Markets Update - 3/4/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

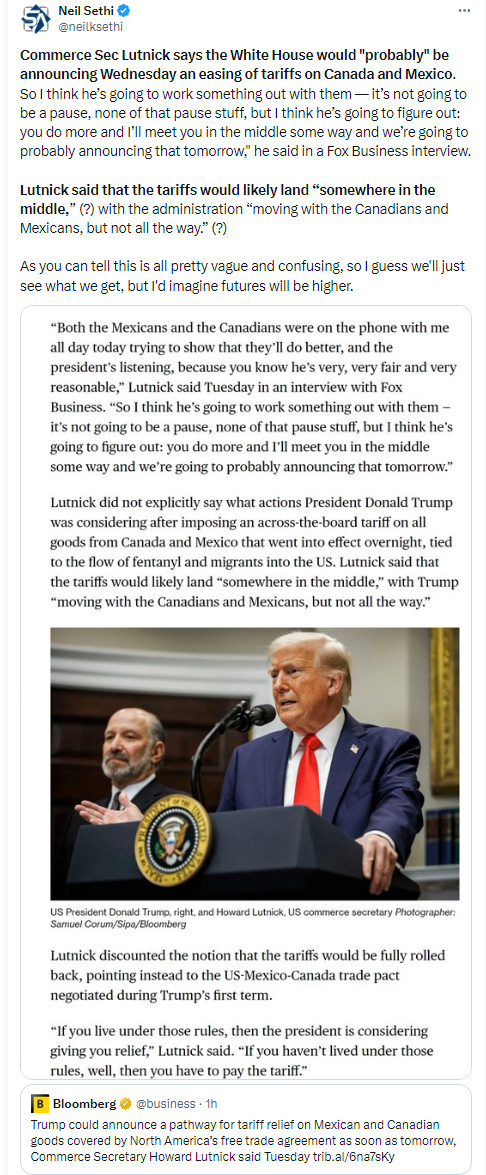

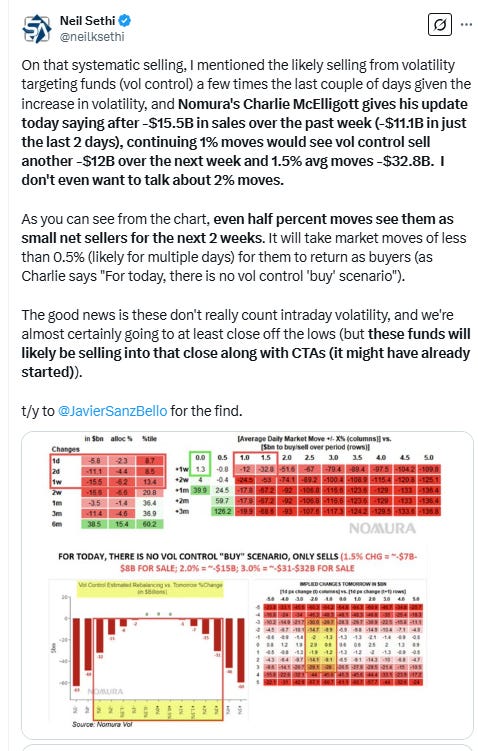

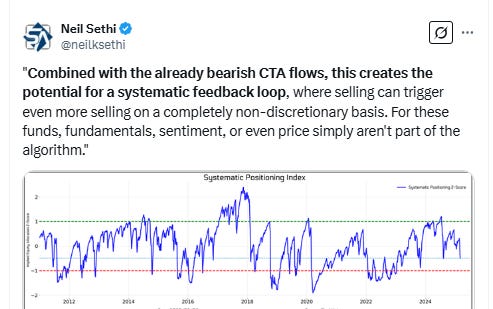

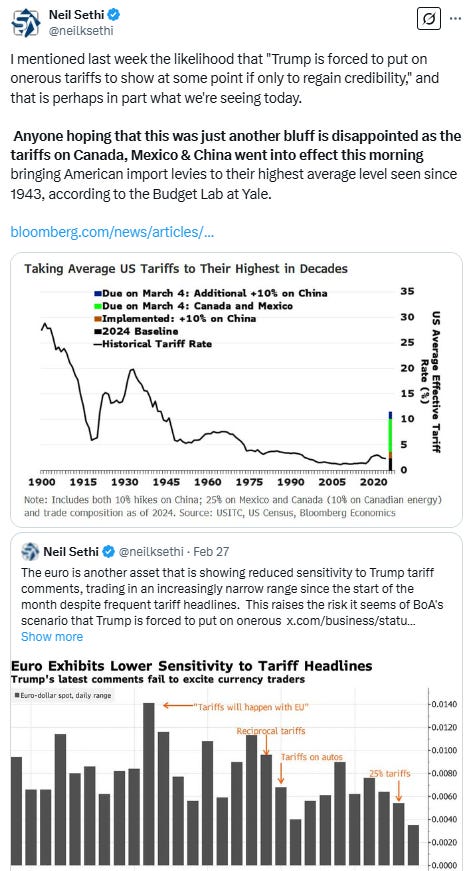

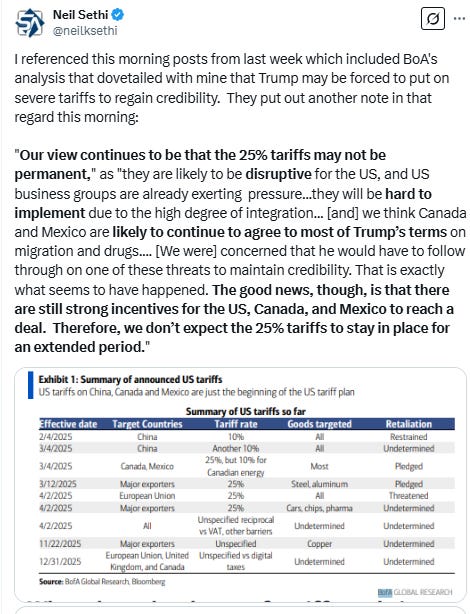

Major US equity indices started the day with solid losses following the implementation of 25% tariffs on Canada and Mexico in the morning along with additional 10% tariffs on China. But they were able to rally following the S&P 500 successfully testing its 200-day moving average and the bounce carried most of the indices into the green in the afternoon before a wave of selling from systematic strategies in the last 15 minutes pushed them back down to finish with losses, although less severe than Monday’s, the worst 2-day drop of the year. Also note that after the close Commerce Sec Lutnick said the White House would "probably" be announcing Wednesday an easing of tariffs on Canada and Mexico. Futures have opened higher.

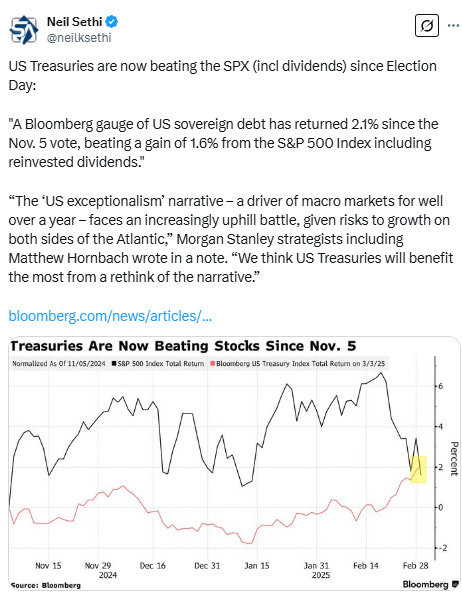

Treasury yields rebounded along with stocks and Fed rate cut bets were pared slightly on cautious Fed speakers. The dollar though fell sharply for a second day to the lowest since November. Crude fell but like stocks finished off the lows, while gold, nat gas, and bitcoin finished higher. Copper was little changed.

The market-cap weighted S&P 500 (SPX) was -1.2%, the equal weighted S&P 500 index (SPXEW) -1.6%, Nasdaq Composite -0.4% (and the top 100 Nasdaq stocks (NDX) -0.4%), the SOX semiconductor index +0.6% (still down -10.6% the past 6 sessions), and the Russell 2000 (RUT) -1.1% (-5.0% this week).

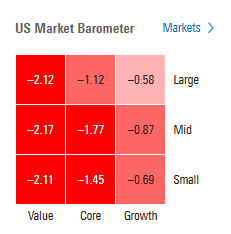

Morningstar style box showed the broad weakness but today it was focused towards value stocks.

Market commentary:

“We’re in a downward market and we don’t know when it’s going to stop,” said Nicolas Domont, a fund manager at Optigestion in Paris. “It’s by no means catastrophic, but we are still waiting for some good news.”

