Markets Update - 2/5/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below!

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

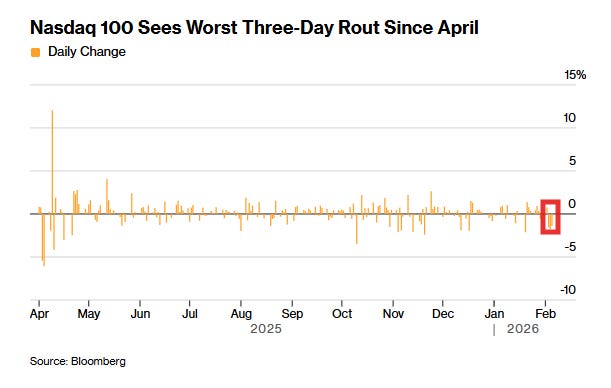

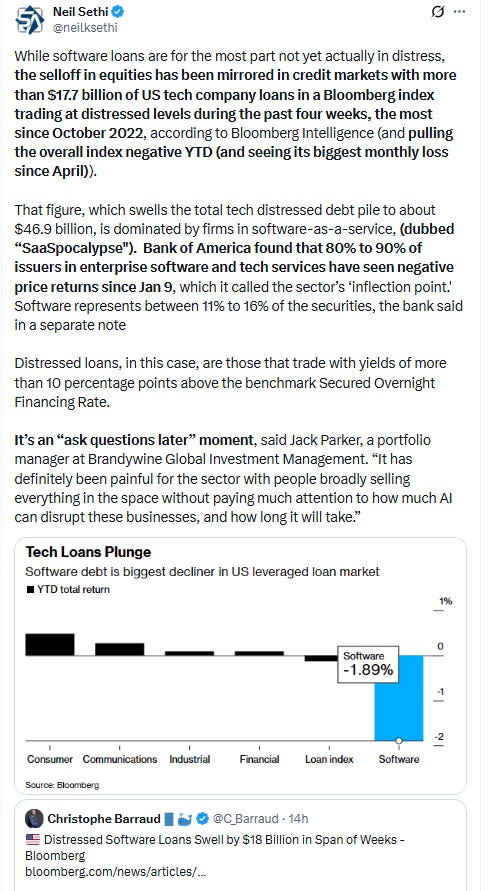

US equity indices opened today’s session lower as tech stocks remained under pressure following Google parent Alphabet’s earnings last night which projected a sharp increase in artificial intelligence spending that spooked investors (and would carry over into Amazon’s report discussed below, which will pressure them again Friday). Alphabet shares though would recover to end down just -0.5% Other tech names though were not so lucky including Qualcomm which slid -8% after posting a weaker-than-expected forecast because of a global memory shortage, and software names continued to see aggressive selling with the IGV Tech Software ETF down another -5% Thursday.

