Markets Update - 2/12/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

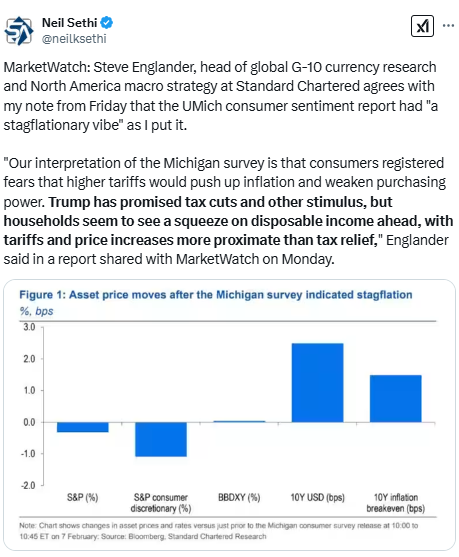

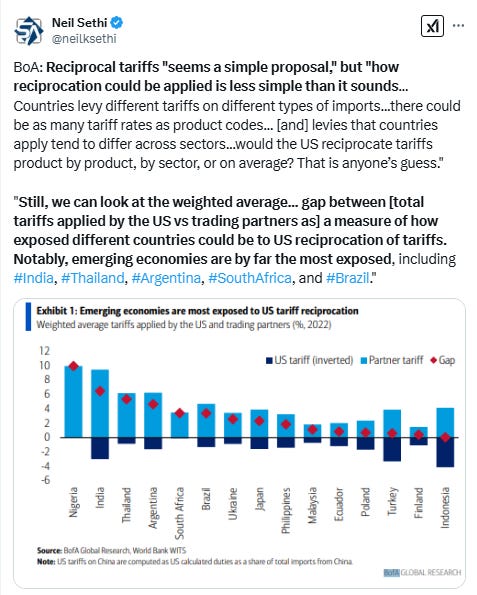

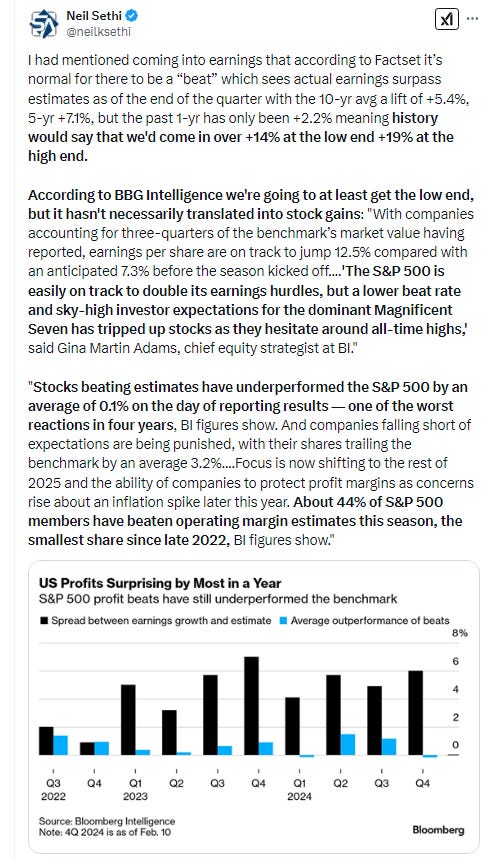

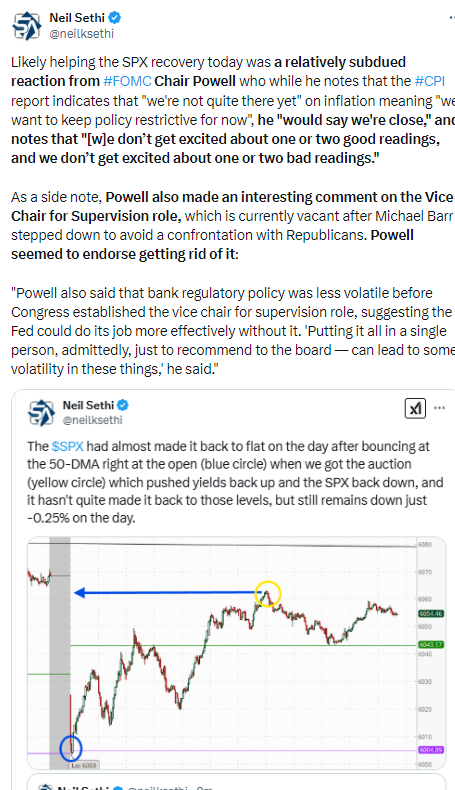

US equities started the day off solidly lower following a much hotter than expected CPI report which saw bond yields jump and FOMC rate cut bets slashed. However, stocks were able to find their footing immediately after the open and start a recovery which brought them to around flat levels for the day for large caps (less recovery for small caps) until a weak 10yr Treasury auction at 1pm ET pushed them back down. Still they finished near the highs with modest losses at the large cap level, larger for small caps (although small cap growth outperformed according to Morningstar).

Elsewhere, the dollar initially jumped but ended little changed, while copper, nat gas, and bitcoin finished higher. Gold and crude finished lower.

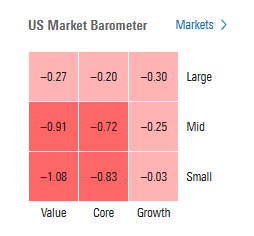

The market-cap weighted S&P 500 (SPX) was -0.3%, the equal weighted S&P 500 index (SPXEW) -0.6%, Nasdaq Composite unch (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index +0.2%, and the Russell 2000 (RUT) -0.9%.

Morningstar style box showed a clear underperformance to smaller value stocks today.