“While Tuesday’s tariffs are a go, it remains very unclear on just how long these tariffs will remain,” said Clark Geranen, chief market strategist at CalBay Investments. “We tend to believe these are more of a negotiation tactic and not the start of a long and drawn out reciprocal trade war,” he said. “Still, in these situations, investors sell first and ask questions later.”

“I’m calling it a conditional correction,” said Sam Stovall, chief investment strategist at CFRA Research. “It’s really based on one condition: By how much Trump is going to retain the tariffs.”

“We tend to believe these are more of a negotiation tactic and not the start of a long and drawn out reciprocal trade war,” said Clark Geranen, chief market strategist at CalBay Investments. “Still, in these situations, investors sell first and ask questions later.”

“Where’s the Trump Put,” said Tom Essaye at The Sevens Report. “At what level of stock market ‘pain’ would Trump and the administration reverse course? Obviously, we don’t know the exact number, but if we look back at Trade War 1.0, history implies the ‘Trump Put’ would be elected around a 10% decline in the S&P 500.”

To Nancy Tengler at Laffer Tengler Investments, while it’s “always excruciating” to be in the middle of a market correction — this is essentially what she think is happening after the S&P 500’s 6% slide from all-time highs.

“This time, of course, it’s spurred by the tariffs,” she noted. “And I think we have to analyze not just what the tariffs will be, but how long we think they’re going to last. I hope we start to get some indication if they’re short lived. If it is short lived this is just an opportunity to buy stocks for the long term.”

To Clark Geranen at CalBay Investments, it’s extremely difficult for investors to make investing decisions off of tariff news, and they should avoid making any drastic portfolio moves at this stage. “While Tuesday’s tariffs are a go, it remains very unclear on just how long these tariffs will remain,” he said. “We tend to believe these are more of a negotiation tactic and not the start of a long and drawn out reciprocal trade war. Still, in these situations, investors sell first and ask questions later.”

