Markets Update - 6/18/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

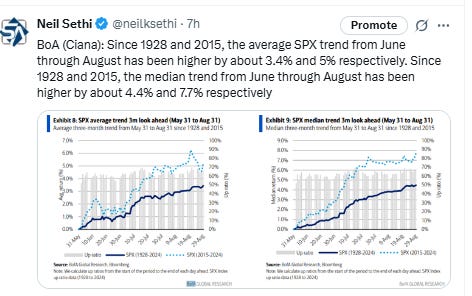

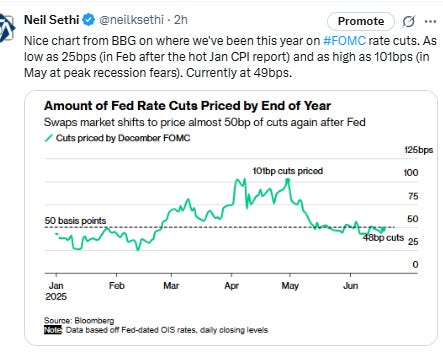

Major US equity indices started the day little changed ahead of the Fed policy decision and Powell press conference and with the Israel/Iran conflict showing no signs of abating. With little new information on the latter beyond Israel’s continued battering of Iran, markets turned to the former with their typical pre-Fed drift higher. And they continued to roughly follow the typical FOMC day hitting near the day’s highs right after the statement and then again at the beginning of Chair Powell’s press conference, but selling off starting in the middle as Powell made it clear that the Fed was in no hurry to lower rates given expectations were for tariffs to show up in inflation “in coming months” and saw the median projection of two rate cuts as something “no one holds…with a great deal of conviction”. “The size of the tariff effects, their duration and the time it will take are all highly uncertain,” Powell said. “That is why we think the appropriate thing to do is to hold where we are as we learn more.” Equities finished near the lows of the day. The RUT outperformed with a decent gain, the other indices little changed.

Elsewhere, Treasury yields were little changed, while Fed rate cut expectations followed the dot plot in slightly boosting 2025 cuts but pricing out almost a half cut from 2026. The dollar rose as did nat gas, while crude, gold, bitcoin, and copper all were lower.

The market-cap weighted S&P 500 (SPX) was UNCH, the equal weighted S&P 500 index (SPXEW) UNCH, Nasdaq Composite +0.1% (and the top 100 Nasdaq stocks (NDX) UNCH), the SOX semiconductor index +0.5%, and the Russell 2000 (RUT) +0.5%.

Morningstar style box showed muted gains/losses across styles with small caps outperforming.

Market commentary:

“The consensus was leaning toward the 2025 median dot showing one cut” going into the meeting, said Subadra Rajappa, head of US rates strategy at Societe Generale. So the statement and the dots were “somewhat dovish” compared with market expectations, she said.

“It skews slightly dovish,” Matthew Luzzetti, chief US economist for Deutsche Bank, said on Bloomberg Television. But the changes to the 2026 and 2027 rate projections suggest “they think inflation will be persistent.”

“They are clearly in wait-and-see mode,” said Chris Zaccarelli at Northlight Asset Management. “They are sitting on their hands, waiting to see if tariffs increase inflation or the jobs market starts to falter, and whichever part of their dual mandate is impacted first will likely guide whichever direction they take.”

Federal Reserve officials are "in a pickle" with U.S. economic activity lackluster in the second quarter and business surveys pointing to a pickup in inflation, said Bill Adams, chief economist for Comerica Bank in Dallas.

"To the extent that the Israel-Iran war affects the U.S. economy, it will likely raise inflation and lower growth even more, pulling the Fed even harder in opposite directions," Adams wrote in an email on Wednesday. He added that, in the short run, Fed officials are "likely to sit on their hands" and "wait and see” how these stagflationary forces play out.

David Russell, global head of market strategy at TradeStation, said the markets didn't really expect dovish inflation expectations from the Fed on Wednesday, so the projection of higher inflation "didn’t hurt sentiment much."

At Strategas, Don Rissmiller says that with inflation likely to pick up over the summer, the next opportunity to cut rates could be in fact in the fourth quarter.

“The Fed does not want to move preemptively given how fluid the US economic situation still is,” said Rissmiller. “Pausing a while longer would buy additional time to see the effects of recent shocks.”

To Ellen Zentner at Morgan Stanley Wealth Management, solid economic footing will allow the Fed to remain patient and away greater clarity before cutting interest rates. “Markets will need to be patient as we await incoming data that will reveal the extent to which tariffs will drive higher inflation and slower growth,” she said.

