Markets Update - 2/3/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

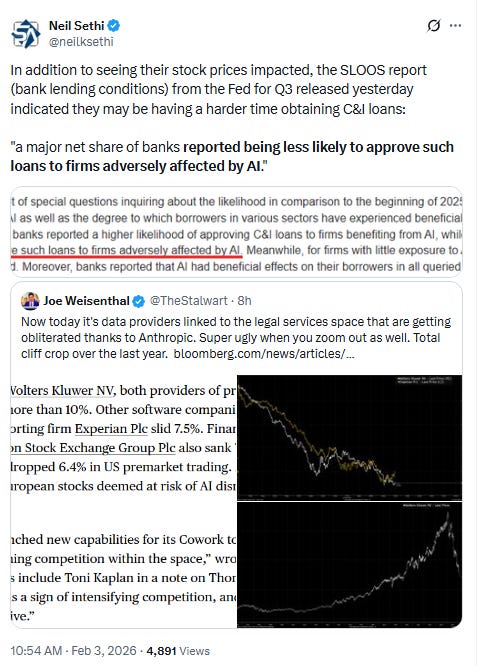

US equity indices opened today’s session modestly higher with a return to the 2025 story of tech leading after defense tech company Palantir jumped 11% following its strong fourth-quarter financial results and upbeat guidance (it would finish +7%). Additionally, robotics play Teradyne surged 22% after posting a solid outlook for the first quarter, BBG reported Elon Musk is combining SpaceX and xAI in a deal that values the enlarged entity at $1.25 trillion, and Anthropic’s new productivity tool for in-house lawyers triggered a selloff in stocks vulnerable to AI disruption.

In some other earnings news PepsiCo Inc. reported better-than-expected fourth-quarter profit and announced a $10 billion share buyback. It also said it was cutting prices by as much as 15% for key brands. PayPal Holdings though tumbled 17% (it would finish -20%) after missing profit estimates and announcing a change in its chief executive officer.

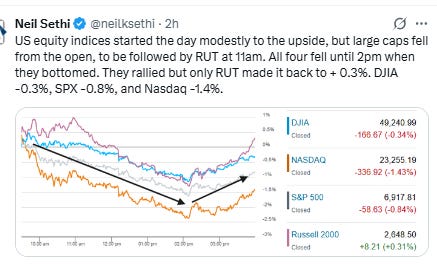

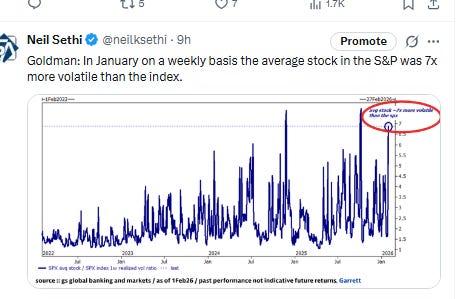

Large cap indices would fall from the open with that intense pressure on stocks vulnerable to AI which spilled over to asset managers, and the Russell 2000 small cap index (RUT) would follow around 90 minutes later. All fell until 2pm ET when they bottomed. They rallied from that point, but only the RUT made it back to into positive territory ending +0.3%. The DJIA was -0.3%, SPX -0.8%, and Nasdaq -1.4%.

Elsewhere, bond yields were little changed as the dollar edged lower. Bitcoin fell to the least since Nov ‘24, but crude, gold, copper, and natgas all saw gains with less dramatic moves than the last few days.

The market-cap weighted S&P 500 (SPX) was -0.8%, the equal weighted S&P 500 index (SPXEW) -0.2%, Nasdaq Composite -1.4% (and the top 100 Nasdaq stocks (NDX) -1.6%), the SOXX semiconductor index -2.0%, and the Russell 2000 (RUT) +0.3%.

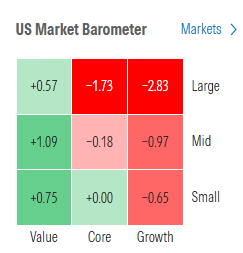

Morningstar style box continued to see growth on the weaker side of things.

Market commentary:

“I think we have one or two of these periods every year. The cause is always different, but the effect is always the same. Some of the most popular trades of the previous uptrend just get absolutely nuked,” Josh Brown, CEO of Ritholtz Wealth Management, said on CNBC’s “Halftime Report,” pointing to Palantir Technologies giving up some of its morning gains.“There is a lot of liquidity out there and it’s remaining committed to financial assets,” said Guy Miller, chief strategist at Zurich Insurance. “It’s rotating within the markets, and the macro backdrop is supportive of that continuing.” Brown added, “It tells you risk appetite is coming out of anything that has to do with technology.”

