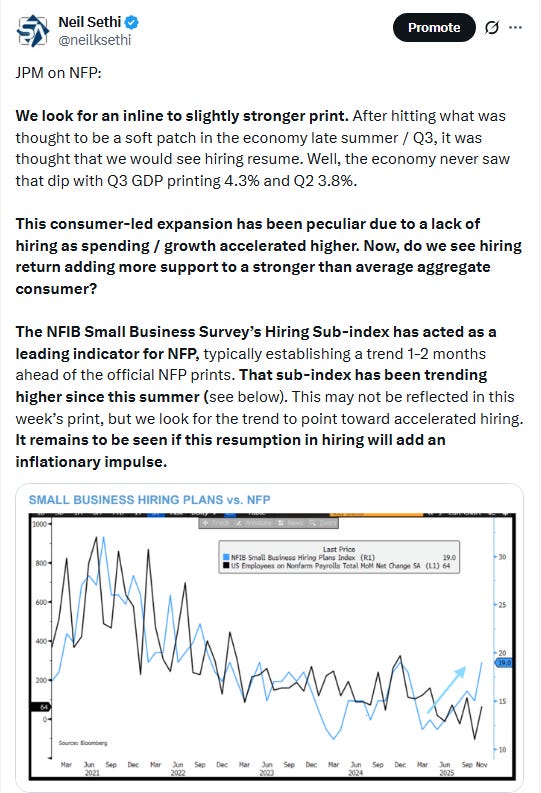

There could be another driver for markets in the coming days. The U.S. Supreme court will potentially rule on the legality of President Donald Trump’s global tariffs on Friday — coincidentally, the same day the all-important December jobs report will be released. “The combination of a nonfarm-payroll report and the U.S. court ruling could combine to make it a volatile end to the week,” Brooks said. “If the court rules the tariffs legal, then it could take the edge off the recent equity-market rally, as fears grow that Trump could announce even more tariffs. If the court rules them illegal, then it could limit the administration’s plans for tax cuts, as these were expected to be partly funded by tariff levies, which could weigh on stocks that are linked to the consumer.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts (all free).

In individual stock action:

“Magnificent Seven” member Amazon lifted the three major averages, rising more than 3%. Other stocks related to artificial intelligence also supported the broader market, including Micron Technology and Palantir Technologies. Micron advanced around 10%, while Palantir climbed more than 3%. It’s only the third trading day of the new year, and semiconductor stocks have already been on a tear, with Micron being one of the leaders. With Tuesday’s gains, the stock has risen more than 20% year to date. That’s coming off of a blockbuster year for the name, as it soared more than 240% in 2025.

Nvidia Corp., countering fears about an AI spending bubble, said on Tuesday that an upbeat revenue forecast delivered in October has only gotten brighter due to strong demand. In October, Nvidia had projected about half a trillion dollars of revenue from current and future data center chips by the end of 2026.

Corporate Highlights from BBG:

One of the largest US oil refiners sees a potential reopening of Venezuela’s oil industry as a major boost to fuel-makers that rely on heavier crude grades.

American International Group Inc. said Chief Executive Officer Peter Zaffino intends to retire as CEO by midyear, and will be replaced by Aon Plc’s Eric Andersen.

Buyout firm Hg is in advanced talks to acquire financial software maker OneStream Inc., according to people familiar with the matter. OneStream surged 22% in premarket trading.

Nvidia Corp. Chief Executive Officer Jensen Huang said that the company’s highly anticipated Rubin data center processors are in production and customers will soon be able to try out the technology.

Intel Corp. showed off laptop computers based on processors with a new design, part of the chipmaker’s effort to make its products competitive again.

Advanced Micro Devices Inc., aiming to make a dent in Nvidia Corp.’s stranglehold on the AI hardware market, announced a new chip for corporate data center use and talked up the attributes of a future generation of products for that market.

Anheuser-Busch InBev SA/NV will reacquire a 49.9% stake in its US metal container plants from a consortium of institutional investors led and advised by Apollo Global Management Inc. in a deal estimated to be around $3 billion.

Mid-day movers from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

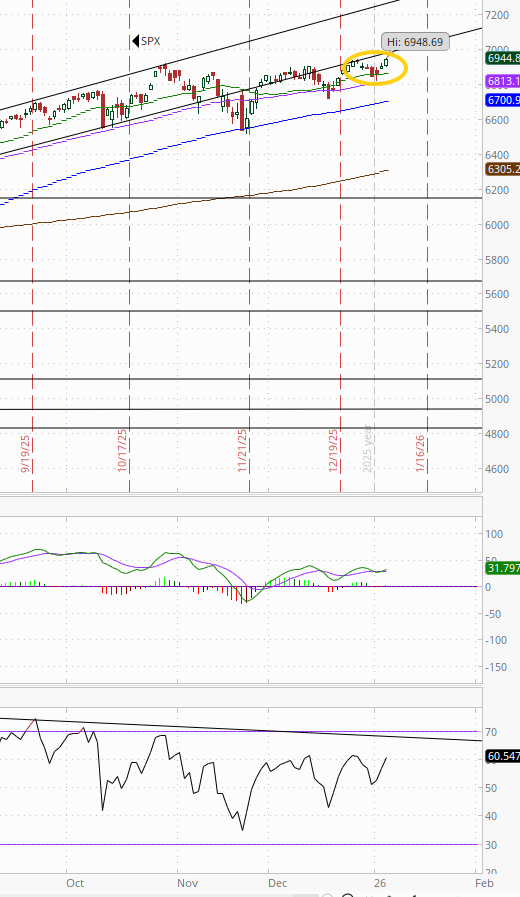

The SPX finally made it to a new ATH. The daily MACD and RSI are both neutral but starting to look a little more positive.

