Markets Update - 6/27/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

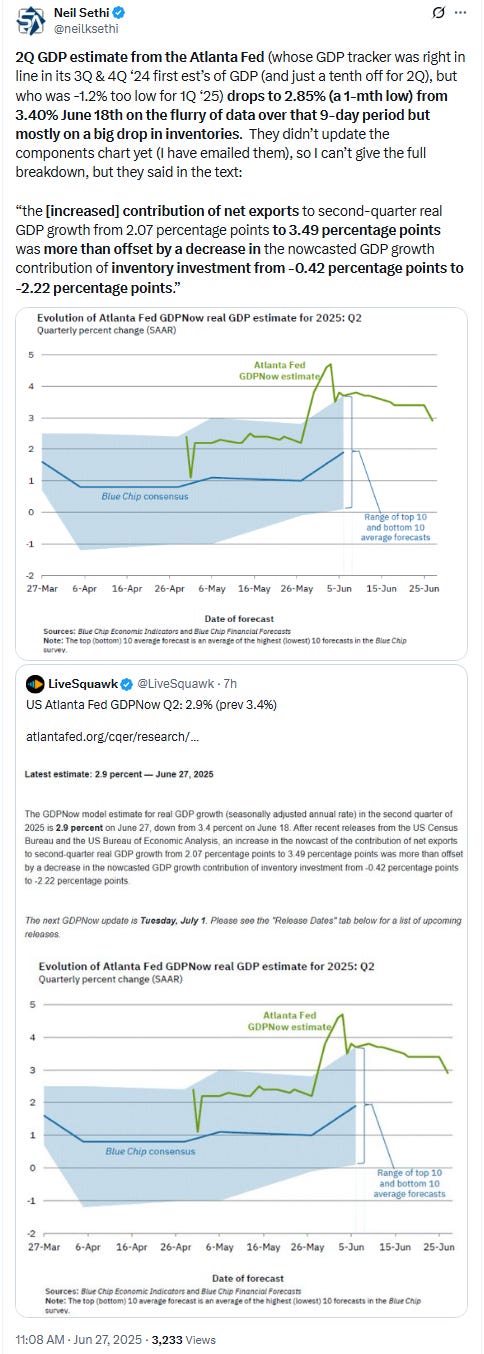

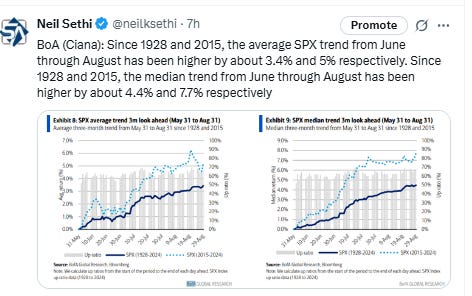

Major US equity indices started the day with modest gains, but off the highs after a personal income and spending report that showed higher than expected inflation paired with much weaker than expected incomes and spending (although at least wages held up). Still the small gains were enough to push the SPX and Nasdaq into record high territory. And equities started moving higher from there encouraged by positive trade deal chatter from Treas Sec Bessent as well as Pres Trump, hitting their peak in the early afternoon before dropping almost 1% on a social media post from Pres Trump that he was ending all trade discussions with Canada saying the country had moved to implement a digital services tax (the avoidance of such taxes was in part behind Trump dropping the Section 899 "Revenge Tax" from the OBBBA), and he threatened to impose a fresh (higher) tariff rate within the next week. Equities hit their lows just before 3pm, but what appeared to be some strong systematic buying in the last hour got the SPX & Nasdaq back into positive territory and to ATHs. It was overall the best week for the SPX since early May, up 3.4% (Nasdaq was up 4.3%).

Elsewhere, Treasury yields edged higher while the dollar was little changed at 3+ yr lows. Crude was also little changed for a third day, while bitcoin, copper, and nat gas advanced. Gold though fell to a 1-mth low.

The market-cap weighted S&P 500 (SPX) was +0.5%, the equal weighted S&P 500 index (SPXEW) +0.4%, Nasdaq Composite +0.5% (and the top 100 Nasdaq stocks (NDX) +0.4%), the SOX semiconductor index +0.1%, and the Russell 2000 (RUT) UNCH.

