Markets Update - 2/11/26

Detailed update on US equity and Treasury markets, US economic data, the Fed, select commodities and a look at the upcoming day with lots of charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

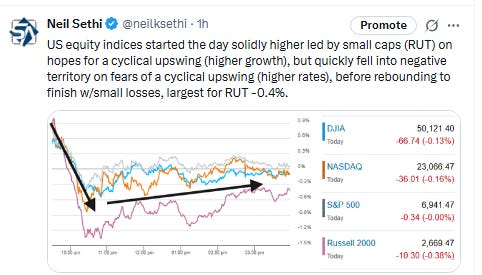

US equity indices opened today’s session solidly higher, taking in stride a very strong Nonfarm Payrolls report which showed employers adding 130k jobs, double expectations and with broader gains than in previous months (although still overwhelmingly led by health care), and the household survey saw an even greater +580k new jobs pushing the unemployment rate down a tenth to 4.3% (no change was expected). This saw bond yields move higher while Fed rate cut bets were cut back (although neither dramatically).

Immediately following the open, though, things started to unravel as the positives of a cyclical upswing (stronger growth, etc.) became more balanced by the negatives (higher rates, less Fed cuts) and the small cap Russell 2000 (RUT) went from first to worst falling over -2% from the open. The other indices also fell back with another round of AI-related fears again hitting software and financial stocks and spreading today to real estate servicers. The indices all bottomed though around 10.30am and gradually made their way higher, but none into the green, finishing slightly lower with the RUT the worst at -0.4%.

Elsewhere, bond yields were higher, while the dollar was little changed for a second day. Also up were crude, gold, copper, and natgas, while bitcoin fell for a third session.

The market-cap weighted S&P 500 (SPX) was UNCH, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite -0.2% (and the top 100 Nasdaq stocks (NDX) +0.3%), the SOXX semiconductor index +2.3%, and the Russell 2000 (RUT) -0.4%.

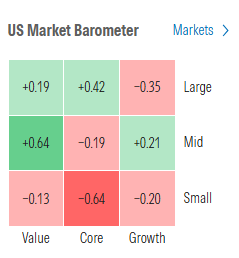

Morningstar style box continued to be mixed, this time with growth and small caps underperforming.

Market commentary:

“This is generally a good sign, as you’d expect, but we are certainly not out of the woods yet with respect to the labor market. ‘Moving in the right direction’ would be a better description. The unemployment rate is gradually improving, but there are still plenty of signs that the labor market remains exceedingly weak,” Rick Wedell, CIO at RFG Advisory, said, citing a low quit rate as one example. “In this environment, it is clear that we still have a long way to go before the labor market can be considered ‘solid,’” he added.

“The better-than-expected job numbers for January are a bright spot in an otherwise uncertain labor market,” said Jerry Tempelman at Mutual of America Capital Management.

“The Non-Farm Payroll report checked all the boxes today with better headline results, stronger participate rates, and the unemployment rate ticking lower,” Art Hogan, B. Riley Wealth chief market strategist, wrote in an email to CNBC. “This is unambiguously good news.” While the data suggests a slower pace in job postings, there is also a rebound in hiring plans by small and midsize firms, Hogan said. This implies further stabilization in the labor market, he said.

“While employment growth remains concentrated in the healthcare sector, manufacturing showed encouraging signs of improvement with a return to positive growth,” said Kevin O’Neil at Brandywine Global.

“Don’t let the revisions fool you,” said Mike Reid at RBC Capital Markets. “The January employment report showed continued improvement in the US labor market. Looking ahead, this print solidifies our view that the Fed will go on a long pause in 2026.” Still, Reid warns about reading too much into one month of data.

“Markets may have been expecting a downshift in today’s numbers after last week’s soft data, but the jobs market hit the gas pedal instead,” said Ellen Zentner at Morgan Stanley Wealth Management. “Today’s data shows an acceleration in employment that was strong enough to drive unemployment lower.” Zentner says that’s “vindication” for Fed Chair Jerome Powell’s holding pattern.

The material surprise in January’s jobs report spells stabilization in the labor market — not reacceleration, according to Oscar Munoz and Gennadiy Goldberg at TD Securities. “More evidence is necessary to make that assessment leap,” they said. “All told, a more constructive outlook for employment should allow the Fed to be more patient and shift its attention toward the inflation mandate.” They still expect the Fed to cut rates by 75 basis points this year while saying easing won’t be the result of worsening economic conditions, but rather the continued normalization of policy as inflation gradually makes inroads toward the 2% objective.

The release provides ammunition to the “Fed hawks” to maintain a patient approach to rate cuts, reinforcing the narrative of a stabilizing labor market, according to Angelo Kourkafas at Edward Jones. “From a portfolio standpoint, we expect the 10‑year yield to drift back toward the middle of its 4%–4.5% range, and we believe the rotation toward ‘old economy’ and pro‑cyclical sectors should continue,” he said.

