Markets Update - 2/13/26

Detailed update on US equity and Treasury markets, US economic data, the Fed, select commodities and a look at the upcoming day with lots of charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

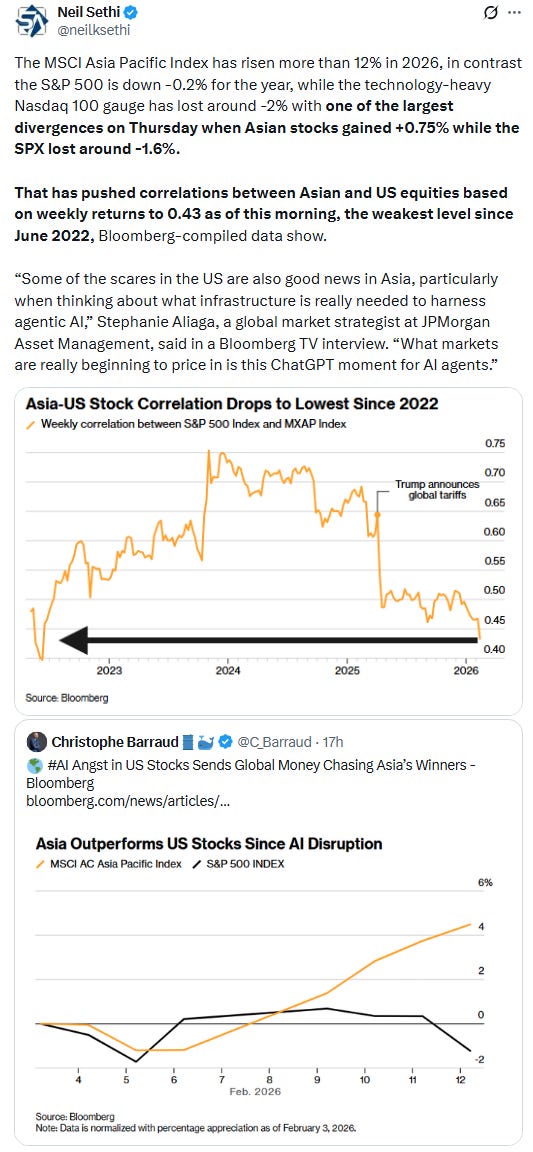

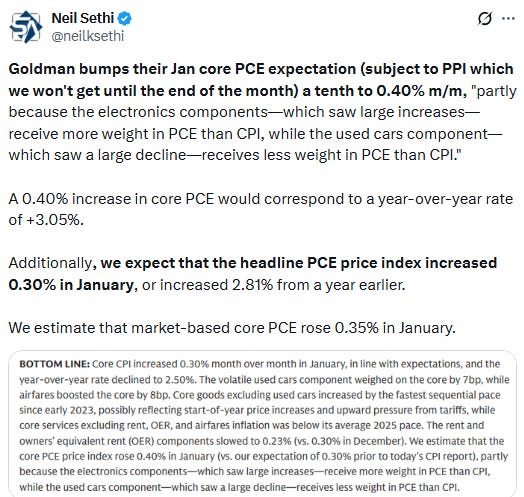

US equity indices opened today’s session modestly higher, for a third day (pre-market) led by small caps (Russell 2000 (RUT)), following a slightly cooler than expected CPI report which showed headline consumer inflation at +0.2% m/m in January, and +2.4% on an annualized basis, both a tenth below expectations. The more important (for the Fed) core CPI though was in line with expectations at +0.3% on the month and +2.5% year over year which was still though the least since 2021 (full report link below). Bonds gained (yields lower hitting the lows of the year) and Fed rate cut bets were boosted (all covered in the subscriber section).

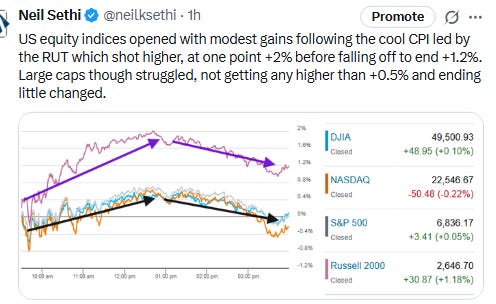

Post-open the RUT would extend higher on the back of the foregoing, at one point +2% before falling off to end +1.2%. Large caps though struggled, with continued weakness in tech and financial shares, with the large cap indices not getting any higher than +0.5% and ending little changed despite more stocks advancing than falling (the equal-weight SPX was +1%).

