Markets Update - 2/14/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

(Note graphic is from 2021)

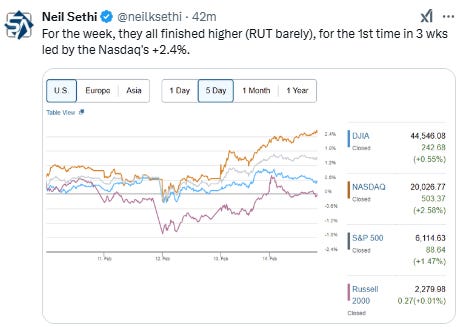

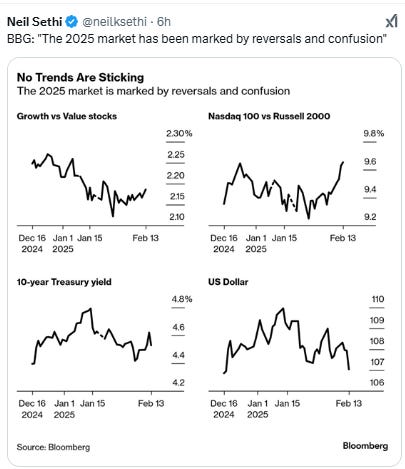

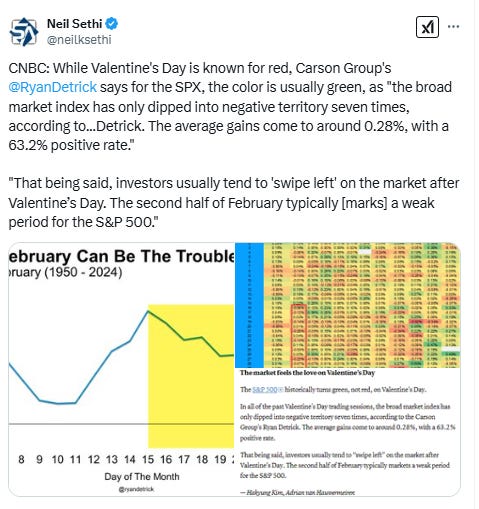

US equities started the day off mixed with large caps little changed but small caps seeing modest gains after a much weaker than estimated (by consensus, but BoA had called for it as I noted earlier this week) retail sales report and finally a coolish inflation read in import prices (a tenth cool but December revised a tenth higher) which saw Fed rate cut bets jump and bond yields and the dollar fall back for a second day. As the day progressed though they flip flopped with small caps falling into negative territory while the Nasdaq moved higher. The SPX traded around unchanged all day while the DJIA lagged them all. Still for the week they all finished higher (Russell 2000 barely), for the first time in three weeks, led by the Nasdaq's +2.4%.

Elsewhere, as noted Treasury yields and the dollar fell, as did crude, copper, and gold, while nat gas and bitcoin were higher.

The market-cap weighted S&P 500 (SPX) was unch, the equal weighted S&P 500 index (SPXEW) -0.1%, Nasdaq Composite +0.4% (and the top 100 Nasdaq stocks (NDX) +0.4%), the SOX semiconductor index +0.1%, and the Russell 2000 (RUT) -0.1%.

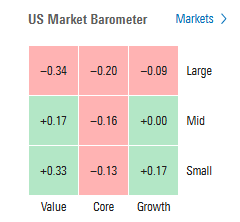

Morningstar style box showed the muted action extended across styles.

Market commentary:

"Markets are attempting to break out to a fresh record high despite geopolitical uncertainty and weak seasonality," Nationwide's Mark Hackett said in commentary shared with MarketWatch via email. "...[T]he key tenets of the bear argument are breaking down, and odds are improving that the S&P 500 breaks out of the trading range it has been stuck in since the election."

“The positive scenario from today’s data is this: rates ease as the economy moderates and the consumer weakness is a blip that doesn’t impact investors’ love affair with stocks,” said Steve Sosnick at Interactive Brokers. “The flipside is a much worse scenario: the consumer and the government both slam their wallets shut, impacting GDP faster than the Fed is willing or able to operate.”

“Bond yields have certainly bounced around this week, and the fact that they’ve been able to come back down played a big role in yesterday’s strong rally in the stock market,” said Matt Maley at Miller Tabak. “However, this seemed to have more to do with the inflation issue than with the war or with tariffs.” Given that the stock market has been range-bound for almost three months now, any meaningful upside breakout of this range will be quite positive on a technical basis, Maley concluded.

“Don’t freak out, folks, monthly economic indicators are often volatile during natural disasters and bad winter weather,” Comerica Bank’s chief economist Bill Adams said in emailed comments on the drop in retail sales in January. “Retail categories where consumers can put off purchases for a few weeks took a hit in January.”

“The consumer sentiment report showed people were getting nervous and today’s weak retail sales number confirmed it,” said David Russell at TradeStation. “However, the resulting slack is good news for the Fed and tilts the balance a little bit more toward rate cuts.”