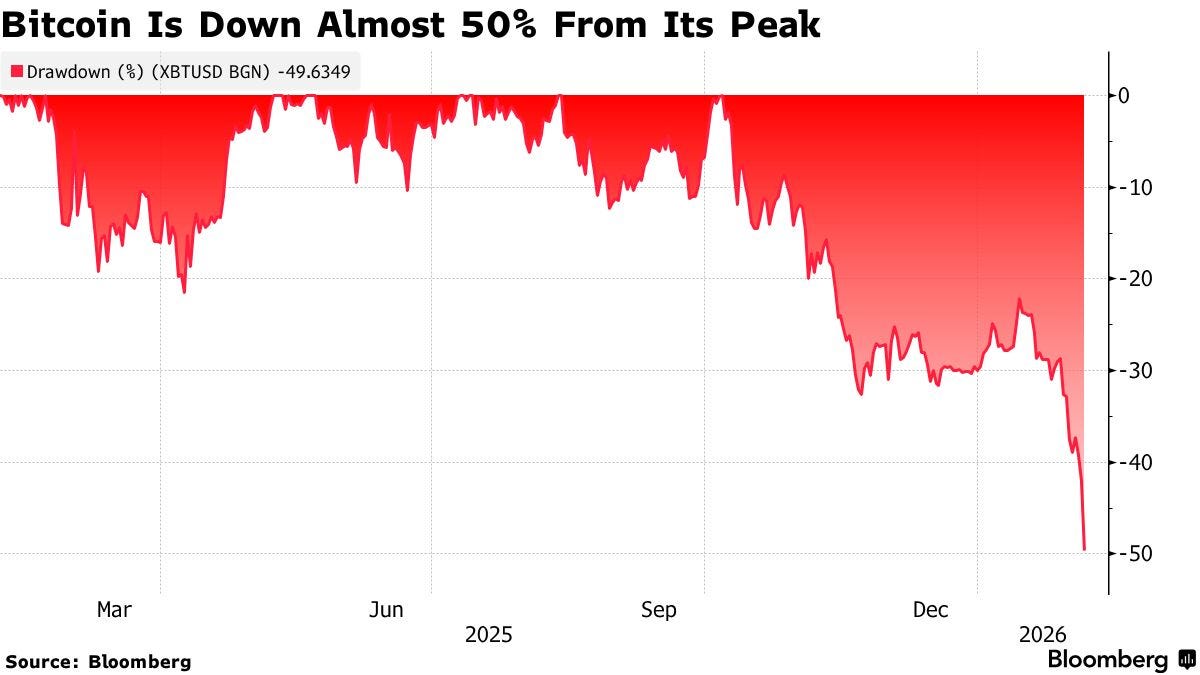

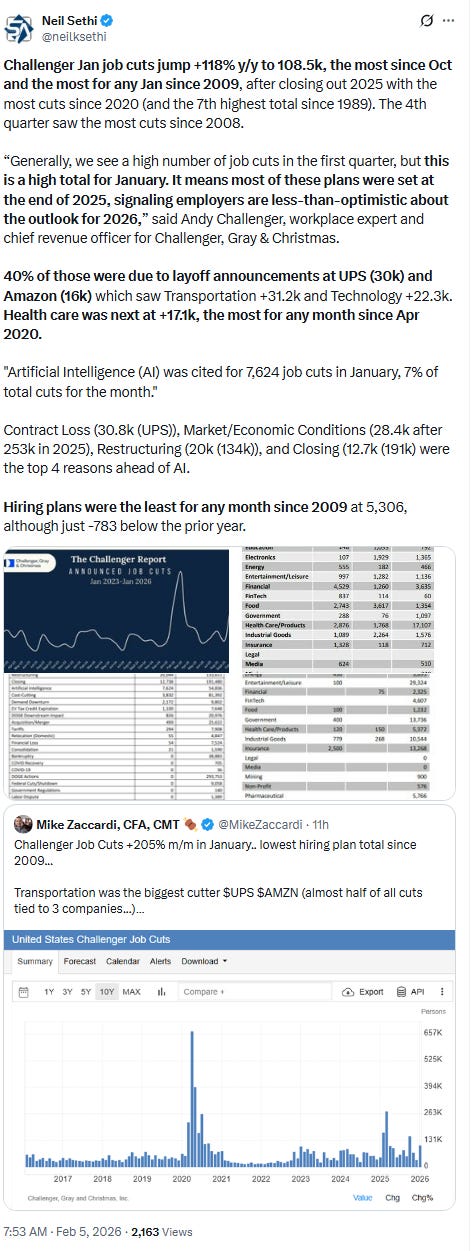

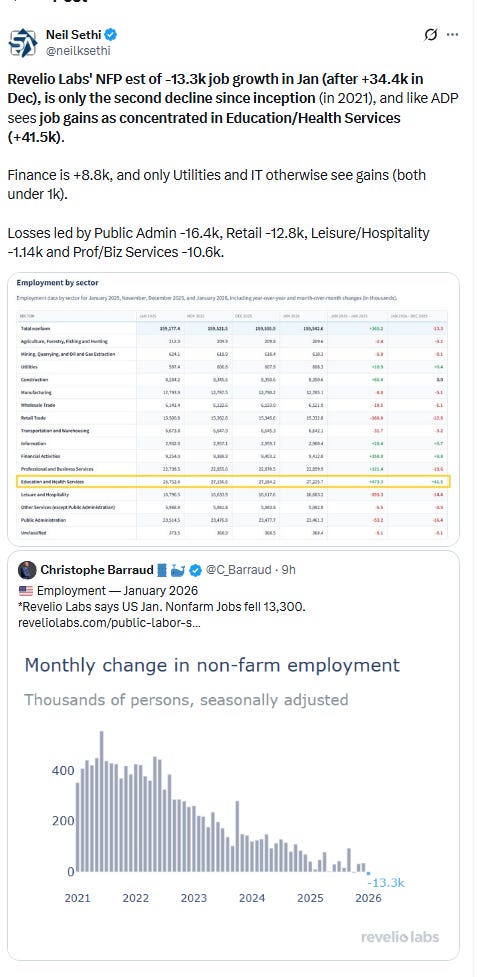

Adding to the downbeat sentiment, the selloff in bitcoin continued unabated while in economic data outplacement firm Challenger, Gray & Christmas reported that U.S. employers announced 108,435 layoffs (CNBC link) in January (see more below), the highest January total since the global financial crisis. Also, initial jobless claims for the week ended Jan 31st rose more than expected (CNBC link with Substack link later) although continuing claims were below expectations and both remain low historically. That was not a great setup