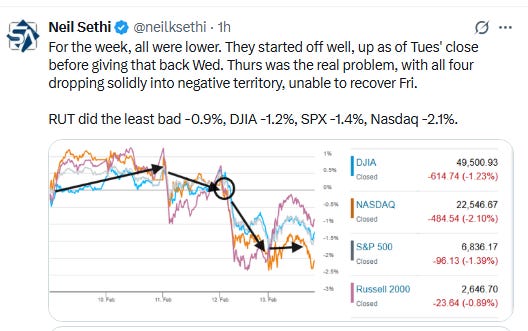

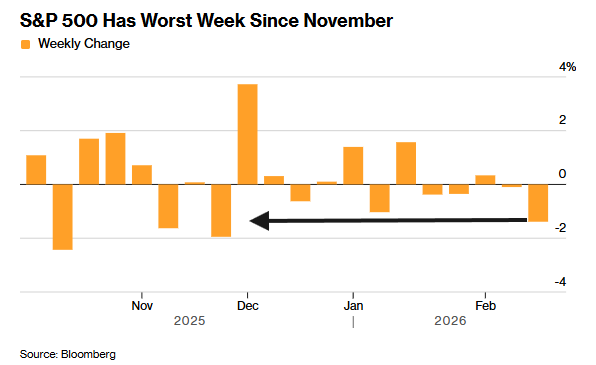

For the week, all four indices were lower. They started off well, up as of Tuesday's close before giving that back Wednesday. Thursday was the real problem, with all four dropping solidly into negative territory, unable to recover Friday. RUT did the least bad -0.9%, DJIA was -1.2%, SPX -1.4%, Nasdaq -2.1%. For the SPX and Nasdaq it was the worst week since November (and for the Nasdaq the worst two weeks since April). Charts in the subscriber section.

Elsewhere, bond yields as noted fell to the lows of the year, while the dollar was little changed for a fourth day. Commodities mostly saw mild gains with crude, gold, copper, and natgas all moving up, bitcoin seeing a little larger gain but still ending at the lowest weekly close since Sep ‘24 (all covered in the subscriber section).

The market-cap weighted S&P 500 (SPX) was +0.1%, the equal weighted S&P 500 index (SPXEW) +1.0%, Nasdaq Composite -0.2% (and the top 100 Nasdaq stocks (NDX) +0.2%), the SOXX semiconductor index +0.7%, and the Russell 2000 (RUT) +1.2%.

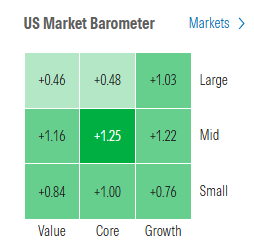

Morningstar style box flipped from all red to all green.

Market commentary:

“Today’s inflation report is a relief for investors rattled by AI disruptions in the stock market. It also offsets this week’s strong payrolls report, giving the Fed a little more reason to lean dovish. However it’s still well above the central bank’s target and does little to move the needle near term,” said David Russell, global head of market strategy at TradeStation. “Policy expectations are going nowhere in a hurry.”

Seema Shah at Principal Asset Management - “For the Fed, however, it still falls short of justifying near‑term rate cuts. Continued labor market strength gives policymakers cover to stay on hold, while further disinflation in the second half of the year—as tariff effects fade—should reopen the door to easing.”

Ali Jaffery at CIBC Capital Markets points out that the annual readings of 2.4% and 2.5% for the headline and the core gauges are “essentially consistent” with the other main inflation gauge -- the PCE price index that the Fed uses for its official target -- running at policymakers’ desired 2% pace. The CPI has historically averaged around half a percentage point or so higher than the PCE: “Today’s data is telling us annual inflation pressures are fairly subdued as firms are still absorbing tariff costs, shelter costs are coming down and a softening labor market is keeping wage pressures subdued.”

