Markets Update - 2/11/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

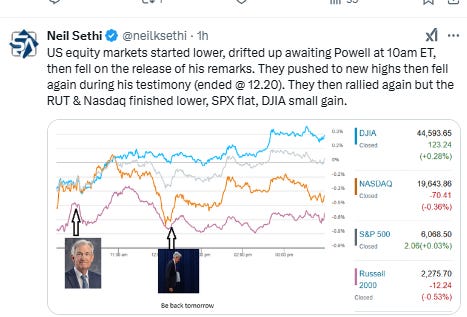

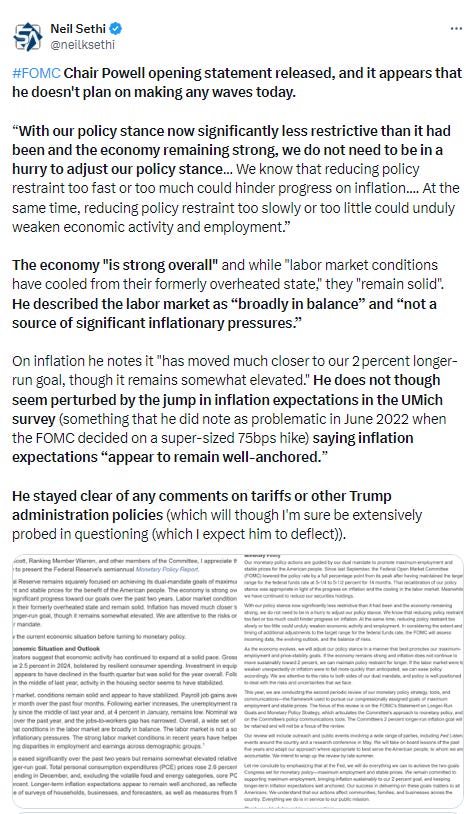

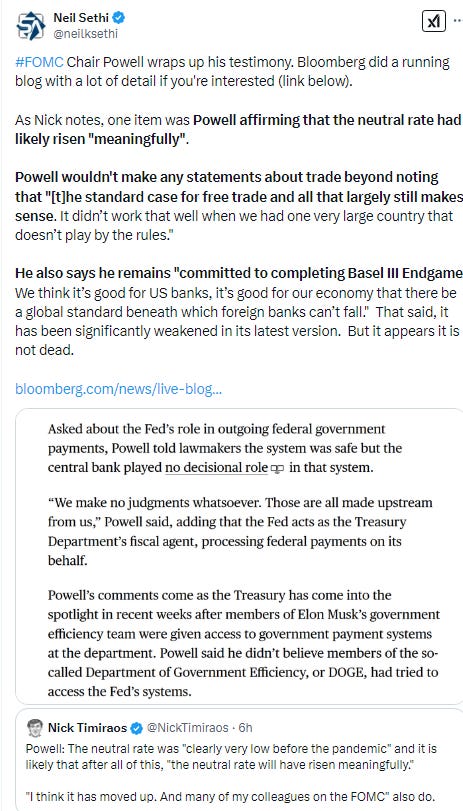

US equities started the day off modestly lower as they awaited testimony from Fed Chair Powell and updates on the stream of actions from the Trump administration. They drifted higher after the open, fell on the release of Powell’s prepared remarks at 10am ET (which emphasized the Fed did “not need to be in a hurry” to change rates with the economy and labor market “strong” and “solid”), moved up then down during his testimony, finally making some gains when he finished a little after noon but ending the day with either just modestly to the upside (SPX and DJIA) or down for the day (Nasdaq and Russell 2000).

Elsewhere, bond yields edged higher as FOMC rate cut bets were pared further following Powell’s remarks, but the dollar fell back as did gold, copper, and bitcoin. Crude and nat gas were higher.

The market-cap weighted S&P 500 (SPX) was +0.1%, the equal weighted S&P 500 index (SPXEW) unch, Nasdaq Composite +1.0% (and the top 100 Nasdaq stocks (NDX) +1.2%), the SOX semiconductor index +1.5%, and the Russell 2000 (RUT) +0.4%.

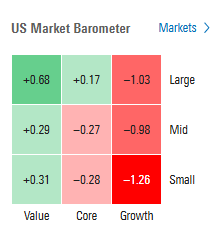

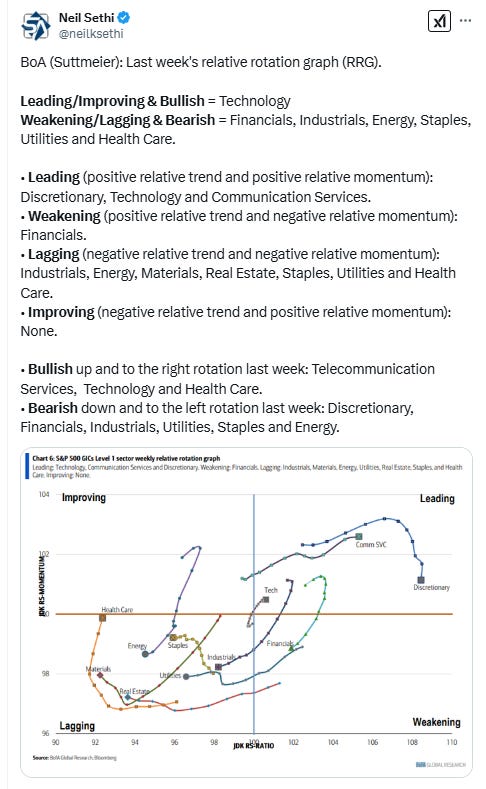

Morningstar style box showed a clear underperformance of growth today.