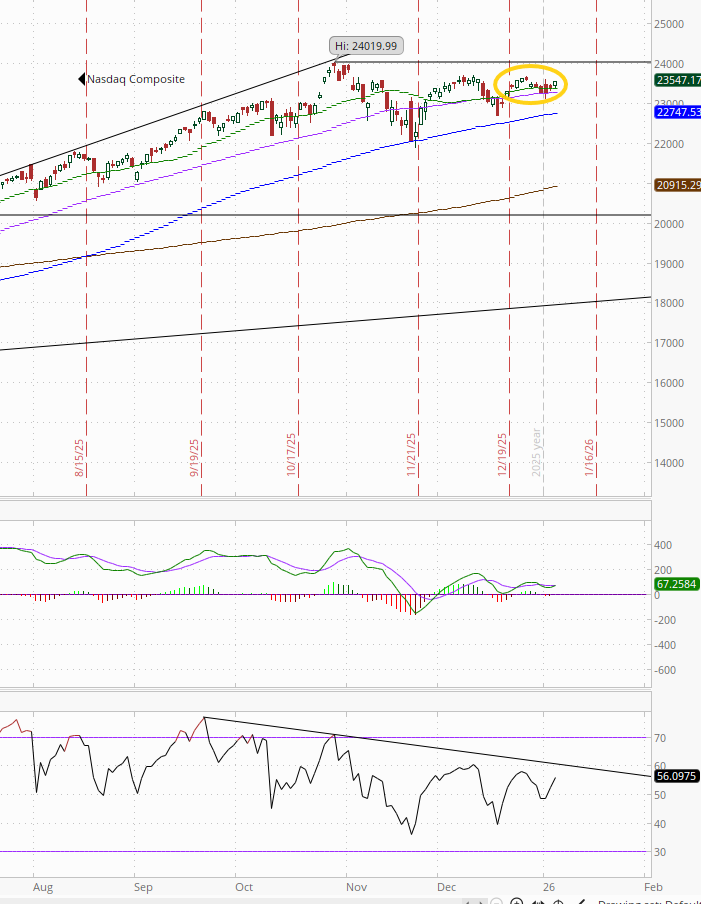

The Nasdaq Composite remains below its ATH with larger divergences.

RUT (Russell 2000) continued its rebound from its 50-DMA hit Thursday now on the verge of an ATH. Its MACD is getting read to cross and the RSI is now over 60.

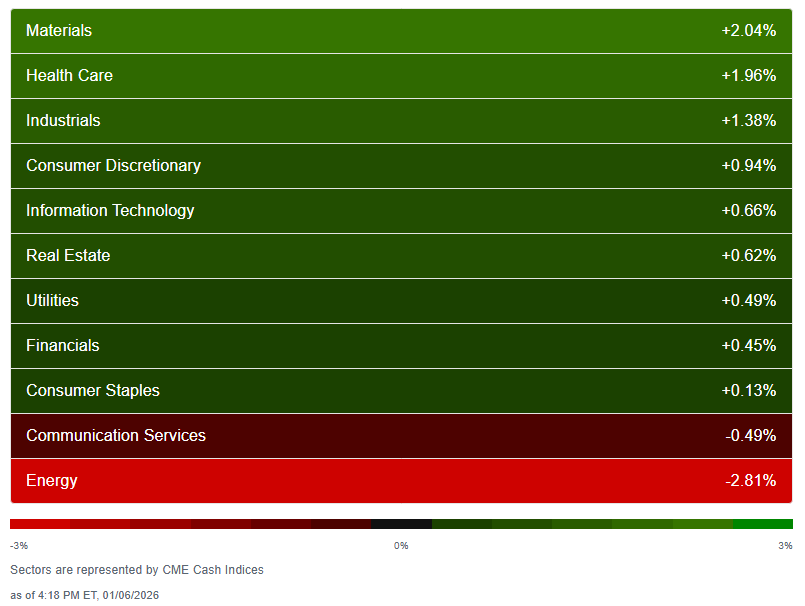

Sector breadth according to CME Cash Indices (uses futures prices) improved to 9 of 11 sectors higher (up from 7 Mon, 8 Fri), although just four were up over +0.7% (vs six Mon) and three at least +1% (vs five) led by Materials and Health Care both up +2%.

Monday’s leader, Energy, gave back all of that gain falling -2.8%, the only sector down more than -0.5% (the other down sector was Comm Services).

SPX stock-by-stock flag from @finviz_com consistent with the red continuing to shift around the board moving today to Energy from Utilities and drug makers Mon. The bright green gravitated to Health Care and most Tech names (particularly chipmakers). Staples remained weak but the bigger stocks did better lifting it finally to a green session, while Industrials and Materials remained very solid.

