Markets Update - 2/24/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

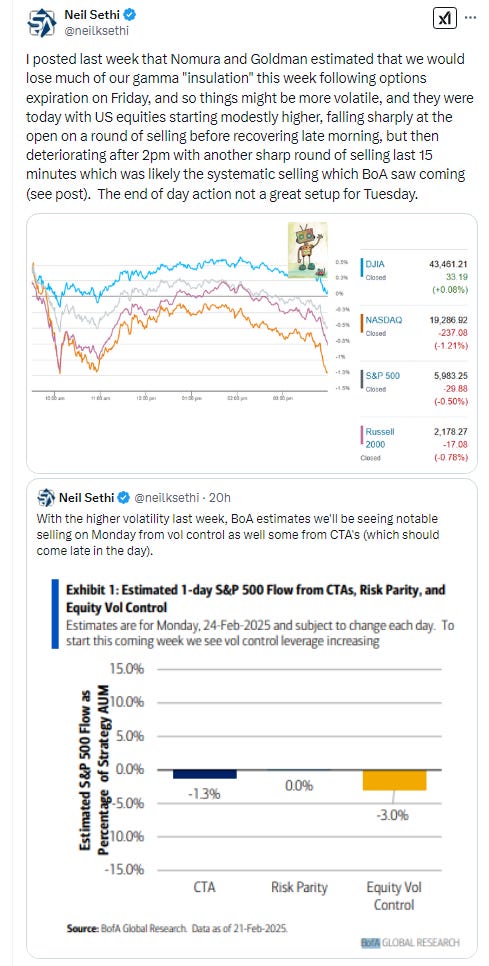

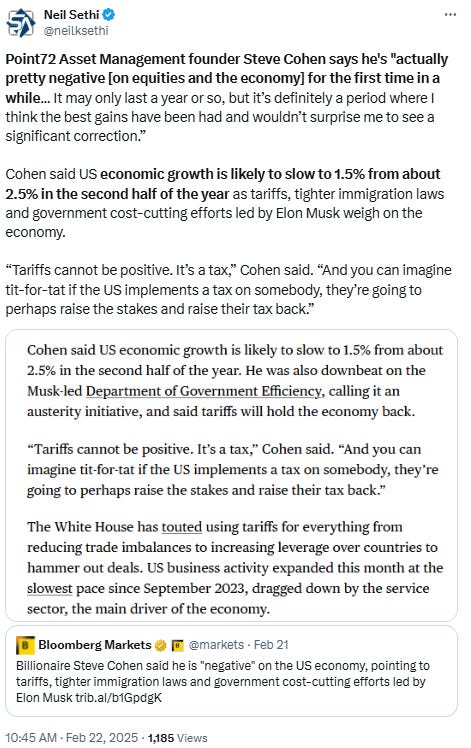

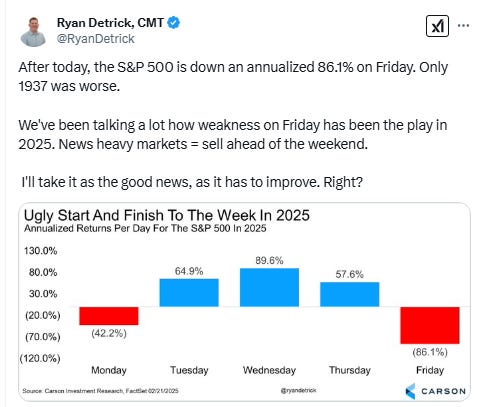

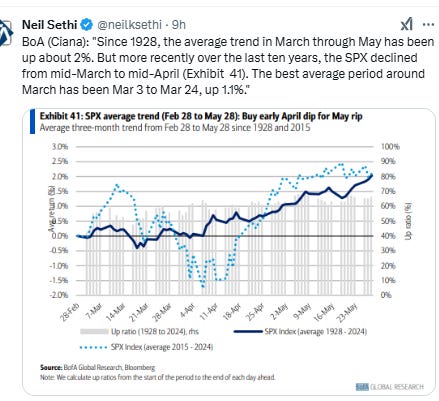

Major US equity indices started Friday’s session mostly higher, following their worst day of the year Friday, after another weekend of lower volume out of Washington, Berkshire Hathaway’s earnings beat (which also showed a record cash hoard), and Germany’s parliamentary election coming out mostly as expected (but with slim odds of lifting the country’s “debt brake” which limits borrowing). But as we saw Friday, selling started from the open taking the indices sharply lower. They were able to bounce, but the selling resumed in the late afternoon after President Trump indicated that tariffs on Canada and Mexico will go into effect as scheduled after the 30 day pause, with another sharp pullback into the close, evidence of the systematic selling noted as likely in the Week Ahead. The good news is the losses were more mild than Friday. The bad news is it was a more volatile day, in line with the reduced gamma also talked about this weekend, which means we may see more of that in coming days. Losses were led by growth stocks with the Mag 7 index hitting near 3-mth lows.

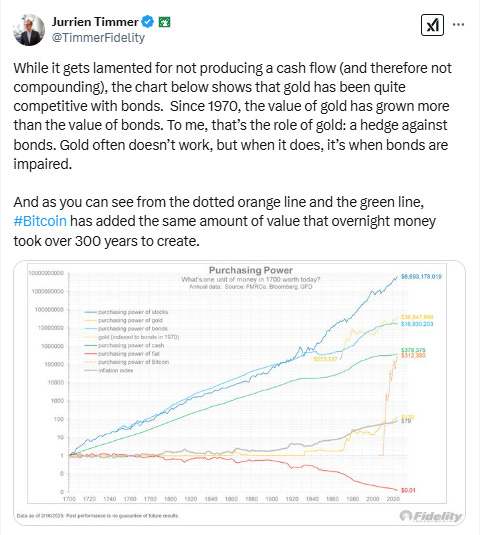

Treasury yields turned down as equities fell with Fed rate cut bets moving towards the highs of the month. The dollar though edged further off 1-month lows, while gold closed at another record high. Crude was also able to advance while copper and bitcoin fell.

