Markets Update - 2/21/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

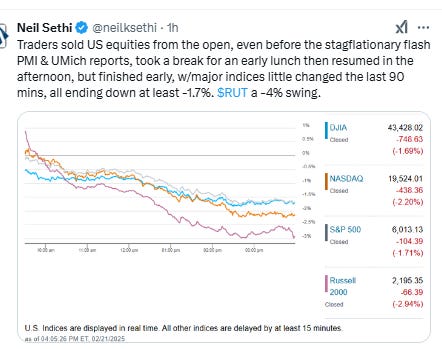

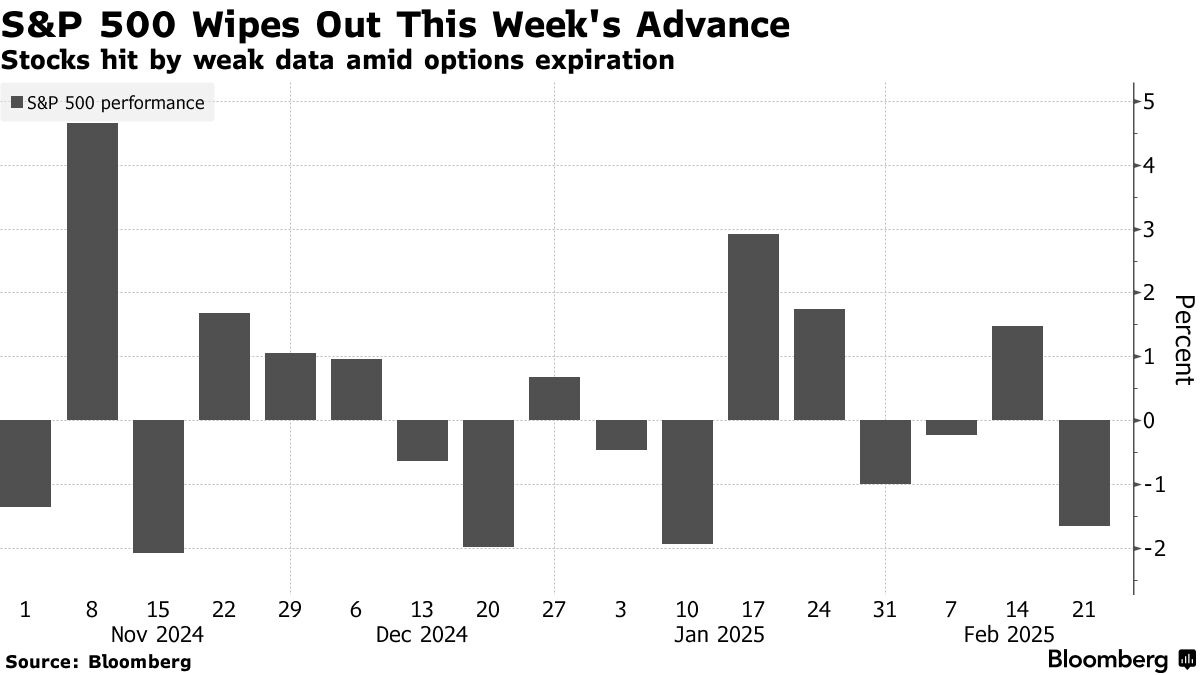

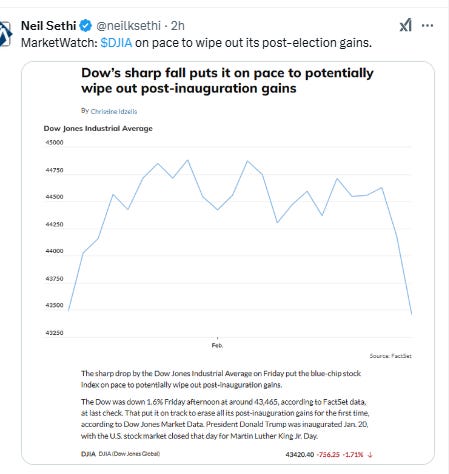

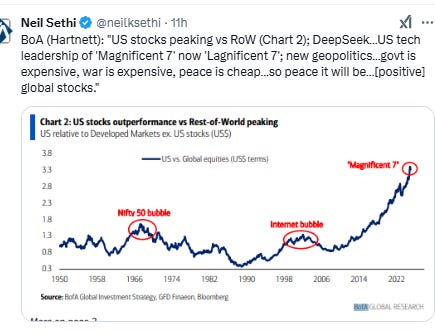

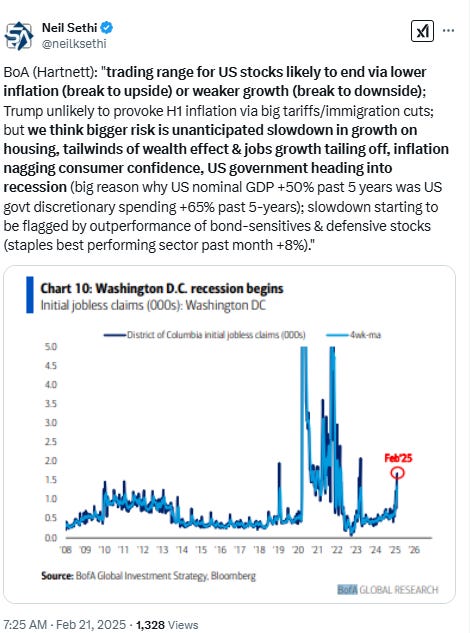

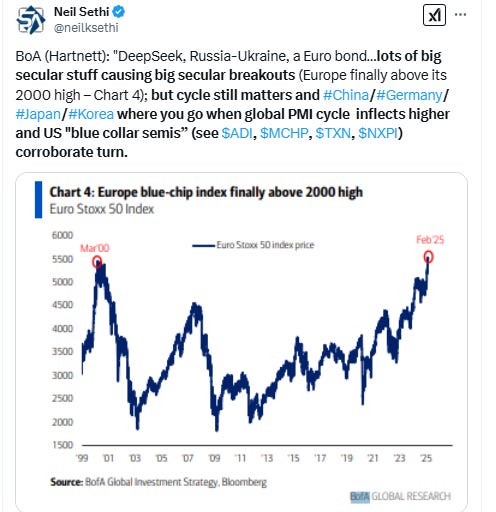

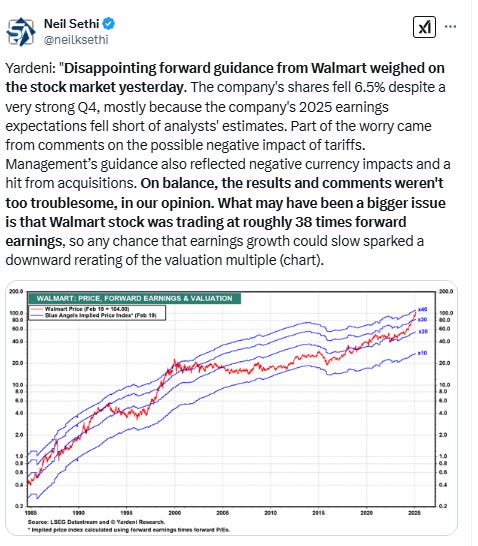

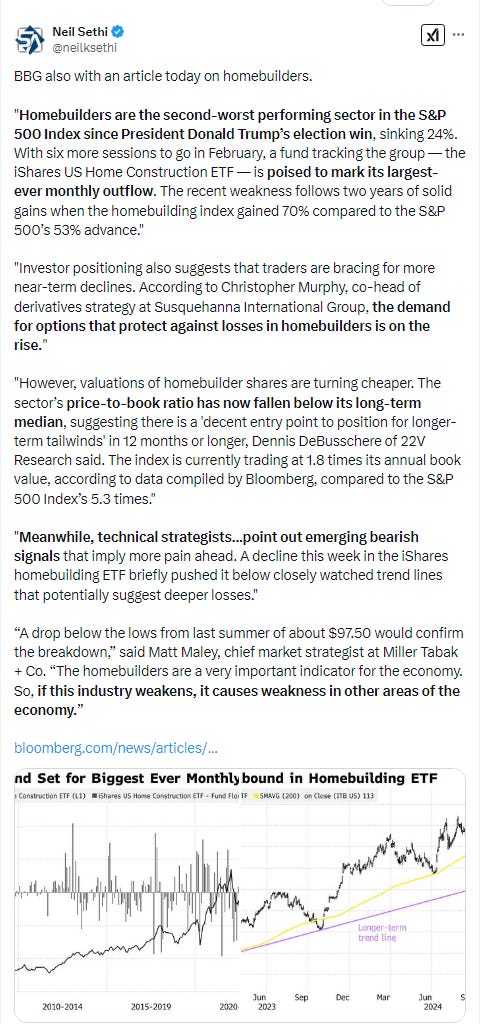

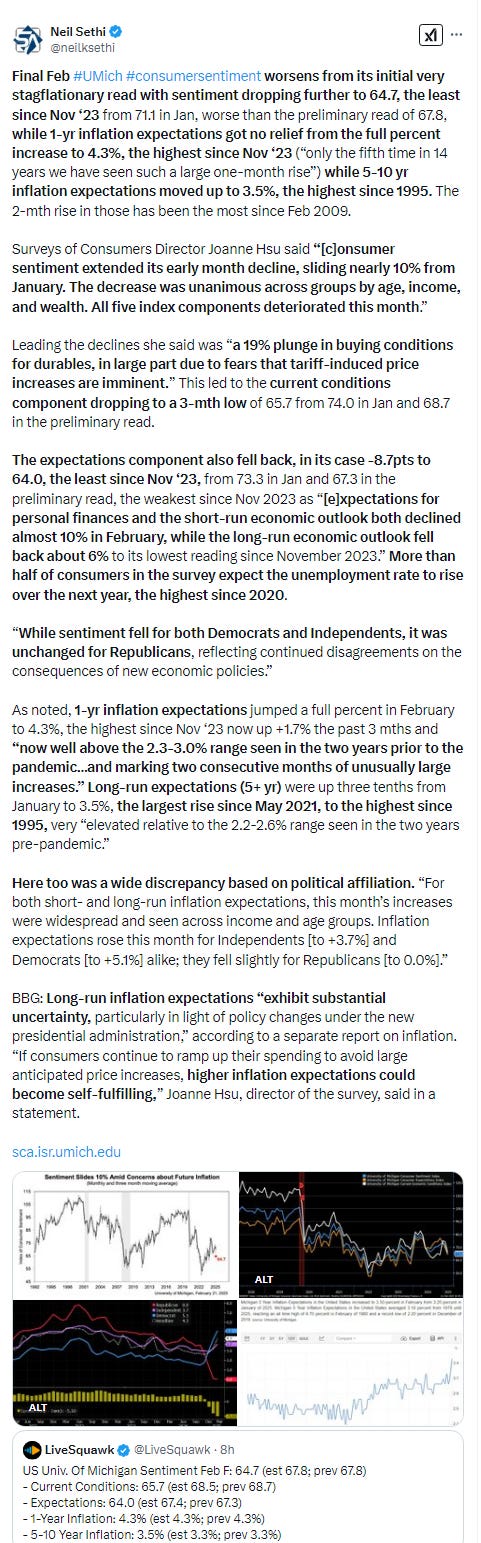

Major US equity indices started Friday’s session mostly higher led by growth stocks and small caps with the SPX little changed just below all-time high territory, but selling started from the opening bell, and picked up steam at 9.45am ET following a weaker than expected flash PMI reading from S&P Global that showed the services sector component dropping to a 17-mth low (even as manufacturing moved to a 9-mth high) along with a jump in input prices, both linked to uncertainty around President Trump’s policies and