Markets Update - 3/12/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

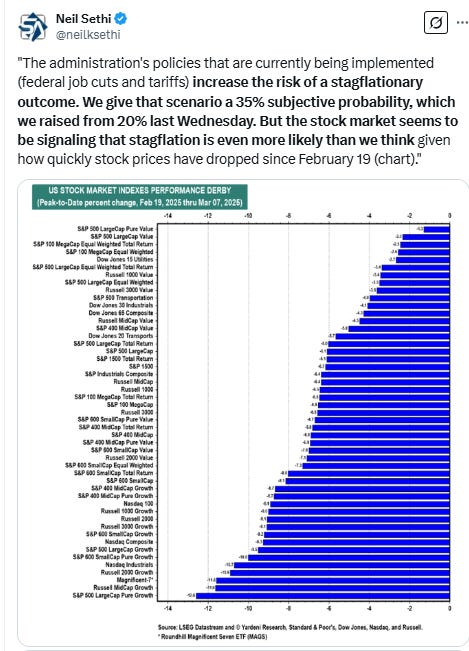

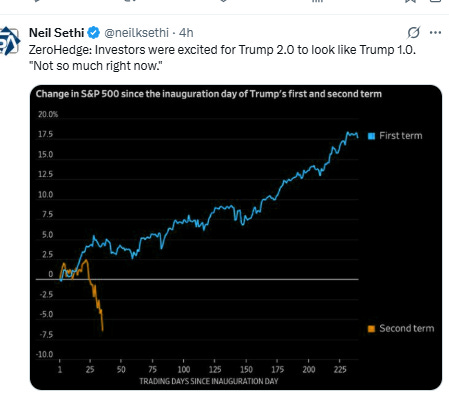

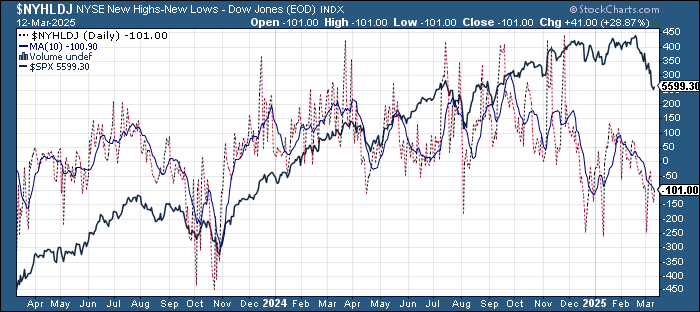

Major US equity indices started solidly higher Wednesday boosted by a cooler than expected CPI report, although bonds fell (yields higher) and Fed rate cut bets were trimmed as the elements which feed through to core PCE (the Fed’s preferred inflation metric) were hotter than expected seeing estimates for that (which we get at the end of the month) raised. Whether it was that or something else, stocks fell from the open before finding a floor late morning. They moved back towards the highs before fading into the close still ending mostly positive (DJIA was mildly lower) led by the Nasdaq which in turn was led by the megacap growth stocks. In contrast the equal weight SPX was lower by a half percent. No big drop in the last 30 mins today which might mean that the systematic selling is drying up?

Treasury yields as noted moved higher back as Fed rate cut bets fell back again. The dollar also was higher, as were gold, copper, and crude, while nat gas was lower and bitcoin was little changed.

The market-cap weighted S&P 500 (SPX) was +0.5%, the equal weighted S&P 500 index (SPXEW) -0.5%, Nasdaq Composite +1.2% (and the top 100 Nasdaq stocks (NDX) +1.1%), the SOX semiconductor index +2.5%, and the Russell 2000 (RUT) +0.1%.

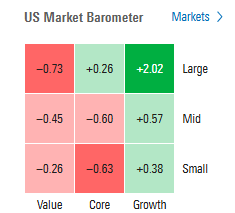

Morningstar style box saw large growth stocks with a second day of outperformance lapping the field.

Market commentary:

“Wednesday’s weaker-than-expected CPI is a slight sigh of relief for the Federal Reserve and the markets, because it shows that inflation is moving in the right direction, which is a nice setup as the market starts to prepare for a potential resurgence of inflation from tariffs,” said Skyler Weinand at Regan Capital.

“We’re just waiting on some kind of policy response, either from the Fed or the administration,” 3Fourteen Research co-founder Warren Pies told CNBC’s “Closing Bell” on Tuesday. “I think that’s going to be a little bit slow coming. And so I don’t think it’s time to buy the dip just yet.”

“Historically, it has been common for stocks to trade in a choppy fashion early into year one of a new presidential cycle as investors digest new policies,” writes Keith Lerner, co-chief investment officer and chief market strategist at Truist. “With the feverish pace of activity in Washington, the current cycle has been amplified. Moreover, the current elevated level of policy uncertainty came at a time of elevated investor expectations.”

The uncertainty created by shifting White House policies—particularly around tariffs—have led to a number of "yellow flags" in the economic data that RBC’s chief economist Frances Donald say now pose a risk of "bleeding into the real economy in more tangible ways if left unchecked."

Aside from a compelling argument that the market was overdue for a downturn of this magnitude, 10% corrections usually don’t become 20% bear markets unless they’re accompanied by either an economic recession, an earnings recession, or a Fed hiking cycle, according to Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team.

“We’re not seeing any of those right now,” he noted. “That said, even if the majority of this drawdown is potentially behind us, volatility may not be, and there’s a good chance the market could chop sideways for a while.”