Christopher Hodge at Natixis describes the numbers as a “curious mix,” but says ultimately they point in one direction: “In the coming months, we expect inflation to continue to be higher than preferred, but not accelerating, which will allow the Fed to lower rates in response to soft labor data.”

“There remain some trouble spots, but overall, the trend in inflation is lower,” said Steve Wyett at BOK Financial. “While the Fed is on pause for now, we expect somewhat lower rates as we move forward in 2026.”

Two key positives emerge from this report: significantly lower goods inflation and reduced housing inflation persistence. These developments keep the Fed on track for a potential third rate cut, though this remains data-dependent, noted Florian Ielpo at Lombard Odier Asset Management. “The report fundamentally reinforces the ‘Goldilocks’ narrative – improving growth alongside moderating inflation – creating an ideal environment for diversified investment portfolios,” he said.

While normally these types of inflation readings would give the Fed the go-ahead to ease policy, the robust job numbers that came out Wednesday mean we seemingly are entering a “gold medal” economy with strong growth, a stabilizing job market and lower inflation, noted John Kerschner at Janus Henderson Investors. “The bond market is basically telling investors ‘nothing to worry about here’,” he added.

Tiffany Wilding, economist at Pacific Investment Management Co., said on Bloomberg Television that the inflation report was “pretty encouraging under the surface.” She points out two positive developments. First, “Shelter inflation, which had been consistent since the pandemic, is really decelerating.”

Second, the tariff-related effects are largely fading. “As that fades, you should have a Federal Reserve that feels more comfortable cutting interest rates,” she said. “Getting a couple more cuts in this year seems reasonable to us.”

“Friday’s delayed CPI for January was muted and in-line with expectations and it won’t increase the likelihood of a rate cut within the next few months largely because of Wednesday’s blowout employment numbers, which threw ice cold water on any hopes of a near-term rate cut,” said Skyler Weinand, CIO at Regan Capital, in written commentary shared with MarketWatch. “The Fed is always in a tug of war between balancing inflation with employment, but they just can’t cut rates right now with the economy having just created a six-figure jobs number.”

“This should be welcome news for markets, and the presumptive incoming Fed Chair Kevin Warsh,” said Phil Blancato, Osaic chief market strategist. “This is only one month’s worth of data, but if the trend continues it should pave a path for lower interest rates and reined in inflation.”

Inflation is also “not unrelated” to existing fears among investors that artificial intelligence will disrupt revenue potential in various industries, according to Keith Buchanan of Globalt Investments. While Friday’s CPI print “has nothing to do with what we’re anticipating” as far as industry disruption goes, the market is still trying to figure out what AI and its implementation throughout the economy really means, he said, noting that it’s creating “upward pressure on unemployment” as well as “downward pressure on inflation.”

“How do we think that everyone was going to win and there wouldn’t be a loser?” the senior portfolio manager told CNBC.

“In terms of an AI bubble, the reality is there’s some steam coming out of certain names as the market tries to determine winners and losers and is becoming more discriminate,” Brian Levitt, global market strategist at Invesco, said Thursday on CNBC’s “Closing Bell.”

“But the Dow Jones Industrial Average is close to 50,000. The S&P 500 is close to 6,900... There is, obviously, some carnage underneath, but in general, this is not an AI bubble. The markets are holding up very nicely,” he continued.

“This is a market that is dominated by AI, both positive and negative, with seemingly every sector / sub-sector taking a turn at being declared obsolete,” JPMorgan traders wrote in a Friday note. “The reality is, the market is struggling to understand the full scope of what AI can do ranging from impressive audio / video features to less impressive usage in consumer services, e.g. changing a flight.”

“We think it makes sense to refocus on macro fundamentals where the US is throwing off mixed signals,” they added.

“Investors show no mercy for anything seen as an AI loser. The list is growing by the day, driving divergence between new/old economy sectors and U.S./[Rest Of World] equities,” said Barclays analyst Emmanuel Cau. “Amid erratic price action and fears of AI disruption turning into a broader macro/credit issue, growth, rates & earnings backdrop is okay.

