Markets Update - 2/20/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

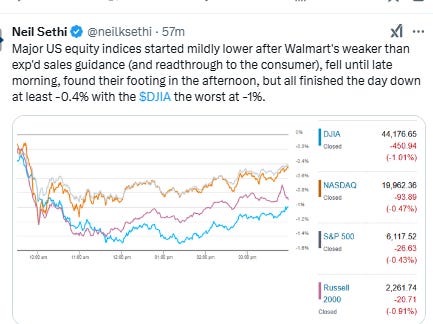

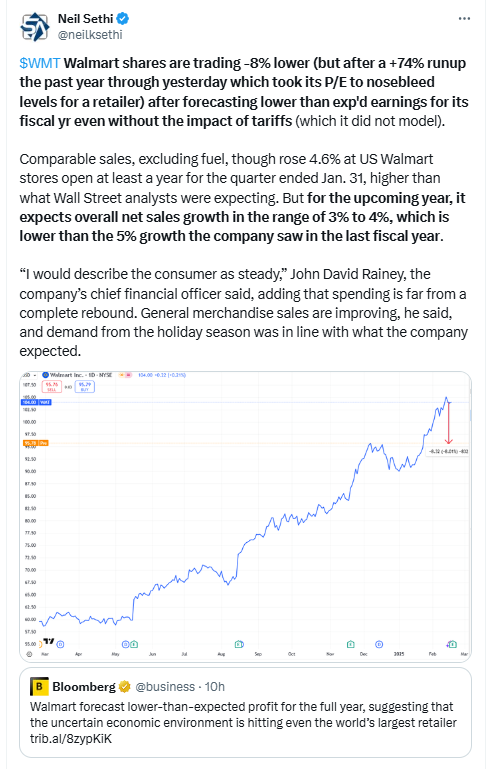

Major US equity indices started mildly lower after Walmart's weaker than expected sales guidance (even though the underlying report wasn’t really that weak, which seemed to spread to a general concern about the consumer after its CFO noted “uncertainties related to the consumer” and turned into an even more generalized desire to take some profits in recent winners (financials in that regard was the most sold sector). Stocks found their footing in the afternoon, but all the major indices finished the day down at least -0.4% with the DJIA the worst at -1%.

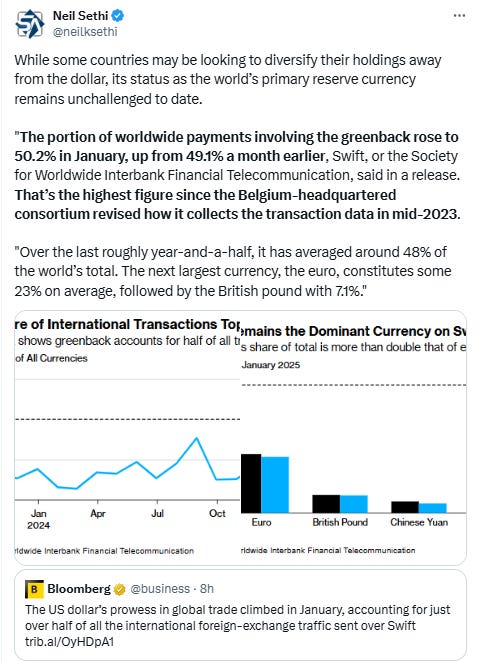

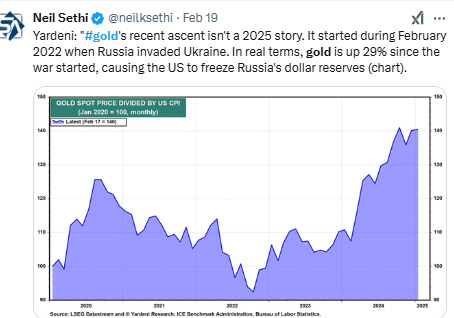

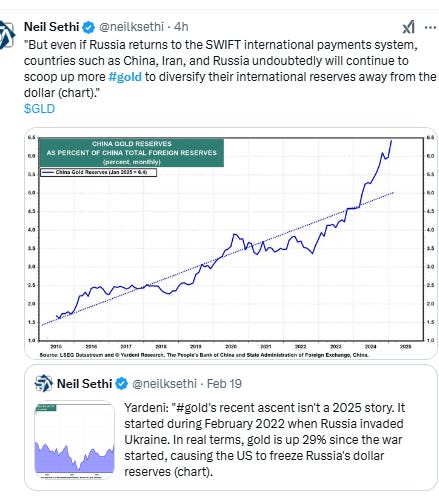

The losses were despite Treasury yields remaining placid and the dollar dropping to the lowest since early December. The weaker dollar helped crude, gold and copper to gains (with gold a new all-time high), and bitcoin also advanced. Natgas though fell back from 2-yr highs.

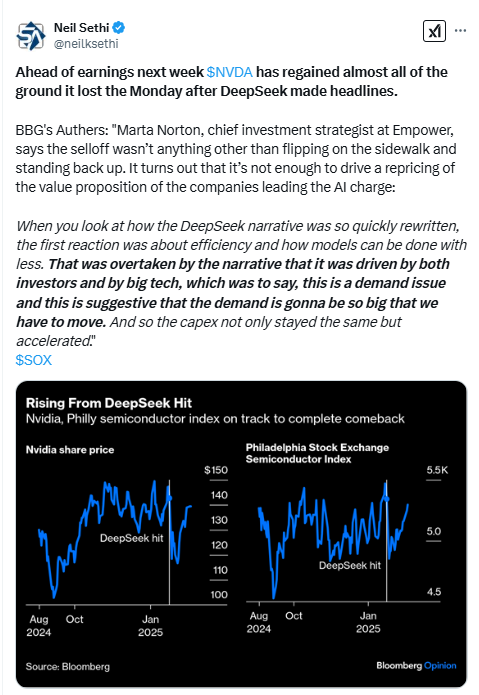

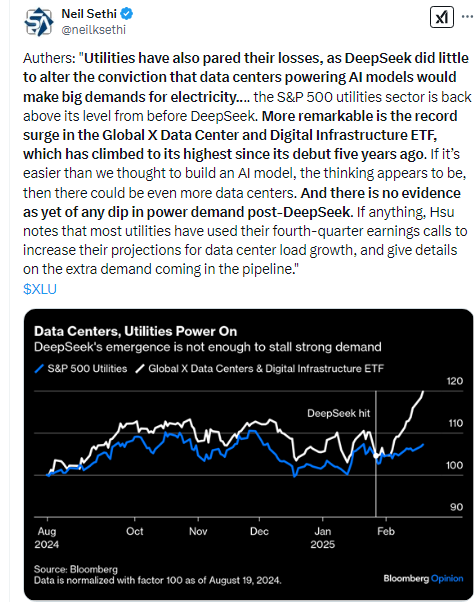

The market-cap weighted S&P 500 (SPX) was -0.4%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite -0.5% (and the top 100 Nasdaq stocks (NDX) -0.5%), the SOX semiconductor index unch, and the Russell 2000 (RUT) -0.9%.

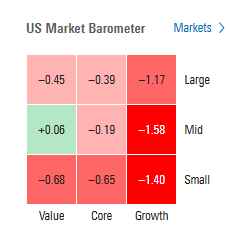

Morningstar style box showed the weakness concentrated in small caps and growth.

