Markets Update - 2/19/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

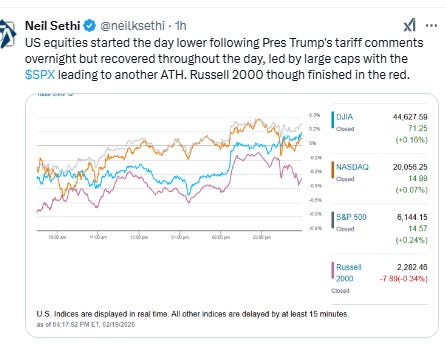

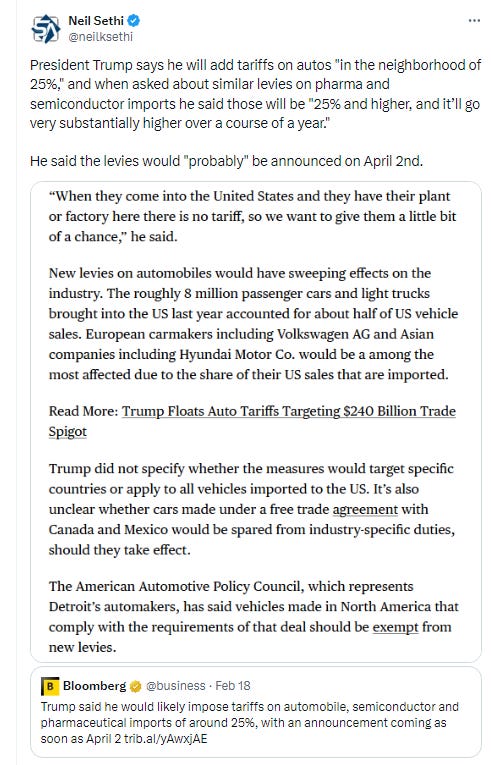

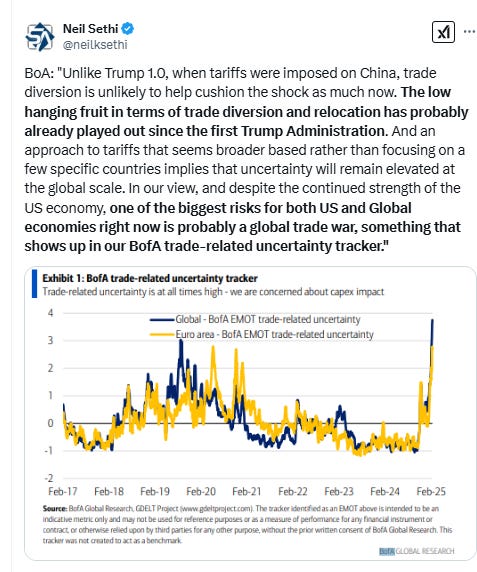

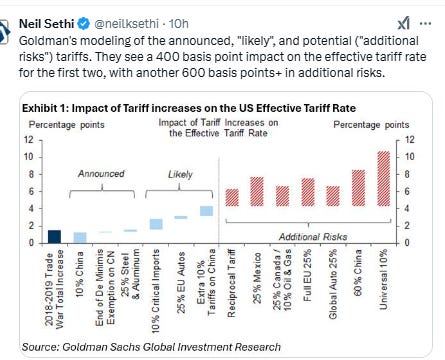

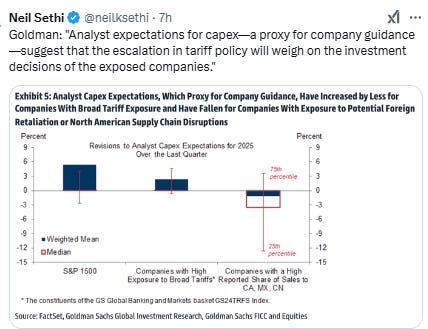

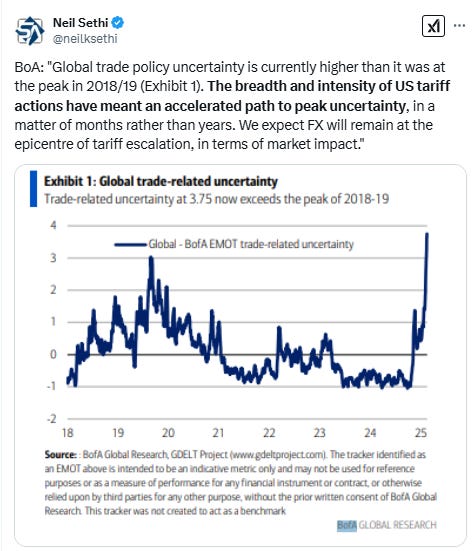

US equities started the day lower following Pres Trump's comments overnight that he was looking to put 25% tariffs on autos, pharma products, and other items to be announced April 2nd, but recovered throughout the day, led by large caps pushing the S&P 500 to another ATH. Russell 2000 though finished in the red today.

The gains were helped by Treasury yields remaining placid. The dollar did gain though, as did nat gas (to a 2-yr high), crude, and bitcoin. Copper fell while gold was little changed.

The market-cap weighted S&P 500 (SPX) was +0.2%, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite +0.1% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index +1.2% (up 3% last two sessions), and the Russell 2000 (RUT) -0.3%.

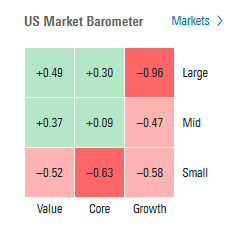

Morningstar style box showed the weakness in small caps but also a lot more weakness in growth than we saw in the indices.

Market commentary:

“Tariffs and other newsflow have a lot of potential to, to disrupt markets and to weigh on sentiment,” said Lilian Chovin, head of asset allocation at Coutts & Co. “Every day brings a new headline. It’s not so much the timing, but the details of the tariffs and which sort of goods will be included.”

“I think there’s a lot of noise tied to DOGE, Elon Musk and tariffs in the short-term, which is what you’re seeing today. And I think a lot of this stuff will linger,” said Jim Elios, founder and chief investment officer at Elios Financial Group. “It’s the Trump effect with headlines that are weighing on markets and causing some pain. In the long-term, I’m still really bullish about how this can become a pro-business environment.”

“The stock market’s resiliency has been impressive year-to-date as investors refuse to ‘back down’ in the face of rising negative sentiment and concerns about tariff and inflation headlines,” Craig Johnson, chief market technician at Piper Sandler, said in a Tuesday note. “We expect market conditions to remain choppy as investors rotate ‘down-cap’ amid declining Treasury yields, weakening crude oil, and a pullback in the U.S. dollar.”

