Markets Update - 2/18/26

Detailed update on US equity and Treasury markets, US economic data, the Fed, select commodities and a look at the upcoming day with lots of charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

US equity indices opened today with large caps trading modestly higher on the back of a bounceback in tech shares after Meta announced Tuesday that it’s going to use millions of Nvidia’s chips (all links to CNBC in this section) in its data center buildout (Nvidia shares gained 1.6% today), while fellow “Magnificent Seven” member Amazon rose around 1% (it would end +1.7%) after regulatory filings showed Bill Ackman’s Pershing Square grew its stake in the e-commerce giant by 65% during the fourth quarter, making Amazon the fund’s third-largest holding (the gains came despite Berkshire selling 75% of its stake). Additionally, Micron Technology saw gains after David Tepper’s Appaloosa Management increased its holdings in the chipmaker (it would end over 5% higher). The small cap Russell 2000 though traded slightly lower at the open.

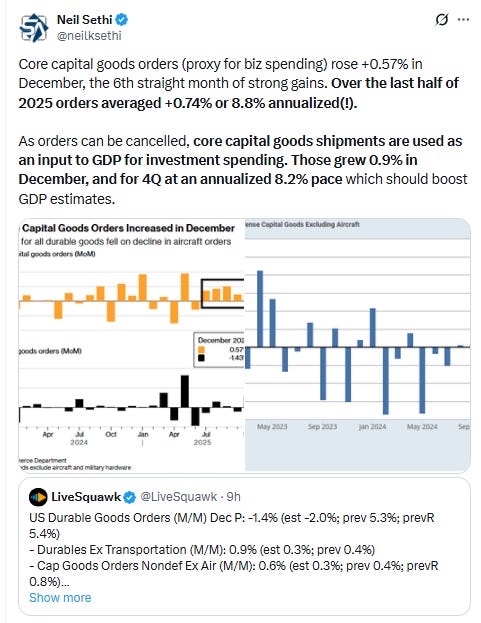

