Markets Update - 1/8/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

NOTE: NO UPDATE TOMORROW W/US EQUITY MARKETS CLOSED (BONDS CLOSING A LITTLE EARLY AT 2 PM ET), AND NO MAJOR DATA IN OBSERVANCE OF PRES CARTER’S FUNERAL. WILL BE POSTING UPDATES ON X.

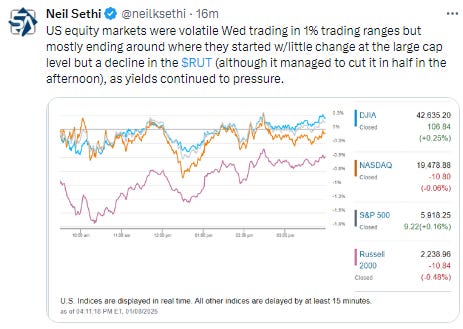

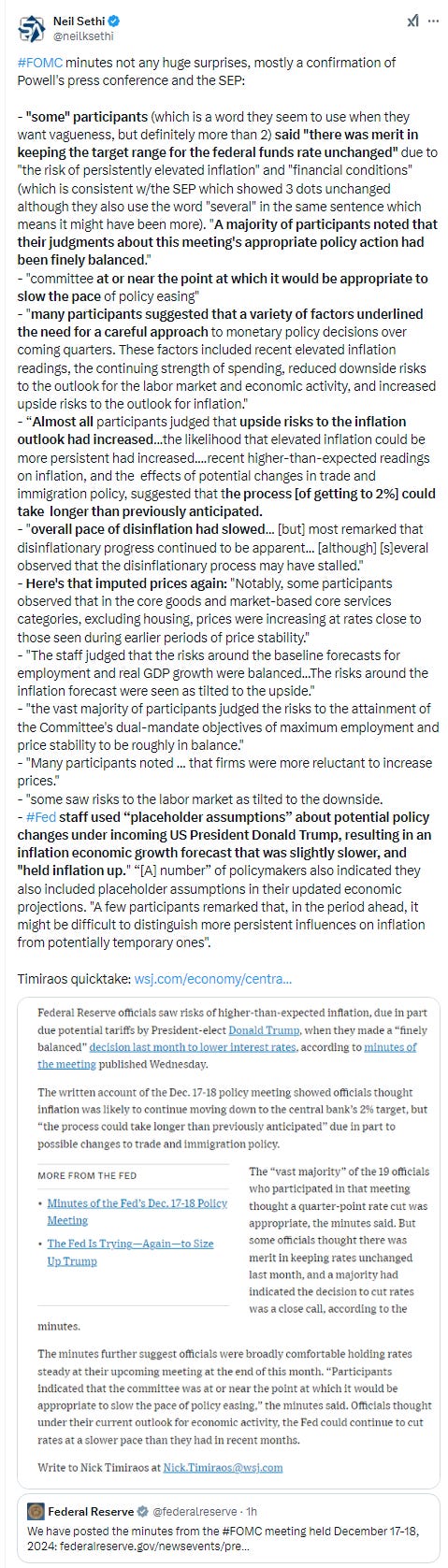

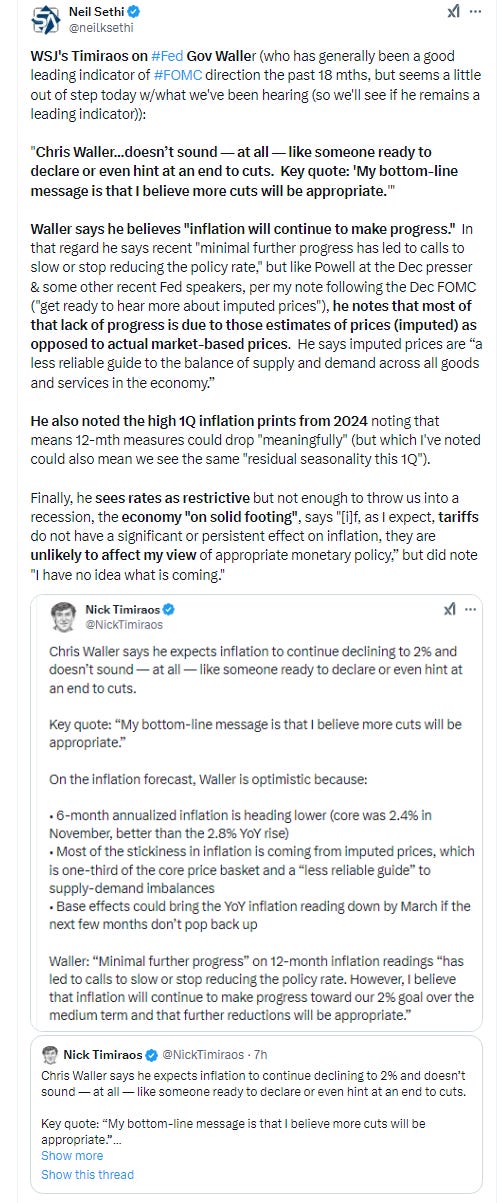

US equities started off flat (for large caps) and down (for small caps) and after a relatively volatile day (moving over 1%) ended not far from where they started (although small caps did cut their losses in half) as bond yields continued to edge towards decade+ highs despite some soothing words from Fed Gov Chris Waller who stated “my bottom-line message is that I believe more cuts will be appropriate” (the FOMC minutes later in the day though were much less conclusive).

Elsewhere, the dollar moved higher as did gold, copper, and nat gas while bitcoin and crude fell back.