Trump has been “pretty open about there’s going to be some short-term pain for long-term gain, but there is a point where that short term pain is gonna get to be too much,” said Art Hogan chief market strategist at B. Riley Wealth. “It certainly feels like he will pull back on things. I don’t know if that’s today’s business, but it’s certainly on the short term horizon.”

To Chris Zaccarelli at Northlight Asset Management, the market finally took the Trump administration at its word, and the realization that the tariff talk wasn’t just a negotiating tactic is starting to sink in. “The caution we have been advocating all year has largely been ignored by the market, but nothing that is happening today is a surprise – these tariffs were well telegraphed – but investors haven’t been willing to believe Trump was serious, even though he has said many times that this was what he was going to do,” he added.

“We believe markets could get worse before they get better, as investors are having to rapidly recalibrate tariffs as a longer-term reality vs. pure negotiation tool, as well as concerns on what that may do to corporate profits and earnings growth,” said Victoria Greene at G Squared Private Wealth. Greene adds that earnings growth is key to the market continuing in its uptrend and right now.

“If the world shrinks and barriers go up to global trade, that makes profit growth more difficult,” she said.

At Miller Tabak, Matt Maley notes that the market — and several of its key stocks — are becoming “quite oversold.”

“So, even though we are still looking for a deep correction at some point this year, it won’t come in a straight line,” Maley said. “We have been saying for a while now that investors should ‘sell the rallies’ — and we still feel this way. But we just might get a bounce sooner than many people are thinking.”

“I personally believe that any sort of ‘Trump put’ in equities remains meaningfully (out of the money) lower,” Nomura cross-asset strategist Charlie McElligott wrote in a research note Tuesday. “Clients are dynamically hedging and pressing this short right now, with almost nothing he could say right now to solve this unless he completely backed down on policy.”

“On a short-term basis, while we wait for the markets to bottom, the next leg lower could prove sinister,” said Dan Wantrobski at Janney Montgomery Scott. “So folks should remain on guard for some big moves in our opinion.”

He noted that while the “buy side” has done a good deal of paring down their technology exposures, they remain overweight US equities in general- which comes alongside some of the heaviest positioning seen on the retail side in years. “This again presents a good deal of potential firepower in the event that selling pressure gains more momentum from here,” Wantrobski added. “We have not seen any signs of panic yet, and selling has been rather orderly and on moderate volume.”

A Goldman Sachs Group Inc. measure of risk appetite has turned negative for the first time since October amid concerns around a slowing economy. Those worries have hit the US harder than the rest of the world, strategist Andrea Ferrario says, suggesting international markets could extend their outperformance. Sentiment around S&P 500 earnings is now “very negative” even as companies enjoyed a strong fourth-quarter reporting season, the strategist writes in a note. Meanwhile, the outlook for profits in other developed markets remains positive.

