Markets Update - 6/23/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

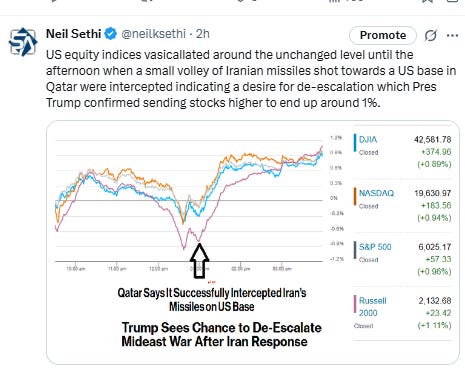

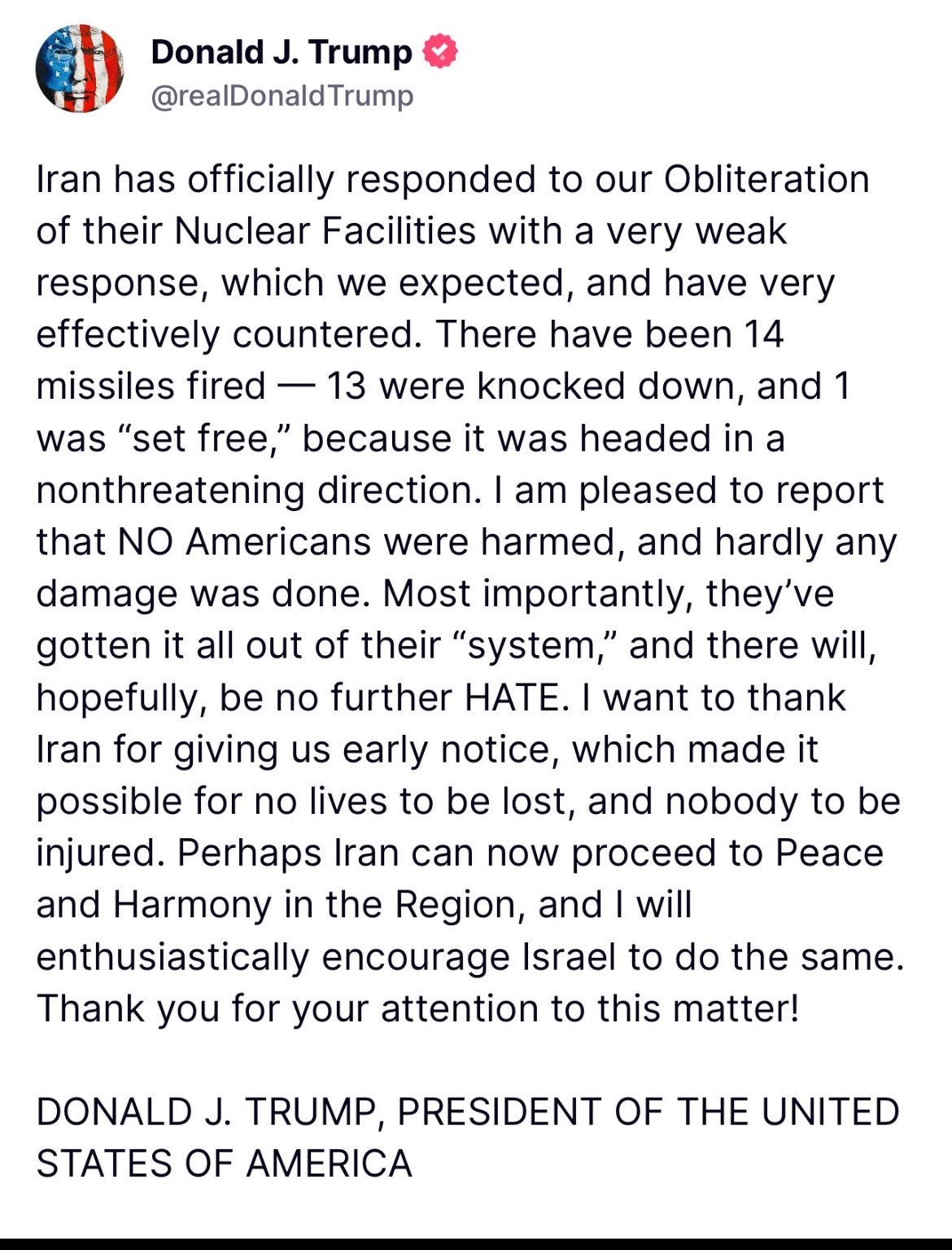

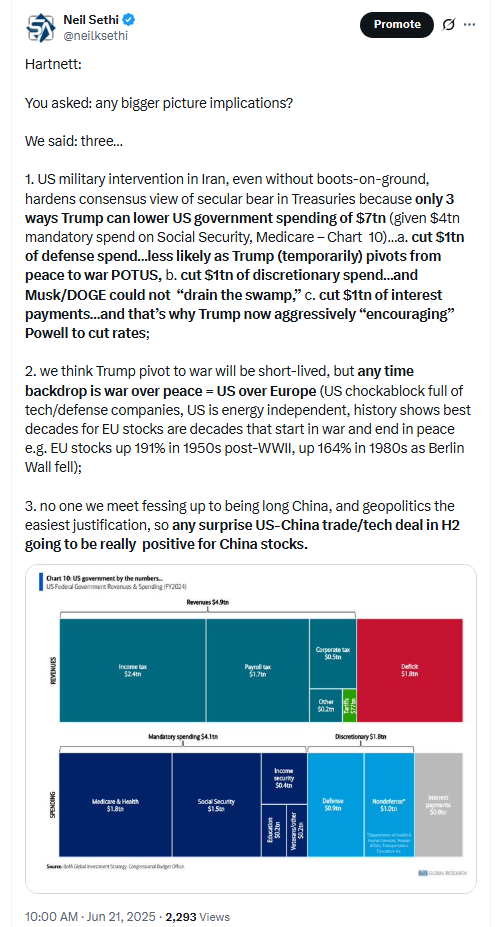

Major US equity indices started the day little changed reversing declines seen overnight following the open of futures after the US attack on Iran’s nuclear sites over the weekend. They vasicallated around the unchanged level until the afternoon when a small volley of Iranian missiles shot towards a US base in Qatar were intercepted by the host country with the modest “for show” attack appearing to indicate a desire on the part of Iran for de-escalation which Pres Trump seemed to reciprocate saying the attack was “very weak” and telegraphed ahead of time by Tehran. “Perhaps Iran can now proceed to Peace and Harmony in the Region, and I will enthusiastically encourage Israel to do the same,” the President said. “Most importantly, they’ve gotten it all out of their ‘system,’ and there will, hopefully, be no further HATE,” he added. Stocks from that point rallied for the rest of the session ending up around 1%.

As I am wrapping this up Pres Trump has just posted that there has been a ceasefire agreed to between Israel and Iran to start at midnight (although it’s a little unclear as to the timing and sounds like it might not be until 6pm tomorrow ET).

