Markets Update - 3/19/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

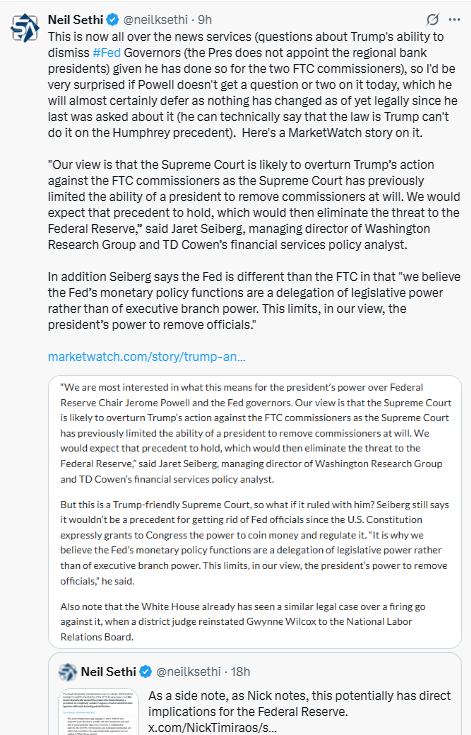

Major US equity indices started the day off with moderate gains and they drifted up and down as they awaited the FOMC decision and Powell press conference, which came at 2 & 2.30 pm ET respectively. They clearly liked what they saw/heard as immediately upon the release of the statement & Summary of Economic Projections (which includes the “dot plot”) they ran higher as it broadly showed what I had previewed last night and in the weekend update: no change to the expectation for two 2025 and 2026 rate cuts, but higher expectations for inflation and unemployment, lower expectations for GDP, while trimming QT.

The rally continued right through the Powell press conference, as Powell was constructive on the economy (calling it “strong overall” with recession risk “not high”), dismissive of the jump in UMich inflation expectations, gave some comfort about how the Fed might look through tariff inflation (even using the word “transitory” once), and before falling back as soon as he finished. They tried to bounce thereafter but ran into a wall of institutional/systematic selling. Still the major indices finished broadly higher, up around a percent or more, the best Fed Day since July.

Much more on the Fed and market reaction below.

Treasury yields fell back, particularly on the short end, as 2025 Fed rate cut bets increased for the 2nd half, but the dollar was still able to edge off 6-mth lows. Gold continued its push to record highs, joined today by copper (but just the US index as discussed in previous updates). Crude, bitcoin, and nat gas also gained.

The market-cap weighted S&P 500 (SPX) was +1.1%, the equal weighted S&P 500 index (SPXEW) +0.7%, Nasdaq Composite +1.4% (and the top 100 Nasdaq stocks (NDX) +1.3%), the SOX semiconductor index +1.0%, and the Russell 2000 (RUT) +1.6%.

Morningstar style box saw broad gains with growth in the lead.

Market commentary:

“Powell came in and gave a pretty dovish performance in the sense of, ‘We got this, we’re in a good place, we can afford to wait, we’ll see how it goes, we’re gonna get the job done’,” said Bill Dudley, the former president of the New York Fed, on Bloomberg Television. “He was pretty reassuring to people that this was all quite manageable.”

“The most important thing to recognize is that the information that came across was almost exactly what people had expected,” Michael Green, chief strategist at Simplify Asset Management, told CNBC. “We’ve now had two consecutive summers in which the inflation has been much weaker than expected, and two consecutive winter and spring periods in which inflation has been higher. That suggests that there is residual seasonality that is not being properly captured.”

"Uncertainty around the economic outlook has increased." Federal Reserve officials inserted that sentence into their latest statement on the economy, and it really says it all. They don't know how President Donald Trump's tariffs will affect inflation and economic growth. (MarketWatch).

The Federal Reserve adopted a "cautious tone” at its latest policy meeting, with the central bank remaining “on hold” as it waits for clarity on the growth outlook in the U.S. and on evolving trade policy, according to Goldman Sachs Asset Management’s Whitney Watson. Revisions to FOMC members’ projections “had a somewhat ‘stagflationary’ feel with forecasts for growth and inflation moving in opposite directions,” Watson, global co-head and co-chief investment officer of fixed income and liquidity solutions within Goldman Sachs Asset Management, said in emailed comments on Wednesday. “For the time being the Fed is in wait and see mode, as it monitors whether the recent growth slowdown develops into something more serious.”

