Markets Update - 6/21/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

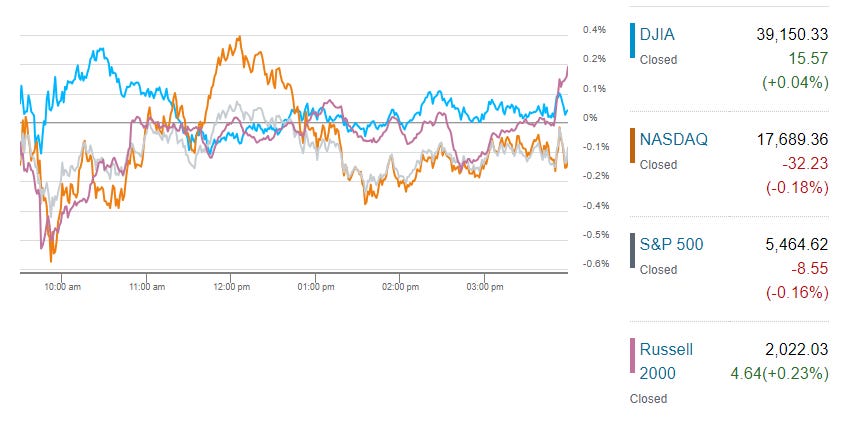

US equities traded on both sides of the unchanged line today as they navigated the quarterly options expiration which saw a few stocks make larger than normal moves, but overall passed without much volatility. In the end equities ended little changed as did bonds. The dollar pushed to its highest close since April, which may have pressured major commodities with crude, gold, nat gas, and copper all closing lower as did Bitcoin.

Keith Lerner at Truist Advisory Services says the firm is downgrading the technology sector to neutral after the industry largely outperformed the S&P 500 since their overweight call in November. “Although we still have a favorable long-term view of technology, on a shorter-term basis the sector appears extended, and we would not be chasing the sector,” Lerner noted. “That said, the sector appears far from bubble territory, and we believe secular tailwinds will persist around artificial intelligence.

“Technology stocks continue to be in the spotlight,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management. “I can’t remember a time when one single stock ... has been so influential on the market, and that’s really been a key driver of the market action as of late.”

“It’s probably not a bad time to take some chips off the table,” said Dave Grecsek, a managing director at Aspiriant. “We’ve had a magnificent run, and the market is looking a little extended.”

“Investors should brace for drama,” said Solita Marcelli at UBS Global Wealth Management. “The second half of 2024 is shaping up to be a time of transition and volatility. The decisions that investors make now will be key to navigating this period effectively.”

John Stoltzfus at Oppenheimer Asset Management says he remains positive in the outlook for stocks as prospects for improved fundamentals this year show potential to be realized. “That said, history shows us that stocks and other asset class prices don’t go up in a straight line but rather tend to climb the proverbial ‘wall of worry,’ requiring prudent diversification, patience, and a sense of one’s tolerance to risk and fluctuation for private investors and discipline tied to an institution’s mandate for professional investors,” he noted.

The Nasdaq Composite was -0.2% (and the top 100 Nasdaq stocks (NDX) -0.3%), the SOX semiconductor index -1.3%, the market-cap weighted S&P 500 -0.2%, the equal weighted S&P 500 index (SPXEW) +0.1%, and the Russell 2000 +0.2%.

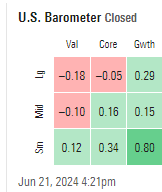

The Morningstar style box a little surprising to me with growth leading particularly smaller caps.

