Markets Update - 3/11/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

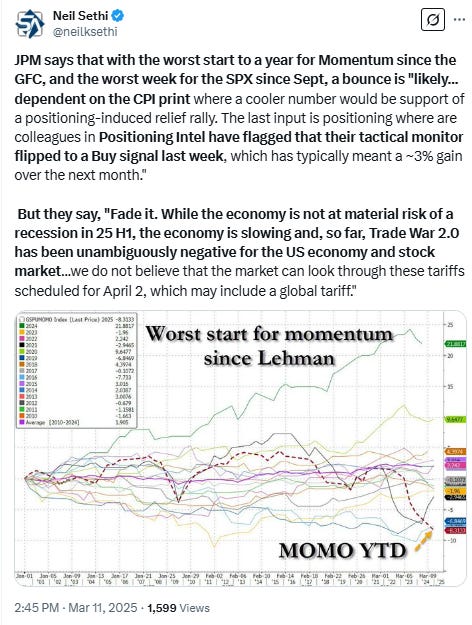

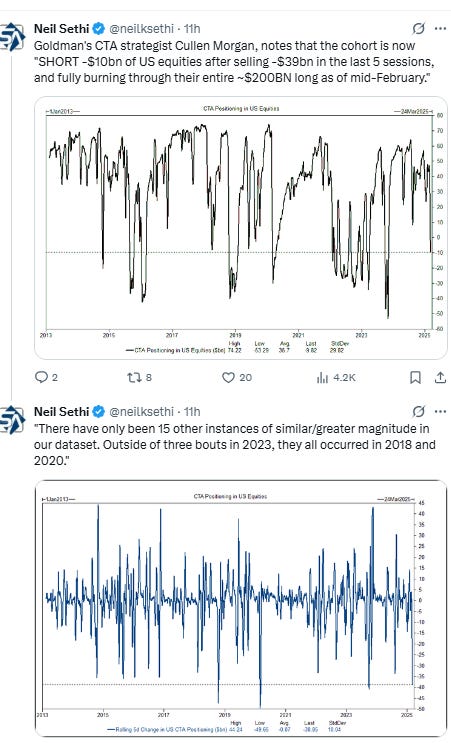

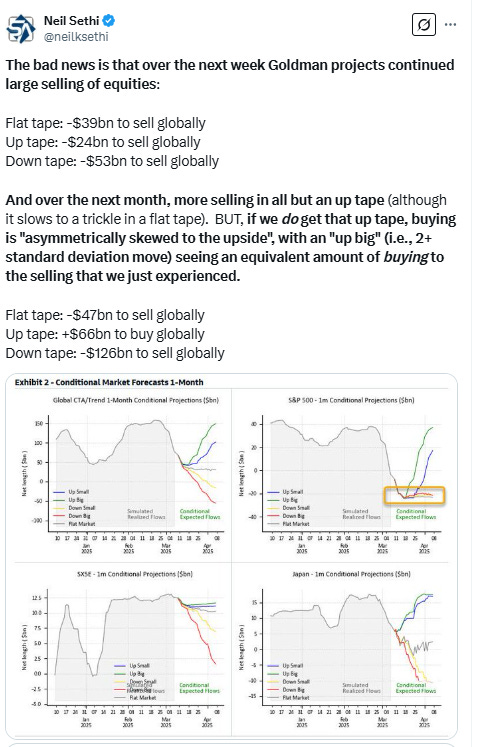

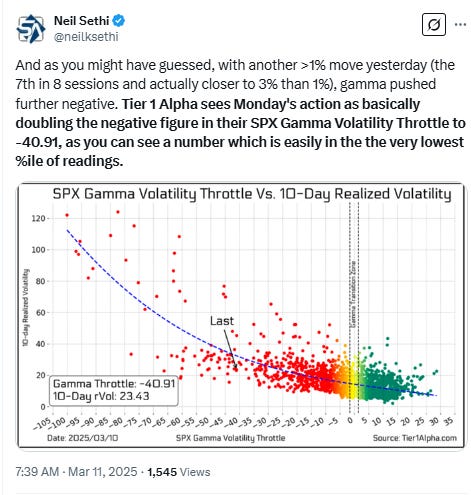

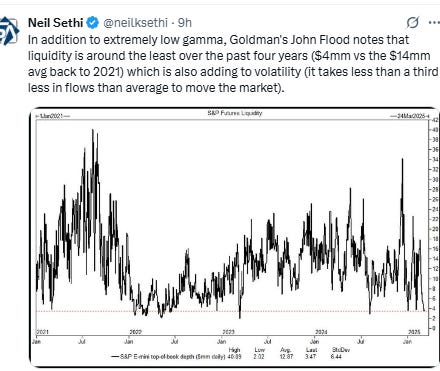

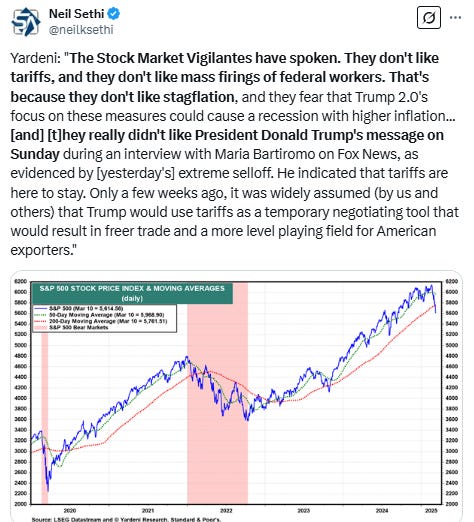

Major US equity indices started the day little changed following the worst day for the Nasdaq since 2022 which saw markets move more than 1% for the 7th session in 8 (which as I noted yesterday meant a high likelihood of continued systematic selling today). But at 10am ET they started to fall despite a solid JOLTS report following Pres Trump announcing a doubling of Canadian steel/aluminum import tariffs in response to Ontario putting an electricity export tax on sales to the US (both of which have now been reversed (the doubling not the original 25% steel/aluminum tariffs). A mid-morning rally was also sold.