Market commentary:

“US equities are seeing some broader de-risking today,” said Dan Wantrobski at Janney Montgomery Scott. While the overall consolidation pattern remains intact/healthy at this time, Wantrobski is watching for key support within the 5,950-6,000 range for the S&P 500 in sessions ahead. “A closing break below this threshold still opens the door to a bigger drawdown towards the 200-day moving average — which resides within our 5,600-5,800 support target,” he added. The gauge is currently above 6,100.

“You start to see a little de-risking just based off of the fact that valuations are becoming more scrutinized,” JC O’Hara, chief technical strategist at Roth Capital Partners, told CNBC. “Walmart was one of the first signals that consumer behavior in terms of spending could be changing or could be becoming a little bit more conservative. So I think managers are looking at, again, their portfolio and just becoming a little bit more cautious.”

“If Walmart is giving bad guidance, you should be paying attention to it,” said Tom Fitzpatrick, managing director at R.J. O’Brien and Associates. “Perhaps this is suggesting that the general consumer is tapped out.”

“Walmart, a bellwether for consumer spending, raised another red flag, just as mounting trade tensions threaten to drive up the costs of goods,” said Jose Torres at Interactive Brokers.

“This news out of Walmart raises even more concerns about the state of the consumer,” said Matt Maley at Miller Tabak + Co. “We have already seen some very disappointing numbers on consumer confidence and last week’s retail sales data was much lower than expected. It raises some questions about how strong growth will be over the rest of this year.”

Among the reasons, Jason Goldberg at Barclays Plc cited Walmart’s outlook and a contraction in the Conference Board leading economic index as factors fueling macroeconomic concerns. But there’s also the fact that banks have also “had a decent move” resulting in “some profit taking,” the analyst wrote.

“While we haven’t reached the point where investor anxiety is translating into outflows from US equity funds, it’s reasonable to assume that this may be where we are headed if sentiment doesn’t stabilize soon,” Lori Calvasina, head of US equity strategy at RBC Capital Markets, wrote in a recent note.

“The one thing I don’t see, given that we’ve gone through this earnings [season], is that catalyst to really explode the market higher,” said Jay Woods, chief global strategist at Freedom Capital Markets. “Right now, we can go up slow and steady. We can see rotation under the surface. This is all positive. We’re churning. We’re digesting gains.”

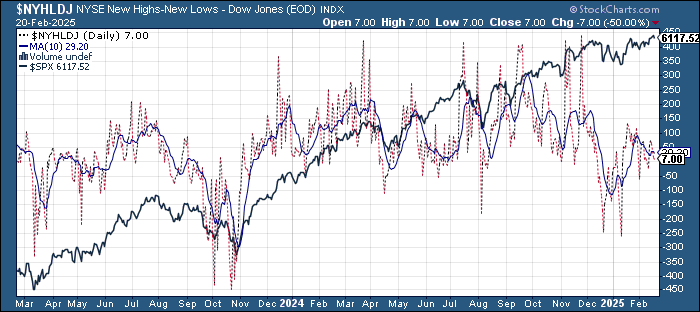

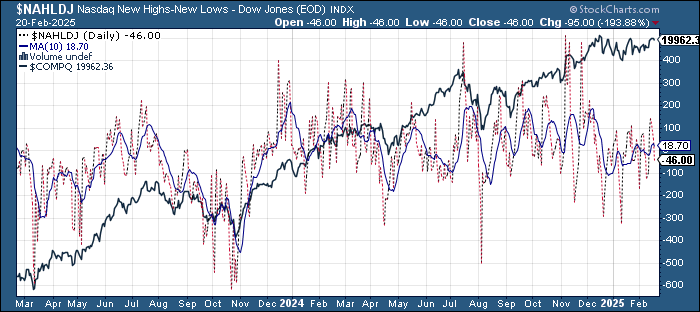

Frank Gretz, technical analyst at Wellington Shields, noted that a little more than half of all New York Stock Exchange stocks are trading above their 200-day moving average, an unusual 50-50 split that seldom holds. “That to me suggests half of the stocks in the New York Stock Exchange ... are in downtrends, against an S&P that’s at a new all-time high,” he said. “That’s not a healthy technical background.”

“With equity markets at all-time highs and recent decline in volatility, we see rising investor interest in hedging near-term drawdown risks,” wrote Arun Prakash, a vice president at Goldman Sachs.

“A correction may soon be necessary to restore a more attractive valuation for US stocks,” said Fawad Razaqzada at City Index and Forex.com. “While there are no overt warning signs just yet, it pays to be alert to signals that would put the S&P 500 forecast on a downward trajectory in the short-term.”

Robert Ruggirello of Brave Eagle Wealth Management believes it’s “an encouraging sign” that the S&P 500 hasn’t fallen below 6,000, even with the latest decline. “The S&P 500 has been able to remain above 6,000 for some time now, which is an encouraging sign as the index looks to keep climbing the wall of worry,” Brave Eagle’s chief investment officer said.

After back-to-back strong years for the stocks, more moderate gains would be normal, according to Ari Wald, head of technical analysis at Oppenheimer.

“Today’s weakness is not overly damaging, [and is] still within the context of a trend that is still higher for the market,” he told CNBC. “This continues to be a market of haves and have nots, and you got to pick your spots a little bit better than we’ve had to versus the last two years, when kind of everything was rallying together.”

"The Fed has been very judicious with acting appropriately and not acting out of step with where the economy is headed," Lorne Bycoff, CEO of the Bycoff Group, told MarketWatch. "I think that the market has been relatively [on the] same line of not overreacting."

“We have been using the word ‘resilient,’” Elyse Ausenbaugh, head of investment strategy at JPMorgan Wealth Management said on CNBC’s “Closing Bell” on Wednesday. She added that she expects another high single-digit total return upside from here. “We think that 2025 is going to be a year that investors have a chance to build on strength,” Ausenbaugh continued. “We see more room for this market rally to run.”

“Our fixed-income team perceives US policies as potentially constituting a supply shock, slowing the pace of both US growth and disinflation,” according to Andrew Craig at BNP Paribas Asset Management’s Investment Insights Centre. “We view it as less likely that the Federal Reserve will ease policy rates in a stagflationary scenario.”

