Markets Update - 2/25/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

Major US equity indices started Tuesday’s session around unchanged levels as they digested a further ratcheting of trade tensions between the US and China (with the former looking to tighten the latter’s access to advanced semiconductors), a mixed report from housing bellwether Home Depot (who returned to sales growth with contractor sales growing but remodeling remaining weak), Bitcoin dropping to the least since November, and a continued slide in Treasury yields.

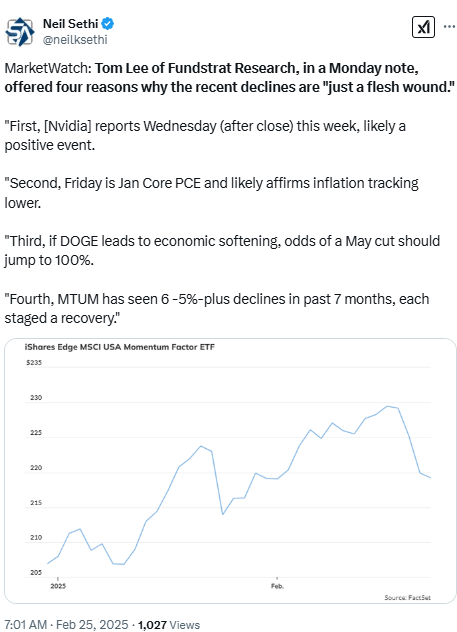

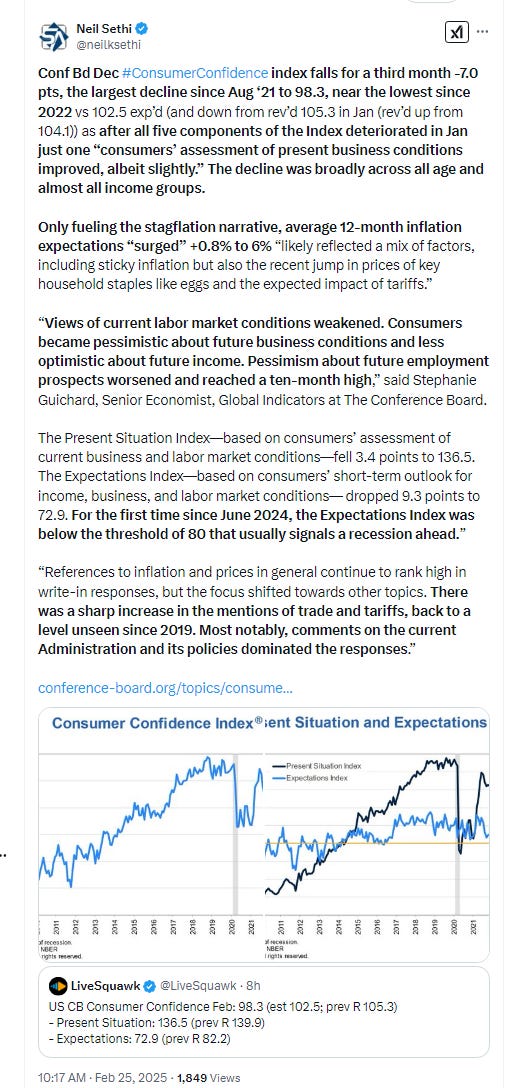

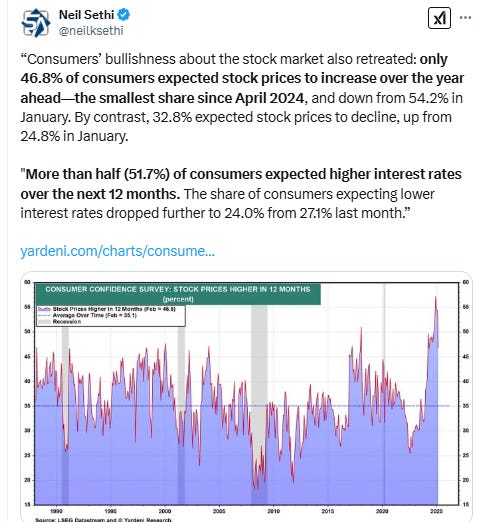

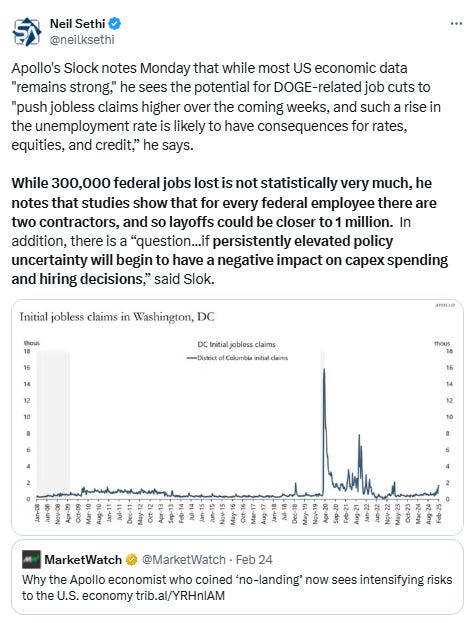

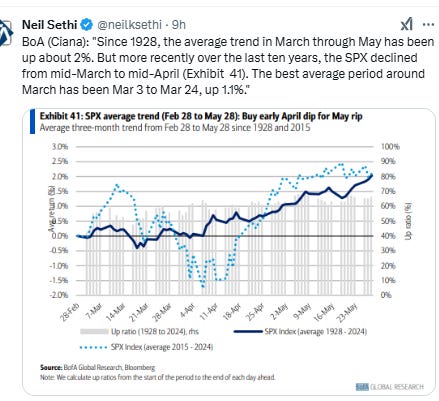

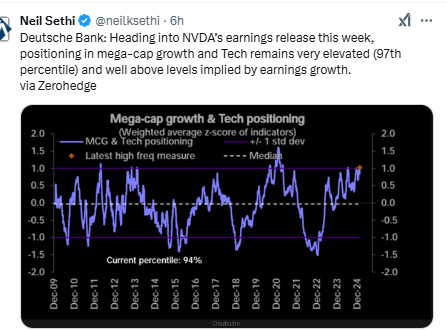

But stop me if you’ve heard this before, selling started from the opening bell and gained steam on an economic report, in this case the Conference Board’s consumer confidence measure ,which like the UMich survey on Friday, showed both a drop in confidence (the largest drop since Aug 2021 to near the lowest since 2022) and a jump in inflation expectations (to the highest since May 2023). The selloff was again led by the megacap growth stocks. Equities again though were able to find their footing in the afternoon before again falling into the close, evidence of continued systematic selling (although less dramatic than Monday). The overall volatility has been in line with the reduced gamma positioning discussed in the Week Ahead, and may very well continue through at least Nvidia’s earnings which are after the close tomorrow.

Treasury yields fell for a fifth session to the lows of the year with Fed rate cut bets now at the highs of the year. The dollar fell back as did crude, gold, and bitcoin. Nat gas and copper were higher, the latter on new tariff threats from the White House.

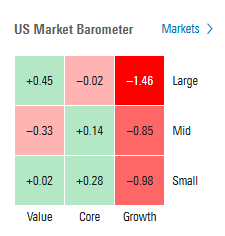