The market-cap weighted S&P 500 (SPX) was -0.5%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite -1.2% (and the top 100 Nasdaq stocks (NDX) -1.2%), the SOX semiconductor index -2.6% (-5.9% last two days), and the Russell 2000 (RUT) -0.8%.

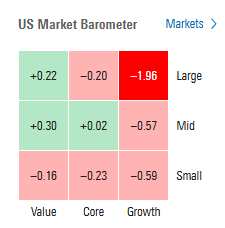

Morningstar style box showed the outsized weakness in large cap growth (for a 2nd session).

Market commentary:

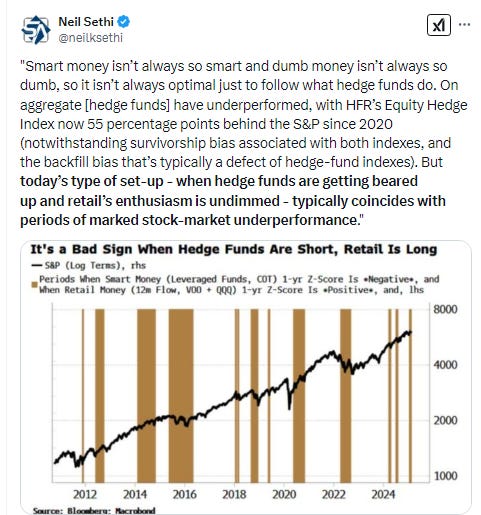

“Because sentiment and positioning in US equities was so extreme for so long, this reversal can now go a long way,” said Brad Conger, who oversees about $20 billion as chief investment officer at Hirtle Callaghan.

“The AI narrative was the justification for the extreme bullishness in US stocks,” Hirtle Callaghan’s Conger said. “It would not have been possible for non-US equities to outperform had there not been a readjustment of the AI expectations in the US.”

“This shift [to international stocks] has the potential to be secular, not cyclical,” said Mark Hackett, chief market strategist at Nationwide Investment Management Group, that has about $75 billion of assets under management. “The only other time on record that had a performance and valuation gap this wide between domestic and international markets was during the technology bubble. When the shift came then, it was dramatic and extended.”

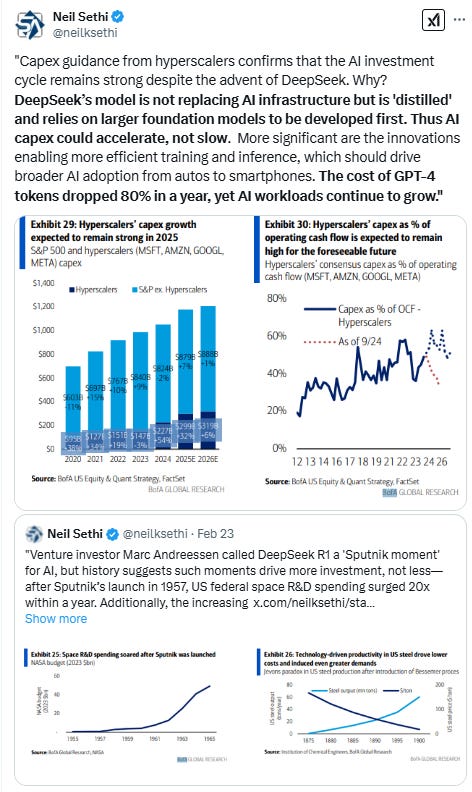

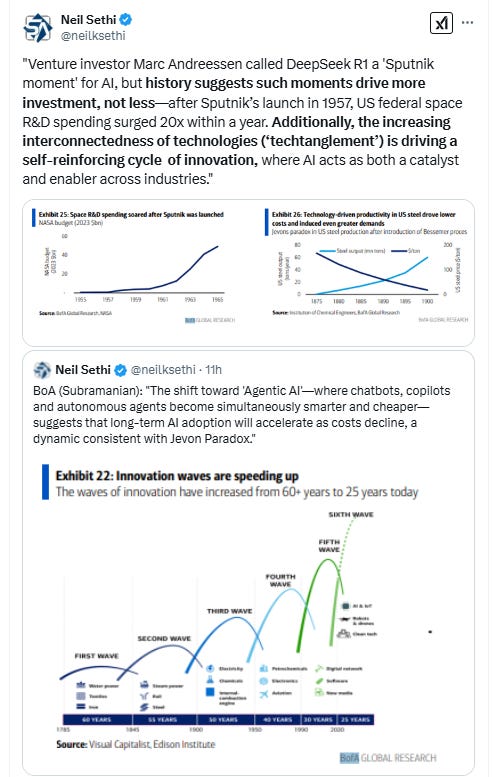

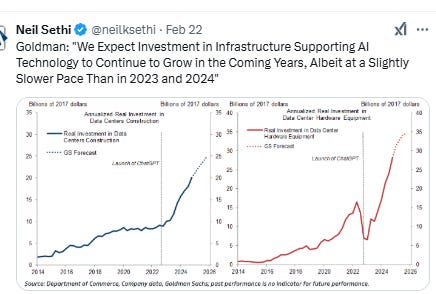

This will be Nvidia’s first earnings report since the emergence of the DeepSeek large language model from China that cast doubt on the sustainability of the AI trade. “It’s definitely one of the top things that the markets will be looking at [this] week. They really want to see whether the DeepSeek news ... is solid in terms of disrupting these types of companies’ margins in the future,” said Lale Akoner, global market analyst at eToro.

