Markets Update - 2/10/26

Detailed update on US equity and Treasury markets, US economic data, the Fed, select commodities and a look at the upcoming day with lots of charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

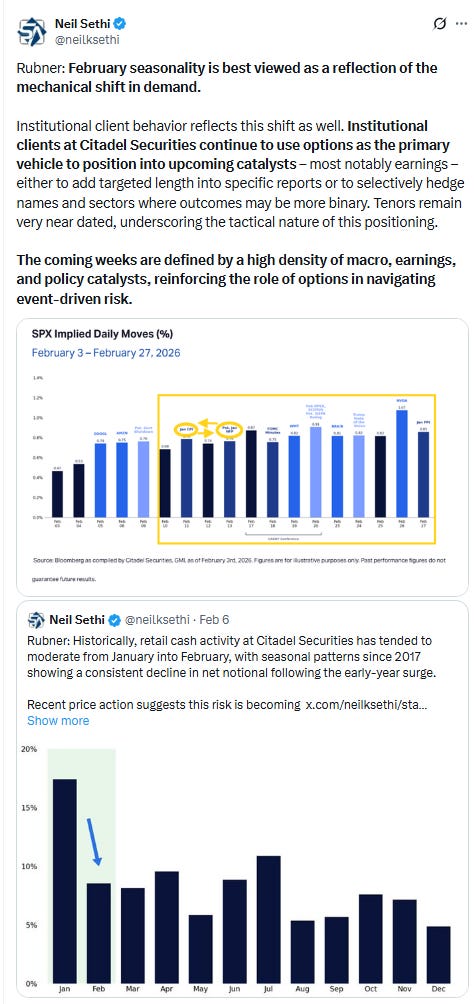

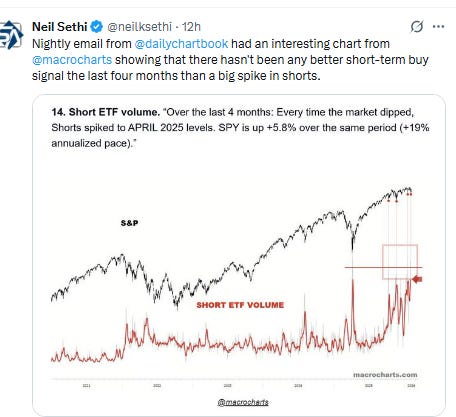

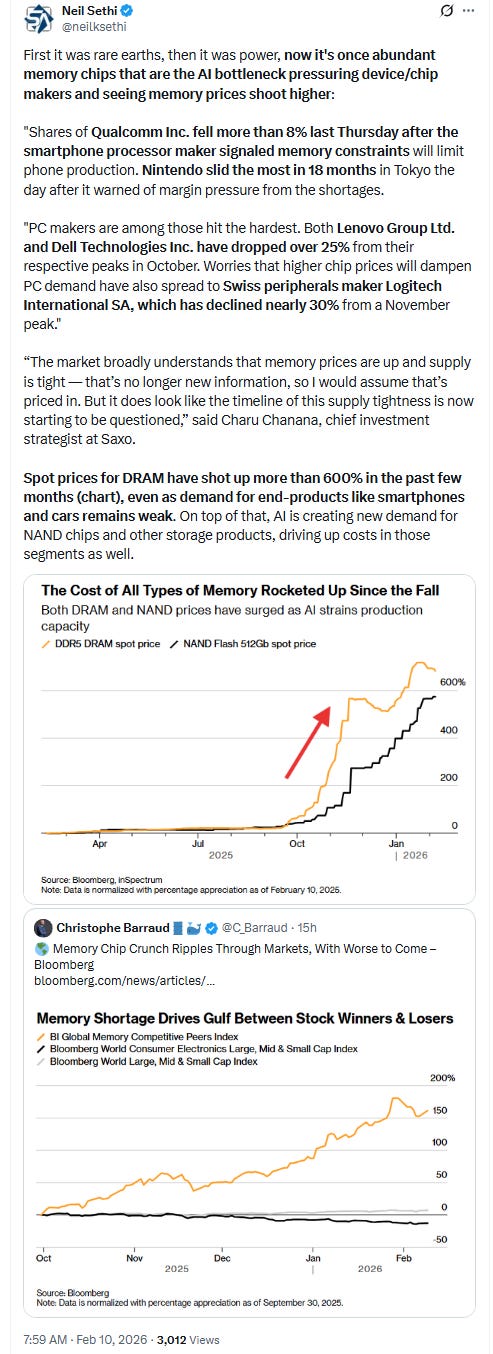

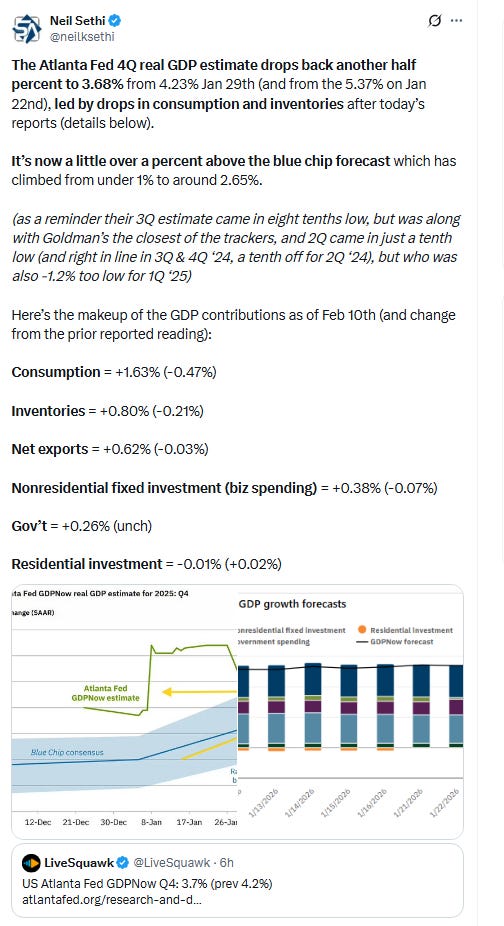

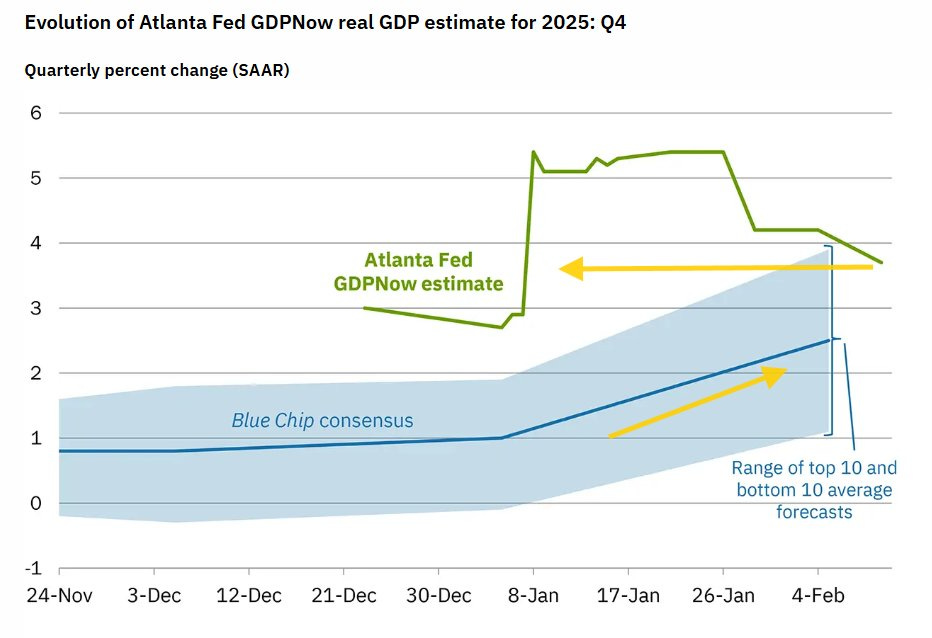

US equity indices opened today’s session little changed, not seeing such movement after a weaker-than-expected December retail sales report which showed headline sales coming in flat vs a +0.4% m/m gain expected while the important control group number (which feeds into GDP) came in at -0.1% (vs the same +0.4% expected gain) and November was revised down two tenths. The weak report resulted in cuts to 4Q GDP estimates and a modest boost to FOMC rate cut expectations and bonds (yields lower.

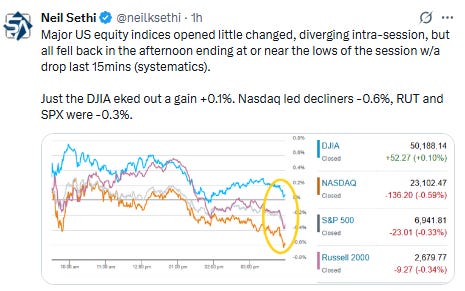

After the muted open, indices diverged intra-session with the DJIA running higher, and after a slow start, the small cap Russell 2000 (RUT) following, but all the indices fell back in the afternoon led by weakness in tech and financial stocks to finish at or near the lows of the session. Just the DJIA eked out a gain +0.1%. Nasdaq led decliners -0.6%, while the RUT and SPX were -0.3% (but the equal-weight SPX was +0.3% to a new record high).

Elsewhere, bond yields were lower, while the dollar was little changed. Also lower were crude, gold, copper, natgas, and bitcoin.

The market-cap weighted S&P 500 (SPX) was -0.3%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite -0.6% (and the top 100 Nasdaq stocks (NDX) -0.6%), the SOXX semiconductor index -0.7%, and the Russell 2000 (RUT) -0.3%.