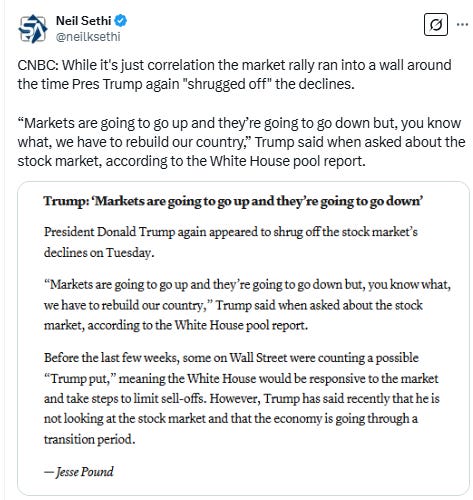

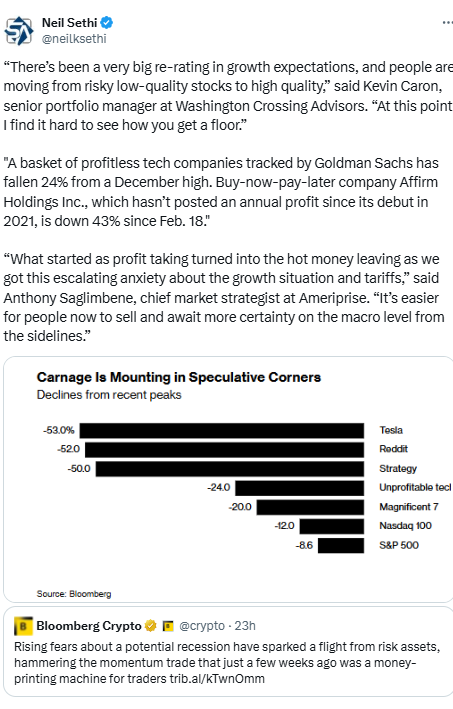

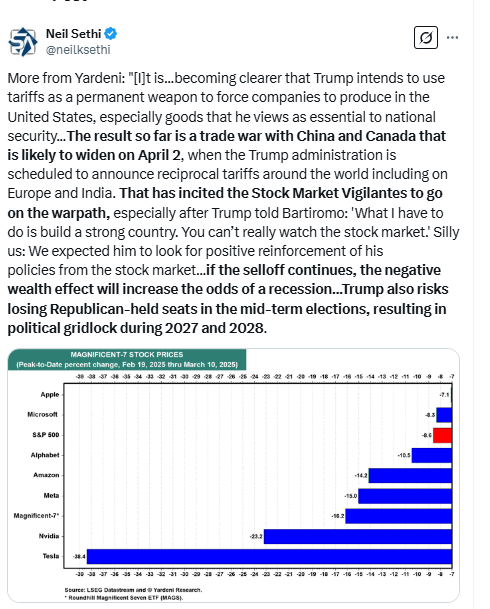

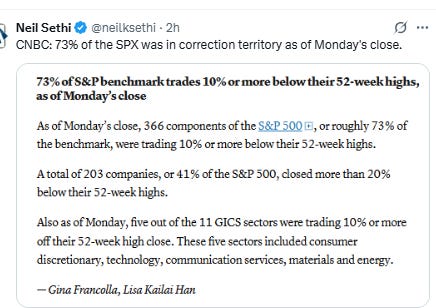

But equities were able to find a bottom in the afternoon aided by a Ukraine cease-fire deal, and they rallied until Pres Trump reiterated at a White House briefing that he was unconcerned with the recent market declines. That caused a pullback from the highs which turned into more when the systematic selling kicked in the last 15 minutes taking all but the Russell 2000 into negative territory. Positively, though, the SPX and Nasdaq both finished with declines under -1%. Still the S&P 500 is off -9.5% from its all-time high reached Feb. 19th, and the Nasdaq Composite is off around -14%.

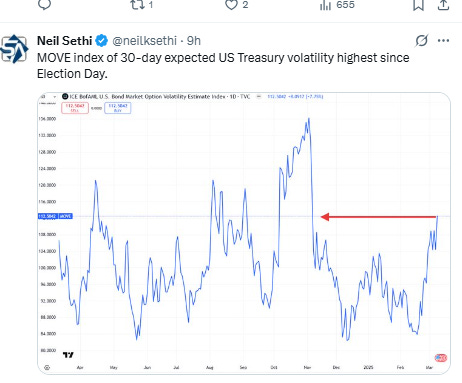

Treasury yields moved higher back as Fed rate cut bets fell back. The dollar though fell to its lowest since Election Day. Gold, copper, crude, and bitcoin though gained while nat gas fell back.

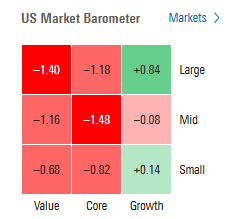

The market-cap weighted S&P 500 (SPX) was -0.8%, the equal weighted S&P 500 index (SPXEW) -1.4%, Nasdaq Composite -0.2% (and the top 100 Nasdaq stocks (NDX) -0.3%), the SOX semiconductor index -0.7%, and the Russell 2000 (RUT) +0.2%.

Morningstar style box saw large growth stocks with a rare (of late) day of outperformance.

Market commentary:

“While Washington policy makers talk of ‘Little Disturbances,’ these disturbances have significant impacts on the markets and the economy,” writes economic strategist John Silvia. “The higher probability of a recession that is now in market forecasts have a significant, not little, impact on household job/income expectations as well as small business planning.”

“To be sure, the outlook for stocks has changed for the worse in the near term,” notes Sevens Report President Tom Essaye. “Prior to the onslaught of tariff headlines that hit markets in early February, stocks enjoyed a near-perfect setup of stable growth, Fed rate cuts, AI enthusiasm, and expected fiscal positive momentum.”

“How growth and earnings trends evolve from here remains tied, in the near-term, to how tariffs evolve,” writes 22V Research’s Dennis DeBusschere. “That means uncertainty will remain high, which suggests elevated internal volatility and more short-term mean reversals.”

“This could continue,” Peter Cardillo, chief market economist at Spartan Capital Securities, said on Monday, adding that the Nasdaq being in a correction and the S&P 500 being on the cusp of one could “bring on more selling until it exhausts itself.”

He added: “Is it too early to talk of bear market? The potential of a bear market in the Nasdaq is pretty high, at this point.”

“The market went from exuberance to despair in just a couple of weeks,” said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities USA. “Really what the bond market is concerned with is slowing growth momentum, exacerbated by trade and fiscal uncertainty,” Goldberg told MarketWatch.

“Our takeaway is that the sell-off has been exacerbated by the unwinding of extended positioning in certain market segments, such as momentum and tech stocks, and is not necessarily a signal that US economic risks have escalated significantly,” wrote Ulrike Hoffman-Burchardi, head of CIO global equities at UBS Financial Services.

Anastasia Amoroso, chief investment strategist at iCapital, thinks recession fears are overblown. “Why do we have a recession all of a sudden? What indicators actually point to a recession?” she continued. “We have a relatively strong payrolls report. We have consumer spending that is still pacing 3% or 4%, so I don’t actually see the reasons to fear a recession at this very moment.”

