Markets Update - 3/6/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

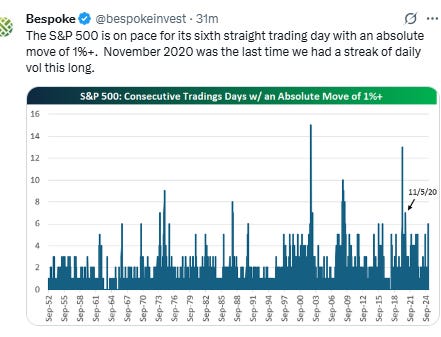

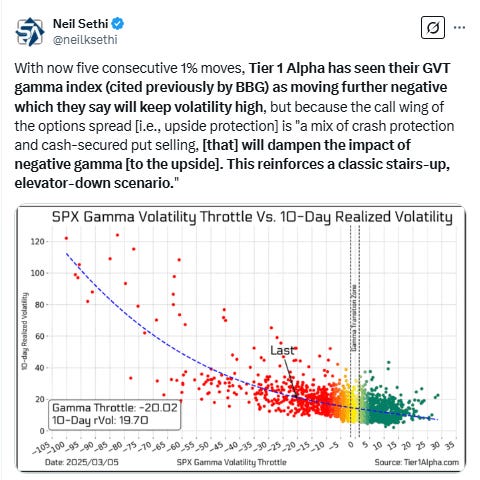

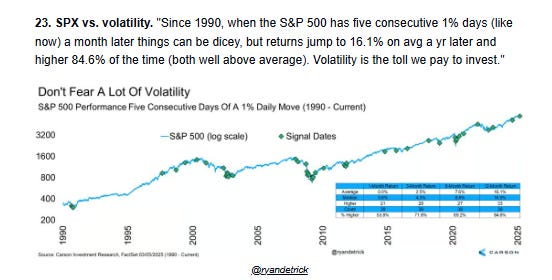

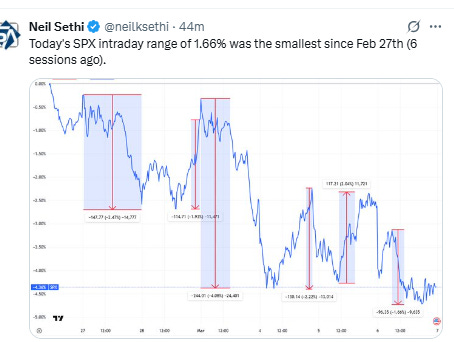

Major US equity indices started the day solidly lower, taking the S&P 500 back down to a third test of its 200-DMA in as many days following a batch of tech earnings last night that didn’t meet investors lofty expectations seeing large drops in shares of Marvell, CrowdStrike, and MongoDB Inc, and after Alibaba Group Holding Ltd. introduced its Qwen platform, a model that it claims performs as well as Chinese start-up DeepSeek but with a fraction of the data. Markets tried to rally for an hour then sold off taking the SPX at multiple times today beneath the key 200-DMA level. They were saved by a brief rally following Pres Trump lifting tariffs until April 2nd on USMCA goods from Canada and Mexico (which the White House though says is only 50% of Mexican imports and 38% of Canadian) but still ended with solid losses (the worst day for the SPX this year). Likely not helping was Pres Trump saying “I'm not even looking at the market.” It was the sixth straight session of daily gains or losses of at least 1% for the SPX, its longest such streak since the seven-session stretch ending Nov. 5, 2020.

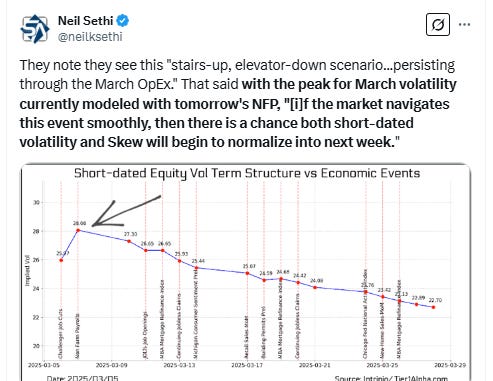

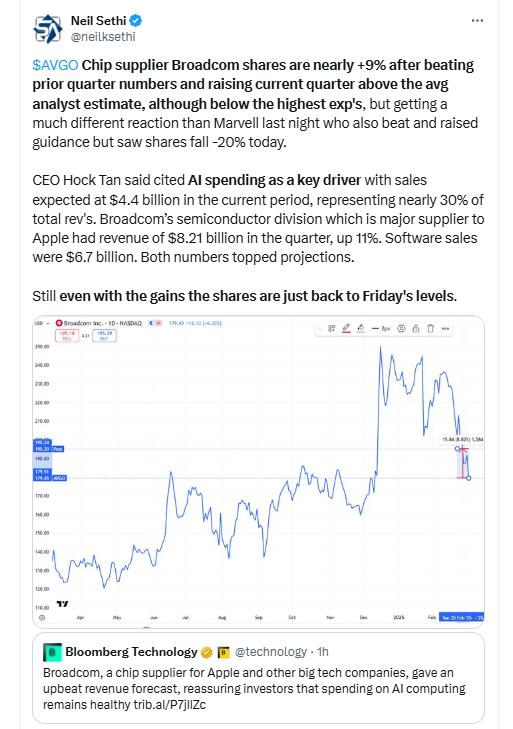

Good news is after the bell chip supplier Broadcom gave guidance that investors seemed to like sending shares nearly 10% higher which will hopefully carry over to tomorrow, although it will likely be all about the Nonfarm Payrolls report at 8.30am ET and Jerome Powell speaking at 12.30pm ET.

Treasury yields were mixed with longer duration continuing to rebound while shorter fell as Fed rate cut bets moved to the highs of the year. The dollar continued its decline for a 4th day (after the worst three days since Nov ‘22). Nat gas also fell back while copper, gold and bitcoin were little changed.

