Markets Update - 1/7/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

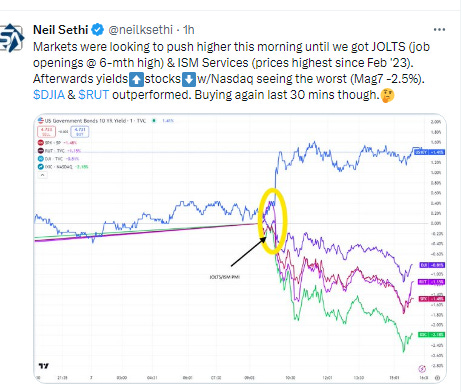

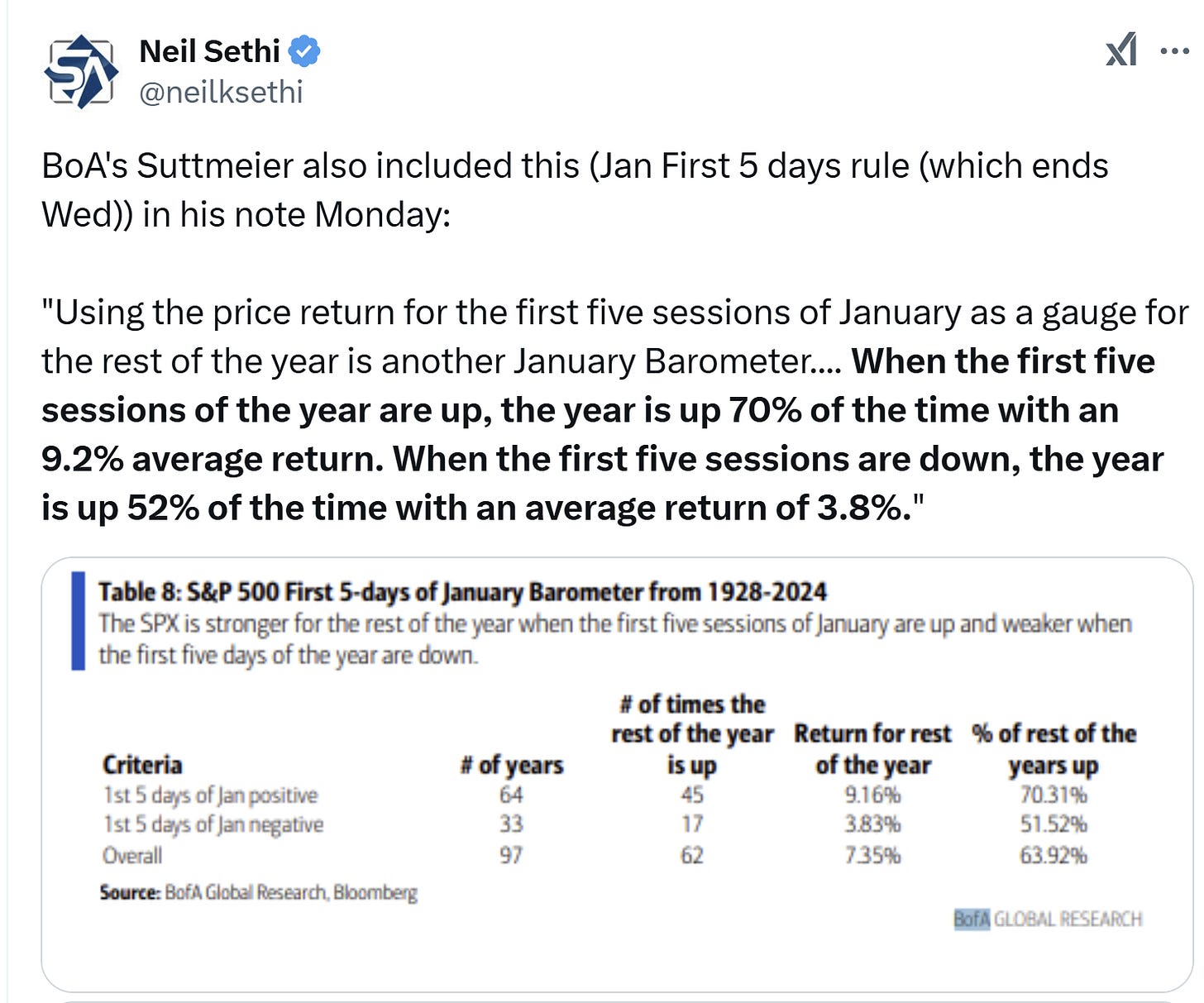

US equities started off in the green like Monday, but today another strong services PMI report (this time ISM’s) which contained a jump in the “prices” component to the highest since Feb ‘23 came at the same time (10:00 am ET) as the JOLTS report, which showed job openings moving to a 6-mth high (nevermind that it also showed hiring falling to the least since Apr 2020 or quits to the least since Aug 2020), saw bond yields shoot higher moving towards the highest since 2007 and taking the wind out of the sails of equities who fell into the red and remained pressured the rest of the day. While Monday it was the megacap growth stocks which outperformed, Tuesday those led to the downside with the Mag-7 index falling -2.5%. Losses were widespread though with 9 of 11 sectors lower.

