Markets Update - 2/12/26

Detailed update on US equity and Treasury markets, US economic data, the Fed, select commodities and a look at the upcoming day with lots of charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

SORRY FOR THE DELAY, SUBSTACK WENT DOWN FOR A WHILE AFTER THE CLOSE

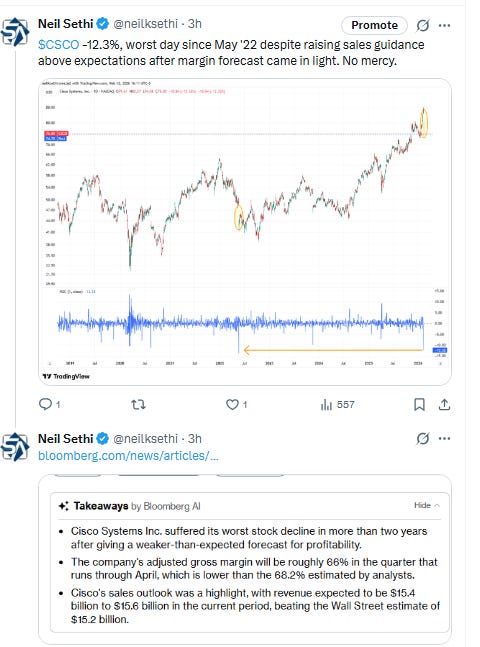

US equity indices opened today’s session like Wednesday’s trading solidly higher, again led by small caps (RUT), on a lighter news day. Cisco Systems was down sharply in premarket trading after the maker of networking hardware issued disappointing guidance for the current quarter (it would have its worst day since 2022 ending nearly -14%), but most other names were higher.

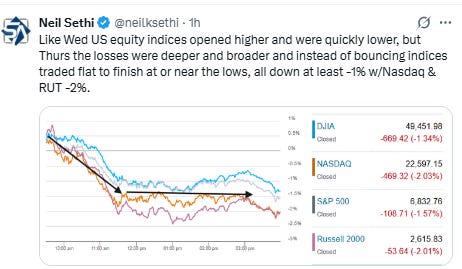

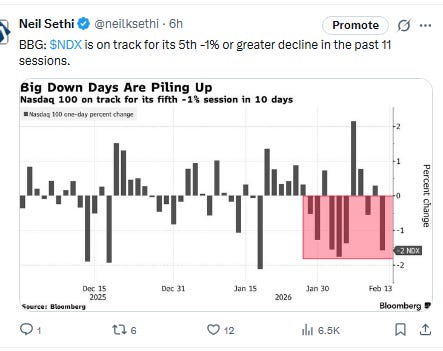

Like Wednesday, though, that would change after the open with indices falling quickly into the red, once again fueled by AI disruption fears and other unfavorable headlines (Apple fell -5%, the most since April, after reports of hiccups in its Siri revamp (more below)), but unlike Wednesday the losses today were deeper and broader, and instead of bouncing, indices would trade relatively flat to finish at or near the lows, all down at least -1% with the Nasdaq & RUT lagging at -2%.

Elsewhere, bond yields fell back towards the lows of the year, while the dollar was little changed for a third day. Along with equities, commodities were mostly sold with crude, gold, copper, bitcoin all lower. Natgas bucked the trend for a small gain.

The market-cap weighted S&P 500 (SPX) was -1.6%, the equal weighted S&P 500 index (SPXEW) -1.4%, Nasdaq Composite -2.0% (and the top 100 Nasdaq stocks (NDX) -2.0%), the SOXX semiconductor index -2.5%, and the Russell 2000 (RUT) -2.0%.

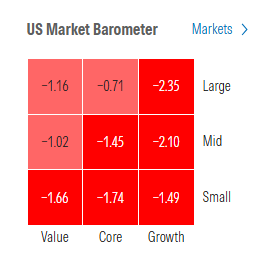

Morningstar style box not mixed today with nothing but red, the worst again hitting growth and small caps.

Market commentary:

“This is a year of the bullish stock market, but a very volatile stock market — and the volatility will be induced by the AI trade, which is evolving,” said Beata Manthey, head of European Equity Strategy at Citigroup Inc. “Right now we are concentrating on losers. But we also need to discover who the new winners are going to be.”