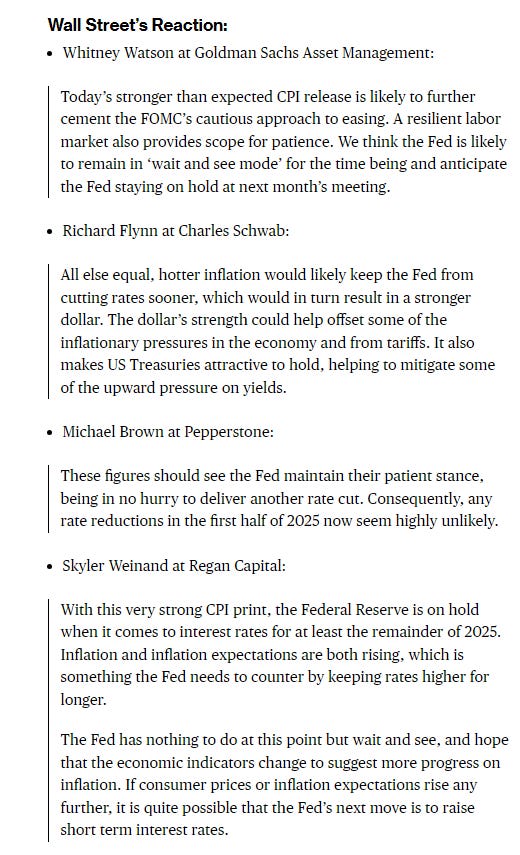

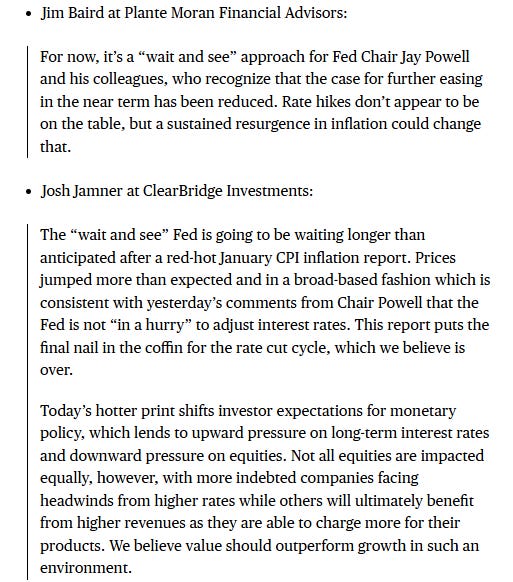

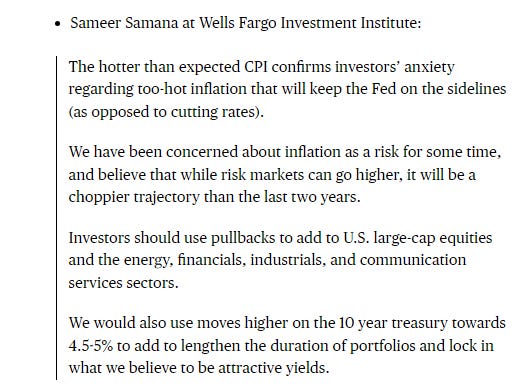

Market commentary:

“Investors were looking for reassurance in this morning’s inflation report — and they didn’t get it,” said Bret Kenwell at eToro. “The immediate reaction to today’s report will likely weigh on stocks in the short term, as a higher-than-expected print further lowers the odds of rate cuts from the Fed this year and stokes investors’ reflationary fears.”

“Higher-than-expected CPI data across the board has caused yields to jump and stocks drop. inflows into the TIP ETF of inflation-linked bonds have been rising, as they also did in 2020 and 2021. On top of that shorts have been covered. Expected rate cuts this year are diminishing, with one now barely priced. Still, the likelihood of a hike this year is still small at ~15%, and has not yet materially risen since the data.” —Simon White, BBG Macro Strategist,

“Today’s CPI print is clearly on the toasty side of warm,” said Guy LeBas, chief fixed income strategist for Janney Montgomery Scott. For the Fed, “the data simply aren’t cooperating for the moment.”

“Higher-for-longer may have just gotten a little longer,” said Ellen Zentner at Morgan Stanley Wealth Management. “The Fed has been waiting for clear signs that inflation is trending lower again, and this morning they got the opposite. Until that changes, the markets are going to have to remain patient about additional rate cuts.”

Chris Zaccarelli at Northlight Asset Management, although it’s too early to predict that officials will begin raising rates any time soon, the market is going to start seriously considering that the next move the Fed makes – even if it is in late 2025 or early 2026 – is going to be a hike and not a cut. “The market will likely have a negative knee-jerk reaction to the increasing risks of ‘higher-for-longer’ or even ‘higher-from-here.’ So caution is warranted,” he said.

The Fed has made “a pretty big pivot from focusing on the labor market, which was a concern at the tail end of last year, to now focusing on inflation,” said Anastasia Amoroso, iCapital chief investment strategist, on Bloomberg Television just before the report.

“This is almost starting to look like a re-run of the first half of 2024, when inflation surprised everyone, including the Fed, on the upside,” said Brian Coulton, chief economist at Fitch Ratings. “And it illustrates how the Fed has not completed the job of getting inflation back down just as new inflation risks — from tariff hikes and a squeeze on labor supply growth — start to emerge.”

“How can anyone justify any rate cuts with such inflationary pressure?,” said Roger Landucci, a partner at Alphamatrix Finance in Geneva.

At the Blue Chip Daily Trend Report, Larry Tentarelli says while he does not expect any immediate change in Fed policy, if there is a series of two or three hot inflation reports, they could put pressure on the Fed to raise rates. “In the near-term, we expect higher bond yields and higher volatility in equity markets,” he said. “Investors should keep a close eye on the 10-year US Treasury yield. Any move closer to or above 4.80% could create negative near-term headwinds for stocks.”

While the report spooked markets and reduced odds of a Fed interest-rate cut in the first half of the year, the advances were “mostly due to residual seasonality — the ‘January effect’ — limiting the signal from the hot print,” Bloomberg Economics’ Anna Wong and Stuart Paul wrote. At the same time, inflation ran a touch cooler at the end of 2024.

“Residual seasonality was likely at play in the January CPI report, but we think the data still showed underlying price pressures,” said Andy Schneider at BNP Paribas. “While the Fed is cognizant of the pattern of early-year inflation strength, the print will do little to ease policymakers’ inflation anxieties.”

To Jamie Cox at Harris Financial Group, lack of progress on inflation is the story here. “This is not the start of a resurgence in inflation,” he said. “Food and energy are big players in the hot reads, so there’s a chance we get a little reprieve in the spring.”

Matt Maley at Miller Tabak noted that Wednesday’s CPI, last week’s employment report and concerns over tariffs have all taken the yield on the 10-year note back above its trend-line from last September. “This does not mean that they will push above 5% level soon nor that these yields will not reverse lower at some point later this year,” Maley said. “However, it should raise concerns that the Fed will wait quite a bit longer to cut short-term rates than the Street had been thinking until recently and also raise concerns that Secretary Scott Bessent’s goal of lower long-term yields will take longer to achieve as well.”

To Dan Wantrobski at Janney Montgomery Scott, the issue is that US equity markets have been “positioned for perfection” for quite some time now, which means any potholes on the macro front could lead to elevated volatility over the short run (like we are seeing today). “And when we say positioned for perfection, we note the difference vs being priced to perfection: we are not at peak valuation in this current cycle, and thus the market multiple has a good deal of bandwidth for further expansion in the coming years in our opinion (reflationary bull market cycle),” he said. “However, we are seeing an historic skew of equity positioning by both Main Street and institutional investors at this time.” Wantrobski notes that effectively, long equities remains a very crowded trade at this time- and this is despite the recent pairing of large-cap tech exposure by the buyside. “This makes for a very lopsided position in our view, which leaves little room for error (like today’s hotter-than-anticipated CPI print).”

In individual stock action, Tesla Inc. led gains in megacaps while Apple (AAPL 236.87, +4.25, +1.8%) and Meta Platforms (META 725.38, +5.58, +0.8%) were integral in the turnaround in the indices after being down as much as -0.8% and -1.0%, respectively. META finished up for an 18th straight day, a Nasdaq record.