potential tariffs. Fifteen minutes later we got the U of Mich consumer sentiment survey which not only didn’t show some softening of the stagflation vibe from the preliminary read, but built on it with confidence softening further while 5-10yr inflation expectations jumped to the highest since 1995. The market seemed to seize on the growth implications (the US is roughly 80% a services economy) as Fed rate cut bets jumped, as did bonds (yields falling) while equities sold off throughout the day. In the end it was the worst day for stocks this year. The S&P 500 fell -1.7%. The Nasdaq 100 slid -2.1%, the Dow Jones Industrial Average -1.7%, and the Russell 2000 small cap index -2.9%. A gauge of the Magnificent Seven megacaps lost -2.5%.

Despite the drop in Treasury yields, the dollar edged off 1-month lows. Nat gas also was able to gain, and gold saw minimal selling, but riskier assets (crude, copper, and bitcoin) fell.

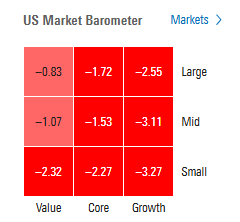

The market-cap weighted S&P 500 (SPX) was -1.7%, the equal weighted S&P 500 index (SPXEW) -1.4%, Nasdaq Composite -2.2% (and the top 100 Nasdaq stocks (NDX) -2.1%), the SOX semiconductor index -3.3%, and the Russell 2000 (RUT) -2.9%.

Morningstar style box showed the broad weakness but once again the worst of the selling in small caps and growth.

Market commentary:

“It’s definitely a period where I think the best gains have been had and [it] wouldn’t surprise me to see a significant correction,” said Cohen, citing proposed tariffs dragging on the economy, as well as some of the government’s cost-cutting efforts.

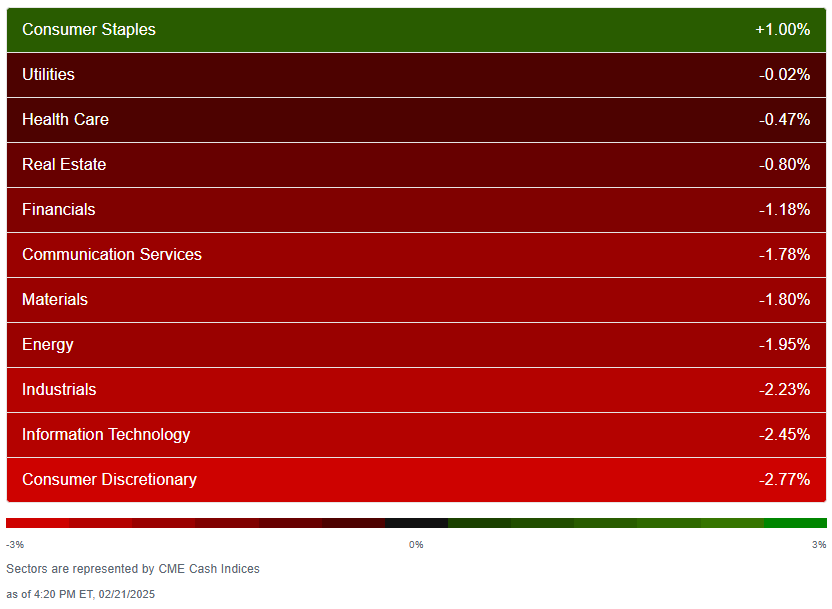

“The top 20 performers in the S&P 500 today are all from defensive sectors: consumer staples, utilities and healthcare,” said Larry Tentarelli, chief technical strategist and founder of the Blue Chip Daily Trend Report. “Investors often rotate into these so-called defensive sectors when economic growth concerns appear.”

