Markets Update - 4/2/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

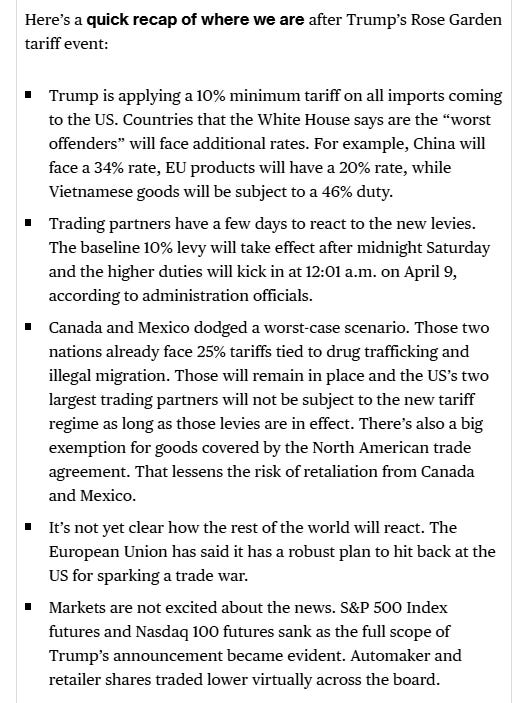

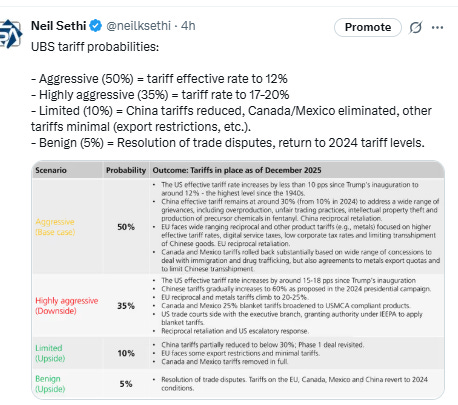

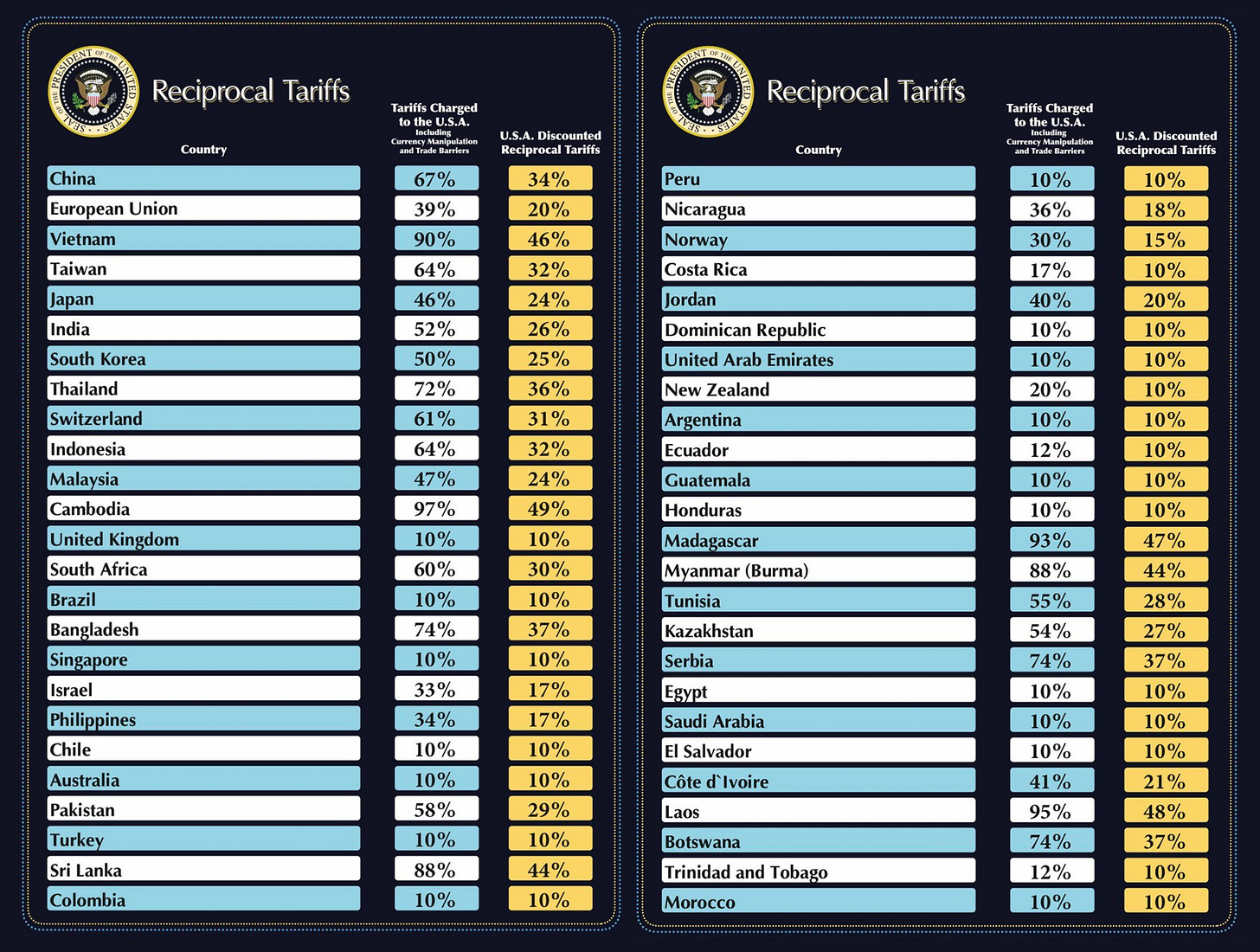

Going to do today a little different due to the fact that the “Liberation Day” announcement was a much more aggressive tariff regime than really anyone expected with reciprocal tariffs of at least 10% on all countries plus much higher tariffs on many major trading partners (more details below but they include China with a 34% rate (which is in in addition to the 20% existing rate (so a 54% rate on China)), the European Union with a 20% levy, and Japan a 24% tariff). Stocks are down sharply (over -3.5%), and just about every asset class is moving after-hours, so there’s no point in breaking down today’s charts and metrics beyond putting in the economic data we got and updating on posts about the various asset classes that continue to have relevance. Everything I didn’t update today I just left in italics.

Today the market-cap weighted S&P 500 (SPX) was +0.7%, the equal weighted S&P 500 index (SPXEW) +0.9%, Nasdaq Composite +0.9% (and the top 100 Nasdaq stocks (NDX) +0.8%), the SOX semiconductor index +0.9%, and the Russell 2000 (RUT) 1.7%.

Morningstar style box consistent with every styles higher with small caps leading.

Market commentary (this was all before the announcement (I compile during the day)):

“Liberation Day” will likely cut investor and even business uncertainty, but at what inflation cost, Sam Tombs, chief U.S. economist at Pantheon, pondered on Tuesday afternoon. He remains skeptical the tariff saga will be over "cleanly and quickly."