“Powell played it safe,” said Haris Khurshid, chief investment officer at Karobaar Capital in Chicago. “They’re sticking to two cuts for now, but clearly rattled by tariffs. No urgency to move. It’s a tough spot: growth slowing, inflation lingering, and geopolitical risk heating up.”

More Fed commentary below.

“There is a lot of mixed data and perspectives right now,” says Adam Hetts, global multi-asset head at Janus Henderson Investors.

Morningstar chief US market strategist Dave Sekera characterizes the current moment as “the eye of the hurricane” ahead of potential upheaval in the months ahead.

“The market just seems very keen to fade geopolitical risk,” Zachary Hill, head of portfolio management at Horizon Investments, said to CNBC. “That has been historically the right thing to do, so I think that’s kind of what’s driving us so far today.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Shares of steel producer Nucor jumped more than 3% mid-day. The company issued rosy guidance for its second-quarter earnings, calling for $2.55 to $2.65 per share, while FactSet consensus estimates sought $2.36 per share. In contrast, Steel Dynamics’ guidance fell short of Wall Street’s estimates, ranging from $2.00 to $2.04 per share, while analysts were looking for $2.73 per share. The stock slipped 1%. The moves follow the completion of the Nippon Steel-U.S. Steel deal. Shares of peer companies Cleveland-Cliffs and Reliance were little changed

Circle Internet Group — Stock in the company behind stablecoin USDC advanced almost 16% by mid-day, after the U.S. Senate passed the GENIUS bill. The legislation is the first of its kind and establishes federal guidelines for digital dollars that are pegged to the greenback.

Corporate Highlights from BBG:

The top US bank regulators plan to reduce a key capital buffer by up to 1.5 percentage points for the biggest lenders after concerns that it constrained their trading in the Treasuries market.

The Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency are focusing on what’s known as the enhanced supplementary leverage ratio, according to people briefed on the discussions. This rule applies to the largest US banks, including JPMorgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley.

Nippon Steel Corp. closed its $14.1 billion acquisition of United States Steel Corp., bringing an end to a bruising takeover battle that was embroiled in American politics for months until finally gaining support from US President Donald Trump.

US safety investigators called for urgent actions to be taken in response to an engine issue on Boeing Co. 737 Max aircraft that can lead to smoke in the cockpit or cabin.

Robert F. Kennedy Jr.’s plan for America’s vaccines is coming into focus, with his revamped immunization advisory panel set to discuss the use of measles shots in kids next week and vote on an ingredient that’s been wrongly linked to autism.

Alphabet Inc.’s Waymo has applied for a permit to test its robotaxis in New York City, underscoring its intent to operate in one of the largest ride-hailing markets in the US despite an absence of local regulations supporting commercially operated autonomous vehicles.

Visa Inc. and Mastercard Inc. slipped amid continued worries about the impact of stablecoins on credit-card issuers.

Kellanova fell after a report from Reuters that European Union regulators are opening an investigation into Mars Inc.’s acquisition of the maker of Pop-Tarts and Eggo waffles.

Ford Motor Co. has instructed its dealers to stop selling the electric Mustang Mach-e because a software defect could lock the doors, potentially trapping occupants inside.

Texas Instruments Inc. touted plans to spend more than $60 billion on semiconductor plants in the US, making it the latest chipmaker to promote its domestic manufacturing ambitions as the Trump administration urges investments and threatens to upend the sector with tariffs.

Intel Corp. named new engineering leadership as part of a turnaround effort under Chief Executive Officer Lip-Bu Tan, tapping veterans of Cadence Design Systems Inc., Apple Inc. and Google.

OpenAI is phasing out the work it does with data-labeling startup Scale AI, cutting ties with the company days after Meta Platforms Inc. invested billions of dollars in it and hired its founder.

Nike Inc.’s new brand with entrepreneur and reality TV star Kim Kardashian’s Skims label has pushed back its launch after initially planning to release its first collection this spring.

Some tickers making moves at mid-day from CNBC:

In US economic data:

Initial jobless claims (SA) in wk through June 14th edge back -5k to 245k from the highest level since October, remaining at the top of the range over the past yr, but still just +58k above the 50-yr lows in Oct '23 (187k). Four-wk moving avg moves to 246k (+14k y/y), the highest since Aug ‘23. As noted last week, though, we’ve seen similar moves higher in initial claims in early summer the past two years as well. Continuing claims (SA) in wk through June 7th (1-wk lagged) also ease but remain just off the highest since Nov ‘21, -6k to 1.945mn, remaining also for a second week above the 1.8-1.9mn range it had been in since June. The 4wk moving avg up to 1.926mn, the highest since Nov ‘21, +110k y/y, evidencing that while layoffs have remained very low, workers are having a little harder time finding a new job.

