Markets Update - 2/17/26

Detailed update on US equity and Treasury markets, US economic data, the Fed, select commodities and a look at the upcoming day with lots of charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

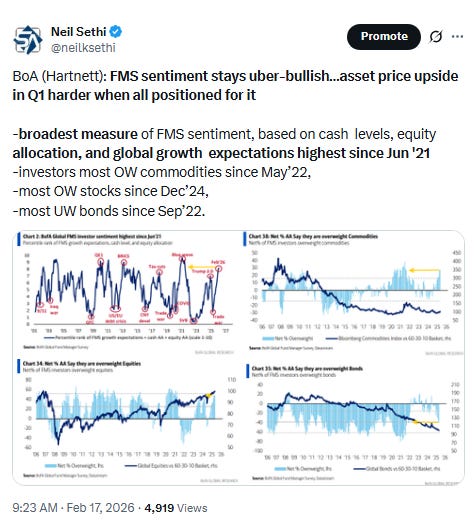

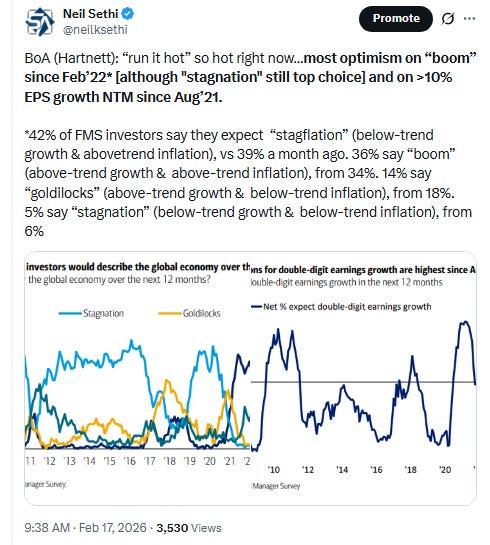

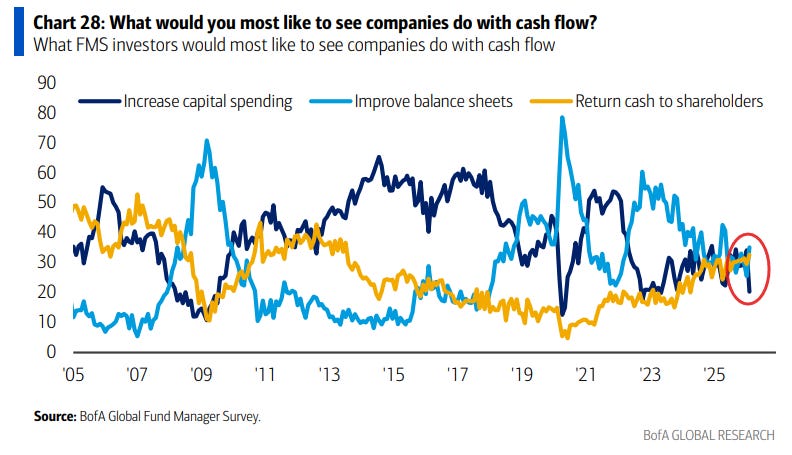

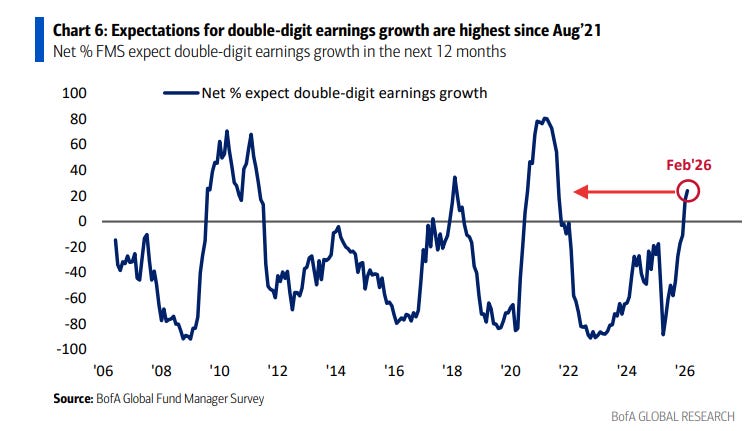