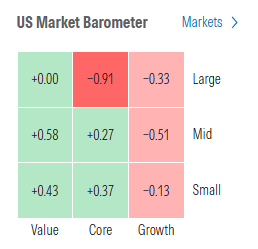

Morningstar style box continued to be mixed this time with growth shares lagging along with large core (perhaps where they house most of the top 11 and financials (more below on them)).

Market commentary:

“We believe markets are in a period of healthy rotation,” noted Anthony Saglimbene, Ameriprise chief market strategist, on Monday. “Investors are rightfully looking for opportunities beyond the AI theme. And a more diverse set of sectors is helping broader averages like the S&P 500 tread water while near- and intermediate-term Tech dynamics play out.” Moreover, the expansion beyond tech is happening at a time when markets are still near highs—not like in the past when stocks were selling off. That’s more indicative of healthy investor interest beyond the usual suspects.

“A prolonged economic expansion, driven by a strong consumer AND a massive investment capex investment cycle would typically encourage a rotation into smaller caps with more leverage and strong fundamental momentum,” writes 22V Research’s Dennis DeBusschere, who thinks investors should be looking toward banks, retail, and cyclical names too. “Today’s backdrop, where mega caps’ capex is expanding at an accelerating pace only encourages that rotation.”

With the equal-weighted S&P 500 index outperforming the regular market-cap-weighted index this year, it’s hard to be “too bearish” about the stock market, said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions. “The rotations you’ve seen are ultimately pretty healthy,” he told MarketWatch.