“The news comes at a time when the market is already feeling jittery based on some economic news,” said Keith Lerner at Truist Advisory Services. “You throw that on top when you have a market that’s so richly valued, and it’s enough for a little bit of a shakeout.”

“Today seems to be a classic risk-off type of day,” Katy Kaminski at AlphaSimplex Group LLC told Bloomberg Radio. “Consumer confidence is down, long-term inflation expectations are up. People are just a little nervous about what all this means.”

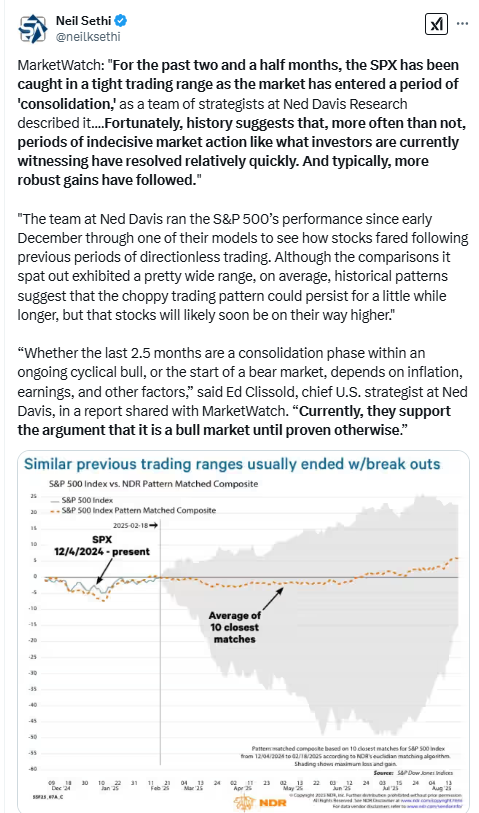

To Mark Hackett at Nationwide, equity markets remain in a period of consolidation following an impressive two-year run, with little change in the S&P 500 since early December. The index is attempting to break out of the trading range it has been in since the election, remaining in a 4% range over the past three months, the narrowest range since 2017, he noted.

“Beneath the surface, however, there is an interesting shift in market leadership, which could propel markets forward, as the risk/reward dynamics in the international and value space catch the eye of investors,” Hackett said.

“With policy uncertainty and weaker retail sales guidance yesterday from consumer spending bellwether Walmart, we may have the catalyst we need for a healthy correction,” said Gina Bolvin at Bolvin Wealth Management Group. “However, there’s still a strong foundation in place for the bull market to continue.” Bolvin said earnings growth is up, and while the Fed may be on a pause, their next move is a cut. “A cranky consumer may finally reign in spending, which will help ease inflation,” she said.

The recent slump in stocks could be tied to Wall Street seriously considering the effect of tariffs and seeing consumers changing buying patterns as a result, according to Harris Financial Group managing partner Jamie Cox.

“It’s pretty clear that markets are waking up to the consumer impact of tariffs. While the tariffs themselves may never get implemented, consumers are voicing their opinions with major changes in buying behaviors and sentiment about the prospects of their implementation,” Cox told CNBC. “The good news is that markets are taking some wind out of the recent inflation in the sails. The 10-year is catching a bid as investors are moving to be more cautious,” he continued.

In individual stock action, investor favorites such as Nvidia and Palantir saw steep losses on Friday as traders shifted toward traditionally safer assets. Procter & Gamble climbed 1.8%, while General Mills and Kraft Heinz advanced more than 3% each. Walmart shares fell 2.5%, marking a second day of declines after the company issued a weaker-than-expected forecast that also soured the outlook for the consumer and the economy.

CrowdStrike (CRWD), which was up 27.5% in 2025 heading into Friday, dropped 6.8% on Friday and 10.0% for the week. That was still better than Akamai Technology (AKAM), which got clobbered Friday following its earnings report, plunging 21.7%. It was by far the worst-performing sector component on Friday. Fortunately, the biggest stock in the land -- Apple (AAPL) -- dipped just 0.1% on a day when the S&P 500 declined 1.7%. For the week, which saw the company introduce its lower-priced iPhone 16e, Apple was up 0.4%.

BBG Corporate Highlights:

The US Justice Department has been investigating UnitedHealth Group Inc.’s Medicare billing practices, a person familiar with the matter said.

Coinbase Global Inc. said the Securities and Exchange Commission has agreed to drop its lawsuit that accused the largest US cryptocurrency trading platform of running an illegal exchange. The agreement is pending commissioner approval.

President Donald Trump told a gathering of governors that Apple Inc. Chief Executive Officer Tim Cook plans to shift manufacturing from Mexico to the US, a move that the iPhone maker hasn’t publicly discussed.

B. Riley Financial Inc. jumped after the investment and brokerage firm said it has enough cash for the next 12 months, as it continues to navigate a slew of soured investments and cope with upcoming debt payments.

US prosecutors and regulators are investigating a $32 million deal between CrowdStrike Holdings Inc. and a technology distributor to provide cybersecurity tools to the Internal Revenue Service, according to two people familiar with the matter and a document seen by Bloomberg News.