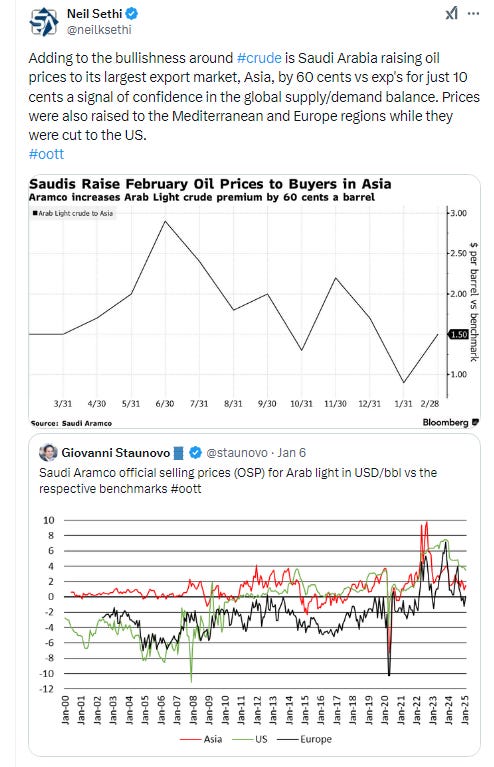

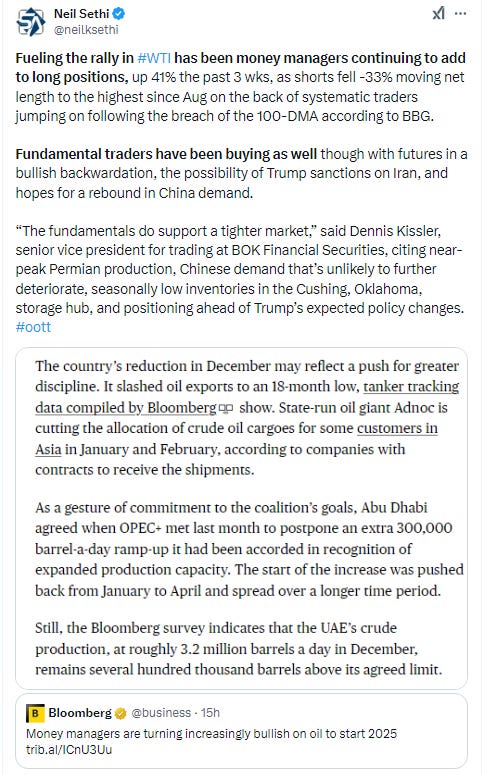

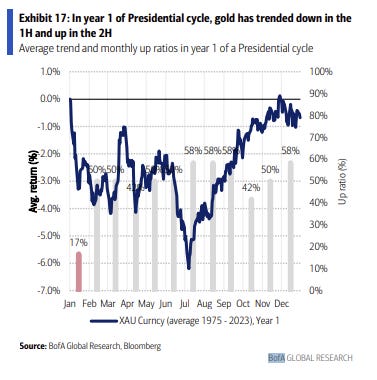

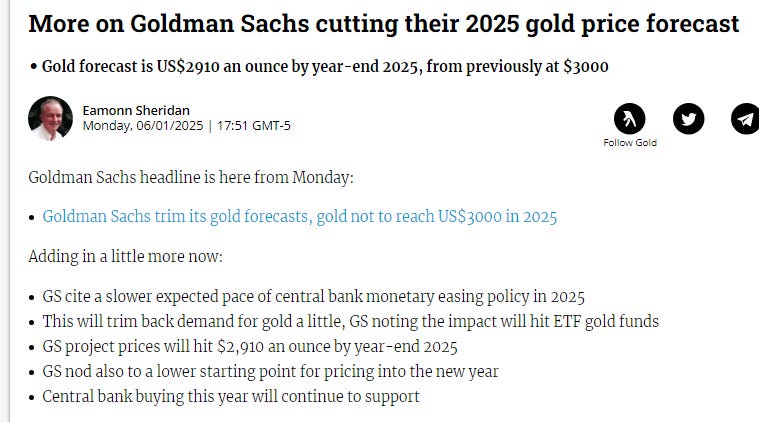

Elsewhere, the dollar moved higher as did crude and copper while nat gas and bitcoin fell back. Gold was little changed again today.

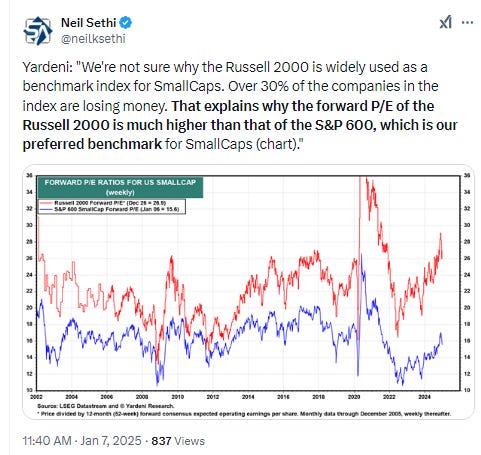

The market-cap weighted S&P 500 was -1.1%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite -1.9% (and the top 100 Nasdaq stocks (NDX) -1.8%), the SOX semiconductor index -1.8%, and the Russell 2000 -0.7%.

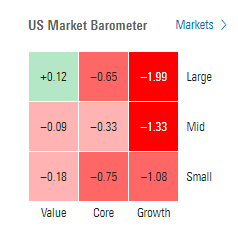

Morningstar style box also showed the weakness in growth. Surprised value wasn’t down more.

Market commentary:

“You’re getting a recalibration of inflation expectations and Fed rate expectations. That’s triggered this small sell-off in the equity markets after the earlier enthusiasm,” said Tom Hainlin, senior investment strategist at U.S. Bank Asset Management Group. Still, Hainlin noted that the ISM number reflects a strong consumer and labor market, which he said ties into a broader picture of strong economic growth that favors corporate earnings growth.

Investors should expect further market volatility as the year progresses, according to Cameron Dawson, chief investment officer at NewEdge Wealth.

“That is our base case, this idea that you’re going into 2025 with such a higher bar that it sets up for some choppy price action when you consider the valuations that we’re starting the year with, where positioning is and where most expectations are,” she said on CNBC’s “Closing Bell” Monday afternoon.

The data “reinforced the market’s view on a strong US economy and rates are not restrictive,” said Tracy Chen, a portfolio manager at Brandywine Global Investment Management.

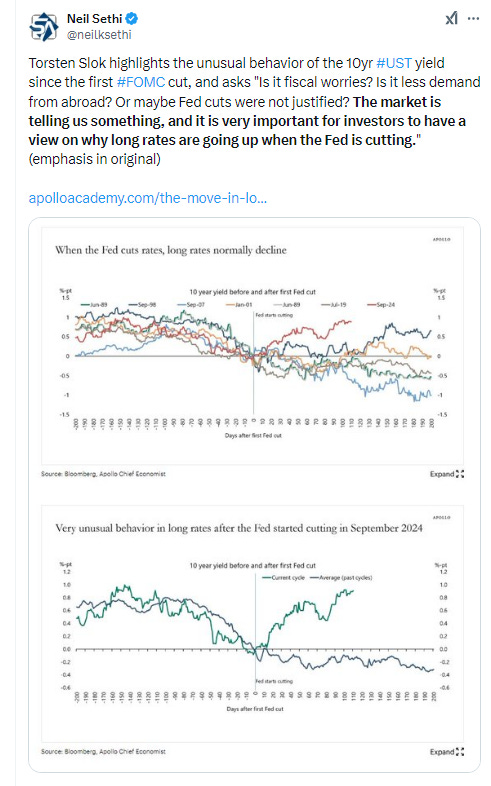

“There’s still concern about elevated inflation risks that has created more of a term premium, there’s concern about these budget deficits needing to be financed, and there’s been a shift from last year that’s leading to more of a focus now on a soft landing — or no landing — as opposed to a hard landing,” said Michael Cloherty, head of US rates strategy at UBS Securities.

“Rising yields are not necessarily an issue for stocks unless, of course, the economy starts to fail. Then all bets are off,” said Kenny Polcari at SlateStone Wealth. “But rising yields will be an issue if inflation rears its ugly head

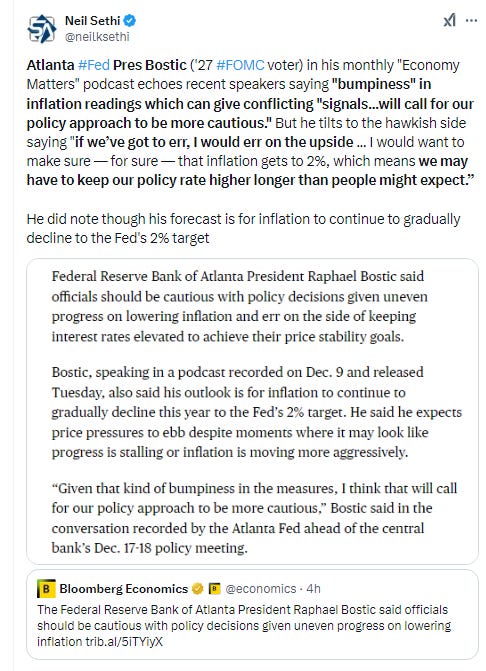

To Mark Streiber at FHN Financial, the latest US services report supports the Fed’s recent communication that rate cuts would likely slow in 2025 due to upside price risks. Fed Bank of Atlanta President Raphael Bostic said officials should be cautious given uneven progress on lowering inflation. “The Fed will likely switch from cutting interest rates at every decision, as they did between September and December, to pausing in between rate cuts in 2025,” said Bill Adams at Comerica Bank.