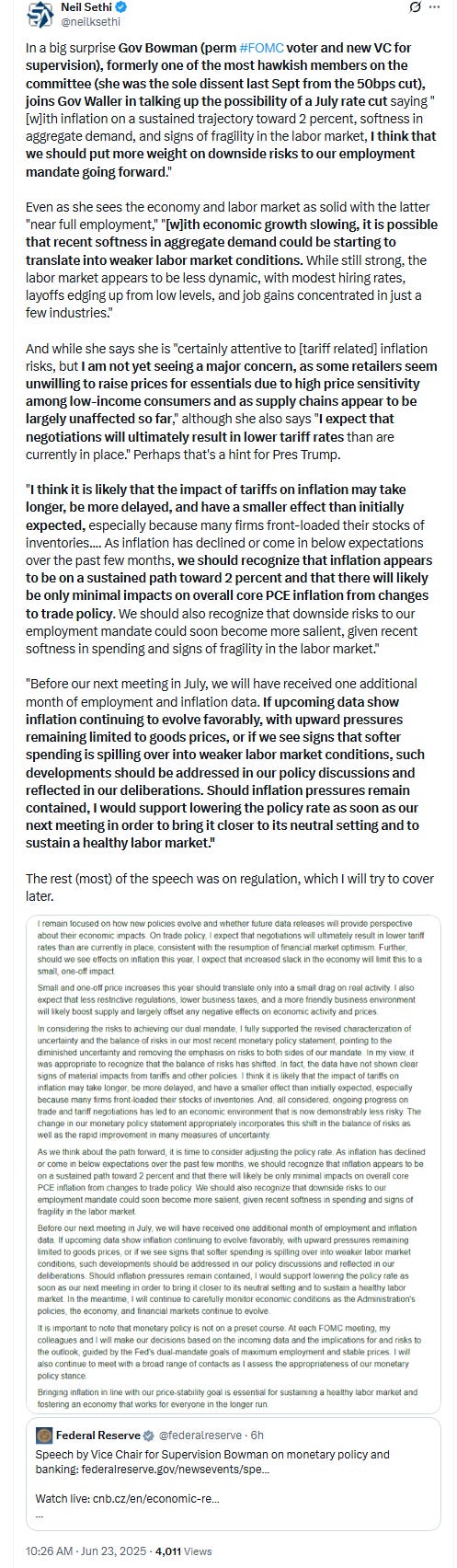

Elsewhere, Treasury yields, the dollar, and crude all fell following Iran’s “for show” attack and as two Fed members, most notably former hawk Gov Bowman, joined Gov Waller in calling for cuts as soon as July if tariff effects don’t show up by then. Nat gas also fell while, bitcoin and copper were higher, gold little changed.

The market-cap weighted S&P 500 (SPX) was +1.0%, the equal weighted S&P 500 index (SPXEW) +0.8%, Nasdaq Composite +0.9% (and the top 100 Nasdaq stocks (NDX) +0.9%), the SOX semiconductor index +0.6%, and the Russell 2000 (RUT) +1.1%.

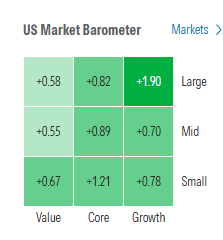

Morningstar style box showed solid gains/losses across styles with large cap growth outperforming.

Market commentary:

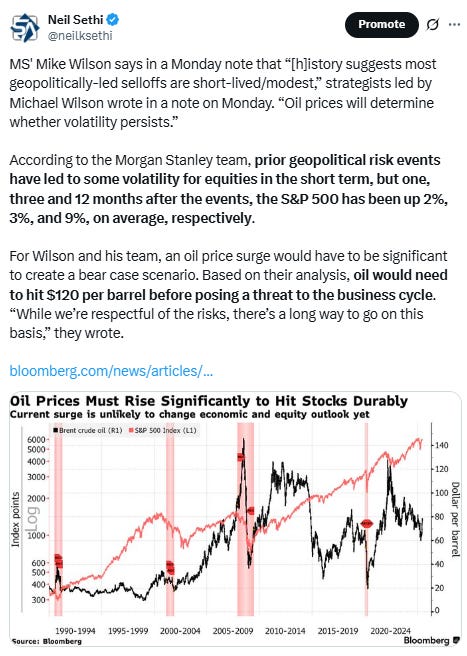

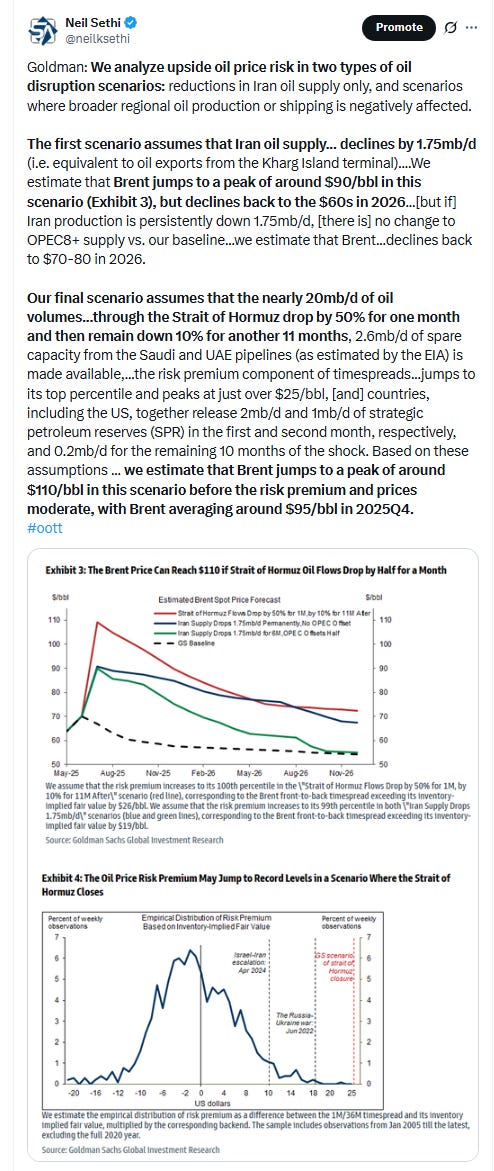

“Despite ominous headlines, we are not seeing an increase in oil prices or geopolitical tensions in the markets as fears of the conflict spreading remain low,” said Tom Essaye at The Sevens Report. “Unless investors fear the conflict will spread and engulf the entire region and dramatically reduce oil supplies, then rising geopolitical tensions won’t be a material negative on this market.”

"Markets only care about oil supply shocks, so as long as they stay at bay, we'll see markets sharply higher," said Jamie Cox, managing director at Harris Financial Group. "Regardless of whether the President oversold the effectiveness of the strikes or not, the nuclear program in Iran was set back decades."

To Krishna Guha at Evercore, the symbolic strike allows Iran to claim that it has retaliated against the US military, while sending a clear message it doesn’t want to get drawn into a war with the US it cannot win, which would threaten its regime stability.

“The Iranian response today seems manageable and perhaps a clearing event,” said Michael Bailey at FBB Capital Partners. “Lower oil prices are providing a release valve for stress that built up over the weekend, also allowing the bull case of steady global growth to continue.”

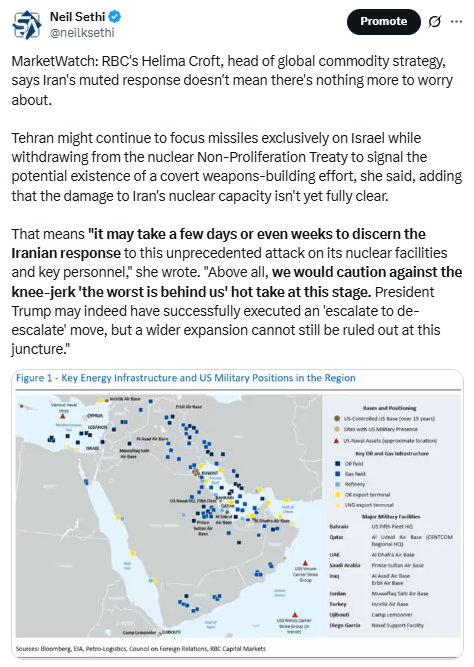

“It is possible that Iran will fire against other US bases in the region in the coming days, but such attacks are not likely to be any less ‘scripted’ than this attack, de facto sealing a de-escalatory Iranian stance,” said Jacob Funk Kirkegaard at 22V Research. “Today’s attack hence should serve to lower global geopolitical risk premia affecting crude oil and gas trade in the Gulf region.”

“Markets are judging that the response may not be quite as dramatic, because Iran would risk antagonizing others who are not yet pulled in,” John Bilton, head of multi-asset strategy at JPMorgan Asset Management, told Bloomberg TV. The market is “absorbing a geopolitical event that is going on and judging that this does not, on face value, change the direction of travel.”

