Markets Update - 5/29/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

US equity indices started the session solidly higher, but off the overnight session highs, as investors digested the court ruling temporarily pausing most of the Trump tariffs (which itself was paused around 3.30pm ET) and the results from Nvidia which were being taken in a positive light as they showed little slowdown in the robust growth of AI investment. But the softening from the overnight session continued into the cash session. Equities were able to find a bottom (after a quick dip) at noon and move back into positive territory.

Elsewhere, Treasury yields fell back, while Fed rate cut expectations firmed. The dollar finished lower after a large reversal. Also lower were crude, copper, bitcoin, and nat gas, while gold was up.

The market-cap weighted S&P 500 (SPX) was +0.4%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite +0.4% (and the top 100 Nasdaq stocks (NDX) +0.2%), the SOX semiconductor index +0.5%, and the Russell 2000 (RUT) +0.3%.

Morningstar style box showed the modest gains outside of the larger growth shares.

Market commentary:

“The tariff drama isn’t over,” wrote Vital Knowledge’s Adam Crisafulli in a morning note. “Trump has other legal avenues to pursue an aggressive tariff agenda, and investors expect he will utilize them.”

“Wednesday’s Nvidia earnings report is pivotal not just for Nvidia but for the entire stock market,” said James Demmert, chief investment officer of Main Street Research. “It can rejuvenate investor optimism across the board and help investors to focus on the power of AI and less on headlines out of Washington on tariffs and taxes.”

The move Wednesday night “was the market exhaling after weeks of white-knuckle volatility sparked by trade war brinkmanship,” said Stephen Innes, managing partner at SPI Asset Management in a note. “This ruling is more than just a legal footnote. It’s a structural pivot in the narrative: from strongman tariffs to institutional guardrails,” Innes wrote. “And traders, ever the momentum-chasing species, are already front-running the unwind.” That said, the ruling isn’t the last word, Innes and others noted.

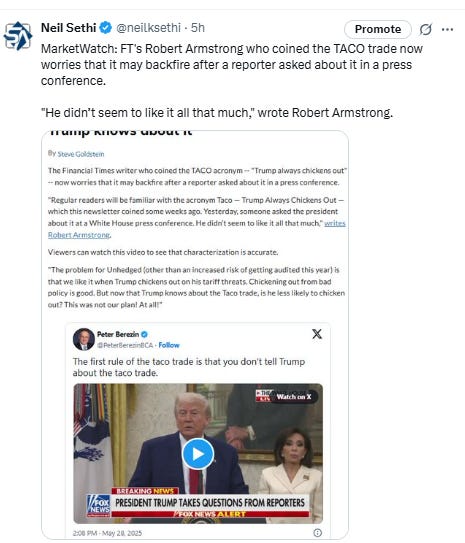

“As this ruling gets appealed, it will prolong the uncertainty that’s presently weighing on business investment,” said analysts at Renaissance Macro Research, in a post on X. For all the talk about TACO — a popular Wall Street acronym that champions buying tariff-induced dips because “Trump always chickens out — it’s worth remembering that Trump “usually follows through on at least some of his tariff threats,” they wrote. “If Trump wins on appeal, tariffs likely return.”

“The tariff levels that we had yesterday are probably going to be the tariff levels that we have tomorrow, because there are so many different authorities the administration can reach into to put it back together,” Michael Zezas, Morgan Stanley’s global head of fixed income and thematic research, said on Bloomberg TV Thursday.

"For the moment, it is anyone's guess as to whether these very unpopular tariffs will be reinstated on appeal or by the Supreme Court. So, uncertainty is now poised to escalate," Carl B. Weinberg, chief economist at High Frequency Economics, said in a note. "Our theory is that extreme uncertainty is corrosive to business activity and finance. This is extreme uncertainty," he wrote. "Even though the news is what the business community wants to hear, companies surely will postpone investment until the tax and tariff environment is very clear."

“We expect further market volatility ahead as headlines on both trade and fiscal policy emerge,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “We still expect US equities to rise over the next 12 months, but near-term gains this year are likely to be more limited.”

