Markets Update - 2/27/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

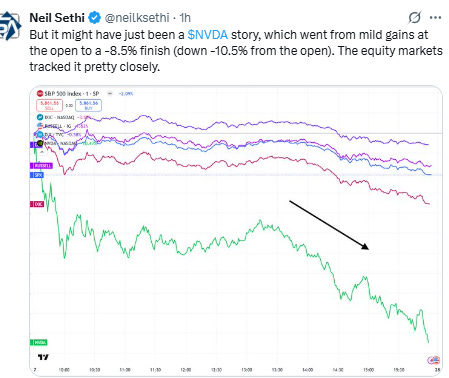

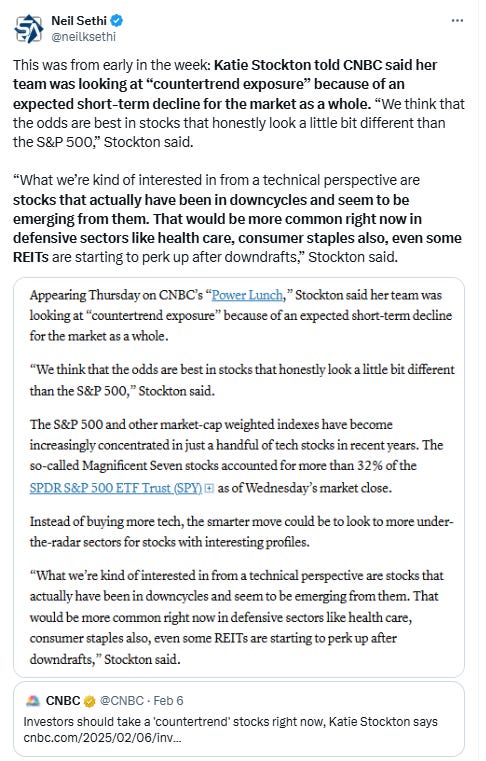

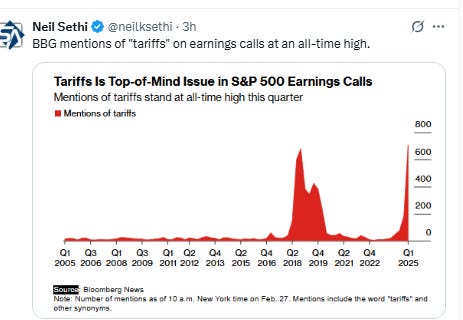

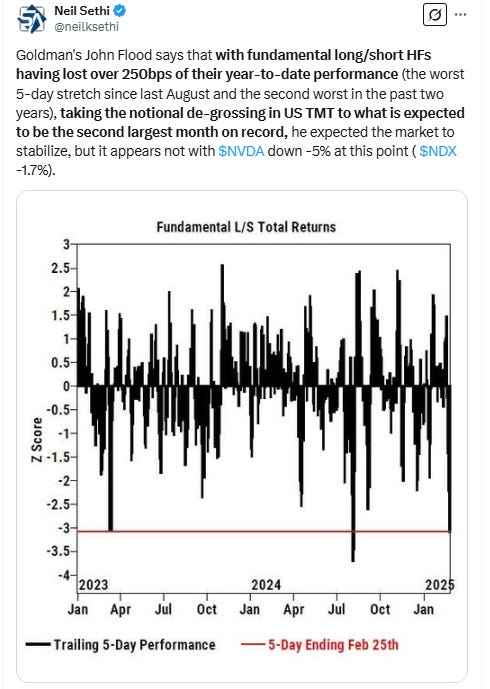

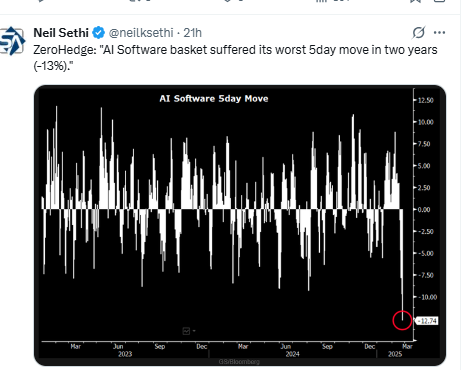

Major US equity indices started the day mixed with large cap indices looking to open higher again Thursday as they digested a mixed earnings report from Nvidia (but overall positive with shares up around +2%), a jump in initial jobless claims (but still low historically as are continuing claims), an upgrade to Q4 core PCE prices, a solid durable goods report, and a Trump social media post confirming 25% tariffs on Canada & Mexico to be implemented Mar 4th plus 10% additional tariffs (taking them to 20%) on China. They held up pretty well until later in the afternoon but they eventually succumbed led down by Nvidia which ended up losing -8.5% on the day. Some systematic selling at the end didn’t help with the indices finishing at the lows.