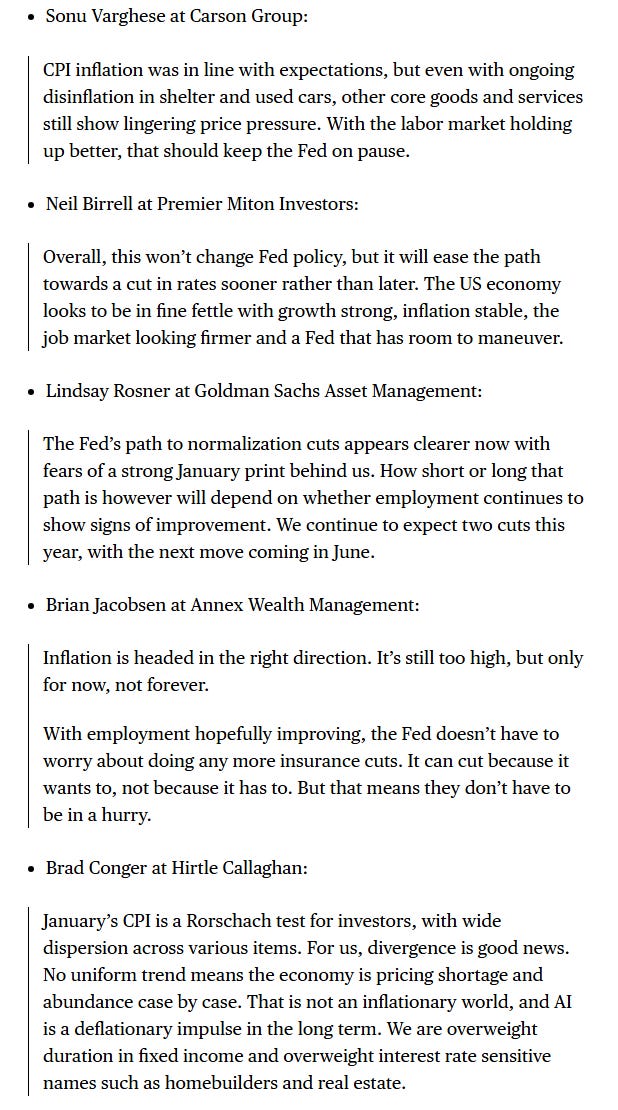

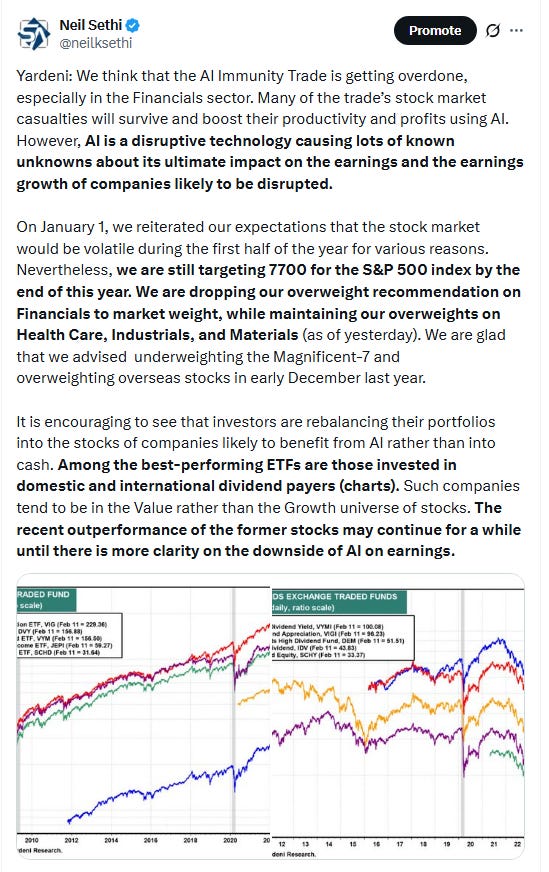

“After a powerful rally since last April, some consolidation during a typically weak February isn’t unhealthy,” said Mark Hackett at Nationwide. “Valuations have moderated, earnings expectations continue to improve, and bond yields are easing. The fundamental backdrop still supports this bull market.” Still, he noted that leadership is shifting, with investors finding better risk-reward in international, value and small-cap stocks.