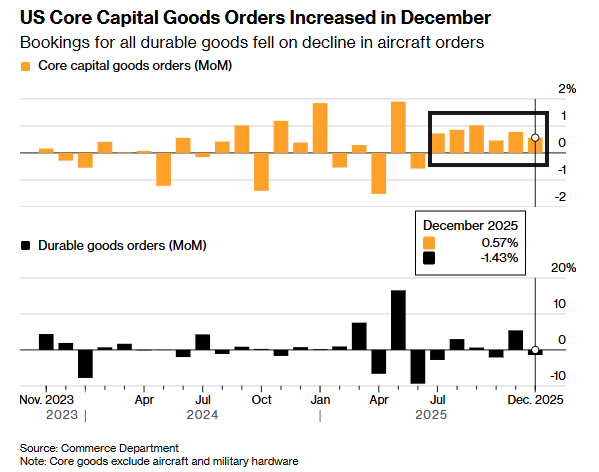

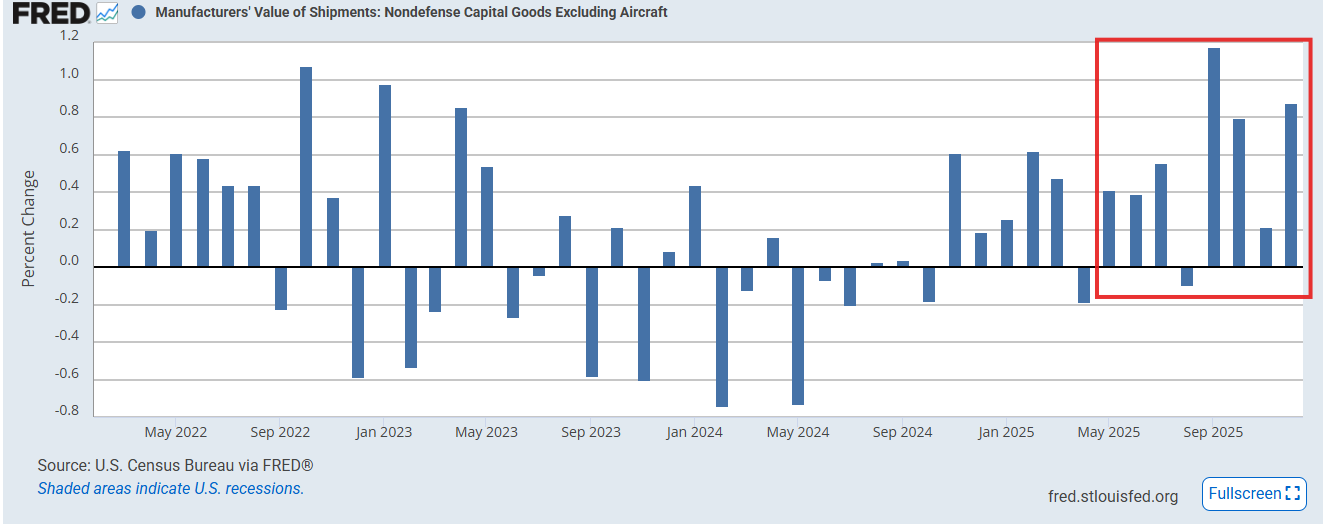

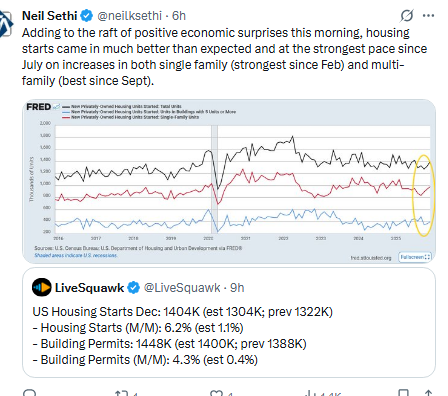

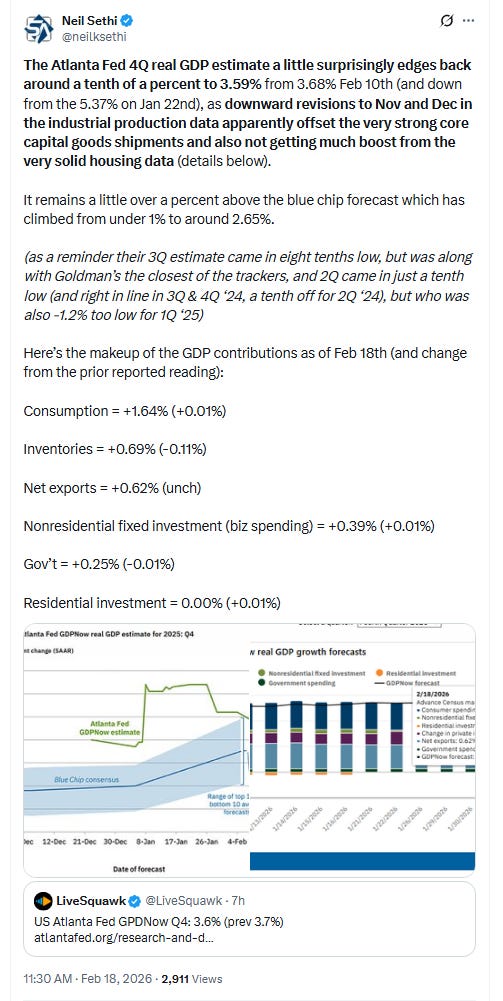

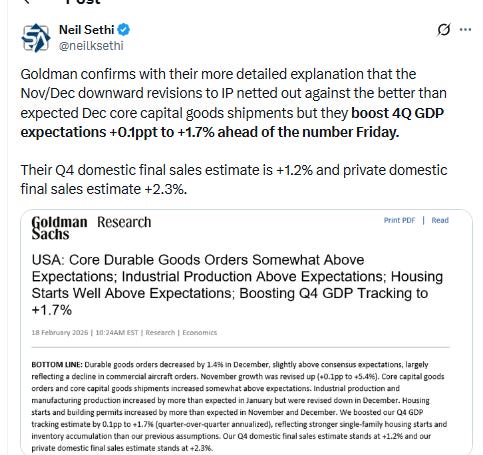

Equities were also lifted by a round of strong economic reports with core capital goods spending and housing starts and permits data both well better than expectations. Jan industrial production was also very solid although Nov and Dec were revised lower.

Indices climbed the first hour to their peak, but steadily lost traction with the largest drop coming after the Fed minutes at 2pm where the headline was “several” members thought rate hikes should be on the table if inflation remained above target. Equites though would rebound the last half hour (potential systematic buying?), with all finishing in the green led by the Nasdaq’s +0.8%. Charts in the subscriber section.

Elsewhere, bond yields moved higher for a second day, and the dollar pushed to a 1-week high. Crude, gold and copper also gained while bitcoin and natgas fell (all covered in the subscriber section).