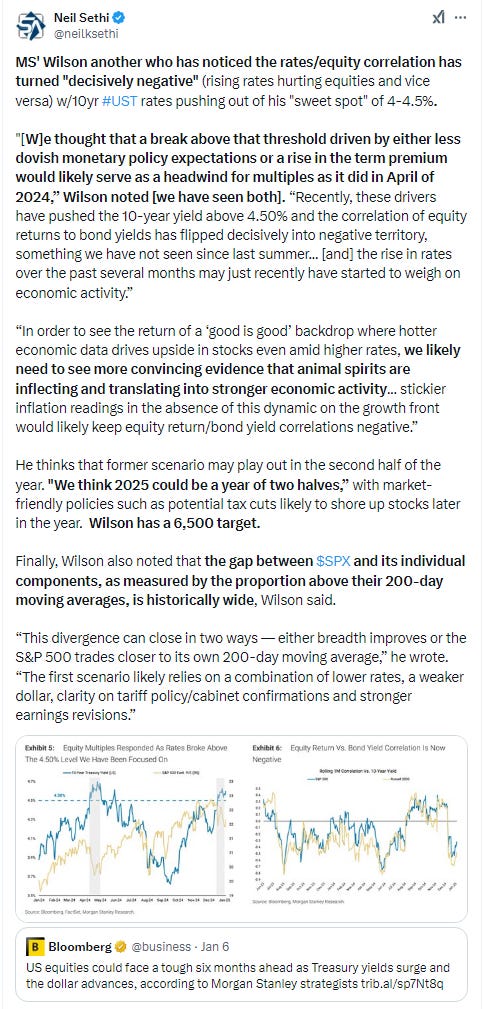

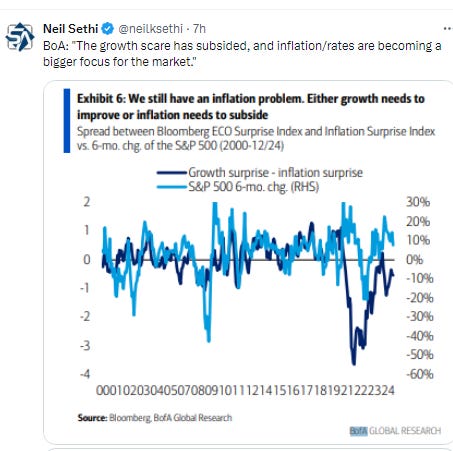

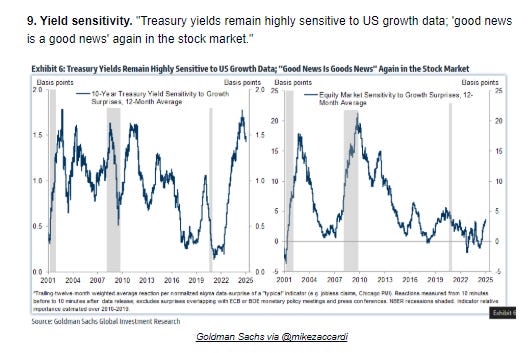

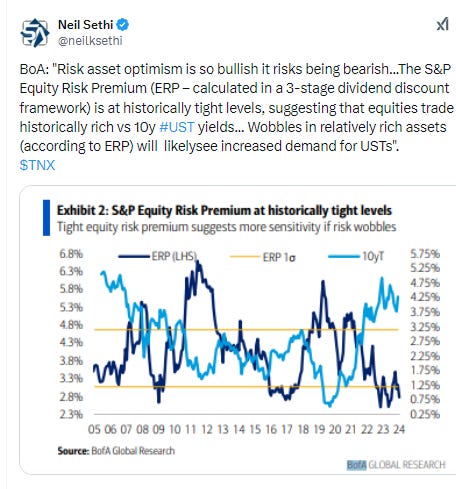

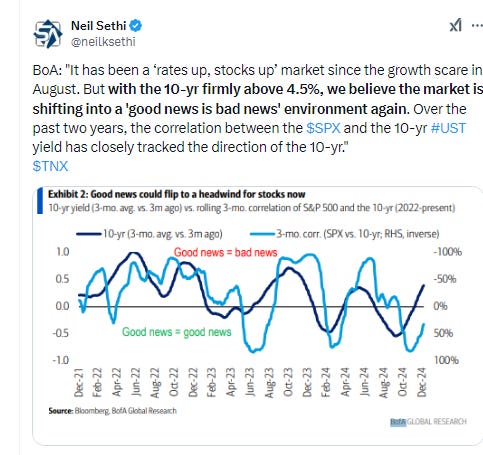

With Treasury yields climbing again, Bank of America Corp. strategists predict traders could return to perceiving strong economic data as negative, as it signals the Fed will need to keep rates elevated for longer. Growth scare is subsiding as inflation and rates become a bigger focus, the team led by Ohsung Kwon said.

“By now, plenty of faces have been ripped off by this most recent bond-market tantrum, and even though we’d love to say that the worst is over, there’s no indication that shorts are exhausted or that data is supportive of a duration rally,” said Thomas Tzitzouris at Strategas. “That could change by Friday, with the jobs number, and we have to assume that there will be some profit taking on duration shorts by tomorrow, with equity markets being closed on Thursday. But for now, the growth in the short base appears to be tentatively supported by growth in float,” he said.

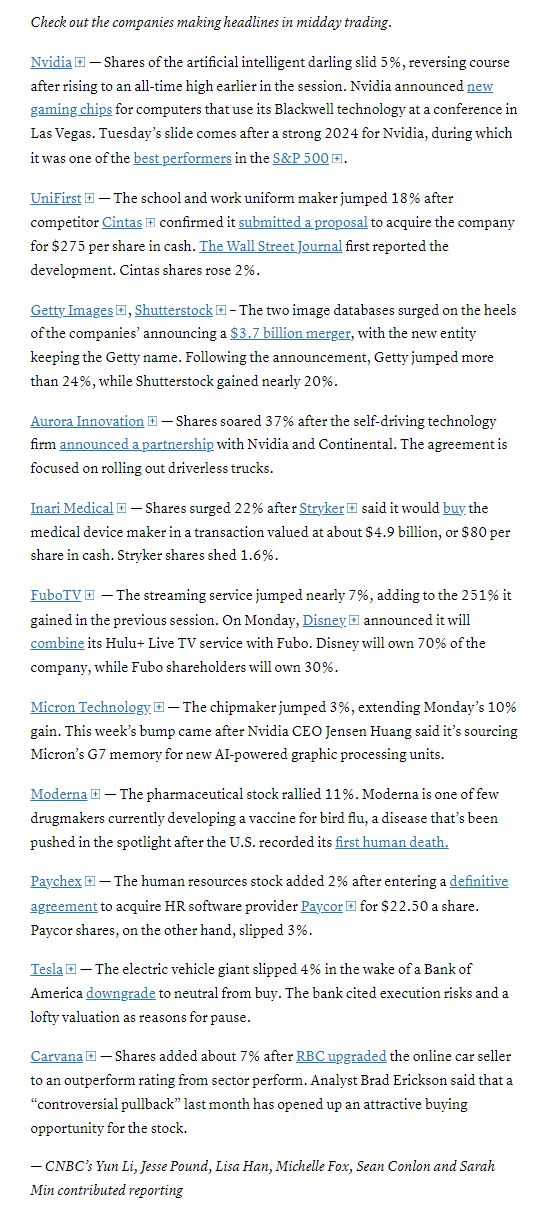

In individual stock action, declines in mega cap names had an outsized impact on index losses. Apple (AAPL 242.21, -2.79, -1.1%), which was downgraded to Sell from Neutral at MoffettNathanson, and Tesla (TSLA 394.36, -16.69, -4.1%), which was downgraded to Neutral from Buy at BofA Securities, were standouts in that respect. NVIDIA (NVDA 140.14, -9.29, -6.2%) was another influential loser after trading up as much as 2.5% at its high following Jensen Huang's keynote address last night at the Consumer Electronics Show. The price action in NVDA and AAPL contributed to the -2.4% decline in the information technology sector, along with the loss in Microsoft (MSFT 422.37, -5.48, -1.3%). TSLA shares weighed down the consumer discretionary sector (-2.2%), along with the move in Amazon.com (AMZN 222.11, -5.50, -2.4%). Meta Platforms shed nearly 2%

BBG Corporate Highlights:

Meta Platforms Inc. will end third-party fact checking on its social media platforms in the US, letting users comment on posts’ accuracy with a community notes system it said will promote free expression.

Uber Technologies Inc. said it’s teaming up with Nvidia in order to accelerate the development of autonomous driving technology.

Johnson & Johnson said its combination therapy for lung cancer outperformed AstraZeneca Plc’s blockbuster Tagrisso in a head-to-head study, a finding that could change the standard of care for one of the most deadly tumor types.

