Markets Update - 2/28/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

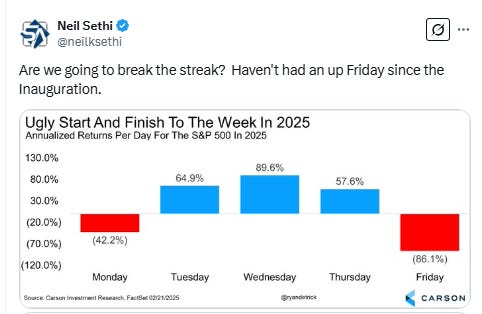

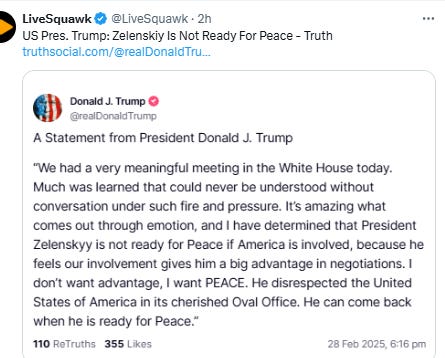

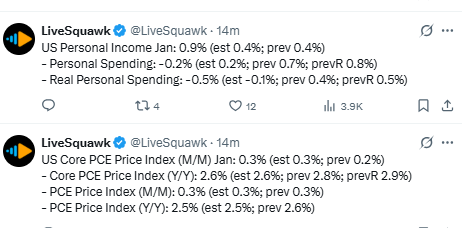

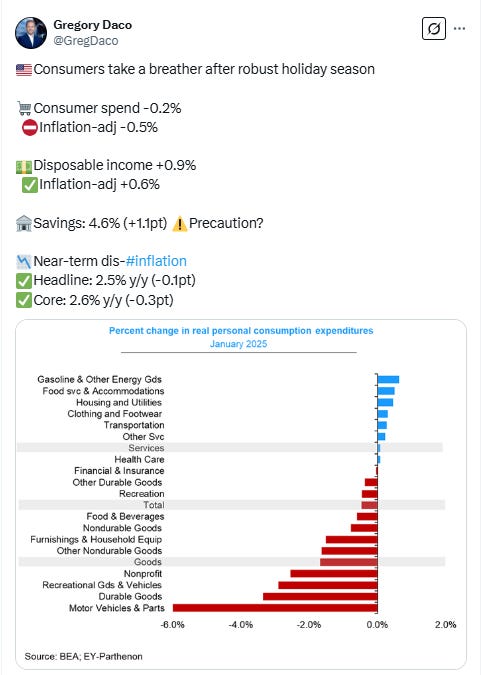

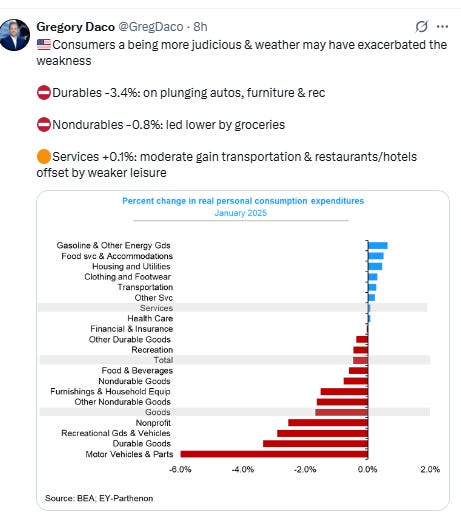

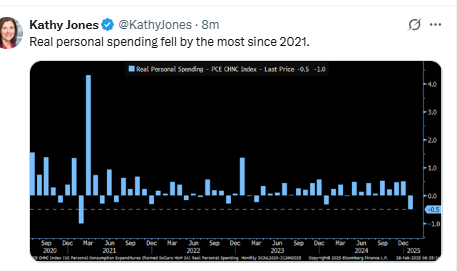

Major US equity indices started the day again mixed with large cap indices looking to open modestly higher trying to avoid a second down week, but with a lot of work to do, particularly as there hadn’t been an up Friday since the inauguration, after a mixed personal income and spending report (which showed much stronger than expected incomes, but much weaker than expected spending (which saw the savings rate jump) but in-line PCE prices). Stocks did though rise from there but encountered some turbulence in the afternoon after President Zelenskyy argued with President Trump and VP Vance during an extraordinary moment in front of the media in the Oval Office during which Trump made a reference to “World War III”. This saw equities give back their gains, but they found their footing later in the afternoon to press higher again, finishing at the highs with solid gains. Still, it wasn’t quite enough to get most of the indices (the DJIA an exception) into the green.

Treasury yields fell again as Fed rate cut bets moved to new highs of the year. The dollar though continued its rise on the Trump tariff threats, while gold, crude, nat gas and copper fell back. Bitcoin saw a slight gain but only after a big reversal from a steep loss early in the session.

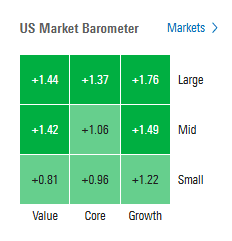

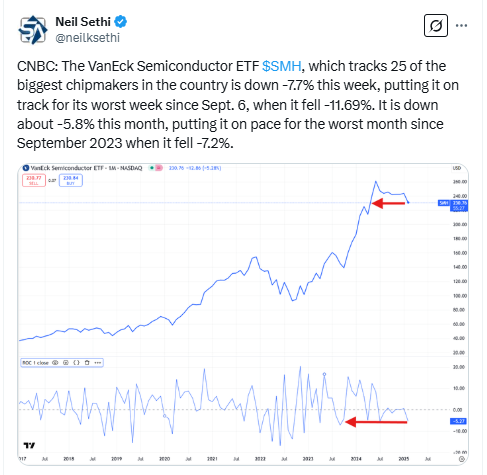

The market-cap weighted S&P 500 (SPX) was +1.6%, the equal weighted S&P 500 index (SPXEW) +1.1%, Nasdaq Composite +1.6% (and the top 100 Nasdaq stocks (NDX) +1.6%), the SOX semiconductor index +1.7% (still down -7.2% for the week), and the Russell 2000 (RUT) +1.1%.