“Markets are in wait-and-see mode until we see those bellwether AI earnings as that could be a key turning point,” Laura Cooper, head of global investment strategy at Nuveen, said in an interview.

“There is very little room for Nvidia to disappoint analyst profit expectations this year, given its assumed leadership position in AI, already elevated valuations, and new developments and entrants in the space that could threaten its dominance over time,” said Anthony Saglimbene at Ameriprise.

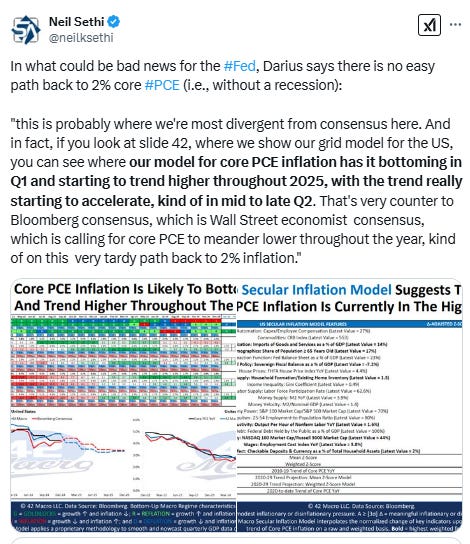

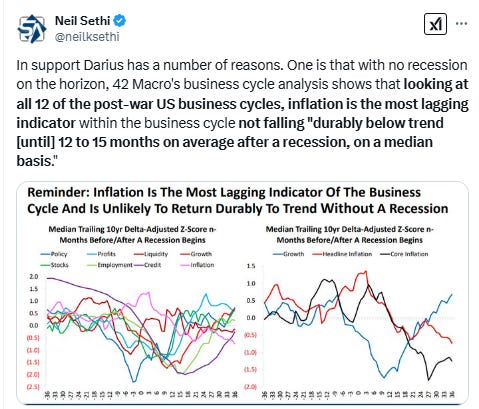

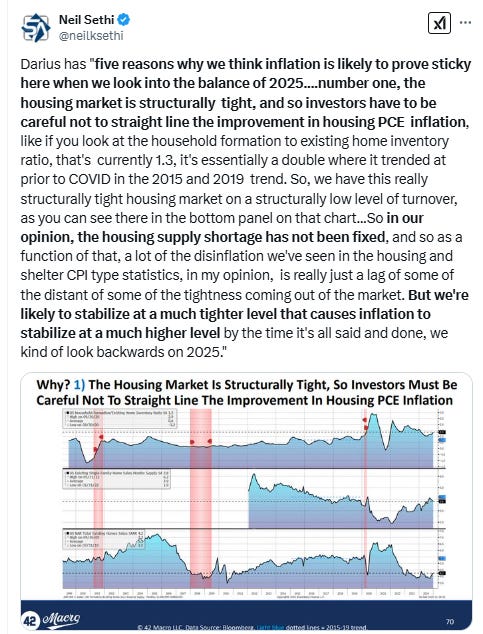

“Friday’s PCE for January will be extra important for markets, because it will help to confirm if inflation did indeed spike at the start of 2025, since the other January inflation readings, such as CPI and PPI, came in very strong for January,” said Clark Bellin, president and chief investment officer at Bellwether Wealth. However, “Regardless of what Friday’s PCE says, it’s likely that the Federal Reserve remains on hold when it comes to any interest rate decision for at least the next 6-months,” Bellin added.

“In the next couple of weeks, there’s little data-wise to shock the market out of its current sentiment. So it’s possible we stay in a generally pessimistic outlook where inflation stays high, the fed-funds rate stays high, and economic growth slows,” said Will Compernolle at FHN Financial. A lot of optimism is being placed on Friday’s PCE data, though. “We could see a selloff [in bonds] if it does not meet expectations,” Compernolle said via phone.

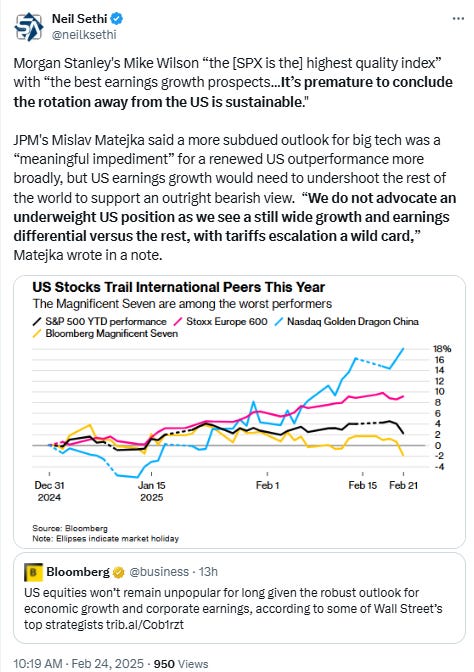

One of the biggest trading themes entering 2025 is starting to show cracks amid debate about the U.S. growth outlook, according to strategists at Morgan Stanley. "Investors have begun to question the sustainability of the `U.S. exceptionalism' investment narrative," they said in a note on Monday. "In fact, it's come up in the vast majority of conversations we've had with clients over the past several weeks. Europe and China are the two markets where there seems to be the most demand away from the U.S."

“Recent economic and survey data do raise some warning flags, but S&P 500 companies delivered strong growth along with continued record profitability last quarter,” said Scott Helfstein at Global X. “Fundamentals will ultimately win out, but waning sentiment could well lead broad equity indexes sideways for a little while.”

“The White House had investor support for the first four weeks of the term, but the honeymoon may be coming to an end,” said Helfstein.