for a JOLTS report that saw job openings in December fall to their lowest level since September 2020 even as other aspects of the JOLTS report were more favorable (again Substack link below).

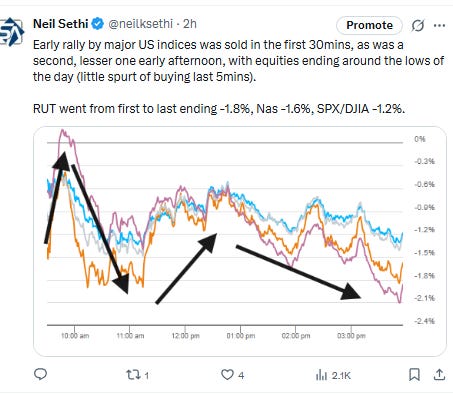

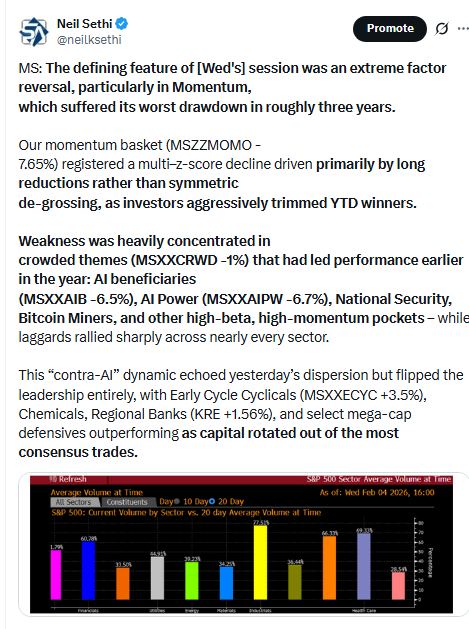

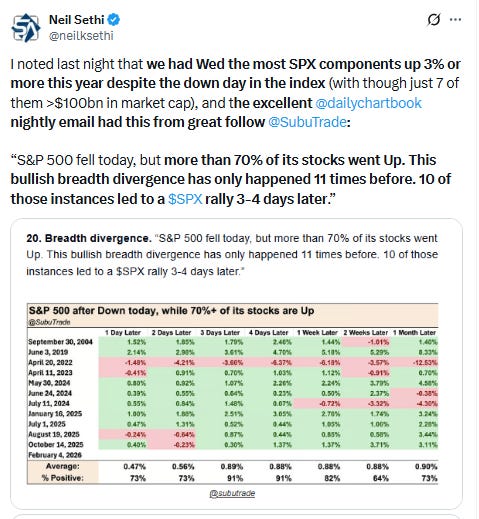

That last report quashed an attempted rally and saw indices fall to new lows. They would attempt another rally late morning but that was also sold in the afternoon with indices finishing near the lows of the session. The small cap Russell 2000 index went from first to last ending -1.8%. The tech heavy Nasdaq was -1.6%, SPX/DJIA -1.2%.