Morningstar style box showed the broad strength with a slight edge to growth but not by much.

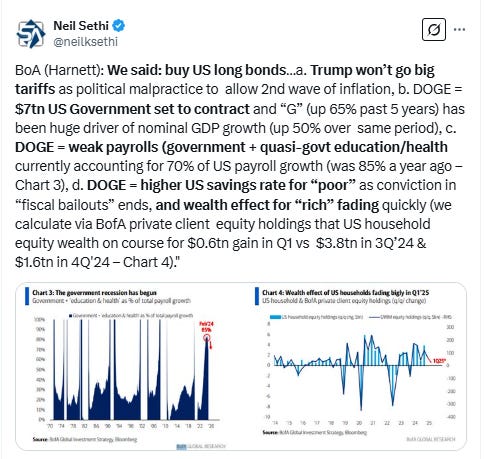

Market commentary:

“While additional rate cuts are still probably many months away, we believe this report helps to keep one or two rate cuts on the table for 2025,” said Robert Ruggirello at Brave Eagle Wealth Management. “We believe that inflation is yesterday’s problem and that the data will continue to improve going forward.”

To David Russell at TradeStation, the PCE report provides a “little comfort” after the worrisome print on consumer prices (CPI). “The drop in personal spending confirms the negative retail sales data we got earlier, suggesting the economy started 2025 on a soft footing,” he said. “Combined with the weak data so far in February, growth is becoming more of a concern for Wall Street. The consumer may finally be throwing in the towel.”

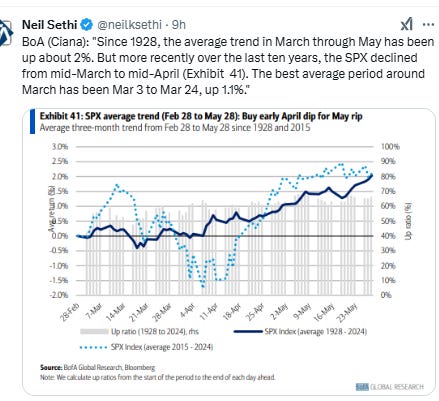

“February is seasonally a volatile period of time for stocks, and that historical trend is playing out right now,” said Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management. “Investors are in search of more clarity on tariffs, elevated inflation and the state of the consumer.”

Chris Zaccarelli at Northlight Asset Management says he’s very cautious on the market given the high current valuations, the high policy uncertainty companies are forced to navigate and a consensus belief that recession risk is non-existent (or extremely low).

“I’m disturbed by what I just saw,” said investor Jim Lebenthal of Cerity Partners on CNBC’s “Halftime Report.” “If the policies in foreign affairs are now to empower Russia and Vladimir Putin, I don’t think that’s good for the stock market. I don’t think that’s good for the global economy. I find it hard to make a case otherwise.”

“This is a fragile market,” said Adam Phillips at EP Wealth Advisors. “The anxiety is clear in the market’s behavior and we’re hearing it in the voices of many clients as well. The market is struggling for direction today, but we’re bracing for additional volatility ahead as we await clarity on a long and growing list of issues.”

“This is still a very news-driven market and any hints of escalation, or no resolution with Russia [and] Ukraine, should be expected to add to volatility, in an already volatile week,” said Larry Tentarelli, founder and CEO of Blue Chip Daily Trend Report. “From a markets perspectives, I would expect these higher volatility newsbytes at any time, until resolved.”

To Jay Hatfield at Infrastructure Capital Advisors, while the market was rattled by the US-Ukraine headlines, the indication is that Trump will force peace - which is positive. George Goncalves at MUFG Securities Americas says that after major moves like we’ve had in the last week, there’s “always that one last grain of sand - this time geopolitical.”

“It’s just uncertainty in general,” said Matt Maley at Miller Tabak + Co. “With so many different comments coming out of the White House that impact the markets, it’s hard for investors to have a lot of confidence on the near-term outlook.”

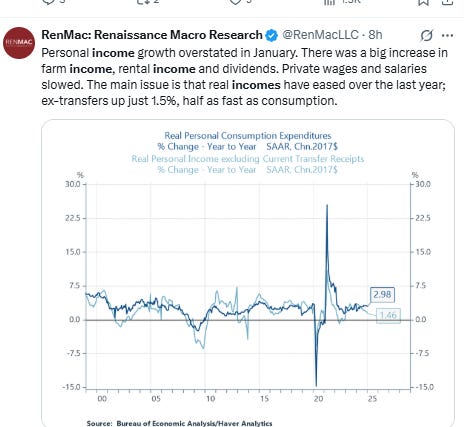

“Softer consumer spending and slower income growth should catch the Fed’s attention,” said Jeff Roach at LPL Financial. “Despite the deceleration in the annual pace of inflation, the monthly rate is still running hotter than the Fed would like.” Roach says investors will continue to focus on the uncertain growth trajectory as real spending unexpectedly fall in January from weaker consumer demand. “The odds are rising that the Fed’s next rate cut will be in June,” he said. “Whether the next cut happens then or in July is less relevant than the number of cuts by end of year. The current macro backdrop suggests only two cuts in total this year but more in 2026.”

