Markets Update - 4/19/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

US equities fell again today capping the worst week for the SPX since March 2023 and bringing its drawdown to over -5% from the highs, initially rattled by Israel’s attack on Iran, but after bouncing the selling later in the day was likely due to systematic selling and traders wanting to take off risk in front of another weekend (and perhaps next week’s huge slate of earnings as well). The SPX and Nasdaq finished down for a 6th day, the longest streak since Oct ‘22, and for a 3rd week, the longest stretch since Sep ‘22. And for a 5th straight session large cap indices finished lower than where they started, with growth shares again leading the selling. In fact, outside of the growth sectors, equity performance was pretty good today. Yields fell but finished well off the lows as the risk premium evaporated after things settled down in the Mid-East, and crude and gold were little changed both also giving up early gains.

“There was a relief sigh” as investors realized Israel’s response was “muted” and designed to minimize escalation, said George Ball, chairman of Sanders Morris.

Still, “investors are very much on edge,” Ball said. “Investors are much more aware of geopolitical risks today in their decision-making than they have been for a long time.

“There are a number of cross-currents that the market is working to digest,” said Bill Northey, investment director at U.S. Bank Wealth Management. Inflation “has been a little bit more problematic than I believe the market expected, or even what the Federal Reserve expected.”

“Geopolitical and political uncertainty join inflation, rates, and the Fed in pressuring markets, driving a rapid and dramatic shift in the complexion of markets and the attitude of investors,” said Mark Hackett at Nationwide.

The Nasdaq Composite was -2.1% (and the top 100 Nasdaq stocks (NDX) -2.1%), the SOX semiconductor index -4.1%, the market-cap weighted S&P 500 -0.9%, while the equal weighted S&P 500 index (SPXEW) was +0.3%, and the Russell 2000 +0.2%.

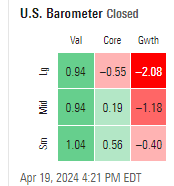

The Morningstar style box saw value leading for the fourth day in five.

Corporate news continued to be dominated by earnings reports, but a lot of the action was in other names. Shares of NVIDIA (NVDA 762.00, -84.71, -10 .0%) for example tumbled -10% on no news (its worst day since March 2020), bringing the stock below its 50-day moving average (841.99) although it is still up 53.9% since the start of the year. Similarly Super Micro (SMCI) fell -17%. Dow component American Express (AXP 231.04, +13.54, +6.2%) did see an earnings related gain as did fellow Dow component Procter & Gamble (PG 158.12, +0.85, +0.5%). Netflix (NFLX) though fell -7%.

Some other corporate news from BBG:

And here were some SPX stocks highlighted by CNBC at mid-day.

No major economic releases today.

See the Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX continued its downtrend started last week now down -5% from the highs, and falling through the key 5000 level now at its 100-DMA. Daily technicals remain the worst they’ve been since October.

The Nasdaq Composite similar. but through the 100-DMA. It does have some support at the 15000 round number level.

RUT I noted Monday had fallen through its “last line of defense to avoid what could be a much deeper correction,” but today at least it was able to bounce after probing new 3mth lows. Daily technicals very weak here as well.

SPX sector breadth continued to move more positive despite the declining index performance with 6 green sectors (up from 4 the last two days) although all three growth sectors were down more than -1% (and two down over -2%) compared with none yesterday. So today’s weakness was mostly a growth story.

Stock-by-stock SPX chart from Finviz. A lot of bifurcation.

Positive volume though another day of positive divergence with NYSE moving to 64% and Nasdaq to 52%, so again despite the indices in the red almost two-thirds of the volume on NYSE and over half on the Nasdaq was in advancing shares. Issues were similar at 66 and 50%. New highs-new lows were also improved at -26 and -173 the best since last Friday.

Yields as noted ended slightly lower but well off the lows of the day and not far from the highs of the year. The 10-yr note was down 3 basis points to 4.62%, still up 42 basis points since the start of the month, the 2-yr note was unchanged at 4.99%, up 37 basis points since the start of the month, and the 30-yr bond yield was down 3 basis points to 4.71% up 37 basis points since the start of the month.

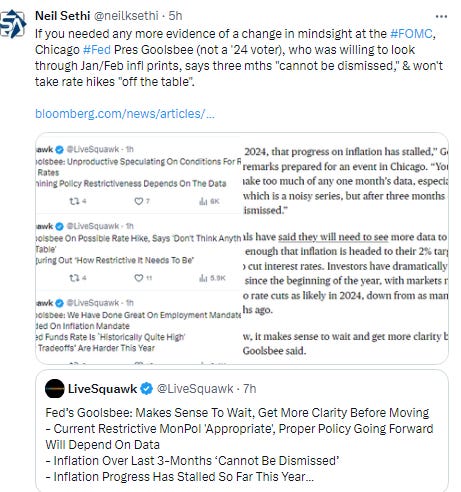

Fed rate cut expectations were not much changed although the small probability for hikes fell out of the CME Fedtool but expectations remained near the lowest since October. A cut by July is 43%, by Sept 67% and now just 39bps cuts for 2024.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

The dollar finished in the middle of this week’s range not far from the highs. Daily technicals remain supportive.

VIX made it over 20 today for the first time since October although ended back in the range of the week, still elevated compared to prior weeks though.

WTI spiked on the Israel attack but fell back after hitting the downtrend line of the past 2 weeks ending unchanged above its 50-DMA (purple line). Daily technicals remain negative though.

Gold also finished well off the highs but at the same time did manage to finally close over the $2400 level. Daily technicals starting to roll over again.

Copper continued its run to another 22mth high. Daily technicals remain supportive.

Nat gas also continued its bounce off the uptrend line from the Feb lows, up for a 3rd day, but remains stuck beneath its 20 and 50-DMAs. Daily technicals are neutral.

More on Sunday.

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,