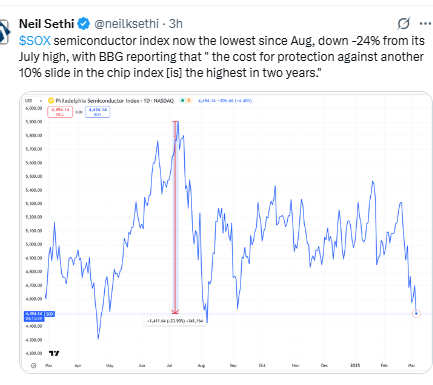

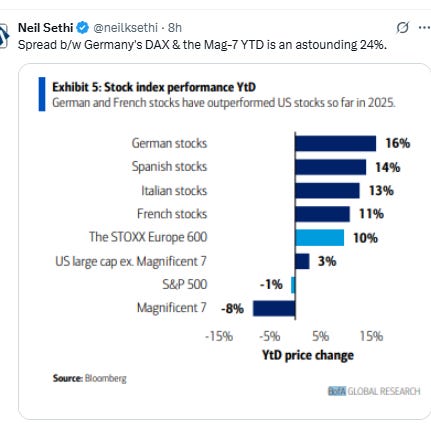

The market-cap weighted S&P 500 (SPX) was -1.8%, the equal weighted S&P 500 index (SPXEW) -1.1%, Nasdaq Composite -2.8% (and the top 100 Nasdaq stocks (NDX) -2.8%), the SOX semiconductor index -4.5% (now -6% this week), and the Russell 2000 (RUT) -1.6% (now -5.6% this week).

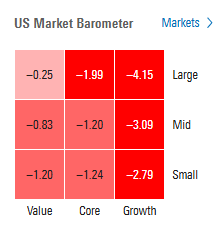

Morningstar style box showed the broad weakness with the focus returning to growth stocks.

Market commentary:

“Volatility seems like the only certainty as policies are implemented, challenged, modified, then often re-implemented,” said Chris Low at FHN Financial.

“Right now, trade policy is dominating market action,” said Chris Larkin at E*Trade from Morgan Stanley. “Until the tariff smoke clears, it could continue to be a bumpy ride for traders and investors.”

“You’re just having confusion,” said Keith Lerner, chief market strategist at Truist. “That confusion is permeating into the day-to-day swings of the market.”

To Steve Chiavarone of Federated Hermes, the market “isn’t really forgiving” at this stage. “At the end of the day, we think we are just in a period of max uncertainty and a bit of an economic soft patch,” he noted. “That said, we think this gives way to a much better second half.”

“On any other day, today’s modest jobless claims number may have offset some of the concerns raised by yesterday’s weak ADP report,” said Chris Larkin at E*Trade from Morgan Stanley. “But right now, trade policy is dominating market action. Until the tariff smoke clears, it could continue to be a bumpy ride for traders and investors.”

“Hold on tight, because there’s going to be a lot of volatility,” said Eric Diton, president and managing director of the Wealth Alliance. “Traders are nervous and worried about how tariffs will impact US multinational companies, so tech is the first target. That’s going to batter major indexes given their big weightings.”

Big swings in stocks aren't attracting the "dip buyers" like they used to.

"Dip buyers are waiting a bit longer," said Chris Zaccarelli, chief investment officer at Northlight Asset Management, adding that it's unlike 2023 and 2024, when "any small drop was bought."

“Investors are repricing the growth prospects of these stocks in a market that will be driven by tariff and inflation headlines, not future growth potential from AI,” said Dave Mazza, chief executive officer of Roundhill Investments. “In other words, the days of good vibes have come to a screeching halt.”

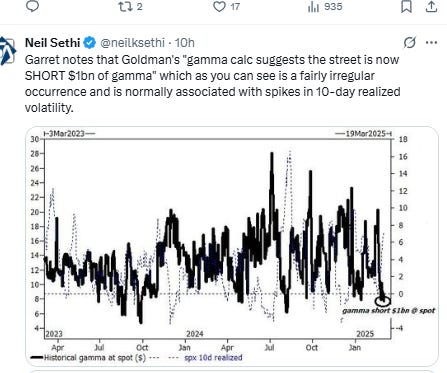

"This PNL environment is not one for long-form directional trades, and people are chopping their feet tactically to book winners while suffering under 'tight stops' risk-management as a function of the return of 'Trump gamma shocks.'" -- Charlie McElligott, Nomura

Certuity chief investment officer Scott Welch said Thursday that investors would be better off taking a break from following the constantly evolving ins-and-outs of the trade war. “That’s what the market’s paying attention to right now. In my opinion, everybody should just take their dog for a walk and relax,” Welch said.

Globalt Investments senior portfolio manager Thomas Martin similarly is sticking to a patience approach. “There’s just things that are changing so much. If you don’t like how things are now, just wait a minute, right? It’s like the weather in the mountains. So we’re not trying to trade every little thing that’s going on,” Martin said.

In individual stock action, a continued unwind of the popular artificial intelligence trade that has boosted the market for more than a year also hurt stocks on Thursday. Notably, chipmaker Marvell Technology dropped nearly 20% after the company issued mixed first-quarter guidance. Other semiconductor builders such as ON Semiconductor, Taiwan Semiconductor and Nvidia also slid. Shares of Tesla tumbled a further 5% on Thursday to the lowest levels since Nov. 5,

Both the SPDR S&P Regional Banking ETF (KRE) and the SPDR S&P Bank ETF (KBE) slipped 2% on Thursday, putting the exchange-traded funds on pace for a 7% weekly decline. This marks the worst week for both ETFs since Aug. 2, 2024.

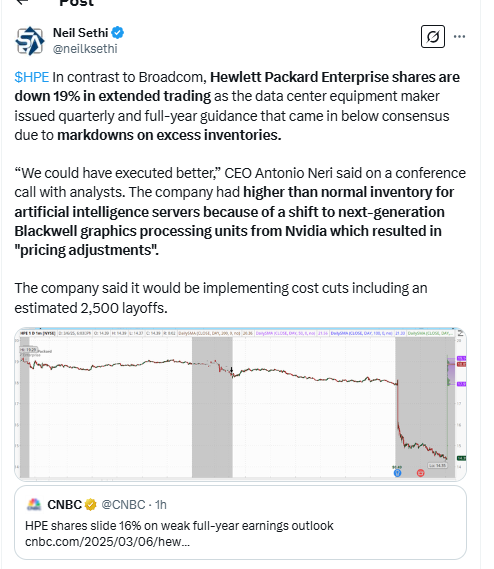

In late hours, Broadcom Inc. gave an upbeat revenue forecast, reassuring investors that spending on artificial-intelligence computing remains healthy. Hewlett Packard Enterprise Co. issued a weak profit outlook and announced plans to eliminate about 3,000 jobs.