Other stocks that went against the downside grain included DoorDash (DASH 200.89, +7.80, +4.0%), Gilead Sciences (GILD 103.31, +7.17, +7.5%), and Confluent (CFLT 37.65, +7.55, +25.1%), which hit 52-week highs after reporting earnings.

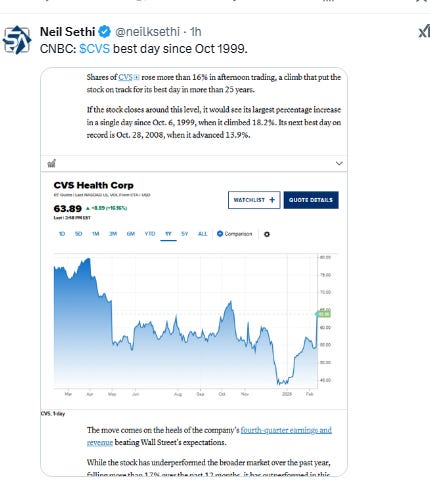

Shares of CVS rose more than 16% in afternoon trading, its best day in more than 25 years. Kraft Heinz shares though fell 3% to a fresh 52-week low after the food company warned fiscal 2025 earnings would fall short of analysts’ estimates. The maker of Ore-Ida fries and Philadelphia cream cheese expects its organic sales will be flat to down this year.

Stocks making moves after-hours from CNBC:

BBG Corporate Highlights:

Chevron Corp. plans to cut its global workforce by 15% to 20% by next year, as part of efforts to reduce costs at the US oil major.

Kraft Heinz Co. said it will discount key items in the coming year while improving products and boosting marketing in order to compete for inflation-weary customers.

DoorDash Inc., the largest food delivery service in the US, issued an outlook for orders in the first quarter that surpassed Wall Street’s expectations, serving as yet another sign that consumer demand remains resilient.

CVS Health Corp. shares climbed the most in more than 25 years after its fourth-quarter results signaled improved performance from the company whose insurance and drugstore units have been struggling.

Spirit Airlines Inc. rejected a refreshed acquisition offer from rival budget carrier Frontier Group Holdings Inc., saying it would instead proceed with a planned restructuring in bankruptcy.

Biogen Inc. forecast a bigger decline in annual sales than Wall Street expected, dimming the drugmaker’s strong finish to 2024.

Some tickers making moves at mid-day from CNBC.

In US economic data:

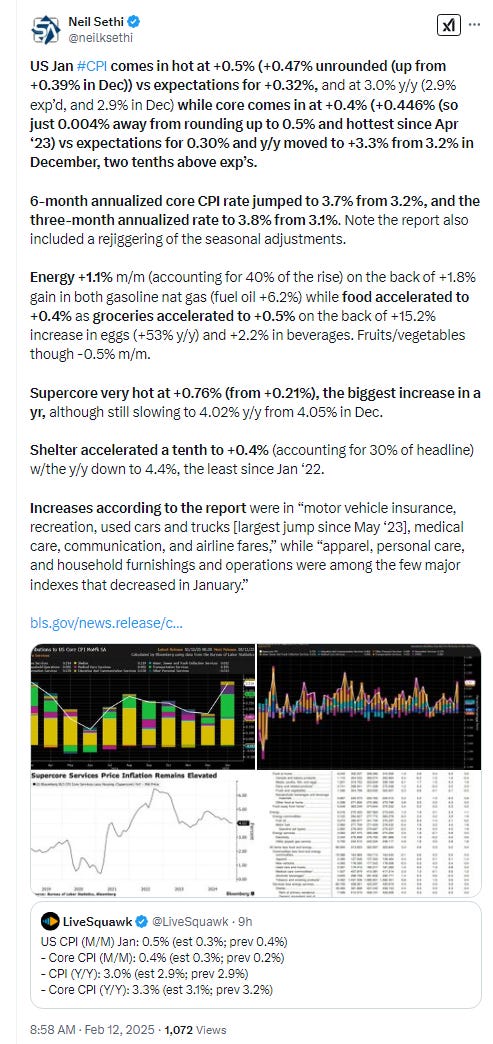

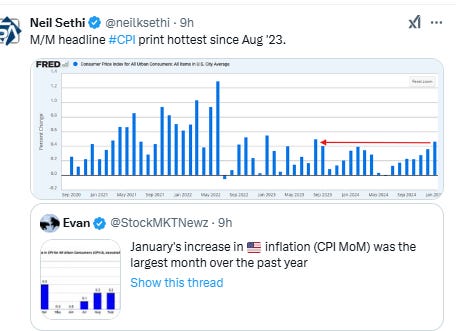

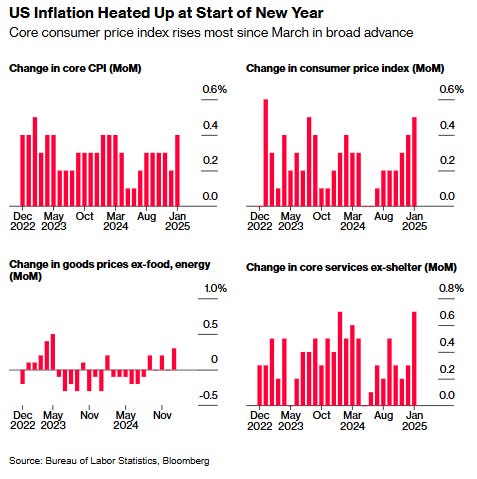

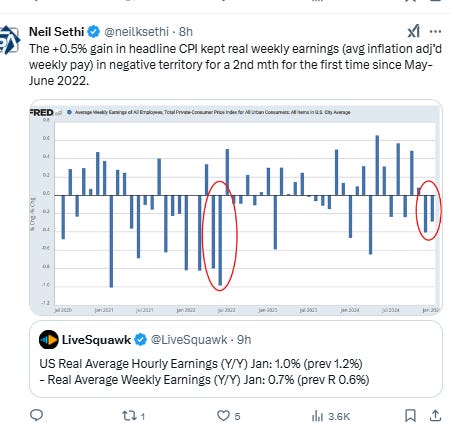

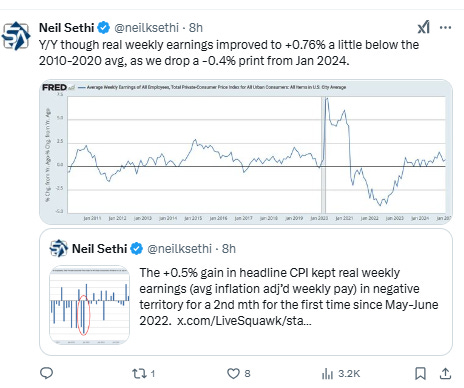

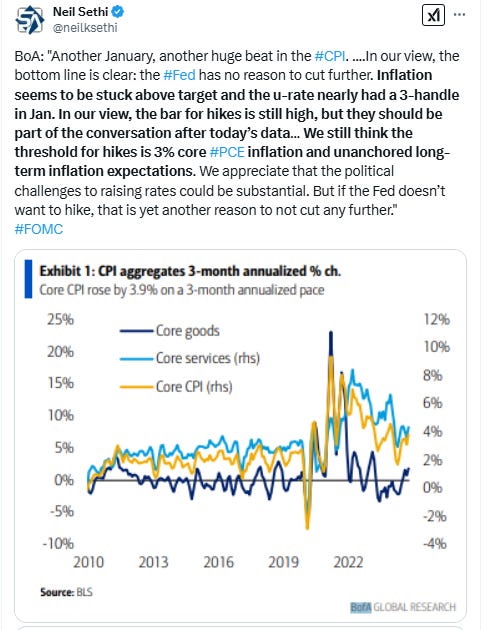

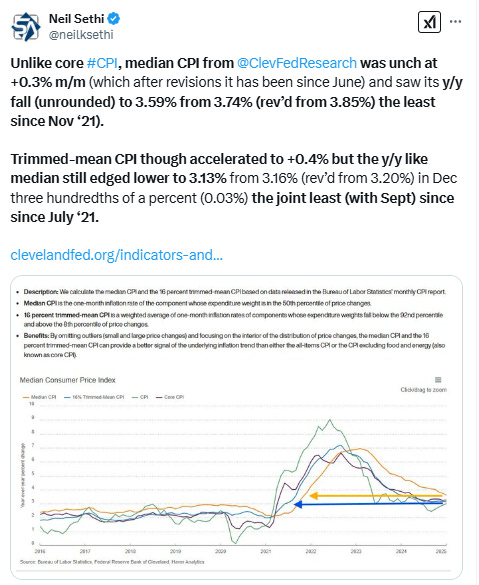

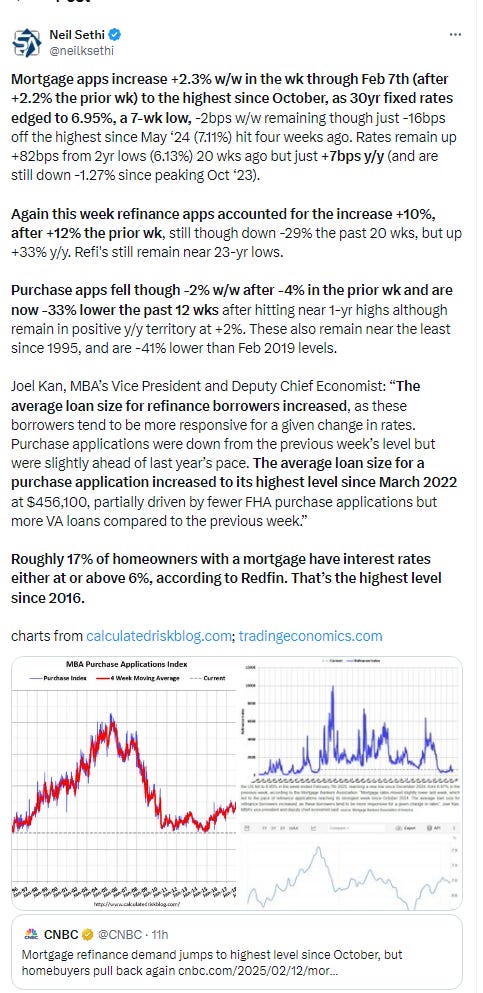

Economic data was dominated by the CPI report which as noted came in much hotter than expected.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

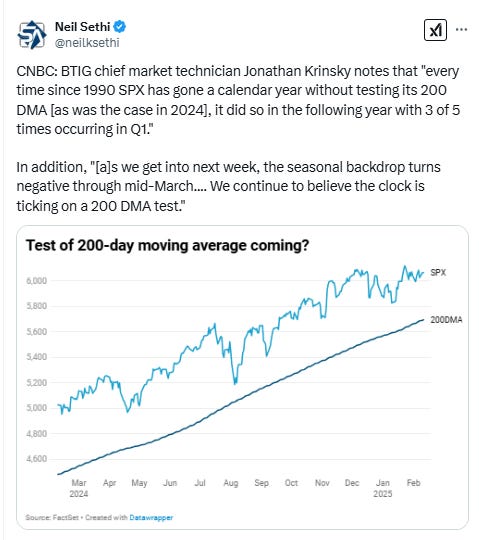

The SPX as noted at the top was able to bounce off the 50-DMA to finish just modestly lower for remaining under the downtrend resistance which as I noted Friday is “turning into a more difficult challenge than I had thought, although it might just be coincidence given the newsflow.” The daily MACD and RSI are now basically neutral.

The Nasdaq Composite again closed right on its 50-DMA after falling below during the session. Its daily MACD and RSI are basically neutral as well.

RUT (Russell 2000) though continues to deteriorate falling towards the low end of its range over the past few weeks. Its daily MACD and RSI have also turned more negative.

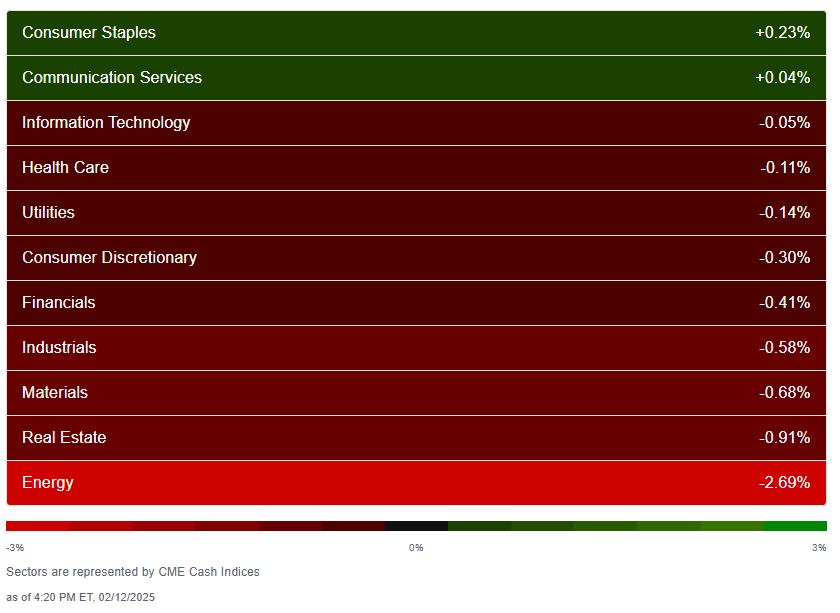

Equity sector breadth from CME Cash Indices was quite weak with just two sectors above the flatline neither up more than 0.25% (Staples the best performer for a 2nd day +0.23%). Seven sectors down that much or more although just one down >-1%. Growth outperformed while cyclicals lagged taking four of bottom five spots.

SPX sector flag from Finviz consistent with lots of red. Tesla a notable exception, up for the first time in a week.