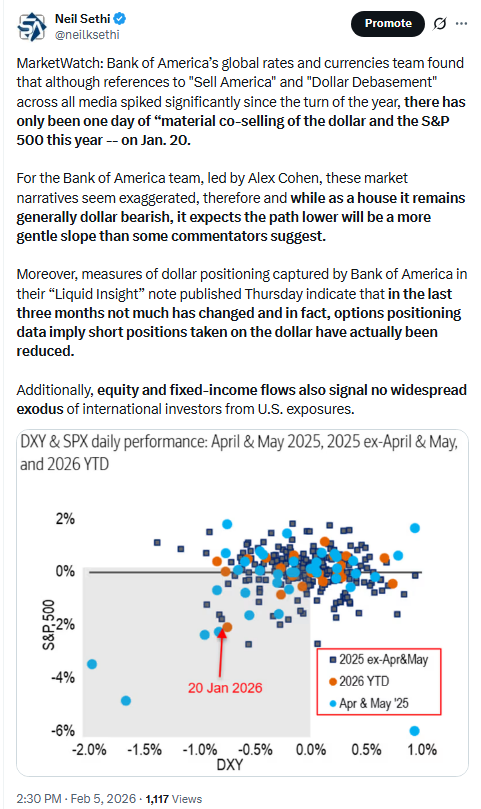

Elsewhere, bond yields fell sharply on the economic data as Fed rate cut bets jumped (more below), but the dollar moved higher as did natgas. Bitcoin though fell to the least since Oct ‘24, and crude, copper, and gold all pulled back.

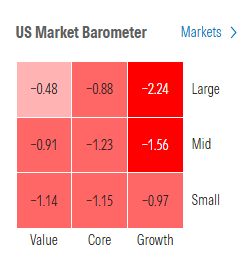

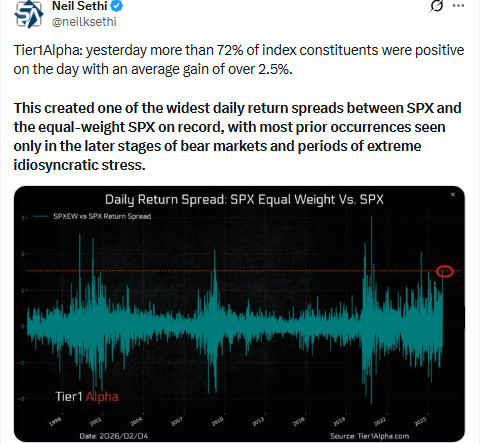

The market-cap weighted S&P 500 (SPX) was -1.2%, the equal weighted S&P 500 index (SPXEW) -0.9%, Nasdaq Composite -1.6% (and the top 100 Nasdaq stocks (NDX) -1.4%), the SOXX semiconductor index -0.1%, and the Russell 2000 (RUT) -1.8%.

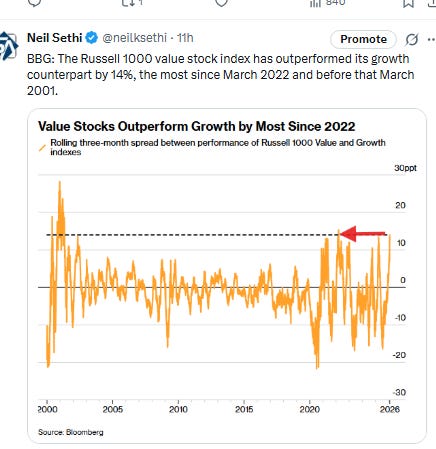

Morningstar style box continued to see growth on the weaker side of things but nothing escaped the red today.

Market commentary:

“The weak jobs data in the US is the clearest expression we have of the K-shaped economy,” said Joachim Klement, head of strategy at Panmure Liberum. “While the technology sector is booming, the rest is suffering from higher tariffs and a lack of demand. This creates the seemingly contradictory picture where GDP growth is solid but the job market is weak.”