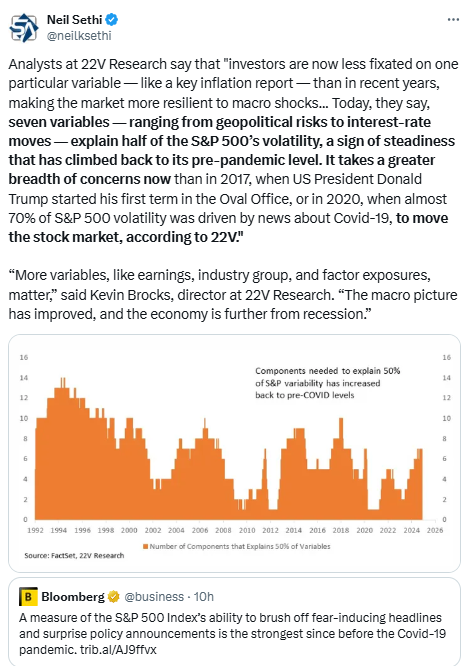

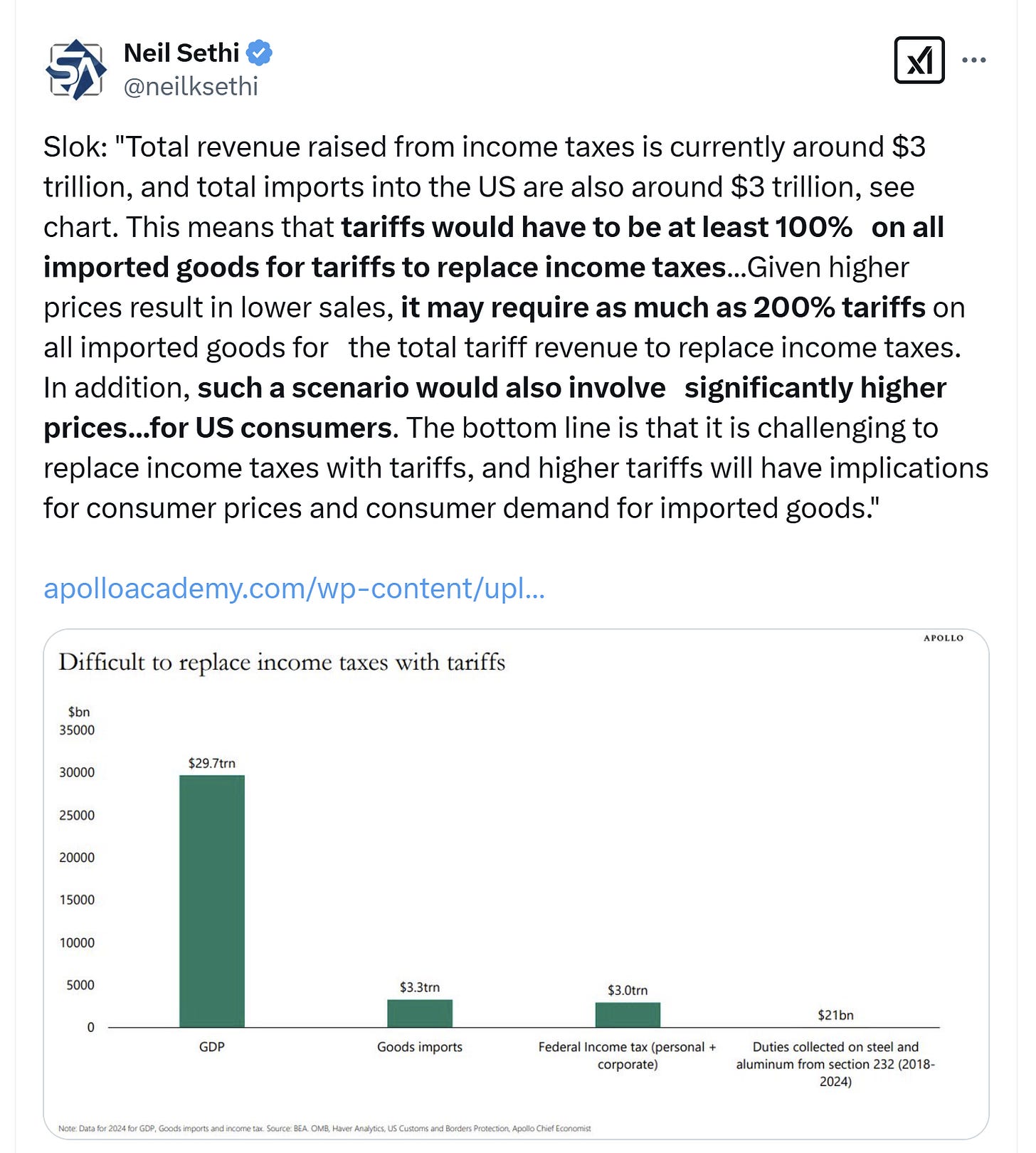

Neuberger Berman co CIOs Jeff Blazek and Erik Knutzen, who write that after two years, inflation is no longer the big data to watch and a “new dynamic is at play. Last Wednesday’s unexpectedly high U.S. inflation data was a significant test for this analysis, and the market took it largely in stride. That underlines our view that investors need to shift from an ‘inflation mindset’ to a ‘growth mindset’ to understand current dynamics,” Blazek and Knutzen told clients in an investor note. The investors noted the new year is seeing more optimism in the economy, owing to consumer confidence, falling unemployment, rising wages and positive manufacturing surveys. Added to that is a budding rebound in China’s economy and positive signs from Europe as well. “The result since the start of the year, has been notable outperformance from U.S. value stocks, industrials, financials, higher-quality U.S. midcaps and, especially, European equities,” said Blazek and Knutzen, who expected this setup for 2025. In December, their positive outlook for stocks came with advice for clients to approach the S&P 500 cautiously and diversify for a broadening market performance. They note the broadening performance comes as worries about inflation haven’t died down, with market expectations on prices creeping higher and plenty of commentary out there about the inflationary impact of tariffs. “And yet, aside from the prospect of tariffs, none of those things have knocked equity markets off course. And note that the sell-off triggered by President Trump’s tariff announcements was accompanied by falling bond yields, affirming…that their growth implications are far more important for market prices than their inflation implications,” Blazek and Knutzen said.

“We think the initial sell-off following Wednesday’s inflation release was quickly erased for the same reason. Investors know that January’s inflation data has a seasonal tendency to overshoot, but we see the growth mindset at work here, too.”

In individual stock action, EPAM Systems and Axon Enterprise led the S&P 500 down on Thursday with losses of more than 15% and 10%, respectively. Royal Caribbean followed, posting an 8% drop. Dow member Walmart dropped 6.5% after the company said it expects fiscal-year sales to grow between 3% and 4%. The company’s fiscal 2026 earnings outlook, meanwhile, was below analysts’ expectations. The weak guidance overshadowed fiscal fourth-quarter earnings that topped estimates as its chief financial officer acknowledged “uncertainties related to consumer behavior and global economic and geopolitical conditions.”. Target and Costco each fell about 2%, following Walmart’s move, amid rising worries about the health of earnings moving forward.

A slide in banks also weighed on trading, with JPMorgan Chase & Co. and Goldman Sachs Group Inc. each falling over 3.8%.

Add Carvana to the list of recently hot stocks where investors are now getting cold feet. Shares of the car retailer fell more than 12% on Thursday. The fall came despite a fourth-quarter report that showed $159 million in net income and $3.55 billion of revenue. Analysts were expecting $73.2 million in net income and $3.43 billion in revenue, according to FactSet.