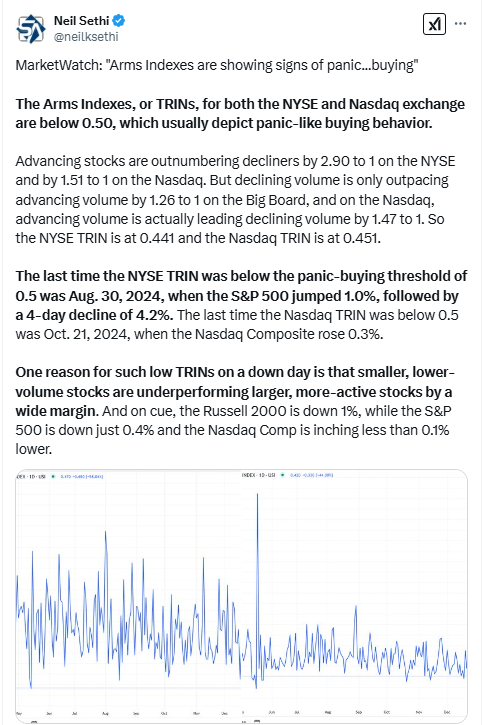

Positive volume (percent of total volume that was in advancing stocks) was little changed on the NYSE Wednesday at 46%, a great result considering the NYSE Composite index was -0.5% vs +0.25% on Tuesday. The Nasdaq improved as would be expected (the index was flat versus down -0.4% Tuesday), but at 62% it was better than would be expected. Positive issues (percent of stocks trading higher for the day) though much weaker on both at 29 & 41% respectively so the buying was concentrated in just certain stocks (which caused a “buy panic” on the ARMS ratio (see post)).

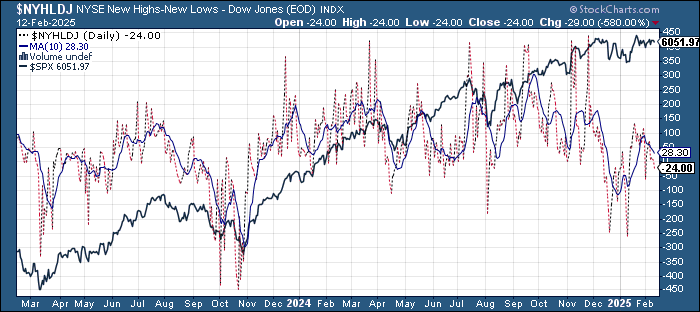

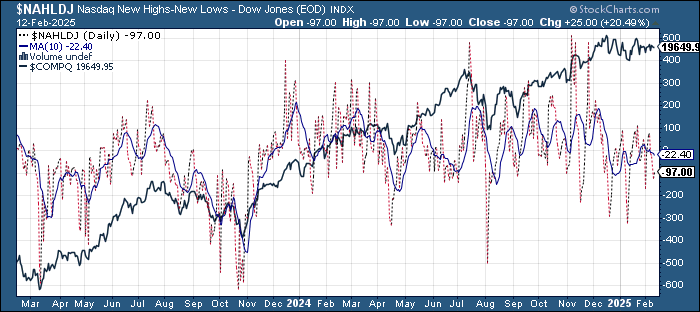

New highs-new lows (charts) were mixed with the NYSE falling to -24 while the Nasdaq improved a touch -99. NYSE is the least since Feb 3rd and both remain below their 10-DMAs and those continue to head lower (more bearish).