“We remain in a global bull market, with participation broadening both internationally and within the US – a constructive and healthy development,” said Keith Lerner at Truist Advisory Services. “Bull markets tend to be more durable when leadership expands.” Much of the year-to-date action reflects rotation, Lerner noted. Areas that lagged last year, particularly cyclical and economically sensitive groups, have led as growth expectations have improved, while money rotated out of last year’s biggest winners in technology and AI, he added. “While we are watching closely for any signs of technical deterioration, we continue to see merit in balancing cyclical exposure, including small- and mid-caps, alongside technology,” Lerner said.

Bob Savage, head of markets macro strategy at BNY. “Software companies that adapt toward client-specific solutions and integrate AI as an enabler rather than a replacement should regain investor confidence, particularly outside the U.S., where valuations remain more compelling,” he said. In terms of equity markets overall, Savage believes they’re positioned well for the remainder of 2026, saying that they look capable of navigating a “more complex investment regime defined by diversification, valuation discipline, and geopolitical realities.” While Savage noted that AI will continue to be a “structural growth driver” for the year, investors are shifting their attention “from broad-based enthusiasm toward differentiated business models, capital efficiency, and defensible revenue streams,” he continued.

It has been tough for investors to stomach the volatility in recent weeks, but that doesn’t mean a “rejection of AI as a long-term investment theme,” according to Lauren Goodwin, Economist and Chief Market Strategist at New York Life Investments. “The market is no longer rewarding AI ambition alone – it is demanding evidence of monetization,” Goodwin wrote in Tuesday commentary. What we’ve recently seen was not a rejection of AI as a long-term investment theme, but a shift in what investors are willing to underwrite in the near term, Goodwin said. “Our conviction in the long-term AI investment case remains intact because hyperscalers are funding capex from profitable core franchise – and because demand for AI chips and infrastructure continues to outpace supply,” she said. Despite near-term volatility, Goodwin remains constructive on the broader macro backdrop. A confluence of real-time market indicators suggests cyclical improvement is underway: copper prices have risen sharply, small caps and financials are outperforming, and market breadth is improving - all signals consistent with strengthening growth expectations, she said. The cross-currents facing the economy – AI disruption, restrictive monetary policy, late-cycle labor dynamics, and geopolitical uncertainty – reinforce the need for discipline in portfolio construction, noted Goodwin.

“Upcoming jobs and inflation data represent a critical crossroads for the Fed – and for near-term market sentiment,” she concluded. “Markets are searching for confirmation that growth is slowing just enough to justify further policy easing, but not so much to risk breaking.”

“We don’t think that it’s going to be a clean trade,” Sonali Basak, chief investment strategist at iCapital, told CNBC’s “Closing Bell” on Monday. “It will be choppy, you have to be selective, but there will be winners through this.”

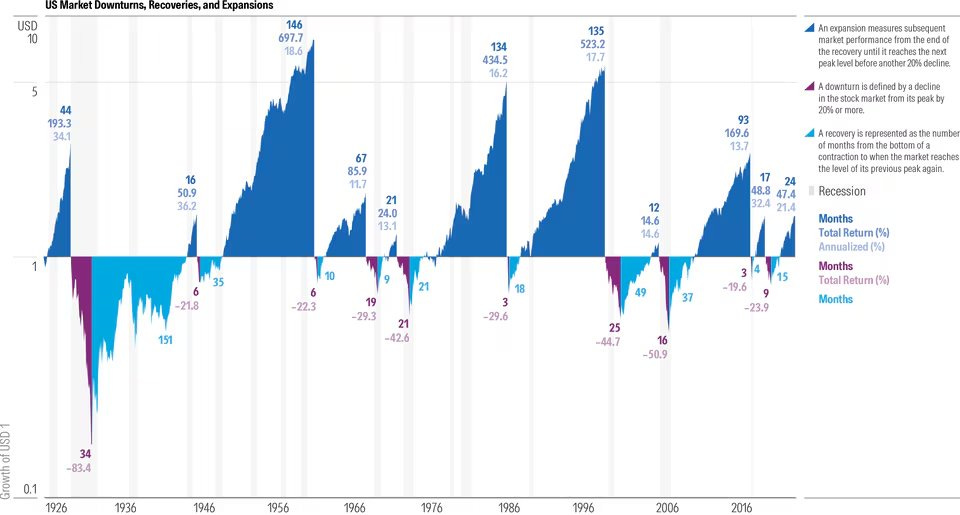

Clark Bellin, investing chief at Bellwether Wealth. “The bull market is not dead, but it is aging,” Bellin said. “We are not be surprised to see investors paying more attention to corporate earnings and profitability.”

“Early in bull markets, expectations are low,” he added. “But as this bull market progresses into its fourth year, expectations for earnings are rising.”

Bellin said he isn’t surprised to see rocky trading this month following January’s gains. He said investors should “remain opportunistic” when stocks dip, but don’t need to feel like they have to buy every pullback. “2026 should still be a positive year, with plenty of opportunities to buy stocks on sale,” he said.

"It feels like we are kind of finding our footing after a lot of technical resetting," said Garrett Melson, portfolio strategist at Natixis Investment Managers Solutions, of the weakness in stocks in afternoon trade.

“A big economic week this week, with CPI and payrolls will test the

stability of bond markets, but we suspect ‘Goldilocks’ will continue for economic data,” notes Raymond James’s Tavis McCourt.Jim Reid, strategist at Deutsche Bank noted Treasury yields have eased after NEC Director Kevin Hassett said Tuesday that markets should expect “slightly lower jobs numbers”, but that this “shouldn’t trigger any panic.”