At Interactive Brokers, Jose Torres says the weak consumption report is reopening the door to a potential Fed reduction this summer, a prospect that was dampened by a “piping hot” inflation print earlier this week.

“Consumers pulled back hard on spending after a generous holiday season, but they were still willing to open their pocketbooks when it came to dining out,” said Ellen Zentner at Morgan Stanley Wealth Management. “This suggests households remain confident in the economy even as policy uncertainty has risen.”

“Are consumers taking a break?” said Bret Kenwell at eToro. “Investors should be careful not to extract too much meaning from one data point. However, weaker retail sales amid increasing or stubbornly high inflation is a burden for US consumers and companies. It’s too early to call it a trend, but if that trend were to develop, it would be a troubling sign.”

“The large fall in control group retail sales in January, together with the timelier data showing a slump in vehicle sales, suggests that real consumption fell last month,” Capital Economics said in a note Friday. “The polar vortex that hit the continent in the second half of the month probably helps to explain some of the weakness.”

Will Compernolle at FHN Financial says he’s skeptical the report signals a true inflection point in consumer spending. Paired with an “overzealous reaction” to Thursday’s producer price index, bonds have moved into “overbought territory,” he said.

Overall, Andy Wells, chief investment officer of investment management firm SanJac Alpha LP in Houston believes the secular inflation environment will remain elevated although growth will slow a little bit. "We're kind of having a stagflation backdrop, not scary stagflation, just saying that growth is going to be slower, and the lower end of inflation will be a little higher than what we're accustomed to," said Wells.

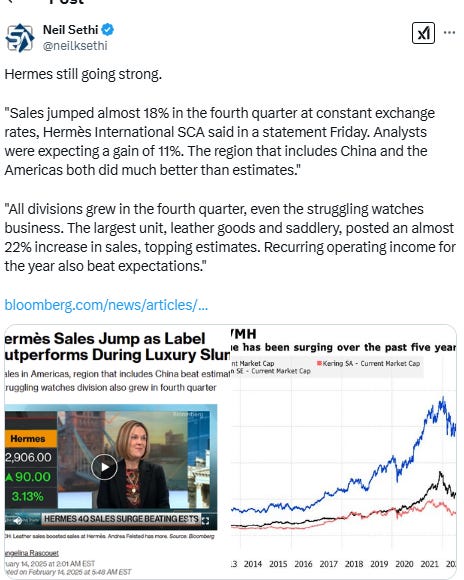

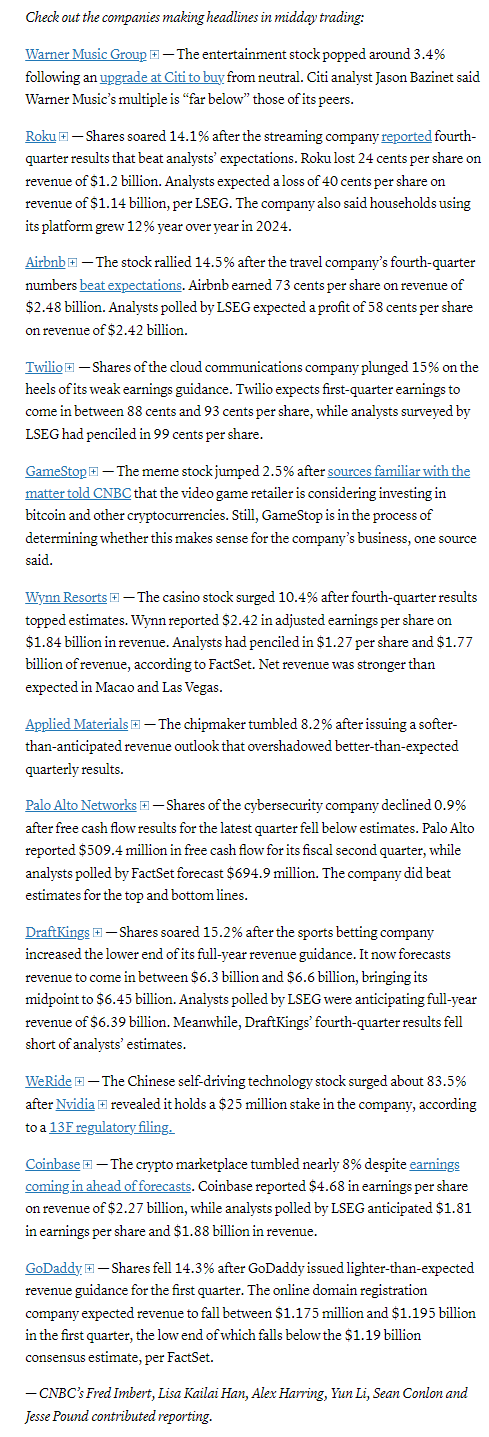

In individual stock action, Airbnb (ABNB 161.42, +20.38, +14.5%) and Wynn Resorts (WYNN 88.82, +8.35, +10.4%) were sharply higher after reporting earnings, and Dell shares were up nearly 4% after Bloomberg News reported, citing people familiar with the matter, that the chipmaker was nearing a deal to sell servers with Nvidia chips to Elon Musk’s xAI. Roku shares soared 14.1% after the streaming company reported fourth-quarter results that beat analysts’ expectations. DraftKings shares jumped 15.2% after the sports betting company increased the lower end of its full-year revenue guidance.