Wednesday's policy statement from the Federal Reserve fell short of providing further clarity into how officials are looking at the outlook, according to one strategist. For those hoping the Fed might provide some insight on how officials are thinking about the future, "the meeting statement was about as uncommittable as possible," said Steve Wyett, chief investment strategist at BOK Financial.

To Mark Hackett at Nationwide, the market reaction was interesting in the face of the adjustments in the Summary of Economic Projections. “The ‘bad news is good news’ reaction suggests that investors believe the SEP is less of a crystal ball than a reflection of the current level of uncertainty, with incrementally dovish leanings,” Hackett noted. “It is also an indication that the universal pessimism of the past month is waning, though a sustained recovery will require improved clarity on tariffs and growth.”

"The stock market will like the rate guidance remaining as is despite the increase in the inflation forecasts. It illustrates the worries about growth," said Mohamed El-Erian, adviser at Allianz and former Pimco CEO, in a post on X.

The correction in stocks already accounted for a significantly worse economic backdrop than existed when the Fed last met, according to Amanda Lynam at BlackRock. “A lot of that was baked in,” Lynam said on Bloomberg Television. “We’ve had such a bruising few weeks in the equity market. Most forecasters have reflected lower growth and higher inflation, and that’s part of what’s driving us here.”

At Citigroup, Stuart Kaiser said the market reaction suggests those changes were both largely expected and fully discounted by the recent sell-off.

“We are surprised if that is the case, but can’t argue with the price action,” he said. Kaiser also noted that the S&P 500 lost a bit of momentum into the close.

“That suggests the fundamental aspects of the event are less favorable absent positioning dynamics that pushed the market higher intraday,” Kaiser said. “However, today’s trading did offer further evidence that position de-risking is in the later innings and also that growth risks are persistent. We remain cautious on risk markets here given growth, policy, budget and tariff risks, although risk/reward has clearly improved during the past week.”

“Start making T-shirts: ‘Transitory: We are so back!’” said Christian Hoffmann at Thornburg Investment Management. “The market will read this as dovish at the margin, with the Fed not overtly concerned with the economy or inflation. Stocks and bonds rejoice.” After an epic bout of cross-asset volatility, Powell threaded the needle. His calibrated tone on recession risk – stating it was not “not high” – soothed nerves among stock investors. Meantime, the central bank’s move to trim growth assessments gave fuel to the bond rally, with traders and the Fed now aligned on the rate-cut outlook this year.

“They changed the language enough and the dots enough that a market, that was possibly looking for a hawkish Fed, felt the need to buy stocks and bonds,” said Peter Tchir of Academy Securities.

To Bret Kenwell at eToro, while many observers are focused on the word “transitory” from today’s Fed commentary — triggering flashbacks to 2021 when rampant inflation ultimately forced the Fed to aggressively raise rates — perhaps the word of the day should be “uncertainty.”

“Investors may be wondering why the Fed is forecasting two rate cuts in 2025 if they believe inflation will be higher this year than they did three months ago,” Kenwell said. “Despite Powell arguing that the economy is strong overall, the Fed reduced its GDP growth expectations for 2025 too, allowing them to leave rate-cut expectations unchanged for the time being.” While stocks are rebounding from a clearly oversold condition, Kenwell says investors should keep an eye on bonds. “If Treasury yields continue to move lower, we could see a further rally in dividend stocks, utilities and other yield-sensitive assets,” he noted. “Further, if tech can continue to rebound — even if it’s just a short-term bounce — it could fuel a larger overall rebound in US stocks given the disproportionately large decline we’ve seen in this group.”

“The Fed indirectly cut rates today by taking action to reduce the pace of runoff of its Treasury holdings,” said Jamie Cox at Harris Financial Group. “This paves the way for the Fed to eliminate runoff by summer, and, with any luck, inflation data will be in place where reducing the Federal Funds rate will be the obvious choice.”

Stocks could see more pullback from current trading levels, according to Ross Mayfield, an investment strategist at Baird. “Your average nonrecession pullback or correction is in the 15% range, which is not all that different from what the average entry year drawdown is over the last 40 or 50 years anyway, so would I be surprised at all if we reenter traction territory and press toward 14% or 15%? Not at all,” he said to CNBC on Tuesday. “I don’t think that a recession is imminent, and without more significant economic weakness, I think that’s the probably the extent of it,” Mayfield continued.