There is no relief yet in sight for the current market pullback, according to Sam Stovall, chief investment strategist at CFRA Research.

“I think there is more concern ahead as we’ve been seeing a reduction in earnings estimates for 2025 by about 300 basis points mainly because of the strength, the pull forward of orders and whatnot for the Q4 — so I think that investors are getting a little more cautious at this point,” he said on CNBC’s “Squawk on the Street” on Monday morning.

Investors should look for stocks that get unnecessarily beat down during bouts of volatility as long as the economy remains strong, according to John Stoltzfus, chief investment strategist at Oppenheimer.

“The likely transience of the levels of uncertainty that have roiled the stateside markets ... likely presents yet another opportunity to seek out ‘babies that get thrown out with the bath water’ in market downdrafts,” Stoltzfus wrote to clients on Monday.

To be sure, Stoltzfus added the caveat that the economy, consumer, labor market and business world need to remain in tact.

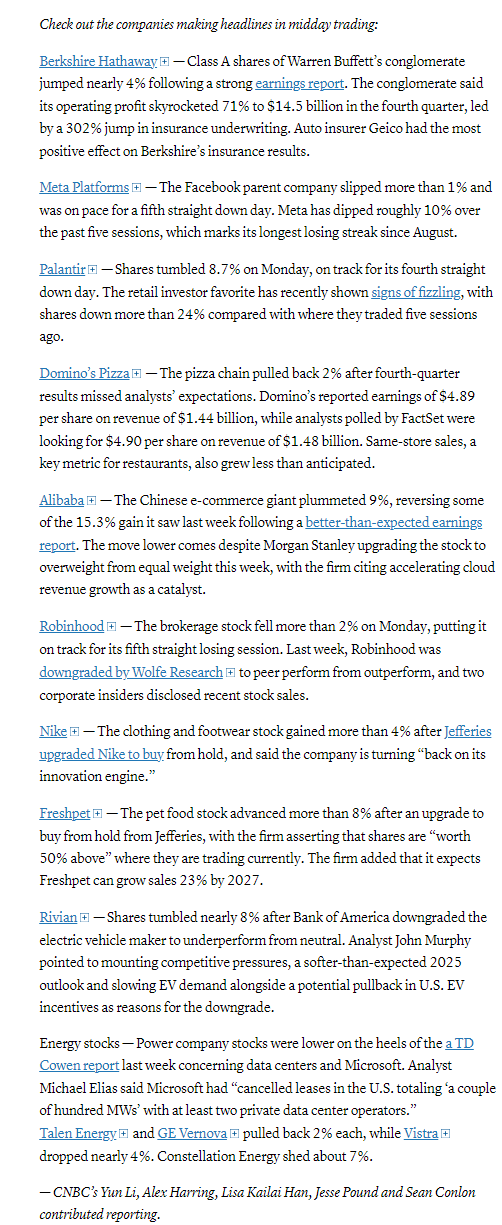

In individual stock action, shares of major tech companies came under pressure, leading the Nasdaq lower on the day and into negative territory for 2025. Palantir tumbled 10.5%, dragging on the tech-heavy index. Microsoft shed about 1% after an analyst report from TD Cowen said the company is cutting spending on data centers, raising fears of weakness in the artificial intelligence trade. Chipmaking giant Nvidia pulled back 3%. Apple (AAPL 247.10, +1.55, +0.6%), meanwhile, was a winning standout today after revealing plans to invest over $500 billion domestically over the next four years. There was also speculation that the commitment could result in a tariff exemption for the company.

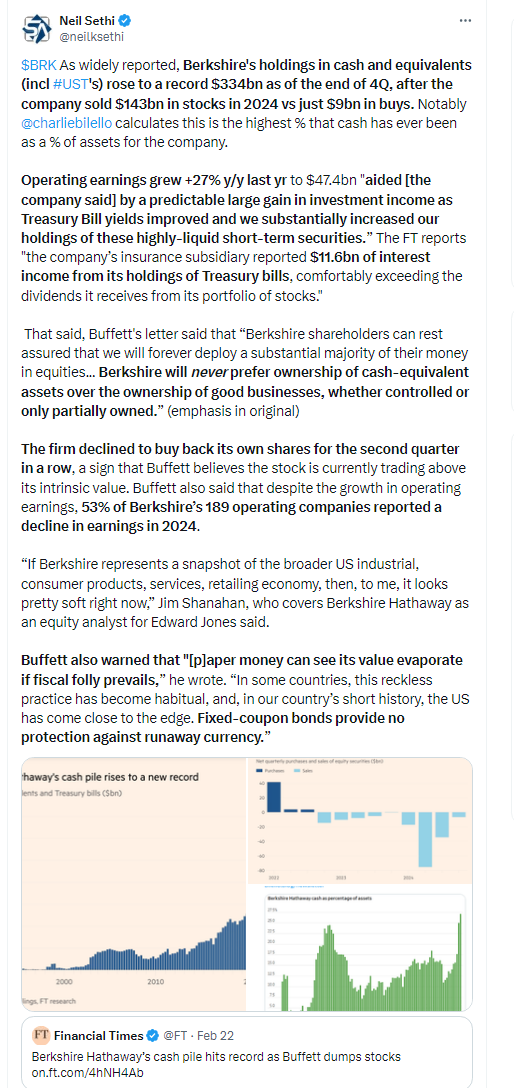

Alibaba Group Holding Ltd. tumbled in US trading amid a $53 billion AI spending pledge and as The Trump administration took aim at China with a series of moves involving investment and trade. Berkshire Hathaway Inc. jumped on a surge in operating profit.

BBG Corporate Highlights:

Zoom Communications Inc. projected worse-than-expected revenue growth for the year, dimming optimism that an expanded suite of products will bring a sales surge.