The market-cap weighted S&P 500 was +0.2%, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite -0.1% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index -1.0%, and the Russell 2000 -0.5%.

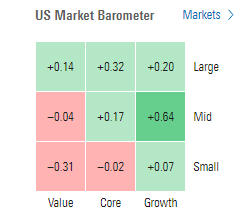

Morningstar style box showed the overall muted action. Tilt to growth.

Market commentary:

“While further near-term strength in the labor market is likely to keep expectations around 1-2 cuts in 2025 for now, we continue to believe that inflation will continue to slowly trend down while employment stays in balance allowing the Fed to cut rates three times in 2025,” said Chris Senyek at Wolfe Research.

“The start of the new year has been volatile,” said Craig Johnson at Piper Sandler. “Increased sensitivity to rising bond yields and short-term oversold conditions are testing investors’ patience and nerves. Despite the increased caution, we remain optimistic as the major indices’ primary uptrends remain well-intact.”

“Forecasters find it increasingly difficult to model out the path for interest rates, growth, and inflation because of the uncertainty surrounding Trump policies still being developed,” Jeffrey Roach, chief economist for LPL Financial, said. “Markets could get choppy if there is a surprise in Friday’s payroll release.”

“While further near-term strength in the labor market is likely to keep expectations around 1-2 cuts in 2025 for now, we continue to believe that inflation will continue to slowly trend down while employment stays in balance allowing the Fed to cut rates three times in 2025,” said Chris Senyek at Wolfe Research.

A survey conducted by 22V Research showed most investors are watching payrolls closer than normal. Only 26% of the respondents think Friday’s data will be “risk-on,” 40% said “risk-off,” and 34% “mixed/negligible.”

“Investors will want to see a return to Goldilocks data, consistent with a cooling labor market to help temper the recent spike in yields and help stocks stabilize,” said Tom Essaye at The Sevens Report.

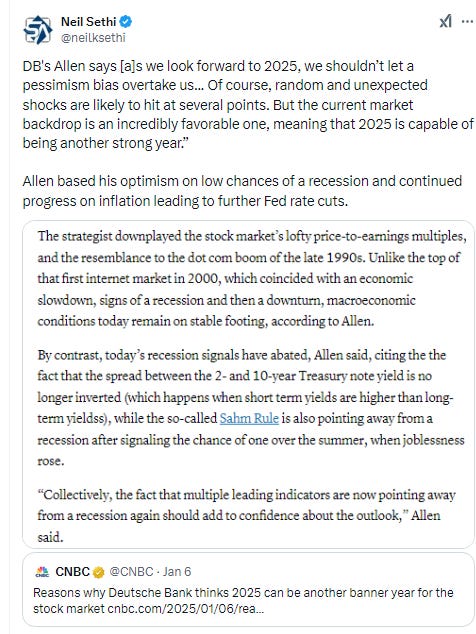

“Historically, the most common driver of significant losses are recessions,” said Henry Allen at Deutsche Bank AG. “The huge plunges in 2020 and 2008 required an economic contraction, and the bursting of the dot-com bubble also happened amidst a slowdown that ended up in a recession in 2001. But right now, there’s no sign of a slowdown, and if anything, several leading indicators are looking increasingly positive.” If economic growth stays robust and the Fed doesn’t start pivoting in a hawkish direction, it’s not implausible that elevated valuations continue for some time, Allen noted. However, if signs of a slowdown emerge or rate hikes move back on the table, the historic precedents show that equities are capable of a notable decline, even without a recession, he concluded.

Concentration is a key risk to start 2025, with much of the market’s gains dependent on the performance of a handful of mega-cap tech companies, Venu Krishna, head of U.S. equity strategy at Barclays, wrote on Wednesday.

“The percentage of SPX constituents beating the index rose to the highest level in over a year by October, but fell sharply over the final 2 months of 2024,” Krishna wrote. “Our US broadening basket weakened over the same period.”

“Big Tech is now 29.3% of the S&P 500 by weight and accounted for half of the index’s gains last year, down slightly from 2023′s 56%,” he added.

In individual stock action, quantum computing stocks tanked after Nvidia CEO Jensen Huang said Tuesday during the company’s analyst day that quantum computers are years away. “If you said 15 years for very useful quantum computers, that would probably be on the early side,” he said. “If you said 30, it’s probably on the late side. But if you picked 20, I think a whole bunch of us would believe it.” Rigetti Computing fell -47%, IonQ -44%, D-Wave Quantum -44%, and Quantum Computing -47%. Shares of Edison International were down by more than -12.5%, as thousands flee the Los Angeles area due to wildfires destroying homes and infrastructure in the region. The decline put the California-based utility on track for its worst trading day since March 2020. Constellation Energy shares tumbled more than 5% in Wednesday afternoon trading on a report that the power company is nearing a deal to acquire Calpine Corp. EBay’s stock headed for its best day in nearly seven years after the company announced that Meta is testing using the site’s listings on Facebook Marketplace.

BBG Corporate Highlights:

Albertsons Cos. raised its adjusted earnings outlook for the full year, a positive sign for the grocer seeking to pave a new path after its proposed deal with Kroger Co. fell apart.

BlackRock Inc. told employees it’s cutting roughly 1% of its workforce after it committed more than $25 billion for acquisitions last year to expand its reach in private-market assets and data.

Ally Financial Inc. will cut jobs, end mortgage originations and consider strategic alternatives for its credit-card business as borrowers have struggled to pay down costly debt.

Constellation Energy Corp. is nearing an acquisition of Calpine Corp., people familiar with the matter said, in what would be one of the biggest ever deals in the power generation sector.