The “AI disruption vigilantes” were at it again this week with new targets, but the initial reactions to that story may turn out to be “overblown,” since many industries and individual businesses could very well turn out to be AI beneficiaries in the long term, said Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

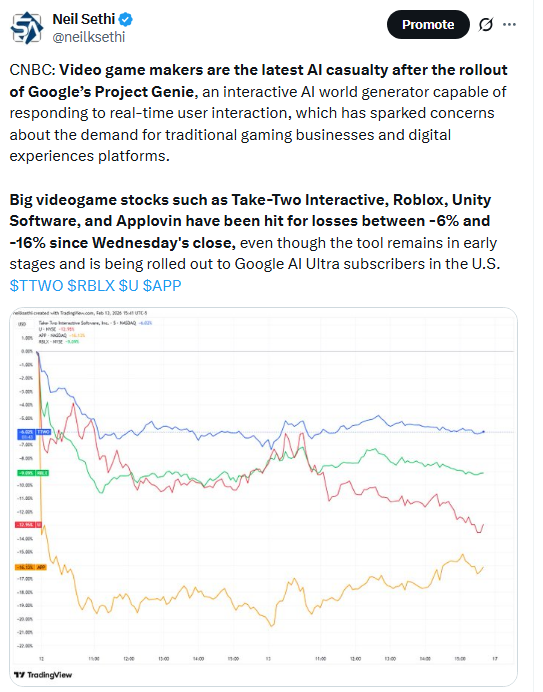

AI disruption fears rattled the market this week, spreading beyond the sell-off seen in software and into real estate, trucking and financial services. Financial stocks Charles Schwab and Morgan Stanley fell 10.8% and 4.9% this week, respectively, while software stock Workday dropped 11% in the period. Shares of commercial real estate firm CBRE lost 16% week to date.

Those fears widened to the media industry as well, hitting Walt Disney and Netflix. Disney shares added about 3% on the week, while Netflix shares tumbled 6%.

Amazon.com Inc. saw its longest slide in almost 20 years.

Companies making the biggest moves after-hours from CNBC.

None today.

Corporate Highlights from BBG:

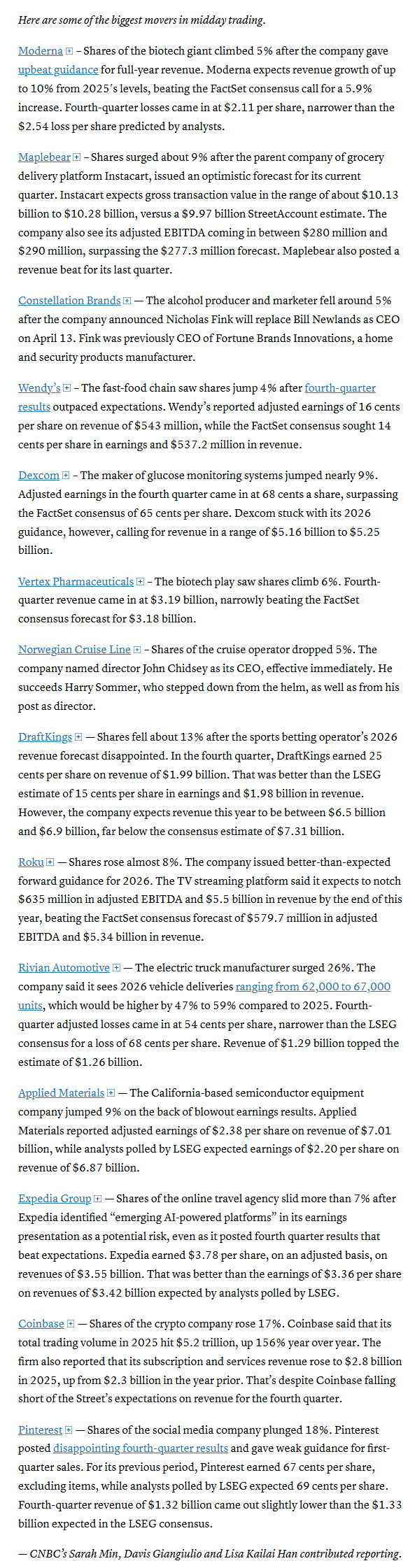

Applied Materials Inc. soared after the company delivered a surprisingly upbeat sales forecast, signaling that demand for artificial intelligence and memory semiconductors is fueling equipment purchases.