The court decision to block much of President Donald Trump’s tariff plans may not have had much of an impact on the market’s expectations, according to WisdomTree senior economist and Wharton professor emeritus Jeremy Siegel. “I think the market had already anticipated that we’re not going to get back to those reciprocal tariffs of April 2. We’re not going to get back at all to those 100%-plus tariffs on China,” Siegel said on “Squawk on the Street.”

The market “could live with” 10% base tariffs on most countries and a 30% on tariff on China if that is where things settle out, he added.

A report by Barclays managing director of global FICC research, Ajay Rajadhyaksha, argues it’s not clear that [the court ruling] is a catalyst for a sustained, new risk-on, given the complications it could pose for tariff revenues, the tax bill and bond markets. First, any appeal and subsequent hearings in other courts could take four to eight weeks to resolve leaving markets in limbo while this is played out. Front-loading by importers to get around the tariffs could see the U.S. trade deficit in the first half of 2025 balloon. Moreover, the ruling incentivizes U.S. trading partners to slow down tariff negotiations and it may delay Trump’s planned tax cuts and deregulation policies as the White House’s administrative bandwidth is occupied with legal procedure. Also there could be implications for the tax bill working its way through Congress. "This ruling arguably weakens the political argument for a new, fiscally expansive tax bill, especially given the Congressional timetable. The Senate will want to pass their version of the tax bill by end June. But now, it becomes harder to placate fiscal hawks (like Senators Paul and Johnson), when the argument for large tax revenues is now shaky," he said.

U.S. GDP may receive a minor fillip from the big rush to import without tariffs in the interim but this probably won’t translate into a positive for risk assets, he added.

"As we get into June, we should begin to get a clearer picture of how tariffs are impacting the economy, which could determine whether the market can make a run at new highs in the near future," said Daniel Skelly, head of Morgan Stanley's wealth management market research and strategy team.

"But a longer-term extension of the rally may still depend on second-half policy initiatives, including deregulation and a pro-growth tax bill that doesn’t raise concerns about runaway deficits," Skelly said in an email.

After the U.S. Court of International Trade shot down President Donald Trump’s tariffs on Wednesday night, the market now has even more uncertainty to contend with, according to Harris Financial Group managing partner Jamie Cox. “The only thing this court ruling did was extend the uncertainty of how this ends. All of the [yet]-to-be announced trade deals likely are now on ice and, if Trump wins on appeal, he’ll hit harder and faster in round two,” Cox told CNBC. “Given how far along things were and seemingly causing less heartburn than feared, this ruling may be effective in restraining the executive, but not accomplish much otherwise,” he added.

"We still expect U.S. equities to rise over the next 12 months, but near-term gains this year are likely to be more limited," Ulrike Hoffmann-Burchardi, chief investment officer of global equities at UBS Global Wealth Management, said in a Thursday client note. UBS has a S&P 500 target of 6,000 by year-end and of 6,400 by June 2026.

HSBC increased its view of U.S. equities to neutral from underweight. Max Kettner, the firm’s chief multi-asset strategist, said in a note to clients that political risks have declined for the U.S. markets. “Various tariff pauses should provide a window of relief – use further dips to scale up exposure to risk assets,” the note said. Stocks have already bounced back from their tariff lows, but positioning in stocks is still relatively light, Kettner said. “Despite the rebound to pre-Liberation Day levels in US equities, our sentiment and positioning indicators are still flashing a buy signal,” the note said.

Bill Adams, chief economist at Comerica Bank, views the "surprise court decision" that invalidated many of President Donald Trump's new tariffs as reinforcing "the depth of uncertainty overhanging the economy in 2025."

"Tariff uncertainty causing many businesses to slow-roll investment and hiring decisions while they wait for clarity," Adams said in emailed comments Thursday. As for the Fed, Comerica expects it to hold interest rates unchanged through the end of 2025.