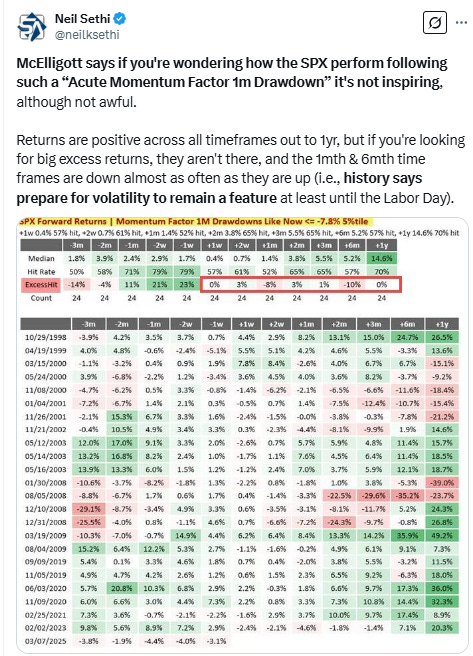

“To regain a semblance of market confidence as to where this is going, the Trump administration needs to find a way to collapse the timeline and pull-forward the ‘goods’ in order to shift the messaging and negative sentiment to the things the private sector will require to offset the downside of current headwinds,” Nomura’s Charlie McElligott wrote in a Monday note. “But that is going to be a monster struggle.”

“There’s going to be a period where I think it’s going to be panic at the disco,” Amy Wu Silverman, RBC Capital Markets equity derivatives strategist, said on Bloomberg Television. “We haven’t gotten there yet. But as these levels climb there will be unwinds and more uncertainty that triggers even more.”

“The bears are in control right now and every time the market tries to bounce we see another violent leg down,” Sarhan said. “If this continues, fast forward a few more days, we are looking at a complete change in environment from a bull market to a bear market.”

“We are in a situation where the pendulum has shifted and fear has taken over,” said Adam Sarhan, founder of 50 Park Investments. “A lot of this has to do with the ‘Trump trade’ being unwound, but also concerns about growth going forward, and also the R-word, which is recession.”

“It took a few weeks for Trump to break the international economic regime, presumably with a plan to fix and replace it with something ‘better,’” said Michael Rosen, chief investment officer of Angeles Investment Advisors. “Absent a clear idea of what ‘better’ is, investors are just left with the detritus of the broken global economic framework. Unless and until we see what replaces it, investors will be cautious, at best.”

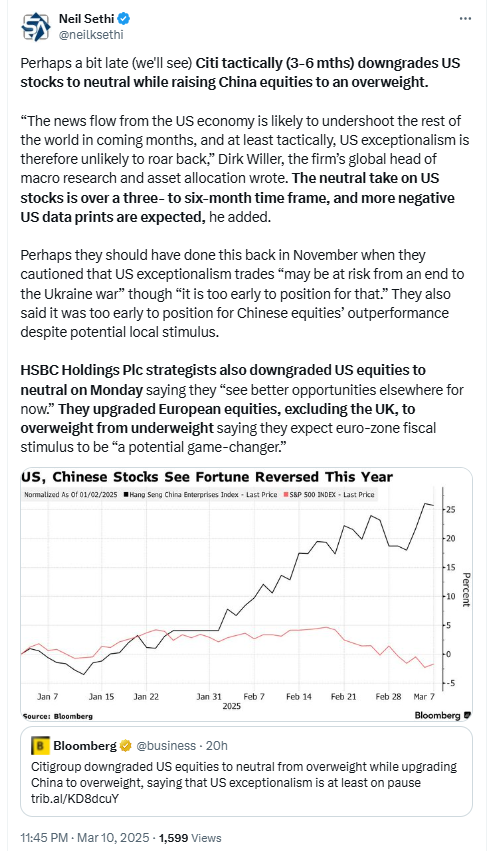

“US exceptionalism is starting to unravel — you want to preserve capital in this environment,” said Kellie Wood, money manager at Schroders Plc that oversees over $1 trillion globally. The fund last month flipped from buying the dollar to favoring the yen and euro, and is bullish on short-dated Treasuries and Australian government debt, she said.

“Markets right now are like Olympic-level tennis except we, traders, are the ball,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors Pte. in Singapore. Yeoh likes long-dated Treasuries and is bearish on US stocks, though “with moderate commitment” amid volatile markets.

The stock-market selloff is a result of a “spike in uncertainty” tied to worries over the economic impact of tariffs as well as other concerns, including a looming showdown over the debt ceiling and efforts to extend the tax cuts enacted during Trump’s first term, said Tom Essaye, founder of Sevens Report Research, in a Monday note. The fear is that uncertainty will cause consumers and businesses to “hole up” and wait for clarity, sparking an economic slowdown and a fall in S&P 500 earnings, he said, noting that the index is seen as “very vulnerable” to a 10% pullback given that it was still trading at over 21 times expected earnings. Essaye said he appreciates those fears and agrees that if they’re realized, the S&P 500 could see a pullback extend to 10% or more. But he emphasized that at present, “it’s fear driving this market, not actual bad data,” while corporate earnings have held up and analysts have yet to deliver wholesale cuts to earnings estimates.

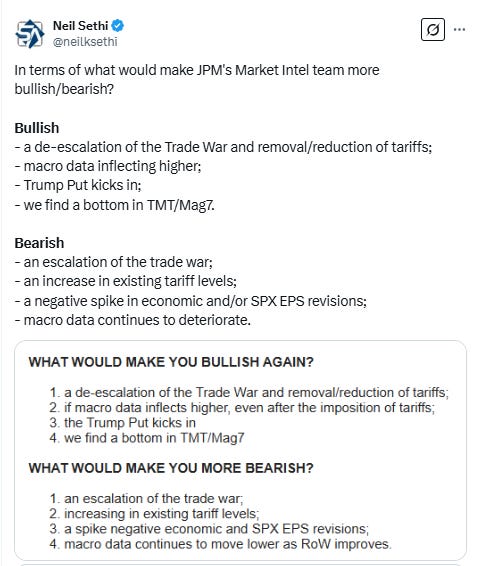

“Markets are questioning the notion that the Trump administration would adapt policies in response to equity market volatility or economic growth concerns,” Mark Haefele, Global Wealth Management chief investment officer, wrote in a note on Monday. Haefele added, “Investor nerves are also likely being added to by the potential for a US government shutdown this weekend, and more headlines about ‘reciprocal’ tariffs coming out on 2 April.”

“This market is just blatantly sick and tired of the back-and-forth on trade policy. It feels as though the administration continues to move the goal posts,” Art Hogan, chief market strategist at B. Riley Wealth Management, told CNN in a phone interview Tuesday. “With that much uncertainty, it’s impossible for investors to have any confidence.”

“No one is blinking on the trade war yet and that’s troubling to our clients,” said Jamie Cox, managing partner at Harris Financial Group. “The market thought Trump was bluffing. Now we’re living through the difficulties of it.”

“Senior leaders are talking about transition periods and that is making people very nervous,” R.J. Grant, global head of equity trading at Stifel Nicolaus. “It seems like there’s going to be more pain before we have better growth again. This is all bleeding into the market.”

In the wake of the carnage, Wedbush analyst Daniel Ives urged patience. “We clearly need stable Trump policy and investors need to know the rules of the game… but that will all happen over the coming months and we do not believe this dramatically changes the trajectory of the AI revolution over the coming years,” he wrote Monday afternoon.

