Markets Update - 2/10/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

US equities started the day off to the upside despite the Trump administration announcing new tariffs on steel and aluminum imports over the weekend with many analysts saying that investors were already becoming “numbed” by the constant drumbeat of announcements. From there indices diverged a bit with large cap growth stocks leading, but all the major indices finished with gains with many different sectors powering the advance (8 of 11 sectors were up at least a half percent).

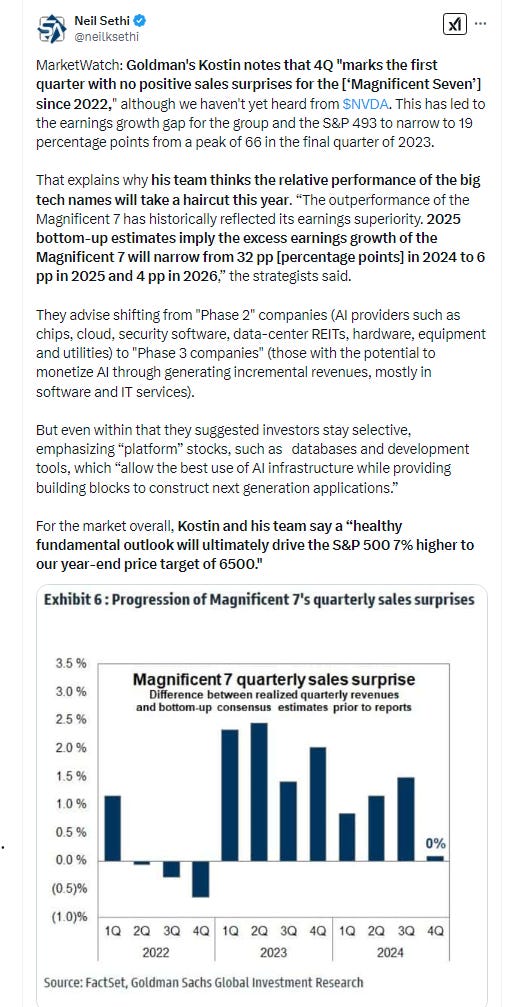

Elsewhere, bond yields were little changed not getting in the way of equities today, while the dollar edged higher for a third session. Also up (many notably) were crude, gold, copper, nat gas, and bitcoin.

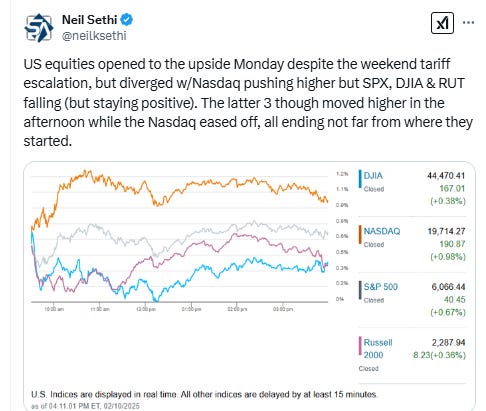

The market-cap weighted S&P 500 (SPX) was +0.7%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite +1.0% (and the top 100 Nasdaq stocks (NDX) +1.2%), the SOX semiconductor index +1.5%, and the Russell 2000 (RUT) +0.4%.

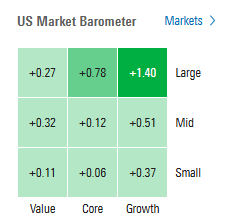

Morningstar style box showed the broad gains led by large cap growth.

Market commentary:

“Nothing is clear,” said John Kornitzer, founder of Kornitzer Capital Management and the Buffalo Funds. Whether on tariffs, foreign aid, oil policies or shrinking the U.S. government, “everything is in disarray.”

Still, a volatile policy backdrop won’t necessarily be bad for stock pickers in the weeks and months ahead. “Take advantage of situations,” Kornitzer said — adding that if headlines “hit something you like, if you like a company long term, you buy it.”

“Inflation data, Powell’s congressional testimony, and tariffs are poised to drive the market story,” said Chris Larkin at E*Trade from Morgan Stanley. “If the S&P 500 is going to break out of its two-month consolidation, it may need a respite from the types of negative surprises — like DeepSeek, tariffs, and consumer sentiment — that have tripped it up over the past few weeks.”

“The market is right to be cautious,” said Matt Peron, global head of the solutions group at Janus Henderson Investors, who noted that Friday’s jobs data reinforced worries that the battle against inflation probably “is not out of the woods yet.” Should longer-term rates “grind up slowly” from here, the market can probably digest that, Janus’s Peron said, while warning that the path still could have potholes. “You want to be selective, stay higher in quality,” Peron said. For now, he thinks the next sweet spot for stocks will be in “GARP” equities, or growth at reasonable prices. “But there will be some volatility.”

“The volatility around DeepSeek and concerns over tariffs do not derail our positive outlook on risk assets, especially in the U.S. Over the short term, we expect lingering volatility on tariff headlines and potential April bill passage in the U.S., but we keep 6,500 as S&P 500 year-end target,” JPMorgan analyst Fabio Bassi said in a note to clients.

“It’s early in the year, but so far markets are going up, even without tech participating,” James Ragan, director of Wealth Management Research at D.A. Davidson said. “That’s a positive thing.”

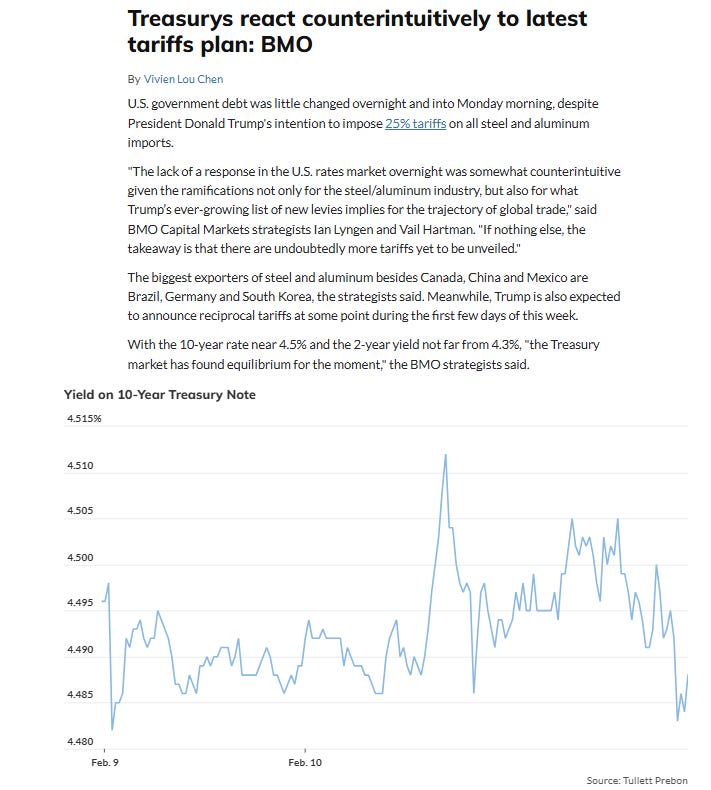

“The [jobs report] bought the Committee some more time to evaluate and incorporate the trade war into its outlook, and we maintain that the first truly ‘live’ meeting during the first half of this year is June — and that is by no means a done deal,” BMO’s Ian Lyngen and Vail Hartman said. “This isn’t to suggest the probability of cuts won’t remain volatile,” they added. “In fact, that’s precisely what we’re expecting as the incoming data and Trump’s policy influence the market’s economic and monetary policy expectations.”