But shares of the cloud communications company Twilio plunged 15% on the heels of its weak earnings guidance, and chipmaker Applied Materials tumbled 8.2% after issuing a softer-than-anticipated revenue outlook that overshadowed better-than-expected quarterly results. Crypto marketplace Coinbase tumbled nearly 8% despite earnings coming in ahead of forecasts while shares of online domain registration company GoDaddy fell 14.3% after lighter-than-expected revenue guidance for the first quarter.

BBG Corporate Highlights:

Airbnb Inc. issued an upbeat forecast for the first three months of 2025, citing “continued strong demand” after a bustling holiday travel season.

Applied Materials Inc., the largest US maker of chip-manufacturing equipment, issued a lukewarm revenue forecast for the current period, citing the risk of export controls crimping its business.

Coinbase Global Inc. said revenue more than doubled and profit increased more than forecast during last quarter’s Trump-inspired rally in digital assets.

Dell Technologies Inc. is in advanced stages of securing a deal worth more than $5 billion to provide Elon Musk’s xAI with servers optimized for artificial intelligence work.

DraftKings Inc. shares rose as much as 15% to their highest level in nearly three-and-a-half years after the company reported fourth-quarter earnings that beat expectations and raised its sales guidance for the current year.

Moderna Inc. recorded a quarterly loss as vaccine sales waned and the company had an unexpected charge for a canceled manufacturing contract.

Palo Alto Networks Inc. issued a disappointing earnings outlook for the current quarter, despite rivals including Fortinet Inc. and Check Point Software Technologies Ltd. posting strong results.

Roku Inc., the streaming-video platform company, reported fourth-quarter results that beat expectations.

SoundHound AI Inc., Serve Robotics Inc. and Nano-X Imaging Ltd. tumbled after Nvidia Corp. filed a 13F indicating that the chipmaker exited its stakes in the companies.

Taiwan Semiconductor Manufacturing Co. is considering taking a controlling stake in Intel Corp.’s factories at the request of Trump administration officials, a person familiar with the matter said, as the president looks to boost American manufacturing and maintain US leadership in critical technologies.

Some tickers making moves at mid-day from CNBC.

In US economic data:

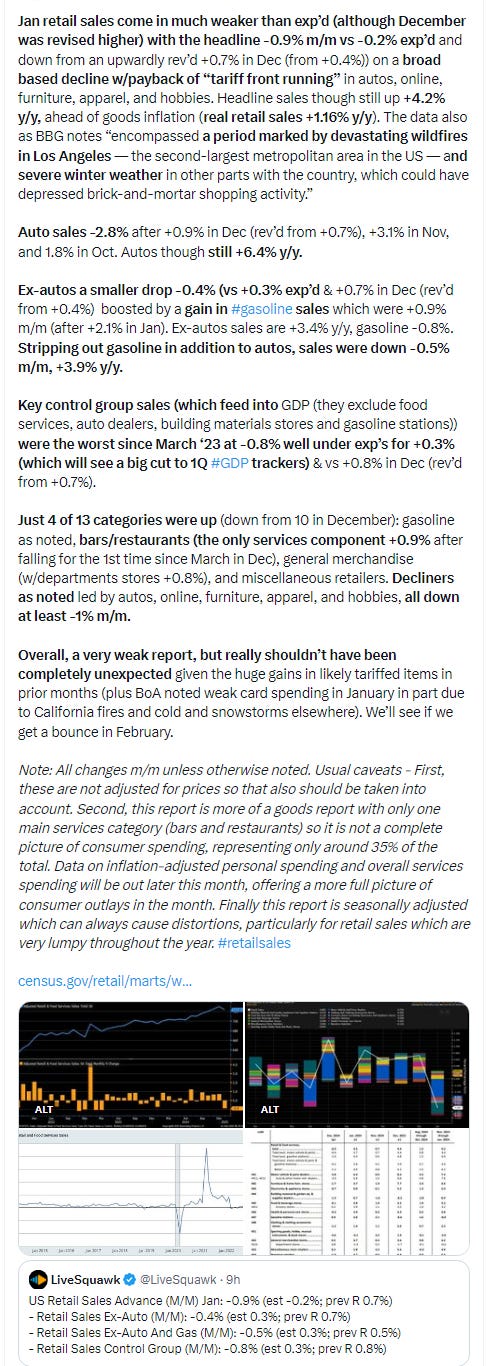

Jan retail sales came in much weaker than exp’d (although December was revised higher) with the headline -0.9% m/m vs -0.2% exp’d and down from an upwardly rev’d +0.7% in Dec (from +0.4%)) on a broad based decline w/payback of “tariff front running” in autos, online, furniture, apparel, and hobbies. Headline sales though still up +4.2% y/y, ahead of goods inflation (real retail sales +1.16% y/y). The data also as BBG notes “encompassed a period marked by devastating wildfires in Los Angeles — the second-largest metropolitan area in the US — and severe winter weather in other parts with the country, which could have depressed brick-and-mortar shopping activity.” Key control group sales (which feed into GDP (they exclude food services, auto dealers, building materials stores and gasoline stations)) were the worst since March ‘23 at -0.8% well under exp’s for +0.3% (which will see a big cut to 1Q GDP trackers) & vs +0.8% in Dec (rev’d from +0.7%).