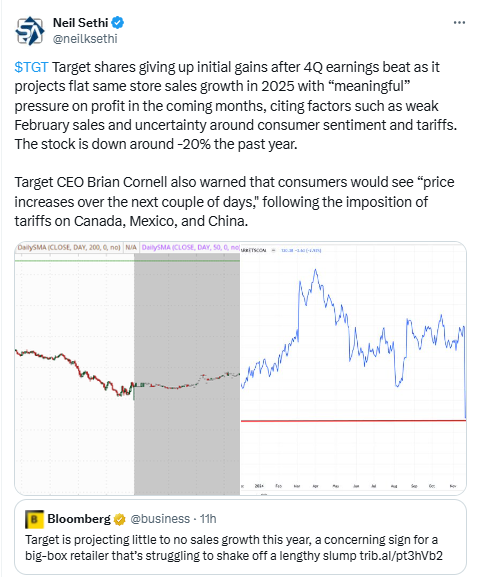

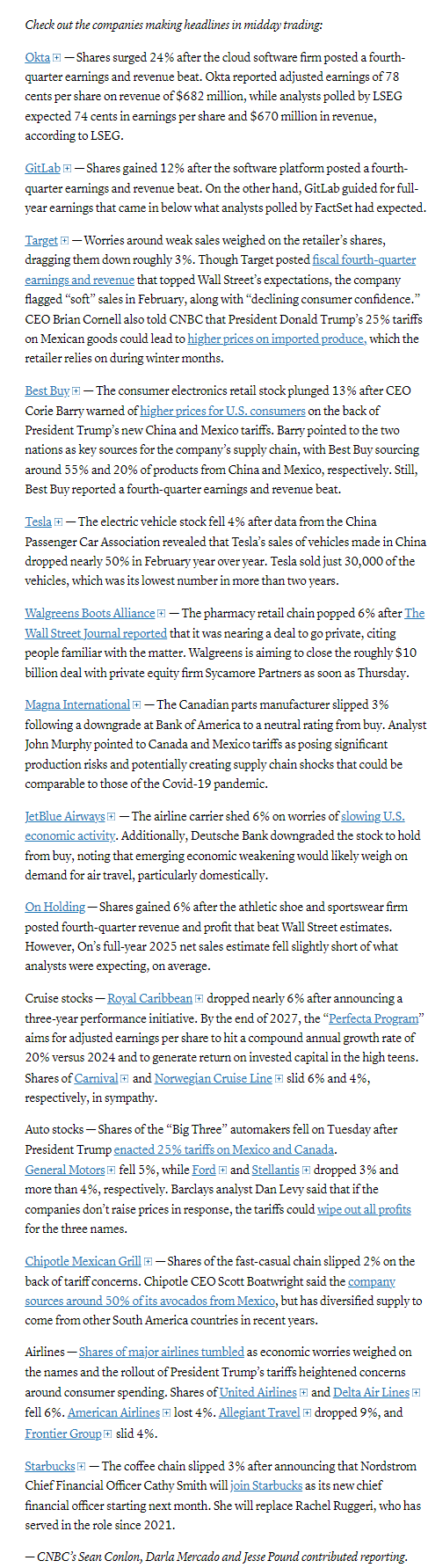

In individual stock action, shares of companies with significant imports came under pressure. Shares of GM and Ford dropped more than 4% and nearly 3%, respectively. Chipotle, which sources about half of its avocados from Mexico, slipped 2%. Target shed 3% with its CEO saying prices for some produce would be going higher in the next few days because of the tariffs. Best Buy shares fell more than 12% in early afternoon trading on Tuesday, a move lower that put the stock on pace for its worst day in nearly five years.

Tuesday afternoon though saw notable bounceback activity, with Monday’s worst-performing decile of S&P 500 stocks trading an average of 4.5% from their intraday lows on Tuesdays. Shares of Super Micro Computer, for instance, opened Tuesday in negative territory after sliding 13% on Monday. Shares were last trading 10% higher, while during their lows of the day they were over 4% in the red. ast up nearly 4% and trading at its session highs. Palantir was down around 5% by mid-morning but was last up 4% on the day.

BBG Corporate Highlights:

CrowdStrike Holding Inc., a cybersecurity company, issued a worse-than-expected earnings outlook, signaling that it may still be struggling to recover from a flawed software update that crashed millions of computers globally last year.

Google is urging officials at President Donald Trump’s Justice Department to back away from a push to break up the search engine company, citing national security concerns, according to people familiar with the discussions.

Apple Inc. rolled out a new iPad Air along with a redesigned keyboard accessory and an upgraded low-end tablet, enhancing devices that helped lift holiday sales despite an iPhone slump.

Mars Inc. is talking to investors on Tuesday about selling around $26 billion of bonds to help finance its purchase of Kellanova, according to people with knowledge of the matter, in what would be the biggest US corporate bond sale of the year.

Bankers are working on funding packages of around $12 billion for Walgreens Boots Alliance Inc. to back a potential take-private deal by Sycamore Partners, in what would be one of the largest leverage buyout debt deals since the great financial crisis.

UnitedHealth Group Inc. moved closer to winning dismissal of a long-running lawsuit in which the US government claims the company overbilled Medicare by at least $2.1 billion.

Target Corp. is projecting little to no sales growth this year, a concerning sign for a big-box retailer that’s struggling to shake off a lengthy slump.

Best Buy Co. said shoppers will remain constrained by inflation this year as it forecast that annual sales could be little changed.

A BlackRock Inc.-led consortium agreed to buy control of key ports near the Panama Canal from Hong Kong-based conglomerate CK Hutchison Holdings Ltd. after pressure from US President Donald Trump to limit Chinese interests in the region.

Aramco plans to trim the world’s biggest dividend, lowering a key source of funds for Saudi Arabia’s budget while relieving stress on its own finances.

Some tickers making moves at mid-day from CNBC.

In US economic data: No major releases today.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX fell to its 200-DMA consistent with the note Friday that the selloff should continue. It was able to get a textbook-like bounce at the 200-DMA although still finished down for the day now back to below the close on Election Day (where supposedly the “Trump put” resides, we’ll see). The daily MACD remains in “sell longs” positioning, and RSI now the weakest since Aug (so unlike Nasdaq no higher low). This would be a more “natural” place for a bottom, but that doesn’t mean we won’t retest the 200-DMA again in the next few weeks.

The Nasdaq Composite chart is a bit messy but unlike the SPX it fell below and closed below its 200-DMA. That’s not a huge deal if it can get back over in the next week or so, but something to take note of.

It did stop at a trendline running back to the Oct ‘23 lows (in yellow). I’m not a huge fan of lines with just two touches but it would at least give it a “reason” to bounce here. Otherwise no solid support in my work until down around 16,000.

Its daily MACD remains firmly in “go short” positioning, and its RSI around the weakest since August (although a slightly higher low so that’s a positive divergence).

RUT (Russell 2000) was able to (just) reclaim its trendline running back to the Jan lows. Its daily MACD remains in “go short” positioning, and its RSI now the weakest since Jan 2022.