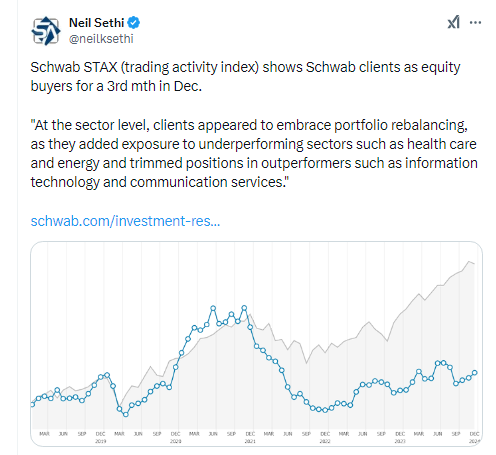

Toronto-Dominion Bank will consider the fate of its 10.1% stake in Charles Schwab Corp. as part of a strategic review stemming from the Canadian bank’s US money-laundering scandal, incoming Chief Executive Officer Raymond Chun said.

Getty Images Holdings Inc. agreed to acquire rival stock-photo provider Shutterstock Inc. in a deal that would create a combined company worth about $3.7 billion including debt.

Paychex Inc. agreed to acquire rival payroll processor Paycor HCM Inc. for about $4.1 billion in cash, including debt.

Apollo Global Management Inc. and BC Partners agreed to acquire a controlling stake in GFL Environmental Inc.’s environmental services unit, in a deal that values the business at C$8 billion ($5.6 billion) including debt.

Phillips 66 agreed to acquire EPIC NGL, an owner of natural gas liquids pipelines, for $2.2 billion in cash as it moves to expand its transport business in the Permian basin in the southwestern US.

Southwest Airlines Co. will gain $92 million from selling and leasing back 35 of its Boeing Co. 737-800 aircraft, the first move in the carrier’s broader plan to monetize part of its large fleet and extensive aircraft order book.

Some tickers making moves at mid-day from CNBC.

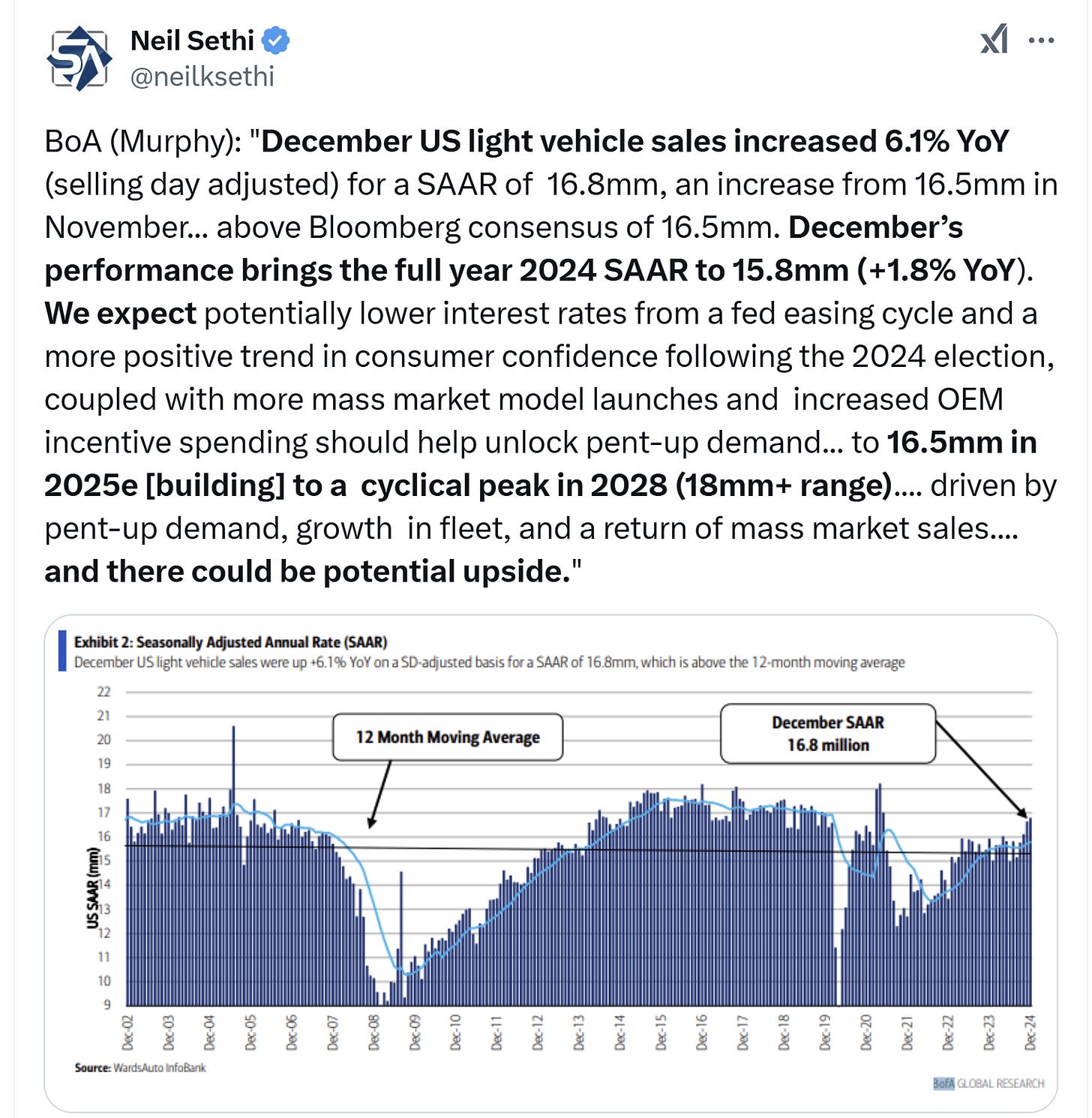

In US economic data:

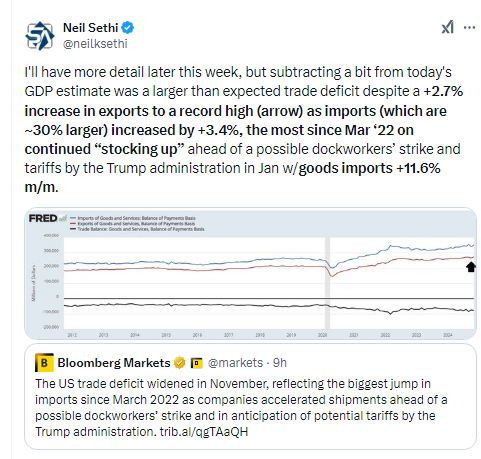

The US trade deficit widened in Nov by $5.6 billion to -$78.2 billion, despite a +2.7% increase in exports as imports (which are ~30% larger) increased by +3.4%, the most since Mar ‘22 on continued “stocking up” ahead of a possible dockworkers’ strike and tariffs by the Trump administration in Jan.

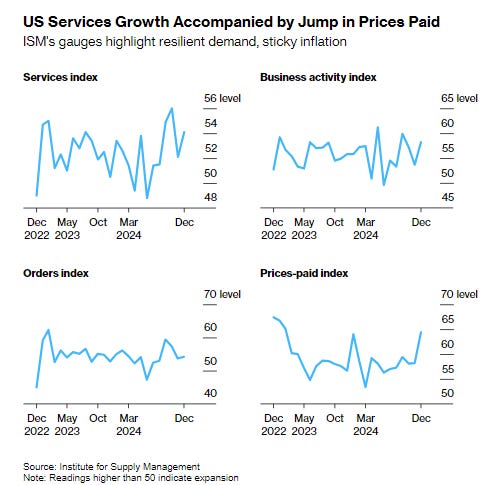

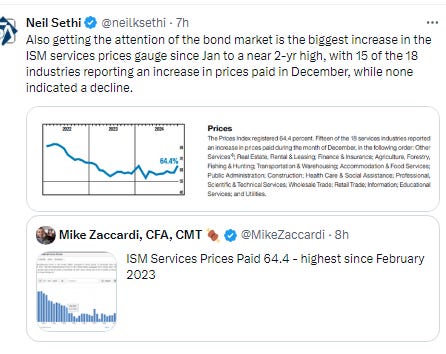

The Institute for Supply Management’s Services PMI advanced 2 points to 54.1 in Dec. Readings above 50 indicate expansion. The measure of prices paid for materials and services though rose more than 6 points to 64.4, the highest since Feb ‘23.