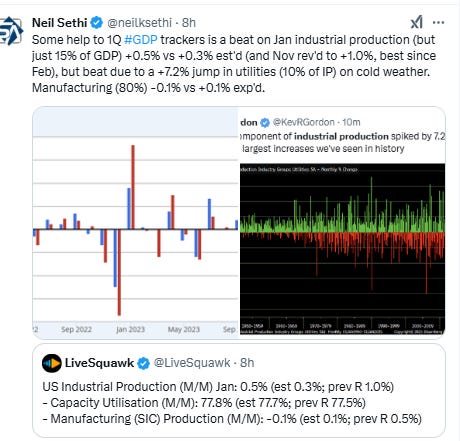

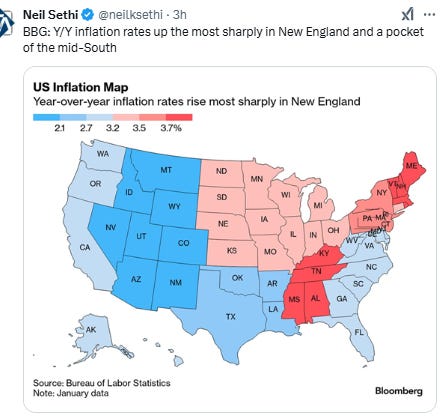

Jan industrial production (15% of GDP) +0.5% vs +0.3% est'd (and Nov rev'd to +1.0%, best since Feb), but beat due to a +7.2% jump in utilities (10% of IP) on cold weather. Manufacturing (80%) -0.1% vs +0.1% exp'd.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX made again finished just below a new closing ATH Friday. The daily MACD and RSI are positive, but RSI still has a negative divergence with another lower high (but that’s been the case since July).

The Nasdaq Composite now right at its downtrend line, less than a percent below its ATH. Its daily MACD and RSI are positive with the same RSI divergence.

RUT (Russell 2000) made it into the resistance zone Friday which runs to 2325 before falling back under. Its daily MACD and RSI are neutral.