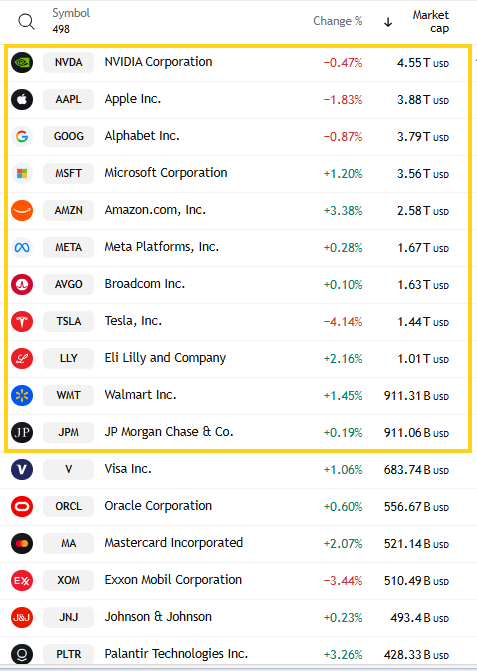

4 of the top 11 were lower (after 6 Mon, 5 Fri, all 11 Wed). TSLA led to the downside for the third session in four -4.1%, giving back all of Mon’s +3.1% gain and taking it to 1-month lows. AMZN led to the upside +3.4%. Mag-7 was -0.4% after +0.9% Mon, as it remains choppy following its worst week since April.

~75 SPX components were up 3% or more (after 50 Mon, 68 Fri but a total of just four the week coming into Friday) with, like Friday, 2025’s top three stocks leading with SNDK +27.6%(!), WDC +16.8%, STX +14.0%. Also up over 10% were MCHP, MRNA, MU (fellow chipmaker NXPI just missed +9.9%). Twenty >$100bn in market cap up 3% or more (after fourteen Mon, sixteen Fri but only one total in the previous four sessions to that) in MU, TXN, LRCX (for a third session), UBER, ADI, NEM, SYK, ISRG, ACN, VRTX, DE, AMAT (again), QCOM, AMZN, SBUX, ETN, PLTR (again), KLAC (for a third session) (in descending order of percentage gains).

14 SPX components down -3% or more (up from 11 Mon, down from 20 Fri) led by AIG -7.5%. Five >$100bn in market cap down -3% or more (up from three Mon, down from nine Fri but after seeing just one total the six sessions prior to that) in CVX, TSLA, XOM, ANET, AMD (in order of percentage losses).

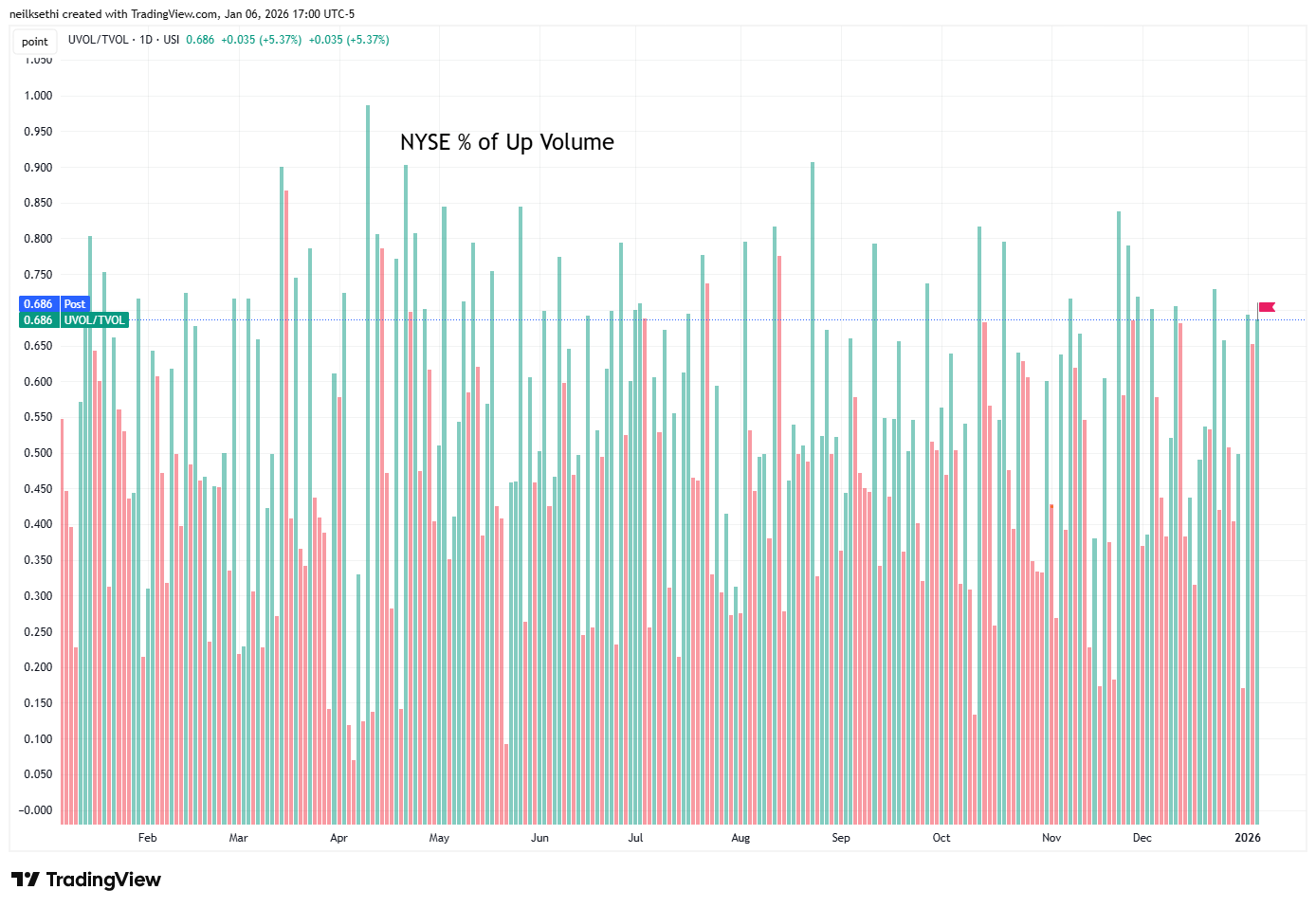

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) improved to 68.6% from 65.1% even as the index gain decelerated for a second day to +0.62% from +0.89%, so a stronger relative performance Tuesday.