Morningstar style box remained mostly positive but much smaller changes today.

Market commentary:

“There were fears that the revenge tax would make it much harder for companies and individuals to invest in the US, since it would increase their tax rates,” said Kathleen Brooks, research director at Xtb Ltd. “There are still more trade agreements to be done, for example with the European Union, but things are moving in the right direction.”

"The Treasury market is taking direction from the consumption figures over the inflation data -- a notable tone shift that implies growth concerns are mounting," said Ian Lyngen, rates strategist at BMO Capital Markets, in a note.

“The bearish narratives — Middle East conflict, tariffs, soft economic data — keep getting invalidated by the price action. Every chance the market has had to break down has failed. Instead, it continues to do what bull markets do best: climb the wall of worry,” said Ken Mahoney, CEO at Mahoney Asset Management.

BNY's Bob Savage has pointed out that stock-market bulls have a lot going for them right now, as fears that the global economy could start to sputter have yet to pan out. "There are many drivers behind the rally, including the China/U.S. trade agreement announced late yesterday; the ongoing Iran/Israel ceasefire, which has led energy prices down sharply on the week; the push to remove the section 899 “revenge tax” from the Senate tax bill; the ongoing pressure on Fed Chair Jerome Powell to ease rates, mixed with President Trump’s plans to replace him; and better earnings reports, as exemplified by Nike overnight," Savage said in commentary shared with MarketWatch on Friday. "The balance of fears about growth globally is easing, and hopes of a better second half of 2025 have the upper hand. As we near the end of June, some of the factors driving uncertainty are proving less powerful in disrupting markets and the economy, countering the ongoing uncertainty over policy into July."

If recent history is any guide, the good times should continue in July, according to George Cipolloni, a veteran portfolio manager. "The interesting thing is that July has been pretty good recently," Cipolloni said. The journey hasn't always been easy, as investors have faced down a number of potential threats during the ride back into record territory. But as of Friday, it seemed as if most of the big issues that had weighed on investors' minds have found a resolution — at least for now. "We got through the Iran situation so far relatively unscathed, the tariff negotiations look like there's going to be some progress, and the resumption of the positive [artificial-intelligence] growth trade has all combined to lead us to new highs," Cipolloni told MarketWatch during a phone interview on Friday.

To Bret Kenwell at eToro, the latest PCE reading showed that inflation is still not spiraling out of control. However, it did snap a three-month streak of lower year-over-year readings, while last month’s figures were revised higher.

“Today’s inflation report shouldn’t be enough to give markets a significant scare, but it probably dashes the slim hopes investors had for a July rate cut,” Kenwell said. “Further, it may give investors a bit of hesitation with stocks surging into record high territory as we near quarter-end.” Kenwell says that stocks can do pretty well in a mild-inflationary environment. “The key will be a reassuring earnings cycle and a strong consumer as we go into the second half of the year,” he noted.

“A window of opportunity is more likely to open at one of the final three policy meetings of the year — in September, October or December — when the impact of tariff increases on inflation becomes clearer,’ said Gary Schlossberg at Wells Fargo Investment Institute.

In an email, Greg Wilensky, head of U.S. fixed income and a portfolio manager at Janus Henderson, said, "We still expect [tariff] impacts to show up in a more meaningful way in the next few months." For now, "contained" inflation data will not change the preference of most on the Federal Open Market Committee, who have stated a preference to wait and see how much of the tariff increases get passed through to consumers in the upcoming months, he said. Although a Fed rate cut could come as soon as September, "we think a September cut is more likely to require more meaningful weakness in the labor markets," Wilensky added.

Morgan Stanley economists are sticking with their view that the Federal Reserve is not likely to cut interest rates at its next two meetings since most officials are aligned with Chair Jerome Powell's cautious stance.

The economists' view is in contrast to that of fed-funds futures traders, who see a 72.7% chance that the central bank will cut in a quarter-point increment by September, according to the CME FedWatch Tool. Traders also see an 18.3% likelihood of a bigger half-point reduction by then. Morgan Stanley's economists, including Michael Gapen, elaborated on their thinking in a note on Friday, saying: "First, we think the data flow will continue to be consistent with a cautious Fed. We expect firmer inflation prints showing more signs of a tariff push over the summer. And we see relatively solid upcoming employment reports, with slowing employment gains but no signs of [a] crack that would put the Fed in a hurry."