“The almost $2 trillion that has been wiped off US software stocks is likely to entice some bargain hunters who take a less apocalyptic view. ...The set up with underlying fundamentals, global underperformance and pockets of potentially attractive valuations, could together be enough to propel the S&P convincingly above 7,000.” — Simon White, macro strategist.

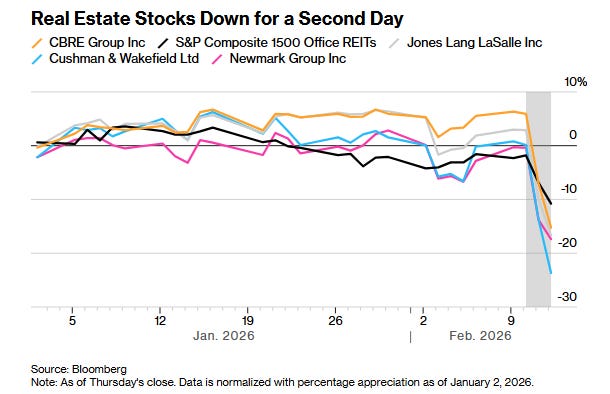

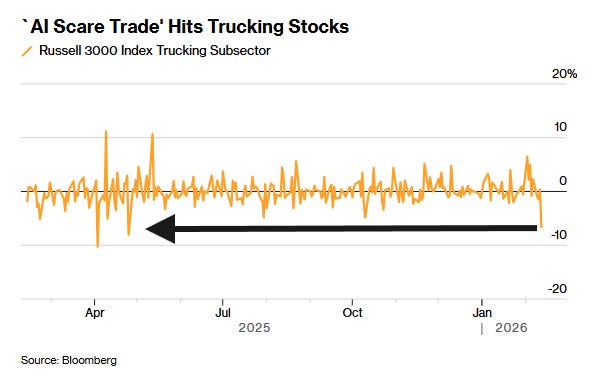

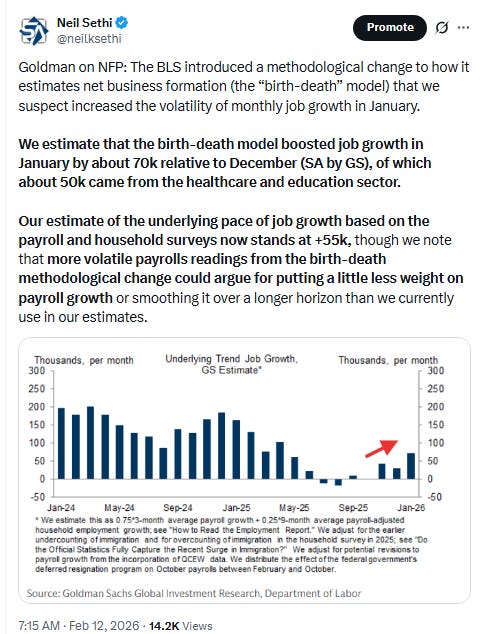

A positive jobs report out yesterday was being overshadowed by the “AI scare trade,” or gloom around the technology’s potential to displace human-based work, according to Thierry Wizman’s strategy team at Macquarie. “On Tuesday, it was the legacy financial companies that were the targets of the AI scare trade, and yesterday, it was the real estate services companies that fell down,” the team wrote in a Thursday client note. Wizman thinks the Federal Reserve will need to consider the potential implications of artificial intelligence on inflation and the labor market.

“AI might be boosting the economy thanks to massive capex investments and productivity enhancements but it’s becoming a net negative for the stock market,” said Vital Knowledge founder Adam Crisafulli. AI is “demolishing” stocks in legacy industries, he said.

“This is the most uncertain outlook we’ve seen for AI and the tech-driven rally since this bull market started,” said Tom Essaye at The Sevens Report. “That does not mean tech won’t recover like it has since then. But I do want to caution against dismissing this weakness as ‘just another bump in the road’.”

Despite some stabilization in US equity benchmarks in recent days, investor concerns over the disruption of AI continue to weigh on various sectors, according to UBS Global Wealth Management’s Ulrike Hoffmann-Burchardi.

“With AI acting both as a driver and a detractor of performance, investors should hold a diversified exposure as they dynamically evaluate the AI landscape,” she said. “We also believe companies that actively use AI to enhance operations and evolve their business models should benefit, especially those in the financials and health care sectors.”

“From AI-phoria to AI-phobia,” said Yardeni Research strategists in a note. “For those who lived through the advent of the Internet, this feels like ‘déjà vu all over again.’ Both AI and the Internet are technological disruptions profound enough to shift the behavior of just about everyone.”