Companies making the biggest moves after-hours from CNBC:

BBG Corporate Highlights:

The Republican-led House Judiciary Committee subpoenaed Alphabet Inc. and its CEO Sundar Pichai as part of its ongoing investigation into the biggest tech companies’ relationships with the Biden administration.

OpenAI and Oracle Corp. plan to begin filling a massive new data center in Texas with tens of thousands of powerful AI chips from Nvidia Corp. in the coming months, part of a push to get the first facility for their $100 billion Stargate infrastructure venture up and running.

Boeing Co. Chief Executive Officer Kelly Ortberg told employees that tariffs imposed by President Donald Trump risk driving up costs, highlighting the fragility of a finely tuned supply-chain network that now faces disruption.

Macy’s Inc. is the latest retailer to post better-than-expected results only to issue a downbeat annual outlook for sales and profit, citing “external uncertainties.”

Kroger Co. forecast higher-than-expected sales guidance, seeking to pacify concerns as questions linger about its chief executive officer’s abrupt exit.

Alibaba Group Holding Ltd. took the wraps off a model that it claims performs as well as DeepSeek with just a fraction of the data required.

Some tickers making moves at mid-day from CNBC.

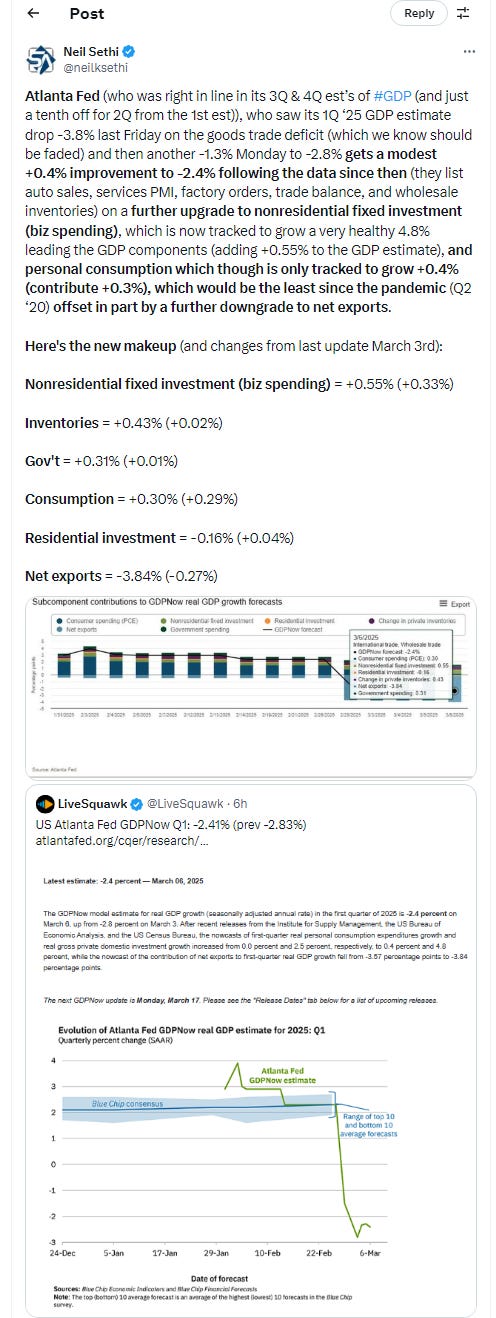

In US economic data:

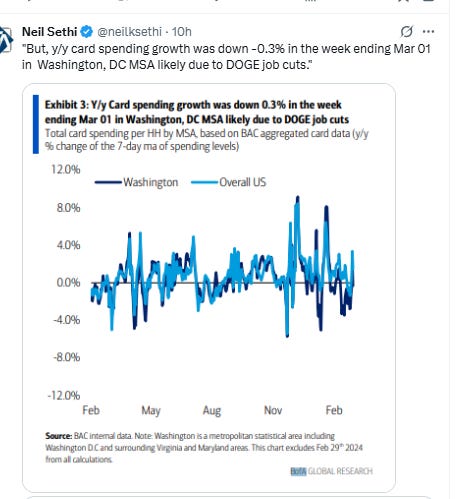

Challenger Feb job cuts surge +245% m/m to 172k, the highest for any month since July 2020 and any Feb since 2009, from 50k in Jan (rev’d from 39k), +103% y/y.

“Private companies announced plans to shed thousands of jobs last month, particularly in Retail and Technology. With the impact of the Department of Government Efficiency [DOGE] actions, as well as canceled Government contracts, fear of trade wars, and bankruptcies, job cuts soared in February,” said Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.

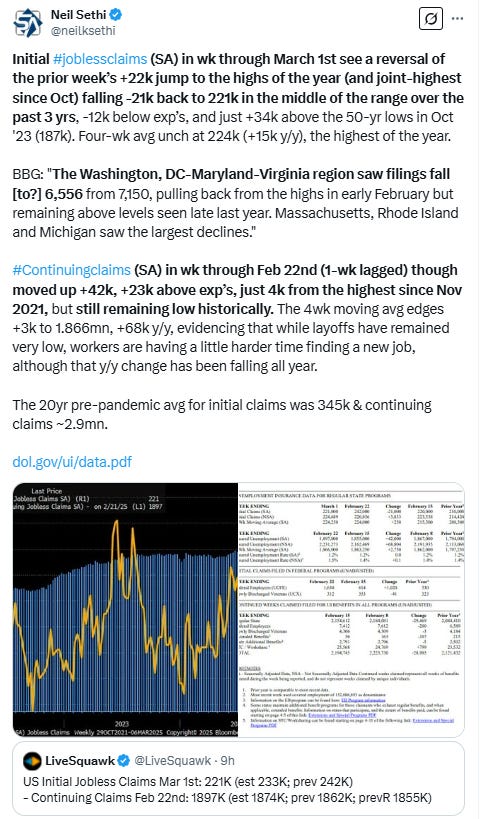

Initial jobless claims (SA) in wk through March 1st see a reversal of the prior week’s +22k jump to the highs of the year (and joint-highest since Oct) falling -21k back to 221k in the middle of the range over the past 3 yrs, -12k below exp’s, and just +34k above the 50-yr lows in Oct '23 (187k). Continuing claims (SA) in wk through Feb 22nd (1-wk lagged) though moved up +42k, +23k above exp’s, just 4k from the highest since Nov 2021, but still remaining low historically.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