Treasury yields were mixed with the 10yr finding some support at a technical level, but the 2yr fell for a 7th session as Fed rate cut bets moved to new highs of the year. The dollar jumped on the Trump tariff comments, as did crude on Trump comments last night revoking Chevron’s license to operate in Venezuela, and copper and bitcoin also gained, while gold and nat gas fell back.

The market-cap weighted S&P 500 (SPX) was -1.6%, the equal weighted S&P 500 index (SPXEW) -0.9%, Nasdaq Composite -2.8% (and the top 100 Nasdaq stocks (NDX) -2.8%), the SOX semiconductor index -6.1%(!), and the Russell 2000 (RUT) -1.6%.

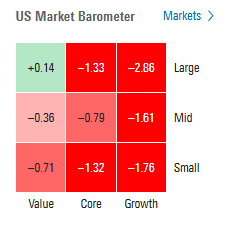

Morningstar style box back to growth leading the weakness for the 4th session in five (large cap in particular).

Market commentary:

“Caution is warranted. The remarkable strength of equities in recent months suggests that any downside should be approached with care,” said Fawad Razaqzada, market analyst at Forex.

“As the last few days have shown us, we’re in an environment where what the market is doing right now is hardly indicative, no less a guarantee of where we’ll be an hour from now let alone the end of the day,” said Bespoke Investment Group strategists.

“You do not only have uncertainty here in the United States, but you have a lot of uncertainty in terms of relationships with other countries, impact on markets,” said Dan Ivascyn at Pacific Investment Management Co. “And that’s creating not only a lot of localized volatility but volatility across countries, across sectors, across yield curves and that’s a great opportunity as well.”

“We’re in a stalled, range-bound, slightly irrational market as we wait for policy clarity,” said Jay Hatfield, CEO of Infrastructure Capital Advisors.

“Investors want lower rates from the Fed, but they don’t want to get there by seeing a notable deterioration in the underlying economy,” said Bret Kenwell at eToro. “At the very least, if the economy is going to slow, investors will want to see inflation slow down too.”

“Indications that price pressures may be catching a second wind even before the potential impact of additional tariffs should send a cautionary message about the near-term inflation outlook,” said Jim Baird at Plante Moran Financial Advisors.

“Today’s jobless claims surprise will dial up anticipation for next week’s employment data, but it remains to be seen whether the increase is just an outlier or the beginning of a trend,” said Chris Larkin at E*Trade from Morgan Stanley. “Despite recent concerns about the strength of the US consumer, most numbers continue to point to a US economy that may have softened, but is still on solid ground.”

“While markets have begun to react to these developments, deep tariff risks are still being underpriced,” Goldman Sachs wrote in a note released Wednesday. Kamakshya Trivedi, the investment bank’s head of global FX, rates and EM strategy, said that the scope for U.S. equities to fall further and a stronger move in the dollar still exists if Trump “walks the walk” on broader and bigger tariffs.

“Nvidia’s earnings were good, but they did not do a lot to lessen the growing fears that the earnings from the AI market will not be as strong as investors had been thinking,” said Matt Maley at Miller Tabak + Co. “The quotes out of Washington, DC continue to create decent sized intraday moves in the markets.”

“Although revenue growth has decelerated, Nvidia’s 78% YoY increase remains impressive given its scale, underscoring strong demand for AI infrastructure,” said Ido Caspi, research analyst at Global X. “This robust performance should similarly alleviate investor concerns about potential slowdowns stemming from emerging competitors like DeepSeek.”

“Nvidia earnings were outstanding, but they come during an extremely jittery stock market,” said James Demmert, chief investment officer at Main Street Research.

In individual stock action, megacaps bore the brunt of the selling as good-but-not-great numbers from Nvidia Corp. disappointed investors. The chipmaker sank 8.5%, the company's worst postearnings drop since Nov. 16, 2018, according to Dow Jones Market Data.

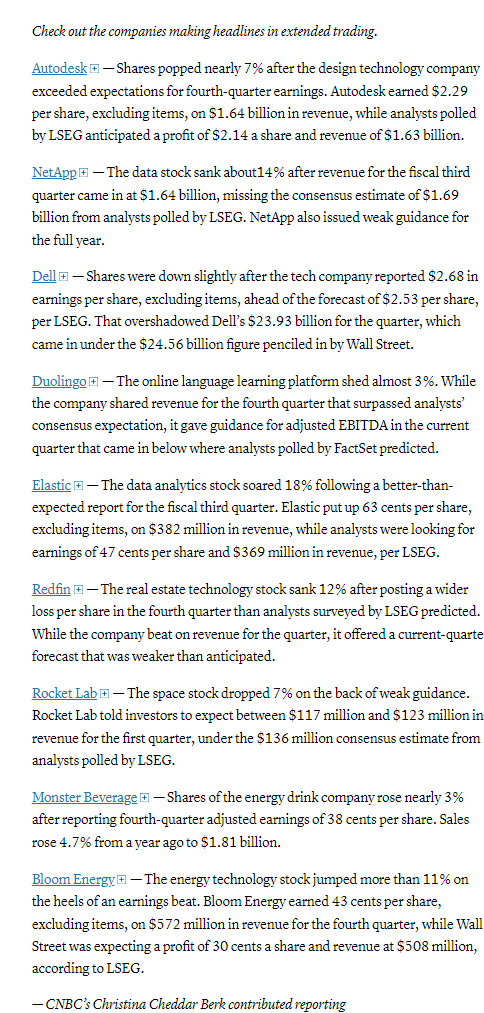

In late hours, Dell Technologies Inc. gave a bullish outlook but guided below estimates.