“The broad sweep of Republican policy looks expansionary,” wrote TS Lombard economists in a Feb. 5 briefing to clients, but they warned that rolling out tariffs before tax cuts risks crimping household spending and corporate profits. Eventually investments in domestic production might turn things around. “It seems a little bold, however, to assume that this will happen seamlessly,” they wrote.

Ryan Young, a senior economist at the Competitive Enterprise Institute, says taking an ax to the thicket of permits that slow down investments in housing, infrastructure or mining “will do a lot of good.” Still, Young cautions that much depends on Trump’s execution. “He is overpromising and will likely underdeliver,” he says.

Citigroup Inc. global economist Nathan Sheets is among those reappraising their view of the Trump economy after the president’s first weeks in office. Trump’s “tone on tariffs has been somewhat more muscular and vigorous than I was expecting,” he says. There’s a scenario, Sheets says, in which “we get kicked in the shins in 2025, and then some of the more stimulative stuff” balances that out in 2026.

Given the risks around tariffs and inflation, plus significant back-to-back yearly gains for stocks, the "market’s multiple expansion tank is out of gas and stocks will require earnings growth to move higher," said Richard Saperstein, chief investment officer at Treasury Partners. "Protecting capital is key during a market like this when valuations are elevated," Saperstein said in emailed comments. "We are more focused on the return of capital instead of the return on capital."

“Although multiples are elevated, we remain fully invested due to the potential for continued economic growth, moderating inflation and an accommodative Fed,” said Richard Saperstein at Treasury Partners. “Our characterization for stocks this year is a choppy market that trends higher over the year.”

Callie Cox at Ritholtz Wealth Management says high expectations, elevated rates and policy uncertainty “don’t mix well together.”

“We’re learning that in real time,” Cox said. “Strive for portfolio balance, and remember that there’s a world outside of AI.”

While headlines continue to be dominated by concerns over tariffs and megacap tech spending, the market narrative shift around broadening and leadership is being confirmed by fundamentals and market dynamics, according to Lisa Shalett at Morgan Stanley Wealth Management. “Watch for rotation of stock index leadership from the Magnificent Seven toward value, cyclicals and non-GenAI infrastructure secular growth,” she said. “Consider adding cyclicals like financials, energy, domestic manufacturers and consumer services to US stock positions.”

“We stay overweight US equities on a solid macro outlook and the AI mega force – a big, structural shift,” said BlackRock Investment Institute strategists including Jean Boivin and Wei Li. “We go overweight government bonds in the euro area, where the potential growth hit from tariffs should reinforce rate cuts.”

“For investors, the greatest market risk likely lies in policy unpredictability,” according to Christian Floro at Principal Asset Management. “Given this environment, diversification is essential to manage portfolio risk and capture opportunities as companies, countries and markets adjust.”

“Investors may be better served by not reacting to the news cycle,” said Anthony Saglimbene at Ameriprise. “Stand still and let tariff, Big Tech, and interest-rate developments play out over the near term. Making investment decisions on still unknown outcomes increases the risk of being wrong or offside if developments shift in the opposite direction.”

“Our view in tariffs remain that they will cause volatility, are a negotiating tool and will eventually be not as bad as feared,” said Mohit Kumar at Jefferies International.

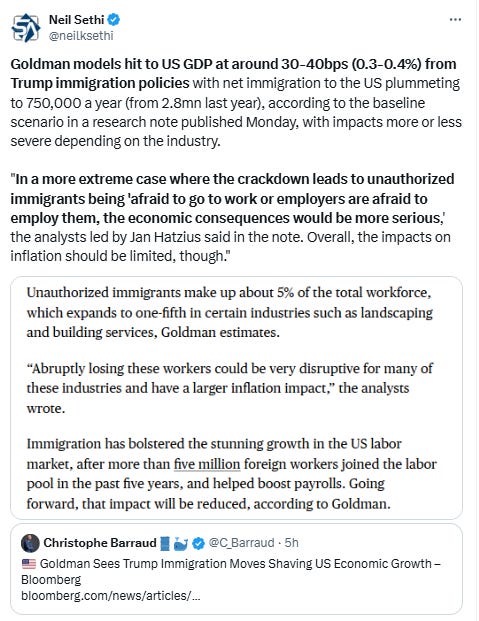

"Steep tariffs and heightened policy uncertainty could push businesses to increasingly adopt wait-and-see behaviors and pull back on hiring," said Lydia Boussour, senior economist at EY-Parthenon. "This could lead to a more severe job slowdown, weaker income and restrained consumer spending amidst much higher inflation."

"While it’s still unclear quite how Trump’s trade agenda will unfold, we can clearly expect the drama to continue," Jennifer McKeown and Hamad Hussain, economists at Capital Economics wrote. "in this environment of uncertainty and renewed price pressures in the U.S., world GDP growth looks set to remain pretty soft."

While investors remain concerned that President Donald Trump’s tariff plans may put upward pressure on inflation again, they are “looking at the light at the end of the tunnel,” said José Torres, senior economist at Interactive Brokers.“The outcome is likely to be much better than feared,” Torres said.

Sameer Samana, head of global equities and real assets at Wells Fargo Investment Institute, argued in a Monday note that stocks are proving so resilient because investors "appear to us to be viewing them as part of a portfolio of policies that includes extending tax cuts, reducing regulation, and generally fostering a pro-business environment."

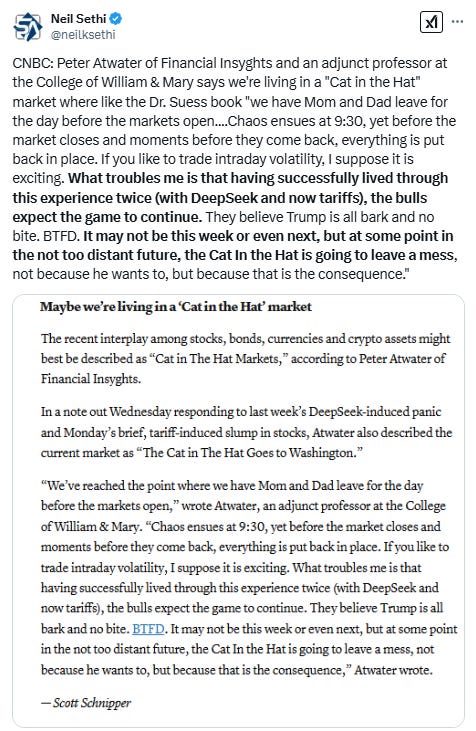

Mark Hackett, chief market strategist at Nationwide, argues in a Monday note that the market's behavior right now is best compared to the waterfowl.

"The market is gliding along like a duck — steady on the surface but churning underneath — as sideways action masks a broader transition from tech dominance toward value, small caps, and international leadership," he wrote.