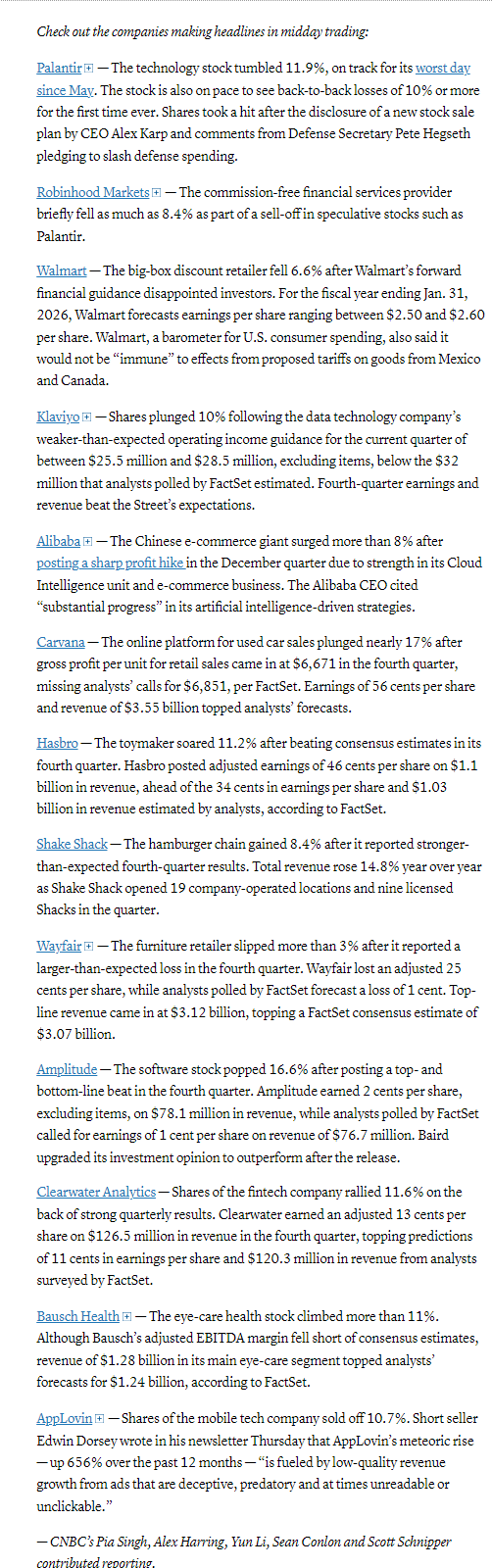

Companies making the biggest moves after-hours from CNBC:

BBG Corporate Highlights:

Spirit Airlines Inc. won court approval to leave bankruptcy via a lender-backed take-private deal after rejecting a takeover offer from rival Frontier Group Holdings Inc.

Boeing Co.’s chief executive officer said Elon Musk and his DOGE team are helping the planemaker work through bottlenecks that have caused the next fleet of Air Force One jets to fall years behind schedule.

Carvana Co. tumbled after the used-car retailer reported lower gross profit per vehicle and shrinking wholesale volumes for the latest quarter, undercutting a turnaround narrative that had buoyed the stock.

Alibaba Group Holding Ltd. posted its fastest pace of revenue growth in more than a year, as the Chinese internet pioneer co-founded by Jack Ma takes another step toward a recovery after years of turbulence.

Hasbro Inc. is targeting mid-single-digit sales growth through 2027 and savings of about $1 billion, as the toymaker laid out a plan to expand its reach over the next few years.

Herbalife Ltd., a nutrition company, reported fourth-quarter adjusted earnings per share that beat consensus estimates.

Birkenstock Holding Plc opted to keep its outlook unchanged, even as sales of its high-end sandals and clogs jumped more than expected in the first quarter.

Grab Holdings Ltd. predicted full-year revenue that trailed estimates, suggesting caution around a Southeast Asian ride-hailing and food delivery market where GoTo Group remains a formidable rival.

Some tickers making moves at mid-day from CNBC.

