Markets Update - 3/7/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Want to take a moment to welcome the many new subscribers from

. As a warning this blog is not as polished as many (most?), as I do this alone in my free time, so apologize for errors (there are always some), but I welcome questions, comments, suggestions, so feel free to let me know. Be sure to check out the Week Ahead, which I will send out Sunday evening.Major US equity indices started the day modestly lower, giving up gains immediately after a mixed employment report which showed a solid (if slightly below expectations) headline payrolls number, but a soft household survey which saw the unemployment rate edge higher (more below), and despite a 10% gain in heavyweight Broadcom following its earnings. They tried to rally, and made it quickly into the green, but at 10am ET they hit a wall for no obvious reason (no news or important technical levels) and started heading lower. Things looked dicey until FOMC Chair Powell started speaking at an event in NY (12.30pm), and they immediately turned around and started a rally that carried through his appearance (more on his appearance in the FOMC section).

Equities were able to hold the gains and end the day in positive territory near the highs of the day, but up less than 1% which ended the 6-session steak of daily gains or losses of at least 1% for the SPX (the longest since Nov. 5, 2020). For the week, though, the indices ended broadly lower (3rd straight for the SPX, Nasdaq, and Russell 2000, all down at least -3%, the worst week for the SPX since Sept), although it could have been worse with SPX -4.7% at the lows today.

Treasury yields ended higher, with the 10yr yield seeing its first weekly rise since the Inauguration, as Fed rate cut bets were trimmed after Powell’s appearance. The dollar continued its decline for a 5th day (capping the worst week since Nov ‘22). Gold, copper, and bitcoin also fell back while nat gas and crude saw gains.

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +0.9%, Nasdaq Composite +0.7% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +3.1%, and the Russell 2000 (RUT) +0.4% (but -4% this week).

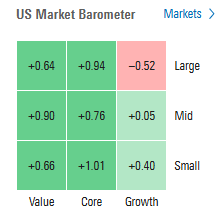

Morningstar style box saw broad gains outside of the larger growth stocks (despite the strong day from semiconductors).

Market commentary:

Powell's remarks "contain no big surprises but provide an anxious market with some reassurance on growth while conveying an underlying somewhat dovish tone on policy," said Krishna Guha, head of the global policy and central-bank strategy team at Evercore ISI, in a note.

“What I do know is that volatility seems like the only thing that is certain at the moment,” said Kenny Polcari at SlateStone Wealth. “Investors should make sure they understand that and are prepared for what that means. So, make sure you are well diversified for this ride.”

“The market does not like uncertainty,” said Glen Smith, chief investment officer at GDS Wealth Management. “While we expect the market to find its footing and recover from the tariff-driven selloff, investors should brace for continued choppiness until these uncertainties clear.”

Friday's jobs report doesn't do much for bond investors in terms of clarifying the likely path of interest rates from the Federal Reserve, said Bryce Doty, a senior portfolio manager at Sit Invest. "Essentially this report provides zero clarity for bond investors," Doty wrote in emailed comments. "You can argue the Fed will keep rates high or you could say this report means they may need to cut sooner than previously expected."

Friday's jobs report for February reflects an economy that remains healthy, "but fears of what could come next are likely to overshadow the positive news from today’s release," said Josh Jamner, senior investment analyst at ClearBridge Investments. While the data showed a decline of 10,000 in federal employment, a number of layoff announcements last month came after the survey period for the jobs report closed, said Jamner, whose New York-based firm manages $189.6 billion in assets. "Investors are likely to temper their reactions to this morning’s data due to the perception of it being `already stale' given the rapid policy shifts coming from DC."

Friday's nonfarm-payrolls report reveals the economy is slowing but not falling off a cliff, according to Charlie Ripley, senior investment strategist for Allianz Investment Management in Minneapolis. "Overall, this report is a sigh of relief for the Fed as they can continue to sit on the sidelines for the next couple meetings as they assess the potential inflation impacts resulting from U.S. tariff policy over the coming months," Ripley wrote in an email.

The U.S. labor market is continuing to cool and probably won't stop doing so without the Federal Reserve taking steps, according to Renaissance Macro Research. “I don't see an end unless the Fed takes steps to lift demand,” Neil Dutta, head of economic research at RenMac, said in a note Friday.

“We are not putting much stock in the jobs report at the moment,” said Byron Anderson at Laffer Tengler Investments. “Today’s data was mixed at best, but we still have no clarity on the economy moving forward. Markets, businesses, and consumers do not like uncertainty and that means increased volatility.”