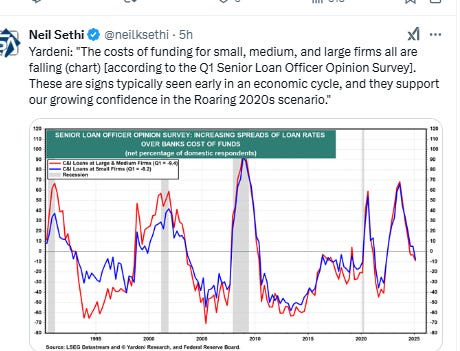

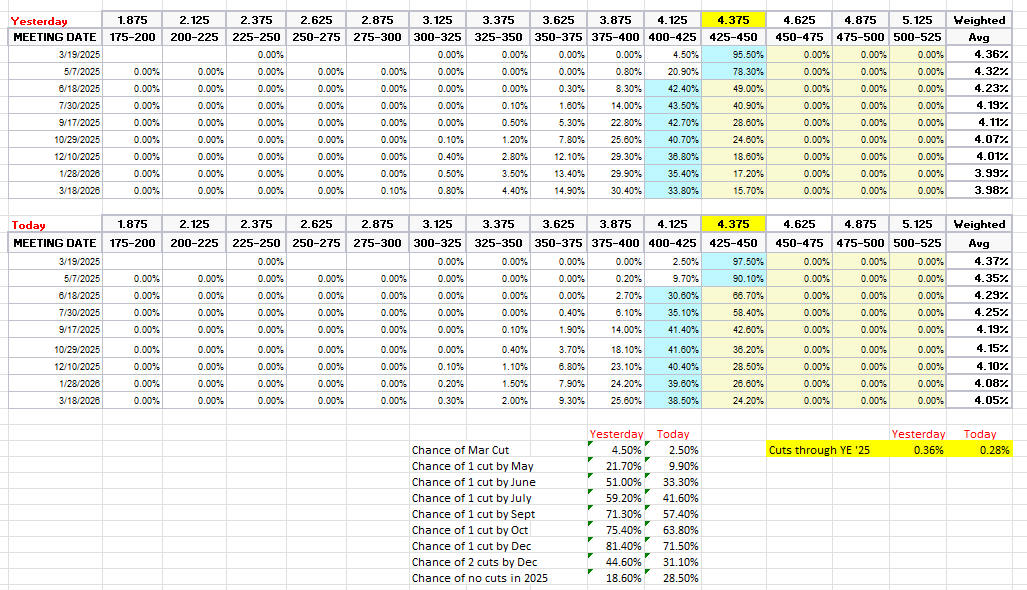

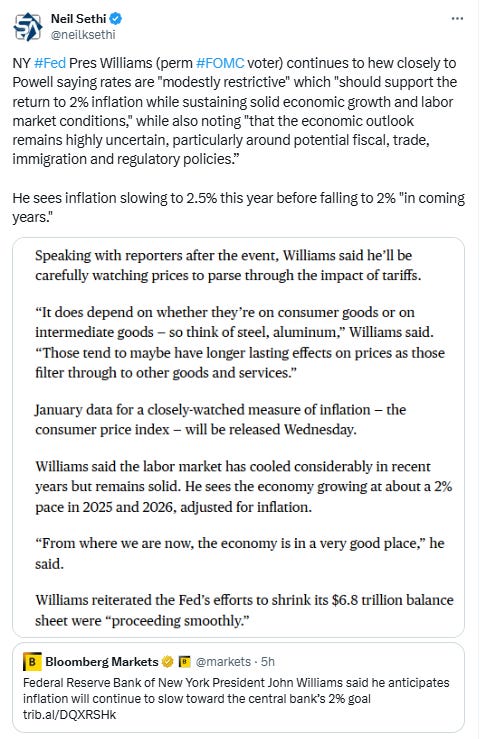

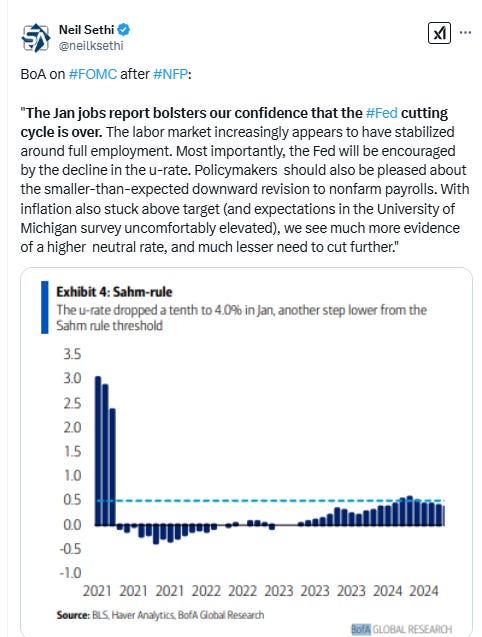

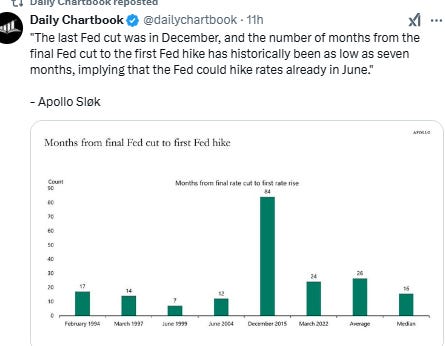

FOMC rate cut probabilities from CME’s #Fedwatch tool slashed today. A cut by March down to 2.5% (from 15% Thursday before NFP and the UMich report), by July to 41% (from 83%), with the first cut over 50% in Oct (64%). Chance of two 2025 cuts at 31% (from 57%) and no cuts at 29% (from 12%) with 28bps of cuts priced (from 44) so now basically just one cut priced and roughly equal odds of 2 cuts and no cuts.

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, but CPI could change that, and it has made me think that cuts are becoming less likely, but I continue to expect them versus no cuts at this point. It’s a long time until December.

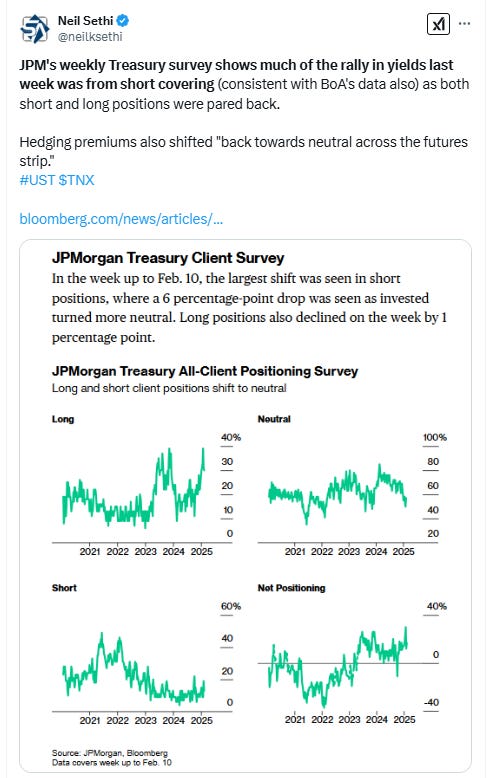

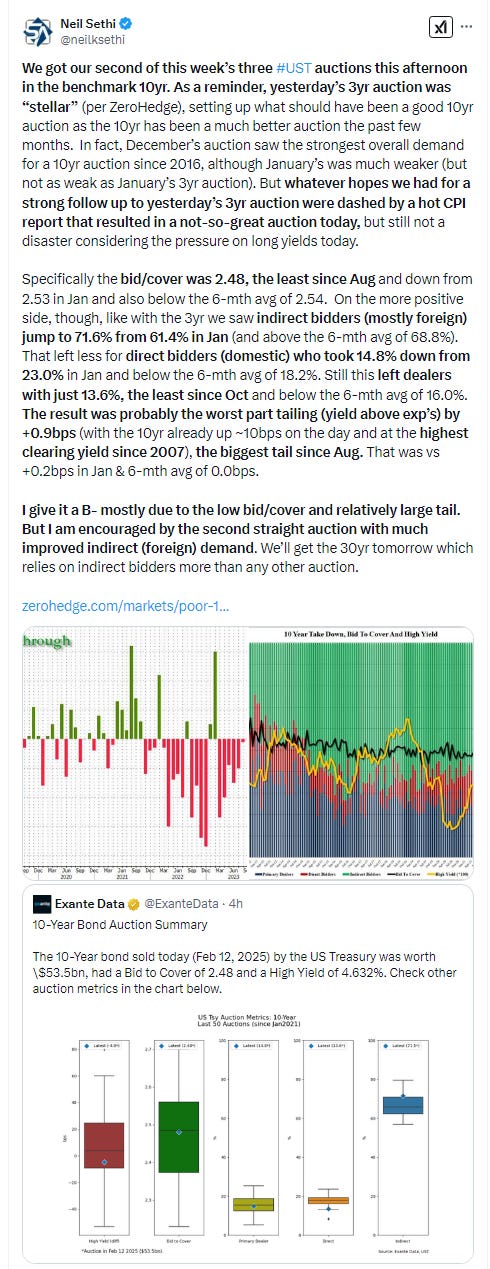

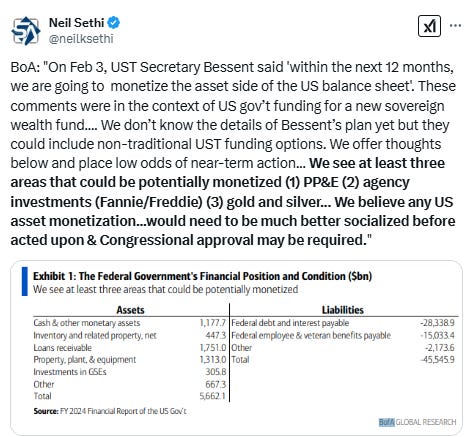

Longer duration #UST yields rose sharply with the 10yr moving back to the middle of its range over the past month +10bps to to 4.64%.

The 2yr yield, more sensitive to Fed policy, was up +7bps to 4.36% near a 1-mth high. I still find this level rich, but I’m no longer expecting it to soften materially in the near term, consistent with my note that the possibility is growing of no further rate cuts which would mean it’s fairly priced right here. That said, it is now reflecting a higher chance of rate hikes than cuts, and I still think though it’s too early to take all 2025 rate cuts off the table.