The market-cap weighted S&P 500 (SPX) was -0.5%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite -1.4% (and the top 100 Nasdaq stocks (NDX) -1.2%), the SOX semiconductor index -2.3% (-8% last three days), and the Russell 2000 (RUT) -0.4%. These numbers were almost identical to yesterday’s.

Morningstar style box like the overall performance of the indices very similar to Monday with outsized weakness in large cap growth (for a 3rd session).

Market commentary:

“Although the primary stock market uptrend remains intact and our team’s work suggests recession risks remain relatively low, the near-term risk/reward appears more mixed,” wrote Truist’s Keith Lerner, who downgraded his view on equities to neutral from attractive late Monday afternoon. “Indeed, we have seen modest deterioration in earnings, technical, and economic trends that warrants a more neutral equity posture and slightly higher cash.”

At Brown Brothers Harriman, Elias Haddad says “red flags are emerging,” and another month or two of weak US data would deliver “a blow to the US exceptionalism narrative.”

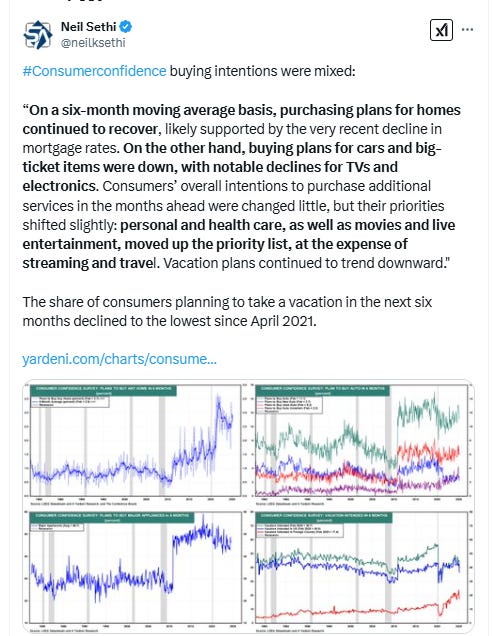

To Jeff Roach at LPL Financial, consumers are increasingly nervous about the unknown impacts from potential tariffs and could pull forward consumer demand as they anticipate higher prices for imports in the near future.

One note of caution from Roach: Consumer surveys are much more volatile than the hard data of retail sales. That means the Fed will not likely change their stance on monetary policy at the next couple meetings, according to the economist.

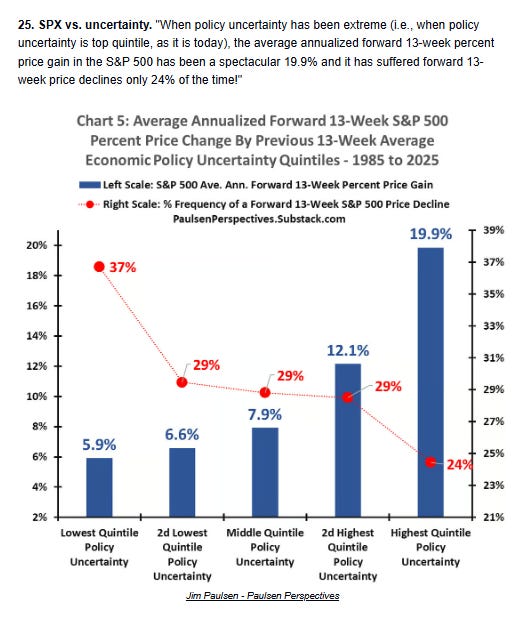

“Consumer confidence continues to come off its election-fueled sugar high from November,” said Bret Kenwell at eToro. “Economic uncertainty remains elevated, whether that’s around tariffs or more US-centric data like inflation or retail sales.”

“There’s concerns about growth, there’s still concerns about inflation,” said Alec Young, chief investment strategist at Mapsignals. “You don’t normally have concerns about both at the same time, but that’s a factor. And then the tariffs kind of fan both.”

