Markets Update - 2/3/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

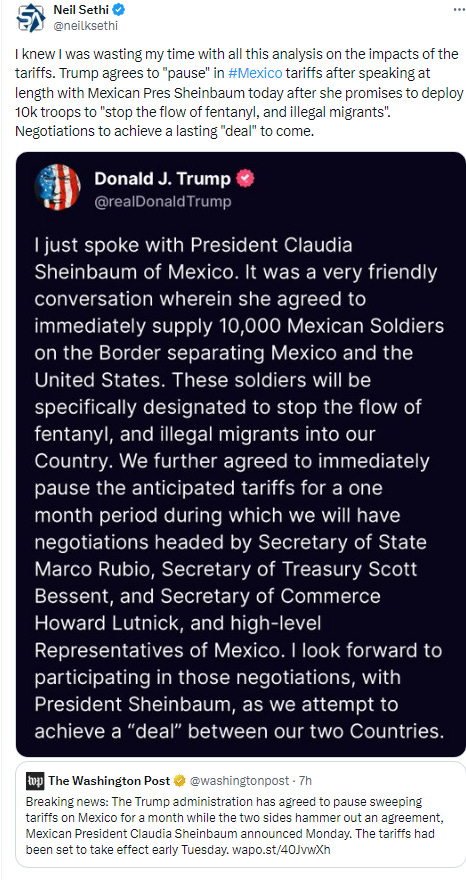

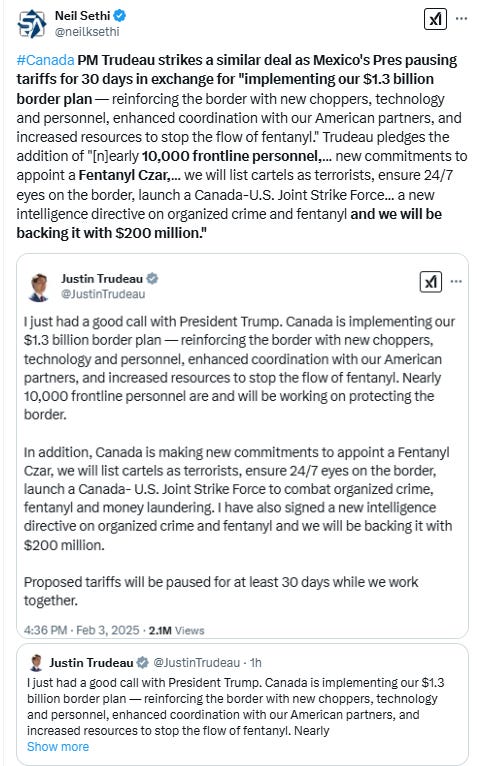

US equities started the week off deep in the red following US Pres Trump signing executive orders over the weekend instituting tariffs against Canada, Mexico, and China and threatening them against the EU. Stocks were able to find their footing after the open, but they really weren’t able to make much progress until it was announced that the Mexico tariffs would be paused for 30 days. Equities cut their losses by more than half, but trailed off into the close not able to regain positive ground. That said, the announcement on the pause with Canada was after the close, so I would imagine we will see futures in the green when they open.

