Markets Update - 6/12/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

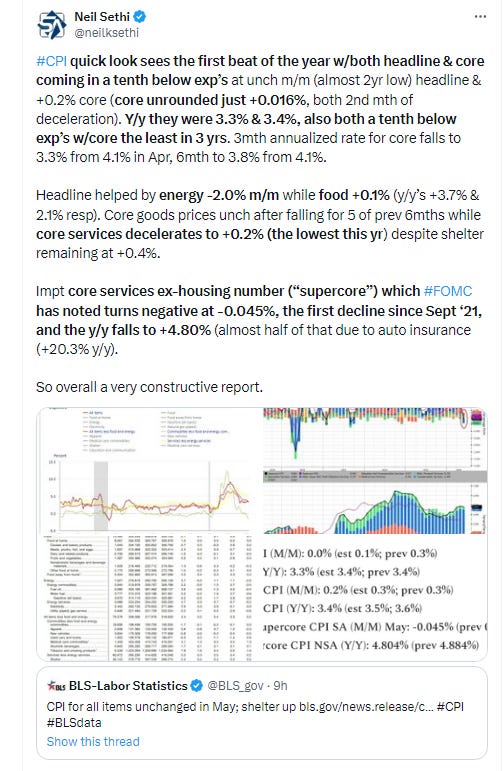

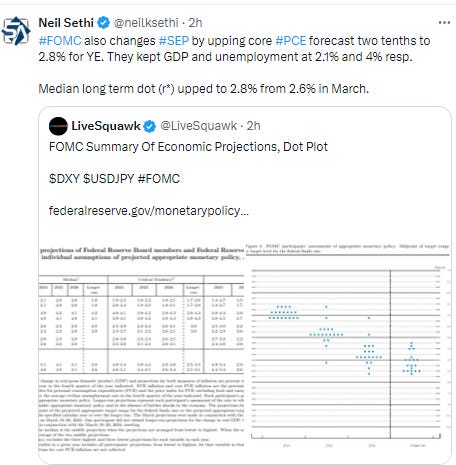

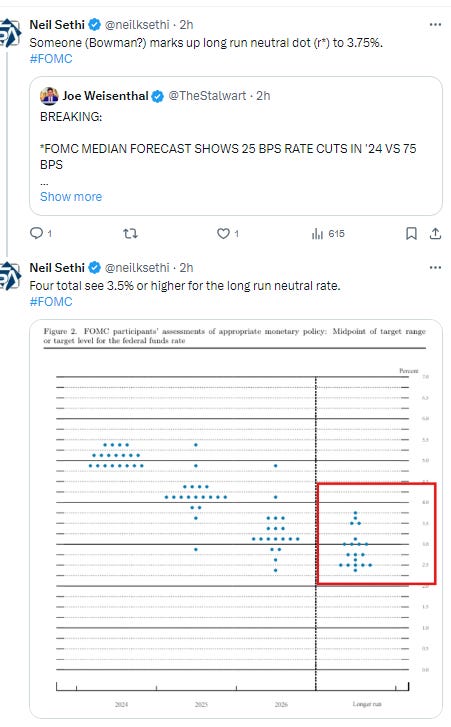

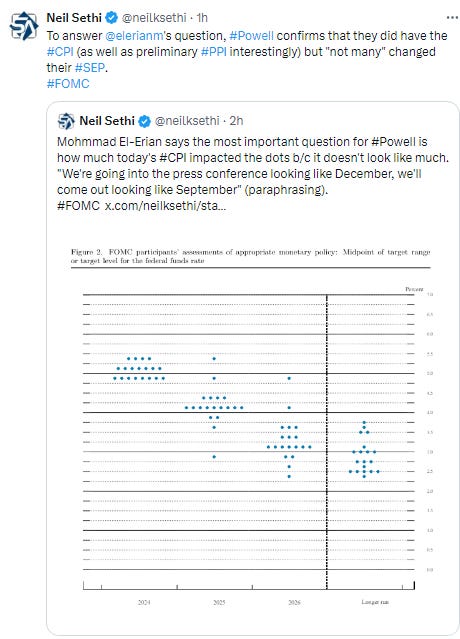

I had said in the weekend post that today would be a big day, and it delivered. US equities jumped out of the gate on the back of the first cooler than expected CPI report of the year with small caps shooting up over 3% at the open on the back of the biggest drop in Treasury yields since the December FOMC meeting (Powell pivot). Both bonds and stocks ended up giving back some of those gains following a more hawkish than expected (given the CPI print) FOMC (although equities did hit the highs of the day as Powell was speaking before dropping after he finished). The dollar dropped along with yields helping crude, gold, and copper all finish higher (although like equities off their highs), while nat gas closed lower but remained over $3.

Ashwin Alankar at Janus Henderson Investors: “Today’s soft CPI puts the Fed back in the driver’s seat to steer towards a precautionary cut later this year to ensure recession remains remote. Until greater disinflation evidence is seen both in breadth and depth, today’s softness is supportive of a preemptive cut rather than a pivot in Fed policy towards accommodation.