After a brutal opening to March for U.S. stocks, long-term bullish investors may now be buying a market that’s not “widely overvalued,” Sevens Report founder Tom Essaye said. “If fears of a policy-inspired growth slowdown don’t occur, then this market is now in a ‘fair value’ range that could invite nibbling on the long side, if you can withstand the volatility,” he said in a note Tuesday. The S&P 500 is now trading at a price-to-earnings ratio of 20 to 21 times, according to his note.

Recent economic commentary from U.S. officials has raised red flags for TS Lombard economist Dario Perkins. “I’m not turning bearish. I’m not even forecasting a recession,” Perkins wrote to clients Friday. “But it is odd to see US policymakers talk as if they want to inflict damage on the economy, or at least do things that risk causing damage.” Perkins called the combination of tariff policy and the push to slash federal government spending “dangerous.” He said this marks a shift from the “whatever-it-takes” policy that markets have become used to. “This is something new,” he said. “It is Muck-Around-and-Find-Out policy, to use the polite term.”

“What Trump has been doing has not been helpful for US equity markets,” said Neil Dutta at Renaissance Macro Research. “For now, I don’t see recession. We’ve never really had a recession from policy uncertainty itself. And, we don’t yet know how markets would respond if Trump’s escalation now results in de-escalation later.”

“What is being questioned in the market is US exceptionalism,” said Aneeka Gupta, head of macroeconomic research at Wisdom Tree UK Ltd. “When Trump came back into the White House, the focus on was on the positive impact of his policies, but now the market is really drilling down into the negatives.” While there are signs of some traders stepping in to buy stocks, it’s “too soon to call the end” of the pullback, Gupta added.

Peter Tchir, head of macro strategy at Academy Securities, sees Tuesday’s choppy session as little reprieve. “I’m treating this like the Great Financial Crisis or European debt crisis,” he said. “I think we get a chance to have a small bounce, but I’m beginning to think we might have 20% downside from here.”

“US exceptionalism is starting to unravel — you want to preserve capital in this environment,” said Kellie Wood, money manager at Schroders Plc that oversees over $1 trillion globally. The fund last month flipped from buying the dollar to favoring the yen and euro, and is bullish on short-dated Treasuries and Australian government debt, she said.

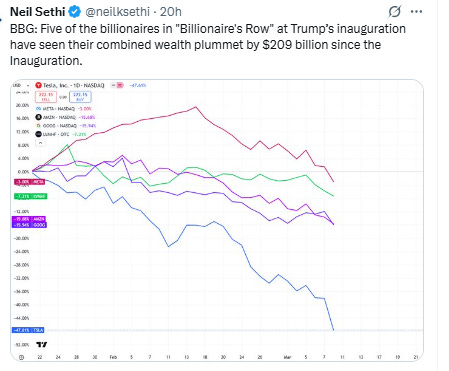

In individual stock action, Delta Air Lines added to recession worries Tuesday as the airline slashed its earnings outlook due to weaker U.S. demand, pushing the stock down 7.3%. Other travel-related stocks followed suit with Disney and Airbnb both off 5%. American Airlines (AAL 11.46, -1.04, -8.3%), and Southwest Airlines (LUV 30.53, +2.35, +8.3%) also lowered their Q1 revenue outlook, while Dick's Sporting Goods (DKS 198.97, -12.05, -5.7%) and Kohl's (KSS 9.15, -2.90, -24.1%) disappointed with full-year guidance after reporting their quarterly results. It was the worst day for Kohl’s

On the flip side, some of the biggest losers Monday bounced back with Tesla (TSLA 230.58, +8.43, +3.8%) and NVIDIA (NVDA 108.76, +1.78, +1.7%) among the standouts.

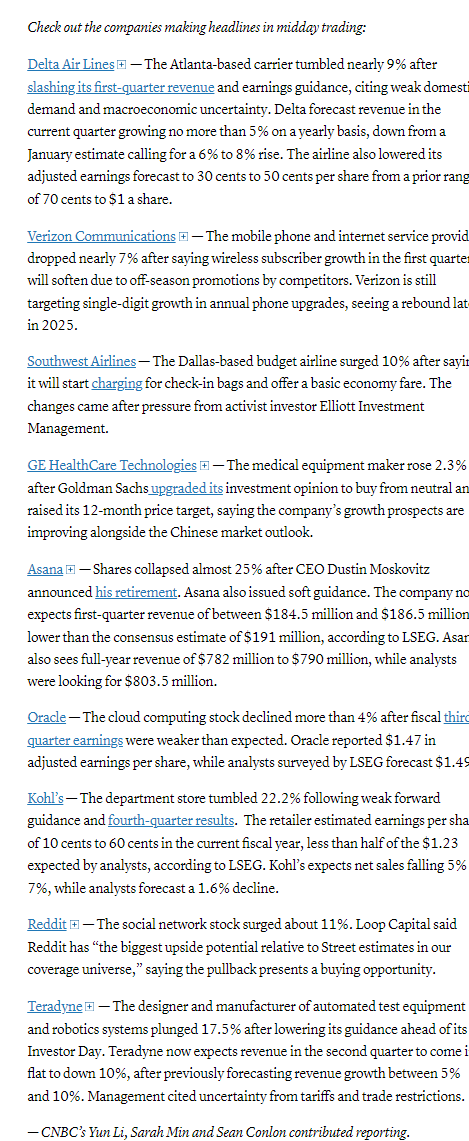

Some tickers making moves at mid-day from CNBC.

In US economic data:

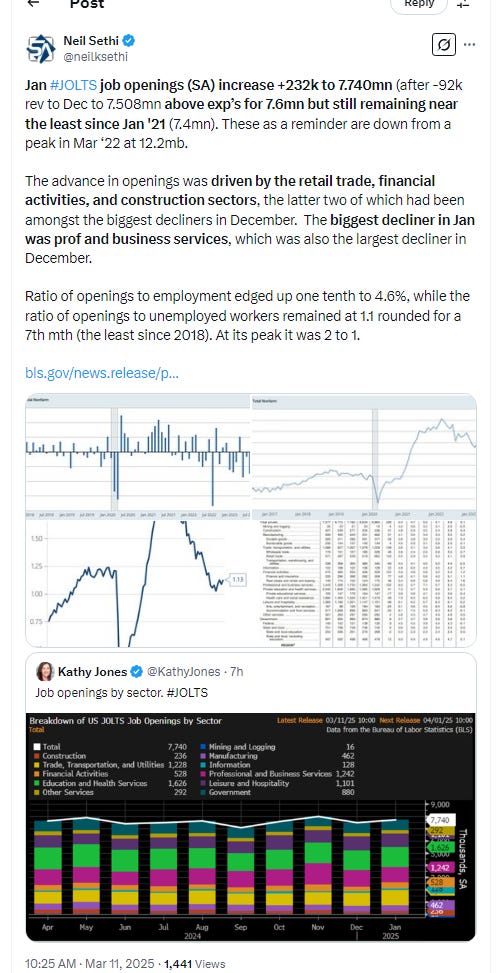

Jan JOLTS job openings (SA) increase +232k to 7.740mn (after -92k rev to Dec to 7.508mn above exp’s for 7.6mn but still remaining near the least since Jan '21 (7.4mn). These as a reminder are down from a peak in Mar ‘22 at 12.2mb. “Details of the Job Openings and Labor Turnover Survey showed the hiring rate remained unchanged in January, while the layoffs rate dipped to 1%, the lowest since June. The so-called quits rate, which measures the percentage of people voluntarily leaving their jobs each month, rose to 2.1%, the highest since July.” BBG