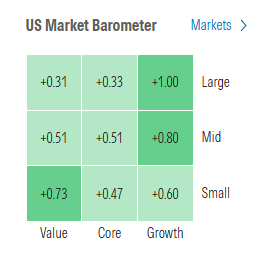

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +0.6%, Nasdaq Composite +0.8% (and the top 100 Nasdaq stocks (NDX) +0.8%), the SOXX semiconductor index +1.0%, and the Russell 2000 (RUT) +0.5%.

Morningstar style box back to all green.

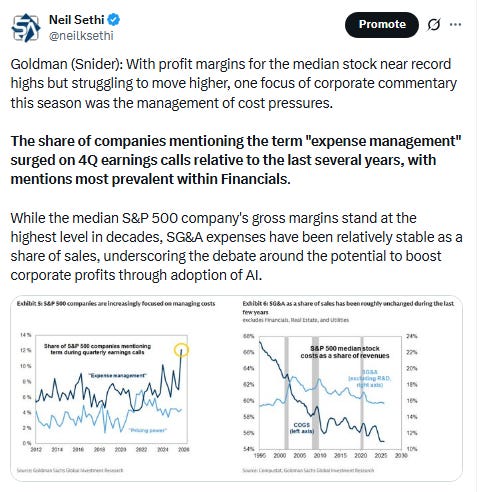

Market commentary:

“Investors have been spending the last six weeks trying to find places to hide” in sectors that are not being impacted by AI, said portfolio manager Jed Ellerbroek Jr., who oversees large-cap strategy at Argent Capital Management in St. Louis. “Today we are just reversing some of that fear trade that’s been going on in the last six weeks,” he said in a phone interview. “That’s been a really strong, pervasive trade in the last two weeks. I don’t know if the change in direction will continue.”

“US stock indices have regained their upside momentum,” said David Morrison at Trade Nation. “But will this prove strong enough to keep buyers engaged, and protracted enough to drive the S&P 500 above key resistance at 7,000?”

“We view the stock market as currently being in a ‘shaken, not stirred’ state,” said Craig Johnson at Piper Sandler. “Investors need to embrace the rotation as this year shapes up to be more of a ‘stock picker’s market’.”

Despite the recent breakdown in the “Magnificent Seven” megacaps and software makers, there hasn’t been much evidence of the broader market rolling over, according to Mark Newton at Fundstrat Global Advisors. “Moreover, sentiment has turned more negative in the last week, given the volatility in equities,” he said. “However, I feel that the resilience of equity indices themselves is truly what to highlight as being a relative positive in 2026.”

The software stock rout is likely “overdone” as that was a largely knee-jerk reaction, with investors trying to figure out the winners and losers from AI, according to Paul Stanley at Granite Bay Wealth Management. “While AI is very promising, investors should not assume that all companies will win on the AI front,” he said.

“What I am seeing is a lot of churning and back and forth as people try to understand what the AI effects are going to be,” said Thomas Martin, senior portfolio manager at Globalt Investments in Atlanta. “In the meantime, people are coming back to some of those larger companies ... The trade today is about an acknowledgement that there’s still a lot of reason to be involved in large-cap growth stocks.”

As market structure continues to be dominated by Commodity Trading Advisors, fund flows, and an increasing share of retail investors, Chris Senyek at Wolfe Research says volatility is likely to continue in the near-term, especially given the heightened sensitivity of stocks to AI disruption and other headline risk. “One of the most frequently asked questions we’ve received recently from investors has been: What changes the market’s view on AI disruption?,” he said. “With hyperscaler capital expenditures growing at a breakneck pace, we see bottlenecks in data center buildout likely emerging over the coming quarters.” Whether these bottlenecks are related to power generation, material costs, or regulatory hurdles, a cut/delay in spending would likely serve as a positive catalyst to areas of the market that have seen downward pressure due to AI concerns, namely software stocks, he said.

“Investors should review current exposures to US technology and communication services and consider hedging or diversifying exposures that are above benchmark levels,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. In such a case, she says investors should consider diversifying toward preferred areas of the market where we see superior risk-reward, including industrials, banks, health care, utilities, and consumer discretionary.

Underlying trends suggest a “far more dynamic environment” ripe for stock-picking, writes Adam Turnquist, chief technical strategist for LPL Financial. “Shifts in the AI narrative, rotations out of mega‑cap tech, improving economic conditions, and accelerating inflows into active strategies are all driving performance gaps across sectors, with more value-tilted and economically sensitive sectors emerging as early 2026 winners. Against this backdrop, investors may benefit from active management, selective stock-picking, and sector‑rotation strategies designed to capitalize on broader dispersion and the increased opportunities it presents.”

