Markets Update - 3/24/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

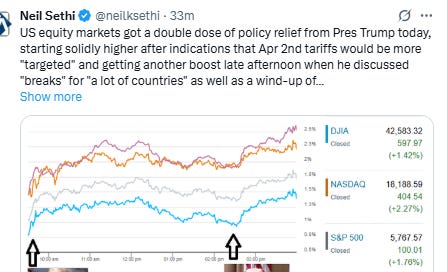

Major US equity markets soared on a double dose of policy relief from the Trump administration today, starting solidly higher after indications over the weekend that Apr 2nd tariffs would be more "targeted" and getting another boost late afternoon as they were sagging when the President discussed "breaks" for "a lot of countries" as well as saying he foresees a wind-up of DOGE job cuts in the next 2-3 months. Indices finished near the highs of the day led by the Russell 2000 and Nasdaq, both up over 2%.

Treasury yields moved higher as 2025 Fed rate cut bets were cut back following a better than expected flash PMI reading. The dollar moved to a 3-wk high as did crude and bitcoin, while gold, copper, and nat gas fell back.

The market-cap weighted S&P 500 (SPX) was +1.8%, the equal weighted S&P 500 index (SPXEW) +1.6%, Nasdaq Composite +2.3% (and the top 100 Nasdaq stocks (NDX) +2.2%), the SOX semiconductor index +3.0%, and the Russell 2000 (RUT) +2.6%.

Morningstar style box consistent with a broad based rally led again by growth.

Market commentary:

“Omitting the sectoral tariffs from the April 2nd package significantly reduces both its aggregate scale and the maximum rate on targeted sectors, given that all of Trump’s tariffs to date have been designed to stack,” stated Tobin Marcus of Wolfe Research in a note. “The ceiling for reciprocal tariffs on April 2 remains dramatic, and we still expect a negative market reaction, but the scale won’t be as severe and the sectoral impacts won’t be as concentrated.”

“This raises the possibility that some sectors and countries may fare better than others, helping explain market optimism,” said Daniel Murray, chief executive officer of EFG Asset Management in Zurich.

“We said last week that we had already seen ‘peak chaos’ in US tariff policy,” said Thierry Wizman at Macquarie. “Events over the weekend seemed to confirm that regularization and rationalization of tariff policy is coming, followed by negotiations and concessions.”

“Market conditions are improving dramatically as the angst around reciprocal tariffs is somewhat diminishing. From a risk standpoint, escalation or retaliation has always been a concern, but should the administration come through with a more targeted and tactical strategy around tariff implementation, risks of a full-blown trade war are reduced,” said Charlie Ripley, senior investment strategist at Allianz Investment Management. “We see this as a potential lift to growth in the U.S., should reciprocal tariffs come in a more watered-down form.”

“Yes, tariffs hurt the economy by complicating capex decisions about the future,” said Scott Wren at Wells Fargo Investment Institute. “But today the issue is mainly price increases, which we foresee as incremental and diluted. What’s more, the economy has slowed from 2024, but we think to a sustainable pace.”

“Animal spirits are catching tailwinds to start the week as traders step up to the plate and swing hard at risk assets,” said Jose Torres at Interactive Brokers.

“Many people, particularly in the last three or four years, buy [the S&P 500] every time it goes down and immediately get gratification,” said John Flahive, head of fixed income at BNY Wealth. “You need to have a market environment or a landscape that you actually have equity prices that don’t bounce immediately back to change the psychology.”

“Stocks look to continue to rally from oversold levels, and any reduction in potential tariff impacts will be an upward catalyst,” said Ivan Feinseth, chief investment officer at Tigress Financial Partners. “I believe we have seen the worst of the market’s pullback, though we will continue to see increased volatility at the beginning of next month based on the outcome of President Trump’s tariff policies.”

“I would say investors need to lean on diversification even more than normal,” Pete Hecht, head of the North America portfolio solutions group at AQR Capital Management said. “I wish I had a crystal ball, because if I did, I wouldn’t hold a diversified portfolio. I would only hold the best performing market. But in reality it’s really hard to time markets.”

“The US equity pullback has put a dent in US outperformance over the rest of the world,” said BlackRock Investment Institute’s Strategists including Jean Boivin and Wei Li. “We stay overweight US stocks and see opportunities across global stocks.”