“Investors continue to search for a policy circuit breaker, either from the White House or the Fed,” said Robert Griffiths, an equity strategist at L&G Investment Management Ltd. Griffiths noted the Fed’s dovish pivot in late-2019 had come after a 30% drop in the Nasdaq, a far steeper decline than the index has suffered this year. What’s more, the full impact of the tariffs on inflation and the economy remains unclear, implying “the Fed’s ability to act pre-emptively on this occasion is extremely limited,” he added.

“Fed Chair Powell has repeatedly said that the risks to price stability and full employment are balanced,” said Scott Helfstein, Global X’s head of investment strategy. “That is likely still true, but risks to both are rising. This is not time to sell and go away, but perhaps time to review long-term strategy against near-term volatility.”

In individual stock action, megacaps like Nvidia Corp. and Tesla Inc. led market gains. Boeing Co. saw its shares pop 6.3% after Chief Financial Officer Brian West gave upbeat commentary at an investor conference, saying Boeing’s cash burn is easing this quarter and its factories are improving. West also brushed off concerns about Trump’s tariffs, but said that any impact depends on how long the uncertainty lasts.

Some tickers making moves at mid-day from CNBC.

In US economic data: No major economic data today.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX recovered Tuesday’s drop but again stalled out right at that 5670 level noted last Friday which was important in 2024 representing the July peak, September breakout, and October low.

The daily MACD remains in “sell longs” positioning for now (although it’s getting narrower), and the RSI remains under 50 but the highest of the month.

The Nasdaq Composite similarly back to where it closed Monday. Its daily MACD also remains in “go short” positioning (but also is narrowing), and its RSI is also the highs of the month.

RUT (Russell 2000) highest close in two weeks, now coming up on its 20-DMA (and I guess a trendline which runs back to the Jan lows (not sure I’d make too much of that, just like I wouldn’t make too much of the upcoming “death cross” (50-DMA crosses under the 200-DMA))). Positively though its daily MACD has now crossed over to “cover shorts” positioning, and its RSI while not at 50 is the highest in a month.

Equity sector breadth according to CME Cash Indices back to all green, matching Friday, although five of the sectors (three defensives, RE & Materials) were up less than +0.3%. The others though all up at least 1%, although none up over 2%. Megacap growth sectors outperformed taking 3 of the top 5 spots.

SPX stock-by-stock flag from Finviz consistent w/a lot of green but more red than you’d expect for having every sector higher.

Positive volume (percent of total volume that was in advancing stocks) solid but nothing like what we saw Friday on the NYSE (where it was over 90%) at 74% although the index was only up +0.82% vs over double that Friday. Nasdaq was 74% which was a little weak for the 1.4% index gain.

Positive issues (percent of stocks trading higher for the day) continued to be a little weaker at 71 & 69% respectively.

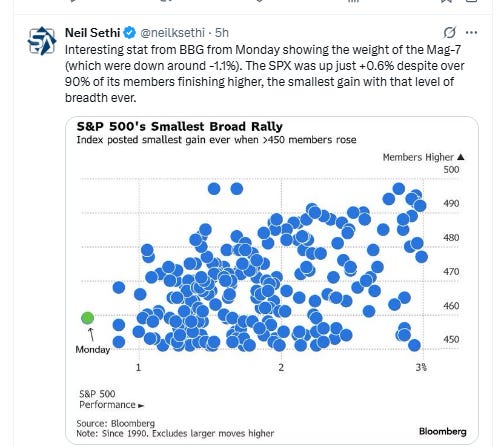

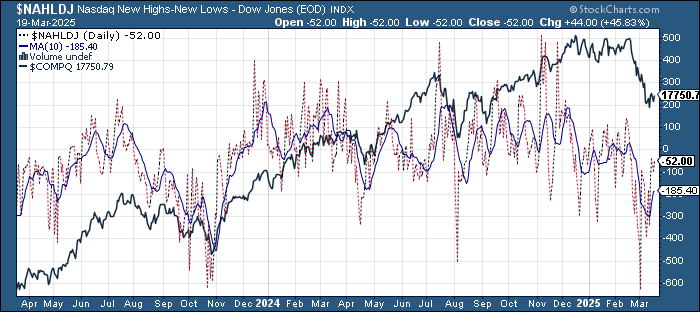

New highs-new lows (charts) also notably fell for a second day on the NYSE despite the index gain to -10 while they improved to -54 for the Nasdaq. They both though remain above the 10-DMAs which are now heading higher (more bullish).