Apple Inc., as it seeks relief from US President Donald Trump’s tariffs on goods imported from China, said that it will hire 20,000 new workers and produce AI servers in the US.

Starbucks Corp. is eliminating 1,100 corporate jobs in a move aimed at increasing efficiency and quickly enacting changes to revitalize the company.

Domino’s Pizza Inc.’s US sales rose less than expected in the fourth quarter, highlighting the mounting challenge to appeal to cash-strapped Americans.

Boeing Co. has hired an adviser to market a defense subsidiary that manufactures small, long-range military drones as the planemaker looks to unload businesses that aren’t central to its core commercial and defense operations, according to people familiar with the talks.

Apollo Global Management Inc. agreed to buy Bridge Investment Group Holdings Inc. for about $1.5 billion in an all-stock deal as the asset manager expands in real estate.

Strategy, the self-styled Bitcoin treasury company that until recently was known as MicroStrategy, said it acquired $1.99 billion more of the cryptocurrency with the proceeds from last week’s convertible bond sale.

Some tickers making moves at mid-day from CNBC.

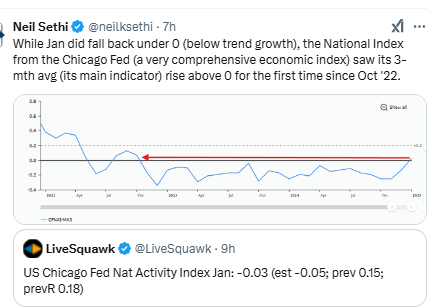

In US economic data: No major US economic data Monday.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX fell through its 50-DMA to the lowest close since Jan 16th. The daily MACD remains in “sell longs” positioning, and RSI now the weakest since then as well.

The Nasdaq Composite fell through its trendline back to the August lows, in its case to the lowest close since Jan 14th. Its daily MACD also in “sell longs” positioning and its RSI also the weakest since mid-January.

RUT (Russell 2000) fell through its 200-DMA to the lowest close since mid-Sept. Its daily MACD remains in “go short” positioning, and its RSI has to the weakest since December (which was the weakest since 2023).

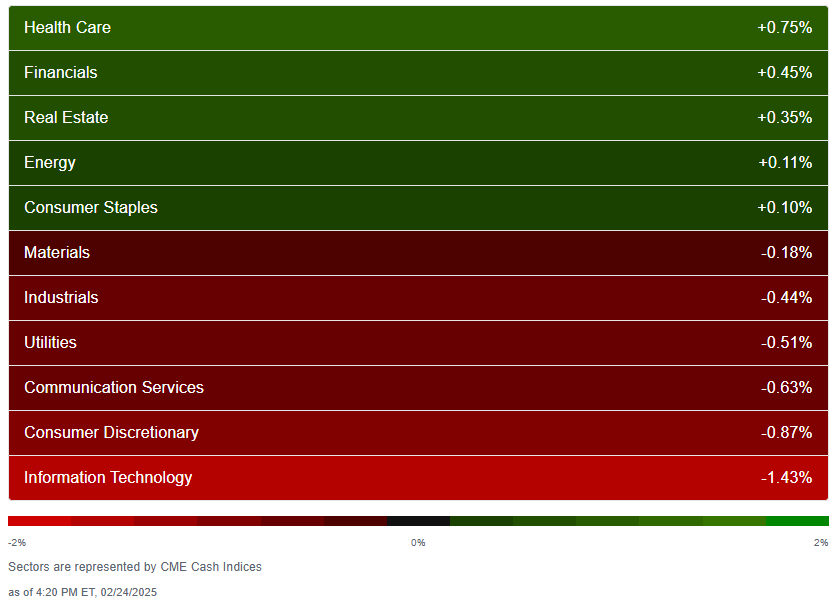

Equity sector breadth according to CME Cash Indices at least saw some improvement with five green sectors, up from just one Friday, although for a 4th consec session it was defensives outperforming taking three of the top give spots (after taking all four on Friday). No sectors though up more than 1% (vs one Friday) but also none down more than -1.5% vs six Friday. Growth underperformed again taking the bottom three spots.

SPX sector flag from Finviz relatively consistent with definitely a lot more green than Friday but with the Mag 7 continuing to be weak as a group, down for a third day, -1.4%. Semiconductors a notably weak subsector, SOX index was -2.6% today.

Positive volume (percent of total volume that was in advancing stocks) which generally has been pretty good over the past week was mediocre Monday at 44% on the NYSE, a little weak for the -0.1% loss in the NYSE Composite index, while the Nasdaq was 32% not terrible for the -1.2% loss, but it was 36% Friday when the Nasdaq lost -2.2%. Positive issues (percent of stocks trading higher for the day) at least were in line for the first session in five (for the Nasdaq) at 44 & 33% respectively.

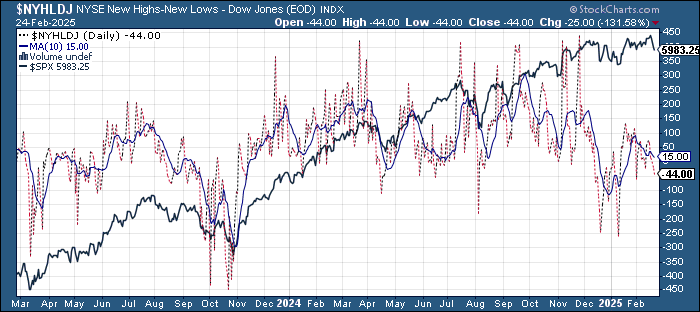

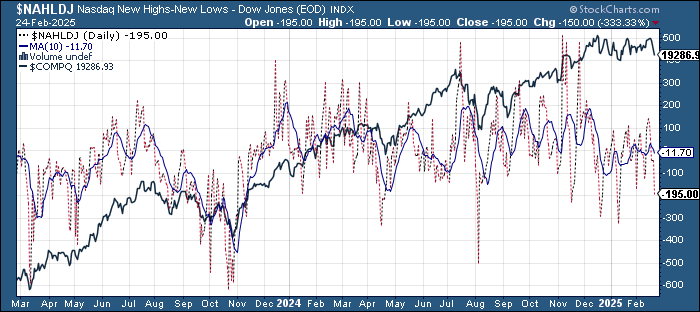

New highs-new lows (charts) continued to deteriorate with the NYSE down to -44 from +75 the week prior to last while the Nasdaq fell to -198 (the least since mid-Jan) from +140. Both are below their 10-DMAs which are rolling over (less bullish).