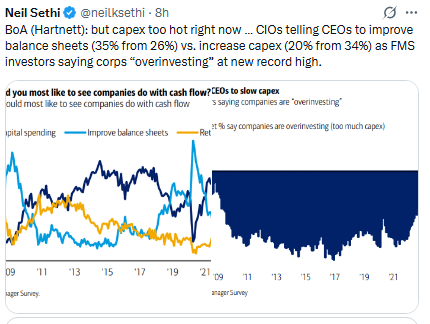

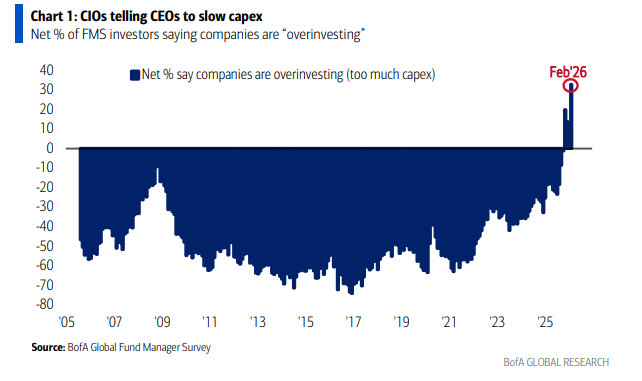

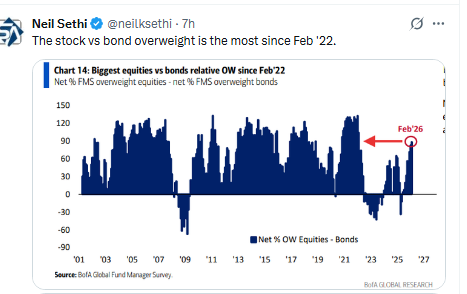

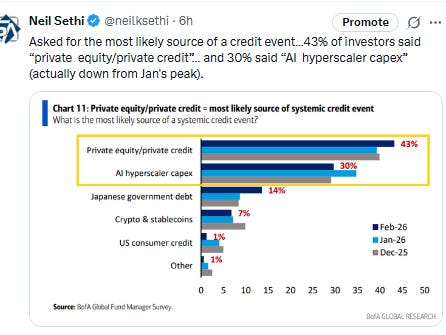

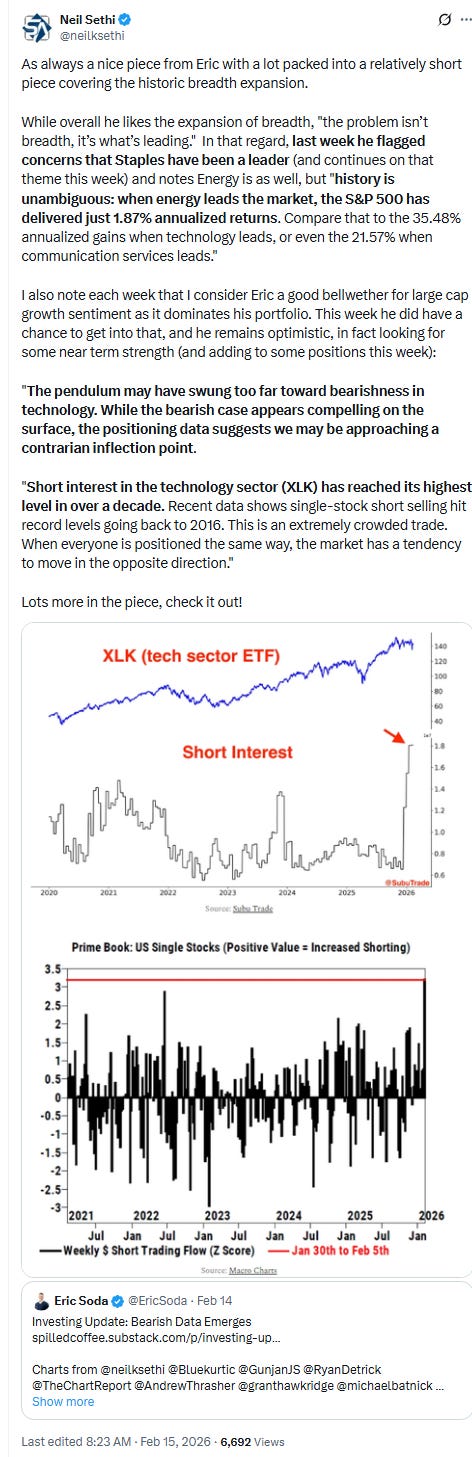

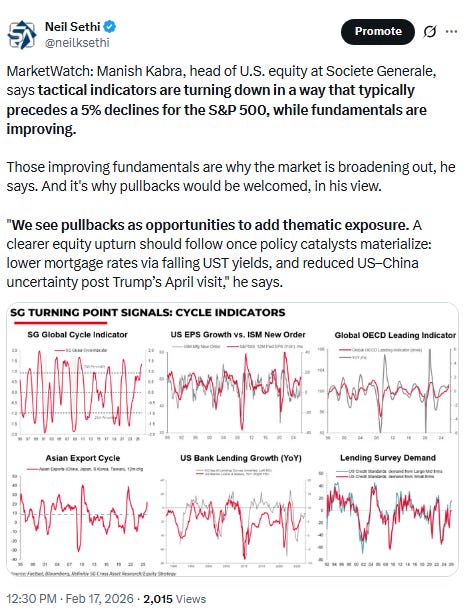

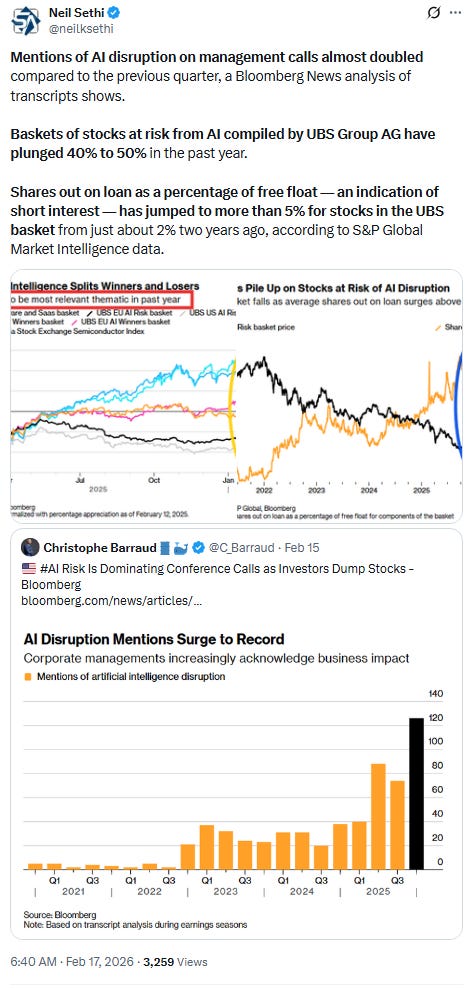

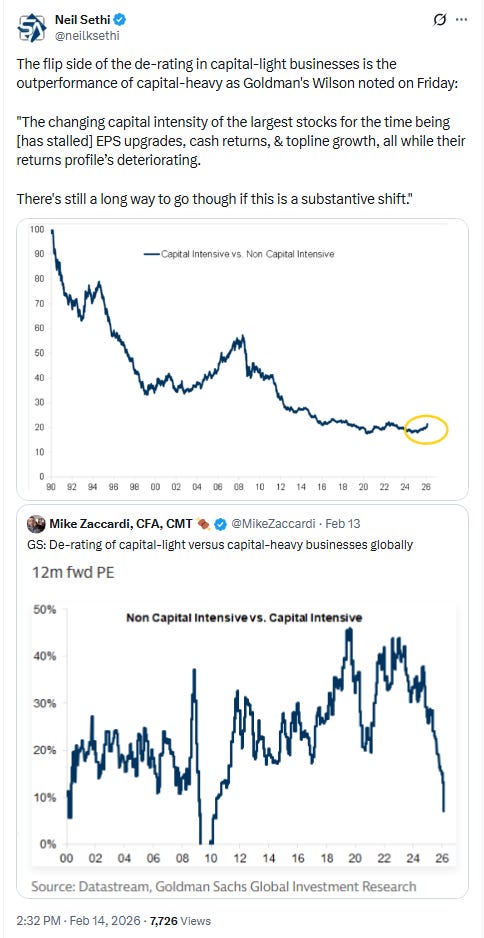

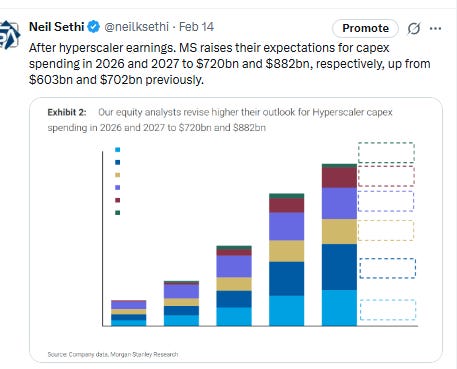

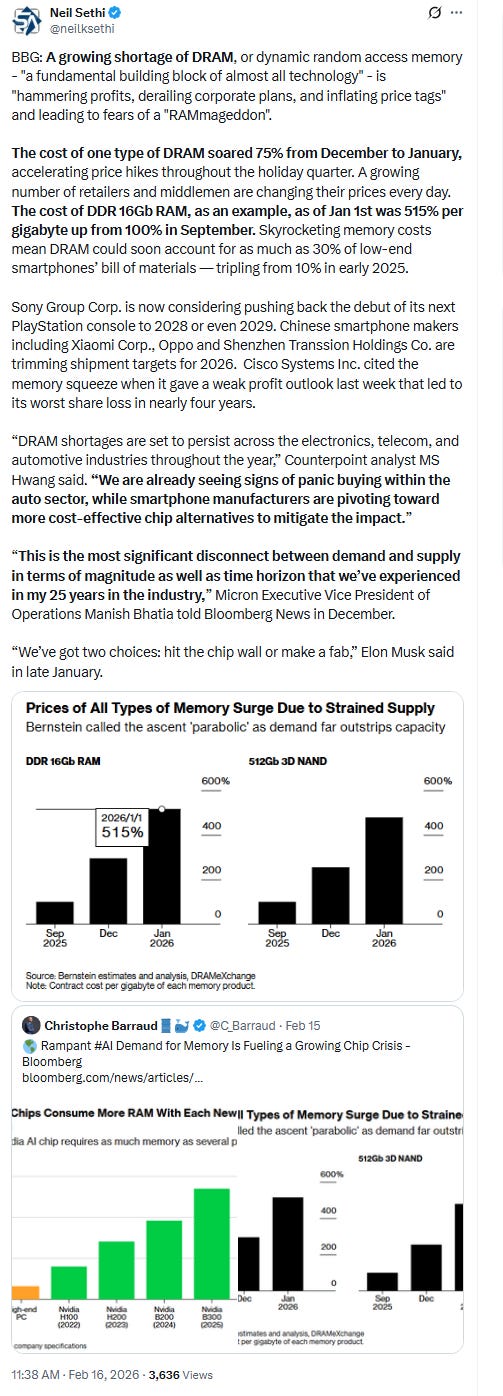

US equity indices opened today’s session in the red, led lower by tech stocks on continued concerns regarding AI both in terms of costs and implications, heightened by a record number of investors saying companies are spending too much on capex according to Bank of America Corp.’s latest fund manager survey, even as the survey reflected the most bullish outlook since 2021 (see posts below).