Companies making the biggest moves after-hours from CNBC.

BBG Corporate Highlights:

Tesla Inc. is seeking approval to offer ride-hailing services in California, a key step by Elon Musk’s company to begin carrying paying customers while its traditional car-selling business falters.

Apollo Global Management Inc. is in talks to lead a roughly $35 billion financing package for Meta Platforms Inc. to help develop data centers in the US, according to people with knowledge of the matter.

Amazon.com Inc.’s cloud unit has built its first quantum-computing chip, joining a growing roster of technology companies showing off futuristic hardware.

B. Riley Financial Inc. lined up new funding to replace Nomura Holdings Inc., erasing what’s left of a loan tied to an ill-fated buyout deal that has hobbled the brokerage and investment firm.

Walgreens Boots Alliance Inc. rose after a report that a potential take-private deal from Sycamore Partners would lead to a breakup of the drugstore chain.

Peanut butter and jelly maker JM Smucker Co. increased full-year profit guidance, offering a view that’s more optimistic than what Wall Street anticipated.

Toronto-Dominion Bank beat estimates on better-than-expected wealth-management and capital-markets results, capping off an earnings season that saw all of Canada’s big banks benefit from higher trading activity.

Royal Bank of Canada beat estimates on higher results in its capital-markets and wealth-management divisions as both units benefited from strong markets.

Canadian Imperial Bank of Commerce came ahead of analyst expectations with gains across all segments, particularly with strength in the capital markets business.

Elliott Investment Management is ramping up pressure on BP Plc after its new strategy fell short of the activist investor’s expectations, people with knowledge of the matter said.

Some tickers making moves at mid-day from CNBC.

In US economic data:

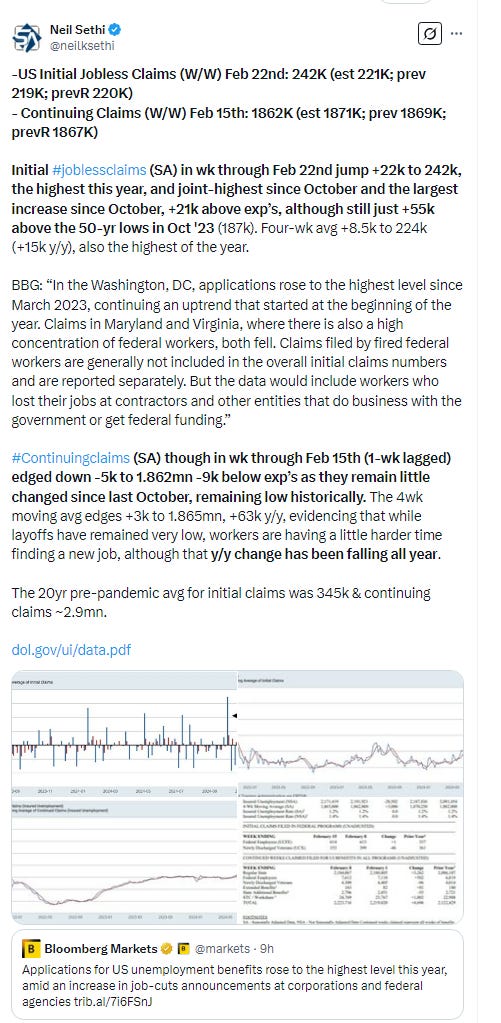

Initial jobless claims (SA) in wk through Feb 22nd jumped +22k to 242k, to the joint-highest since October and the largest increase since October, +21k above exp’s, although still just +55k above the 50-yr lows in Oct '23 (187k). Four-wk avg +8.5k to 224k (+15k y/y), also the highest of the year. Continuing claims (SA) though in wk through Feb 15th (1-wk lagged) edged down -5k to 1.862mn -9k below exp’s as they remain little changed since last October, remaining low historically.