Lauren Goodwin at New York Life Investments says markets need policy clarity to stabilize. “In uncertain markets, a ‘wait and see’ approach risks missing opportunities and building ballast against risks. Instead, investors should use volatility to their advantage and position for long-term themes.”

To Matt Maley at Miller tabak, US stocks are a long way from a “great” buying opportunity. “A ‘great’ buying opportunity comes after the stock market has fallen to a cheap level.” he said. “This does not mean that the stock market has to fall further. However, to call this a great buying opportunity is much is way too optimistic in our opinion.”

“For the last three weeks, traders have felt like buying this market is like trying to catch a falling knife, but extreme oversold conditions and near-universal pessimism suggest a relief rally is likely,” said Mark Hackett at Nationwide.

Stocks after the sell-off could be a good spot for a relief rally, but the longer-term outlook does not look as compelling, according to Oppenheimer.

“The caveat is that we think the next market snapback is likely a trade,” Ari Wald, head of technical analysis at the firm, wrote Tuesday. “We have less conviction putting long-term money to use in what looks like the 8th or 9th inning of this bull cycle.”

“The US administration has described a compelling future US economy,” said Michael Reid at RBC Capital Markets. “But the challenge is, of course, getting there. And perhaps, what is weighing most on these goals is the growing recognition that the bridge from now to that desired outcome isn’t seamless or guaranteed.” Reid says he’s been a long believer of the US “soft landing” theme. And broadly speaking, he continues to believe the US will avert a recession and produce moderate, albeit sub-trend, growth in 2025. “However, over the past month, some “yellow flags” have popped up in the data that are worth monitoring closely — some more concerning than others. Of course, one month of data isn’t enough to shift an entire base case forecast for the world’s most resilient economy.”

“I think the theme of the laggards catching up is still in play. A lot of the domestic midcaps, financials, things that are less exposed to trade … still have that catch-up potential and valuation discount,” said Angelo Kourkafas, investment strategist at Edward Jones.

Andrew Smith, chief investment officer of Delos Capital Advisors in Dallas, said he wanted to see signs of economic strength before switching up his currently defensive portfolio. “Until we get confirming economic data from the leading economic side, we’re in the wait and hold pattern. Right now all of our [purchasing managers’ indexes] are in expansion territory — they have moderated, but they’re not decelerating or in negative growth territory, and that’s a positive sign for us. In April, if it shows a more meaningful move higher, we’ll start getting more aggressive in our cyclical and value allocations,” Smith said.

JJ Kinahan, CEO of IG North America and president of tastytrade, the online brokerage firm under IG Group, said the firm has been deluged with questions from clients, especially younger investors more accustomed to market ups than downs. “Clients are confused,” he said. “Even professional traders are struggling right now with all the constant changes related to the tariff shifts.”

“Now obviously there’s a headline every 15 minutes — that is a bit scary,” said Brian Frank, president and portfolio manager at Frank Funds. “With the market action how it is, even the strongest of clients doesn’t like to see the market down a lot.”

“How far might Trump be willing to go? We don’t buy the notion that he’s trying to cause a recession, but we think it’s clear he’s willing to tolerate significant pain. This was our argument last week when he let the MEX/CAN tariffs take effect,” wrote Tobin Marcus, Wolfe Research’s head of U.S. policy and politics. “We’ve never been believers in an easy, mechanical ‘Trump put,’ and at this point, we think investors should take the President at his word. He is determined to use tariffs to restructure the global economy, and we think he’s a long way from done, in terms of both time and pain tolerance.”

Deutsche Bank analyst Luke Templeman argues that the continued weakness for U.S. equities this week isn’t indicative of both slowing corporate expansion and a looming recession. “The upshot is that while the US equity market sell-off will undoubtedly make many CEOs nervous, it does not have the hallmarks of prior sell-offs that were actually associated with a material dip in corporate and ‘uncontrollable’ economic factors,” Templeman wrote Tuesday. “We run the numbers and show that the majority of companies have been relatively resilient in the market this year,” he added. “So, even though the market is legitimately worried about very high levels of economic uncertainty at present, it is premature to predict an extended pause in corporate expansion activity and we continue to expect this to pick up materially in H2 of 2025.”

In a Wednesday note, investment research firm Ned Davis Research said tariff fears may be overblown. “The overall takeaway from the reports and composite is that the market fears are out of proportion with market performance,” wrote Tim Hayes, the firm’s chief global investment strategist. “If the economic and market worries are justified, much more market weakness and contraction evidence may lie ahead. But the weight of the evidence says something different.” He added: “We’re more likely to see widespread recognition that the fears have not been justified, in which case equities will start recovering from the extreme pessimism.”

“This is the first time in the cycle in which such a benign inflation print has been completely discounted in favor of other risks,” said BMO’s Ian Lygan noting that bond yields moved higher following the release.