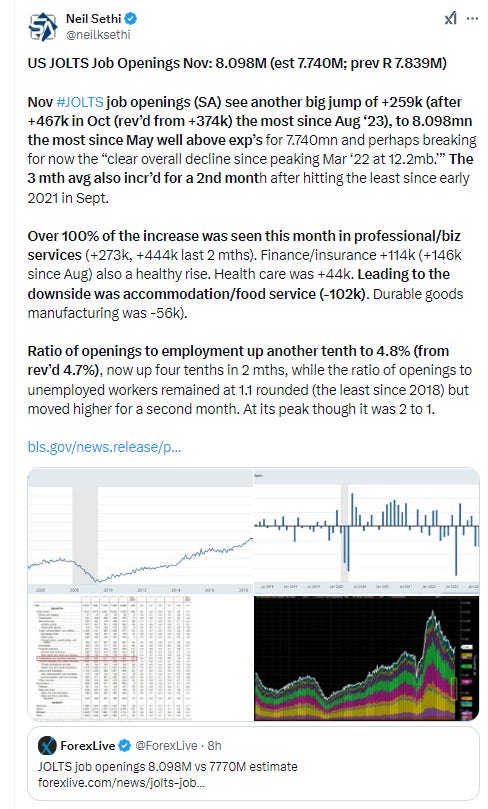

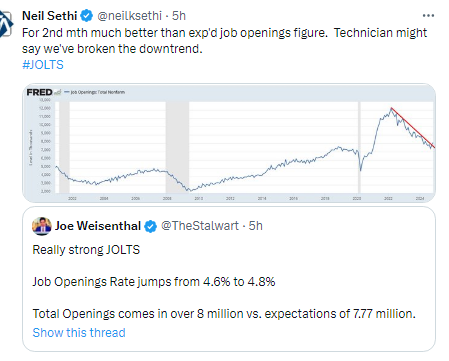

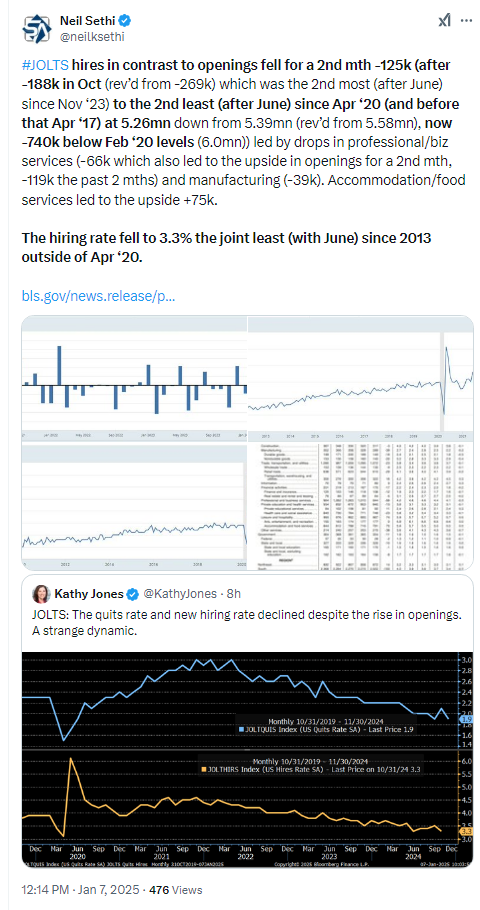

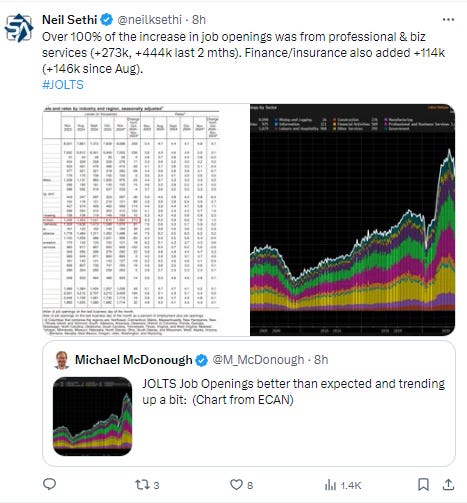

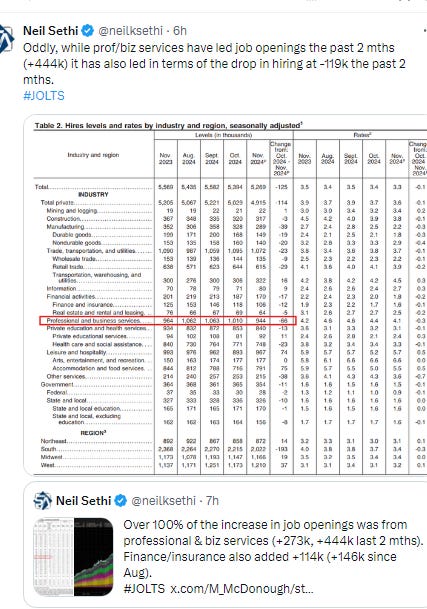

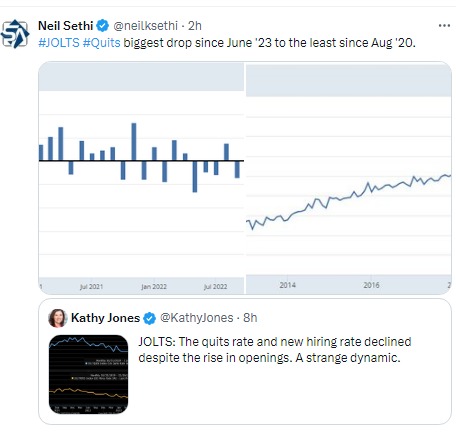

Job openings increased to 8.1 million in November from an upwardly revised 7.8 million in October, the Bureau of Labor Statistics Job Openings and Labor Turnover Survey, known as JOLTS, showed Tuesday. The figure exceeded all estimates in a Bloomberg survey of economists. The advance was led almost entirely by openings at professional and business services — which stand at an almost two-year high — as well as finance and insurance. Meantime, accommodation and food services and manufacturing reduced postings. Layoffs were relatively unchanged at a low level, but the pace of hiring cooled and matched the lowest since April 2020, the JOLTS data showed. The quits rate declined to 1.9%, also matching the lowest since early in the pandemic and was fairly broad across industries. That suggests more people are losing confidence in their ability to find a new job. The number of vacancies per unemployed worker, a ratio the Fed watches closely, held at 1.1, in line with pre-pandemic levels. At its peak in 2022, the ratio was 2 to 1.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX fell back under its 50-DMA although remains above last week’s lows for now. Daily MACD & RSI deteriorated as well.

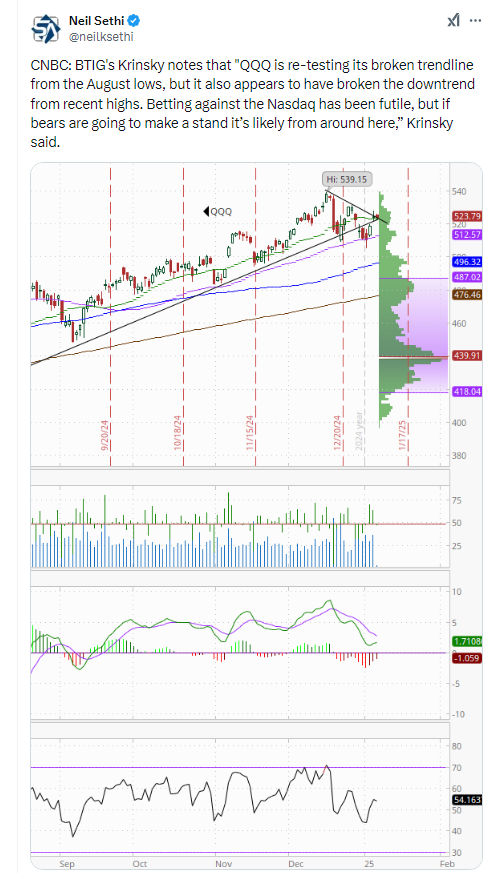

The Nasdaq Composite for its part fell back under its 20-DMA and uptrend channel back to August. Its daily MACD and RSI deteriorated as well.