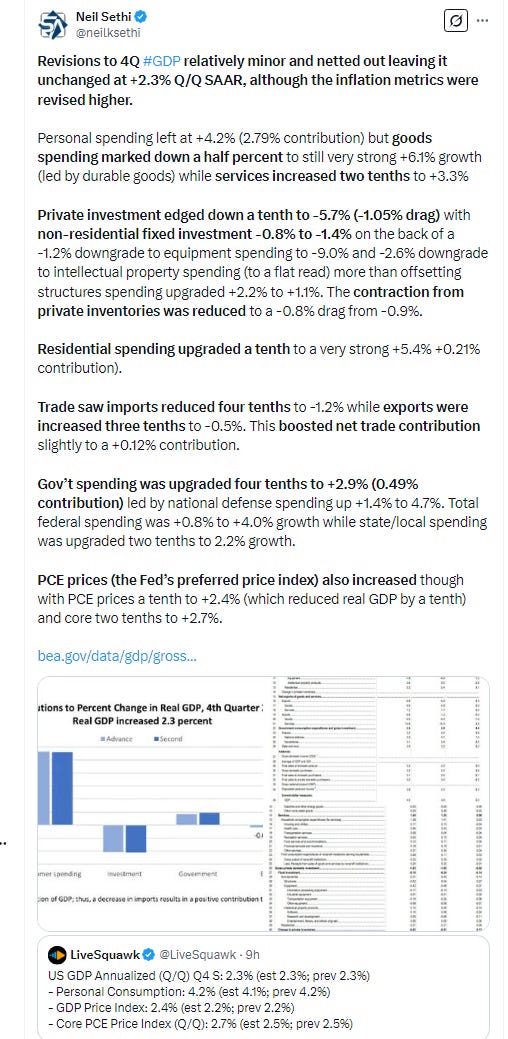

Revisions to 4Q GDP relatively minor and netted out leaving it unchanged at +2.3% Q/Q SAAR, although the inflation metrics were revised higher.

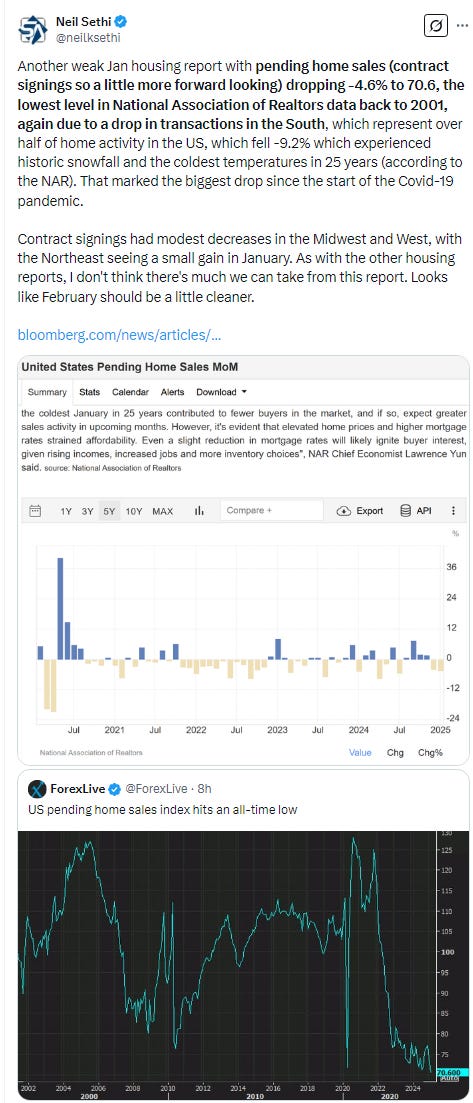

Pending home sales (contract signings so a little more forward looking) dropped -4.6% to 70.6, the lowest level in National Association of Realtors data back to 2001, again due to a drop in transactions in the South, which represent over half of home activity in the US, which fell -9.2% which experienced historic snowfall and the coldest temperatures in 25 years (according to the NAR). That marked the biggest drop since the start of the Covid-19 pandemic.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX fell to a trendline running back to the Oct ‘23 lows, the lowest close since mid-Jan. The daily MACD remains in “sell longs” positioning, and RSI the weakest since July.

The Nasdaq Composite fell below the 18,700 “breakout” level from the July high closing in on its 200-DMA. Its daily MACD tipping into “go short” positioning and its RSI also the weakest since July.

RUT (Russell 2000) fell to the weakest since mid-Sept. Its daily MACD remains in “go short” positioning, and its RSI now the weakest since 2023).