Retail investors drove record January inflows, Hackett said, while a wave of share buybacks now that earnings season is winding up should help provide a further tailwind to the market. "Despite day-to-day confusion," he said, "tariff uncertainty, the geopolitical environment, and elevated valuations in the tech space remain the biggest unknowns for investors. Together, these factors point to measured gains this year rather than blockbuster returns of recent years."

“I have talked to many clients who have suggested that there’s maybe tariff fatigue,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York. He noted that while there was a “dramatic” reaction on Friday to the prospect of reciprocal tariffs by Trump — with the Dow finishing down by 444.23 points, or 1% — there were only some knee-jerk responses Sunday night to the president’s talk of steel and aluminum tariffs that would affect countries such as Canada, China, Mexico, Brazil, Germany and South Korea. “There’s some skepticism that tariffs will come to fruition because Trump could end up getting a concession” that allows him to change his mind, Chandler said via phone.

“Our base case is a scenario of ‘selective tariffs,’ which have the potential to dent, but not derail, US economic growth,” Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, wrote in a note Monday. “Although we continue to monitor trade and tariff policy closely, we still expect that a solid U.S. economy, AI tailwinds, and gradual Fed rate cuts will offer a favorable backdrop for equities.” Still, with Trump having recently threatened new tariffs on metals as well as "reciprocal" tariffs, she cautioned that "highly aggressive U.S. tariffs would almost certainly trigger retaliation by U.S. trading partners, and there are risks of a tit-for-tat ratcheting up of measures." UBS Global Wealth Management expects the S&P 500 to rise to 6,600 by the end of the year, but “the journey up is likely to be accompanied by heightened volatility.”

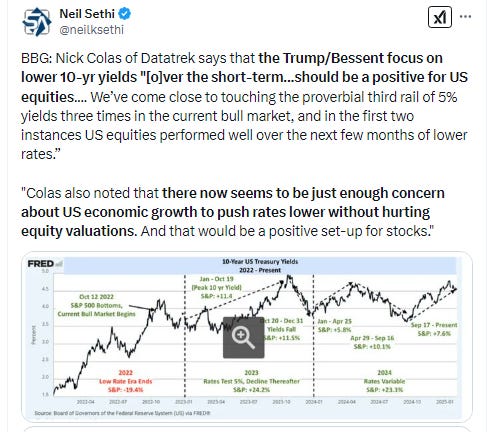

Large-cap tech stocks are likely to continue to lead the U.S. stock rally based on the technical levels, according to Adam Turnquist, chief technical strategist at LPL Financial. While small-cap stocks and value stocks have seen outperformance over short periods during the past few months, “when you look at the longer-term trends, it's hard to say that the large-cap Big Tech trade is over,” Turnquist said in a phone interview. “Those trends are still very much intact.” The 4.50% level of the 10-year Treasury yield has been a pain point for U.S. equities, Turnquist noted. “For above 4.50%, we've seen risk-off rotations around that level. If we can stay below 4.50%, I think that's going to be a good sign for equity markets — maybe [we will see a] recovery, and maybe [it is] a good sign for a sustainable breakout if the S&P 500 rises above 6,100,” Turnquist said.

In individual stock action, steel and aluminum stocks popped. U.S. Steel and Nucor were up 4.8% and 5.6%, respectively. Cleveland-Cliffs climbed nearly 18%, and Alcoa ended the day 2.2% higher. Shares of chipmakers also rose as sentiment appeared to improve after the late January sell-off in technology stocks, fueled by the concerns around the emergence of Chinese AI startup DeepSeek. Nvidia gained 2.9%, extended a five-day surge to about 15% while Meta Platforms Inc. rose for a record 16th consecutive session. Broadcom and Micron added 4.5% and 3.9%, respectively. Megacap tech names Alphabet, Microsoft (MSFT 412.22, +2.47, +0.6%), and Amazon.com (AMZN 233.14, +3.99, +1.7%) were other standouts from the space. The Vanguard Mega Cap Growth ETF (MGK) closed 1.0% higher.

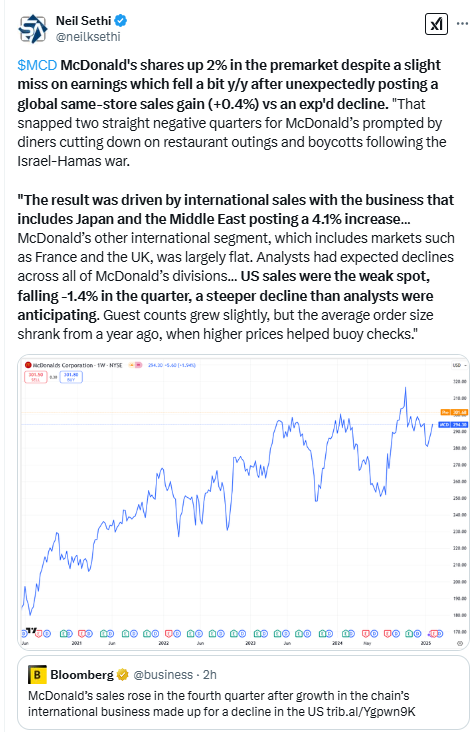

Earnings reports also fueled buying interest. McDonald's (MCD 308.42, +14.12, +4.8%) posted strong results, along with Monday.com (MNDY 326.58, +68.34, +26.5%) and Rockwell Automation (ROK 302.34, +33.94, +12.7%) whose shares rose nearly 13% on Monday, leading the S&P 500 higher and putting the stock on track to close with its largest single-day percentage increase since March 24, 2020, when it gained 17.6%. The gain comes after the company reported an earnings beat for its fiscal first quarter. Rockwell also said orders were up around 10% compared to the year-ago period.

BBG Corporate Highlights:

Toronto-Dominion Bank expects to raise about $14 billion through the sale of its entire stake in Charles Schwab Corp. as part of a corporate overhaul in the wake of its historic US money-laundering settlement.

Microsoft Corp. is under investigation from the French antitrust authority amid concerns the US tech giant is degrading the quality of results when smaller rivals pay to use Bing technology in their own search-engine products.

McDonald’s Corp. sales rose in the fourth quarter after growth in the chain’s international business made up for a decline in the US.

Lyft Inc. will launch driverless rides with technology vendor and Intel Corp. spinoff Mobileye Global Inc. in Dallas as soon as 2026, building on a partnership that was first announced last November.

Hyatt Hotels Corp. struck a deal to purchase Playa Hotels & Resorts NV for about $2.6 billion, expanding its reach into the all-inclusive resort market in countries including the Dominican Republic and Jamaica.

Hertz Corp. has kicked off negotiations to settle litigation surrounding a make-whole payout of over $270 million that has been demanded by some bondholders, the company said on Monday.

BP Plc surged after Elliott Investment Management built a stake in the company, seeking to end years of under-performance by pushing for significant change.

The notion that China’s DeepSeek spent under $6 million to develop its artificial intelligence system is “exaggerated and a little bit misleading,” according Google DeepMind boss Demis Hassabis.

Some tickers making moves at mid-day from CNBC.