“Three quarters of software stocks are in oversold territory, and the momentum trade that has been the way to play tech and software last year is under severe pressure,” said Andrea Gabellone, head of global equities at KBC Securities. “I expect reason to come back to the table and a rebound shortly, probably a selective one.”

“Signs of a softer US labor market have in recent months held back risk sentiment and sustained bets on further Fed interest-rate cuts in 2026. The latest data on Thursday only feeds speculation that the US economy isn’t out of the woods; that combined with lingering worry over the AI trade is giving traders plenty of reason to be cautious.“ — Kristine Aquino, Managing Editor, Markets Live.

“This week’s data has been discouraging,” said Bret Kenwell at eToro. “The latest labor figures reiterate that the US jobs market is not firing on all cylinders, a risk the Fed and investors will have to take seriously should further deterioration occur. Volatility could persist, particularly if near-term uncertainty increases.”

“It’s been a tough week for investors who were heavily exposed to the parts of the market that led the upside,” said Mona Mahajan at Edward Jones. “Technology and AI come to mind, but more recently we’ve also seen gold and precious metals sell off, as well as Bitcoin and the broader crypto space.”

“We don’t see it as a big plummet in tech stocks, we see it more as the rest catching up in terms of earnings,” Shanti Kelemen, co-chief investment officer at 7IM, told Bloomberg TV.

“Another day, another set of declines in popular financial assets,” said Steve Sosnick at Interactive Brokers. “What is different this time is that today is less about rotation than outright selling. The jobs data gave economic bulls a bit of pause.” Yet most questions Sosnick continues to receive involve the selloff in software — and the outlook for the broad tech space. “The consensus has flipped to software companies being AI victims – not beneficiaries,” he said. “Investors were willing to pay premium multiples for software companies that could reap efficiencies from utilizing AI in their coding and final products. That view abruptly reversed, with software companies now perceived as victims of AI’s disruption.” And the second issue here, he noted, is that “crowded trades are difficult to exit.”

Recent selling has been concentrated around three major themes: crypto/payments, software that could be undercut by AI, and AI buildout plays specifically, according to Bespoke Investment Group strategists. “Whenever a wave of extreme selling hits the market, investors with a value or contrarian bent will start wading through the carnage to look for longs,” they said. “These proverbial babies who have been thrown out with the bathwater can prove great trades long-term, even if investors stepping up to buy huge waves of red have to stomach volatility in the meantime.” Of course, selloffs happen for a reason, so sometimes those longs are stopped out long before any rebound, the Bespoke strategists warned.

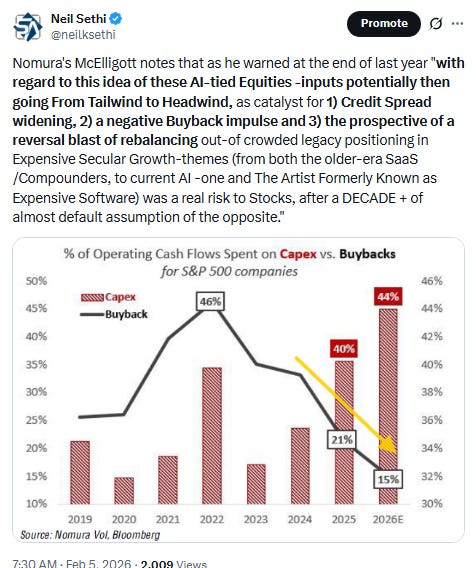

“We view the weakness as part of a valuation reset across growth sectors, one that, given tech’s substantial index weight, is dragging on broader market performance,” said Angelo Kourkafas at Edward Jones.

Historical episodes of major disruption risk suggest that share price stabilization will require stability in the earnings outlook, according to Ben Snider at Goldman Sachs Group Inc. “In this case, the uncertainty around the eventual impact of AI means near-term earnings results will be important signals of business resilience, but in many cases insufficient to disprove the long-term downside risk,” he said.

There’s no doubt that AI will be making major inroads, but at the moment, the unpredictability of how fast it will actually ramp into profits is clearly bringing near-term volatility, according to Louis Navellier at Navellier & Associates.