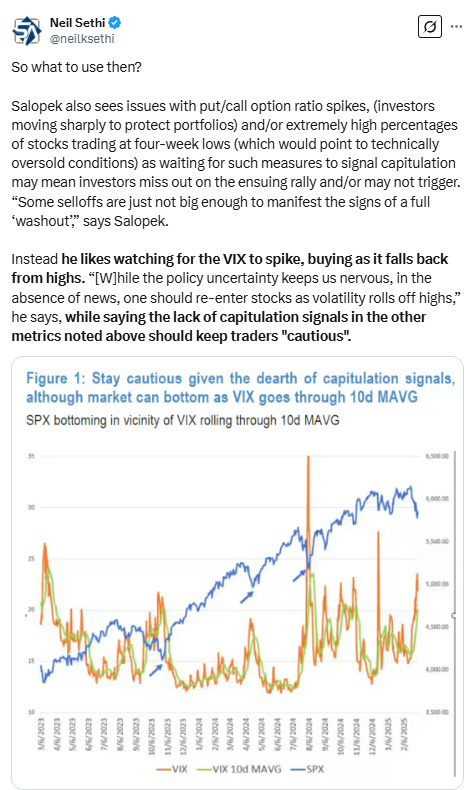

The SPX as noted fell below its 200-DMA but was able to recover. As I said Wednesday, “when I said we would likely retest it again, I didn’t really mean the next day,” and clearly now the first test is not “done”. The daily MACD remains firmly in “sell longs” positioning, and RSI just off the weakest since Aug. As I said Tuesday, “this would be a more ‘natural’ place for a bottom, but that doesn’t mean we won’t retest the 200-DMA again in the next few weeks,” and I guess it also means it doesn’t have to be the place it bottoms.

The Nasdaq Composite fell back to test Tues’s low which it stayed over for now. Still, the lowest close since pre-Election Day. Holding for now that weak uptrend line I talked about Tuesday. Its daily MACD remains firmly in “go short” positioning, and its RSI around the weakest since August but still has a small positive divergence.

RUT (Russell 2000) similar to the Nasdaq pushed down towards Tuesday low but stayed above but still closed lower, in its case the lowest close since Aug. Its daily MACD remains in “go short” positioning, and its RSI just off the weakest since Jan 2022 and has fallen back under 30.

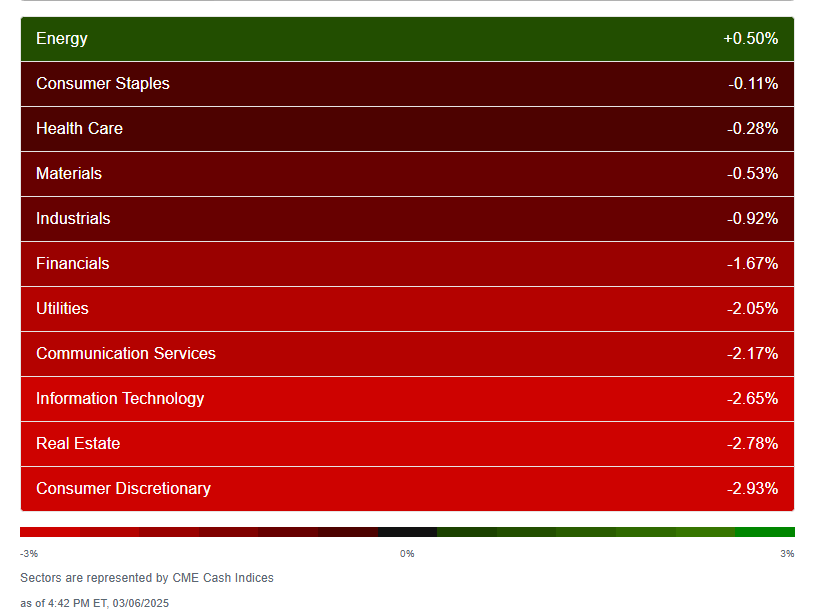

Equity sector breadth according to CME Cash Indices deteriorated as you would expect with the down day in the indices with just one green sector (Energy +0.5%) & 7 of 11 sectors finishing down at least -0.9% and five more than -2%. Megacap growth which outperformed the past two days lagged today (taking 3 of the bottom 4 spots).

