Markets Update - 2/2/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

Note: Per my earlier mentions, today I am starting the subscription model (which has been set at $9/month or $85 per year). Again, the goal is to make this into something that benefits the greater good. At year end, all proceeds from subscriptions will be donated to charities as chosen by the subscribers (the only caveat is they have to be 4-star rated by Charity Navigator (which has no political leanings with both right and left-leaning organizations receiving 4-star ratings)).

US equity indices opened today’s session modestly lower, but well off the session lows overnight which came after a continued drop in metals including gold, silver, and copper (which similarly were paring their losses as we approached the open) and a continued jump in the dollar. There was also pressure from weekend question marks around Nvidia’s investment in Open AI and Oracle’s $25 billion bond sale to help fund its cloud-infrastructure build-out. Mining equities such as Newmont and Barrick Mining were also rebounding but crypto-linked stocks, including Riot Platforms and Strategy, were not, as bitcoin did not (at least initially) see the same bounce (it would end -7%) lower. Crude also was down around -5% as tensions were dialed back between the US and Iran. Disney reported mixed earnings but with strong park sales that pulled the overall number to a beat. Its shares though would suffer their worst loss since November -7.4%.

Equity indices would continue their rebound post-open taking them into positive territory, then jumping higher following the release of the manufacturing PMIs which both came in better than expected (analysis below) with the more closely watched ISM the best since Aug 2022. After that, they drifted higher until 2pm ET, then mostly drifted lower into the close other than the DJIA which led the pack +1.1%. The Russell 2000 was +1%, SPX/Nasdaq ~+0.55%.

Elsewhere, bond yields moved higher as the dollar as noted continued its rebound. Natgas fell the most since 1995, and crude the most since Oct. Gold and copper were also lower, but finished well off the lows of the session, while bitcoin fell to the lowest since April.

The market-cap weighted S&P 500 (SPX) was +0.5%, the equal weighted S&P 500 index (SPXEW) +0.5%, Nasdaq Composite +0.6% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOXX semiconductor index +1.7%, and the Russell 2000 (RUT) +1.0%.

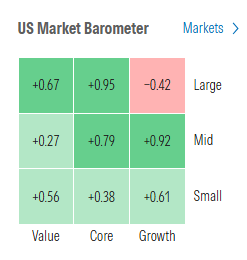

Morningstar style box saw just large growth in the red.

Market commentary:

“If we could go a weekend without some sort of tariff threats, or arresting of a foreign leader, or threatening to bomb Iran—if we could go a couple of days, I think the market would appreciate it,” Sevens Report Research’s Tom Essaye told me. “I think it would help sentiment a bit and let us refocus on the data—which is pretty Goldilocks—and earnings, which, on balance, are fine.”

“Markets are nervous,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “We see a broad selloff across markets in Asia, Europe and the US. With the volatility increase in gold, but also in silver, investors have to de-risk.”

“This pullback looks healthy to me, there was really some excess across gold, silver and some tech stocks too,” said David Kruk, head of trading at La Financiere de l’Echiquier. “My take is that there will be a bounce back in the coming days.”

“It’s typical of the 2026 constant stream of complicated news flow,” wrote Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG. “This follows a January that managed to both shock and awe in various ways, yet still delivered broad-based gains across all global assets.”

"There's insatiable appetite from investors for equities," said Mark Hackett, chief market strategist at Nationwide Investment Management Group, who added that recent data on investor fund flows supports this thesis, as does "any period of weakness" that ends up triggering "aggressive buying."

“It seems to us that the bigger trends, which are mostly positive, are still in place,” said Tim Holland, chief investment officer at Orion. “What matters right now is still earnings, the fiscal policy backdrop – which is still constructive even with the temporary shutdown – and seasonality.”

“If you think about sort of what’s had folks worried about equity prices here at home, it would be valuations, especially up the cap spectrum,” Holland said. “Double-digit earnings growth ... for the fifth consecutive quarter would go a long way to assuage those valuation concerns that we’ve all lived with for the last couple years.”With earnings season is in full swing, Jason Pride and Michael Reynolds at Glenmede noted that after strong earnings results in 2025, that momentum is expected to continue into 2026 for most equity classes.

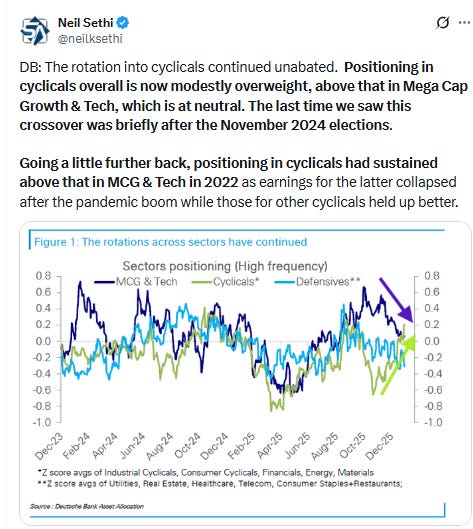

Robust earnings and well behaved inflation should counter geopolitical and other risks, according to JPMorgan Chase & Co. strategists led by Mislav Matejka, who see more broadening in equities this year, with a constructive view on cyclicals, value and small caps.