The latest inflation and spending data from Friday’s personal consumption expenditures report point to “a worrisome monetary policy conundrum” for the Federal Reserve, according to Olu Sonola, the head of U.S. economic research at Fitch Ratings. “The decline in consumer spending, the first since April of 2024, was largely driven by a pullback in durable goods spending, particularly motor vehicles,” Sonola said in emailed comments Friday. “The decline is not necessarily a surprise given the very strong pace of growth at the end of 2024. A pull back at some point was inevitable.” While the inflation reading from the PCE price index was in line with Wall Street’s expectations, it’s still above the Fed’s 2% target. The “combination of sticky inflation and a potential growth scare” seen in Friday’s PCE report risks complicating the Fed’s monetary policy, said Sonola. “The outlook gets even murkier as the threat of tariffs permeates business and consumer confidence,” he said. “We may be entering a deer in the headlights moment for the Fed."

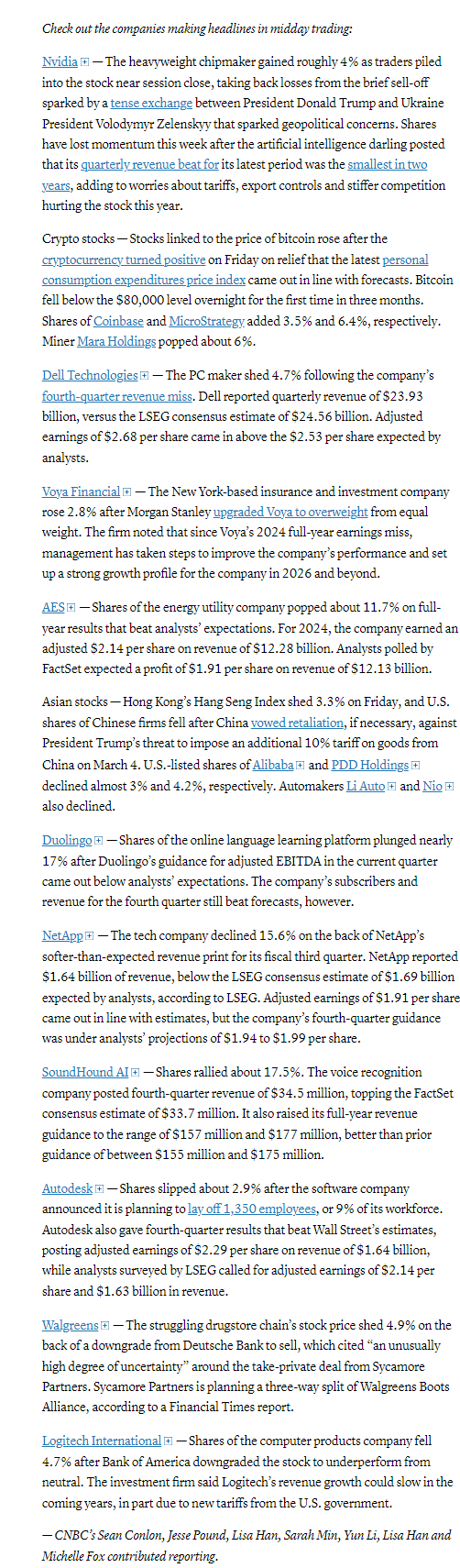

In individual stock action, just about everything came along for the afternoon rise, which was led by big gains in mega cap stocks following a soft showing this week in the space. NVIDIA (NVDA 124.92, +4.77, +4.0%), Apple (AAPL 241.84, +4.54, +1.9%), and Microsoft (MSFT 396.99, +4.46, +1.1%), which comprise nearly 20% of the S&P 500 in terms of market capitalization, were standouts from the space. Berkshire Hathaway shares hit another record during Friday’s trading, riding high on a stellar earnings report.

Solar energy stocks though were feeling the heat. Enphase Energy, which is down around 4.8% Friday, is trading at lows not seen since July 2020 as it paces for its worst week since November 2024. Meanwhile, First Solar is trading at lows not seen since November 2023 as it paces for its worst month since October 2024. On Friday, shares fell 2.8%. Solar stocks have gotten burned since President Trump won the election in 2024. Enphase Energy and First Solar have plunged 35.2% and 36.4%, respectively, during the period.

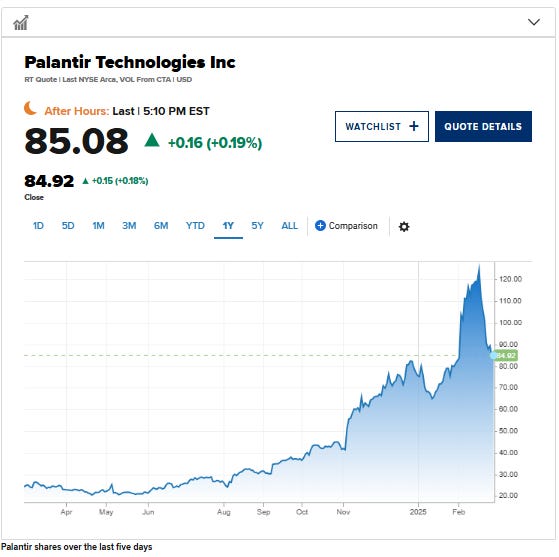

Shares in tech darling Palantir were able to edge to a +0.2% close but still finished down -16% this week, Palantir’s worst weekly performance since the week ending Feb. 26, 2021, when it fell 17.6%, its worst week on record. It was the first back-to-back double-digit weekly loss for Palantir since August 2022. Shares are now trading more than 30% below their 52-week high.

BBG Corporate Highlights:

Microsoft Corp. is signaling the end of the line for Skype, the iconic internet calling and chat service it bought almost 14 years ago.