“The news in the last week has been unambiguously good, and unambiguously good for the stock market too,” said Thierry Wizman, global FX and rates strategist at Macquarie Group. “Put it this way - there’s nothing in the way of a weaker dollar, but there’s also nothing in the way of a stronger stock market in the U.S. right now.”

Progress on the U.S. trade front and weaker economic data bolster the case for a September rate cut by the Federal Reserve, according to Thierry Wizman, global foreign-exchange and rates strategist at Macquarie Group.

"Starting about three weeks ago, the deteriorating US data made it likelier that, by mid-June, Jay Powell would abandon the strict neutrality he offered in May," Wizman wrote in a Friday client note. Comments by U.S. Commerce Secretary Howard Lutnick indicating the U.S. and China signed a trade truce were in focus. Lutnick added that progress was being made with 10 other major trading partners. "Mind you, however, those agreements will likely pertain to the reciprocal-universal tariffs only," Wizman said.

It's clear that investors think the Israel-Iran conflict "will remain contained, although that could change at anytime," said Robert Ruggirello, chief investment officer at Brave Eagle Wealth Management in New York.

In an email, he wrote: "While stocks are back at record highs, that does not mean that there won't be volatility during the second half of 2025. We are expecting more volatility and wouldn't be surprised if it were in both directions." Ruggirello added that "we are sticking with our plan and not trying to time the market. Our strategy continues to be an aggressive equity posture, complemented by an allocation to US TIPS [Treasury inflation-protected securities], and a downside hedge to protect capital against a major drawdown."

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Tech megacaps led gains, with Nvidia Corp. approaching the $4 trillion mark and Alphabet Inc. up almost 3%.

Shares of Nike Inc. rose more than 15%, lifted by the athletic-gear and sneaker maker’s better-than-expected sales forecast, its largest percentage increase since Oct. 21, 1987, when it rose 16.67%, Dow Jones Market Data show.

Shares of credit score providers Fair Isaac, Equifax and TransUnion took a sharp drop in afternoon trading after Bill Pulte, the director of the Federal Housing Finance Agency, said on X “We are doing a full scale review of all credit bureaus.”

Corporate Highlights from BBG:

Nike Inc. said its yearlong sales decline is starting to ease, suggesting that Chief Executive Officer Elliott Hill’s strategic moves are paying off.

Apple Inc. and Google’s Android have been warned by a top German privacy regulator that the Chinese AI service DeepSeek, available on their app stores, constitutes illegal content because it exposes users’ data to Chinese authorities.

JPMorgan Chase & Co. shares have soared from an April low on a grab bag of positive developments, but to Baird analysts that’s too far, too fast. They downgraded the lender to underperform from a neutral rating.

Shares of Boeing Co. are set to make gains as the company speeds up production of commercial aircraft and takes steps to move on from a series of crises in recent years, according to Rothschild & Co. Redburn, which raised the recommendation on the shares to buy.

B. Riley Financial Inc. has sold its financial advisory services business GlassRatner to Canadian private equity firm TorQuest Partners, adding to a series of asset sales as the financial services firm deals with its woes.

Alibaba Group Holding Ltd. unveiled a new iteration of its artificial-intelligence technology that will make it easier for users to generate and modify images from texts and visuals, as the Chinese e-commerce giant continues its aggressive push into AI.

Some tickers making moves at mid-day from CNBC:

In US economic data:

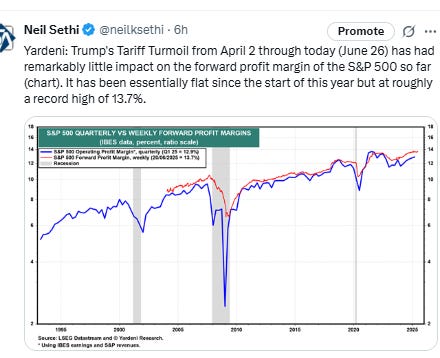

Quick look at May PCE shows it coming in as expected at the headline level (+0.1% m/m (+0.14% unrounded), same as Apr, 2.3% y/y up from 2.1% in Apr (the first rise since Feb ‘05)) but core a tenth hot on the headline m/m at +0.2% (+0.18% unrounded) after +0.14% in Apr) but the y/y comes in four tenths hot at 2.7% on the higher than exp’d m/m read paired with a tenth upward revision to Apr to 2.6%.