AI disruption risk is only partially priced in credit, with further repricing likely through 2026 and early 2027, according to UBS strategists led by Matthew Mish. “February’s selloff reflects faster AI adoption, but spreads – particularly in US leveraged finance markets – do not yet fully discount higher default risk and refinancing challenges,” they said.

“There is simply more bad news about AI disruption than good news about AI implementation and margins right now,” said Dennis DeBusschere at 22V Research. “AI usage baskets can bounce when there is a friendlier balance between good margin/implementation news and existential risk. Today’s market action is a broad deleveraging, he said. While there may be a macro contribution from investors becoming more concerned about easy financial conditions following strong jobs data, the contribution of idiosyncratic risk (AI) to returns is still outsized, he concluded.

“AI might be boosting the economy thanks to massive capex investments and productivity enhancements but it’s becoming a net negative for the stock market,” said Adam Crisafulli at Vital Knowledge. AI is “demolishing” stocks in legacy industries, he said.

In the past few weeks, and specifically the past few days, it feels the market landscape is “full of AI landmines,” according to Steve Sosnick at Interactive Brokers. The software sector, then insurance brokers, wealth managers, and real estate brokers succumbed sequentially to fears of being decimated by advancements in AI that could impair their business models. The outsized downward reactions are a testament to a momentum-driven market’s ability to overreact to bad news as well as good, he said. It is also a testament to a huge change in market psychology. “For most of the past three years, investors took a ‘glass half-full’ approach to AI,” noted Sosnick. “It was, ‘What can AI do to make a business or industry more efficient?’ It now seems to be ‘How can AI ruin a business’s or industry’s profitability model?’ – and rather than searching for winners, investors are hunting for potential losers.”

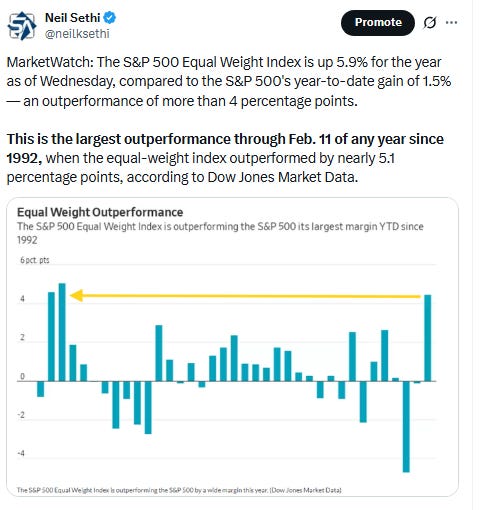

To start 2026, markets have broadened out over hopes of a “run hot” US economy, driven by a combination of monetary and fiscal stimulus and investor angst over AI capital spending plans, noted Chris Senyek at Wolfe Research.

“Throughout earnings season we’ve seen wild, whipsaw price action as AI news has created headline risk across a variety of industries, with the carnage in software spreading to other areas at risk of being “AI’d” such as asset managers and other data providers,” he said. To be fair, he says some recent positive US economic datapoints such as payrolls and manufacturing further support a broadening out trend causing factor unwinds beneath the surface.

Equity leadership is indeed broadening beyond mega-cap tech, and if the path for longer-term yields continues to be flat to slightly higher, valuations and fundamentals take on heightened importance, according to Simeon Hyman at ProShares. That has been one of the drivers of broadening equity market performance so far this year, he noted.

For the past 2 1/2 years, AI stocks have absorbed virtually all money flow while the rest of the market languished, but the AI monopoly on capital flows is ending, according to Brett Ewing at First Franklin Financial Services. “We’re not calling for a massive crash, but rather a normalization as investors finally demand real metrics around adoption rates and monetization,” he said. “The easy money in AI is done — these stocks have been consolidating sideways for 4-5 months and will face increased scrutiny in 2026 as fundamentals finally rule the day over hype.”

“The spreads for the hyperscalers have widened within the indices, and supply is being impacted in a meaningful way by AI,” said Christian Hoffmann at Thornburg Investment Management. “A major theme related to AI is the ‘software scare,’ which is still playing out in equity markets,” he said. “This dynamic is also reverberating through fixed income markets, particularly in lower-quality segments. As those fears get repriced, investors are reassessing assets and applying greater scrutiny to their underlying exposures.”