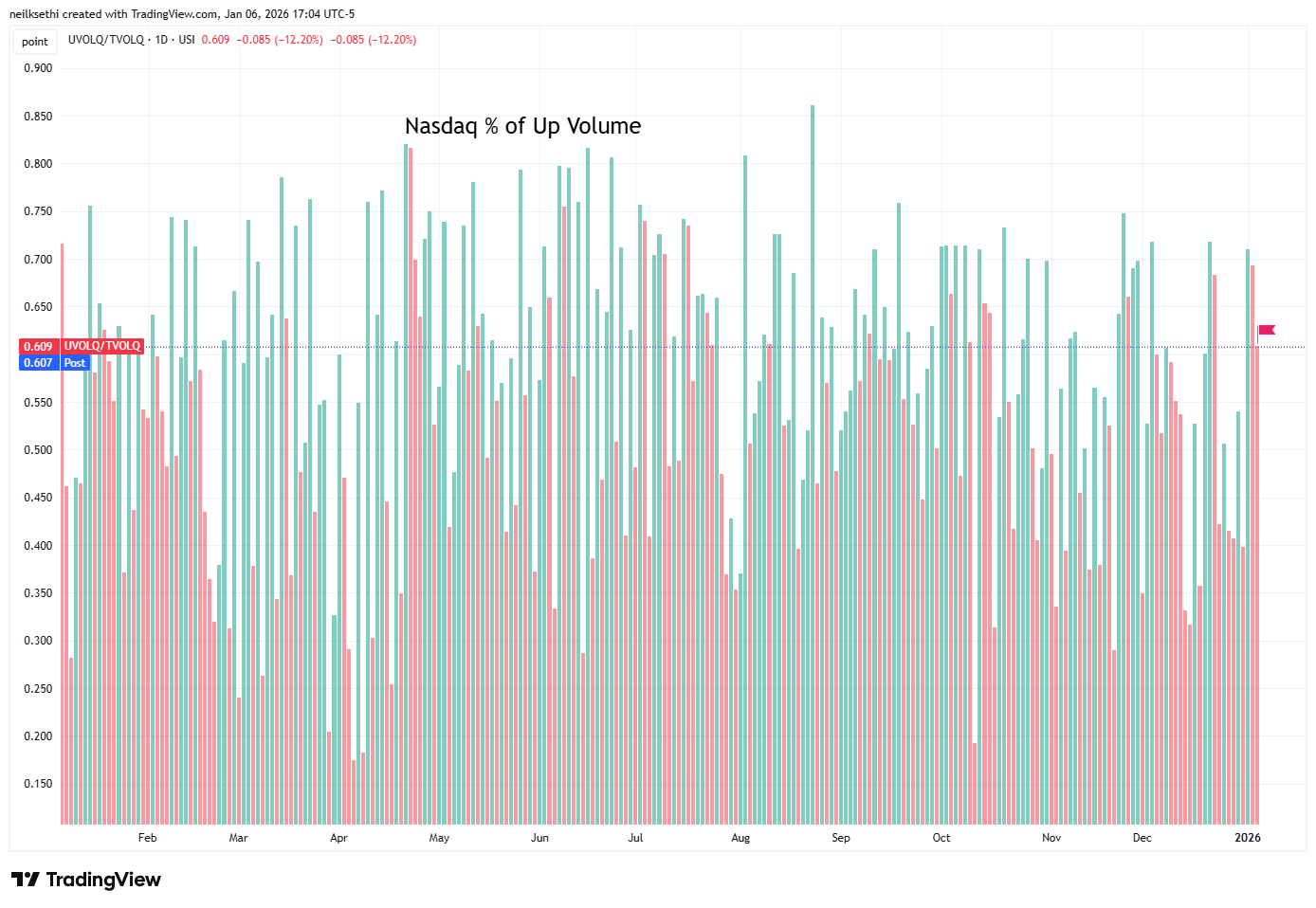

But Nasdaq positive volume (% of total volume that was in advancing stocks) fell to 60.9% from 72.1% Mon (which was the best since Nov 24th), even as the gain fell marginally to 0.65% from +0.69%. Still the Monday read was very strong, so this remains a healthy reading, but down from what we saw Monday and Friday.

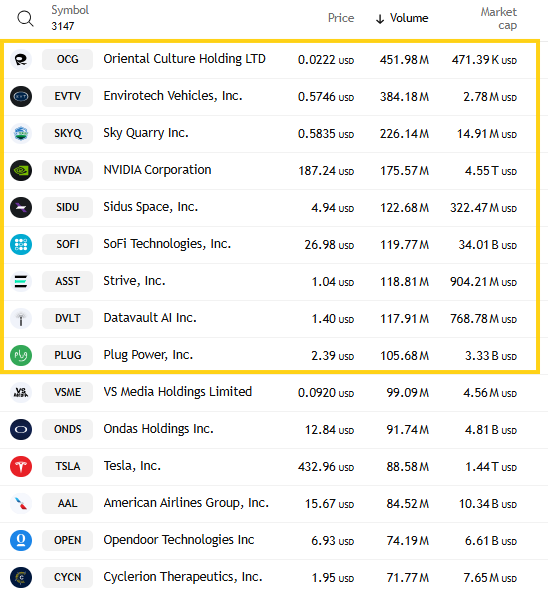

The weaker positive volume on the Nasdaq was despite speculative volumes increasing for a second day with the top three stocks by volume collectively trading a little over ~1bn shares, up from ~700mn Mon. While, that’s down from 1.3bn two weeks ago, it is still one of the higher readings over the past month. Again 9 companies had volumes over 100mn shares but two more were over 90mn.