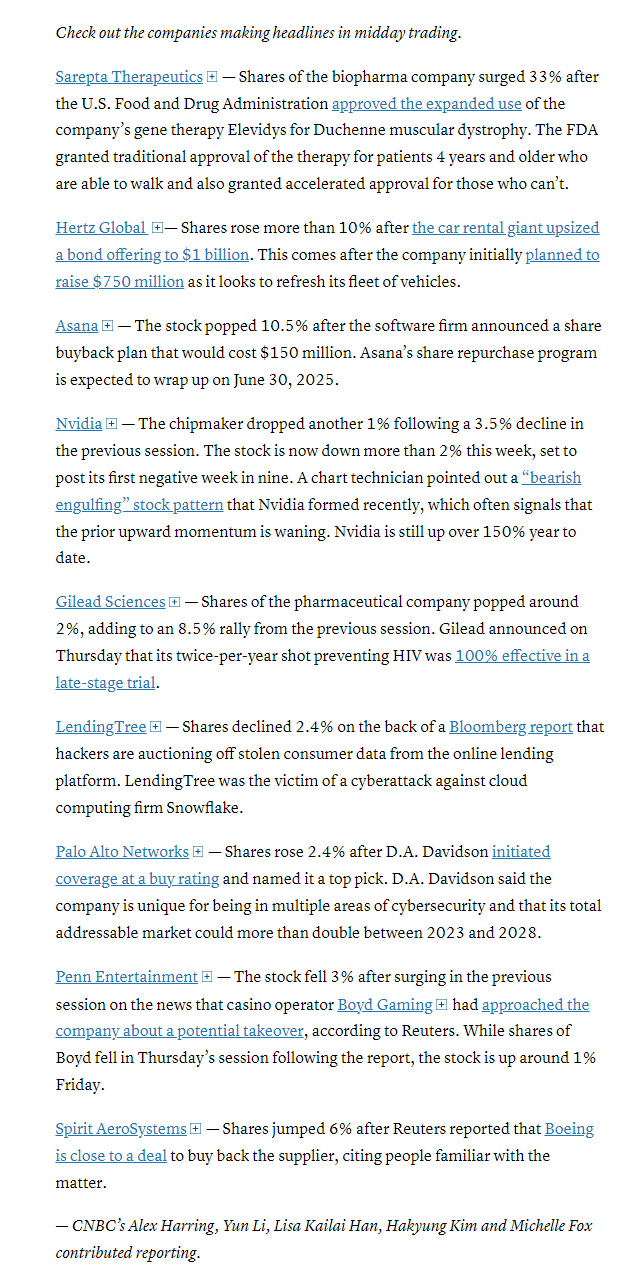

In individual stock action it was a less newsy day although Nearly 18 billion shares changed hands on US exchanges Friday. That’s over 55% above the three-month average. We did see some larger than normal moves in Nvidia (NVDA 126.57, -4.21, -3.2%), and Apple (AAPL 207.49, -2.19, -1.0%), who strangely were both lower despite a big rebalance in an ETF (XLK) that saw a swap in their relative sizing. Meta Platforms (META 494.78, -6.92, -1.4%) and Broadcom (AVGO 1658.63, -75.93, -4.4%) also finished lower.

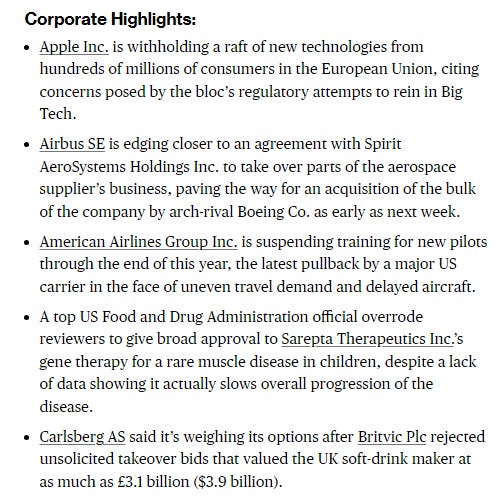

And some corp news from BBG:

And companies making the biggest moves at mid-day from CNBC.