Bath & Body Works Inc., a retailer of personal care products, was upgraded at Citigroup Inc. in the wake of the company’s results.

Redfin Corp., an online real estate company, reported fourth-quarter results that were weaker than expected on key metrics and gave an outlook that is seen as disappointing.

Rocket Lab USA Inc. delayed the launch of its Neutron rocket to the second half of the year and issued a revenue forecast for the first quarter which fell short of estimates. This prompted analysts to either lower or place their price targets under review.

Some tickers making moves at mid-day from CNBC.

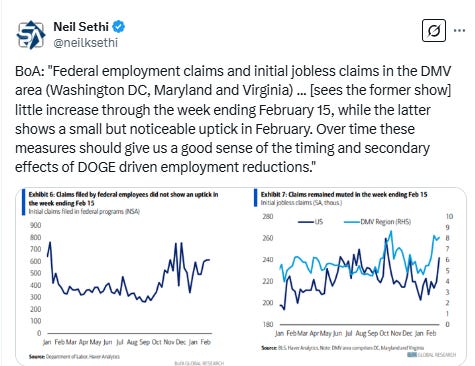

In US economic data:

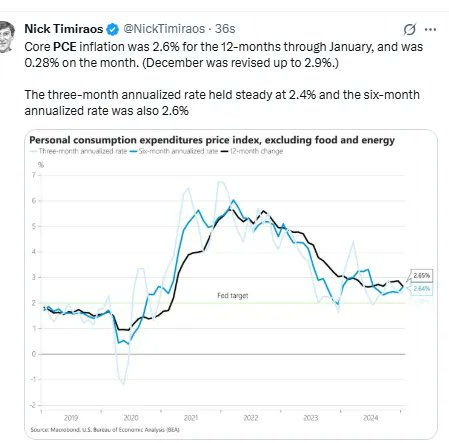

We got a mixed personal income and spending report which showed much stronger than expected incomes, but much weaker than expected spending (which saw the savings rate jump) but in-line PCE prices. I’ll have more details on this Monday, but good details below.

The Jan goods trade deficit blew out another +$31.3bn (+25.6%) to $153.3bn, way above exp's for +$116.6bn on a surge in imports (+12%) on continued tariff front-running. The goods deficit is now +57% since October. I’ll have more details on this as well.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

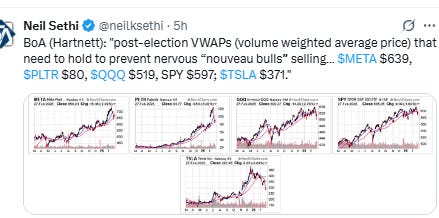

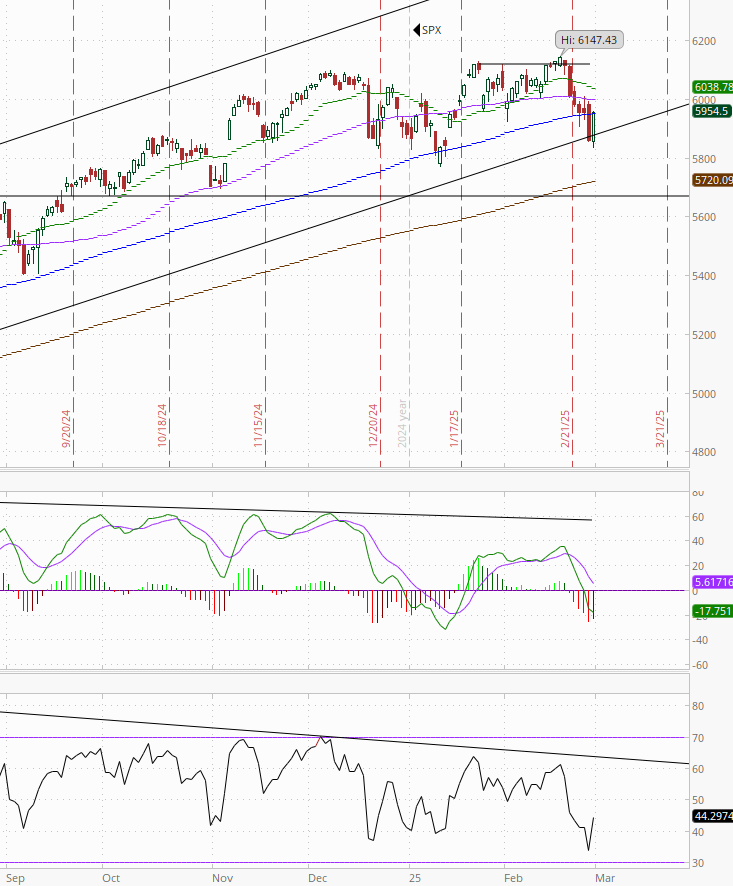

The SPX got a much needed bounce Friday, interestingly at level (5858) that has no particular significance that I can tell (but perhaps coincided with Nasdaq bounce (see below)). It gets it back above that trendline running back to the Oct ‘23 lows from the lowest close since mid-Jan. The daily MACD remains in “sell longs” positioning, and RSI was the weakest since July, so technicals for now say it’s just a bounce..

The Nasdaq Composite unlike the SPX bounced at a key level, the 200-DMA. It also got back over the “breakout” level of 18,700. Its daily MACD though remains in “go short” positioning and its RSI like the SPX off the weakest since July.

RUT (Russell 2000) like the SPX bounced Friday from an area with no particular significance in my work from the weakest since mid-Sept. Its daily MACD remains in “go short” positioning, and its RSI just off the weakest since 2023.