May housing starts return to volatility, dropping -9.8%, the fifth move of at least 9% in the past six months, after having risen +2.7% in Apr (revised from +1.6%) which takes them down to 1.256mn SAAR, the least in five years (to May 2020). The drop was way more than estimates for -0.8% to 1.350mn. The decline though was all in multifamily which fell -30.3% (after +15.5% in May (rev’d from +11.1%), the largest drop on a percentage basis since Nov ‘24, taking that pace down to 316k, the least since November (from the highest since 2023), while single-family were little changed (+0.4%) at 924k, just off the 920k in Apr which was the least since July ‘24. The big miss will have a negative impact on 2Q GDP, although less so given it was all in multifamily which are less economically impactful.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

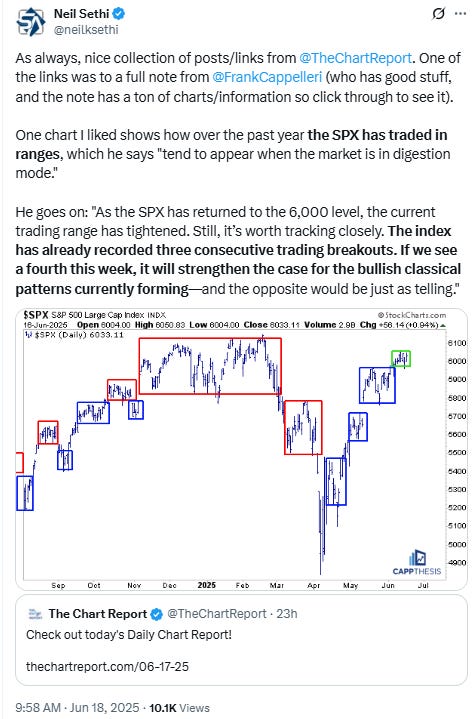

The SPX little changed remaining above Friday’s lows and the 20-DMA. Its daily MACD though continues to slip less positive as does the RSI although it remains above 50.

The Nasdaq Composite very similar setup.

RUT (Russell 2000) as well although it remains also under its 200-DMA.

Sector breadth from CME Cash Indices improved some but to just four green sectors (from one (Energy) Tues) despite equities spending most of the day in positive territory. And no sector was up over +0.4% while two were down more than that (Comm Services & Energy). Still it was one of the narrowest spreads this year at just 1% from top to bottom. No clear pattern in terms of style again today.

SPX stock-by-stock flag from Finviz seems consistent with more red than green but most of the moves very moderate. V & MA continued their selloffs now down -10% from the highs, and software was weak as were defense names. Mag-7 was mixed today (+0.1%).

NYSE positive volume (percent of total volume that was in advancing stocks) which had been pretty solid the past few weeks but has been generally less so since last Wednesday continued to improve to 53.1% not bad considering the -0.09% loss in the NYSE Composite Index. Compare that with last Wednesday when it was just 46.9% despite a small +0.02% gain in the index.

Nasdaq positive volume was even better at 65.0% and today it was “cleaner” with no big volume in penny stocks (at least none in the top 10), very good for the +0.13% gain in the index.

Positive issues (percent of stocks trading higher for the day) were also pretty good at 54 & 56% respectively.

New 52wk highs-new lows (red-black dotted line) also improved to 18 on the NYSE, and 30 on the Nasdaq, keeping them in their range over the past couple of months.

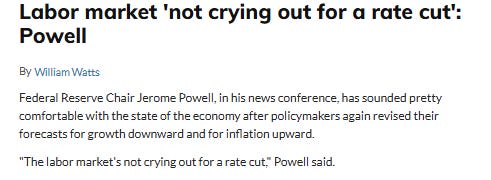

With the #FOMC meeting behind us, 2025 rate cut pricing actually didn’t change all that much with 2025 cuts +3bps to 48bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; they peaked this year at 103bps on Apr 8th, and the low was 36bps Feb 11th).

The probability of a cut at the July meeting is just 10% (down from 31% two weeks ago and 78% at the start of May) but a cut by the following meeting (Sept) is over six times July at 66% (on the idea that the Fed will feel that they don’t have enough data (especially now with the oil spike) to cut before that point, but will want/need to cut by Sept, although that is still down from 95% May 1st).

Chances of 2 cuts this year is 69% (up from 62% Tuesday which was around the least we’d seen since Feb but down from 76% last week and 99% at the start of May), three is 27% (down from 92% May 1st), and four is 2% (from 76%). The chance of no cuts remains low at 6% (but up from under 1% May 1st).