“We expect to learn a lot more today from the president, but we also think the market will continue to remain on edge until we know about retaliation and/or escalatory measures [or] rhetoric from the major trading counterparts,” said Jon Brager, portfolio manager at Palmer Square Capital Management.

“There isn’t anywhere to purely hide, because of the huge uncertainty that is in the market at the moment,” said Helen Jewell, chief investment officer of fundamental equities EMEA at BlackRock Inc. Jewell does not expect the confusion to dissipate after Trump’s announcement. “It is very much the opposite,” she said. “It just keeps that risk in the market and it kicks that risk can down the road.”

“Markets can deal with a lot of bad news - they sell off and then eventually find some silver lining and begin a recovery (or get the Fed to help along with easing),” said Jan Szilagyi, CEO and co-founder of Reflexivity. “However, in the current environment the complexity of possible scenarios would be tough to analyze even if you know definitively that one of them will happen - and we don’t. ”

“Perhaps the most important question is whether this announcement will tip the scales toward a global recession,” said Oliver Blackbourn, portfolio manager at Janus Henderson Investors.

To Dave Lutz at JonesTrading, a handful think the announcement will be a “buy the news” event as it removes a bit of uncertainty. Andrew Brenner at NatAlliance Securities is betting the “bark will be worse than the bite.”