While a closure of the Strait of Hormuz by Iran would be the biggest upside risk to oil, investors should lean against overshoots in crude prices, according to Elias Haddad at Brown Brothers Harriman & Co. “First, Iran relies heavily on this passageway for its own exports. Closing it is unlikely as it would cripple its own economy. Second, the US and allies maintain strong naval presence in the region. Blocking the strait could trigger more severe military repercussions against Iran,” he said.

“While Iran has flirted with closing the Strait of Hormuz, investors aren’t terribly panicked about an oil market calamity, an equanimous view that’s appropriate at this point,” wrote Adam Crisafulli of Vital Knowledge in a Monday note. “Geopolitical risks are undoubtedly elevated in the Middle East right now, but our view remains that the extreme asymmetry of the conflict (with Iran’s military capabilities, and those of its proxy partners, significantly degraded), coupled with Tehran’s relative isolation (with few, if any, allies willing to come to its assistance) and ample global oil supplies, will help keep the fallout contained.”

“Markets only care about oil supply shocks, so as long as they stay at bay, we’ll see markets sharply higher,” said Jamie Cox, managing director at Harris Financial Group. “Regardless of whether the President oversold the effectiveness of the strikes or not, the nuclear program in Iran was set back decades.”

“Despite all the heat generated by Trump’s tariff turmoil and now the war in the Middle East, the US economy continues to display its resilience, as it has over the previous three years when Russia invaded Ukraine and the Fed tightened monetary policy,” wrote Ed Yardeni, president and chief investment strategist of Yardeni Research, in a Sunday note

The market’s sanguine reaction offers investors an opportunity to reduce their risk exposure, noted Mohit Kumar, chief European strategist at Jefferies International. “We don’t see a closure of the Hormuz strait but see possibility of disruption,” Kumar said. “Our base case would be a period of uncertainty lasting a few weeks, but without a sharp escalation.”

If Iran was to close the Strait of Hormuz, “a stagflation scenario with lower growth and higher inflation due to elevated oil prices is the main risk for markets,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “It would also curb the abilities of central banks to support markets.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

See below.

Corporate Highlights from BBG:

Tesla Inc. jumped after the electric-vehicle giant rolled out its long-promised driverless taxi service to a handful of riders.

Novo Nordisk A/S scrapped a partnership with Hims & Hers Health Inc. after less than two months, saying the US company is using “deceptive marketing” to sell copycat versions of its obesity blockbuster Wegovy.

Northern Trust Corp. said it plans to remain a standalone company following a report that Bank of New York Mellon Corp. approached it about a possible merger.

Meta Platforms Inc.’s WhatsApp messaging platform has been added to a list of apps banned from government-issued devices for congressional staffers in the US House of Representatives, a move driven by concerns about the app’s data security.

VSCO, the popular photo-editing and social media app, is planning to release its own camera software for iPhones, as it joins a growing wave of third-party developers offering an alternative to Apple Inc.’s own camera experience.

Ford Motor Co. intensified its campaign to preserve clean energy manufacturing subsidies Monday, warning jobs at its electric-vehicle battery plant in southwestern Michigan could be at risk if Republicans in Congress pare back tax credits in President Donald Trump’s multi-trillion dollar economic package.

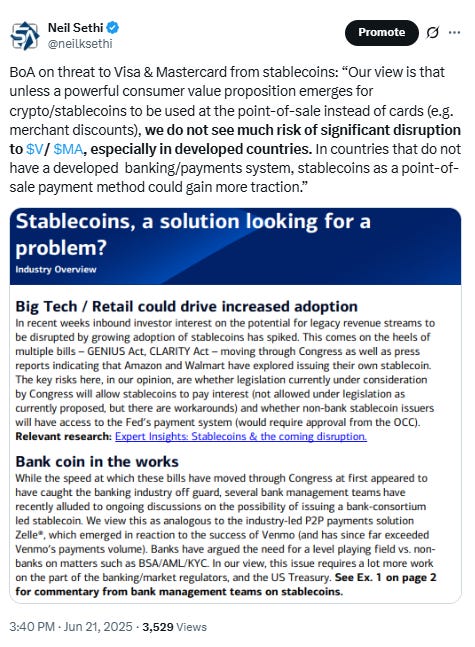

Fiserv Inc. is launching its own stablecoin and joining with both traditional and crypto payments firms PayPal Holdings Inc. and Circle Internet Group Inc. to develop products for financial institutions and merchants within the banking technology provider’s ecosystem.