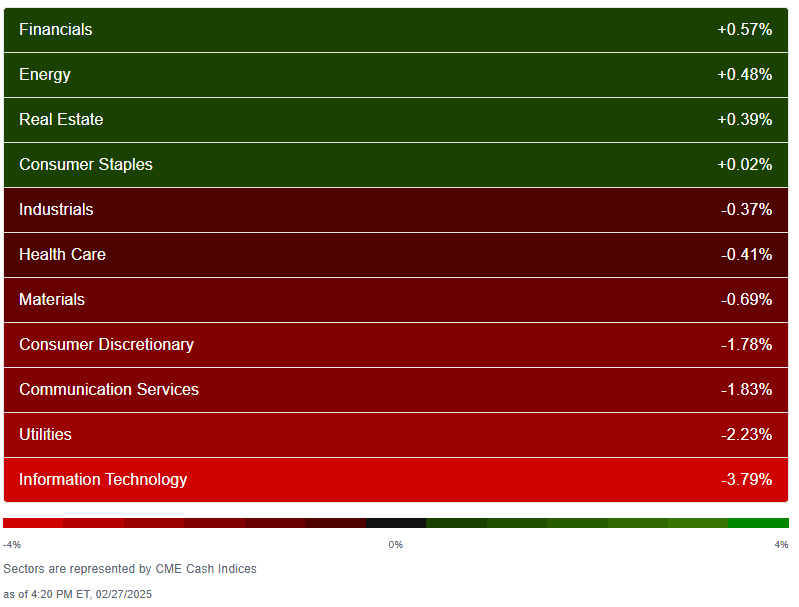

Equity sector breadth according to CME Cash Indices actually not that bad outside of the bottom four spots (the three big growth sectors and utilities) which were all down at least -1.7% (versus none Wednesday and one Tues). Still four green sectors (same as Wed, though down from 5 Mon & Tues), and two were up up more than +0.4%, versus one Wed, but still none up over +0.9% (vs two Tues).

SPX sector flag from Finviz pretty much what you would expect given that with lots of red in growth sectors (led to the downside by semiconductors) and utilities along with diagnostics and travel names. Good amount of green elsewhere.

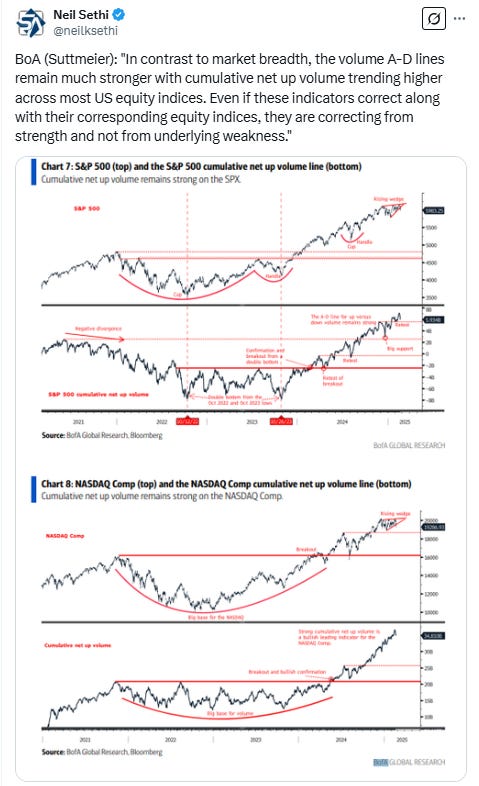

Positive volume (percent of total volume that was in advancing stocks) which has been back and forth the past few days on the weak side Thursday but not out of line with the losses at 32% on the NYSE vs the -0.6% loss in the NYSE Composite index, while the Nasdaq was 29%, again not terrible given the -2.8% loss.

Positive issues (percent of stocks trading higher for the day) were similar at 32 & 26% respectively.

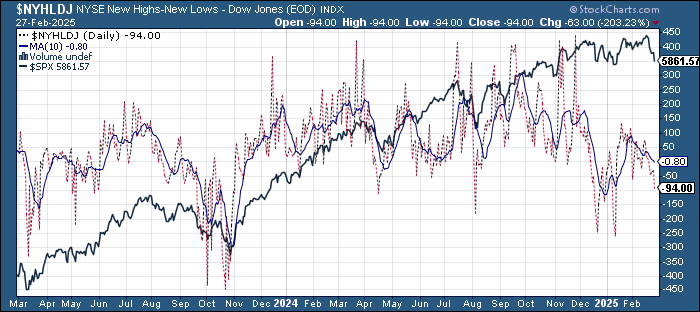

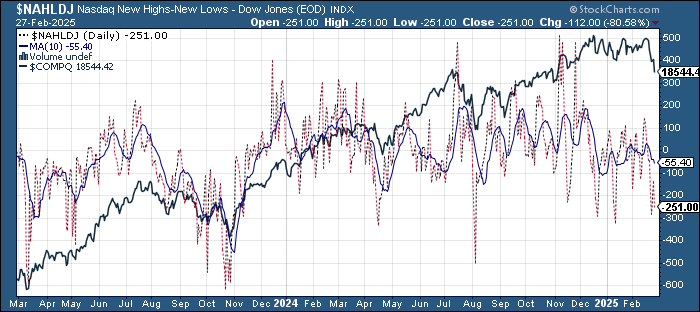

New highs-new lows (charts) deteriorated as you might expect to -92 on the NYSE (the worst since mid-Jan) while the Nasdaq fell to -252 (but still up from -288 Tues, the least since mid-Jan). Both remain below their 10-DMAs which are heading lower (less bullish).