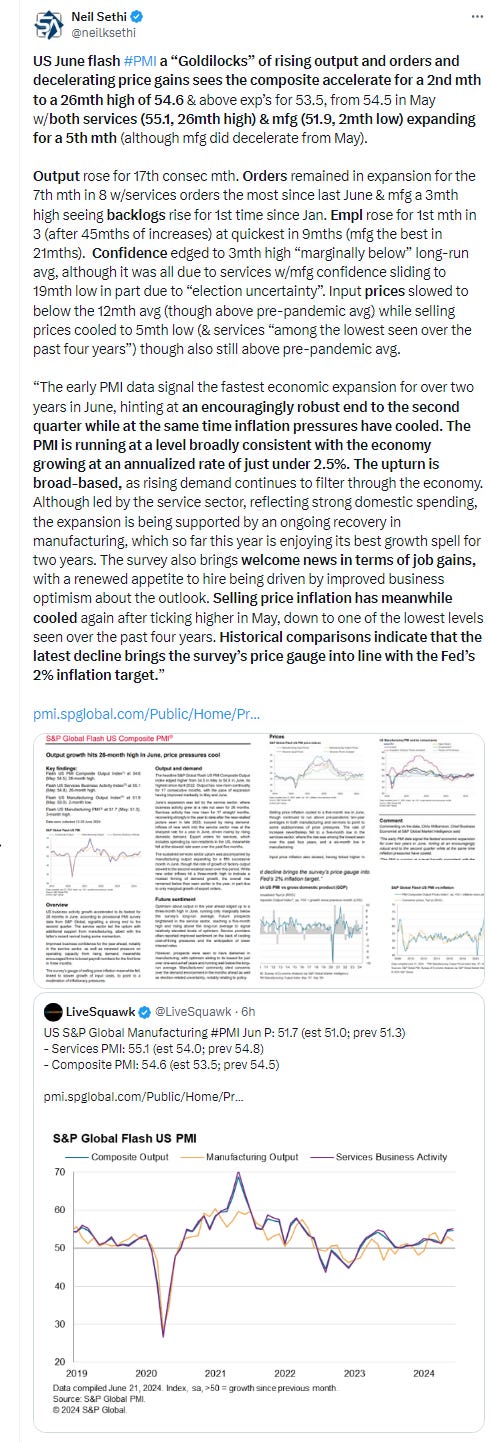

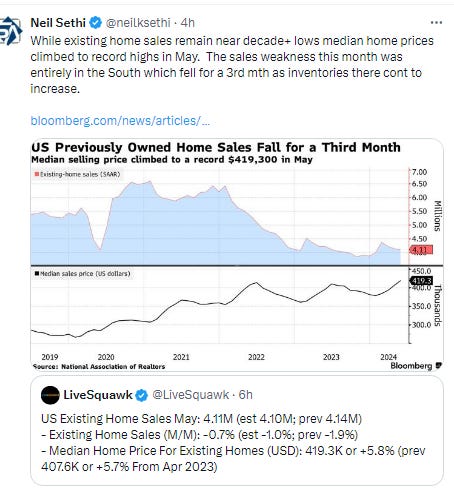

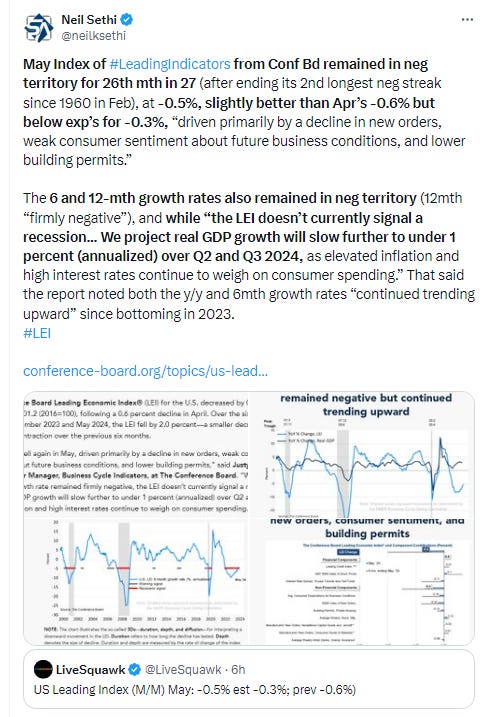

Economic data headlined by June flash PMIs which accelerated to a 26mth high supported by both services (which also hit a 26mth high) and manufacturing expanding for a 5th mth, but also saw a deceleration in prices to what the report called “levels consistent with the Fed’s 2% inflation target.” We also got May existing home sales which fell slightly from April remaining near decade+ lows while prices moved to new ATH’s and leading indicators which remained mired in negative territory.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX edged lower but certainly not with the huge volatility many promised with options expiration. Daily technicals remain tilted positive although they’re now starting to roll over from very overbought levels which is often associated with a dip if it continues.