Last week’s tech selloff saw lofty expectations for cloud revenues – now a proxy for how well AI is being monetized – disappointed, noted Lauren Goodwin at New York Life Investments. “We are in the earliest days of AI, and monetization of these capabilities is a moving target,” she said. “Instead of near-term AI revenues, we are looking for ongoing capex commitments from AI hyperscalers to assess the resilience of the AI boom, and we continue to see physical investment plans expand.”

“The biggest concern about the AI revolution is that tech companies are spending hun-dreds of billions on AI infra-structure, without any guarantee that it will produce a positive ROI (Return on Investment),” said Tom Essaye at The Sevens Report. “I’ve often compared the current AI revolution to the rollout of electricity in the country, where the industrialists of the 20th century funded the wiring of the country. Well, what if people preferred candles and didn’t buy electricity? They would have lost the equivalent of billions,” he said.

While the trend in equities remains positive, it has become somewhat more guarded with the weakness in tech, according to Louis Navellier at Navellier & Associates.

“We have seen a more nuanced view of AI recently, with skepticism and optimism more balanced,” said Mark Hackett at Nationwide. “Skepticism is warranted given the enormous sums of money being spent with uncertain returns on investment, along with the greater use of debt.”

“Our sense is that markets are churning underneath the surface as worries over AI capital spending battle with ‘hopes and dreams’ of broadening out as a result of an accelerating US economy,” said Chris Senyek at Wolfe Research.

“Rotation is occurring,” said Steve Sosnick at Interactive Brokers. “The tricky question is whether it is a benign reallocation of exposure or a sign of some underlying instability.”

“Despite elevated volatility across the macro landscape, the underlying structure of this market is clear: We are in a ‘rotational’ bull market,” said Craig Johnson at Piper Sandler. “Capital is rotating into cyclicals and value stocks.”

“Bifurcated action is characterizing today’s Wall Street trading, as tech surrenders the floor to cyclicals even as Palantir delivered a blockbuster beat-and-raise last night, which initially boosted optimism regarding AI prospects,” said Jose Torres at Interactive Brokers. Small caps, meanwhile, are outperforming as they are relatively sensitive to economic health, he added.

“Investors keep on focusing on the earnings season, which isn’t bad so far, with reasonable expectations that are not hard to meet,” said Roland Kaloyan, head of European equity strategy at Societe Generale. “I don’t see a reason for momentum to switch in the short term.”

“The themes that have been driving risk assets higher — the Federal Reserve obviously not tightening rates, probably reducing rates a little bit more this year, the strong economy and profit backdrop and the tariff story not getting worse ... you still have those tailwinds in place,” Solus Alternative Asset Management strategist Dan Greenhaus said Monday on CNBC’s “Closing Bell.” “The AI story is still driving markets.”

“I think when you put all of that together, you might get a little more volatile in February, but what’s driving the market is still there,” Greenhaus added.

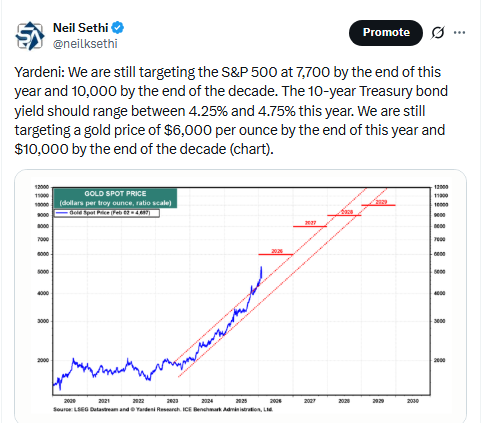

“With continued demand, durable spending, and encouraging monetization trends, we believe AI will remain a key engine of overall equity performance,” she said. “We also expect beneficiaries to continue to broaden to the application layer of the AI value chain as well as users of the technology in other sectors.” Her firm expects the S&P 500 to move higher, and maintains its December price target of 7,700.“We recommend investors position for a broadening rally, favoring financials, health care, utilities, and consumer, discretionary beyond the tech sector,” Hoffmann-Burchardi said.