Market commentary:

"The trading environment in recent weeks has been wildly interesting, with no easy days, as the markets lunge from headline to headline. Specific to US equities, the fact is this: we have traded these same levels in S&P over and over again during the past three months; as a colleague put it, ‘we’re running hard to stand still.’ The moral of the story so far: markets are jigsaw puzzles, and the current assembly is more difficult than it had been.” - Tony Pasquarelli , JPM

"Last week, hedge funds and retail investors bought more stocks than any time in the past couple years, yet the SPX and NDX were flat. We believe this significant buying was offset by macro investor selling through the futures/swaps/options channels; we believe these professional investors focused on long-term asset allocation have been net sellers since mid-December as they focus on the change in interest rate environment." - Goldman

To Krishna Guha at Evercore, the Fed is taking an “extended time-out on rates,” but remains oriented towards lowering borrowing costs further if and when there is further sustained inflation progress.

“The stock market has been stuck in a sideways range,” said Matt Maley at Miller Tabak. “Despite the narrative on Wall Street, the market is not broadening out to the degree that some people are trying to portray. So, until we break out of this range, investors will want to remain nimble.”

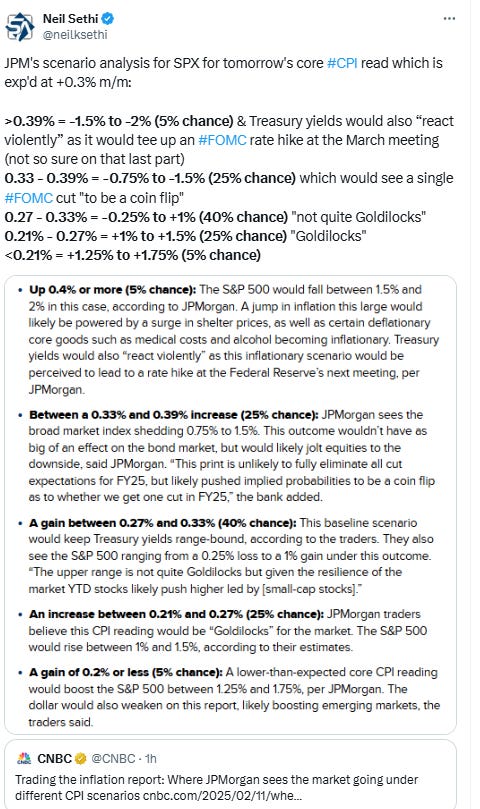

“The CPI data will be the most important this week,” said Viktor Hjort, global head of credit and equity derivatives strategy at BNP Paribas. “The risks are asymmetric; if inflation were to go higher, that’s worse for credit markets than the upside if inflation were to move lower.”

“Recent inflation prints, coupled with a strong jobs market will allow patience from the Federal Reserve who will likely hold policy at its target range of 4.25%-4.50% in March,” said Josh Hirt at Vanguard.

“I really think that the market is treading water, listening to Powell and waiting to see what tomorrow’s CPI will bring,” said Sam Stovall, CFRA Research chief investment strategist. “I’m of the belief that investors are really going to push prices higher based on earnings growth, not expecting P/E multiple expansion.”

“The only concern regarding earnings could be that some of this quarter’s enthusiasm was the result of something being taken from next quarter’s estimates,” Stovall added. “The question we’re going to have to see in the months ahead is, did we indeed see an acceleration of ordering ahead of the expected Trump tariffs, and that gave an artificial boost to the appearance of an improving economy?”

“The best approach in terms of asset allocation is to find assets that can protect you,” said Christian Mueller-Glissmann, head of asset allocation research for Goldman Sachs, on Bloomberg Television. “The big challenge is that this is going to be much more difficult from here because the tariffs are very specific.”

"Not only is it difficult to estimate the true impact of the new tariffs already announced, but it is even more challenging to project the fallout from what additional levies might be coming in the near-term," wrote Ian Lyngen, head of U.S. rates strategy at BMO.

“With the labor market remaining strong and inflation still slightly above the Fed’s target, it’s not surprising that traders are pushing out prospects of another interest rate cut from the Fed toward the middle of the year,” said Matthew Weller at Forex.com and City Index.

Weller bets the volatility around this week’s inflation reading may be more limited than in the past, as the Fed will, in all likelihood, still get another handful of inflation and jobs reports before making any additional changes to interest rates.

“That said, a pickup in price pressures could lead traders to start asking whether the Fed’s interest rate cutting cycle may be completed already, complicating the path forward for a central bank that has clearly been hinting that the easing cycle isn’t done yet,” he noted.

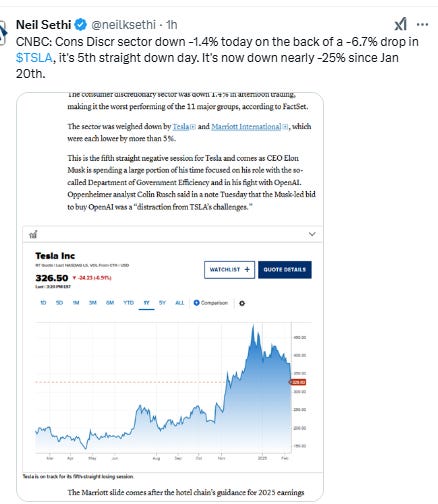

In individual stock action, many big techs dropped, though Meta Platforms Inc. climbed for a 17th consecutive day. Intel Corp. and GlobalFoundries Inc. surged as Vice President JD Vance said the US will make sure the most sophisticated artificial-intelligence hardware is made domestically. Apple gained 2.2% after The Information reported that the company is partnering with Alibaba to develop artificial intelligence features for iPhone users in China, curbing the market’s losses. NVIDIA (NVDA 132.80, -0.77, -0.6%) was a notable standout in the mega cap space, trading up as much as 0.7% at its high and and down as much as 1.9% at its low. Tesla fell for a fifth session now down nearly -25% since Jan 20th.