Hershey Co. is asking the US’s top derivatives regulator for permission to buy a huge amount of cocoa through the New York exchange after global shortages sent prices to a record, according to people familiar with the matter.

New York City is trying to close a loophole that Uber Technologies Inc. and Lyft Inc. have used to deny drivers millions of dollars in pay with a raft of new measures that would effectively raise their rates by roughly 6.1%.

Advanced Micro Devices Inc. was downgraded to reduce from buy at HSBC, which cited difficulty in competing with Nvidia Corp.

Merck & Co. was downgraded to hold from buy at Truist Securities, which cited growth concerns at the pharmaceutical company.

Palo Alto Networks Inc., a security software company, received a pair of analyst downgrades.

The US utilities sector was upgraded to overweight from market weight at RBC Capital Markets, which called the group the “top defensive sector.”

Some tickers making moves at mid-day from CNBC.

In US economic data:

Nov consumer credit saw the largest drop in over a year, -$7.5bn SAAR (-1.8%) as revolving (credit card) debt dropped -$13.7bn (-12%), the most since May 2020. Nonrevolving (student/auto, which is nearly 3x bigger than revolving) was up $6.7bn (+2.0%).

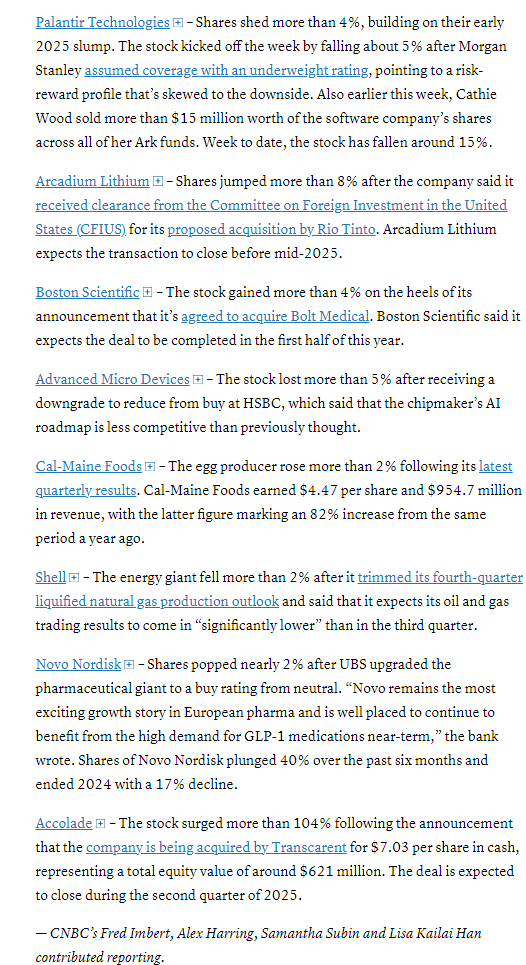

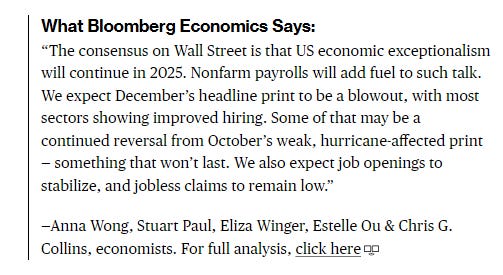

Initial jobless claims (SA) in wk through Jan 4th fall -10k to 201k, the least since last Feb, -14k below exp’s and now just +14k above the 50-yr lows in Oct '23 (187k). Continuing claims (SA) in wk through Dec 28th (1 wk lagged) pop back up after falling the prior wk to the least since Sept 21st, +23k (after a -10k revision to prior wk) to 1.867mn (+30k below the highest since Nov ‘21), +7k above exp’s but remaining low historically. Note though seasonal adjustments can be tricky around the holidays.

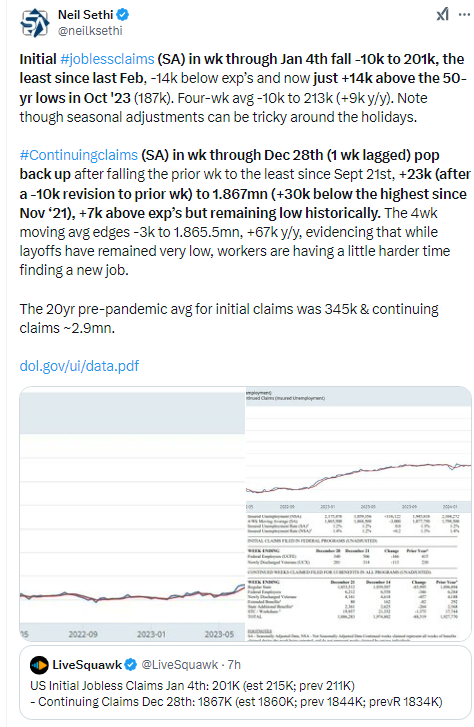

Dec ADP job growth came in a little under exp’s for a 2nd mth at 122k, the least since Aug, vs 139k exp’d (after 146k in Nov). Good producing sectors lost jobs though ex-construction. Health care saw a little less than half of the total jobs although most services categories saw job growth. The West accounted for 2/3 of jobs (after lagging the prior 3 mths) while large employers accounted for 80% of the growth. Wages edged lower.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