The Nasdaq Composite also fell back from an all-time high. Its daily technicals are also positive although also coming off even more overbought levels showing a clear loss of momentum.

RUT remains the laggard continuing to churn just above 2 mth lows. The daily technicals also remain weaker here.

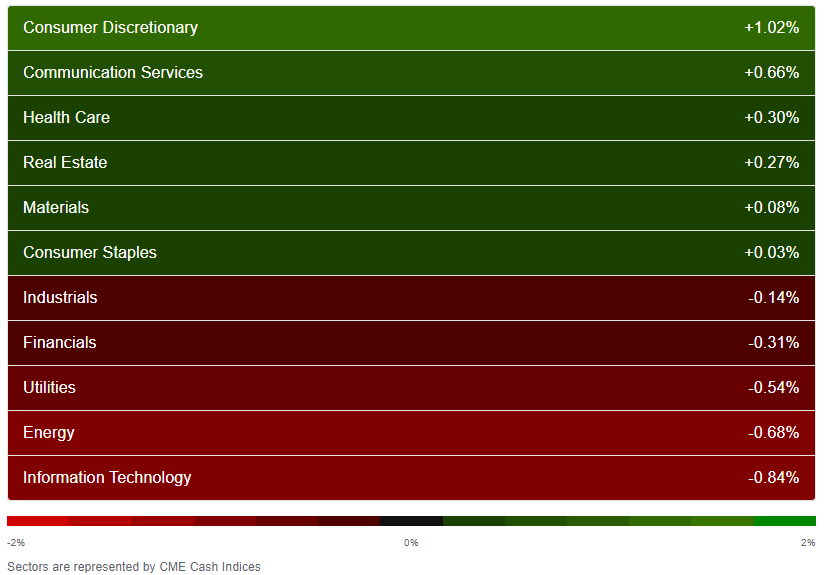

SPX sector breadth a little less broad but not bad for a mildly down day at the headline index level with 6 green sectors (down from 8 the rest of the week). Tech in last place for a 2nd day (on another bad day in semiconductor stocks).

Stock-by-stock SPX chart from Finviz consistent with a lot of green outside of semiconductors, banks, utilities, and energy.

Positive volume Friday was worst of the week on the NYSE falling to 46% from 57% Thursday despite flipping from a slightly down finish Thurs to a slightly up finish Friday. Nasdaq though improved as would be expected with a much smaller loss on Friday to 56% from 46% Thursday. Issues were 50 and 49% respectively.