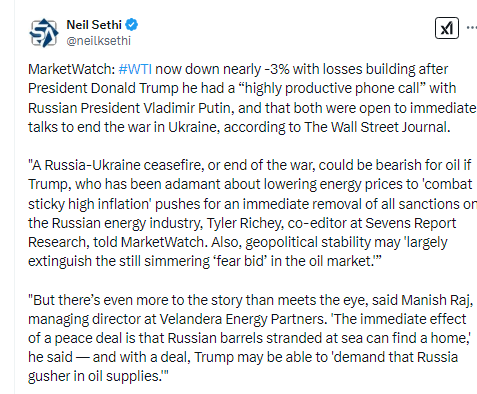

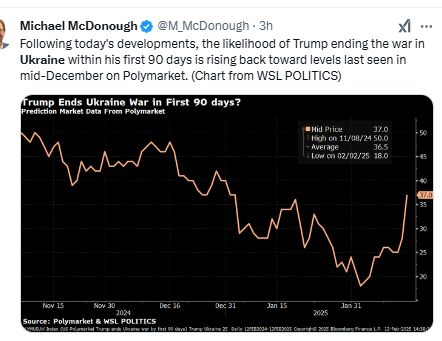

Dollar ($DXY) jumped along with bond yields early in the session but gave it all back throughout the day much of it after Pres Trump announced he had a "lengthy and productive call" with Pres Putin and they agreed to work on finding a resolution to the war in Ukraine which saw the euro jump. The dollar finished unchanged just above its new trendline. Daily MACD and RSI remain neutral.

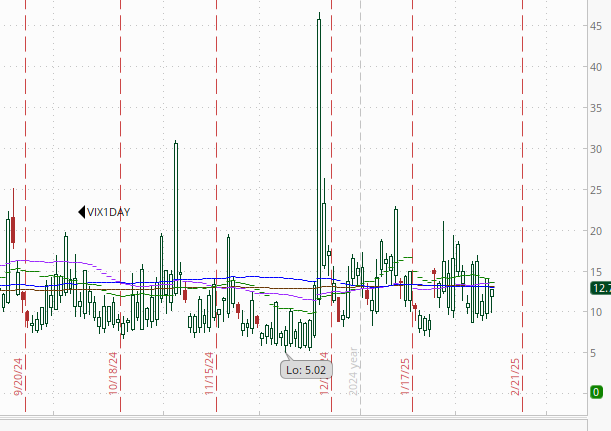

The VIX despite the drama in equity and bond markets edged a tenth lower to 15.9 (consistent w/~1% daily moves over the next 30 days). Still relatively elevated, but not what I was expecting to see. The VVIX (VIX of the VIX) similarly remained just under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX also fell back to 12.75 looking for a move of around 0.80% Thursday.

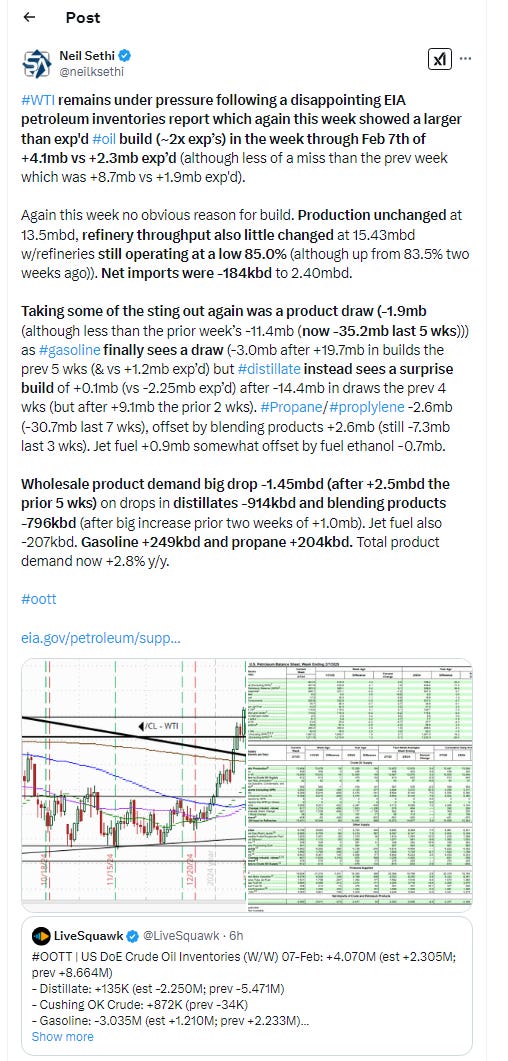

WTI futures fell ending their 3-day run with the worst day in a month after another larger than expected storage build along with headlines about potential Russia/Ukraine peace talks gaining traction. Daily MACD remains not yet supportive, and the RSI fell back under 50, so we’ll just have to see if it can bounce back.

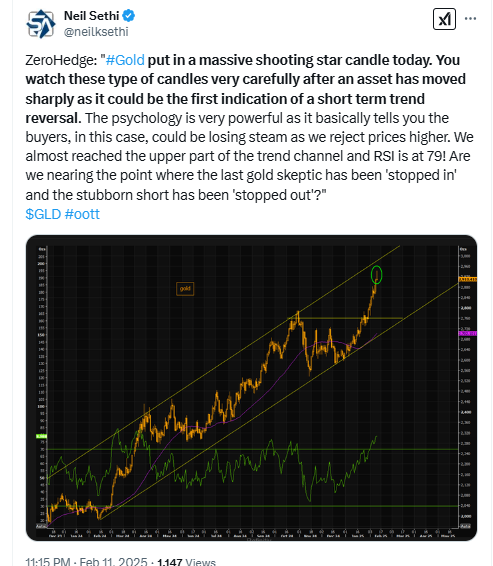

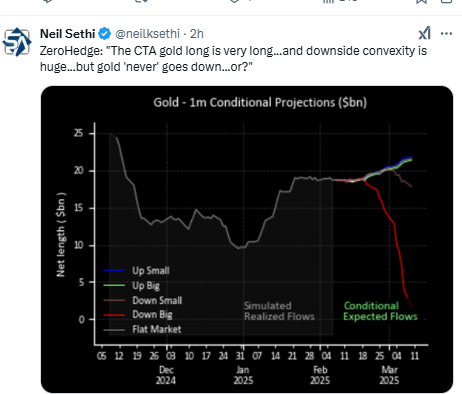

Gold futures little changed for a 2nd day as they sit just below all-time highs. Daily MACD & RSI remain very supportive, although as noted Monday it’s just off the most overbought since April.

Copper (/HG) up 7th session in 8, getting a big boost from China requiring that smelters secure copper supplies for any new facilities. That saved it from a likely consolidation, but it still couldn’t close over the $4.70 resistance. I still think as I said Tuesday “if it can’t rally soon, a consolidation is a likely result which is supported by the RSI falling from well over to under 70. Daily MACD remains supportive though for now.”