“While this was more a comment on the general jobs trend amid slowing population growth and rising productivity, it still created some fears over a weaker number for the delayed January jobs report tomorrow,” said Reid.

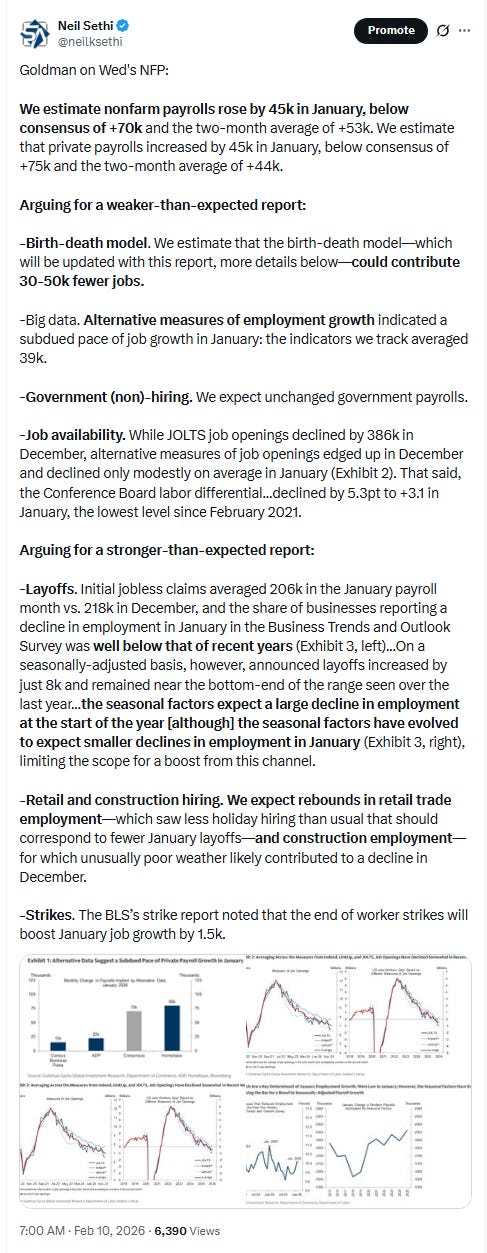

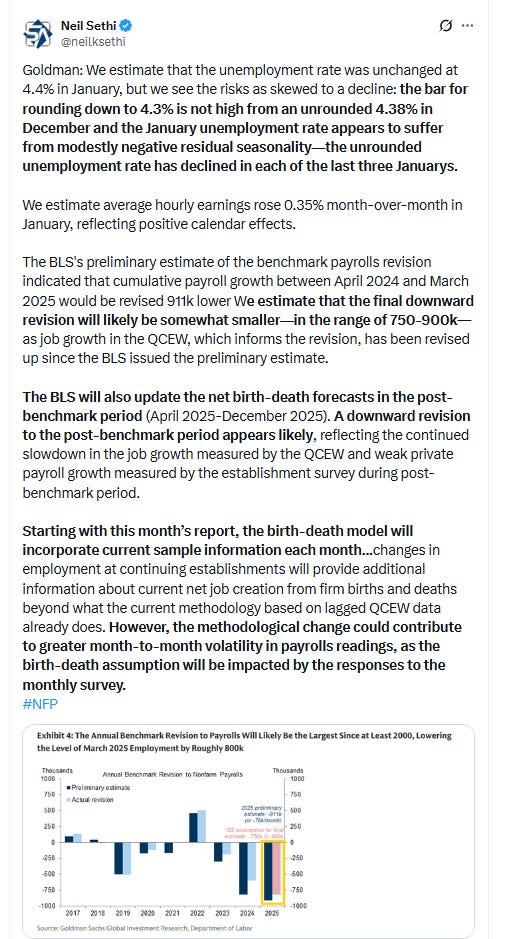

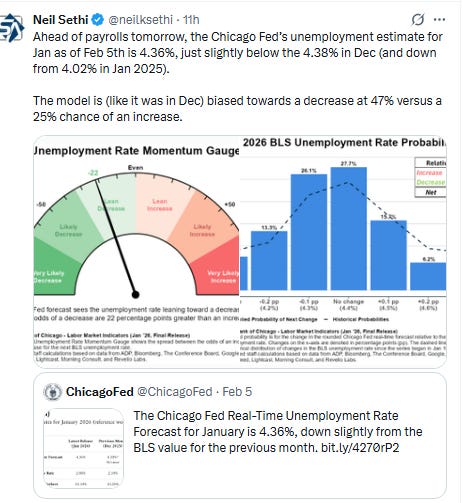

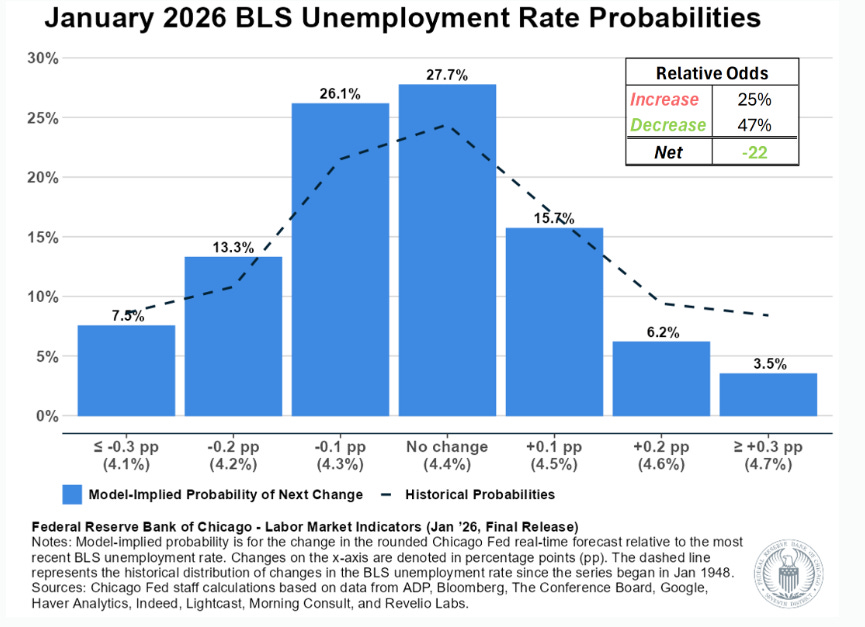

Wednesday’s nonfarm-payrolls report for January is one of the highlights of this week for investors. But anecdotal information gathered for the report is skewing “softer,” according to BMO Capital Markets strategist Vail Hartman.

In a note, Hartman wrote that “there’s been a building sense of apprehension” that the January jobs numbers could underwhelm. He said this is the case even though consensus expectations are consistent with a “status quo” payrolls report that produces a gain of roughly 68,000 jobs, a 4.4% unemployment rate and a 0.3% increase in average hourly earnings. The median estimate of economists polled by the Wall Street Journal is for a gain of 55,000 jobs.

“The other component of a stretched lower- and middle-income consumer right now is how they feel about the job environment, and we know that they’re a little bit more uncertain,” Anthony Saglimbene, Ameriprise Financial’s chief market strategist, told CNBC. “If we do see weaker-than-expected job growth in January, that could kind of strain this broadening theme a little bit.”

“There seems to be a rotation into other areas that may be more insulated from that AI trade,” Saglimbene added, noting recent gains in sectors such as materials and utilities.“I think the narrative over the last week has been a little bit too broad,” David Solomon said Tuesday at a UBS Group AG conference in Key Biscayne, Florida. “There’ll be winners and losers — plenty of companies will pivot and do just fine.”

“The retail-sales report was a little light, but not terrible, so there was a little bit of ‘bad news is good news’ because there’s more confidence that the Fed can cut rates this year,” said Tom Hainlin, a Minneapolis-based national investment strategist at U.S. Bank Asset Management Group. In addition, “fourth-quarter earnings are coming in pretty good,” Hainlin said in a phone interview. “The Dow is benefiting from a rotation into industrials, financials and materials involved in building the physical part of the economy related to AI infrastructure. And the Dow doesn’t have the same sensitivity to AI disruptions” like the one recently seen in the software sector.