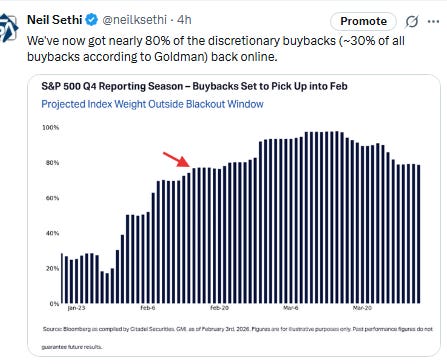

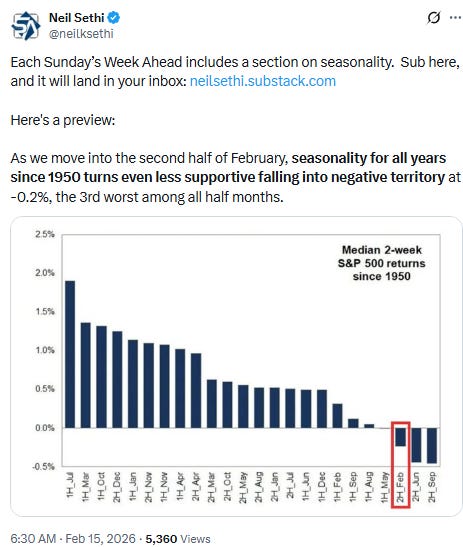

Indices traded in a rare (of late) lockstep pattern. After starting lower they fell to the lows of the day around 10.45am, rebounded to around flat levels, fell back into the red, rebounded again to modestly positive, then finally gave that back to finish little changed from Friday’s close. A lot of downs and ups but not much to show for it. Charts in the subscriber section.

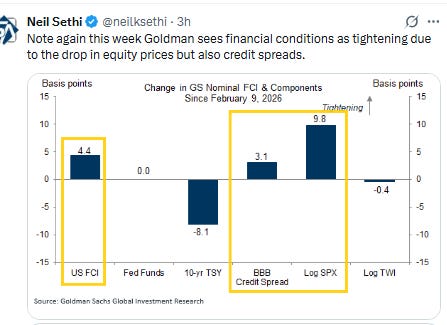

Elsewhere, bond yields edged higher from the lows of the year, while the dollar was little changed for a fourth day giving up early gains. Commodities mostly were lower with crude, gold, copper, bitcoin and natgas all falling (all covered in the subscriber section).

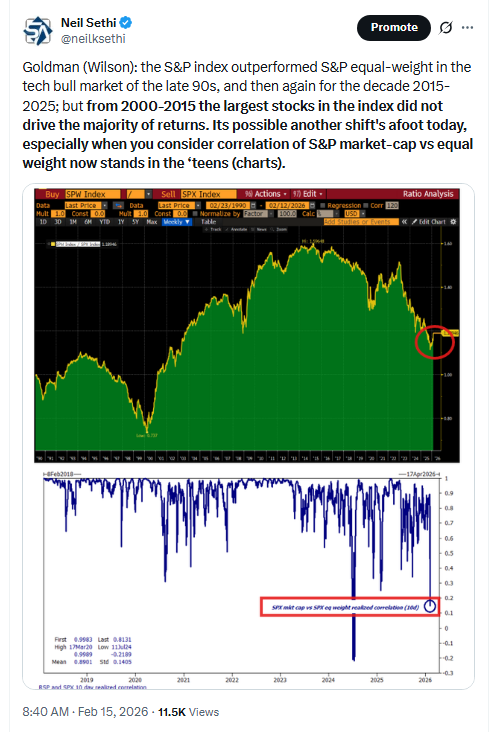

The market-cap weighted S&P 500 (SPX) was +0.1%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite +0.1% (and the top 100 Nasdaq stocks (NDX) -0.1%), the SOXX semiconductor index UNCH, and the Russell 2000 (RUT) UNCH.

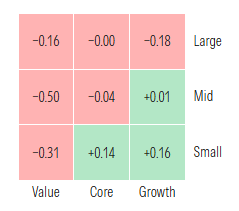

Morningstar style box mixed but all styles with relatively subdued moves.

Market commentary:

“There’s “lingering anxiety about whether AI spending will be profitable enough, concerns about competition, and a broader de-risking from the most crowded trades after a very strong run,” said Aneeka Gupta, macroeconomic research director at WisdomTree.

“The AI disruption vigilantes were at it again ... with new targets,” said Daniel Skelly, head of the market research and strategy wealth management team at Morgan Stanley. “With the S&P 500 flattish for the year, the bull market has certainly paused, and given way to a bull market in ‘disruption hysteria.’”“We just need time to see what earnings are going to look like from some of these companies,” Leah Bennett, chief investment strategist at Concurrent Investment Advisors, said in an interview with CNBC. “I think those that aren’t able to compete and don’t really have moats around their business, you’re going to see a deterioration,” she continued, adding that such a disruption will also lead the market to decipher winners in the space.

A stock-market theme as of late has been tied to the growing concerns that artificial intelligence will render certain industries obsolete. Jason Draho, head of asset allocation at UBS, said that this has led to a “sell first, answer questions later” mentality as investors try to figure out which businesses will be negatively impacted by AI. However, those same forces that could negatively impact certain businesses could create a larger boost for the economy overall. “The debate over who will be the corporate beneficiaries and losers from AI shouldn’t obscure the potentially large macro implications. Higher productivity, lower inflation, and labor market disruptions are all possible,” Draho wrote in a note. “While the terminal value for some companies may indeed be zero because of AI, the ‘terminal GDP’ for the entire US economy is likely to be a lot larger in a decade because of that same AI disruption than had it not occurred.”