Although all three major U.S. stock indexes were rising Monday morning on reports that President Donald Trump will narrow the scope of planned tariffs, a senior market analyst at Cyprus-based broker XM sees reasons for investors to remain cautious.

“We’re in a major policy-change environment and tariff policies haven’t come to fruition yet, so there’s noise going on and it’s not surprising that consumer confidence [for March] would again show that people are concerned,” said Arthur Laffer Jr., president of Laffer Tengler Investments. “You will see euphoria and then depression in the economic data, and then see the stock market going up and down, up and down, until things get clear.”

Arguing that the worst is over "may be a premature conclusion," analyst Charalampos Pissouros wrote in a note. "Trump has shown how unpredictable he is, while data could reinforce the notion that the U.S. economy is losing momentum. Another round of risk aversion as soon as this week cannot be ruled out."

In individual stock action, Shares of Tesla, which have fallen nine straight weeks, were up nearly 12%, adding to their Friday gains. Meta Platforms and Nvidia each climbed more than 3%. A gauge of the “Magnificent Seven” megacaps rallied the most in two months.

Some tickers making moves at mid-day from CNBC.

In US economic data:

March US flash Composite PMI recovered Feb’s drop moving to a 3-mth high of 53.5 from Feb’s 10-mth low of 51.6, signaling “an acceleration of activity growth,” but “the rate of expansion remains well below December’s 32-month high.” Also in a reversal of Feb, the services sector similarly reversed its Feb drop to climb back to 54.3, also a 3-mth high from a 15-mth low in Feb, on “new business inflows” and “better weather” although exports fell for a 3rd mth. Manufacturing, which had hit an 8-mth high in Feb fell back into contraction after its brief 2-mth stint in expansion although just to a 3-mth low at 49.8 as output also contracted after rising the most since Feb ‘22 in Feb as tariff front-running appears to have run its course, although exports fell the least in 9 mths.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX was able to push over the 200-DMA Monday after blowing through the the 5670 level. We’ll see if it can hold above (need a confirming close).

The daily MACD as noted Friday has crossed to “cover shorts” positioning, and the RSI remains just under 50 but the highest of the month.

The Nasdaq Composite for its part moved through the 17,800 level but has over one percent more to get to its 200-DMA. Its daily MACD also close to crossing to “cover shorts” positioning, and its RSI is also at the highs of the month.

RUT (Russell 2000) was able to move through the 20-DMA. Like the SPX its daily MACD is also in “cover shorts” positioning, and its RSI while not at 50 is the highest in a month. We may see this turn into a big short covering rally according to BoA.

Equity sector breadth according to CME Cash Indices back to very solid after taking a break Friday with every sector but utilities up at least +0.6% and 8 of 11 up at least 1% led by megacap growth sectors again which took the top two spots (both up over 2% and three of the top five spots) while defensives lagged taking the bottom three spots.

SPX stock-by-stock flag from Finviz consistent with lots of bright green and just some pockets of weakness in utilities and healthcare. Mag-7 was up +3.5% today led by TSLA's +12%.

Positive volume (percent of total volume that was in advancing stocks) was much stronger but far from the around 90% days we saw a week ago (although the index gains were arguably less) at 77% on the NYSE vs the +1.3% gain in the index, while Nasdaq was 78% despite a 2.27% gain (although that was in-line with the previous week).

Positive issues (percent of stocks trading higher for the day) continued to be weaker on both at 72 & 65% respectively.

New highs-new lows (charts) also improved with the NYSE up to +10, just the best though since Tuesday, and Nasdaq to -37, which was the best in a month (but still negative). Both are back above their 10-DMAs.

#FOMC rate cut probabilities for 2025 from CME’s #Fedwatch tool saw some material softening after the flash PMIs seeing some of last week’s increased bets fall back out. A cut by May is now a longshot at 10%, and one by June down to 66% (from 78%), while the probability of two 2025 cuts fell to 79% (from 88%, still in Sept), and three cuts now 48% (from 62%). No cuts remains low at 3% but 62bps of 2025 cuts priced (-9bps from Fri and now -14bps from Mar 10th (the highs of the year)).

2026 cuts remained 36bps (so just under 50/50 for a second cut in 2026).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 70 “maybe actually going a little too far”). But as I said then “It’s a long time until December.”

10yr #UST yields continued Friday’s rebound +8bps to 4.33%, edging to the top of its range over the past few weeks, and the highest close in a month. As I’ve said the past three weeks “I still think it’s going to take a deeper equity selloff or some more worrisome economic signals before it breaks the 4.13% level, but I also think it might struggle to clear that downtrend line which comes in currently at around 4.5% [now closer to 4.4.%].”