To Matt Maley at Miller Tabak, even if the announcement gives stocks a near-term boost, the market will possibly have to see a move below the March lows to fully “price in” the fundamental backdrop this year.

“While today’s tariff revelations might offer investors some additional clarity from which to reassess the economic implications from Trump’s attempts to restructure the global trade landscape, the developments are unlikely to offer anything definitive,” said Vail Hartman and Ian Lyngen at BMO Capital Markets. “As a result, elevated uncertainty and volatility should emerge.”

“I think we’re overpriced to the downside here,” Jeff Kilburg, founder and CEO at KKM Financial, said on CNBC’s “Power Lunch” Tuesday. “I think the market has the ability to have a little bit of a 2% to 4% rally to really reprieve everyone’s anxiety.”

Christopher Harvey, head of equity strategy at Wells Fargo Securities, said he remains constructive on the long-term outlook for stocks, but warned investors not to underestimate the potential risks around the April 2nd tariff announcement. “We remain constructive on equities longer term given: (1) potential monetary stimulus (i.e., 75+ bps of 2025 Fed rate cuts) starting by mid-year; (2) anticipated tax bill movement (and possible enactment) this summer; and (3) several uber-caps already look oversold (TSLA, AVGO, NVDA),” Harvey wrote Tuesday. “However, the risks are not small and recession is possible. We are worried most about the potential unintended consequences of aggressive tariff moves,” Harvey said.

Uncertainty may keep having a “spook effect” on markets even after U.S. President Donald Trump’s highly anticipated tariff announcement on Wednesday, Zoe Gillespie, chartered wealth manager at RBC Brewin Dolphin, told CNBC’s “Squawk Box Europe” on Wednesday. “The danger is we don’t get much clarity for a long period of time ... that could delay any peak bottom signals,” she said. Gillespie said it was unlikely that full details on tariffs would be announced Wednesday, with other unknowns including whether trade partners such as the European Union would announce retaliatory tariffs, and the impact on inflation and interest rates. “It’s been really difficult because you’re trying to prepare for something you don’t really know the detail of... for sectors it’s whether there is a degree of supply chains globally, or whether at this stage you’re looking at more domestic-focused companies that are less reliant on that. The service sector is another unknown as well,” she said.

The Trump administration has guided that it will impose “maximum” reciprocal tariffs on trading partners on April 2, but the scale of the upside scenario is still to be gauged, Florian Ielpo, head of macro at Lombard Odier, told CNBC on Wednesday. Ielpo said that according to his calculations, markets were pricing an effective tariff rate of between 6% and 10%, accounting for elements like import levels and exemptions. “Markets are ready for that, they’ve been discounting the immediate effect of that — not the long-term, forward effect of that because it’s very difficult to know,” Ielpo said.

“The worst-case scenario is probably something in the region of 17%, which would be the largest increase in tariff duties we would have seen in 125 years of tariff data. For that, the Vix [Volatility Index] is clearly not high enough.”

“The key message for markets is rather than looking at sectors, [look at] the overall level of tariffs and the scale of magnitude with which they will be applied,” he added.

Rather than trying to read the tea leaves and adjust investments based off of what’s going on in Washington, David Bahnsen at The Bahnsen Group says he’s focused on investing in companies that have superior cash flow generation during all seasons — and not just seasons when we’re worried about tariffs.

“Companies that are committed to growing their dividend tend to do so for a very long time,” according to Bahnsen.

Commentary from after the tariff announcement:

“We expect to learn a lot more today from the president, but we also think the market will continue to remain on edge until we know about retaliation and/or escalatory measures [or] rhetoric from the major trading counterparts,” said Jon Brager, portfolio manager at Palmer Square Capital Management.

To Steve Chiavarone at Federated Hermes, if Wednesday’s announcement marks the most draconian levels of tariffs, and the news flow from here is about how countries are negotiating reductions to these rates, that could be good for markets. “This may create enough of a selloff over the next day or so that it creates a buying opportunity,” he said. “Worst case scenario today would’ve been a low rate with threats of escalation. I’d rather, at this point, have higher rates with the potential to deescalate.”