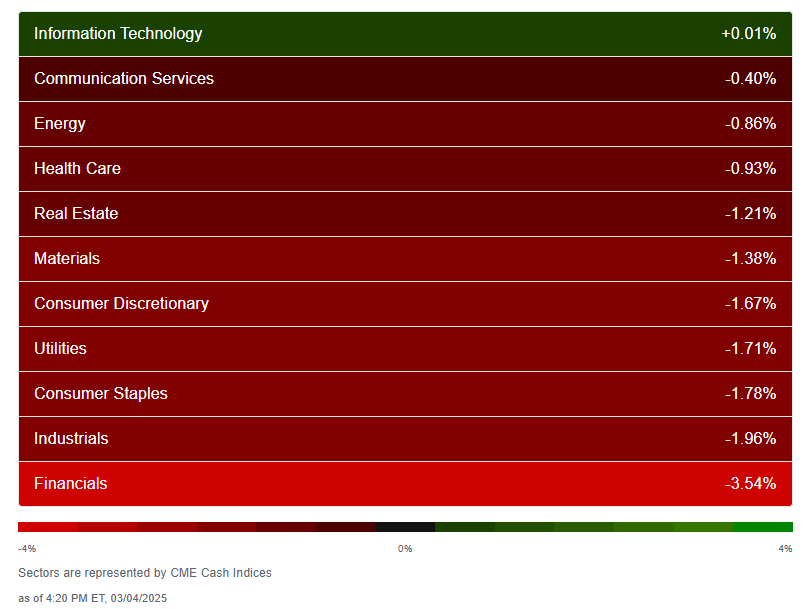

Equity sector breadth according to CME Cash Indices deteriorated despite the smaller losses at the index levels which were boosted by megacap rich Tech finishing flat and Comm Services just -0.4% lower. But 10 total sectors were red vs 7 Mon, with every other sector finishing down around -0.9% or more (so 9 total). Fewer huge losers with only one sector >-2% versus four Monday.

SPX stock-by-stock flag from Finviz with lots and lots of red outside of tech and the Mag 7. Financials just crushed with just one stock up (MKTX). Most down over -3%. Every utilities stock red, and most of the industrials, telecoms, retailers, real estate, etc.

Positive volume (percent of total volume that was in advancing stocks) improved slightly to 25% on the NYSE from the least this year a positive considering the index was -1.65% vs -1.0% on Monday, while the Nasdaq was a surprising 51%, better than the small loss.

Positive issues (percent of stocks trading higher for the day) though weaker, particularly for the Nasdaq at 22 & 37% respectively.

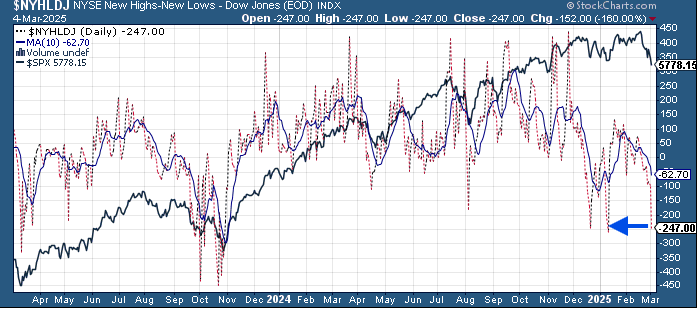

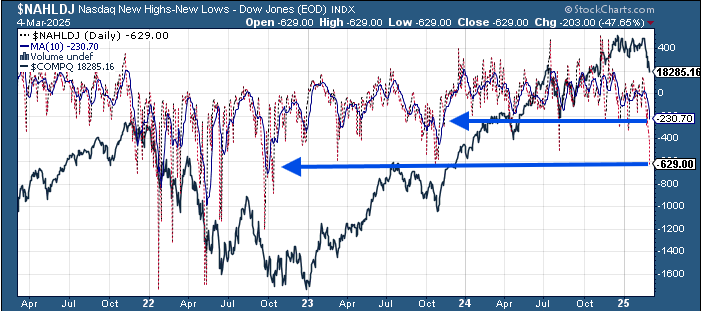

New highs-new lows (charts) though cratered. NYSE fell to -247 (almost the worst since Oct ‘23) while the Nasdaq fell to -629 the least since 2022. Both remain below their 10-DMAs which are plummeting lower (less bullish) with the Nasdaq’s the least since November.