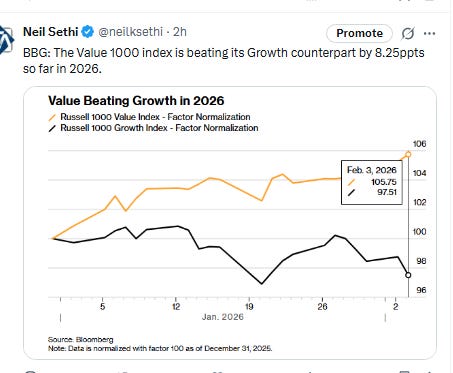

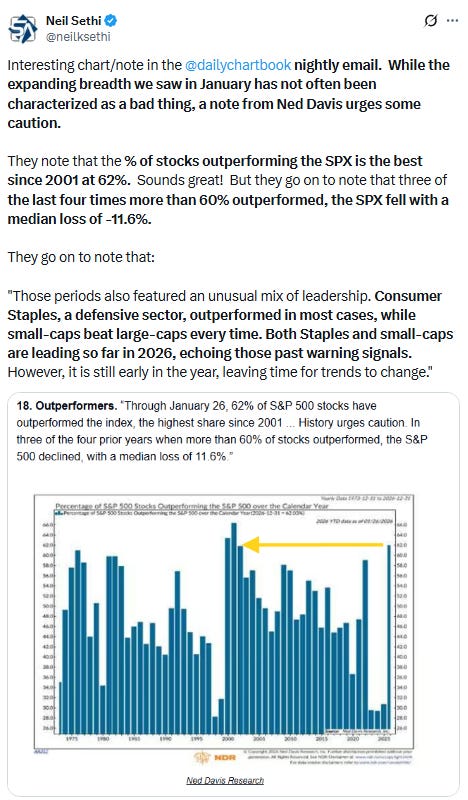

“We are shifting our tactical allocation from neutral to favoring value over growth,” said Ed Clissold and Thanh Nguyen at Ned Davis Research. “Several of the factors we said we were watching when we moved to neutral have moved in value’s direction.” The strategists noted that earnings growth from value stocks has exceeded expectations. While results from tech megacaps were in line or better than expected, market reaction to their spending plans varied wildly.

“We view the challenge for some Magnificent Seven stocks as more of a valuation issue than an earnings growth issue,” they said. “If economic growth moderates in the second half of 2026 as our macro team expects, investors may return to paying a premium for companies that can deliver EPS growth.”

Given the massive capex spend by hyperscalers, the premium may be less than in 2021-2025, but we do not rule out a return to the growth premium trade later this year, which would necessitate a rotation back into growth stocks., they concluded.

“We expect global equities to rise around 10% by the end of this year, and investors who have concentrated positions in the US should benefit from diversifying into other markets,” said Mark Haefele at UBS Global Wealth Management. “Ultimately, we believe one of the most effective ways to manage macroeconomic uncertainty and market volatility is to ensure portfolio diversification.”

“Sticky inflation means, at current yields, investors are not being adequately compensated for the erosion of purchasing power by being long Treasury notes,” Steven Ricchiuto, U.S. chief economist at Mizuho Securities, wrote in a Tuesday client note. “This supports our forecast of long-term rates at 4.6% by year-end.”

A recent increase in industrial metals prices could prove resilient, but inflation traders have not “fully incorporated this impulse” and appear to be underpricing the upside risk, according to a team at Barclays. One reason is that declines in crude oil prices appear to be complicating the picture, analyst Amarpreet Singh, strategist Jonathan Hill and economist Pooja Sriram said in a note released on Tuesday. “While the metals rally does not dramatically change our near-term baseline projections, it could materially shift the distribution of inflation outcomes higher, especially if the price action extends and/or is durable,” they said.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

In individual stock action:

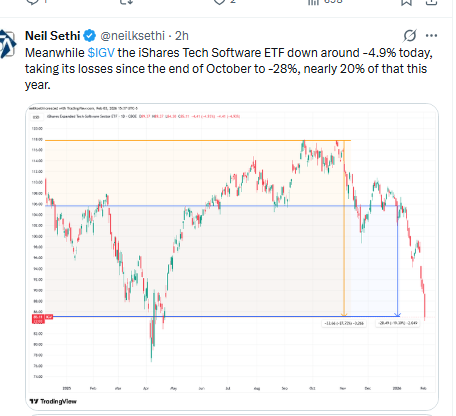

Most tech shares were in the red, including most of the “Magnificent Seven” names that have reported earnings so far — Microsoft and Meta Platforms were both down more than 2%, while Apple was marginally lower. Nvidia also slumped, with the artificial intelligence bellwether’s nearly 3% drop adding to its losses for the year. Meanwhile, software stocks continued their 2026 tumble, with shares of ServiceNow and Salesforce falling close to 7% each.