Residential real estate brokerage Compass Inc. sued Zillow Group Inc., alleging that the home-search website is using “anticompetitive tactics” with its plan to restrict certain listings.

Omnicom Group Inc., the third-largest US advertising agency, agreed to stop withholding online ads for political reasons to clear the way for federal antitrust regulators to approve the company’s $13.5 billion buyout of rival Interpublic Group.

Spanish drugmaker Grifols SA paid a higher price to buy blood plasma from an entity linked to its controlling family than from third-party suppliers, according to a regulator’s findings submitted in a court case.

Huawei Technologies Co.’s latest computer product is powered by a chip manufactured using years-old technology, suggesting US sanctions are still preventing China from developing cutting-edge semiconductor technologies.

Some tickers making moves at mid-day from CNBC:

In US economic data:

June US flash Composite PMI edges back to 52.8 from 53.0 in June remaining though in expansion and above the 19-mth low of 50.2 in Apr. “US business activity continued to grow in June, though the overall rate of expansion lost a little momentum to remain well below those seen late last year.” The drop was entirely on the services side which fell to 53.1 from 53.7 while manufacturing was unchanged at 52.0, the 5th mth in expansion.

May existing home sales edge up +0.8% in May as they bump along at levels near the least since just after the GFC at 4.03mn, just the second advance this year and the slowest pace for May since May 2009 (after the worst March and April since then as well). Note as these are closings, contracts were signed 1-3 mths earlier.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX a nice gain but just puts it back in the middle of its range over the past couple of weeks just above the 20-DMA. Its daily MACD remains less positive but the RSI now back over 60.

The Nasdaq Composite very similar setup.

RUT (Russell 2000) a similar story as well.

Sector breadth from CME Cash Indices improved notably with just energy lower (-2.5% on the drop in crude prices) with 8 of 11 sectors up over 1% and with no sector style dominating.

SPX stock-by-stock flag from Finviz consistent with energy hammered (just KMI was not down) but very few other stocks down over -1% (AMGN was another standout to the downside). Lots of stocks up over 1% with TSLA a leader +8%.

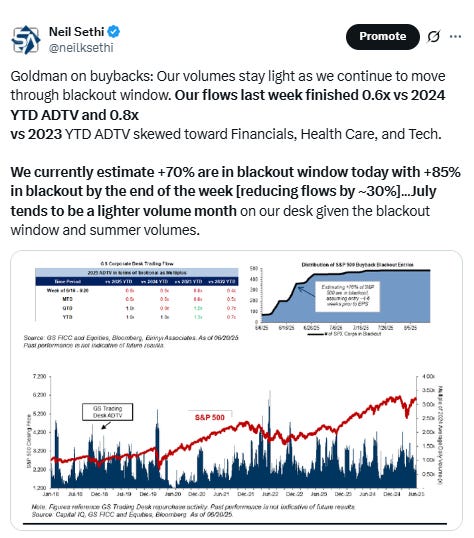

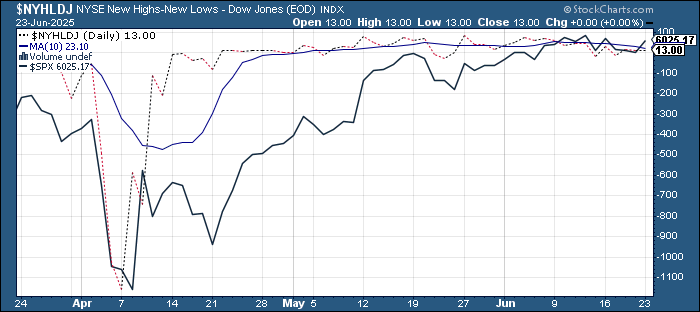

NYSE positive volume (percent of total volume that was in advancing stocks) which has been mixed the last couple of weeks improved to 61.8% but a little weak for the +0.70% gain in the NYSE Composite Index. Compare that with June 16th when it was 69.2% despite a smaller +0.53% gain in the index.