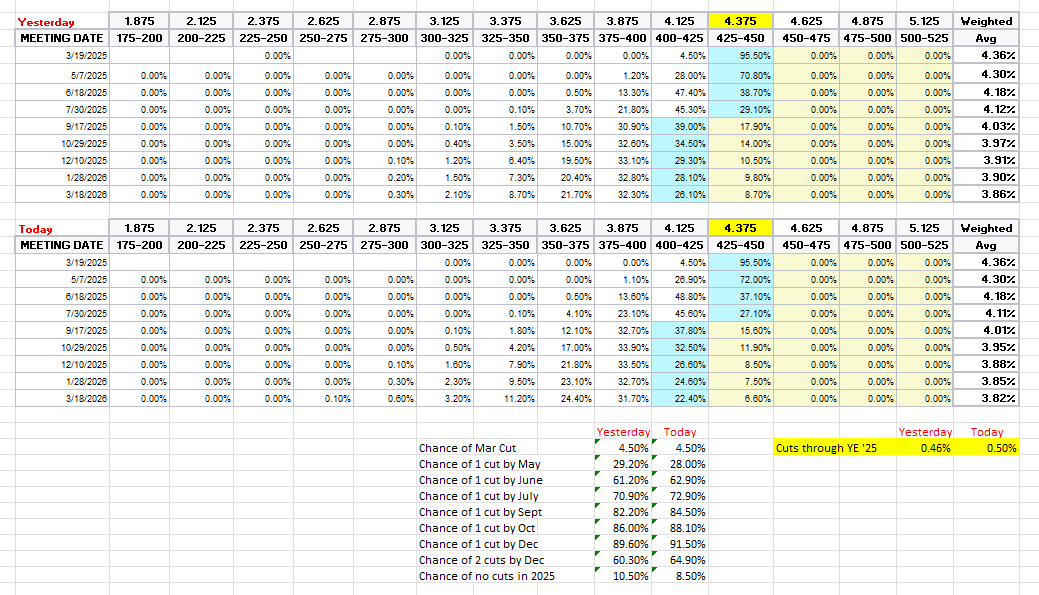

FOMC rate cut probabilities from CME’s #Fedwatch tool now back to the pricing two full rate cuts in 2025 (i.e., back to where they were prior to the NFP/UMich inflation expectations Feb 7th). A cut by March remains off the table at 5%, but one by June now to 63% (up from 33% the Wednesday after CPI). Chance of two 2025 cuts at 65% (vs 31%) and no cuts down to 9% (vs 29%) with 50bps of cuts priced (vs 28).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and I think we’re getting back to fairly priced. But as I said then “It’s a long time until December.”

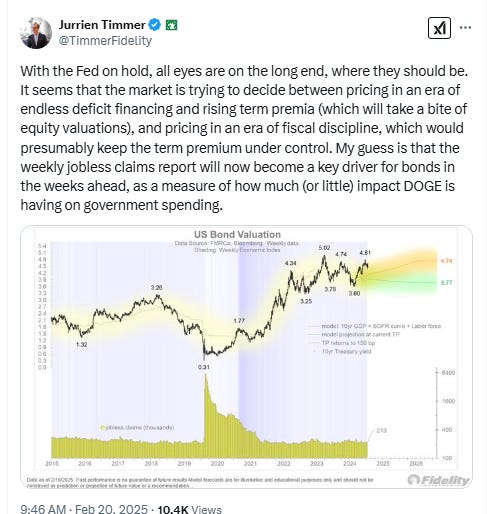

Longer duration #UST yields fell back for a 4th session with the 10yr yield -2bps to 4.40%, a 2-mth closing low.

The 2yr yield, more sensitive to Fed policy, also fell for a 4th session -2bps to 4.18%, also the lowest close in 2 months. I had said when it was 20-30bps higher (in Jan & again 2 wks ago) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, getting closer to where I think fair value is.

Dollar ($DXY) bounced from nearly 3-mth lows to finish up for a second day as it tries to stabilize above the 100-DMA again despite the drop in bond yields and increase in Fed rate cut expectations. As noted last Thursday it broke the 3rd “fanline” which is normally supposed to mean a reversal from the uptrend (which we’d seen until Friday), and daily MACD and RSI as also noted then are quite negative w/the latter around the weakest since August, so technicals still point to more downside.