BBG Corporate Highlights:

Charles Schwab Corp. is expanding overnight trading to all of its retail clients as it seeks to capture demand from investors piling into US stocks amid elevated prices.

Lyft Inc. issued a disappointing first-quarter gross bookings outlook, following a similarly muted forecast from rival Uber Technologies Inc. citing impact from the extreme winter weather and LA wildfires.

DoorDash Inc., the largest food delivery service in the US, issued a disappointing profit outlook for the current quarter, noting “significant” investments in new types of deliveries and overseas markets.

Gilead Sciences Inc. sees 2025 earnings rising faster than Wall Street expected after a big fourth-quarter beat highlighted continued demand for its top-selling HIV medicines.

Boeing Co. delivered more jets in a month than Airbus SE for the first time in almost two years as the planemaker begins to recover from a lengthy strike and years of turmoil.

Coca-Cola Co.’s profit beat Wall Street expectations as shoppers paid higher prices for the company’s sodas, energy drinks and juices.

Shopify Inc. reported quarterly revenue that exceeded expectations, suggesting its e-commerce software solutions stood out with merchants during the busy holiday quarter.

Humana Inc. will cut membership in its Medicare Advantage plans, its biggest business, while spending to improve government quality ratings that have hurt revenue from the program.

Travelers Cos. said it expects about $1.7 billion of pretax losses from the wildfires that devastated Los Angeles last month.

DuPont de Nemours Inc.’s earnings jumped on growth in the electronics market, suggesting the conglomerate’s push to cut costs and break up into smaller, more focused businesses is paying off.

S&P Global Inc. reported fourth-quarter earnings that beat estimates as strong issuance of corporate debt bolstered the firm’s ratings business.

WK Kellogg Co. posted fourth-quarter profit that topped Wall Street’s expectations, even as the cereal maker called out challenges weighing on sales.

Marriott International Inc.’s guidance for net rooms growth in 2025 proved softer than some analysts expected.

Elliott Investment Management disclosed a more than $2.5 billion stake in oil refiner Phillips 66 and plans to push the company to sell or spin off its pipeline business.

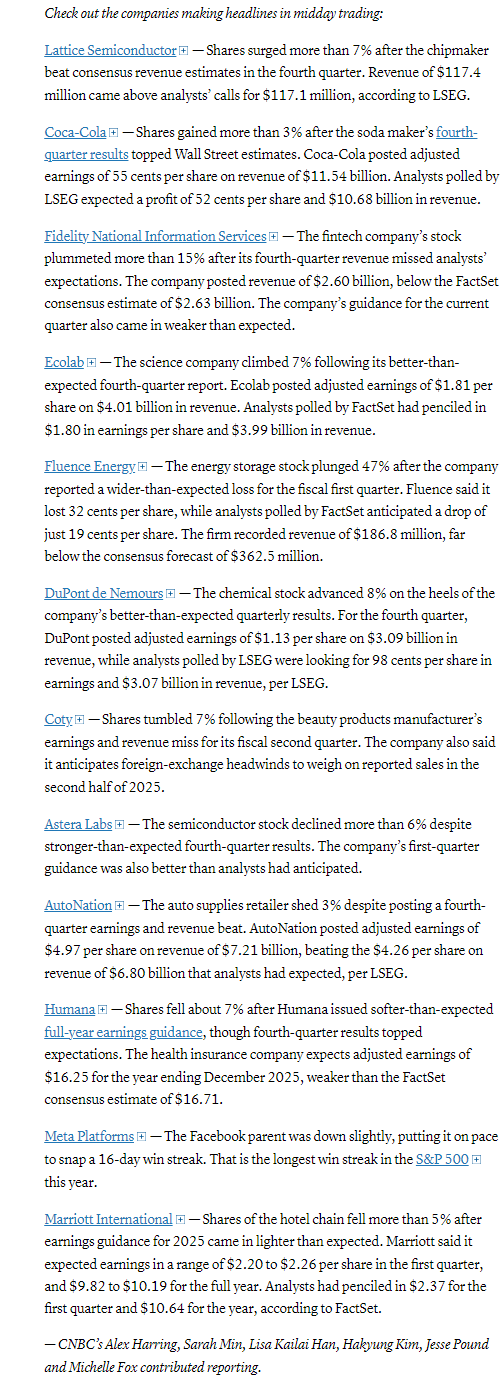

Some tickers making moves at mid-day from CNBC.

In US economic data:

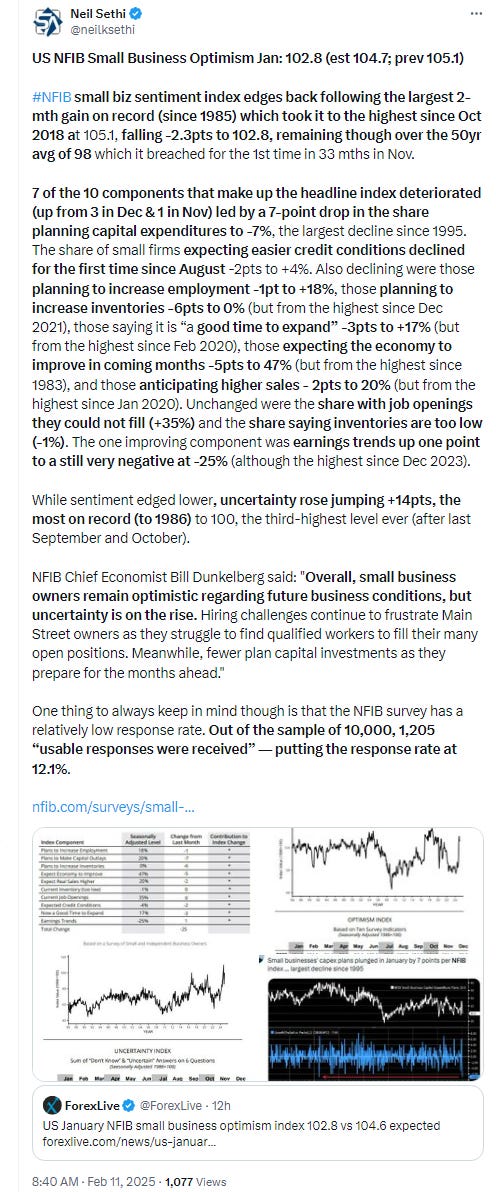

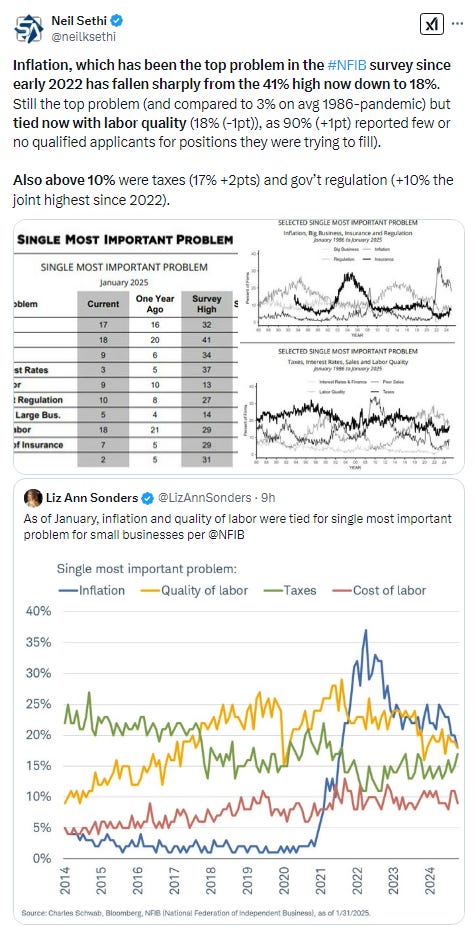

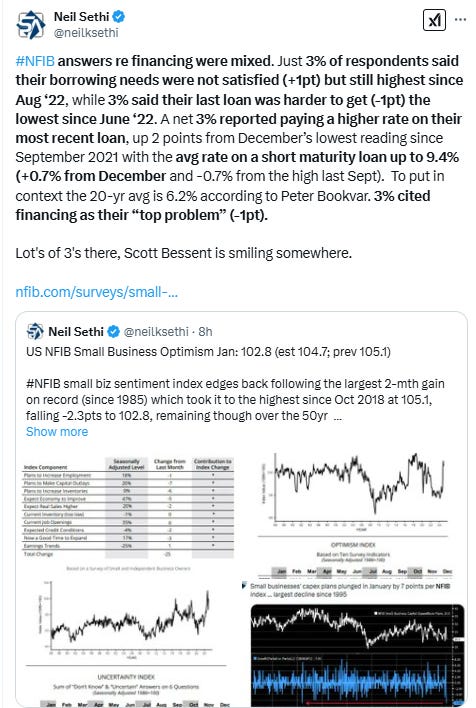

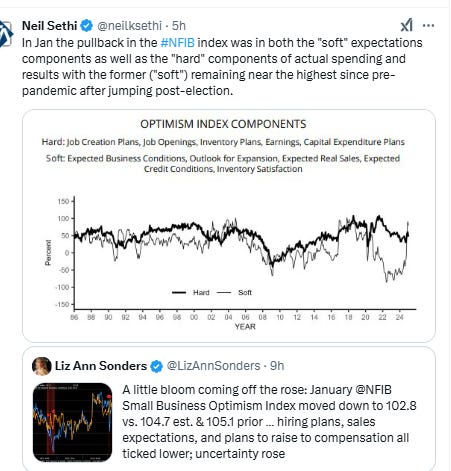

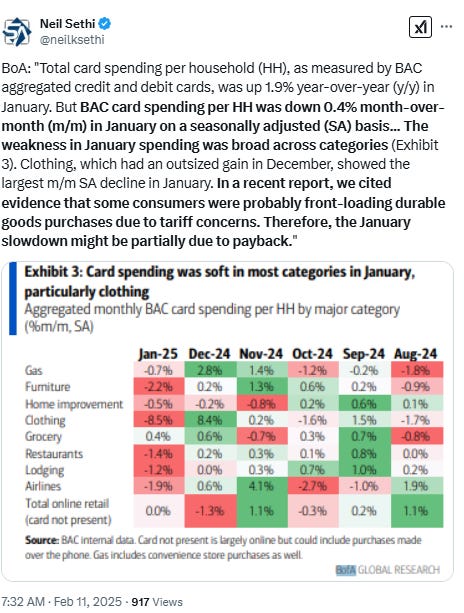

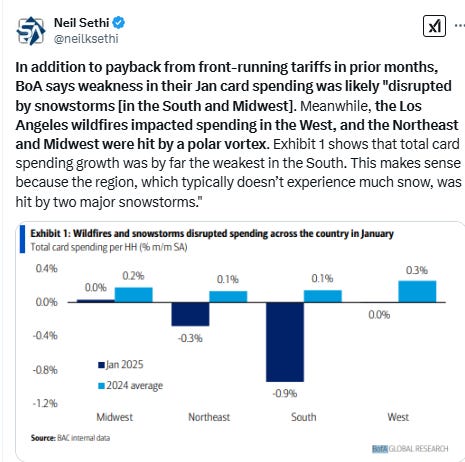

Another light day with just one headline data release in the Jan NFIB small biz sentiment survey which edged back following the largest 2-mth gain on record (since 1985) which took it to the highest since Oct 2018 at 105.1, falling -2.3pts to 102.8, remaining though over the 50yr avg of 98 which it breached for the 1st time in 33 mths in Nov. While sentiment edged lower, uncertainty rose jumping +14pts, the most on record (to 1986) to 100, the third-highest level ever (after last September and October).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