Nasdaq positive volume was similar at 63.7% a little weak for the +0.94% gain in the index. June 12th it was 76% with a much lower +0.24% gain (although that might have been due to high penny stock volume which we didn’t have today).

Positive issues (percent of stocks trading higher for the day) were similar at 66 & 58% respectively.

New 52wk highs-new lows (red-black dotted line) though didn’t improve falling by one to 13 on the NYSE and by 25 to 4 on the Nasdaq, still keeping them in their range over the past couple of months.

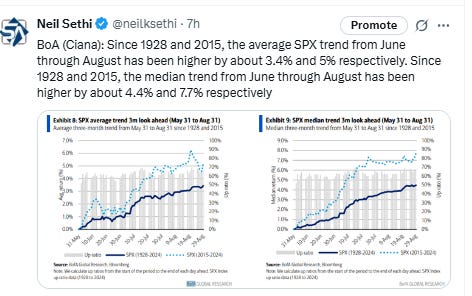

Pricing for 2025 #FOMC rate cuts continued to firm following the comments from Gov Bowman and Chicago Fed Pres Goolsbee today, although we’re still not even back to the levels from a few weeks ago (not to mention the start of May), and it was mostly pulling 2026 cuts into 2025.

Specifically, 2025 cuts were +5bps to 56bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; they peaked this year at 103bps on Apr 8th, and the low was 36bps Feb 11th).

The probability of a cut at the July meeting moved up to 23% (up from 10% on Wed, but still down from 31% three weeks ago and 78% at the start of May) while a cut by the following meeting (Sept) is over three times July at 79% (on the idea that despite recent comments the Fed will feel that they don’t have enough data to cut before that point, but will want/need to cut by Sept, although that is still down from 95% May 1st).

Chances of 2 cuts this year is 80% (up from 62% Tuesday which was around the least we’d seen since Feb and now above the 76% three weeks ago but down from 99% at the start of May), three is 40% (down from 92% May 1st), and four is 7% (from 76%). The chance of no cuts remains low at 3% (down from 8% Wednesday but up from under 1% May 1st).

2026 cuts were little changed -2bps to 65bps, seeing total cuts through Dec '26 at 120bps, +11bps from Wed but -28bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

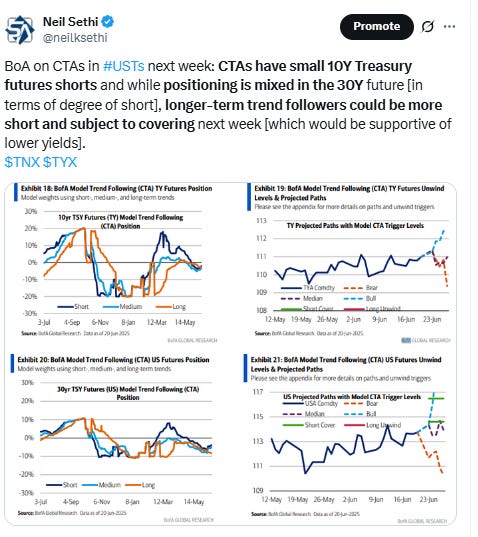

With the drop in oil prices, 10yr #UST yields fell -6bps to 4.32%, the lowest close since May 7th, but still remaining in the middle of the range this year.

The 2yr yield, more sensitive to #FOMC policy, also edged lower -5bps to 3.86%, the least since May 8th but also in its range this year. It is now -47bps below the Fed Funds midpoint, so continuing to call for a rate cut or two.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) reversed earlier gains following the mutual calls for de-escalation to finish lower. It had made it up to the 50-DMA and through the downtrend line from February that hadn’t previously been breached but ended back under. The daily MACD and RSI are mixed.

VIX was remarkably subdued through it all today moving up a couple of points then falling back to finish slightly lower at 19.8. That level is consistent w/~1.24% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) similar edging down to 104, just over Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “elevated” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX though dropped back to 13.5, continuing to respect that uptrend line from December. It’s consistent with traders implying an ~0.84% move in the SPX Tuesday.