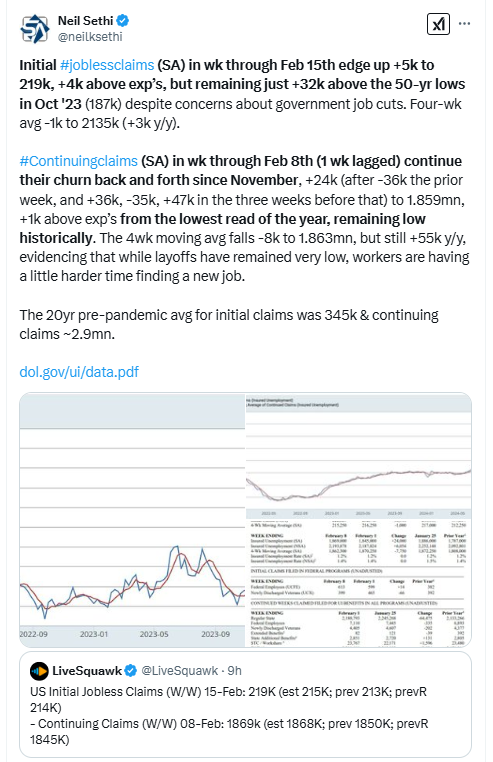

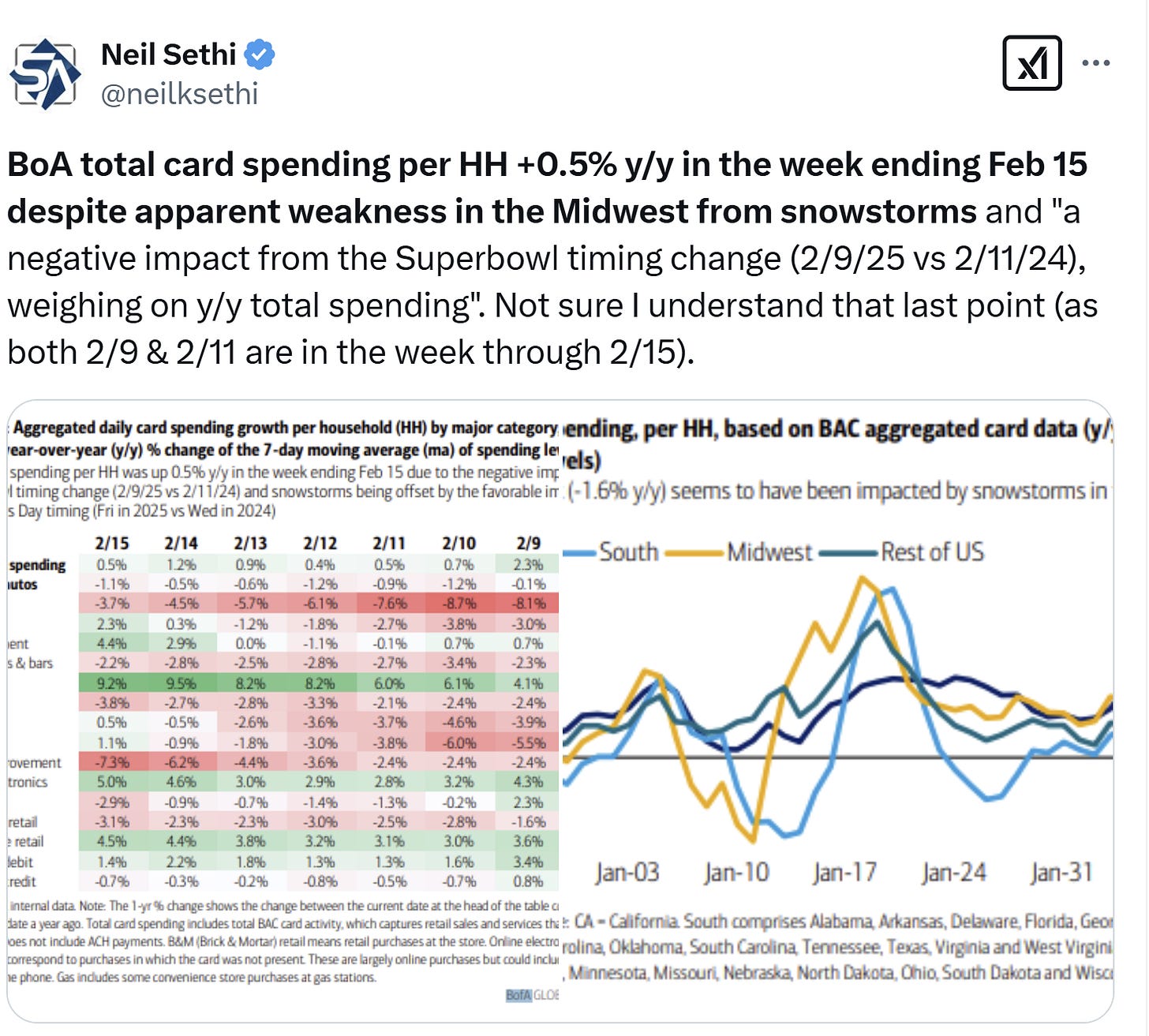

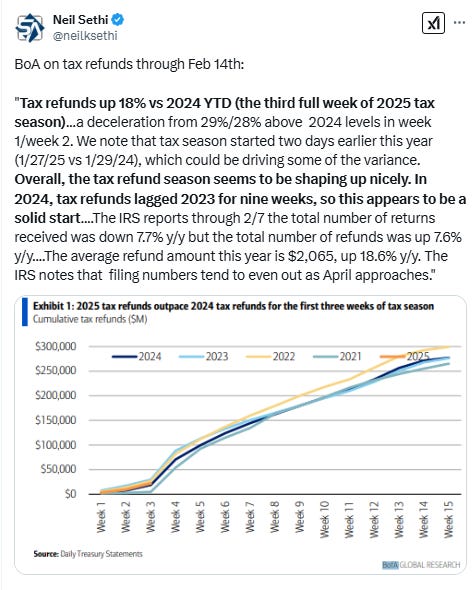

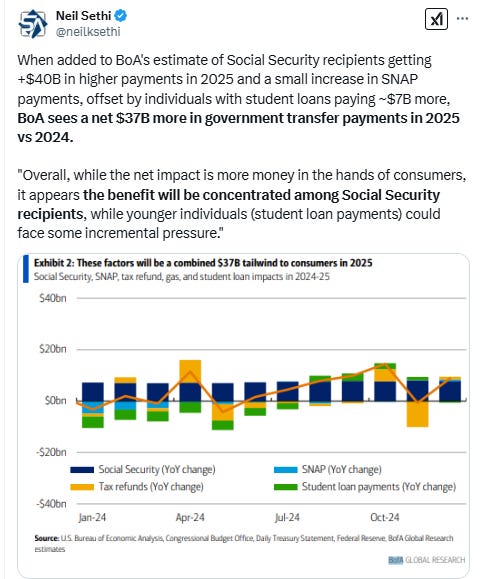

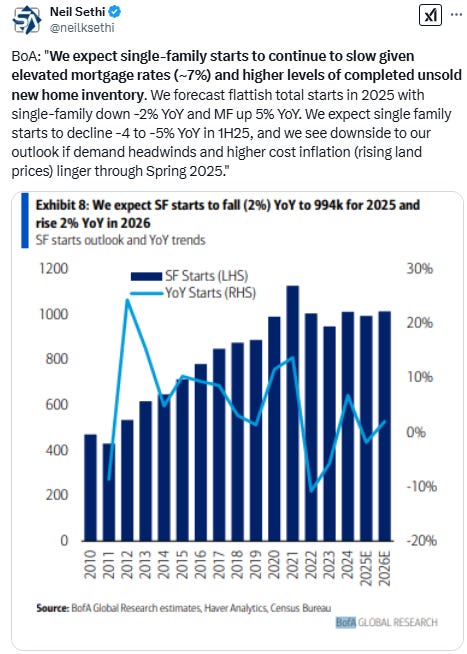

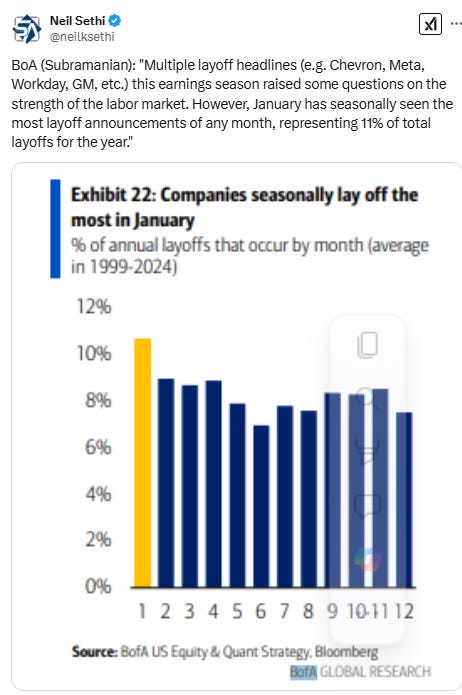

In US economic data:

Initial jobless claims (SA) in week through Feb 15th edged up +5k to 219k, +4k above exp’s, but remaining just +32k above the 50-yr lows in Oct '23 (187k) despite concerns about government job cuts. Continuing claims (SA) in wk through Feb 8th (1 wk lagged) continue their churn back and forth since November, +24k (after -36k the prior week, and +36k, -35k, +47k in the three weeks before that) to 1.859mn, +1k above exp’s from the lowest read of the year, remaining low historically.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

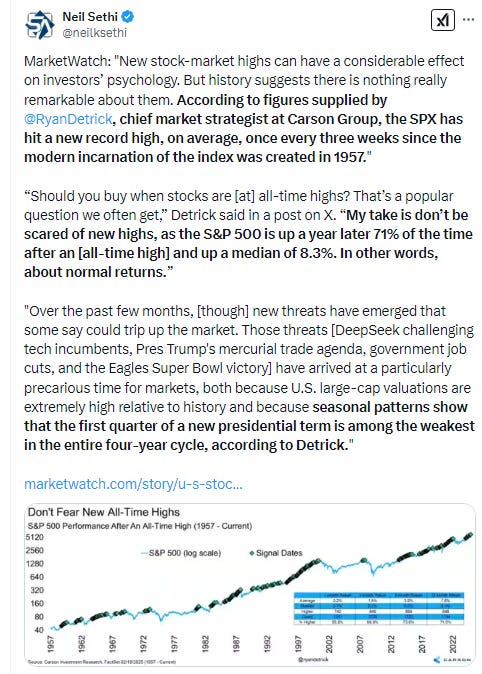

The SPX fell back from Wed’s all-time high. The daily MACD and RSI are positive, but both have clear negative divergences with lower highs (of course that’s been the case since July for the RSI).

The Nasdaq Composite remains just on top of its downtrend line, less than a percent below its ATH. Its daily MACD and RSI are positive with the same divergences.

RUT (Russell 2000) remains under the resistance zone which runs to 2325. Its daily MACD and RSI are neutral.

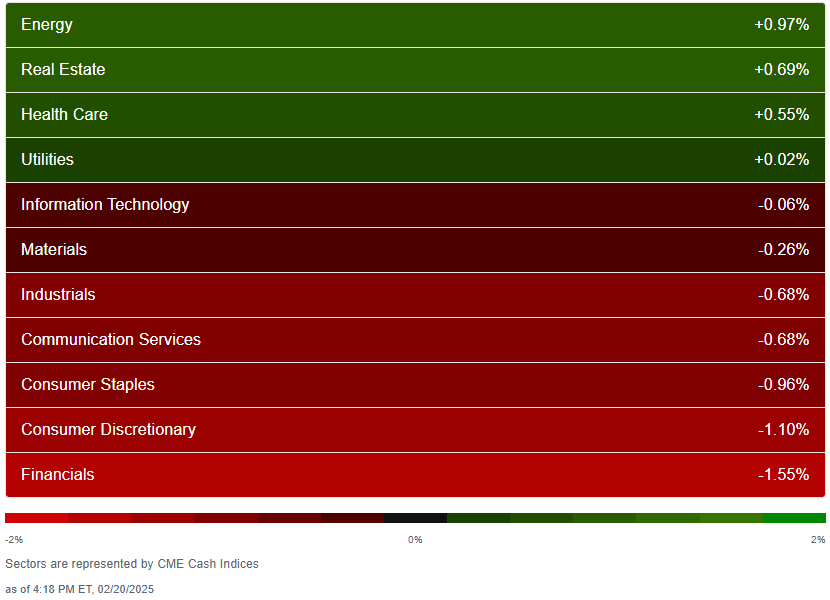

Equity sector breadth from CME Cash Indices deteriorated as might be expected with 4 green sectors (half of Wednesday & Tuesday), and just one up up >+0.7%, down from three Wed, five Tues. None >1%. Two sectors down more than that Cons Discr & Financials. Defensives outperformed for a second day taking 3 of the top 4 spots (staples weak though due to retailers (WMT, COST, TGT).