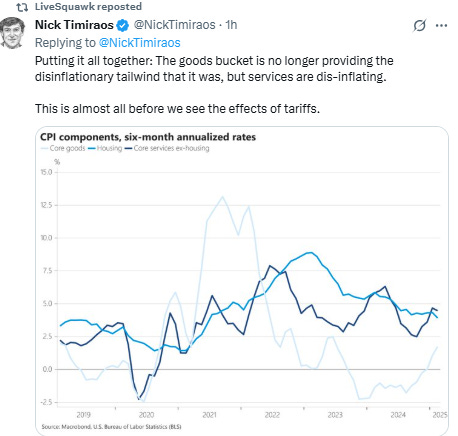

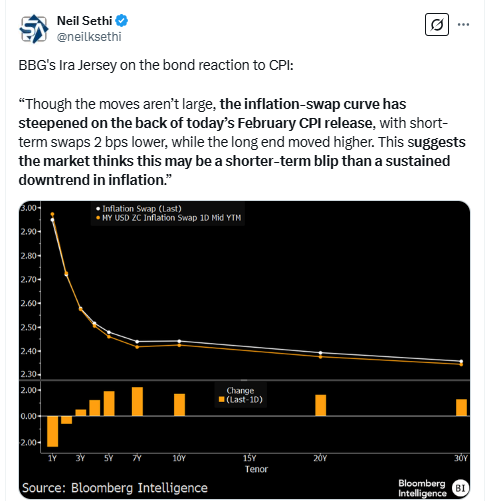

For the Treasury market, the CPI report hasn’t changed much in terms of trend, BI’s Jersey says. “The only clear result is tariffs haven’t yet affected goods prices very much, so the rate market appears to be worried the next shoe will drop. But stable inflation may keep the Fed on hold, causing some readjustment of longer-term Fed expectations.”

“The combination of easing inflationary pressures and rising downside risks to growth suggest that the Fed is moving closer to continuing its easing cycle,” Kay Haigh, global co-head of fixed income and liquidity solutions in Goldman Sachs Asset Management, said in a note.

“This reading is going to be a little dilutive to this stagflation narrative, and it is going to restore to some extent policy flexibility from the Fed,” said Dave Grecsek, managing director in investment strategy and research at Aspiriant Wealth Management. “If this inflation number was higher, you’d have some of these concerns weighing much more heavily, like the Fed would not be in a position to respond if the economy continues to weaken.”

“We’re not surprised the market’s pulled down. Obviously, U.S. equity markets have been exceptionally strong over the last two years. It’s right to expect a correction,” Grecsek added. “But I think once we get through this — we’re in the very early events of these key fiscal policy changes — there’s better news to come.”

“This report is a positive sign in terms of inflation (consistent with our nowcasting signals), potentially bad news in terms of growth, but potentially good news in terms of a Federal Reserve rate cut,” says Florian Ielpo of Lombard Odier Investment Managers.

The gain in the rate of inflation “has come down greatly from its pandemic-era, supply chain disruption highs, but still there are many areas of the consumption basket that have held at stickier levels,” said Rick Rieder, BlackRock’s chief investment officer of global fixed income and head of the firm’s global allocation investment team, in emailed comments on Wednesday’s CPI report. “The Fed will have to balance its focus on inflation with its full employment mandate to determine whether economic growth and national job prospects are soft enough to resume its rate-reduction process,” said Rieder.

“Our eyes will be keenly focused on the next couple of payroll reports, and very much on immigration’s impact therein, to determine whether the Fed will feel the need to allow for some distance from its inflation objective in order to prevent a more persistent labor deterioration,” he said.

“The White House and the Fed are breathing a sigh of relief because tariffs didn’t filter through to consumer prices,” he said. “This is a positive for investors because a huge amount of negativity is priced into stocks. For the first time in several weeks, we might get a break in the streak of frightening news. The other shoe didn’t drop, and that could be good news for Wall Street. Next week’s Fed meeting got a little less worrisome.”

“Today’s cooler-than-expected CPI reading was a breath of fresh air, but no one should expect the Fed to start cutting rates immediately,” said Ellen Zentner at Morgan Stanley Wealth Management. “Given the uncertainty of how trade and immigration policy will impact the economy, they’re going to want to see more than one month of friendly inflation data.”

As we entered 2025, investors’ main economic worry centered around reflation. But as the trade war continues to escalate and as economic policy uncertainty continues to rise, that worry has shifted from inflation to the labor market and the economy as a whole, according to Bret Kenwell at eToro. “In that respect, it will take more than a few reassuring inflation reports to ease investors’ worries,” he said. “Moving forward, the Fed will soon take center stage, but not just for its latest view on inflation. Investors will want to hear the committee’s stance on the economy and the labor market, while they’ll also be on the lookout for the Fed’s quarterly update to its economic projections.”

Today’s report brings some much-needed relief for equity markets, says Seema Shah of Principal Asset Management, averting immediate concerns around stagflation and giving the Fed space to cut policy rates. But she warns that “equities are unlikely to get into full Fed-put glee mode.”

“It’s worth remembering that this may be the calm CPI report before the storm. Not only does the Fed need to wait for tariff policy clarity, but once tariff implementation arrives it is likely to bring at least some price increases, with the inflation picture potentially getting uglier as the months go on. The Fed – and markets – are not yet in the clear.”

“In the near term, Treasuries will rally further as the trade war escalates and growth scares predominate,” wrote Matt Gertken, BCA Research’s chief geopolitical strategist. “For now, we will stick with our defensive trades: favoring Treasuries over high-yield corporate bonds and defensive equity sectors over cyclicals. We also recommend holding cash.” Gertken added that investing in energy stocks could also be a good idea, at least in the short term.

“To hedge against the risk of an oil shock, we recommend favoring US energy stocks over cyclicals, namely tech. The speed of the tech selloff could force us to close this trade in the near term, but we will still hedge for a surprise spike in oil prices despite the growth fears throughout the year,” he wrote.