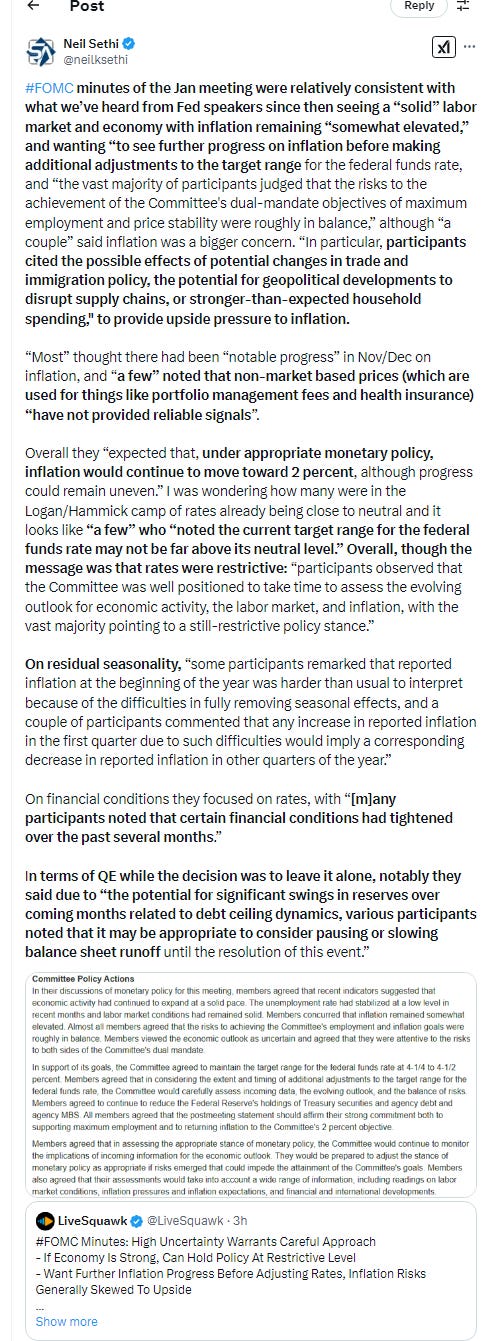

"The bottom line with the just-released minutes from the FOMC meeting three weeks ago [is] they will sit and wait before cutting again. I say ‘cut’ because it still seems like they have an easing bias and [that's] maybe why yields came down a touch after the release," said Peter Boockvar, chief investment officer at Bleakley Financial Group, in a note.

Investors have no practical way to evaluate the effectiveness of initiatives from the Elon Musk-led entity known as the Department of Government Efficiency, and it’s hard to see any clarity for the foreseeable future, BMO Capital Markets strategists Ian Lyngen and Vail Hartman said. For now, the takeaway is "is similar to the changing sentiment on the trade front," they said in a note. "Said differently, a concerted effort to reduce government inefficiency is, in and of itself, the tradable event — and it has already been traded." It is "simply too soon to have a meaningful understanding of what can and will be achieved in this regard. Hence, the U.S. rates market has become desensitized from DOGE headlines for the time being," the strategists said.

In individual stock action, strength in semiconductor names and some megacaps played an integral role in index gains. The PHLX Semiconductor Index (SOX) jumped 1.2%, and Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG), and Tesla (TSLA) registered gains. Analog Devices surged nearly 10% after posting better-than-expected quarterly results on the top and bottom lines.

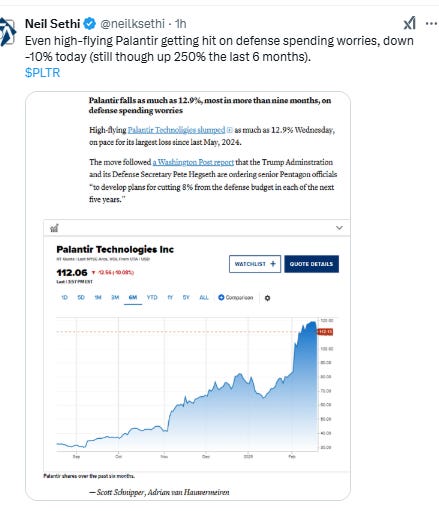

Outsized moves in either direction were mostly limited to companies that reported quarterly results. Occidental Petroleum (OXY) and Devon Energy (DVN) were upside standouts in that regard, boosting the energy sector. On the flip side, Celanese (CE) and Toll Brother (TOL) logged big losses in response to disappointing results. Homebuilders overall sank after Toll’s results, and key construction data indicated the residential real estate market may be in store for more turbulence. Defense stocks fell on worries related to DOGE cuts.

Quantum stocks rallied on Wednesday following Microsoft’s release of its first quantum computing chip, Majorana 1. In the news release, Microsoft said the reveal showed that “quantum computers capable of solving meaningful, industrial-scale problems” are “years, not decades” away. Shares of BTQ Technologies surged about 36%, while Rigetti Computing added 3.9% and D-Wave Quantum popped about 10%. IonQ stock followed with a 1% gain. Microsoft shares were slightly higher. Shares of the electric truck maker Nikola plunged more than 40%. At one point, they were halted for trading. Nikola filed for Chapter 11 bankruptcy protection after the company failed to secure a buyer or raise additional funds.

Companies making the biggest moves after-hours from CNBC:

BBG Corporate Highlights:

Apple Inc. introduced a new low-end smartphone called the iPhone 16e priced at $599, aiming to revive growth after a sluggish holiday season.

Nikola Corp. filed for bankruptcy, culminating a long decline for the onetime darling of the electric-vehicle industry, which grappled with weak sales and cycled through CEOs in the wake of a fraud scandal.

Carvana Co. expects retail vehicle sales and earnings to continue growing this year after reporting a record fourth quarter that easily beat Wall Street forecasts.