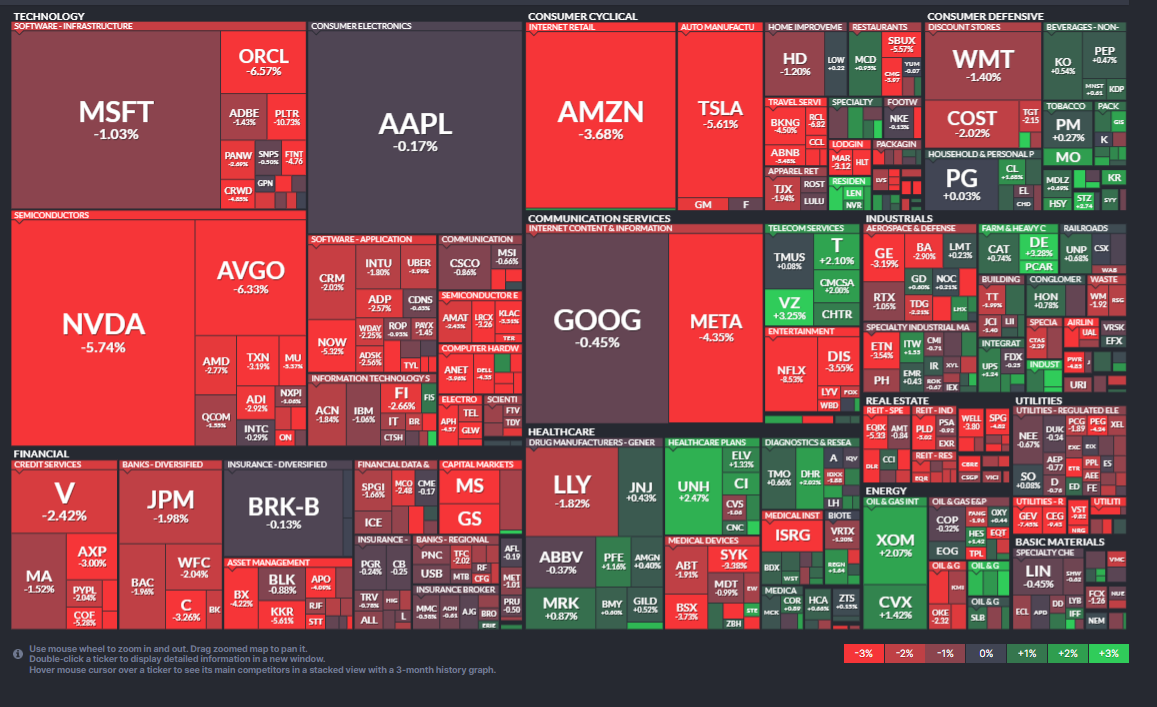

SPX stock-by-stock flag from Finviz back to very red although there were more pockets of green than I was expecting. Another heavy day of selling in tech, financials, real estate, and consumer cyclicals.

Positive volume (percent of total volume that was in advancing stocks) fell back to where it had been before Wed’s big improvement at 28% on the NYSE, I guess in line with the -1.3% loss in the index, while the Nasdaq was 34%, a little better than the -2.6% loss would indicate. Neither was “great” though (and haven’t been for a couple of weeks now).

Positive issues (percent of stocks trading higher for the day) though again a little weaker at 27 & 31% respectively.

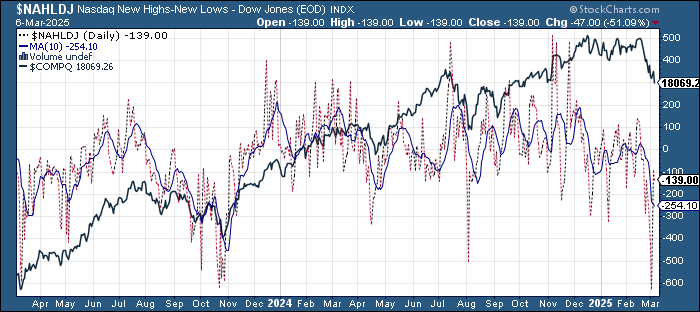

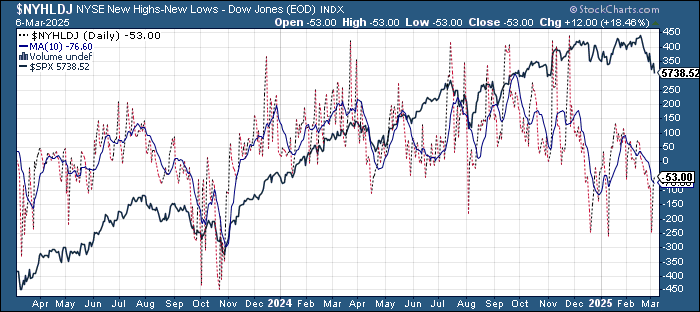

New highs-new lows (charts) though improved on the NYSE to -52, after hitting -247 Tuesday (almost the worst since Oct ‘23) while the Nasdaq fell to -141 from -95 but still up from -629 Tuesday which was the least since 2022. With the 10-DMAs plummeting lower (less bullish) though the both remain over them (for now).