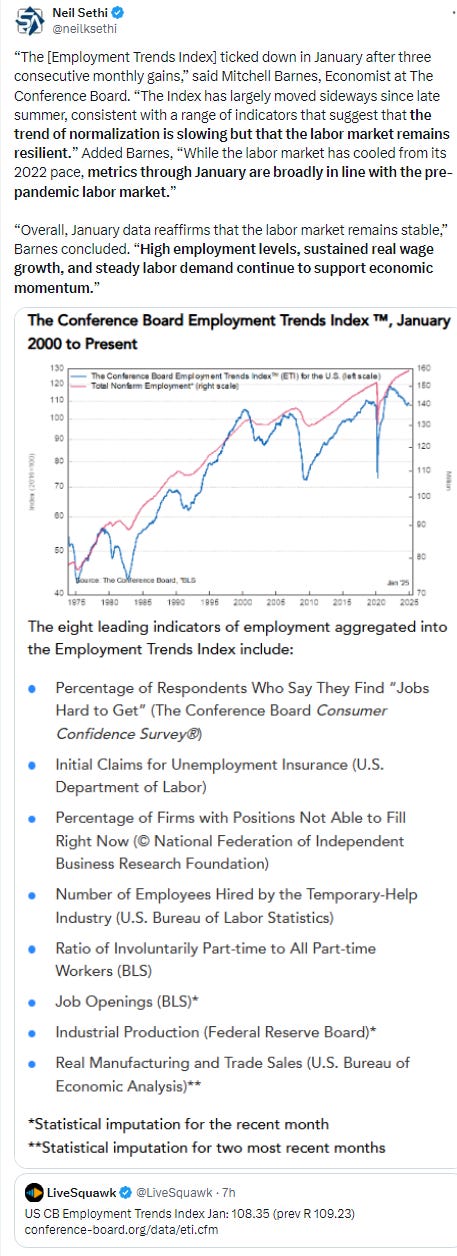

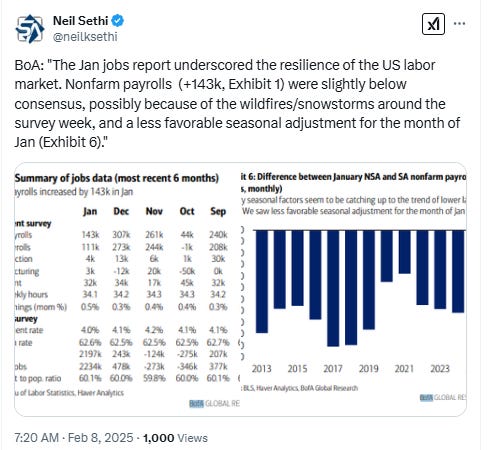

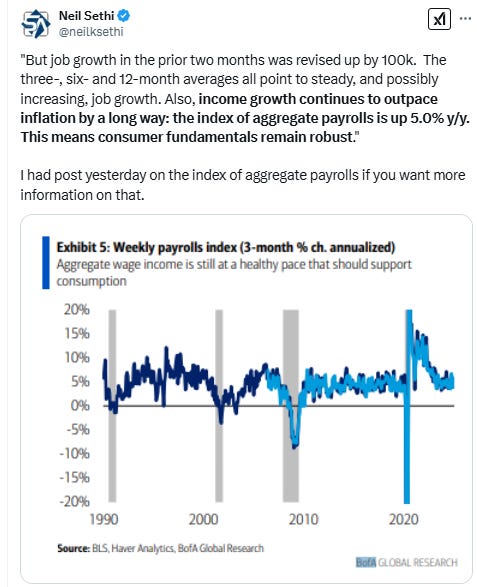

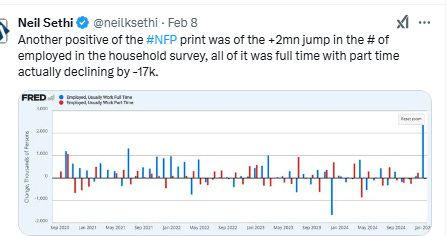

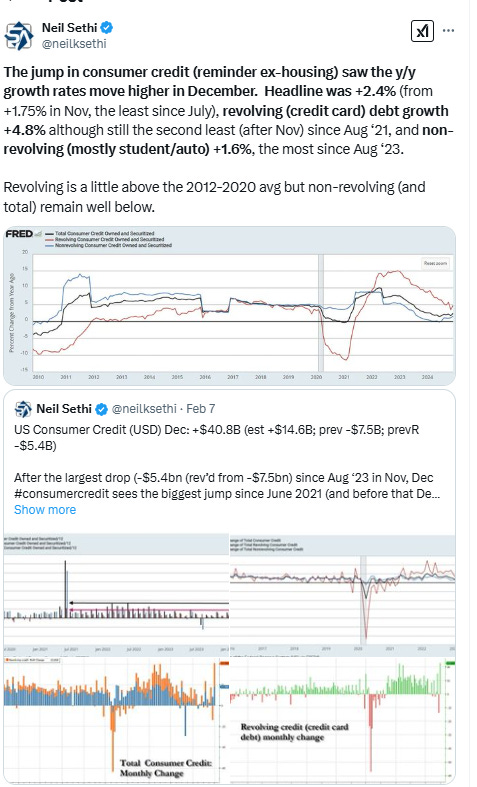

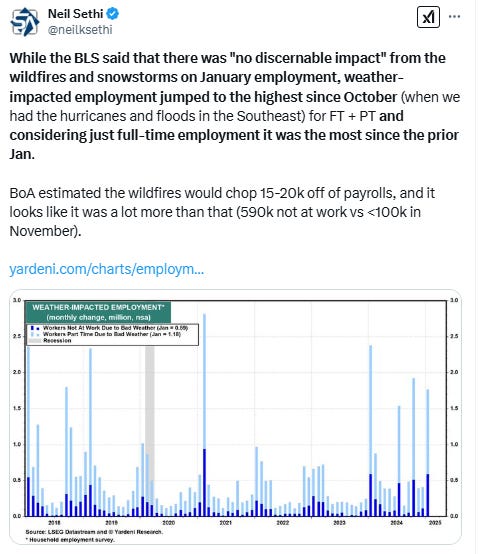

In US economic data:

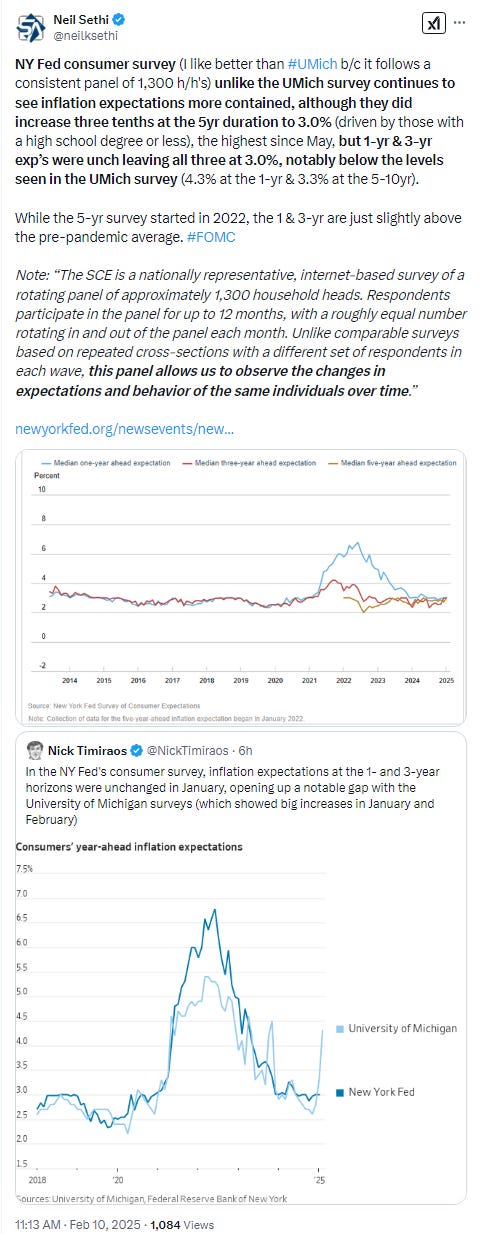

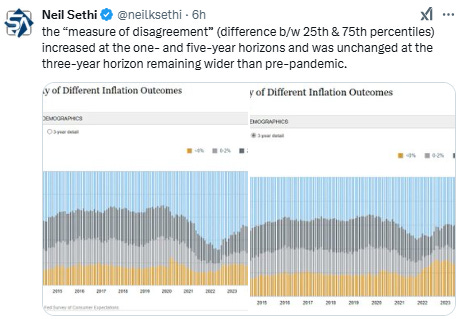

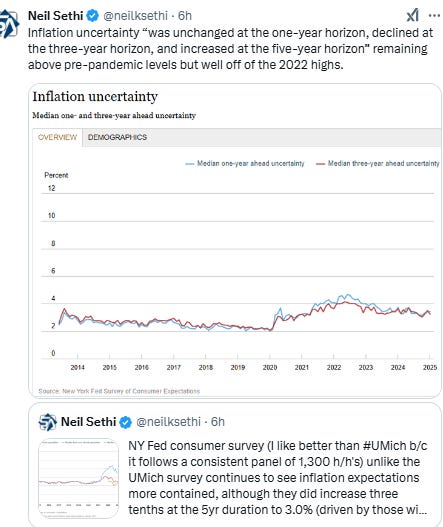

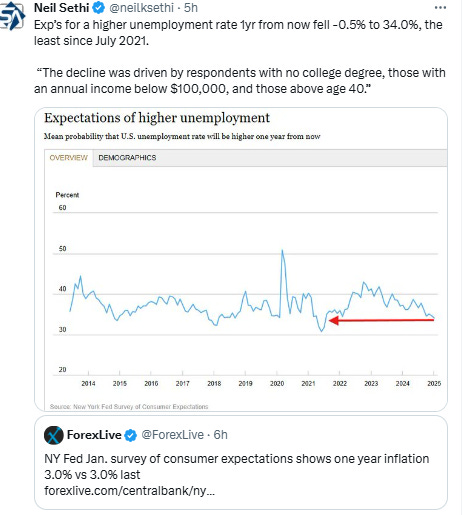

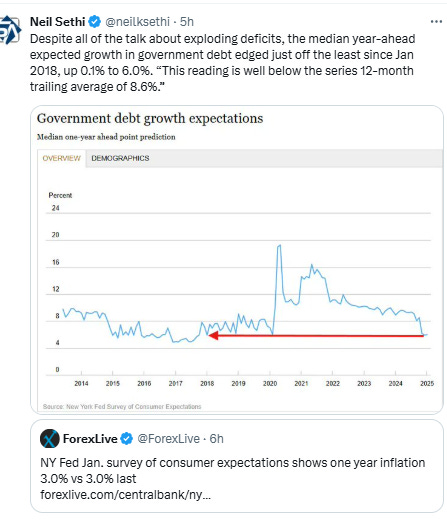

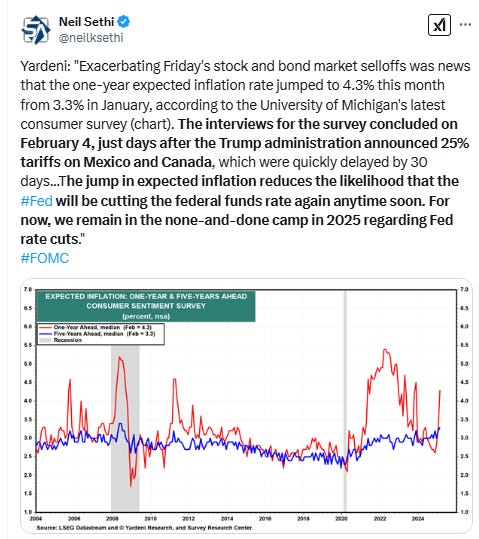

The data calendar was pretty sparse Monday but we did get the NY Fed’s consumer survey, which like the UMich survey has an inflation expectations component. That was much less headline grabbing as it remained little changed just slightly above the pre-pandemic average.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX moved back closer to the downtrend resistance which as I noted Friday is “turning into a more difficult challenge than I had thought, although it might just be coincidence given the newsflow.” The daily MACD and RSI continue to tilt mildly positive.

The Nasdaq Composite back over its 50-DMA but that’s about it. Its daily MACD and RSI are basically neutral.

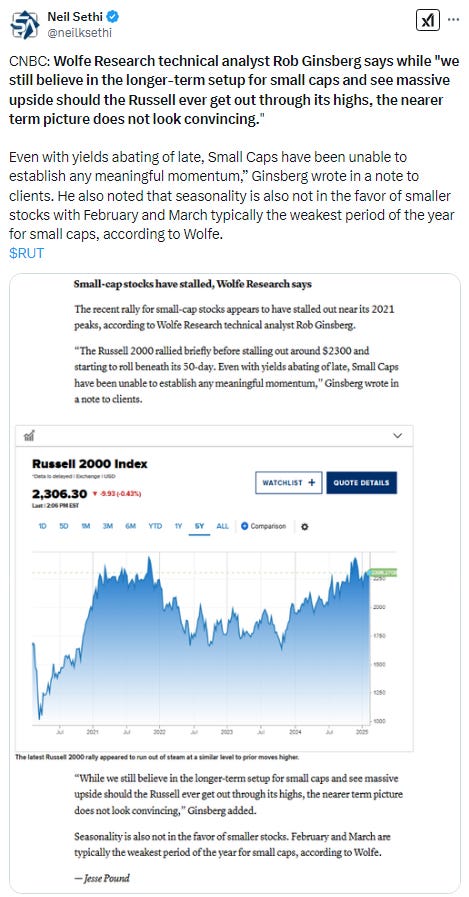

RUT (Russell 2000) remains in the middle of its range over the past few weeks. Its daily MACD and RSI are turning more neutral from positive.