“We’ve had a big three-year run,” said Richard Steinberg, senior global market strategist at Focus Partners Wealth, noting that the stock market typically averages a roughly 14% intrayear drawdown but often still finishes higher.

“In midterm election years it is around 19%,” Steinberg said. “So investors should adjust their expectations to these normal kinds of ebbs and flows.”

“The fact that some of these companies do release and they announce just additional capex spending — and it is astronomical at this point — we’re actually viewing that as a positive sign for the market’s health in general, because ... it’s more that the market is discerning at this point rather than just irrational exuberance,” said Stephen Tuckwood, director of investments at Modern Wealth Management. “It feels like we’re shifting out of this no-hire, no-fire period that we’ve been in for the past several months,” Tuckwood said, adding that the upcoming BLS jobs report “could likely confirm what we’re seeing here with the others, where the firing and layoffs pieces is starting to turn negative.” If that turns out to be the case, he believes that the Federal Reserve will deliver an interest rate cut at the end of at least one of its March or April meetings.

Ben Fulton, the chief executive of WEBs Investments, said that this volatility could be here to stay for the near term, and that investors should be paying attention. “[The VIX] is communicating to the market that you should have some fear,” Fulton told MarketWatch. “Long term, I think there’s a good argument on why the U.S. market should be a good thing. If you’re asking right now, I’ve been thinking volatility is going to come back in pretty strong.”

“Volatility echoed in areas that have been the beneficiary of retail investor attention and leverage, including Bitcoin,” said Mark Hackett at Nationwide.

John Roque at 22V Research frames it in cycles. Bitcoin has lived through five substantial bear markets since 2011, with an average drawdown of 80%. The smallest of those came in at 72%. If this cycle hits that threshold, the token would fall to about $35,200. For now, he’s maintaining a target of $60,000 — until and unless that point is also breached.

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

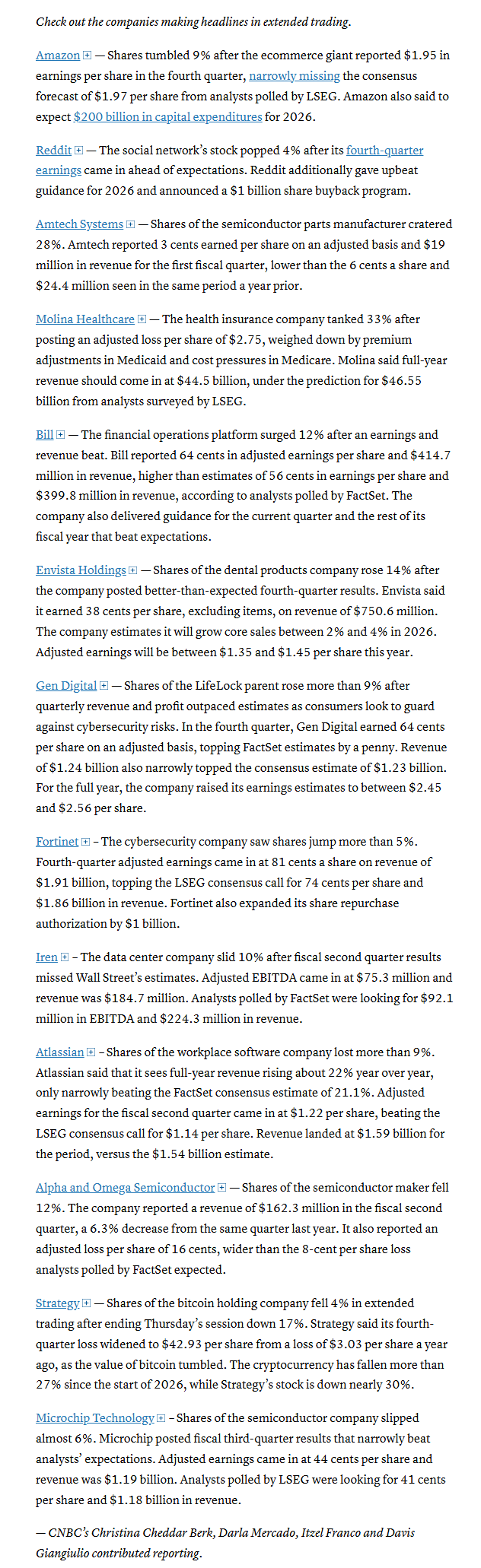

In individual stock action:

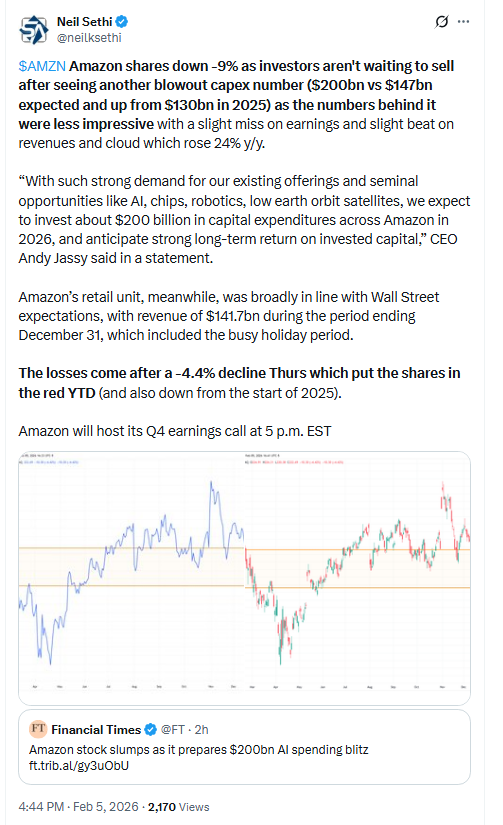

Alphabet was the latest of the “Magnificent Seven” companies to report earnings results. The company projected a sharp increase in artificial intelligence spending that spooked some investors, calling for 2026 capital expenditures of up to $185 billion. Shares lost 0.5%. However, shares of Broadcom climbed almost 1% following news of Alphabet’s spending plans, offering some hope for the artificial intelligence trade as the market deciphers its winners and losers.

In late hours, Amazon.com Inc. plunged after its results.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Apple Inc. Chief Executive Officer Tim Cook told employees that he’s “deeply distraught” with the current US approach to immigration and will continue pressing the issue with lawmakers.

Qualcomm Inc., the largest maker of smartphone processors, gave a lackluster revenue forecast for the current period, stoking concern that component shortages will hurt consumer demand by driving prices up.

Arm Holdings Plc rose after Wall Street analysts praised the chip designer’s latest quarterly report, which initially drew a tepid response from investors.

Peloton Interactive Inc. provided a weaker-than-expected revenue forecast for the fiscal third quarter, disappointing investors who hoped a recent hardware revamp would spur a long-promised turnaround.

Reddit Inc. projected current-quarter sales that surpassed Wall Street’s expectations, a reflection on the company’s growing advertising business just two years in as a publicly traded company.

Roblox Corp. reported fourth-quarter users and bookings that beat analysts’ expectations thanks to a slate of hit games.

Snap Inc. sank after the company reported a decline in daily users, partly driven by Australia’s ban on social media for children.

Saudi Arabia’s flagship carrier is in early talks with Boeing Co. and Airbus SE for what could be its largest plane purchase ever as the kingdom commits billions of dollars toward becoming a travel and tourism hub.

Hims & Hers Health Inc. launched a cheaper copycat version of Novo Nordisk A/S’s Wegovy pill. The move comes during a brutal week for the Danish drugmaker, which has warned investors that sales could decline as much as 13% this year.

ConocoPhillips is forecasting a cut to its crude production this year as oil prices slump and prime drilling sites in US shale fields grow scarce.

Ralph Lauren Corp.’s quarterly report raised concerns that strategic investments and a sales miss in Europe could slow the high-end apparel company’s momentum.

Estée Lauder Cos.’s outlook boost failed to reassure investors about the pace of the cosmetics conglomerate’s turnaround.

Bristol Myers Squibb Co. forecast 2026 sales and profit above Wall Street’s expectations, a sign that the company’s newer medicines are helping stem the losses from its older drugs that are losing patent protection.