Quick look at personal income and spending shows the former (income) falling for the first time since Sep ‘21 (-0.42% m/m vs +0.3% exp’d) on a large drop in gov’t transfer payments (which fell -2.2% due to social security payments being cut from the Social Security Fairness Act after rising +6.8% the previous four months combined) as well as a -2.3% drop in small biz income (due to lumpy assistance payments for farms from the ECAP program). Wages though did increase a very solid +0.4% for a second month. Personal spending also fell, in its case -0.14% m/m (vs +0.1% exp’d) and outside of Jan (which was -0.18%) it was the largest decline since Feb ‘21 as goods spending dropped -0.8% led by durable goods falling -1.8% (with autos -49%) and gasoline -20% while services cooled to +0.1% (food/accommodation services fell -11%). Real spending (inflation adj’d) was -0.28% also the weakest since January.

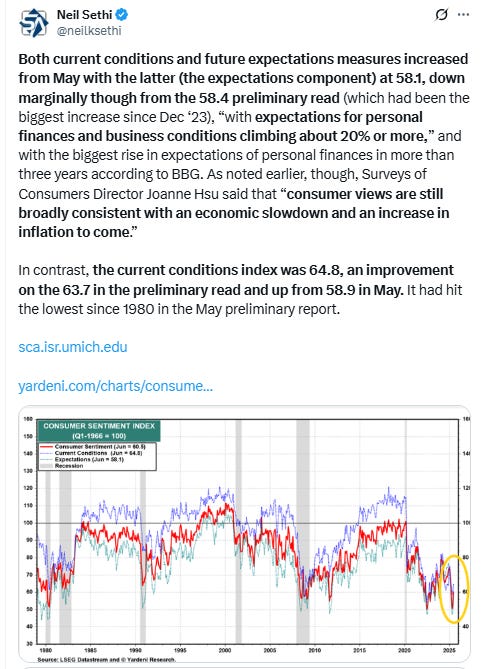

After five months of increasingly stagflationary #UMich consumer sentiment surveys, June continued the softening seen in the final May read from the preliminary, with sentiment improving further from that preliminary read (which was the 2nd lowest on record after June ‘22) up 10 points from those levels to 60.7, a four month high (two tenths above the preliminary read which as a reminder “easily topped all expectations in a Bloomberg survey of economists,” the largest beat on record), and up from 52.2 in May’s final read, the largest increase since early 2024. The gauge of sentiment among Republicans increased to the highest level since October 2020, while confidence among Democrats and political independents rose to four-month highs.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX as noted got its ATH. Its daily MACD is also turning more positive and the RSI is just about at the highs since July 2024 which would confirm the breakout..

The weekly charts on all three indices look even better than the daily.

The Nasdaq Composite very similar setup.

Weekly.

RUT (Russell 2000) was able to clear the 200-DMA but ended up finishing right on it. Still the highest since February, and it has a clear path to move at least to the 2300 level.

Weekly.

Sector breadth from CME Cash Indices remained very good with the fourth day in five of at least 9 green sectors (we had 9 today) with megacap growth sectors outperforming again with Comm Services and Cons Discr taking two of the top three spots for a second day (actually the top two spots today). Four sectors were up over +0.6% while no sector was down that much (worst was Energy -0.5%.

SPX stock-by-stock flag from @FINVIZ_com relatively consistent although at first glance seems a little more mixed particularly in tech.