Positive issues (percent of stocks trading higher for the day) which are not as inflated by penny/meme stocks still though remain close on the Nasdaq at 59.5% while the NYSE was 68.1%.

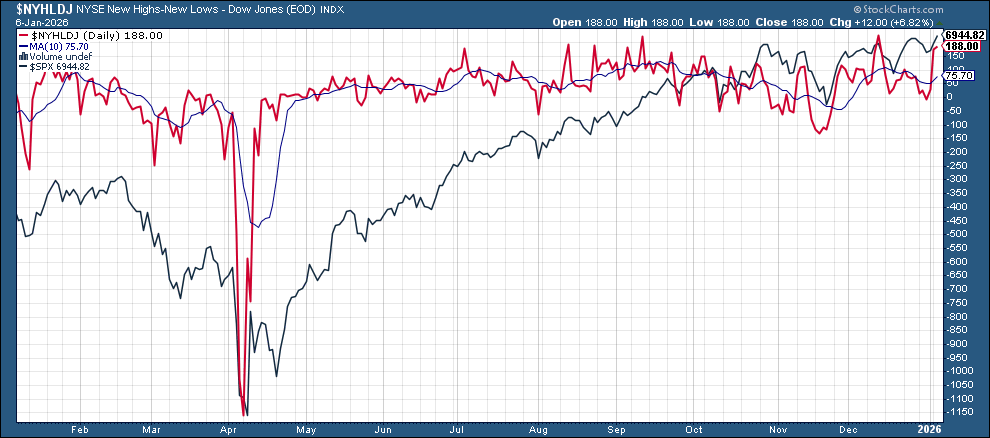

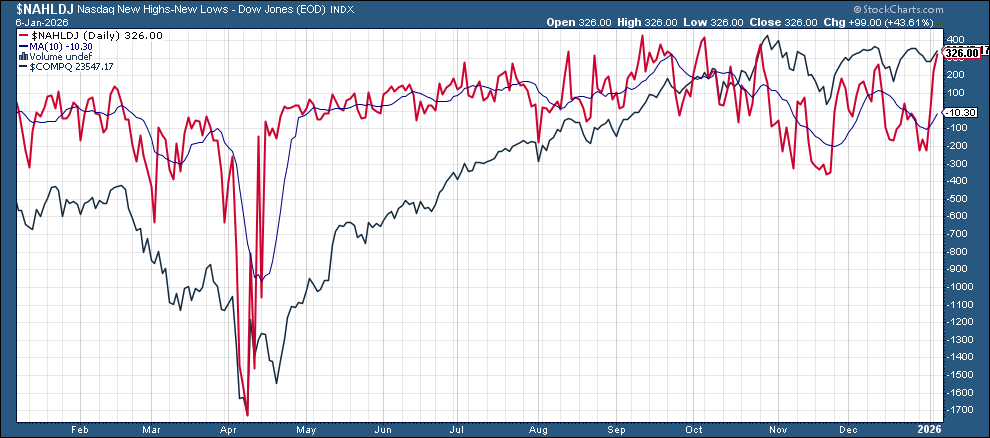

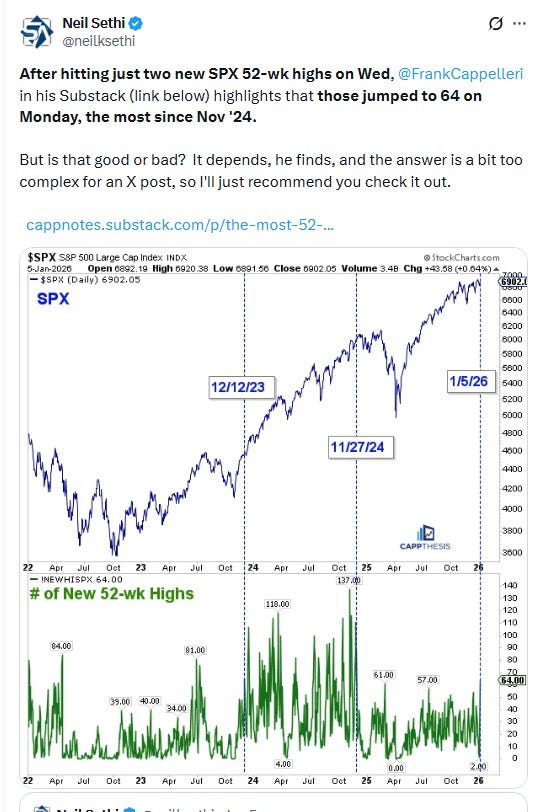

New 52-wk highs minus new 52-wk lows (red lines) were the story though continuing to see good improvement to 189 on the NYSE, the second highest since Aug, up from -6 on Wed and to 326 on the Nasdaq, the best since Oct.