SolarEdge Technologies Inc. surpassed sales forecasts, triggering an apparent short-covering rally.

Elliott Investment Management is seeking seats on the board of oil refiner Phillips 66, the latest effort in a multi-year campaign pushing the company to sell assets, improve operational performance and bolster board oversight.

Hims & Hers Health Inc. is expanding beyond its successful foray into providing copycat weight-loss drugs with the acquisition of a home blood-testing company.

Roper Technologies Inc. is exploring a sale of its Neptune Technology Group division, according to people with knowledge of the matter.

Some tickers making moves at mid-day from CNBC.

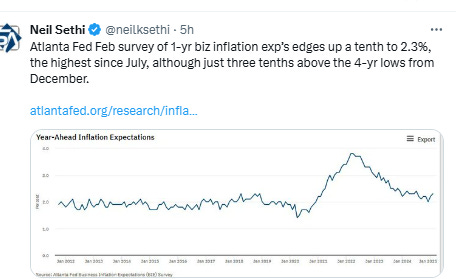

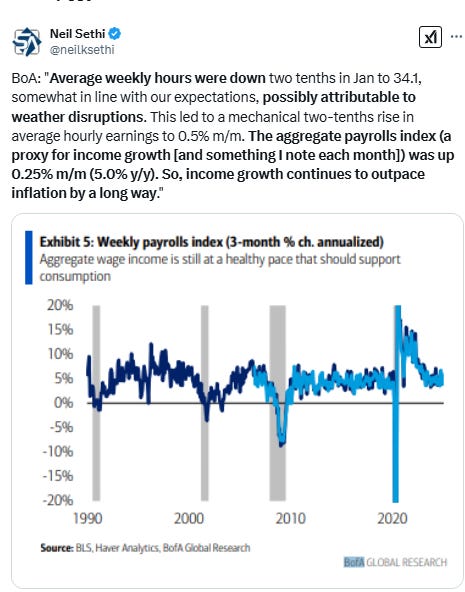

In US economic data:

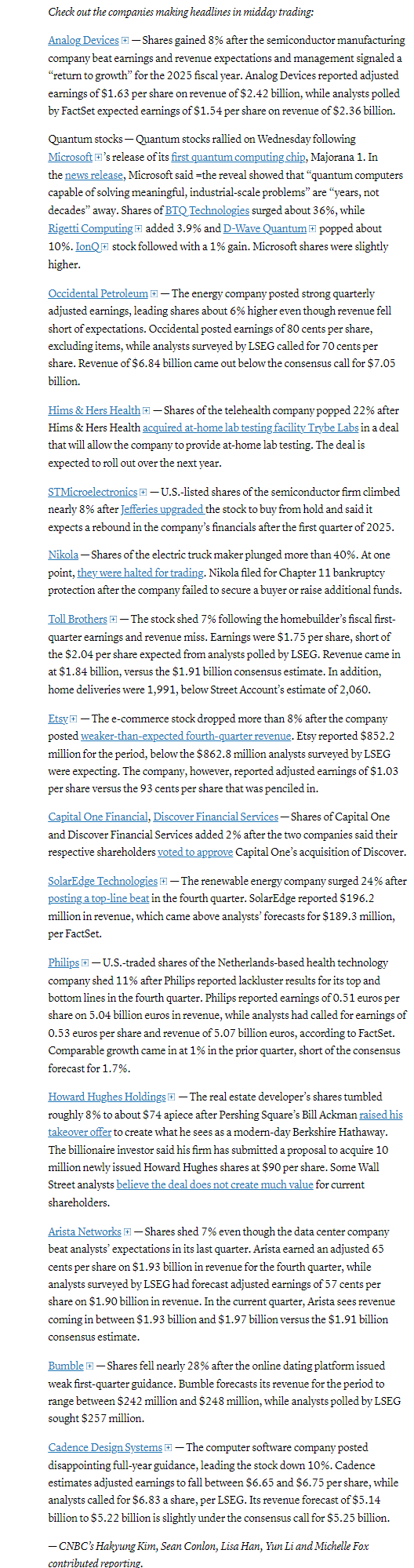

Jan housing starts reverse much of Dec’s +16.1% m/m jump to 1.15mn SAAR (rev’d from 1.499mn), which was the highest since Feb (and on a percentage basis the biggest jump since Mar '21), falling -9.8% to 1.366mn, worse than the exp’d -7.3% decrease to 1.390mn as both single family (-8.4% to 993k from the highest since last February and first decline since Oct) and multi-family (-11.0% to 355k from the highest since Dec ‘24) fell back. It was the largest drop in total starts since March, but likely impacted by unusually cold temperatures in the South which makes up over half of housing starts.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