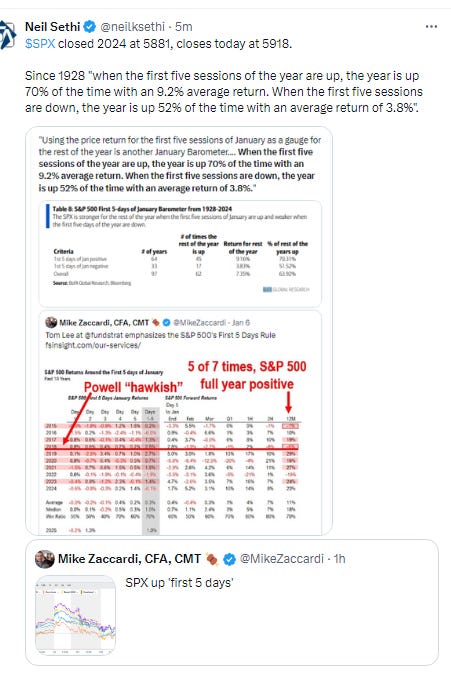

The SPX remained under its 50-DMA although with the recovery from the lows it gets the up for the “first five days” rule. Daily MACD & RSI weak for now.

The Nasdaq Composite fell to its 50-DMA where it found support. Its daily MACD and RSI are weak as well.

RUT (Russell 2000) now hanging in “no man’s land” which normally doesn’t last for long. I’d imagine it will either get moving again to the upside or fall to the 200-DMA area. As I noted last week until it gets over the 2290 level “we can’t really look higher.” Daily MACD & RSI remain weak but are close to improving.

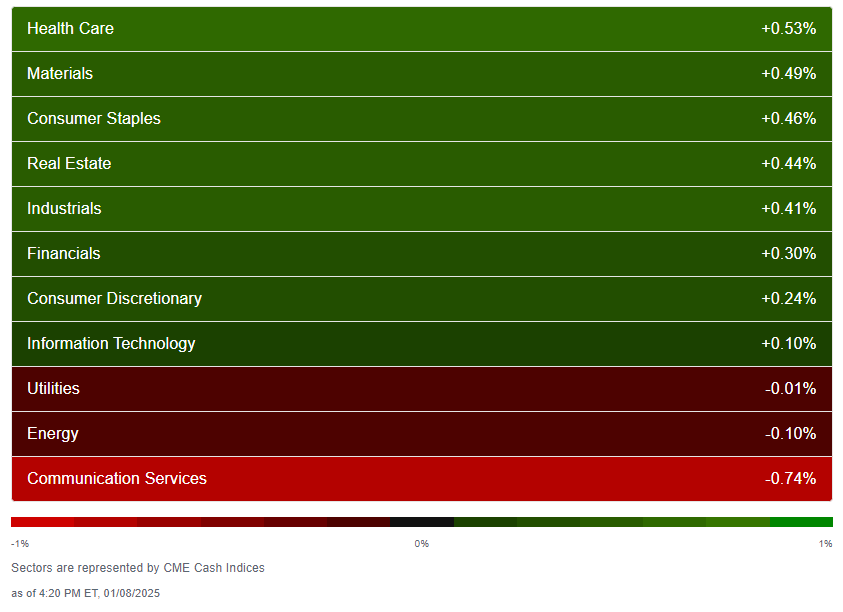

Equity sector breadth from CME Indices much better today despite the muted gains with 8 of 11 sectors in the green the best of the week, but the bad news is no sector was up over around a half percent (vs 2 Tues & 4 Mon), and one was down by more than that (Comm Services -0.7%). Still, it has a much better look and no style dominated.

Stock-by-stock SPX chart from Finviz consistent showing a lot more green.

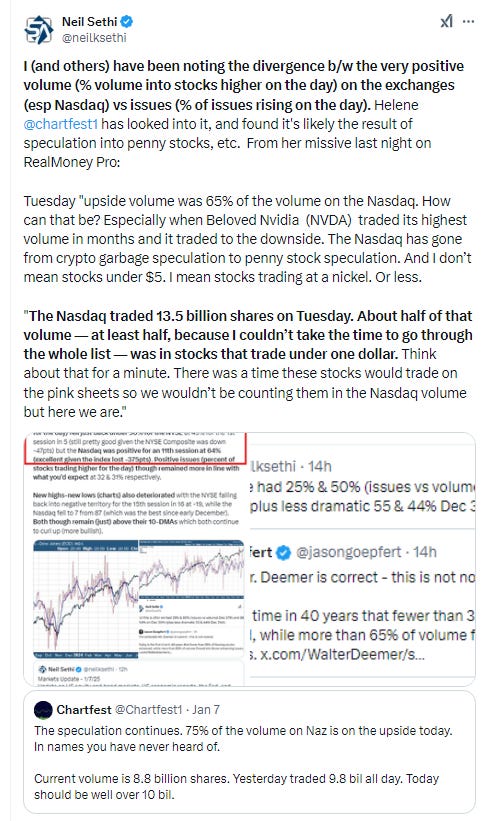

Positive volume (the percent of volume traded in stocks that were up for the day) remained under 50% for the NYSE at 43% not great considering the NYSE Composite was up for the day), and the Nasdaq broke its streak after 11 sessions at 30% (also weak given the index lost just -10pts). Positive issues (percent of stocks trading higher for the day) was a little better at 43 & 33% respectively.