“It appears that there was less momentum behind the consumer in the final months of 2025 than previously assumed — a less encouraging departure point for growth estimates in 2026,” said Vail Hartman at BMO Capital Markets.

This report “isn’t a disaster,” but it isn’t a constructive signal either, especially with lingering labor-market concerns and continued volatility across several asset classes, according to Bret Kenwell at eToro. “Tomorrow’s jobs report will be key,” Kenwell said. “A weak print could push sentiment further toward risk-off if growth worries start to build, but a solid print may ease some of those concerns.”

“Consumer spending has finally caught up with consumer sentiment, and not in a good way,” said Chris Zaccarelli at Northlight Asset Management.

For months, consumers have been complaining about the cost of everything – and yet they kept spending, he said. However, the latest data show that consumers are no longer relentlessly doing that, he noted. “To the extent that the labor market holds up and consumers see more cash in their pockets from all of the pro-cyclical measures, then the economy can keep growing,” Zaccarelli said. “But if this is a more permanent change in spending patterns then it could be the canary in the coalmine that signals a more serious slowdown.”

The weaker-than-expected retail sales data for December won’t be enough to spoil the fourth quarter, according to Thomas Ryan at Capital Economics.

“But together with the likely weakness of spending in January amid extreme winter weather in most of the country, it leaves consumption growth on track to slow sharply this quarter,” he said.

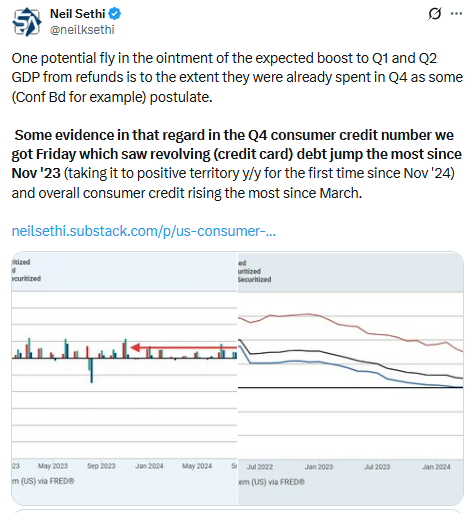

Looming tax refunds and windfall gains in the stock market could rekindle retail sales and other consumer spending in coming months, according to Gary Schlossberg at Wells Fargo Investment Institute.