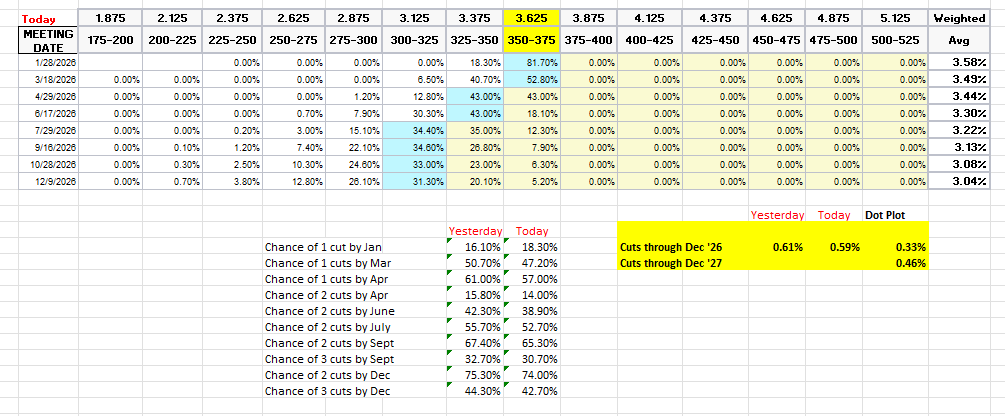

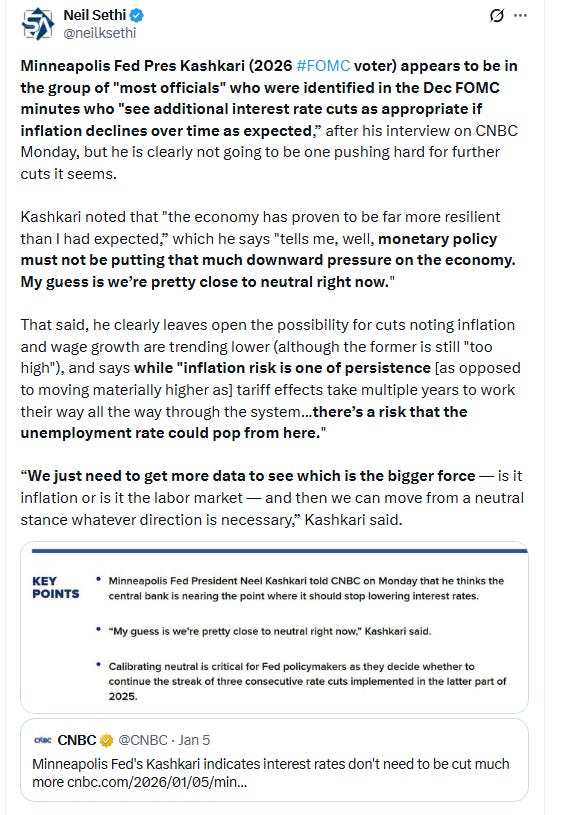

#FOMC rate cut pricing edged lower (fewer cuts) according to the CME’s Fedwatch tool. Probability of a cut in Jan remains low at 18% (up slightly from the recent low of 13% two weeks ago, the least since pre-Dec FOMC), but the first cut was pushed to April (57%) with March falling to 47%, the least since the Dec FOMC. A second cut is in July at 53%.

Pricing for 2026 overall moved up to 59bps, with pricing for two cuts 74% and three cuts 43%, down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

The dot plot as a reminder has just 33bps for the average dot for 2026.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

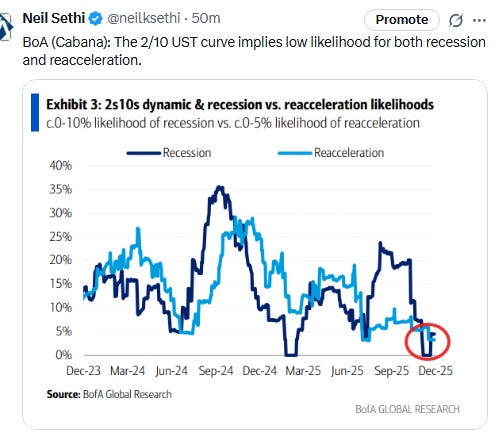

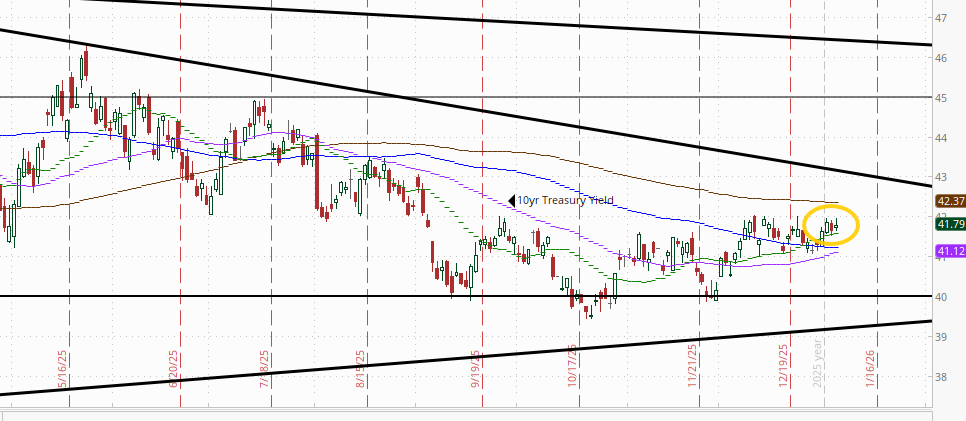

The 10yr #UST yield edged up to 4.18% remaining closer to the top of its range since the start of December.