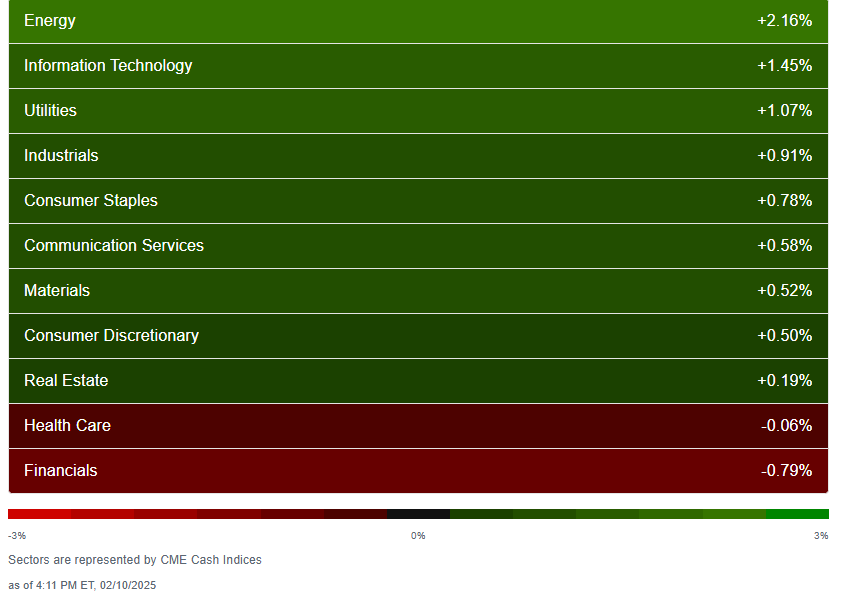

Equity sector breadth from CME Cash Indices big improvement from an ugly Friday where every sector finished in the red and four down more than -1%. Monday just two red sectors and none down that much (worst was financials -0.8%) while 8 sectors finished up a half percent or more, four up +0.9% or more (energy led +2.1%). A good mix of sectors though at the top w/cyclicals, growth, and defensives evenly distributed.

SPX sector flag from Finviz consistent with a lot of green outside of financials and drug manufacturers. Tesla down another -3% (it’s down over -8% over the past week).

Positive volume (percent of total volume that was in advancing stocks) with a notable improvement as would be expected Monday with the NYSE up to 64%, not bad with the NYSE Composite index up just +0.4%. The Nasdaq up to 74% also not bad for a +1.0% day in the index. Positive issues (percent of stocks trading higher for the day) though again weaker, particularly on the Nasdaq, at 59 and 54% respectively.

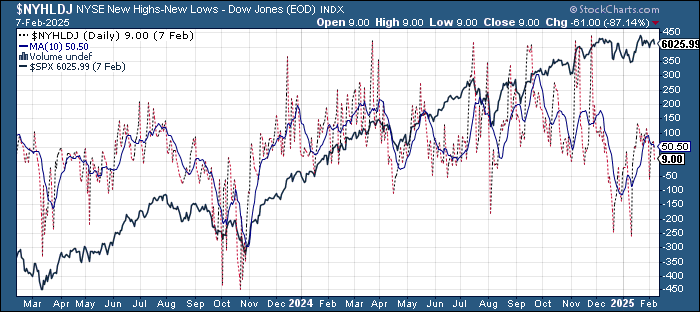

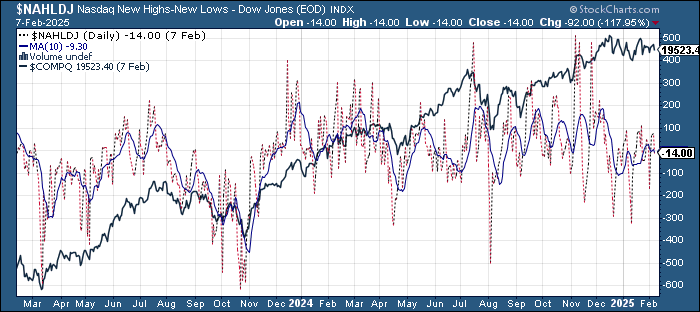

New highs-new lows (charts) didn’t see much improvement also (and the Nasdaq actually deteriorated) with just 16 on the NYSE (up from 9 Friday but down from 70 Thursday) and to -27 from -16 (still though up from -171 Monday) on the Nasdaq. Both also remain below their 10-DMAs and those are now turning back down (more bearish).

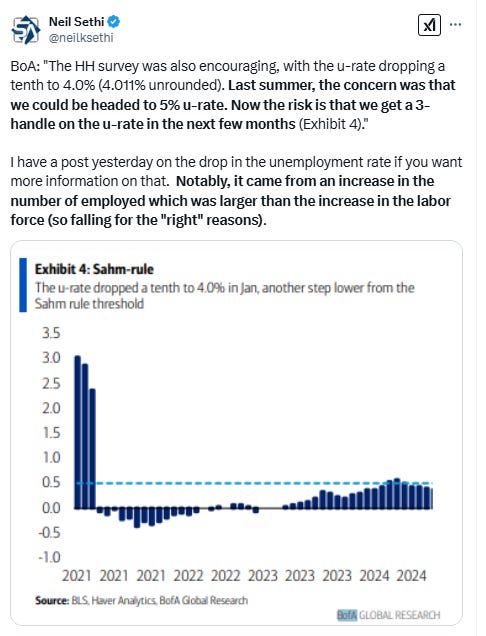

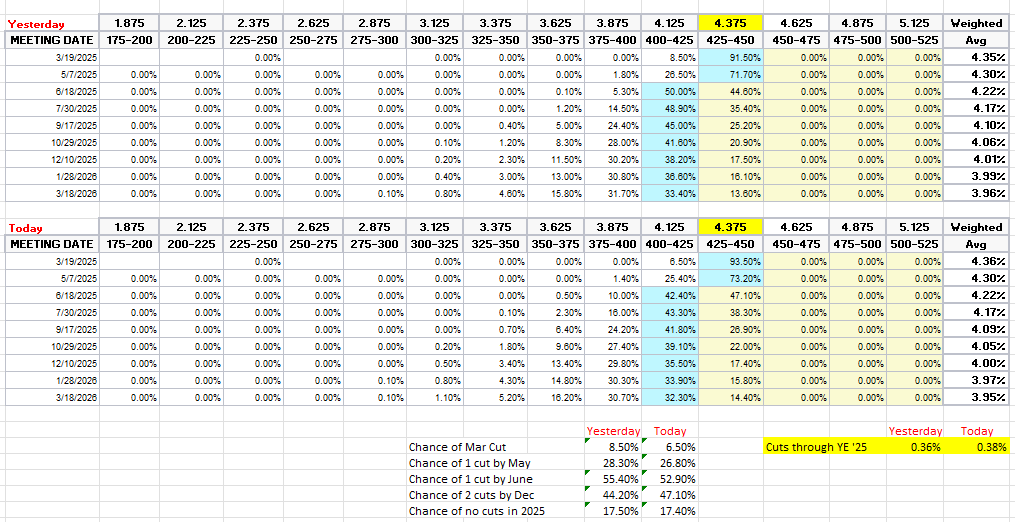

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool were little changed. A cut by March eased down to 7% (now half of the 15% Thursday before NFP and the UMich report), by May down to 26% (from 38% Thursday), and by June to 53% (from 63%). Chance of two 2025 cuts at 47% (from 57%) and no cuts at 17% (from 12%) with 38bps of cuts priced (from 44).