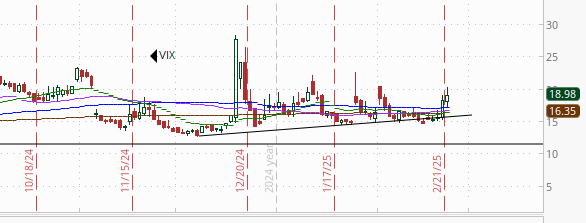

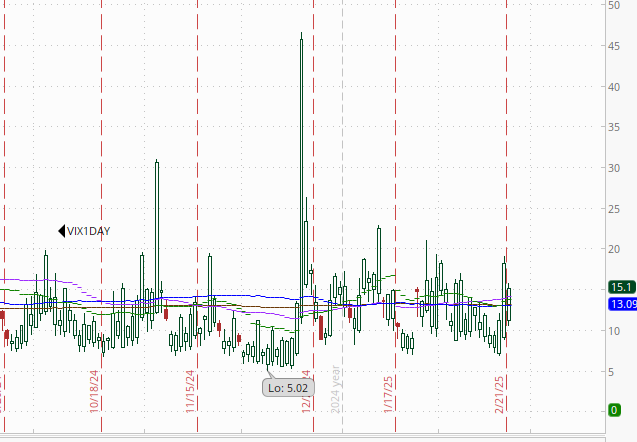

The VIX edged higher now up to 19 (consistent w/~1.19% daily moves over the next 30 days), keeping it above its uptrend line from the December lows. As a reminder, Charlie McElligott said call strikes were clustered at around 24 so there may be further to go.

The VVIX (VIX of the VIX) also moved higher to 107 further over the 100 “stress level” identified by Nomura’s Charlie McElligott and the highest close in 3 weeks (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX interestingly fell back from Friday’s level although remained elevated at 15.1 so looking for a move of around 0.94% Tuesday.

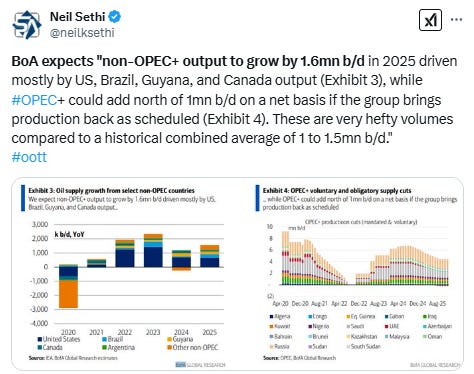

#WTI futures initially fell to new lows for the year Monday before rebounding to finish nearly 1% higher despite mostly bearish news (Iraq potentially restarting some exports, possible lifting of Russia sanctions on Ukraine settlement, possibility of OPEC pumping more to appease Trump, etc.), although still below lots of resistance. Daily MACD remains negative, and the RSI under 50 (although has a slight positive divergence (higher low)).

You know what they say about something that goes up on bad news though...

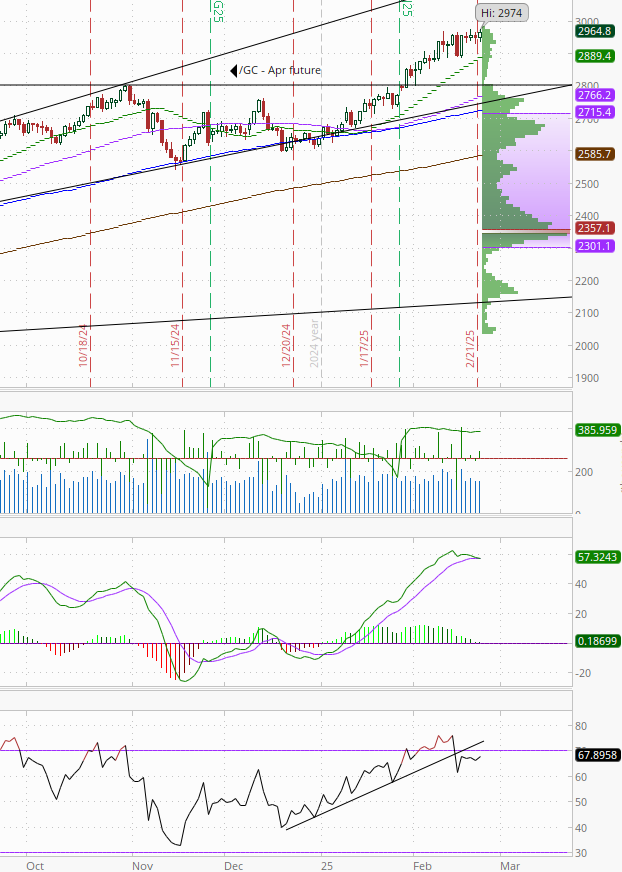

Gold futures traded in a slightly larger range but still unusually narrow for a fourth day but were able to push to both an intraday and closing all-time high following their 8th up week in a row, the longest streak since 2020. The daily MACD remains positive for now but very close to crossing over to “sell longs”, while the RSI continues to have a clear negative divergence (lower high).

Copper (/HG) continued its consolidation, down for the 5th day in 6 to the lowest close in two weeks, but now at the initial target of $4.50, so we’ll see if it can bounce here. Its daily RSI remains the weakest since Jan though, and the daily MACD has crossed to a “sell longs” positioning (circle).

Nat gas futures (/NG) dropped -6.5%, falling back under the $4 support level after the highest weekly close since Dec 2022 on Friday. Daily MACD remains in “go long” positioning, and the RSI over 50 but both are rolling over. Stil it has a few layers of support not far away.