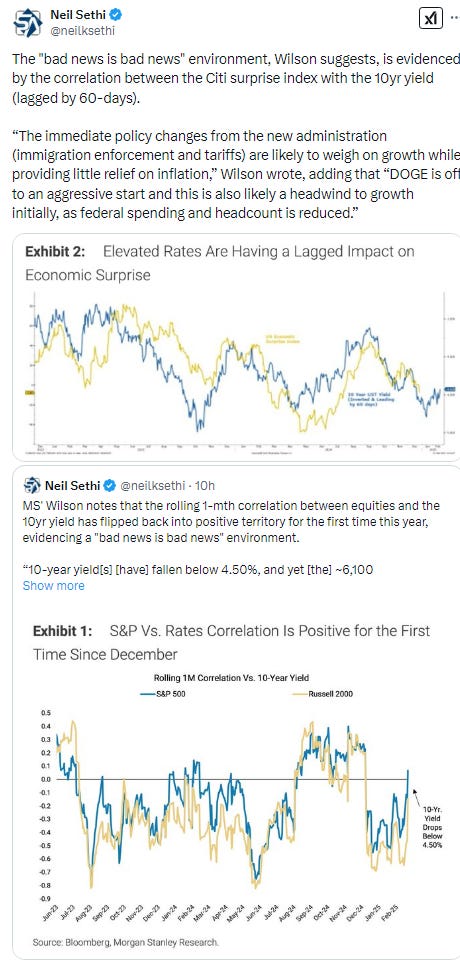

“The market still seems more worried about growth than inflation,” said Chris Verrone at Strategas.

"We've come through a very strong earning season, so now the focus is shifting to the economy [possibly] slowing and uncertainty around the Trump administration's tariff policy, budget reconciliation and cost reduction ... so that's driving the defensive posture in the stock market," said James Ragan, director of investment management and research at D.A. Davidson. Ragan said the big difference in the current defensive rotation compared with last year is that while the so-called Magnificent Seven group of stocks were previously considered a defensive play, Big Tech no longer holds that status this year, "even though the earnings have been pretty good in that sector," he told MarketWatch via phone on Tuesday.

“All of that comes together to call into question the underpinning of what has been the strength of the U.S. economy the last couple years, which is the consumer and the job market,” said Ross Mayfield, investment strategist analyst at Baird Private Wealth Management.

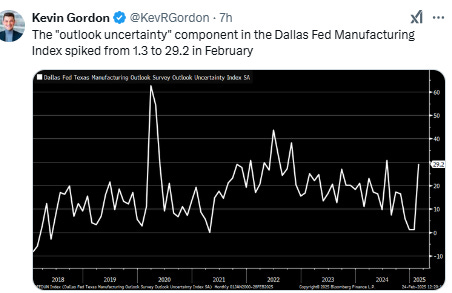

“Markets have suddenly begun declining on fears over a slowdown in growth. Wasn’t everyone just worried about too-strong growth and higher inflation a couple of weeks ago?” said Bespoke Investment Group strategists. “We would also note that three of the five Fed manufacturing reports released in February were all in growth territory. So not all the news is bad. The economic outlook is uncertain, but isn’t it always?”

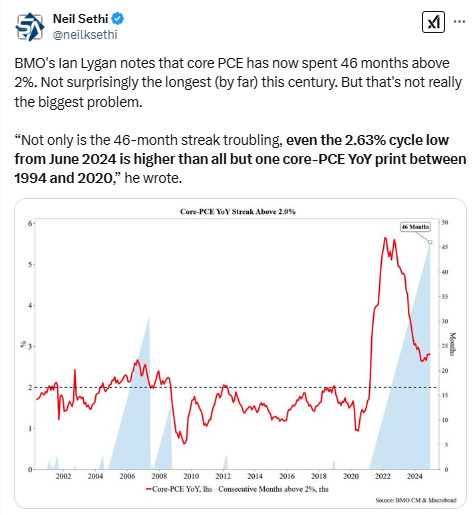

“Investors should keep an eye on this week’s PCE report,” said Kenwell. “It will give another clue as to how consumers are feeling about their purchasing power. An in-line or lower reading may act as a relief catalyst for consumers and investors alike.”

“People are taking profits ahead of Nvidia’s results,” said Michael Matousek, head trader at US Global Investors. “People are ringing the register, taking some off ahead of the results.”

“There are fewer volatility buffers in place to stabilize the market” and a weak print from Nvidia could just be the catalyst “we need to send volatility significantly higher,” the option strategists at Tier 1 Alpha said.

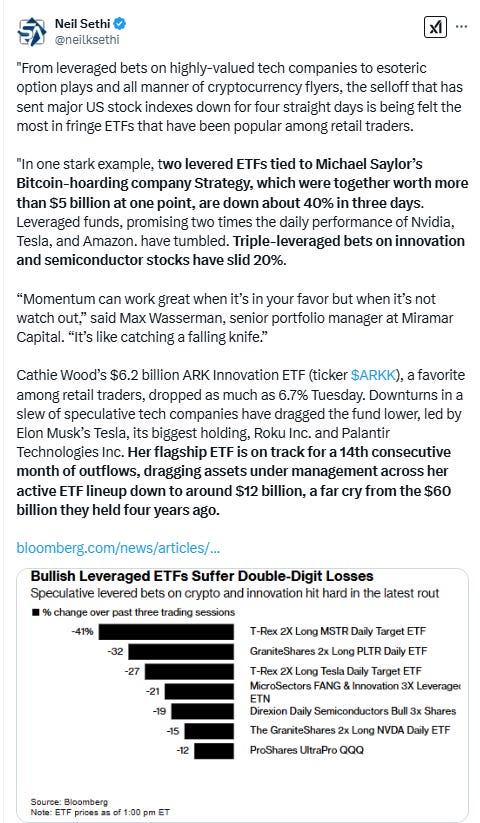

“The underperformance will be centered on some of the big winners, which is where the fast aggressive money went into single-stock leveraged ETFs,” says Peter Tchir of Academy Securities.