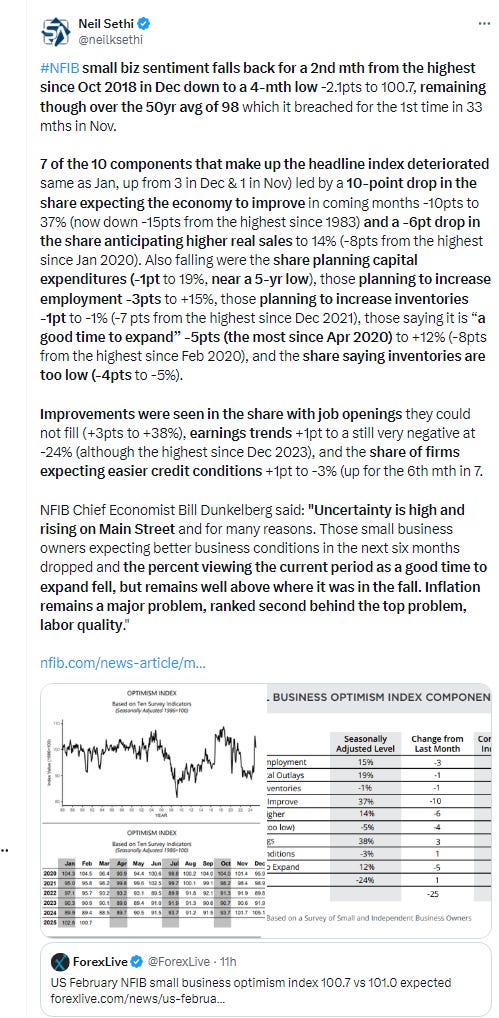

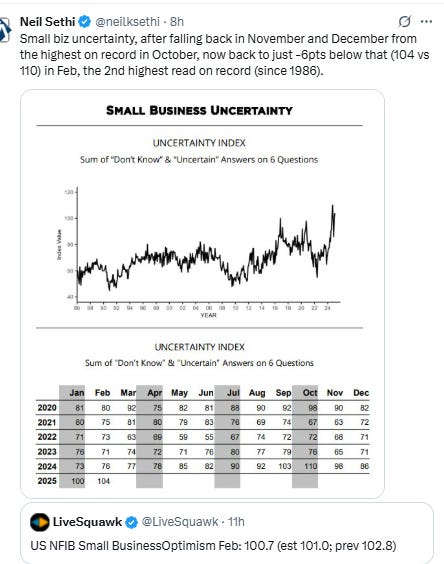

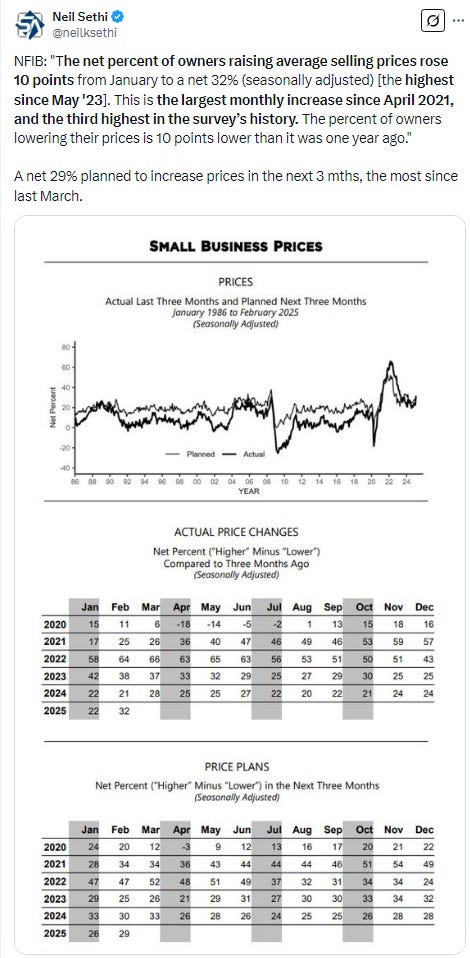

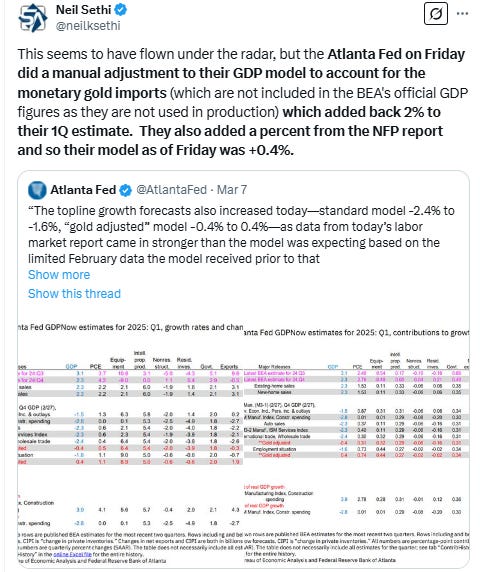

NFIB small biz sentiment falls back for a 2nd mth from the highest since Oct 2018 in Dec down to a 4-mth low -2.1pts to 100.7, remaining though over the 50yr avg of 98 which it breached for the 1st time in 33 mths in Nov. Small biz uncertainty, after falling back in November and December from the highest on record in October, now back to just -6pts below that (104 vs 110) in Feb, the 2nd highest read on record (since 1986).

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX remained at the lowest since Sept, well under its 200-DMA. It is also below the 5666 level noted Friday which was an important level in 2024 representing the July peak, September breakout, and October low.

The daily MACD remains firmly in “sell longs” positioning, and RSI remans the weakest since Oct ‘23.

The Nasdaq Composite like the SPX fell to the lowest since Sept, even further below its 200-DMA. Its daily MACD also remains firmly in “go short” positioning, and its RSI is the weakest since Jan 2022.

RUT (Russell 2000) has seemed to find some support at the 2000 level. We’ll see if it can continue to hold. It did hit the lowest since August intraday and the second lowest close since June (after Monday). Its daily MACD remains firmly in “go short” positioning, and its RSI is also the weakest since Jan 2022.