The slightly weaker-than-expected February jobs report will likely ease the financial markets' "overly sour expectations" on the U.S. economy, but there’s still "no clear sign to take from this report, and the path ahead will be muddy," said Lara Castleton, U.S. head of portfolio construction and strategy at Janus Henderson. "This was a critical print after confidence on the economy has taken a turn and market participants were looking to either confirm or reverse that sentiment," Castleton said in emailed commentary on Friday. However, she said the job cuts from the Department of Government Efficiency, or DOGE, will not start to materialize until March’s print, and the impact of immigration will continue to be in focus. "Without much signal from the noise, investors should gain comfort from the idea that diversified portfolios seem to be working again," she said. "Healthcare, real estate and international stocks have come back to life while bonds have started to perform as a ballast once again."

“The week confirmed that tariffs remain a wildcard for market confidence,” said Mark Malek, investment chief at at Siebert Financial. “Traders are exhausted from the back-and-forth.”

“The stock market is moving in lockstep with tariff headlines, and that is likely to keep volatility very elevated for the foreseeable future, as the market does not like uncertainty,” said Glen Smith, investijg chief at GDS Wealth Management. “While we expect the market to find its footing and recover from the tariff-driven selloff, investors should brace for continued choppiness until these uncertainties clear.”

“Investors are going to effectively decide — not just next week — they will ask themselves this question on and on, with each new piece of data and news, ‘Is this over, in terms of negotiations and tariffs, and what have you, or are we just beginning?’” said Giuseppe Sette, co-founder of Reflexivity. “Because in the first case, you buy the dip. In the second case, it’s a bear market.”

In individual stock action, strength in the semiconductor space was also a big help to the broader equity market. Broadcom (AVGO 194.96, +15.51, +8.6%) fueled buying in the space after reporting strong results and guidance. The PHLX Semiconductor Index (SOX) logged a 3.2% gain.

Some tickers making moves at mid-day from CNBC.

In US economic data:

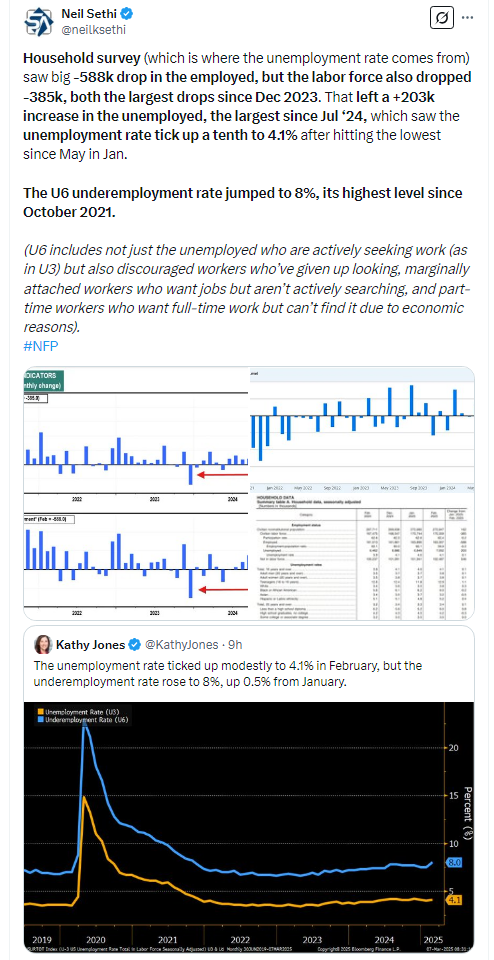

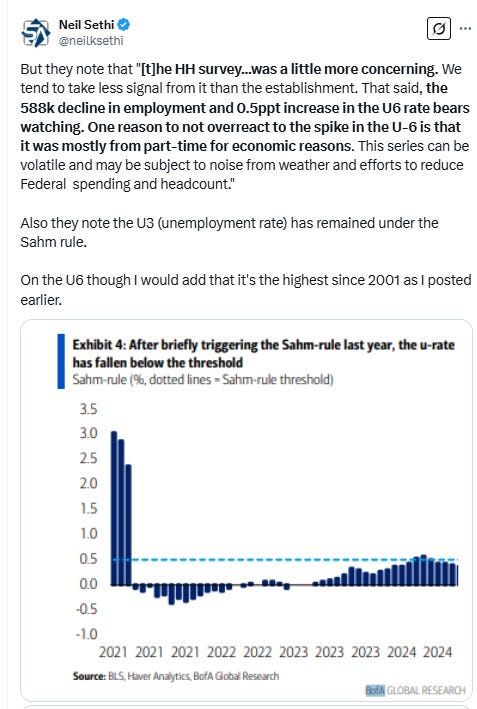

Feb NFP payrolls come in slightly above exp's at +151k vs 160k exp’d, but up from 125k in Jan (rev’d lower from 143k, seeing the 3-mth avg fall to 200k from 236k in Jan. The household survey (which is where the unemployment rate comes from) though saw a big -588k drop in the employed, and the labor force also fell -385k, both the largest declines since Dec 2023. That left a +203k increase in the unemployed, the largest since Jul ‘24, which saw the unemployment rate tick up a tenth to 4.1% after hitting the lowest since May in Jan. The U6 underemployment rate jumped to 8%, its highest level since October 2021.

After the largest jump on record in December (which was also revised higher to $40.8bn from +$37.1bn, but which followed the largest drop since Aug ‘23 in Nov), Jan consumer credit was higher than estimated, but less than half of Dec at +$18.1bn (I’ll have more on this Monday).

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX traded further below its 200-DMA Friday making it down to the lowest levels since October, but found support at 5666 which was an important level in 2024 representing the July peak, September breakout, and October low, so holding that level this time is important, particularly given there are clearly buyers there (who will become sellers on any significant breach).

As I said Wednesday, “when I said we would likely retest the 200-DMA again, I didn’t really mean the next day,” and as I said then Thursday “clearly now the first test is not ‘done’”. That remains the case, although as I also said we don’t always retest. The daily MACD remains firmly in “sell longs” positioning, and RSI just off the weakest since Aug. As I said Tuesday, “this would be a ‘natural’ place for a bottom,” but that certainly doesn’t mean it will be the bottom.

The Nasdaq Composite like the SPX fell to its October lows where it bounced. That weak uptrend line I mentioned earlier in the week didn’t hold as expected. Its daily MACD also remains firmly in “go short” positioning, and its RSI around the weakest since August but still has that small positive divergence.

RUT (Russell 2000) fell to the lowest since August before rebounding but unlike the SPX and Nasdaq there really isn’t any support level in this area. The August low is down around 2000. Its daily MACD remains firmly in “go short” positioning, and its RSI just off the weakest since Jan 2022 but like the Nasdaq has a small positive divergence (higher low).

Equity sector breadth according to CME Cash Indices saw a big improvement as you would expect with the up day in the equity markets with 8 of 11 sectors finishing higher (after just one Thursday (Energy, which was 2nd Friday)). Four were up at least +1.2% and none down by more than -0.6%. For the first time this week no particular sector style led or lagged with even dispersion.

SPX stock-by-stock flag from Finviz consistent with that with a lot of green but plenty of red mixed in. Some high profile weakness in WMT, COST & LLY all down over -3% despite the rally. Notable strength in semi’s and industrials ex-airlines.

Positive volume (percent of total volume that was in advancing stocks) improved as would be expected with the positive day in the indices to 66% on the NYSE, I guess a little better than +0.3% gain in the NYSE index, while the Nasdaq was 70%, also probably a little better than the +0.7% gain would indicate. We haven’t though seen a “great” number in a couple of weeks.

Positive issues (percent of stocks trading higher for the day) again much weaker as it’s mostly been during those couple of weeks at 55% on both (meaning the buying was concentrated in fewer names).

New highs-new lows (charts) improved on the NYSE to -34 after hitting -247 Tuesday (almost the worst since Oct ‘23) but the Nasdaq deteriorated to -164 from -141 so not good on that front although still up from -629 Tuesday (which was the least since 2022). With the 10-DMAs plummeting lower (less bullish) they both remain over them (for now).

#FOMC rate cut probabilities from CME’s #Fedwatch tool were back and forth today, first pricing in more cuts after the NFP report then pricing them back out and more after Powell (and other Fed speakers I’ll go through over the weekend) all emphasized a lot of uncertainty and a solid economy which mean “a cautious approach” and no “need to hurry”.

A cut by March 3% (meaning there won’t be one as we’re now in the blackout period no matter what CPI comes in at), one by May fell to 35% from 50% Thursday, and one by June to 81% (from 87% but still up from 33% the Wednesday of CPI). Chance of two 2025 cuts at 87% (vs 90 & 31%), three cuts at 60% (from 66%), but no cuts still at 2% (vs 29% on CPI Wed) with 71bps of cuts priced (-4bps from Thurs & but up from 28bps CPI Wed).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 70 “maybe actually going a little too far”). But as I said then “It’s a long time until December.”