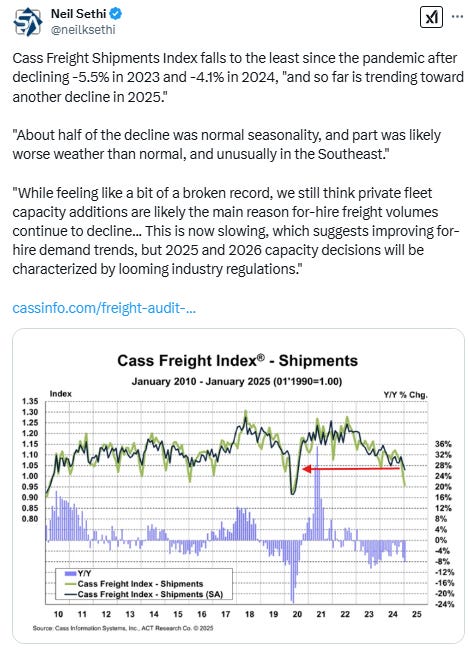

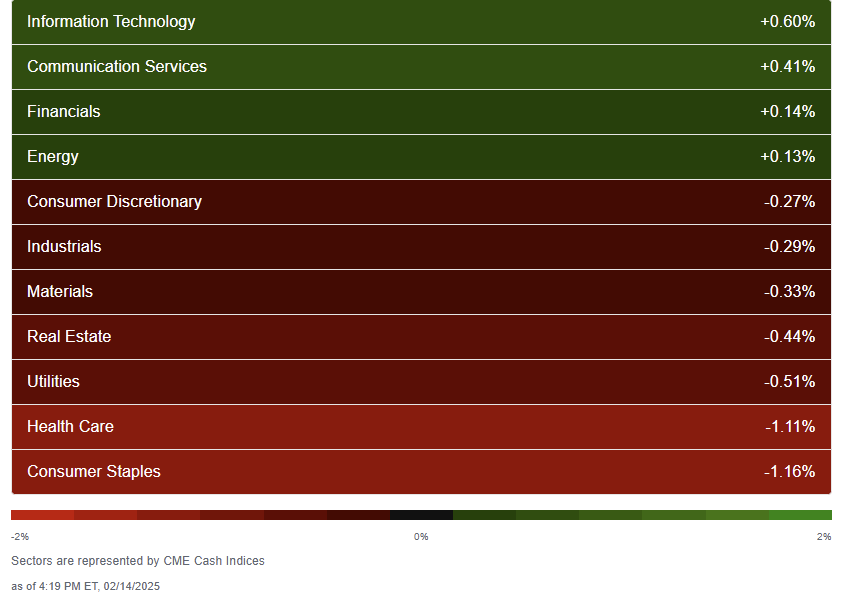

Equity sector breadth from CME Cash Indices pretty weak with just four green sectors (down from all 11 Thursday) and none up more than +0.6% (eight up that much Thursday). Two sectors down more than that though (Health Care & Staples both >-1%). Megacap growth sectors outperformed for a second day taking 3 of the top 5 spots.

SPX sector flag from Finviz relatively consistent with a very mixed showing. The weakness in health care was quite broad after Trump requires schools to drop Covid vaccine mandates (even though no schools have Covid vaccine mandates) and also defense stocks on Trump comments about halving the military budget. Staples weakness led by a -4.75% drop in $PG. AMAT was a downside leader -8%.

Positive volume (percent of total volume that was in advancing stocks) which was very good Thursday at 74% on the NYSE weakened to 49% but with NYSE Composite index -0.25% it was again better than that would indicate. The Nasdaq fell back as well to 58% as with Thursday in line with its gain (+0.4% Friday). Positive issues (percent of stocks trading higher for the day) 54 & 52% respectively.

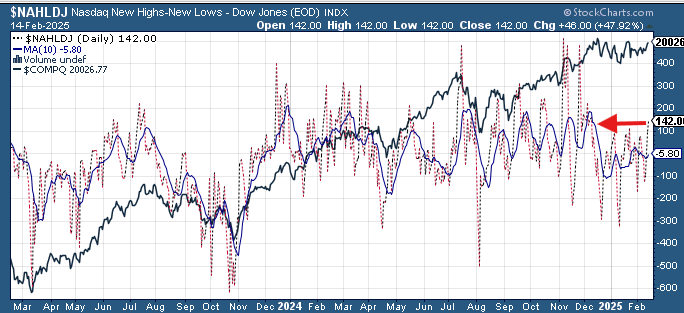

New highs-new lows (charts) though again improved with the NYSE up to +75 from -24 on Wednesday while the Nasdaq jumped is now up to +140 from -99 Wednesday. NYSE is the best this month while the Nasdaq is the best since early December, putting both further above their 10-DMAs which are starting to turn up (more bullish).