“Stocks are a bit tired after a very strong start to 2026,” said Charlie Anderson at UBS Wealth Management. “Some of the market’s biggest tech stocks are getting hit after reporting earnings, which shows that investor expectations have risen.”

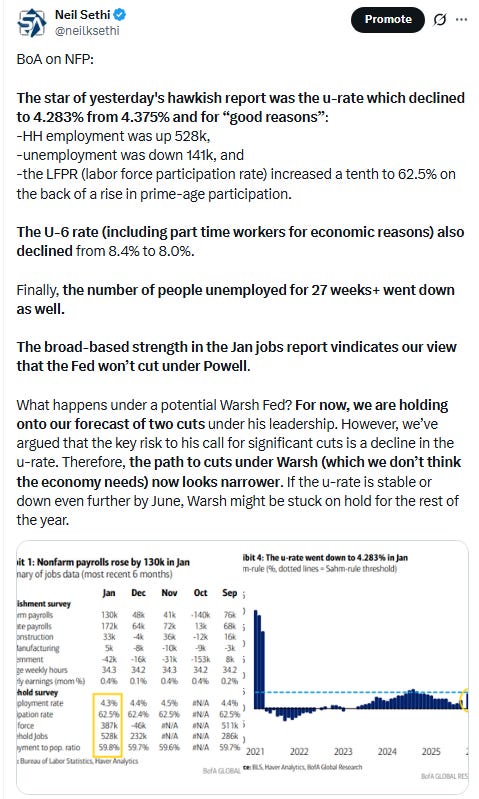

The jobs report is “going to put a lot of weight on Friday’s CPI report, because if that comes in tame, at least the market can understand that the inflation part of the Fed’s equation is cooling,” Tom Lee, head of research at Fundstrat Global Advisors, told CNBC’s “Closing Bell” on Wednesday. “And of course, now, if the job market is showing decent strength, it kind of relieves us from a macro perspective, because at least we’re not seeing an economic downturn,” Lee continued.

“Our takeaway is that the economy is seeing neither broad-based disinflation nor an inflation pickup,” said Anna Wong at Bloomberg Economics.

“CPI is a little bit less important now that we got the good jobs number, because it already allows the Fed to kind of pause for a substantial amount of time,” Mayfield said. “If CPI came in hot, you’d have a couple of months of data to kind of get a sense of the trend before the Fed actually has to make a hard call.” On the flip side, if the data were to come in light, the strategist anticipates that Friday could be a risk-on kind of day, though “it would have to be a pretty, pretty brutal number to the upside to really impact equity markets and fed fund futures,” he added.

Markets are complacent on the outlook for US inflation, making trades that pay out if price pressures climb look attractive, said to Benjamin Wiltshire at Citigroup Inc. Investors may be underestimating the resilience of the US consumer and market expectations for inflation are likely to be revised slightly higher, he noted. “Markets seem to have this conviction that inflation is going to come down,” Wiltshire said in an interview. “We’re still in a structurally higher inflation environment.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