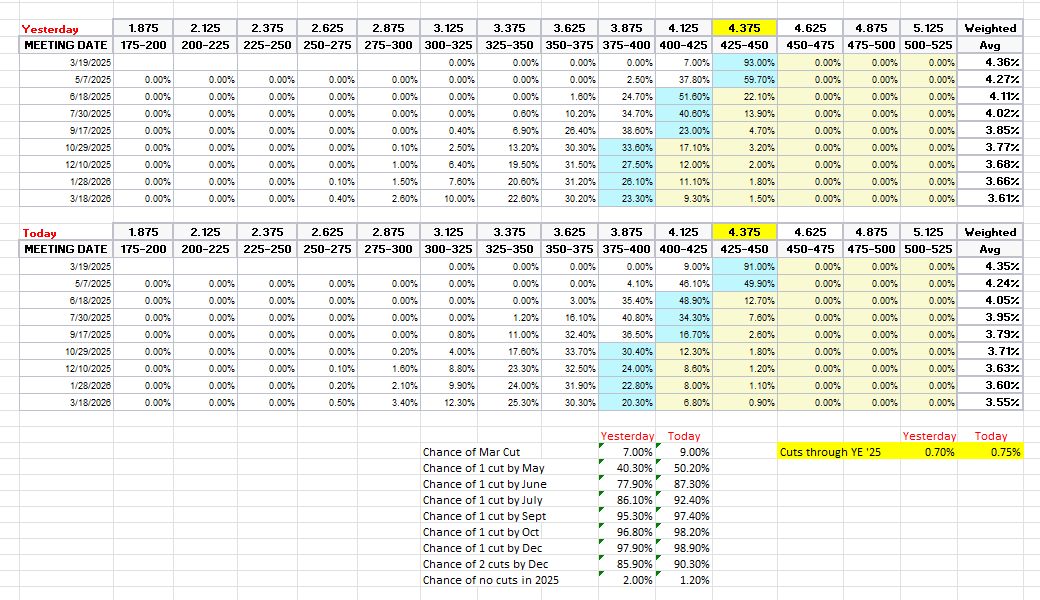

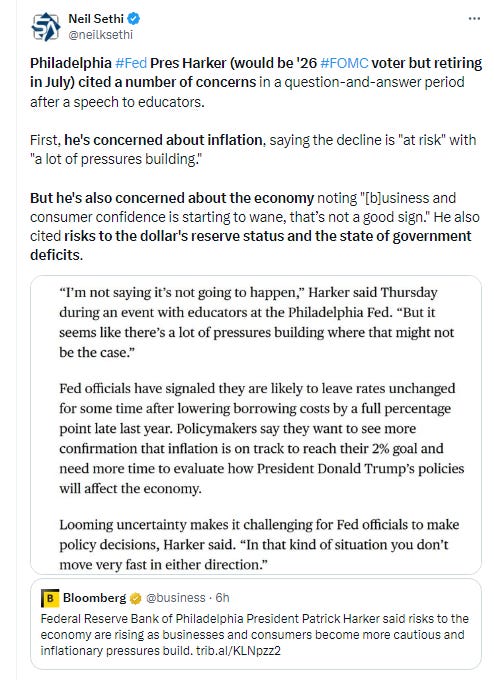

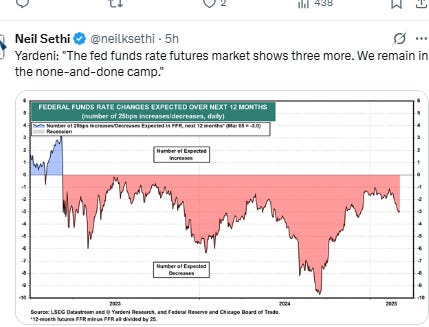

#FOMC rate cut probabilities from CME’s #Fedwatch tool got back to the highs of the year.

A cut by March 9%, one by May 50%, and one by June 87% (up from 33% the Wednesday after CPI). Chance of two 2025 cuts at 90% (vs 31%), three cuts at 66%, and no cuts at 1% (vs 29%) with 75bps of cuts priced (+5bps from Wed & from 28 CPI day).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and I think we’re getting back to fairly priced (maybe actually going a little to far). But as I said then “It’s a long time until December.”

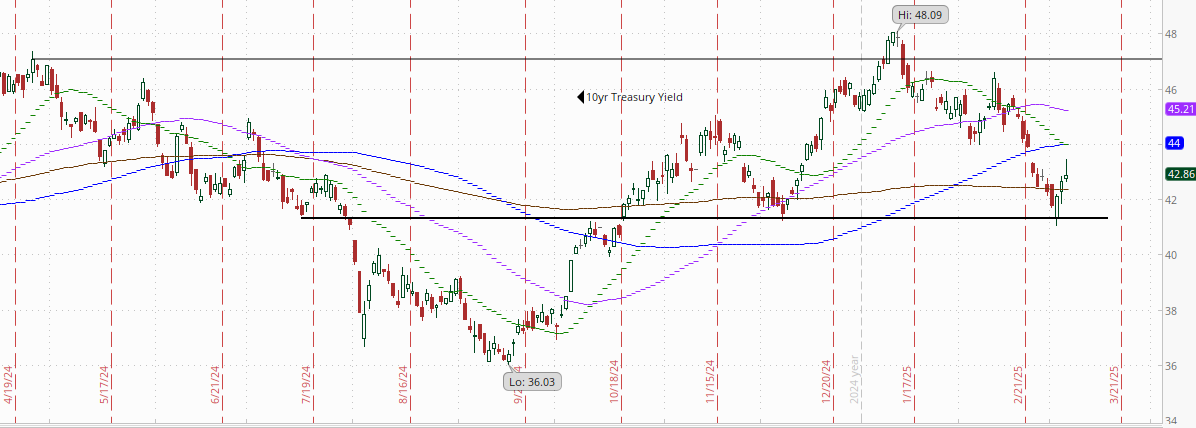

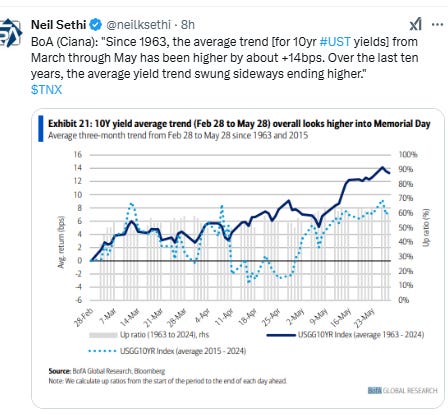

10yr #UST yield continued its rebound from the 4.13% target hit Friday up +2bps to 4.29%, a 1-wk high. Still down -37bps since CPI day (Feb 12th). As I said Tues “the question now is whether that 4.13% level continues to hold. I think it might,” and the price action has been consistent with that.

The 2yr yield, more sensitive to Fed policy, moved along with rate cut bets again falling back to the joint lowest since Oct, -5bps to 3.96%, -36bps below the Fed Funds midpoint so continues to price far fewer cuts than SOFR markets.

I had said when it was 40-50bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now definitely getting closer to where I think fair value is although still only pricing a little more than 1 cut. Ian Lygan of BMO sees it going to 3.5% by year’s end.