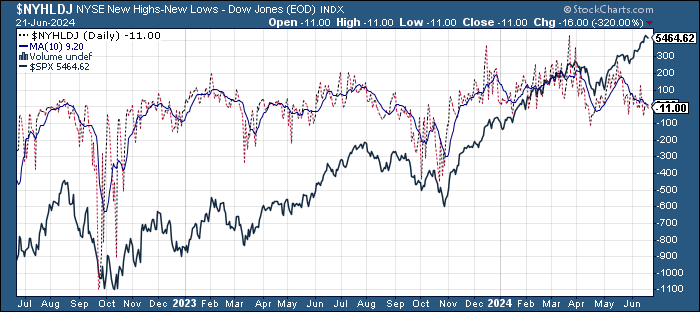

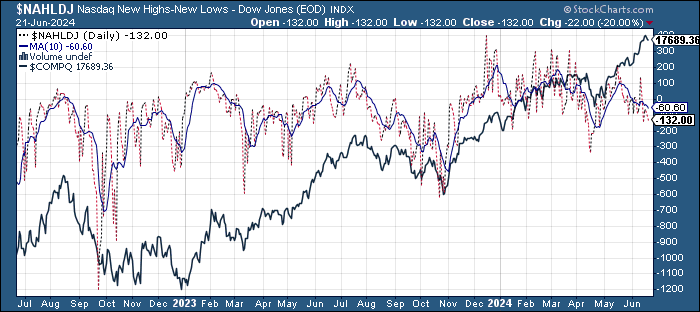

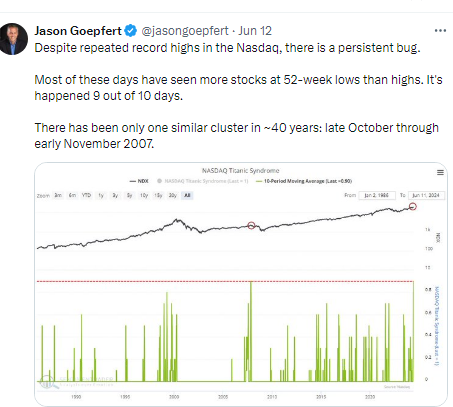

New highs-new lows (charts) continued to fall back, now down to -11 and -134 at least I guess better than a week ago when they were -54 and -143 but otherwise one of the weaker readings since April. Again, that was despite the indices finishing within a percent of record highs on the SPX and Nasdaq. That’s keeping the 10-DMA moving lower. Someday it will matter.

Make it 15 out of 16 days.

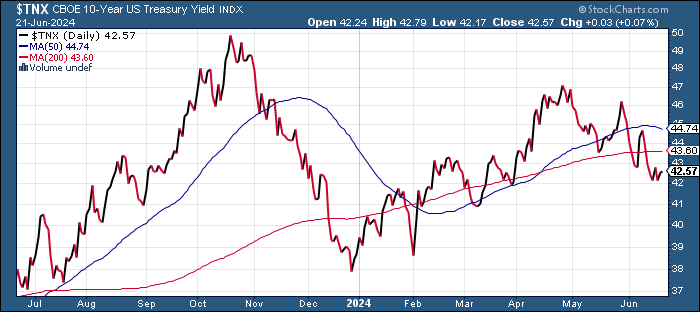

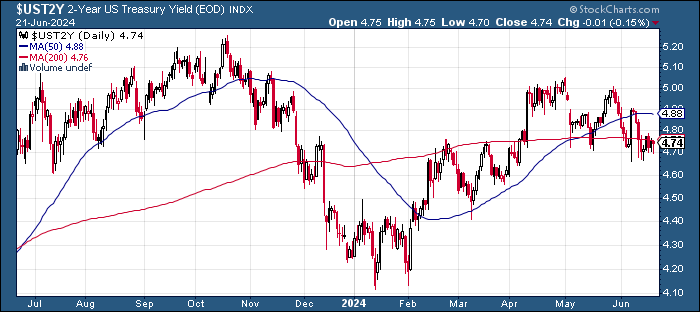

Treasury yields little changed. The 10-yr note yield was unchanged at 4.26%, while the 2-yr note yield was -1 basis point at 4.73% (both +5 basis points on the week).