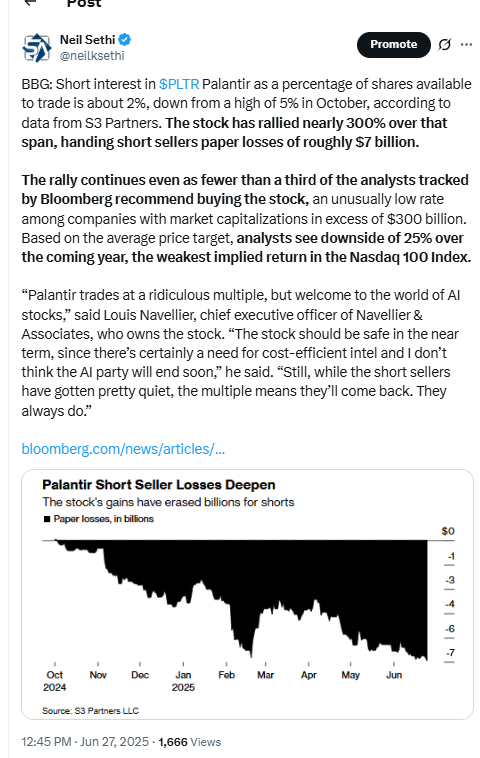

That said as with Thursday plenty of stocks up over 2% (although again not many up more than 3%) while fewer were down that much (but more than Thursday with PLTR (-9%), COIN, ANET, SMCI, LLY, ABBV, NEM, INCY, ADM, BG all down that much).

NYSE positive volume (percent of total volume that was in advancing stocks) which has been mixed the last couple of weeks but was very good Thurs at the best since May 27th, back to mixed Friday at 52.4% weak for the +0.41% gain in the NYSE Composite Index. In comparison it was 53.1% June 18th with a -0.09% loss in the index.

Nasdaq positive volume was even worse at just 41.4%, very poor for the +0.52% gain in the index. In comparison June 18th it was 65% with just a +0.13% gain in the index.

Positive issues (percent of stocks trading higher for the day) were not far off at 54 & 47% respectively.

New 52wk highs-new lows (red-black dotted line) though improved to 105 on the NYSE which was the best since January and to 147 on the Nasdaq a little below the 155 hit Tues which was the best since December.

Despite the weak data Friday (but perhaps because of the PCE prices data coming in hot) Fed rate cut bets were little changed, but remained at the highest since the start of May with pricing for 2025 #FOMC rate cuts -1bps to 64bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; and the peak this year at 103bps on Apr 8th (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting is now 19% (from 25% Wed but 10% a week ago (it was 78% at the start of May)) while a cut by the following meeting (Sept) is now at 93% (up from 68% a week ago and now almost to the 95% May 1st).

Chances of 2 cuts this year is 92% (up from 62% on FOMC Day which was around the least we’d seen since Feb also closing in on the 99% at the start of May), three is 57% (so better than 50-50), and four is 9%. The chance of no cuts has fallen to 0.5% (down from 8% FOMC Day and almost the least since May 1st).

More notable though 2026 cuts gave back much of yesterday’s jump falling -6bps to 67bps (still seeing 2.5 cuts next year), seeing total cuts through Dec '26 at 131bps, +22bps from FOMC Day but -17bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields rose for the first time in a week +3bps to 4.28%, from the lowest close since May 7th, remaining around the middle of the range this year. They were -10bps this week.

The 2yr yield, more sensitive to #FOMC policy, also rose, in its case for the first time in nearly two weeks, +4bps to 3.75% from the least since May 1st. It is still -57bps below the Fed Funds midpoint, so calling loudly for rate cuts. It is now down -29bps since June 6th and was -15bps this week.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) was little changed remaining near 3+ yr lows. The daily MACD and RSI are starting to tilt more negative.

A fresh 3-yr low this week on the weekly chart, but do have a little positive divergence going on with the RSI making a higher low so far (circle).

VIX edged lower for the lowest close since late Feb at 16.3. That level is consistent w/~1.02% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) though edged higher but at 92 remains under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX like the VVIX moved higher Friday but stayed near the lowest levels since Feb 20th at 12.2. It’s consistent with traders implying an ~0.77% move in the SPX next session.

After seeing its most volatile two weeks since the Russian invasion of Ukraine, #WTI futures have seen one of their least volatile three-day stretches, trading sideways just above the uptrend line from the May lows and in the $65 area which I said I thought would hold on Monday. So far it has for the most part.