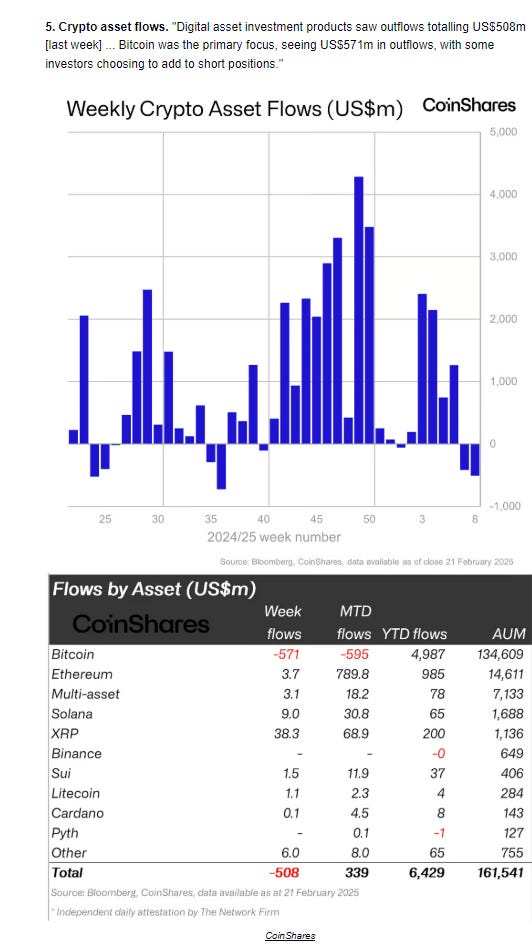

“There’s no question that the animal spirits in the marketplace are receding. It began last week with the declines in stocks like Palantir Tesla, and Meta,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Now we’re seeing it with the outsized drops in Bitcoin.”

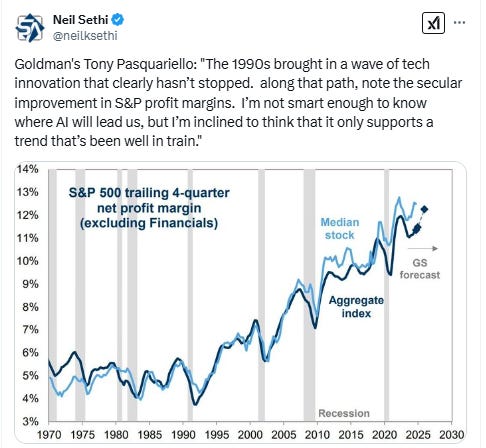

Charles Lemonides, founder and chief investment officer at ValueWorks recalls his advice 12 years ago as the world was emerging from the global financial crisis “just go buy stocks, it’s all great, it’s all cheap, you’re not going to go wrong.” But he says 2025 is setting up to be the “first year of the last leg of the bull run,” in our call of the day. And that final stage often “ends with an overextended, speculative market top,” the manager of the $300 million-plus New York hedge fund said in a recent client letter. Much like what happened between 1996 and March 2000, the next three to five years will be a “bubbly period,” Lemonides told MarketWatch in a Tuesday interview. “It’s going to be tough for value investors, generally unloved companies are not the ones that bring you to crazy market peaks.”

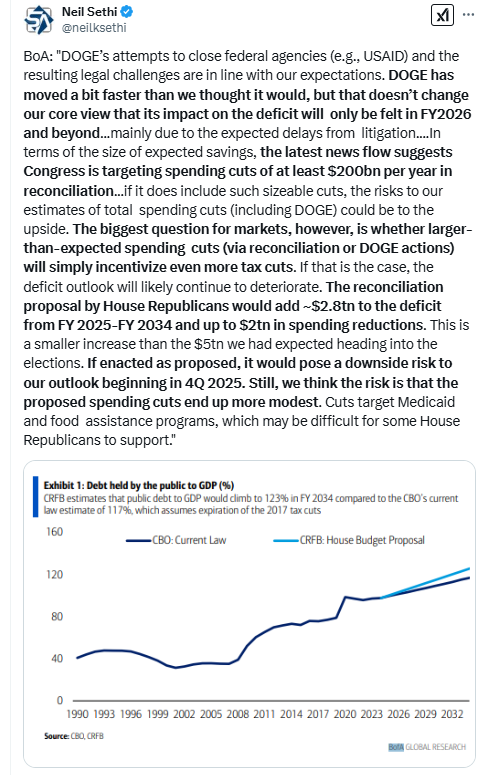

There’s growing “suspicion” among investors about the scope for more S&P 500 gains at a time when European and Chinese stocks are outperforming, according to Bank of America Corp. strategist Michael Hartnett.

“The longer it takes and the harder it is for the S&P to get to new highs, the doubts grow,” Hartnett said in an interview on Bloomberg TV. “Europe’s working, China’s working, even bonds in America are starting to work.” While he said investors are far from pessimistic about big tech, these stocks are vulnerable to declines if the trade “doesn’t keep working.” Hartnett said investors are likely to look for fiscal intervention from the Trump administration if the S&P 500 were to drop to 5,600-5,700 points — a decline of as much as 6% from current levels.

“The stock market is his traffic light,” the strategist said, referring to US President Donald Trump.