Akamai Technologies Inc. tumbled after the infrastructure software company gave an outlook that was weaker than expected.

Block Inc. sank the most in almost five years after the digital-payments company posted fourth-quarter profit and revenue that fell short of analysts’ forecasts.

Booking Holdings Inc., the parent to travel brands such as Kayak and Priceline, delivered better-than-expected fourth-quarter results following a bustling holiday season.

Rivian Automotive Inc. tumbled after warning it’s poised for a first-ever decline in electric-vehicle deliveries in 2025, heralding a new challenge after the company achieved a long-held profitability goal.

Some tickers making moves at mid-day from CNBC.

In US economic data:

Final Feb UMich consumer sentiment worsened from its initial very stagflationary read with sentiment dropping further to 64.7, the least since Nov ‘23 from 71.1 in Jan, worse than the preliminary read of 67.8, while 1-yr inflation expectations got no relief from the full percent increase to 4.3%, the highest since Nov ‘23 (“only the fifth time in 14 years we have seen such a large one-month rise”) while 5-10 yr inflation expectations moved up to 3.5%, the highest since 1995. The 2-mth rise in those has been the most since Feb 2009.

Feb US flash Composite PMI fell back -2.3pts to a 17-mth low of 50.4, signaling “a near-stalling of business activity.” In contrast to much of the past two years, though, it was services which was weaker falling -3.3pts into contraction territory for the first time in 25 mths “a sharp contrast to the robust expansion seen late last year”. In contrast it was manufacturing which kept the composite above 50 for a 24th consec mth, moving to 51.6, an 8-mth high. "The upbeat mood seen among US businesses at the start of the year has evaporated, replaced with a darkening picture of heightened uncertainty, stalling business activity and rising prices.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

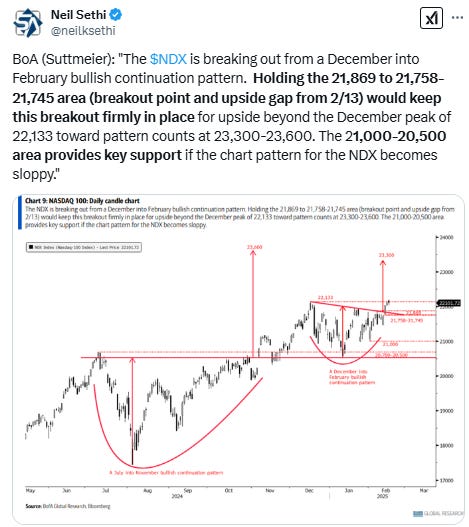

The SPX fell to its 50-DMA Friday which held. The daily MACD though crossed to “sell longs” (although it’s more neutral than anything), and RSI has fallen below 50.

The Nasdaq Composite fell back to its trendline Friday. Its daily MACD and RSI are like the SPX weakening, although the MACD hasn’t quite crossed over yet.

RUT (Russell 2000) fell to its 200-DMA, the 2nd lowest close of the year. Its daily MACD has crossed all the way to “go short” and its RSI has fallen well below 50.

Equity sector breadth from CME Cash Indices deteriorated again as might be expected with just one green sector (Staples, although it was up 1% (and Utilities were basically flat as defensives took the top 4 spots, outperforming for a 3rd session)). Growth underperformed taking the two bottom spots, two of the three sectors down at least -2% (Industrials the other) although six sectors down over -1.7%.

SPX sector flag from Finviz relatively consistent with a pretty clear distinction today between the few subsectors that were up (staples ex-retail), pharma, and utilities, where there was broad strength, and everything else (lots and lots of red).

Positive volume (percent of total volume that was in advancing stocks) which generally has been pretty good over the past week not terrible given the losses Friday falling to 22% on the NYSE not out of line with the -1.3% loss in the NYSE Composite index, while the Nasdaq was 36% I guess better than the -2.2% loss in the index would indicate. Positive issues (percent of stocks trading higher for the day) though remained weaker on the Nasdaq for a 4th session at 25 & 24% respectively.

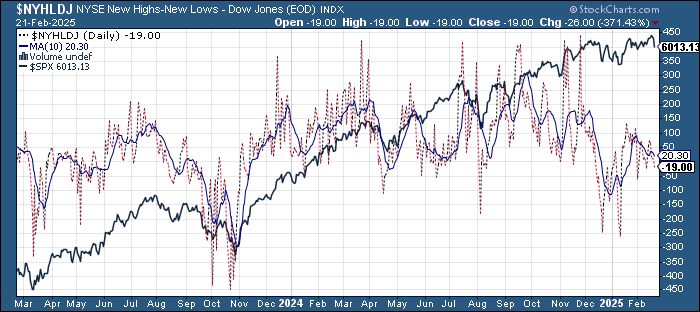

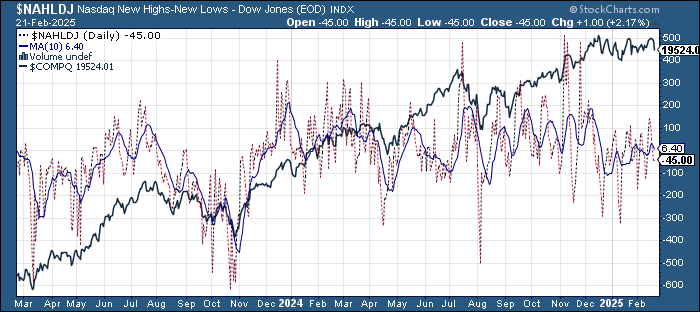

New highs-new lows (charts) also fell back again after hitting the best of the month Friday with the NYSE down to -19 from +75 the prior Friday while the Nasdaq fell to -48 from +140. Both are below their 10-DMAs which are rolling over (less bullish), but they also aren’t even the weakest reads of the month.