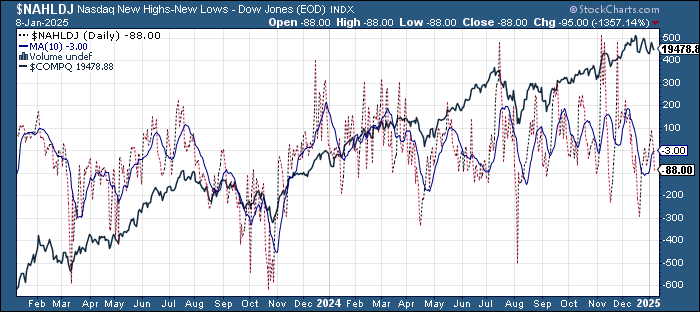

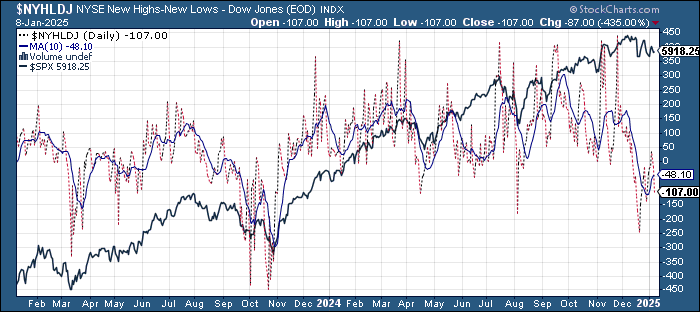

New highs-new lows (charts) also deteriorated with the NYSE at -106 & the Nasdaq fell -89 (both the least of the year). Both are also now under their 10-DMAs although they continue to move up for now (more bullish).

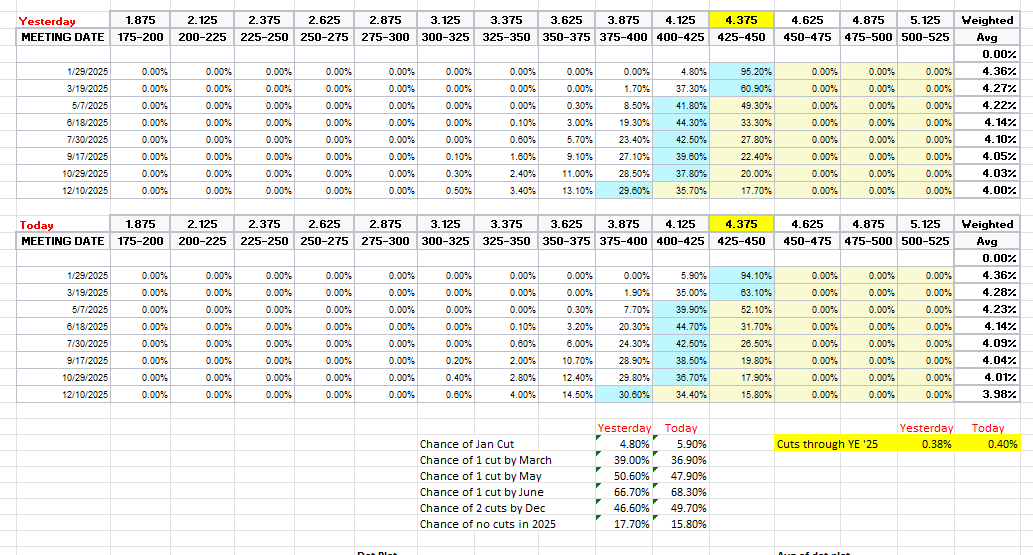

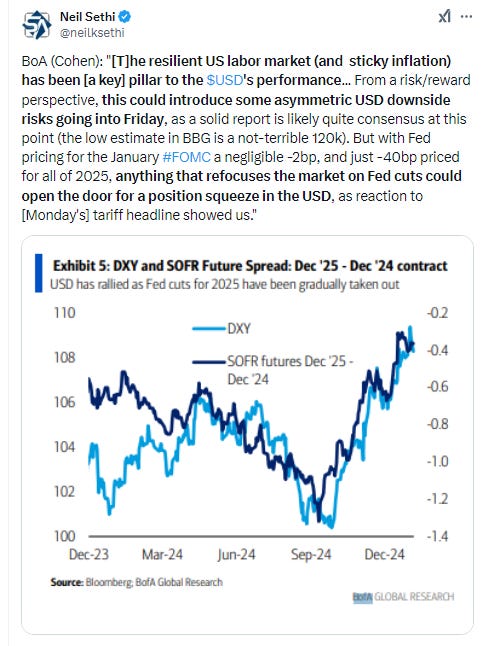

FOMC rate cut probabilities from CME’s #Fedwatch overall moved to more cuts after a strong endorsement by Gov Waller that “more cuts will be appropriate,” but near term chances fell. Chance for a Jan cut remained at 5%, but pricing for a 2nd cut in 2025 up to 50% with overall 2025 cut expectations down +2bps at 40bps but the chance of a March cut fell to 37% and to 48% for May (June is 68%). Chance of no cuts at 16%.

I had previously noted the market seemed quite aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that. Of course it’s all just a big guess as we know it will all come down to the data, and payrolls on Friday will be an important piece.