Goldman Sachs President John Waldron said Thursday the court ruling striking down President Donald Trump's tariffs will create more volatility in financial markets and the legal dispute over the import levies may reach the U.S. Supreme Court on appeal. But on the bright side, the tariff situation appears to be wreaking less havoc for companies, he said. "We're now shifting to a framework that appears more manageable for global economies to adapt and adjust to still higher tariff levels, but more manageable,," Waldron said, according to a transcript of his remarks at the Bernstein Strategic Decisions Conference. Dealmakers must be prepared to "live with...volatility for some time," Waldron said. The current legal wrangling over tariffs, "will ultimately get to the Supreme Court," he said.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Nvidia shares provided upward market momentum with a jump of more than 3%. The chipmaker exceeded expectations on the top and bottom lines in the first quarter, as its data center business recorded year-over-year growth of 73%.

Salesforce Inc. reported signs of traction in its new AI products, but that wasn’t enough to ease investor anxieties over a long trend of slowing revenue growth. United Airlines Holdings Inc. said Newark disruptions will cut into profits.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

Best Buy Co. reduced its sales and profit outlook as the electronics retailer grapples with tariffs on imports from China, its top source of goods.

Wells Fargo & Co. resolved another regulatory punishment, the seventh this year, as the Office of the Comptroller of the Currency terminated its 2015 agreements relating to the company’s previously held financial subsidiaries.

Meta Platforms Inc. is partnering with defense contractor Anduril Industries Inc. to develop new products for the US military, including an artificial intelligence-powered helmet with virtual and augmented reality features.

Synopsys Inc., a top maker of chip-design software, suspended its financial guidance for the current quarter and fiscal year after receiving word from the US government about new restrictions on exports to China.

HP Inc.’s profit outlook fell short of estimates and it cut the annual earnings forecast, pointing toward a weaker economy and continuing costs from US tariffs on goods from China.

Walt Disney Co. is expanding a program of perks for subscribers to its flagship Disney+ streaming service and adding one for Hulu customers.

Kohl’s Corp. reported better-than-expected comparable sales, a positive sign amid a tumultuous run of events for the retailer.

Foot Locker Inc.’s sales slump persisted in the latest quarter, a potential headache for Dick’s Sporting Goods Inc. as it prepares to acquire the struggling sneaker chain.

Some tickers making moves at mid-day from CNBC:

In US economic data:

Initial jobless claims (SA) in wk through May 24th continue to remain subdued although move back to around the highs of the year +11k to 240k still in the middle of the range over the past yr, +53k above the 50-yr lows in Oct '23 (187k). Four-wk moving avg unchanged at 231k (+9k y/y). Continuing claims (SA) in wk through May 17th (1-wk lagged) though +26k to 1.919mn (after -10k revision to prior week), the highest since Nov ‘21 as it back to pushes out of the top of the 1.8-1.9mn range since June.

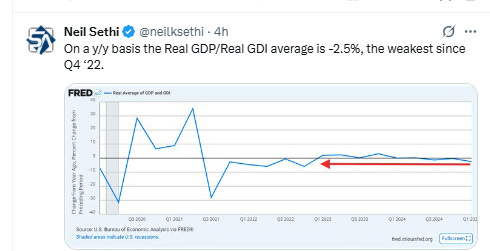

1Q #GDP revised higher as I expected but not yet to positive territory up just a tenth to -0.2% Q/Q SAAR as upgrades to inventories, biz spending, net trade, and gov’t spending were mostly offset by downgrades to consumption and property investment. The inflation metrics were little changed (GDP prices left at 3.7%), although core was marked down a tenth to 3.4%.

Apr pending home sales (contract signings so more forward looking) unlike new home sales fell sharply -6.3%, the most since Sept ‘22 and giving back all of March’s +5.5% gain (revised from +6.1% which was the most since Dec ‘23), well under the -1.0% expected (actually under every BBG estimate), in line though with the increase in mortgage rates (see attached post). Y/Y pending home sales are -2.5%.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX continued its now sideways action over the past couple of weeks (although in the overnight session it hit the highest since Feb) above the confluence of support in its 200, 100, and 20-DMA’s. Its daily MACD remains in danger of flipping out of “go long” positioning, but the RSI remains around 60.

The Nasdaq Composite opened at the highest since Feb before edging back giving it a little different look than the SPX, closer to breaking above last week’s highs.