SPX sector flag from Finviz relatively consistent with a lot more red particularly in retailers, travel, tech (outside of the “Big 3”), renewables, and financials. Again, with no catalyst for financials it looks like we’re seeing profit taking in recent winners. JPM was down over -4%.

Positive volume (percent of total volume that was in advancing stocks) which generally has been pretty good over the past week remained so Thursday at 47% on the NYSE better than the -0.4% performance of the NYSE Composite index would indicate, while the Nasdaq was 43% closer to what the -0.5% would indicate. Positive issues (percent of stocks trading higher for the day) though remained much weaker for a 3rd session at 42 & 36% respectively so buying again concentrated in the fewer advancing names.

New highs-new lows (charts) also fell back again after hitting the best of the month Friday with the NYSE down to +7from +75 on Friday while the Nasdaq fell to -47 from +140. Both are below their 10-DMAs which are rolling over (less bullish).

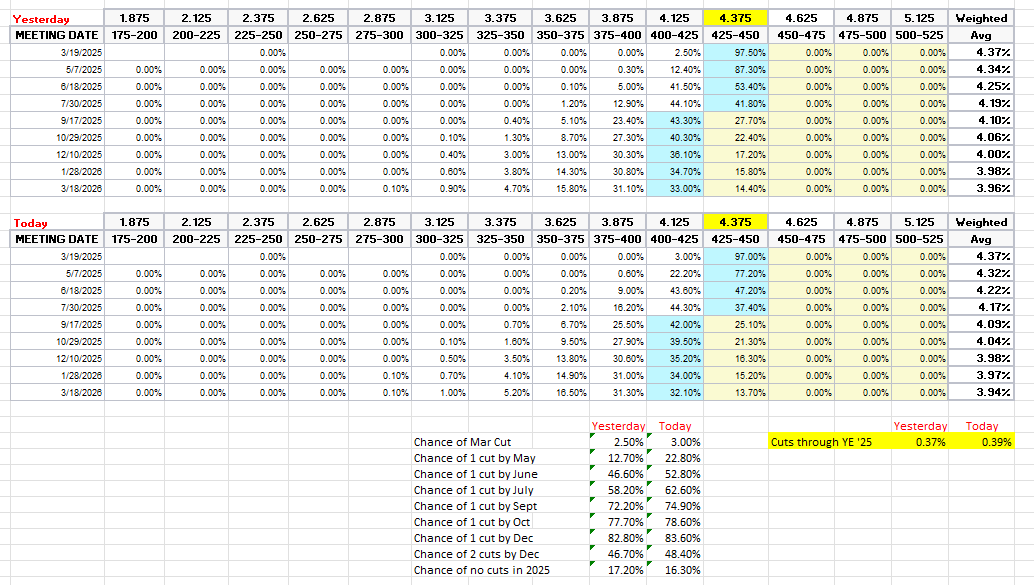

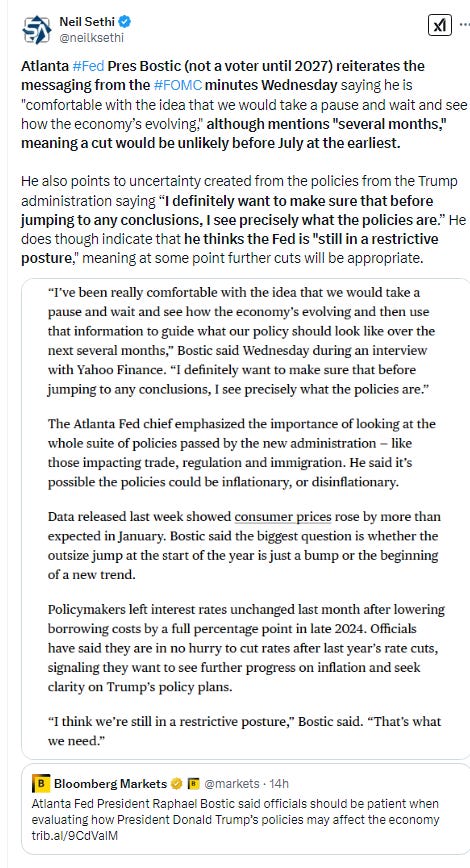

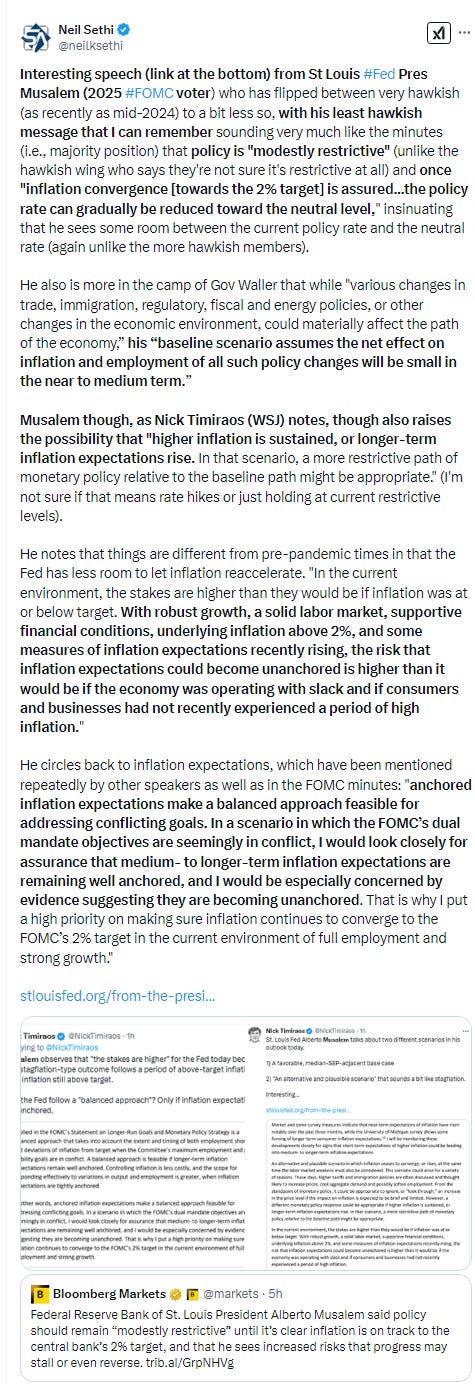

FOMC rate cut probabilities from CME’s #Fedwatch tool saw a small move towards more cuts following relatively constructive comments from Fed speakers (all indicated their bias was to cut rates if inflation moved sustainably towards 2%). A cut by March remains at 3%, but one by July edged up to 62% (up from 58% Wed and further from the 42% the Wednesday after CPI but still down from the 83% the Thursday before NFP/UMich). Chance of two 2025 cuts at 48% (vs 47%, 31% & 57%) and no cuts down to 16% (vs 17%, 29% & 12%) with 39bps of cuts priced (vs 37, 28 & 44).