“People looking for that ‘V-shaped’ recovery in software stocks are not getting it, and software continues to be one of those sectors where this AI disruption is front and center,” said Jay Woods, chief market strategist at Freedom Capital Markets. Woods also said there’s still no clarity of how disruptive AI will be to established software companies, and those companies that feel threatened still have to prove that “they can handle any AI-driven innovation” and won’t be easily destroyed. “So right now, it remains in the penalty box,” Woods told MarketWatch via phone on Tuesday. “The selling subsided [from earlier this month], but we didn’t have the recovery that we were hoping for.”

AI disruption and continued tech rotation overshadowed last week’s jobs and inflation data, and unless this week’s economic numbers deliver notable surprises, the same dynamic could play out again, according to Chris Larkin at E*Trade from Morgan Stanley. “The market is still close to records highs, but it may not feel that way to some investors because of the sharp selloffs that seem to derail upswings almost as soon as they begin,” he said. “If that theme persists, it could result in a bumpy road for the market, even if the overall trend is to the upside.” That said, Larkin notes some pullbacks may offer opportunities in industries and specific stocks where AI is just as much of a potential tailwind as a headwind.

Many big tech and certain AI-related stocks have taken a hit as investors continue to question the likely return on investment, noted David Morrison at Trade Nation. Meantime, Morrison noted that the S&P 500 remains stuck under 7,000, with investors appearing “wary” of adding to their exposure at current levels.

“We need tech/AI/Mag 7 to stabilize, and need to see less ‘sell first/ask questions later’ behavior from investors,” said Sameer Samana at Wells Fargo Investment Institute.

“First, the AI-blamed selloff started with the software industry, triggering renewed fears that AI companies will adversely affect their businesses,” said Sam Stovall at CFRA. “Soon after, the sector version of ‘Whac-a-Mole’ kicked in, initiating rolling corrections in such groups as transportation, wealth management, insurance, and commercial real estate in succession, causing investors to wonder: Where next?” Stovall cautions investors against getting caught up in the emotional instability generated by these selloffs.

“They remind us that AI will indeed offer cost savings from increased efficiencies and depth of analysis, but these should aid companies by making them nimbler and more profitable,” Stovall added. “Today, the equity markets are going through a much-needed digestion of gains.”

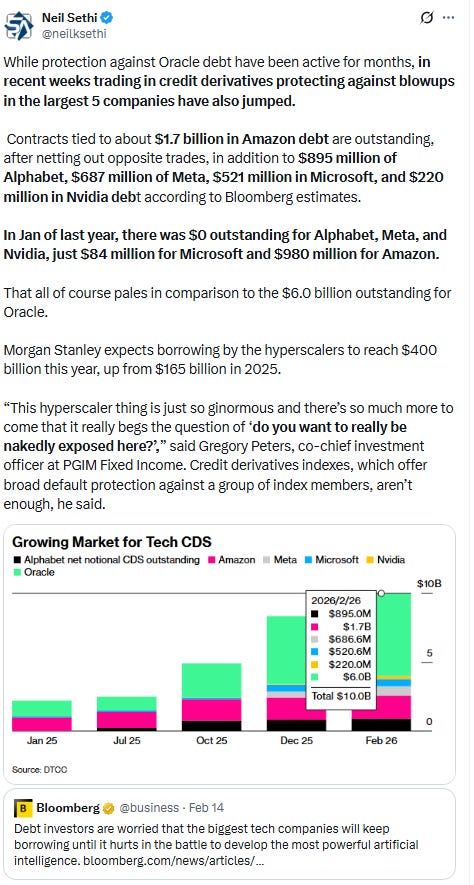

Hyperscalers such as Microsoft Corp., Meta Platforms Inc., Alphabet Inc. and Amazon.com Inc. still have positive outlooks despite massive investments in AI and concerns around cash flows, according to JPMorgan Chase & Co. strategists led by Dubravko Lakos-Bujas. They said AI-related capex is projected to grow by 53% over the next 12 months. “The Street is increasingly more sensitive about what this rate of spending means for cash flow,” the strategists said. While cash flow is expected to turn negative for some companies, the bank’s analysts see spending coming from a “position of strength.”

“A few months ago, the market debated whether AI was real,” said Jean Boivin at BlackRock Investment Institute. “Today, it’s seen as an active threat to business models. We believe the hunt to sort the winners and losers reinforces AI’s massive buildout - and the borrowing spree by to finance it.” Boivin says the market has been “laser-focused” on identifying companies exposed to AI disruption - and sorting out which ones it thinks will be able to evolve and adapt. “We are still firmly in the AI buildout phase. The mega cap tech companies are spending heavily on chips, data centers and power infrastructure. This is a key reason why we still like infrastructure,” Boivin noted. “What has changed is the market’s focus: it now asks how AI adoption will translate into revenues and profits. This sorting of winners and losers means it’s prime time for active investing.”