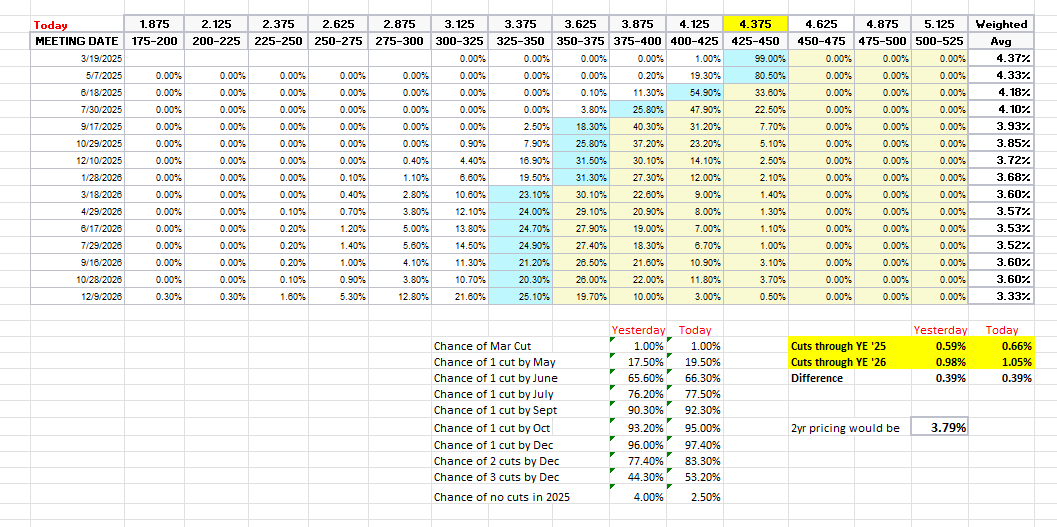

After the Fed, #FOMC rate cut probabilities for 2025 from CME’s #Fedwatch tool edged higher in terms of the chances of a third 2H cut. A cut by by May edged to 20% from 18% (but it was 50% last Monday (Mar 10th)), and one by June stayed at 66% (from over 90% Mar 10th), but the probability of two 2025 cuts did move up to 83% from 77%, while three cuts moved to 53% from 44% (was though 66% Mar 10th). No cuts remains low at 3% with 66bps of 2025 cuts priced (+7bps from Tues but -10bps from Mar 10th (which was the high of the year)).

2026 cuts remained at 39bps (so better than 50/50 for two additional cuts in 2026).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 70 “maybe actually going a little too far”). But as I said then “It’s a long time until December.”

10yr #UST yield edged down but just -2bps to 4.26% overall trading sideways over the past week. As I’ve said the past three weeks “I still think it’s going to take a deeper equity selloff or some more worrisome economic signals before it breaks the 4.13% level.” That said, I also said I think it might struggle to clear that downtrend line which comes in currently at around 4.5%. As expected the Fed didn’t make any big waves.

The 2yr yield, more sensitive to Fed policy, moved along with rate cut bets dropping -13bps following the release of the FOMC statement/SEP and Powell press conference ending -6bps on the day at 3.98%, still just -35bps below the Fed Funds midpoint so continues to price almost one cut fewer than SOFR markets (which say it should be 3.79% today).

I had said when it was 40-50bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market moved in that direction before rebounding the past couple of weeks, so closer to where I think fair value is but, there should be more to go. Ian Lygan of BMO sees it going to 3.5% by year’s end.

Dollar $DXY was able to recover the Election Day lows (103.37) but not much more. I said two weeks ago “seems this new support level really needs to hold, as not much under that until around 100,” but we didn’t get our “confirming close” as noted yesterday. Daily MACD remains firmly in “go short” positioning but starting to close while the RSI is back above 30 making another higher low (so positive divergence there).