10yr #UST yield continued its rebound from the 4.13% target hit Friday up +3bps to 4.32%, a 2-wk high. Still down -34bps since CPI day (Feb 12th). As I said Tues “the question now is whether that 4.13% level continues to hold. I think it might,” and the price action has been consistent with that.

The 2yr yield, more sensitive to Fed policy, moved along with rate cut bets again falling back to the joint lowest since Oct before rebounding to finish modestly higher +4bps to 4.0%, now -32bps below the Fed Funds midpoint so continues to price far fewer cuts than SOFR markets.

I had said when it was 35-45bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market has continued to move in that direction, now definitely closer to where I think fair value is although still only pricing a little more than 1 cut, so think there’s more to go. Ian Lygan of BMO sees it going to 3.5% by year’s end.

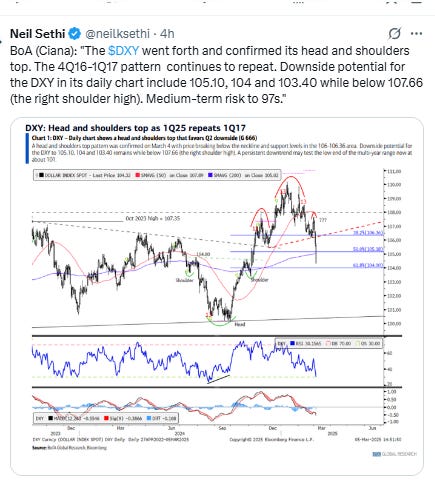

Dollar $DXY fell through the 104 support level Friday to the Election Day low where it was able to bounce. Still finished lower for a 5th session, the worst week since Nov ‘22. Daily MACD remains firmly in “go short” positioning while the RSI is now into oversold territory on the daily RSI for the 1st time since Aug. Seems this new support level really needs to hold, as not much under that until around 100.

The VIX fell back from the highest close since the Dec FOMC but remained elevated at 23.4 consistent w/~1.46% daily moves in the SPX over the next 30 days. It has a textbook uptrend in place.

The VVIX (VIX of the VIX) also fell back from the highest close the Dec FOMC but remains well over the 100 “stress level” identified by Nomura’s Charlie McElligott (consistent with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)) with an uptrend in place.

1-Day $VIX fell back from the highest close since the Dec FOMC (and the 3rd highest close since inception (in Apr ‘21)) but still elevated at 24.7. It’s looking for a move of 1.54% Monday.

#WTI futures broke their 5-session losing streak, but not their 8-wk one, finishing down for the week once again, although edging back above the $67 level that they closed under this week for consecutive days for the first time since Aug 2021. As I said Thursday “not an area it wants to ‘hang out’ in I don't think,” so hopefully it can move higher, although it was rejected at some light resistance Friday. But the key to me for now is holding the 2024 low of $65.27. Daily MACD remains in “go short” positioning, while the RSI is just off the weakest since Sept.

Gold futures little changed for a third day, but did finish higher for the week, the 11th in 12, despite the daily MACD remaining in “sell longs” positioning and the RSI showing a clear negative divergence, as noted Tuesday. As I mentioned Thursday, not giving up on my target of $2800 quite yet.

Copper (/HG) fell back to the top of the new $4.70 support level. Daily RSI and MACD are also supportive although both have lower highs (negative divergence).

Nat gas futures (/NG) ended higher, but below the highs of the week. Still the 4th weekly gain in 5, not far from the 26-mth closing high hit Wednesday. Daily MACD remains in “go long” positioning while the RSI remains over 50 although both with lower highs (negative divergence).

Bitcoin futures had a volatile session falling -7% after Pres Trump established a Bitcoin reserve last night but the “Crypto Czar” confirmed no government funds would be used to acquire more bitcoin. It recovered some but still finished the session -4% lower as it continues to stay under a trendline running back to the start of the selloff in Jan. Relative strength remains under 50 while the daily MACD remains in “go short” territory for now.

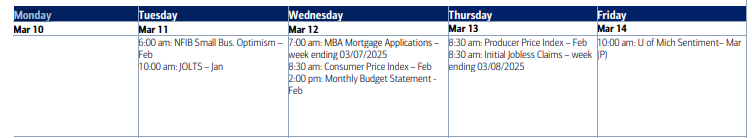

The Day Ahead

It was a busy week. Enjoy the weekend as next week we’ll have our hands full with tariffs, government shutdowns, and inflation reports.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,