The 2yr yield, more sensitive to Fed policy, moved along with rate cut bets also up +8bps to 4.03%, just off a 1-mth high, now just -30bps below the Fed Funds midpoint, so continues to price around one cut fewer than SOFR markets (which say it should be 3.77% today).

I had said when it was 30-40bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market moved in that direction before rebounding the past couple of weeks, so closer to where I think fair value is but, there should be more to go. Ian Lygan of BMO sees it going to 3.5% by year’s end.

Dollar $DXY up for a fourth session since it briefly dipped under the Election Day lows (103.37) pushing to 2-wk highs. I said four weeks ago “seems the new support level really needs to hold, as not much under that until around 100,” and it did so, now as I said Friday “looking like it’s setting up to push higher.” Daily MACD has crossed over to “cover shorts” positioning while the RSI is not quite to 50 but is also at a 3-wk high confirming the advance.

The VIX fell for the 9th session in 10 now down to 17.5 the lowest close in a month, consistent w/~1.09% daily moves in the SPX over the next 30 days.

The $VVIX (VIX of the VIX) like the VIX down for the 9th session in 10 but it’s now at the lowest since July at 82 shattering the trendline that’s held since then, well under the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “average” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX fell to 13, the lowest close in a month and looking for a sub-1% move (~0.87% next session) for the first time this month.

#WTI futures continued their rebound pushing to a 3-wk high looking for a 3rd week of gains and through the top of the range since that time fueled by Pres Trump announcing “secondary tariffs” on Venezuela crude exports. I said Friday “another green day would be a change in the pattern” and that is the case as it seems to have a straight shot to test the $70.50 level which is where the 100-DMA is as well as the “volume point of control” (most volume) over the past year. As I mentioned last Monday when I asked “things perhaps turning more positive for crude?” daily MACD crossed to “cover shorts” positioning, and now the RSI has pushed over 50.

Gold futures fell back but remain above the $3000 level after its 13th positive week in 14. The daily MACD remains in “go long” positioning for now, but as noted last week the RSI has now fallen out of overbought territory (which is a sign of a potential reversal). If it breaks $3000 next support would be $2970.

Copper (/HG) down for a 3rd day after finishing its 4th up week (and 6th in 7), but as I noted Thursday “seems to be struggling with moving through the record high level.”

Daily RSI and MACD remain supportive, but the latter continues to have that lower high (negative divergence), but as we've seen with gold sometimes that doesn't much matter. RSI like gold also falling out of overbought territory, so some loss of momentum.

Nat gas futures (/NG) again tested the 50-DMA target, which did again hold as I thought it would (on the first test at least). That said, as I noted Friday it’s the lowest close of the month, and the daily MACD remains in “sell longs” positioning with the RSI now under 50, “so TBD if it can hold the 50-DMA. Doesn’t look like weather is going to be much help from here.” If it breaks probably goes to the 100-DMA (blue line) around $3.55.

Bitcoin futures rallied with tech stocks pushing through the downtrend line from Feb as I indicated was my expectation Friday now with a clear shot to test the $92.5k level. As mentioned, the daily MACD is in “cover shorts” positioning while the RSI keeps making higher highs and lows, “so the technical setup is there for it to get through.”

The Day Ahead

Heavier day for US economic data Tuesday with the Jan repeat home price indices (preferred for that reason - they track the same home not just all homes sold in the month), along with March Conf Bd consumer confidence report (expected to be the weakest in four years, note while UMich focuses more on inflation and spending, this one focuses more on the labor market) and Feb new home sales (expected like existing home sales to see a rebound from a weak Jan).

In Fed speakers, we’ll get Gov Kulger and NY Fed Pres Williams, both permanent FOMC voters and important voices if for that reason alone. We’ll also get our first of this week’s Treasury auctions in the 2-yr (which has often been weak over the past seven months or so).

In earnings, one SPX component reporting in McCormick & Company (MCK), and we do get GameStop which always seems to garner headlines.

Ex-US highlights are BoJ minutes overnight, then in the morning Germany’s Ifo business sentiment and a number of ECB speakers. In EM, we’ll get a policy decision from Hungary (a hold is expected) along with Brazil central bank minutes and Mexico retail sales.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,