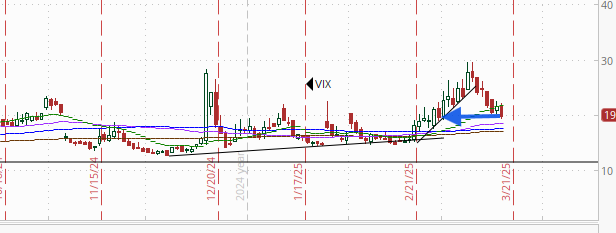

The VIX fell for the 6th session in 7 and closed below 20 for the first time this month (barely at 19.9) consistent w/~1.24% daily moves in the SPX over the next 30 days.

The $VVIX (VIX of the VIX) like the VIX down for the 6th session in 7 but it’s now at the lows of the year and testing a trendline that’s held since July at 93.2, well under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX fell back but remained relatively elevated at 18.5 looking for a move of ~1.16% Wed.

#WTI futures edged higher but overall continued their sideways trade of the past two weeks. It continues though for now to hold the 2024 low of $65.27 which as I noted two weeks ago is the key level for me. As I mentioned Monday daily MACD crossed to “cover shorts” positioning, but the RSI remains under 50.

Gold futures continued their push higher extending further over the $3000 level (now actually closer to $3100) working on a 13th up week in 14. The daily MACD remains in “go long” positioning, and the RSI is now edging into overbought territory (which is bullish not bearish).

Copper (/HG) up for 6th day in 7 working on a 4th up week (and 6th in 7) and closing at a record high (just under the intraday high in May 2024). That said, as noted in the post on Monday, it appears that much of this is due to the /HG contract being settled in NY (where traders are scrambling to get their hands on the metal ahead of potential import tariffs), as London prices have not seen the same run up.

Daily RSI and MACD remain supportive but the latter continues to have that lower high (negative divergence) but as we've seen with gold sometimes that doesn't much matter. Just starting to get overbought.

Nat gas futures (/NG) higher for a second day trying to break out of the sideways range of the the past five sessions and edging back into its channel from the start of the year. The daily MACD remains in “sell longs” positioning but the RSI continues to bounce above 50 indicating decent relative strength. Maybe we won’t get a test of the 50-DMA (purple line).

Bitcoin futures a solid day +4% to a nearly 2-wk high. Also got some good news in the daily MACD crossing to “cover shorts” positioning while the RSI keeps making higher highs and lows. Has a big test in the 20-DMA/downtrend line from the Feb highs.

The Day Ahead

US economic calendar Thursday a little heavier with Feb existing home sales and Conference Board leading indicators (the latter of which you can ignore until they fix it (too manufacturing heavy) which is basically what everyone does at this point although the coincident index is worthwhile IMO as it focuses on broader indicators) and weekly jobless claims.

No Fed speakers on the schedule currently, but we do have a 10yr TIPs auction (reopening) which it’s safe to ignore unless something highly unusual happens.

Thursday though is our big earnings day of the week with 8 SPX components reporting and three >$100bn in market cap in Accenture (ACN), Nike (NKE), and Micron Technology (MU) (see the full earnings calendar from Seeking Alpha).

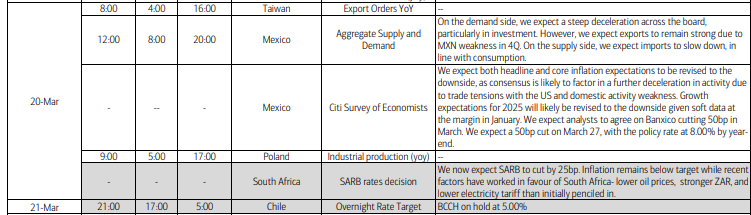

Ex-US the highlight is the policy decision from the Bank of England. As with the Fed and BoJ today, a hold is expected so the attention will be on the guidance. There are also policy decisions in Sweden and Switzerland. A hold is also widely expected on the former, but the latter is a bit up on the air with guesses tilted towards a cut that would take the rate down to 0.50%. In data we’ll get Australia employment overnight and New Zealand GDP with UK employment following in the morning. We’ll also get a number of central bank speakers including Christine Lagarde. In EM we’ll get policy decisions from South Africa (markets are split on whether they will cut or not) and Chile (hold is expected), along with Mexico economist inflation expectations.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,