Markets Update - 3/1/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,

Link to today’s tweets - Neil Sethi (@neilksethi) / X (twitter.com)

US large cap equities built on yesterday’s rally pushing to new all-time highs, despite mixed economic data and a slew of Fed speakers parroting the higher for longer message (and some high profile analyst calls for no Fed cuts in 2024), supported ironically by a drop in yields as markets apparently ignored the Fedspeak focusing more on the data (they said to be “data dependent right"?"). Small caps again joined in, with the RUT able to edge to a nearly 23-mth high (although it is still down -15% from its 2021 high). The Vanguard Mega Cap Growth ETF (MGK) was +0.7% (and the SOX semiconductor index +0.8%), the Nasdaq Composite +1.1% (and the top 100 Nasdaq stocks (NDX) +1.4%), and the market-cap weighted S&P 500 was +0.8%. All those indices hit new all time highs today. The equal weighted S&P 500 index (SPXEW) was +0.6% to a 2yr high, and the Russell 2000 +1.1% to an almost 23-mth high.

The Morningstar style box saw all styles up today and growth outperforming.

Corporate news focused on earnings today.

Link to today’s tweets - Neil Sethi (@neilksethi) / X (twitter.com)

Data was heavy with diverging manufacturing PMI’s (S&P’s pushed to the highest since July 2022 on expanding orders, production, exports, employment, and optimism (but also prices) while ISM fell further into contraction (but under the hood the details were much more constructive)). We also got the final U of Michigan consumer sentiment survey which reversed the gains seen in the preliminary report, but maintained most of the big jumps in the prior two months, and construction spending which unexpectedly fell for the first time in a year on what I think was likely poor weather in January and/or seasonal adjustment issues (there seems to have been a lot of that (seasonal adjustment issues) in the January reports).

Link to today’s tweets - Neil Sethi (@neilksethi) / X (twitter.com)

The SPX as noted pushed to a new closing high. The daily technicals remain weakish but are close to turning more positive, and in any event as noted in previous weeks, we haven’t seen it mean more than a 2-3% pullback since October (and as noted last week we didn’t even get that on the last “pullback” to the 20-DMA). I asked Monday, “maybe something similar this time?” And as I said yesterday, “it looks like we won’t even get there (to the 20-DMA) this time.”

The Nasdaq Composite as noted also made it to an all-time high. Daily technicals continue to evidence a loss of momentum here as well for now. As noted last week, “someday it will matter,” but not yet.

RUT as noted moved to highest in almost 23 months. Daily technicals a little more supportive here.

SPX sector breadth remained pretty good with eight green sectors (we had either eight or nine green sectors four out of five days this week) with five up around nine tenths of a percent or more for a second day, and the mix at the top was not just all one sector type. Again, no sector was down that much.

Here’s the stock-by-stock SPX chart from Finviz. Semi’s killed it today.

Positive volume was disappointing though w/NYSE at 61% and Nasdaq at 65%, weaker than what we saw Tuesday despite the point gains being nearly 4x today. Issues were 61 and 59%. New highs-new lows though up to the highs of the year at 245 NYSE and 308 Nasdaq.

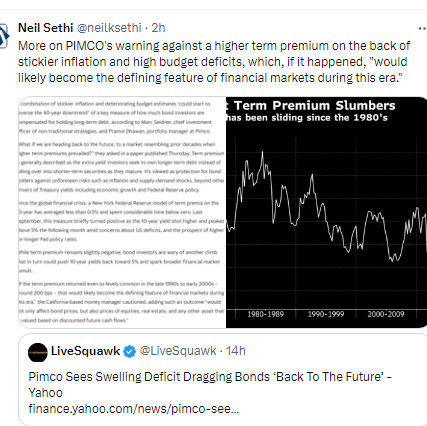

Yields fell on the ISM report and then again on the short end after Fed Governor Waller suggested shortening the Fed’s duration of held Treasuries. The 10-yr note yield ended down 7 basis points at 4.18%, the 2-yr note yield was down 11 basis points to 4.53%, and the 30-yr bond yield was down 4 basis points to 4.33%. All were 2-week lows.

Fed rate cut expectations moved around today. A March cut remained almost fully priced out although moved up to 5%, but a cut in May edged to 29% and a cut by June to 75%, while a cut by July remained at 84%. The December 2024 implied rate is 4.51% w/2024 rate cuts at 86bps, basically the same as yesterday, so 3 cuts plus around a 40% chance of a 4th.

Link to today’s tweets - Neil Sethi (@neilksethi) / X (twitter.com)

The dollar finished down moving back into the middle of its range for the week and continuing the sideways pattern over the past few weeks. Daily technicals remain weak but trying to flip.

VIX edging under that uptrend line from its mid-December low again. Do we get the bounce we saw last month?

WTI was able to break out briefly before falling back under the $80 level. Still highest close in almost 4 months, and daily technicals continue to be mildly supportive.

ING: “The time spread for both Brent and WTI remains tight and continues to point to a tight physical market.”

It took all week, but Gold did end up testing the $2100 area as I thought it might way back last week when it first moved over the 50-DMA. Next question is whether it can push through? Daily technicals remain tilted positive as noted Friday.

Copper up but remains under the trendline that has capped it the last 20 months.

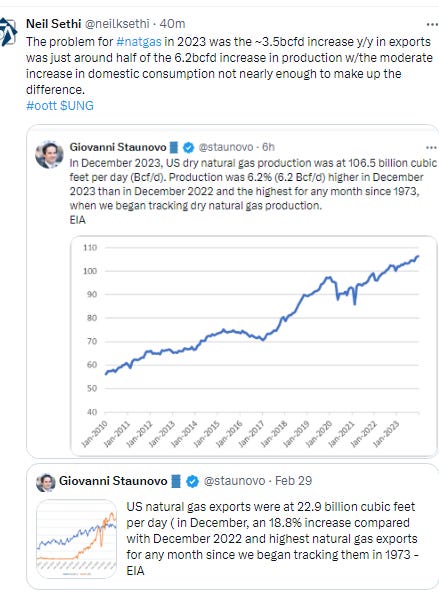

Nat gas again couldn’t make any progress after pushing through the 20-DMA Wednesday. Daily technicals remain very supportive, and as indicated Monday there’s a huge short position that will need covering at some point, but as noted yesterday the weather forecast and overall inventory positioning is not conducive to a big rally.

More on Sunday.

Link to today’s tweets - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,