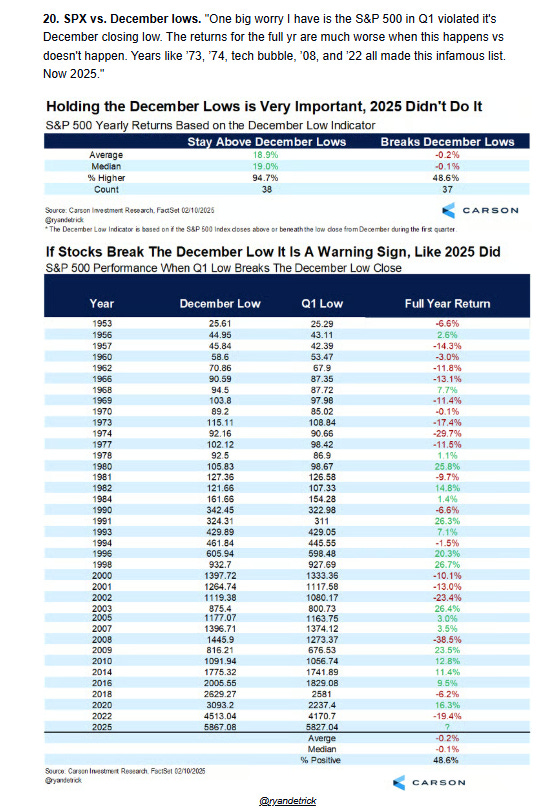

The SPX moved a little closer to the downtrend resistance which as I noted Friday is “turning into a more difficult challenge than I had thought, although it might just be coincidence given the newsflow.” The daily MACD and RSI continue to tilt mildly positive.

The Nasdaq Composite closed right on its 50-DMA. Its daily MACD and RSI are basically neutral.

RUT (Russell 2000) fell back pushing towards the low end of its range over the past few weeks. Its daily MACD and RSI are turning more negative.

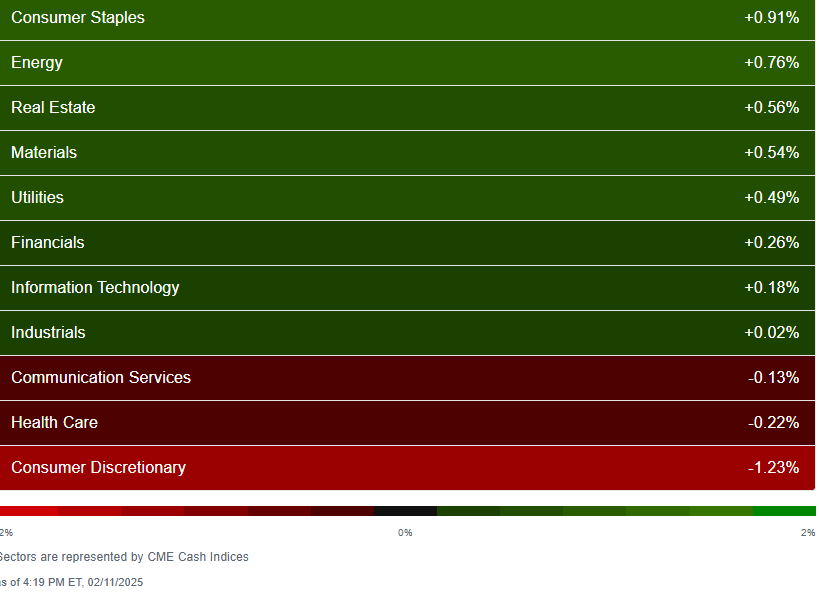

Equity sector breadth from CME Cash Indices deteriorated but less than would be expected from the weaker performance in the equity markets with still 8 green sectors (down one from Monday) and still five up a half percent or more (down from eight), but just one up +0.9% or more (staples) down from four. Also while sectors were fairly evenly distributed Monday, Growth lagged taking 3 of the bottom 5 spots.

SPX sector flag from Finviz consistent with still a decent amount of green but also definitely more red. Tesla continues to be a standout down another -6% (it’s down over -16% over the past week and -24% since Jan 21st).

Positive volume (percent of total volume that was in advancing stocks) fell back as would be expected Tuesday with the NYSE down to 47%, weak for the NYSE Composite index up +0.25%. The Nasdaq actually slightly better at 48% despite the index falling -0.4%. Positive issues (percent of stocks trading higher for the day) though again weaker on the Nasdaq at 39% (NYSE 49%).

New highs-new lows (charts) continued to deteriorate with just 5 on the NYSE and to -124 on the Nasdaq. Both are the least since Feb 3rd and remain below their 10-DMAs and those are now turning back down (more bearish).