“That should slow trade and raise prices squeezing profit margins,” said Michael O’Rourke at JonesTrading Institutional Services. “This will further slow a decelerating economy as it it creates friction and distortion in global trade. I think we need to expect retaliation which will likely lead to further escalation.”

“US import tariffs threaten to intensify the economic slowing, as well as add to inflationary pressures,” said Todd Jablonski at Principal Asset Management. “However, the performance of the Magnificent Seven suggests markets may have already priced in these impacts. The Fed could act as a tailwind for markets if rate cuts are implemented in response to economic softness.”

To Chris Zaccarelli at Northlight Asset Management, markets are going to continue to struggle with the speed at which tariff details change as well as the ultimate result of the tariffs themselves. “The silver lining for investors could be that this is only a starting point for negotiations with other countries and ultimately tariff rates will come down across the board – but for now traders are shooting first and asking questions later,” he said.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action after the announcement, Nike shares fell 6.4% in extended trading at 5:06 p.m. New York time. Gap Inc., which buys about 27% of its goods from Vietnamese factories and 19% from Indonesia, slid 11%. Lululemon Athletica Inc., which makes 40% of its products in Vietnam and 17% in Cambodia, tumbled almost 9.6% in late trading. Abercrombie & Fitch Co., which gets 35% of its merchandise from Vietnam and 22% from Cambodia, fell 7.7%.

Some tickers making moves at mid-day from CNBC.

In US economic data:

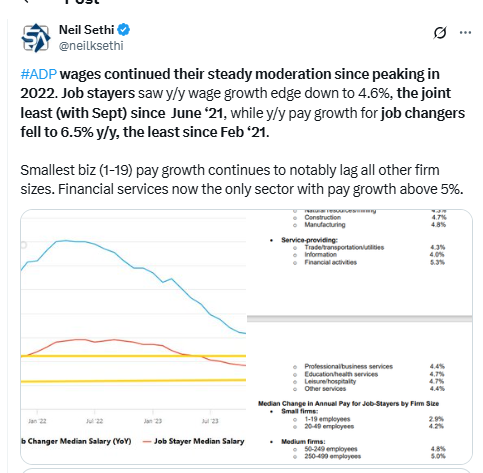

Mar ADP came in a little above exp’s (and the well below consensus 77k in Feb was revised +7k) at 155k vs 120k exp’d. “Despite policy uncertainty and downbeat consumers, the bottom line is this: The March topline number was a good one for the economy and employers of all sizes, if not necessarily all sectors,” said Nela Richardson, chief economist, ADP.

Feb factory orders (new orders for manufactured goods) came in a tenth better than exp’d at +0.6%, slowing from Jan’s +1.8% (which was rev’d up a tenth and boosted by nondefense aircraft (+93%, almost entirely Boeing orders, which fell off (-5.0%) in Feb while autos (which are the largest component of transportation orders) improved to +1.9% in Feb, revised down though from the preliminary print of +4.0%). Ex-transportation orders were solid accelerating to +0.4%, the best since April ‘24.

Core capital goods shipments (ex-aircraft & defense) which feed into GDP (and are a proxy for biz capital spending) which we got the preliminary read on last week were revised a tenth lower to a still solid +0.8%, the most since Jan '24, but the revision will be a drag to 1Q GDP estimates that took into account the preliminary read. These are just off all-time highs, but like overall factory orders have been around the same level for two years, actually -2.0% y/y.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

The SPX continued its rebound from the lowest since Sept, remaining though below a number of key resistance levels.

The daily MACD as noted Friday remains in a bullish ‘cover shorts’ positioning for now, but the RSI has fallen under 50. We also remain under the 5670 level which I called “important support/resistance” previously.

Here’s what the futures chart looks like for SPX:

The Nasdaq Composite saw similar action and is in a similar positioning. Its daily MACD though as noted Friday has lost its positive bias, and its RSI is further below the 50 level.

As noted Friday, “no really great place to bounce. The 61.8% retracement level of the move from the Oct ‘22 lows is way down at 16,385.” As I said Monday, “Maybe what we got today will serve as a low.”