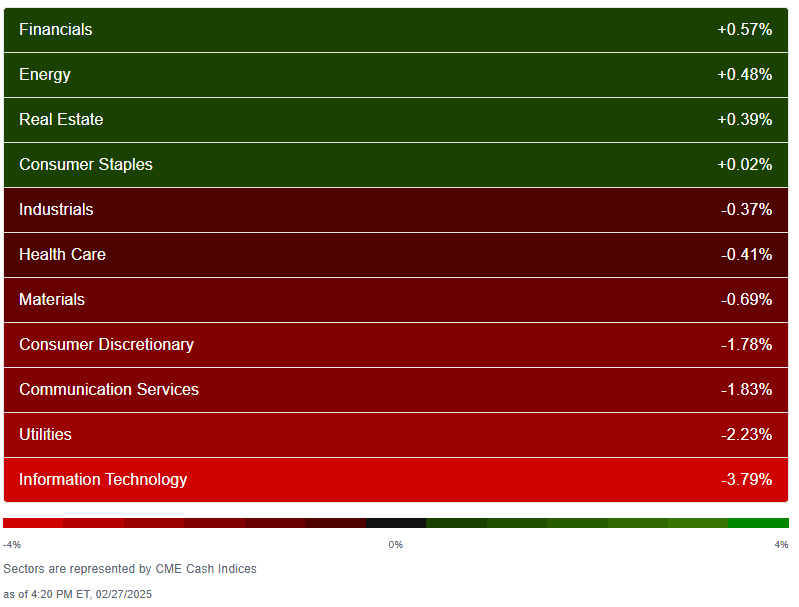

Equity sector breadth according to CME Cash Indices very strong with every sector up at least +0.8% and nine of the eleven up over 1%. The megacap growth sectors did well (two of top three spots along w/financials) while defensives lagged taking 3 of bottom 4 spots.

SPX sector flag from Finviz pretty much what you would expect given that with lots (and lots) of green with some of the hardest hit sectors this week bouncing back the strongest. Have to pick out the red.

Positive volume (percent of total volume that was in advancing stocks) which has been back and forth the past few days improved but nothing to write home about Friday at 69% on the NYSE mediocre versus the +1.1% gain in the NYSE Composite index, while the Nasdaq was 68%, even more mediocre considering the +1.6% gain.

Positive issues (percent of stocks trading higher for the day) a little worse at 67 & 61% respectively.

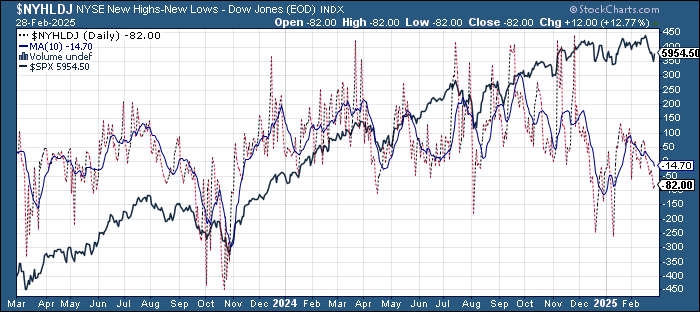

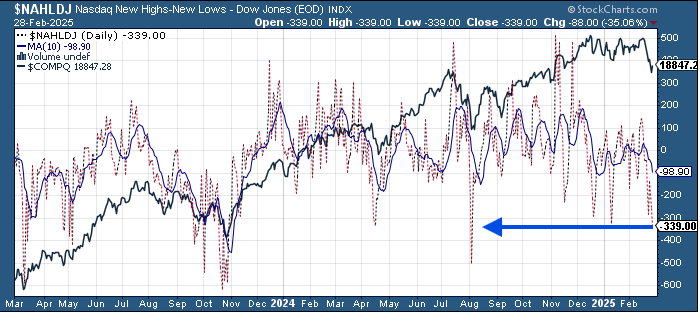

New highs-new lows (charts) were even more disappointing. NYSE barely improved to -81 from -92 (which was the worst since mid-Jan) while the Nasdaq fell to -341 (the least since August). Both remain below their 10-DMAs which are heading lower (less bullish).