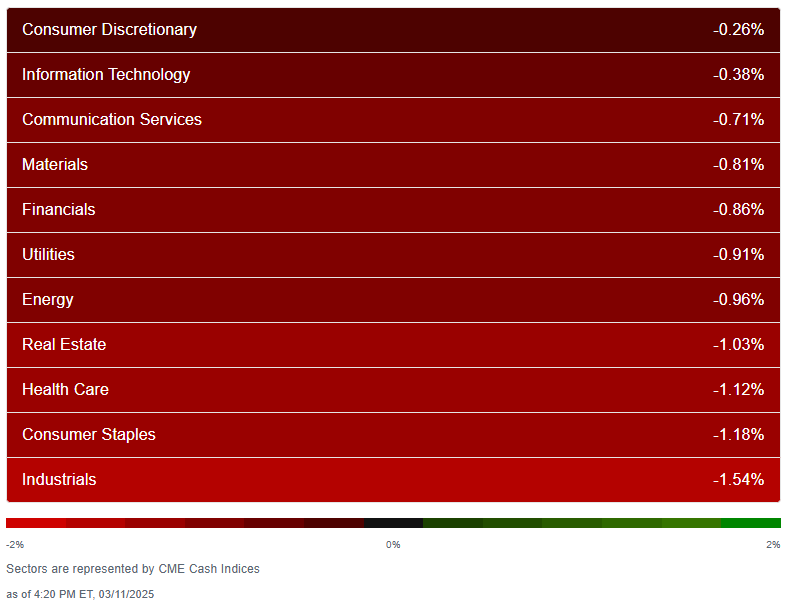

Despite the better performance in the markets, equity sector breadth according to CME Cash Indices deteriorated with every sector down (from 9 Monday), although the overall losses were milder. Still 10 of 11 sectors were down at least -0.7% (from 9 Monday), but just 4 were down >-1% (vs 8 Monday) and none down >-2% (vs 5).

Megacap growth sectors which were all down at least -3.5% Monday were the least sold Tuesday. Defensives lagged taking 4 of the bottom 6 spots.

SPX stock-by-stock flag from Finviz consistent with more big green boxes but lots and lots of little red ones.

Positive volume (percent of total volume that was in advancing stocks) improved Tues and was actually better than I would have expected at 45% on the NYSE, and 59% on the Nasdaq (a very good number given the index finished modestly lower).

Positive issues (percent of stocks trading higher for the day) though again weaker as it’s mostly been during those couple of weeks at 39 & 45% respectively meaning the buying was concentrated in fewer names).

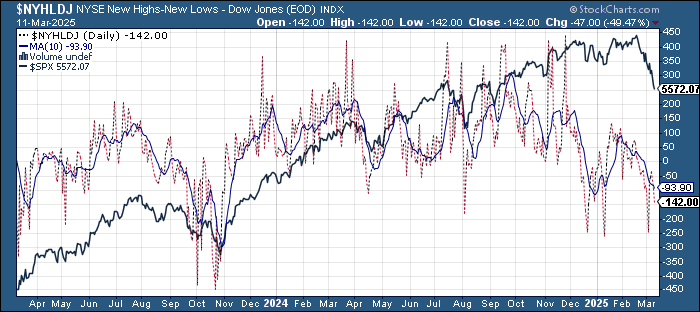

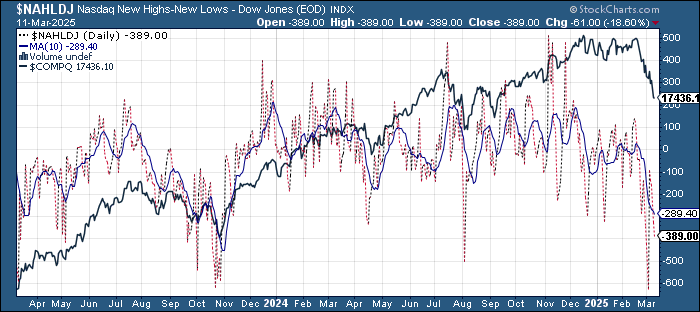

New highs-new lows (charts) though fell on the NYSE to -141 (still better I guess than the -247 last Tuesday (almost the worst since Oct ‘23)) while the Nasdaq deteriorated to -390 still up from -629 Tuesday (which was the least since 2022) but otherwise the weakest since August. They are now back below the 10-DMAs (less bullish) which continue to fall.