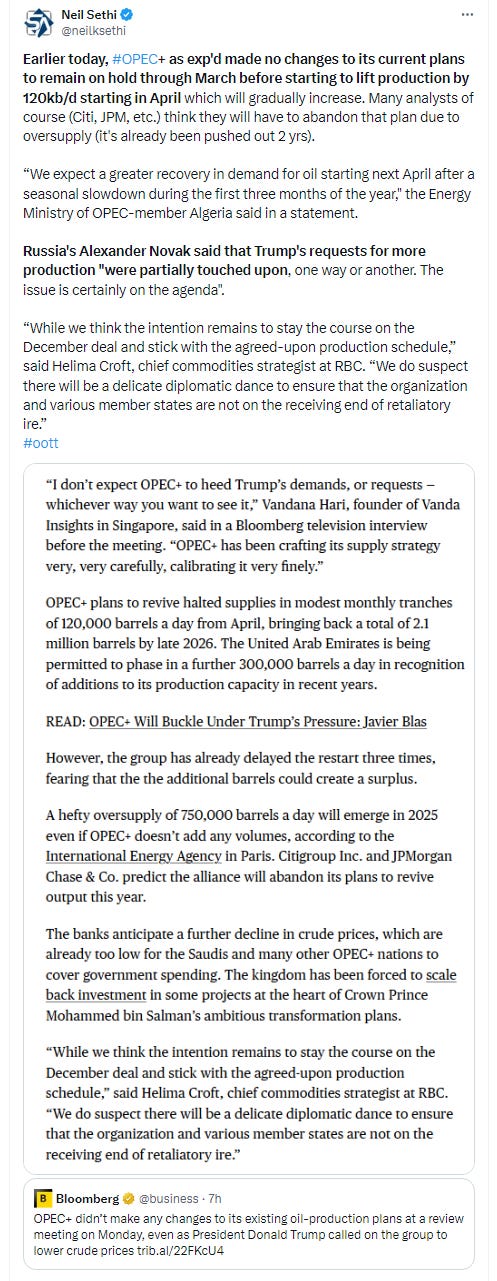

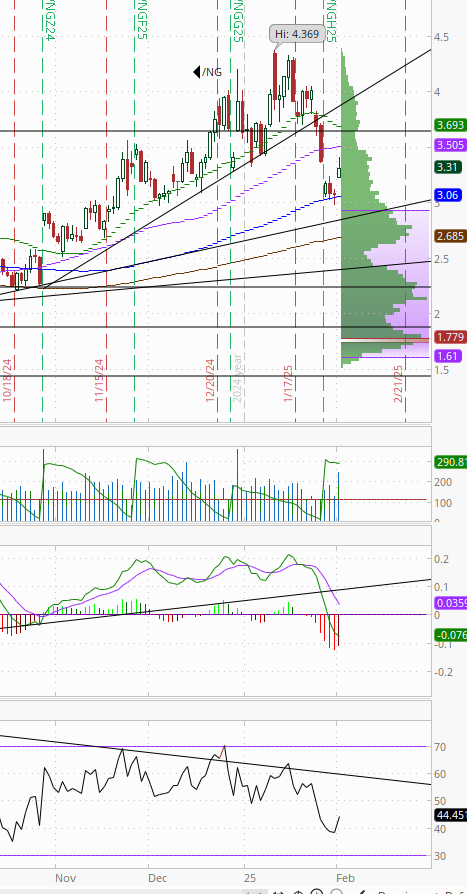

Elsewhere, bond yields were mixed with longer duration falling on growth concerns while shorter rose on inflation concerns, the dollar shot higher only to lose all of its gains by the end of the the extended session (following the Canada news), crude similarly jumped only to give all of it back by the close of futures trading, gold and bitcoin went the other direction turning big losses into small gains while nat gas finished up almost +8% on a colder long-term forecast.

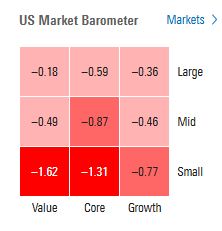

The market-cap weighted S&P 500 (SPX) was -0.8%, the equal weighted S&P 500 index (SPXEW) -0.6%, Nasdaq Composite -1.2% (and the top 100 Nasdaq stocks (NDX) -0.8%), the SOX semiconductor index -1.8%, and the Russell 2000 (RUT) -1.3%.

Morningstar style box showed the outperformance of larger caps.

Market commentary:

“Trump has made an end to the self-delusion in markets, the media and in politics that his tariff threats should be taken with a grain of salt. It has taken him only three weeks since his inauguration to raise tariffs on Canada, Mexico and China,” said Philip Marey, senior U.S. strategist at Rabobank, in a Sunday note.

“While the tariff news is not a surprise, markets had held on to a vague hope Trump may not follow through. He used tariffs as a negotiating tactic with Colombia and withdrew them once they agreed to demands,” wrote analysts at U.K.-based Matrix Trade, in a Sunday note.

“This is a very fluid and evolving situation,” said Victoria Greene at G Squared Private Wealth. “For now, our baseline thesis is the bulk of these are transitory and likely more watered down with concessions. We are on top of developments and watching how this may affect earnings, the US dollar and inflation.”

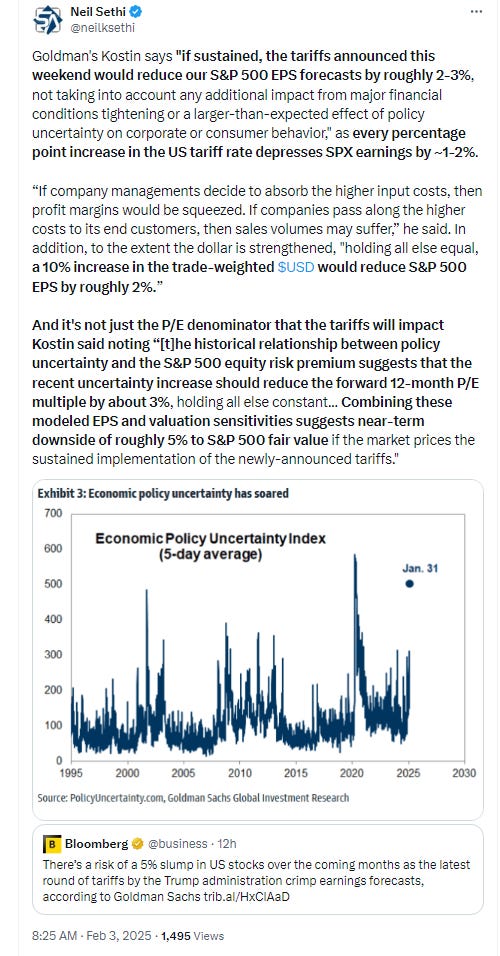

“While the direct impact on U.S. growth from the announced tariffs is still quite modest, the risk is that these policy shifts amplify concerns about future trade policy risks and potential retaliation,” wrote Goldman’s Dominic Wilson in a Sunday note. “The actions may also challenge the market’s confidence that the Administration will avoid policies that push growth lower or inflation higher.”

“Our view is that because the uncertainty is so prevalent, we are not going to make any drastic adjustments,” said Jeff Rubin at Birinyi Associates Inc. “But we would be hesitant about adding new monies to the market until the picture becomes less foggy.”

“Markets may now need to take the rest of Trump’s tariff agenda literally rather than just seriously,” said Tobin Marcus, Wolfe Research head of U.S. policy and politics, in a note. “If this new level of seriousness gets priced in suddenly, Monday could be a rough day for markets.”

To David Lefkowitz at UBS Global Wealth Management, tariff announcements could indeed generate volatility, “but in our base case, we don’t think the Trump administration will take actions that materially dent the outlook for economic or corporate profit growth.”

“At this point, we are doubtful that the tariffs on Canada and Mexico will be long-lasting, if enacted at all,” said Keith Lerner and Michael Skordeles at Truist Advisory Services. “Nevertheless, until there is clarity on the duration or magnitude of tariffs, these actions inject uncertainty into supply chains and pricing for many companies – large and small – across North America.”

At J.P. Morgan Asset Management, David Kelly says investors have every reason to be concerned about a trade war, which has the potential to impart a stagflationary impulse to the investment environment, boosting inflation and interest rates while dragging on growth and profits. “If this scenario unfolds, U.S. equities with the highest valuations are likely the most vulnerable while non-US assets and real assets could provide ballast to portfolios,” Kelly said. “Most of all, investors should ensure that they are well diversified and balanced as we head into much stronger and uncertain trade winds.”