RUT (Russell 2000) again failed at the 2290 level I noted last week it “really needs to get back over before we can really look higher.” Daily MACD & RSI remain weak but are improving.

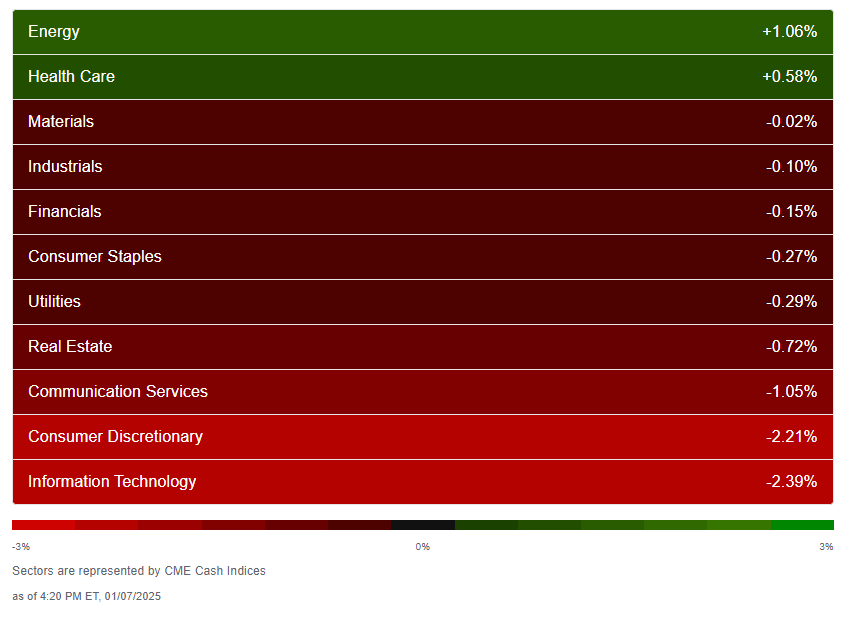

Equity sector breadth from CME Indices weakened further with just two sectors in the green after four Monday and all 11 on Friday. Both were up around +0.6% or more though (all 4 were Monday) with one up over 1% (down from two Monday/six Friday). The megcap growth sectors which led on Monday taking three of the top four spots (along with materials) lagged on Tuesday taking all three of the bottom spots (with two (Cons Discr & Tech) down over -2%..

Stock-by-stock SPX chart from Finviz consistent showing the same reversal with all that green on the top left half Monday now red.

Positive volume (the percent of volume traded in stocks that were up for the day) fell just back under 50% for the NYSE at 49% for the 1st session in 5 (still pretty good given the NYSE Composite was down -47pts) but the the Nasdaq was positive for an 11th session at 64% (excellent given the index lost -375pts). Positive issues (percent of stocks trading higher for the day) though remained more in line with what you’d expect at 32 & 31% respectively.

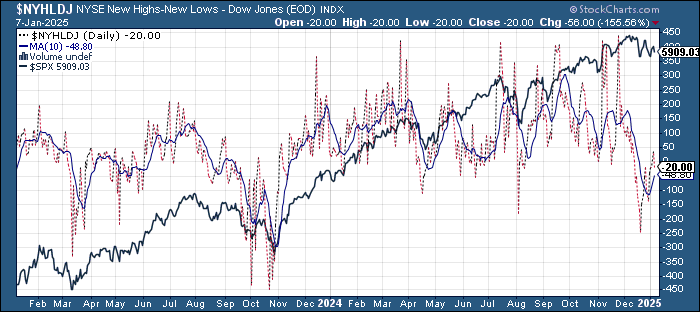

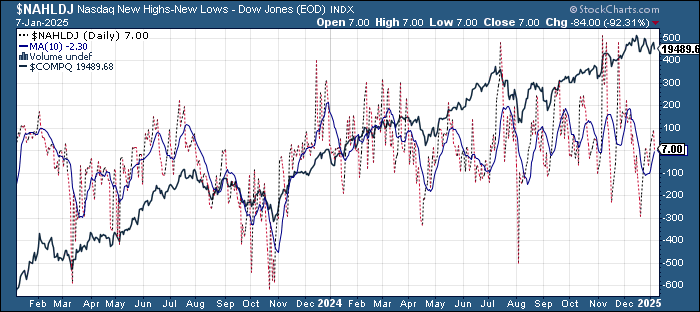

New highs-new lows (charts) also deteriorated with the NYSE falling back into negative territory for the 15th session in 16 at -19, while the Nasdaq fell to 7 from 87 (which was the best since early December). Both though remain (just) above their 10-DMAs which both continue to curl up (more bullish).

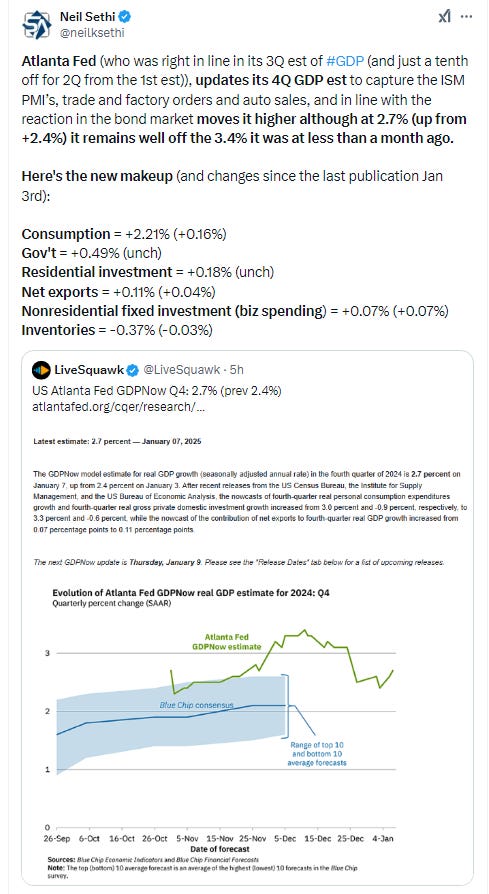

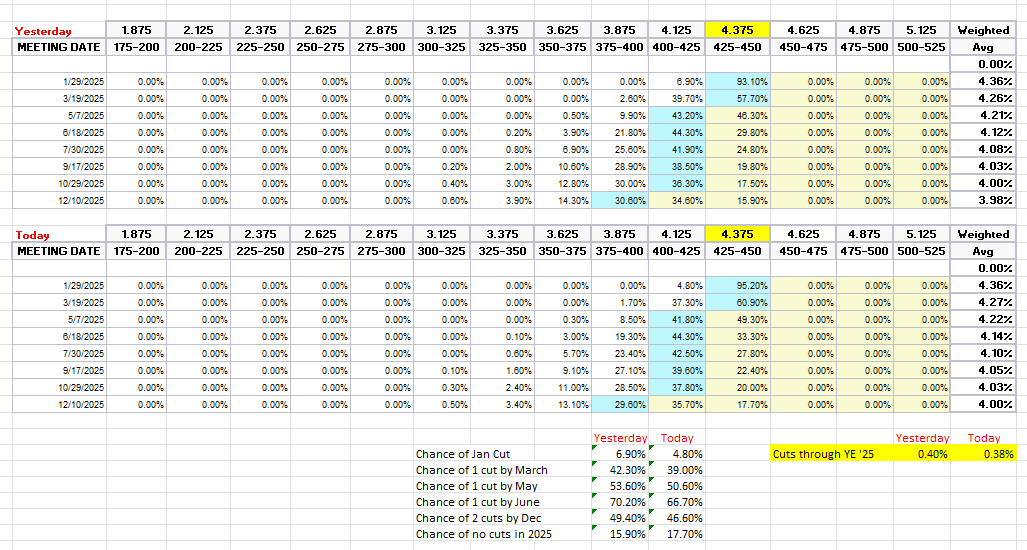

FOMC rate cut probabilities from CME’s #Fedwatch pulled back (fewer cuts) more sharply Tuesday following the economic data noted above with chances for a Jan cut down to just 5%. Pricing for a 2nd cut in 2025 fell 47% with overall 2025 cut expectations down -2bps at 38bps but the chance of a March cut fell to 39% (51% for May). Chance of no cuts at 18%.