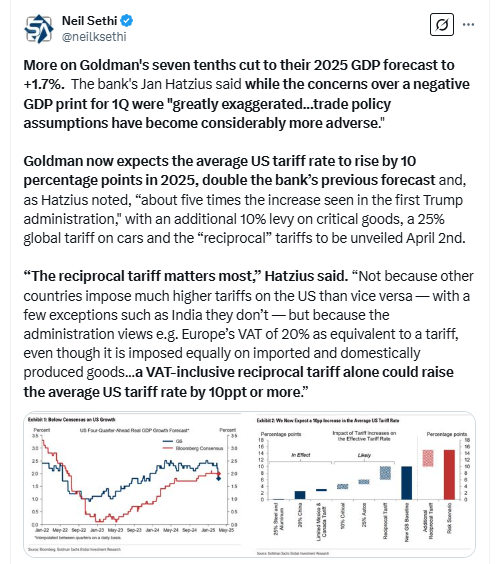

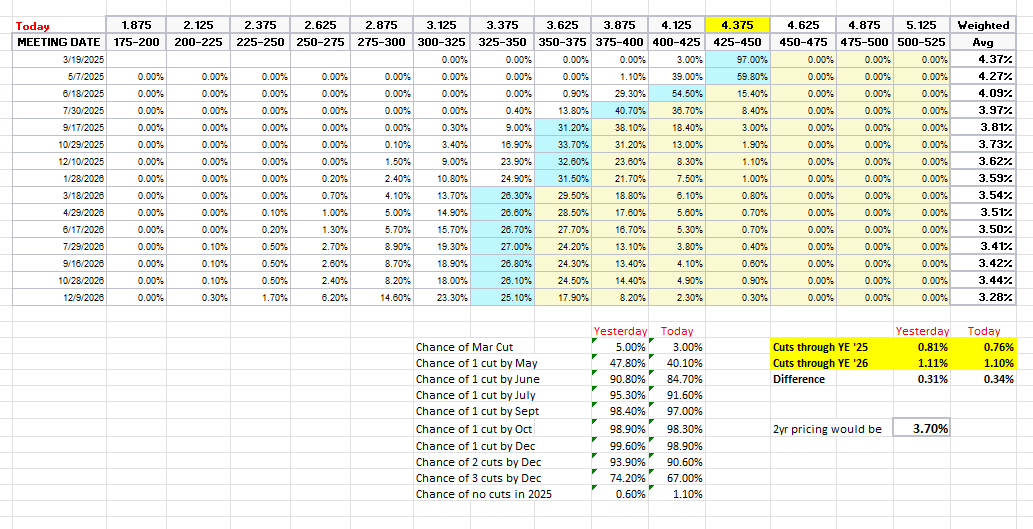

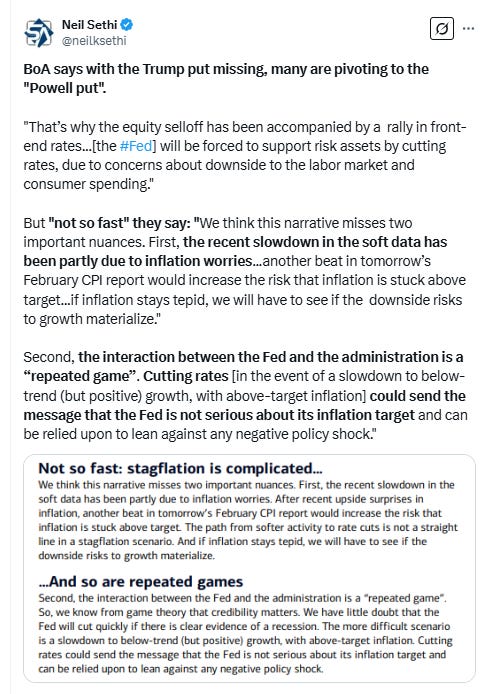

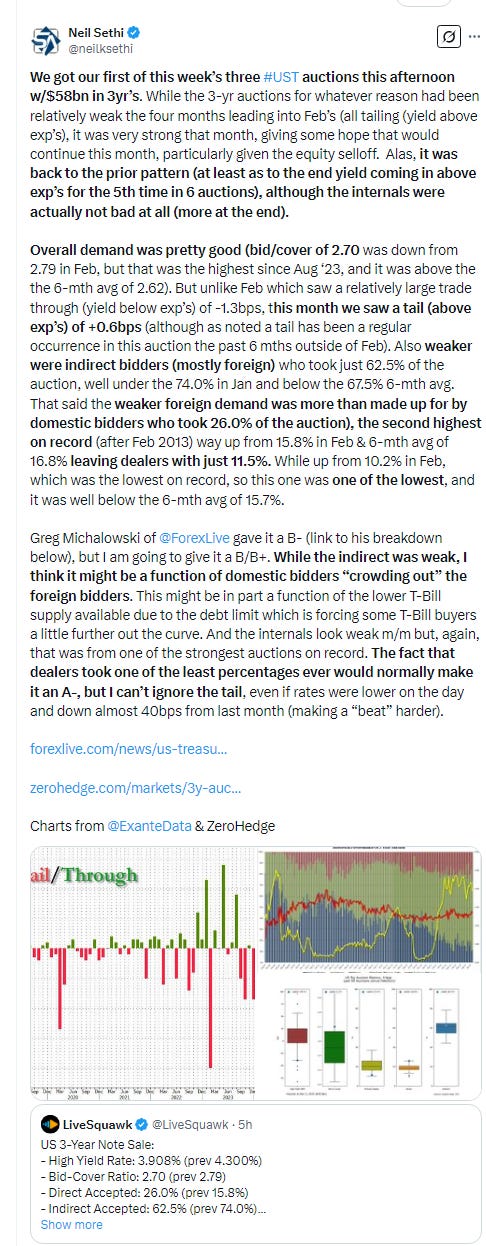

#FOMC rate cut probabilities from CME’s #Fedwatch tool fell back from the highs of the year.

A cut by March remains off the table, and one by May fell back to 40% from 48%. One by June edged back to 85% from 91%. The probability of two 2025 cuts at 91% (vs 94%), three cuts at 67% (from 74%), and no cuts 1.1% (vs 0.6%) with 76bps of cuts priced (-5bps from Monday but up from 28bps last CPI Day).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 70 “maybe actually going a little too far”). But as I said then “It’s a long time until December.”

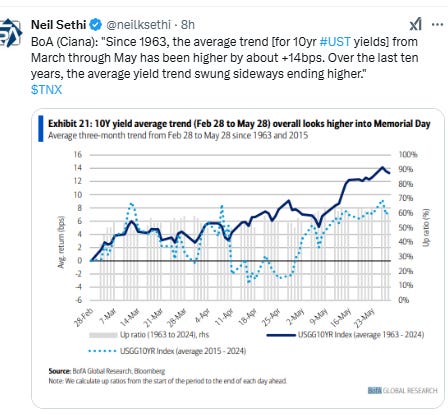

10yr #UST yield continued its back and forth action of the past few days +8bps to 4.29%. Still down -37bps since CPI day (Feb 12th). I still think it’s more likely than not that it holds the 4.13% level. CPI tomorrow will obviously have a big say in that though.

The 2yr yield, more sensitive to Fed policy, moved along with rate cut bets up +6bps to 3.95% from the least since early Oct, now -37bps below the Fed Funds midpoint so continues to price far fewer cuts than SOFR markets (which say it should be 3.70% today).

I had said when it was 45-55bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now definitely closer to where I think fair value is but, there could be a little more to go. Ian Lygan of BMO sees it going to 3.5% by year’s end.

Despite the gains in yields, dollar $DXY down for the 6th session in 7 right at the Election Day lows it bounced from on Friday (it actually cut just below them today). Daily MACD remains firmly in “go short” positioning while the RSI is now the most oversold since Dec 2020. As I noted Friday “seems this new support level really needs to hold, as not much under that until around 100.”

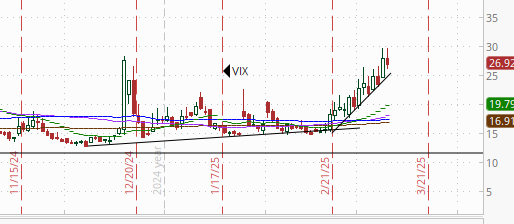

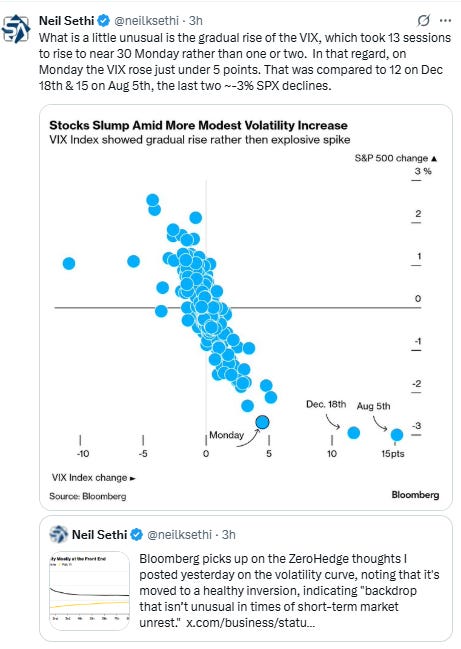

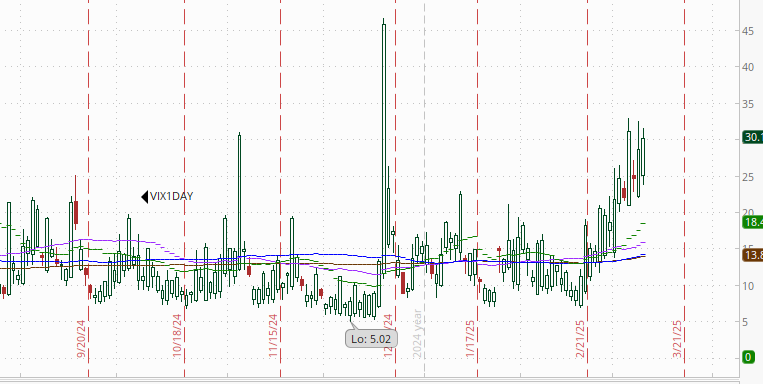

The VIX continued its textbook uptrend again testing but not breaching 30 before settling back a touch at 26.9 consistent w/~1.69% daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) though continued higher at one point hitting the highest since the August meltdown (and before that 2022) remaining well over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day $VIX ended up at 30.1, the 4th highest close since inception (in Apr ‘21)). It’s looking for a move of 1.88% Wednesday.