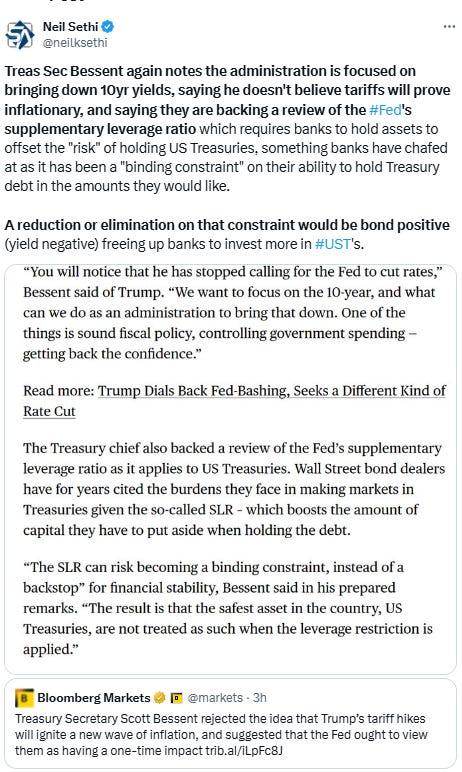

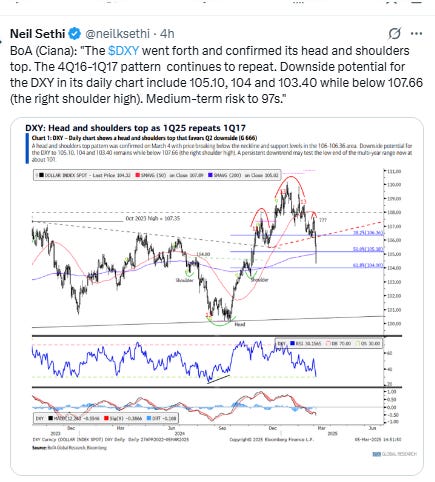

Dollar $DXY fell to the 104 support level noted yesterday after the largest 3-day drop since Nov ‘22. Daily MACD remains in “go short” positioning while the RSI is now into oversold territory on the daily RSI for the 1st time since Aug. As noted Wed, 104 has been a big level over the past year+.

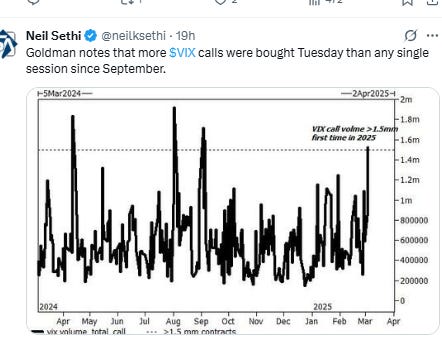

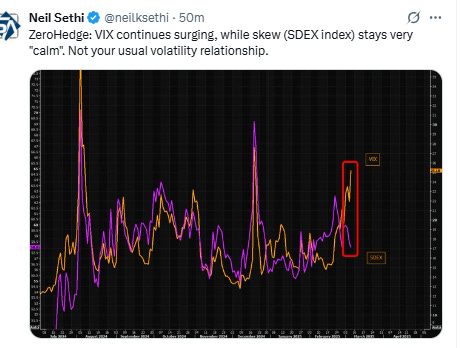

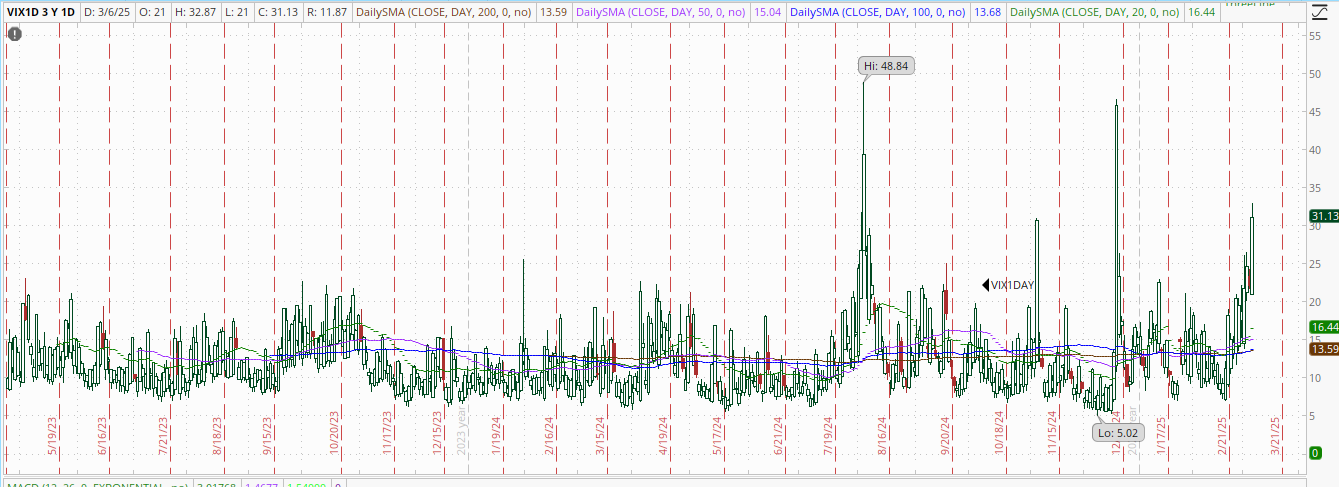

The VIX up to the highest close since the Dec FOMC at 24.9 consistent w/~1.56% daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also the highest close the Dec FOMC remaining well over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100))

1-Day $VIX jumped to 31.1, the highest close since the Dec FOMC and the 3rd highest close since inception (in Apr ‘21). It’s looking for a move of nearly 2%(!) Friday.

#WTI futures were little changed closing under $67 for consecutive days for the first time since Aug 2021, and even then it was brief, so not an area it wants to “hang out” in I don't think. Seems it really needs to continue to hold the 2024 low of $65.27. Working on an 8th consecutive weekly loss. Daily MACD remains in “go short” positioning, while the RSI the weakest since Sept.

Gold futures little changed but did hold again the 20-DMA despite the daily MACD remaining in “sell longs” positioning as noted Tuesday, and the RSI showing a clear negative divergence. That said, as I noted earlier this week, not sure I can stick with my target of $2800 much longer (but not giving up quite yet).

Copper (/HG) fell back but remained just off the highest close since May and above the new $4.70 support level. Daily RSI and MACD are also supportive although both have lower highs (negative divergence).