The report pours cold water on the idea the Fed could cut rates again before mid-year and will fuel internal debate as to how restrictive policy is and how much slack there is in the labor market, according to Krishna Guha at Evercore.

“If January labor strength turns out to be noisy, we could still get to three cuts, but if it is sustained, getting the old Committee to three will be very hard,” he said.

Despite labor-market softening observed last year, economic strength is likely coming out of 2025 and carrying into this year — and that should leave companies reluctant to fire, while tight labor supply should keep a lid on the unemployment rate, noted Jennifer Timmerman at Wells Fargo Investment Institute. Overall, this still looks like “low-hire, low-fire” labor market rather than a broad-based reacceleration, said Mark Hamrick at Bankrate. “For the Federal Reserve, a steadier jobs picture reduces the urgency to rush into rate cuts, assuming inflation behaves,” he noted.

With the latest jobs data being so strong, it likely keeps the Fed on hold for now, according to Brad Conger at Hirtle Callaghan. “The bigger implication may be for stocks,” Conger said. “A stronger job market will support the ‘broadening trade’ – the rotational to industrial cyclicals and consumer discretionary from technology.”

“After a long period of prognosticators offering a tepid outlook for the economy based on a weakening labor market, this print provides a solid datapoint on the side of robust economic growth, an improving labor market and wage growth that can support consumer spending,” said Brad Smith, portfolio manager at Janus Henderson Investors. “The Fed will take this point in to its calculus when it makes its decision next month on whether to hold rates steady. With its wait-and-see data dependent stance, this will surely put the balance towards a hold.”

“The U.S. labor market appears to have gotten off to the new year on the right foot,” Jason Pride, chief of investment strategy and research at Glenmede, said in emailed comments Wednesday. “The relatively healthy state of the labor market” suggests that interest-rate cuts by the Federal Reserve are not “imminently needed,” he said.

Worst-case scenarios didn’t play out thanks to a private-sector rebound, according to David Russell at TradeStation. Today’s numbers seem to confirm the manufacturing rebound we’ve recently seen, he said. “It’s good news for people worried about an imminent slowdown, but it also reduces the urgency to cut interest rates,” he noted.

While a stronger rebound in payrolls and a lower unemployment rate lessen chances of any near term cut, reductions will depend on “disinflation,” noted Michael Gapen at Morgan Stanley.

The labor market is showing some tentative signs of re-tightening, although there remains a way to go, according to Kay Haigh, at Goldman Sachs Asset Management. “The FOMC’s gaze instead will turn to the inflation picture with the economy continuing to perform above expectations,” he said. “We still see room for two more cuts this year; however, an upside surprise in the CPI on Friday could tilt the balance of risks in a hawkish direction.”

"Looking through the noise, today's print is a positive for risk assets given it shows a solid labor backdrop that can fuel further upside in consumption," said Jeff Schulze, head of economic and market strategy at ClearBridge Investments. With fed-funds futures priced for the next interest-rate cut by the Fed to take place this summer, Wednesday's data "suggests less of a need for additional monetary easing to lift the labor market. However, the drag from higher rates is being more than fully offset [by] the improved growth outlook, and equity futures are up modestly."

After the release of the January jobs report, “you’re seeing the market take down expectations for rate cuts and being impacted by a rise in long-term yields,” said Ross Mayfield, a Kentucky-based investment strategist at Baird Private Wealth Management. “If things go haywire for whatever reason by this summer, the Fed has plenty of room to react if it needs to and can probably pivot before then.”

With the jobs market in January surprising to the upside, any dips in this stock market can be bought, according to Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management. Wednesday’s jobs report, in the short run, should soothe any recent “jitters in the stock market” around “concerns of a weakening labor market” and any fears about the economy sliding into a recession, Zaccarelli said in emailed comments.

“There might be a glass half full and a glass half empty perspective on the moves here,” said Kyle Rodda at Capital.com. “On the one hand, tech stocks are potentially too richly valued. On the other hand, the strength in the market is broadening out in a sign of improving economic fundamentals.”

Valuations are “elevated” with a “narrow margin of error,” Terry Sandven, the Minneapolis-based chief equity strategist for U.S. Bank Asset Management Group said in a phone interview. “We expect equities to trade sideways until there’s more clarity from big box retailers that report in the next couple of weeks.” Among the headwinds he cited are lingering questions about “robust capital expenditures with no clear visibility on returns from AI,” as well as ongoing U.S. trade issues and geopolitical tensions with other countries.

Nonetheless, “there’s much to like about equities. Inflation is stable, interest rates are low, and earnings are trending higher,” Sandven said. “Today’s jobs report would suggest the economy is chugging along.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

Software stocks, which were a key driver of last week’s rout amid fears of disruption from artificial intelligence, came under pressure yet again Tuesday. Salesforce was down 4%, while ServiceNow fell 5%. The iShares Expanded Tech-Software Sector ETF (IGV) dropped more than 2%, putting it nearly 30% below its 52-week high. The fund entered bear market territory last month.