As noted Tuesday though the daily MACD has crossed to “sell longs” positioning and the RSI has plunged from over 70 to under 50.

#oott

Biggest weekly loss since March ‘23 (banking crisis). Still though the weekly MACD remains positive and the RSI is just under 50.

Gold futures (/GC) down -1.7% Friday breaking under the 50-DMA and testing the bottom of the uptrend channel from January. Daily MACD and RSI have turned more negative as noted Wed, with the latter the lowest this year. Lowest close since May 19th.

Worst week for gold since November, and the MACD has crossed to “sell longs” for the first time since then, and the RSI is almost down to those levels. The good news is that was basically the low, gold went sideways for seven weeks then started its current, steeper uptrend.

Copper (/HG) futures tested again but couldn’t get over the $5.15 resistance level it has closed over only twice ever (in March). Still the highest close since March. The daily MACD and RSI are more strongly positive as noted Thursday.

MACD and RSI have turned more positive on the weekly chart as well. Best week in a year.

Nat gas futures (/NG) continue to be volatile jumping +5.7%, the best day since the start of the month, overall remaining in the middle of its range this year. Daily MACD and RSI are mixed.

Just staying in that box on the weekly chart.

Bitcoin futures little changed Friday at the top of what sort of looks like a larger flag formation forming than we’ve seen previously. We’ll see which way they break out, currently right at the top, but overall remaining in their range since late May. The daily MACD remains in “sell longs” positioning, while the RSI is above 50 and both are improving.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

MACD & RSI more supportive on the weekly chart.

The Day Ahead

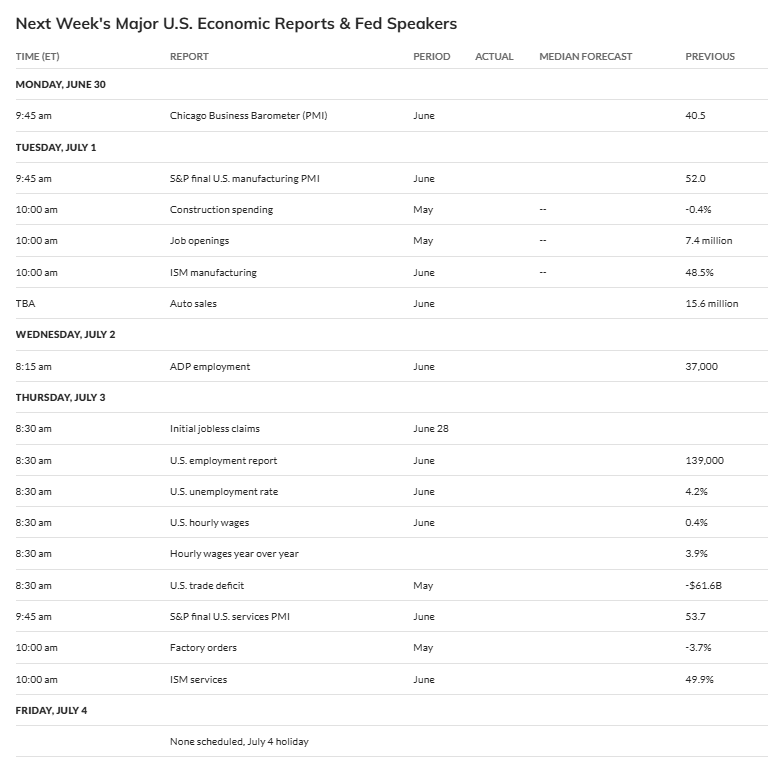

Have a great weekend! Next week brings us another holiday shortened week, but this time with a Friday holiday. It’s also though the first week of the month which brings us all our standard first week reports including NFP. But instead of spreading them evenly throughout the already shortened week, they’re mostly jammed into Tuesday and Thursday with the latter a particularly busy day that includes NFP in addition to jobless claims, the trade deficit, factory orders, and services PMIs.

Fed calendar is currently light, but I’m sure there will be plenty of appearances (the highlight is a panel discussion Tuesday with Powell (Fed), Lagarde (ECB), Bailey (BoE) and Ueda (BoJ)).

Earnings calendar at least is very light.

PMIs headline the global calendar according to JPM.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,