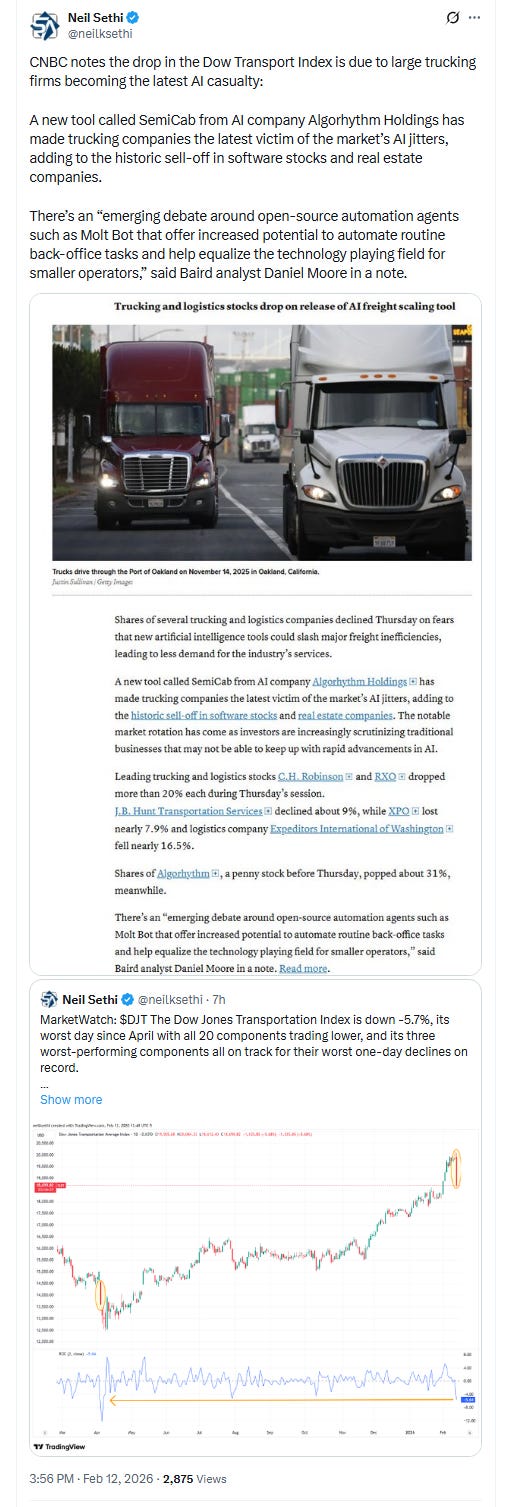

CNBC: The Dow was led lower by Cisco Systems, which slid 12% after the maker of networking hardware such as switches and routers issued disappointing guidance for the current quarter. Financial stocks such as Morgan Stanley came under pressure on fears that AI would disrupt wealth management businesses, while shares of trucking and logistics companies such as C.H. Robinson plummeted 14% on fears that AI would streamline freight operations, thereby weighing on certain revenue lines.

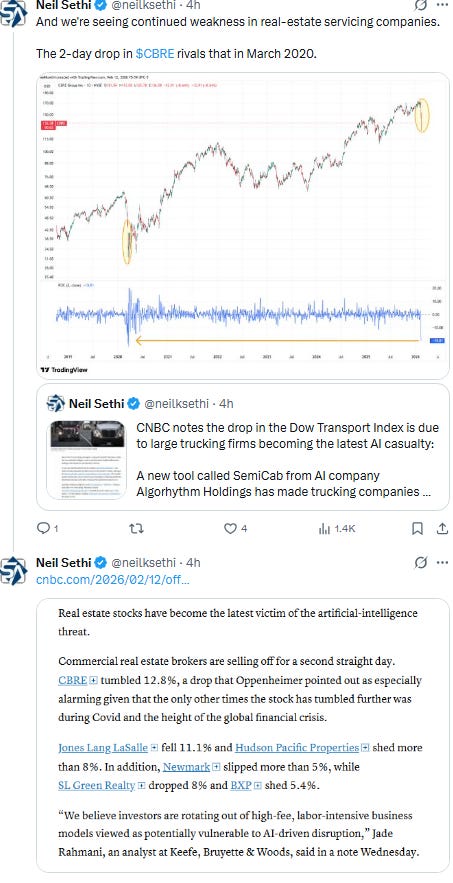

AI disruption fears even spread to the real estate sector, hurting stocks like CBRE and SL Green Realty, on the notion higher unemployment will hit demand for office space.

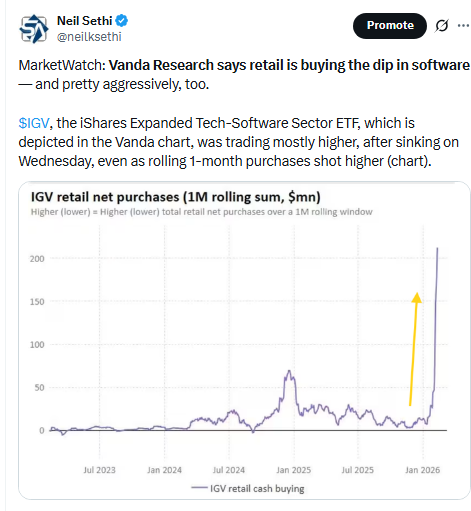

Software stocks — a group that has been plagued by disruption worries in recent weeks — extended their year-to-date losses during the trading day. Palantir Technologies shares pulled back almost 5%, putting its retreat this year at more than 27%. Shares of Autodesk dropped nearly 4%, and the stock’s year-to-date slide is now about 24%. The iShares Expanded Tech-Software Sector ETF (IGV) fell nearly 3%. The fund now stands about 31% below its recent high after first entering a bear market last month.