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that, although the tomorrow’s NFP and next week’s CPI could change that.

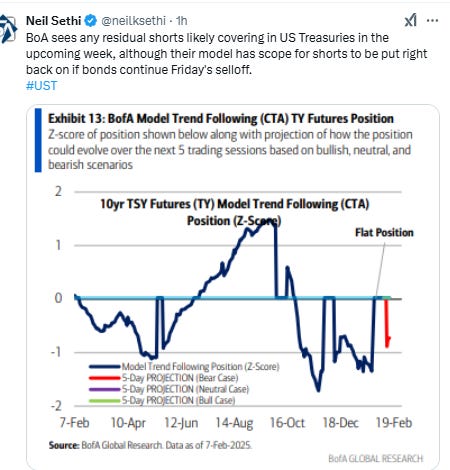

Longer duration #UST yields were little changed with the 10yr remaining at 4.49%, notably still under the 4.50% key resistance.

The 2yr yield, more sensitive to Fed policy, was also little changed edging down a basis point to 4.28% from a two-week high Friday. I still find this level rich, and I’m looking for it continue to soften in coming weeks although the possibility is growing of no further rate cuts which would mean it’s fairly priced right here.

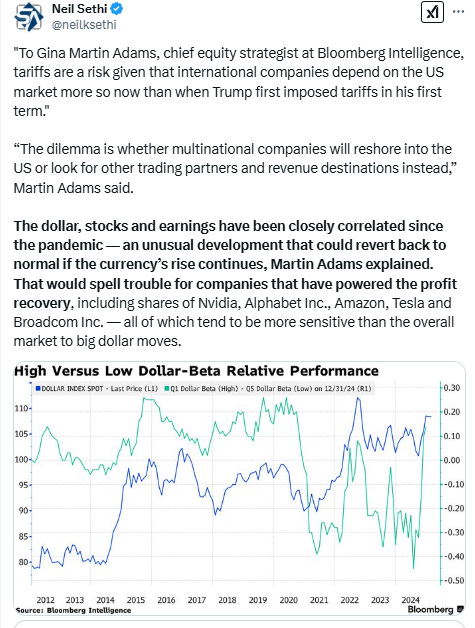

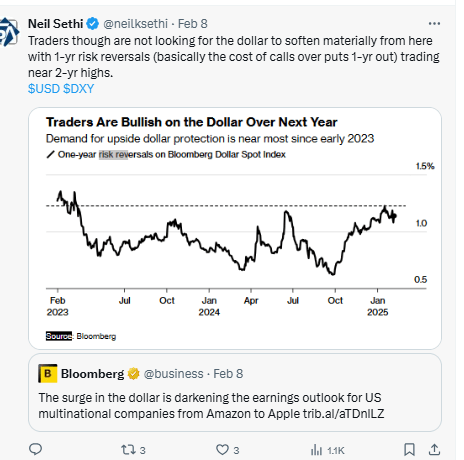

Dollar ($DXY) rose for a third session Monday still for now remaining under last week’s highs. Daily MACD and RSI are neutral and moving to the positive side.

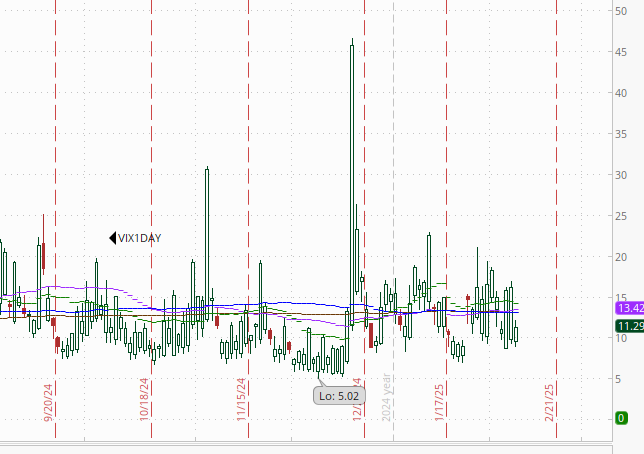

The VIX fell back although remained above the lows of last week at at 15.8 (consistent w/~1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly edged lower to just under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX dropped sharply to the 2nd lowest close since Jan 24th at 11.3, looking for a more modest move of 0.71% Tuesday compared to the 1% it was looking for today.

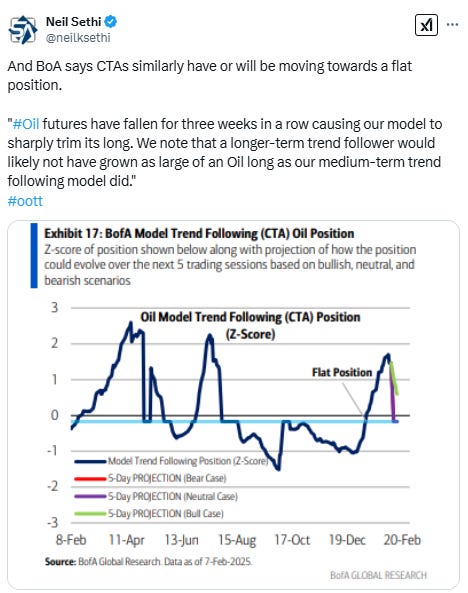

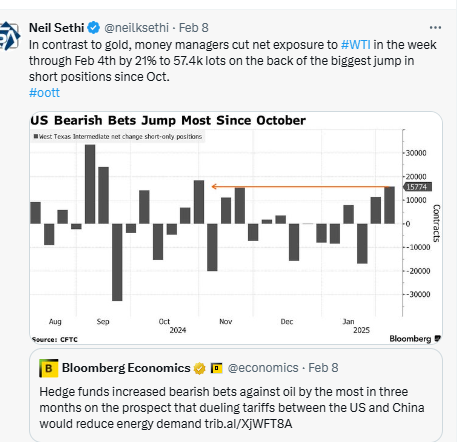

WTI futures got a surprise bounce, up 2% and getting back over that key support $71.70 level. I would have thought we’d be seeing instead a retest of the trendlines in the high 60’s, as I wrote last week. Daily MACD remains unsupportive though, and the RSI has hooked up but remains under 50, so we’ll see if it can keep the rally going and perhaps test that downtrend line from the Sep ‘23 highs again.

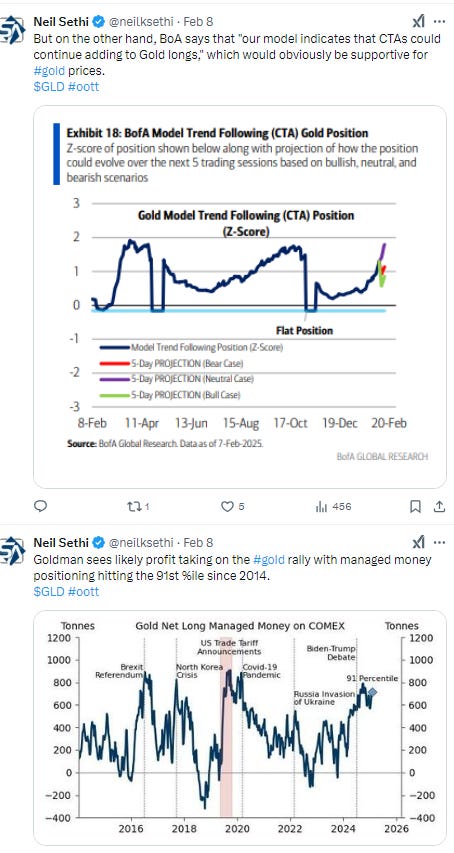

Gold futures made it through $2900 and the technical buyers jumped in pushing it to another all-time closing high (the 12th this yr), up another +1.7%. Daily MACD & RSI remain very supportive, although it’s the most overbought since April.