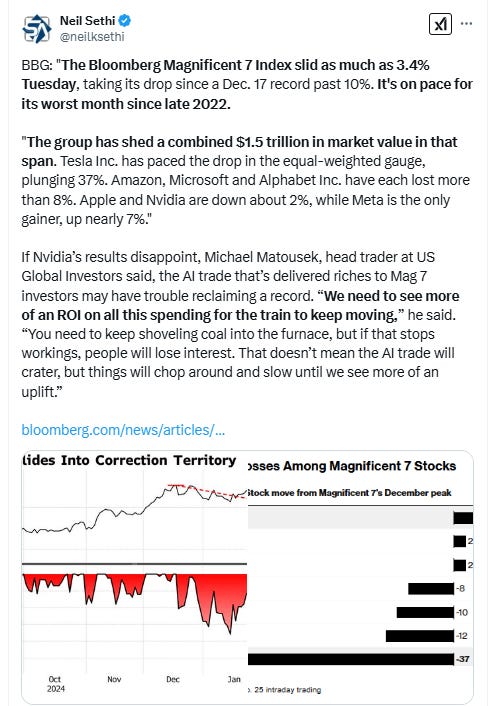

In individual stock action, shares of major bank stocks rolled over on Tuesday on rising recession concerns. Goldman Sachs, Wells Fargo and JPMorgan Chase fell more than 1% each. Momentum stocks that have powered the market’s gains also slipped. In addition to Nvidia, Palantir lost 3%, bringing the stock down around 13% for the week, more than 30% off their recent high. Meta Platforms declined 1.6% during Tuesday’s session. Electric vehicle maker Tesla, another favorite among retail investors, fell more than 8%. The slide brought Tesla’s market capitalization below the $1 trillion threshold. Nvidia Corp. lost 2.8% ahead of its results. In late hours, Super Micro Computer Inc. jumped after meeting a deadline for submitting outstanding financial reports to regain compliance to stay listed on the Nasdaq.

Hims & Hers Health shares plunged more than 27% in midday trading on Tuesday after the telehealth company’s gross margin came up short of expectations, eclipsing its fourth-quarter earnings and revenue beat. That move lower puts the stock on track for its largest percentage decline ever. The stock’s next-worst day on record is Feb 21, 2025, when it plummeted 25.8%.

Companies making the biggest moves after-hours from CNBC.

BBG Corporate Highlights:

Lucid Group Inc. will begin a search for a new chief executive officer after it said its current leader, Peter Rawlinson, has stepped aside to serve in a strategic advisory role.

AMC Entertainment Holdings Inc. reported better-than-expected fourth-quarter profit.

Cava Group Inc., one of the hottest US restaurant chains, gave a sales outlook for 2025 that disappointed investors.

Home Depot Inc. expects a key sales metric to return to growth this year, though the retailer cautioned that housing demand won’t change significantly in the near term.

Nvidia Corp., the top provider of chips used in new artificial intelligence computers, is extending a partnership with networking-gear maker Cisco Systems Inc. in a push aimed at making it easier for corporations to deploy AI systems.

ASM International NV’s first-quarter revenue forecast beat estimates as an artificial intelligence boom drives demand for the Dutch semiconductor-equipment maker’s products.

PayPal Holdings Inc. predicted growth in earnings and transaction margins in coming years, as its new leadership continues to streamline the sprawling business.

Eli Lilly & Co. is ramping up the fight against cheaper, copycat versions of Zepbound by lowering prices for a version of its blockbuster obesity drug.

Krispy Kreme Inc.’s net revenue forecast disappointed. The company is weighing refranchising some of its businesses in international markets even as it expands its distribution network in the US, Chief Executive Officer Josh Charlesworth said.

Some tickers making moves at mid-day from CNBC.

In US economic data: The consumer confidence report noted above dominated US economic data today. We also did get home prices in December which heated up in December on pent-up buyer demand and a drop in mortgage rates in 4Q.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

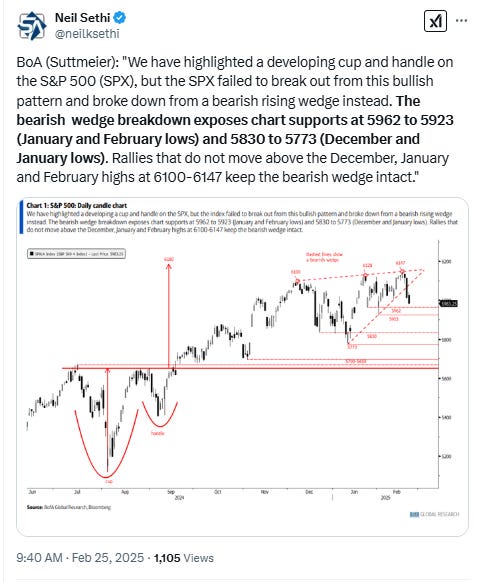

The SPX fell through its 100-DMA before recovering it, to the lowest close since mid-Jan. The daily MACD remains in “sell longs” positioning, and RSI now the weakest since then as well.

The Nasdaq Composite fell through its 100-DMA also to the lowest close since mid-Jan. Its daily MACD also in “sell longs” positioning and its RSI also the weakest since mid-January.

RUT (Russell 2000) fell to the lowest close since mid-Sept. Its daily MACD remains in “go short” positioning, and its RSI has to the weakest since December (which was the weakest since 2023).