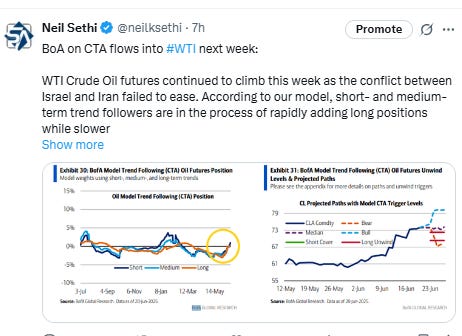

#WTI futures had quite the 22-hour ride jumping at the open last night 6% to the $78 level but falling back almost immediately and opening the cash session with just a small gain from Friday’s levels. It held those gains until the de-escalatory Iran strike after which it plummeted, ending down -9.2%, its worst day since Mar ‘22 (just after Russia invasion of Ukraine) now below the 200-DMA and potentially heading to better support at the $65 level. The daily MACD is now rolling over while the RSI plunged from over to well under 70.

#oott

Gold futures (/GC) like the VIX also seemed to indicate little concern little changed throughout the day in the middle of the uptrend channel from January. Still not far from the all-time closing high hit two weeks ago. Daily MACD and RSI are neutral.

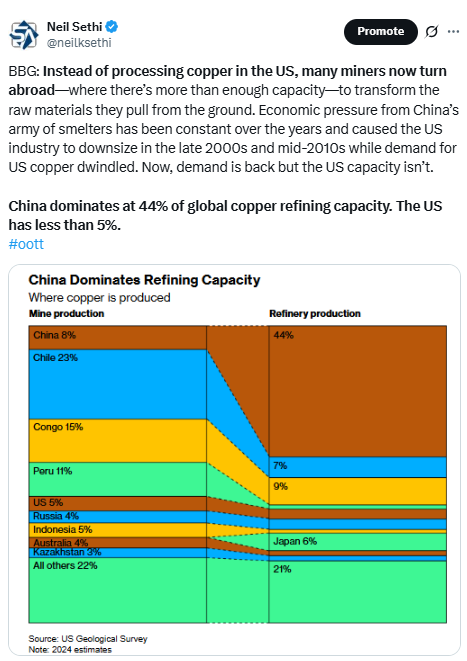

Copper (/HG) futures up 1% to start to push out of the top of the now narrow wedge they have been in since March. The daily MACD and RSI remain relatively neutral.

Nat gas futures (/NG) gave back over half of last week’s rally to the highest since early April, falling -5.6%, although unlike crude it was a steady drip lower all day. Daily MACD and RSI remain supportive for now.

Bitcoin futures at one point fell to the $100k level before rebounding to finish a touch higher remaining in their range since late May. The daily MACD remains in “sell longs” positioning, while the RSI has fallen under 50.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 3 weeks.

The Day Ahead

US economic data Tuesday brings us the repeat sale home price indices and Conf Bd consumer confidence.

The Fed will be a highlight with the first of Jerome Powell’s two-day testimony before Congress with the House. His appearance has gotten a lot more interesting with now four Fed members since the June FOMC on Wednesday saying they are not yet seeing tariff impacts on inflation and are looking for rate cuts this year if that continues with two (both Fed Governors) saying they would be in favor of cuts as soon as July. Typically though if he has something notable to say, it will be in his opening statement. In addition to Powell we’ll hear from Governor Barr along with regional Fed Presidents Hammack, Williams, and Collins (Williams and Collins are voters this year, Williams and Hammack in 2026).

We’ll also get our first Treasury auction of the week in 2-yr notes.

In earnings, we’ll get two SPX reports tomorrow including FedEx after the bell, often looked to as a bellwether for the global economy. The other is Carnival Corp.

Ex-US DM we’ll get Germany’s Ifo biz sentiment survey as well as Canada CPI among other reports.

In EM we’ll get a policy decision from Hungary, Brazil central bank meeting minutes, and Mexico CPI among other reports.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,