[Charts weren’t updated yet, so will post when they are]

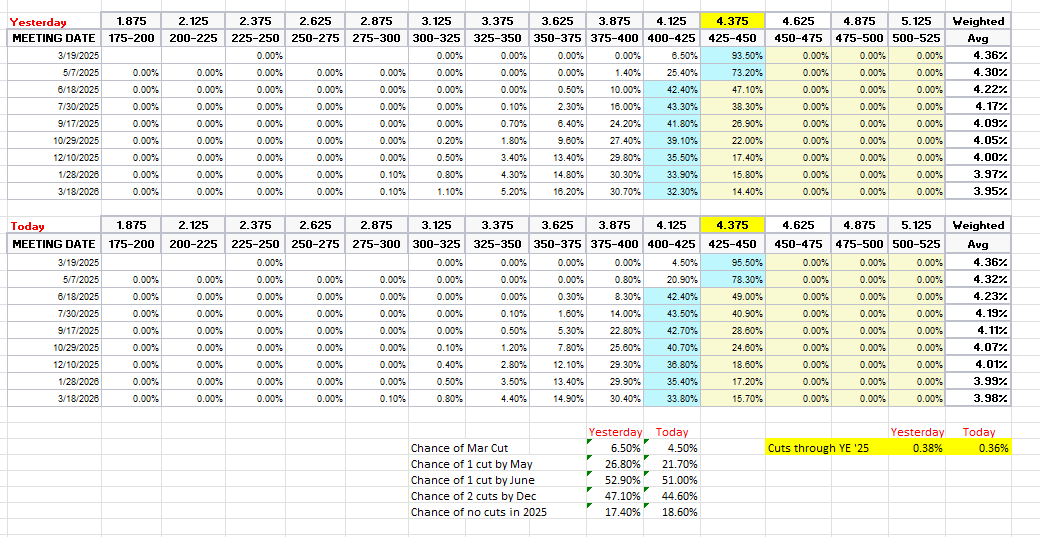

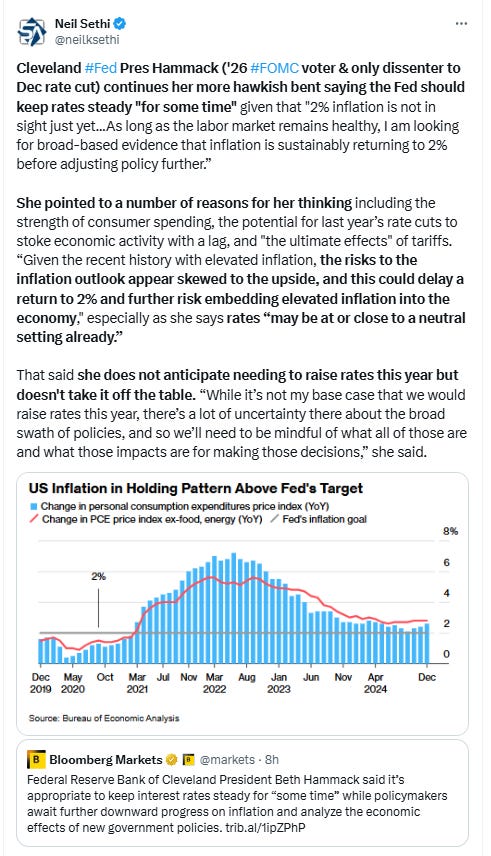

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool fell further back towards the lowest of the year. A cut by March eased down to 5% (now a third of the 15% Thursday before NFP and the UMich report), by May down to 22% (from 38% last Thursday), and by June to 51% (from 63%). Chance of two 2025 cuts at 45% (from 57%) and no cuts at 19% (from 12%) with 36bps of cuts priced (from 44) so now less than 1.5 cuts priced.

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that, although CPI could change that.

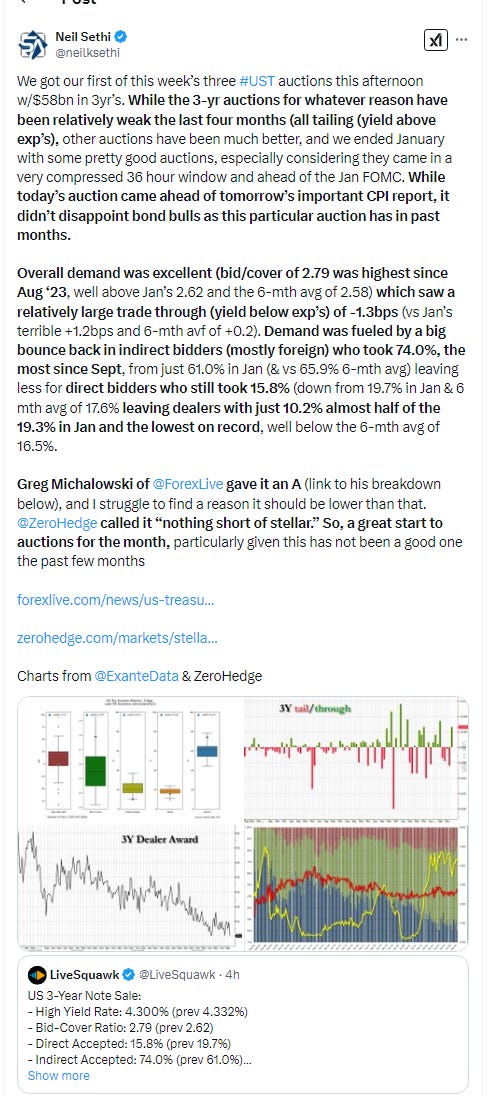

Longer duration #UST yields rose with the 10yr moving back over the 4.50% key resistance to 4.54%. CPI will decide if that sticks.

The 2yr yield, more sensitive to Fed policy, was also little changed edging up a basis point to 4.29% equal to the two-week high Friday. I still find this level rich, and I’m looking for it continue to soften in coming weeks although the possibility is growing of no further rate cuts which would mean it’s fairly priced right here.

Dollar ($DXY) fell back for first session in four holding for now its new trendline. Daily MACD and RSI remain neutral.