NDX futures

RUT (Russell 2000) wasn’t able to make any progress but at least put in a higher low. Like the SPX its daily MACD is still in “cover shorts” positioning, but its RSI has also softened notably. As I said Friday, the “2000 level remains important support,” which it fell under again but recovered today.

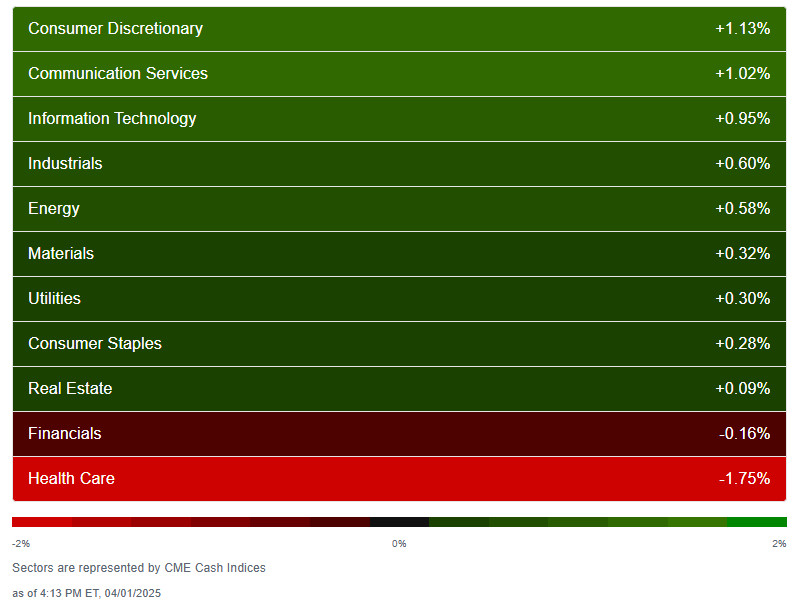

Equity sector breadth Wed according to CME Cash Indices another solid day with again 9 of 11 sectors up (after 10 of 11 were up Monday) and today no sector more than -0.2% lower. Again three sectors up around +0.9% or more, down from seven Monday, but in a change, megacap growth wasn’t “all or nothing” today (it took the top three spots Tuesday after taking the bottom three spots 3 of the previous 4 sessions) with the .

SPX stock-by-stock flag from Finviz consistent showing the strength today outside of health care.

Positive volume (percent of total volume that was in advancing stocks) was mixed with NYSE falling back to 58% but that was with a flat day for the NYSE index, so a relatively good reading. The Nasdaq did improve to 60% but that I think underperformed the +0.8% gain in the index (but still not terrible). Positive issues (percent of stocks trading higher for the day) were 61 & 52% respectively.

New highs-new lows (charts) saw notable improvement to -110 & -398 from -225 & -639 on the NYSE & Nasdaq respectively. Both though still below their 10-DMAs which are rolling over.

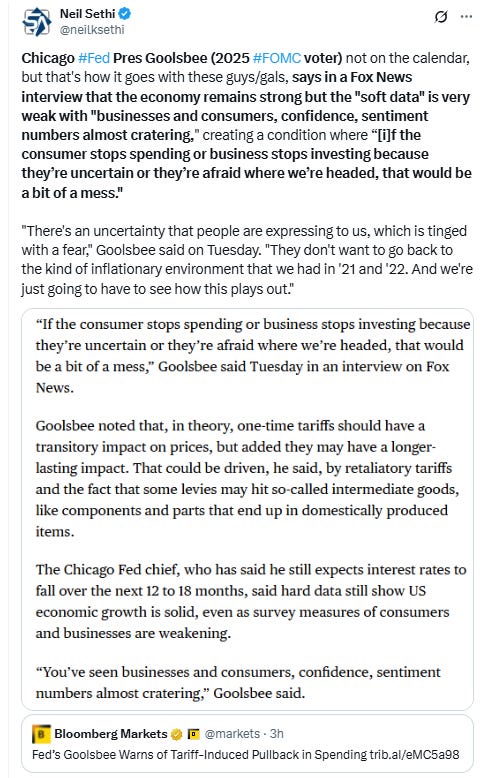

#FOMC rate cut probabilities from CME’s #Fedwatch tool edged back from the most cuts this year following the better than expected economic data. A cut by May fell back to 12% priced, one by June 61%, and the probability of two 2025 cuts to 89% (2nd cut in July though fell to 38% from 53%) (Sept now the 2nd cut), and three cuts is 63% from 71% (with the chance of four cuts now 29%). No cuts remains low at 1% with 72bps of 2025 cuts priced (-6bps from Mon and the highs of the year). Will be interesting to see how the relatively aggressive tariffs being announced now impact that.