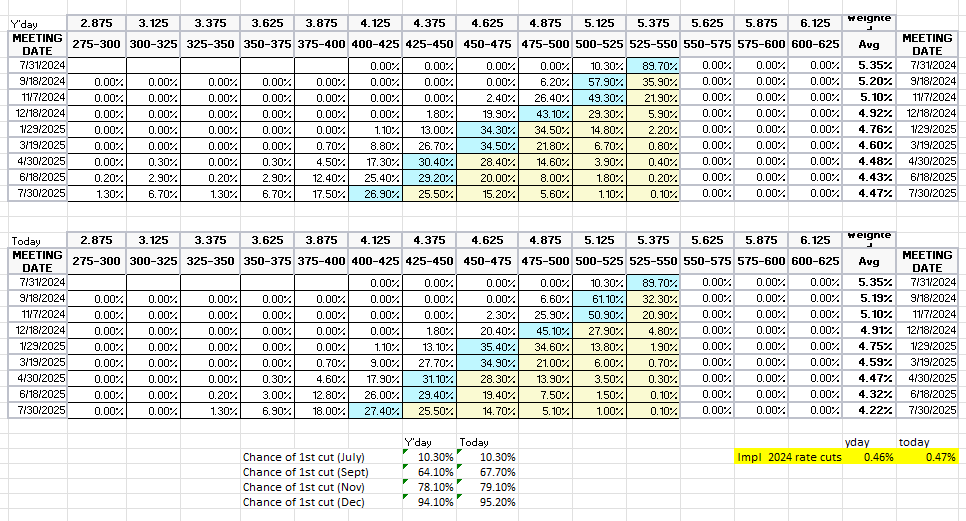

FOMC rate cut probabilities were little changed at 47bps of '24 cuts with a 67% chance of a cut by Sept, 79% chance of a cut by Nov & 5% chance of no ‘24 cuts.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Dollar saw its highest close since April, pushing over that trendline running back to Sep '22, and its daily technicals (bottom two panels) also are looking to break out. I have been saying “the daily technicals remain positive so I wouldn’t give up on it just yet,” and that looks like its coming through.

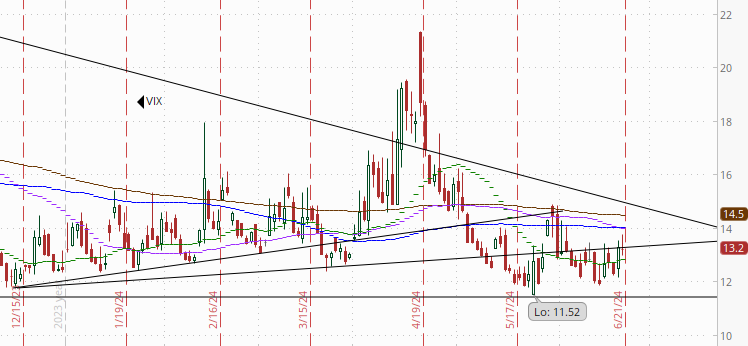

VIX little changed just off highest close since May.

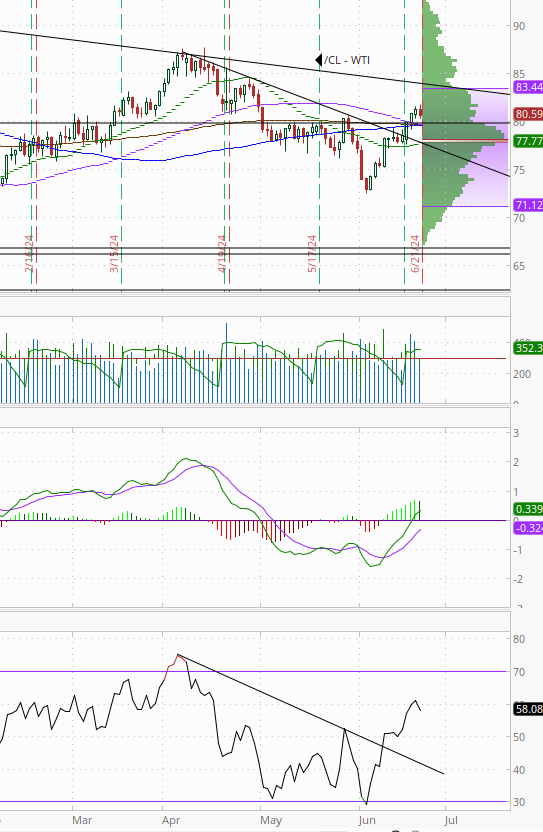

WTI fell back but remained over the key $80 level just off the highest close since April. I said Monday the daily technicals are supportive so that may allow this to push on to the resistance of a downtrend line from the Sept highs which is also the 78.6% Fibonacci line from the downtrend from April, and that remains in play.