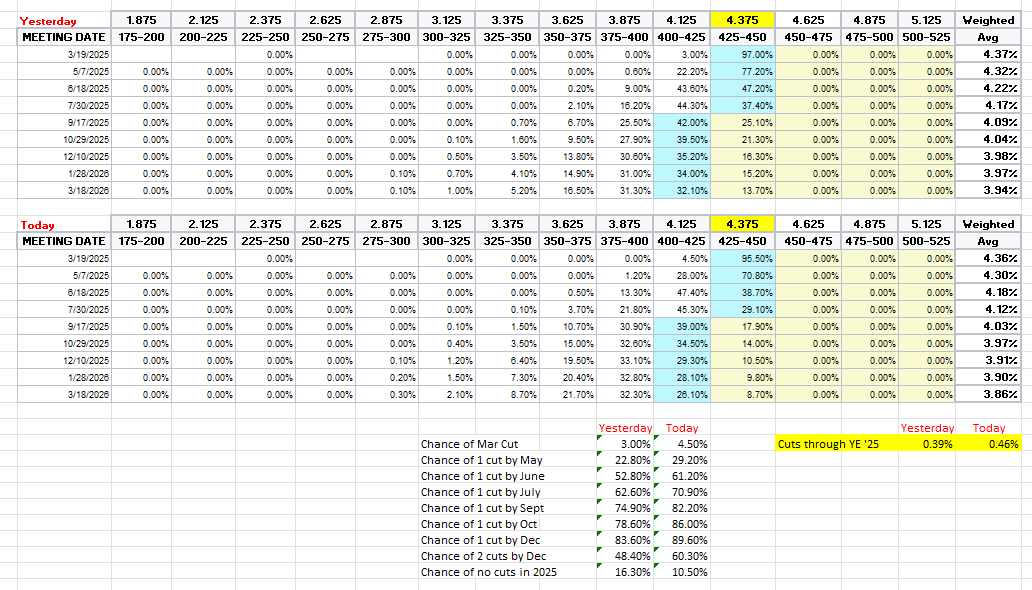

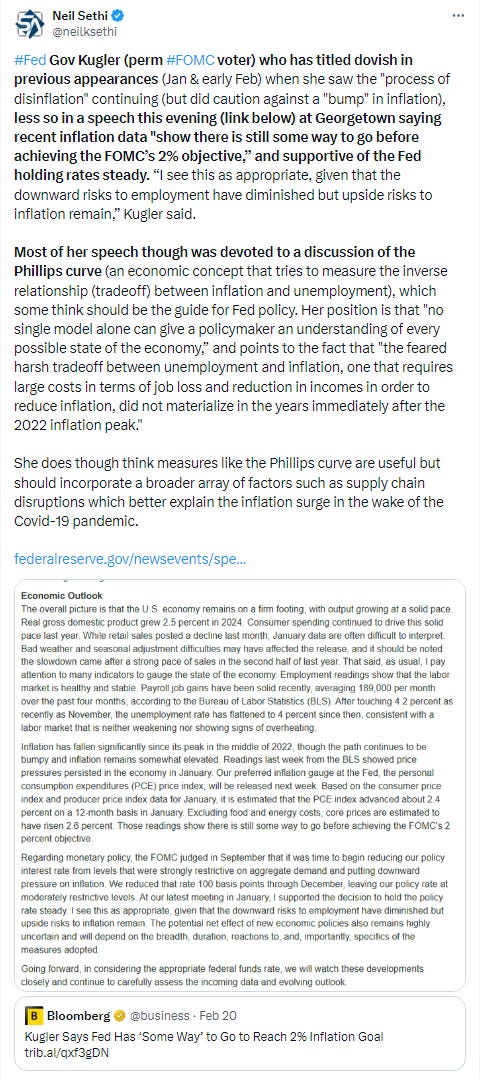

FOMC rate cut probabilities from CME’s #Fedwatch tool saw a notable move towards more cuts following the weak services PMI, despite the jump in input prices and the concerning rise in inflation expectations in the UMich survey. A cut by March edged to 5%, and one by June now to 61% (up from 53% Wed and further from the 33% the Wednesday after CPI and almost back to the 64% the Thursday before NFP/UMich). Chance of two 2025 cuts jumps to 60% (vs 48%, 31% & 57%) and no cuts down to 11% (vs 16%, 29% & 12%) with 46bps of cuts priced (vs 39, 28 & 44).