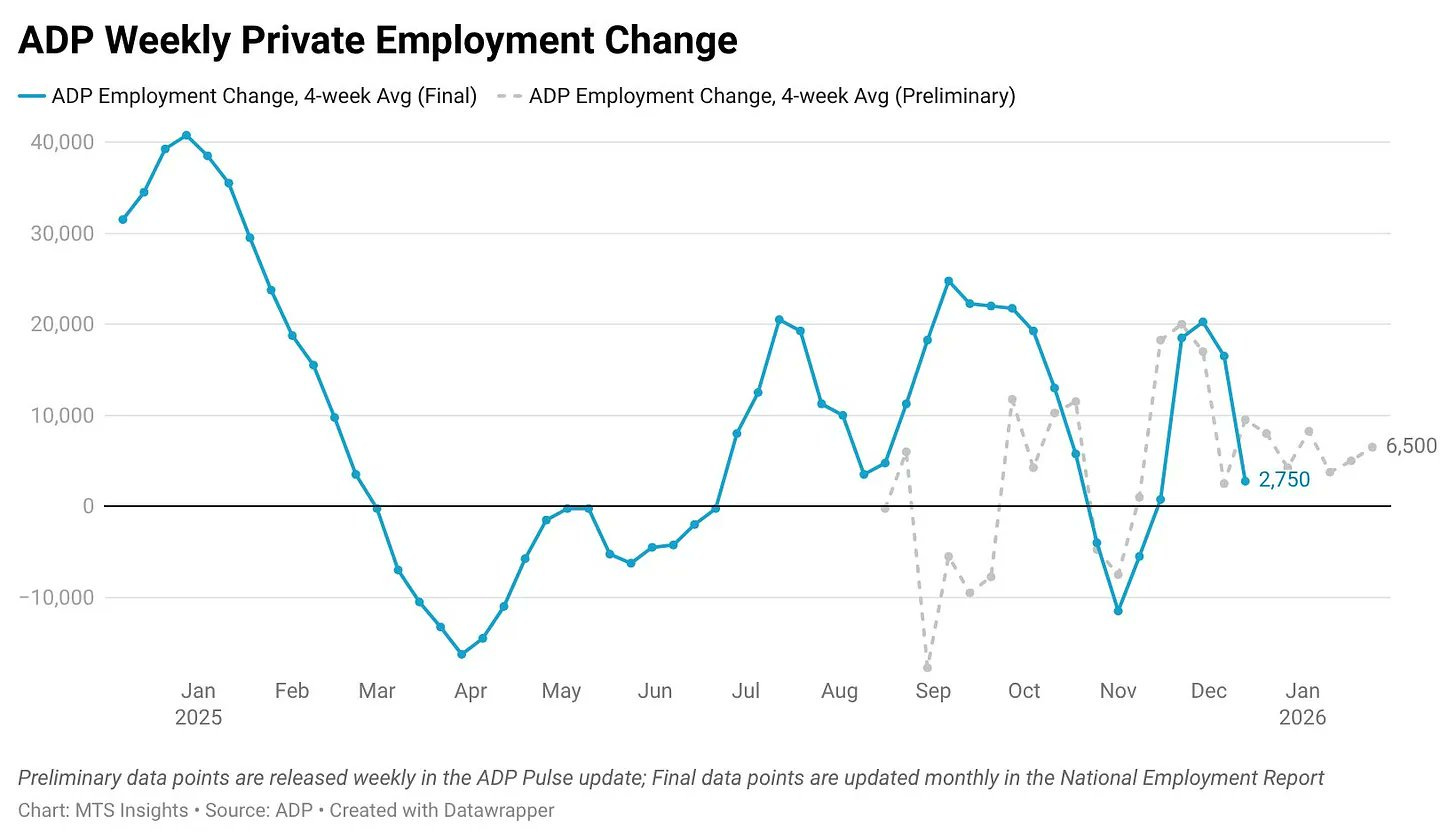

“Given the context of the jobs report — which includes weak ADP numbers, a very weak job-openings report last week and a spike in initial jobless claims — we have a labor market that has gone beyond normalizing to showing signs of being outright weak,” said Tom Bruce, a macro investment strategist at Tanglewood Total Wealth Management in Houston. If Wednesday’s nonfarm payrolls report comes in weaker than many expect, this could have an outsized impact on the market, Bruce said in a phone interview. One big reason is that Federal Reserve officials are unlikely to be in any urgency to respond, he said. Cleveland Fed President Beth Hammack seemed to confirmed this on Tuesday, when she said interest rates could be on hold for “quite some time.”

“While it’s not yet time for the victory parade, it does look like the finish line on the Fed’s inflation fight is in sight,” said BeiChen Lin, senior investment strategist at Russell Investments, in an email. “Balanced labor markets have helped put a lid on services inflation, and by the second half of this year, the inflationary impulse from tariffs should fade away.”

“We expect a further two rate cuts of 25 basis points from the Federal Reserve this year,” said Mark Haefele at UBS Global Wealth Management. “Solid economic growth, in part supported by productivity gains, is supporting corporate earnings.” He maintains his June 2026 and December 2026 S&P 500 price targets of 7,300 and 7,700. The gauge closed at 6,941.81 on Tuesday. Still, UBS Global Wealth Management downgraded the tech sector to neutral, citing a likely deceleration in hyperscaler capex growth, the fact that hardware valuations look full and that uncertainty could linger around software names.

“We recommend that investors maintain strategic exposure to broad technology, AI, and the US market as a whole,” Haefele said. “Moving the US IT sector to neutral is also not a negative view on technology as a whole, and it is important to recognize that there is more to the AI opportunity than this sector.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

Financial stocks also took a hit Tuesday after tech platform Altruist launched a new AI-powered tax planning tool. Shares of LPL Financial declined 8.3%, while shares of Charles Schwab dropped 7.4% and Morgan Stanley dipped more than 2%.

Also under pressure Tuesday were shares of retailers Costco and Walmart, which fell more than 2% and more than 1%, respectively after the weak retail sales report.