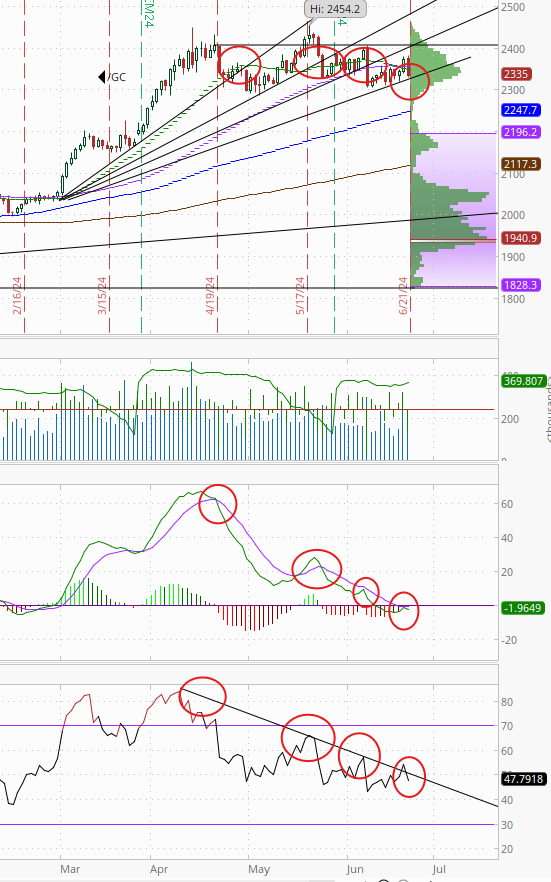

Gold fell back under the 50-DMA a disappointment for bulls. Interesting pattern playing out as it is again testing a trendline. This is the 4th time the past 2mths, and the pattern is similar to the breaks in the previous 3 in terms of failed MACD & RSI breakouts (circles).

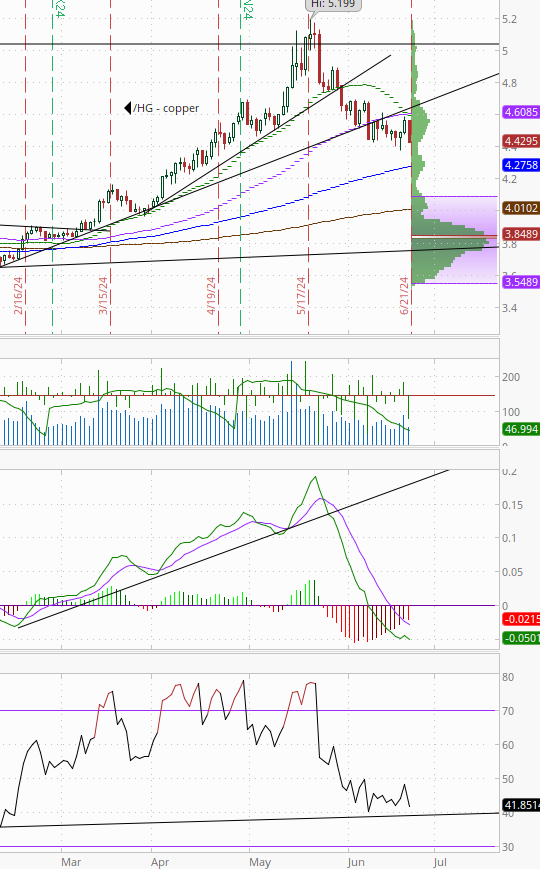

Copper not a good finish to the week rejected from its 50-DMA resistance and the lowest close since April. Daily technicals haven’t yet turned here so they remain tilted negative.

Nat gas down for 6th day in 7, and now under the support turned resistance of its 20-DMA. Daily technicals are negative so I continue to think the 200-DMA ($2.50) seems a natural target.

Bitcoin continues its steady decline this month another 1mth low.

More on Sunday.

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,