Stephen Lee of Logan Capital Management noted that “lesser-known” names in the tech space are also performing well, including those in industrial tech such as Trimble. Shares of that company were up about 2% in the session.

“I’m not sure today is actually eliminating the broadening out thesis when we kind of peel the onion and look at relative winners,” the founding principal said, adding that the market is growing “a little bit more discerning.”

“It’s hard to know where the floor on valuation is going to be,” Sophie Huynh, portfolio manager at BNP Paribas Asset Management, told Bloomberg TV. “So I think there’s going to be some temptation to buy on dips.”

“The AI scare trade is creative destruction in the making, and when one doesn’t know how it will unfold, one diversifies,” said Nicolas Domont, fund manager at Optigestion in Paris. “Investors are particularly interested in companies which have predictable order books and revenues, such as in defense.”

“From our perspective, the minutes support our view that rate cuts are off the table for the foreseeable future,” said Charlie Ripley at Allianz Investment Management.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

The SOX gauge of chipmakers climbed 1% and the IGV ETF tracking software firms jumped 1.3%.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Mark Zuckerberg testified that it’s “very difficult” to enforce Instagram’s age limits as he sought to defend the platform during a landmark trial over social media addiction.

Tesla Inc. will be allowed to continue selling electric vehicles in California uninterrupted after the company revised what the state had called misleading marketing of driver-assistance technology.

Alphabet Inc.’s Google and Apple Inc. are adding music-focused generative artificial intelligence features to their core consumer apps, underscoring how advanced AI tools are moving into mainstream use.

Alphabet’s Google introduced its latest entry-level Pixel smartphone, hoping that new AI software capabilities, minor hardware refinements and an unchanged $499 price can make up for an otherwise iterative update.

Berkshire Hathaway Inc. slashed its holding in Amazon.com Inc. by more than 75% in the fourth quarter, while also building a stake in the New York Times Co. — Warren Buffett’s last new bet as chief executive officer.

Cybersecurity company Palo Alto Networks Inc. tumbled after releasing a forecast for adjusted earnings that was weaker than anticipated.

EBay Inc. reported quarterly sales and profit that exceeded estimates, indicating that a focus on luxury items and refurbished goods is helping the company stand out in an increasingly cluttered e-commerce market.

DoorDash Inc. issued an earnings outlook that missed Wall Street’s expectations, with the delivery company warning that winter storms in the US and investments into growth areas will weigh on profits in the near term.

Carvana Co. posted strong profit growth in the fourth quarter that still missed Wall Street’s estimates due to higher-than-expected operating costs.

Booking Holdings Inc. reported better-than-expected first-quarter gross bookings, indicating continued strength across the travel industry.

Figma Inc. gave an annual revenue outlook that topped estimates, potentially easing broad Wall Street anxiety that the creative software company’s business is threatened by the emergence of rival artificial intelligence products.

Powerlaw Corp., a fund that owns stakes in Anduril Industries Inc., SpaceX, OpenAI and Anthropic PBC, is filing to sell shares in New York, giving retail investors a shot at profiting from some of the biggest private companies in artificial intelligence, defense and space.

The US Food and Drug Administration will review a Moderna Inc. flu shot made with mRNA technology, reversing a previous decision that shocked Wall Street and spurred a public spat between the company and its regulator.

Kraft Heinz Co. announced it’s replacing its North American president this month as its new chief executive officer embarks on a plan to bolster growth at the struggling food company, rather than continue with a planned split.

Madison Square Garden Sports Corp.’s board of directors approved a plan to explore spinning off the NBA’s New York Knicks and NHL’s New York Rangers, a move that would make it easier to attract investors to the teams.

Bank of America Corp. is broadening the scope of its rewards program to encourage customers to do more business with the company, part of an effort to reach lofty financial targets it promised investors last year.

US banks including Huntington Bancshares Inc., First Horizon Corp. and M&T Bank Corp. are working to build a tokenized deposit network as financial firms fight to stay relevant amid the rise of digital assets.

Uber Technologies Inc. is planning to spend more than $100 million to build fast-charging, autonomous-vehicle charging stations in the US, the latest move to establish itself as a critical player in the robotaxi industry.

Wingstop Inc. reported better-than-expected results, easing fears of a marked slowdown at the chicken chain.

A ruling requiring Kalshi to shut down its sports prediction contract offerings in Massachusetts won’t take effect until after an appeals court considers the company’s challenge to the ban.

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X