Macro conditions have momentarily taken a back seat to AI disruption, but the two are “inseparable” in the long term, according to Jason Draho at UBS Global Wealth Management. Thus, thinking about what AI means for terminal values at a macro level is just as important to evaluating the investment outlook. “The debate over who will be the corporate beneficiaries and losers from AI shouldn’t obscure the potentially large macro implications,” he said. “Higher productivity, lower inflation, and labor market disruptions are all possible. While the terminal value for some companies may indeed be zero because of AI, the ‘terminal GDP’ for the entire US economy is likely to be a lot larger in a decade because of that same AI disruption than had it not occurred.” In other words, the overall economic pie will be bigger, Draho noted.

“The critical question for asset allocation is how will that pie be divided across society, and asset classes,” he said. “Even if AI doesn’t end up being particularly disruptive for labor markets, capital (i.e., investors) are still likely to get many of the benefits. That big picture conjecture on the division of macro terminal values is important to keep in mind while wondering which sector might be impacted next.”

“After spending most of the last two years favouring risk-off products, speculators’ risk-on exposure has hit its highest level since February 2024. Their timing could be off, however. Stocks are faltering as tech starts to lag, with the market questioning the vast AI infrastructure spending commitments. And 10-year US yields have dropped quite sharply this month. That move appeared to catch macro funds out.” — Simon White, BBG macro strategist.

Investor Jenny Harrington believes that buying hard asset, low obsolescence dividend stocks could be a good hedge against growing artificial intelligence threats. “They’re stocks that, assuming humanity survives AI, we’re going to be using these products throughout in the next 10, 15, 20 years,” the CEO of Gilman Hill Asset Management said on CNBC’s “Halftime Report” on Tuesday afternoon. “Nothing too exciting, just slow and steady

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

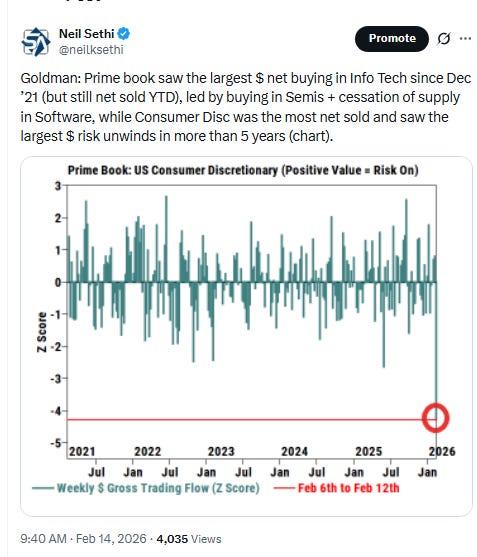

Investors rotated out of beaten-down software names, which added to the losses they’ve seen this year, and into financial stocks such as Citigroup and JPMorgan. Shares of Citi jumped 2.6%, while shares of JPMorgan were up more than 1%.

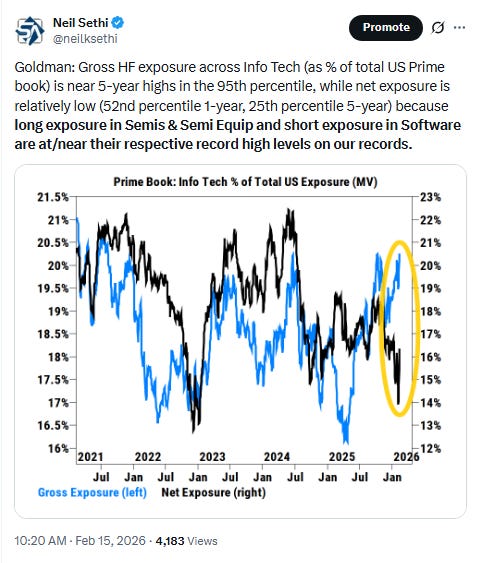

ServiceNow, however, was more than 1% lower, with its drop in 2026 standing at about 31%. Autodesk and Palo Alto Networks were down more than 2%. The former has notched a roughly 24% decline this year, while the latter has fallen 11%. Salesforce and Oracle shares declined nearly 3% and almost 4%, and their year-to-date losses were at 30% and 21%, respectively. The iShares Expanded Tech-Software Sector ETF (IGV) slid more than 2%, putting its loss for the year at 23%.

In late hours, Meta Platforms Inc. said it agreed to deploy “millions” of Nvidia Corp. processors over the next few years.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Apple Inc. is accelerating development of three new wearable devices as part of a shift toward artificial intelligence-powered hardware, a category also being pursued by OpenAI and Meta Platforms Inc.

Anthropic PBC is releasing a new artificial intelligence model that’s intended to be better at using people’s computers in increasingly complicated ways, building on the startup’s efforts to make

Palantir Technologies Inc. said it’s moved its headquarters to Miami from Denver at a time when tech firms are headed to South Florida as local officials promote the region as an alternative to California’s Silicon Valley.

Robinhood Markets Inc. is seeking to raise $1 billion in an initial public offering of a closed-end fund designed to give US retail investors access to private companies, as the brokerage associated with meme stocks chases the latest frenzy

After submitting multiple bids to buy Warner Bros. Discovery Inc., all of which have been rebuffed, the chief executive officer of Paramount Skydance Corp. finally has snagged a seat at the table again and will be able to make a “best and final” offer for the storied film and entertainment company, potentially upsetting a rival deal with Netflix Inc. that’s long been supported by the board.