Shares of Palantir jumped almost 7% after the defense tech company gave strong fourth-quarter financial results and upbeat guidance. At one point, shares were trading 11% higher in Tuesday’s premarket session.

FedEx Corp. - an economic barometer - extended a record-breaking rally. Walmart Inc. topped $1 trillion in market cap (more on that later). In late hours, Advanced Micro Devices Inc. gave a disappointing forecast.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Palantir Technologies Inc.’s revenue forecast for fiscal 2026 that significantly exceeded Wall Street expectations, a boost for the data analytics company after its shares have gotten off to a lackluster start so far this year.

Nvidia Corp. Chief Executive Officer Jensen Huang said that the massive build-out of artificial intelligence capacity, which is currently straining the power grid in many locations, will eventually lead to cheaper energy costs.

Netflix Inc. and Warner Bros. Discovery Inc. faced a skeptical Senate panel Tuesday as their executives defended their $82.7 billion media merger against lawmakers’ concerns about the proposed tie-up and its impact on streaming consumers and Hollywood workers.

Walt Disney Co. said Josh D’Amaro will succeed Bob Iger as chief executive officer of the entertainment giant, passing the reins at a key moment in the company’s history and after struggles to find a new leader in the past.

Paramount Skydance Corp. Chief Executive Officer David Ellison turned down an invitation to testify before the Senate at an antitrust hearing about the proposed tie-up between Netflix Inc. and Warner Bros. Discovery Inc.

Bank of America Corp. priced $7 billion sale of investment-grade bonds, adding to a flurry of offerings by major Wall Street banks.

Banco Santander SA agreed to acquire Webster Financial Corp. for $12 billion as Spain’s largest bank bets big on the US.

PayPal Holdings Inc. said HP Inc. Chief Executive Officer Enrique Lores will take the top job from Alex Chriss, whose turnaround plan failed to meet targets and streamline the sprawling payments business.

Chipotle Mexican Grill Inc.’s doldrums are set to extend into 2026, with the burrito chain offering a full year-sales target that fell short of Wall Street’s expectations.

PepsiCo Inc. is cutting prices by as much as 15% for key brands, including Lay’s and Doritos, in a bid to lift sales by offering more affordable products.

Archer-Daniels-Midland Co. sees emerging US biofuels policy as the key to its outlook for 2026, as weak crush margins continue to weigh on the company’s results.

Amgen Inc. exceeded fourth-quarter expectations on strong sales of its biggest medicines, and forecast 2026 performance that aligns with what Wall Street is anticipating, positive results for the company as it faces rising challenges from rivals.

Pfizer Inc. revealed data from one of its new obesity treatments early Tuesday with little detail, leaving investors wondering if the up to $10 billion it spent purchasing the company that created the medicine will pay off.

Merck & Co. forecast 2026 sales and profit that missed Wall Street’s expectations and said its HPV vaccine Gardasil may remain off the market in China this year as it continues to face challenges in the once-hot market for its shot.

Novo Nordisk A/S said its sales will drop this year as its blockbusters Ozempic and Wegovy face ever-tougher competition and the company gets hit by the US government’s push to cut drug prices.

The US Food and Drug Administration turned down a self-administered version of AstraZeneca Plc’s lupus medicine, but the UK drugmaker said it’s still working with regulators to advance the request.

Uber Technologies Inc. is rolling out its ride hailing service in the Chinese gambling hub of Macau, expanding into a new Asian market for the first time in years.

Billionaire Michael Novogratz said he remains optimistic even after Galaxy Digital Inc. posted a wider-than-expected loss of almost $500 million during the crypto market’s fourth-quarter crash.

The crypto exchange Kraken, which is planning to go public, saw revenue and earnings fall sequentially in the fourth quarter while digital asset prices tumbled and investor demand plummeted.

Ivanhoe Mines Ltd. is looking to supply the US with minerals mined in the Democratic Republic of Congo as the Trump administration moves to build strategic stockpiles and loosen China’s grip on global supply chains.

Mercuria Energy Trading SA has signed a 20-year agreement to buy liquefied natural gas from the US through Commonwealth LNG’s planned facility in Louisiana, as the trading house looks to bolster its gas positions globally.

Siemens Energy AG will invest $1 billion (€847 million) in manufacturing capacity in the US over the next two years as power demand surges.

Nintendo Co.’s profit rose a smaller-than-expected 23% after the US levied tariffs on the Switch 2 console, revealing a big hit to margins while concerns grow about the impact of soaring memory chip prices in 2026.

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X