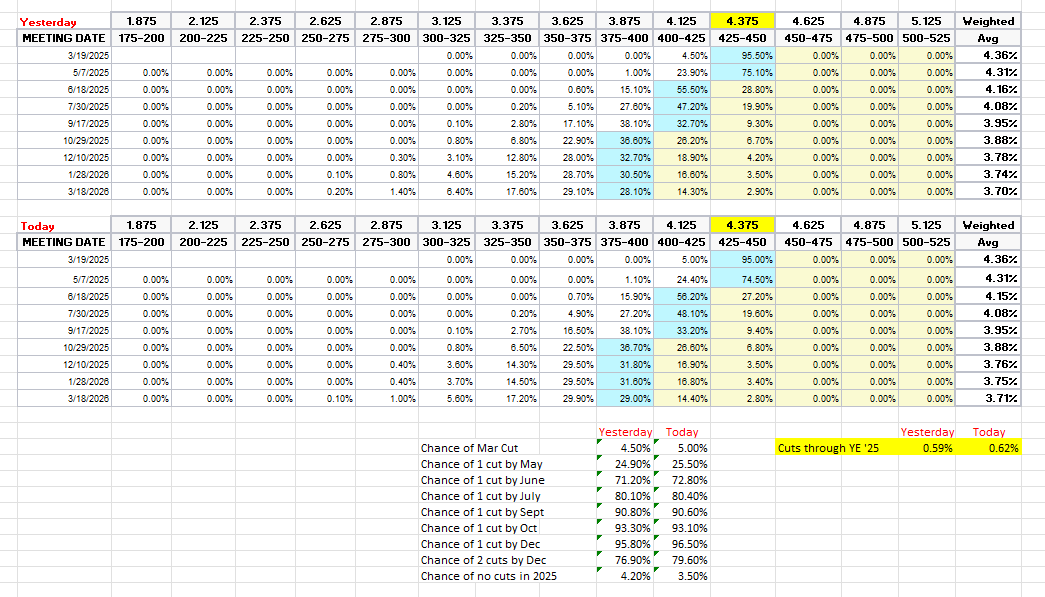

FOMC rate cut probabilities from CME’s #Fedwatch tool little added a few more basis points of 2025 rate cuts. A cut by March remains off the table at 5%, but one by June now at 73% (up from 33% the Wednesday after CPI). Chance of two 2025 cuts at 80% (vs 31%) and no cuts down to 4% (vs 29%) with 62bps of cuts priced (vs 28).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and I think we’re getting back to fairly priced. But as I said then “It’s a long time until December.”

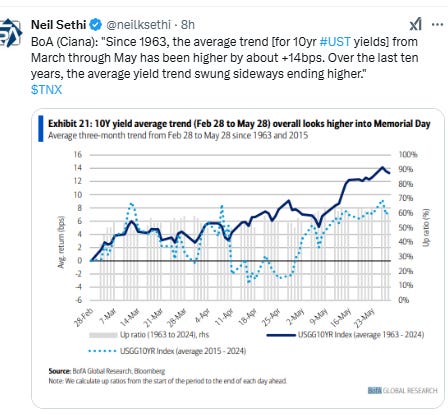

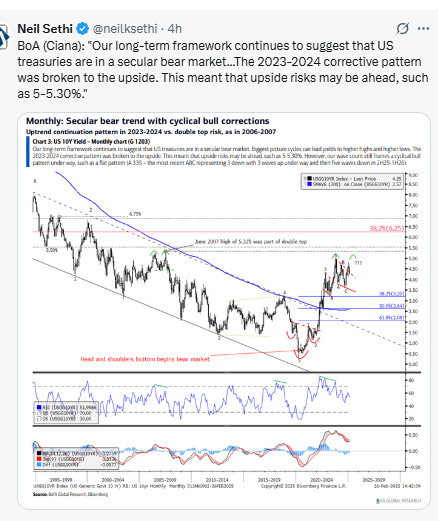

10yr #UST yield broke its 6-session streak of declines bouncing at the 200-DMA, ending +4bps to 4.29%, from the lowest close since Dec 10th, still down -37bps since CPI day (Feb 12th).

The 2yr yield, more sensitive to Fed policy, though fell for a 7th session -2bps to 4.05%, the lowest close since Oct. I had said when it was 35-45bps higher (in Jan & again 2 wks ago) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now getting closer to where I think fair value is although still only pricing around one cut.