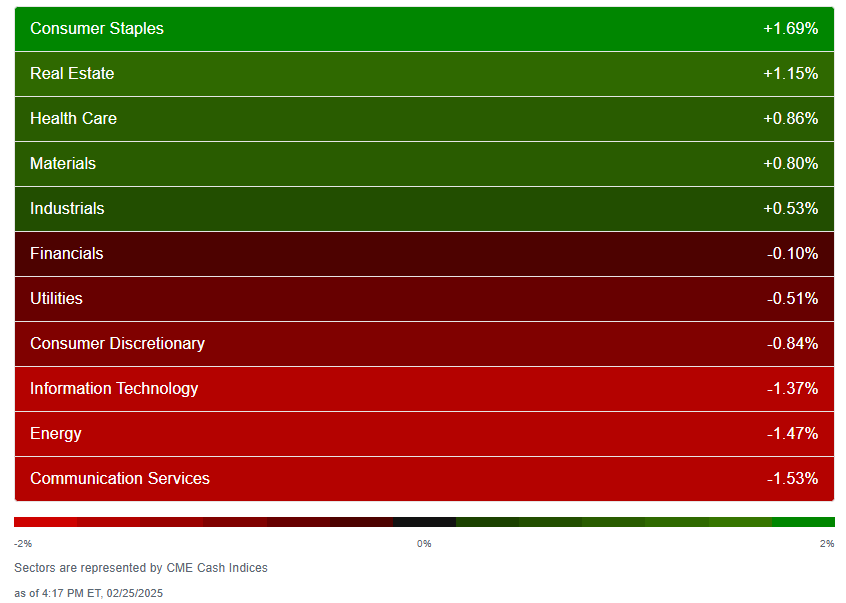

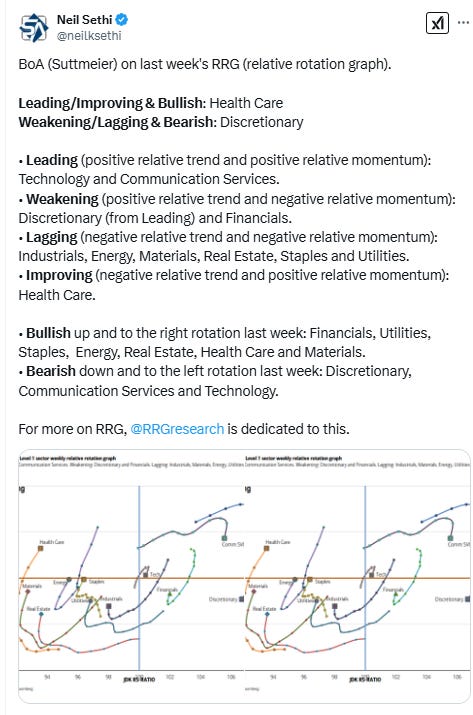

Equity sector breadth according to CME Cash Indices w/a little more dispersion Tuesday. Again though five green sectors, and for a 5th consec session it was defensives outperforming taking the top three spots (the same as Mon, all four on Friday). But two sectors up more than 1% (vs none Mon, one Friday) but also one down more than -1.5% vs none Mon (but six Friday). Growth underperformed again taking three of the bottom four spots, after bottom three on Monday.

SPX sector flag from Finviz relatively consistent with again a pretty good amount of green outside of growth, energy, and certain pockets like big banks, media and entertainment, with the Mag 7 continuing to be weak as a group, down for a fourth day, -6.4% over that span. Semiconductors continued to be notably weak as well a notably weak subsector, with the SOX index was -8% the last 3 sessions.

Positive volume (percent of total volume that was in advancing stocks) which generally has been pretty good over the past week+ but was mediocre Monday was again Tuesday at 43% on the NYSE, weak given the +0.3% gain in the NYSE Composite index (it was 44% Monday when it lost -0.1%), while the Nasdaq was 33% again not terrible for the -1.4% loss (actually a little better than Monday despite a slightly bigger loss, but it was 36% Friday when the Nasdaq lost -2.2%).

Positive issues (percent of stocks trading higher for the day) were better though at 57 and 38% respectively.

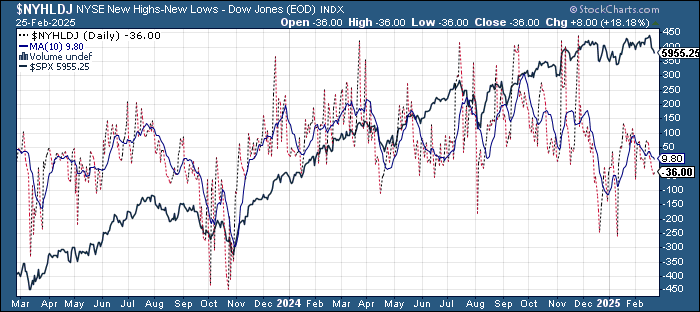

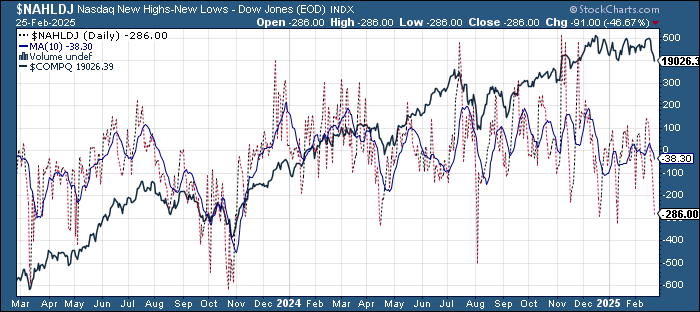

New highs-new lows (charts) stopped their deterioration on the NYSE edging up to -35 (still down from +75 the week prior to last) while the Nasdaq fell to -288 (the least since mid-Jan) from +140 the week prior to last. Both are below their 10-DMAs which are rolling over (less bullish).