UnitedHealth Group Inc.’s chairman and chief executive officer, Stephen Hemsley, has invested in health-care startups for years, creating the potential for conflicts of interest, according to The Wall Street Journal.

The US Air Force said it intends to complete by the end of the year a restructuring plan for the new Sentinel intercontinental ballistic missile system from Northrop Grumman Corp., after the projected $141 billion program was plagued by skyrocketing costs and fielding delay

Home Depot Inc. is making the requirements for bonus payouts to managers more strict as the retailer confronts a business slowdown.

Gemini Space Station Inc., the crypto exchange founded by Cameron and Tyler Winklevoss that went public just before Bitcoin’s plunge, said three top executives left the company in a sweeping leadership shakeup that followed a broad round of layoffs earlier this month.

Michael Saylor’s Strategy Inc. bought nearly $170 million in Bitcoin, roughly half of which was financed with perpetual preferred stock, the highest proportion since November.

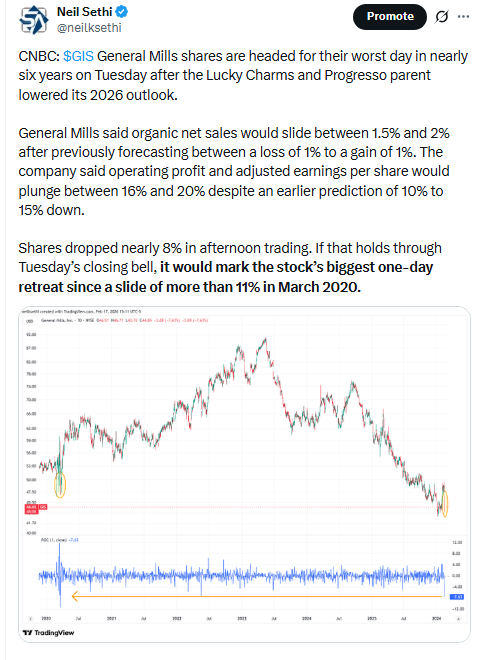

General Mills Inc. lowered its fiscal 2026 sales outlook, citing a more challenging consumer environment.

Genuine Parts Co. will split into two publicly traded companies following a review of options for its automotive and industrial business lines.

Danaher Corp. agreed to buy Masimo Corp., in a deal with an enterprise value of about $9.9 billion, allowing it to gain a foothold in the medical supply business.

Blackstone Inc. has agreed to acquire residential services provider Champions Group in a deal that shows how private equity firms are seeking refuge in sectors less vulnerable to AI disruption.

Tech enthusiasts’ craze for artificial intelligence program OpenClaw has sparked a blistering rally in shares of Raspberry Pi Holdings Plc, the company that makes one of the simplest forms of personal computers.

Adani Group plans to invest $100 billion by 2035 to develop green-powered, AI-ready data centers as billionaire Gautam Adani seeks to capitalize on India’s bid to emerge as a hub for artificial intelligence and cloud computing.

Bayer AG agreed to pay more than $7 billion as part of a settlement push to resolve current and future cancer lawsuits over its top-selling Roundup weedkiller, the company announced Tuesday.

Emirates Chief Financial Officer Michael Doersam, one of the senior executives who helped transform the Dubai carrier into the world’s biggest international airline, will leave his job by the end of June.

Mid-day movers from CNBC:

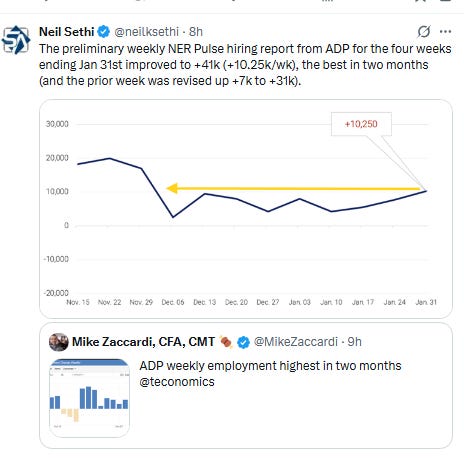

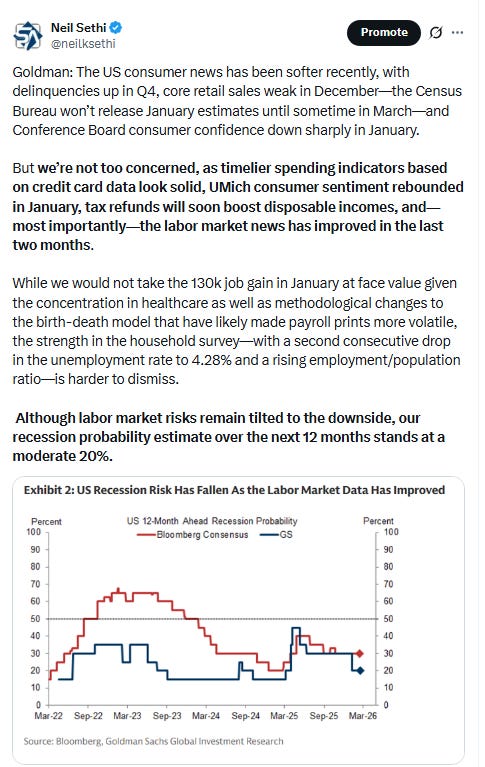

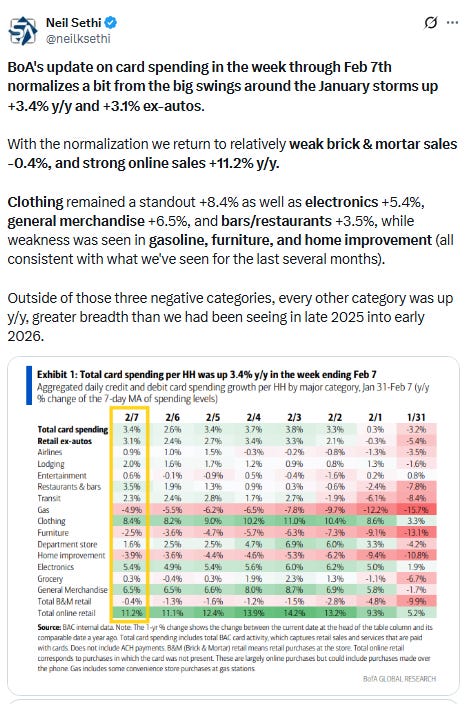

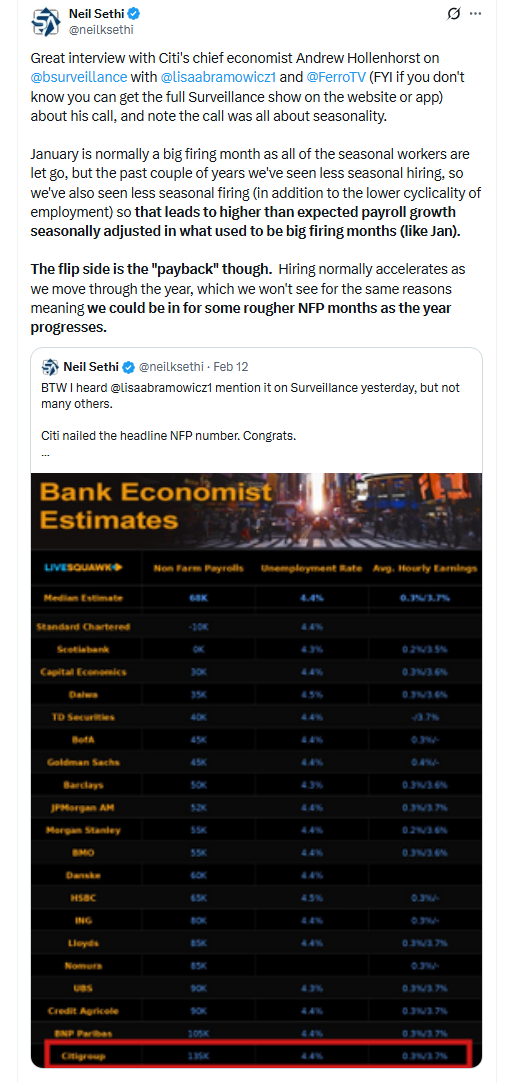

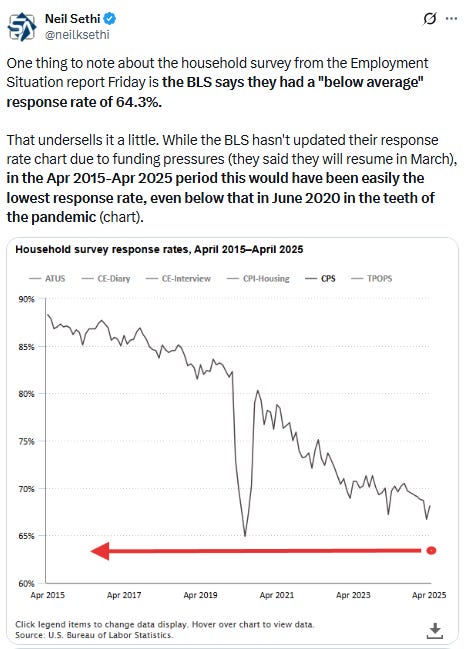

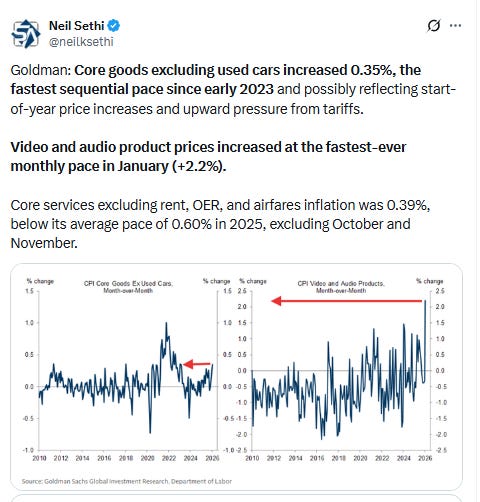

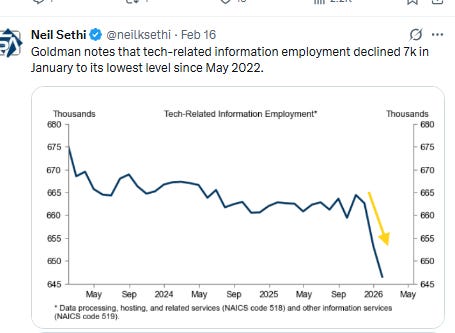

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X