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, but CPI could change that, and as I noted after that report it has made me think that cuts are becoming less likely (so perhaps just one cut), but as I also said I continue to expect cuts versus no cuts at this point. “It’s a long time until December.”

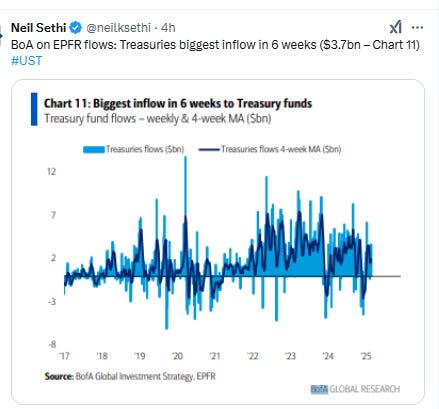

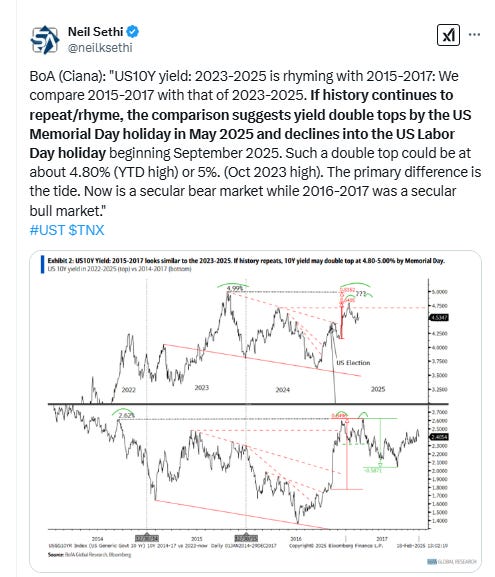

Longer duration #UST yields as noted fell back with the 10yr yield -8bps to 4.42%, a 2-mth closing low.

The 2yr yield, more sensitive to Fed policy, fell -7bps to 4.20%, 1bps above the lowest in 2 months. I had said when it was 10-20bps higher that I find the 2-yr trading rich as it was reflecting as much chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has moved that direction, but I think there could be more to go.

Dollar ($DXY) was able to stabilize above the 100-DMA despite the drop in bond yields and increase in Fed rate cut expectations although the lowest weekly close since mid-December. As noted last Thursday it broke the 3rd “fanline” which is normally supposed to mean a reversal from the uptrend (which we’ve seen so far), and daily MACD and RSI as also noted then are quite negative w/the latter around the weakest since August, so technicals would point to more downside.

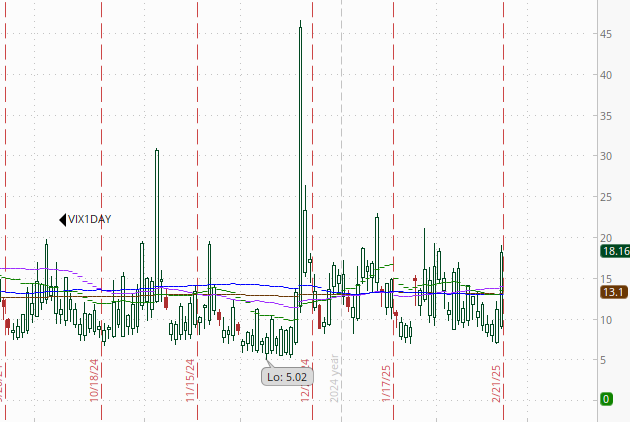

The VIX jumped Friday consistent with all the predictions this week that VIX was a “coiled spring”, up to 18.2 (consistent w/~1.15% daily moves over the next 30 days), keeping it above its uptrend line from the December lows. As a reminder, Charlie McElligott said the call strikes were clustered at around 24 so there may be further to go next week.

The VVIX (VIX of the VIX) also jumped Friday in its case from the lowest close since Jan 3rd, pushing back over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX also jumped to 18.2 Friday so looking for a move of around 1.15% Monday.

WTI futures entered Friday on pace for their first weekly gain in the last 5 weeks, but ended it at the lowest close of the year, down -3.2%. Daily MACD turned back negative after it was just about to cross to “cover shorts”, and the RSI fell back under 50 (although has a slight positive divergence (higher low).

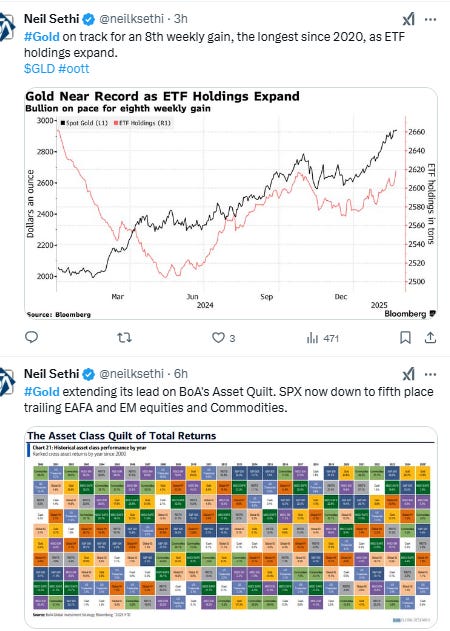

Gold futures traded in a narrow range again Friday just under record highs mostly immune to the selling in risk assets as they completed their 8th up week in a row, the longest streak since 2020. The daily MACD remains positive for now, but the RSI has a clear negative divergence (lower high).