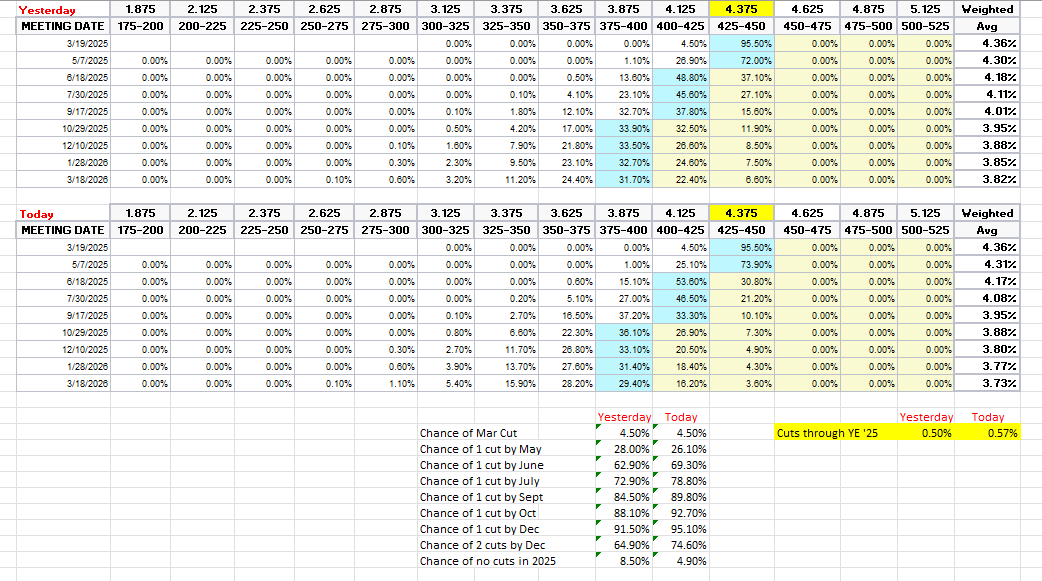

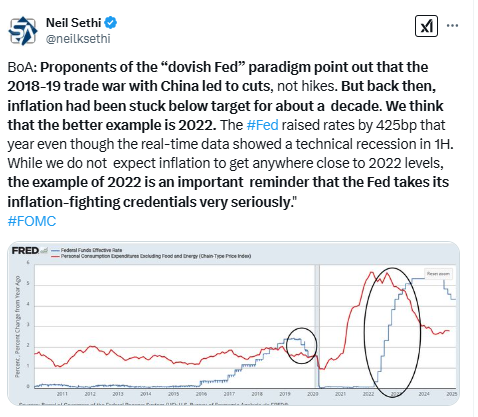

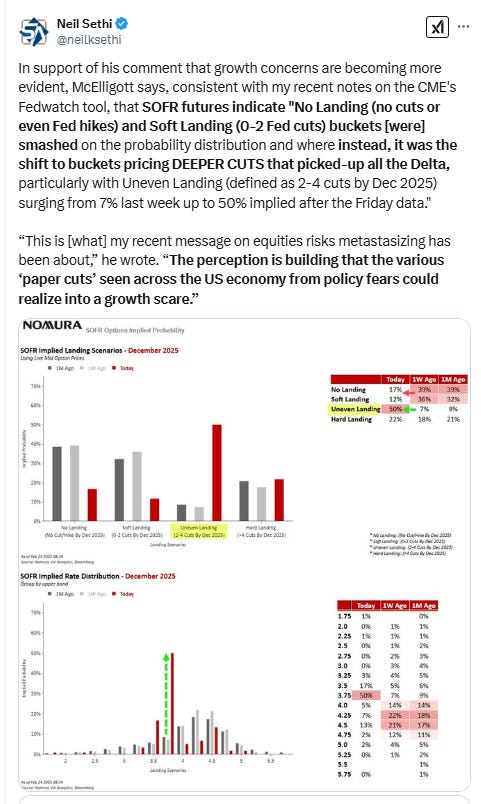

FOMC rate cut probabilities from CME’s #Fedwatch tool now seeing the most cuts this year. A cut by March remains off the table at 5%, but one by June now to 69% (up from 33% the Wednesday after CPI). Chance of two 2025 cuts at 75% (vs 31%) and no cuts down to 5% (vs 29%) with 57bps of cuts priced (vs 28).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and I think we’re getting back to fairly priced. But as I said then “It’s a long time until December.”

Longer duration #UST yields fell back for a 5th session with the 10yr yield -10bps to 4.30%, the lowest close since Dec 11th, now down -36bps since CPI day (Feb 12th). 200-DMA at 4.24%.

The 2yr yield, more sensitive to Fed policy, also fell for a 5th session -8bps to 4.10%, the lowest close since Dec 6th. I had said when it was 30-40bps higher (in Jan & again 2 wks ago) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now getting closer to where I think fair value is although still only pricing around one cut.

Dollar ($DXY) fell back to the lowest close since Dec 9th as it continues to just hold the 100-DMA. As noted last Thursday it broke the 3rd “fanline” which is normally supposed to mean a reversal from the uptrend (which we’ve seen so far), and daily MACD and RSI as also noted then are quite negative w/the latter around the weakest since August, so technicals still point to more downside.

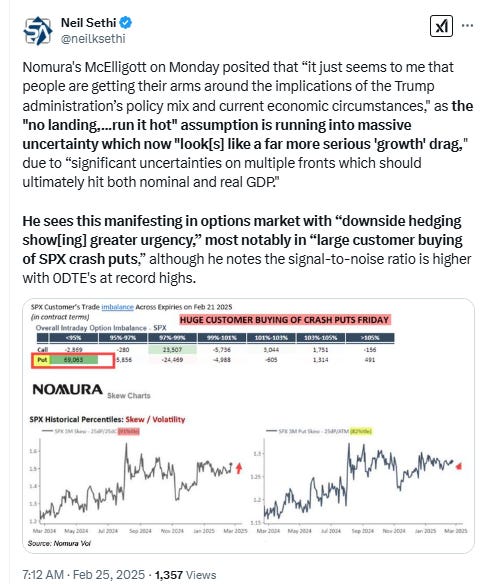

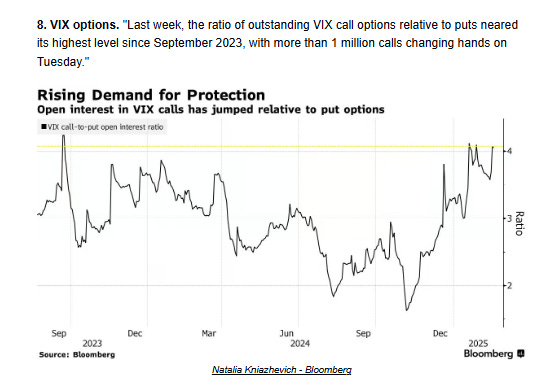

The VIX edged higher now up to 19.4 (consistent w/~1.20% daily moves over the next 30 days), after trading over 20 earlier in the day. As a reminder, Charlie McElligott said call strikes were clustered at around 24 so there may be further to go.