The 2yr yield, more sensitive to FOMC rate cut pricing, +2bps to 3.47% from the least since Oct 22nd still just 5bps above the least since 2022. It remains in the channel it’s been in since the start of 2024, -16bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so still calling for at least a couple more rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield.

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) closed at a 2-week high up for the fourth session in five. As noted Fri, the daily MACD has now crossed to “cover shorts” positioning and the RSI is the best since Nov (and now over 50).

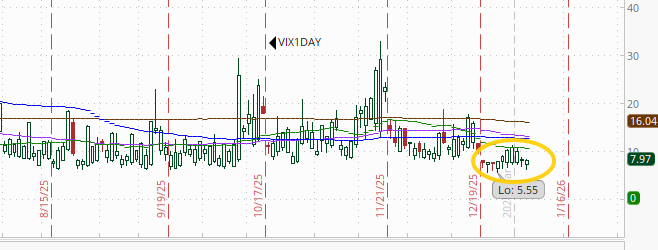

VIX little changed at 14.8, remaining around the lows of 2025. The current level is consistent w/~0.93% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) similarly edged lower but has moved further off the lows to 89.0 while also remaining around the lowest levels in all of 2025. The current level remains consistent with “moderate” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)).

The 1-Day VIX fell back to 8.0, just above the lows of 2025. That reading implies a ~0.50% move in the SPX next session.

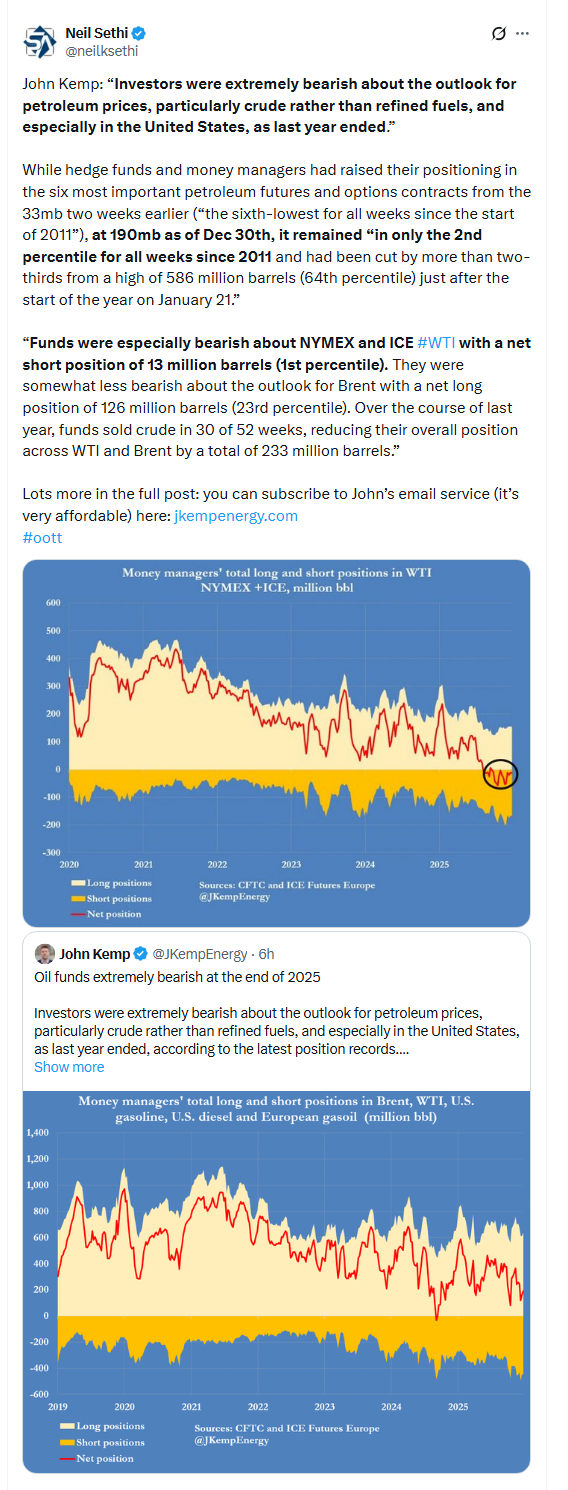

#WTI futures once again fell back from the resistance they have struggled with since the start of Oct (50-DMA and downtrend line from the July highs). As I said two weeks ago, “like several previous times the daily MACD crossing to ‘cover shorts’ and the RSI moving over 50 weren’t enough [so far at least] to push it through.” Neither was an embargo on Venezuela or the seizing of its leader for that matter.