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that. Of course it’s all just a big guess as we know it will all come down to the data, and I’m not sure there’s a great correlation with ISM prices or job openings and inflation. I think it really comes down to what we get Friday with payrolls.

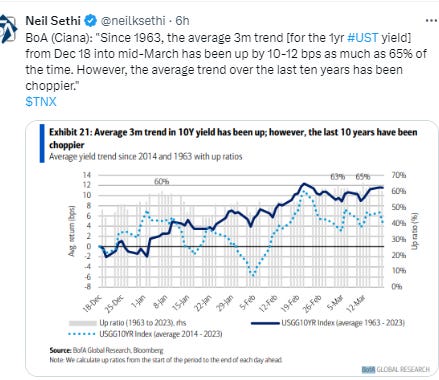

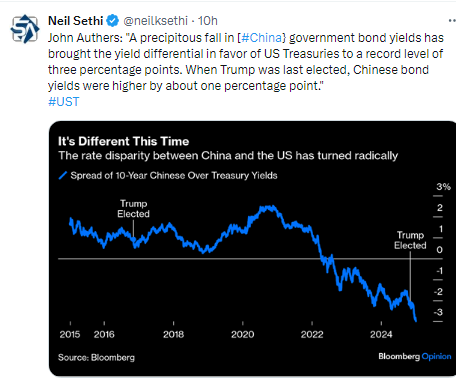

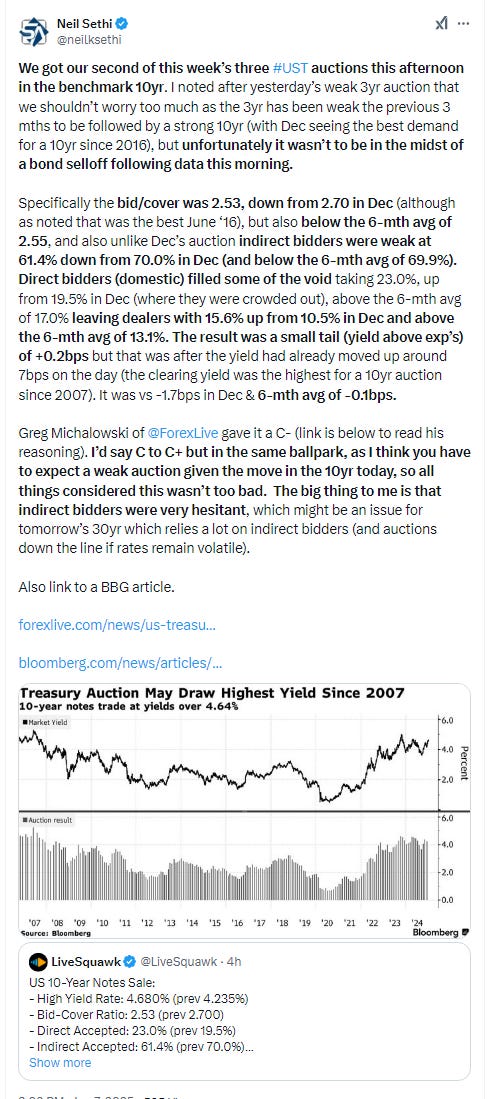

Longer duration Treasury yields as noted up for a 5th session with the 10yr yield +6bps at 4.68%, the highest since the 2024 peak in April, and +29bps since the Dec FOMC meeting (& +92bps from the Sept FOMC meeting), as I’ve said the past 3 weeks “eyeing the 4.7% level,” and now it’s there. The NFP report Friday probably decides if it breaks through. The 2yr yield, more sensitive to Fed policy, was +2bp to 4.29%, in the middle of its range since November (where it will likely stay until we get a notable move in Fed rate cut or hike expectations).

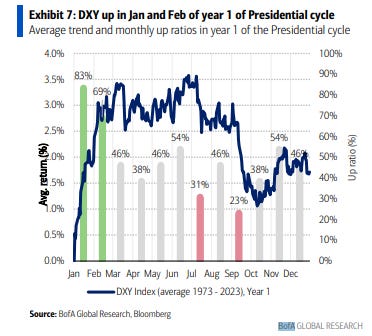

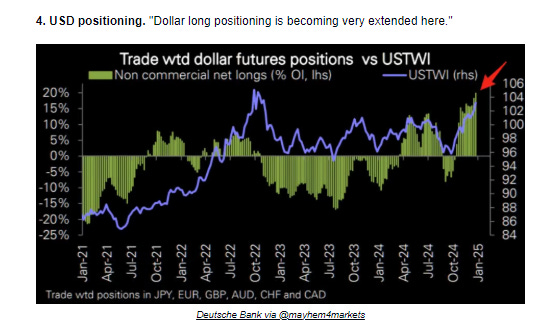

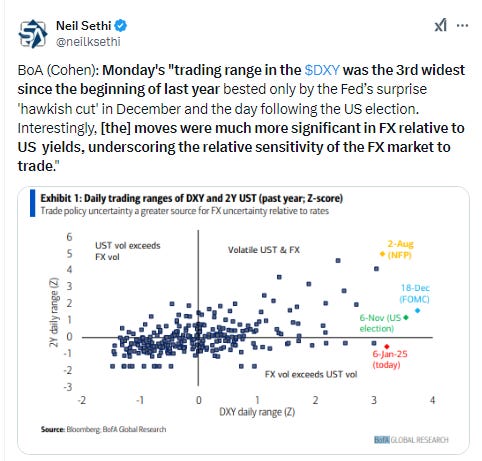

Dollar ($DXY) continued to be volatile, again trading down to test its 20-DMA before bouncing, then getting a lift from the economic data noted above. Still unlike yields it remains down from the highs at the start of the month. Daily MACD and RSI remain positive but less so than the start of the month as well.

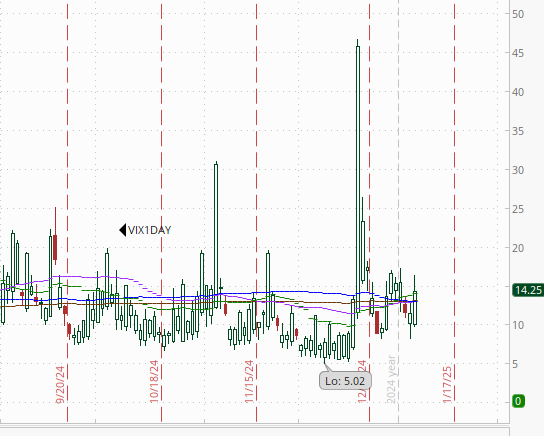

The VIX moved higher but remains below the levels of last week still elevated at 17.8 (consistent w/1.1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly moved to 106, just below the close on Jan 2nd, back under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

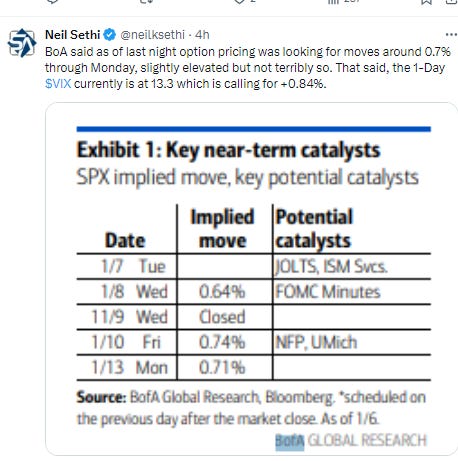

1-Day VIX now up to 14.25, just below the close on Jan 2nd, looking for a move of 0.90% Wed, well above the 0.64% BoA saw coming into the week.