“Trade acquiescence is what the US economy needs to skirt turbulence and widen the path toward non-inflationary growth,” said Jose Torres at Interactive Brokers. “A ramp-up in trade rhetoric and disagreements concerning global commerce will weigh on revenues, costs and margins, challenging corporate America’s ability to grow earnings.”

“We doubt that many companies will be able to avoid the impact of tariffs,” said Kathleen Brooks, research director at XTB Ltd. “Their actual implementation and the retaliatory tariffs that followed felt like crossing the Rubicon.”

The onset of tariffs on Mexico, Canada and China raises the risk that the S&P 500 will experience at least one 5%-10% drawdown this year, RBC Capital Markets strategists led by Lori Calvasina said.

Morgan Stanley strategist Michael Wilson said equity markets had so far been sanguine about the possibility of sustained levies, but that view “is likely to be tested the longer these tariffs stay on.”

“Call us deluded, but we still think that permanent tariffs on the U.S.‘s allies (Canada, Mexico) will not be a thing,” said Thierry Wizman, global FX and rates strategist at Macquarie. “That’s because concessions are an ‘easier’ way to deal with Trump’s ‘problems’ (from a cost-benefit and game-theoretic perspective), and Trump likes to make ‘deals’. Political and market pressure will also weigh on the parties to make concessions, as in 2018.”

Markets are worried that President Donald Trump’s tariffs on China, Mexico and China could spill over to Europe and further stoke volatility, according to BMO Wealth Management’s chief investment officer, Yung-Yu Ma. ″The fear for markets is that the duration of this trade war could drag on and that escalation not only with Canada, Mexico, and China is possible, but that new fronts could emerge, such as tariffs on the European Union in areas such as pharmaceuticals, semiconductors and steel, are likely to be opened while the existing ones are raging. To call this a daring strategy is a tremendous understatement,” Ma said.

“While we believe that tariffs are primarily a negotiating tool for President Trump, it’s very difficult to say whether these tariffs will be short-lived or if there is a scenario where a deal is struck that reduces the tariffs,” said Yung-Yu Ma at BMO Wealth Management. “Be patient and opportunistic; there may be a time to be aggressive, but it is not upon us yet.”

"The Trump whisperers were quite creative in explaining why Trump was not going to raise tariffs anytime soon and certainly not by early February. Well, here we are, less than three weeks into his presidency..." -- Philip Marey, Rabobank

"Globalization can only be partially dialed back, and it needs to occur over time. Doing too much too soon creates destabilizing risks. For example, one can't imagine iPhones being made in the United States, unless the process is fully automated." -- Mike O'Rourke, JonesTrading

Still, Thomas Hainlin, investment strategist at U.S. Bank, said he is cautiously optimistic about U.S. equity prices this year. “I think it’s a period where you’ve got a much lower volatility of interest rates in terms of what the Fed may do this year,” Hainlin said in a phone interview. That provides a much different backdrop from the past few years, Hainlin noted. “We just have this environment where growth is good. Interest rates seem relatively stable and inflation seems relatively stable. We still think that’s a pretty strong backdrop for solid equity price potential going forward,”noted Hainlin.

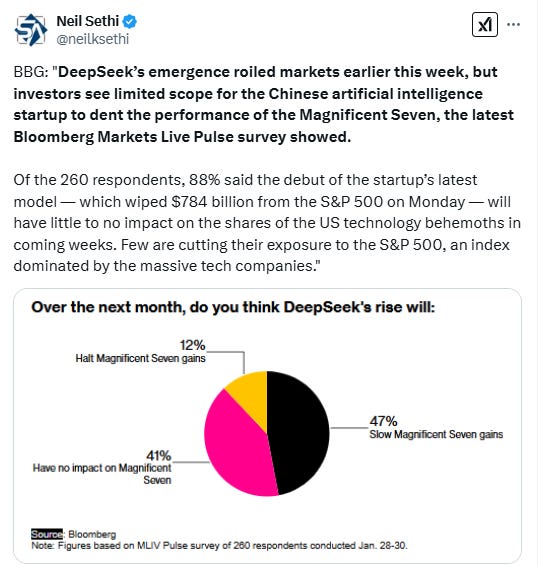

In individual stock action, carmakers, chip and industrial shares all bounced from session lows, they remained among the biggest losers. Defensive groups gained, underscoring the market’s bid for safety. A gauge of the “Magnificent Seven” megacaps sank -1.7%. A UBS Group AG basket of stocks at risk from the proposed tariffs fell -3.1%.

BBG Corporate Highlights:

Palantir Technologies Inc. gave a full-year revenue forecast that exceeded analysts’ estimates, thanks to what Chief Executive Officer Alex Karp described as “untamed organic growth” in demand for its artificial intelligence software.

Nippon Steel Corp. and United States Steel Corp. claimed former President Joe Biden unfairly prejudged their $14.1 billion merger and gave the companies no chance for feedback on a “sham” national security review before he blocked the deal.

Tyson Foods Inc.’s quarterly earnings beat even the highest of analyst estimates as stronger chicken profits helped offset losses in its beef business, prompting the company to raise its 2025 profit estimate.