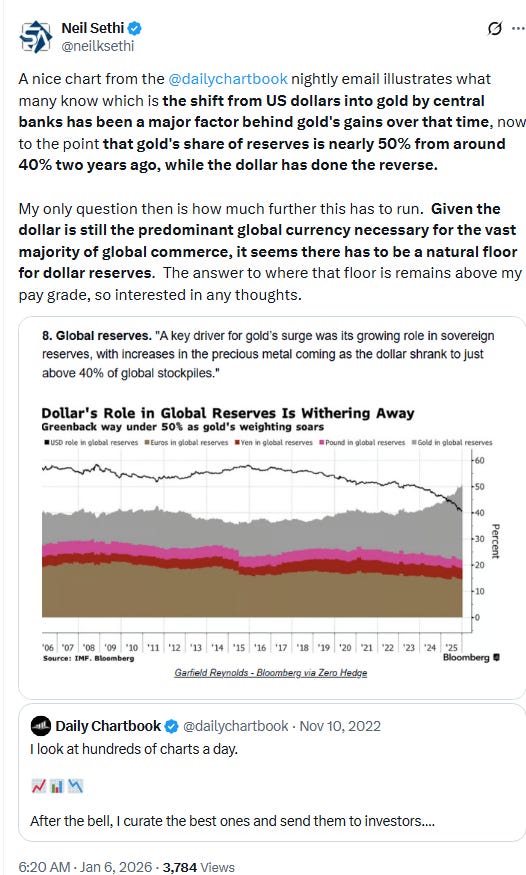

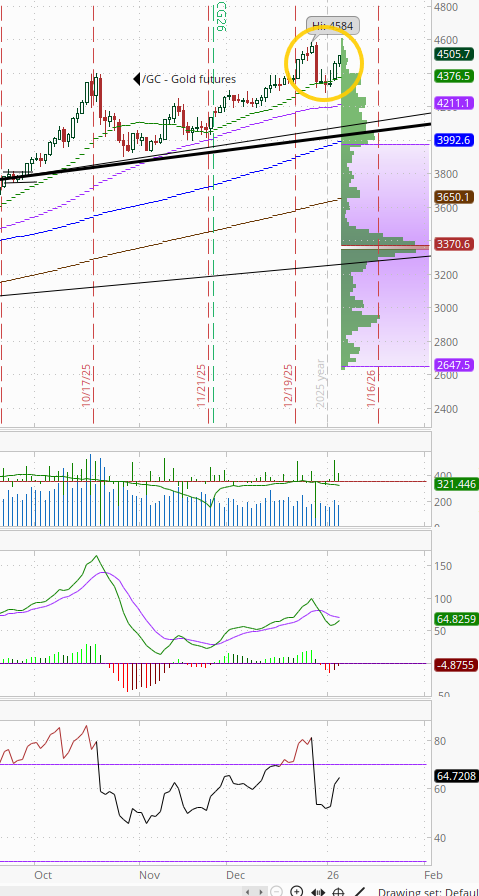

Gold futures (/GC) up another +1% after +2.7% Mon, their best day since Nov 10th, as they seem on their way back to test the all-time highs. Daily MACD remains negative but close to turning positive while the RSI is now over 60.

US copper futures (/HG) also added to gains Monday in their case +1.2% after +5.2%, (the best day since Oct), already in all-time high territory. Daily MACD remains firmly in “go long” positioning while the RSI has a negative divergence (lower high) currently but is getting closer to correcting as it enters overbought territory.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Natgas futures (/NG) down another -1.8% after Monday falling under the 200-DMA back down to levels around where they were Oct 28th before their big run higher, now down nearly -42% from the intraday high Dec 5th. The daily MACD remains in ‘sell longs’ positioning, and RSI is the weakest since Aug.

Bitcoin futures not able to clear $95k after jumping +4.4% Monday to the highest close since Nov 14th. The daily MACD remains in “cover shorts” positioning, and the RSI is now above 50 and near the strongest since mid-Oct.

The Day Ahead

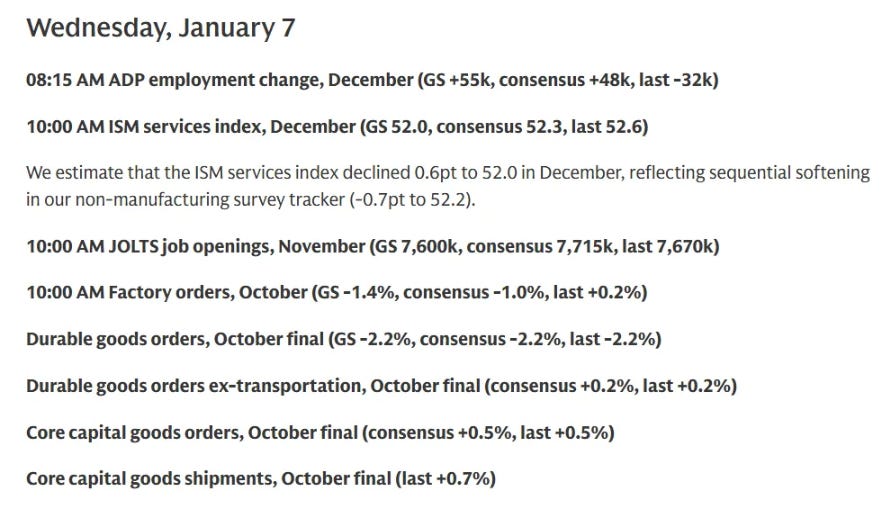

I mentioned last night that US economic data this week is backloaded, and Wednesday starts things off with Dec ADP and ISM services PMI, Nov JOLTS, Oct factory orders, and weekly MBA mortgage applications and EIA petroleum inventories.

In Fed speakers, on the official calendar we have Gov Bowman. As I noted in the Week Ahead, I’m interested in what she has to say now that she’s gotten the three rate cuts she wanted back in Sept and is now out of the running for the Fed Chair job so may be more free to speak her mind (she was fairly hawkish before turning quite dovish when she was under consideration). A less than dovish speech from her would be notable.

We’ll also get our sole SPX earnings report of the week in Constellation Brands STZ.

Ex-US highlights are EU and Australia CPI, Germany retail sales and unemployment, and France consumer confidence.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,