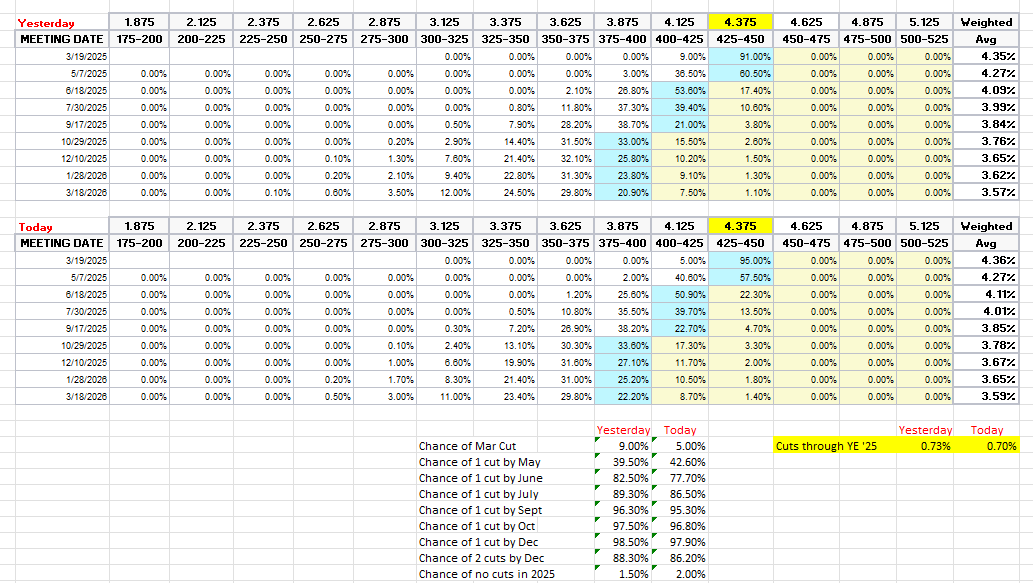

FOMC rate cut probabilities from CME’s #Fedwatch tool at one point pushed to the highest of the year but reversed after some cautious comments from regional Fed Presidents Williams (NY, an important voice) and Goolsbee (also a 2025 voter) that rate cuts would likely need to be pushed out due to heightened uncertainty. A cut by March fell back to 5% from 9%, one by May at one point was 50% but ended the day 43%, while one by June edged down to 78% (still up from 33% the Wednesday after CPI). Chance of two 2025 cuts at 86% (vs 31%) and no cuts at 2% (vs 29%) with 70bps of cuts priced (vs 73 yesterday but 28 CPI day).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and I think we’re getting back to fairly priced (maybe actually going a little to far). But as I said then “It’s a long time until December.”

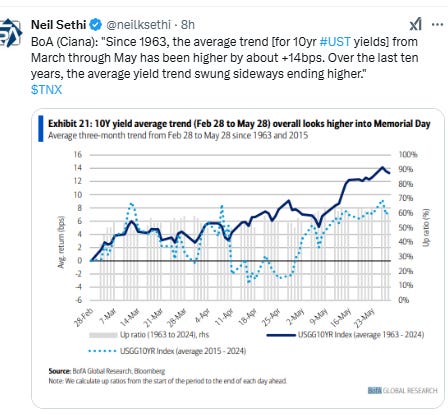

10yr #UST yield made it to 4.13% target from Friday (actually cut a little below) where it did bounce to end higher for the day +3bps at 4.21% (although still down for the week which would be the 8th straight week, the longest post-pandemic). It is still though below the 200-DMA and down -46bps since CPI day (Feb 12th). Question now is whether that level continues to hold. I think it might, but we’ll see.

The 2yr yield, more sensitive to Fed policy, also moved higher breaking a 9-session streak of declines, moving with Fed rate cut bets, +4bps to 3.99% from the lowest close since Oct, still though -33bps below the Fed Funds midpoint.

I had said when it was 45-55bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now definitely getting closer to where I think fair value is although still only pricing around 1.5 cuts. Ian Lygan of BMO sees it going to 3.5% by year’s end.