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, but CPI could change that, and as I noted Wednesday it has made me think that cuts are becoming less likely, but as I also said I continue to expect them versus no cuts at this point. “It’s a long time until December.”

Longer duration #UST yields as noted edged lower now with the 10yr yield now back at its “fanline” -4bps at 4.50%.

The 2yr yield, more sensitive to Fed policy, though was unchanged at 4.27%. I still find this level rich, but I’m no longer expecting it to soften materially in the near term, consistent with my note that the possibility is growing of no further rate cuts which would mean it’s fairly priced right here. That said, it is now reflecting as much chance of rate hikes as cuts, and I still think it’s too early to take further rate cuts off the table (and too early to put hikes in the next two years on).

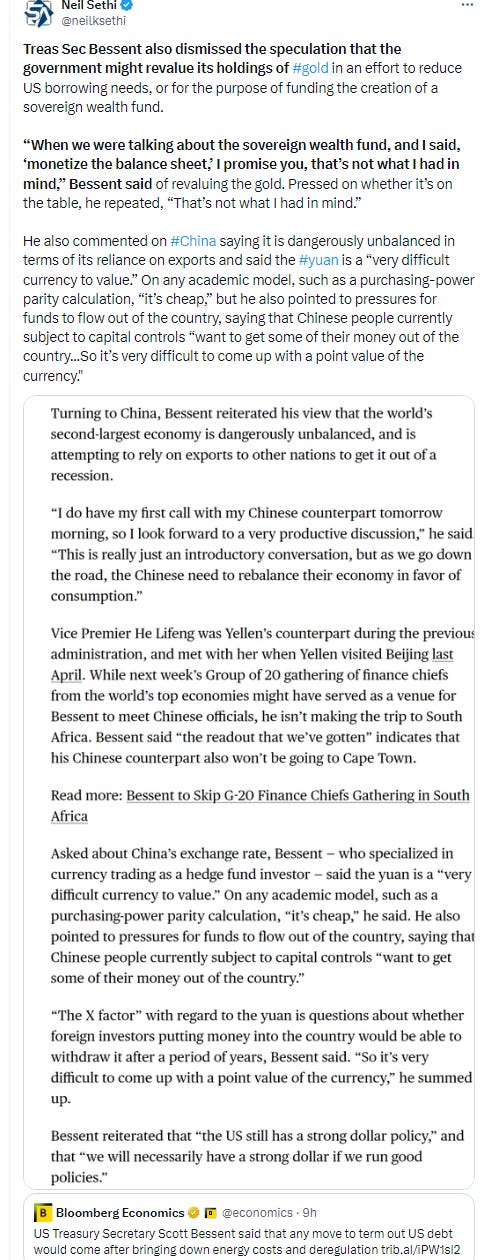

Dollar ($DXY) fell -0.7% breaking its 2-day stabilization down to the least since early December. As noted last Thursday it broke the 3rd “fanline” which is normally supposed to mean a reversal from the uptrend (so far so good), and daily MACD and RSI as also noted then are negative w/the latter falling to the joint weakest since August, so technicals would point to more downside.

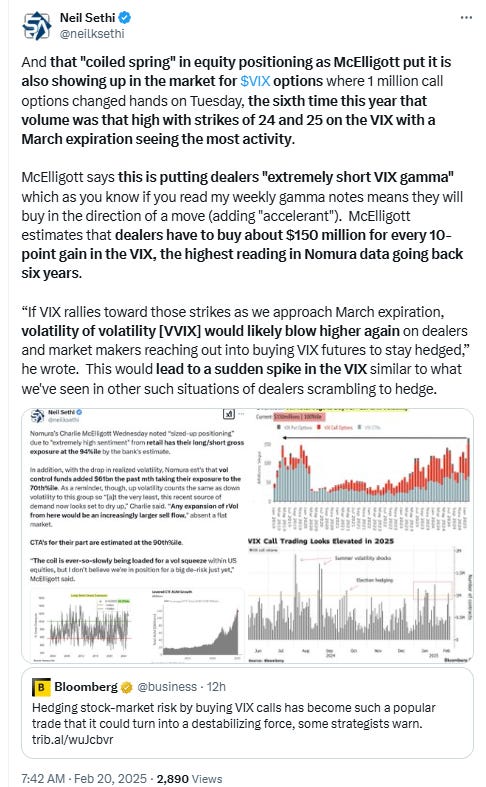

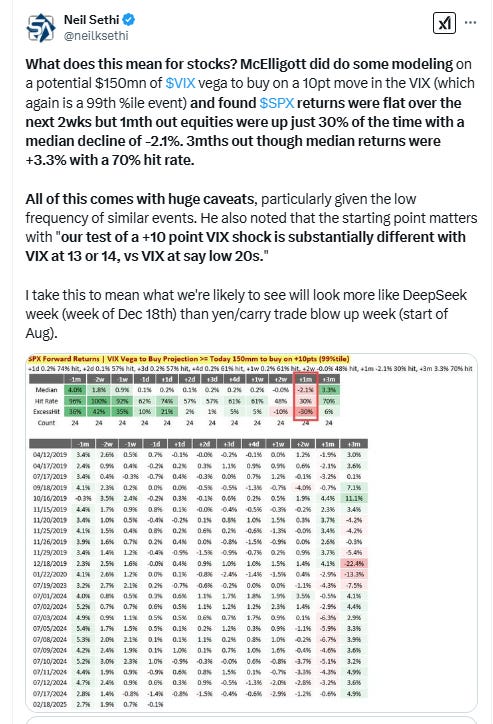

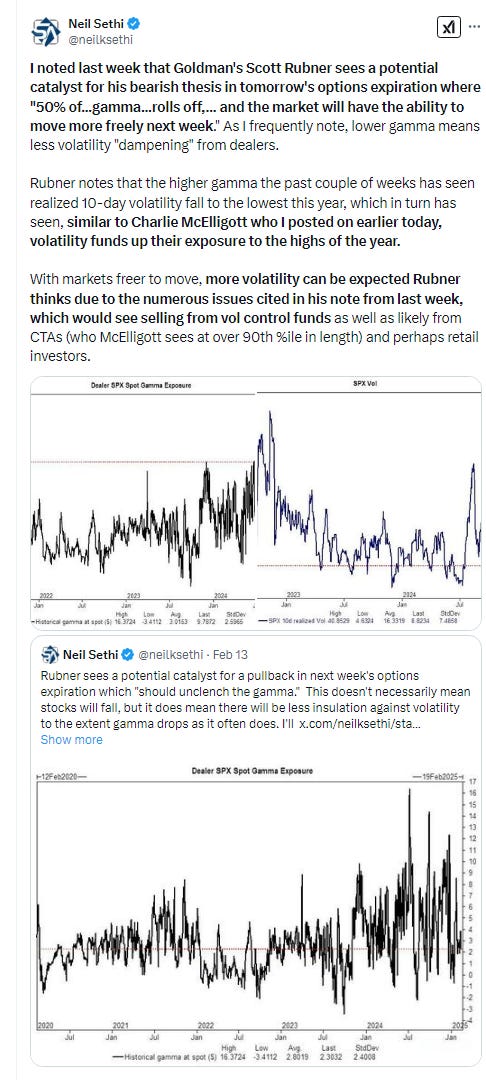

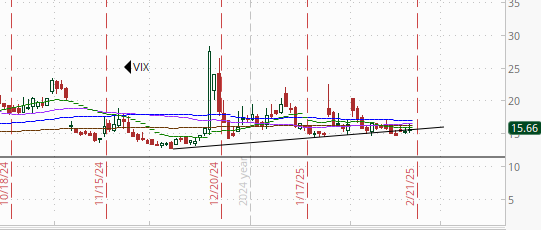

The VIX edged higher to 15.6 (consistent w/~0.96% daily moves over the next 30 days), keeping it on its uptrend line from the December lows.