2026 cuts -3bps to 40bps (still over 1.5 cuts).

I said after the big repricing in December (and again earlier this month) that the market seemed too aggressively priced to me, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 70 “maybe actually going a little too far” which is back to where we are). But as I said then “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two or three cuts much of it is bets on a lot of cuts (5+) or just one or none (per Charlie McElligott’s post).

10yr #UST yields fell for a 3rd day breaking under that trendline running back to the Sept lows ending -9bps at 4.26%, the lowest close since Dec 6th. As I’ve said the past month “I still think it’s going to take a deeper equity selloff or some more worrisome economic signals before it breaks the 4.13% level, but I also think it might struggle to clear that downtrend line which comes in currently at around 4.5% [now closer to 4.4%].” So far that’s been the case, but now we’re testing the downside.

The 2yr yield, more sensitive to Fed policy, moved along with 2025 rate cut bets falling -1bps to 3.88%, the lowest close since October, -45bps below the Fed Funds midpoint, so continues to price around one cut fewer than SOFR markets (which say it should be 3.62% today).

I had said when it was 55-60bps higher (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), and the market is now back closer to where I think fair value is, but there could be more to go. Ian Lygan of BMO sees it going to 3.5% by year’s end.

Dollar $DXY was little changed again holding the 104 level. I said Friday it’s “looking like it’s setting up to push higher,” and that remains the case for now, but as I said last week “a drop back under 104 makes that more questionable.” It also seems like it might be developing into a bear flag (which would be bearish). Daily MACD is in “cover shorts” positioning but the RSI below 50.

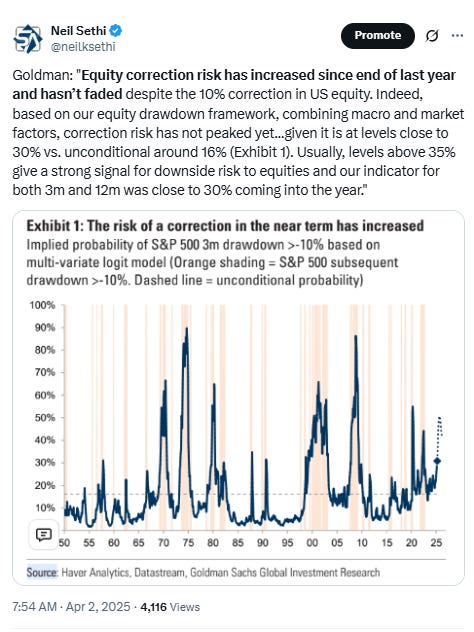

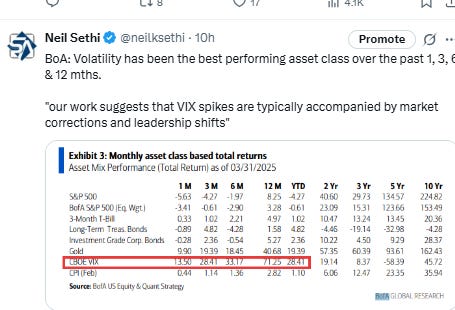

The VIX edged lower but remained elevated at 21.8, consistent w/~1.36% daily moves in the SPX over the next 30 days.

The $VVIX (VIX of the VIX) also fell back, in its case further below the 100 “stress level” of Nomura’s Charlie McElligott at 97.6 (consistent with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

With the tariff announcement moving to after-hours, the 1-Day VIX dropped back to 20.1, still though looking for ~1.26% move tomorrow.

#WTI futures not able to make further progress after pushing through the $70 level Monday on the back of Pres Trump talking up potential Russia sanctions and catching what was a likely short covering rally working on a 4th week of gains (I forgot to include my post from the weekend on the short CTA position in oil).