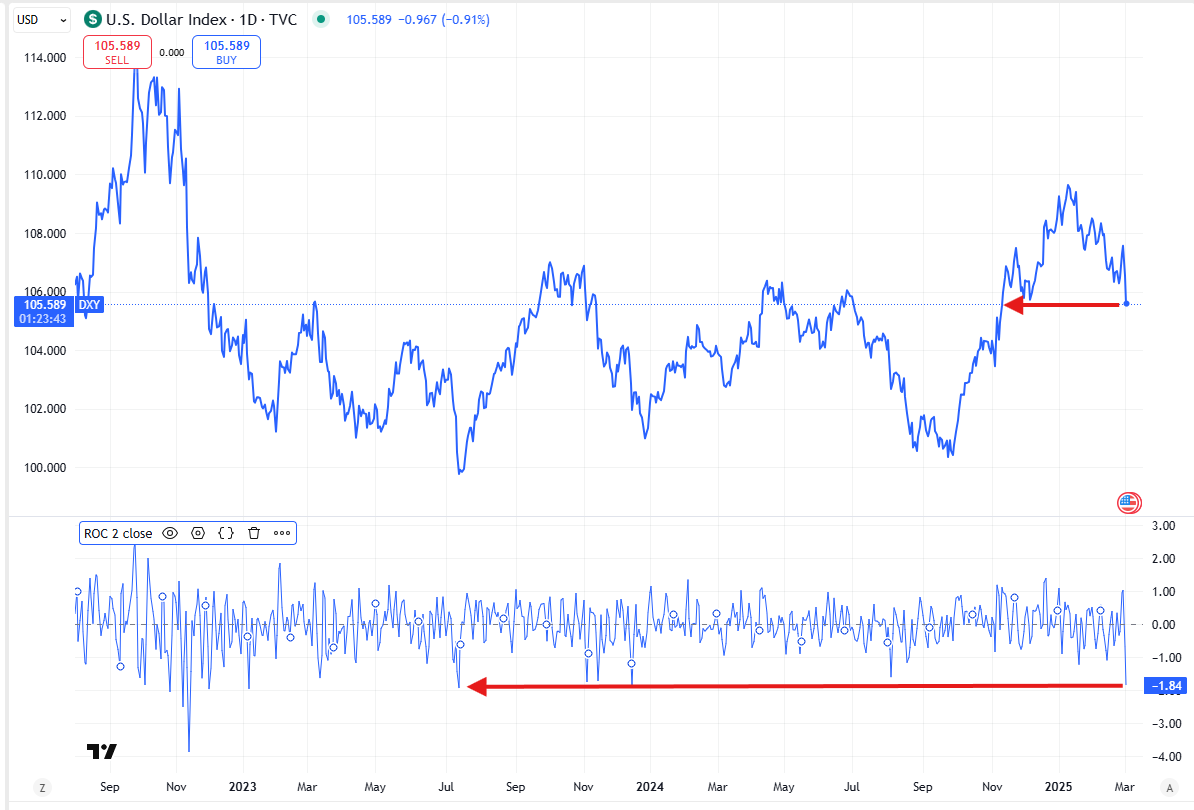

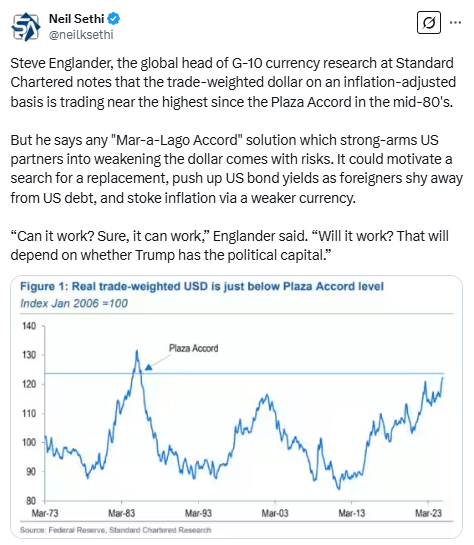

Dollar $DXY though fell sharply with no rebound during the day to the lowest close since Nov 11th after the largest 2-day drop since July ‘23 with the 200-DMA at 105 the next logical support level. Daily MACD remains in “cover shorts” positioning and the RSI fell towards the lowest since Sept, but did not make a lower low, a slight positive divergence.

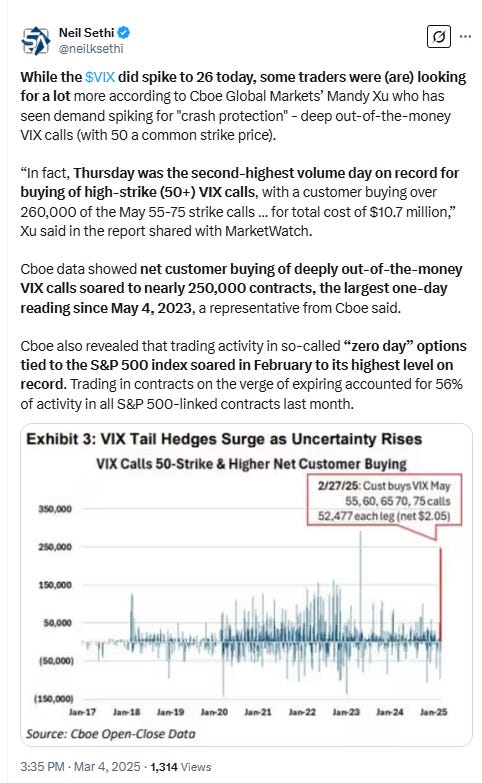

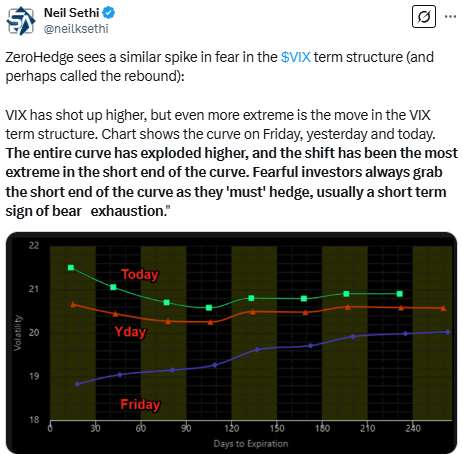

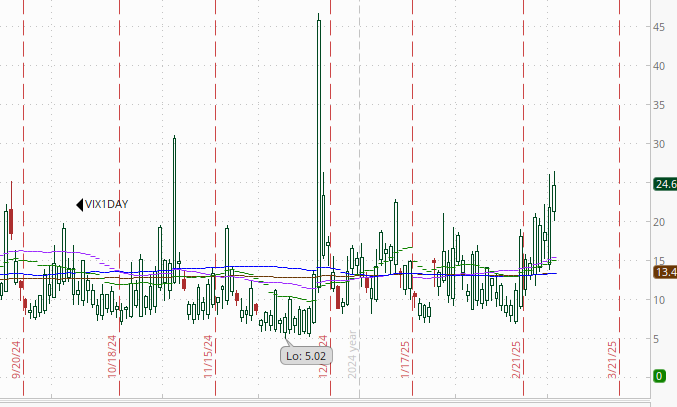

The VIX continued to push higher making it to 26 before ending at 23.5, the highest close since the Dec FOMC meeting consistent w/~1.47% daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also highest close since the Dec FOMC moving further over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100))

1-Day $VIX pushed to 24.6 the highest since the Dec FOMC (which was unusually high). It’s looking for a move of 1.54% Wednesday, although this should ease off if Trump does dial back tariffs as hinted at by Howard Lutnick.

#WTI futures fell along with risk assets today testing the key $67 level which has been support multiple times since August which again held, and it was able to rally back towards unchanged levels. Still it is working on an 8th consecutive weekly loss. Daily MACD remains in “go short” positioning, while the RSI the weakest since Sept.