Copper (/HG) resumed its consolidation, down for the 4th day in 5 to the lowest close in two weeks. Its daily RSI remains weak, and the daily MACD has crossed to a “sell longs” positioning (circle), so as I noted Thursday I’m sticking with my target of the $4.50 area as the natural pullback area I put on last Friday.

Nat gas futures (/NG) took a shot at new closing highs Friday but fell back. Still they were able to gain 2% holding above the $4 support level, the highest weekly close since Dec 2022. It’s been up 10 of the last 12 sessions. Daily MACD remains in “go long” positioning, and the RSI solidly over 50.

Bitcoin futures went from trying to push through 100k to 3-wk highs Friday to falling -3.3% towards the 1-mth low hit Wed. Daily MACD remains negative while the RSI fell back under 50.

The Day Ahead

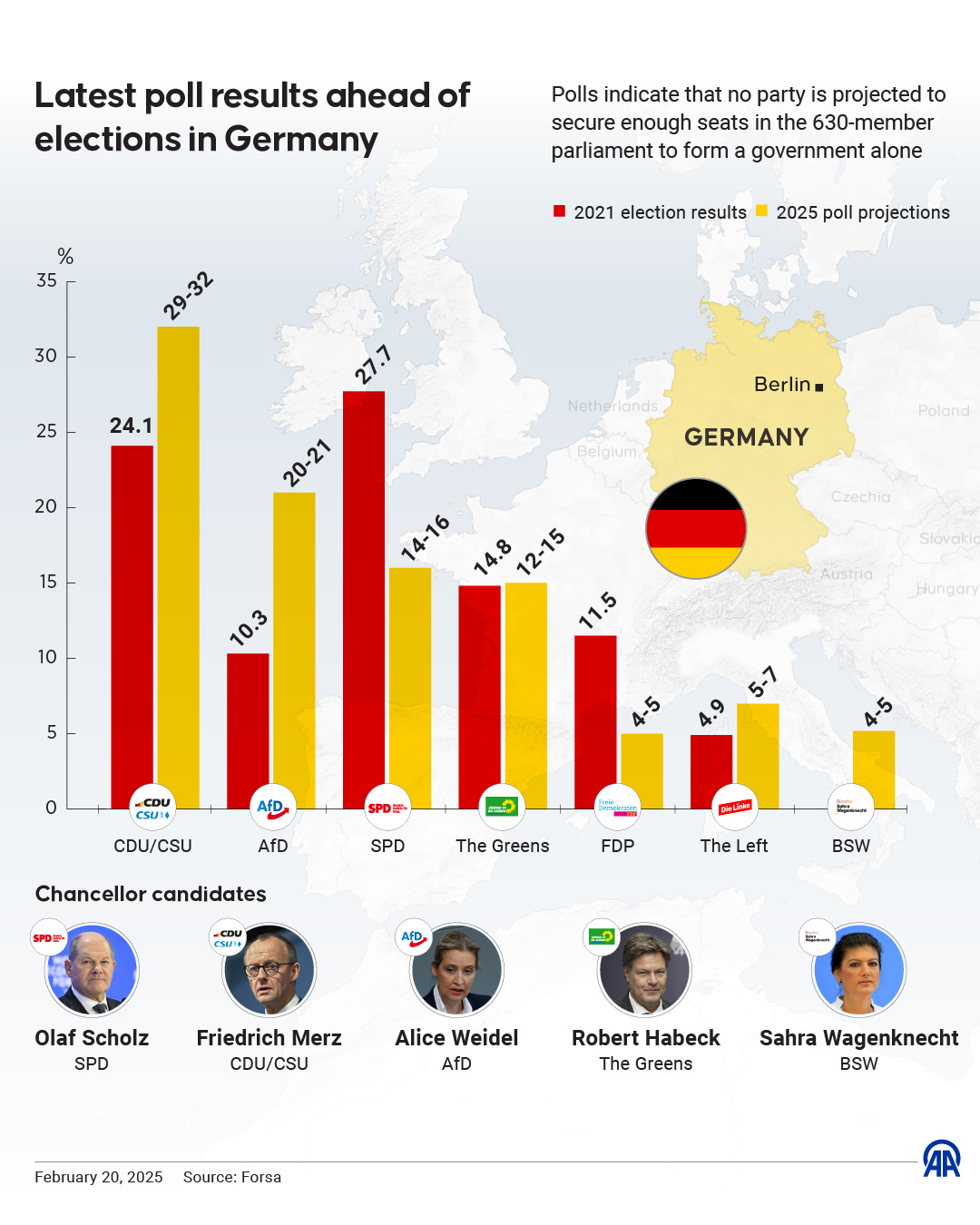

Enjoy the weekend, more on Sunday. As a reminder the German elections are Sunday.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,