Cigna Group set the floor for its 2026 earnings outlook shy of Wall Street expectations as the health-care conglomerate revamps its drug benefit plans, a move the company has warned will drag on profits.

Hershey Co. offered a better-than-expected 2026 outlook, saying higher prices and new products would bolster the candymaker’s performance.

The Washington Post, owned by billionaire Jeff Bezos, cut about one-third of its staff in an effort to pare losses and restore the struggling newspaper to profitability.

Bank of America Corp. — aiming to double the profit it makes from consumers — is revamping its approach to credit cards as the lender embarks on a plan to meet one of its most audacious financial targets set last year.

The crypto exchange run by billionaires Tyler and Cameron Winklevoss is slashing as much as 25% of its workforce and winding down operations in the UK, European Union and Australia, marking a major pullback for two of the industry’s most high-profile figures amid a rout in the sector.

Rio Tinto Group is walking away from talks to acquire Glencore Plc after the two sides failed to agree on valuation, scuttling a potential mega merger that would have created the world’s largest mining company.

Barrick Mining Corp. plans to spin off its top North American gold assets in an initial public offering later this year as part of a strategic reset by the Canadian metals producer.

BP Plc is looking for a partner to help ramp up production and share some costs at one of the Middle East’s oldest oil fields, according to people with knowledge of the situation.

Shell Plc profits slumped in the fourth quarter, undershooting expectations as lower crude prices and a struggling chemicals business dented earnings.

BNP Paribas SA beat expectations and raised some targets, boosting Chief Executive Officer Jean-Laurent Bonnafe and his plan to prop up a lender that has long lagged peers.

HSBC Holdings Plc is preparing to hand some bankers little or zero bonuses as the 160-year-old British lender seeks to emulate its Wall Street rivals with a more hard-edged, “eat-what-you-kill” stance.

A.P. Moller-Maersk A/S plans to cut jobs and focus on cost discipline this year as the container giant seeks to insulate its earnings against deteriorating freight rates with Red Sea routes reopening.

A number of European nations announced recalls of Danone SA infant formula due to possible contamination with the toxin cereulide.

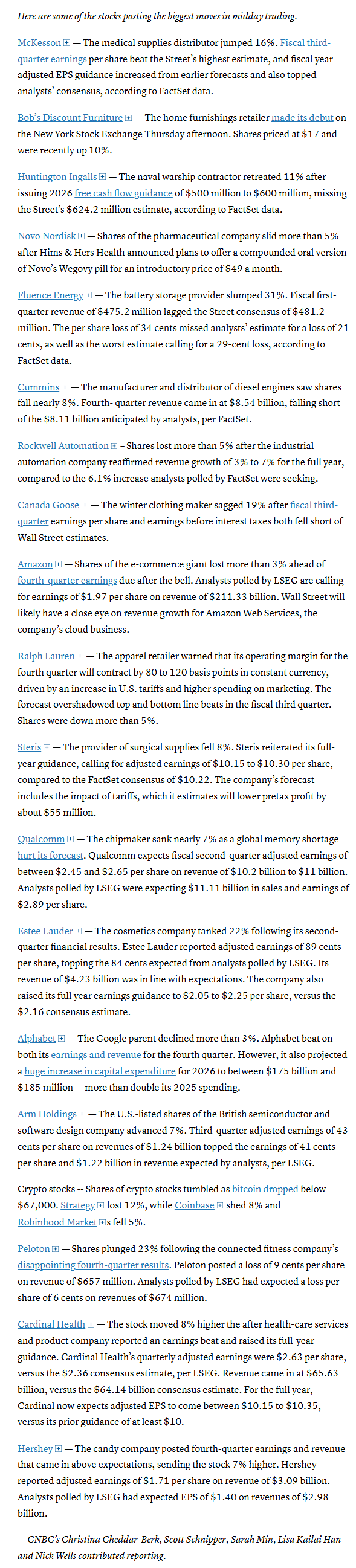

Mid-day movers from CNBC:

In US economic data:

Substack articles:

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X