Real estate services stocks sank as investors assessed the companies’ vulnerability to the newest crop of artificial intelligence applications and tools that threatens to disrupt several industries.

Conversely, shares of stocks that would benefit from an accelerating economy gained, as well as those involved in the buildout of AI data centers. Shares of digital infrastructure provider Vertiv surged 24% after the company posted a fourth-quarter earnings beat and issued a strong 2026 outlook. Others such as Caterpillar, GE Vernova and Eaton were all higher in the session as well.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Apple Inc.’s long-planned upgrade to the Siri virtual assistant has run into snags during testing in recent weeks, potentially pushing back the release of several highly anticipated functions.

Meta Platforms Inc. said it will spend more than $10 billion to build a data center campus in Lebanon, Indiana, ranking it among the company’s largest artificial intelligence infrastructure investments to date.

Bill Ackman’s Pershing Square said it has taken a sizable stake in Meta Platforms Inc. It acquired a stake that amounts to about 10% of the investment manager’s capital as of the end of the year, according to an investor presentation Wednesday. The position dates to late November.

Elon Musk said he reorganized xAI, his artificial intelligence startup, following the exit of two of its co-founders earlier this week.

Google is adding a way for consumers to buy things while seeking artificial intelligence-powered answers on search and in its Gemini chatbot — part of a plan to make money more directly from consumers’ AI use.

Micron Technology Inc. jumped after Chief Financial Officer Mark Murphy assured investors that the company is producing its new much-prized HBM4 memory chips in high volumes.

Real estate services stocks sank as investors assessed the companies’ vulnerability to the newest crop of artificial intelligence applications and tools that threatens to disrupt several industries.

Charles Schwab Corp.’s top executive said artificial intelligence is poised to aid the wealth-management sector rather than hurt it as fears around AI-driven financial advice have mounted, sending shares down this week.

Private equity software specialists Thoma Bravo and Vista Equity Partners are rushing to reassure fund investors that their portfolios are healthy after anxiety over artificial intelligence disruptions sparked a broad equity selloff last week.

Apollo Global Management Inc. traded almost $10 billion of high-grade private loans last year, as part of the alternative asset manager’s push to syndicate investment-grade credit on a broader scale.

T-Mobile US Inc. reported it added fewer mobile-phone subscribers than analysts expected in the fourth quarter, highlighting the challenge ahead for new Chief Executive Officer Srini Gopalan.

Kraft Heinz Co. halted plans to split in two, a surprising reversal weeks after bringing in a new chief executive officer with experience breaking up a food company.

Novo Nordisk A/S aims to start selling its weight-loss blockbuster Wegovy in vials, its latest move to win over customers it’s lost to rival Eli Lilly & Co.

Humana Inc. forecast profit that fell short of Wall Street’s expectations for the year, the latest insurer to disappoint investors as the industry grapples with rising costs and government pressure.

Ford Motor Co. expects profit to jump in 2026 even after a surprise $900 million tariff bill at the end of last year dented the carmaker’s earnings.

Ford is planning to launch five new models priced under $40,000 by the end of the decade in a gambit to offer more affordable vehicles as the average cost of new cars tops $50,000 in the US.

Lyft Inc. tumbled after the rideshare firm issued a disappointing forecast that missed Wall Street expectations, a sign that its global expansion and new product offerings are not performing as quickly and as well as anticipated.

Nike Inc. expects its wholesale business to pick up steam across the world as it accelerates the launch of new footwear and apparel products and doubles down on its commitment to sports.

Activist investor Ancora Holdings Group is urging the board of Warner Bros. Discovery Inc. to reject the offer by Netflix Inc. and reconsider a competing bid by Paramount Skydance Corp., adding a new plot twist to one of Hollywood’s biggest takeover battles.

Robinhood Markets Inc. sank after reporting lower fourth-quarter profit as sharp declines in Bitcoin and other cryptocurrencies weighed on results at the online brokerage.

US regulators refused to review Moderna Inc.’s novel mRNA flu vaccine, dealing a major blow to the company as it seeks more products beyond its Covid shot.

Baker Hughes Co. is exploring a potential sale of its Waygate Technologies unit, which provides industrial testing and inspection equipment, people with knowledge of the matter said.

Bonus payouts at Lululemon Athletica Inc. are currently tracking below target this year, according to a recording of an internal meeting reviewed by Bloomberg News.

Toymaker Mattel Inc. reported holiday results that fell short of analysts’ estimates and issued a 2026 forecast for lower profit.

Hasbro Inc. Chief Executive Officer Chris Cocks said he’ll be focusing even more on video games and the collector card game Magic: The Gathering to reduce the company’s exposure to tariffs associated with traditional toys.

Shopify Inc.’s adjusted earnings missed analyst forecasts despite stronger-than-expected revenues. The shares fell.

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X