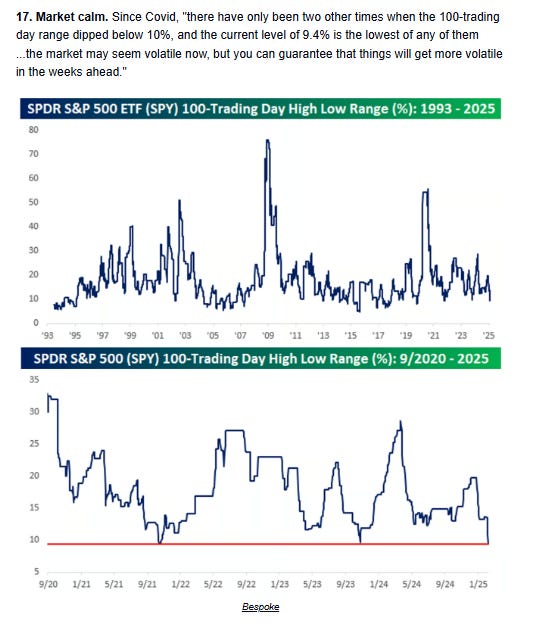

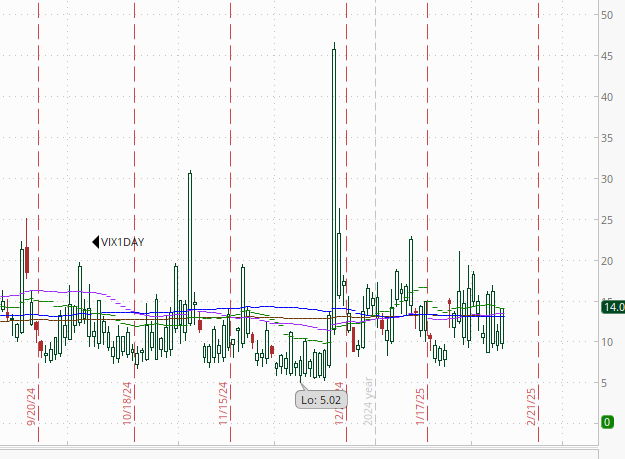

The VIX fell little changed at 16.0 (consistent w/~1% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly remained just under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX jumped as would be expected with Jan CPI tomorrow, although at 14.1 it’s looking for a sub-1% move of around 0.89% Wednesday. It was 22.5 before the December CPI release (in Jan) but 10 before the Nov release (in December).

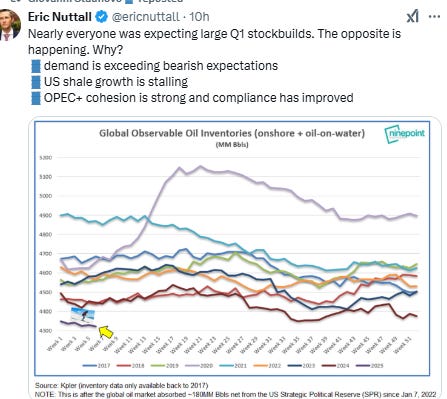

WTI futures continued their now 3-day run on what I would think for now is a short covering rally following a big jump in shorts last week, up another 1%, and nearing that test of the downtrend line of the Sep ‘23 highs (200-DMA just below) I mentioned Monday. Daily MACD also turning more supportive, and the RSI has pushed over 50, so we’ll see if we can get another breakout over the line like we saw in January.

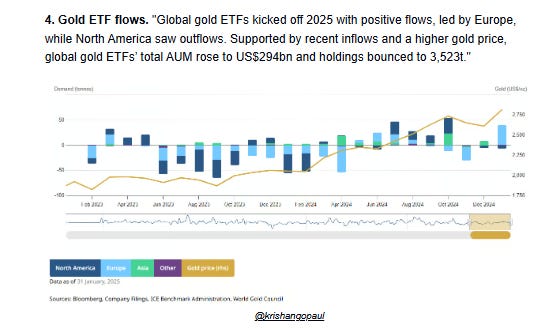

Gold futures pushed up to new all-time highs before falling back to close slightly lower. Daily MACD & RSI remain very supportive, although as noted Monday it’s just off the most overbought since April.

Copper (/HG) fell for the 1st session in 7 as it couldn’t get over the $4.70 resistance. If it can’t rally soon, a consolidation is a likely result which is supported by the RSI falling from well over to under 70. Daily MACD remains supportive though for now.

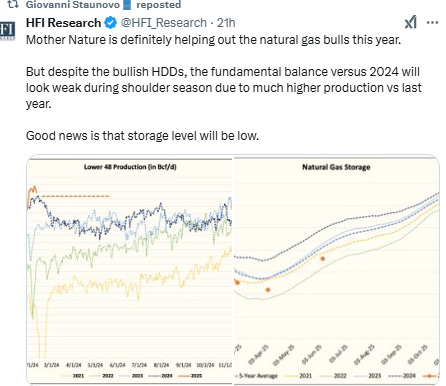

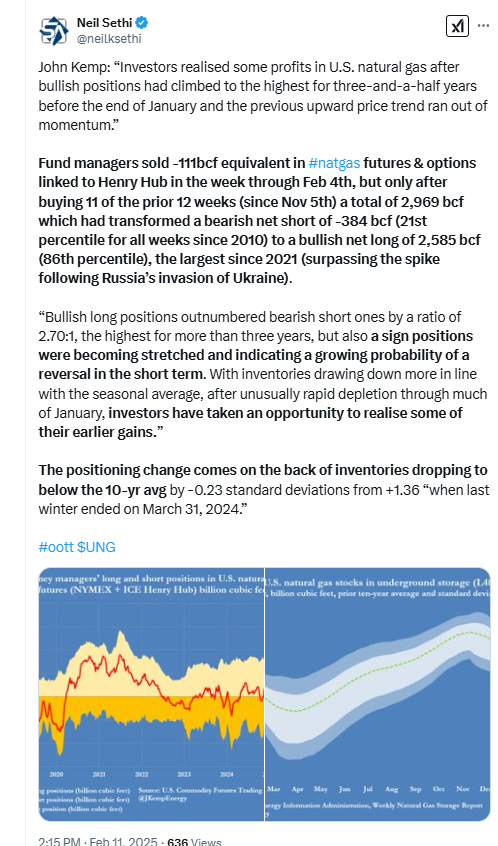

Nat gas futures (/NG) made it over the $3.50 level, but couldn’t hold, finishing right on the number, and remaining at the bottom of a resistance zone which runs to $3.70. Daily MACD remains in “go short” position but will likely cross to “cover shorts” tomorrow, and the RSI has hooked up and pushed over 50, so we’ll see if it can keep up the momentum.