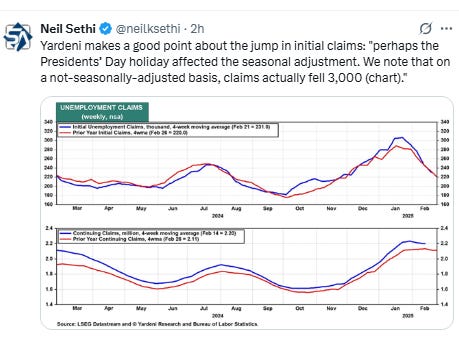

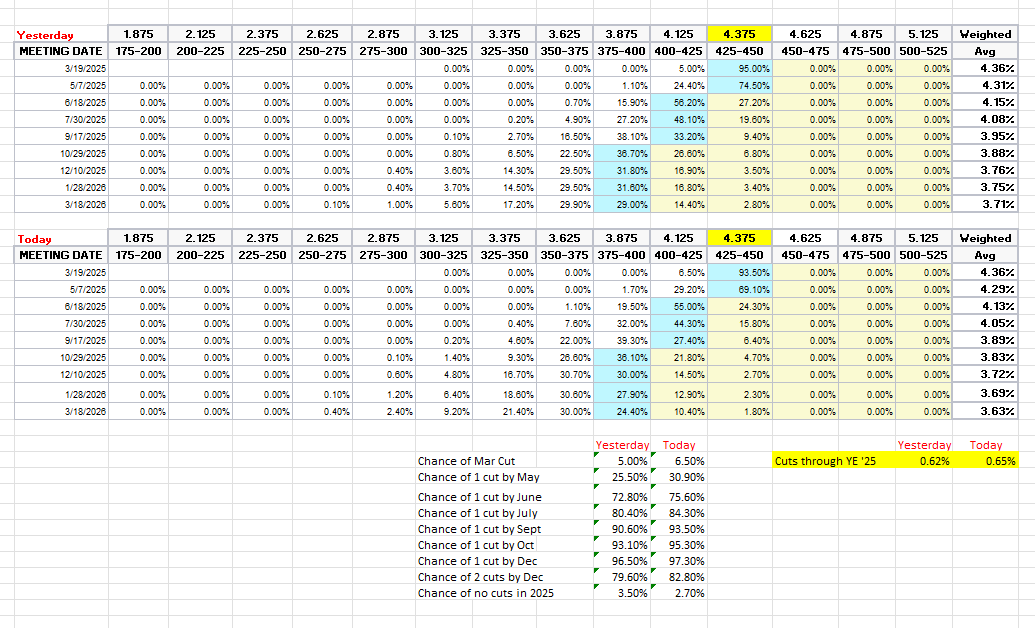

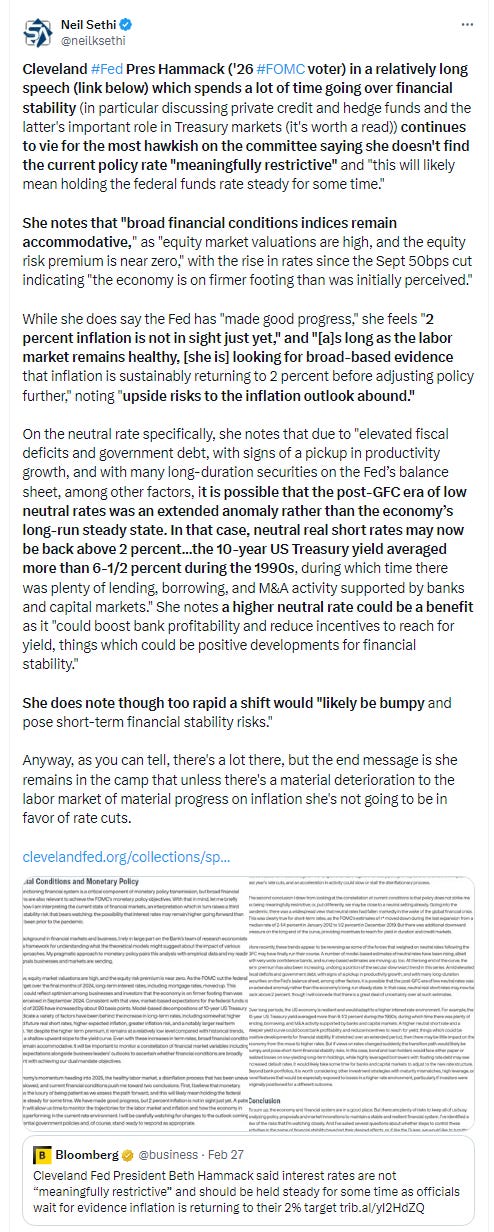

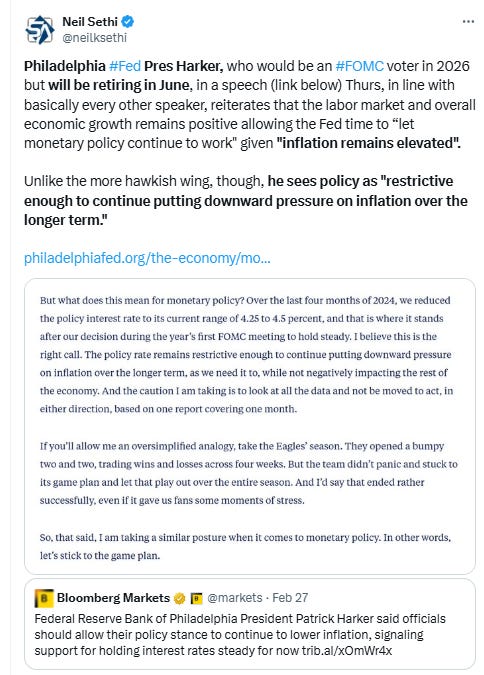

FOMC rate cut probabilities from CME’s #Fedwatch tool little added a few more basis points of 2025 rate cuts. A cut by March remains off the table at 7% (although that’s up from 3% earlier this week), but one by June now at 76% (up from 33% the Wednesday after CPI). Chance of two 2025 cuts at 83% (vs 31%) and no cuts down to 3% (vs 29%) with 65bps of cuts priced (vs 28).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and I think we’re getting back to fairly priced. But as I said then “It’s a long time until December.”

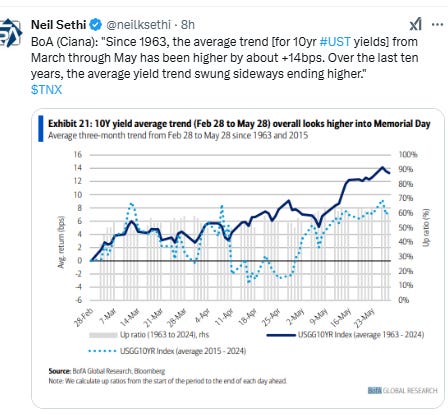

10yr #UST yield down for the 7th session in eight Friday (and 5th straight week) edging just under the 200-DMA, -6bps to 4.23%, the lowest close since Dec 10th, now down -43bps since CPI day (Feb 12th). Feels like we might be heading for that test of 4.13% (the Dec low)?