RUT (Russell 2000) continues to struggle with the downtrend line from the December highs and its 100-DMA. Daily MACD is neutral, while the RSI does remain above 50.

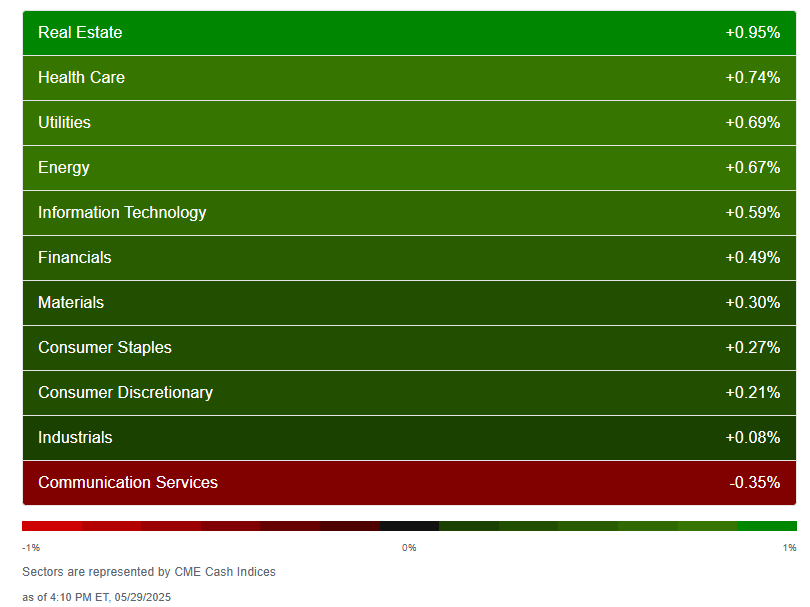

While the index gains were modest, the action under the hood was more positive, as the “all or nothing” sector breadth from CME Cash Indices remained with 10 of 11 sectors higher (after all 11 were down Wed but all up Tues), although none were up >1%.

The megacap growth sectors who took the top three spots Tuesday and 2 of the top 3 Wed took 2 of the bottom 3 today despite the strong NVDA earnings. Defensives ex-Staples outperformed.

SPX stock-by-stock flag from Finviz a similar story with a lot more red in growth shares than I would have expected.

NYSE positive volume (percent of total volume that was in advancing stocks) also was a little better than I would have expected given the index gains at 61%, pretty good for the +0.3% gain in the NYSE Composite index.

Nasdaq positive volume even better at 67%, very good for the +0.4% day in the index.

Positive issues (percent of stocks trading higher for the day) though remained weaker on the Nasdaq for a ninth session at 66 and 58% respectively meaning the buying has been concentrated in fewer names.

New highs-new lows (red-black dotted line) though were the fly in the ointment falling back to 38 & -2 back into the sideways chop over the past month.

2025 #FOMC rate cut pricing firmed a bit after easing Wednesday to the weakest since Feb (and the July contract to the weakest yet) +6bps to 51bps of cuts in 2025, still down -47bps from the start of the month according to CME’s #Fedwatch tool (they peaked this year at 103bps on Apr 8th, and the low was 36bps Feb 11th).

The probability of a cut at the June meeting remains a distant possibility at 2% (it was well over 50% at the start of the month) and July is just 24% (down from 78% at the start of the month) while a cut by the next meeting (Sept) remains over twice July at 67% (up from 59% Wed, I guess on the idea that the Fed will feel that they don’t have enough data to cut before that point, but will want to cut by then, although that is still down from 95% at the start of the month).

Chances of 2 cuts this year is 70% (it was 99% at the start of the month), three is 30% (down from 92%), four is 5% (from 76%), and five is 0.1% (from 27%). The chance of no cuts remains low but has risen from under 1% to 5% (the highest since Feb).

2026 cuts through the Oct ‘26 meeting (the Dec contract has proven to be unreliable) added +1bps to 58bps, seeing total cuts through Oct '26 +6bps at 108bps, -39bps from the start of the month (overall in line with my thinking that we would start to see cuts shifting into 2026 given Powell’s tenure ends that May).