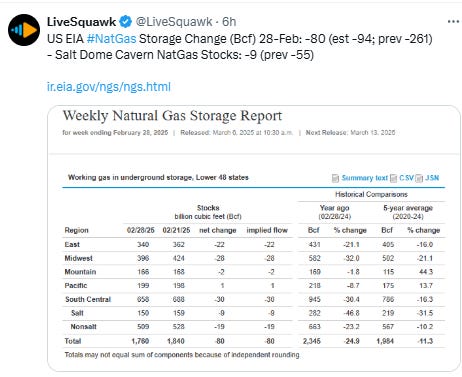

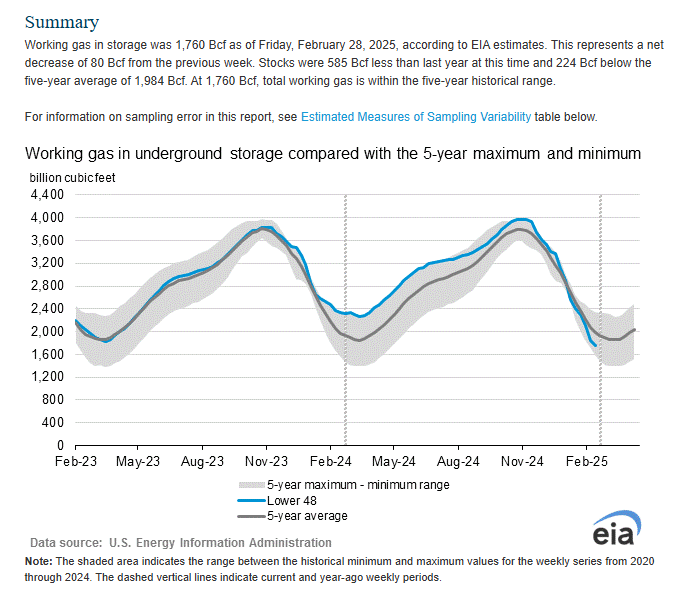

Nat gas futures (/NG) fell back from the 26-mth closing high hit Wednesday after a smaller than expected storage injection (-80Bcf vs -94Bcf exp’d). Still inventories are -224Bcf below the five-year average. Daily MACD remains in “go long” positioning while the RSI remains over 50 although both with lower highs (negative divergence).

Bitcoin futures edged lower as they appear to be having some trouble with a trendline running back to the start of the selloff in Jan. Relative strength remains just under 50 while the daily MACD remains in “go short” territory for now.

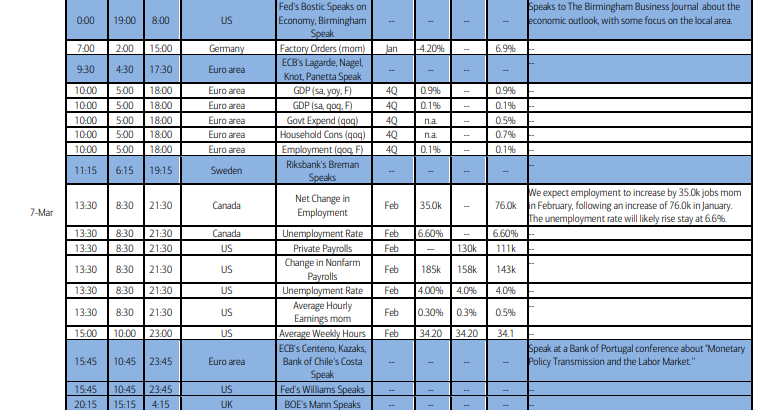

The Day Ahead

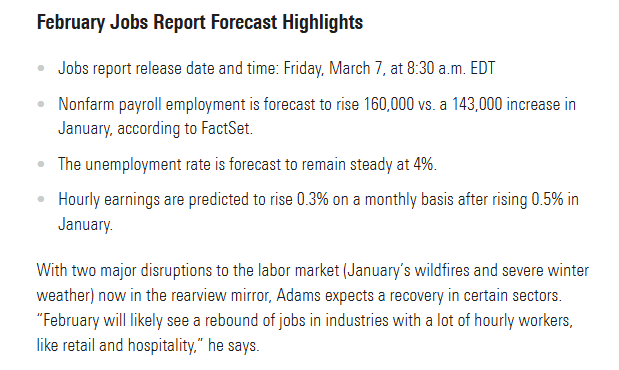

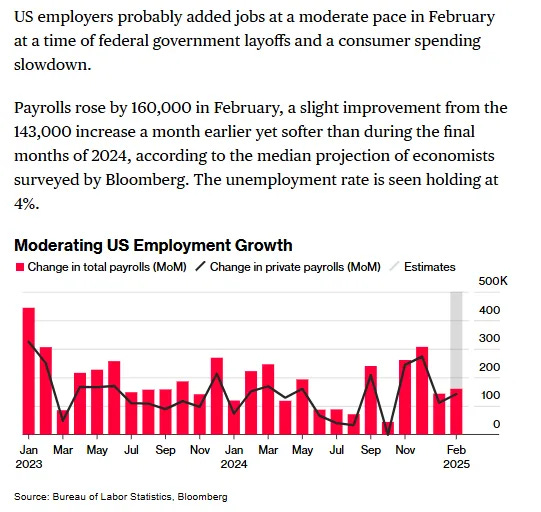

In US economic data Friday its Jobs Day with the Feb Nonfarm Payrolls report. It feels like it will take a super-strong report to break through the growth scare gloom, but could definitely happen. We’ll also be getting Jan consumer credit at 3pm ET (somebody needs to explain to me why this is always released so late in the day).

In Fed speakers it’s the last day before the start of the blackout period, and they’re taking advantage with Barkin and Bostic tonight followed by Bowman, Williams, and Kugler (twice!) tomorrow along with the other highlight of the day (along with NFP) in Jerome Powell speaking at The University of Chicago Booth School of Business 2025 U.S. Monetary Policy Forum (oddly in New York) at 12.30 ET. The topic is the economic outlook.

President Trump will also host a “crypto summit” Friday.

Earnings though will be light with no SPX components reporting Friday (see the full earnings calendar from Seeking Alpha).

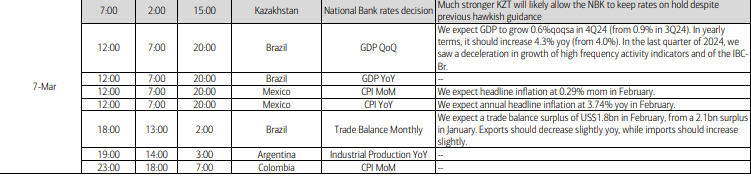

Ex-US we’ve got Canada Feb employment, EU 4Q GDP, confidence, and employment, and Germany Jan factory orders. In EM we’ll get Brazil GDP and Mexico CPI.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,