“The S&P 500 closed January with a modest 1.4% gain, which carries bullish implications for the rest of the year. However, mid-term election years are often less robust, supporting our own modest expectations for a ‘rotational bull market, with a lowercase ‘b’,” said Craig Johnson at Piper Sandler. Johnson noted that while February brings a seasonal slowdown in market returns, investors should not mistake a seasonal pause for a change in trend.

“The major indices are likely to ‘back and fill’ around their 50-day moving averages as this ‘rotational bull market’ remains intact,” he added.

“Manufacturing activity seems to be emerging from a cold winter,” said Brian Jacobsen at Annex Wealth Management. “We’ve seem signs of life before, only for manufacturing to dip again, but with new orders growing, maybe this revival is real.”

The report suggests the Federal Reserve could remain on hold for an extended period as the central bank has successfully reinvigorated the manufacturing sector, according to Florian Ielpo at Lombard Odier Asset Management. “This development is fundamentally positive for corporate earnings, benefiting both US stocks and global equities with exposure to US growth momentum,” he said. “In the near term, it reinforces the ‘Goldilocks’ narrative of solid growth with contained inflation.”

“The surge in the ISM Manufacturing Index in January suggests that after years of malaise, perhaps the manufacturing sector might be turning a corner,” said Alexandra Brown at Capital Economics. “While the headline index is still at a level that historically has been consistent with weak sub 2% growth, growth has been stronger than implied by the index for the past three years.”

“The surprisingly strong ISM Manufacturing survey this morning caused a selloff in Treasuries,” said Mark Streiber at FHN Financial. “But featured survey responses and the Institute for Supply Management’s caveat take the wind out of January manufacturing index’s sails.”

To Vail Hartman at BMO Capital Markets, the move in Treasury yields is on the verge of opening the door for buyers to come in. “We maintain that a move back to last week’s peak of 4.30% will be an attractive entry point to bring in sidelined investors awaiting a dip-buying opportunity,” he said.

“Hawkish perceptions on Warsh appointment still linger,” said Darrell Cronk at Wells Fargo. “We expect Warsh to support a more dovish stance with difficulty shrinking the Fed balance sheet of any materiality. We still believe two interest-rate cuts for 2026 are in the offing.”

“The return of ‘Buy America’ sentiment is poised to continue weighing on precious metals’ performance on balance,” said Jose Torres at Interactive Brokers. He bets that gold and silver are likely to decline further following a ferocious rally that was initially sparked by fundamentals but has since detached from the driving themes of “Sell America” and a focus on relatively accommodative global central banks that enable excessive fiscal deficits and generate currency debasement.

The dramatic movement in precious metals served as a reminder that emotion remains a driver of investor decision making, according to Mark Hackett at Nationwide. He notes that volatility is showing up in some surprising places at the same time that gold and silver are behaving more like “speculative trades” than safe havens. “The same investors who chased Bitcoin last year rotated into precious metals looking for the next big return, and now those trades are unwinding,” he said. “It’s a barbell market — sharp moves at the extremes — while diversified equity portfolios are still holding up, which tells you this is more about positioning and sentiment than a broad move away from risk.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