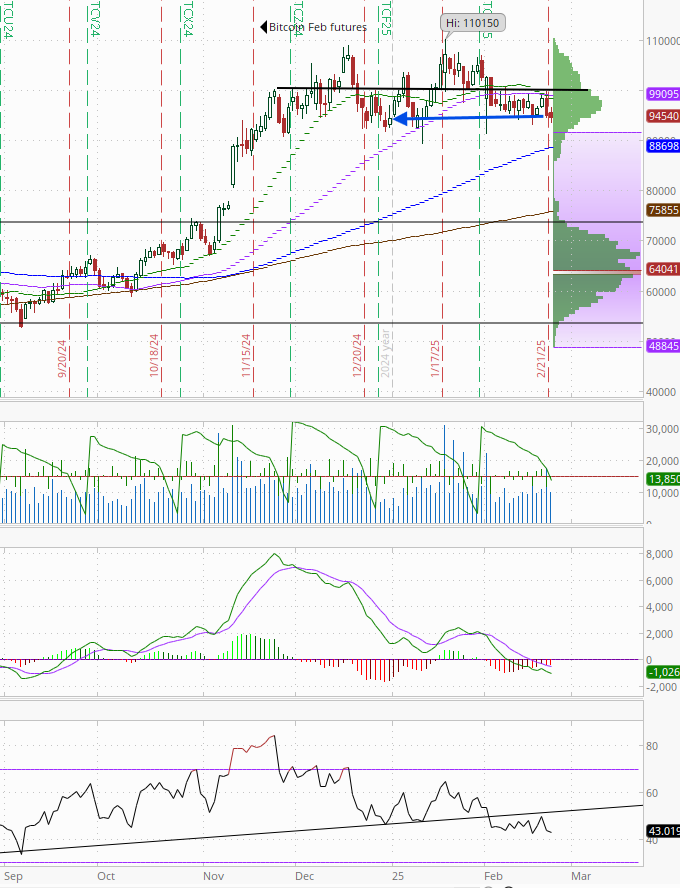

Bitcoin futures fell another half percent to a new closing low for the year. Daily MACD remains negative while the RSI is moving back down towards the lowest since Sept.

The Day Ahead

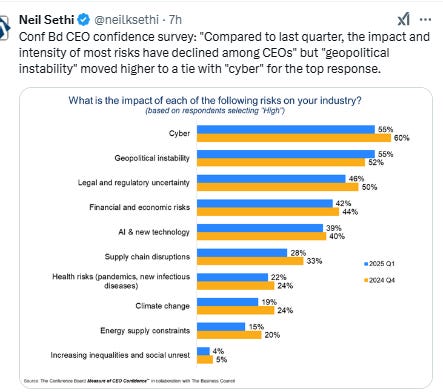

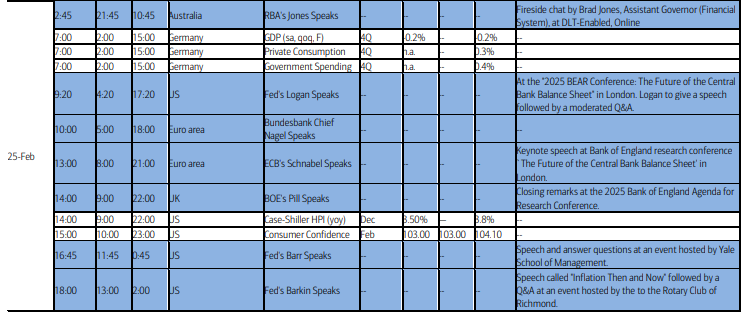

US economic data picks up a bit Tuesday with the repeat home price indices (through December) and Feb Conference Board consumer confidence. We’ll see if we see a softening in confidence and rise in inflation expectations in this survey like we did in the UMich. We’ll also get some regional Fed PMI’s.

In Fed speakers we’ll hear from Logan, Barr, and Barkin. While we’ve heard from all of them over the past week, as noted in the Week Ahead “Logan will also be an interesting one, as she is one of the ‘go tos’ with respect to the balance sheet due to her stint at the NY Fed, and so we will likely get more detail on the comment in the FOMC minutes that the Fed might slow or pause QT given the event is called the ‘Balance Sheet Conference’.”

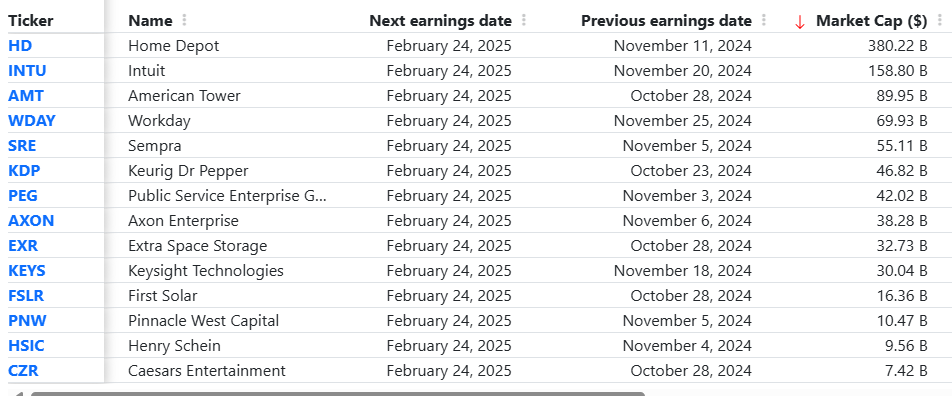

Earnings also pick up with 15 SPX components reporting, two > $100bn in market cap in Home Depot (HD) and Intuit (INTU) (see the full earnings calendar from Seeking Alpha).

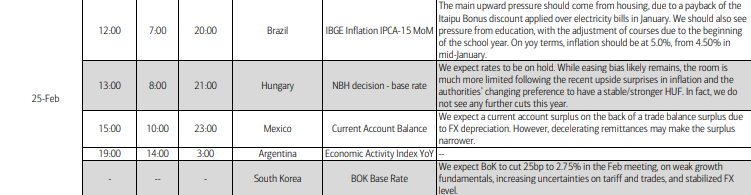

Ex-US headlined by Germany’s 4Q GDP. We’ll also hear from the President of Germany’s Bundesbank. Will be interesting to see if he has any thoughts following the election. In EM we’ll get a policy decisions from South Korea and Hungary (BoA expects a cut and hold respectively).

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,