#WTI futures were up for only the 2nd time in 8 sessions as they look for their first weekly gain in 9 weeks, continuing for now to hold the 2024 low of $65.27 which as I noted last week is the key level for me. Daily MACD remains in “go short” positioning, while the RSI is just off the weakest since Sept (but at a 1-week high).

Gold futures got back Monday’s losses as they look for a 12th weekly gain in 13 weeks. Remains below the 20-DMA. The daily MACD though remains in “sell longs” positioning, and the RSI continues to show a clear negative divergence (as I’ve noted for two weeks now), so as I said last week, not giving up on my target of $2800 quite yet.

Copper (/HG) was able to bounce from its 20-DMA back to the highs of last week. Daily RSI and MACD flipped back to more supportive but continue to have lower highs (negative divergence).

Nat gas futures (/NG) edged lower after hitting the highest since Dec ‘22 Monday following the 4th weekly gain in the last 5 weeks. Daily MACD remains in “go long” positioning while the RSI remains over 50 although both with lower highs (negative divergence).

Bitcoin futures did better than tech stocks today bouncing over 4% after filling the gap in the futures chart Monday. As I noted, then “it also coincides with the 200-DMA where it found some support, so this seems like a key level.” Relative strength near the lowest since July ‘23 while the daily MACD remains in “go short” territory but won’t take much of a rally for that to cross over.

The Day Ahead

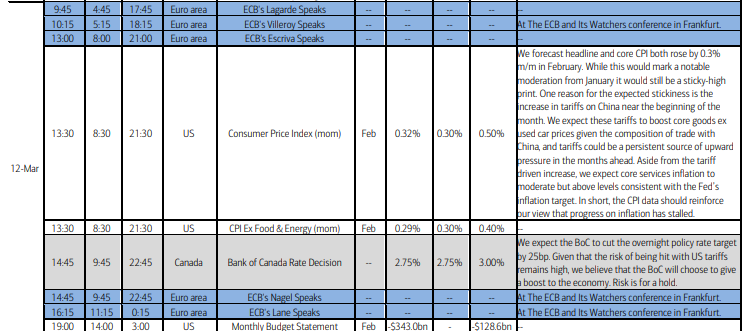

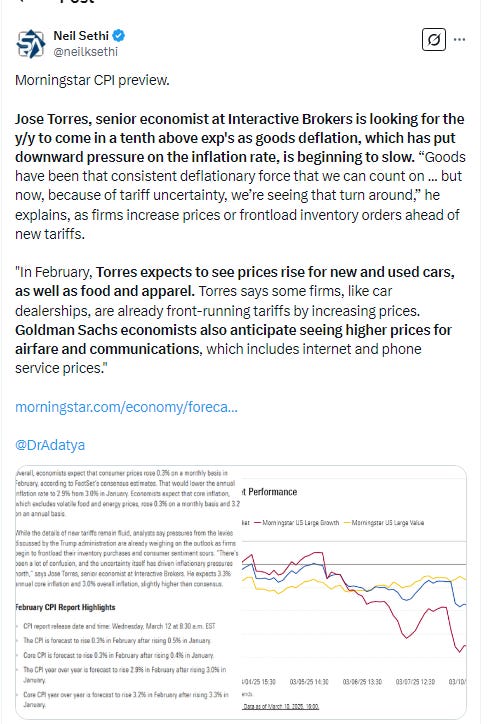

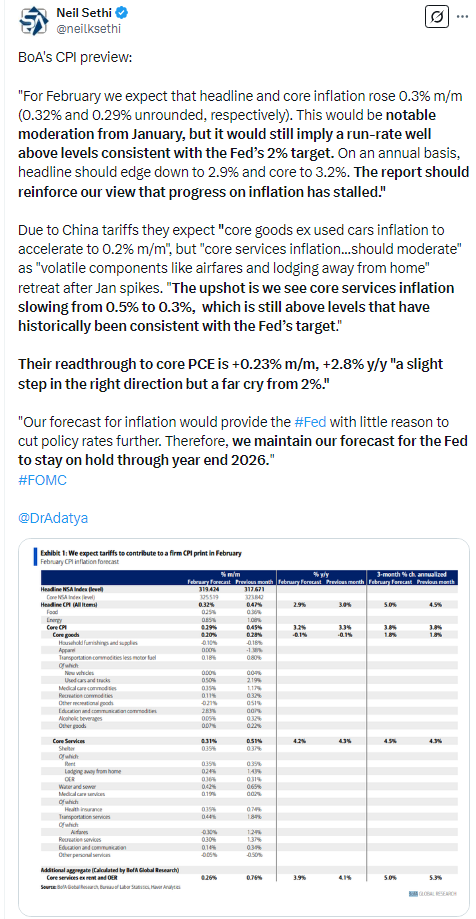

US economic data gives us our key data point of the week in Feb CPI. Some expectations are below. We’ll also get weekly mortgage applications and petroleum inventories.

No Fed speakers with the blackout, but we will get our second non-Bill Treasury auction in $39bn of the benchmark 10yr (reopening).

We’ll get two SPX components reporting Wednesday with one >$100bn in market cap in Adobe (ADBE) (see the full earnings calendar from Seeking Alpha).

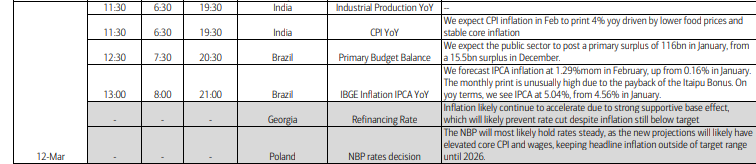

Ex-US the highlight is the policy decision from the Bank of Canada. A cut is expected but not a sure thing. We’ll also get a highly anticipated speech from Christine Lagarde at the ECB leader’s meeting. In EM we’ll get policy decisions in Poland and Georgia and Brazil and India CPI. We also get OPEC’s monthly update.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,