The 2yr yield, more sensitive to Fed policy, though fell for an 8th consec session Friday -7bps to 3.99%, the lowest close since Oct (and first time under 4% since then). I had said when it was 40-50bps higher (in Jan & again 2 wks ago) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now definitely getting closer to where I think fair value is although still only pricing around 1.5 cuts. Ian Lygan of BMO sees it going to 3.5% by year’s end.

Dollar $DXY up for a third session Friday to a 2-week closing high, continuing to gain strength from Trump tariff comments. Daily MACD has now crossed over to “cover shorts” positioning (circle) and RSI has broken its downtrend line and pushed above 50. I said Thursday “seems like if it can clear the $107.60 level it has a chance to run higher,” and it’s right there.

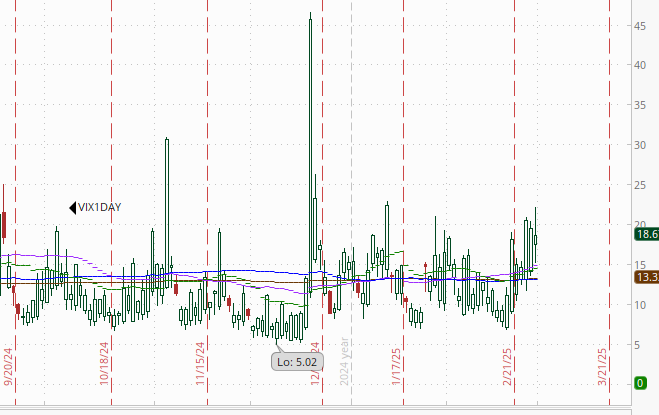

The VIX fell back Friday to 19.6 after closing over 20 for the first time since Dec 19th Thursday (still though consistent w/~1.2% daily moves in the SPX over the next 30 days).

The VVIX (VIX of the VIX) also fell back Friday from its highest close since Dec 19th remaining though over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100))

1-Day VIX also fell back but remained elevated at 18.7 consistent with what we’ve seen since the Inauguration (higher implied volatility heading into the weekend). It’s looking for a move of 1.14% Monday).

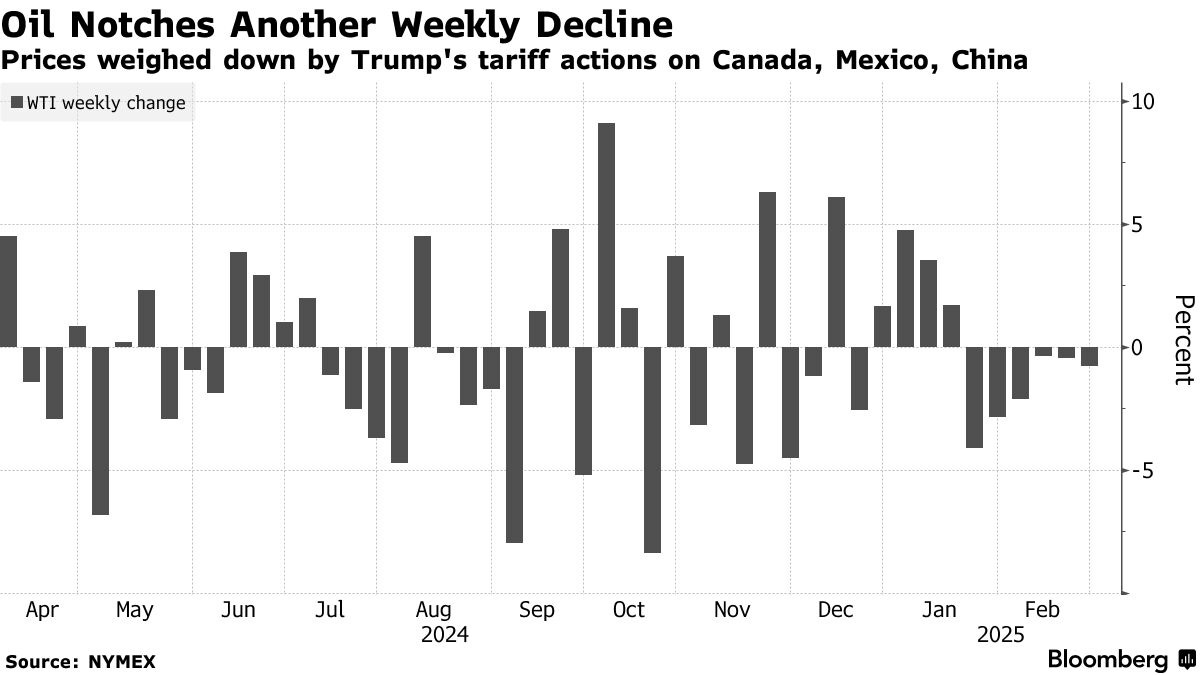

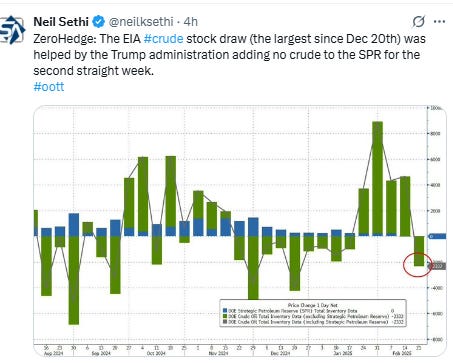

#WTI futures edged lower Friday to close out a 6th consecutive weekly loss with the lowest weekly close of the year, not able to build on Thursday’s gain after Pres Trump revoked Chevron’s license to operate out of Venezuela. Daily MACD remains in “go short” positioning, while the RSI remains near the weakest since Sept. So as I noted Thursday it doesn’t really have the technical support yet to make a run higher.