As I mentioned two weeks ago when I asked “things perhaps turning more positive for crude?” daily MACD has crossed to “cover shorts” positioning, and now the RSI has pushed over 50. But as I also noted “beyond $70.50 lies the 200-DMA and MOT (Mother of Trendlines which runs back to Sep ‘23 and so far has been undefeated beyond one week in January) just above that.”

As I said Monday,”I thought we might get there, but not super confident we’ll get through (or stay through if we do).”

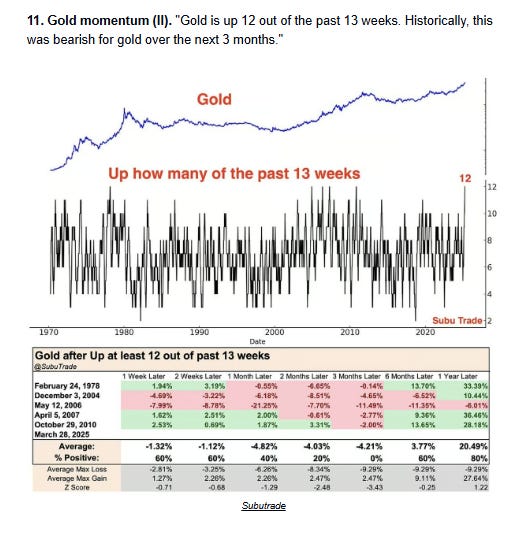

Gold futures pushed to new highs before edging back, still working on a 15th positive week in 16. The daily MACD remains in “go long” positioning, and the RSI just off the most overbought since last April.

Copper (/HG) continues the “shooting star” technical reversal pattern I noted Wed. As I noted then “if the pattern continues, I’d expect it to fall to the 20-DMA around $4.90. Next support is the $4.80 breakout area.” As noted Monday it fell to just above the 20-DMA before getting a little boost and did so again today (seeming to test the $5 level). As I said Monday, '“we’ll see if that can hold, I have my doubts.” A tariff announcement on copper tomorrow though would be a different story.

In that regard, the daily MACD has now crossed over to “sell longs”, and while the RSI remains supportive, it has fallen from over to under 70 (another reversal sign) and is at a 3-wk low, although as we just saw with gold sometimes that doesn't much matter.

Nat gas futures (/NG) fell back as they continue to trade overall in the same range since mid-Feb. That they’re remaining around the $4 level despite the end of winter is impressive. This time last year it was trading at $1.70.

Daily MACD remains in “sell longs” positioning for now while the RSI is around 50. I had thought a test of the 100-DMA around $3.55 was the most likely scenario, but as I said Thursday “nat gas is notoriously fickle.”

Bitcoin futures continued to trade with tech stocks, jumping +3.6% and pushing just over the 20-DMA. Overall, though, just trading in the middle of its range over the past month or so.

The daily MACD remains in “cover shorts” positioning but the RSI is under 50.

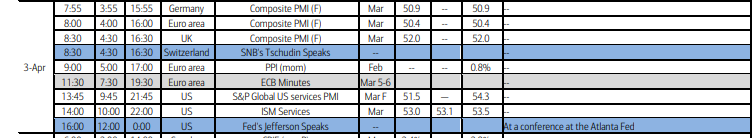

The Day Ahead

US economic data heavier Thursday ahead of NFP on Friday headlined by the Mar services PMI’s, but we’ll also get final Feb trade data, and weekly jobless claims.

In Fed speakers, we’ll get Fed Vice-Chair Jefferson along with Gov Lisa Cook, both permanent voters on the FOMC.

Earnings are a bit heavier with our two SPX components of the week in Conagra Brands (CAG) and Lamb Weston (LW) (see the full earnings calendar from Seeking Alpha)

Ex-US the highlight is final March services PMIs, EU Feb PPI, and the ECB minutes from the March meeting.

In EM, we’ll get some data from Mexico and Turkey CPI.

Also, OPEC will start their normally 2-day meeting, but there have been reports that they might cut it short and do everything Thursday which is expected to include the second tranche of their lifting of the voluntary output reductions by 135k/b/d (the first started Tuesday but has been buffered by compensation cuts from overproducing countries).

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,