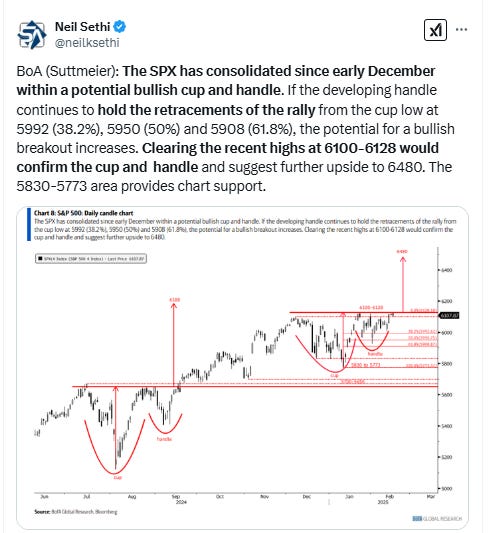

The SPX as noted edged to an all-time high. The daily MACD and RSI are positive, but both have clear negative divergences with lower highs (of course that’s been the case since July for the RSI).

The Nasdaq Composite remains just on top of its downtrend line, less than a percent below its ATH. Its daily MACD and RSI are positive with the same divergences.

RUT (Russell 2000) remains just under the resistance zone which runs to 2325. Its daily MACD and RSI are neutral.