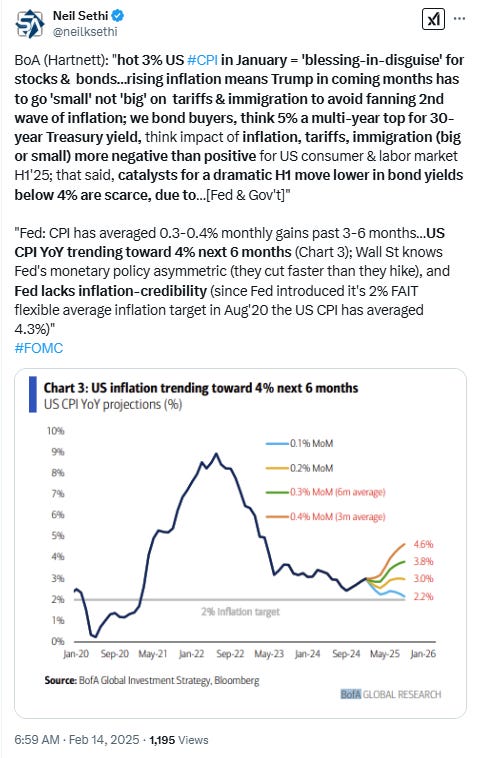

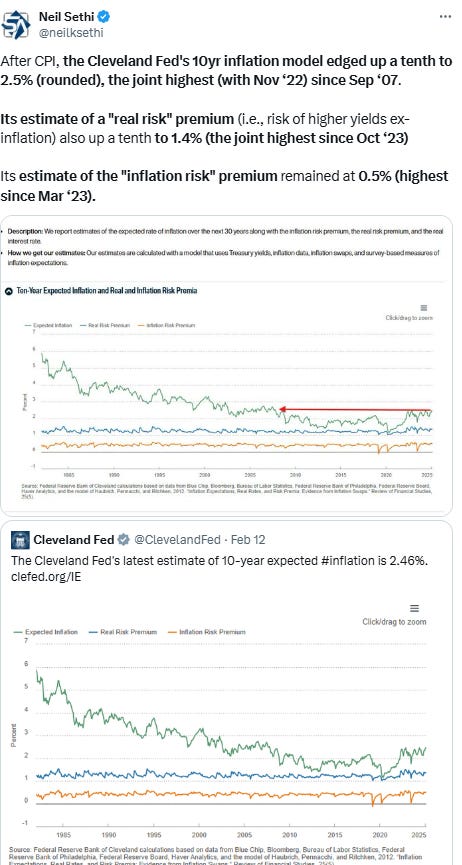

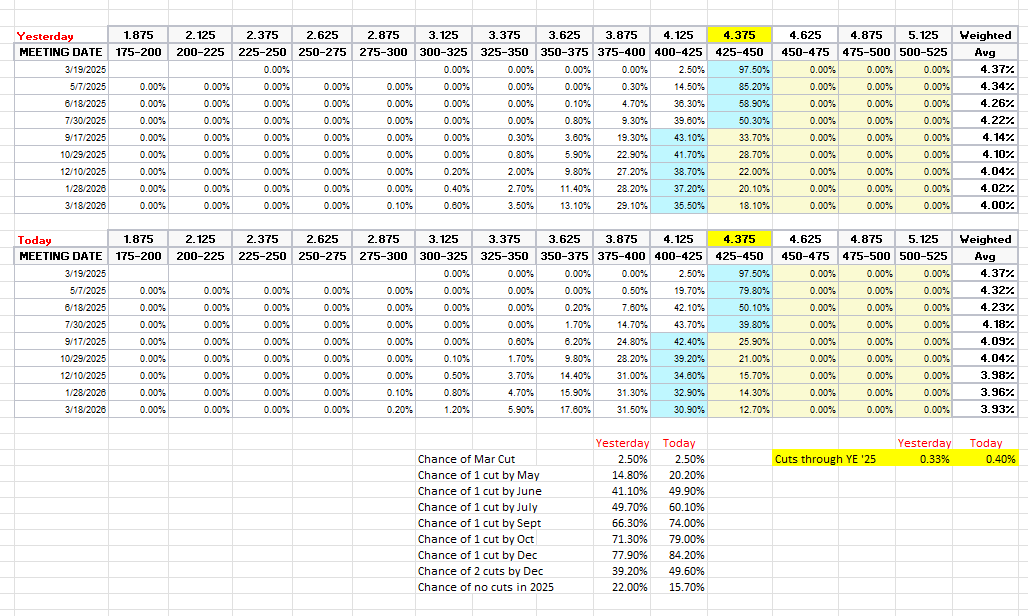

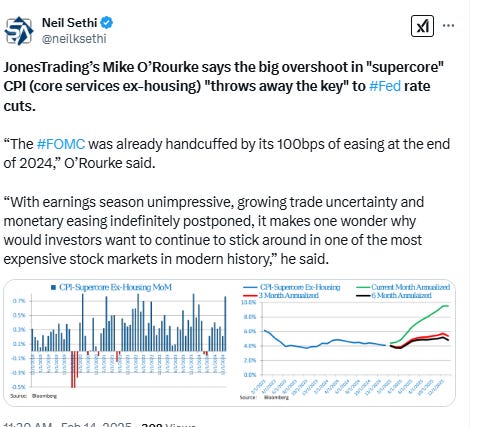

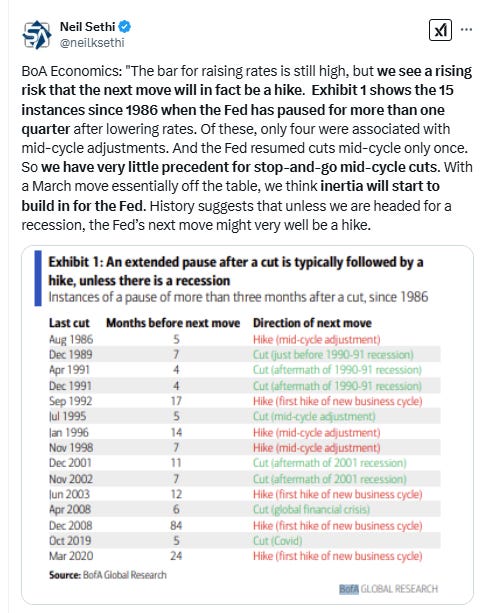

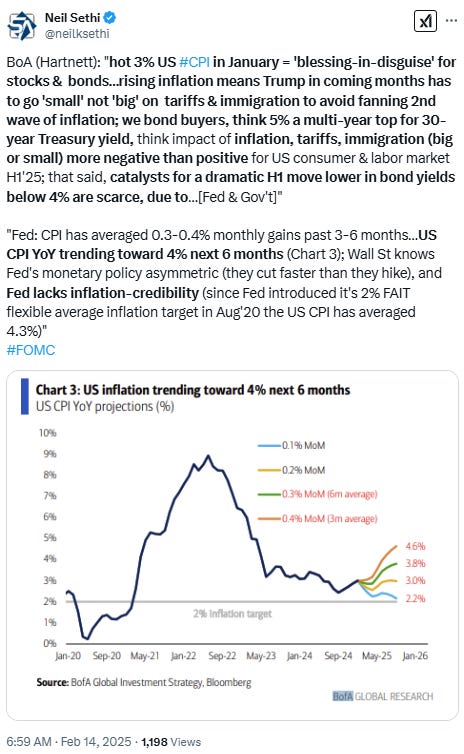

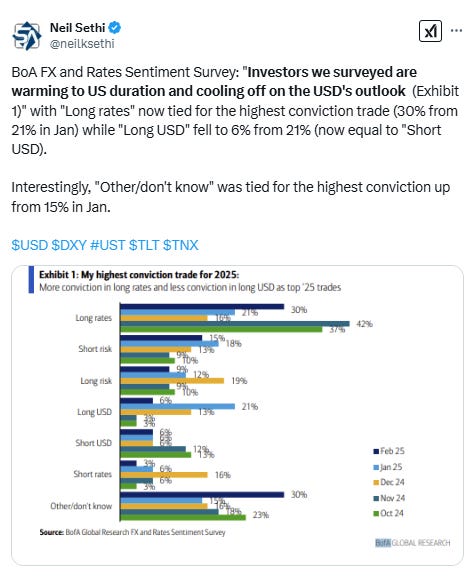

FOMC rate cut probabilities from CME’s #Fedwatch tool following the weak retail sales report and cooler than expected import prices Friday continued to put back in the cuts that were removed following NPF, UMich & CPI. A cut by March remains at 2.5% (from 15% Thursday before NFP and the UMich report), but one by July improved to 60% (up from 42% Wednesday after CPI but still down from 83% last Thursday). Chance of two 2025 cuts at 50% (vs 31% & 57%) and no cuts down to 16% (vs 29% & 12%) with 40bps of cuts priced (vs 28 & 44) so now back to closer to two cuts priced this yr than one.

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, but CPI could change that, and as I noted Wednesday it has made me think that cuts are becoming less likely, but as I also said I continue to expect them versus no cuts at this point. “It’s a long time until December.”

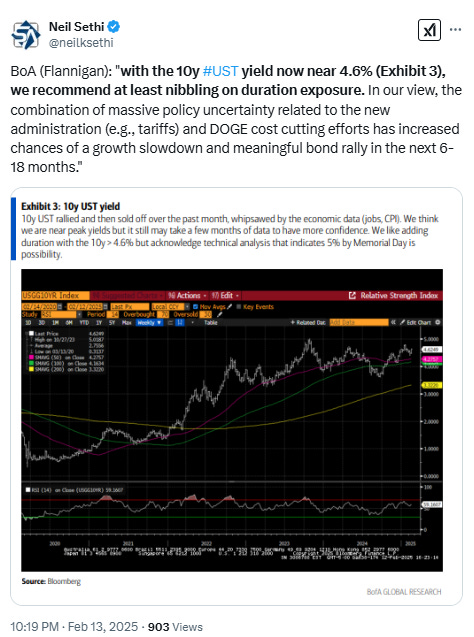

Longer duration #UST yields as noted fell further now giving back all of the gains over the past week Friday falling -4bps to 4.47 back below the key 4.51% level and now confirming a second “fanline” from the Sept lows.