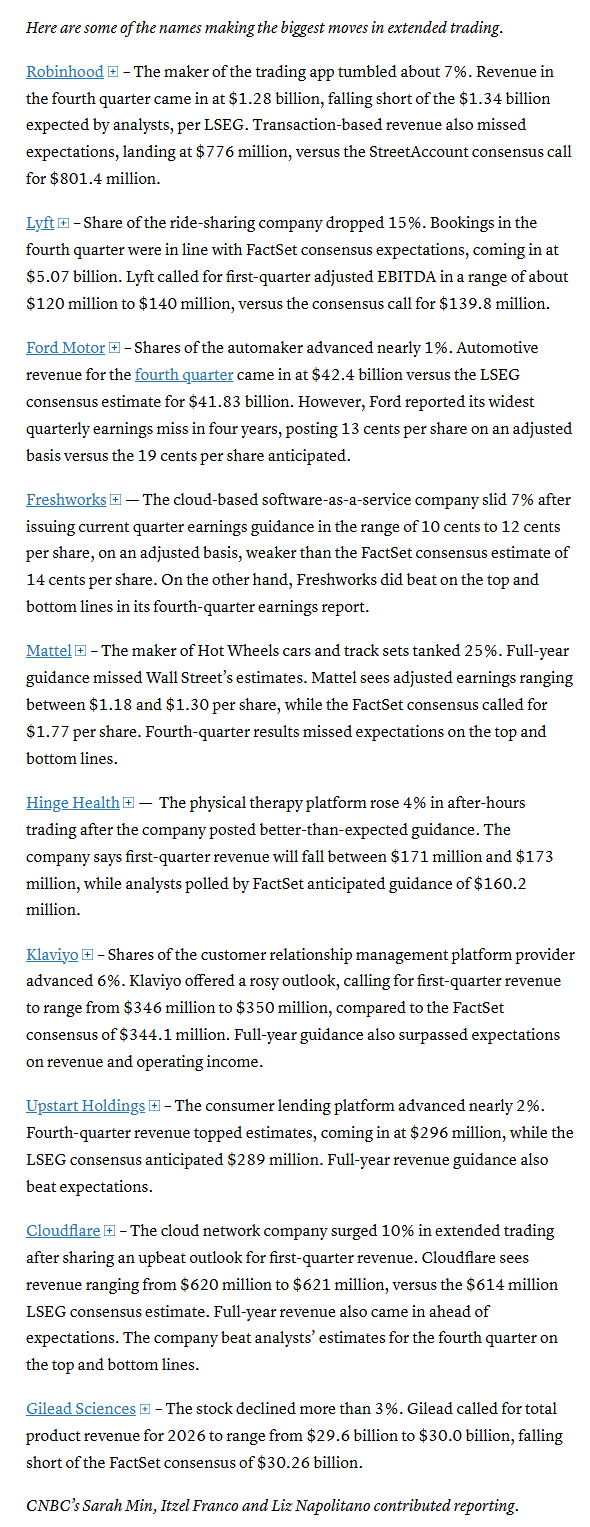

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Alphabet Inc. raised almost $32 billion in debt in less than 24 hours, showing the enormous funding needs of tech giants competing to build out their artificial intelligence capabilities — and the huge appetite from credit markets to fund them.

Blackstone Inc. is increasing its investment in artificial intelligence firm Anthropic PBC, elevating its stake to roughly $1 billion at the startup’s current valuation, according to people familiar with the matter.

Tesla Inc. tapped a leader of its European operations to oversee electric-vehicle sales globally in the latest leadership change at the company’s struggling automotive business.

Apple Inc. and Alphabet Inc.’s Google committed to making app stores changes to ensure fairness to developers and consumers, the UK’s antitrust watchdog said announcing the first assurances from Big Tech firms under the country’s digital market rules.

Instagram owner Meta Platforms Inc. has paid for thousands of television commercials to promote its safety work with teens ahead of a landmark jury trial that will examine whether the company builds products deliberately to get kids addicted to social media.

Ford Motor Co. expects profit to jump in 2026 after being saddled with a surprise tariff bill at the end of last year.

Gilead Sciences Inc. forecast 2026 product revenue and profit that missed analysts’ expectations, even after it outperformed during last year’s fourth quarter.

Lyft Inc. posted a surprise $185 million operating loss in the fourth quarter and issued a disappointing earnings forecast for the start of the year, a sign that its global expansion and new product offerings may weigh on profits in the short term.

Robinhood Markets Inc. reported lower fourth-quarter profit as sharp declines in Bitcoin and other cryptocurrencies weighed on results at the online brokerage.

American International Group Inc. reported fourth-quarter profit that beat analysts’ expectations, driven by a boost in underwriting income and on the heels of key partnerships and acquisitions the insurer expects to boost earnings in 2026.

Walt Disney Co. priced $4 billion of bonds, its first sale since 2020, as the company joined a record rush of activity as companies lock in lower borrowing premiums.

Electronic Arts Inc.’s bonds plunged as the prospective buyers of the videogame maker launched a buyback offer that tied the notes’ prices to US Treasuries.

Paramount Skydance Corp. made enhancements to its hostile offer for Warner Bros. Discovery Inc., addressing some of the company’s concerns in an effort to thwart a rival deal with Netflix Inc.