The VVIX (VIX of the VIX) also edged higher to 108 further over the 100 “stress level” identified by Nomura’s Charlie McElligott and the highest close in 3 weeks (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

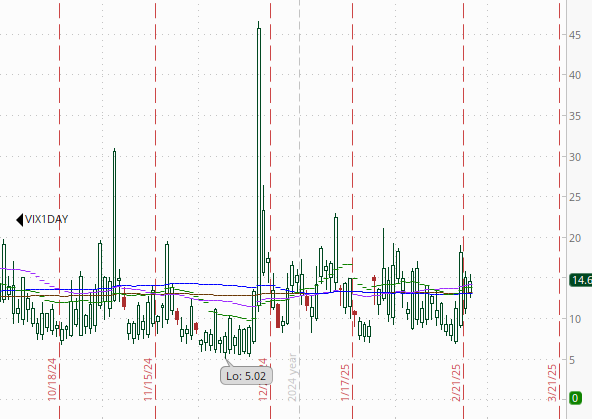

1-Day VIX fell back again from Friday’s level although remained elevated at 14.6 so looking for a move of around 0.91% Wednesday, but this will spike at the open as it takes into account Nvidia’s earnings report after the close.

#WTI futures joined the flight from risk assets Tuesday falling to new lows for the year (lowest cash settle since early December) now sub-$70 and heading for an uptrend line running back to the Sept lows. Daily MACD remains in “go short” positioning, and the RSI now the weakest since Sept.

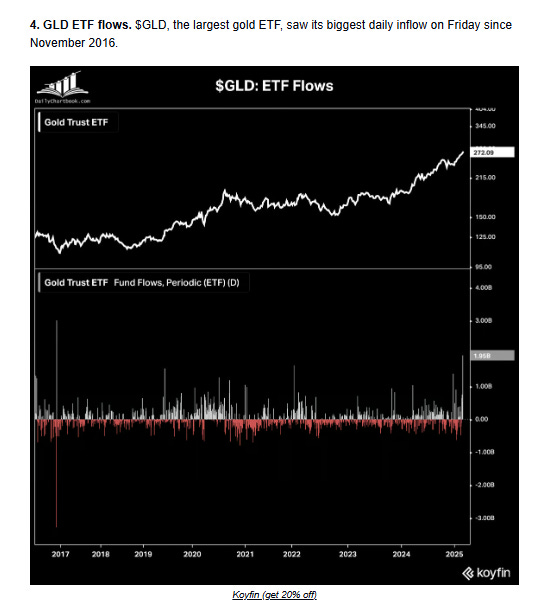

Gold futures fell back but held the uptrending 20-DMA (green line) as they won’t give up on a 9th consecutive up week. Technicals though starting to turn with the daily MACD crossing over to “sell longs” (circle), while the RSI continues to have a clear negative divergence (lower high) and is now the weakest in a month.

Copper (/HG) futures jumped +3.2% after President Trump signed an executive action directing the Commerce Department to examine possible tariffs on the metal. It is conveniently also at a natural bounce point as noted Monday after making it to the initial target of $4.50 (as I said then “we’ll see if it can bounce here”). Its daily RSI and daily MACD though are not favorable yet.

Nat gas futures (/NG) continue to jump around up +5% reversing most of Monday’s -6.5% decline after the highest weekly close since Dec 2022 on Friday. Daily MACD remains in “go long” positioning, while the RSI remains over 50.

Bitcoin futures fell sharply, down -5.6%, breaking through $90k to the lowest close since mid-November. Daily MACD remains in “go short” territory while the RSI is the lowest since Sept.

The Day Ahead

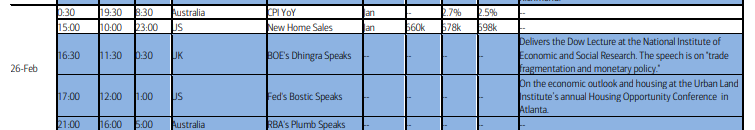

US economic data relatively light Wednesday with just Jan new home sales and weekly mortgage applications and EIA petroleum inventories.

In Fed speakers Bostic (who we heard from a few times last week) is the lone speaker on the calendar.

Earnings though are the star of the show Wednesday as we get Nvidia after the close. In all we’ll get 12 SPX components reporting. In addition to NVDA there are three others > $100bn in market cap in Salesforce (CRM), Lowe’s (LOW), and TJX (TJX) (see the full earnings calendar from Seeking Alpha).

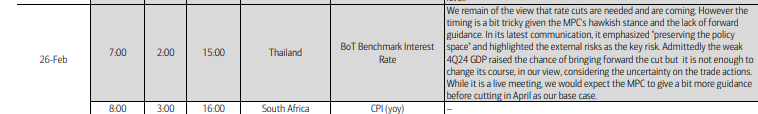

Ex-US a light day as well headlined by Australia Jan CPI. In EM we’ll get a policy decision from Thailand (BoA says cuts are needed but they may hold off due to the bank’s hawkish stance and lack of forward guidance (i.e., markets are not expecting it)).

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,