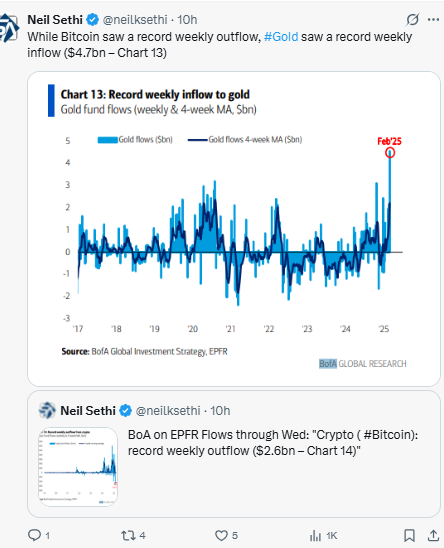

Gold futures fell for a third day in four Friday to end the 9-week streak of weekly gains. It’s at the lowest level in 3 weeks, and as noted Thursday “we have some technical issues creeping into the chart. They fell through the 20-DMA (green line), the daily MACD has crossed over to “sell longs” as noted Tuesday, while the RSI, which had a clear negative divergence (lower high), is breaking down with relative strength now the weakest since the start of the year (and below 50). Good news is solid support starting at 2800.” That’s now my target.

Copper (/HG) futures edged lower Friday remaining trapped between the $4.70 level on the upside and $4.50 on the downside. As noted Tuesday the daily RSI and daily MACD are not really supportive yet.

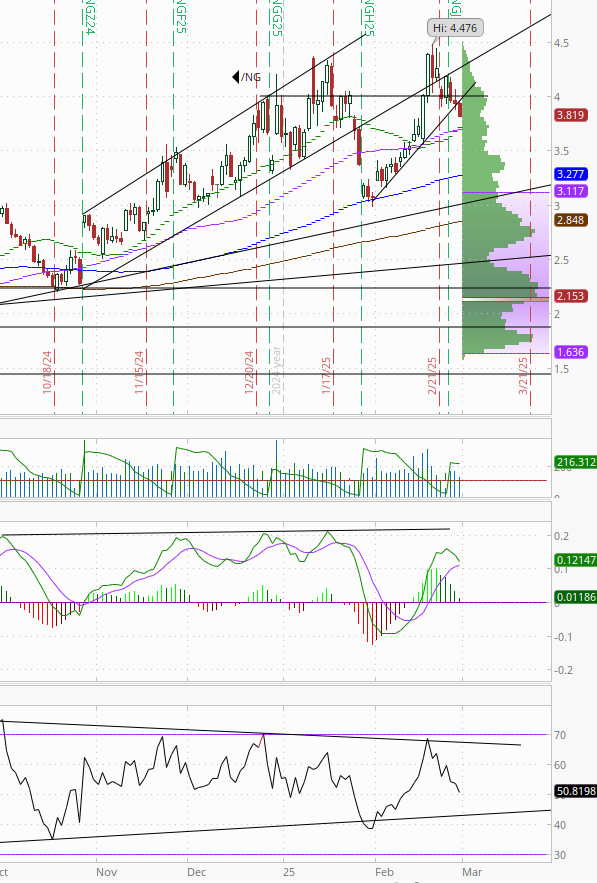

Nat gas futures (/NG) fell back -3% Friday to finish at a 10-day low and breaking the uptrend from the Jan low. Daily MACD remains in “go long” positioning but is very close to crossing over while the RSI remains just over 50 but falling.

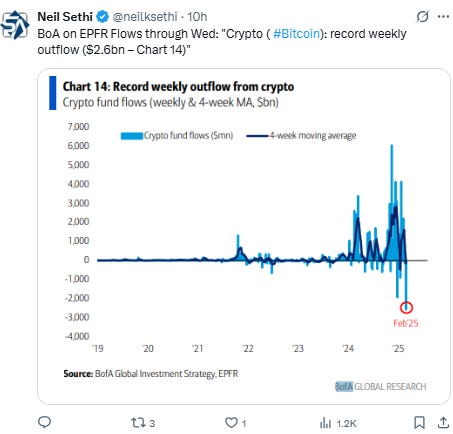

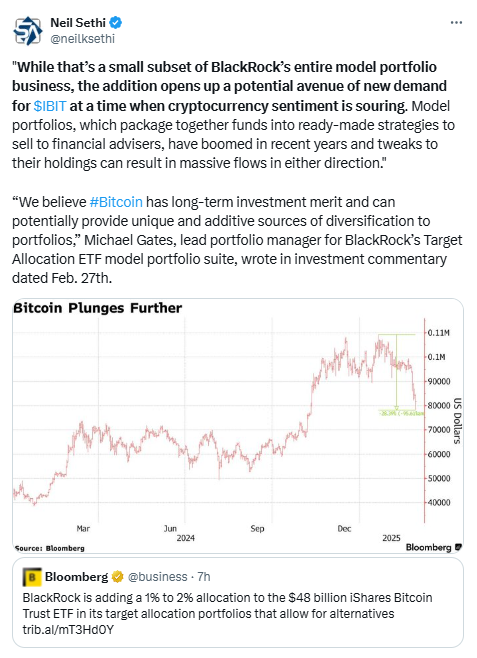

Bitcoin futures fell early in the Friday session to just above my $77k target but saw a sharp rebound from there to finish slightly higher on the day. Relative strength remains just off the weakest since July '23, but crossed from under to over 30 (generally bullish), although the daily MACD remains solidly in “go short” territory. Still I think this sets up that $77k level as potentially providing some solid support.

The Day Ahead

Enjoy the weekend. Somehow this “lighter” week seemed to be busier than some of the “busier” weeks earlier in the month. Unfortunately no rest for the weary with a “busier” week upcoming. More on Sunday.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,