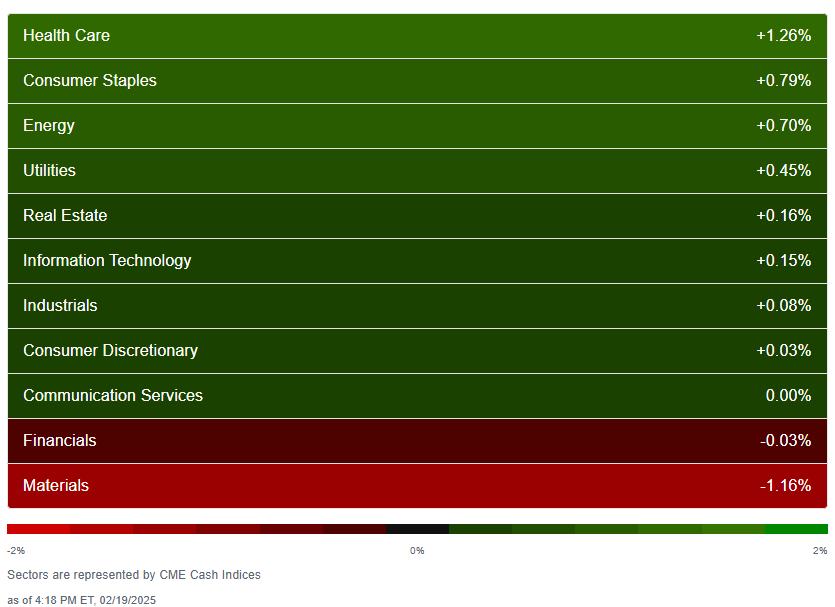

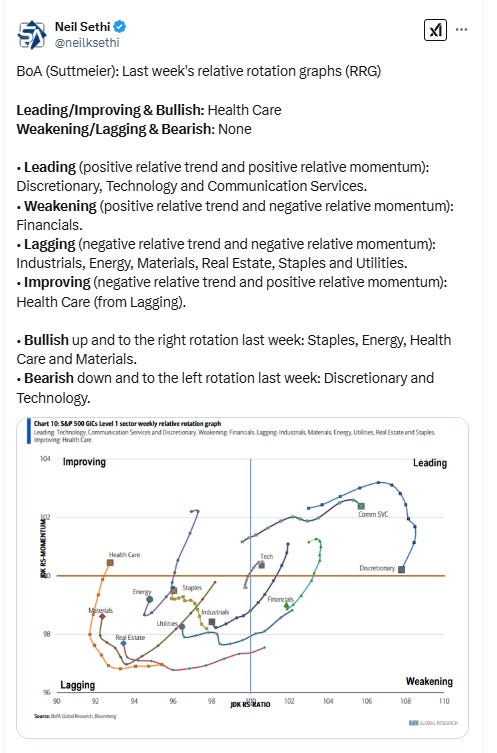

Equity sector breadth from CME Cash Indices remained good in quantity with 8 green sectors (the same as Tuesday), the 3rd day in 4 with at least 8 green, but four of those were up less than +0.2%. Just three were up >+0.7%, down from five Tuesday. But just one sector down more than that again (Materials today on no particular news catalyst). Defensives outperformed taking 4 of top 5 spots.

SPX sector flag from Finviz relatively consistent with again a lot of green, particularly in health care and staples. META down a second day (now -4.6% last two days). Some big up days in semi’s. ADI and MCHP nearly +10%, NXPI and ON +7%, TXN +5%.

Positive volume (percent of total volume that was in advancing stocks) which has been very good the last several sessions a little less so Wednesday at 48% on the NYSE a little weak given the flat day in the NYSE Composite index. The Nasdaq was better at 60% than the +0.1% day would indicate. Positive issues (percent of stocks trading higher for the day) though much weaker at 42 & 44% respectively so buying again concentrated in the fewer advancing names.

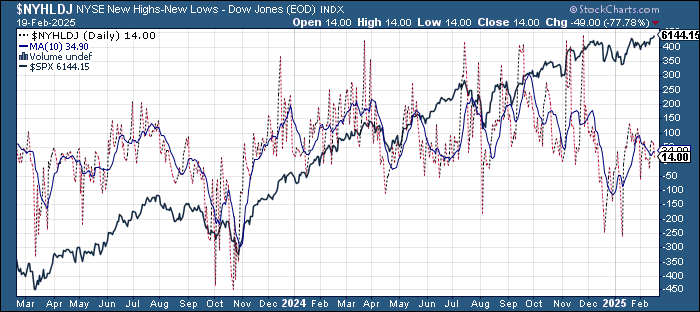

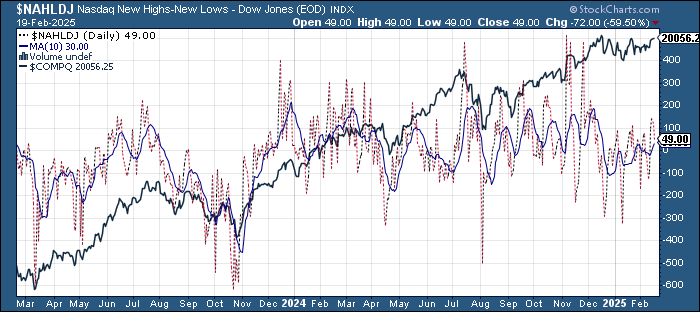

New highs-new lows (charts) also fell back again after hitting the best of the month Friday with the NYSE down to +13 from +75 on Friday while the Nasdaq fell to +46 from +140. NYSE now below its 10-DMAs while the Nasdaq just above. Both 10-DMA’s though still turned up (more bullish).