Investors sought safety in more defensive areas of the market. Walmart and Coca-Cola shares were up 3.8% and 0.5%, respectively. Consumer staples and utilities led the gains among S&P 500 sectors, rising more than 1% each. That move led consumer staples to a fresh record close.

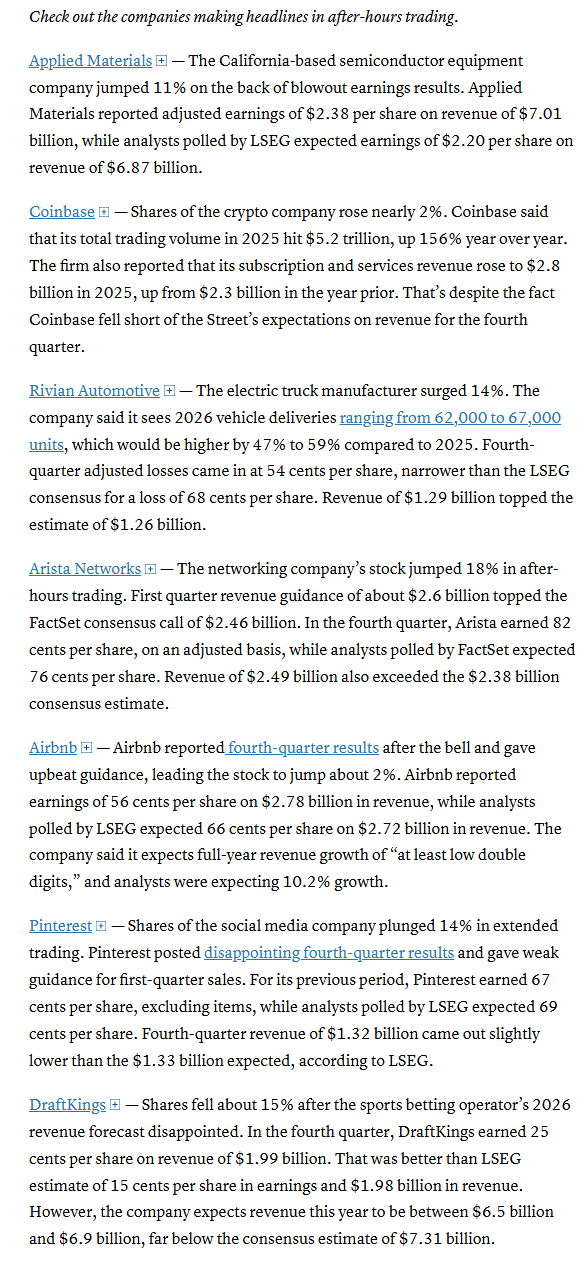

BBG: In late hours, Applied Materials Inc. gave an upbeat forecast.

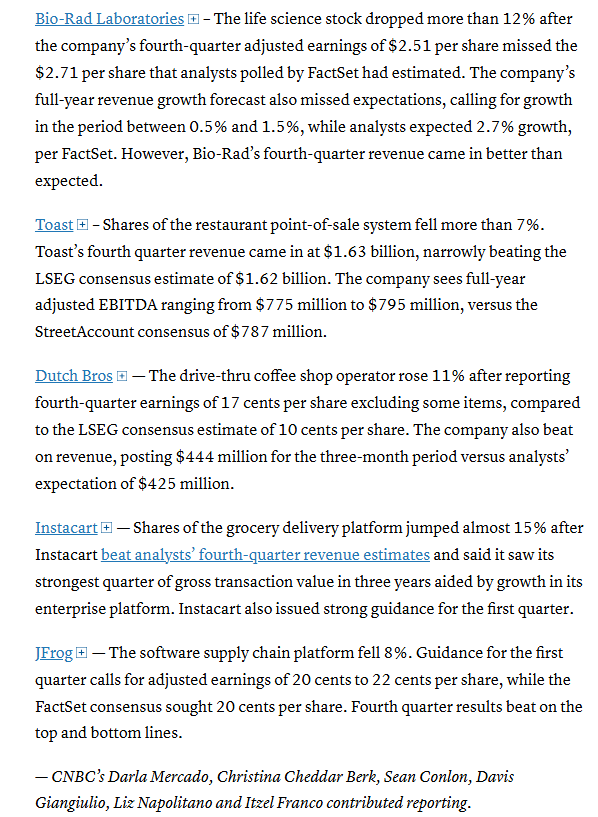

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Nvidia Corp. is expected to lease a data center being built with funds from a $3.8 billion junk-bond sale, adding to the borrowing frenzy around artificial-intelligence infrastructure.