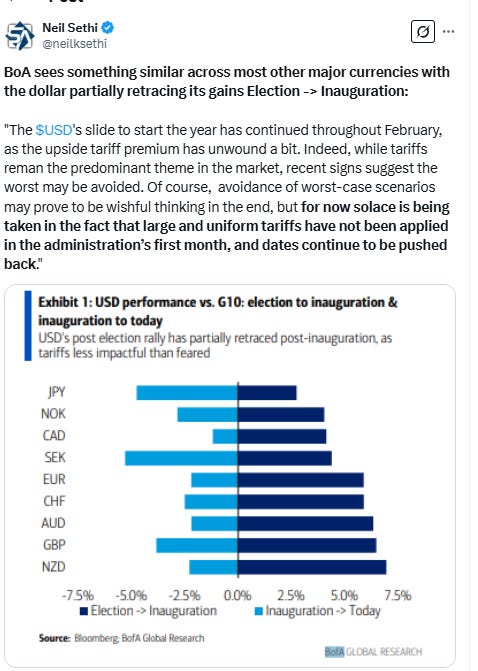

Dollar $DXY up for a second session to a 2-week closing high, gaining strength from the Trump tariff comments. Daily MACD remains in “go short” positioning but is starting to turn and RSI has broken its downtrend line and is close to pushing above 50. Seems like if it can clear the $107.60 level it has a chance to run higher.

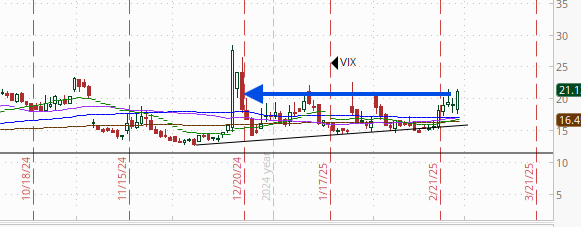

The VIX closed over 20 for the first time since Dec 19th at 21.1 (consistent w/~1.32% daily moves in the SPX over the next 30 days). As a reminder, Charlie McElligott said all strikes were clustered at around 24 but with a lower high today and Nvidia not seeing a huge reaction I don’t know that we’ll get there.

The VVIX (VIX of the VIX) also got its highest close since Dec 19th at 114 pushing further over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

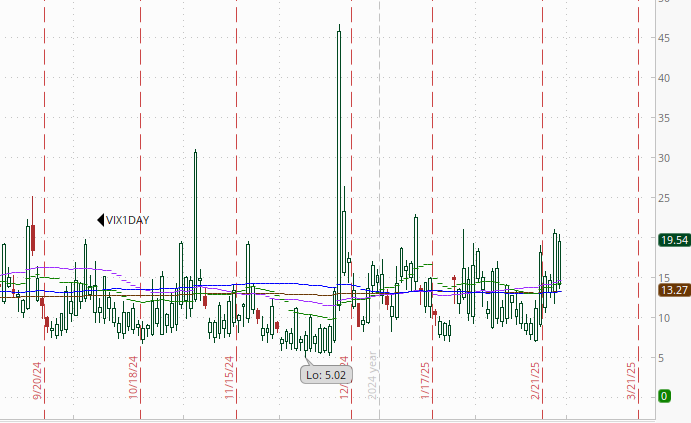

1-Day VIX remained elevated at 19.5 despite clearing Nvidia earnings (so looking for a move of 1.21% Friday). We do have personal income and spending in the morning, but probably more a function of the overall environment (as evidenced by the elevated VIX reading).

#WTI futures gained nearly 2% after Pres Trump last night revoked Chevron’s license to operate out of Venezuela, which is expected to take up to 400kbd off the market. Still, it has layers of resistance above and the daily MACD remains in “go short” positioning, while the RSI remains near the weakest since Sept. So it doesn’t really have the technical support yet.

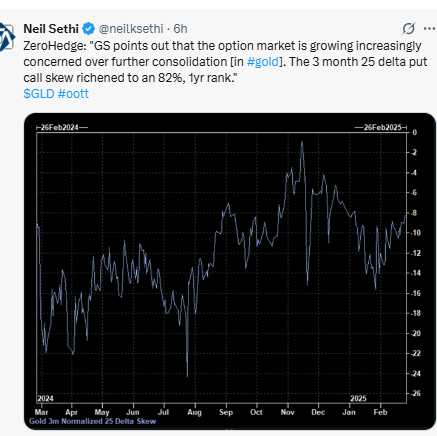

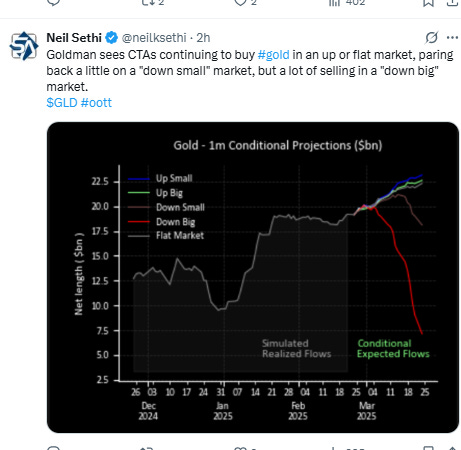

Gold futures, which closed at the lowest level in 3 weeks, have some technical issues creeping into the chart. They fell through the 20-DMA (green line), the daily MACD has crossed over to “sell longs” as noted Tuesday, while the RSI, which had a clear negative divergence (lower high), is breaking down with relative strength now the weakest since the start of the year. The 9-week up streak is definitely in jeopardy. Good news is solid support starting at 2800.