Sonu Varghese at Carson Group: May CPI was softer than expected across headline and core readings, indicating the disinflation process is playing out. This keeps the Fed on track for cuts in 2024, with the first cut likely coming in September, especially with the unemployment rate at 4% and risk of going higher.

“The CPI neutralized the hawkish Fed,” said Jay Hatfield, founder and chief investment officer of InfraCap. “Most market participants believe the economy is slowing, and they’re going to have to cut rates. So that’s why we think the market was shrugging off this really hawkish SEP of just one cut.”

Quincy Krosby at LPL Financial “[The hawkish dot plot] is most likely a function of not wanting to ease financial conditions unnecessarily as the data dependent Fed requires a series of cooler inflation reports before initiating a rate easing cycle.”

A lot more quotes on CPI and the Fed meeting later.

The Nasdaq Composite was +1.5% (and the top 100 Nasdaq stocks (NDX) +1.3%), the SOX semiconductor index +2.9%, the market-cap weighted S&P 500 +0.9%, the equal weighted S&P 500 index (SPXEW) +0.5%, and the Russell 2000 +1.6%.

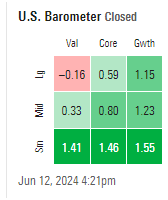

The Morningstar style box shows large value surprisingly completely sat this one out.

In individual stock action Oracle (ORCL 140.38, +16.50, +13.3%), jumped 13% after its quarterly results and guidance last night. Apple (AAPL 213.07, +5.92, +2.9%) overtook Microsoft for the top spot in the SPX although both it and Nvidia still had very good days ((NVDA 125.20, +4.29, +3.6%) & (MSFT 441.06, +8.38, +1.9%)). Broadcom is up 9% afterhours following its earnings report.

And some from BBG:

And companies making the biggest moves at mid-day from CNBC.

Economic data limited to the CPI and associated reports.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX another all-time high although now has a gap (most gaps get filled). Daily technicals remain positive.

The Nasdaq Composite also all-time high. Its daily technicals are a little stronger although now the most overbought this year (but remember being overbought is not a bad thing until it loses momentum)

RUT remains the laggard not even able to clear its downtrend line. The daily technicals remain weaker here.

SPX sector breadth improved as would be expected but still just 7 green sectors (not even as many as Monday despite 3x the point gain), and again most of the gain concentrated in the tech sector.

Stock-by-stock SPX chart from Finviz also shows it wasn’t the broadest of rallies.

Positive volume remained weak on the NYSE which barely got over 50%, very low given the index gains. Nasdaq better at 70%, but certainly nothing to write home about. Issues were 68 and 62%.

New highs-new lows (charts) though saw big improvement to 131 & 133 the best in 3 weeks. That’s got the 10-DMA flattening out.

Treasury yields fell as noted. The 10-yr note yield was -10 basis points to 4.30%, while the 2-yr note yield was -8 basis points to 4.75%, and the 30-yr bond yield was -6 basis points to 4.48%.

Fed rate cut expectations improved but not by as much as you’d think given the constructive CPI due to the more hawkish FOMC. Probability of July cut actually fell to 8%. By Sept is 63% (from 53% y’day) and by Nov 76% (from 67%) with 43bps priced (from 38 but it was 49bps after CPI) with a 7% probability of no '24 cuts.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Dollar fell but finished off the lows in the middle of its range over the past month. Daily technicals remain positive.

VIX never made it above 13 today not back to the lowest in 2 weeks.

WTI up (mildly) for 5th day in 6, at one point making it over the downtrend line to the 100-DMA before falling back. It was also limited by a poor storage report. As I said Monday it’s now “into the teeth of resistance”, but as also noted, the daily technicals are more supportive.

Gold was green for a third day making it to the 50-DMA before falling back. Daily technicals remain weak though with lots of resistance above.

Copper actually had made it over the important resistance of the 50-DMA/trendline but fell back. As I noted Tuesday it really needs to get back over that resistance soon. Daily technicals remain very weak though.

Nat gas fell back but held the $3 line. Daily technicals remain positive.

Well, we made it past what will be one of the more newsy days of the summer. We do have PPI tomorrow which factors into PCE (the Fed’s preferred inflation metric) so we’ve got to pay attention to that as well as weekly jobless claims. We’ll also get a 30yr Treasury bond auction. Earnings highlighted by Adobe. We also get Signet and RH which are normally interesting earnings calls as well. Ex-US highlights are Australia employment, EU industrial production, and rate decisions in Serbia and Ukraine. There’s also another UK debate tonight.

8:30 ET: May PPI (Briefing.com consensus 0.1%; prior 0.5%), Core PPI (Briefing.com consensus 0.3%; prior 0.5%),

8:30 ET: Weekly Initial Claims (Briefing.com consensus 224,000; prior 229,000), and Continuing Claims (prior 1.792 mln)

10:30 ET: Weekly natural gas inventories (prior 98 bcf)

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,