Nat gas futures (/NG) climbed for a 5th session in 6 closing over the $3.50 level as well as the 50-DMA now just needing to get over $3.70 to have a chance to really run higher. Daily MACD remains in “go short” position but will cross to “cover shorts” tomorrow, and the RSI has hooked up and pushed over 50, so we’ll see if it can keep up the momentum.

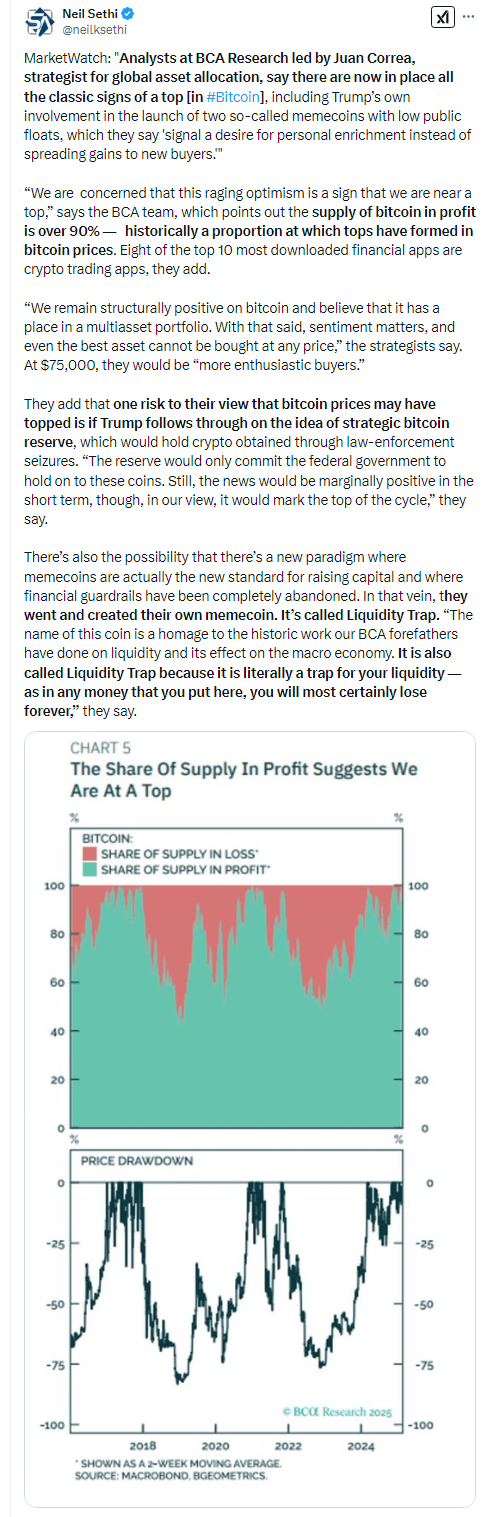

Bitcoin futures continue the back and forth action which has seen it trade sideways for now 6 sessions remaining around 3-wk lows and under its uptrend line from the Oct lows. Daily MACD and RSI remain negative with relative strength just off the weakest since Sept.

The Day Ahead

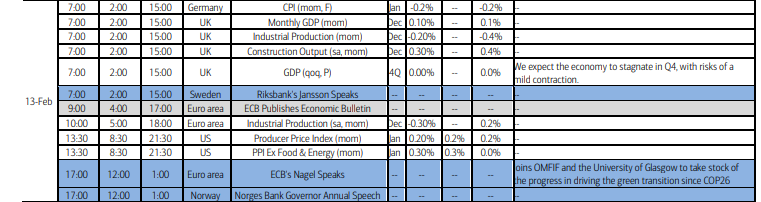

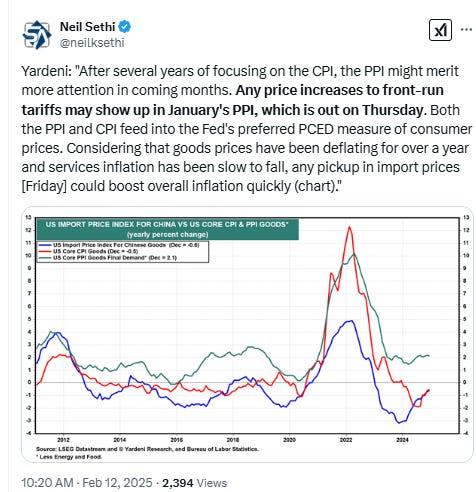

US economic data continues Thursday with another inflation report in PPI along with weekly jobless claims and natural gas inventories.

We’ll get a break from Fed speakers, but we’ll get our last Treasury auction of the week with $25bn in 30yr bonds.

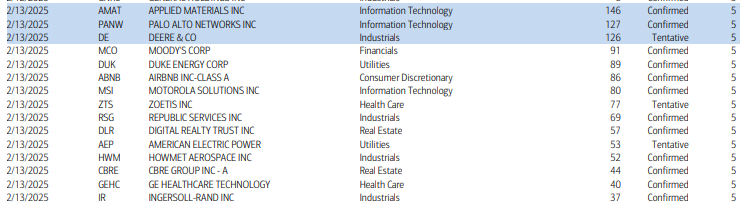

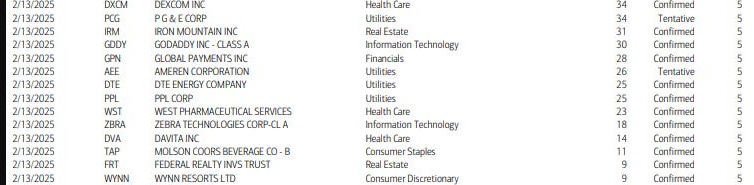

Earnings continue with 29 SPX components, and three > $100bn in market cap in Applied Materials (AMAT), Palo Alto Networks (PANW), and Deere (DE), although we’ll also get non-S&P 500 members Swisscom (SCMWY), L’Oreal (LRLCY), Siemens (SIEGY), Unilever (UL), and Sony (SONY), all >$100bn reporters (see the full earnings calendar from Seeking Alpha).

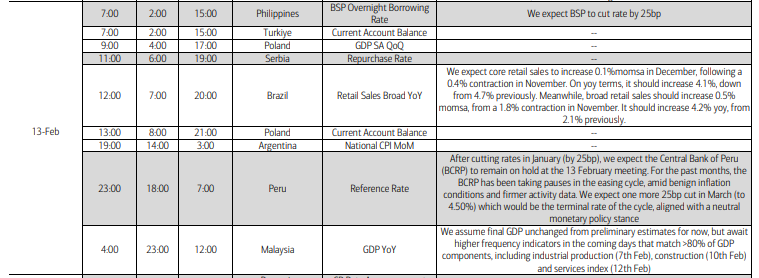

Ex-US data things pick up a bit with UK GDP, EU industrial production and economic forecasts, Japan PPI, and some other reports. In EM we’ll get rate decisions in Peru and Serbia, and CPI from Argentina among other reports. The IEA also releases their monthly report.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,