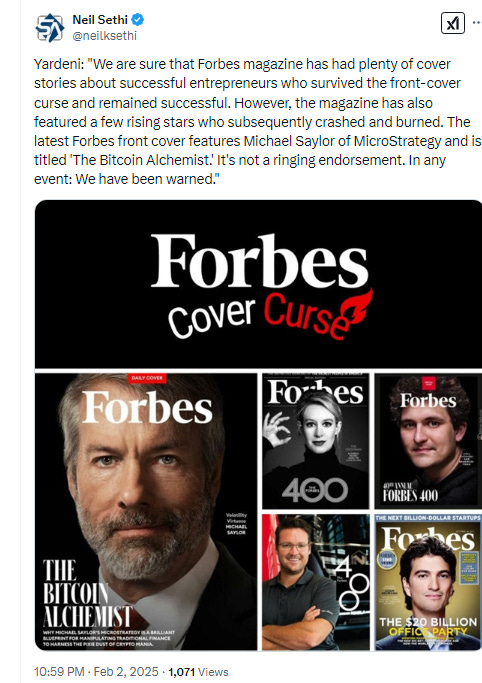

MicroStrategy Inc. said it didn’t buy any Bitcoin in the prior week, halting a string of 12 consecutive weekly purchases that began in late October.

Some tickers making moves at mid-day from CNBC.

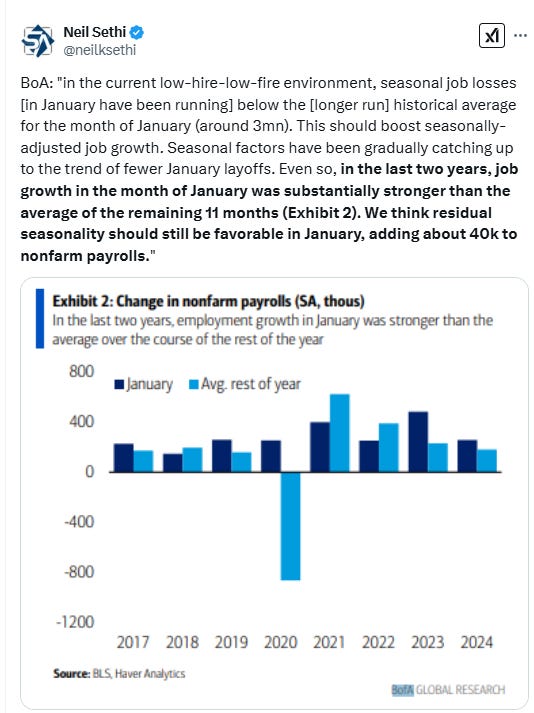

In US economic data:

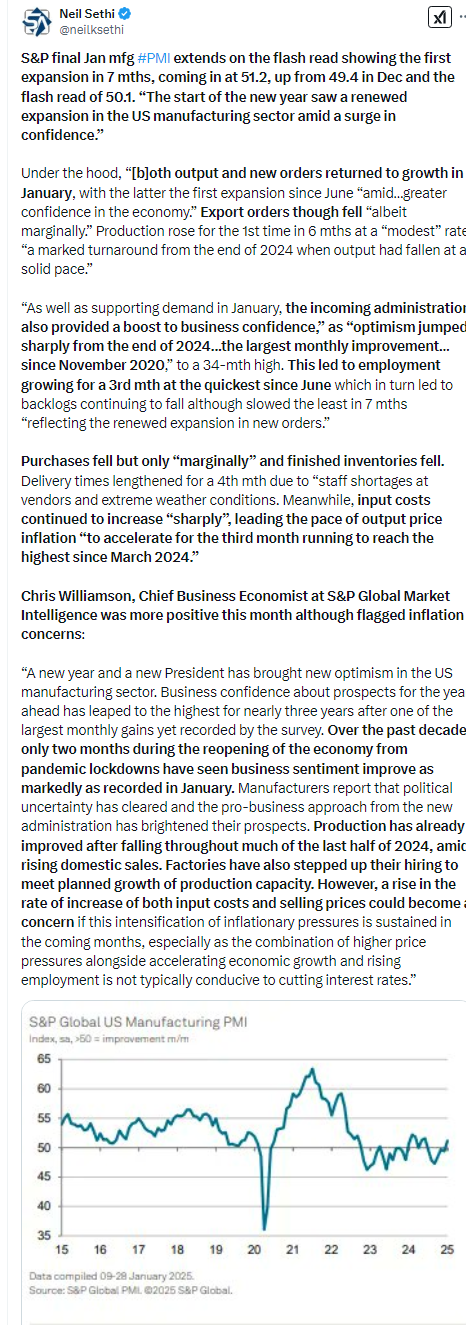

S&P final Jan manufacturing PMI extended on the flash read showing the first expansion in 7 mths, coming in at 51.2, up from 49.4 in Dec and the flash read of 50.1. “The start of the new year saw a renewed expansion in the US manufacturing sector amid a surge in confidence.”