“Our base case remains that US economic growth can remain resilient, enabling the equity rally to resume — supported by continued heavy investment in AI and progress toward monetization,” UBS wrote in a Tuesday note. “We see further upside for U.S. equities and expect the S&P 500 to reach 6,600 by the end of 2025, around 18% higher than current levels. U.S. policy uncertainty could lead to short-term volatility, but we believe that robust U.S. economic growth and continued structural AI tailwinds should be supportive overall.”

Wells Fargo Investment Institute president Darrell Cronk said in a note to clients that investors should look for the “signal through the noise” of the frequently changing tariff policy coming out of the White House. “The noisy headlines around geopolitical, trade, and fiscal policy have fueled a heightened state of uncertainty. The good news up to this point is that the actual delivery of policies has been milder than the more extreme measures proposed,” the note said. Similarly, Cronk pointed out that signs of economic weakness have not yet materialized into a full slowdown on the ground. “We have yet to see sentiment spill materially into the ‘hard’ economic data, like actual consumer spending, capital expenditures, and company earnings. We will watch this trend closely,” the note said.

Brad Gerstner, Altimeter Capital founder and CEO, said he is waiting out this current uncertain macroeconomic backdrop. “We have high economic uncertainty, high political uncertainty and high technological uncertainty,” Gerstner said on CNBC’s “Squawk Box.” Discount rates have to go up. Risk premiums have to go up … so for us, that was just a period to say OK, we’ll go to the sidelines to wait this out.” The hedge fund manager said he has taken down the net and gross exposure to the bottom decile of exposure that Altimeter would normally have. That being said, Gerstner revealed he picked up some beaten-down stocks Tuesday.

In individual stock action, Though the tech sector is off more than 3% week to date, the cohort bounced on Wednesday to lead the S&P 500 higher. Nvidia gained 6.4%, and AMD added more than 4%. Meta Platforms advanced 2% and Tesla jumped more than 7%, up 12% since Monday.

Brown-Forman's stock fell 5.1% to pace the S&P 500's losers after the European Union's plan of tariffs on U.S. whiskey. The stock was having its worst two-day run in a year. The company's whiskey brands include Jack Daniel's, and Woodford Reserve, Old Forester and Coopers' Craft bourbon.

In late hours, Intel Corp. said it named industry veteran Lip-Bu Tan as its next chief executive officer. Adobe Inc. fell on a tepid revenue outlook.

Some tickers making moves at mid-day from CNBC.

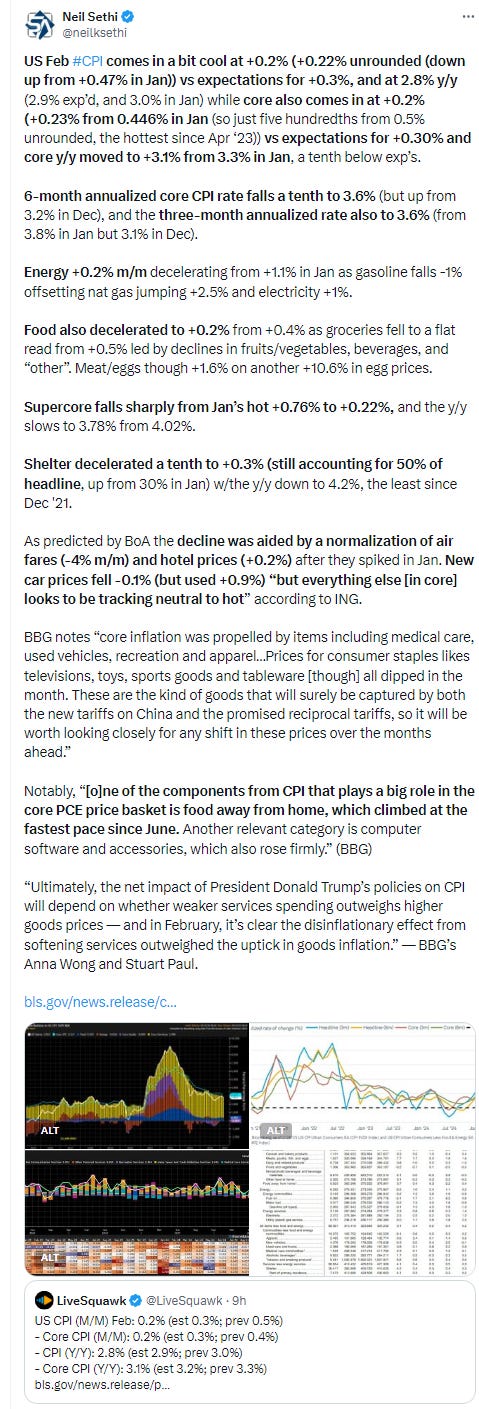

In US economic data:

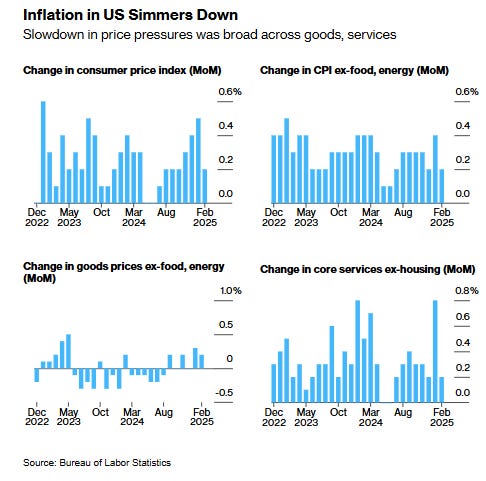

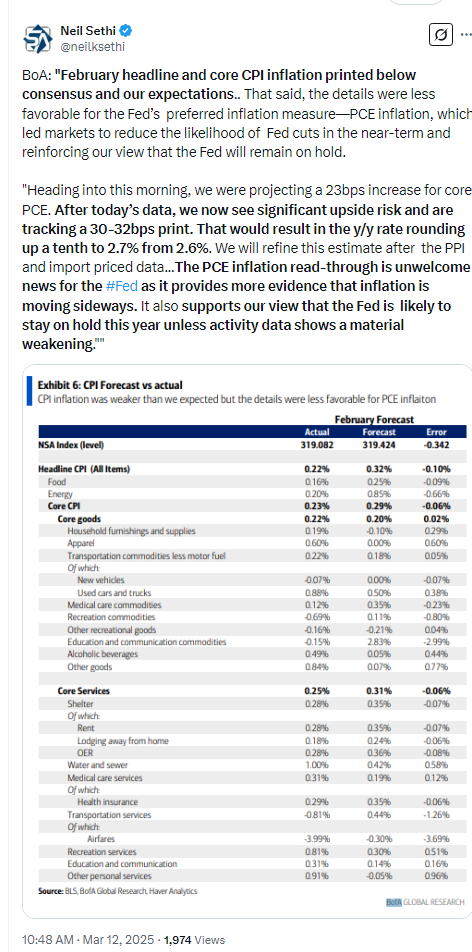

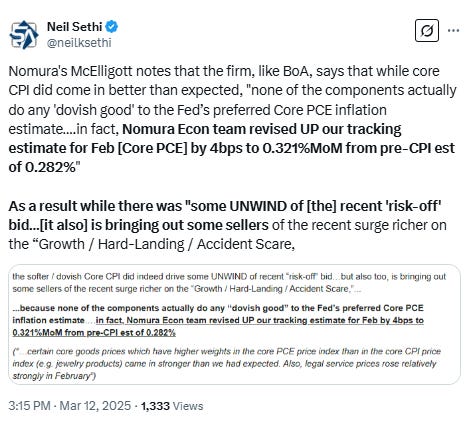

US Feb CPI comes in a bit cool at +0.2% (+0.22% unrounded (down up from +0.47% in Jan)) vs expectations for +0.3%, and at 2.8% y/y (2.9% exp’d, and 3.0% in Jan) while core also comes in at +0.2% (+0.23% from 0.446% in Jan (so just five hundredths from 0.5% unrounded, the hottest since Apr ‘23)) vs expectations for +0.30% and core y/y moved to +3.1% from 3.3% in Jan, a tenth below exp’s.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX edged up from the lowest since Sept, remaining well under its 200-DMA. It is also still below the 5666 level noted Friday which was an important level in 2024 representing the July peak, September breakout, and October low.

The daily MACD remains firmly in “sell longs” positioning, and RSI just off the weakest since Oct ‘23 although moving from under to over 30 which can be a bullish signal if it continues moving higher.

The Nasdaq Composite like the SPX improved from the lowest since Sept up to its sharp downtrend line and the Oct lows. We’ll see if those prove any resistance. Its daily MACD also remains firmly in “go short” positioning, and its RSI is also moving from under to over 30 after hitting the weakest since Jan 2022.

RUT (Russell 2000) continued to hold above the 2000 level. Edged a little further off the lowest close since June. Its daily MACD remains firmly in “go short” positioning, and its RSI is just off the weakest since Jan 2022.

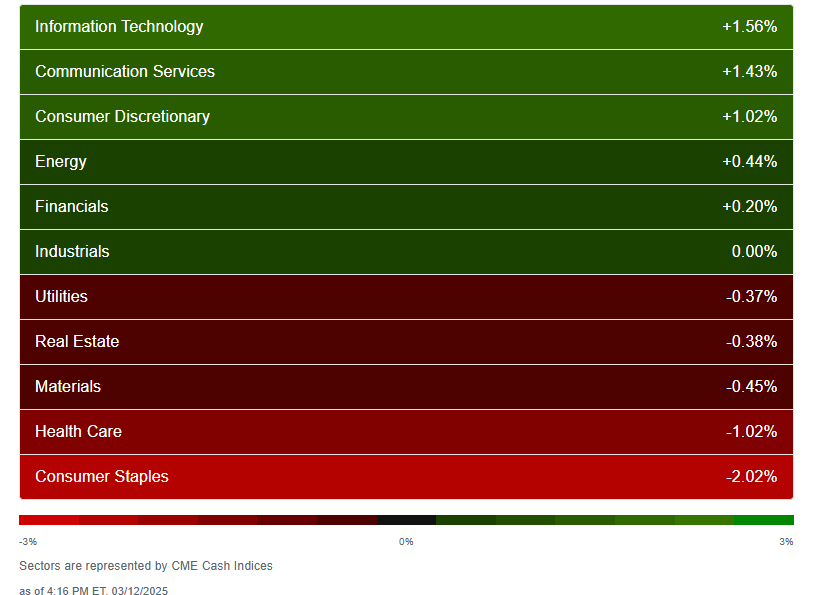

Equity sector breadth according to CME Cash Indices improved as you might expect but still just 6 of 11 sectors higher. Three were >1%, the megacap growth sectors. Two down that much, both defensives, which lagged for a second day.