2026 cuts though fell -11bps to 61bps, seeing total cuts through Dec '26 at 109bps, -7bps from Tuesday and -39bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

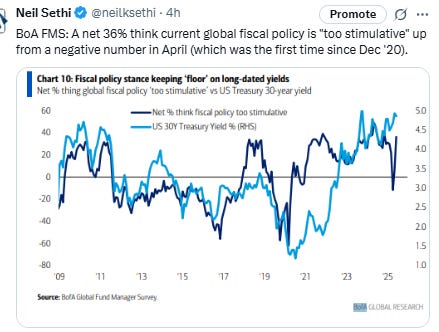

10yr #UST yields were sleepy up less than 1bps to 4.40%, remaining in the middle of the range this year.

The 2yr yield, more sensitive to #FOMC policy, also little changed -1bps to 3.94%, also in the middle of its range this year. It is now -39bps below the Fed Funds midpoint, so continuing to call for a rate cut or two but around one less than it was at the beginning of May.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) pushed a little higher now right up against the downtrend line from February that hasn’t yet been breached. The daily MACD and RSI as noted Tuesday turned more neutral.

VIX fell back but remained just over 20. That level is consistent w/~1.25% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) fell back to 106 from the highest close since Apr 22nd, still just over Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

But 1-Day VIX pushed higher to 22.1, the highest close since May 9th. That level is consistent with traders looking to hedge an ~1.38% move in the SPX Friday.

#WTI futures recovered from deeper losses after having dived following reports that Israel was attacking the headquarters of Iran’s leader Khamenei, helped by another weekly storage draw, but still finished lower for the session after the highest close since January Tuesday.

#oott

Gold futures (/GC) down modestly still just off its all-time closing high from Friday in the middle of the uptrend channel from January. Daily MACD as noted Thursday has turned more positive and the RSI is above 50.

Copper (/HG) futures pushed up to the top of the wedge they have been in since March. The daily MACD and RSI are relatively neutral.

Nat gas futures (/NG) up another 2.8% Wednesday, taking their 4-day run to nearly 10%, to the highest close since Apr 3rd. Daily MACD and RSI also are supportive. As noted Tuesday, no real overhead resistance until the $4.25 area.

Bitcoin futures little changed remaining in their range since late May. As noted Monday, while the daily MACD is in “sell longs” positioning, it is not far from turning positive (although it’s further now) while the RSI remains around 50 for now.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high).

The Day Ahead

As a reminder US markets closed Thursday in observance of the Juneteenth holiday to commemorate the ending of slavery in the United States.

On Friday, not much US economic data just the Philadelphia Fed’s regional manufacturing PMI and the LEI’s (leading indicators, which as I’ve noted are only a good gauge of the manufacturing economy, but the CEI’s (coincident indicators) as I’ve mentioned are a good real time indicator of the entire economy).

As of now, no Fed speakers are scheduled, but it wouldn’t be surprising to see some now that the blackout is over.

Friday is oddly (given it’s a summer Friday) the heaviest day of the week for SPX earnings reports with four including our only $100bn+ this week in Accenture (ACN).

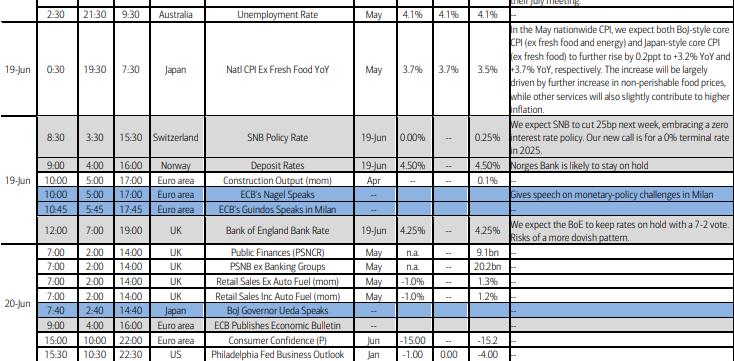

Ex-US DM Thursday we’ll get policy decisions from the UK, Switzerland, and Norway, Australia employment, and Japan CPI among other reports, while Friday we’ll get UK and Canada retail sales, EU consumer confidence, and an appearance from BoJ Gov Ueda.

In EM we’re getting a policy decision from Brazil as I write this (it looks like they hiked 25bps to a remarkable 15%) and Thursday we’ll get policy decisions from Turkey, the Philippines, and Costa Rica, while Friday we’ll get Mexico’s economist survey.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,