Anthropic has completed a deal to raise $30 billion in funding from investors at a $380 billion valuation, including the money raised, bolstering the artificial intelligence company as it gains ground on rival OpenAI.

OpenAI is releasing its first artificial intelligence model that runs on chips from semiconductor startup Cerebras Systems Inc., part of a push by the ChatGPT maker to broaden the pool of chipmakers it works with beyond Nvidia Corp.

International Business Machines Corp. said it will triple entry-level hiring in the US in 2026, even as artificial intelligence appears to be weighing on broader demand for early-career workers.

Alphabet Inc.’s YouTube released a dedicated app for Apple Inc.’s Vision Pro on Thursday, filling a notable gap in the headset’s lineup of entertainment options two years after its debut.

Alphabet updated its Gemini Deep Think artificial intelligence model for better performance in math and science research, the company said.

Alphabet’s Waymo is enlisting DoorDash Inc. drivers in Atlanta to close robotaxi doors that have been left open, letting the driverless vehicles continue on their way.

AppLovin Corp. While fourth-quarter results and outlook were above consensus expectations on key metrics, they were not be strong enough to assuage recent concerns over AI-related disruption seeing shares lead the S&P 500 to the downside.

Fastly Inc., an infrastructure software company, posted fourth-quarter results that beat expectations and it gave a robust full-year forecast. William Blair upgraded their recommendation on the stock.

A drumbeat of bearish signals is building across the crypto industry, with Standard Chartered slashing its Bitcoin price target and Coinbase Global Inc. getting cut to sell as momentum traders struggle to push Bitcoin back toward its highs.

Pinterest Inc. projected current-quarter sales that fell short of Wall Street estimates, just weeks after announcing layoffs and a pivot toward artificial intelligence products.

DraftKings Inc., the online betting company, issued a 2026 forecast for sales and profit that fell short of Wall Street estimates.

Airbnb Inc. posted strong fourth-quarter bookings and issued an upbeat revenue outlook, citing strong travel demand and growing adoption of its new flexible payment and booking options.

Rivian Automotive Inc. closed out 2025 with better-than-expected financial results, sending the shares higher ahead of the electric-vehicle maker’s critical debut of its next-generation SUV.

Instacart issued a strong outlook for the start of 2026 that far exceeded analyst expectations, signaling sustained demand for its grocery delivery services.

Constellation Brands Inc., the owner of the Modelo beer brand in the US, said its board named Nicholas Fink as its next chief executive officer.

McDonald’s Corp.’s US sales grew at the fastest pace in more than two years in the fourth quarter as value meals continued to resonate with cost-conscious diners.

CarMax Inc. named Keith Barr as chief executive officer, bringing in the former InterContinental Hotels Group Plc chief to modernize the company and revive performance.

Clear Street Group Inc. slashed the targeted size of its initial public offering by nearly two thirds, after the broker faced pushback from prospective investors.

Cargill Inc. is permanently closing a plant that produces ground beef in Milwaukee, joining other meatpackers who have pulled back amid a severe cattle shortage.

Brookfield Corp.’s profit rose in the fourth quarter as the company reported record earnings from its asset manager and strong growth in its wealth business.

Birkenstock Holding Plc saw robust holiday demand for its clogs, boots and high-end shearling-lined footwear as the German sandal maker continues a push to become a footwear brand for all seasons.

Novo Nordisk A/S is planning to boost investment in Ireland where it will make its hit Wegovy weight-loss pill for markets outside the United States.

Sanofi abruptly replaced Chief Executive Officer Paul Hudson after a massive research spending boost failed to deliver rapid results, appointing its first female leader, Merck KGaA’s Belén Garijo.

L’Oréal SA sales missed estimates in the final months of last year after the French beauty group’s luxury division disappointed.

Ubisoft Entertainment SA reported net bookings that beat analysts’ estimates in the fiscal third quarter, buoyed by strong demand for the video game publisher’s most popular franchises such as Assassin’s Creed.

Nuveen is buying Schroders Plc in a £9.9 billion ($13.5 billion) deal, creating one of the world’s largest active asset managers with nearly $2.5 trillion of assets.

dMid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X