The VVIX (VIX of the VIX) though fell again, now the lowest close since Jan 3rd, pushing further under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)) to around the lows of the year.

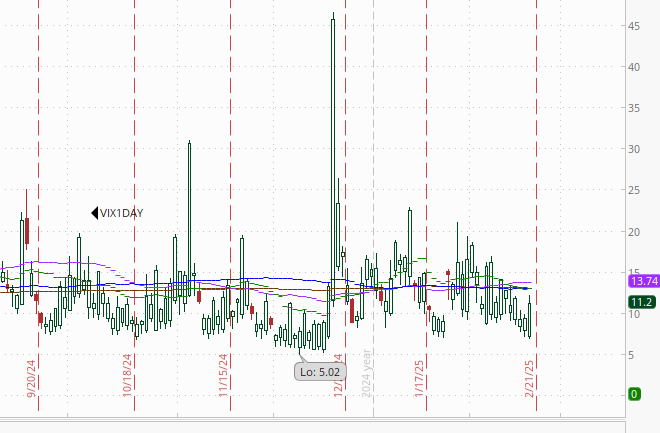

1-Day VIX “jumped” two points to 11.2 with options expiration tomorrow. Still just Looking for a move of around 0.7% Friday.

WTI futures up for a third day to the middle of the range over the past 6 months. Daily MACD remains negative but is about to cross to “cover shorts”, and the RSI is moving over 50, so both will be turning more supportive tomorrow if it can manage another gain.

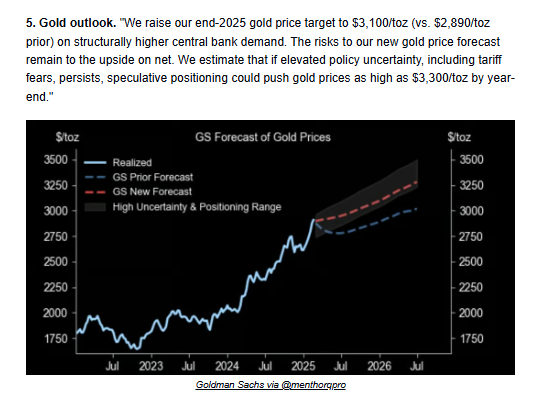

Gold futures traded in a very narrow range Thursday just under record highs, working on an 8th up week in a row, the longest streak since 2020. The daily MACD remains positive for now, but the RSI has a clear negative divergence.

Copper (/HG) was able to some support above the $4.50 target on the back of the dollar weakness. Its daily RSI remains weak, and the daily MACD is very close to crossing to a “sell longs” positioning, so I’m not changing my thinking. The $4.50 area would be a natural pullback area as noted Friday.

Nat gas futures (/NG) dropped back -5% but finished off the lows after successfully testing the $4 support level after having shot up +14% in two days to the highest close since Dec 2022. Only the 2nd down session in the last 11. Daily MACD now in “go long” positioning, and the RSI just off the highs of the year.

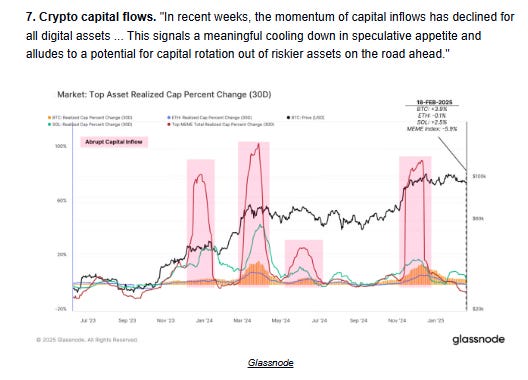

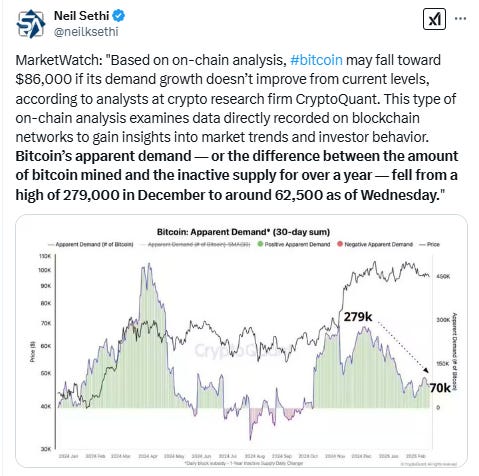

Bitcoin futures moved back to the top of the range they’ve been in the past 2 weeks after closing at a 1-mth low Wed. Daily MACD remains negative (but has started to turn up) while the RSI bounced back to just over 50, so some technical support may be close.

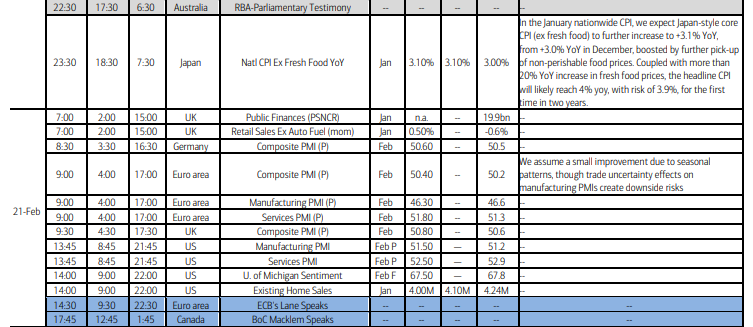

The Day Ahead

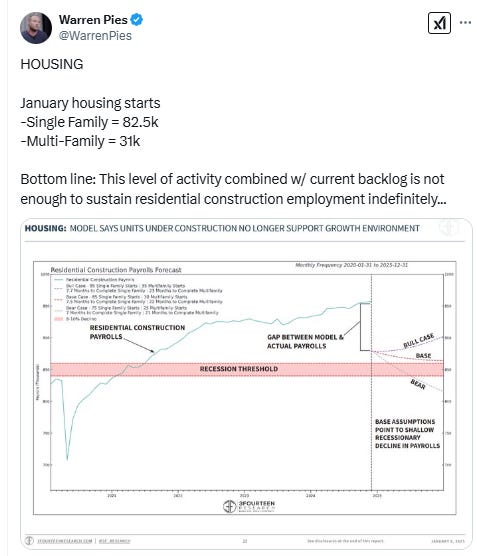

US economic data ends a light week with its heaviest day as we get flash Feb PMIs (does manufacturing stay in expansion?) and the final UMich consumer sentiment read (does the jump in inflation expectations stick?), along with Jan existing home sales.

In Fed speakers we’ll hear from Mary Daly and Fed Vice-Chair Jefferson (both of whom we’ve already heard from this week).

Earnings are light with no SPX components reporting (see the full earnings calendar from Seeking Alpha).

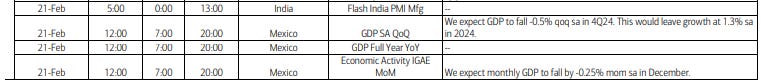

Ex-US headlined by flash PMI’s but we’ll also get Jan Japan CPI and UK retail sales and GfK consumer confidence. In EM we’ll get Mexico GDP and India RBI minutes.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,