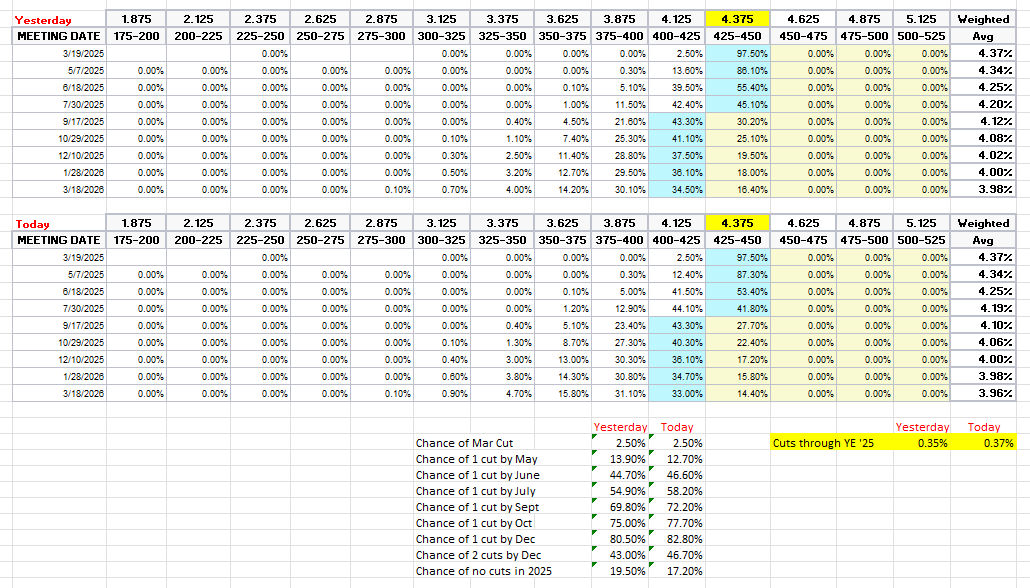

With the #FOMC minutes mostly as expected, FOMC rate cut probabilities from CME’s #Fedwatch tool saw modest movements. A cut by March remains at 2.5%, but one by July edged up to 58% (from 55% Tuesday, up further from the 42% the Wednesday after CPI but still down from the 83% the Thursday before NFP/UMich). Chance of two 2025 cuts at 47% (vs 43%, 31% & 57%) and no cuts down to 17% (vs 20%, 29% & 12%) with 37bps of cuts priced (vs 35, 28 & 44).

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, but CPI could change that, and as I noted Wednesday it has made me think that cuts are becoming less likely, but as I also said I continue to expect them versus no cuts at this point. “It’s a long time until December.”

Longer duration #UST yields as noted little changed with the 10yr yield at 4.54%.

The 2yr yield, more sensitive to Fed policy, edged lower -4bps to 4.27%. I still find this level rich, but I’m no longer expecting it to soften materially in the near term, consistent with my note that the possibility is growing of no further rate cuts which would mean it’s fairly priced right here. That said, it is now reflecting as much chance of rate hikes as cuts, and I still think it’s too early to take further rate cuts off the table (and too early to put hikes in the next two years on).

Dollar ($DXY) up for a second day from the lowest close in 2 months. As noted Thursday it broke the 3rd “fanline” which is normally supposed to mean a reversal from the uptrend, and daily MACD and RSI as also noted Thursday are negative w/the latter falling to the weakest since September, so technicals would point to more downside, but so far it’s hung in there.

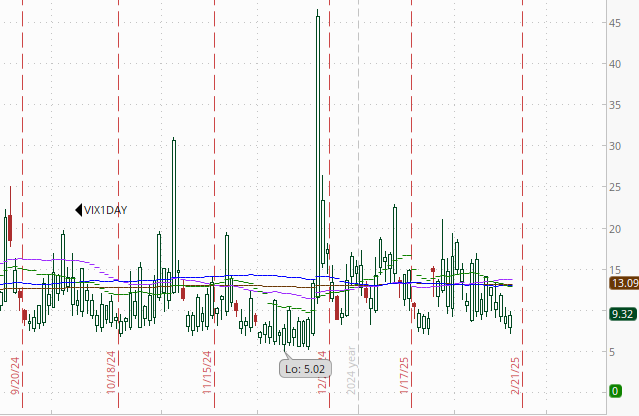

The VIX edged down to 15.3 (consistent w/~0.94% daily moves over the next 30 days), keeping it on its uptrend line from the December lows.

The VVIX (VIX of the VIX) fell more pushing further under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)) to around the lows of the year.

1-Day VIX remained at 9.3, the joint lowest close since Jan 24th. Looking for a move of around 0.59% Wednesday.