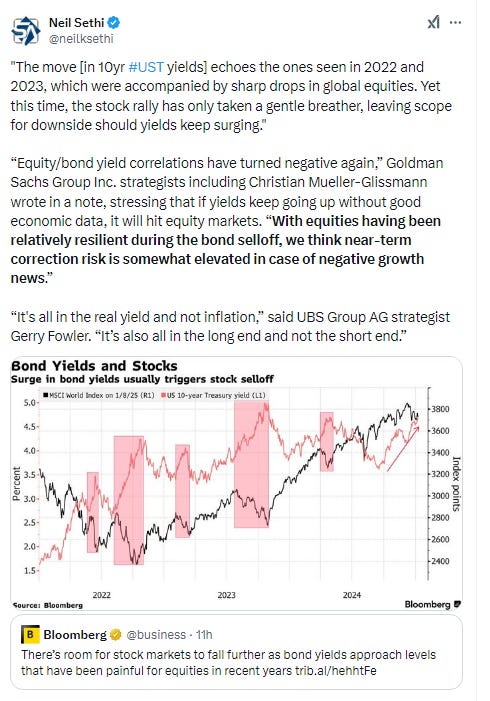

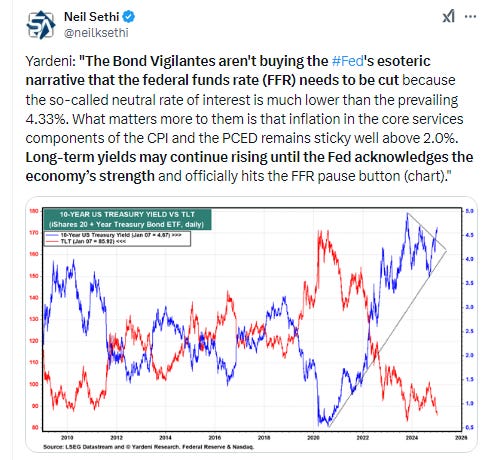

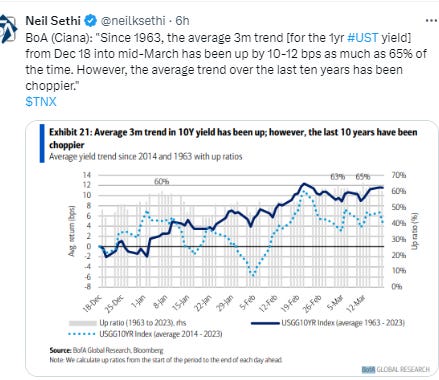

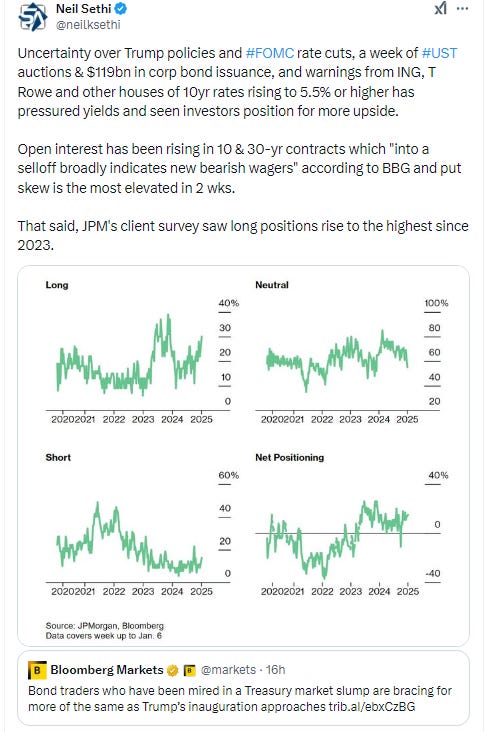

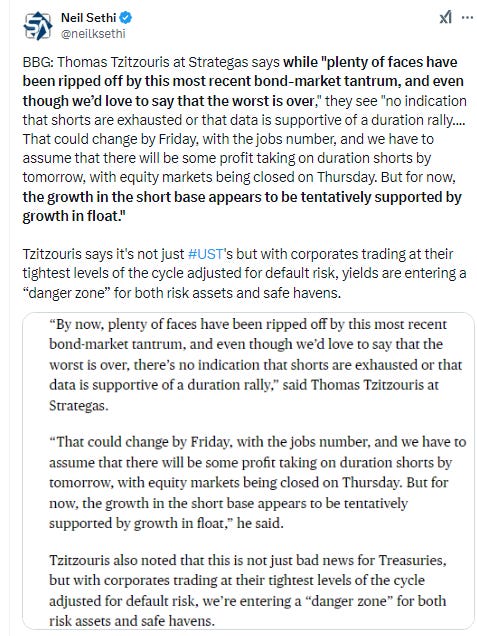

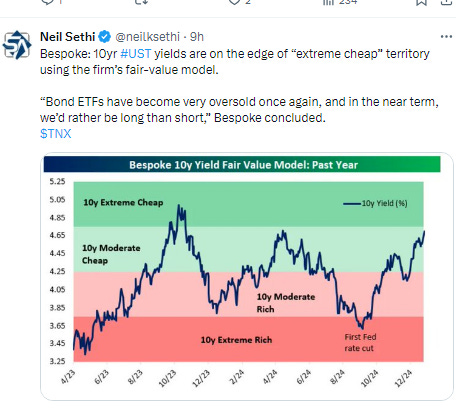

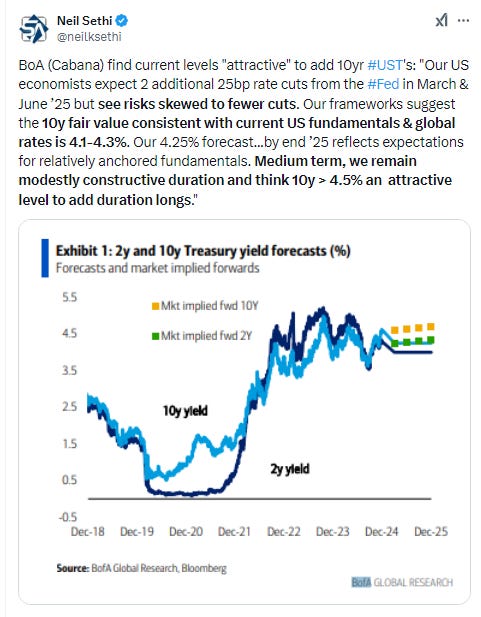

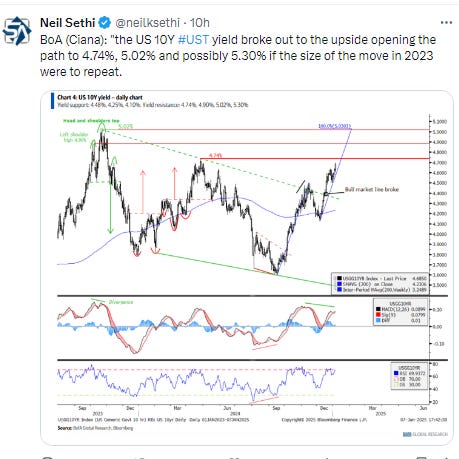

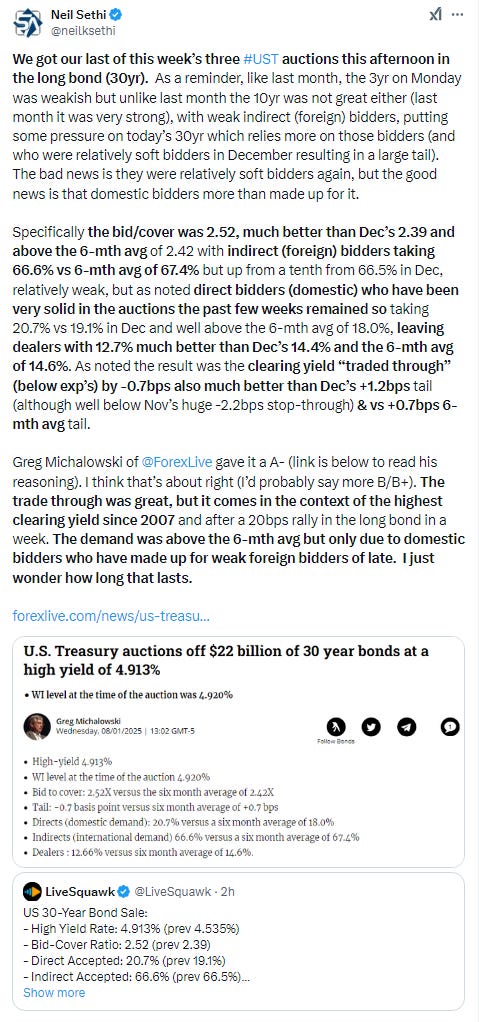

Longer duration Treasury yields as noted up for a 6th session with the 10yr yield +1bps at 4.69% (but at one point breached 4.7%), the highest since the 2024 peak in April, and +30bps since the Dec FOMC meeting (& +93bps from the Sept FOMC meeting), as I’ve said the past 3 weeks “eyeing the 4.7% level,” and now it’s there. Question is what it does now. As I said Monday, “the NFP report Friday probably decides if it breaks through.” The 