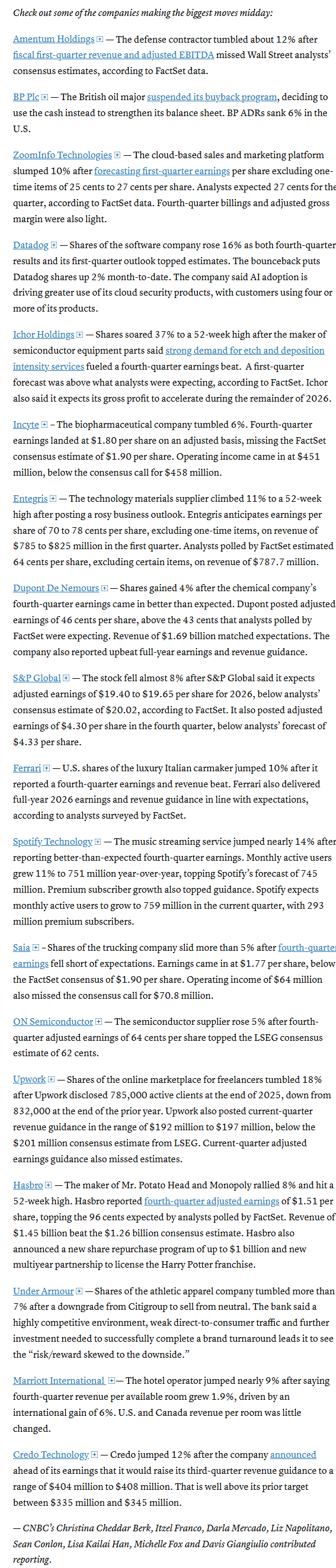

Spotify Technology SA jumped after the Swedish music streaming giant added a record number of users last quarter, far surpassing analysts’ expectations.

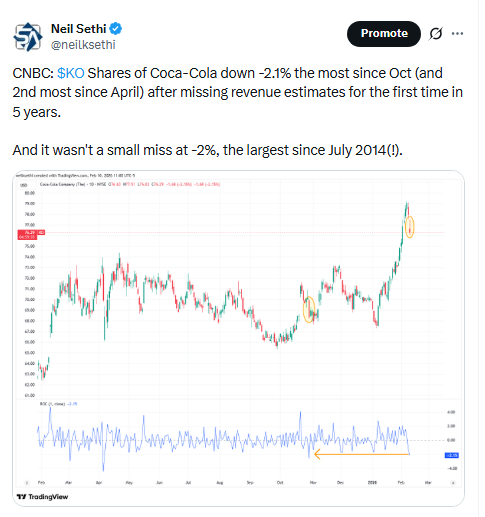

Coca-Cola Co. offered a more conservative 2026 full-year sales outlook than expected, as the soda company works to boost its sales overseas.

Coca-Cola will retain full ownership of Costa Coffee, but it’s reviewing the unit’s challenged business in China, the company’s chief financial officer said.

McDonald’s Corp. named Ford Motor Co. Chief Executive Officer Jim Farley to its board of directors, bringing one of the auto industry’s most outspoken executives to the burger chain that typically tries to stay out of the fray on hot-button issues.

Harley-Davidson Inc. shares recovered after executives forecast retail sales would be flat to slightly higher this year after a sharp, unexpected drop in fourth-quarter bike shipments sparked a rout in the stock.

CVS Health Corp. disappointed Wall Street by reiterating its profit guidance for 2026, a move analysts are calling a letdown after a strong fourth-quarter performance.

Under Armour Inc. was downgraded to sell from neutral at by Citigroup Inc., which cited caution on the NAM brand turnaround, including “a highly competitive environment” and weak direct-to-consumer traffic.

FTX co-founder Sam Bankman-Fried filed a long-shot request for a new trial on the charges for which he’s currently serving a 25-year prison sentence, arguing that new witnesses can refute the prosecution’s case that he defrauded the cryptocurrency exchange’s customers.

Saks Global Enterprises said it’s closing more than 10% of its full-price stores across the US as part of its efforts to emerge from bankruptcy as a smaller and more profitable department-store operator.

QVC Group Inc. is negotiating a voluntary debt restructuring agreement with its creditors that could be implemented as part of a Chapter 11 bankruptcy process, as the television shopping network grapples with viewer declines and a heavy debt burden.

S&P Global Inc., a company that rates bonds and sells market data, slumped after reporting a 2026 profit forecast that fell short of analyst expectations.

Mid-day movers from CNBC:

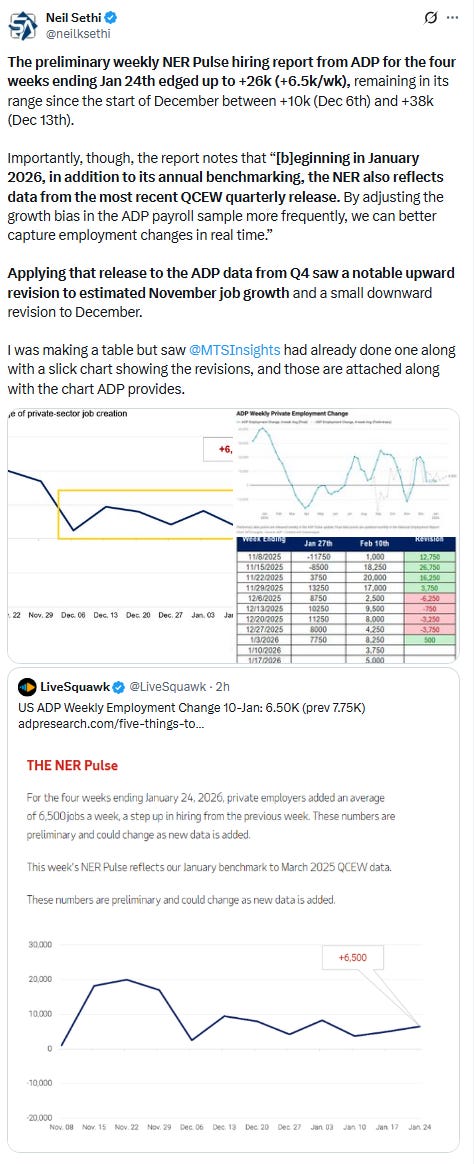

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X