A data center project expected to be leased by Nvidia Corp. sold $3.8 billion of junk bonds on Friday after receiving about $14 billion of orders from investors, an indication that lenders are eager to continue funding the buildout of artificial-intelligence infrastructure.

OpenAI has partnered with two defense technology companies that the Pentagon has selected to compete to develop voice-controlled, drone swarming software for the US military, according to multiple people familiar with the matter.

Goldman Sachs Group Inc. has rolled out a new custom basket aimed at navigating the growing upheaval in software stocks, betting on companies perceived to be better insulated from artificial intelligence disruption than others.

The US Federal Trade Commission is accelerating scrutiny of Microsoft Corp. as part of an ongoing probe into whether the company illegally monopolizes large swaths of the enterprise computing market with its cloud software and AI offerings, including Copilot.

Anthropic PBC has named Chris Liddell to its board of directors, expanding its leadership with a seasoned finance executive who played a key role in taking General Motors Co. public.

SpaceX is considering a dual-class share structure in its planned IPO this year, according to people familiar with the matter, mirroring a strategy its billionaire founder Elon Musk floated for Tesla Inc.

Blackstone Inc.’s private equity fund for wealthy individuals notched a net 20% gain last year, thanks in part to some artificial intelligence investments the firm doesn’t hold in its institutional portfolios.

The Pentagon added Alibaba Group Holding Ltd., BYD Co., Baidu Inc. and TP-Link Technologies Co. to a list of companies that aid the Chinese military – before withdrawing it minutes later without explanation.

Pinterest Inc. tumbled after the company projected current-quarter sales that fell short of Wall Street estimates, the latest in a rocky period marked by layoffs and a pivot toward artificial intelligence products.

DraftKings Inc., the online betting company, issued a 2026 forecast for sales and profit that fell short of Wall Street estimates, sending the stock slumping.

Instacart climbed after the company issued a strong outlook for the start of 2026 that far exceeded analyst expectations, signaling sustained demand for its grocery delivery services.

Airbnb Inc. gained after the company posted strong fourth-quarter bookings and issued an upbeat revenue outlook, citing strong travel demand and growing adoption of its new flexible payment and booking options.

Rivian Automotive Inc. closed out 2025 with better-than-expected financial results, sending the shares higher ahead of the electric-vehicle maker’s critical debut of its next-generation SUV.

Moderna Inc. beat fourth-quarter revenue estimates as its struggling Covid vaccines business declined less than expected.

Moderna lashed out at the US Food and Drug Administration for making it harder for companies to create new medicines, escalating a dispute between the vaccine maker and the regulator.

Wendy’s Co. rebounded after the chain said sales would be little changed this year, suggesting that the struggling fast food chain has reached a low point.

Constellation Brands Inc., the owner of the Modelo brand in the US, named Nicholas Fink its next chief executive officer as the company looks for new ways to spur growth amid a drop in the beer business.

Toyota Motor Corp. is safeguarding its nearly $1 billion investment pledge to air taxi maker Joby Aviation Inc. by troubleshooting production processes and mulling a deeper manufacturing role.

First Brands Group and some of its creditors are weighing a shift of some of its units into the Chapter 7 bankruptcy liquidation process as the company runs low on cash, according to people familiar with the matter.

Capgemini Chief Executive Officer Aiman Ezzat said the French IT company is “clearly pivoting” to facilitate artificial intelligence adoption, which will fuel sales this year.

The Paris prosecutor’s office opened probes into allegedly tainted infant formula distributed by Nestlé SA, Danone, Groupe Lactalis and two other brands.

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X