SPX stock-by-stock flag from Finviz consistent showing that much of the gains were concentrated in the biggest stocks explaining why the equal-weight SPX was -0.5% today. Lots of little red boxes. Every staples stock was lower ex-Kellanova (+0.07%).

Positive volume (percent of total volume that was in advancing stocks) improved Tues but nothing spectacular. NYSE moved to 51% which is in-line with the flat day in that index, while Nasdaq was 65%, a little weak I think for the 1.2% gain in the index. It was 59% Tues when the index was lower.

Positive issues (percent of stocks trading higher for the day) were closer Wed at 53 & 57% respectively.

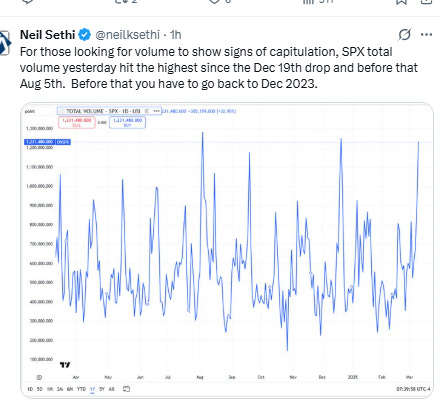

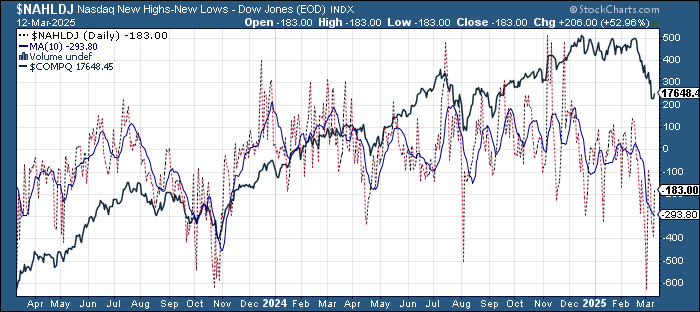

New highs-new lows (charts) also improved on the NYSE to -101 from -141, while the Nasdaq improved to -185 from -390 Tues and -629 the week before (which was the least since 2022). They are now back above the 10-DMAs which though continue to fall.

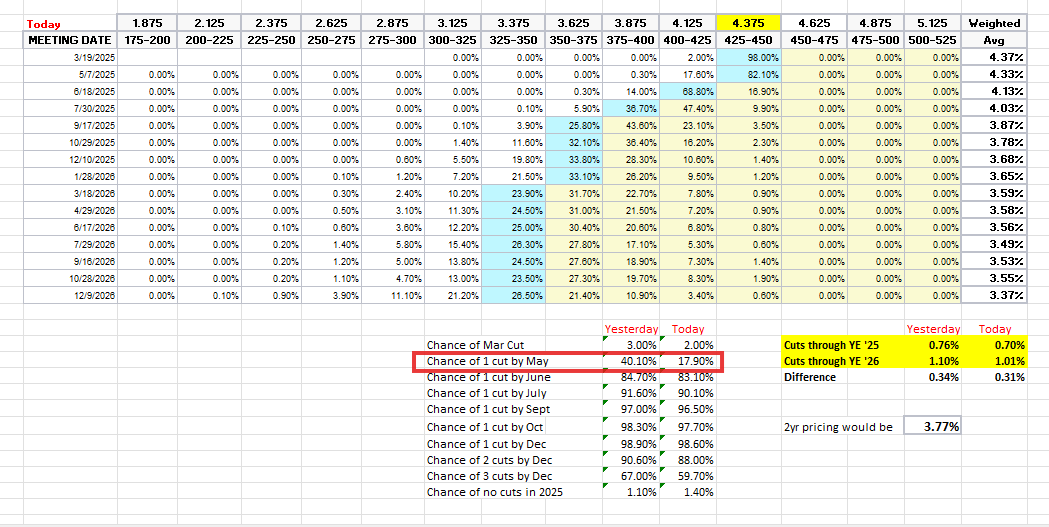

#FOMC rate cut probabilities from CME’s #Fedwatch tool fell back again with a notable drop in the chance of a May cut which fell to just 18% from 40% while the rest of the curve saw more modest softening.

A cut by March remains off the table, one by June edged back to 83% from 85%. The probability of two 2025 cuts at 88% (vs 91%), three cuts at 60% (from 67%), and no cuts 1.4% (vs 1.1%) with 70bps of cuts priced (-6bps and -11bps from Monday but up from 28bps last CPI Day).

2026 expectations -3bps to 31bps of cuts.

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 70 “maybe actually going a little too far”). But as I said then “It’s a long time until December.”