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields continued their back and forth action -6bps to 4.42% the lowest close since from the lowest close since May 9th, but still up +25bps this month.

The 2yr yield, more sensitive to #FOMC policy, also fell to the least since May 9th at 3.94% (still up +35bps this month), remaining -46bps below the Fed Funds midpoint, so continuing to call for rate cuts. It also continues to price around one cut fewer than CME’s Fedwatch tool (which says it should be around 3.67% today).

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) saw a big reversal today, at one point up over 1% but ending the day down -0.4% under the 100 level. The daily MACD and RSI are tilted negative.

VIX little changed at 19.2, remaining around its uptrend line from December after rising last week for the first week in 7. That level is consistent w/~1.20% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also little changed at 95, just below Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “moderately elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

The 1-Day VIX fell back to 17.4, but remained above the lows from earlier in the week. That’s consistent with traders looking to hedge a ~1.09% move Thursday.

#WTI futures continued the sideways chop from last week just above the 60 level, continuing to be capped by the 50-DMA and $65 area that also capped the April rally. In that regard, they tested the 50-DMA today before falling back. The next support is in the high 50’s. Daily MACD remains in “cover shorts” positioning, while the daily RSI continues to fluctuate around 50.

Gold futures (/GC) continued their sideways action in the middle of the uptrend channel from January, after hitting the highest weekly close ever last week.

The daily MACD remains in “sell longs” positioning, but is turning and the RSI is back over 50. As noted two weeks ago, when we've gotten a MACD crossover the past year, we generally get some localized weakness (which we had), but nothing sustained (which is consistent with what we’re seeing).

Copper (/HG) futures continued to fall back disappointingly after seeming to break out of their sideways chop of the past several weeks on Friday, now back under $4.80 resistance and back into the range they were in for most of May. The daily MACD and RSI are mixed

Nat gas futures (/NG) continued to fall back filling the gap from the contract roll. Still they are above the downtrend line from the March highs, so maybe they can use that as support. Daily MACD and RSI now tilt more positive as they don’t account for the fact it was a contract roll.

Bitcoin futures were down for a second session Thurs and have slipped out of the channel from the April lows. They also are taking on a different form than we’ve seen in the prior bull flags since then. The daily MACD has also crossed to “sell longs” positioning, while the RSI is now further under the 70 mark from well above last week which as noted then resulted in a long period of sideways consolidation when it happened back in November.

The Day Ahead

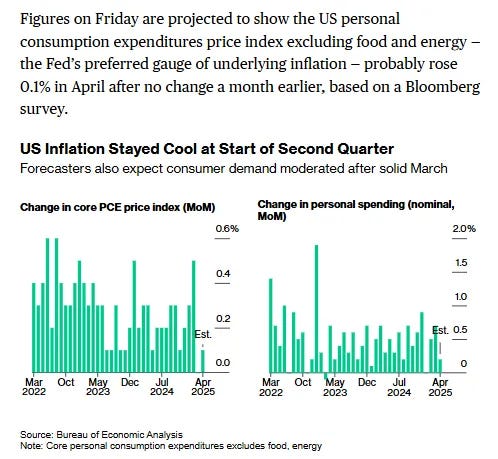

US economic data remains heavy on Friday with the April personal income and spending report our most wholistic look at incomes and spending (and which comes with core PCE prices, the Fed’s favorite inflation metric which is expected to remain subdued). We’ll also get the final UMich consumer sentiment index (do we see a jump as we did with the Conference Board and perhaps some softening in inflation expectations?), and the Apr goods trade balance and inventories.

Fed speakers will continue with Logan (tonight), Bostic, Daly, and Goolsbee on the calendar. We’ve heard from all within the last week. Goolsbee is a voter this year, Logan in 2026, Daly and Bostic not until 2027.

Earnings are light with no SPX reporters.

Ex-US highlights are CPI from Tokyo (leading indicator for the whole country), Germany, Italy, and Spain, German retail sales, EU money supply, and Canada GDP.

In EM, we’ll get GDP from India, Brazil, and Turkey, and unemployment in Mexico and Turkey among other reports.

Link to X posts - Neil Sethi (@neilksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,