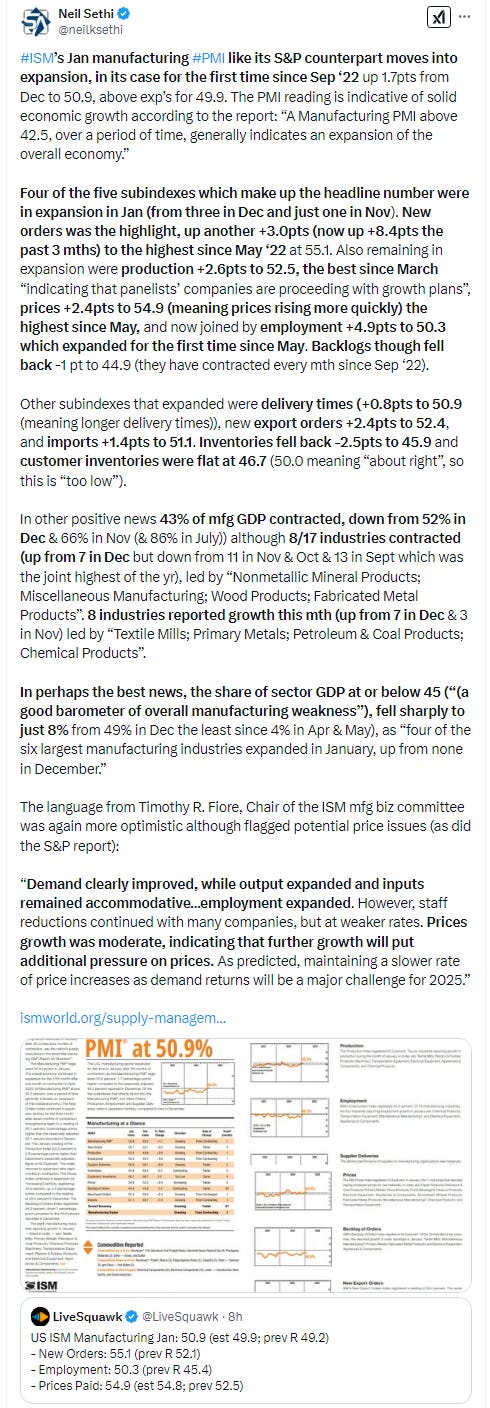

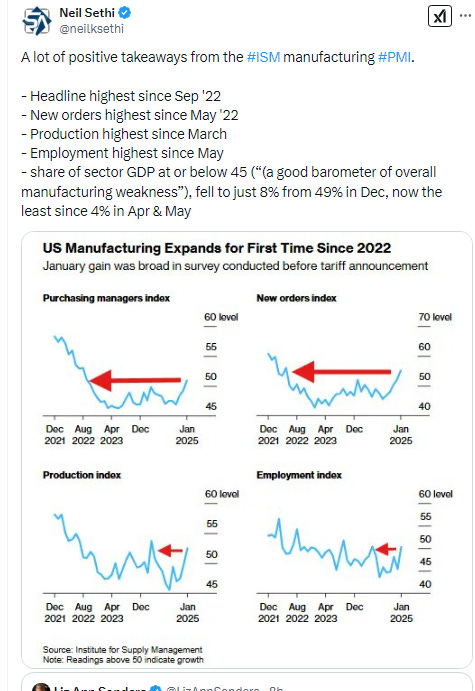

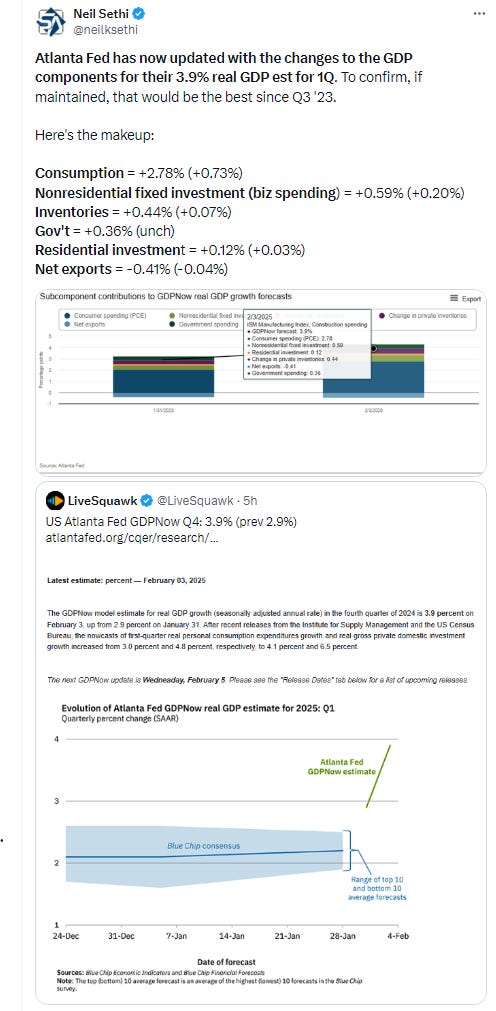

ISM’s Jan manufacturing PMI like its S&P counterpart moved into expansion, in its case for the first time since Sep ‘22 up 1.7pts from Dec to 50.9, above exp’s for 49.9. In perhaps the best news, the share of sector GDP at or below 45 (“(a good barometer of overall manufacturing weakness”), fell sharply to just 8% from 49% in Dec the least since 4% in Apr & May), as “four of the six largest manufacturing industries expanded in January, up from none in December.”

Dec construction spending came in over double exp’s at +0.54% unrounded (so almost triple) vs exp’s for a +0.2% gain, up from +0.2% in Nov (rev’d from unch) as the overall deceleration since May of last year may have bottomed with the y/y number remaining at 4.3%, still though the least since Apr ‘23 (dark blue line on the chart). Private residential construction was +1.5% m/m, the strongest since May.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX gapped below a few different support levels. It was able to recover almost all of them but seemed to have trouble with 6020 which has been support and resistance at various times in the past few months. The daily MACD is rolling over, and the RSI now tilts neutral (under 50 and falling). Getting back above 6020 soon would be very helpful to the chart.

The Nasdaq Composite similarly had trouble with the 19500 level. Its daily MACD has now crossed to “sell longs,” and its RSI is also falling below 50.