The 2yr yield, more sensitive to Fed policy, also down to 1-wk lows -5bps to 4.26% from 1-mth highs. I still find this level rich, but I’m no longer expecting it to soften materially in the near term, consistent with my note that the possibility is growing of no further rate cuts which would mean it’s fairly priced right here. That said, it is now reflecting a higher chance of rate hikes than cuts, and I still think it’s too early to take 2025 rate cuts off the table.

Dollar ($DXY) fell again Friday to the lowest close in 2 months, and importantly under the key 107 level as both the continual building of chances of a resolution to the Ukraine conflict, the less aggressive tariff response than expected from Trump and the weak retail sales print saw traders continue to dump positions. As noted Thursday it also broke the 3rd “fanline” which is normally supposed to mean a reversal from the uptrend, which is what we’ve seen so far. Daily MACD and RSI as also noted Thursday are negative w/the latter the weakest since September.

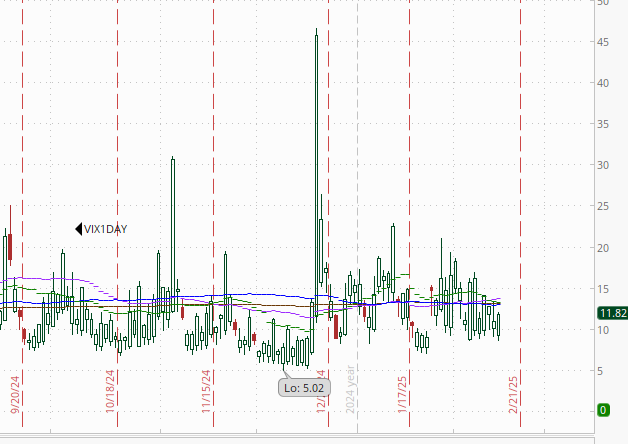

The VIX fell back again to the lowest close of the year at 14.7 (consistent w/~0.90% daily moves over the next 30 days). It’s also threatening to break its uptrend line from the December lows.