Bitcoin futures little changed for a 5th session remaining around 3-wk lows and under its uptrend line from the Oct lows. Daily MACD and RSI remain negative with relative strength just off the weakest since Sept.

The Day Ahead

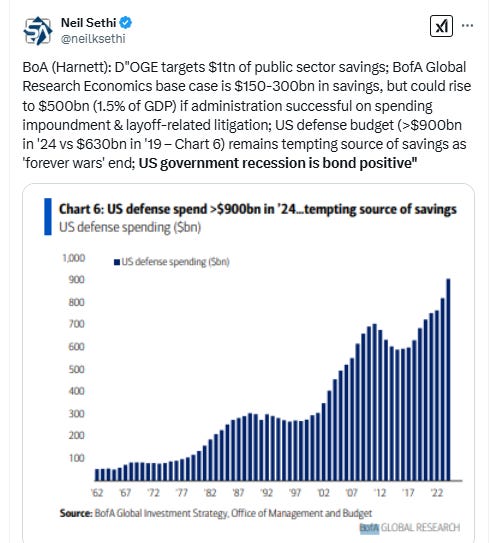

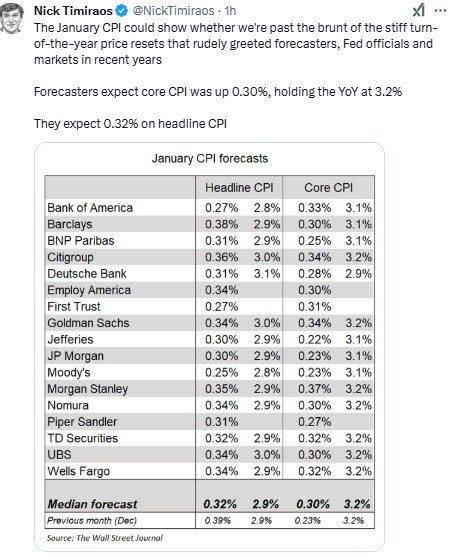

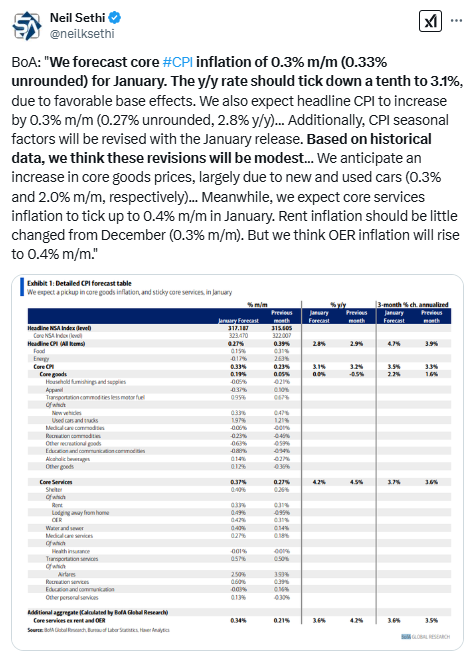

US economic data picks up considerably Wednesday with the highlight of the week in Jan CPI. As noted in the weekend blog post, “a hot print with a Fed already coming into the month unsure about inflation’s trajectory (and on the heels of Friday’s hot wage number and jump in inflation expectations), will see Fed rate cut bets, which have already been cut aggressively over the past week slashed further (and increase chatter around hikes). Bond yields would also likely move back towards the highs of the year. Note Jan CPI also includes a reweighting and update to the seasonal adjustments so it can be a bit messy.” Expectations are for +0.3% m/m prints on both the core and headline figures. We’ll also get weekly mortgage applications and EIA petroleum inventories.

We’ll also get Day 2 of Jerome Powell on the Hill as he testifies before the House. Normally I would say don’t bother tuning in as he’s not going to say anything that he didn’t say today (and the questions are normally not very good with a lot of grandstanding outside of a few notables like Chair French Hill of Arkansas) but if CPI comes in notably above or below expectations, Powell is going to have to talk about it, so in that event, I’ll be paying (more) attention. We’ll also hear (again) from NY Fed President Williams (still always notable given his influence (he’s also a permanent FOMC voter)), Gov Chris Waller (who the last time he spoke about monetary policy was talking at least a couple more rate cuts so we’ll see if that’s changed), and Atlanta Fed Pres Bostic.

Earnings continue with 22 SPX components, but just one > $100bn in market cap in Cisco Systems (CSCO), although we’ll also get non-S&P 500 member AppLovin (APP), another >$100bn reporter (see the full earnings calendar from Seeking Alpha).

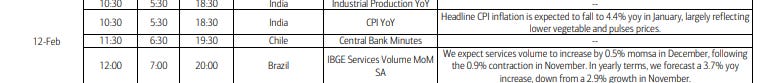

Ex-US another light day with again no major economic reports in developed markets (Italy industrial production and the Bank of Canada minutes are probably the most notable). In EM we’ll get India CPI and industrial production as the highlight. OPEC also releases their monthly report. We’ll see if we see another month of cuts in demand expectations.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,