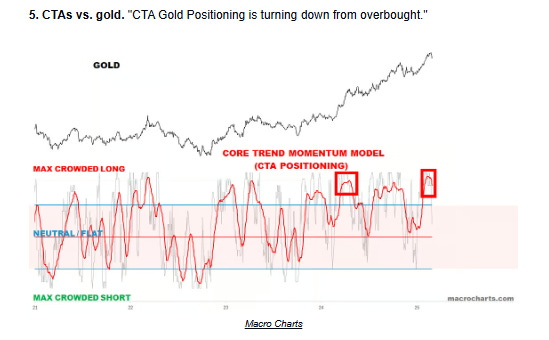

Gold futures up again edging just over resistance at the 20-DMA despite the daily MACD remaining in “sell longs” positioning as noted Tuesday, and the RSI showing a clear negative divergence. That said, not sure I can stick with my target of $2800 much longer.

Copper (/HG) little changed for a fourth session remaining trapped between the $4.70 level on the upside and $4.50 on the downside. As noted Tuesday the daily RSI and daily MACD are not really supportive yet.

Nat gas futures (/NG) at one point jumped to a 26-mth high before falling back, still finishing up over 3%. Daily MACD remains in “go long” positioning while the RSI remains over 50.

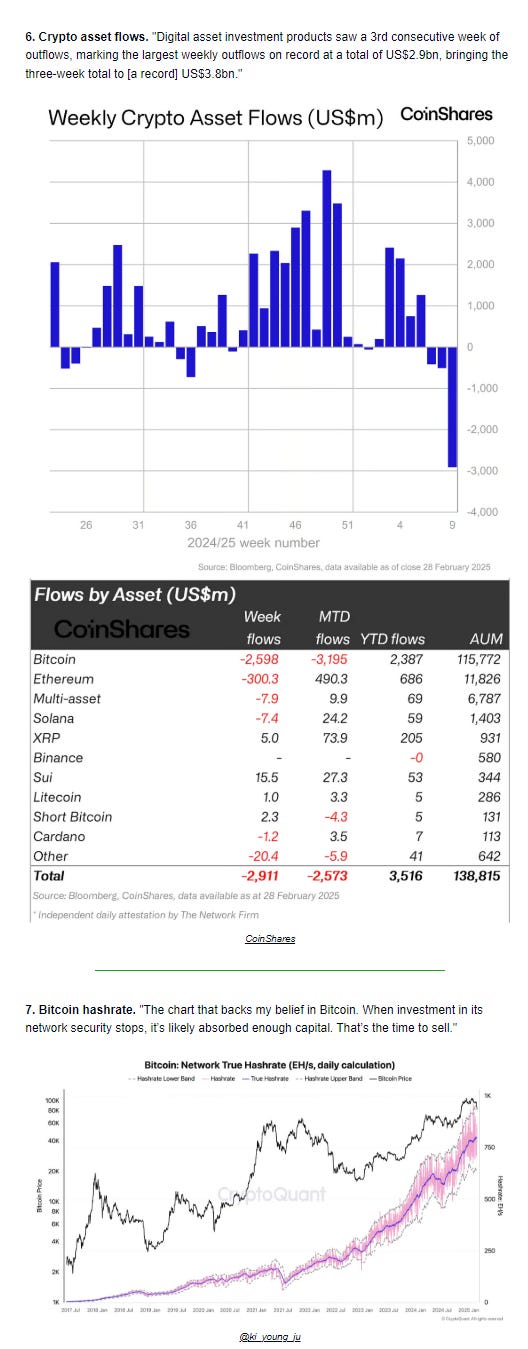

Bitcoin futures another volatile session again trading along with risk assets although they were able to close in the green. Relative strength remains not far from the weakest since July '23, but as noted Friday crossed from under to over 30 (generally bullish), although the daily MACD remains in “go short” territory for now.

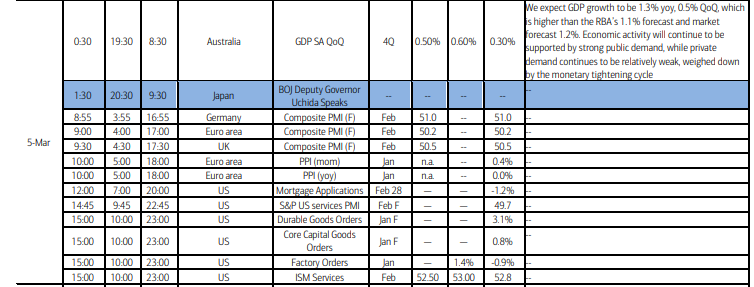

The Day Ahead

US economic data picks up significantly with Feb ADP and services PMIs, and Jan factory orders.

No Fed speakers but we’ll get the Fed’s Beige Book in the afternoon.

In earnings I think we’ll get 7 SPX components reporting Wednesday but none > $100bn in market cap (largest is MRVL ($82bn) (see the full earnings calendar from Seeking Alpha).

Ex-US a heavier day as well with services PMI’s, EU PPI, Australia GDP. We’ll also get speaking engagements from BOJ Gov Ueda and BoE head Bailey. In EM we’ll a lot of data from Mexico and South Korea CPI.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,