Copper (/HG) futures little changed, trapped between the $4.70 level on the upside and the support of the 20-DMA on the downside. As noted Tuesday the daily RSI and daily MACD are not really supportive yet.

Nat gas futures (/NG) finally had a less volatile day (6 of the previous 7 sessions had moved at least 5%) finishing down modestly right on a trendline running back to the Jan low. Daily MACD remains in “go long” positioning but is rolling over while the RSI remains over 50 but falling.

Bitcoin futures were able to make a stand at the $82k level finishing little changed. I still think $77k is the most logical place for a bottom, but that certainly doesn’t mean it can’t be $82k. Relative strength remains the weakest since July '23, while the daily MACD remains solidly in “go short” territory.

The Day Ahead

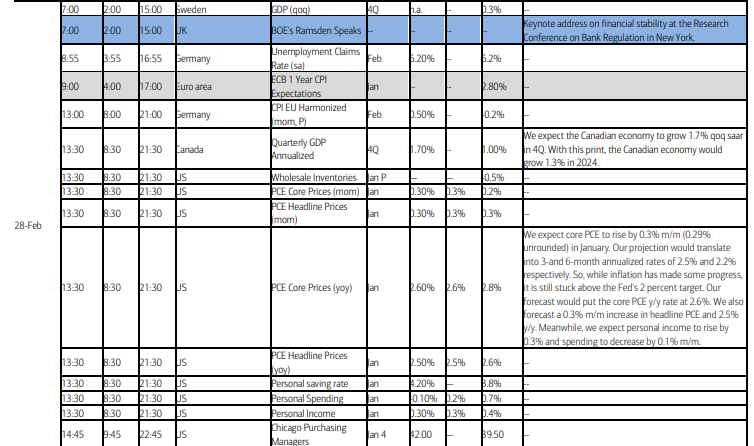

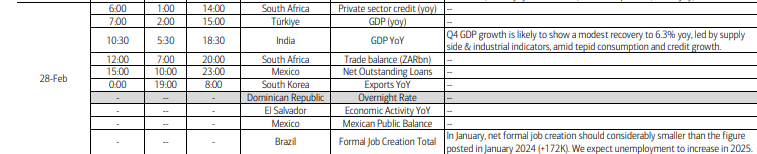

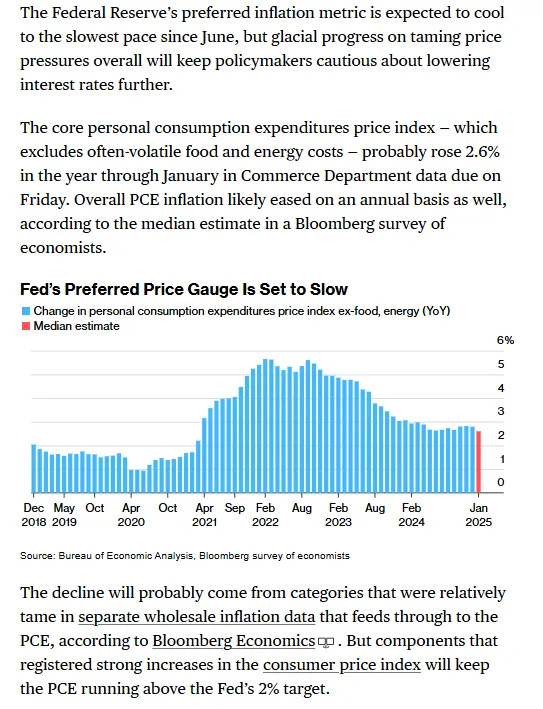

US economic data gives us our premier report of the week in the Jan personal income and spending report, our most wholistic look at incomes and spending which also includes the Fed’s favorite inflation metric, core PCE prices. The good news is you can get a pretty good indication for how that report is going to play out from all the data that precedes it during the month (CPI, PPI, nonfarm payrolls, spending reports, etc.), but you just never know until you get it for sure. . The median estimate for core PCE is a very "low"+0.3% (+0.26%) which could easily slip to a "better than expected" +0.2% just by coming in a couple hundredths under that (some more below on expectations). Also, watch the personal spending number. If that comes in under expectations, it could add to the “growth scare” bets. We’ll also get preliminary Jan wholesale inventories and the goods trade balance.

In Fed speakers we’ll get Barkin and Goolsbee.

Earnings light with no SPX components reporting (see the full earnings calendar from Seeking Alpha).

Ex-US highlights are Feb Tokyo CPI (overnight, leading indicator for Japan), Germany, France & Italy CPI as well and Germany unemployment (BBG had it yesterday mistakenly), UK home prices, and EU inflation expectations, Jan Japan industrial production and retail sales, Germany trade prices and retail sales, Canada 4Q GDP. In EM we’ll get GDP from India and Turkey, South Korea exports, and a policy decision in the Dominican Republic among other items.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,