2yr yield, more sensitive to Fed policy, was unch at 4.29%, in the middle of its range since November (where it will likely stay until we get a notable move in Fed rate cut or hike expectations).

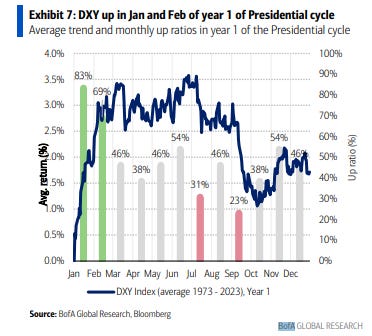

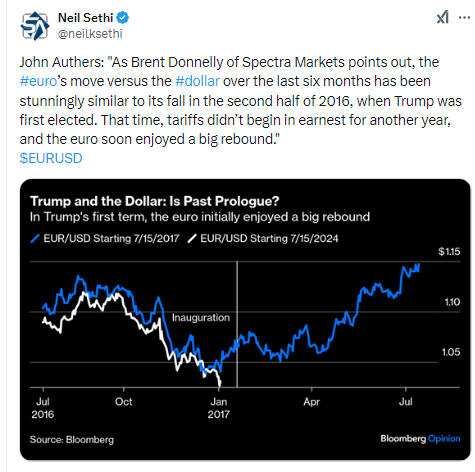

Dollar ($DXY) continued to be volatile, up for a second day at one point near the 26-mth highs hit last week before falling back a bit. Daily MACD and RSI remain positive but less so than the start of the month.

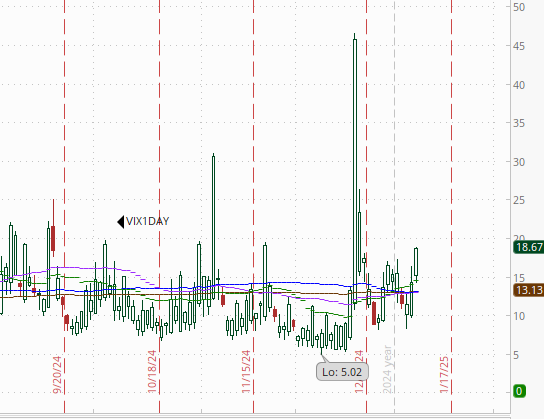

The VIX pushed up near 20 before falling back ending still elevated at 17.7 (consistent w/1.1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly moved to the highest of the year before falling back a bit to 103, over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