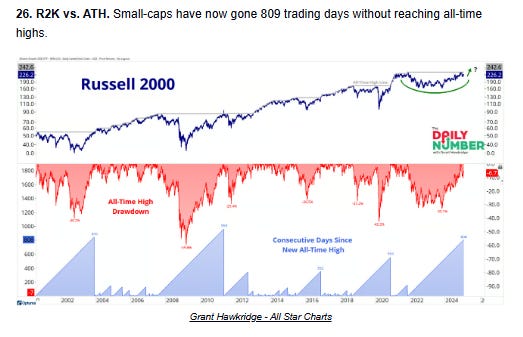

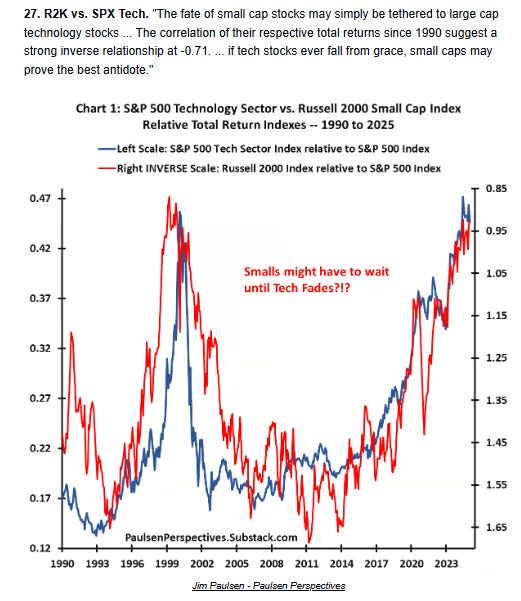

RUT (Russell 2000) hit its resistance at the 20-DMA. Like the SPX its daily MACD is rolling over, and its RSI tilts negative.

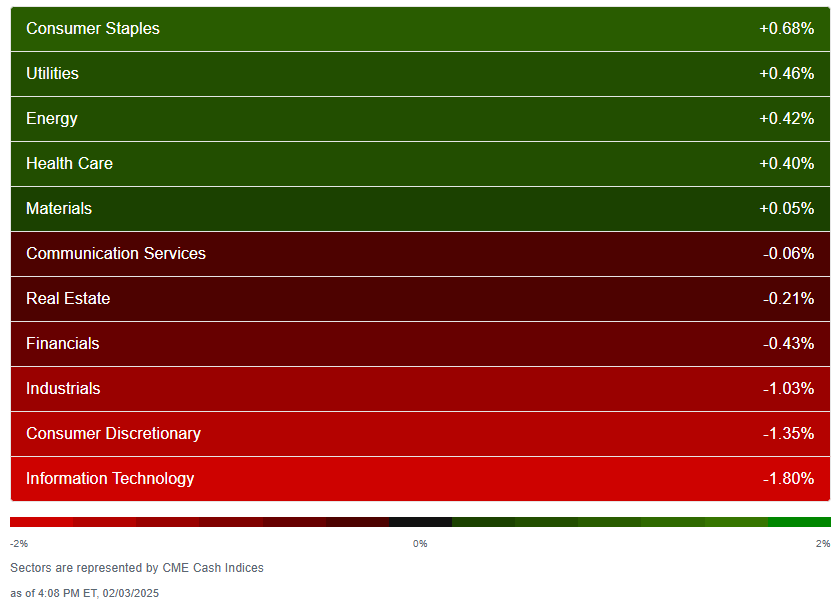

Equity sector breadth from CME Cash Indices improved from Friday with five green sectors, up from two, but none up more than +0.7% again and three were down over -1% (vs one Friday). Defensives outperformed taking three of the top four spots. Growth underperformed taking two of the bottom three spots.

SPX sector flag from Finviz consistent w/some notable decliners (Apple & Tesla both down over -3%, Nvidia almost that much) but some interesting winners (Meta, Wal-Mart, P&G up over 1% (but Target down -2.7%)).

Positive volume (percent of total volume that was in advancing stocks) improved slightly but remained weak on the NYSE Monday at 32%, up though from 23% Friday, while the Nasdaq continued to be much better at 47% (although down from 52% Friday), still a good result given that index was down over 200 pts. As a reminder, this (positive volume outperforming on the Nasdaq) was something we saw for much of the fourth quarter. Positive issues (percent of stocks trading higher for the day) though were weak on both again at 31 & 29% respectively.

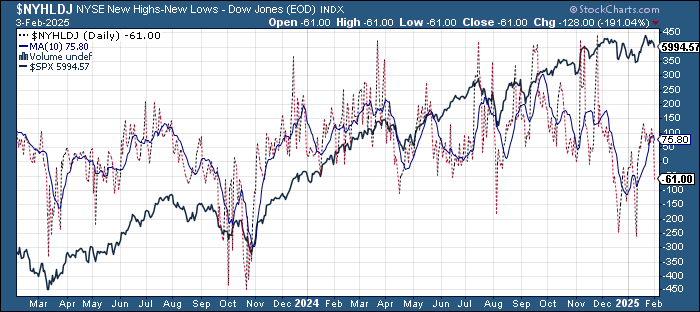

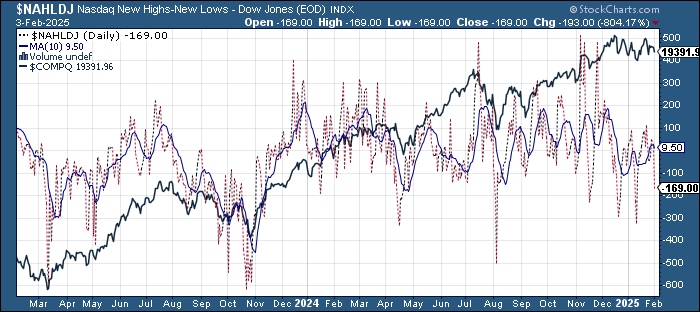

New highs-new lows (charts) though deteriorated sharply to -60 (from 68) on the NYSE (and 116 Thursday which was the best since mid-Dec) and to -171 (from 21) on the Nasdaq. Both are the least since Jan 13th and remain below their 10-DMAs which are now rolling over (less bullish).