The VVIX (VIX of the VIX) though edged higher but remained under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)). It is also around the lows of the year.

1-Day VIX edged a little higher Friday which is something we might see for a while ahead of weekends given the President doesn’t really seem to have “off” days. It ended at 11.8 looking for a move of around 0.72% Monday.

WTI futures Friday gave back most of Thursday’s rebound from the lows of the year finishing down for the week despite the Treasury Secretary saying the administration's goal was to sharply reduce Iranian oil exports. Daily MACD remains negative, and the RSI under 50, so as noted earlier in the week not a lot of hope technically for a rebound.

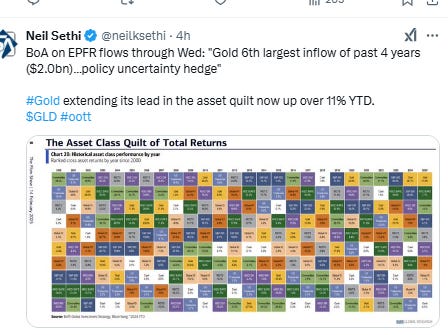

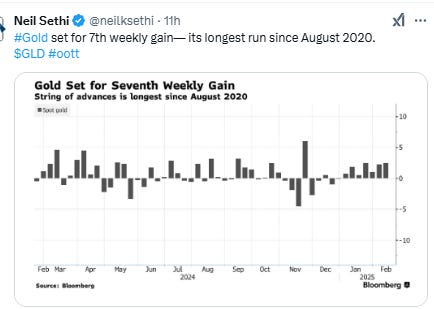

Gold futures fell back over -2% Friday but still were able to eek out a positive week, the 7th in a row, the longest streak since Aug 2020. However the big drop seems like it might be a reversal, and gold has needed a consolidation. Supporting that idea is the daily RSI crossed sharply from over to under 70. Also the daily MACD is rolling over. Still I wouldn’t think any pullback will be long lasting, and it has a lot of support in the 2700-2800 area.

Copper (/HG) like gold also saw a sharp reversal Friday just when it had broken out above the key $4.70 level. The -3% drop took it back below, and like gold it also has seen its daily RSI fall sharply under 70. It’s MACD is more supportive though. Not a lot of support until around $4.50 in terms of prices.

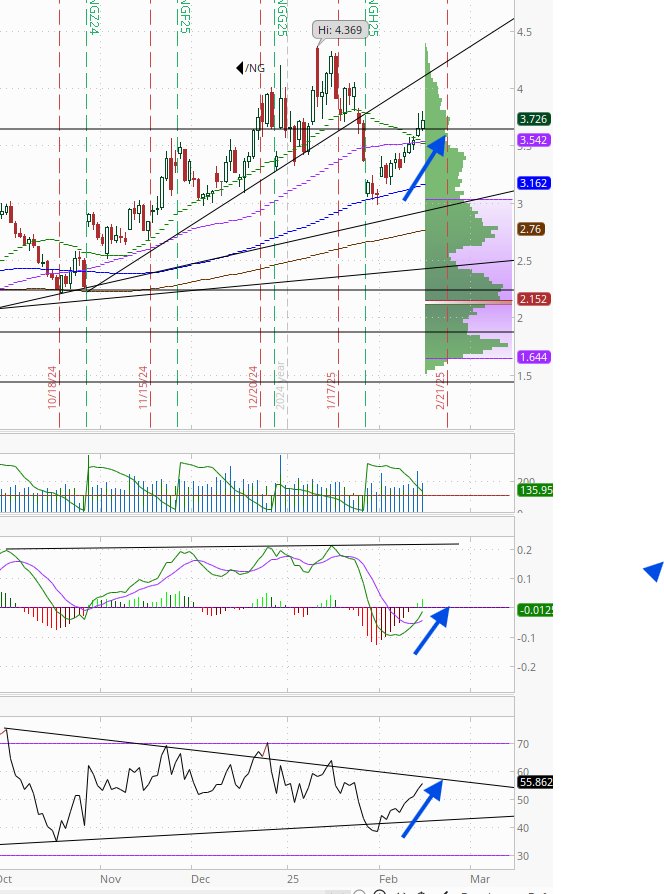

Nat gas futures (/NG) climbed for a 7th session in 8 and now closing over the $3.70 level noted Wednesday. I said Wednesday if it can stay over that level it will “have a chance to really run higher.” Daily MACD remains in “cover shorts” positioning (bullish) as noted, and the RSI has hooked up and pushed over 50, so it has the technical setup to do so.

Bitcoin futures continue the back and forth action which has seen it trade sideways for 8 sessions now remaining around 4-wk lows and under its uptrend line from the Oct lows. Daily MACD and RSI remain negative with relative strength just off the weakest since Sept

The Day Ahead

Enjoy the weekend (and the Monday holiday (but of course the rest of the world won’t be taking Monday off, and I have a feeling neither will President Trump, so feel free to catch up with me on X)).

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,