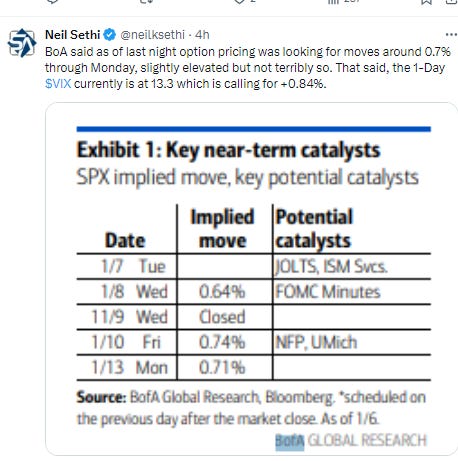

1-Day VIX up to 18.7, the highest of the year, looking for a move of 1.18% Friday, well above the 0.74% BoA saw coming into the week.

WTI made it to the 200-DMA just over $75, but as I thought was likely continues to find the level too much to overcome easily. As I said Monday, “it has some strong momentum, but it also did in March, June and October when it tested the area of the same downtrend line but couldn’t get through. Still I would expect it will at least take one more shot. Daily MACD & RSI remain supportive.” I’m not sure at this point if it will continue to try to push through before pulling back.

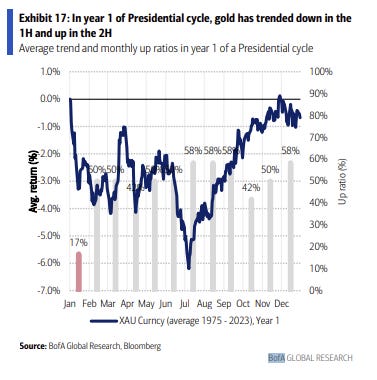

Gold edged higher, but it was enough to get it over the 50-DMA, which I have described as “key resistance”. Daily MACD remains in "cover shorts" signal & daily RSI moving above 50, so it has the setup to take a run at the downtrend line.

Copper (/HG) had a good day as it continued its bounce from just above the $4 mark for a 4th session, closing at a 4-wk high, through its 50-DMA and up to the downtrend line it hasn’t closed over since May. Its RSI and MACD remain positive, with the former the best since Oct. Not sure if it will be enough though.

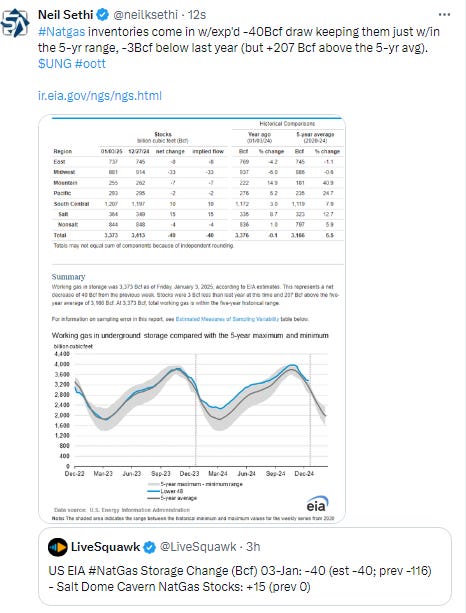

Nat gas (/NG) remained volatile Tuesday up nearly +7% (it’s moved over 6% in 8 of the past 9 sessions) bouncing again from its uptrend line. Daily MACD remains in “sell longs” position and RSI is just over 50 but around the weakest since October.

Bitcoin futures fell for 2nd day down the 50-day just above recent lows. Feels like the 50-day needs to hold. The daily MACD and RSI remain weak though.

The (Two Days) Ahead

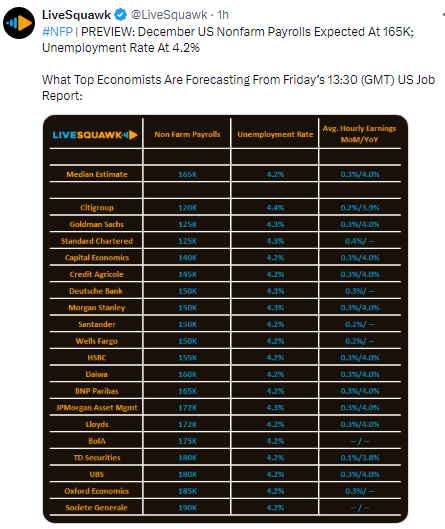

US economic data was mostly moved to today (it looks like we still might get Challenger data Thursday), but Friday brings us one one the key reports (if not the key report of the month) in Nonfarm Payrolls. We’ll also get U of Mich Jan prelim consumer sentiment.

We do though have our biggest day for Fed speakers scheduled for Thursday (not sure if they will move to Friday) with Governor Bowman plus regional Fed Presidents Harker, Barkin, and Schmid. No US Treasury auctions.

In earnings, it looks like most of the Thursday reports moved to Wednesday, but Friday we do get three SPX components in Constellation Brands (STZ), Delta Air Lines (DAL) and Walgreens Boots Alliance (WBA) (links to Seeking Alpha, see the full earnings calendar).

Ex-US tonight we’ll get Nov Japan wage and Australia trade data and China Dec CPI & PPI then Thursday Nov Germany trade data & industrial production, EU retail sales, Japan household spending, and Friday Dec China loan growth, and Canada employment. In EM Thursday we’ll get Dec Mexico CPI and Nov Brazil retail sales, and Friday Dec Brazil CPI and Nov India and Mexico industrial production.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,