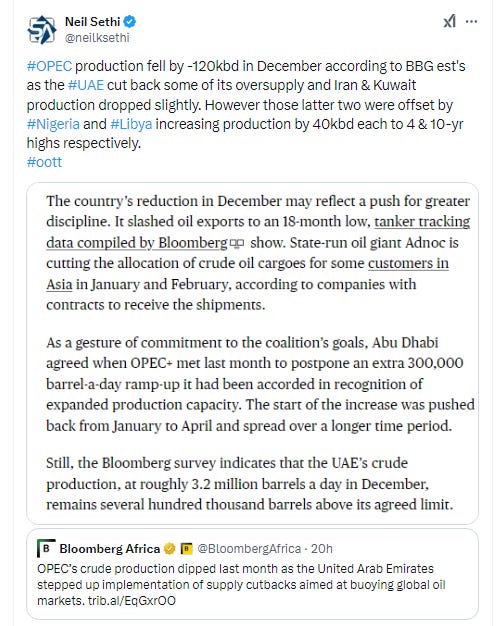

WTI was up for a 6th day in 7 to the highest close since Oct 11th but continues to find the resistance of the $75 area too much to overcome easily. As I said Monday, “it has some strong momentum, but it also did in March, June and October when it tested the area of the same downtrend line but couldn’t get through. Still I would expect it will at least take one more shot. Daily MACD & RSI remain supportive.”

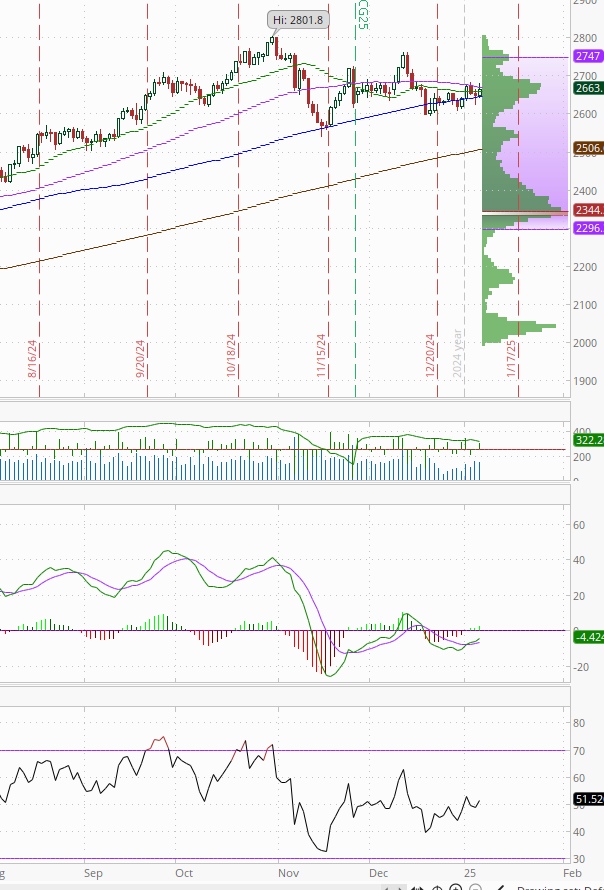

Gold little changed again today despite confirmation that China was a buyer in December, remaining under the 50-DMA which is key resistance, holding its uptrend. Daily MACD remains in "cover shorts" signal & daily RSI just over 50.

Copper (/HG) able to continue its bounce from just above the $4 mark it has mostly stayed over since March, closing at a 3-wk but again not able to get through its 50-DMA. Its RSI and MACD have moved more positive, but it has very strong resistance just above.

Nat gas (/NG) remained volatile Tuesday falling -7% (it’s moved over 6% in 7 of the past 8 sessions) back to its uptrend line. Daily MACD remains in “sell longs” position and RSI is just over 50 after falling to the weakest since October Friday.

Bitcoin futures followed risk assets lower breaking a 4-day win streak and falling back under the 20-DMA/$100k level. The daily MACD remains weak, and the RSI fell back to just over 50.

The Day Ahead

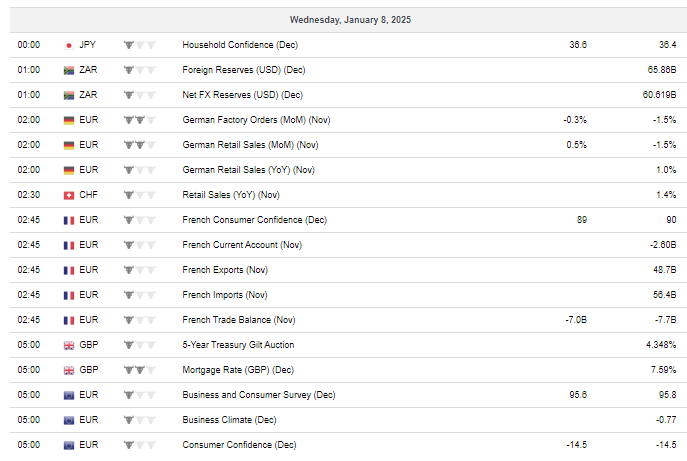

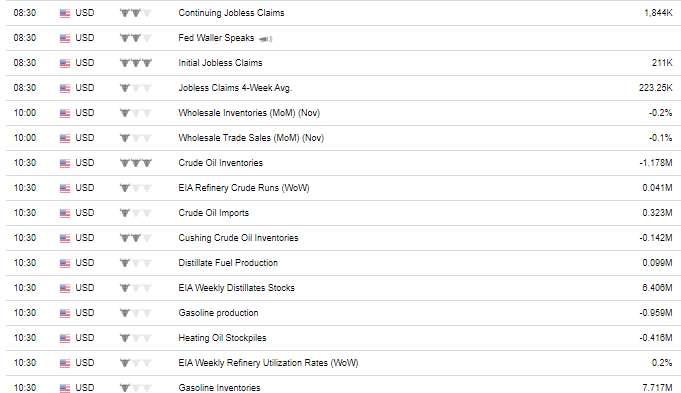

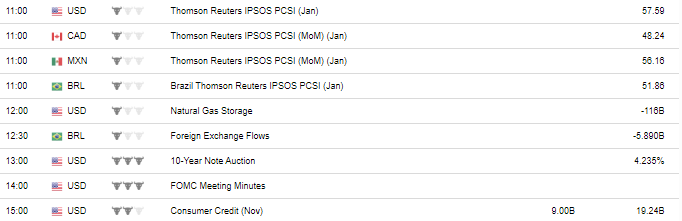

US economic data will include Dec ADP and consumer credit, Nov wholesale inventories and weekly jobless claims (moved forward a day due to President Carter’s funeral Thursday), mortgage applications and EIA petroleum inventories.

Fed speakers include a leading voice in Gov Waller. More importantly, though, we get the minutes from the Dec FOMC meeting which will be parsed for more color on some of the changes to the SEP including uncertainty around inflation, the trimming of rate cut expectations for 2025, and perhaps the neutral rate.

We’ll also get the last of this week’s three US Treasury auctions with the long bond (30yr). Hopefully it goes a little better than today’s 10yr.

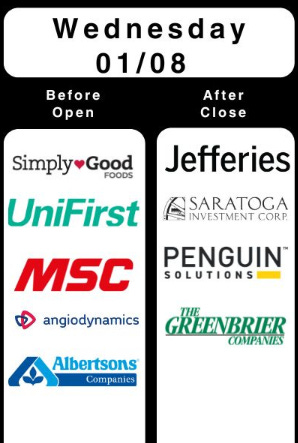

Earnings will be a little heavier with one SPX component in Acuity Brands (AYI). We’ll also get Jefferies Financial Group (JEF), a component of the S&P 400, among some others.

Ex-US highlights are Germany factory orders and biz/consumer confidence from Japan, France, and the EU. In EM we’ll get industrial production from Brazil.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,