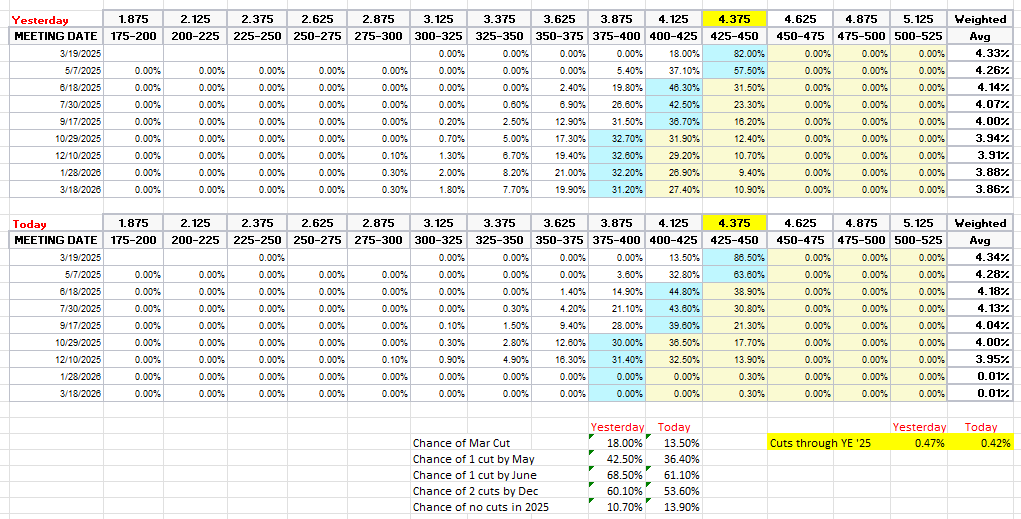

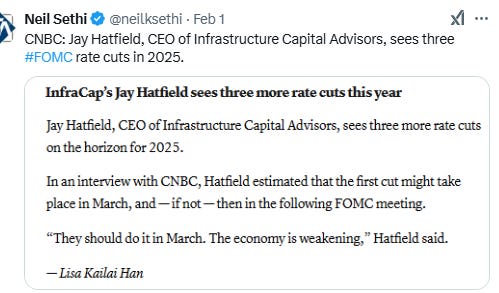

FOMC rate cut rate cut probabilities from CME’s #Fedwatch tool fell on fears of higher inflation from the Trump tariffs (even as the Fed members who spoke today indicated the Fed would “look through” them so long as they did not raise inflation expectations). A cut by March fell to 14% from 18% (and down from 32% before the Dec FOMC), by May at 36% from 51% before the FOMC, and by June 61% from 72%. Chance of two 2025 cuts down to 54% (from 60% Friday) and no cuts at 14% with 42bps of cuts priced (from 47 Friday).

I said after the big repricing in December that the market seemed too aggressively priced to me, and that I continued to expect at least two cuts, and for now I’m sticking with that.

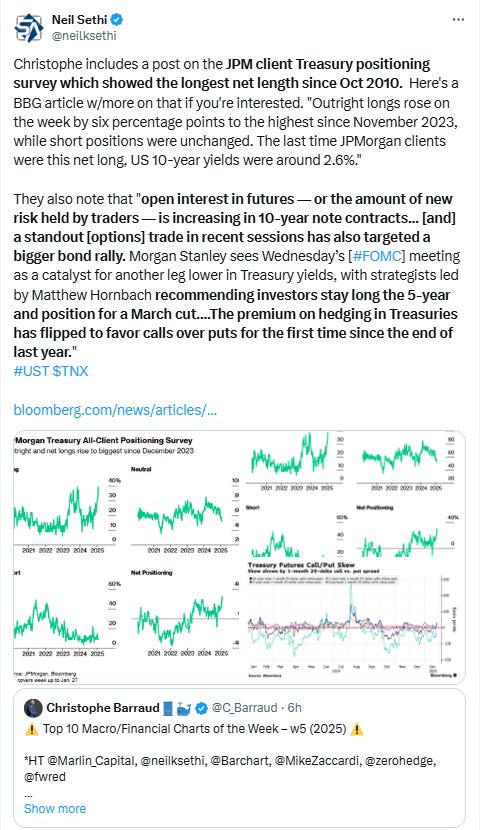

Longer duration #UST yields fell despite the inflation worries as growth fears won out, at one point falling to the least since Dec 18th, and ending at 5.4%, lower by -6bps from Friday’s cash settle.

The 2yr yield, though, more sensitive to Fed policy, was up +5bps to 4.26%. I still find this level rich, and I’m looking for it continue to soften in coming weeks (subject to this week’s NFP report).

Dollar ($DXY) ended higher for a 5th session at a 1-wk closing high Monday but only after shooting up to test the 110 level early in the session which it subsequently gave all back when counting the extended trading after first Mexico then Canada reached deals to pause tariffs, leaving behind a huge “wick” on the daily candle. Daily MACD and RSI are negative and positive respectively, but the former is turning to more constructive.

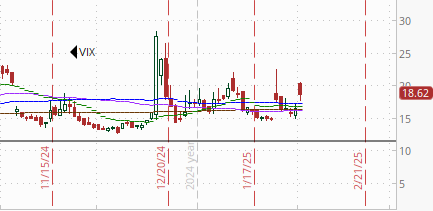

The VIX jumped but edged back from over 20 to 18.6 (consistent w/1.17% daily moves over the next 30 days). The VVIX (VIX of the VIX) similarly jumped then edged back but remained over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX pushed up to 18.25, the highest close since the day before the Dec CPI report, looking for a move of 1.15% Tuesday.

WTI went from a 1-week high early in the session to the lowest close of the year in extended trading following the Trump agreement with Canada, now sitting just above the $71.70 support level. Daily MACD remains unsupportive and the RSI is starting to lose its trendline. As I said a week ago, “I don’t have a lot of confidence in it regaining the $75 level quickly,” and that remains the case.