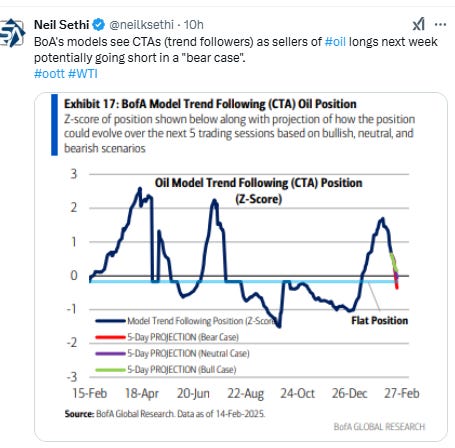

WTI futures up for a second day to the middle of the range over the past 6 months. Daily MACD remains negative, and the RSI under 50, but both are pretty close to turning more constructive if it can put together another day or two of gains.

Gold futures traded in a narrow range Wednesday just under record highs, working on an 8th up week in a row, the longest streak since 2020. The daily MACD remains positive for now, but the RSI has a clear negative divergence.

Copper (/HG) unlike gold continues its consolidation, down for a 3rd day to a 1-week low. Like gold it also has seen its daily RSI break lower, and the daily MACD is very close to crossing to a “sell longs” positioning. The $4.50 area would be a natural pullback area as noted Friday.

Nat gas futures (/NG) jumped another +7%, up for the 9th session in 10 to the highest close since Dec 2022. I had said Wednesday if it could stay over $3.70 it will “have a chance to really run higher,” and it got the excuse. Daily MACD now in “go long” positioning, and the RSI is breaking out to the highs of the year.

Bitcoin futures edged higher broken from their 8 session sideways trade falling to the lowest close of the year, although remaining above the key $90k level. Daily MACD and RSI remain negative with relative strength the weakest since Sept.

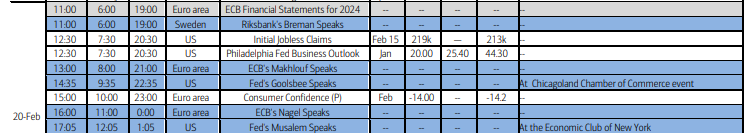

The Day Ahead

US economic data lighter led by weekly jobless claims. We’ll also get the Philly Fed’s manufacturing survey, the LEI’s, and weekly petroleum inventories.

In Fed speakers we’ll hear from Chicago Fed Pres Goolsbee in the morning and Vice Chair for Supervision (until the end of the month) Barr, Gov Kugler, and St. Louis Fed Pres Musalem in the afternoon/evening. FOMC Vice-Chair speaks tonight at 5pm ET.

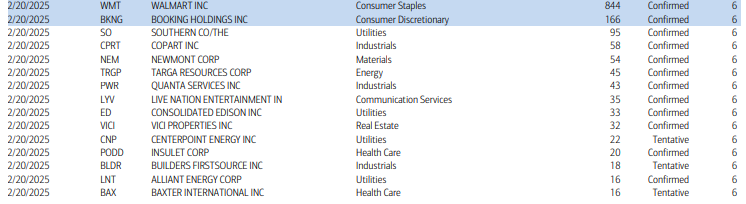

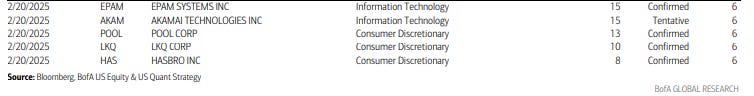

Earnings see our heaviest day of the week with 20 SPX components, and two > $100bn in market cap in Walmart (WMT) and Booking Holdings (BKNG), although we’ll also get non-S&P 500 members Alibaba (BABA), Schneider Electric (SBGSY), Airbus (EADSY), Safran (SAFRY), and Mercadolibre (MELI) all also >$100bn reporter (and Southern Company is just below at $93bn, see the full earnings calendar from Seeking Alpha).

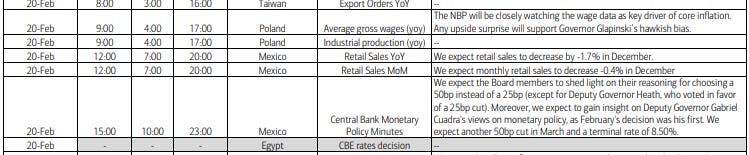

Ex-US a light day with Australia Jan employment and EU Feb consumer confidence. In EM we’ll get a policy decision from Egypt, Taiwan exports, and Mexico retail sales and central bank minutes.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,