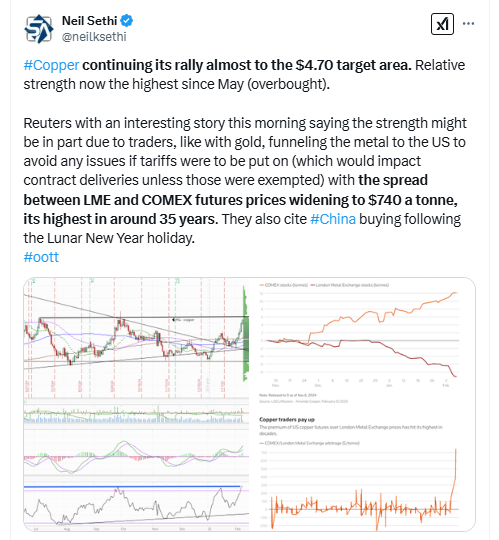

Copper (/HG) was up for a 6th session Friday shooting the past two days right to the $4.70 target, the highest close since May. Daily MACD and RSI are supportive but the latter is now around the levels at the May peak.

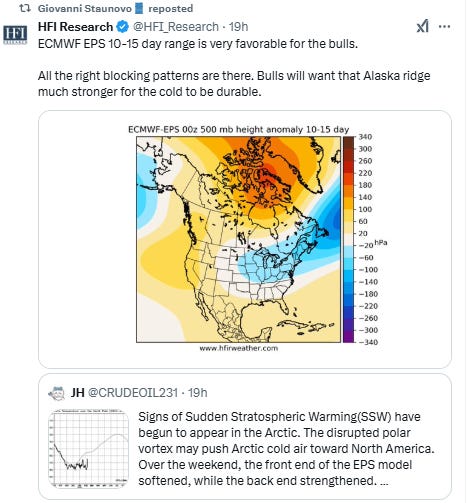

Nat gas futures (/NG) made it up to the $3.50 level, the bottom of a resistance zone which runs to $3.70. Daily MACD remains in “go short” position but is trying to turn up, and the RSI has hooked up but remains under 50 for now.

Bitcoin futures up from the lowest close in 3 wks Friday but now under its uptrend line from the Oct lows. Daily MACD and RSI remain negative with relative strength just off the weakest since Sept.

The Day Ahead

US economic data remains on the lighter side Tuesday with just the NFIB small business survey. We’ll see if their sentiment has fallen back as we’ve seen with consumers. We’ll also get the EIA’s monthly energy report.

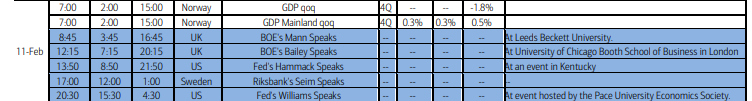

The highlight tomorrow is on the Fed speaker side with Jerome Powell appearing before the Senate Banking Committee at 10am ET. It goes on for several hours (the Senate questions are normally pretty good, much better than the House on Wednesday), but if Powell has anything notable to say, he’ll likely put it up front in his opening statement. We’ll also hear from Cleveland Fed Pres Hammack (the sole December dissenter (but not a voter on the FOMC this year)) and NY Fed President Williams (always notable given his influence (he’s also a permanent FOMC voter)) as well as San Fran Fed Pres Daly & Gov Bowman, both of whom we heard from last week. We'll also get our first non-Bill Treasury auction of the month w/$58bn in 3-yr notes.

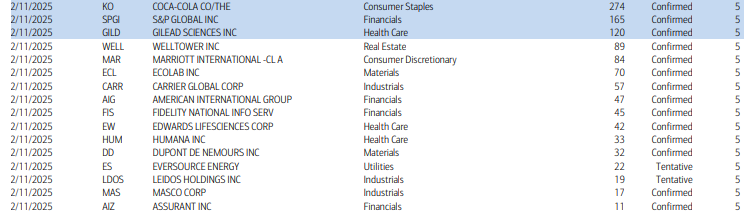

Earnings pick up a bit Tuesday with 16 SPX components, three > $100bn in market cap in Coca-Cola (KO), S&P Global (SPGI), and Gilead Sciences (GILD). We’ll also get non-S&P 500 member Shopify (SHOP) another >$100bn reporter (see the full earnings calendar from Seeking Alpha).

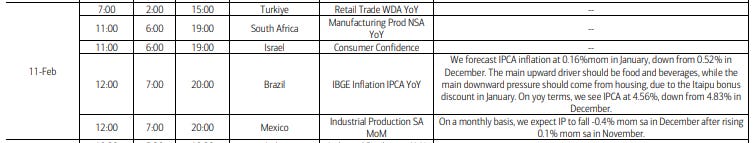

Ex-US a light day with no major economic reports in developed markets, although will be interesting to get comments from BoE member Catherine Mann who went from not voting for a rate cut to dissenting for a 50bps cut last week. In EM we’ll get Brazil CPI and Mexico industrial production among other reports.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

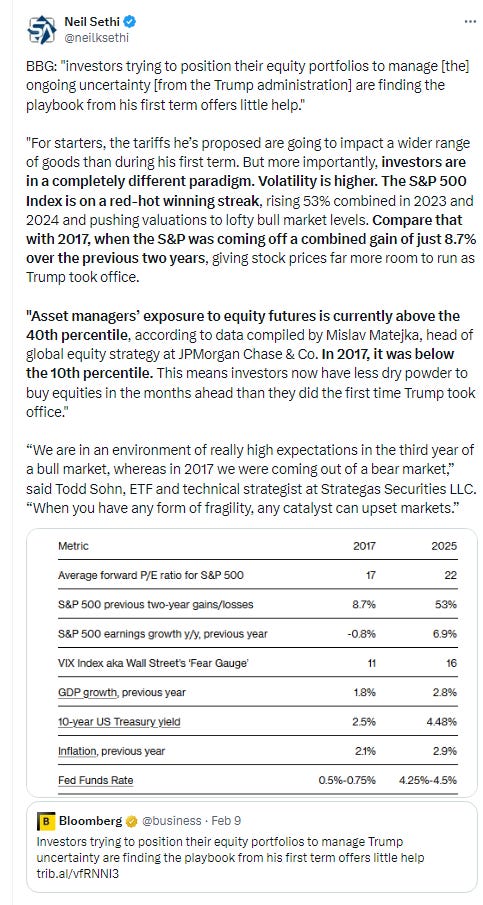

To invite others to check it out,