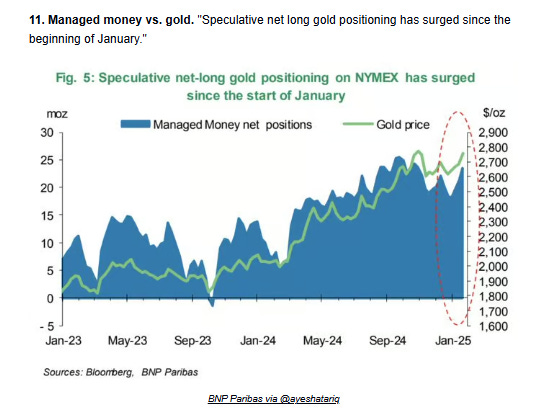

Gold futures tested the $2800 level just after futures opened last night where they bounced then at one point hitting an ATH in the morning before falling back a touch. Daily MACD & RSI remain very supportive.

Copper (/HG) ended higher Friday as it remains in the middle of its range over the past 6 mths. Daily MACD & RSI remain neutral.

Nat gas futures (/NG) jumped at the open on a colder 8-15 day forecast, filling the “roll gap” from the roll to the March future from last week, and ending up +7.7%. Still a lot of resistance above. Daily MACD remains in “sell longs” position, and the RSI has hooked up but remains under 50 for now.

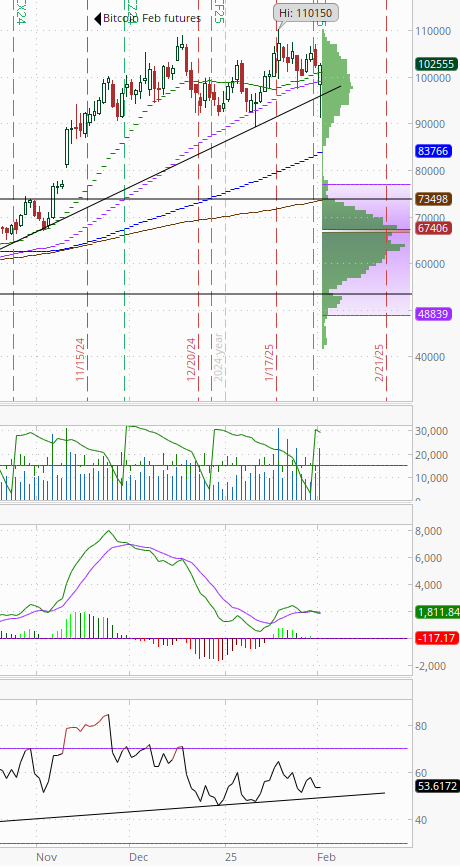

Bitcoin futures another notable chart, at one point last night falling near $90k, down around -10%, before steadily moving higher (particularly following the deal with Mexico) and making it all the way back to unchanged on the session, back above $100k where it’s been the past few weeks. Daily MACD and RSI tilt positive for now.

The Day Ahead

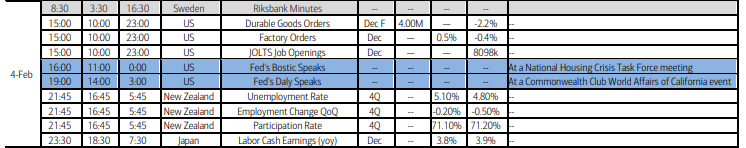

We continue the busy economic week with the Dec JOLTS and factory orders reports.

We’ll also get a couple more Fed speakers. BoA has Bostic (again) as well as Daly. We’ll also get St. Louis Fed Pres Musalem this evening.

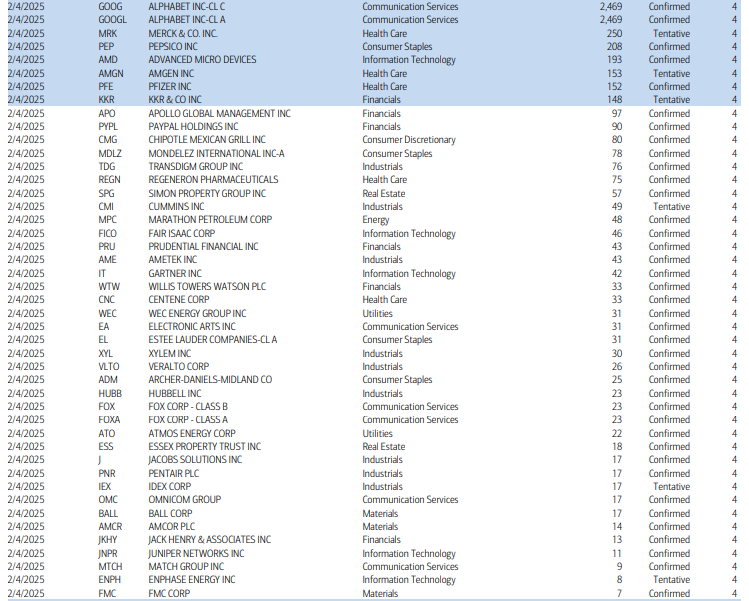

Earnings will be another highlight with 43 SPX components (not double counting FOX/FOXA & GOOG/GOOGL) reporting, including seven > $100bn in market cap in Merck (MRK), PepsiCo (PEP), Advanced Micro Devices (AMD), Amgen (AMGN), Pfizer (PFE), and KKR & Co (KKR) (plus Apollo Global (APO) is right there ($97bn)) along with our fifth Mag-7 component this season in Alphabet (GOOG) (GOOGL), a $2.5tn company (see the full earnings calendar from Seeking Alpha).

Ex-US a lighter day. We’ll get the minutes from the last meetings of Sweden’s and Brazil’s central banks and some data out of Mexico.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,