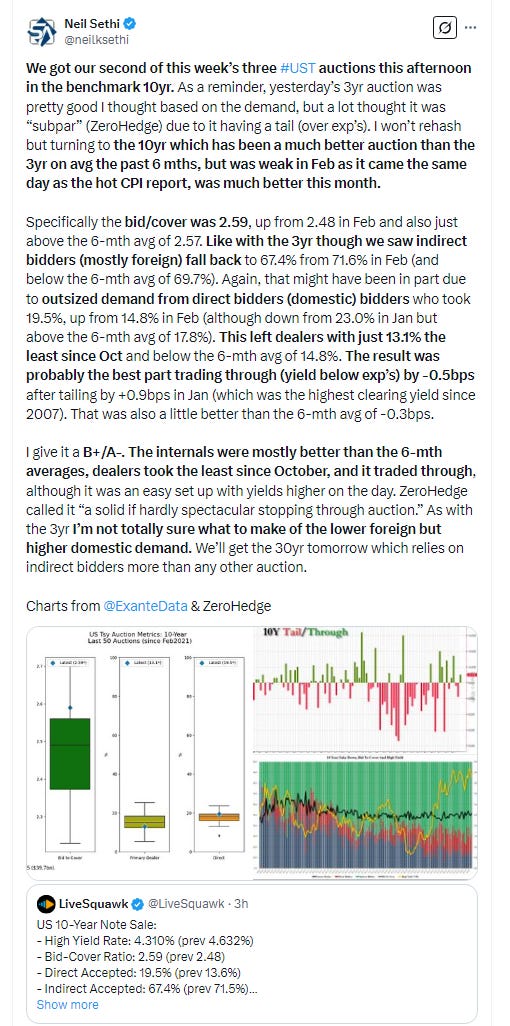

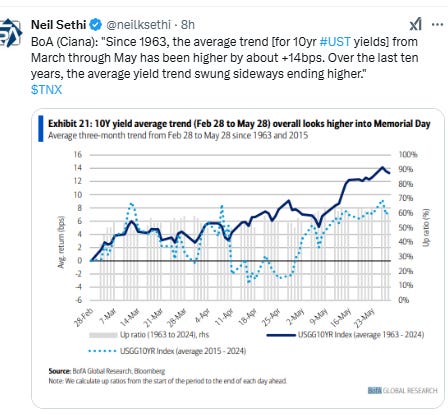

10yr #UST yield added another +3bps to 4.32%, a 2-week high. Still down -34bps since last CPI day (Feb 12th). Given the action today, seems my thinking that “it’s more likely than not that it holds the 4.13% level” after it tested it and held is firming up.

The 2yr yield, more sensitive to Fed policy, again moved along with rate cut bets up another +4bps to 3.99%, now -3bps below the Fed Funds midpoint so continues to price far fewer cuts than SOFR markets (which say it should be 3.77% today).

I had said when it was 45-55bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now definitely closer to where I think fair value is but, there could be a little more to go. Ian Lygan of BMO sees it going to 3.5% by year’s end.

Dollar $DXY up for only the 2nd time in the last 8 sessions continuing to hold those Election Day lows. Daily MACD remains firmly in “go short” positioning while the RSI is just off the most oversold since Dec 2020. As I noted Friday “seems this new support level really needs to hold, as not much under that until around 100.”

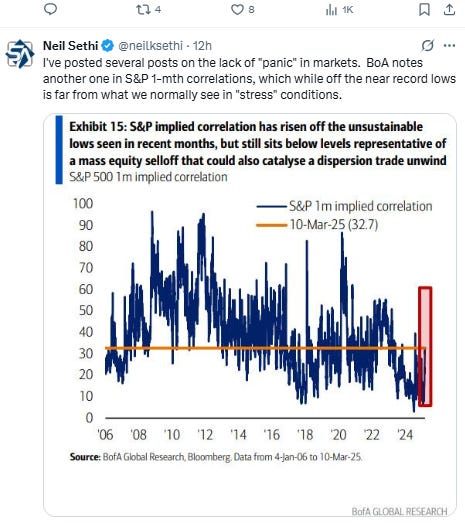

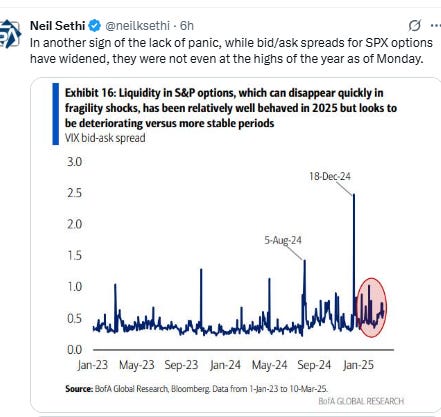

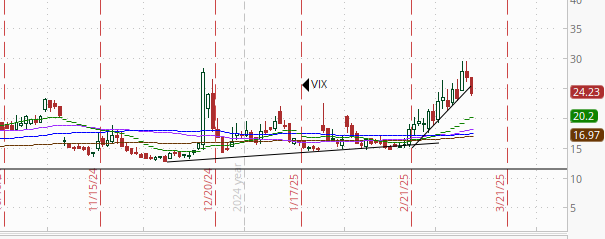

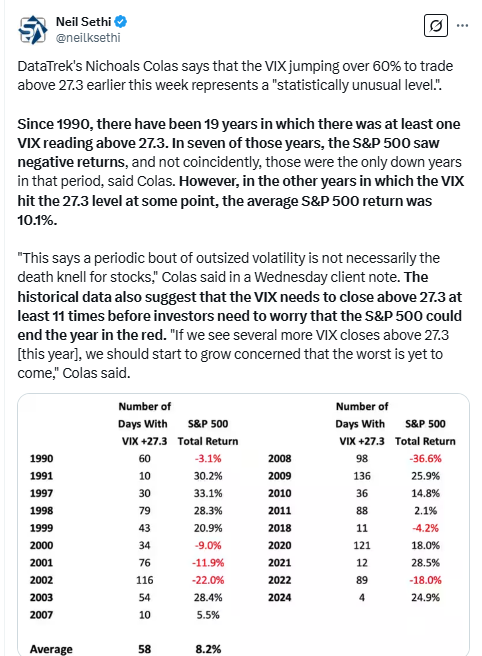

The VIX broke “its textbook uptrend” line falling back to 24.2 consistent w/~1.51% daily moves in the SPX over the next 30 days.