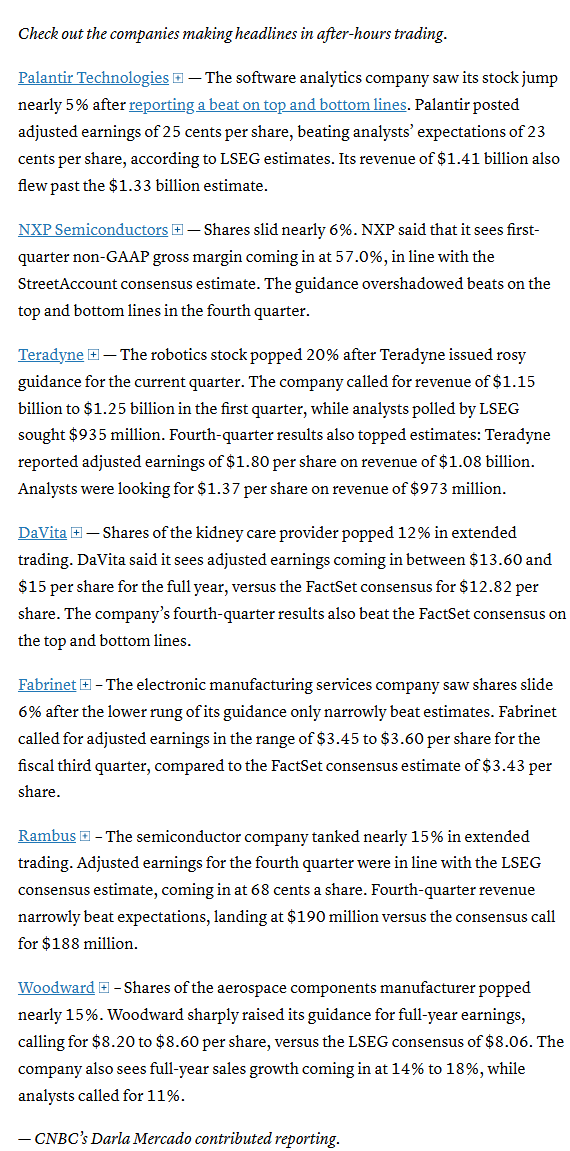

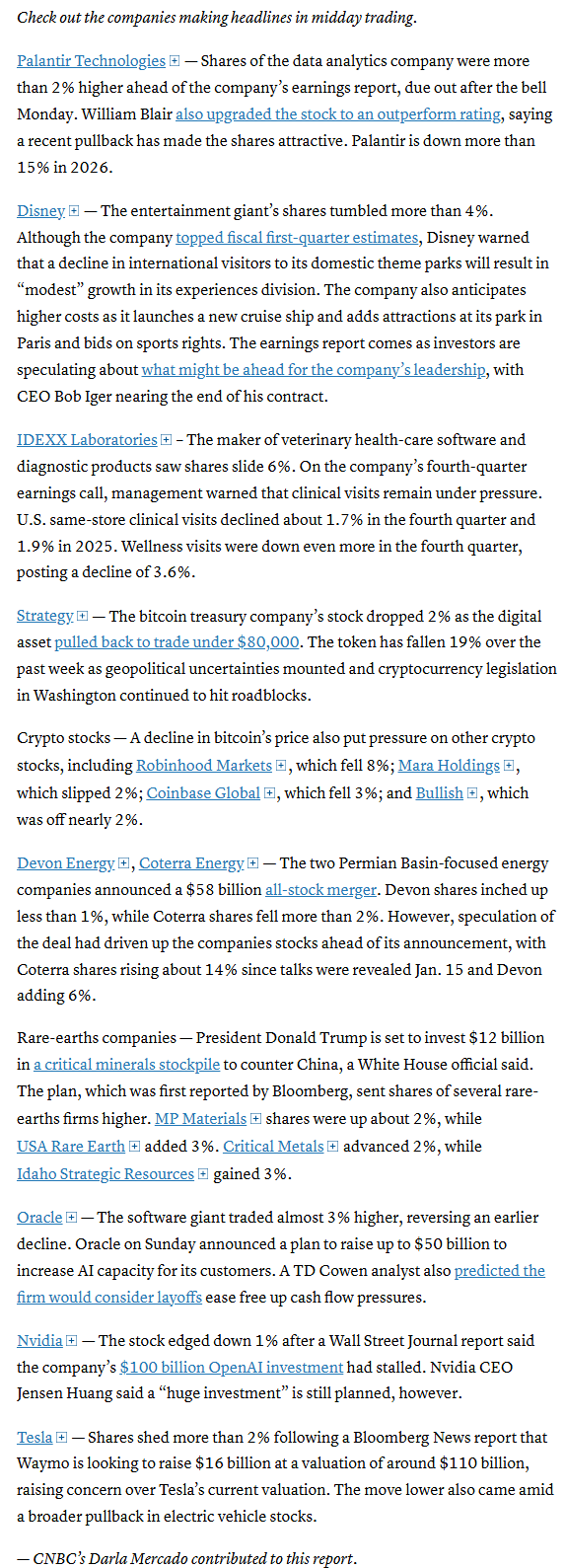

In individual stock action:

Nvidia shares were down almost 3% after The Wall Street Journal reported, citing people familiar with the matter, that Nvidia’s plans to pour $100 billion into OpenAI had stalled, with chipmaker execs expressing doubt about the deal.

Disney kicked off this week with reporting earnings that beat analyst expectations. However, the stock fell 7% after the company warned of headwinds from international travelers attending domestic parks.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Nvidia Corp. Chief Executive Officer Jensen Huang said the company’s proposed $100 billion investment in OpenAI was “never a commitment” and that the company would consider any funding rounds “one at a time.”

Elon Musk plans to merge SpaceX with xAI in a deal that encompasses the billionaire’s increasingly costly ambitions to dominate artificial intelligence and space exploration.

Walt Disney Co., the world’s biggest entertainment company, gave a tepid forecast for growth in the current period and the market awaits news on who will be its new leader.

Boeing Co. still needs to do more to win back the ability to certify the airworthiness of its aircraft and other powers the aviation giant lost after a series of manufacturing lapses, according to the head of the US Federal Aviation Administration.

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X