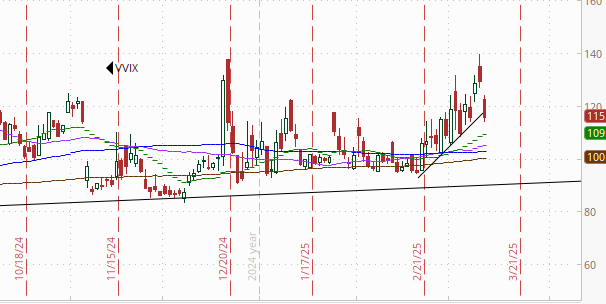

The VVIX (VIX of the VIX) also broke its trendline falling back to 116 still over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

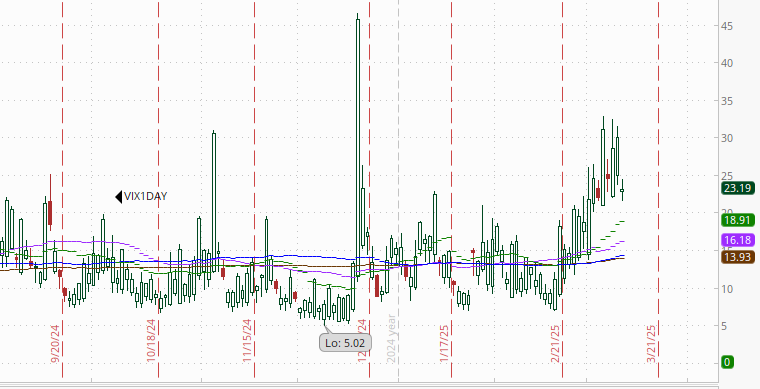

1-Day $VIX fell to 23.2, the lowest close in a week. It’s still looking for a move of 1.45% Wednesday.

#WTI futures were able to string two green days together for the first time in nearly a month as they look for their first weekly gain in 9 weeks, putting some breathing room between them and the 2024 low of $65.27 which as I noted last week is the key level for me. Still below lots of resistance. Daily MACD remains in “go short” positioning, while the RSI is just off the weakest since Sept (but at a 1-week high) but both are making positive signals.

Gold futures pushed over the 20-DMA to the highest close in over 2 wks as they look for a 12th weekly gain in 13 weeks. The daily MACD though remains in “sell longs” positioning, and the RSI continues to show a clear negative divergence (as I’ve noted for two weeks now) but broke its downtrend line, so it’s starting to look like I’m not going to get my consolidation to the $2800 level.

Copper (/HG) was able to continue its bounce from its 20-DMA to the best close since last May. Daily RSI and MACD remain supportive but continue to have lower highs (negative divergence).

Nat gas futures (/NG) fell back for a second day after hitting the highest since Dec ‘22 Monday which followed the 4th weekly gain in the last 5 weeks to a trendline running back to the Jan low. Starting to have some technical issues though with the daily MACD crossing over to a “sell longs” positioning while the RSI remains over 50 but is falling fast.

Bitcoin futures did better than tech stocks yesterday but worse today, little changed on the day. Relative strength continues to improve from near the lowest since July ‘23 while the daily MACD remains in “go short” territory but as noted Tuesday, it won’t take much of a rally for that to cross over.

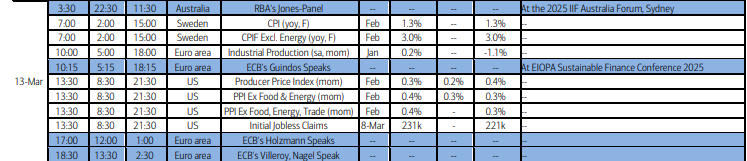

The Day Ahead

US economic data gives us our second key piece to the PCE prices puzzle (the Fed’s favorite inflation metric) in PPI. Remember it was last month after a hot CPI print it was the readthrough from PPI that saw all the “inflation trades” reverse sharply. Maybe we’ll get the same this month (or the opposite?). We’ll also get weekly jobless claims and the EIA’s monthly update.

No Fed speakers with the blackout, but we will get our final non-Bill Treasury auction in $22bn of 10yr bonds (reopening).

We’ll get two SPX components reporting Thursday in Ulta Beauty (ULTA) and Dollar General (DG), but neither >$100bn in market cap (see the full earnings calendar from Seeking Alpha).

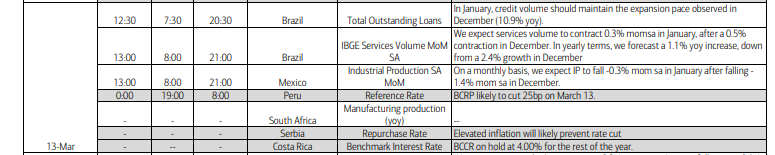

Ex-US a lighter day with EU industrial production and Sweden CPI the highlights. In EM we’ll get policy decisions in Peru, Serbia, and Costa Rica and Mexico industrial production.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,